UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For

the Fiscal Year Ended:

or

Commission

file number

(Exact name of registrant as specified in its charter)

| State

or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

Tel:

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act: None

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| N/A | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: None

N/A

(Title of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the fi ling reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

The

aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of June 30, 2022, based on the

price at which the common equity was last sold on the OTCQB Market on such date, was $

As of March 28, 2023, there were shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

| 2 |

Forward-Looking Statements

This Annual Report on Form 10-K includes a number of forward-looking statements that reflect management’s current views with respect to future events and financial performance. Forward-looking statements are projections in respect of future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. Those statements include statements regarding the intent, belief or current expectations of our Company and members of our management team as well as the assumptions on which such statements are based. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors including, but not limited to:

| ● | our financial performance, including our history of operating losses; | |

| ● | our ability to obtain additional funding to continue our operations; | |

| ● | our ability to successfully develop and commercialize our products; | |

| ● | changes in the regulatory environments of the United States and other countries in which we intend to operate; | |

| ● | our ability to attract and retain key management and marketing personnel; | |

| ● | competition from new market entrants; and | |

| ● | our ability to identify and pursue development of additional products. |

Readers are urged to carefully review and consider the various disclosures made by us in this Annual Report and in our other reports filed with the Securities and Exchange Commission. We undertake no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes in future operating results over time except as required by law. We believe that our assumptions are based upon reasonable data derived from and known about our business and operations. No assurances are made that actual results of operations or the results of our future activities will not differ materially from our assumptions.

As used in this Annual Report and unless otherwise indicated, the terms “ScoutCam,” “we,” “us,” “our,” or “our Company” refer to ScoutCam Inc. Unless otherwise specified, all dollar amounts are expressed in United States dollars.

| 3 |

Part I

Item 1. Business

Overview

Our Mission

We are a pioneer in the development, production, and marketing of innovative Predictive Maintenance (PdM) and Condition Based Monitoring (CBM) technologies, providing visual sensing and AI-based video analytics solutions for critical systems in the aviation, maritime, industrial non-destructing-testing industries, transportation, and energy industries. Some of our products utilize our unique micro visualization technology in medical devices for complex and minimally invasive medical procedures. Our technology includes proven video technologies and products amalgamated into a first-of-its-kind, FDA-cleared minimally invasive surgical device. At the present time, we derive a substantial portion of our revenue from applications of our micro visualization technology within the medical field.

Our Business Model

Our unique video-based sensors, embedded software, and AI algorithms are being deployed in hard-to-reach locations and harsh environments across a variety of PdM and CBM use cases. Our solution allows maintenance and operations teams visibility into areas which are inaccessible under normal circumstances, or where the operating ambience otherwise is not suitable for continuous real-time monitoring, and has various applications which have relevancy in a wide range of industry segments that utilize complicated mechanics requiring ongoing monitoring and predictive maintenance applications. Our current business model is a business-to-business (B2B) approach in which we seek to identify target businesses interested in integrating our micro visualization technology or commissioning individual projects using our technology. We have several successful proof of concepts in airborne platforms of various OEM’s in aerospace and have completed a successful demonstration project for a top global elevator systems manufacturer. As provided above, we are developing additional applications for our visual solutions portfolio (composed of image acquisition, data collection, and storage and image processing), including PdM and CBM (we refer to these applications and sectors as Industry 4.0, or I4.0), which generate a number of potential benefits for our customers.

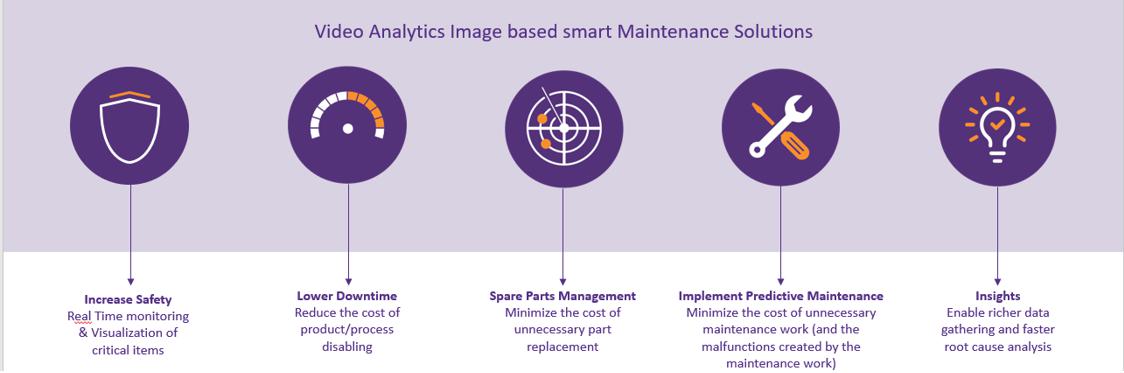

The following graphic demonstrates ScoutCam’s value proposition, starting with increased safety and reduced down time due to our ability to visually analyze any failure occurrence in real time, and including more sophisticated benefits like big data analytics that provide predictive insights regarding to an entire system life cycle, spare parts management and smart prediction regrading system performance.

| 4 |

Who we are: History and Background

We were incorporated as a corporation under the laws of the State of Nevada on March 22, 2013, under the name Intellisense Solutions Inc. We were initially engaged in the business of developing web portals to allow companies and individuals to engage in the purchase and sale of vegetarian food products over the Internet. However, we were unable to execute our original business plan, develop significant operations or achieve commercial sales.

We received initial funding in March 2014 in the aggregate amount of $19,980 through the sale of common stock to two of our former officers and directors, who purchased in the aggregate 1,998,000 shares of our common stock at $0.01 per share.

On January 10, 2019, we formed Canna Patch Ltd., or Canna Patch, an Israeli corporation, of which 90% was initially owned by our Company, and the remaining 10% owned by Rafael Ezra, Canna Patch’s Chief Technology Officer. Canna Patch did not have any operations and on December 4, 2019, we sold 100% of our holdings in Canna Patch.

On September 16, 2019, Intellisense and Medigus Ltd., an Israeli company traded on the Nasdaq Capital Market, entered into an Exchange Agreement (as defined herein).

On December 30, 2019, we acquired ScoutCam Ltd. As a result of our acquisition of ScoutCam Ltd., we now own all of ScoutCam Ltd.’s issued and outstanding share capital and have integrated and adopted ScoutCam Ltd.’s business into our Company as our primary business activity.

ScoutCam Ltd. was formed in the State of Israel on January 3, 2019, as a wholly-owned subsidiary of Medigus and commenced operations on March 1, 2019. ScoutCam Ltd. was incorporated as part of a reorganization of Medigus, which was designed to distinguish ScoutCam Ltd.’s miniaturized imaging business, or the micro ScoutCam™ portfolio, from Medigus’ other operations and to enable Medigus to form a separate business unit with dedicated resources focused on the promotion of such technology. On December 1, 2019, Medigus and ScoutCam Ltd. consummated a certain Amended and Restated Asset Transfer Agreement, which transferred and assigned certain assets and intellectual property rights related to its miniaturized imaging business. On May 18, 2020, in connection with the Arkin Transaction (as defined below), the Company and Medigus entered into a certain Side Letter Agreement (the “Letter Agreement”), whereby the parties agreed to amend certain terms of the Amended and Restated Asset Transfer Agreement and the License Agreement.

On April 20, 2020, ScoutCam Ltd. entered into an Amended and Restated Intercompany Services Agreement with Medigus (the “Intercompany Services Agreement”), which effectively amended and restated an intercompany services agreement dated May 30, 2019.

For additional information about the Exchange Agreement, the Amended and Restated Asset Transfer Agreement, the Letter Agreement and the Intercompany Services Agreement, refer to – “CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE” below.

Sales and Marketing

ScoutCam’s vision is to become a leading provider of video analytics based, PdM solutions for the aerospace, other industry and medical critical system markets.

We engage companies seeking to add video visualization to their existing or new product(s) or considering the development of new products that include micro video visualization. Our approach to the medical market is ordinarily conducted in two phases. During the first phase, we conduct the research and development that is required in order to specify, design, develop, and produce the designated visualization apparatus, for an agreed-upon compensation amount (e.g., a non-recurrent engineering fee). During the second phase, we manufacture the apparatus and offer it to the customer for an agreed-upon transfer price.

In the I4.0 domain, which target PdM and CBM applications, we engage with companies that wish to increase the monitoring capabilities of different elements of a device using our visual monitoring solutions (these include build of image acquisition, data collection and storage, and image processing capabilities based on AI, ML, cloud, and additional algorithm concepts). Based on our product portfolio with customized solutions as needed, this will allow our customers to receive real time alerts on anomalies and failures of monitored components, analyze and track trends and development of the anomaly, and predict any impending failure of the component as a result of such anomaly over time and usage. As a result, we expect customers to benefit from a reduction in downtime, lower maintenance expenses, and increased safety of their monitored equipment, using the prediction capabilities of the platform to efficiently plan maintenance work on future faulty components. Another outcome we expect is more cost effective management of resources, since components will only need to be replaced as a result of their actual condition rather than a strict maintenance schedule.

| 5 |

The use of an image based platform in the fields of PdM and CBM provides richer and more informative data and insights than traditional sensing methods. Together with the AI and ML models customized for the relevant use cases, we expect this will provide customers with a clearer view of the status of their equipment, increasing revenues by saving on direct expenses, and increasing the uptime of their equipment.

On February 6, 2023, we announced the completion of a major development stage in equipping Elbit Systems Ltd.’s leading defense UAS aerial platforms with our real time video monitoring system. Through the program, our unique video-based sensors, embedded software, machine vision and algorithms support a variety of predictive maintenance and condition-based monitoring use cases for unmanned aerial vehicles in harsh environments and hard-to-reach locations, as it features a modular open system architecture, enabling seamless integration with advanced unmanned aerial platforms.

In order to engage new customers, we employ various marketing strategies. We employ several professional experienced managers in relevant fields of expertise, in addition to a team of consultants who analyze global trends and designated geographical territories to assist us in targeting potential customers.

Our marketing efforts include, but are not limited to, the following:

| ● | engaging third party companies and local consultants as territorial representatives in key markets and leading companies in relevant industries; | |

| ● | initiating business engagements based on leads received through our marketing efforts, through active interaction with key industry influencers, providing financed proof of concept in order to generate tailored product orders, or via other methods or means; | |

| ● | conducting proof of concept demonstrations in order to evaluate the feasibility of integration for monitoring their systems and to demonstrate the significant value proposition of our technology to customers; | |

| ● | networking through personal contacts in the aerospace, critical industry, transportation, maritime, medical, and defense industries; and | |

| ● | participating in major aerospace, maritime, and vision technology exhibitions as well as industry 4.0 specific events. |

In addition to our business development efforts that are mainly based on currently existing or future customer needs, we aim to identify new market opportunities. These efforts include systematic analysis of various industrial and medical fields and procedures to identify where visualization solutions, including image analysis, might add value. When a potential opportunity is identified, we seek to protect our rights by establishing relevant intellectual property safeguards, developing prototypes for the required application. In the medical domain, we currently sell our system to a fortune 500 corporation; in this respect, we seek to partner with additional relevant companies to progress our technology into prototypes which, in turn, will be developed into market-ready products.

In January 2022, we entered into a patent cross-licensing arrangement with Japan-based Sumita Optical Glass, Inc. (Sumita), a specialty optical fiber technology company, pursuant to which we granted a non-exclusive license to Sumita to our patents related to “Small Diameter Video Camera Heads and Medical Devices and Visualization Probes containing them” in return for payment of royalties and a grant-back license to ScoutCam of Sumita’s patent and patent applications related to fiber optics illumination. For additional information on our patent portfolio, refer to – “PROPRIETARY RIGHTS AND TECHNOLOGY” below.

| 6 |

Our Customers

Currently, we have one major customer, a leading Fortune 500 multinational healthcare corporation, that is expected to generate most of our forecasted revenue in the near term. In June 2022, we announced that we completed the verification and validation stage of our miniature camera solution with this client and, on January 26, 2023, we announced that we had received an order from this client for $1.45 million.

In addition, we derive a substantial portion of our revenue from applications of our micro visualization technology within the medical field.

In addition, we announced the completion of a major development stage to equip Elbit Systems Ltd.’s leading defense UAS aerial platforms with our real time video monitoring system.

Competition

There are currently several companies that develop and provide monitoring solutions for PdM and CBM. These monitoring solutions can be the sensor itself, data collection and storage, AI processing, or a combination of these capabilities. The CBM and PdM solutions are usually based on traditional sensing solutions such as vibration, temperature, and acoustic sensors. Based on our research and discussions with customers, we believe these traditional sensing methods are limited in their ability to provide an in depth view of the condition of the monitored components and usually alert on the occurrence of an anomaly when component failure has already occurred, which is too late in some cases. From the AI perspective, there are several vendors providing off-the-shelf AI capabilities which then require customization per market, use case, and/or data source. We believe that our more holistic approach and reliance on image-based solutions creates richer and more informative data, leveraged by AI and ML algorithms, enabling our customers to deploy predictive maintenance programs.

Proprietary Rights and Technology

Our solution for the market is based on our core intellectual property which we seek to review and patent on a regular basis, where applicable. We are heavily invested in creating patents for our core technology.

Our patent portfolio currently contains patent families which we consider material to our business and operating success. Our intellectual property rights include patents and patent applications that were transferred to us by Medigus as part of the Addendum No. 1 to Amended and Restated Asset Transfer Agreement (the “Addendum”), the License Agreement and the Letter Agreement, and additional patent assets developed by ScoutCam. For additional information about the License Agreement refer to – “CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE” below. Under the Addendum, and subject to certain limitations as further set forth therein, Medigus transferred to us the following material patent families in exchange for a license in connection with the marketing and sale of the Medigus Ultrasonic Surgical Endostapler:

● Patent family related to Integrated Endoscope Irrigation: this patent family relates to our ability to develop visualization components and endoscopes, which include irrigation with a smaller outer diameter by saving the space of the tube that is required to lead the fluids in a conventional manner. This patent has been granted in Canada, Europe (validated in Germany, Spain, France, Great Britain and Italy), Israel, Japan (original and divisional), and the United States (two patents), and has two pending continuations in the United States. The expiration dates for the two patents in the United States are November 28, 2033 and February 28, 2033;

● Patent family related to Small Diameter Video Camera Heads and Medical Devices and Visualization Probes containing them: this patent family relates to our ability to develop cameras, visualization components, and medical devices with a small diameter, thus enabling the insertion of the camera into smaller cavities or leaving more space in the device for the use and application of other functions, such as a working channel. This patent has been granted in Japan, Korea, Israel, the United States (2 patents, original and continuation in part), and Europe (3 patents, original and 2 divisionals, currently under appeal after opposition proceedings, validated in Germany, France, Great Britain, and Italy). The expiration dates for these patents are March 16, 2031 (for the patents in the United States), and September 16, 2030 (for patents in each of the other aforementioned jurisdictions).

| 7 |

As a result of oppositional proceedings initiated by a third party in 2018, the Opposition Division of the EU Patent Office decided in 2019 to revoke two of the three European patents (EP 2.478.693 and EP 2.621.159) and in 2021 to maintain the third patent (EP 2.621.158). Following appeals by Company and the third party of the 2019 and 2021 decisions, respectively, the Opposition Division of the EU Patent Office is expected to hear and decide these matters in early 2024;

As a result of a supplemental examination filed by the Company regarding one of the U.S. Patents (10,188,275), the U.S. Patent Office decided to open reexamination proceedings for 23 of the 24 granted claims. The U.S. Patent Office is expected to conduct the reexamination proceedings during the course of 2024; and

In addition, our intellectual property rights further include the following material patent applications filed by ScoutCam:

● Patent family related to Miniature Precision Medical Device: these pending patent applications relate to our ability to develop a miniature precision medical device comprising an endoscope with at least one camera, where at least one sensor of one camera is distally located at a tip of a shaft of the endoscope. Surrounding or next to the sensor, such shaft has sufficient space to accommodate at least one accessory such as, for example, illumination source, irrigation tool, or suctioning tool. This patent family has pending patent application in the United States and its expected expiry dates, if issued, will be in 2039-2040.

● Patent family related to Medical Ophthalmic Device: this patent family is related to a tool comprising a hand piece having a flattened cannulated tip that is adapted to receive flow from a pumping unit, in order to generate a jet of fluid suitable for procedures such as “hydro-dissecting” cells in the eye. According to a representation of the invention, the tool comprises a visualization probe with at least one camera, wherein the sensor of the camera is distally located at the tip of the tool to be inserted into the eye for imaging from within the eye. This patent family is pending in China, Europe, Japan, Korea, and the United States. The patent application’s expected expiry dates, if issued, will be in 2039-2040.

● Patent family related to Systems and Methods for Monitoring Potential Failure in a Machine or a Component Thereof. This patent family relates to system and methods for monitoring potential failure in a machine or a component thereof using at least one optical sensor. Such sensors can be used in conjunction with diagnostic software/hardware tools to display and analyze changes in critical images that could not have been displayed or analyzed using existing systems. This patent family includes a pending Patent Cooperation Treaty patent application and national phase applications filed in Israel and the U.S. If ultimately issued by the United States Patent and Trademark Office, such patent would be expected to expire in early 2042. Additional national phase patent application can be filed in other jurisdictions by the end of July 2023.

We have also applied for provisional applications relating to our predictive maintenance innovative technology and developments. All of these applications are expected to have a lifetime of 20 years from filing.

Despite our efforts to protect our intellectual property, unauthorized parties may still copy or otherwise obtain and use our technology. For additional information, refer to – “WE MAY NOT BE SUCCESSFUL IN ENFORCING OUR INTELLECTUAL PROPERTY RIGHTS AGAINST THIRD PARTIES” below.

Employment

We currently have approximately 45 full-time (or near full-time) employees. This number is expected to grow. We may recruit additional employees to the R&D team.

Research and Development

Our R&D organization is responsible for the design, development, testing, and delivery of new technologies, features, products, and integrations of our component parts. Research and development employees are located primarily in our principal corporate office on Omer, Israel. We currently have approximately 21 employees in our research and development organization. We intend to continue to invest in our research and development capabilities.

| 8 |

Our R&D efforts are focused on the following areas: (i) maturing our multi camera solution based on advanced visualization sensor technologies focusing on sensing, computing, and prediction, cooperating with customers for mutual development projects that demonstrate our technology by reaching customer KPIs and (ii) our industrial cloud-based product, which leverages our already in place cloud environment to develop mutual proof of concept and minimal valuable product for our customers that enable cloud base solutions for customer KPIs.

Regulation

Our approach to regulation is generally determined based on a given project. In our engagements with customers operating in the biomedical sector, we comply with the medical device standards in that corresponding territory, such as the FDA or International Organization for Standardization (ISO), among others. Compliance with these regulations is achieved through our QA department and the support we receive from highly experienced quality assurance and regulatory affairs consultants. In addition, we are being audited annually by MEDCERT GmbH, a German Notified Body.

For instance, ISO 13485:2016 is a regulatory benchmark that we comply with while working on our medical device projects. ISO 13845:2016 is similar to ISO 9001 in terms of its quality management system (QMS) requirements, however, ISO 13485:2016 is generally considered more rigorous and comprehensive.

Given that we do not manufacture or distribute end-user products to the medical sector, and instead service businesses pursuant to a B2B model, we are subject to fewer regulatory standards commonly associated with medical device manufacturers or distributors. We develop and manufacture components for other companies, and therefore our involvement in the regulatory submission demands comparatively less responsibility. This notwithstanding, we communicate with business customers in order to identify certain regulatory dimensions inherent to a project, to which we should pay additional attention. For example, when a component of ours is integrated into a business’s end-user product, such as for the purpose of touching human tissue, we develop and manufacture our parts and components while taking into account certain applicable regulatory standards. These standards might include, inter alia, relevant FDA regulations (e.g. CFR 21 part 820, the medical device reporting requirements (MDR), among others) as well as ISO regulations (e.g. ISO 14644-1, specifically in connection with cleanrooms and associated controlled environments, among other items, or ISO 10993, in connection with the biological evaluation of medical devices). Furthermore, we prioritize our team’s compliance with the Restriction of Hazardous Substances Directives (RoHS) and REACH (EC 1907/2006).

Similarly, if a component part of ours is incorporated into an electronic device for the purpose of being used inside a human body, we comply with certain FDA requirements as well as IEC 60601 for safety and electrostatic discharge, including the heating of parts at more than 42 degrees Celsius and a variety of additional technical standards designed for the safety and essential performance of electronic medical equipment. Moreover, we perform risk management assessments in accordance with EN ISO 14971:2019 and ISO/TR 24971:2020.

In certain instances, our customers prefer that we conduct the testing of its products in internationally certified labs in order to further guarantee that our component parts satisfy applicable regulatory standards. In this scenario, we perform the required tests as a service to the customer and provide the customer with the official test results, specifically in accordance with ISO/IEC 17025:2017, which the customer can later use in order to apply for the required marketing clearance of its end-user product.

Since we are seeking to sell our products to customers in the aviation sector, we have completed the process of implementing the AS9100D Standard to comply with aerospace industry requirements.

As a U.S. company with foreign offices, we are subject to a variety of foreign laws governing our foreign operations, as well as U.S. laws that restrict trade and certain practices, such as the Foreign Corrupt Practices Act.

| 9 |

Israeli Government Programs

As a result of certain agreements between Medigus and ScoutCam Ltd. (for additional information about these agreements refer to – “CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE” below) the Israel Innovation Authority, or the IIA, approved a transfer of IIA know-how developed by Medigus in the framework of the Bio Medical Photonic Consortium, or the Medigus Consortium, to ScoutCam Ltd.

Accordingly, all rights and obligations with regard to the IIA under the Encouragement of Research, Development and Technological Innovation in the Industry Law, 5744-1984, or the Innovation Law, in connection with such know-how now apply to ScoutCam Ltd.

The following are details regarding the rights and obligations within the framework of ScoutCam Ltd.’s activity in the Medigus Consortium, which continue to apply to ScoutCam Ltd. notwithstanding the termination of the Medigus Consortium:

| (i) | The property rights to information which has been developed belongs to the Medigus Consortium member that developed it. However, the developing entity is obligated to provide the other members in the Medigus Consortium a license for the use of the new information, without consideration, provided that the other members do not transfer such information to any entity which is not a member of the Medigus Consortium. The provision of a license or of the right to use the new information to a third party is subject to approval by the administration of the MAGNET Program at the IIA; | |

| (ii) | The Medigus Consortium member is entitled to register a patent for the new information which has been developed by it within the framework of its activity in the Medigus Consortium. The foregoing registration does not require approval from the administration of the MAGNET Program at the IIA; and | |

| (iii) | The know-how and technology developed under the program is subject to the restrictions set forth under the Innovation Law, including restrictions on the transfer of such know-how and any manufacturing rights with respect thereto, without first obtaining the approval of the IIA. Such approval may entail additional payments to the IIA, as determined under the Innovation Law and regulations. |

Obligations relevant to us under the Innovation Law include the following:

| ● | Local Manufacturing Obligation. The terms of the grants under the Innovation Law require that we manufacture the products developed with these grants in Israel. Under the regulations promulgated under the Innovation Law, the products may be manufactured outside Israel by us or by another entity only if prior approval is received from the IIA (such approval is not required for the transfer of less than 10% of the manufacturing capacity in the aggregate, in which case a notice should be provided to the IIA). In general, due to manufacturing outside Israel, with respect to royalties bearing grants we would be required to pay royalties at an increased rate, usually 1% in addition to the standard rate and increased royalties cap (between 120% and 300% of the grants, depending on the manufacturing volume that is performed outside Israel). | |

| ● | Know-How Transfer Limitation. The Innovation Law restricts the ability to transfer, in any manner, know-how funded directly or indirectly by the IIA (sale of products is not prohibited), unless the IIA approves doing so and subject to the terms of the Innovation Law and of the IIA’s approval.

Among other things, transfer of IIA funded know-how outside of Israel requires prior approval of IIA and in certain circumstances is subject to certain payments to the IIA, calculated according to a formula provided under the Innovation Law. If we wish to transfer IIA funded know-how outside of Israel, the terms for approval will be determined according to the character of the transaction and the consideration paid to us for such transfer. The IIA approval to transfer know-how created, in whole or in part, in connection with a IIA-funded project to third party outside Israel where the transferring company remains an operating Israeli entity is subject to payment of a redemption fee to the IIA calculated according to a formula provided under the Innovation Law that is based, in general, on the ratio between the aggregate IIA grants to the company’s aggregate investments in the project that was funded by these IIA grants, multiplied by the transaction consideration, considering statutory depreciation and less royalties already paid to the IIA. The transfer of such know-how to a party outside Israel where the transferring company ceases to exist as an Israeli entity is subject to a redemption fee formula that is based, in general, on the ratio between aggregate IIA grants received by the company and the company’s aggregate research and development expenses, multiplied by the transaction consideration considering statutory depreciation and less royalties already paid to the IIA.

|

| 10 |

| The regulations promulgated under the Innovation Law establish a maximum payment of the redemption fee paid to the IIA under the above mentioned formulas and differentiates between two situations: (i) in the event that the company transfers its IIA funded know-how, in whole or in part, or is sold as part of an M&A transaction, and subsequently ceases to conduct business in Israel, the maximum redemption fee under the above mentioned formulas will be no more than six times the amount received (plus annual interest) for the applicable know-how being transferred, or the entire amount received from the IIA, as applicable; (ii) in the event that following the transactions described above (e.g. asset sale of IIA funded know-how or transfer as part of an M&A transaction) the company continues to conduct its research and development activity in Israel (for at least three years following such transfer and maintain staff of at least 75% of the number of research and development employees it had for the six months before the know-how was transferred and keeps the same scope of employment for such research and development staff), then the company is eligible for a reduced cap of the redemption fee of no more than three times the amounts received (plus annual interest) for the applicable know-how being transferred. In addition, special rules and payment formulas apply for certain kinds of transfers of know-how outside of Israel, such as R&D licenses. Transfer of IIA-funded know-how outside of Israel not according to the R&D Law may give rise to financial exposure as well as criminal liability. | ||

| ● | Approval of the transfer of IIA funded technology to another Israeli company may be granted only if the recipient assumes and abides by the provisions of the Innovation Law and related regulations, including the restrictions on the transfer of know-how and manufacturing rights outside of Israel (in addition, there will be an obligation to pay royalties to the IIA from the income of such sale transaction as part of the royalty payment obligation). | |

| ● | Approval to manufacture products outside of Israel or consent to the transfer of technology, if requested, might not be granted. Furthermore, the IIA may impose certain conditions on any arrangement under which it permits ScoutCam Ltd. to transfer technology or development out of Israel. |

item 1a. risk factors

Risk Factor Summary

Below is a summary of the principal factors that make an investment in the Company speculative or risky. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, and other risks that we face, can be found below, after this summary, and should be carefully considered.

Risks Related to Our Business, Operations and Financial Condition

| ● | We have had a limited operating history and may not be able to successfully operate our business or execute our business plan. | |

| ● | If we are unable to establish sales, marketing and distribution capabilities or enter into successful relationships with business targets and third parties to perform these services, we may not be successful in commercializing our products and technology. | |

| ● | We may require substantial additional funding, which may not be available to us on acceptable terms, or at all. | |

| ● | Our failure to effectively manage growth could impair our business. | |

| ● | Our commercial success depends upon the degree of market acceptance by prospective markets and industries. | |

| ● | Weakened global economic conditions may harm our industry, business and results of operations. | |

| ● | The continuing effects of the COVID-19 pandemic are highly unpredictable and could be significant, and the duration and extent to which this will impact our future results of operations and overall financial performance remains uncertain. |

| 11 |

Risk Related to Third Parties

| ● | Our reliance on third-party suppliers for most of the components of our products, including miniature video sensors could harm our ability to meet demand for our products in a timely and cost-effective manner. | |

| ● | We may not be able to manage our strategic partners. | |

| ● | We may not have sufficient manufacturing capabilities to satisfy any growing demand for our products. We may be unable to control the availability or cost of producing such products. |

Risks Related to Competition

| ● | We expect to face some competition possibly from our customer. If we cannot successfully compete there might be adverse effect on the company. | |

| ● | Failure to comply with anti-bribery, anti-corruption and anti-money laundering laws could subject us to penalties and other adverse consequences. |

Risks Related to Intellectual Property

●

|

We may not be able to obtain all possible patents or other intellectual property rights necessary to protect our proprietary technology and business.

| |

| ● | We may not be successful in enforcing our intellectual property rights against third parties. | |

| ● | We may be subject to infringement claims and other litigation, which could adversely affect our business. | |

| ● | Governmental regulation of non-practicing patent holders may adversely affect our business. |

General Risk Factors Related to Our Business

| ● | Our business and operations would suffer in the event of computer system failures, cyber-attacks, or deficiencies in our cyber-security. | |

| ● | We may be subject to product liability claims, product actions, including product recalls, and other field or regulatory actions that could be expensive, divert management’s attention, and harm our business. | |

| ● | Testing of our technologies potential applications for our products will be required and there is no assurance of regulatory approval. | |

| ● | We rely on highly skilled personnel, and, if we are unable to attract, retain, or motivate qualified personnel, we may not be able to operate our business effectively. |

Risks Related to this Offering and Our Common Stock

| ● | Although we have filed an application to list our securities on Nasdaq, there can be no assurance that our securities will be so listed or, if listed, that we will be able to comply with the continued listing standards. | |

| ● | Trading on the OTC Markets is volatile, sporadic and often thin, which could depress the market price of our common stock and make it difficult for our stockholders to resell their common stock. | |

| ● | Nevada law and provisions in our amended and restated articles of incorporation and amended and restated bylaws could make a merger, tender offer or proxy contest difficult, thereby depressing the market price of our common stock. | |

| ● | The market price of our common stock may be highly volatile and such volatility could cause you to lose some or all of your investment. | |

| ● | Because our common stock may be deemed a “penny stock,” it may be more difficult for investors to sell shares of our common stock, and the market price of our common stock may be adversely affected. | |

| ● | Compliance with the reporting requirements of federal securities laws can be expensive. | |

| ● | Our investors’ ownership in the Company may be diluted in the future. | |

| ● | Directors, executive officers, principal stockholders, and affiliated entities own a significant percentage of our capital stock, and they may make decisions that our stockholders do not consider to be in their best interests. | |

| ● | We do not anticipate paying any cash dividends in the foreseeable future. |

| 12 |

Risks Related to our Operations in Israel

| ● | We are subject to the risks of political, economic, health, and military instability in countries outside the United States in which we operate. | |

| ● | Political, economic and military instability in Israel may impede our ability to operate and harm our financial results. | |

| ● | It may be difficult for investors in the United States to enforce any judgments obtained against us or some of our directors or officers. | |

| ● | Exchange rate fluctuations between foreign currencies and the U.S. Dollar may negatively affect our earnings. | |

| ● | Certain technology developed and used by us received Israeli government grants for certain research and development activities. The terms of those grants require us to satisfy specified conditions in addition to repayment of the grants upon certain events. | |

| ● | We may become subject to claims for remuneration or royalties for assigned service invention rights by our employees, which could result in litigation and adversely affect our business. |

Certain factors may have a material adverse effect on our business, financial condition, and results of operations. You should carefully consider the following risks, together with all of the other information contained in this Annual Report on Form 10-K, including the sections titled “Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this Annual Report on Form 10-K. Any of the following risks could materially and adversely affect our business, strategies, prospects, financial condition, results of operations, and cash flows. In such case, the market price of our common stock could decline. Our business, prospects, financial condition, or results of operations could also be harmed by risks and uncertainties not currently known to us or that we currently do not believe are material.

Risks Related to Our Business, Operations and Financial Condition

We have had a limited operating history and may not be able to successfully operate our business or execute our business plan.

Given our limited operating history, it is hard to evaluate our proposed business and prospects. Our proposed business operations will be subject to numerous risks, uncertainties, expenses and difficulties associated with early-stage enterprises. Such risks include, but are not limited to, the following:

| ● | the absence of a lengthy operating history; | |

| ● | potential for ongoing operating losses; | |

| ● | operating in multiple currencies; | |

| ● | our ability to anticipate and adapt to a developing market(s); | |

| ● | acceptance of our products by the medical and industrial (I4.0) markets and consumers; | |

| ● | introducing innovation to conservative industries; | |

| ● | development risks and implementation of new software and algorithm for AI and cloud utilization; | |

| ● | insufficient capital to fully realize our operating plan; | |

| ● | a competitive environment; | |

| ● | the ability to identify, attract, and retain qualified personnel; and | |

| ● | operating in an environment that is highly regulated by a number of agencies. |

Because we are subject to these risks, evaluating our business may be difficult, our business strategy may be unsuccessful and we may be unable to address such risks in a cost-effective manner, if at all. We have not earned a profit in any full fiscal year since our inception, and we cannot be certain as to when or if we will achieve or maintain profitability. If we are unable to successfully address these risks our business could be harmed.

| 13 |

If we are unable to establish sales, marketing and distribution capabilities or enter into successful relationships with business targets and third parties to perform these services, we may not be successful in commercializing our products and technology.

Given that we are currently as a B2B company, our business is reliant on our ability to successfully attract potential business targets. Furthermore, we have a limited sales and marketing infrastructure and have limited experience in the sale, marketing, or distribution of our technologies beyond the B2B model. To achieve commercial success for our technologies or any future developed product, we will need to establish a sales and marketing infrastructure or to out-license such future products.

In the future, we may consider building a focused sales and marketing infrastructure to market any developed products and potentially other products in the United States or elsewhere in the world. There are risks involved with establishing our own sales, marketing, and distribution capabilities. For example, recruiting and training a sales force could be expensive and time consuming and could delay any product launch. This may be costly, and our investment would be lost if we cannot retain or reposition our sales and marketing personnel.

Factors that may inhibit our efforts to commercialize any future products on our own include:

| ● | we have not recruited adequate numbers of effective sales and marketing personnel; | |

| ● | the challenge of sales personnel to obtain access to potential customers; | |

| ● | the lack of complementary products to be offered by sales personnel or lack of product-market fit, which may put us at a competitive disadvantage relative to companies with more extensive product lines; and | |

| ● | unforeseen costs and expenses associated with creating an independent sales and marketing organization. |

If we are unable to establish our own sales, marketing, and distribution capabilities or enter into successful arrangements with third parties to perform these services, we will not be successful in commercializing our technologies or any future products we may develop and our revenues and profitability may be materially adversely affected.

We may require substantial additional funding, which may not be available to us on acceptable terms, or at all.

Our cash and short-term deposit balance as of December 31, 2022 was $13.1 million. We may require additional funding to fund and grow our operations and to develop certain products. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. In the event we required additional capital, the inability to obtain such capital will restrict our ability to grow and may reduce our ability to continue to conduct business operations. If we require and are unable to obtain additional financing, we will likely be required to curtail our development plans. In that event, current stockholders would likely experience a loss of most or all of their investment. Additional funding that we do obtain may be dilutive to the interests of existing stockholders.

Our failure to effectively manage growth could impair our business.

Our business strategy contemplates a period of rapid growth which may put a strain on our administrative and operational resources, and our funding requirements. Our ability to effectively manage growth will require us to successfully expand the capabilities of our operational and management systems, and to attract, train, manage, and retain qualified personnel. There can be no assurance that we will be able to do so, particularly if losses continue and we are unable to obtain sufficient financing. If we are unable to appropriately manage growth, our business, prospects, financial condition, and results of operations could be adversely affected.

| 14 |

Our commercial success depends upon the degree of market acceptance by such prospective markets and industries as defense and aviation, as well as by the medical community.

Our current business model is that of a B2B approach in which we seek to identify target businesses interested in integrating our technology or commissioning individual projects using our technology. Any product that we commission or that is brought to the market may or may not gain market acceptance by prospective customers. The commercial success of our technologies, commissioned products, and any future product that we may develop depends in part on the medical community as well as other industries for various use cases, depending on the acceptance by such industries of our commissioned products as a useful and cost-effective solution compared to current technologies. During 2022, we commenced proactive market penetration into industries other than the biomedical sector, such as the defense and aviation industries. If our technology or any future product that we may develop does not achieve an adequate level of acceptance, or does not garner significant commercial appeal, we may not generate significant revenue and may not become profitable. The degree of market acceptance will depend on a number of factors, including:

| ● | the cost, safety, efficacy/performance, perceived value and convenience of our technology and any commissioned product and any future product that we may develop in relation to alternative products; |

| ● | the ability of third parties to enter into relationships with us; | |

| ● | the effectiveness of our sales and marketing efforts; | |

| ● | the strength of marketing and distribution support for, and timing of market introduction of, competing technology and products; and | |

| ● | publicity concerning our technology or commissioned products or competing technology and products. |

Our efforts to penetrate industries and educate the marketplace on the benefits of our technology, and reasons to seek the commissioning of products based on our technology, may require significant resources and may never be successful. Such efforts to educate the marketplace may require more resources than are required by conventional technologies.

Weakened global economic conditions may harm our industry, business and results of operations.

Our overall performance depends in part on worldwide economic conditions. Global financial developments and downturns seemingly unrelated to us or may harm us. The United States and other key international economies have been affected from time to time by falling demand for a variety of goods and services, restricted credit, reduced liquidity, reduced corporate profitability, volatility in credit, equity and foreign exchange markets, bankruptcies, inflation and overall uncertainty with respect to the economy, including with respect to tariff and trade issues. Weak economic conditions or the perception thereof, or significant uncertainty regarding the stability of financial markets related to stock market volatility, inflation, recession, changes in tariffs, trade agreements, or governmental fiscal, monetary and tax policies, among others, could adversely impact our business, financial condition and operating results.

More recently, inflation rates in the U.S. have been higher than in previous years, which may result in decreased demand for our products and services, increases in our operating costs including our labor costs, constrained credit and liquidity, reduced government spending and volatility in financial markets. The Federal Reserve has raised, and may again raise, interest rates in response to concerns over inflation risk. Increases in interest rates on credit and debt that would increase the cost of any borrowing that we may make from time to time and could impact our ability to access the capital markets. Increases in interest rates, especially if coupled with reduced government spending and volatility in financial markets, may have the effect of further increasing economic uncertainty and heightening these risks. In an inflationary environment, we may be unable to raise the sales prices of our products at or above the rate at which our costs increase, which could reduce our profit margins and have a material adverse effect on our financial results and net income. We also may experience lower than expected sales and potential adverse impacts on our competitive position if there is a decrease in consumer spending or a negative reaction to our pricing. A reduction in our revenue would be detrimental to our profitability and financial condition and could also have an adverse impact on our future growth.

| 15 |

The continuing effects of the COVID-19 pandemic are highly unpredictable and could be significant, and the duration and extent to which this will impact our future results of operations and overall financial performance remains uncertain.

The extent to which the COVID-19 pandemic ultimately impacts our business will depend on future developments, which are highly uncertain and cannot be predicted, such as the duration of future outbreaks, including current and subsequent variants of COVID-19, travel restrictions and social distancing in Israel, the United States and other countries, business closures or business disruptions, and the effectiveness of actions taken in Israel, the United States and other countries to contain and treat the disease and to address its impact, including on financial markets or otherwise. These measures have impacted, and may further impact, our suppliers and other business partners from conducting business activities as usual (including, without limitation, the availability and pricing of materials, manufacturing and delivery efforts, clinical trials and other aspects that may affect our business) for an unknown period of time. In addition, we, our suppliers and other business partners may experience significant impairments of business activities due to operational shutdowns or suspensions that may be requested or mandated by national or local governmental authorities or self-imposed by us, our suppliers or other business partners.

Risk Related to Third Parties

Our reliance on third-party suppliers for most of the components of our products could harm our ability to meet demand for our products in a timely and cost-effective manner.

We rely on our third-party suppliers to obtain an adequate supply of quality components on a timely basis with favorable terms to manufacture our commissioned products. Some of those components that we sell are provided to us by a limited number of suppliers. We will be subject to disruptions in our operations if our sole or limited supply contract manufacturers decrease or stop production of components or do not produce components and products of sufficient quantity or quality. Alternative sources for our components will not always be available.

Though we attempt to ensure the availability of more than one supplier for each important component in any product that we commission, the number of suppliers engaged in the provision of miniature video sensors which are suitable for our CMOS technology mainly in the medical domain is very limited, and therefore in some cases we engage with a single supplier, which may result in our dependency on such supplier. This is the case regarding sensors for the CMOS type technology that are produced by a single supplier in the United States. As we do not have a direct general contract in place with this supplier, there is no contractual commitment on the part of such supplier for any set quantity of such sensors. The loss of our sole supplier in providing us with miniature sensors for our CMOS technology products mainly in the medical domain, and our inability or delay in finding a suitable replacement supplier, could negatively affect our business, financial condition, results of operations, and reputation.

We are also subject to other risks inherent in the manufacturing of our products and their supply chain, including industrial accidents, natural disasters (including as a result of climate change), environmental events, strikes, and other labor disputes, capacity constraints, disruptions in material or packaging supplies, as well as global shortages, disruptions in supply chain or information technology, loss or impairment of key manufacturing sites or suppliers, product quality control, safety, increase in commodity prices and energy costs, licensing requirements and other regulatory issues, as well as other external factors over which we have no control. If such an event were to occur, it could have an adverse effect on our business, financial condition, and results of operations.

In addition, if we cannot supply commissioned products or future potentially developed products due to a lack of components or are unable to utilize other components in a timely manner, our business will be significantly harmed. If inventory shortages occur, they could be expected to have a material and adverse effect on our future revenues and ability to effectively project future sales and operating results.

| 16 |

We may not be able to manage our strategic partners effectively.

We have entered into, and we may continue to enter into, strategic alliances with third parties to gain access to new and innovative technologies and markets. These parties are often large, established companies. Negotiating and performing under these arrangements involves significant time and expense, and we may not have sufficient resources to devote to our strategic alliances, particularly those with companies that have significantly greater financial and other resources than we do. The anticipated benefits of these arrangements may never materialize and performing under these arrangements may adversely affect our results of operations.

Failure to manage our current partners effectively or enter into new strategic alliances may affect our success in executing our business plan and may adversely affect our business, financial condition, and results of operation. We may not realize the anticipated benefits of any or all partnerships or may not realize them in the time frame expected.

We may not have sufficient manufacturing capabilities to satisfy any growing demand for our commissioned products. We may be unable to control the availability or cost of producing such products.

Our current manufacturing capabilities may not reach the required production levels necessary in order to meet growing demands for any products we may commission or future products we may develop. There can be no assurance that our commissioned products can be manufactured at our desired commercial quantities, in compliance with our requirements, and at an acceptable cost. Any such failure could delay or prevent us from shipping said products and marketing our technologies in accordance with our target growth strategies.

Risks Related to Competition

We expect to face competition. If we cannot successfully compete with new or existing technologies or future developed products, our marketing and sales will suffer and we may never be profitable.

We expect to compete against existing technologies and proven products in different industries. In addition, some of these competitors, either alone or together with their collaborative partners, operate larger research and development programs than we do, and may have substantially greater financial resources than we do, as well as significantly greater experience in obtaining regulatory approvals applicable to the commercialization of relevant competitive technologies and future products.

Failure to comply with anti-bribery, anti-corruption and anti-money laundering laws could subject us to penalties and other adverse consequences.

We are subject to the U.S. Foreign Corrupt Practices Act, or the FCPA, Chapter 9 (sub-chapter 5) of the Israeli Penal Law, 5737-1977, and the Israeli Prohibition on Money Laundering Law, 5760-2000, collectively, the Israeli Anti-Corruption Laws, and the UK Bribery Act 2010, or UK Bribery Act, and other anticorruption, anti-bribery and anti-money laundering laws in the jurisdictions in which we do business, both domestic and abroad. These laws generally prohibit us and our employees from improperly influencing government officials or commercial parties in order to obtain or retain business, direct business to any person or gain any advantage. The FCPA, the Israeli Anti-Corruption Laws, the UK Bribery Act, and other applicable anti-bribery and anti-corruption laws also may hold us liable for acts of corruption and bribery committed by our third-party business partners, representatives and agents. In addition, we leverage third parties to sell our products and conduct our business abroad. We and our third-party business partners, representatives and agents may have direct or indirect interactions with officials and employees of government agencies or state-owned or affiliated entities and we may be held liable for the corrupt or other illegal activities of these third-party business partners and intermediaries, our employees, representatives, contractors, channel partners and agents, even if we do not explicitly authorize such activities. These laws also require that we keep accurate books and records and maintain internal controls and compliance procedures designed to prevent any such actions. While we have policies and procedures to address compliance with such laws, we cannot assure you that our employees and agents will not take actions in violation of our policies or applicable law, for which we may be ultimately held responsible and our exposure for violating these laws increases as our international presence is established and as we increase sales and operations in foreign jurisdictions. Any violation of the FCPA, the Israeli Anti-Corruption Laws, the UK Bribery Act, or other applicable anti-bribery, anti-corruption laws and anti-money laundering laws could result in whistleblower complaints, adverse media coverage, investigations, imposition of significant legal fees, loss of export privileges, severe criminal or civil sanctions or suspension or debarment from U.S. government contracts, substantial diversion of management’s attention, a decline in the market price of our common stock or overall adverse consequences to our reputation and business, all of which may have an adverse effect on our results of operations and financial condition.

| 17 |

Risks Related to Intellectual Property

We may not be able to obtain patents or other intellectual property rights necessary to protect our proprietary technology and business.

We may seek to patent concepts, components, processes, designs and methods, and other inventions and technologies that we consider to have commercial value or that will likely give us a technological advantage. Despite devoting resources to the research and development of proprietary technology, we may not be able to develop technology that is patentable or protectable. Patents may not be issued in connection with pending patent applications, and claims allowed may not be sufficient to allow them to use the inventions that they create exclusively. Furthermore, any patents issued could be challenged, re-examined, held invalid or unenforceable, or circumvented and may not provide sufficient protection or a competitive advantage. In addition, despite efforts to protect and maintain patents, competitors and other third parties may be able to design around their patents or develop products similar to our work products that are not within the scope of their patents. Finally, patents provide certain statutory protection only for a limited period of time that varies depending on the jurisdiction and type of patent.

Prosecution and protection of the rights sought in patent applications and patents can be costly, lengthy, and uncertain, often involve complex legal and factual issues, and consume significant time and resources. In addition, the breadth of claims allowed in our patents, their enforceability, and our ability to protect and maintain them cannot be predicted with any certainty. The laws of certain countries may not protect intellectual property rights to the same extent as the laws of the United States. Even if our patents are held to be valid and enforceable in a certain jurisdiction, any legal proceedings that we may initiate against third parties to enforce such patents will likely be expensive, take significant time, and divert management’s attention from other business matters. We cannot assure that any of our issued patents or pending patent applications provide any protectable, maintainable, or enforceable rights or competitive advantages to us.

In addition to patents, we plan to rely on a combination of copyrights, trademarks, trade secrets, and other related laws and confidentiality procedures and contractual provisions to protect, maintain, and enforce our proprietary technology and intellectual property rights in the United States and other countries. However, our ability to protect our brands by registering certain trademarks may be limited. In addition, while we will generally enter into confidentiality and nondisclosure agreements with our employees, consultants, contract manufacturers, distributors and resellers, and with others to attempt to limit access to and distribution of our proprietary and confidential information, it is possible that:

| ● | misappropriation of our proprietary and confidential information, including technology, will nevertheless occur; |

| ● | our confidentiality agreements will not be honored or may be rendered unenforceable; |

| ● | third parties will independently develop equivalent, superior, or competitive technology or products; |

| ● | disputes will arise with our current or future strategic licensees, customers, or others concerning the ownership, validity, enforceability, use, patentability, or registrability of intellectual property; or |

| ● | unauthorized disclosure of our know-how, trade secrets, or other proprietary or confidential information will occur. |

We may not be successful in enforcing our intellectual property rights against third parties.

Unlicensed copying and use of our intellectual property or infringement of our intellectual property rights may result in the loss of revenue to us and cause us other harm. We seek diligently to enforce our intellectual property rights. Although we devote significant resources to developing and protecting our technologies, and evaluating potential competitors of our technologies for infringement of our intellectual property rights, these infringements may nonetheless go undetected or may arise in the future. In the ordinary course of business, we encounter companies that we suspect are infringing on our intellectual property rights. When we encounter a company that we suspect is infringing our intellectual property rights, we may try to analyze their products and/or try to negotiate a license arrangement with such party. If we try and are unable to negotiate a license or secure the agreement of such alleged infringing party to cease its activities, we must make decisions as to how best to enforce our intellectual property rights.

| 18 |

The process of negotiating a license with a third party can be lengthy, and may take months or even years in some circumstances. Even if we are successful in securing a license agreement, there can be no assurance that our technologies will be used in a product that is ultimately brought to market, achieves commercial acceptance or results in significant royalties to us. We generally incur expense prior to entering into our license agreements, generating a license fee, and establishing a royalty stream from each customer. We may incur costs in any particular period before any associated revenue stream begins, if at all. Further, it is possible that third parties who we believe are infringing our intellectual property rights are unwilling to license our intellectual property from us on terms we can accept, or at all.

If we cannot persuade a third party who we believe is infringing our technology to enter into a license with us, we may be required to consider other alternatives to enforce our rights, including commencing litigation. The decision to commence litigation over infringement of a patent is complex and may lead to several risks to us, including the following, among others:

| ● | the time, significant expense and distraction to management of managing such litigation; | |

| ● | the uncertainty of litigation and its potential outcomes; | |

| ● | the possibility that in the course of such litigation, the defendant may challenge the validity of our patents, which could result in a re-examination or post grant review of our patents and the possibility that our patents may be limited in scope or invalidated altogether; | |

| ● | the potential that the defendant may successfully persuade a court that their technology or products do not infringe our intellectual property rights; | |

| ● | the impact of such litigation on other licensing relationships we have or seek to establish, including the timing of renewing or entering into such relationships, as applicable, as well as the terms of such relationships; and | |

| ● | adverse publicity to us or harm to relationships we have with customers or others. |

Also, enforcement of patent protection throughout the world is generally established on a country-by-country basis and we may not have as much success enforcing our patents in foreign jurisdictions as in the United States. Further, in some instances, certain foreign governmental entities that might infringe our intellectual property rights may enjoy sovereign immunity from such claims. Consequently, effective protection of our intellectual property rights may be unavailable or limited.

Defendants in any litigation we consider commencing may have substantially greater financial and management resources necessary to manage litigation than we have. Further, such potential defendants may also have their own substantial patent portfolio. Patent litigation can endure for years and result in millions of dollars of expenses. If our counterparties in such litigation have substantially greater resources than we have, we may not be able to withstand the time, expense, or distraction of the litigation, even though we may have a better litigation position than such counterparties. In such instances we may not recover the expenses of litigation, and we may be required to enter into settlement agreements that would be adverse to us or our intellectual property portfolio.

The foregoing and other factors may cause us not to file or continue litigation against alleged infringers of our intellectual property rights, or may cause us not to file for, or pursue, patent protection for our inventive technology, in certain jurisdictions. Our failure to seek to enforce our intellectual property rights may weaken our ability to enforce our intellectual property in the future or make our efforts to license our intellectual property rights more difficult.

If we fail to protect our intellectual property rights adequately, if there are adverse changes in applicable laws, or if we become involved in litigation relating to our intellectual property rights or the intellectual property rights of others, our business could be seriously harmed. In such cases, the value ascribed to our intellectual property could diminish, we may incur significant legal expenses that could harm our results of operations, and our patents or other intellectual property rights may be limited or invalidated. Any of the foregoing could have a negative effect on the value of our common stock.

| 19 |

We may be subject to infringement claims and other litigation, which could adversely affect our business.

As more companies engage in business activities relating to predictive maintenance solutions, and develop corresponding intellectual property rights, it is increasingly likely that claims may arise which assert that some of our products or services infringe upon other parties’ intellectual property rights. These claims could subject us to costly litigation and divert management resources. These claims may require us to pay significant damages, cease production of infringing products, terminate our use of infringing technology, or develop non-infringing technologies. In these circumstances, continued use of our technology may require that we acquire licenses to the intellectual property that is the subject of the alleged infringement, and we might not be able to obtain these licenses on commercially reasonable terms or at all. Our use of protected technology may result in liability that could threaten our continued operation.

Some of the contracts with our customers include indemnity and similar provisions regarding our non-infringement of third-party intellectual property rights. As deployment of our technology increases, and more companies enter our markets, the likelihood of a third party lawsuit resulting from these provisions increases. If an infringement arose in a context governed by such a contract, we may have to refund to our customer amounts already paid to us or pay significant damages, or we may be sued by the party whose intellectual property has allegedly been infringed upon.

Governmental regulation of non-practicing patent holders may adversely affect our business.

Governmental policymakers and commercial participants have proposed reforming U.S. patent laws and regulations in a manner that may limit a patent-holder’s ability to enforce its patents against others to the extent that the holder is not practicing the subject matter of the patent at issue. The U.S. International Trade Commission has also recently taken certain actions that have been viewed as unfavorable to patentees seeking recourse in this forum. While we cannot predict what form any new patent reform laws or regulations may ultimately take, or what impact they may have on our business, any laws or regulations that restrict our ability to enforce our patent rights against third parties could have a material adverse effect on our business.

General Risk Factors Related to Our Business

Our business and operations would suffer in the event of computer system failures, cyber-attacks, or deficiencies in our cyber-security.