UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

OR

For the transition period from to

Commission File Number

(Exact name of registrant as specified in its charter)

| (I.R.S. Employer |

(Address of principal executive offices) | (Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

QTS Realty Trust, Inc. | QualityTech, LP | Yes ☐ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

QTS Realty Trust, Inc. | Yes ☐ | QualityTech, LP | Yes ☒ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

QTS Realty Trust, Inc. | QualityTech, LP |

(1) QualityTech, LP is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, but has filed all such reports during the preceding 12 months.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

QTS Realty Trust, Inc. | QualityTech, LP |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

QTS Realty Trust, Inc.

☒ | Accelerated filer | ☐ | |

Non-accelerated filer | ☐ | Smaller reporting company | |

Emerging growth company |

QualityTech, LP

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. □

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

QTS Realty Trust, Inc. | Yes | QualityTech, LP | Yes |

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the Class A common stock, $0.01 par value per share, was last sold at June 30, 2019 was approximately $

Documents Incorporated by Reference

Portions of the Definitive Proxy Statement for our 2020 Annual Meeting of Stockholders are incorporated by reference into Part III of this report. We expect to file our proxy statement within 120 days after December 31, 2019.

TABLE OF CONTENTS

1

EXPLANATORY NOTE

This report combines the annual reports on Form 10-K of QTS Realty Trust, Inc. (“QTS”) and QualityTech, LP, a Delaware limited partnership, which is our operating partnership (the “Operating Partnership”). This report also includes the financial statements of QTS and those of the Operating Partnership, although it presents only one set of combined notes for QTS’ financial statements and those of the Operating Partnership.

Substantially all of QTS’s assets are held by, and its operations are conducted through, the Operating Partnership. QTS is the sole general partner of the Operating Partnership, and, as of December 31, 2019, its only material asset consisted of its ownership of approximately 89.7% of the Operating Partnership. Management operates QTS and the Operating Partnership as one business. The management of QTS consists of the same employees as the management of the Operating Partnership. QTS does not conduct business itself, other than acting as the sole general partner of the Operating Partnership and issuing public equity from time to time. QTS has not issued or guaranteed any indebtedness. Except for net proceeds from public equity issuances by QTS, which are contributed to the Operating Partnership in exchange for units of limited partnership interest of the Operating Partnership, the Operating Partnership generates all remaining capital required by our business through its operations, the direct or indirect incurrence of indebtedness, and the issuance of partnership units. Therefore, as general partner with control of the Operating Partnership, QTS consolidates the Operating Partnership for financial reporting purposes.

We believe, therefore, that a combined presentation with respect to QTS and the Operating Partnership, including providing one set of notes for the financial statements of QTS and the Operating Partnership, provides the following benefits:

| ● | enhances investors’ understanding of QTS and the Operating Partnership by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

| ● | eliminates duplicative disclosure and provides a more streamlined and readable presentation since a substantial portion of the disclosure in this report applies to both QTS and the Operating Partnership; and |

| ● | creates time and cost efficiencies through the preparation of one presentation instead of two separate presentations. |

In addition, in light of these combined disclosures, we believe it is important for investors to understand the few differences between QTS and the Operating Partnership in the context of how QTS and the Operating Partnership operate as a consolidated company. With respect to balance sheets, the presentation of stockholders’ equity and partners’ capital are the main areas of difference between the consolidated balance sheets of QTS and those of the Operating Partnership. On the Operating Partnership’s consolidated balance sheets, partners’ capital includes partnership units that are owned by QTS and other partners. On QTS’ consolidated balance sheets, stockholders’ equity includes common stock, additional paid-in capital, accumulated other comprehensive income (loss) and accumulated dividends in excess of earnings. The remaining equity reflected on QTS’s consolidated balance sheet is the portion of net assets that are retained by partners other than QTS, referred to as noncontrolling interests. With respect to statements of operations, the primary difference in QTS’ Statements of Operations and Statements of Comprehensive Income is that for net income (loss), QTS retains its proportionate share of the net income (loss) based on its ownership of the Operating Partnership, with the remaining balance being retained by the Operating Partnership.

In order to highlight the few differences between QTS and the Operating Partnership, there are sections and disclosure in this report that discuss QTS and the Operating Partnership separately, including separate financial statements, separate audit reports, separate controls and procedures sections, separate Exhibit 31 and 32 certifications, and separate presentation of certain accompanying notes to the financial statements, including Note 10 – Partners’ Capital, Equity and Incentive Compensation Plans and Note 18 – Quarterly Financial Information (unaudited). In the sections that combine disclosure for QTS and the Operating Partnership, this report refers to actions or holdings as being actions or holdings of “we,” “our,” “us,” “our company” and “the Company.” Although the Operating Partnership is generally the entity that enters into contracts, holds assets and issues debt, we believe that these general references to “we,” “our,” “us,” “our company” and “the Company” in this context are appropriate because the business is one enterprise operated through the Operating Partnership.

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this Form 10-K constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In particular, statements pertaining to our capital resources, portfolio performance, results of operations, anticipated growth in our funds from operations and anticipated market conditions contain forward-looking statements. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You also can identify forward-looking statements by discussions of strategy, plans or intentions.

The forward-looking statements contained in this Form 10-K reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

| ● | adverse economic or real estate developments in our markets or the technology industry; |

| ● | obsolescence or reduction in marketability of our infrastructure due to changing industry demands; |

| ● | global, national and local economic conditions; |

| ● | risks related to our international operations; |

| ● | difficulties in identifying properties to acquire and completing acquisitions; |

| ● | our failure to successfully develop, redevelop and operate acquired properties or lines of business |

| ● | significant increases in construction and development costs; |

| ● | the increasingly competitive environment in which we operate; |

| ● | defaults on, or termination or non-renewal of, leases by customers; |

| ● | decreased rental rates or increased vacancy rates; |

| ● | increased interest rates and operating costs, including increased energy costs; |

| ● | financing risks, including our failure to obtain necessary outside financing; |

| ● | dependence on third parties to provide Internet, telecommunications and network connectivity to our data centers; |

| ● | our failure to qualify and maintain QTS’ qualification as a real estate investment trust (“REIT”); |

| ● | environmental uncertainties and risks related to natural disasters; |

| ● | financial market fluctuations; |

| ● | violations of our prohibition on harassment could result in liabilities and/or litigation; |

| ● | the expansion of social media platform presents new risks and challenges; |

| ● | changes in real estate and zoning laws, revaluations for tax purposes and increases in real property tax rates; and; |

| ● | limitations inherent in our current and any future joint venture investments, such as lack of sole-decision making authority and reliance on our partners’ financial condition |

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes. For a further discussion of these and other factors that could cause our future results to differ materially from any forward-looking statements, see the section entitled “Risk Factors.”

3

PART I

ITEM 1. BUSINESS

Unless the context requires otherwise, references in this Form 10-K to “we,” “our,” “us,” “our company” and “the Company” refer to QTS Realty Trust, Inc. (“QTS”), a Maryland corporation, together with its consolidated subsidiaries, including QualityTech, LP, a Delaware limited partnership, which we refer to in this Form 10-K as the “Operating Partnership” or “predecessor.”

Overview

QTS is a leading provider of data center solutions to the world’s largest and most sophisticated hyperscale technology companies, enterprises and government agencies. Through our technology-enabled platform, delivered across mega scale data center infrastructure, we offer a comprehensive portfolio of secure and compliant IT solutions. Our data centers are facilities that power and support our customers’ IT infrastructure equipment and provide seamless access and connectivity to a range of cloud, communications and IT services providers. Across our broad footprint of strategically-located data centers, we provide flexible, scalable, and secure IT solutions including data center space, power and cooling, connectivity and value-add managed services for more than 1,200 customers in the financial services, healthcare, retail, government, and technology industries, among others. We build out our data center facilities to accommodate both multi-tenant environments (hybrid colocation) and dedicated build-to-suit requirements that involve significant amounts of space and power (hyperscale), depending on the needs and availability of each facility at that time. We believe that we own and operate one of the largest portfolios of multi-tenant data centers in the United States, as measured by gross square footage, and have the capacity to nearly double our sellable data center raised floor space without constructing or acquiring any new buildings. In addition, we own approximately 730 acres of land that is available at our data center properties that provides us with the opportunity to significantly expand our capacity to further support future demand from current and new potential customers.

We operate a portfolio of 24 data centers located throughout the United States, Canada and Europe. Across our footprint, our data centers are concentrated in the markets which we believe offer the highest growth opportunities. Our data centers are highly specialized, mission-critical facilities utilized by our customers to store, power and cool the server, storage, and networking equipment that support their most critical business systems and processes. We believe that our data centers are best-in-class and engineered to adhere to the highest specifications commercially available to customers, providing fully redundant, high-density power and cooling sufficient to meet the needs of the largest companies and organizations in the world. We have demonstrated a strong operating track record of “five-nines” (99.999%) reliability since QTS’ inception.

QTS is a Maryland corporation formed on May 17, 2013 and is the sole general partner and majority owner of QualityTech, LP, our operating partnership (the “Operating Partnership”). Substantially all of our assets are held by, and our operations are conducted through, the Operating Partnership. QTS’ Class A common stock trades on the New York Stock Exchange under the ticker symbol “QTS.”

The Operating Partnership is a Delaware limited partnership formed on August 5, 2009 and was QTS’ historical predecessor prior to QTS’s initial public offering on October 15, 2013 (the “IPO”), having operated the Company’s business until the IPO. As of December 31, 2019, QTS owned an approximate 89.7% ownership interest in the Operating Partnership.

We believe that QTS has operated and has been organized in conformity with the requirements for qualification and taxation as a REIT commencing with its taxable year ended December 31, 2013. Our qualification as a REIT, and maintenance of such qualification, depends upon our ability to meet, on a continuing basis, various complex requirements under the Internal Revenue Code of 1986, as amended (the “Code”) relating to, among other things, the sources of our gross income, the composition and values of our assets, our distributions to our stockholders and the concentration of ownership of our equity shares.

Our Portfolio

We operate 24 data centers located throughout the United States, Canada and Europe, containing an aggregate of approximately 7.2 million gross square feet of space, including approximately 3.2 million “basis-of-design” raised floor

4

square feet (approximately 96.0% of which is wholly owned by us including our data center in Santa Clara which is subject to a long-term ground lease), which represents the total sellable data center raised floor potential of our existing data center facilities. This reflects the maximum amount of space in our existing buildings that could be leased following full build-out, depending on the space and power configuration that we deploy. As of December 31, 2019, this space included approximately 1.7 million raised floor operating net rentable square feet, or NRSF, plus approximately 1.6 million square feet of additional raised floor in our development pipeline, of which approximately 167,000 raised floor square feet is expected to become operational by December 31, 2020. Of the total 167,000 raised floor square feet in our development pipeline that is expected to become operational by December 31, 2020, approximately 142,000 square feet was related to customer leases which had been executed as of December 31, 2019 but not yet commenced. Our facilities collectively have access to approximately 894 megawatts (“MW”) of available utility power. Access to power is typically the most limiting and expensive component in developing a data center and, as such, we believe our significant access to power represents an important competitive advantage.

We account for the operations of all our properties in one reporting segment.

Our Customer Base

Our data center facilities are designed with the flexibility to support a diverse set of solutions and customers. Our customer base is comprised of more than 1,200 different companies of all sizes representing an array of industries, each with unique and varied business models and needs. We serve Fortune 1000 companies as well as small and medium-sized businesses, or SMBs, including financial institutions, healthcare companies, retail companies, government agencies, communications service providers, software companies and global Internet companies.

We have customers that range from large enterprise and technology companies with significant IT expertise and data center requirements, including financial institutions, “Big Four” accounting firms and the world’s largest global Internet and cloud companies, to major healthcare, telecommunications and software and web-based companies.

As a result of our diverse customer base, customer concentration in our portfolio is limited. As of December 31, 2019, only five of our more than 1,200 customers individually accounted for more than 3% of our monthly recurring revenue (“MRR”), with the largest customer accounting for approximately 10.9% of our MRR and the next largest customer accounting for only 5.8% of our MRR.

The majority of our MRR is generated from customers deployed in our U.S. data center locations. Customers deployed in our U.S. data center locations accounted for $33.6 million, $31.0 million and $31.3 million of total MRR as of December 31, 2019, 2018 and 2017, respectively, and MRR from our international locations represented $0.5 million, $0.2 million and $0.4 million of MRR as of December 31, 2019, 2018 and 2017, respectively. As of December 31, 2019, our booked-not-billed MRR balance (which represents customer leases that have been executed, but for which lease payments have not commenced as of December 31, 2019) was approximately $7.8 million, or $93.1 million of annualized rent. As of December 31, 2018, our booked-not-billed MRR balance (which represents customer leases that have been executed, but for which lease payments have not commenced as of December 31, 2018) was approximately $5.2 million, or $62.6 million of annualized rent.

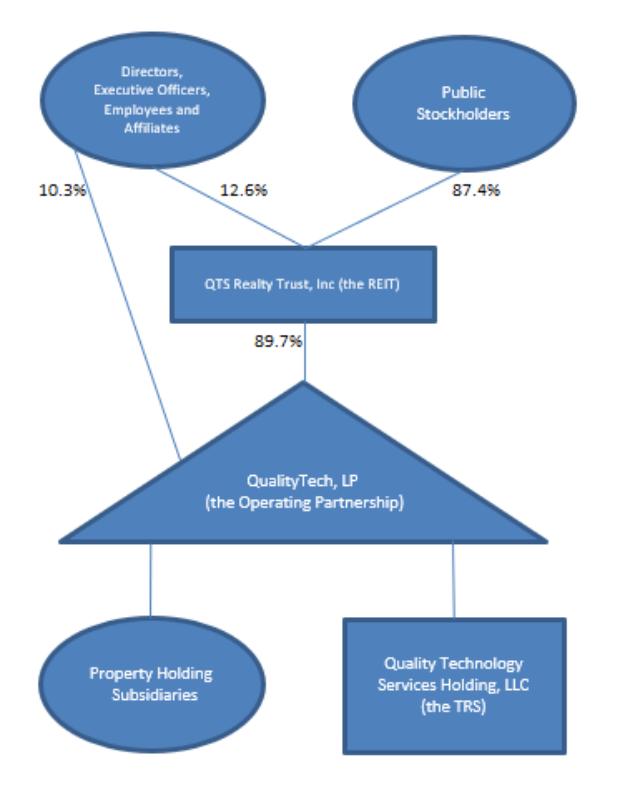

Our Structure

Substantially all of our assets are held by, and our operations are conducted through, the Operating Partnership. Our interest in the Operating Partnership entitles us to share in cash distributions from, and in the profits and losses of, the Operating Partnership in proportion to our percentage ownership. As the sole general partner of the Operating Partnership, we generally have the exclusive power under the Operating Partnership’s partnership agreement to manage and conduct the Operating Partnership’s business and affairs.

5

The following diagram depicts our ownership structure, on a non-diluted basis as of December 31, 2019.

Our Competitive Strengths

We believe that we are uniquely positioned in the data center industry and distinguish ourselves from other data center providers through the following competitive strengths:

| ● | Software-Defined Data Center Platform. QTS’ Service Delivery Platform (“SDP”) is a software-defined orchestration platform that empowers customers to interact with their data and QTS services by providing real-time visibility, access and dynamic control of critical metrics across hybrid environments from a single platform. Collectively, the ability to digitize, analyze and automate significant amounts of data through SDP enables customers to innovate, make better business decisions and maximize their outsourced IT investments both within QTS and across multiple integrated service providers. |

| ● | Platform Anchored by Strategically Located, Owned “Mega” Data Centers. Our larger “mega” data centers are located in Ashburn, Atlanta (DC-1) (formerly known as our Atlanta Metro facility), Atlanta-Suwanee, Chicago, Fort Worth, Irving, Piscataway, Princeton, Richmond and Manassas (which we contributed to an unconsolidated entity), with future sites available in Phoenix and Hillsboro. Our facilities are constructed with the flexibility and capacity to support multi-tenant environments across a broad range of customer types, sizes and IT infrastructure requirements, which we believe delivers greater efficiency than single-use or smaller scale data centers. We believe that our data centers are engineered to among the highest specifications commercially available. As of December 31, 2019, our portfolio of 24 data centers (16 of which are wholly |

6

| owned, representing 96.0% of our raised square feet, including our data center in Santa Clara which is subject to a long-term ground lease) provides the opportunity to nearly double our sellable data center raised floor capacity without constructing or acquiring any new buildings. In addition, we own approximately 730 acres of land at our existing data center properties that provides us with the opportunity to significantly expand our capacity to further support future demand from current and new potential customers. |

| ● | Substantial Data Center Development Expertise. We have gained substantial expertise in developing data center facilities through the acquisition and redevelopment and/or construction of our operating facilities. Our data center development strategy is primarily focused on “mega” scale facilities that allow for significant incremental growth opportunity, either through ground up development or redevelopment of existing data center powered shell footprint. Our data center development strategy allows us to rapidly scale our developments in a modular manner to coincide with customer demand, and drives higher efficiency into our model through increased operating and build cost leverage at scale. |

| ● | Balanced Approach to Hyperscale and Hybrid Colocation Verticals. The scale of our facilities combined with our innovative SDP platform and world-class customer service capability, gives us the ability to meet the needs of a broad set of customers ranging from large hyperscale users to smaller enterprises and government agencies. We believe customers will continue to have evolving and diverse IT needs and will prefer providers that can offer the flexibility, scalability and technology solutions that de-risk their future IT journey. We believe our ability to provide solutions to a broad addressable market enhances our leasing velocity, diversifies our customer mix, results in more balanced lease terms and optimizes cash flows from our assets. |

| ● | Diversified, High-Quality Customer Base. As of December 31, 2019, our customer base consists of over 1,200 customers, with our largest customer accounting for approximately 10.9% of our MRR and no others greater than 5.8%. Only five of our customers exceeded 3% of our MRR. Our focus on premium customer service and our ability to grow with their IT needs allows us to achieve a low rental churn rate (which is the MRR lost in the period to a customer intending to fully exit our platform in the near term compared to the total MRR at the beginning of the period). |

| ● | Robust In-House Sales Capabilities. Our in-house sales force has deep knowledge of our customers’ businesses and IT infrastructure needs and is supported by sophisticated sales management, reporting and incentive systems. Our internal sales force is structured by product offerings, specialized industry segments and, with respect to our colocation product, by geographical region. Therefore, unlike certain other data center companies, we are less dependent on data center brokers to identify and acquire or renew our customers, which we believe is a key enabler of our integrated strategy. |

| ● | Security and Compliance Focused. Our operations and compliance teams, led by seasoned management, are focused on providing a high level of physical security, cybersecurity and compliance solutions and consulting in all of our data centers and integrated across our product offerings. |

| ● | Balance Sheet Positioned to Fund Continued Growth. As of December 31, 2019 we had approximately $872 million of available liquidity consisting of cash and cash equivalents, net proceeds available under forward equity agreements, and the ability to borrow under our unsecured senior revolving credit facility. As we continue to expand our real estate portfolio, we can increase availability under our unsecured revolving credit facility by an additional $500 million through an accordion feature, as well as access additional net proceeds available under forward equity agreements. |

| ● | Seasoned Management Team with Proven Track Record and Strong Alignment with Our Stockholders. Our senior management team represents a strong balance of significant experience across the commercial real estate and technology services industries. We believe our senior management team’s experience will enable us to capitalize on industry relationships by accessing capital from various sources and by providing an ongoing pipeline of attractive leasing and development opportunities while ensuring the future differentiation of our technology-enabled platform. |

| ● | Ability to Increase Our Margins Through Our Operating Leverage. We anticipate that our business and growth strategies can be substantially supported by our existing platform. The scale of our data center |

7

| facilities provides a significant opportunity to realize positive operating leverage as we achieve higher customer occupancy. |

| ● | Continuing to Selectively Expand Our Platform to Other Strategic Markets. We expect to continue to selectively pursue attractive opportunities in strategic locations where we believe our fully integrated platform would give us a competitive advantage in the leasing of a facility or portfolio of assets. We also believe we can integrate additional data center facilities into our platform without adding significant incremental headcount or general and administrative expenses. |

| ● | Commitment to Environmental Sustainability. We have committed to leading the industry in sustainability by implementing cost effective, impactful programs that create value for investors and benefit society. We have committed to procuring 100% of our energy from renewable sources by 2025. We build world class LEED-designed facilities, and conserve millions of gallons of water each year through rainwater collection and greywater reuse systems. Our second annual ESG report will come out in April 2020, in which we intend to highlight 2019 environmental results, introduce new social programs, and discuss our governance structure. |

Competition

We compete with developers, owners and operators of data centers and with IT infrastructure companies in the market for data center customers, properties for acquisition and the services of key third-party providers. In addition, we continue to compete with owners and operators of data centers and providers of cloud and managed services that follow other business models and may offer one or more of these services. We believe, however, that our product offerings set us apart from our competitors in the data center industry and makes us more attractive to customers, both large and small. In addition, we believe other providers are seeking ways to enter or strengthen their positions in the data center market.

We compete for customers based on factors including location, network connectivity, critical load capacity, flexibility and expertise in the design and operation of data centers. New customers who consider leasing space at our properties and using our products and existing customers evaluating whether to renew or extend a lease also may consider our competitors, including wholesale infrastructure providers and colocation and managed services providers. In addition, our customers may choose to own and operate their own data centers rather than lease from us.

As an owner, developer and operator of data centers, we depend on certain third-party service providers, including engineers and contractors with expertise in the development of data centers and the provision of managed services. The level of competition for the services of specialized contractors and other third-party providers increases the cost of engaging such providers and the risk of delays in operating our data centers and completing our development and redevelopment projects. We also rely upon the services of specialized contractors for the provision of internet connectivity and software-related platforms and services. Competition for their services could lead to a negative impact on our business if they became unavailable to us.

In addition, we face competition for the acquisition of additional properties suitable for the development of data centers from real estate developers in our industry and in other industries and from customers who develop their own data center facilities. Such competition may have the effect of reducing the number of available properties for acquisition, increasing the price of any acquisition and reducing the demand for data center space in the markets we seek to serve.

Regulation

General

Data centers in our markets are subject to various laws, ordinances and regulations, including regulations relating to common areas. We believe that each of our properties has the necessary permits and approvals to operate its business.

Americans With Disabilities Act

Our properties must comply with Title III of the Americans With Disabilities Act (“ADA”) to the extent that such properties are “public accommodations” or “commercial facilities” as defined by the ADA. The ADA may require, for example, removal of structural barriers to access by persons with disabilities in certain public areas of our properties

8

where such removal is readily achievable. We believe that our properties are in substantial compliance with the ADA and that we will not be required to make substantial capital expenditures to address the requirements of the ADA. However, noncompliance with the ADA could result in imposition of fines or an award of damages to private litigants. The obligation to make readily achievable accommodations is an ongoing one, and we will continue to assess our properties and to make alterations as appropriate in this respect.

Environmental Matters

Under various federal, state and local laws and regulations, a current or former owner or operator of real property may be liable for the cost to remove or remediate contamination resulting from the presence or discharge of hazardous or toxic substances, wastes or petroleum products on, under, from or in such property. These costs could be substantial, liability under these laws may attach without regard to whether the owner or operator knew of, or was responsible for, the presence of the contaminants, and the liability may be joint and several. Most of our properties presently contain large underground or aboveground fuel storage tanks for emergency power, which is critical to our operations. If any of our tanks has a release of fuel to the environment, we likely would have to pay to clean up the contamination. In addition, prior owners and operators used some of our current properties for industrial and other purposes, which could have resulted in environmental contamination. Moreover, the presence of contamination or the failure to remediate contamination at our properties may (1) expose us to third-party liability (e.g., for cleanup costs, bodily injury or property damage), (2) subject our properties to liens in favor of the government for damages and costs the government incurs in connection with the contamination, (3) impose restrictions on the manner in which a property may be used or businesses may be operated, or (4) materially adversely affect our ability to sell, lease or develop the real estate or to borrow using the real estate as collateral. We also may be liable for the costs of remediating contamination at off-site disposal or treatment facilities where we arranged for disposal or treatment of hazardous substances at such facilities, without regard to whether we comply with environmental laws in doing so. Finally, there may be material environmental liabilities at our properties of which we are not aware. Any of these matters could have a material adverse effect on us.

Our properties are subject to federal, state, and local environmental, health, and safety laws and regulations and zoning requirements, including those regarding the handling of regulated substances and wastes, emissions to the environment, and fire codes. For instance, our properties are subject to regulations regarding the storage of petroleum for auxiliary or emergency power and air emissions arising from the use of power generators. In particular, generators at our data center facilities are subject to strict emissions limitations, which could preclude us from using critical back-up systems and lead to significant business disruptions at such facilities and loss of our reputation. In addition, we lease some of our properties to our customers who also are subject to such environmental, health and safety laws and zoning requirements. If we, or our customers, fail to comply with these various requirements, we might incur costs and liabilities, including governmental fines and penalties. Moreover, we do not know whether existing requirements will change or whether future requirements will require us to make significant unanticipated expenditures that will materially and adversely affect us. Environmental noncompliance liability also could affect a customer’s ability to make rental payments to us. We require our customers to comply with these environmental and health and safety laws and regulations.

See ITEM 1A. RISK FACTORS, Risks Related to the Real Estate Industry, for additional information regarding these risks.

Privacy and Cybersecurity

We may be directly and/or contractually subject to laws, regulations and policies for protecting sensitive data, consumer privacy and vital national interests, some of which are new or evolving. For example, the U.S. government has promulgated regulations and standards subject to authority provided through the enactment of a number of laws, such as the Health Insurance Portability and Accountability Act (“HIPAA”), the Health Information Technology for Economic and Clinical Health Act (“HITECH Act”), the Gramm-Leach-Bliley Act (“GLBA”), and the Federal Information Security Management Act of 2002 (“FISMA”), which require many corporations and federal, state and local governmental entities to control the security of, access to and configuration of their IT systems. A number of states also have enacted laws and regulations that require covered entities, such as data center operators, to implement and maintain security measures to protect certain types of information, such as Social Security numbers, payment card information, and other types of data, from unauthorized use and disclosure. In recent years, three states have passed biometric data security laws and a number of other states are exploring similar laws. QTS designed its policies and practices based on the Illinois Biometric Information Privacy Act (“BIPA”), which we believe is the most comprehensive and restrictive law. In addition, industry organizations have adopted and implemented various security and compliance policies. For

9

example, the Payment Card Industry Security Standards Council has issued its mandatory Payment Card Industry Data Security Standard (“PCI DSS”) which is applicable to all organizations processing payment card transactions. In addition to federal laws, the California Consumer Privacy Act (“CCPA”), which regulates data collection and privacy collection, took effect on January 1, 2020. As drafted, the CCPA presents significant compliance challenges, including assessing how to respond to rights request and structure internal processes. California’s law may still be subject to change based on regulations from the California Attorney General’s office and other states are considering similar laws.

In connection with certain of these laws, we are subject to audits and assessments, and we may be required to obtain certain certifications. Audit failure or findings of non-compliance can lead to significant fines or decertification from engaging in certain activities. For example, violations of HIPAA/HITECH Act regulations can lead to fines of up to $1.5 million for all violations of a particular provision in a calendar year and our failure to demonstrate compliance in an annual PCI DSS audit may result in fines and exclusion from payment card networks. Additionally, violations of privacy or security laws, regulations or standards increasingly lead to class-action litigation, which can result in substantial monetary judgments or settlements. We cannot assure you that future laws, regulations and standards, or future interpretations of current laws, regulations and standards, related to privacy and security will not have a material adverse effect on us.

As a company that may process European personal data, we also may be subject to European data protection laws and regulations. The European General Data Protection Regulation (“GDPR”) which took effect in May 2018, increases the likelihood of applicability of European law to entities like us, which are established outside the EU but may process data of European data subjects. Under the GDPR, there can be fines of up to €10,000,000 or up to 2% of the global sales, whichever is greater, for certain comparatively minor offenses, or up to €20,000,000 or up to 4% of the global sales, whichever is greater, for more serious offenses.

To facilitate and legitimize the transfer of both client and personnel data from the European Union (“EU”) to the United States, we self-certified to the U.S. Department of Commerce that we adhere to the EU-U.S. Privacy Shield Framework, which requires organizations operating in the United States to provide assurance that they are adhering to relevant European standards for data protection for such transfers. QTS complies with the EU-U.S. Privacy Shield Framework as set forth by the Department of Commerce regarding the collection, use and retention of personal information transferred from the EU to the United States. However, our self-certification under the EU-U.S. Privacy Shield Framework may not be sufficient to ensure compliance with GDPR. Legal challenges have been brought in European courts seeking to declare the Privacy Shield Framework invalid under European law as a mechanism to legitimize transfers of personal data from the EU to the United States, which could require us to implement alternative means to address European cross border data transfer requirement. Also in 2018, EU member states were required to enact national laws to enforce the EU’s “Directive on security of network and information systems” (the “NIS Directive”), which lays out a number of cybersecurity expectations and notification obligations for regulated entities.

Insurance

We carry comprehensive general liability, property, earthquake, flood, business interruption and rental loss insurance covering all of the properties in our portfolio. We also carry coverage for technology professional liability, and cybersecurity. We have selected policy specifications and insured limits that we believe to be appropriate given the relative risk of loss, the cost of the coverage and industry practice. In the opinion of our management, the properties in our portfolio are currently adequately insured and the risk for any failure related to professional liability or a physical or cybersecurity breach are adequately covered by our insurance. We will not carry insurance for generally uninsured losses such as loss from riots, war, wet or dry rot, vermin and, in some cases, flooding and earthquake, because such coverage is not available or is not available at commercially reasonable rates. In addition, although we carry earthquake and flood insurance on our properties in an amount and with deductibles that we believe are commercially reasonable, such policies are subject to limitations in certain flood and seismically active zones. Certain of the properties in our portfolio are located in areas known to be seismically active. See “Risk Factors—Risks Related to the Real Estate Industry—Uninsured and underinsured losses could have a material adverse effect on us.”

Employees

As of December 31, 2019, we employed approximately 612 persons, none of whom were represented by a labor union. We believe our relations with our employees are good.

10

Offices

Our executive headquarters is located at 12851 Foster Street, Overland Park, Kansas 66213, where our telephone number is (913) 814-9988. We believe that our current offices are adequate for our present operations; however, based on the anticipated growth of our company, we may add regional offices depending upon our future operational needs.

Available Information

Our Internet website address is www.qtsdatacenters.com. You can obtain on our website, free of charge, a copy of our Annual Report on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and any amendments to those reports, as soon as reasonably practicable after we electronically file such reports or amendments with, or furnish them to, the SEC. Our Internet website and the information contained therein or connected thereto are not intended to be incorporated into this Annual Report on Form 10-K.

Also available on our website, free of charge, are copies of our Code of Business Conduct and Ethics, our Corporate Governance Guidelines, and the charters for each of the committees of our board of directors—the Audit Committee, the Nominating and Corporate Governance Committee, the Compensation Committee and the Security Committee.

ITEM 1A. RISK FACTORS

Set forth below are the risks that we believe are material to our stockholders. You should carefully consider the following risks in evaluating our Company and our business. If any of the risks discussed in this Form 10-K were to occur, our business, prospects, financial condition, liquidity, funds from operations and results of operations and our ability to service our debt and make distributions to our stockholders could be materially and adversely affected, which we refer to herein collectively as a “material adverse effect on us,” the market price of our common stock could decline significantly and you could lose all or part of your investment. Some statements in this Form 10-K, including statements in the following risk factors, constitute forward-looking statements. Please refer to the section entitled “Special Note Regarding Forward-Looking Statements” at the beginning of this Form 10-K.

Risks Related to Our Business and Operations

Because we are focused on the ownership, operation, redevelopment and/or construction of data centers, any decrease in the demand for data center space could have a material adverse effect on us.

Because our portfolio consists entirely of data centers, or land to be developed or converted into data centers, we are subject to risks inherent in investments in a single industry. Adverse developments in the data center market or in the industries in which our customers operate could lead to a decrease in the demand for data center space, which could have a greater material adverse effect on us than if we owned a more diversified real estate portfolio. These adverse developments could include: a decline in the technology industry, such as a decrease in the use of mobile or web-based commerce, industry slowdowns, business layoffs or downsizing, relocation of businesses, increased costs of complying with existing or new government regulations and other factors; a slowdown in the growth of the Internet generally as a medium for commerce and communication; a downturn in the market for data center space generally such as oversupply of or reduced demand for space; and the rapid development of new technologies or the adoption of new industry standards that render our or our customers’ current products and services obsolete or unmarketable and, in the case of our customers, that contribute to a downturn in their businesses, increasing the likelihood of a default under their leases or that they become insolvent or file for bankruptcy protection. To the extent that any of these or other adverse conditions occur, they are likely to impact market rents for, and cash flows from, our data center space, which could have a material adverse effect on us.

Our data center infrastructure may become obsolete or unmarketable and we may not be able to upgrade our power, cooling, security or connectivity systems cost-effectively or at all.

The markets for the data centers we own and operate, as well as certain of the industries in which our customers operate, are characterized by rapidly changing technology, evolving industry standards, frequent new service introductions, shifting distribution channels and changing customer demands. As a result, the infrastructure at our data centers may become obsolete or unmarketable due to demand for new processes and/or technologies, including, without limitation: (i) new processes to deliver power to, or eliminate heat from, computer systems; (ii) customer demand for additional

11

redundancy capacity or, conversely, reduced redundancy capacity; or (iii) new technology that permits lower levels of critical load and heat removal than our data centers are currently designed to provide. In addition, the systems that connect our data centers to the Internet and other external networks may become outdated, including with respect to latency, reliability and diversity of connectivity. When customers demand new processes or technologies, we may not be able to upgrade our data centers on a cost-effective basis, or at all, due to, among other things, increased expenses to us that cannot be passed on to customers or insufficient revenue to fund the necessary capital expenditures. The obsolescence of our power and cooling systems and/or our inability to upgrade our data centers, including associated connectivity, could reduce revenue at our data centers and could have a material adverse effect on us. Furthermore, potential future regulations that apply to industries we serve may require customers in those industries to seek specific requirements from their data centers that we are unable to provide. These may include physical security regulations applicable to the defense industry and government contractors and privacy and security requirements applicable to the financial services and health care industries. If such regulations were adopted, we could lose customers or be unable to attract new customers in certain industries, which could have a material adverse effect on us.

We face considerable competition in the data center industry and may be unable to renew existing leases, lease vacant space or re-let space on more favorable terms, or at all, as leases expire, which could have a material adverse effect on us.

Leases representing approximately 16% of our leased raised floor and approximately 29% of our annualized rent (including all month-to-month leases), in each case as of December 31, 2019, are scheduled to expire by the end of 2020. The global multi-tenant data center market is highly fragmented and we compete with numerous developers, owners and operators in the data center industry, including managed service providers and other REITs, some of which own or lease properties similar to ours, or may do so in the future, in the same submarkets in which our properties are located. Our competitors may have significant advantages over us, including greater name recognition, longer operating histories, higher operating margins, pre-existing relationships with current or potential customers, greater financial, marketing and other resources, and access to greater and less expensive power. These advantages could allow our competitors to respond more quickly to strategic opportunities or changes in our industry or markets. If our competitors offer space at rental rates below current market rates or below the rental rates we currently charge our customers, or if our competitors offer products and services in a greater variety, that are more state-of-the-art or that are more competitively priced than the products and services we offer, we may lose customers or be unable to attract new customers without lowering our rental rates and improving the quality, mix and technology of our products and services. We cannot assure you that we will be able to lease vacant space, renew leases with our existing customers or re-let space to new customers if our current customers do not renew their leases. Even if our customers renew their leases or we are able to re-let the space, the terms (including rental rates and lease periods) and costs (including capital) of renewal or re-letting may be less favorable than the terms of our current leases. In addition, there can be no assurances that the type of space and/or services currently available at our properties will be sufficient to retain current customers or attract new customers in the future. Although we offer a full spectrum of data center products from hyperscale to hybrid colocation to certain cloud and managed services, our competitors that specialize in only one of our product and service offerings may have competitive advantages in that space. If rental rates for our properties decline, we are unable to lease vacant space, our existing customers do not renew their leases or we do not re-let space from expiring leases, in each case, on favorable terms, it could have a material adverse effect on us.

Our business could be negatively affected as a result of actions by activist stockholders.

Stockholder campaigns to effect changes in publicly-traded companies are sometimes led by activist investors through various corporate actions, including proxy contests. Responding to these actions can disrupt our operations by diverting the attention of management and our employees as well as our financial resources. Stockholder activism could create perceived uncertainties as to our future direction, which could result in the loss of potential business opportunities and make it more difficult to attract and retain qualified personnel and business partners. Furthermore, the election of individuals to our board of directors with a specific agenda could adversely affect our ability to effectively and timely implement our strategic plans.

The long sales cycle for data center products could have a material adverse effect on us.

A customer’s decision to lease space in one of our data centers typically involves a significant commitment of resources, time-consuming contract negotiations regarding the service level commitments and substantial due diligence on the part of the customer regarding the adequacy of our infrastructure and attractiveness of our products and services. As a result,

12

the leasing of data center space has a long sales cycle. Furthermore, we may expend significant time and resources in pursuing a particular sale or customer that may not result in any revenue. Our inability to adequately manage the risks associated with leasing the space and products within our facilities could have a material adverse effect on us.

Our customers may choose to develop new data centers, expand their own existing data centers, or choose to go to a cloud provider, which could result in the loss of one or more key customers or reduce demand and pricing for our data centers and could have a material adverse effect on us.

Some of our customers may develop or expand their own data center facilities or choose to take their data to a cloud provider. Our customers may also merge with or be acquired by other entities that are not our customers, and may discontinue or reduce the use of our data centers in the future. If any of these events occurs with respect to our key customers, it could result in a loss of business to us or put downward pressure on our pricing. If we lose a customer, there is no assurance that we would be able to replace that customer at the same or a higher rate, or at all, which could have a material adverse effect on us.

The bankruptcy, insolvency or financial difficulties of a major customer could have a material adverse effect on us.

The bankruptcy or insolvency of a major customer could have significant consequences for us. If any customer becomes a debtor in a case under the federal Bankruptcy Code, we cannot evict the customer solely because of the bankruptcy. In addition, the bankruptcy court might authorize the customer to reject and terminate its lease with us. Our claim against the customer for unpaid future rent would be subject to a statutory cap that might be substantially less than the remaining rent owed under the lease. In either case, our claim for unpaid rent likely would not be paid in full. If any of our significant customers were to become bankrupt or insolvent or suffer a downturn in their business, they may fail to renew, or reject or terminate, their leases with us and/or fail to pay unpaid or future rent owed to us, which could have a material adverse effect on us.

Any inability, temporarily or permanently, to fully and consistently operate either of our Atlanta (DC-1) and Atlanta-Suwanee properties could have a material adverse effect on us.

Our two largest wholly-owned properties in terms of annualized rent, Atlanta (DC-1) (formerly known as our Atlanta Metro facility) and Atlanta-Suwanee, collectively accounted for approximately 43% of our consolidated annualized rent as of December 31, 2019. Therefore, any inability, temporarily or permanently, to fully and consistently operate either of these properties could have a material adverse effect on us. In addition, because both properties are located in the Atlanta metropolitan area, we are particularly susceptible to adverse developments in that area, including as a result of natural disasters (such as hurricanes, floods, tornadoes and other events), that could cause, among other things, permanent damage to the properties and electrical power outages that may last beyond our backup and alternative power arrangements. Further, Atlanta (DC-1) and Atlanta-Suwanee account for several of our largest leases in terms of MRR. Any nonrenewal, credit or other issues with large customers could adversely affect the performance of these properties.

We may be adversely affected by the economies and other conditions of the markets in which we operate, particularly in Atlanta and other metropolitan areas, where we have a high concentration of our data center properties.

We are susceptible to adverse economic or other conditions in the geographic markets in which we operate, such as periods of economic slowdown or recession, the oversupply of, or a reduction in demand for, data centers in a particular area, industry slowdowns, layoffs or downsizings, relocation of businesses, increases in real estate and other taxes and changing demographics. The occurrence of these conditions in the specific markets in which we have concentrations of properties could have a material adverse effect on us. Our Atlanta area data centers and our data centers in Virginia (including Richmond, Ashburn, the Vault facility in Dulles, Virginia and leased facilities acquired in 2015), accounted for approximately 43% and 16%, respectively, of our consolidated annualized rent as of December 31, 2019. We also own a 50% interest in the Manassas, Virginia data center that was contributed to an unconsolidated entity. As a result, we are particularly susceptible to adverse market conditions in these areas. In addition, other geographic markets could become more attractive for developers, operators and customers of data center facilities based on favorable costs and other conditions to construct or operate data center facilities in those markets. For example, some states have created tax incentives for developers and operators to locate data center facilities in their jurisdictions. These changes in other markets may increase demand in those markets and result in a corresponding decrease in demand in our markets. Any adverse economic or real estate developments in the geographic markets in which we have a concentration of properties,

13

or in any of the other markets in which we operate, or any decrease in demand for data center space resulting from the local business climate or business climate in other markets, could have a material adverse effect on us.

Challenging economic and other market conditions could have a material adverse effect on us.

The cost and availability of credit may be limited if global or national market conditions deteriorate. Furthermore, deteriorating economic and other market conditions that affect our customers could negatively impact commercial real estate fundamentals and result in lower occupancy, lower rental rates and declining values in our real estate portfolio. Additionally, the economic climate could have an impact on our lenders or customers, causing them to fail to meet their obligations to us. For example, the United Kingdom withdrew from the European Union effective January 31, 2020 (commonly known as “Brexit”), and is now in a period of transition until the end of 2020. The transition period of at least eleven months, which can be extended up to two additional years, commenced following such departure. While the announcement of Brexit in June 2016 caused significant volatility in global stock markets and currency exchange rate fluctuations that resulted in the strengthening of the U.S. dollar against the U.K. Pound Sterling, the impact of the United Kingdom’s January 2020 departure from the European Union did not trigger similar volatility. Any impact of Brexit depends on the terms of the United Kingdom’s withdrawal from the European Union, which remain under negotiation between the parties during the transition period.

Future consolidation and competition in our customers’ industries could reduce the number of our existing and potential customers and make us dependent on a more limited number of customers.

Mergers or consolidations in our customers’ industries in the future could reduce the number of our existing and potential customers and make us dependent on a more limited number of customers. If our customers merge with or are acquired by other entities that are not our customers, they may discontinue or reduce the use of our data centers in the future. Any of these developments could have a material adverse effect on us.

Our failure to develop and maintain a diverse customer base could have a material adverse effect on us.

Our customers are a mix of hyperscale and hybrid colocation. Each type of customer and their leases with us have certain features that distinguish them from our other customers, such as operating margin, space and power requirements and lease term. In addition, our customers engage in a variety of professional, financial, technological and other businesses. A diverse customer base helps to minimize exposure to economic fluctuations in any one industry, business sector or customer type, or any particular customer. Our relative mix of products used by our customers may change over time, as may the industries represented by our customers, the concentration of customers within specified industries and the economic value and risks associated with each customer, and there is no assurance that we will be able to maintain a diverse customer base, which could have a material adverse effect on us.

Our government customers, contracts and subcontracts may subject us to additional risks, including early termination, audits, investigations, sanctions and penalties, which could have a material adverse effect on us.

We derive revenue from contracts with the U.S. government, state and local governments and from subcontracts with government contractors. Some of these customers may be entitled to terminate all or part of their contracts at any time, without cause.

Recently, political pressure has increased for governments and their agencies, both domestically and internationally, to reduce spending. Some of our federal government contracts and subcontracts are directly or indirectly subject to Congressional approval of appropriations to fund the expenditures under these contracts. Similarly, some of our state and local contracts and subcontracts are subject to government funding authorizations. To the extent that funding underlying any of these government contracts or subcontracts is reduced or eliminated, whether by failure to get Congressional approval or as a result of partial U.S. government shutdowns, there is an increased risk of termination by the counterparties, which could have a material adverse effect on us.

Government contracts and subcontracts also are generally subject to government audits and investigations. To the extent we fail to comply with laws or regulations related to such contracts, any such audit or investigation of us could result in various civil and criminal penalties and administrative sanctions, including termination of such contracts, refund of a portion of fees received, forfeiture of profits, suspension of payments, fines and suspensions or debarment from future government business, any of which could have a material adverse effect on us.

14

We derive significant revenue from our largest customers, and the loss or significant reduction in business from one or more of these customers could have a material adverse effect on us.

Our top 10 customers collectively accounted for approximately 36% of our portfolio’s total MRR as of December 31, 2019. We have one customer that accounted for approximately 10.9% of our MRR and the next largest customer accounted for only 5.8% of our MRR as of December 31, 2019. As a result, if we lose and are unable to replace one or more of these customers, if these customers significantly reduce their business with us or default on their obligations to us or if we choose not to enforce, or to enforce less vigorously, any rights that we may have now or in the future against these significant customers because of our desire to maintain our relationship with them, our business, financial condition and results of operations, including the amount of cash available for distribution to our stockholders, could be materially adversely affected.

Our future growth depends upon the successful expansion or redevelopment of our existing properties, the development of new properties, and any delays or unexpected costs in such expansion, redevelopment or development could have a material adverse effect on us.

We have initiated or are contemplating the redevelopment of multiple of our existing data center properties including: Atlanta (DC-1), Irving, Piscataway, Chicago, Fort Worth, Ashburn and the Manassas facility which was contributed to an unconsolidated entity. Our future growth depends upon the successful completion of these efforts, as well as on development of new properties including Atlanta (DC-2) and Hillsboro. With respect to our current and any future expansions, developments and redevelopments, we will be subject to certain risks, including the following:

| ● | financing risks; |

| ● | increases in interest rates or credit spreads; |

| ● | site selection and lack of availability of adequate properties for development; |

| ● | construction and/or lease-up delays; |

| ● | changes to plans or specifications; |

| ● | construction site accidents or other casualties; |

| ● | lack of availability of, and/or increased costs for, specialized data center components, including long lead-time items such as generators; |

| ● | cost overruns, including construction or labor costs that exceed our original estimates; |

| ● | failure of contractors to perform on a timely basis or at all, or other misconduct on the part of contractors; |

| ● | contractor and subcontractor disputes, strikes, labor disputes or supply disruptions; |

| ● | environmental issues, fire, flooding, earthquakes and other natural disasters; |

| ● | delays with respect to obtaining or the inability to obtain necessary zoning, occupancy, environmental, land use and other governmental permits, and changes in zoning and land use laws, particularly with respect to build-outs at our Santa Clara facility; |

| ● | failure to achieve expected occupancy and/or rental rate levels within the projected time frame, if at all; and |

| ● | sub-optimal mix of products. |

In addition, with respect to any expansions, developments or redevelopments, we will be subject to risks and, potentially, unanticipated costs associated with obtaining access to a sufficient amount of power from local utilities, including the need, in some cases, to develop utility substations on our properties in order to accommodate our power needs, constraints on the amount of electricity that a particular locality’s power grid is capable of providing at any given time, and risks associated with the negotiation of long-term power contracts with utility providers. Local utilities may also experience unexpected costs relating to the production or transmission of power, including environmental and other variability associated with downed utility lines. Similarly, we will be subject to the risks and, potentially, unanticipated costs associated with obtaining access to sufficient internet, telecommunication and fiber optic network connectivity. We may not be able to successfully negotiate such contracts on favorable terms, or at all. Any inability to negotiate utility or telecommunications contracts on a timely basis or on favorable terms or in volumes sufficient to supply the critical load and connectivity anticipated for future developments could have a material adverse effect on us.

While we intend to develop data center properties primarily in markets with which we are familiar, we have and may in the future acquire properties in new geographic markets where we expect to achieve favorable risk-adjusted returns on our investment. We may not possess the same level of familiarity with development or redevelopment in these new

15

markets and therefore cannot assure you that our development activities will generate attractive returns. Furthermore, development and redevelopment activities, regardless of whether they are ultimately successful, also typically require a substantial portion of our management’s time and attention. This may distract our management from focusing on other operational activities of our business.

These and other risks could result in delays, increased costs and a lower stabilized return on invested capital and could prevent completion of our development and expansion projects once undertaken, which could have a material adverse effect on us.

We may commence development of a data center facility prior to having received any commitments from customers to lease any space in the facility and any extended vacancies could have a material adverse effect on our business, results of operations and financial condition.

As part of our growth strategy, we intend to commit substantial operational and financial resources to develop new data centers and expand existing ones. However, we may not require pre‑leasing commitments from customers before we develop or expand a data center, and we may not have sufficient customer demand to lease the new data center space when completed. Once development of a data center is complete, we incur a certain amount of operating expenses even if there are no tenants occupying the space. A lack of customer demand for data center space or excess capacity in the data center market could impair our ability to achieve our expected rate of return on our investment, which could have a material adverse effect on our financial condition, operating results and the market price of our common stock.

Our properties are designed primarily for lease as data centers, which could make it difficult to reposition them if we are not able to lease or re-let available space.

Our properties are highly specialized properties that contain extensive electrical, communications and mechanical systems. Such systems are often custom-designed to house, power and cool certain types of computer systems and networking equipment. Any office space (such as private office space, open office areas and conference centers) located at our properties is merely complementary to such systems, to facilitate our ability to service and maintain them. As a result, our properties are not well-suited for primary use by customers as anything other than data centers. Major renovations and expenditures would be required to convert the properties for use as commercial office space, or for any other use, which would substantially reduce the benefits from such a conversion. In the event of a conversion, the value of our properties may be impaired due to the costs of reconfiguring the real estate for alternate purposes and the removal or modification of the specialized systems and equipment. The highly specialized nature of our data center properties could make it difficult and costly to reposition them if we are not able to lease or re-let available space on favorable terms, or at all, which could have a material adverse effect on us.

We lease space in several locations under long-term non-cancellable lease agreements and the non-renewal or loss of such leases, or the continuing obligations under such leases in the event of a loss of customers or customer revenues, could have a material adverse effect on us.

We lease the space that houses our data centers in several locations under long-term lease agreements. For example, we lease the space housing our data centers in Jersey City, New Jersey and Overland Park, Kansas, where our corporate headquarters is located, under leases expiring (taking into account our extension options) in 2031 and 2028 respectively. We also lease data center space in several locations under non-cancellable leases expiring through 2026 and, in turn, sublease that space to our customers. The landlords could attempt to evict us for reasons beyond our control and we may incur costs if we are forced to vacate this space due to the high costs of relocating the equipment in these facilities and installing the necessary infrastructure in a new data center property. If we are forced to vacate any of these facilities, we could lose customers that chose our services based on our location. In addition, we cannot assure you that we will be able to renew these leases prior to their expiration dates on favorable terms or at all. Certain of such leases relate to data centers owned by companies that may view us as a competitor, which may impact their willingness to extend these leases upon expiration. If we are unable to renew these lease agreements, we could lose a significant number of customers who are unwilling to relocate their equipment to another one of our data center properties, which could have a material adverse effect on us. Even if we are able to renew these leases, the terms and other costs of renewal may be less favorable than our existing lease arrangements. Failure to sufficiently increase revenue from customers at these facilities to offset these projected higher costs could have a material adverse effect on us. Further, we may be unable to maintain good working relationships with our landlords, which would adversely affect our relationship with our customers and could result in the loss of current customers.

16

In addition, the terms of our customer contracts are, in many cases, of shorter duration than the non-cancellable lease agreements for data center space described above. We are obligated to make payments on these long-term non-cancellable leases regardless of whether our customer contracts are terminated or expire and regardless of whether our customers continue to make payments under their contracts. To the extent we experience a loss of customers or customer revenue, including upon expiration or termination of customer contracts, our continuing obligations under the non-cancellable lease agreements for data center space may result in expenses to us without offsetting revenue, which could have a material adverse effect on us.

The ground sublease structure at our Santa Clara property could prevent us from developing the property as we desire, and we may have to incur additional expenses prior to the end of the ground sublease to restore the property to its prelease state.

Our interest in the Santa Clara property is subject to a ground sublease granted by a third party, as ground sublessor, to our indirect subsidiary Quality Investment Properties Santa Clara, LLC (“QIP Santa Clara”). The ground sublease terminates in 2052 and we have two options to extend the original term for consecutive ten-year terms. The ground sublease structure presents special risks. We, as ground sublessee, will own all improvements on the land, including the buildings in which the data centers are located during the term of the ground sublease. Upon the expiration or earlier termination of the ground sublease, however, the improvements on the land will become the property of the ground sublessor. Unless we purchase a fee interest in the land and improvements subject to the ground sublease, we will not have any economic interest in the land or improvements at the expiration of the ground sublease. Therefore, we will not share in any increase in value of the land or improvements beyond the term of the ground sublease, notwithstanding our capital outlay to purchase our interest in the data center or fund improvements thereon, and will lose our right to use the building on the subleased property. In addition, upon the expiration of the ground sublease, the ground sublessor may require the removal of the improvements or the restoration of the improvements to their condition prior to any permitted alterations at our sole cost and expense. If we do not meet a certain net worth test, we also will be required to provide the ground sublessor with a bond in connection with such removal and restoration requirements. In addition, while we generally have the right to undertake alterations to the demised premises, the ground sublessor has the right to reasonably approve the quality of such work and the form and content of certain financial information of QIP Santa Clara. The ground sublessor need not give its approval to alterations if it or its affiliate determines that the work will have a material adverse impact on the fee interest in property adjacent to the demised premises. In addition, though the ground sublease provides that we may exercise the rights of ground lessor in the event of a rejection of the master ground lease, each of the master ground lease and the ground sublease may be rejected in bankruptcy. Finally, in the event of a condemnation, the ground lessor is entitled to an allocable share of any condemnation proceeds. The ground sublease, however, does contain important nondisturbance protections and provides that, in event of the termination of the master ground lease, the ground sublease will become a direct lease between the ground lessor and QIP Santa Clara.

We depend on third parties to provide Internet, telecommunication and fiber optic network connectivity to the customers in our data centers, and any delays or disruptions in service, availability, or additional costs could have a material adverse effect on us.