|

|

David Bonser Partner Hogan Lovells US LLP Columbia Square 555 Thirteenth Street, NW Washington, DC 20004 T +1 202 637 5868 F +1 202 637 5910 David.bonser@hoganlovells.com www.hoganlovells.com |

July 11, 2013

BY EDGAR AND COURIER

Mr. Tom Kluck

Division of Corporation Finance

United States Securities and Exchange Commission

100 F Street, NE

Washington, D.C. 20549

| Re: | QTS Realty Trust, Inc. |

Draft Registration Statement on Form S-11

Submitted May 31, 2013

CIK No. 0001577368

Dear Mr. Kluck:

This letter is submitted on behalf of QTS Realty Trust, Inc. (the “Company”) in response to comments from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) in a letter dated June 28, 2013 (the “Comment Letter”) with respect to the Company’s Registration Statement on Form S-11 submitted to the Commission on May 31, 2013 (the “Registration Statement”). The Company is concurrently submitting confidentially, as an emerging growth company pursuant to Section 6(e) of the Securities Act of 1933, as amended (the “Securities Act”), Amendment No. 1 to the Registration Statement (“Amendment No. 1”), which includes changes in response to the Staff’s comments. We have enclosed with this letter a marked copy of Amendment No. 1, which was submitted confidentially today by the Company via EDGAR, reflecting all changes to the Registration Statement.

For your convenience, the Staff’s numbered comments set forth in the Comment Letter have been reproduced in italics herein with responses immediately following each comment. Unless otherwise indicated, page references in the reproductions of the Staff’s comments refer to the Registration Statement. Defined terms used herein but not otherwise defined herein have the meanings given to them in the Registration Statement.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 2

General

| 1. | Please provide us with copies of any graphics, maps, photographs, and related captions or other artwork including logos that you intend to use in the prospectus. Such graphics and pictorial representations should not be included in any preliminary prospectus distributed to prospective investors prior to our review. |

Response to Comment No. 1

The Company acknowledges the Staff’s comment and undertakes to provide copies of graphics, maps, photographs and related artwork that the Company expects to use in the prospectus prior to distributing the preliminary prospectus to prospective investors. The Company has not yet determined which artwork will be included in the inside front cover and possibly elsewhere in the prospectus.

| 2. | Please provide us with support for all quantitative and qualitative business and industry data used in the registration statement. Clearly mark the specific language in the supporting materials that supports each statement. The requested information should be filed as EDGAR correspondence or, alternatively, should be sent in paper form accompanied by a cover letter indicating that the material is being provided pursuant to Securities Act Rule 418 and that such material should be returned to the registrant upon completion of the staff review process. |

Response to Comment No. 2

In response to the Staff’s comment, the Company is supplementally providing the Staff, under separate cover, support for all quantitative and qualitative business and industry data in paper form pursuant to Securities Act Rule 418. The Company hereby requests that such materials, and all copies thereof, be returned to the undersigned promptly following the completion of the Staff’s review thereof.

| 3. | We note your disclosure on page i that the statements and projections obtained from 451 Research, LLC have not been expertized and are solely your responsibility. Please advise us whether the statements and/or projections provided by 451 Research, LLC were commissioned by you for use in connection with the registration statement. Also please provide us with a copy of any report or study prepared by 451 Research, LLC for you. |

Response to Comment No. 3

The Company confirms that it has not commissioned for use in connection with the Registration Statement any report, research, statements or projections included in the Registration Statement from 451 Research, LLC or any other third party.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 3

| 4. | We note that you have not yet made a decision as to whether you will take advantage of the extended transition period available to emerging growth companies. Please amend your filing to state your election under Section 107(b) of the JOBS Act: |

| • | If you have elected to opt out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b), include a statement that the election is irrevocable; or |

| • | If you have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1), provide a risk factor explaining that this election allows you to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. Please state in your risk factor that, as a result of this election, your financial statements may not be comparable to companies that comply with public company effective dates. Include a similar statement in your critical accounting policy disclosures. |

Response to Comment No. 4

The Company confirms that it has elected to opt out of the extended transition period under Section 107(b) of the JOBS Act. The Company has added disclosure in Amendment No. 1 that states that the Company has elected to opt out of the extended transition period and that this election is irrevocable.

| 5. | Please supplementally provide us with copies of all written communications, as defined in Rule 405 under the Securities Act, that you, or anyone authorized to do so on your behalf, present to potential investors in reliance on Section 5(d) of the Securities Act, whether or not they retain copies of the communications. Similarly, please supplementally provide us with any research reports about you that are published or distributed in reliance upon Section 2(a)(3) of the Securities Act of 1933 added by Section 105(a) of the Jumpstart Our Business Startups Act by any broker or dealer that is participating or will participate in your offering. |

Response to Comment No. 5

The Company confirms that (i) no written communications have been provided by the Company or on its behalf in reliance on Section 5(d) of the Securities Act to potential investors. The underwriters participating in the Company’s initial public offering have confirmed to the Company that they have not published or distributed any research reports about the Company in reliance upon Section 2(a)(3) of the Securities Act added by Section 105(a) of the Jumpstart Our Business Startups Act.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 4

| 6. | Please revise your document and replace technical jargon with plain English descriptions so that an ordinary, reasonable investor can better understand your disclosure. Instead of using industry jargon, explain these concepts in concrete, everyday language. If you must use industry terms, please explain the meaning of the terms the first time they are used. |

Response to Comment No. 6

In response to the Staff’s comment, the Company has revised the Registration Statement and attempted to replace technical jargon with plain English descriptions and explained all industry terms the first time they are used in Amendment No. 1.

Prospectus Cover Page

| 7. | Please revise your cover page to only identify the lead underwriter(s). |

Response to Comment No. 7

In response to the Staff’s comment, the cover page of Amendment No. 1 includes only the six book-running underwriters, consistent with customary practice. The names of the lead underwriters, Goldman, Sachs & Co. and Jefferies, appear in the first line.

Prospectus Summary, page 1

| 8. | We note your summary contains a lengthy description of your market opportunity, competitive advantages, market opportunity and business/growth strategies. Further, we note that similar disclosure appears later in your prospectus. The summary should not include a lengthy description of the company’s business and business strategy. This detailed information is better suited for the body of the prospectus. Please revise to substantially reduce the amount of repetitive disclosure in the summary. |

Response to Comment No. 8

In response to the Staff’s comment, the market opportunity, competitive strengths and business and growth strategies subsections of the “Prospectus Summary” have been substantially revised in Amendment No. 1 to reduce the amount of repetitive disclosure, shortening the summary significantly.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 5

| 9. | We note your reference to annualized rent throughout. Please clarify if the calculation takes into account tenant concessions, such as free rent or abatements. To the extent it does not, please revise to quantify the effect of tenant concessions or explain why such information is not material. Please make conforming changes throughout your prospectus. |

Response to Comment No. 9

In response to the Staff’s comment, the explanations of annualized rent have been revised to clarify that it does not take into account any free rent, rent abatements or future scheduled rent increases and also excludes operating expense and power reimbursements. If the Company were to disclose annualized GAAP basis rent, our annualized rent of approximately $147 million as of March 31, 2013 would increase by approximately $0.5 million. Therefore, the Company respectfully submits that this amount is immaterial and would not provide material additional information to potential investors.

Our Competitive Strengths, page 6

Founder-led management team with proven track record .. . . , page 7

| 10. | We note in your disclosure that your management team has “more than 100 years of combined experience . . . .” Please do not combine management’s experience and revise accordingly. |

Response to Comment No. 10

In response to the Staff’s comment, this sentence has been revised in the “Prospectus Summary” and the “Management” sections of Amendment No. 1 to state: “Our senior management team has significant experience in the ownership, management and redevelopment of commercial real estate through multiple business cycles.”

Summary Risk Factors, page 8

| 11. | Please include a summary risk factor that discloses the conflict of interests risks associated with your formation transaction. |

Response to Comment No. 11

In response to the Staff’s comment, the following risk factor has been added to the summary risk factors of the “Prospectus Summary” and to the “Risk Factors” sections of Amendment No. 1:

Our formation transactions were not negotiated in arm’s length transactions, and the value received by GA REIT and Mr. Williams as a result of the formation transactions and this offering may exceed the fair market value of the assets they originally contributed to our operating partnership.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 6

The value received by GA REIT and Chad L. Williams as a result of the formation transactions and this offering, and the percentage of our company that they will own following the completion of this offering, was not negotiated on an arm’s length basis. Further, the value of their interests in us will increase or decrease if the market price of our common stock increases or decreases. Therefore, the value of the interests that GA REIT and Mr. Williams will own in our company may exceed the fair market value of the assets they originally contributed to our operating partnership.

| 12. | Please include a summary risk factor that discloses that you have not identified specific investments to be acquired with the net proceeds of this offering or advise. |

Response to Comment No. 12

In response to the Staff’s comment, the following risk factor has been added to the summary risk factors of the “Prospectus Summary” and to the “Risk Factors” sections of Amendment No. 1:

Following the repayment of certain indebtedness with the net proceeds of this offering, management will have broad discretion in the application of any remaining net proceeds, and we may not use the proceeds effectively.

The net proceeds of this offering will be used to repay the promissory note secured by our Dallas facility and certain amounts outstanding under our unsecured revolving credit facility, and any remaining net proceeds may be used for other purposes, including to fund ongoing development costs and future acquisitions. We have not identified specific acquisitions for which we may use the remaining balance of the net proceeds of this offering. While we expect to apply any remaining net proceeds in a manner consistent with our business plan and acquisition strategies, we may not be able to identify, acquire, and successfully manage or otherwise exploit new investment opportunities, and we cannot assure you that the net proceeds so applied will result in any improvement in our business. Therefore, you will be unable to evaluate the allocation of this portion of the net proceeds from this offering or the economic merits of any redevelopment projects, acquisitions or other uses of such proceeds before making an investment decision to purchase our common stock.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 7

Distribution Policy, page 12

| 13. | Please revise to clarify that there is no guarantee that you will have the funds necessary to pay the estimated distribution to shareholders. |

Response to Comment No. 13

In response to the Staff’s comment, the following sentence has been added to the distribution policy subsection of the “Prospectus Summary” of Amendment No. 1: “No assurance can be given that our estimated cash available for distribution to our stockholders will be accurate or that our actual cash available for distribution to our stockholders will be sufficient to pay distributions to them at any expected or REIT-required level or at any particular yield, or at all.”

Risk Factors, page 20

| 14. | We note that several risk factor subheadings merely state general factors about your business. For example, we note the following subheadings: |

| • | “We will not recognize any increase in the value of the land or improvements subject to our ground sublease at our Santa Clara property .. . . ,” page 25; |

| • | “We may be unable to identify and complete acquisitions on favorable terms or at all, “ page 27; |

| • | “We may be subject to unknown or contingent liabilities related to properties or businesses that we acquire . . . ,” page 28; |

| • | “Our growth depends on access to external sources of capital that are outside of our control . . . ,” page 29; |

| • | “Hedging transactions involve risks and costs,” page 30; |

| • | “There are special risks relating to our properties in California,” page 32; and |

| • | “We are exposed to ongoing litigation and other legal and regulatory actions,” page 34. |

Please revise through as necessary to identify briefly in your subheadings the specific harm that results from the noted facts or uncertainties. Potential investors should be able to read a risk factor subheading and understand the risk as it specifically applies to you.

Response to Comment No. 14

In response to the Staff’s comment, the Company has revised certain of the risk factor subheadings in the “Risk Factors” section to identify the specific harm or risk that may result from the noted facts or uncertainties.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 8

Dilution, page 55

| 15. | Please include a comparison of the public contribution under the proposed public offering and the effective cash cost to existing investors for the common stock or units. Refer to Item 506 of Regulation S-K for guidance. |

Response to Comment No. 15

In response to the Staff’s comment, the Company has revised the “Dilution” section in Amendment No. 1 to include a table showing the differences between the relative contributions of the continuing investors and the new investors based on the book value of the portfolio of initial operating properties, in the case of the continuing investors, and the cash contributions in the case of the new investors.

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 60

Scheduled Lease Expirations, page 62

| 16. | We note your disclosure of scheduled lease expirations. Please include a discussion of the relationship between market rents and expiring rents. |

Response to Comment No. 16

In response to the Staff’s comment, the Company has added the following sentence to the disclosure regarding scheduled lease expirations in Amendment No. 1: “At expiration, as a general matter, based on current market conditions, we expect that expiring rents will be at or below the then-current market rents.”

Results of Operations, page 62

| 17. | We note your disclosure regarding leasing results for the periods presented. Please also expand your period-on-period disclosure to balance such disclosure with a discussion of tenant improvement costs and leasing commissions for both new leases and for renewals. Provide such information on a per unit or raised floor basis. |

Response to Comment No. 17

In response to the Staff’s comment, the Company has added disclosure regarding total leasing commissions for the three months ended March 31, 2013 and for the years ended December 31, 2012, 2011 and 2010. However, the Company respectfully submits that providing such information on a per unit or raised floor basis would not provide meaningful information due to our Cloud and Managed Services products. Commissions related to our Cloud and Managed Service products are included in our leasing commissions; however, because these products use limited or no raised floor space, leasing commissions on a per unit or raised floor basis would yield a large number that would not appropriately reflect our business.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 9

In addition, the Company also respectfully submits that disclosing tenant improvement costs would not provide useful information to investors. The Company’s business model is to operate scalable data centers so the Company may lease space to customers promptly and efficiently. Therefore, the Company does not have significant tenant improvement costs that solely benefit particular customers. Additionally, to the extent there are certain tenant specific items, these amounts are generally reimbursed through deferred set-up fees.

Short-term Liquidity, page 76

| 18. | Please revise to include additional analysis of your capital expenditures by breaking down total capital expenditures between new development, redevelopment, and other capital expenditures by year. In addition please provide a narrative discussion for fluctuations from year to year and expectations for the future. The total of these expenditures should reconcile to the line item on the cash flow statement entitled additions to property and equipment. |

Response to Comment No. 18

In response to the Staff’s comment, the Company has included in its discussion of short-term liquidity a breakdown of capital expenditures among redevelopment, personal property, maintenance capital expenditures and capitalized interest, commissions and other overhead costs for the years ended December 31, 2012, 2011 and 2010. The total of these expenditures will reconcile to the statement of cash flows. In addition, the Company has added a narrative discussion of fluctuations in capital expenditures from year to year.

| 19. | In addition, please disclose with the above requested disclosure the amount of these costs capitalized that are related to soft costs such as interest, payroll and other general and administrative costs. |

Response to Comment No. 19

In response to the Staff’s comment, the Company has included in its discussion of changes in cash flows in Amendment No. 1, the amount of soft costs, such as interest, payroll and other internal costs to redevelop properties, for the three months ended March 31, 2013 and for the years ended December 31, 2012, 2011 and 2010.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 10

Contractual Obligations, page 78

| 20. | Please revise tables or disclose in a footnote estimated contractual interest payments expected to be made. |

Response to Comment No. 20

In response to the Staff’s comment, the Company has included a footnote to the contractual obligations table that discloses future estimated contractual interest payments.

Our Initial Portfolio, page 96

Customer Diversification, page 98

| 21. | Please also provide a breakdown of tenant-type for your entire portfolio. |

Response to Comment No. 21

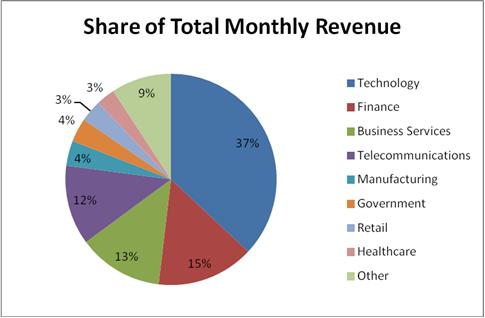

In response to the Staff’s comment, the pie chart below shows the breakdown of the Company’s customers by industry as of June 30, 2013, based on total monthly revenue. The Company intends to include this pie chart in a subsequent amendment to the Registration Statement that includes operating information through June 30, 2013.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 11

Lease Expirations, page 99

| 22. | Please tell us why you have not also included the gross square feet in addition to the raised floor for expiring leases. |

Response to Comment No. 22

The Company respectfully submits that it does not include gross square feet in the lease expirations table because gross square feet is a measurement of the entire building area, which includes common areas, space that is used by the Company, including office space and supporting infrastructure, and other square footage that is not leased to customers and therefore is not subject to lease expirations.

Material Provisions of Maryland Law and of Our Charter and Bylaws, page 161

| 23. | We note your statements on the top of page 161 that the summary is qualified in its entirety by reference to Maryland law and your charter and bylaws. Similar disclosure appears on the top of pages 156 and 147. Please note that a summary by its nature is not complete, but should highlight all the material provisions and should not be qualified by information outside of the prospectus. Please revise appropriately and clarify that your prospectus includes all the material information |

Response to Comment No. 23

In response to the Staff’s comment, the statements on pages 147, 156 and 161 have been revised in Amendment No. 1 to clarify that each disclosure is a summary of material terms, and the Company has deleted the references to the summaries being qualified by information outside of the prospectus.

Financial Statements, page F-1

| 24. | We note that your filing does not include audited financial statements of the registrant QTS Realty Trust, Inc. Please revise to include audited financial statements in accordance with Rule 3-01 of Regulation S-X. |

Response to Comment No. 24

In response to the Staff’s comment, an audited balance sheet of QTS Realty Trust, Inc. as of July 2, 2013 has been included in Amendment No. 1.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 12

Quality Tech, LP

Audited Statements of Cash Flows, page F-33

| 25. | Please revise to disclose that the dollar amounts presented in this statement are in thousands. |

Response to Comment No. 25

In response to the Staff’s comment, the statements of cash flows of QualityTech, LP in Amendment No. 1 clarifies that the dollar amounts are in thousands.

Part II – Information Not Required in Prospectus, page II-1

Item 33. Recent Sales of Unregistered Securities, page II-1

| 26. | Please briefly disclose the facts relied upon to meet the exemption(s) claimed. Refer to Item 701(d) of Regulation S-K. |

Response to Comment No. 26

In response to the Staff’s comment, the disclosure in Item 33 of Amendment No. 1 has been revised to state that the securities have been issued in transactions exempt from registration provided by Section 4(a)(2) of the Securities Act, as the transactions did not involve a public offering.

| 27. | Please explain why you have not included the issuance of OP units and the conversion of OP units by Mr. Williams as contemplated on page 133 of the prospectus or revise. |

Response to Comment No. 27

In response to the Staff’s comment, Item 33 of Amendment No. 1 has been revised to include the issuance of OP units in connection with the formation transactions to Mr. Williams. The Company respectfully submits that the conversion of the OP units for Class B common stock by Mr. Williams is described in Item 33 as the issuance of shares of Class B common stock to Mr. Williams in exchange for an equivalent number of common limited partnership units of QualtyTech, LP. Item 33 of Amendment No. 1 has been revised to state that the securities have been issued in transactions exempt from registration provided by Section 4(a)(2) of the Securities Act, as the transactions did not involve a public offering.

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 13

Exhibit List, page II-5

| 28. | Please tell us why you are filing the “Form of” various agreements. Explain why you are not able to file final, executed agreements prior to effectiveness of the registration statement. |

Response to Comment No. 28

With respect to the exhibits that the Company intends to file “forms of” agreements, the Company intends to execute those agreements concurrently with the closing of the offering. Accordingly, the Company will not be in a position to file final, executed copies of such agreements prior to the effectiveness of the Registration Statement. The Company acknowledges that incomplete exhibits may not be incorporated by reference and that it will refile each such exhibit in final, executed form as an exhibit to the Company’s first Quarterly Report on Form 10-Q or Current Report on Form 8-K filed with the Commission following the consummation of the offering, as required. The Company further advises the Staff that, to the extent any such agreements are executed prior to the effectiveness of the Registration Statement, the Company will file a final, executed copy of such agreements prior to the effectiveness of the Registration Statement.

| 29. | Please file all required exhibits as promptly as possible. If you are not in a position to file your legal or tax opinions with the next amendment, please provide draft copies for us to review. |

Response to Comment No. 29

The Company acknowledges the Staff’s comment and will file all required exhibits as promptly as possible. The Company further advises the Staff that it is not yet in a position to file legal and tax opinions with this Registration Statement but will provide draft copies of such opinions supplementally to the Staff when available.

****

The Company respectfully believes that the proposed modifications to Amendment No. 1, and the supplemental information contained herein, are responsive to the Staff’s comments. If you have any questions or would like further information concerning the Company’s responses to your Comment Letter, please do not hesitate to contact me at (202) 637-5868.

| Sincerely, | ||

| /s/ David W. Bonser | ||

| David W. Bonser | ||

Mr. Tom Kluck

Division of Corporation Finance

July 11, 2013

Page 14

Enclosures

| cc: | Erin E. Martin Bill Demarest Dan Gordon Securities and Exchange Commission Chad L. Williams William H. Schafer Shirley E. Goza QTS Realty Trust, Inc. Eve. N. Howard Matt N. Thomson Hogan Lovells US LLP J. Gerard Cummins Sidley Austin LLP John Passanisi Ernst & Young LLP |