UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM

_______________________________

For the ended

OR

For the transition period from ____________to____________

Commission File NUMBER

__________________________

(Exact Name of Registrant as Specified in Its Charter)

_______________ _____________________________

|

|

|

|

|

|

| ||

(State or Other Jurisdiction of |

| (I.R.S. Employer |

|

| |

(Address of Principal Executive Offices) |

| (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

__________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

x |

| Accelerated filer | o | |

Non-accelerated filer | o |

| Smaller reporting company | |

|

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.) Yes o No

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant on June 30, 2023 was approximately $

As of January 26, 2024, the registrant had

DOCUMENTS INCORPORATED BY REFERENCE:

CENTURY COMMUNITIES, INC.

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2023

Table of Contents

CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS

Some of the statements included in or incorporated by reference into this Annual Report on Form 10-K (which we refer to as this “Form 10-K”) constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, forecasts, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. These statements are only predictions. We caution that forward-looking statements are not guarantees. Actual results could differ materially from those expressed or implied in the forward-looking statements. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “expect,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “continue,” “predict,” “potential” the negative of such terms and other comparable terminology, and the use of future dates. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Actual results and the timing of events may differ materially from those contained in these forward-looking statements due to a number of factors.

The forward-looking statements included in this Form 10-K reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. Statements regarding the following subjects, among others, may be forward-looking and subject to risks and uncertainties, including, among others:

economic changes, either nationally or in the markets in which we operate, including increased interest rates and the resulting impact on the accessibility of mortgage loans to homebuyers, persistent inflation, and decreased employment levels;

shortages of or increased prices for labor, land or raw materials used in housing construction and resource shortages;

a downturn in the homebuilding industry, including a reduction in demand or a decline in real estate values or market conditions resulting in an adverse impact on our business, operating results and financial condition, including an impairment of our assets;

changes in assumptions used to make industry forecasts, population growth rates or trends affecting housing demand or prices;

volatility and uncertainty in the credit markets and broader financial markets and the impact on such markets and our ability to access them in the event of a threatened or actual U.S. government shutdown or sovereign default;

our future business operations, operating results and financial condition, and changes in our business and investment strategy;

availability and price of land to acquire, and our ability to acquire such land on favorable terms or at all;

availability, terms and deployment of capital;

availability or cost of mortgage financing or an increase in the number of foreclosures in the market;

delays in land development or home construction resulting from adverse weather conditions or other events outside our control;

delays in completion of projects, land development or home construction, or reduced consumer demand for housing resulting from significant weather conditions and natural disasters in the geographic areas where we operate;

the impact of construction defect, product liability, and/or home warranty claims, including the adequacy of accruals and the applicability and sufficiency of our insurance coverage;

changes in, or the failure or inability to comply with, governmental laws and regulations;

the timing of receipt of municipal, utility and other regulatory approvals and the opening of projects and construction and completion of our homes;

the impact and cost of compliance with evolving environmental, health and safety and other laws and regulations and third-party challenges to required permits and other approvals and potential legal liability in connection therewith;

the degree and nature of our competition;

unstable economic and political conditions as well as geopolitical conflicts, could adversely affect our supply chain by causing shortages or increases in costs for materials necessary to construct homes and/or increases to the price of gasoline and other fuels and cause higher interest rates, inflation or general economic uncertainty;

our leverage, debt service obligations and exposure to changes in interest rates and our ability to obtain additional or refinance our existing debt when needed or on favorable terms;

our ability to continue to fund and succeed in our mortgage lending business and the additional risks involved in that business;

availability of qualified personnel and contractors and our ability to obtain additional or retain existing key personnel and contractor relationships;

our ability to continue to pay dividends and make stock repurchases in the future; and

taxation and tax policy changes, tax rate changes, new tax laws, new or revised tax law interpretations or guidance.

Forward-looking statements are based on our beliefs, assumptions and expectations of future events, taking into account all information currently available to us. Forward-looking statements are not guarantees of future events or of our performance. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to us. Some of these events and factors are described in “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Form 10-K, and other risks and uncertainties detailed in this report and our other reports and filings with the SEC. If a change occurs, our business, financial condition, liquidity, cash flows and results of operations may vary materially from those expressed in or implied by our forward-looking statements. New risks and uncertainties arise over time,

and it is not possible for us to predict the occurrence of those matters or the manner in which they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Therefore, you should not rely on these forward-looking statements as of any date subsequent to the date of this Form 10-K.

PART I

ITEM 1.BUSINESS.

Overview

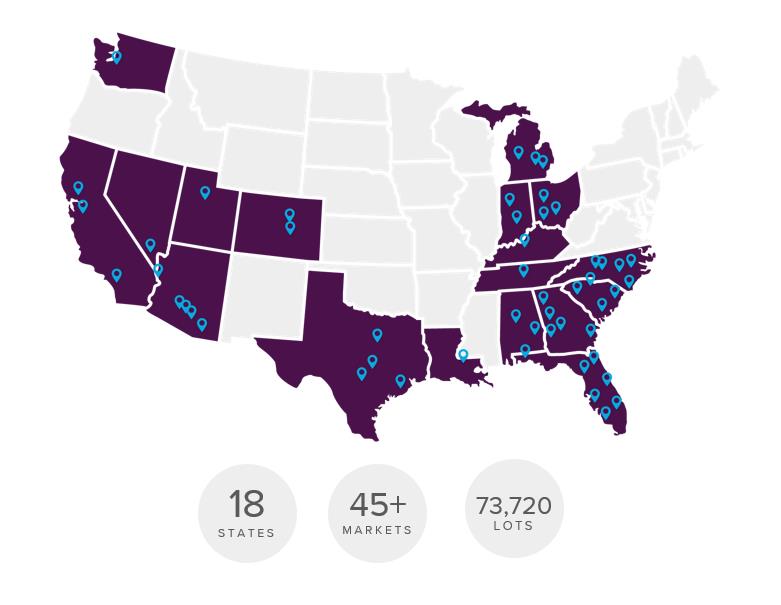

Century Communities, Inc., a Delaware corporation (which we refer to as “we,” “us,” “our,” “CCS,” or the “Company”), is engaged in the development, design, construction, marketing and sale of single-family attached and detached homes in 18 states. In many of our projects, in addition to building homes, we are responsible for the entitlement and development of the underlying land. We build and sell homes under our Century Communities and Century Complete brands.

Our Century Communities brand has an emphasis on serving the entry-level homebuilding market but offers a wide range of buyer profiles including: entry-level, first and second time move-up, and lifestyle homebuyers, and provides our homebuyers with the ability to personalize their homes through certain option and upgrade opportunities. Our Century Complete brand targets entry-level homebuyers, primarily sells homes through retail studios and the internet, and generally provides no option or upgrade opportunities.

Our homebuilding operations are organized into the following five reportable segments: West, Mountain, Texas, Southeast, and Century Complete. Our indirect wholly-owned subsidiaries, Inspire Home Loans Inc., Parkway Title, LLC, IHL Home Insurance Agency, LLC, and IHL Escrow Inc., which provide mortgage, title, insurance, and escrow services, respectively, primarily to our homebuyers, have been identified as our Financial Services segment. Additionally, our wholly owned subsidiary, Century Living, LLC, is engaged in the development, construction and management of multi-family rental properties, currently all located in Colorado. Century Living, LLC is included in our Corporate segment.

While we offer homes that appeal to a broad range of entry-level, move-up, and lifestyle homebuyers, our offerings are heavily weighted towards providing affordable housing options in each of our homebuyer segments. Additionally, we prefer building move-in-ready homes over built-to-order homes, which we believe allows for a faster construction process, advantageous pricing with subcontractors, and shortened time period from home sale to home delivery, thus allowing our customers greater certainty on their financing and allowing us to more appropriately price the homes and deploy our capital. Of the 9,568 homes delivered during 2023, approximately 92% of our deliveries were made to entry-level homebuyers that were below the Federal Housing Administration-insured mortgage limits and approximately 99% of homes delivered were built as move-in ready homes.

Since our initial public offering in 2014, we have expanded geographically through the acquisitions of other homebuilders and organic entrance into new markets. We are one of the largest homebuilders in the United States and our common shares trade on the New York Stock Exchange under the symbol “CCS.” As of December 31, 2023, we operated in the 18 states and over 45 markets depicted below:

We operate within the following reportable segments:

West (California and Washington)

Mountain (Arizona, Colorado, Nevada and Utah)

Texas

Southeast (Alabama, Florida, Georgia, North Carolina, South Carolina and Tennessee)

Century Complete (Alabama, Arizona, Florida, Georgia, Indiana, Kentucky, Louisiana, Michigan, North Carolina, Ohio, South Carolina)

Financial Services (which provide mortgage, title, and insurance services to our and other homebuyers)

Our Corporate operations are a non-operating segment, as it serves to support our homebuilding, and to a lesser extent our Financial Services operations, through functions, such as our executive, finance, treasury, human resources, accounting and legal departments. Additionally, our wholly owned subsidiary, Century Living, LLC, is engaged in the development, construction and management of multi-family rental properties, currently all located in Colorado. Century Living, LLC is included in our Corporate segment. See Note 2 – Reporting Segments in the Notes to the Consolidated Financial Statements for further detail on our reportable segments.

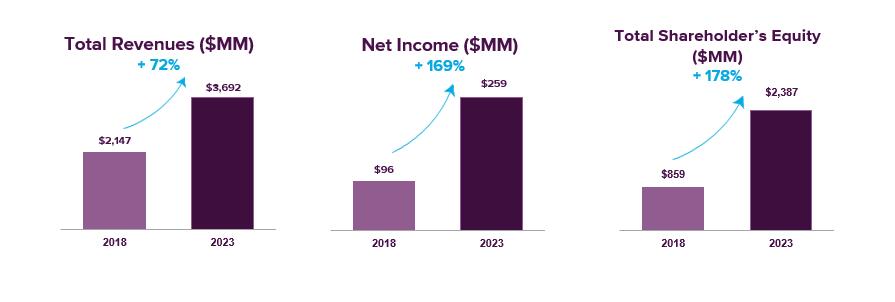

Macro-economic conditions, along with our operating efficiencies, business strategy and geographic expansion through the acquisition of other homebuilders and organic entrance into new markets has resulted in significant increases in total revenue, net income, and total stockholders’ equity as outlined below:

Homebuilding Operations

Strategy

Our strategy is focused on increasing the returns on our stockholders’ equity and inventory, and continuing to generate growth and strong profitability. In general, we are focused on the following:

Maintaining a strong balance sheet and prudent use of leverage;

Offering homes that appeal to a broad range of entry-level, move-up, and lifestyle homebuyers, while heavily weighting our offerings towards providing affordable housing options in each of our homebuyer segments;

Preferring building move-in-ready homes over built-to-order homes, which we believe allows for a faster construction process, advantageous pricing with subcontractors, and a shortened time period from home sale to home delivery, thus allowing our customers greater certainty on their financing and allowing us to more appropriately price the homes and deploy our capital;

Maintaining a strong pipeline of future land holdings, including favoring lot option contracts to manage our risk to land holdings;

Increasing our market share within our existing markets through organic growth and/or acquisitions of other homebuilders already operating in the market; and

Controlling costs, including costs of home sales revenue and selling, general and administrative expenses, and generating further efficiencies, including continued reliance on digital marketing and the ability to buy a home on our website, and cost efficiencies in our direct costs of construction through continued value engineering of our home plans.

Our operating strategy has resulted in significant growth in revenue and net income since 2018. We anticipate the homebuilding markets in each of our operating segments will continue to be tied to both the macro-economic environment and the local economy, and we expect our operating strategy will continue to adapt to market changes, though we cannot provide any assurance that our strategies will continue to be successful or change over time.

The core of our business plan is to acquire land strategically, based on our understanding of population growth patterns, local markets, entitlement restrictions and infrastructure development. We focus on locations within our markets that are generally characterized by diverse economic and employment bases and demographics and increasing populations. We believe these conditions create strong demand for new housing, and these locations represent what we believe to be attractive opportunities for long-term growth. We also seek assets that have desirable characteristics, such as good access to major job centers, schools, shopping, recreation and transportation facilities. Location, product, price point and customer service are key components of the connection we seek to establish with each individual homebuyer. Our construction expertise across an extensive product offering allows us flexibility to pursue a wide array of land acquisition opportunities and appeal to a broad range of potential homebuyers, from entry-level to first- and second-time move-up buyers and lifestyle homebuyers. Additionally, we believe our diversified product strategy enables us to adapt quickly to changing

market conditions and to optimize returns while strategically reducing portfolio risk.

Despite future macro-economic uncertainty, especially in relation to the interest rate environment, we believe we are well-positioned to benefit from the ongoing shortage of both new and resale homes available for purchase in our key markets and the favorable demographics that support the need for new affordable housing. We believe our operations are prepared to withstand volatility in future market conditions as a result of our product offerings which both span the home buying segment and focus on affordable price points, and our current and future inventories of attractive land positions. We have continued to focus on maintaining an appropriate balance of home and land inventories in relation to anticipated future demand, as well as prudent leverage, and, as a result, we believe we are well positioned to continue to execute on our strategy in order to optimize stockholder returns.

Land acquisition process

We acquire land for our homebuilding operations with the primary intent to construct single-family detached or attached homes for sale on the acquired land. From time to time we may sell land to other developers and homebuilders where we have excess land positions. We generally acquire land for cash, either through bulk acquisitions of land or through option contracts. Option contracts are generally structured where we have the right, but not the obligation, to buy land at predetermined prices on a defined schedule. Potential land acquisitions are normally identified by our local management within the markets in which we operate. We typically purchase lots for our Century Communities brand which range in status at acquisition from entitled for residential construction but requiring installation of streets, common areas, and wet and dry utilities to lots which are fully developed and immediately available for permitting and construction of the residence. For lots requiring development work, we negotiate, contract for, and oversee the work performed by subcontractors internally, and in some limited cases, we may hire a third-party general contractor for these services. For our Century Complete brand, we typically purchase lots which are immediately available for permitting and construction of the residence. Our land acquisition process typically includes soil tests, independent environmental studies, other engineering work and financial analysis which includes an evaluation of expected returns, projected gross margins, estimated sales pace and pricing. Potential land acquisitions are approved by our corporate office above established limits to ensure appropriate capital allocations taking into consideration current and projected inventory levels and risk adjusted returns.

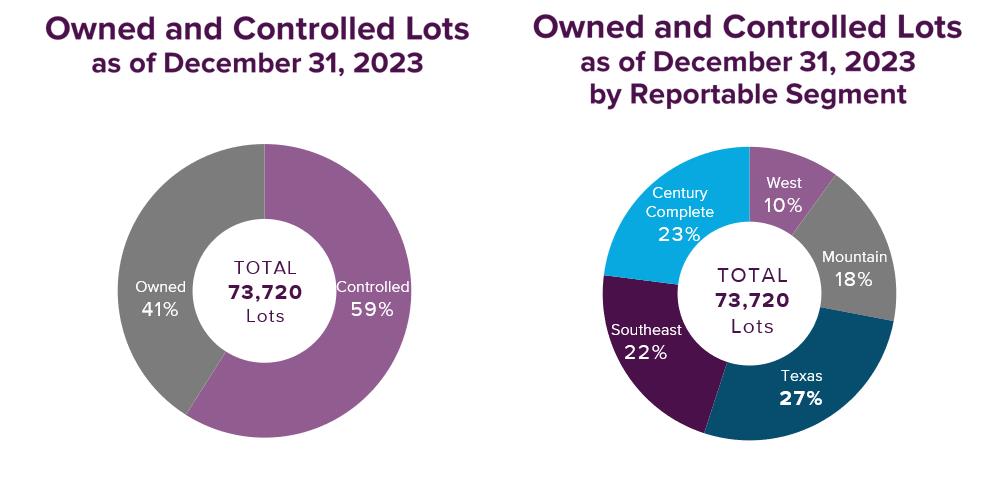

We strive to strategically manage our lot pipeline in order to maintain a balance between the number of owned lots as compared to lots we control through option and other contracts. This balance allows us flexibility to adjust to market conditions as they develop and the ability to exit positions at a reasonable cost in the event of a market downturn, without adversely impacting near term lot pipelines on which to start homes. This strategy has resulted in an owned and under control lot position of 73,720 as of December 31, 2023, of which 41.5% were owned and 58.5% were controlled through option contracts. Our owned and controlled lot position and our owned and controlled lot position by reportable segment as of December 31, 2023 is outlined below.

|

|

Design and construction

We engage architects, engineers and other professionals in connection with the home design process who are familiar with local market preferences, constraints, conditions and requirements, and we generally own the architectural design rights to our home plans. We serve as the general contractor, with all construction work typically performed by subcontractors. While we maintain long-standing relationships with many of our subcontractors and design professionals, we typically do not enter into long-term contractual commitments with them and as a result may be subject to shortages of qualified and skilled labor. Our personnel, along with

subcontracted marketing and design consultants, carefully design the exterior and interior of our home plans to coincide with the needs of targeted homebuyers.

When constructing homes, we use various construction materials and components including lumber, steel and concrete. It typically takes us four to five months, or more in some instances, to construct a home. While we attempt to contract for all input costs of the home at the start of construction, it is not always possible to do so. In those instances, labor and materials are subject to price fluctuations during the construction period. Such price fluctuations are caused by several factors, including recent global supply chain disruptions as well as seasonal variation in availability and demand for labor and materials. We may experience shortages in the availability of materials and/or labor in each of our markets and these shortages and delays may result in delays in the delivery of homes under construction, and/or reduced gross margins from home sales. During the year ended December 31, 2023, we experienced improved cycle times as compared to 2022 and benefitted from reduced direct construction costs on our starts as compared to the high point of our direct construction costs during the second quarter of 2022.

We are dependent upon building material suppliers for a continuous flow of certain materials. Whenever possible, we utilize standard products available from multiple national and international sources and utilize our buying power and relationships throughout the supply chain to ensure availability of products. We may also contract on a national level, directly with suppliers in many instances, to ensure availability and competitive prices of key materials. Further, we design and engineer our homes for energy efficiency to reduce the impact on the environment and lower energy costs to our homeowners.

Homebuilding marketing and sales process – Century Communities brand

Our Century Communities brand has a focus on affordable housing options in each market but builds an extensive range of home types across a variety of price points. Our Century Communities brand strives to provide our customers with “A Home for Every Dream.” ®

In many of our communities, we provide our customers with certain customization options to suit their lifestyle needs and have developed a number of home designs with features such as outdoor living spaces, one-story living and first floor primary bedroom suites to appeal to broad design needs. At times we offer homebuyers environmentally friendly alternatives, such as solar power to supplement a home’s energy needs.

We sell our homes through our own sales representatives often with the assistance of independent real estate brokers. Our in-house sales force typically works from sales offices located in model homes close to or in each community. Additionally, we provide the ability for our customers to purchase homes directly on our website. Sales representatives assist potential buyers by providing them with basic floor plans, price information, development and construction timetables, and tours of model homes where available. Sales personnel are trained by us and generally have had prior experience selling new or resale homes in the local market.

We advertise directly to potential homebuyers through the internet and digital marketing, marketing brochures and to a lesser extent newspapers. We may also use billboards, radio and television advertising, along with our website, to market the location, price range and availability of our homes. We also attempt to operate in conspicuously located areas that permit us to take advantage of local traffic patterns. Model homes play a significant role in our marketing efforts by creating an attractive atmosphere and assisting the customer in visualizing the livability of our floor plans.

Homebuilding marketing and sales process – Century Complete brand

Our Century Complete brand primarily sells affordable homes to entry-level buyers through our own sales representatives located in retail locations which we refer to as studios, as opposed to model homes; however, model and vignetted homes are used in certain instances. We lease our studios within strip malls or other high traffic retail centers, located centrally to our homes under construction. Our studios are generally leased for a period of three years and average approximately 1,600 square feet. We also sell homes directly through our Century Complete website and utilize the services of independent real estate brokers in many cases. Our Century Complete brand aims to provide our customers with “More Home, Less Money.”®

Our Century Complete brand often competes with resales as well as other new home builders within the submarkets in which we operate. We are often able to offer a new home offering to our customers at prices that are lower than other new home offerings. Our goal is to be the price leader through, among other factors, providing a limited number of floor plans, with no options or upgrades offered. Our advertising and marketing efforts are focused on cost effective means of reaching potential customers including centralized digital marketing, and direct outreach to independent real estate brokers. We leverage our studios, advertising and marketing efforts to generate homebuyer leads, which are then actively pursued by our sales associates.

Customer experience

Our goal is to provide a positive experience for our homeowners by engaging them in the homebuying and homeowning processes. We pay particular attention to product design and carefully consider choice of materials in order to provide features that homebuyers today are seeking. We maintain customer service staff whose role includes providing a positive experience for each customer throughout the pre-closing process, home closing process and beyond. This group is also responsible for providing after sales customer service. Our customer service initiatives include using customer survey results to improve our standards of customer satisfaction. Generally, we provide each homeowner with product warranties covering workmanship and materials for one year from the time of closing, and warranties covering structural systems from the time of closing through the statute of repose with the states we operate in, or ten years, whichever is shorter. The subcontractors who perform most of the actual construction also provide to us customary warranties on workmanship.

Seasonality

Historically, the homebuilding industry experiences seasonal fluctuations in quarterly operating results and capital requirements. We typically experience the highest new home order activity during the spring, although this activity is also highly dependent on the number of active selling communities, timing of new community openings and other market factors. Since it typically takes us four to five months to construct a new home, we deliver more homes in the second half of the year as spring and summer home starts convert to home deliveries. Because of this seasonality, home starts, construction costs and related cash outflows have historically been highest in the second and third quarters, and the majority of cash receipts from home deliveries occurs during the second half of the year. This seasonality pattern may be affected by volatility in the homebuilding industry, supply chain challenges, and changes in demand for our homes.

Financial Services Operations

We offer home financing for our customers and other homebuyers through our wholly owned subsidiary, Inspire Home Loans Inc. (which we refer to as “Inspire”). Inspire is authorized to originate Federal National Mortgage Association (“Fannie Mae”), Federal Home Loan Mortgage Corporation (“Freddie Mac”), Government National Mortgage Association (“Ginnie Mae”), FHA, Department of Veterans Affairs-guaranteed (“VA”), and U.S. Department of Agriculture (“USDA”) mortgages (which we refer to collectively as the “government sponsored entities”). We also offer title and homeowners insurance services through our wholly owned subsidiaries, Parkway Title, LLC (which we refer to as “Parkway”), IHL Home Insurance Agency, LLC (which we refer to as “IHL Insurance”), and IHL Escrow Inc. (which we refer to as “IHL Escrow”) respectively. These operations along with Inspire collectively comprise our Financial Services operating segment. We believe that our customers’ use of Inspire, Parkway, IHL Insurance, and IHL Escrow provides us with a competitive advantage by enabling more control over the quality of the overall home buying process for our customers, while also helping us align the timing of the house construction process with our customers’ financing, title and insurance needs.

The results of operations of our Financial Services operating segment are primarily driven by the results of Inspire. Because Inspire originates mortgage loans primarily for our homebuilding customers, Inspire is dependent on our homebuilding operations and its results of operations are highly correlated with our homebuilding operations, and to a lesser degree the overall market demand for mortgages.

Inspire sells substantially all of the loans it originates, either as loans with servicing rights released, or with servicing rights retained, in the secondary mortgage market within a short period of time after origination, generally within 30 days. This strategy results in owning the loans for only a short period of time. After the loans are sold, Inspire may be responsible for potential losses associated with mortgage loans originated and sold in the event of errors or omissions relating to customary industry-standard representations and warranties made by Inspire that the loans met certain requirements. Representations include underwriting standards, the existence of primary mortgage insurance, and the validity of certain borrower representations in connection with the loans.

Governmental Regulation and Environmental Matters

We are subject to numerous local, state, federal and other statutes, ordinances, rules and regulations concerning zoning, development, building design, construction and similar matters which impose restrictive zoning and density requirements in order to limit the number of homes that can eventually be built within the boundaries of a particular area. In the normal course of business, we incur the costs associated with these laws and regulations, which are included in our homebuilding cost of revenues. Projects that are not entitled may be subjected to periodic delays, changes in use, less intensive development or elimination of development in certain specific areas due to government regulations. We may also be subject to periodic delays or may be precluded entirely from developing in certain communities due to building moratoriums or “slow-growth” or “no-growth” initiatives that could be implemented in the future. Local and state governments also have broad discretion regarding the imposition of development fees for projects in their jurisdiction. Projects for which we have received land use and development entitlements or approvals may still require a variety of other governmental

approvals and permits during the development process and can also be impacted adversely by unforeseen municipal, regulatory, health, safety and welfare issues, which can further delay these projects or prevent their development.

We are also subject to a variety of local, state, federal and other statutes, ordinances, rules and regulations concerning the environment. The particular environmental laws which apply to any given homebuilding site vary according to the site’s location, its environmental conditions, and the present and former uses of the site, as well as adjoining properties. Environmental laws and conditions may result in delays, may cause us to incur substantial compliance and other costs, which are difficult or impossible to estimate, and can prohibit or severely restrict homebuilding activity in environmentally sensitive regions or areas. From time to time, the Environmental Protection Agency and similar federal or state agencies review homebuilders’ compliance with environmental laws and may levy fines and penalties for failure to strictly comply with applicable environmental laws or impose additional requirements for future compliance as a result of past failures. Any such actions taken with respect to us may increase our costs. Further, we expect that increasingly stringent requirements will be imposed on homebuilders in the future. Environmental regulations can also have an adverse impact on the availability and price of certain raw materials such as lumber. Any delays and costs associated with our compliance with environmental laws and conditions have not materially impacted our results of operations.

Under various environmental laws, current or former owners of real estate, as well as certain other categories of parties, may be required to investigate and clean up hazardous or toxic substances or petroleum product releases, and may be held liable to a governmental entity or to third parties for property damage and for investigation and cleanup costs incurred by such parties in connection with the contamination. In addition, in those cases where an endangered species is involved, environmental rules and regulations can result in the elimination of development in identified environmentally sensitive areas.

Our mortgage, title, and insurance subsidiaries must comply with applicable real estate, lending and insurance laws and regulations. The subsidiaries are licensed in the states in which they do business and must comply with laws and regulations in those states. These laws and regulations include provisions regarding capitalization, operating procedures, investments, lending and privacy disclosures, forms of policies and premiums. The Dodd-Frank Wall Street Reform and Consumer Protection Act contains a number of requirements relating to mortgage lending and securitizations. These include, among others, minimum standards for lender practices, limitations on certain fees and a requirement that the originator of loans that are securitized retain a portion of the risk, either directly or by holding interests in the securitizations. The impact of those statutes, rules, and regulations can be to increase our homebuyers’ cost of financing, increase our cost of doing business, and restrict our homebuyers’ access to some types of loans.

Several federal, state and local laws, rules, regulations and ordinances, including, but not limited to, the Federal Fair Debt Collection Practices Act (“FDCPA”) and the Federal Trade Commission Act and comparable state statutes, regulate consumer debt collection activity. Although, for a variety of reasons, we may not be specifically subject to the FDCPA or to some state statutes that govern debt collectors, it is our policy to comply with applicable laws in our collection activities. To the extent that some or all of these laws apply to our collection activities, our failure to comply with such laws could have a material adverse effect on us. We are also subject to regulations promulgated by the Federal Consumer Financial Protection Bureau regarding residential mortgage loans.

Competition

We face competition in the homebuilding industry, which is characterized by relatively low barriers to entry. Homebuilders compete for, among other things, home buying customers, desirable land parcels, employees, financing, raw materials and skilled labor. Increased competition may prevent us from acquiring attractive land parcels on which to build homes or make such acquisitions more expensive, hinder our market share expansion or lead to pricing pressures on our homes that may adversely impact our margins and revenues. Our competitors may independently develop land and construct housing units that are superior or substantially similar to our products, or may be significantly larger, have a longer operating history and have greater resources or lower cost of capital than us; accordingly, they may be able to compete more effectively in one or more of the markets in which we operate or plan to operate. We also compete with other homebuilders that have long-standing relationships with subcontractors and suppliers in the markets in which we operate or plan to operate and we compete for sales with individual resales of existing homes and with available rental housing.

Our Financial Services operations compete with other mortgage lenders, including national, regional and local mortgage bankers and brokers, banks, savings and loan associations and other financial institutions, in the origination and sale of residential mortgage loans. Principal competitive factors include interest rates and other features of mortgage loan products available to the consumer. We compete with other title insurance agencies and underwriters for closing services and title insurance. We also compete with other insurance agencies. Principal competitive factors include service and price.

Human Capital Resources

Our mission is to build attractive, high-quality homes at affordable prices as we provide our valued customers “A Home for Every Dream®.” Our team is dedicated to building energy efficient new homes with lasting livability and creating enduring neighborhoods.

We recognize that our employees are key to our ability to achieve our mission and believe our employees have and will continue to be a primary reason for our growth and success. We place a focus on attracting and retaining talented and experienced individuals to manage and support our operations.

Recognizing the importance of our human capital, our Board of Directors, through the Compensation Committee, retains direct oversight of our human capital and oversees and reviews our culture and policies and strategies related to human capital management, including with respect to diversity and inclusion initiatives, pay equity, talent, recruitment and development, performance management and employee engagement.

In 2023, we were named to Newsweek’s list of Most Trustworthy Companies in America.

Employees

The total number of full-time employees as of December 31, 2023 was 1,650, which includes 196 employees related to our Financial Services segment and 1,454 employees related to our corporate and homebuilding operations. Our headcount increased by approximately 7.3% compared to December 31, 2022 as a result of increased active community count during 2023. Within our homebuilding operations, the majority of our employees are related to our construction and sales functions, which totaled 445 and 398 employees, respectively, as of December 31, 2023. We do not have collective bargaining agreements relating to any of our employees, and we have not experienced any strikes or work stoppages. However, we subcontract many phases of our homebuilding operations and some of the subcontractors we use may have employees who are represented by labor unions.

Our Co-Chief Executive Officers and Chief Financial Officer, who are responsible for setting our overall strategy, average approximately 19 years with us, and have extensive experience in the homebuilding industry. Our Co-Chief Executive Officers are also the founders of the company. Our leadership team’s long service history provides consistency in managing our business and helps reinforce and sustain our company culture through all levels of the organization.

Employee compensation and benefits

Our employees are critical to our continued success and execution of our strategic priorities. We understand that our ultimate success and ability to compete are significantly dependent on how well we attract, promote, retain qualified employees with the expertise needed to manage and support our operations. To attract and retain top talent in the industry, we offer our employees pay and benefits packages, which we believe are competitive with others throughout our industry, as well as within the local markets in which we operate. Compensation packages for our employees generally include competitive base pay and the opportunity to receive periodic bonus payments which are tied to individual employee performance and often times the achievement of operational performance targets. These operational performance targets vary by year and may vary based on local market conditions. Additionally, for certain employees critical to the management of our operations, we provide long-term incentive compensation, in the form of restricted stock units, which typically vest over a three-year period. We believe this compensation structure provides our employees with competitive pay and aligns individual performance with our success.

Employee training

In accordance with our Commitment to Training and Professional Development, we train new and existing employees in a variety of areas, including company policies, anti-harassment, anti-discrimination, sales, information technology including cyber security risks, retirement and financial wellness planning, and safety. On an individual level, we are committed to providing employees with the feedback necessary to improve their performance, reviewing expectations of their position, and fostering growth in their current role. As part of our commitment to the ongoing training and development of our employees, we rolled out Century University at the beginning of 2023. With this program, we have developed a learning management system that includes training videos and quizzes covering topics such as construction, customer relations, purchasing, and land development and architecture, and safety, (ii) field training for our construction and sales personnel taught by internal and external subject matter experts, and (iii) periodic leadership seminars for our executives and much more.

Diversity, inclusion, and ethics

As set forth in our Commitment to Diversity and Inclusion, our commitment to equal opportunity does not begin with employment; it begins at the time a position becomes open. We and the recruiting agencies that we use commit to equal opportunity recruiting. We are committed to hiring and supporting a diverse and inclusive workforce. We define diversity as the range of human differences, including but not limited to race, ethnicity, gender, gender identity, sexual orientation, age, social class, physical ability or attributes, religious or ethical values system, national origin, and political beliefs. We aim to create an inclusive organization where all employees are treated

with dignity and respect and are empowered to reach their full potential. Among other programs, all new employees are required to take trainings related to anti-harassment and anti-discrimination. Further, all employees are trained on anti-harassment and anti-discrimination every two years or more often if required by state law. We are committed to equal opportunity from the time a position becomes open, and are committed to pay equity, a core element of our pay-for-performance strategy.

As of December 31, 2023, our overall workforce was comprised of approximately 42% women and 24% identified as racially or ethnically diverse, and our manager level employees, including those at our corporate office, our on-site sales, sales support and construction workforce, was comprised of approximately 47% women and 22% identified as racially or ethnically diverse. Of our U.S. workforce, 3% are veterans. Of the seven members of our Board of Directors, nearly 30% are female and nearly 30% are racially or ethnically diverse.

Additionally, all our employees are expected to display and encourage honest, ethical, and respectful conduct in the workplace. Our employees must adhere to our Code of Business Conduct and Ethics that sets standards for appropriate behavior and includes periodic training on preventing, identifying, reporting, and stopping discrimination of any kind. Employees may anonymously report any suspected violations to our web-based reporting system or Corporate Compliance Line. We also maintain an anti-retaliation policy such that any employee who reports a concern in good faith is protected from harassment, retaliation, or adverse employment consequences.

Vendors and Suppliers

At Century, we aim to conduct our business operations at the highest level of ethical standards. We expect our vendors – including business partners, suppliers and trade partners – to understand and act in accordance with applicable laws, rules and regulations, as well as to abide by our workplace policy standards. This includes our Code of Business Conduct and Ethics Policy Statement, our Environmental, Social and Governance (ESG) Policy Statement, our Human Rights Policy Statement, our Commitment to Workplace Health & Safety Statement and our Commitment to Diversity and Inclusion Policy Statement.

Our goal is to partner with vendors that conduct their businesses with a set of ethical standards comparable to our own and who share our same commitment to workplace health and safety, labor rights and the environment.

We expect that all our vendor business partners commit to providing a safe workplace and standards for employment that respect the rights of their employees under federal, state and local laws. In addition, we have developed a Vendor Code of Conduct to establish principles, guidelines and standards with respect to the conduct of our vendor business partners. These principles, guidelines and standards build on those contained within our own Ethics Policy and are intended to help us address certain risks. Through their vendor agreements with us, we expect our vendor business providers will respect the principles, guidelines and standards reflected in this Code. We also expect our vendor business partners to follow best industry practices.

Health and safety

The philosophy at Century that we pursue each and every day is that “No One Gets Hurt. Everyone Goes Home To Build Another Day.” We are committed to workplace health and safety, as outlined in our Labor Rights Policy. In our corporate structure, we have a Senior Director of National Safety as well as additional staffing who provide centralized administrative support and set guidelines for audit frequency and conduct internal audits. Each division designates Division Safety Officers, who are extensively trained in on-site hazard identification, abatement protocols and safety incident reporting in order to promote and maintain Occupational Safety and Health Administration compliance. Additionally, we conduct monthly safety audits, as well as third-party safety inspections, to ensure our construction operations are safe. We also provide safety training through webinars, classroom settings, field onsite forums, trade toolbox talks, and one-on-one mentoring with third-party safety auditors. During 2023, the recordable injury rate of our direct employees was 0.63%, which decreased from the prior year.

Community support and engagement

As a leading homebuilder with a presence in 18 states and over 45 markets, we play an important role in helping to solve the shortage of housing, especially affordable housing, that exists today in the United States. We are not only dedicated to building sustainable and affordable new homes, but we also believe it is important to support the communities in which we live and operate by donating both our time and additional resources. In 2021, we established Century Communities Foundation, a 501(c)(3) nonprofit, to support our local teams at the corporate level with their initiatives and to make contributions at both national and local levels. To further expand on our community engagement, in 2023, we engaged an outside partner to create an online system where our employees can identify volunteer opportunities, track hours spent volunteering, make donations, and have their donations matched by Century Communities Foundation up to $500 per calendar year. During the year ended December 31, 2023, we pledged $2.0 million to the Century Communities Foundation.

Century ESG report

More information regarding our human capital programs and initiatives can be found in our Environmental, Social and Governance Report. Our Environmental, Social and Governance Report is available under the “Investors-ESG” section of our website located at www.centurycommunities.com. Information on our website, including the Environmental, Social and Governance Report, is not incorporated by reference in or otherwise considered a part of this Annual Report on Form 10-K.

Available Information

We are a U.S. public reporting company under the Securities Exchange Act of 1934, as amended (which we refer to as the “Exchange Act”), and file reports, proxy statements, and other information with the U.S. Securities and Exchange Commission (which we refer to as the “SEC”). Copies of these reports, proxy statements, and other information can be accessed from the SEC's home page on the Internet at http://www.sec.gov. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K are available free of charge on our website at www.centurycommunities.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC. The information contained on our website or connected to our website is not incorporated by reference into this Form 10-K and should not be considered part of this report.

ITEM 1A.RISK FACTORS.

Our business routinely encounters and attempts to address risks, some of which will cause our future results to differ, sometimes materially, from those originally anticipated. Below, we have described our present view of the material risks facing the Company. The risk factors set forth below are not the only risks that we may face or that could adversely affect us. If any of the circumstances described in the risk factors discussed in this Form 10-K actually occur, our business, prospects, liquidity, financial condition and results of operations could be materially and adversely affected. If this were to occur, the trading price of our securities could decline significantly and stockholders may lose all or part of their investment.

The following discussion of risk factors contains “forward-looking statements,” which may be important to understanding any statement in this Form 10-K or in our other filings and public disclosures. In particular, the following information should be read in conjunction with the sections in this Form 10-K entitled, “Cautionary Note about Forward-Looking Statements,” “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Item 8. Financial Statements and Supplementary Data.”

Risk Factors Summary

This summary is not complete and should be read in conjunction with the risk factors that follow.

Risks Related to the Housing Market and General Economic Conditions

We are subject to demand fluctuations in the housing market and the homebuilding industry.

Adverse changes in general economic conditions, including inflation, unemployment rates, interest rates, and availability of financing, global economic and political instability and conflicts and changing home buying patterns and trends could reduce future demand for our homes.

Our long-term growth depends upon our ability to successfully identify and acquire desirable land parcels at reasonable prices and to successfully manage our land and lot inventory.

Our geographic concentration and changes to the population growth rates and other demographics or conditions in our markets could adversely affect our business.

Risks Related to the Homebuilding and Real Estate Industries

Our operating results are dependent on our ability to develop our communities successfully and within expected timeframes and to maintain good relations with the homeowners in our communities.

We face risks regarding utility, resource, raw material, building supply and labor shortages and prices, which have been exacerbated by persistent inflation and supply chain disruptions.

We are subject to potential liability for health and safety incidents and product liability and warranty claims, which may exceed our insured limits.

The homebuilding industry is cyclical, seasonal and competitive.

Real estate investments are risky and dependent upon our ability to successfully manage our land acquisitions and development and construction processes.

Risk Related to Our Financial Services Business

Our mortgage lending business requires substantial capital, which may not continue to be available to us in the amounts we require and at acceptable pricing.

Our Financial Services segment can be adversely affected by reduced demand for our homes and our inability to sell mortgages into the secondary market or potential liability in connection with such sales.

The financial services market is competitive.

Governmental regulation may adversely affect our Financial Services operations.

Our servicing portfolio, interest rate lock commitments, and loans held for sale are subject to fluctuation in values and although we attempt to hedge our exposure, our hedging activities involve risk and may not be effective.

A cyber attack or other security breach of our Financial Services business could subject us to significant liability and harm our reputation.

Risks Related to Human Capital Management

The success of our business is dependent upon highly skilled, competent and key personnel, as well as suitable contractors.

We depend on key personnel, the loss of which could have a material adverse effect on our business.

Risks Related to Governmental, Regulatory, Legal and Compliance Matters

Government regulations and legal challenges may delay the start or completion of our communities, increase our costs and expenses or limit our homebuilding or other activities.

We may face substantial damages or be enjoined from pursuing important activities as a result of existing or future litigation, arbitration or other claims.

We are subject to liability under various data protection laws, the non-compliance of which could subject us to significant monetary damages, regulatory enforcement actions, fines and/or criminal prosecution.

Risks Related to Environmental Matters

We are subject to environmental laws and regulations, which may increase our costs, limit the areas in which we can build homes, delay completion of our projects or result in potential liability.

Risks Related to Weather and Climate Change

Adverse weather and geological conditions may increase our costs, cause project delays and reduce consumer demand for housing.

Changes in global or regional climate conditions and governmental actions in response to such changes, including new climate disclosure rules proposed by the SEC, may adversely affect us by increasing the costs of, or restricting, our planned or future growth activities.

Risk Related to Acquisitions and Joint Venture Investments

Acquisitions, investments and/or disposals involve risks and may result in unexpected costs and unrealized benefits.

A significant portion of our historical growth has been due to our prior acquisitions and we may not be able to continue to grow through acquisitions.

Risks Related to Our Indebtedness and Liquidity

Difficulty in obtaining sufficient additional capital or refinancing our existing indebtedness at reasonable prices when needed could result in an inability to acquire land for our developments or increased costs and delays in the completion of our development projects.

We have substantial indebtedness and expect to continue to use leverage in executing our business strategy.

Interest expense on our debt limits our cash available to fund our growth strategies and we may be unable to generate sufficient cash flows to meet our debt service obligations or comply with our covenants.

Risks Related to Tax Policies and Regulation

Tax policies and regulation, including in particular any limitation on, or reduction or elimination of, tax benefits associated with owning a home or increases in property and sales taxes, may affect our business and increase our costs.

Risk Related to Possible Conflicts of Interest

Conflicts of interest may arise as a result of relationships between our Co-Chief Executive Officers and the Company.

Risks Related to Ownership of our Common Stock

The ownership of our common stock is risky as it is subordinated to our existing and future indebtedness.

Our actual operating results may differ significantly from our guidance or the expectations of analysts, which could cause the market price of our common stock to decline.

General Risk Factors

We are subject to several other risks of which other public companies are subject, including without limitation, the effect of negative publicity; increased scrutiny related to our environmental, social and governance practices; information technology failures or data security breaches; the rise of artificial intelligence; our ability to change our operational policies, investment guidelines and business and growth strategies without stockholder consent; and our ability to maintain an effective system of internal controls.

Risks Related to the Housing Market and General Economic Conditions

We are subject to demand fluctuations in the housing market and the homebuilding industry. Any decline in demand for our homes or in the homebuilding industry generally may materially and adversely affect our business, results of operations, and financial condition.

Demand for our homes is subject to fluctuations, often due to factors outside of our control. These factors may include interest rates and Federal Reserve policy changes; inflation; consumer confidence and spending; employment levels; uncertainty in financial, credit and consumer lending markets; slow economic growth or recessionary conditions in various regions or industries around the world; availability of financing for homebuyers; tight lending standards and practices for mortgage loans that limit consumers’ ability to qualify for mortgage financing to purchase a home, including increased minimum credit score requirements, credit risk/mortgage loan insurance premiums and/or other fees and required down payment amounts, higher home prices, more conservative appraisals, changing consumer preferences, higher loan-to-value ratios and extensive buyer income and asset documentation requirements; changes to mortgage regulations; availability and prices of new homes compared to existing inventory; demographic trends, including slower rates of population growth or population decline in our markets; the effect of pandemics; and other factors, including those described elsewhere in this report. If there is limited economic growth, declines in employment and consumer income, changes in consumer behavior, and/or tightening of mortgage lending standards, practices and regulation in the geographic areas in which we operate, or if interest rates for mortgage loans or home prices continue to rise, there could likely be a corresponding adverse effect on our business, prospects, liquidity, financial condition and results of operations, including, but not limited to, the number of homes we sell, our average sales price per home closed, cancellations of home purchase contracts and the amount of revenues or profits we generate, and such effect may be material. In a housing market downturn when demand for our homes decreases, our revenues and results of operations are typically adversely affected; we may have significant inventory impairments and other write-offs; our gross margins may decline significantly from historical levels; and we may incur substantial losses from operations. At any particular time, we cannot accurately predict whether housing market conditions will improve, deteriorate or continue as they exist at that time.

Adverse changes in general economic conditions could reduce the demand for our homes and, as a result, could have a material adverse effect on our business, results of operations and financial condition.

The residential homebuilding industry is cyclical and is highly sensitive to changes in local and general economic conditions that are outside our control, including:

consumer confidence, employment levels, job growth, spending levels, wage and personal income growth, personal indebtedness levels, and household debt-to-income levels of potential homebuyers;

the availability and cost of financing for homebuyers or restrictive mortgage standards, including private and federal mortgage financing programs and federal, state, and provincial regulation of lending practices;

real estate taxes and federal and state income tax provisions, including provisions for the deduction of mortgage interest payments;

U.S. and global financial system and credit markets, including short- and long-term interest rates and inflation, and any effects from a potential U.S. government shutdown or sovereign default;

housing demand from population growth, household formations, new home buying catalysts (such as marriage and children), second home buying catalysts (such as retirement), home sale catalysts (such as an aging population), demographic changes (including immigration levels and trends in urban and suburban migration), generational shifts, or otherwise, or perceptions regarding the strength of the housing market, and home price appreciation and depreciation resulting therefrom;

competition from other real estate investors with significant capital, including other real estate operating companies and developers, institutional investment funds and companies solely focused on single-family rentals; and

the supply of new or existing homes, including foreclosures, and other housing alternatives, such as apartments and other residential rental property, and the aging of existing housing inventory.

These factors have resulted in the past and in the future could result in a decline in the demand for our homes, as well as a decline in the pricing for our homes, an increase in customer cancellations, an increase in selling concessions and downward pressure on the market value of our inventory, which could have a material adverse effect on our business, prospects, liquidity, financial condition and results of operations and increase the risk for asset impairments. A significant or sustained downturn in the homebuilding market would likely have an adverse effect on our business and results of operations for multiple years.

In addition, the portion of our customer base that consists of first- and second-time move-up buyers, often purchase homes subject to contingencies related to the sale and/or closing of their existing homes. If these potential buyers face difficulties in selling or closing their homes, whether due to rising interest rates for mortgage loans, periods of weak economic conditions, oversupply, restrictive mortgage standards or otherwise, our sales may be adversely affected. Moreover, we may need to reduce our sales prices, possibly in instances where appraised values of our homes are lower than our sales price, and offer greater incentives to buyers to compete for sales that may result in reduced margins. Also, because we have increased our supply of quick move-in (or “spec”) homes relative to our built-to-order homes, adverse changes in economic conditions could cause us to reduce prices more rapidly to avoid carrying large amounts of finished inventory. This, in turn, could adversely affect our results of operations and financial condition

Global economic and political instability and conflicts could adversely affect our business, financial condition or results of operations.

The global economic slowdown, inflation, rising interest rates and the prospects for recession, as well as recent and potential future disruptions in access to bank deposits or lending commitments due to bank failure, could materially and adversely affect our liquidity, our business, financial condition and results of operations. The closures of certain regional banks during the first half of 2023 and their placement into receivership with the Federal Deposit Insurance Corporation (“FDIC”) created bank-specific and broader financial institution liquidity risk and concerns. Although the Department of the Treasury, the Federal Reserve, and the FDIC jointly released a statement that depositors at these banks would have access to their funds, even those in excess of the standard FDIC insurance limits, future adverse developments with respect to specific financial institutions or the broader financial services industry may lead to market-wide liquidity shortages. The failure of any bank with which we do business could reduce the amount of cash we have available for our operations or delay our ability to access such funds. Any such failure may increase the possibility of a sustained deterioration of financial market liquidity, or illiquidity at clearing, cash management and/or custodial financial institutions. In the event we have a commercial relationship with a bank that has failed or is otherwise distressed, we may experience delays or other issues in meeting our financial obligations. If other banks and financial institutions enter receivership or become insolvent in the future in response to financial conditions affecting the banking system and financial markets, our ability to access our cash and cash equivalents and investments may be threatened and could have a material adverse effect on our business and financial condition.

Additionally, our business could be adversely affected by unstable economic and political conditions as well as geopolitical conflicts. While we do not have any customer or direct supplier relationships in foreign countries experiencing war, current military conflicts, and related sanctions, as well as export controls or actions that may be initiated by nations (e.g., potential cyber attacks, disruption of energy flows, etc.) and other potential uncertainties could adversely affect our supply chain by causing shortages or increases in costs for materials necessary to construct homes and/or increases to the price of gasoline and other fuels. In addition, such events could cause higher interest rates, inflation or general economic and geopolitical uncertainty, which could negatively impact our business partners, employees or customers, or otherwise adversely impact our business. Furthermore, deployments of U.S. military personnel to foreign regions, terrorist attacks, other acts of violence or threats to national security and any corresponding response by the United States or others, related domestic or international instability or civil unrest may cause an economic slowdown in the markets where we operate, which could adversely affect our business.

Our future success depends upon our ability to successfully adapt our business strategy to changing home buying patterns and trends.

Future changing home buying patterns and trends could reduce the demand for our homes and, as a result, could have a material adverse effect on our business and results of operations. Our business strategy has historically been to offer homes that appeal to a broad range of entry-level, move-up and, lifestyle homebuyers, with an emphasis towards entry-level or affordably priced homes, based on each local market in which we operate. However, given the significant increases in average home sales prices across our markets and the increased demand for more affordable homes due to generational shifts, affordability concerns, changing demographics and other factors, we have further increased our focus on offering more affordable housing options in our markets. We believe that due to anticipated generational shifts, changing demographics and other factors, the demand for more entry-level and affordable homes will continue to increase. This is particularly true in light of future homebuyers being motivated to move out of their apartments or confined living areas, often in urban areas, and into more spacious homes, often in nearby suburbs, as they spend more time at home as a result of part- and full-time remote-working arrangements, which became significantly more prevalent as a result of the COVID-19 pandemic. Part of our strategy with our Century Complete brand is to target first time homebuyers with an asset light business model. Our Century Complete brand targets entry-level homebuyers, primarily sells homes through retail studios and the internet, and generally provides no

option or upgrade opportunities. We have also pivoted our Century Communities brand to target more affordable price points as well. No assurance can be provided that our current business strategy to focus on more affordable homes will be effective or that we will successfully anticipate and react to future changing home buying patterns and trends, which may include higher levels of single-family rental demand. In addition, if the level of new home demand increases in future periods as a result of changing home buying patterns or trends or otherwise, the risk of shortages and cost increases in residential lots, labor and materials available to the homebuilding industry will likely increase.

Our long-term growth depends upon our ability to successfully identify and acquire desirable land parcels at reasonable prices for residential build-out.

Our future growth depends upon our ability to successfully identify and acquire attractive land parcels for development of our homes at reasonable prices and with terms that meet our underwriting criteria. Our ability to acquire land parcels for new homes may be adversely affected by changes in the general availability of land parcels, the willingness of land sellers to sell land parcels at reasonable prices, competition for available land parcels, availability of financing to acquire land parcels, zoning, governmental and municipal restrictions, including environment restrictions, and other market conditions. There can be no assurance that an adequate supply of homebuilding lots will continue to be available to us on terms similar to those available in the past. If the supply of land parcels appropriate for development of homes is limited because of these factors, or for any other reason, our ability to grow could be significantly limited, and the number of homes that we build and sell could decline. Additionally, our ability to begin new projects could be impacted if we elect not to purchase land parcels under option contracts. To the extent we are unable to purchase land parcels on a timely basis or enter into new contracts for the purchase of land parcels at reasonable prices, our home sales revenue and results of operations could be negatively impacted.

Our geographic concentration could materially and adversely affect us if the homebuilding industry in our current markets decline for a prolonged period.

Our business strategy is focused on the design, construction and sale of single-family detached and attached homes in 18 states throughout the U.S. which results in us being subject to risks associated with the particular markets in which we operate, including their regional and local economies, any industries which are prevalent in these markets, and weather-related or other events impacting these markets. A prolonged economic downturn in one or more of these areas, or a particular industry that is fundamental to one or more of these areas, could have a material adverse effect on our business, prospects, liquidity, financial condition and results of operations. To the extent the oil and gas industry, which can be very volatile, is negatively impacted by declining commodity prices, climate change, legislation or other factors, a result could be a reduction in employment or other negative economic consequences, which in turn could adversely impact our home sales and activities in certain of our markets. Our communities on the West coast are especially susceptible to restrictive government regulations and environmental laws. In addition, certain insurance companies doing business in Florida and Texas have restricted, curtailed or suspended the issuance of homeowners’ insurance policies on single-family homes. This has both reduced the availability of hurricane and other types of natural disaster insurance in Florida and Texas, in general, and increased the cost of such insurance to prospective purchasers of homes in Florida and Texas. Mortgage financing for a new home is conditioned, among other things, on the availability of adequate homeowners’ insurance. There can be no assurance that homeowners’ insurance will be available or affordable to prospective purchasers of our homes in the Florida and Texas markets. Long-term restrictions on, or unavailability of, homeowners’ insurance in the Florida and Texas markets could have an adverse effect on the homebuilding industry in such markets in general, and on our business within such markets in particular. Additionally, the availability of permits for new homes in new and existing developments could be adversely affected by the significantly limited capacity of the schools, roads and other infrastructure in such markets. While our operations are geographically diverse, an economic downturn or other event in one or more of the markets in which we operate for a prolonged period could have a material adverse effect on our business, prospects, liquidity, financial condition and results of operations, and a disproportionately greater impact on us than other homebuilders with larger scale and more diversified operations and geographic footprint.

Any increase in unemployment or underemployment may lead to reduced demand for our homes and an increase in the number of loan delinquencies and property repossessions and have an adverse impact on our business and results of operations.

In the United States, the unemployment rate was 3.7% as of the end of December 2023, according to the U.S. Bureau of Labor Statistics. People who are not employed, are underemployed, or are concerned about the loss of their jobs are less likely to purchase new homes, may be forced to try to sell the homes they own, and may face difficulties in making required mortgage payments. Therefore, an increase in unemployment or underemployment may lead to an increase in the number of loan delinquencies and property repossessions and have an adverse impact on our business by both reducing the demand for the homes we build and increasing the supply of homes for sale, which would also likely adversely affect our Financial Services business, which is dependent upon the sale of our homes. In addition, an increase in unemployment or underemployment may result in increased default rates on mortgage loans we originated, which could expose us to repurchase obligations or other liabilities, reduce our ability to sell or finance the loans we originate or require us to sell or finance the loans we originate on less favorable terms, lead us to impose stricter loan qualification standards, or result in us no longer

being able to offer financing terms that are attractive to potential buyers, all of which would adversely affect our Financial Services business.

If homebuyers are not able to obtain suitable financing, our results of operations may decline.