UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

INFORMATION STATEMENT

PURSUANT TO SECTION 14(A)

OF THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED

SCHEDULE 14A

(RULE 14a-101)

Information Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

AMERICAN BATTERY TECHNOLOGY COMPANY

(Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the Appropriate Box):

| ☒ | No fee required | |

| ☐ | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which the transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): ______________________________________ | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: |

100 Washington Street, Suite 100

Reno, NV 89503

(775) 473-4744

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On November 16, 2023

October 2, 2023

Dear Fellow Shareholder:

The 2023 Annual Meeting of Shareholders (the “2023 Annual Meeting” or “Meeting”) of American Battery Technology Company (the “Company, “we”, or “us”) will be held at 12:00 p.m., Pacific Daylight Time on Thursday, November 16, 2023. We have adopted a completely virtual format for our Meeting to provide a healthy, consistent, and convenient experience to all stockholders regardless of location. You may attend, vote, and submit questions during the Meeting online at www.virtualshareholdermeeting.com/ABTC2023.

You may also attend the Meeting by proxy, and may submit questions ahead of the Meeting through the designated website. For further information about the Meeting, please see the Questions and Answers about the Meeting beginning on page 2 of the accompanying proxy statement (the “Proxy Statement”). The purpose of the Meeting is as follows:

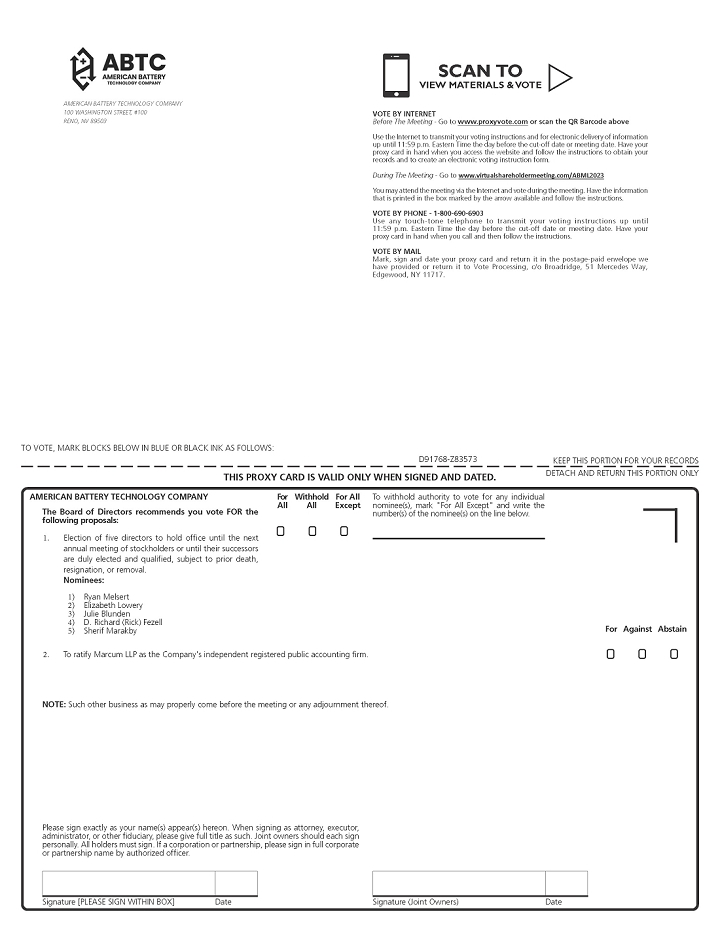

(1) to elect five directors to hold office until the next annual meeting of stockholders or until their respective successors are duly elected and qualified, subject to earlier death, resignation, or removal; and

(2) to ratify the appointment of Marcum, LLP as our independent registered public accounting firm for the fiscal year ended June 30, 2024;

All shares represented by Proxies will be voted at the 2023 Annual Meeting in accordance with the specifications marked thereon, or if no specifications are made, the Proxy confers authority to vote “FOR” for each of the forgoing proposals.

The Company’s Board of Directors believes that a favorable vote for each nominee for a position on the Board of Directors and for all other matters described in the attached Proxy Statement is in the best interest of the Company and its shareholders and recommends a vote “FOR” each of the forgoing proposals.

Your vote is important no matter how large or small your holdings in the Company may be. If you do not expect to be present at the Meeting virtually, you are urged to promptly complete, date, sign, and return the proxy card. Please review the instructions on your voting options described in the enclosed Proxy Statement as well as in the Notice of Internet Availability of Proxy Materials you received in the mail. This will not limit your right to virtually attend or vote at the Meeting. You may revoke your proxy at any time before it has been voted at the Meeting.

Thank you for your investment and continued interest in American Battery Technology Company.

| Sincerely, | ||

| /s/ Ryan Melsert | ||

| Name: | Ryan Melsert | |

| Title: | Chief Executive Officer | |

TABLE OF CONTENTS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON NOVEMBER 16, 2023

The Company has enclosed a copy of the proxy statement, the proxy card and the Company’s annual report to stockholders for the year ended June 30, 2023 (the “2023 Annual Report”). The proxy statement, the proxy card and the Annual Report are also available on the Company’s website at https://investors.americanbatterytechnology.com/.

I M P O R T A N T

YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING VIRTUALLY. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN, AND RETURN THE PROXY CARD AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. PLEASE REVIEW THE INSTRUCTIONS ON YOUR VOTING OPTIONS DESCRIBED IN THE ENCLOSED PROXY STATEMENT AS WELL AS IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS YOU RECEIVED IN THE MAIL. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK, OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN A PROXY CARD ISSUED IN YOUR NAME FROM THAT INTERMEDIARY. AT LEAST THIRTY-THREE AND ONE-THIRD PERCENT (33 1/3%) OF THE VOTING POWER OF THE COMPANY’S OUTSTANDING SHARES OF CAPITAL STOCK MUST BE REPRESENTED AT THE MEETING, EITHER VIRTUALLY OR BY PROXY, TO CONSTITUTE A QUORUM

PROXY STATEMENT

2023 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of American Battery Technology Company (the “Company”, “we” or “us”) for use at the annual meeting of stockholders (the “Meeting” or the “2023 Annual Meeting”) of the Company, to be held on November 16, 2023, at 12:00 p.m. Pacific Daylight Time. You may attend, vote, and submit questions during the Meeting via the Internet at www.virtualshareholdermeeting.com/ABTC2023. You may also attend the Meeting by proxy and may submit questions ahead of the Meeting through the designated website. For further information about the Meeting, please see the Questions and Answers about the Meeting beginning on page 2 of this Proxy Statement. This Proxy Statement and the enclosed proxy card will be made available to our stockholders on or about October 1, 2023.

Only stockholders of record at the close of business on September 19, 2023 (the “Record Date”), are entitled to notice of, and to vote at, the Meeting. At the close of business on the Record Date, 46,139,014 shares of the Company’s common stock, par value $0.001 per share (“Common Stock”), were issued and outstanding. At the close of business on the Record Date, the Common Stock were held by approximately 150 individual participants in securities positions listings of our capital stock, respectively. One such holder is Cede & Co., a nominee for Depository Trust Company, or DTC. Shares of common stock that are held by financial institutions as nominees for beneficial owners are deposited into participant accounts at DTC and are considered to be held of record by Cede & Co. as one stockholder. Shares cannot be voted at the Meeting unless the holder thereof as of the Record Date is present or represented by proxy. The presence, virtually or by proxy, of the holders of at least 33 1/3 percent of the Company’s outstanding shares of capital stock as of the Record Date will constitute a quorum for the transaction of business at the Meeting and any adjournment or postponement thereof.

Our Board has selected Ryan Melsert, Chief Executive Officer, and Andrés Meza, Chief Operating Officer, or either of them to serve as the holders of proxies for the Meeting. The shares of capital stock represented by each executed and returned proxy will be voted by Messrs. Melsert and Meza in accordance with the directions indicated on the proxy card. If you sign your proxy card without giving specific instructions, Messrs. Melsert and Meza will vote your shares “FOR” the proposals being presented at the Meeting. The proxy also confers discretionary authority to vote the shares authorized to be voted thereby on any matter that May be properly presented for action at the Meeting; we currently know of no other business to be presented at the Meeting.

Any proxy given may be revoked by the person giving it at any time before it is voted at the Meeting. If you have not voted through your broker, there are three ways for you to revoke your proxy and change your vote. First, you may send a written notice to the Company’s Secretary stating that you would like to revoke your proxy. Second, you may complete and submit a new proxy card, but it must bear a later date than the original proxy card. Third, you may vote virtually at the Meeting. However, your attendance at the Meeting will not, by itself, revoke your proxy. If you have instructed a broker to vote your shares, you must follow the directions you receive from your broker to change your vote. Your last submitted proxy will be the proxy that is counted. Please note that dissenters’ rights are not available with respect to any of the proposals to be voted on at the Meeting.

We pay the cost of soliciting the proxies. We will provide copies of this Proxy Statement and accompanying materials to brokerage firms, fiduciaries, and custodians for forwarding to beneficial owners and will, upon request, reimburse these persons for their costs of forwarding these materials. Our directors, officers, and employees may solicit proxies by telephone, facsimile, or personal solicitation. We will not pay additional compensation for any of these services.

| 1 |

QUESTIONS AND ANSWERS REGARDING THIS SOLICITATION AND VOTING AT THE MEETING

Q. When is the Meeting?

A. November 16, 2023, 2023, at 12:00 PM. Pacific Daylight Time.

Q. Where will the Meeting be held?

A. You may attend the Meeting via the Internet at www.virtualshareholdermeeting.com/ABTC2023. If you plan to attend virtually, we recommend that you log in to the Meeting fifteen minutes before the scheduled meeting time on November 16, 2023, to ensure you are logged in when the Meeting starts.

Q. Will there be a Q&A session during the Meeting?

A. As part of the Meeting, we will hold a live Q&A session, during which we intend to answer questions submitted online during or prior to the Meeting that are pertinent to the Company and the Meeting matters, as time permits. Only stockholders that have accessed the Meeting as a stockholder will be permitted to submit questions during the Meeting. If you have questions, you may type them into the dialog box provided at any point during the meeting (until the floor is closed to questions). Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

| ● | irrelevant to the business of the Company or to the business of the Meeting; | |

| ● | related to material non-public information of the Company, including the status or results of our business since our last earnings release; | |

| ● | related to any pending, threatened or ongoing litigation; | |

| ● | related to personal grievances; | |

| ● | derogatory references to individuals or that are otherwise in bad taste; | |

| ● | substantially repetitious of questions already made by another stockholder; | |

| ● | in excess of the two-question limit; | |

| ● | in furtherance of the stockholder’s personal or business interests; or | |

| ● | out of order or not otherwise suitable for the conduct of the annual meeting as determined by the Chair or Secretary in their reasonable judgment. |

Q. Why am I receiving these Proxy Materials?

A. As permitted by rules adopted by the Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 (the “Annual Report”) available to our stockholders electronically via the Internet. The Notice of Internet Availability of Proxy Materials containing instructions on how to access this Proxy Statement and our Annual Report and vote via the Internet, by phone, or by mail is first being mailed to all stockholders of record entitled to vote at the 2023 Annual Meeting on or about October 6, 2023. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the Proxy Materials, unless specifically requested. If you received a Notice of Internet Availability of Proxy Materials by mail and would like to receive a printed copy of the Proxy Materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials. We sent you the Notice of Internet Availability of Proxy Materials because the Board is soliciting your proxy to vote at the 2023 Annual Meeting. You are invited to virtually attend the 2023 Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Meeting to vote your shares. Instead, you may follow the instructions on the Notice of Internet Availability of Proxy Materials to vote by Internet, by phone or by mail.

Q. Who is entitled to vote at the Meeting?

A. Only stockholders who owned shares of our common stock at the close of business on the Record Date are entitled to notice of the Meeting and to vote at the Meeting, and at any postponements or adjournments thereof. At the close of business on the Record Date, 46,139,014 shares of the Company’s Common Stock were issued and outstanding. At the close of business on the Record Date, the Common Stock were held by approximately 150 individual participants in securities positions listings of our capital stock, respectively. One such holder is Cede & Co., a nominee for Depository Trust Company, or DTC. Shares of common stock that are held by financial institutions as nominees for beneficial owners are deposited into participant accounts at DTC and are considered to be held of record by Cede & Co. as one stockholder. For each share of Common Stock held as of the Record Date, the holder is entitled to one vote on each proposal to be voted on. As such, holders of Common Stock are entitled to a total of 46,139,014 votes.

| 2 |

Q. How many shares must be present to conduct business?

A. The presence at the Meeting, virtually or by proxy, of the holders of at least 33 1/3 percent of the Company’s outstanding shares of capital stock as of the close of business on the Record Date will constitute a quorum. A quorum is required to conduct business at the Meeting and any adjournment or postponement thereof.

Q. What will be voted on at the Meeting?

A. The following chart sets forth the proposals scheduled for a vote at the 2023 Annual Meeting and the vote required for such proposals to be approved.

| Board Proposal | Vote Required | Voting Options | Recommendation | |||

Proposal 1: To elect five directors to hold office until the next annual meeting of stockholders or until their successors are duly elected and qualified, subject to prior death, resignation, or removal. |

The plurality of the votes cast. This means that the nominees receiving the highest number of affirmative (“FOR”) votes (among votes properly cast virtually or by proxy) will be elected as directors.

Only votes “FOR” will affect the outcome. Withheld votes or broker non-votes will not affect the outcome of the vote on this proposal. |

“FOR ALL”; or “WITHHOLD ALL”; or “FOR ALL EXCEPT” |

“FOR” the nominated slate of directors | |||

Proposal 2: To ratify the appointment of Marcum LLP as our independent registered public accounting firm for the fiscal year ending June 30, 2024.

|

The affirmative (“FOR”) vote of a majority of the votes cast by the stockholders entitled to vote at the 2023 Annual Meeting.

Abstentions will not be counted for voting purposes, and thus, will not affect the outcome of the vote on this proposal. If you sign your proxy card with no further instructions and you are a shareholder of record, then your shares will be voted in accordance with the recommendations of our Board. Broker discretionary voting is allowed for Proposal 2. |

“FOR”; or “AGAINST”; or “ABSTAIN” |

“FOR” |

| 3 |

Q. What shares can I vote at the Meeting?

A. You may vote all shares owned by you as of the Record Date, including (i) shares held directly in your name as the stockholder of record, and (ii) shares held for you as the beneficial owner through a broker, trustee, or other nominee such as a bank.

Q. What is the difference between holding shares as a stockholder of record and as a beneficial owner?

A. Some of our stockholders may hold shares of our capital stock in their own name rather than through a broker or other nominee. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, Securities Transfer Corporation, you are considered to be, with respect to those shares, the stockholder of record, and the Notice of Internet Availability of Proxy Materials was sent directly to you. As the stockholder of record, you have the right to vote at the 2023 Annual Meeting and to vote by proxy. Whether or not you plan to attend the 2023 Annual Meeting, we urge you to vote by Internet, by phone or by mail to ensure your vote is counted. You may still attend the 2023 Annual Meeting and vote virtually if you have already voted by proxy.

Beneficial Owner. If your shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of shares held in “street name,” and these Proxy Materials, together with a voting instruction card, are being forwarded to you from that organization. As the beneficial owner, you have the right to direct your broker, trustee, or nominee how to vote on your behalf and are also invited to attend the 2023 Annual Meeting. Please note that since a beneficial owner is not the stockholder of record, you may not vote these shares at the 2023 Annual Meeting unless you obtain a “legal proxy” from the broker, trustee, or nominee that holds your shares, giving you the right to vote the shares at the 2023 Annual Meeting. If this applies to you, your broker, trustee, or nominee will have enclosed or provided voting instructions for you to use in directing the broker, trustee, or nominee how to vote your shares.

Q. How can I vote my shares without attending the Meeting?

A. Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct how your shares are voted without attending the Meeting. If you are a stockholder of record, you may vote by proxy by Internet, by phone or by mail by following the instructions provided on the Notice of Internet Availability of Proxy Materials. To vote using the proxy card, you must request a paper copy of the Proxy Materials by following the instructions available on the Notice of Internet Availability of Proxy Materials and then simply complete, sign, and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the 2023 Annual Meeting, we will vote your shares as you direct. Stockholders who hold shares beneficially in street name may cause their shares to be voted by proxy in accordance with the instructions provided by their broker, trustee, or nominee, by using the proxy card provided by the broker, trustee, or nominee and mailing them in the envelope provided by such person.

Q. How can I vote my shares?

A. Stockholders who attend the virtual 2023 Annual Meeting should follow the instructions at www.virtualshareholdermeeting.com/ABTC2023 to vote or submit questions during the Meeting. Voting online during the Meeting will replace any previous votes. Record holders who received a copy of this Proxy Statement and accompanying proxy card in the mail can vote by filling out the proxy card, signing it, and returning it in the postage paid return envelope. Record holders can also vote by telephone at 1-800-690-6903 or by Internet at www.proxyvote.com. Voting instructions are provided on the proxy card. If you hold shares in street name, you must vote by giving instructions to your bank, broker, or other nominee. You should follow the voting instructions on the form that you receive from your bank, broker, or other nominee.

Q. How do I gain admission to the virtual 2023 Annual Meeting?

A. You are entitled to participate in the virtual 2023 Annual Meeting only if you were a stockholder of record who owned shares of the Company’s capital stock (Common Stock and/or Preferred Stock) at the close of business on September 19, 2023, the Record Date. To attend online and participate in the 2023 Annual Meeting, stockholders of record will need to use the control number included on their Notice of Internet Availability of Proxy Materials or proxy card to log into ww.virtualshareholdermeeting.com/ABTC2023. Beneficial owners who do not have a control number may gain access to the Meeting by logging into their brokerage firm’s website and selecting the stockholder communication mailbox to link through to the virtual 2023 Annual Meeting. Instructions should also be provided on the voting instruction card provided by their broker, bank, or other nominee.

We encourage you to access the Meeting prior to the start time. Please allow time for online check-in, which will begin at 11:30 a.m. Pacific Daylight Time.

| 4 |

Stockholders have multiple opportunities to submit questions to the Company for the 2023 Annual Meeting. Stockholders who wish to submit a question in advance may do so in the question tab of the webcast online during the Meeting at www.virtualshareholdermeeting.com/ABTC2023. See “Will there be a Q&A session during the Meeting?” for information about how the Q&A session at the Meeting will be conducted.

Q. How are my shares voted?

A. If you provide specific instructions with regard to an item, your shares will be voted as you instruct on such item. If you sign your proxy card without giving specific instructions, your shares will be voted in accordance with the recommendations of the Board (“FOR” all nominees identified in Proposal 1 and “FOR” Proposal 2 in the discretion of the proxy holder on any other matters that properly come before the Meeting).

Q. What is a “broker non-vote”?

A. A broker non-vote occurs when a beneficial owner of shares held in street name does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. The shares that cannot be voted by brokers and other nominees on non-routine matters but are represented at the Meeting will be deemed present at our Meeting for purposes of determining whether the necessary quorum exists to proceed with the Meeting, but will not be considered entitled to vote on the nonroutine proposals.

We believe that under applicable rules, Proposal 2 is considered a routine matter for which brokerage firms may vote shares that are held in the name of brokerage firms and which are not voted by the applicable beneficial owners. Accordingly, we do not expect to receive any broker non-votes with respect to Proposal 2.

Brokers or other nominees cannot vote on Proposal 1 without instructions from beneficial owners. Only votes “FOR” will affect the outcome of the vote on Proposal 1. As such, broker non-votes will not affect the outcome of the vote on Proposal 1.

Q. How are abstentions counted?

A. If you return a proxy card that indicates an abstention from voting on all matters, the shares represented will be counted for the purpose of determining both the presence of a quorum and the total number of votes with respect to a proposal, but they will not be voted on any matter at the Meeting.

With regard to Proposal 1, votes may be cast in favor of a director nominee or withheld. Because directors are elected by plurality, abstentions will be entirely excluded from the vote and will have no effect on its outcome.

With regard to Proposal 2, because abstentions are not counted as votes cast, abstentions will have no effect on the outcome of such proposal.

Q. Are dissenters’ rights available with respect to any of the proposals?

A. Dissenters’ rights are not available with respect to any of the proposals to be voted on at the Meeting.

Q. What should I do if I receive more than one Notice of Internet Availability of Proxy Materials?

A. If you receive more than one Notice of Internet Availability of Proxy Materials, your shares are registered in more than one name or are registered in different accounts. Please follow the instructions on each Notice of Internet Availability of Proxy Materials to ensure that all of your shares are voted.

Q. Can I change my mind after I return my proxy?

A. Yes. You may change your vote at any time before your proxy is voted at the Meeting. If you are a stockholder of record, you can do this by giving written notice to the Company’s Secretary, by submitting another proxy with a later date, or by attending the Meeting and voting virtually. If you are a stockholder in “street” or “nominee” name, you should consult with the bank, broker, or other nominee regarding that entity’s procedures for revoking your voting instructions.

| 5 |

Q. Who is soliciting my vote and who is paying the costs?

A. The Board is soliciting your proxy for the Meeting and at any postponement or adjournment of the Meeting, and we pay the cost of preparing, assembling and mailing this proxy-soliciting material.

Q. Is there a list of stockholders entitled to vote at the Meeting?

A. The names of stockholders entitled to vote at the Meeting will be available at the Meeting and for ten days prior to the Meeting for any purpose relevant to the Meeting, between the hours of 9:00 a.m. and 4:30 p.m. (Pacific Daylight Time), at our principal executive offices at American Battery Technology Company, 100 Washington Street, Suite 100, Reno, Nevada 89503, by contacting our General Counsel. The list of these stockholders will also be available for examination by our stockholders during the Meeting and on the Meeting webpage for stockholders that have accessed the Meeting as a stockholder.

Q. How can I find out the results of the voting?

A. We intend to announce preliminary voting results at the Meeting and publish final results in a Current Report on Form 8-K within four business days following the Meeting.

Q. Whom should I contact if I have questions?

A. If you have any additional questions about the Meeting or the proposals presented in this Proxy Statement, you should contact our Investor Relations department at our principal executive office as follows:

| Investor Relations: | American Battery Technology Company |

| 100 Washington Street, Suite 100 | |

| Reno, Nevada 89503 | |

| (775) 473-4744 | |

| Email: info@batterymetals.com |

| 6 |

ELECTION OF DIRECTORS

The Nominations and Corporate Governance Committee of the Board (the “Nominating Committee”) is charged with making recommendations to the Board regarding qualified candidates to serve as members of the Board. The Nominating Committee’s goal is to assemble a board of directors with the skills and characteristics that, taken as a whole, will assure a strong board of directors with experience and expertise in all aspects of corporate governance. Accordingly, the Nominating Committee believes that candidates for director should have certain minimum qualifications, including personal integrity, strength of character, an inquiring and independent mind, practical wisdom, and mature judgment. In evaluating director nominees, the Nominating Committee considers the following factors:

(1) The appropriate size of the Board;

(2) The Company’s needs with respect to the particular talents and experience of its directors; and

(3) The knowledge, skills, and experience of nominees, including experience in technology, business, finance, administration, and/or public service.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating Committee may also consider such other factors as it deems to be in the Company’s and its stockholders’ best interests, including the independence requirements for board and committee membership under The Nasdaq Capital Market (“Nasdaq”) listing standards (which the Company has applied to list under), diversity (though the Company does not have a formal policy with regard to the consideration of diversity in identifying director nominees), and the requirements for at least one member of the Board to meet the criteria for an “audit committee financial expert,” as defined by SEC rules. The Nominating Committee also believes it is appropriate for our Chief Executive Officer to serve on the Board.

The Nominating Committee identifies nominees by first evaluating the current members of the Board willing to continue in service. Current members of the Board with skills and experience that are relevant to our business and who are willing to continue in service are considered for re-nomination, but the Nominating Committee at all times seeks to balance the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service, the Nominating Committee’s policy is to not re-nominate that member for reelection. The Nominating Committee identifies the desired skills and experience of a new nominee, and then uses its network and external resources to solicit and compile a list of eligible candidates.

We do not have a formal policy concerning stockholder recommendations of nominees for director to the Nominating Committee. The absence of such a policy does not mean, however, that such recommendations will not be considered. Stockholders wishing to recommend a candidate may do so by sending a written notice to the Nominating Committee, Attn: Chairman, American Battery Technology Company, 100 Washington Street, Suite 100, Reno, Nevada 89503, naming the proposed candidate and providing detailed biographical and contact information for such proposed candidate.

There are no arrangements or understandings between any of our directors, nominees for directors, or officers, and any other person pursuant to which any director, nominee for director, or officer was or is to be selected as a director, nominee, or officer, as applicable. There currently are no legal proceedings, and during the past ten years there have been no legal proceedings, that are material to the evaluation of the ability or integrity of any of our directors or director nominees. There are no material proceedings to which any director, officer, affiliate, or owner of record or beneficially of more than 5% of any class of voting securities of the Company, or any associates of any such persons, is a party adverse to the Company or any of our subsidiaries, and none of such persons has a material interest adverse to the Company or any of its subsidiaries. Other than as disclosed below, during the last five years, none of our directors held any other directorships in any company with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under the Investment Company Act of 1940. Our Nominating Committee currently consists of Elizabeth Lowery, Sherif Marakby, and Julie Blunden, with Ms. Lowery serving as the chairman.

| 7 |

The Nominating Committee has recommended, and the Board has nominated, Ryan Melsert, Elizabeth Lowery, Julie Blunden, Rick Fezell, and Sherif Marakby as nominees for election as members of our Board at the 2023 Annual Meeting for a period of one year or until each such director’s respective successor is elected and qualified or until such director’s earlier death, resignation, or removal. Each of the nominees is currently a director of the Company. At the 2023 Annual Meeting, five directors will be elected to the Board. The following table sets forth the nominees for directors on the Board of Directors. Certain biographical information about the nominees as of the Record Date can be found above in the section titled “Directors and Officers.”

| Name | Age | Position | Audit Committee |

Compensation Committee | Nominations and Corporate Governance Committee | Director since | ||||||

| Ryan Melsert | 41 | CEO, CTO, Director | 2020 | |||||||||

| Elizabeth Lowery | 67 | Director | * | C | 2022 | |||||||

| Julie Blunden | 57 | Director | * | C | * | 2022 | ||||||

| Rick Fezell | 63 | Chairman of the Board, Director | C | * | 2022 | |||||||

| Sherif Marakby | 57 | Director | * | * | 2022 |

C Chair

* Member

The Nominating Committee believes that each of the directors named above has the necessary qualifications to be a member of the Board of Directors. The Nominating Committee believes that each director brings a strong background and skill set to the Board of Directors, giving the Board of Directors as a whole competence and experience in diverse areas, including corporate governance and board service, finance, management and industry experience.

Vote Required and Recommendation of the Board

Directors are elected by plurality of the votes cast at the Meeting. If a quorum is present and voting at the Meeting, the five nominees receiving the highest number of “FOR” votes will be elected. Shares represented by executed proxies will be voted for which no contrary instruction is given, if authority to do so is not withheld, “FOR” the election of each of the nominees named above.

Only votes “FOR” will affect the outcome. Broker non-votes and withheld votes will have no effect on this proposal, as brokers or other nominees are not entitled to vote on such proposals in the absence of voting instructions from the beneficial owner.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE NOMINEES UNDER PROPOSAL 1

| 8 |

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has selected Marcum, LLP (“Marcum”) as our independent registered public accounting firm for the fiscal year ended June 30, 2024, and has further directed that we submit the selection of the independent registered accounting firm for ratification by our stockholders at the 2023 Annual Meeting. Marcum has audited the Company’s financial statements since 2021. Representatives of Marcum are expected to be present at the 2023 Annual Meeting. The representatives of Marcum will have an opportunity to make a statement at the Meeting, if they so desire, and will be available to respond to appropriate questions.

The selection of our independent registered public accounting firm is not required to be submitted for stockholder approval. Nonetheless, the Board is seeking ratification of its selection of Marcum as a matter of further involving our stockholders in our corporate affairs. If our stockholders do not ratify this selection, the Board will reconsider its selection of Marcum and will either continue to retain the firm or appoint a new independent registered public accounting firm. Even if the selection is ratified, the Board may, in its sole discretion, determine to appoint a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our and our stockholders’ best interests.

The Audit Committee reviews and must pre-approve all audit and non-audit services performed by our independent registered public accounting firm, as well as the fees charged by it for such services. In its review of non-audit service fees, the Audit Committee considers, among other things, the possible impact of the performance of such services on the accounting firm’s independence.

Independent Registered Public Accounting Firm’s Fees

The following table sets forth the aggregate fees billed or expected to be billed for audit and other services provided by Marcum, LLP for the fiscal years ended June 30, 2023 and 2022. Marcum, LLP has served as our principal accounting firm since July 2021.

| Fiscal year ended June 30, 2023 | Fiscal year ended June 30, 2022 | |||||||

| Audit fees | $ | 130,000 | $ | 155,000 | ||||

| Review fees | 105,443 | 71,585 | ||||||

| Tax fees | 21,700 | 34,327 | ||||||

| All other fees | 52,725 | 6,953 | ||||||

| Total | $ | 309,868 | $ | 267,865 | ||||

Audit fees include primarily professional services rendered for the audits of the consolidated financial statements and internal controls over financial reporting, the review of documents filed with the SEC, consents, and financial accounting and reporting consultations.

Audit-related fees include reviews of the interim financial statements contained in the Company’s quarterly reports on Form 10-Q and review of regulatory financial statements.

Tax fees include professional service fees for tax compliance, tax planning, and tax advice. Tax compliance involves preparation of original and amended tax returns and claims for refund. Tax planning and tax advice encompass a diverse range of services, including assistance with tax audits and appeals, tax advice related to employee benefit plans, and requests for rulings or technical advice from taxing authorities.

All other fees include professional fees associated with the review and consent of SEC filings related to equity issuance for certain officers and former employees.

Pre-Approval Policies and Procedures

Our Audit Committee has adopted a procedure for pre-approval of all fees charged by our independent auditors. Under the procedure, the Audit Committee pre-approves all auditing services and the terms of non-audit services provided by our independent registered public accounting firm, but only to the extent that the non-audit services are not prohibited under applicable law and the Audit Committee determines that the non-audit services do not impair the independence of the independent registered public accounting firm. Other fees are subject to pre-approval by the Audit Committee, or, in the period between meetings, by a designated member of the Board or Audit Committee. Any such approval by the designated member is disclosed to the entire Board at the next meeting. All fees that were incurred in fiscal year 2023 were pre-approved by the Audit Committee.

Vote Required and Recommendation of the Board

The affirmative “FOR” vote of a majority of the votes cast by the stockholders entitled to vote at the 2023 Annual Meeting is required to approve this proposal.

Because broker discretionary voting is allowed for this Proposal 2, we do not expect any broker non-votes for this proposal. Abstentions will not be counted as votes cast, and thus, will not affect the outcome of the vote on this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF SELECTION OF MARCUM AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE YEAR ENDING JUNE 30, 2024.

| 9 |

DIRECTORS, OFFICERS, AND KEY EMPLOYEES

| Name | Age | Positions | ||

| Ryan Melsert | 41 | CEO, CTO, Director | ||

| Julie Blunden1,2,3 | 57 | Director | ||

| D. Richard (Rick) Fezell1,3 | 63 | Chairman, Director | ||

| Elizabeth Lowery2,3 | 67 | Director | ||

| Sherif Marakby1,2 | 57 | Director | ||

| Jesse Deutsch | 59 | Chief Financial Officer | ||

| Andrés Meza | 43 | Chief Operating Officer | ||

| Scott Jolcover | 72 | Chief Resource Officer |

| 1) | Member of Audit Committee | |

| 2) | Member of Nomination & Governance Committee | |

| 3) | Member of Compensation Committee |

Ryan Melsert, CEO, CTO, Director

Mr. Melsert, age 41, is the CEO, CTO, and Director at American Battery Technology Company, overseeing all aspects of the Company’s battery metal extraction and lithium-ion battery recycling divisions. Mr. Melsert specializes in the development and scale-up of highly innovative first-of-kind systems. This development process consists of fundamental conceptual design, rigorous thermodynamic and process modeling, design and fabrication of bench-scale prototypes, construction and operation of integrated pilot systems, and implementation of commercial-scale systems. Joining the Company in September 2019, Mr. Melsert has been accelerating the development and implementation of the Company’s proprietary battery metal extraction technologies and battery recycling programs with the planning and construction of a multi-functional facility.

From May 2015 to March 2019 Mr. Melsert worked at Tesla as one of the founding members of the battery manufacturing Gigafactory design team, and subsequently as an R&D Manager for the Battery Materials Processing group. He founded and led this cross-functional team of mechanical and chemical engineers who implemented first-principles design to develop novel first-of-kind systems for the extraction, purification, and synthesis of precursor and active battery materials. This development scope included the fundamental conceptual design, rigorous thermodynamic and process modeling, design and fabrication of bench-scale prototypes, construction and operation of integrated pilot systems, and implementation of commercial scale systems for the processing of battery materials. During this time Mr. Melsert was awarded 5 different patents. From April 2013 to May 2015, Mr. Melsert served as R&D Manager, Advanced Energy & Transportation Technologies for Southern Research where he led a project team of 5-10 chemical/mechanical engineers in fundamental design of first-of-kind systems throughout energy systems field. While there Mr. Melsert wrote and won several DOE grants in addition to winning the company-wide “Invention of the Year” 2015, presented at ARPA-E Innovation Summit. His education includes an MS in Mechanical Engineering and an MBA from Georgia Tech awarded in 2007 and 2011, respectively, and a BS in Mechanical Engineering with Minors in Engineering Mechanics, French, and International Studies from Penn State University awarded in 2004.

There have been no transactions since the beginning of the Company’s last fiscal year, and there are no currently proposed transactions, in which the Company was or is to be a participant and in which Mr. Melsert (or any member of his immediate family) had or will have any interest, that are required to be reported under Item 404(a) of Regulation S-K. The appointment of Mr. Melsert was not pursuant to any arrangement or understanding between him and any person, other than a director or executive officer of the Company acting in his or her official capacity.

| 10 |

Julie Blunden, Director

For 35 years, Julie Blunden, age 57, has rapidly grown emerging energy companies to leaders in their sectors from power generation to retail power, solar, energy storage, and EV fast charging. She now focuses on Board work related to batteries for both mobility and stationary storage as well as their supply chains. She was elected the first independent Director on the Board ZincFive, where she chairs the Compensation Committee. In addition, at Plus Power, she is actively engaged through the Board of Advisors, where she also served as the Chief Operating Officer. At New Energy Nexus Ms. Blunden serves as Board Chair as well as serving on Audit, Executive and Finance Committees where she supports diverse energy entrepreneurs around the world to achieve a 100% clean energy economy for 100% of the population.

Ms. Blunden’s global experience includes executive roles at six organizations, including two publicly listed companies as well as the turnaround Chief Commercial Officer at EVgo through the completion of its sale to LS Power in 2020. Ms. Blunden has had P&L responsibility, extensive board engagement as an executive, served as Vice Chair at the Solar Energy Industries Association, a member of the Board of Directors at the national Energy Storage Association, and as a member of four other NGO Boards of Directors as well as two Advisory Boards. While Vice Chair at SEIA she led PV Now’s integration into SEIA as well as a refresh of Executive Compensation and Evaluation.

Additionally, she has served as Vice Chair of the Solar Energy Industries Association, a member of the Board of Directors at the National Energy Storage Association and was a former Executive in Residence for the Global Energy Management Program at the University of Colorado Denver’s Business School. Blunden has an engineering and environmental studies degree from Dartmouth College and a Master of Business Administration degree from Stanford’s Graduate School of Business.

There have been no transactions since the beginning of the Company’s last fiscal year, and there are no currently proposed transactions, in which the Company was or is to be a participant and in which Ms. Blunden (or any member of her immediate family) had or will have any interest, that are required to be reported under Item 404(a) of Regulation S-K. The appointment of Ms. Blunden was not pursuant to any arrangement or understanding between her and any person, other than a director or executive officer of the Company acting in his or her official capacity.

D. Richard (Rick) Fezell, Chairman of the Board

Spanning a distinguished 35-year career as a former auditor, senior partner, and Vice Chairman at Ernst & Young (EY), Mr. Fezell, age 63, held multiple leadership roles at the industry, regional, and executive committee levels for EY, providing deep knowledge of financial reporting, risk management, and market-leading growth strategies to large public multinationals as well as emerging growth and newly public companies.

He was Vice Chair and Managing Partner of the firm’s Central Region, responsible for a $3 billion business across all service lines that included over 7,000 professionals in 17 offices. While serving as the Americas Vice Chair for Markets, Mr. Fezell oversaw growth for a $15 billion practice. Prior to his retirement from EY in 2020, Mr. Fezell served as the Americas Leader for EY’s alliance with Microsoft, at the forefront of transformation and digitalization and responsible for product development, investment allocations and joint go-to-market strategies to help drive digital platform services growth at both EY and Microsoft.

Mr. Fezell has served on the board of many community and higher education organizations including The United Way, the Civic Committee of The Commercial Club of Chicago, the Markkula Center for Applied Ethics at Santa Clara University, the Orfalea School of Business at Cal Poly San Luis Obispo and Perspectives Charter Schools in Chicago. He is a CPA and graduate of Westminster College in Pennsylvania.

There have been no transactions since the beginning of the Company’s last fiscal year, and there are no currently proposed transactions, in which the Company was or is to be a participant and in which Mr. Fezell (or any member of his immediate family) had or will have any interest, that are required to be reported under Item 404(a) of Regulation S-K. The appointment of Mr. Fezell was not pursuant to any arrangement or understanding between him and any person, other than a director or executive officer of the Company acting in his or her official capacity.

| 11 |

Elizabeth Lowery, Director

Elizabeth Lowery, age 67, is a Senior Advisor, Sustainable Finance and ESG with ERM, a sustainability consulting firm. She is also a Senior Executive Advisor with GI Partners and Piva. She was formerly the Managing Director of Sustainability and ESG at TPG. Ms. Lowery joined TPG after a 20-year career with General Motors Company where she was a member of GM’s Senior Leadership Group as Corporate Vice President, Environment, Energy & Safety Policy and Secretary to the Public Policy Committee of the GM Board of Directors. She also served as General Counsel for GM—North America.

Ms. Lowery has held various executive positions, including Senior Knowledge Leader and a Principal of GreenOrder at LRN, where she was focused on working with global enterprises to develop sustainability strategies and initiatives. She was also a partner at Honigman Miller Schwartz and Cohn and a law clerk to Michigan Supreme Court Justice G. Mennen Williams. She has served on several non-profit boards including the World Environment Center, InForum Center for Leadership, Keystone Center and the Alliance for Automobile Manufacturers. Her primary responsibilities within TPG included leading the Sustainability and ESG program development, strategy and deployment across the Firm, engaging with portfolio companies to build sustainable businesses, and assisting deal teams on due diligence matters. Ms. Lowery was a member of the PRI Private Equity Advisory Committee, and she is currently a Board Member of Denali Water Solutions, Keter Environmental Services, Sagard Holdings, and American Battery Technology Company. She is also a member of the Caesars Entertainment CSR External Advisory Board and on the Corporate Eco Forum Advisory Board. She graduated Magna Cum Laude with a Juris Doctorate from Wayne State University and a B.B.A from Eastern Michigan University.

There have been no transactions since the beginning of the Company’s last fiscal year, and there are no currently proposed transactions, in which the Company was or is to be a participant and in which Ms. Lowery (or any member of her immediate family) had or will have any interest, that are required to be reported under Item 404(a) of Regulation S-K. The appointment of Ms. Lowery was not pursuant to any arrangement or understanding between her and any person, other than a director or executive officer of the Company acting in his or her official capacity.

Sherif Marakby, Director

Sherif Marakby, age 57, brings significant operating experience in the automotive OEM industry from a 31-year career in the transformation, electrification, and technology innovation and AV development fields. Mr. Marakby currently serves on the board of directors of Lucid Group, Inc., an electric vehicle manufacturer, as an advisor to MemryX Inc., an automotive and consumer products company, and as a senior advisor at Boyden, an executive search firm. Prior to joining the Company, Mr. Marakby served as Executive Vice President, Corporate R&D of Magna International, one of the largest Tier 1 suppliers to the automotive industry in the world. Previously, he served as Uber’s Vice President of Global Vehicle Programs where he built a team that integrated self-driving technology into vehicles, partnered with Volvo cars for an autonomous vehicle program, and was responsible for business development with OEM partners.

During a close to 30-year career at Ford Motor Company, Mr. Marakby held a variety of product development positions, beginning with Chief Engineer and rising to President & CEO of Ford’s Autonomous Vehicle LLC, where he oversaw the development and launch of five new vehicles, including the all-electric Ford Mustang Mach-E and the Ford Fusion Hybrid. Additionally, during his tenure at Ford, Mr. Marakby served as the Director of Small Cars & SUVs globally overseeing two million vehicles and more than $40 billion of annual revenue in over 70 countries. In his role as Vice President of Electrification and Autonomous Vehicles, he was responsible for over $11 billion of electrification and $4 billion of autonomous vehicle development.

Mr. Marakby has a Master in Electronics Engineering from the University of Maryland College Park, and a Master of Business Administration from the University of Michigan.

There have been no transactions since the beginning of the Company’s last fiscal year, and there are no currently proposed transactions, in which the Company was or is to be a participant and in which Mr. Marakby (or any member of his immediate family) had or will have any interest, that are required to be reported under Item 404(a) of Regulation S-K. The appointment of Mr. Marakby was not pursuant to any arrangement or understanding between him and any person, other than a director or executive officer of the Company acting in his or her official capacity.

| 12 |

Jesse Deutsch, Chief Financial Officer

Jesse Deutsch, age 59, has over 25 years of finance experience in world-class multinational corporations in the U.S. and abroad. He has led several businesses through transformative high-growth phases and has completed more than 75 M&A transactions with strategic partners. He joins the Company with nearly 20 years serving in the role as Chief Financial Officer with global brands such as Kraft Foods and Aramark Inc., and over the course of his tenure has served in executive financial leadership roles at companies such as Visa, and Philip Morris. Mr. Deutsch has in-depth experience in establishing transformative finance processes and has led large systems implementations. He has an MBA from New York University and a Bachelor of Science in economics from The Wharton School of the University of Pennsylvania.

There have been no transactions since the beginning of the Company’s last fiscal year, and there are no currently proposed transactions, in which the Company was or is to be a participant and in which Mr. Deutsch (or any member of his immediate family) had or will have any interest, that are required to be reported under Item 404(a) of Regulation S-K. The appointment of Mr. Deutsch was not pursuant to any arrangement or understanding between him and any person, other than a director or executive officer of the Company acting in his or her official capacity.

Andrés Meza, Chief Operating Officer

Mr. Meza, age 43, has an undergraduate degree in chemical engineering and started his professional career at Georgia Pacific working as a process engineer at a paper mill. After working to gain direct hands-on chemical manufacturing expertise throughout the processing plant, he was promoted to a shift team leader. To further enhance his management and leadership skills, he attended the Harvard Business School. After receiving his MBA, he worked for Apple as a global supply manager focusing on commissioning and scaling up of manufacturing facilities across Asia and the implementation of cost efficiencies throughout their supply chain. After four years optimizing high-volume manufacturing at Apple, Mr. Meza worked for the management consultancy firm McKinsey and Company as an engagement manager. In this role, he analyzed the manufacturing operations of global corporations and developed strategic assessments for executives to implement operational efficiencies in their facilities and business units. Mr. Meza subsequently joined the private equity firm Transom Capital as the Vice President of Operations working with a suite of portfolio companies in which the firm had invested. At Transom Capital, Mr. Meza used his extensive expertise in operational leadership and manufacturing to establish the required procedures and frameworks to help grow these early-stage companies into mature and stable corporations.

There have been no transactions since the beginning of the Company’s last fiscal year, and there are no currently proposed transactions, in which the Company was or is to be a participant and in which Mr. Meza (or any member of his immediate family) had or will have any interest, that are required to be reported under Item 404(a) of Regulation S-K. The appointment of Mr. Meza was not pursuant to any arrangement or understanding between him and any person other than a director or executive officer of the Company acting in his or her official capacity.

Scott Jolcover, Chief Resource Officer

Mr. Jolcover, age 72, has development expertise spanning five decades including expertise in construction, mining and land development, water resource, claims management, economic and environmental solutions. Prior to joining the Company, he served as the Director of Development and General Site Manager for Comstock Mining Inc., where he managed all commercial transactions, including land, water and other major capital expenses and acquisitions and served two years on their Board of Directors. Other roles include President and CEO for Virginia City Ventures, which established the Comstock Gold Mill and partnered with the Tri-County Railway Commission. Mr. Jolcover has board and leadership roles with Nevada Works; Northern Nevada Development Authority (NNDA), Design and Construction Committee; and a 20-year relationship with Virginia City Tourism Commission (VCTC), including Chair and Vice-Chair roles.

There have been no transactions since the beginning of the Company’s last fiscal year, and there are no currently proposed transactions, in which the Company was or is to be a participant and in which Mr. Jolcover (or any member of his immediate family) had or will have any interest, that are required to be reported under Item 404(a) of Regulation S-K. The appointment of Mr. Jolcover was not pursuant to any arrangement or understanding between him and any person, other than a director or executive officer of the Company acting in his or her official capacity.

| 13 |

Board and Stockholder Meetings and Attendance

The Board has responsibility for establishing broad corporate policies and reviewing our overall performance rather than day-to-day operations. The primary responsibility of the Board is to oversee the management of the Company and, in doing so, serve the best interests of the Company and its stockholders. The entire Board selects, evaluates, and provides for the succession of executive officers and, subject to stockholder election, directors. It reviews and approves corporate objectives and strategies, and evaluates significant policies and proposed major commitments of corporate resources. The Board also participates in decisions that have a potential major economic impact on the Company. Management keeps the directors informed of Company activity through regular communication, including written reports and presentations at Board and committee meetings.

Directors are elected annually and hold office until the next annual meeting of stockholders or until their respective successors are duly elected and qualified, subject to prior death, resignation, or removal. The Company encourages, but does not require, directors to attend annual meetings of stockholders. During the year ended June 30, 2023, the Board held two formal meetings and dozens of informal discussions.

Board Composition and Election of Directors

Director Independence

We are currently traded on The Nasdaq Capital Market, and our Board has determined that Elizabeth Lowery, Julie Blunden, Rick Fezell, and Sherif Marakby are all independent directors in accordance with the listing requirements of Nasdaq. Nasdaq’s independence definition includes a series of objective tests, including that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of their family members has engaged in various types of business dealings with us. In addition, as required by Nasdaq rules, our Board has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our Board reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. Ryan Melsert is not an independent director within the meaning of Section 5605 of Nasdaq. There are no family relationships among any of our directors or executive officers.

On March 22, 2022, our Board established three standing committees – an Audit Committee, a Compensation Committee, and a Nominations and Corporate Governance Committee – each of which operates under a charter that has been approved by our Board.

| 14 |

Our Audit Committee consists of Rick Fezell, Julie Blunden, and Sherif Marakby, with Mr. Fezell serving as the chairman. Our Board has determined that Mr. Fezell is an “audit committee financial expert” within the meaning of the SEC regulations. Our Board has also determined that each member of our Audit Committee can read and understand fundamental financial statements in accordance with applicable requirements. In arriving at these determinations, the Board has examined each Audit Committee member’s scope of experience and the nature of their employment in the corporate finance sector. The functions of this committee include:

| ● | selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements; | |

| ● | helping to ensure the independence and performance of the independent registered public accounting firm; | |

| ● | discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, our interim and year-end operating results; | |

| ● | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; | |

| ● | reviewing our policies on risk assessment and risk management; | |

| ● | reviewing related party transactions; | |

| ● | obtaining and reviewing a report by the independent registered public accounting firm at least annually, that describes our internal quality-control procedures, any material issues with such procedures, and any steps taken to deal with such issues when required by applicable law; and | |

| ● | approving (or, as required, pre-approving) all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm. |

During the year ended June 30, 2023, the Audit Committee held seven meetings in person or through conference calls. The Audit Committee operates pursuant to a written charter that is available on the Company’s website at: https://investors.americanbatterytechnology.com/governance.

Report of the Audit Committee of the Board of Directors

The Audit Committee oversees the Company’s financial reporting process on behalf of our Board. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviews the audited financial statements in the Company’s annual report with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting pronouncements.

The Audit Committee reviewed with Marcum LLP, which is responsible for expressing an opinion on the conformity of the Company’s audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the Company’s accounting principles and such other matters as are required to be discussed with the Audit Committee under the applicable requirements of the Public Company Accounting Oversight Board and the SEC. In addition, the Audit Committee has discussed with Marcum LLP its independence from management and the Company, has received from Marcum LLP the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Marcum LLP’s communications with the Audit Committee concerning independence, and has considered the compatibility of non-audit services with the auditors’ independence.

The Audit Committee met with Marcum LLP to discuss the overall scope of its services, and the overall quality of the Company’s financial reporting. Marcum LLP, as the Company’s independent registered public accounting firm, also periodically updates the Audit Committee about new accounting developments and their potential impact on the Company’s reporting. The Audit Committee’s meetings with Marcum LLP were held with and without management present. The Audit Committee is not employed by the Company, nor does it provide any expert assurance or professional certification regarding the Company’s financial statements. The Audit Committee relies, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management and the Company’s independent registered public accounting firm.

The Audit Committee and the Board have recommended, that the ratification of the appointment of Marcum LLP as the Company’s independent registered public accounting firm for the fiscal year ended June 30, 2024 be submitted as a proposal at the Meeting.

The Audit Committee reviews and assesses the adequacy of its charter on an annual basis. While the Audit Committee believes that the charter in its present form is adequate, it may in the future recommend to the Board of Directors amendments to the charter as it may deem necessary or appropriate.

| Respectfully submitted, | |

| The Audit Committee of the Board of Directors: | |

| Rick Fezell (Chairman) | |

| Julie Blunden | |

| Sherif Marakby |

| 15 |

This report of the Audit Committee is not “soliciting material,” shall not be deemed “filed” with the SEC and shall not be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such acts.

Our Compensation Committee consists of Julie Blunden, Rick Fezell, and Elizabeth Lowery, with Ms. Blunden serving as the chairman. The functions of the Compensation Committee will include:

| ● | reviewing and approving, or recommending that our Board approve, the compensation of our executive officers; | |

| ● | reviewing and recommending that our Board approve the compensation of our directors; | |

| ● | reviewing and approving, or recommending that our Board approve, the terms of compensatory arrangements with our executive officers; | |

| ● | administering our stock and equity incentive plans; | |

| ● | selecting independent compensation consultants and assessing conflict of interest compensation advisers; | |

| ● | reviewing and approving, or recommending that our Board approve, incentive compensation and equity plans; and | |

| ● | reviewing and establishing general policies relating to compensation and benefits of our employees and reviewing our overall compensation philosophy. |

During the year ended June 30, 2023, the Compensation Committee held four meetings in person or through conference calls. The Compensation Committee operates pursuant to a written charter that is available on the Company’s website at: https://investors.americanbatterytechnology.com/.

Compensation Committee Interlocks and Insider Participation

No member of the compensation committee will be a current or former executive officer or employee of ours or any of our subsidiaries. None of our executive officers serves as a member of the board of directors or Compensation Committee of any company that has one or more of its executive officers serving as a member of our Compensation Committee.

Nominating and Corporate Governance Committee

Our Nominating Committee consists of Elizabeth Lowery, Sherif Marakby, and Julie Blunden, with Ms. Lowery serving as the chairman. The functions of the nominating and governance committee will include:

| ● | identifying and recommending candidates for membership on our Board; | |

| ● | including nominees recommended by stockholders; | |

| ● | reviewing and recommending the composition of our committees; | |

| ● | overseeing our code of business conduct and ethics, corporate governance guidelines and reporting; and | |

| ● | making recommendations to our Board concerning governance matters. |

The Nominating Committee also annually reviews the Nominating Committee charter and the committee’s performance. During the year ended June 30, 2023, the Nominating Committee held three meetings in person or through conference calls.

| 16 |

The Nominating Committee operates pursuant to a written charter that is available on the Company’s website at: https://investors.americanbatterytechnology.com/.

The Board currently consists of five directors. We have separated the positions of Chairman and Chief Executive Officer. We believe that this structure is appropriate at this time. We believe that having a non-executive Chairman of the Board is in the best interests of the Company and stockholders, due in part to the ever-increasing demands made on boards of directors under federal securities laws, national stock exchange rules and other federal and state regulations. The separation of the positions allows our Chairman of the Board to focus on management of Board matters and allows our Chief Executive Officer to focus his attention on managing our business. Additionally, we believe the separation of those roles contributes to the independence of the Board in its oversight role. Our Board has designated Mr. Fezell as its Chairman and Lead Independent Director. Our Board believes that Mr. Fezell’s strong leadership qualifications, among other factors, contribute to his ability to fulfill the role effectively.

Board’s Role in Risk Management

Risk assessment and oversight are an integral part of our governance and management processes. Our Board of Directors encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Our Board of Directors does not have a standing risk management committee, but rather administers this oversight function directly through the Board of Directors as a whole, as well as through various standing committees of the Board of Directors that address risks inherent in their respective areas of oversight. Our management is responsible for day-to-day management of risk. The Board regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable our Board to understand the Company’s risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic and reputational risk.

The Audit Committee reviews information regarding liquidity, operations and oversees our management of financial and cybersecurity risk exposures and the steps our management has taken to monitor and control such exposure. The Audit Committee also monitors compliance with legal and regulatory requirements and considers and approves or disapproves any related person transactions. Periodically, the Audit Committee reviews our policies with respect to risk assessment, risk management, loss prevention and regulatory compliance. Oversight by the Audit Committee includes direct communication with our external auditors, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures. The Compensation Committee is responsible for assessing whether any of our compensation policies or programs has the potential to encourage excessive risk-taking. The Nominating Committee reviews compliance with external and internal policies, procedures and practices consistent with the Company’s charter and Amended and Restated Bylaws.

While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports and members of our management team about such risks. Matters of significant strategic risk and enterprise-wide risk exposures are considered by our Board as a whole. The Board does not believe that its role in the oversight of our risks affects the Board’s leadership structure.

| 17 |

Our Nominating Committee is responsible for reviewing with the Board, on an annual basis, the appropriate characteristics, skills and experience required for the Board as a whole and its individual members. In evaluating the suitability of individual candidates (both new candidates and current members), the Nominating Committee, in recommending candidates for election, and the Board, in approving (and, in the case of vacancies, appointing) such candidates, will take into account many factors, including the following:

| ● | Personal and professional integrity, ethics and values; | |

| ● | Experience in corporate management, such as serving as an officer or former officer of a publicly-held company; | |

| ● | Experience as a board member or executive officer of another publicly-held company; | |

| ● | Strong finance experience; | |

| ● | Diversity of expertise and experience in substantive matters pertaining to our business relative to other board members; | |

| ● | Diversity of background and perspective, including, but not limited to, with respect to age, gender, race, sexual orientation, place of residence and specialized experience; | |

| ● | Experience relevant to our business industry and with relevant social policy concerns; and | |

| ● | Relevant academic expertise or other proficiency in an area of our business operations. |

Currently, the Company does not have a formal policy with regard to the consideration of diversity in identifying director nominees. Our Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best maximize the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas.

Communications with our Board of Directors

Stockholders seeking to communicate with members of the Board should submit their written comments to American Battery Technology Company, 100 Washington Street, Suite 100, Reno, Nevada 89503, Attn: Secretary. The Secretary will forward such communications to each member of the Board; provided that, if in the opinion of our Secretary, it would be inappropriate to send a particular stockholder communication to a specific director, such communication will only be sent to the remaining directors (subject to the remaining directors concurring with such opinion) or specific committees of the Board, as applicable.

Code of Ethics and Business Conduct

The Company has adopted a Code of Conduct, which is available, free of charge, on our website at https://americanbatterytechnology.com/.

Our Board has adopted an Insider Trading Policy, which applies to all of our directors, officers and employees. The policy is available, free of charge, on our website at https://americanbatterytechnology.com/, and prohibits our directors, officers and employees and any entities they control from engaging in transactions in publicly traded options related to the Company’s equity securities that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s equity securities.

Our Related Persons Transaction Policy, Audit Committee Charter, Compensation Committee Charter, Nominations and Corporate Governance Committee Charter, and other relevant documents are available, free of charge, on our website at https://americanbatterytechnology.com/. The information contained on the website is not incorporated by reference in, or considered part of, this Proxy Statement.

There are no family relationships between or among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

| 18 |

The following table sets forth information regarding the compensation awarded to, earned by, or paid to our directors who served on our Board for the year ended June 30, 2023.

Summary Compensation Table – Independent Members of the Board of Directors

| Name and Principal Position | Fiscal

Year Ended June 30 | Fees

Earned or Paid in Cash ($) | Bonus ($) | Stock

Awards ($) | Option

Awards ($) | Non-Equity

Incentive Plan Compensation ($) | Nonqualified

Deferred Compensation Earnings ($) | All

Other Compensation ($) | Total ($) | |||||||||||||||||||||||||||

| Elizabeth Lowery | ||||||||||||||||||||||||||||||||||||