0001576427DEF 14Afalse00015764272023-01-012023-12-31iso4217:USD00015764272022-01-012022-12-3100015764272021-01-012021-12-3100015764272020-01-012020-12-310001576427ecd:PeoMembercrto:ChangeInPensionValueAndAboveMarketNonQualifiedDeferredCompensationMember2023-01-012023-12-310001576427crto:GrantDateFairValueOfOptionAwardsAndStockAwardsGrantedInFiscalYearMemberecd:PeoMember2023-01-012023-12-310001576427ecd:PeoMembercrto:FairValueAtFiscalYearEndOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInFiscalYearMember2023-01-012023-12-310001576427crto:ChangeInFairValueOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsMemberecd:PeoMember2023-01-012023-12-310001576427ecd:PeoMembercrto:FairValueAtVestingOfOptionAwardsAndStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2023-01-012023-12-310001576427crto:ChangeInFairValueAsOfVestingDateOfOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMemberecd:PeoMember2023-01-012023-12-310001576427crto:FairValueAsOfPriorFiscalYearEndOfOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMemberecd:PeoMember2023-01-012023-12-310001576427ecd:PeoMembercrto:ValueOfDividendsOrOtherEarningsPaidOnStockOrOptionAwardsNotOtherwiseReflectedInFairValueOrTotalCompensationMember2023-01-012023-12-310001576427crto:GrantDateFairValueOfOptionAwardsAndStockAwardsGrantedInFiscalYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001576427ecd:NonPeoNeoMembercrto:FairValueAtFiscalYearEndOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInFiscalYearMember2023-01-012023-12-310001576427crto:ChangeInFairValueOfOutstandingAndUnvestedOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsMemberecd:NonPeoNeoMember2023-01-012023-12-310001576427ecd:NonPeoNeoMembercrto:FairValueAtVestingOfOptionAwardsAndStockAwardsGrantedInFiscalYearThatVestedDuringFiscalYearMember2023-01-012023-12-310001576427crto:ChangeInFairValueAsOfVestingDateOfOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsForWhichApplicableVestingConditionsWereSatisfiedDuringFiscalYearMemberecd:NonPeoNeoMember2023-01-012023-12-310001576427crto:FairValueAsOfPriorFiscalYearEndOfOptionAwardsAndStockAwardsGrantedInPriorFiscalYearsThatFailedToMeetApplicableVestingConditionsDuringFiscalYearMemberecd:NonPeoNeoMember2023-01-012023-12-31000157642712023-01-012023-12-31000157642722023-01-012023-12-31000157642732023-01-012023-12-31000157642742023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) | | | | | |

Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a‑12 |

| | | | | | | | |

Criteo S.A. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check all boxes that apply): |

x | No fee required. |

o | Fee paid previously with preliminary materials. |

o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | | | | |

| Letter to Our Shareholders | |

Dear Fellow Shareholders,

2023 was a critical year in our transformation journey. I am proud of our team’s hard work to realize our vision to be the AdTech partner of choice for Commerce Media. We successfully integrated our Iponweb acquisition and have positioned ourselves at the forefront of our industry with the only unified, AI- driven platform that directly connects advertisers with retailers and publishers to drive commerce on the open internet.

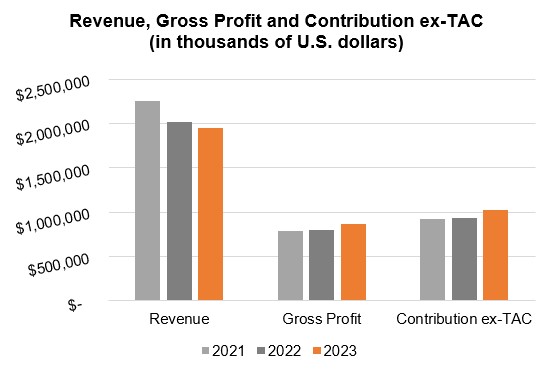

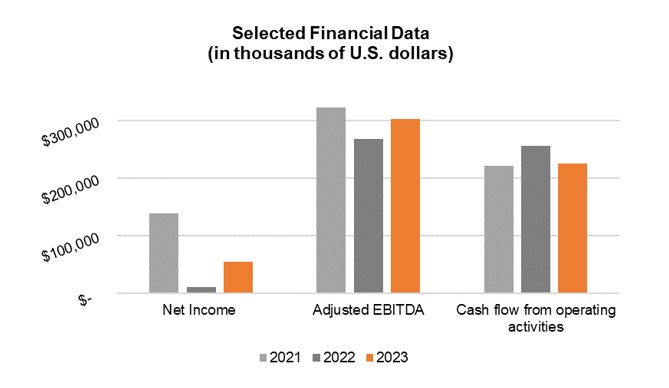

Executing our transformation to a Commerce Media powerhouse

Despite macroeconomic uncertainties and geopolitical tensions, we achieved double digit growth for the second consecutive year in 2023. Retail Media and Commerce Audiences each climbed to new highs, and Retargeting - in line with our vision - now represents less than 50% of our business. As we execute on our turnaround strategy, we maintain strong cost discipline as evidenced by our above target margin this year. This includes over $70 million in annualized cost savings while continuing to invest for growth.

We have built differentiated capabilities that position Criteo as the end-to-end platform of choice for Commerce Media. For example, we launched our first-of-its-kind, self-service Demand Side Platform (DSP), Commerce Max, which provides a single access point to buy premium Retail Media inventory on retailers’ sites and across open Internet inventory offsite with closed-loop measurement. We launched Commerce Grid, our Supply Side Platform (SSP), purpose-built for agencies and publishers looking to efficiently connect media and commerce programmatically. We also enhanced our retailer monetization suite, Commerce Yield, with our acquisition of Brandcrush, a provider of in-store monetization technology.

Importantly, we gained market share with $1.2 billion in activated media spend now flowing through our platform, up 36% year-over-year, bolstering our position as the leading Retail Media AdTech provider. We are partnering with 220 retailers and 2,600 brands globally, and our team continues to work hard to differentiate, deliver and drive scale.

Lastly, we celebrated the fifth anniversary of Criteo’s AI Lab, which has been instrumental in integrating cutting-edge AI into our platform. Our full-funnel targeting capabilities leverage our best-in-class AI and large-scale commerce data to optimize every touchpoint throughout the shopper journey.

Driving shareholder value

We are confident in our strategy and focused on delivering sustainable, profitable growth. We have a strong balance sheet and a disciplined and balanced capital allocation approach. Our capital allocation priorities are to invest in high-ROI organic opportunities and value-enhancing acquisitions, as well as returning capital to shareholders through our share buy-back program.

In 2023, we repurchased 4.3 million shares for $125 million, and we expect to return a record $150 million of capital to shareholders in 2024. This demonstrates our confidence in our business strategy, financial strength and our ongoing commitment to enhance shareholder value.

Building a sustainable future

Our commitment to diversity, equity and inclusion, and a sustainable planet are core to our strategy. In 2023, we aligned our climate goals with the Paris Agreement, and we became the first AdTech company to have its carbon reduction targets approved by the Science-Based Target initiative (SBTi).

We also converted our existing $450 million five-year revolving credit facility to a Sustainability-Linked Loan.

Looking ahead

We are well-positioned to deliver on our plans for growth, healthy profitability and strong cash generation to drive shareholder value in 2024 and beyond. We intend to provide an investor update on our Retail Media business in fall 2024 to discuss our progress and the compelling opportunities ahead of us. 2024 is also expected to be a dynamic year for advertising, as our

industry transitions away from third-party cookies on Chrome. We are confident in our multi-pronged addressability strategy to future-proof our clients’ advertising performance.

On behalf of the Board of Directors and our senior leadership team, I would like to thank you for your confidence and continued trust in Criteo on this journey.

Sincerely,

Megan Clarken

Chief Executive Officer

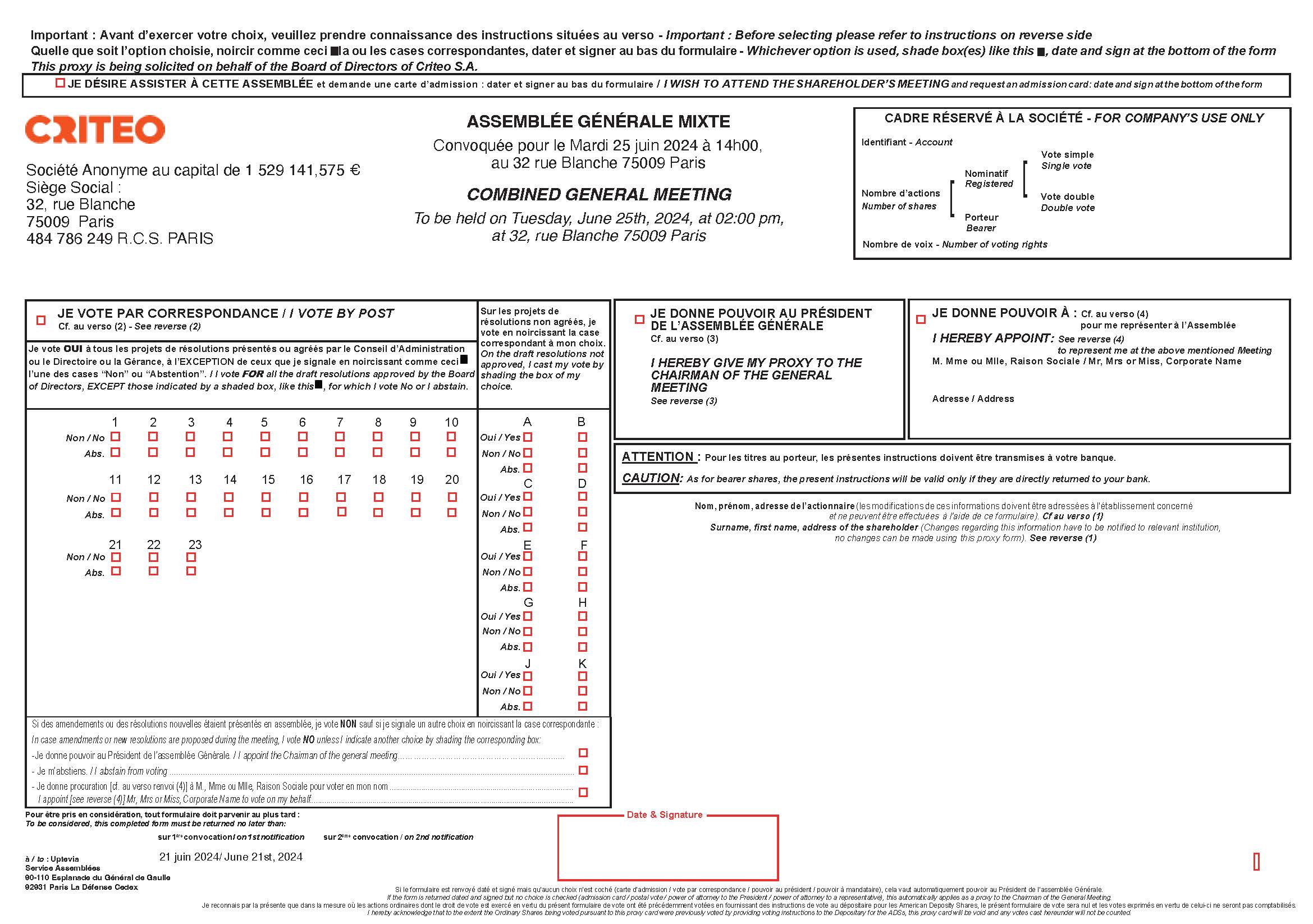

Notice of 2024 Annual General Meeting of Shareholders

To Our Shareholders:

| | | | | | | | | | | |

| What: | Our 2024 Annual Combined General Meeting of Shareholders (the “Annual General Meeting”) | |

| When: | June 25, 2024 at 2:00 p.m., local time | |

| Where: | 32 Rue Blanche, 75009 Paris, France* | |

| Why: | At this Annual General Meeting, shareholders of Criteo S.A. (the “Company”) will be asked to: | |

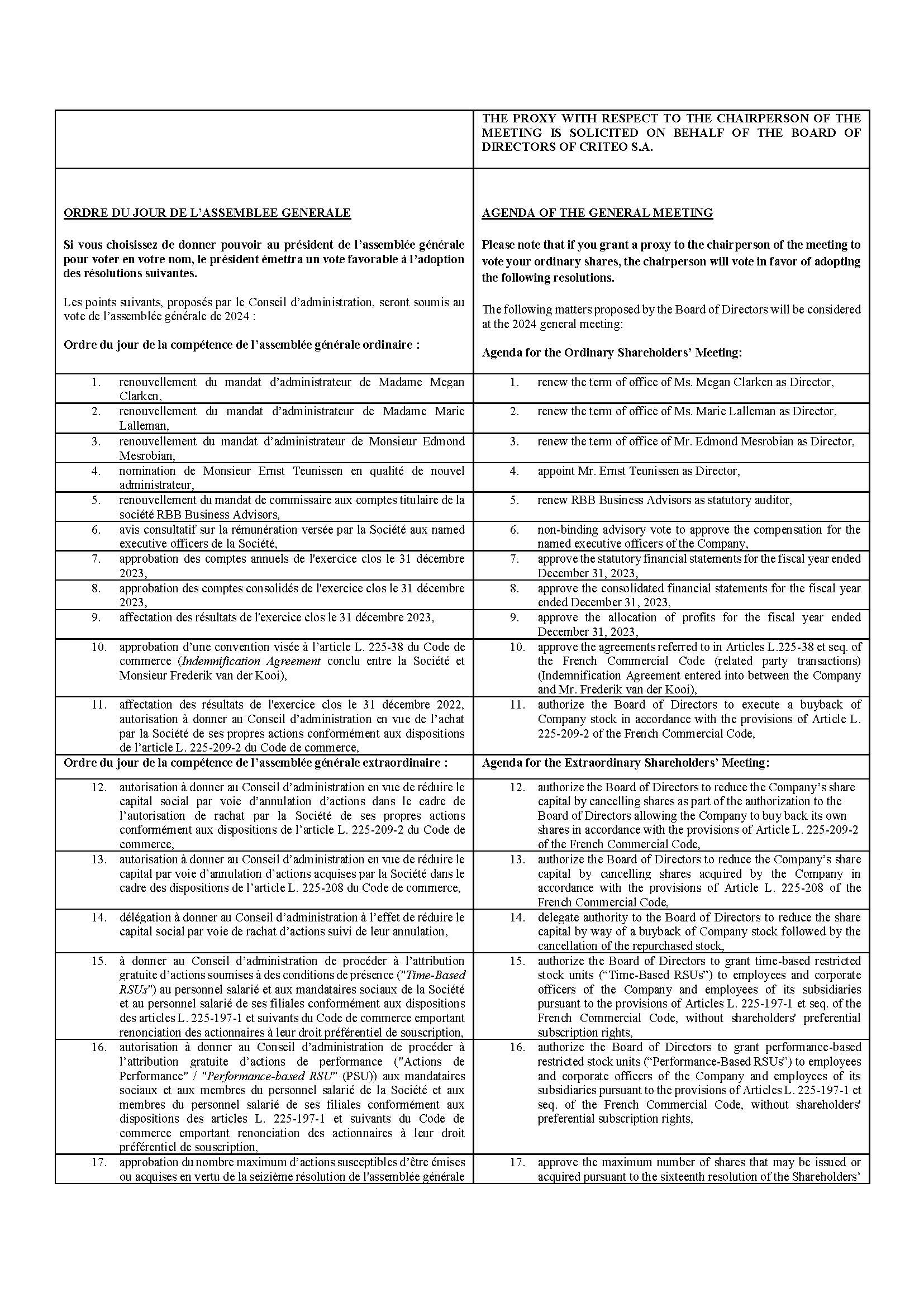

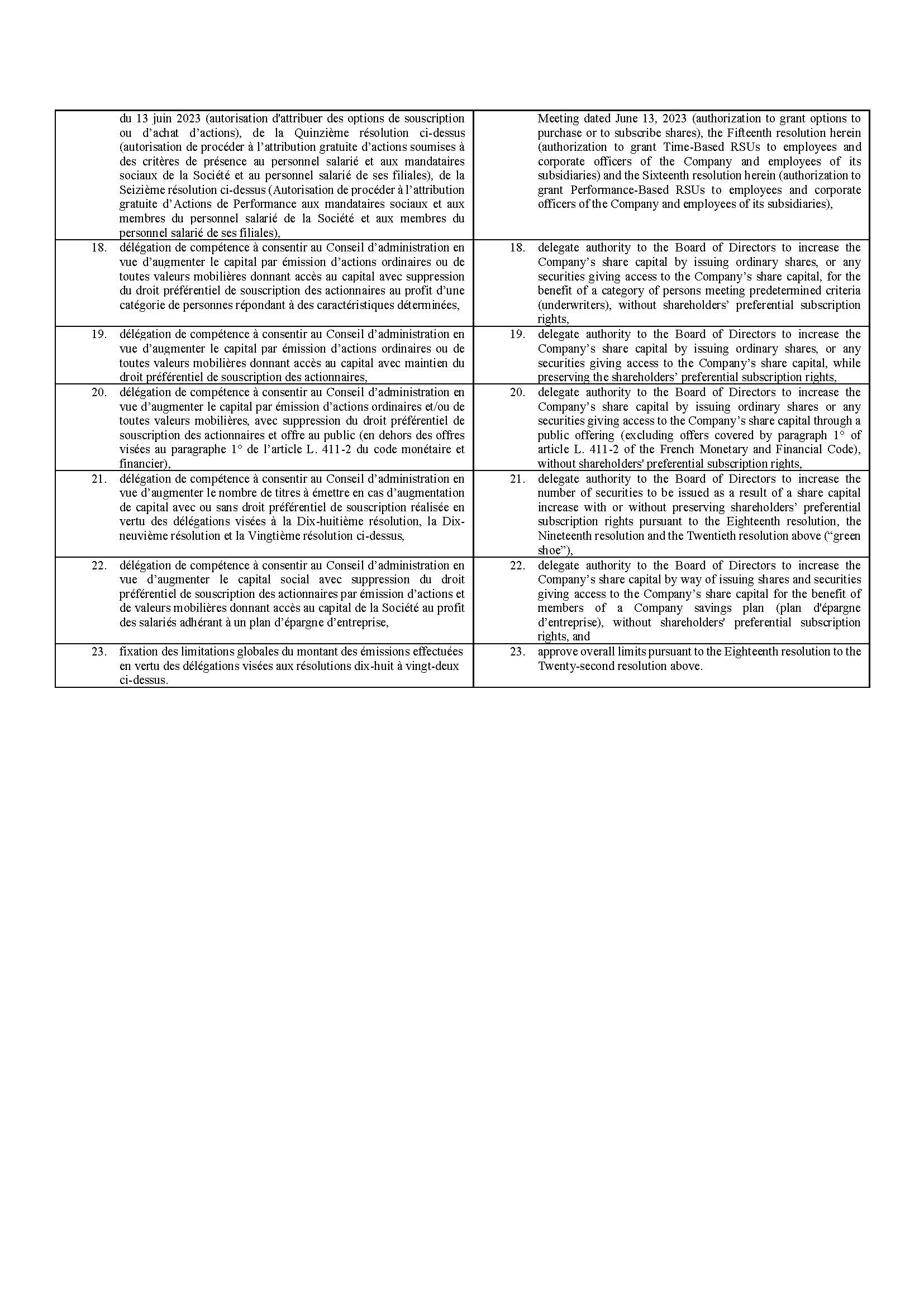

| Resolutions within the authority of the Ordinary Shareholders’ Meeting | Board Recommendation |

| 1. | Renew the term of office of Ms. Megan Clarken as Director, | FOR |

| 2. | Renew the term of office of Ms. Marie Lalleman as Director, | FOR |

| 3. | Renew the term of office of Mr. Edmond Mesrobian as Director, | FOR |

| 4. | Appoint Ernst Teunissen as Director, | FOR |

| 5. | Renew RBB Business Advisors as statutory auditor, | FOR |

| 6. | Non-binding advisory vote to approve the compensation for the named executive officers of the Company, | FOR |

| 7. | Approve the statutory financial statements for the fiscal year ended December 31, 2023, | FOR |

| 8. | Approve the consolidated financial statements for the fiscal year ended December 31, 2023, | FOR |

| 9. | Approve the allocation of profits for the fiscal year ended December 31, 2023, | FOR |

| 10. | Approve the Indemnification Agreement entered into between the Company and Mr. Frederik van der Kooi (agreement referred to in Articles L.225-38 et seq. of the French Commercial Code), | FOR |

| 11. | Authorize the Board of Directors to execute a buyback of Company stock in accordance with the provisions of Article L. 225-209-2 of the French Commercial Code, | FOR |

| Resolutions within the authority of the Extraordinary Shareholders’ Meeting | Board Recommendation |

| 12. | Authorize the Board of Directors to reduce the Company’s share capital by cancelling shares as part of the authorization to the Board of Directors allowing the Company to buy back its own shares in accordance with the provisions of Article L. 225-209-2 of the French Commercial Code, | FOR |

| 13. | Authorize the Board of Directors to reduce the Company’s share capital by cancelling shares acquired by the Company in accordance with the provisions of Article L. 225-208 of the French Commercial Code, | FOR |

| 14. | Delegate authority to the Board of Directors to reduce the share capital by way of a buyback of Company stock followed by the cancellation of the repurchased stock, | FOR |

| 15. | Authorize the Board of Directors to grant time-based restricted stock units (“Time-Based RSUs”) to employees and corporate officers of the Company and employees of its subsidiaries pursuant to the provisions of Articles L. 225-197-1 et seq. of the French Commercial Code, without shareholders' preferential subscription rights, | FOR |

| 16. | Authorize the Board of Directors to grant performance-based restricted stock units (“Performance-Based RSUs”) to employees and corporate officers of the Company and employees of its subsidiaries pursuant to the provisions of Articles L. 225-197-1 et seq. of the French Commercial Code, without shareholders' preferential subscription rights, | FOR |

| | | | | | | | | | | |

| 17. | Approve the maximum number of shares that may be issued or acquired pursuant to Resolution 16 of the Annual General Shareholders' Meeting dated June 13, 2023 (authorization to grant options to purchase or to subscribe shares), Resolution 15 herein (authorization to grant Time-based RSUs to employees and corporate officers of the Company and employees of its subsidiaries) and Resolution 16 herein (authorization to grant Performance-Based RSUs to employees and corporate officers of the Company and employees of its subsidiaries), | FOR |

| 18. | Delegate authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares, or any securities giving access to the Company’s share capital, for the benefit of a category of persons meeting predetermined criteria (underwriters), without shareholders’ preferential subscription rights, | FOR |

| 19. | Delegate authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares, or any securities giving access to the Company’s share capital, while preserving the shareholders' preferential subscription rights, | FOR |

| 20. | Delegate authority to the Board of Directors to increase the Company's share capital by issuing ordinary shares or any securities giving access to the Company's share capital through a public offering (excluding offers covered by paragraph 1 of article L. 411-2 of the French Monetary and Financial Code), without shareholders' preferential subscription rights, | FOR |

| 21. | Delegate authority to the Board of Directors to increase the number of securities to be issued as a result of a share capital increase with or without preserving shareholders' preferential subscription rights pursuant to Resolutions 18, 19 and 20 above ('green shoe'), | FOR |

| 22. | Delegate authority to the Board of Directors to increase the Company’s share capital by way of issuing shares and securities giving access to the Company’s share capital for the benefit of members of a Company savings plan (plan d'épargne d’entreprise), without shareholders' preferential subscription rights, and | FOR |

| 23. | Approve the overall limits pursuant to Resolution 18 to Resolution 22 above. | FOR |

We intend that this notice of the Annual General Meeting and accompanying proxy materials will be first made available to you, as a holder of record of Criteo S.A. Ordinary Shares, on or about April 26, 2024. The Bank of New York Mellon, as the depositary (the “Depositary”), or a broker, bank or other nominee will provide the proxy materials to holders of American Depositary Shares (“ADSs”), each of which represents one Ordinary Share of the Company.

If you are a holder of Ordinary Shares at 12:00 a.m., Paris time, on June 21, 2024 (the “ORD Record Date”), you will be eligible to vote on the items to be presented at the Annual General Meeting. You may (i) vote in person at the Annual General Meeting, (ii) vote by submitting your proxy card by mail, (iii) grant your voting proxy directly to the chairperson of the Annual General Meeting, or (iv) grant your voting proxy to another shareholder, your spouse or your partner with whom you have entered into a civil union. You can change your vote by submitting another properly completed proxy card with a later date (i) by the Annual General Meeting if you choose to (x) grant a proxy to the chairperson of the Annual General Meeting or (y) grant a proxy to another shareholder, your spouse or a partner with whom you are is in a civil union, (ii) at any time prior to June 21, 2024 if you choose to vote in advance by mail, or (iii) by attending the Annual General Meeting and voting in person.

If you hold ADSs, you may instruct the Depositary, either directly or through your broker, bank or other nominee, how to vote the Ordinary Shares underlying your ADSs. Please note that only holders of Ordinary Shares, and not ADS holders, are entitled to vote directly at the Annual General Meeting. The Depositary has fixed a record date for the determination of holders of ADSs who shall be entitled to give such voting instructions. We have been informed by the Depositary that it has set the ADS record date for the Annual General Meeting as of April 8, 2024 (the “ADS Record Date”). If you wish to have your votes cast at the meeting, you must obtain, complete and timely return a voting instruction form from the Depositary, if you are a registered holder of ADSs, or from your broker, bank or other nominee in accordance with any instructions provided therefrom.

Your vote is important. Please read the proxy statement and the accompanying materials. Whether or not you plan to attend the Annual General Meeting, and no matter how many Ordinary Shares or ADSs you own, please submit your proxy card or voting instruction form, as applicable, in accordance with the procedures described above.

By order of the Board of Directors

| | |

| Rachel Picard |

| Chairwoman of the Board of Directors |

|

TABLE OF CONTENTS

Criteo S.A.

32 Rue Blanche

75009 Paris, France

PROXY STATEMENT

FOR THE ANNUAL COMBINED GENERAL MEETING OF SHAREHOLDERS

To Be Held on June 25, 2024

The proxy statement and annual report are available at

http://criteo.investorroom.com/annuals

This proxy statement is being furnished to you by the Board of Directors of Criteo S.A. (the “Company,” “Criteo,” “our,” “us,” or “we”) to solicit your proxy to vote your ordinary shares, nominal value €0.025 per share (“Ordinary Shares”) at our 2024 Annual General Meeting of Shareholders (the “Annual General Meeting”). The Annual General Meeting will be held on June 25, 2024 at 2:00 p.m., local time, at 32 Rue Blanche, 75009 Paris, France. We intend that this proxy statement and the accompanying proxy card will be first made available on or about April 26, 2024 to holders of our Ordinary Shares at 12:00 a.m. Paris time, on June 21, 2024 (the “ORD Record Date”). The Bank of New York Mellon, as the depositary (the “Depositary”), or a broker, bank or other nominee will provide the proxy materials to holders of American Depositary Shares as of April 8, 2024 (the “ADS Record Date”), each representing one Ordinary Share, nominal value €0.025 per share (“ADSs”).

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements and other statements that are not historical facts and involve risks and uncertainties that could cause actual results to differ materially. Factors that might cause or contribute to such differences include, but are not limited to: failure related to our technology and our ability to innovate and respond to changes in technology, uncertainty regarding our ability to access a consistent supply of internet display advertising inventory and expand access to such inventory, including without limitation uncertainty regarding the timing and scope of proposed changes to and enhancements of the Chrome browser announced by Google, investments in new business opportunities and the timing of these investments, whether the projected benefits of acquisitions materialize as expected, uncertainty regarding international growth and expansion (including related to changes in a specific country's or region's political or economic conditions), the impact of competition, uncertainty regarding legislative, regulatory or self-regulatory developments regarding data privacy matters and the impact of efforts by other participants in our industry to comply therewith, the impact of consumer resistance to the collection and sharing of data, our ability to access data through third parties, failure to enhance our brand cost-effectively, recent growth rates not being indicative of future growth, our ability to manage growth, potential fluctuations in operating results, our ability to grow our base of clients, and the financial impact of maximizing Contribution ex-TAC, as well as risks related to future opportunities and plans, including the uncertainty of expected future financial performance and results and those risks detailed from time-to-time under the caption "Risk Factors" and elsewhere in the Company’s SEC filings and reports, including the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on February 23, 2024, and in subsequent Quarterly Reports on Form 10-Q as well as future filings and reports by the Company. Importantly, at this time, macro-economic conditions including inflation and rising interest rates in the U.S. have impacted and may continue to impact Criteo's business, financial condition, cash flow and results of operations.

Except as required by law, the Company undertakes no duty or obligation to update any forward-looking statements contained in this proxy statement as a result of new information, future events, changes in expectations or otherwise.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL GENERAL MEETING

Who is entitled to vote at the Annual General Meeting?

As of March 31, 2024, 56,142,6431 Ordinary Shares were outstanding, the majority of which were represented by ADSs.

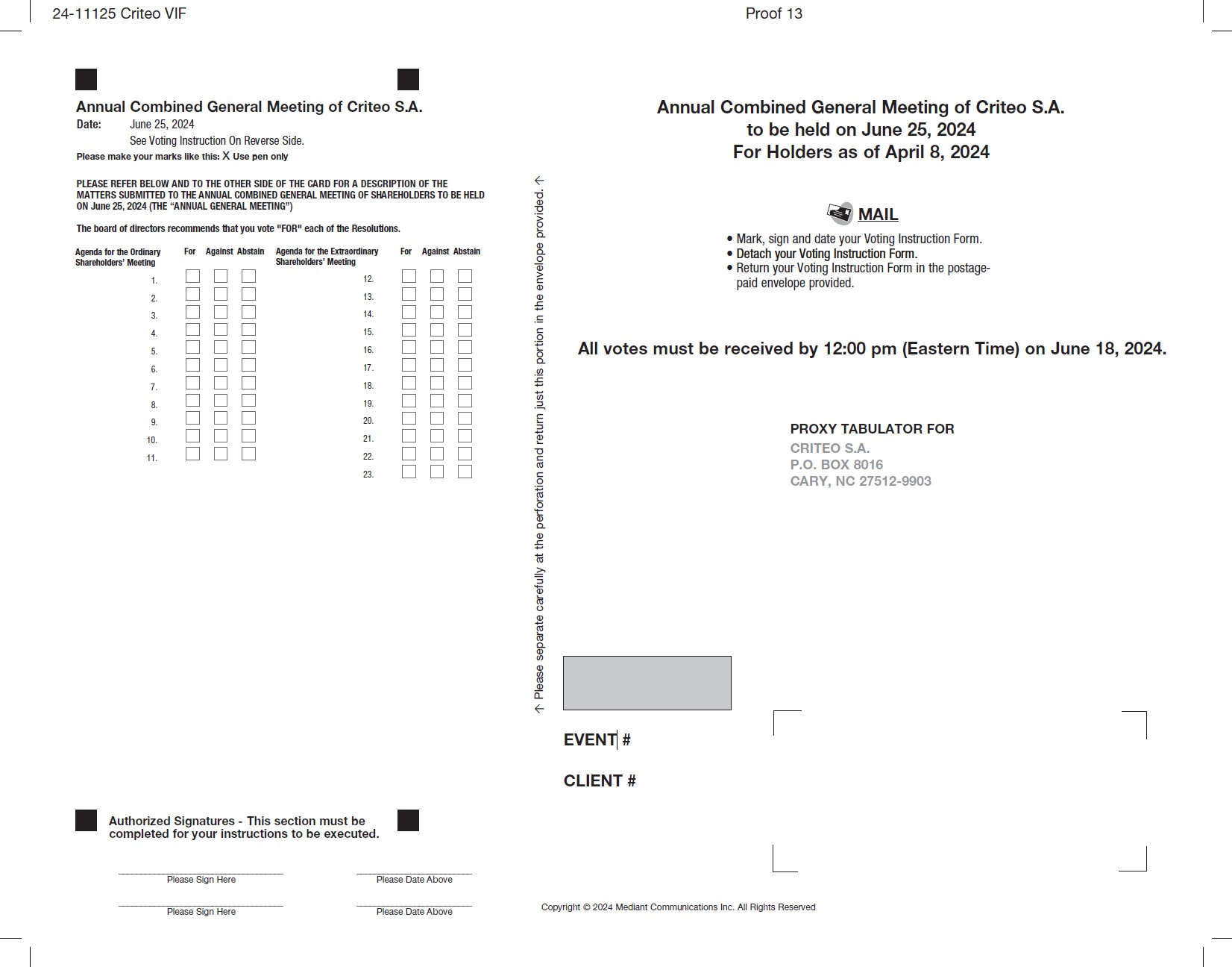

Holders of record of Ordinary Shares at 12:00 a.m., Paris time, on June 21, 2024 (the “ORD Record Date”) will be eligible to vote on the items to be presented at the Annual General Meeting. A holder of ADSs registered in such holder’s name on the books of the Depositary (a “registered holder of ADSs”) as of the ADS Record Date (as defined below) may instruct the Depositary to vote the Ordinary Shares underlying its ADSs, so long as the Depositary receives such holder’s voting instructions by 12:00 p.m., Eastern Time, on June 18, 2024. A holder of ADSs held through a brokerage, bank or other account (a “beneficial holder of ADSs”) as of the ADS Record Date should follow the instructions that its broker, bank or other nominee provides to vote the Ordinary Shares underlying its ADSs. The Depositary has fixed a record date for the determination of holders of ADSs who shall be entitled to give such voting instructions. We have been informed by the Depositary that it has set the ADS record date for the Annual General Meeting as April 8, 2024 (the “ADS Record Date”).

What matters will be voted on at the Annual General Meeting and what are the Board of Directors’ voting recommendations?

There are 23 Resolutions scheduled to be considered and voted on at the Annual General Meeting:

| | | | | | | | |

Resolutions within the authority of the Ordinary Shareholders’ Meeting | Board Recommendation |

| 1. | Renew the term of office of Ms. Megan Clarken as Director, | FOR |

| 2. | Renew the term of office of Ms. Marie Lalleman as Director, | FOR |

| 3. | Renew the term of office of Mr. Edmond Mesrobian as Director, | FOR |

| 4. | Appoint Ernst Teunissen as Director, | FOR |

| 5. | Renew RBB Business Advisors as statutory auditor, | FOR |

| 6. | Non-binding advisory vote to approve the compensation for the named executive officers of the Company, | FOR |

| 7. | Approve the statutory financial statements for the fiscal year ended December 31, 2023, | FOR |

| 8. | Approve the consolidated financial statements for the fiscal year ended December 31, 2023, | FOR |

| 9. | Approve the allocation of profits for the fiscal year ended December 31, 2023, | FOR |

| 10. | Approve the Indemnification Agreement entered into between the Company and Mr. Frederik van der Kooi (agreement referred to in Articles L.225-38 et seq. of the French Commercial Code), | FOR |

| 11. | Authorize the Board of Directors to execute a buyback of Company stock in accordance with the provisions of Article L. 225-209-2 of the French Commercial Code, | FOR |

Resolutions within the authority of the Extraordinary Shareholders’ Meeting | Board Recommendation |

| 12. | Authorize the Board of Directors to reduce the Company’s share capital by cancelling shares as part of the authorization to the Board of Directors allowing the Company to buy back its own shares in accordance with the provisions of Article L. 225-209-2 of the French Commercial Code, | FOR |

1 The number of shares outstanding reflects the total number of shares that can be voted at the Annual General Meeting. The number of shares that can be voted at the Annual General Meeting does not include any Company-owned treasury shares, but does include lock-up shares from the Iponweb founder.

| | | | | | | | |

| 13. | Authorize the Board of Directors to reduce the Company’s share capital by cancelling shares acquired by the Company in accordance with the provisions of Article L. 225-208 of the French Commercial Code, | FOR |

| 14. | Delegate authority to the Board of Directors to reduce the share capital by way of a buyback of Company stock followed by the cancellation of the repurchased stock, | FOR |

| 15. | Authorize the Board of Directors to grant time-based restricted stock units (“Time-Based RSUs”) to employees and corporate officers of the Company and employees of its subsidiaries pursuant to the provisions of Articles L. 225-197-1 et seq. of the French Commercial Code, without shareholders' preferential subscription rights, | FOR |

| 16. | Authorize the Board of Directors to grant performance-based restricted stock units (“Performance-Based RSUs”) to employees and corporate officers of the Company and employees of its subsidiaries pursuant to the provisions of Articles L. 225-197-1 et seq. of the French Commercial Code, without shareholders' preferential subscription rights, | FOR |

| 17. | Approve the maximum number of shares that may be issued or acquired pursuant to Resolution 16 of the Annual General Shareholders' Meeting dated June 13, 2023 (authorization to grant options to purchase or to subscribe shares), Resolution 15 herein (authorization to grant Time-based RSUs to employees and corporate officers of the Company and employees of its subsidiaries) and Resolution 16 herein (authorization to grant Performance-Based RSUs to employees and corporate officers of the Company and employees of its subsidiaries), | FOR |

| 18. | Delegate authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares, or any securities giving access to the Company’s share capital, for the benefit of a category of persons meeting predetermined criteria (underwriters), without shareholders’ preferential subscription rights, | FOR |

| 19. | Delegate authority to the Board of Directors to increase the Company’s share capital by issuing ordinary shares, or any securities giving access to the Company’s share capital, while preserving the shareholders' preferential subscription rights, | FOR |

| 20. | Delegate authority to the Board of Directors to increase the Company's share capital by issuing ordinary shares or any securities giving access to the Company's share capital through a public offering (excluding offers covered by paragraph 1 of article L. 411-2 of the French Monetary and Financial Code), without shareholders' preferential subscription rights, | FOR |

| 21. | Delegate authority to the Board of Directors to increase the number of securities to be issued as a result of a share capital increase with or without preserving shareholders' preferential subscription rights pursuant to Resolutions 18, 19 and 20 above ('green shoe'), | FOR |

| 22. | Delegate authority to the Board of Directors to increase the Company’s share capital by way of issuing shares and securities giving access to the Company’s share capital for the benefit of members of a Company savings plan (plan d'épargne d’entreprise), without shareholders' preferential subscription rights, and | FOR |

| 23. | Approve the overall limits pursuant to Resolution 18 to Resolution 22 above. | FOR |

We encourage you to read the English translation of the full text of the Resolutions, which can be found in Annex A.

Why did I receive a “Notice of Internet Availability of Proxy Materials” but no other proxy materials?

We are distributing our proxy materials to holders of ADSs via the Internet under the “Notice and Access” approach permitted by the rules of the U.S. Securities and Exchange Commission (the “SEC”). This approach expedites shareholders’ receipt of proxy materials while conserving natural resources and reducing our distribution costs. We intend that on or about April 26, 2024, we will make available to ADS holders a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) containing instructions on how to access and review the proxy materials and how to vote. If you would prefer to receive printed copies of the proxy materials in the mail, please follow the instructions in the Notice of Internet Availability for requesting those materials.

If you hold ADSs, how do your rights differ from those who hold Ordinary Shares?

ADS holders do not have the same rights as holders of our Ordinary Shares. French law governs the rights of holders of our Ordinary Shares. The deposit agreement, as amended from time to time (the “deposit agreement”), among the Company, the Depositary and holders of ADSs, and all other persons directly and indirectly holding ADSs, sets out the rights of ADS holders as well as the rights and obligations of the Depositary. Each ADS represents one Ordinary Share (or a right to receive one Ordinary Share) deposited with Uptevia (formerly BNP Paribas Securities Services) as custodian for the Depositary in France under the deposit agreement or any successor custodian. Each ADS also represents any other securities, cash or other property which may be held by the Depositary in respect of the depositary facility. The Depositary is the holder of the Ordinary Shares underlying the ADSs. The Depositary’s offices are located at 240 Greenwich Street, New York, New York 10286.

What is the difference between holding ADSs as a beneficial owner through a broker, bank or other nominee, and as a holder of record?

If you hold ADSs as a holder of record, you may instruct the Depositary directly how to vote the Ordinary Shares underlying your ADSs. If you hold ADSs through a broker, bank or other nominee in “street name”, you must instruct your broker, bank or other nominee how to vote the Ordinary Shares underlying your ADSs and your broker, bank or other nominee will provide voting instructions to the Depositary on your behalf. If you are a record holder of ADSs and fail to provide voting instructions to the Depositary or if you hold ADSs in street name and fail to provide voting instructions to your broker, bank or other nominee, then, in each case, the Ordinary Shares underlying your ADSs will not be voted on any of the Resolutions being presented at the Annual General Meeting, except that if requested by the Company and subject to the terms of the deposit agreement, the Depositary for the ADSs will give a discretionary proxy to a person designated by the Company to vote the Ordinary Shares underlying an ADS, including an ADS held through a broker, bank or other nominee, (i) on each Resolution included in this proxy statement that is not subject to substantial opposition and (ii) against any new matter that is submitted or existing matter that is amended following the date of the proxy statement (including during the Annual General Meeting). If such discretionary proxy under the aforementioned clause (i) is granted to the Company to vote on the Resolutions included in this proxy statement, the Company intends to vote in accordance with the Board of Directors’ recommendation on each Resolution.

From whom will I receive proxy materials for the Annual General Meeting?

If you hold Ordinary Shares registered with our registrar, Uptevia, you are considered the shareholder of record with respect to those Ordinary Shares and you will receive instructions to access the proxy materials from us.

If you hold ADSs in your own name registered on the books of the Depositary, you are considered the registered holder of the ADSs and will receive the Notice of Internet Availability and, if requested, other proxy materials from the Depositary. If you hold ADSs through a broker, bank or other nominee, you

are considered the beneficial owner of the ADSs and you will receive the Notice of Internet Availability and, if requested, other proxy materials from your broker, bank or other nominee.

How can I vote my Ordinary Shares or ADSs?

If you hold Ordinary Shares, you have the right to (i) vote at the Annual General Meeting, (ii) vote in advance by submitting your proxy card by mail, (iii) grant your voting proxy directly to the chairperson of the Annual General Meeting, or (iv) grant your voting proxy to another shareholder, your spouse or your partner with whom you have entered into a civil union, provided in each case that you are the holder of record of such Ordinary Shares on the ORD Record Date. You may vote at the Annual General Meeting so long as you do not submit your proxy card by mail or appoint a proxy in advance of the meeting. If you would like to submit your proxy card by mail, you must first request a proxy card from Uptevia. The deadline for requesting a proxy card from Uptevia is June 19, 2024. Then, simply mark the proxy card in accordance with the instructions, date and sign, and return it. If you choose to vote by mail, however, your proxy card must be received by Uptevia by June 21, 2024 in order to be taken into account. If you cast your vote by appointing the chairperson of the Annual General Meeting as your proxy, the chairperson of the Annual General Meeting will vote your Ordinary Shares in accordance with the Board of Directors’ recommendations. If you appoint another shareholder, your spouse or your partner with whom you are in a civil union to act as your proxy, such proxy must be written and made known to the Company, and such other shareholder’s proxy must be received by Uptevia by June 21, 2024 in order to be taken into account.

If you are a holder of ADSs and you are an ADS record holder, you may instruct the Depositary directly how to vote the Ordinary Shares underlying your ADSs. We have been informed by the Depositary that it has set the ADS Record Date for the Annual General Meeting as April 8, 2024. If you hold ADSs through a broker, bank or other nominee in “street name”, you must instruct your broker, bank or other nominee how to vote the Ordinary Shares underlying your ADSs and your broker, bank or other nominee will provide voting instructions to the Depositary on your behalf. If you held ADSs as of the ADS Record Date, you have the right to instruct the Depositary, if you held your ADSs directly, or the right to instruct your broker, bank or other nominee, if you held your ADSs through such intermediary, how to vote. So long as the Depositary receives your voting instructions by 12:00 p.m., Eastern Time, on June 18, 2024, it will, to the extent practicable and subject to French law and the terms of the deposit agreement, vote the underlying Ordinary Shares as you instruct. If your ADSs are held through a broker, bank or other nominee, such intermediary will provide you with instructions on how you may give voting instructions with respect to the Ordinary Shares underlying your ADSs. Please check with your broker, bank or other nominee, as applicable, and carefully follow the voting procedures provided to you.

As an ADS holder, you will not be entitled to vote in person at the Annual General Meeting. To the extent you timely provide the Depositary, or your broker, bank or other nominee, as applicable, with voting instructions, the Depositary will, to the extent practicable and subject to French law and the terms of the deposit agreement, vote the Ordinary Shares underlying your ADSs in accordance with your instructions.

You also may exercise the right to vote the Ordinary Shares underlying your ADSs by surrendering your ADSs and withdrawing the Ordinary Shares represented by your ADSs pursuant to the terms described in the deposit agreement. However, in connection with voting at the Annual General Meeting and in accordance with the deposit agreement, we understand that the Depositary has temporarily suspended surrenders of ADSs for the purpose of withdrawing the Ordinary Shares during the period from April 5, 2024, until June 26, 2024, the day after the Annual General Meeting (the “Suspension Period”). Notwithstanding such temporary suspension, a holder of ADSs may still request the Depositary to permit it to surrender ADSs and withdraw the Ordinary Shares represented by such ADSs during the Suspension Period, so long as such surrendering holder certifies in writing to the Depositary that: (i) it was the owner of all ADSs being surrendered (the “Surrendered ADSs”) as of the ADS Record Date and has the power to vote and dispose of the Surrendered ADSs; (ii) it has not, prior to the date of such certification, provided and will not provide following the date of such certification, voting instructions with respect to voting the Ordinary Shares underlying the Surrendered ADSs at the Annual General Meeting to

either the Depositary or to a broker, bank or other nominee that is the registered holder of any Surrendered ADSs; (iii) it will not, at any time on or after the date of such certification, cause or attempt to cause the Ordinary Shares underlying any Surrendered ADSs to be voted more than once, including by providing any voting instructions with respect to voting the Ordinary Shares underlying any Surrendered ADSs at the Annual General Meeting to either the Depositary or to a broker, bank or other nominee that is the registered holder of any Surrendered ADSs; and (iv) it confirms its understanding that in the event that it has provided or does provide such voting instructions referenced in the foregoing clauses (ii) and (iii) or otherwise cause the Ordinary Shares underlying any Surrendered ADSs to be voted more than once, any votes cast with respect to Ordinary Shares that are withdrawn upon surrender of Surrendered ADSs will be void and not be counted as votes cast at the Annual General Meeting. Even if you are able to withdraw Ordinary Shares during the Suspension Period by providing the required certification, it is possible that you may not have sufficient time to withdraw your Ordinary Shares and vote them at the upcoming Annual General Meeting as a holder of record of Ordinary Shares. Holders of ADSs may also incur additional costs associated with the surrender process.

How will my Ordinary Shares be voted if I do not vote?

If you hold Ordinary Shares and do not (i) vote at the Annual General Meeting, (ii) vote by submitting in advance a proxy card by mail, (iii) grant your voting proxy directly to the chairperson of the Annual General Meeting, or (iv) grant your voting proxy to another shareholder, your spouse or your partner with whom you have entered into a civil union, your Ordinary Shares will not be counted as votes cast and will have no effect on the outcome of the vote with respect to any matter.

If you hold Ordinary Shares and you vote in advance by mail, your Ordinary Shares will be treated as abstentions (which will not be counted as a vote “FOR” or “AGAINST”) on any matters with respect to which you did not make a selection.

If you hold Ordinary Shares and grant your voting proxy directly to the chairperson of the Annual General Meeting, your Ordinary Shares will be voted in accordance with the Board of Directors’ recommendations.

How will the Ordinary Shares underlying my ADSs be voted if I do not provide voting instructions to the Depositary or my broker, bank or other nominee or if a matter is subsequently added to the agenda of the Annual General Meeting (including during the Annual General Meeting)?

If you are a registered holder of ADSs and do not provide voting instructions to the Depositary on how you would like the Ordinary Shares underlying your ADSs to be voted on one or more matters or do not return your voting instruction form or if you are a beneficial holder of ADSs and do not return your voting instruction form to your broker, bank or other nominee, the Ordinary Shares underlying your ADSs will not be voted on the Resolutions being presented at the Annual General Meeting, except that if requested by the Company subject to the terms of the deposit agreement, the Depositary for the ADSs will give a discretionary proxy to a person designated by the Company to vote the Ordinary Shares underlying an ADS, including an ADS held through a broker, bank or other nominee, (i) on each Resolution included in this proxy statement that is not subject to substantial opposition and (ii) against any new matter that is submitted or existing matter that is amended following the date of this proxy statement (including during the Annual General Meeting). If such discretionary proxy under the foregoing clause (i) is granted to the Company to vote on the Resolutions included in this proxy statement, the Company intends to vote in accordance with the Board of Directors’ recommendation on each Resolution.

Can I surrender my ADSs and withdraw the underlying Ordinary Shares during the period between the ADS Record Date and the ORD Record Date?

In connection with voting at the Annual General Meeting and in accordance with the deposit agreement, we understand that the Depositary has temporarily suspended surrenders of ADSs for the purpose of withdrawing the Ordinary Shares during the Suspension Period (from April 5, 2024, until June 26, 2024). Notwithstanding such temporary suspension, a holder of ADSs may still request the Depositary

to permit it to surrender ADSs and withdraw the Ordinary Shares represented by such ADSs during the Suspension Period, so long as such surrendering holder certifies in writing to the Depositary that: (i) it was the owner of all Surrendered ADSs as of the ADS Record Date and has the power to vote and dispose of the Surrendered ADSs; (ii) it has not, prior to the date of such certification, provided and will not provide following the date of such certification, voting instructions with respect to voting the Ordinary Shares underlying the Surrendered ADSs at the Annual General Meeting to either the Depositary or to a broker, bank or other nominee that is the registered holder of any Surrendered ADSs; (iii) it will not, at any time on or after the date of such certification, cause or attempt to cause the Ordinary Shares underlying any Surrendered ADSs to be voted more than once, including by providing any voting instructions with respect to voting the Ordinary Shares underlying any Surrendered ADSs at the Annual General Meeting to either the Depositary or to a broker, bank or other nominee that is the registered holder of any Surrendered ADSs; and (iv) it confirms its understanding that in the event that it has provided or does provide such voting instructions referenced in the foregoing clauses (ii) and (iii) or otherwise cause the Ordinary Shares underlying any Surrendered ADSs to be voted more than once, any votes cast with respect to Ordinary Shares that are withdrawn upon surrender of Surrendered ADSs will be void and not be counted as votes cast at the Annual General Meeting.

How will my Ordinary Shares be voted if I grant my proxy to the chairperson of the Annual General Meeting?

If you are a holder of Ordinary Shares and you grant your proxy to the chairperson of the Annual General Meeting, the chairperson of the Annual General Meeting will vote your Ordinary Shares in accordance with the Board of Directors’ recommendations. As a result, your Ordinary Shares would be voted “FOR” the nominees of the Board of Directors in Resolutions 1 to 4 and “FOR” each of Resolutions 5 to 23.

Could other matters be decided at the Annual General Meeting?

At this time, we are unaware of any matters, other than as set forth above and the possible submission of additional shareholder resolutions, as described under “Other Matters” elsewhere in this proxy statement, that may properly come before the Annual General Meeting.

Holders of Ordinary Shares: To address the possibility of another matter being presented at the Annual General Meeting, holders of Ordinary Shares who choose to vote in advance by mail may use their proxy card to (i) grant a proxy to the chairperson of the Annual General Meeting to vote on any new matters that are proposed during the meeting, (ii) abstain from voting (which will not be counted as a vote “FOR” or “AGAINST”) on such matters, or (iii) grant a proxy to another shareholder, a spouse or a partner with whom the holder of Ordinary Shares is in a civil union to vote on such matters. If no instructions are given with respect to matters about which we are currently unaware, your Ordinary Shares will be voted “AGAINST” such matters.

If a holder of Ordinary Shares chooses to grant a proxy to the chairperson of the Annual General Meeting, with respect to either all matters or only any additional matters not disclosed in this proxy statement, the chairperson of the Annual General Meeting shall issue a vote in favor of adopting such undisclosed resolutions submitted or approved by the Board of Directors and a vote against adopting any other such undisclosed resolutions.

Holders of ADSs: Ordinary Shares underlying ADSs will not be voted on any matter not disclosed in the proxy statement, or for which specific voting instructions are not provided by the holder of such ADSs, except that if requested by the Company subject to the terms of the deposit agreement, the Depositary for the ADSs will give a discretionary proxy to a person designated by the Company to vote the Ordinary Shares underlying an ADS, including an ADS held through a broker, bank or other nominee, (i) on each Resolution included in this proxy statement that is not subject to substantial opposition and (ii) against any new matter that is submitted or existing matter that is amended following the date of this proxy statement (including during the Annual General Meeting). If such discretionary proxy under the

foregoing clause (i) is granted to the Company to vote on the Resolutions included in this proxy statement, the Company intends to vote in accordance with the Board of Directors’ recommendation on each Resolution.

Who may attend the Annual General Meeting?

Holders of record of Ordinary Shares as of the ORD Record Date and ADS holders as of the ADS Record Date, or their duly appointed proxies, may attend the Annual General Meeting. Holders of Ordinary Shares may request an admission card for the Annual General Meeting by checking the appropriate box on the proxy card, dating and signing it, and returning the proxy card by regular mail or by presenting evidence of their status as a shareholder at the Annual General Meeting as of the ORD Record Date.

Holders of ADSs may be asked to provide proof of ownership in order to be admitted to the Annual General Meeting, such as their most recent account statement or other similar evidence confirming their ownership as of the ADS Record Date.

Holders of Ordinary Shares or ADSs can obtain directions to the Annual General Meeting by contacting our Investor Relations department by phone at +1 929 287 7835 or by email at InvestorRelations@criteo.com.

Can I submit questions to be answered during the Annual General Meeting?

You can submit questions during the Annual General Meeting and in advance of the Annual General Meeting. Questions submitted in advance of the Annual General Meeting must be sent to the Company in written form at least four (4) business days prior to the date of the Annual General Meeting. Such questions should be directed to the attention of the Chief Executive Officer of the Company and can be sent either by mail to the Company’s registered office at Criteo S.A., 32 Rue Blanche, 75009 Paris, France with acknowledgment of receipt or by email at the following address: AGM@criteo.com, in each case, accompanied with proof of a shareholding certificate. At management’s discretion, proper questions raised in advance of the meeting in accordance with these procedures will be addressed by the Company during the Annual General Meeting.

Can I vote at the Annual General Meeting?

If you hold Ordinary Shares as of the ORD Record Date you may vote at the Annual General Meeting unless you submit your proxy or voting instructions prior to the Annual General Meeting.

If you hold ADSs, you will not be able to vote the Ordinary Shares underlying your ADSs at the Annual General Meeting.

Can I change my vote?

Yes. If you are a holder of Ordinary Shares you can change your vote by submitting another properly completed proxy card with a later date (i) by the Annual General Meeting if you choose to (x) grant a proxy to the chairperson of the Annual General Meeting or (y) grant a proxy to another shareholder, your spouse or a partner with whom you are is in a civil union, (ii) at any time prior to June 21, 2024 if you choose to vote in advance by mail, or (iii) by attending the Annual General Meeting and voting in person.

If you hold ADSs, directly or through a broker, bank or other nominee, you must follow the instructions provided by the Depositary or such broker, bank or other nominee if you wish to change your vote. The last instructions you submit prior to the deadline indicated by the Depositary or the broker, bank or other nominee, as applicable, will be used to instruct the Depositary how to vote the Ordinary Shares underlying your ADSs.

What is an “abstention” and how would it affect voting?

With respect to Ordinary Shares, an “abstention” occurs when a shareholder votes in advance by mail with instructions to abstain from voting regarding a particular matter or without making a selection with respect to a particular matter. With respect to ADSs, an “abstention” occurs when a shareholder sends proxy instructions to the Depositary to abstain from voting regarding a particular matter.

An abstention by a holder of Ordinary Shares or by a holder of ADSs will be counted toward the presence of a quorum. Because an abstention from voting is not voted affirmatively or negatively, it will have no effect on the approval of any of the Resolutions.

What is a broker non-vote?

A broker non-vote occurs when a broker, bank or other nominee votes on behalf of a beneficial owner for the Annual General Meeting but does not vote on a particular Resolution because such broker, bank or other nominee does not have discretionary voting power with respect to that Resolution and has not received voting instructions from the beneficial owner. All Ordinary Shares are held in registered name (in accordance with French law) and only ADSs may be held through a broker, bank or other nominee. If requested by the Company and subject to the terms of the deposit agreement, if the holder of an ADS does not provide voting instructions, the Depositary for the ADSs will give a discretionary proxy to a person designated by the Company to vote the Ordinary Shares underlying an ADS, including an ADS held through a broker, bank or other nominee, (i) on each Resolution included in this proxy statement that is not subject to substantial opposition and (ii) against any new matter that is submitted or existing matter that is amended following the date of this proxy statement (including during the Annual General Meeting). If there are broker non-votes at the Annual General Meeting, then broker non-votes will be considered present for the purposes of establishing a quorum, but will not count as votes cast at the Annual General Meeting. Because of this, we do not expect there to be any broker non-votes at the Annual General Meeting. If there are broker non-votes at the Annual General Meeting, then broker non-votes will be considered present for the purposes of establishing a quorum, but will not count as votes cast at the Annual General Meeting.

What are the quorum requirements for the Resolutions?

In deciding the Resolutions that are scheduled for a vote at the Annual General Meeting, each shareholder as of the record date is entitled to one vote per Ordinary Share. Under our by-laws, in order to take action on the Resolutions, a quorum, consisting of the holders of 33 1/3% of the Ordinary Shares entitled to vote, must be present in-person or by proxy. Abstentions and broker non-votes (if any) are treated as Ordinary Shares that are present for purposes of determining the presence of a quorum. If a quorum is not present, the meeting will be adjourned.

What are the voting requirements for the Resolutions?

The affirmative vote of a majority of the total number of votes cast is required for the election of each director nominee named in Resolutions 1 to 4 and for the approval of each matter described in Resolutions 5 to 11. Under French law, this means that the votes cast “FOR” a nominee must exceed the aggregate of the votes cast “AGAINST” that nominee, and the votes cast “FOR” a Resolution must exceed the aggregate of the votes cast “AGAINST” that Resolution. For approval of Resolutions 12 through 23, the affirmative vote of two-thirds of the total number of votes cast is required. Abstentions and broker non-votes (if any) will not count as votes cast on any of the Resolutions to be presented at the Annual General Meeting.

Who will count the votes?

Representatives of Uptevia will tabulate the votes and act as inspectors of election.

Who will conduct the proxy solicitation and how much will it cost?

The Company will pay all expenses in connection with the solicitation of proxies for the Annual General Meeting. To aid in the solicitation of proxies, we have retained Innisfree as proxy solicitor for a fee of up to $50,000.00, plus reimbursement of expenses and indemnification against certain losses, costs and expenses.

We will make arrangements with the Depositary, brokers, banks and other nominees for the forwarding of solicitation material to the direct and indirect holders of ADSs, and we will reimburse the Depositary and such intermediaries for their related expenses.

Where can I find the documents referenced in this proxy statement?

The following documents are included in this proxy statement: (i) an English translation of the statutory financial statements of the Company for the fiscal year ended December 31, 2023 prepared in accordance with generally accepted accounting principles as applied to companies in France (“French GAAP”), (ii) an English translation of the consolidated financial statements of the Company for the fiscal year ended December 31, 2023 prepared in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the European Union, and (iii) an English translation of the full text of the Resolutions to be submitted to shareholders at the Annual General Meeting. This proxy statement will be accompanied by the Company’s 2023 Annual Report on Form 10-K, which includes the consolidated financial statements of the Company for the fiscal year ended December 31, 2023 prepared under generally accepted accounting principles as applied in the United States (“U.S. GAAP”). The Company’s 2023 Annual Report on Form 10-K was filed with the SEC on February 23, 2024 and is available on our website at http://criteo.investorroom.com. In addition, once available, the Report of the Board of Directors and the Management Report will be posted on our website at http://criteo.investorroom.com and filed with the SEC. Information contained on, or that can be accessed through, any website referenced herein does not constitute a part of this proxy statement. Websites referenced herein are included solely as an inactive textual reference.

You may obtain additional information, which we make available in accordance with French law, by contacting the Company’s Investor Relations department at Criteo S.A., 32 Rue Blanche, Paris, France 75009, or by emailing InvestorRelations@criteo.com. Such additional information includes, but is not limited to, the statutory auditors’ reports and the report prepared by the independent expert appointed pursuant to the provisions of Article L. 225-209-2 of the French Commercial Code referenced in the Resolutions described below.

Who can I contact if I have questions about voting my Ordinary Shares or ADSs or attending the Annual General Meeting?

If you have any questions about voting your Ordinary Shares or ADSs or attending the Annual General Meeting, please contact the Company by email at AGM@criteo.com, or our proxy solicitor, Innisfree, in the United States at (877) 687-1874 and outside the United States at +1 (412) 232-3651.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our Board of Directors believes that having a mix of directors with complementary qualifications, expertise, experience, backgrounds, and attributes is essential to meeting its multifaceted oversight responsibilities, representing the best interests of our shareholders, and providing practical insights and diverse perspectives.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Board Member / Nominee | AdTech / Digital Advertising | Corporate Finance and Accounting | Leadership (CEO / Business Unit) | Global Business Operations | Strategy / Business Transformation | M&A | Retail Media | Cyber-security |

Nathalie Balla | x | x | x | x | x | x | x | |

Megan Clarken | x | | x | x | x | x | x | |

Frederik van der Kooi | x | x | x | x | x | x | | |

Marie Lalleman | x | | x | x | x | | x | |

Edmond Mesrobian | x | | | x | x | x | x | x |

Hubert de Pesquidoux | x | x | x | x | x | x | | |

Rachel Picard | x | | x | x | x | x |

| |

Ernst Teunissen | x | x | x | x | x | x | | x |

The lack of a skill in the above table does not mean that the director does not possess that skill or experience. We look to each director to be knowledgeable in these areas; however, the mark indicates that the item is a particularly prominent qualification or characteristic that the director brings to the Board of Directors.

Director and Director Nominee Biographies

Presented below is information with respect to the Board of Director’s seven incumbent directors and its director nominees. The information presented below for each such person includes the specific experience, qualifications, attributes and skills that led the Board of Directors to conclude that such person should serve on the Board of Directors.

| | | | | | | | | | | | | | |

Megan Clarken CEO & Director

Age: 57 Director since: 2020 | Professional Experience |

•Chief Commercial Officer (Nielsen Global Media), President (Watch) & President (Product Leadership & International Media), Nielsen (2004 – 2019) •Operations Consultant, Akamai Technologies (2002 – 2003) •Director (Production), nineMSN (1997 – 2000) |

Key Skills & Qualifications |

•Technology/ AdTech Expertise: As CEO of the Company, Ms. Clarken has overseen Criteo’s transformation into the end-to-end AdTech platform of choice in Retail and Commerce Media –with $4 billion in activated media spend flowing through the platform in 2023. •Corporate Finance / M&A Experience: Under Ms. Clarken’s leadership, the Company has expanded its Retail Media, Commerce Media and omnichannel capabilities through the acquisitions of Mabaya, Iponweb and Brandcrush, becoming the only unified, AI-driven platform that directly connects advertisers with retailers and publishers to drive commerce everywhere. •Strategy / Business Transformation Experience: During Ms. Clarken’s tenure at Nielsen Global Media, she was the chief architect of Nielsen’s Total Audience Strategy, which fundamentally changed the way the marketplace looked at content and ads across platforms and devices. •Global Business Experience: As the former President of Watch (media measurement services) and President of Project Leadership and International Media at Nielsen Global Media, Ms. Clarken led the U.S. Media and International Watch commercial teams and was responsible for Nielsen's commercial business across 45 international markets. |

| Other Public Boards (within past five years) |

| •Director, Capgemini (EPA: CAP) (2023 – Present) |

| | | | | | | | | | | | | | |

Rachel Picard Chairperson of the Board & Independent Director

Age: 57 Director since: 2017

Committee: Compensation and Nomination & Corporate Governance | Professional Experience |

•Chief Executive Officer of SNCF Voyages (2014 – 2020) •Chief Executive Officer of SNCF Gares & Connexions at SNCF Group (2012 – 2014) •Chief Executive Officer of Thomas Cook France and Deputy General Manager of Tour Operating and Marketing at Thomas Cook Group |

Key Skills & Qualifications |

•Business Transformation: As the former CEO of SNCF Voyages, Ms. Picard brings extensive expertise in overseeing and executing successful transformations of large businesses to Criteo’s boardroom. She led a comprehensive transformation of SNCF Train Stations and the TGV business model, which increased growth, quality and profitability and launched two new services that expanded the company’s market reach. •Digital and E-Commerce Strategies: Ms. Picard has over 20 years of experience leading innovative product design projects and her strategic vision has supported early integrated digital efforts in e-commerce, including as the former Head of voyages-sncf.com. Her first-hand knowledge in developing and executing digital strategies adds significant digital innovation and e-commerce expertise to the Board of Directors to guide Criteo’s unified technology platform. •Global CEO Experience: Ms. Picard successfully developed and led corporate strategies, including as CEO of SNCF Voyages and SNCF Gares & Connexions, where she drove the implementation of technology enhancements and service improvement of its high-speed train network, strengthening the long-term value of SNCF for customers and investors. She brings valuable experience leading large, complex companies that supports the ability of Criteo’s Board of Directors to effectively oversee management and increase accountability.

|

Other Public Boards (within past five years) |

| •Director, AXA S.A. (EPA: CS) (2022 – Present) •Member, Supervisory Board of Rocher Participations (2020 – Present) •Director, Compagnie des Alpes (EPA: CDA) (2009 – 2022) |

| Education |

| •Master’s Degree, HEC Paris |

| | | | | | | | | | | | | | |

Nathalie Balla Independent Director & Vice Chairman

Age: 56 Director since: 2017

Committee: Audit | Professional Experience |

•Co-owner and Chief Executive Officer (2014 – 2022), Chief Executive Officer (2009 – 2014), La Redoute •Co-owner and Managing Director (2014 – 2022), Relais Colis •Managing Director, Robert Klingel Europe (2005 – 2008) •Executive Committee (International Operations), Quelle and Neckermann (2001 – 2005) •Managing Director, Quelle Versand and Mode&Preis Switzerland (1998 – 2001) •Managing Director, Madeleine Switzerland and Austria (1992 – 1998) •Auditor, Price Waterhouse Switzerland (1990 – 1991) |

Key Skills & Qualifications |

•Retail Media Expertise: Ms. Balla brings extensive experience in retail media and a keen understanding of how to successfully influence customers at points of purchase having served as CEO of La Redoute, the number one online retailer for apparel and home & decoration in France and one of Europe's largest home shopping organizations. •Global Business Experience: Throughout her career, Ms. Balla has led multi-country teams in the retail industry, including serving as a key leader in charge of international operations at German retailer Quelle and Neckermann and as the CEO of La Redoute at Redcats, part of Kering. •Strategy / Business Transformation Experience: Ms. Balla led the turnaround and successful transformation of Relais Colis and La Redoute by leveraging her deep experience in the digitalization of physical retail to grow sales. •Corporate Finance / M&A Experience: Ms. Balla led the acquisition, capital raising and transformation of Relais Colis and La Redoute, leading to the ultimate sale of La Redoute to Galeries Lafayette Group and Relais Colis to Walden Group in 2022.

|

| Other Public Boards (within past five years) |

| •Director, Edenred (OTCMKTS: EDNMY) (2023 – Present) •Director, IDI (EPA: IDIP) (2021 – Present) •Director, DEE Tech (acquired July 2023) (2021 – 2023) |

| Current Organizations |

| •Partner, 50 Partners Digital, Healthcare, Impact (2023 – Present) •Vice-President, FEVAD (2014 – 2022) |

| Education |

| •PhD in Business Administration (Finance and Accounting), Sankt Gallen University •Master Degree, École supérieure de commerce (ESCP-EAP) of Paris |

| | | | | | | | | | | | | | |

Frederik van der Kooi Independent Director

Age: 57 Director since: 2023

Committee: Audit | Professional Experience |

•Microsoft Corporation ◦Corporate Vice President (Microsoft Advertising) (2010 – 2021) ◦Corporate Vice President & COO (Online Services Division) (2009 – 2010) ◦Corporate Vice President & CFO (Online Services Division and Windows) (2006 – 2009) ◦General Manager (Finance – EMEA) (2003 – 2006) ◦Senior Finance Director (Western Europe) (2001 – 2003) ◦Finance Director (Benelux) (1999 – 2001) •Previously held numerous finance and business roles at General Motors including CFO of IBC Vehicles

|

Key Skills & Qualifications |

•Technology / AdTech Expertise: Mr. van der Kooi has deep expertise in digital advertising, leading Microsoft’s digital advertising business for over a decade, covering search, display, native, retail media and video offerings and leading strategy, sales, marketing and partnerships globally. •Corporate Finance / M&A Experience: Mr. van der Kooi led Microsoft’s acquisitions and integration of PromoteIQ in retail media, Xandr and others, and closed transformative business partnerships with Yahoo, AOL, AppNexus and global agency partners. •Strategy / Business Transformation Experience: Mr. van der Kooi built and scaled Microsoft’s global advertising business fivefold over a decade, reaching ~$10bn by the end of his tenure. •Global Business Experience: Throughout his career, Mr. van der Kooi has led multi-country teams and held positions of leadership in the United States, Western Europe and the United Kingdom.

|

| Education |

| •Master of Business Administration, Instituto de Estudios Superiores de la Empresa (IESE) •Bachelor of Business Administration, Nyenrode University |

| | | | | | | | | | | | | | |

Marie Lalleman Independent Director

Age: 59 Director since: 2019

Committee Chair: Nomination & Corporate Governance | Professional Experience |

•Global External Advisor (Customer/Marketing, Data and Retail Practices, Bain & Company) •The Nielsen Company ◦Executive Vice President (Global Strategic Partners, France/USA) (2017 – 2021) ◦Global Partner, Amazon (Retail, Advertising) (2017 – 2021) ◦Global Operating Leadership Team, USA (Nielsen Media) (2017 – 2021) ◦Retailers Global Partnership & Global Client Partner (Carrefour Group, France) (2007 – 2017) ◦Nielsen Executive Committee, Europe (2007 – 2017) ◦International Client Business Partner for EMEA, Asia, Latam (Unilever/Kimberly Clark, UK/France) (2001 – 2006) ◦Business Unit Director, EMEA (1998 – 2001) ◦International Client Director, Europe (1992 – 1997) •Held leadership positions at several other global companies including Dataquest (Dun & Bradstreet Group), EMS-Chemie and Carillon Importers

|

Key Skills & Qualifications |

•Technology / AdTech Expertise: Ms. Lalleman’s tenure holding various senior positions at The Nielsen Company has given her deep global expertise with the retail and media digital players as well as an understanding of the transformation dynamics of the industry. •Strategy / Business Transformation Experience: With extensive leadership experience at Nielsen, particularly in driving data-driven strategic growth, Ms. Lalleman leveraged her deep expertise in retail, e-commerce and digital media to lead Nielsen in navigating digital disruption and business model transformation. •Global Business Experience: Throughout her career, Ms. Lalleman has led multi-country teams and has worked in a broad range of industries in the United States as well as in Western and Eastern Europe. •Retail Media: Ms. Lalleman brings extensive experience in understanding how retailers transform their business models implementing innovative enterprise data strategy and Retail Media solutions, having served as Global Strategic Partner with Nielsen for e-commerce, digital media & retail global players, and current retail advisory practice.

|

| Current Organizations |

| •Member of the Advisory Board of Tech-for-Retail Conference |

| Other Public Boards (within past five years) |

| •Director & Chair of Nomination & Remuneration Committee, Trainline (LON: TRN) (2024–Present) •Director & Chair of the Remuneration Committee, Payfit SA (2023–Present) •Director & Chair of Nomination & Remuneration Committee, Patrizia (ETR: PAT) (2021–Present)

|

| Education |

| •Diploma in International Business Management and Administration, Kedge School of Business

|

| | | | | | | | | | | | | | |

Edmond Mesrobian Independent Director

Age: 63 Director since: 2017

Committee: Compensation | Professional Experience |

•Chief Technology and Information Officer, Nordstrom (USA) (2018 – 2022) •Group Chief Technology Officer, Tesco (2015 – 2018) •Chief Technology Officer, Expedia Group (2011 – 2014) •Chief Technology Officer, RealNetworks (2003 – 2010) •Chief Technology Officer, ARTISTdirect (2002 – 2003) •Previously held various CTO and leadership positions at Amplified Holdings, Checkout.com and The Walt Disney Company |

Key Skills & Qualifications |

•Retail Media Expertise: Mr. Mesrobian was responsible for implementing Nordstrom’s first retail media solution in his role as its Chief Technology and Information Officer. •Technology / AdTech Expertise: Mr. Mesrobian has extensive experience as an information technology executive having served as Chief Technology Officer of several global companies, including Nordstrom, Tesco and Expedia, over 20+ years. •Strategy / Business Transformation Experience: Mr. Mesrobian has demonstrated expertise in crafting and executing corporate strategies to drive growth and innovation. During his time at Nordstrom, he focused on transforming the company into a digital first enterprise interconnected by the Nordstrom Analytical Platform to power customer, merchandising and inventory processes. At Tesco, as part of the company’s One Tesco initiative, he focused on strengthening the company's technological capabilities and creating innovative solutions for its customers. •Global Business Experience: Mr. Mesrobian has extensive experience leading teams at large international companies, including Tesco and Expedia, to enhance digital strategy and customer engagement efforts with global audiences. At RealNetworks, he focused on media solutions (music, video, and gaming) for direct-to-consumer subscription services as well as SaaS offerings to global telecom and cable operators.

|

Other Public Boards (within past five years) |

| •Director, Apigee Corporation (acquired in November 2016) (2015 – 2016)

|

| Education |

| •Ph.D. in Computer Science, University of California, Los Angeles •Master of Science in Computer Science, University of California, Los Angeles •Bachelor of Science in Math and Computer Science, University of California, Los Angeles |

| | | | | | | | | | | | | | |

Hubert de Pesquidoux Independent Director

Age: 58 Director since: 2012

Committee Chair: Audit | Professional Experience |

•Executive Chair, Mavenir Systems (2016 – Present) •Executive Partner, Siris Capital (2012 – Present) •Executive Advisor, Telmar Network Technology (2009 – 2014) •The Alcatel-Lucent Company ◦President (Enterprise Business Group) & CFO (2006 – 2009) ◦President & Chief Executive Officer (North America) (2003 – 2006) ◦CEO (Alcatel Canada) (2000 -2002) ◦CFO (Alcatel USA) (1998 – 2000) ◦Corporate Treasurer (1991 – 1995)

|

Key Skills & Qualifications |

•Technology / AdTech Expertise: Mr. de Pesquidoux has a deep understanding of sector trends and dynamics with extensive experience making control investments and/or serving data/telecom, technology and technology-enabled business service companies focused on North America (including Mavenir, Tekelec and Sequans Communications). •Corporate Finance / M&A Experience: As an Executive Partner at Siris Capital, Mr. de Pesquidoux has overseen numerous transactions in the technology space, including the sale of Tekelec to Oracle and the sale of a 50% ownership stake in Constant Contact to a consortium led by Clearlake Capital Group. During his tenure as a director at Thales, he oversaw Thales’s ~$2.3bn minority stake sale to Dassault Aviation. •Global Business Experience: Mr. de Pesquidoux spent over two decades in various leadership roles as a senior executive of Alcatel-Lucent, managing businesses across North America and Europe. •Capital Markets Experience: Mr. de Pesquidoux has deep expertise in public capital markets through his experience holding C-Level positions, including Chief Financial Officer, during his tenure at Alcatel-Lucent.

|

| Other Public Boards (within past five years) |

| •Director and Chair of Audit Committee, Sequans Communications (NYSE: SQNS) (2011– Present) •Director, Radisys Corporation (acquired December 2018) (2012 – 2018)

|

| Education |

| •Master in Law, University of Nancy II •Master in Economics and Finance, Institut d’Études Politiques de Paris •DESS in International Affairs, University of Paris Dauphine

|

| | | | | | | | | | | | | | |

Ernst Teunissen Director Nominee

Age: 58

| Professional Experience |

•Chief Financial Officer of TripAdvisor & Chief Executive – Viator, TheFork & CruiseCritic, business units of TripAdvisor (2015 – 2022) •Chief Financial Officer of Cimpress (2009 – 2015) •Founder, ThreeStone Ventures & Co-Founder, Manifold Partners (2003 – 2009) •Executive Director (Media & Communications), Morgan Stanley (1999 – 2003) •Senior Associate Director (Global Telecommunications), Deutsche Bank (1997 – 1999) •Senior Strategy Consultant, Monitor Company (1990 – 1997)

|

Key Skills & Qualifications |

•Corporate Finance / M&A Experience: Most recently, Mr. Teunissen led global finance operations and was responsible for multiple acquisitions, investments and joint ventures as the CFO of TripAdvisor. Prior to that, as CFO of Cimpress, Mr. Teunissen oversaw revenue growth from $600 million to $1.8 billion and multiple successful acquisitions. •Capital Market Experience: Throughout his career as an investment banker and a public company CFO, Mr. Teunissen has executed a significant number of capital market transactions including IPOs, equity follow-ons and debt issuances. •Technology / AdTech Expertise: Mr. Teunissen has deep experience in consumer internet, online marketplaces and online advertising stemming from his tenure at TripAdvisor, where he drove growth acceleration of several business units, as well as his tenure at Cimpress. •Global Business Experience: Over the course of his 30-year career, Mr. Teunissen has held numerous leadership positions in the United States, Europe and Asia. |

| Current Organizations |

| •Advisory Board Member, Mount Auburn Hospital |

| Education |

| •MSc, University of Surrey •Master of Business Administration, University of Oregon •BBA, Nijenrode University, The Netherlands School of Business

|

Family Relationships

There are no family relationships among any of our executive officers, directors or director nominees.

Board Leadership and Corporate Governance Framework

Ms. Picard serves as chairwoman of the Board of Directors, and Mr. Warner serves as vice-chairman of the Board of Directors.

Our governance framework provides the Board of Directors with flexibility to select the appropriate board leadership structure for the Company. The Board of Directors has reviewed its leadership structure in light of the Company’s operating and governance environment and determined that, due to their respective significant expertise and history with the Company, Ms. Picard should serve as the chairwoman of our Board of Directors, and Mr. Warner should serve as vice-chairman of our Board of Directors, until his term as director expires at the Annual General Meeting.

Because the Board of Directors currently has an independent chairwoman and an independent vice-chairman, the Board of Directors does not currently utilize a lead independent director. The Board of Directors previously determined that it was appropriate to have a lead independent director for so long as the chairperson of the Board of Directors is holding an executive position, or otherwise is not an independent director.

Although our chairperson and Chief Executive Officer positions are currently separated, our Board of Directors does not have a policy that requires the combination or separation of these roles. Given the dynamic and competitive environment in which we operate, the Board of Directors continues to believe that retaining the flexibility to vary the leadership structure as appropriate based on certain circumstances over time is in the best interests of the Company and its shareholders at this time.

Our corporate governance framework enables our Board of Directors and management to pursue our goals and strategic objectives in seeking to maximize long-term shareholder value. Our Board of Directors has adopted corporate governance guidelines that set forth the role of our Board of Directors, board composition and structure (including independence requirements), board membership criteria, and other governance policies. In addition, our Board of Directors has adopted written charters for its standing committees (audit, compensation, and nomination and corporate governance), as well as certain other policies, as detailed below. The Board of Directors is committed to sound corporate governance, and regularly evaluates its practices to ensure alignment with our strategy and execution. Annually, the Board of Directors considers updates to our corporate governance framework based on shareholder feedback, results from the annual general shareholders meeting, the Board of Directors and committees’ self-assessments, governance best practices, and regulatory developments.

| | | | | | | | |

| Our Corporate Governance Documents |

| | |

•By-laws | | •Human Rights Policy |

•Code of Business Conduct & Ethics | | •Global Disability Policy |

•Corporate Governance Guidelines and Board Charter | | •Diversity, Equity, and Inclusion Policy |

•Third Party Code of Conduct | | •Modern Slavery Statement |

•Executive Share Ownership Guidelines | | •Audit Committee Charter |

•Non-Employee Director Share Ownership Guidelines | | •Nomination and Corporate Governance Committee Charter |

•Anti-Corruption Policy | | •Compensation Committee Charter |

•Clawback Policy | | |

| | |

| These documents are available on our website at http://criteo.investorroom.com under “Governance Documents.” |

Code of Business Conduct and Ethics