ACUITAS INTERNATIONAL SMALL CAP FUND

ACUITAS US MICROCAP FUND

ANNUAL REPORT

June 30, 2019

Beginning on January 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by contacting the Fund at (844) 805-5628, acuitas.ta@apexfs.com, or by contacting your financial intermediary directly.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (844) 805-5628, acuitas.ta@apexfs.com, or by contacting your financial intermediary directly. Your election to receive reports in paper will apply to all of the Acuitas Funds.

TABLE OF CONTENTS

| Acuitas International Small Cap Fund | |

| A Message to Our Shareholders (Unaudited) | 2 |

| Performance Chart and Analysis (Unaudited) | 5 |

| Schedule of Investments | 6 |

| Statement of Assets and Liabilities | 8 |

| Statement of Operations | 9 |

| Statements of Changes in Net Assets | 10 |

| Financial Highlights | 11 |

| Acuitas US Microcap Fund | |

| A Message to Our Shareholders (Unaudited) | 12 |

| Performance Chart and Analysis (Unaudited) | 14 |

| Schedule of Investments | 15 |

| Statement of Assets and Liabilities | 18 |

| Statement of Operations | 19 |

| Statements of Changes in Net Assets | 20 |

| Financial Highlights | 21 |

| Notes to Financial Statements | 22 |

| Report of Independent Registered Public Accounting Firm | 27 |

| Additional Information (Unaudited) | 28 |

ACUITAS INTERNATIONAL SMALL CAP FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

JUNE 30, 2019

Dear Shareholders:

As of June 30, 2019, the Acuitas International Small Cap Fund’s (the “Fund”) net asset value was $8.74 per share. Year-to-date, the Fund has returned 11.05% net of all fees, compared to 12.31% for the FTSE Global Small Cap ex. U.S. Index (the “Index”). This represents 126 basis points of underperformance vs. the Index so far in 2019. Since the July 18, 2014 inception, the Fund has returned -0.30% net of all fees and expenses, underperforming the Index’s 2.13% return by -243 basis points over the same time period. The Fund’s gross expense ratio, gross of any fee or expense waivers, is 1.99% and 2.24% for Institutional and Investor Shares, respectively. For the most recent month-end performance, please call (844) 805-5628.

Performance data quoted represents past performance, which does not guarantee future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost; and the current performance may be lower or higher than the performance data quoted.

The Acuitas International Small Cap Fund uses a multi-manager structure to invest in publicly traded international small cap companies. We tend to think of small caps as stocks with market caps of $4 billion or less. The Fund invests in equity securities and does not use derivative instruments.

Over the last year we have witnessed a multitude of impactful events affecting non-U.S. markets. We have seen both threats and early actions toward a trade war, oil prices that have risen dramatically and the impact of the Federal Reserve’s increasingly accommodative policy in the U.S. The UK continues toward Brexit with pressure mounting. Many market participants believe that the newly elected Boris Johnson increases the risk of a hard Brexit. Meanwhile the ECB continues to leave rates unchanged amidst forecasts of slower global growth.

From a sector standpoint, the biggest contributors to the Fund were health care and consumer discretionary. Stock selection was the main driver of returns for both sectors.

The greatest detractors from a sector standpoint were producer durables, financial services, and materials and processing. Again, it was stock selection that was most impactful, particularly in materials and processing. Producer durables was the largest weight in the Index and impacted the Fund by approximately -146 basis points of underperformance for the year.

From a country perspective, countries that negatively impacted performance the most were Japan, Canada, and Sweden. A nearly 10% overweight to Canada, and poor stock selection within the country led to a 134 basis point detraction. Similarly, a nearly 12% overweight to Japan dragged on returns. The country with the most positive impact on the Fund was the United Kingdom. Even though our slight overweight was a drag, superior stock selection resulted in an overall contribution of 165 bps.

As of June 30, 2019, the Fund’s sector allocation, as a percentage of equity, was:

| Acuitas International Small Cap Fund | FTSE Global Small Cap ex. U.S. Index | |

| Producer Durables | 23.3% | 19.1% |

| Financial Services | 23.0% | 22.7% |

| Technology | 17.1% | 12.4% |

| Consumer Discretionary | 16.8% | 13.2% |

| Health Care | 6.3% | 6.6% |

| Consumer Staples | 5.5% | 5.7% |

| Materials & Processing | 4.9% | 12.2% |

| Energy | 1.7% | 3.9% |

| Utilities | 1.4% | 4.2% |

ACUITAS INTERNATIONAL SMALL CAP FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

JUNE 30, 2019

As of June 30, 2019, the Fund’s top ten countries, as a percentage of equity, were:

| Acuitas International Small Cap Fund | FTSE Global Small Cap ex. U.S. Index | |

| Japan | 30.0% | 14.7% |

| United Kingdom | 15.4% | 10.4% |

| United States | 7.8% | 0.1% |

| Australia | 7.7% | 4.9% |

| Canada | 5.4% | 14.9% |

| Austria | 5.1% | 1.1% |

| Sweden | 5.0% | 3.7% |

| France | 4.9% | 2.1% |

| New Zealand | 3.0% | 0.8% |

| Germany | 2.8% | 3.5% |

As of June 30, 2019, the 10 largest positions in the Fund, as a percentage of investments, were:

| Name | Weight |

| iShares MSCI Emerging Markets Small-Cap ETF | 3.6% |

| SPDR S&P Emerging Markets SmallCap ETF | 3.6% |

| Internet Initiative Japan, Inc. | 2.8% |

| Nihon Chouzai Co., Ltd. | 2.8% |

| Clipper Logistics PLC | 2.7% |

| Vista Group International, Ltd. | 2.7% |

| FinTech Group AG | 2.5% |

| Yumeshin Holdings Co., Ltd. | 2.5% |

| Palfinger AG | 2.3% |

| Norway Royal Salmon ASA | 2.3% |

Uncertainty remains in international markets as the implementation and effects of tariffs and an escalating trade war between the U.S. and multiple countries continues to progress. While U.S. markets have continued to climb higher, international markets have not fared as well. Signs of further cooling of business activity in China underscore greater worries that investors have about the effects of a continued trade war, and global growth revisions have helped to mute international returns. On the flip side, U.S. valuations are looking less attractive, and we believe there is more opportunity for growth within international equities. Overall, we continue to believe that there are pockets of opportunity within the international landscape with encouraging prospects and we continue to believe that our managers will capitalize on these opportunities through high-quality stock selection.

We thank you for your continued support.

Best Regards,

Christopher Tessin

ACUITAS INTERNATIONAL SMALL CAP FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

JUNE 30, 2019

IMPORTANT RISKS AND DISCLOSURE:

Equity stocks of small-cap companies carry greater risk, and more volatility than equity stocks of larger, more established companies. Foreign securities are more volatile, harder to price and less liquid than U.S. securities; and are subject to different accounting and regulatory standards, and political and economic risks. These risks are enhanced in emerging markets countries. There can be no guarantee that any strategy (risk management or otherwise) will be successful. All investing involves risk, including potential loss of principal.

The views in this report were those of the Fund managers as of June 30, 2019 and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the International Fund and do not constitute investment advice. This letter may contain discussions about certain investments both held and not held in the portfolio. All current and future holdings are subject to risk and to change.

ACUITAS INTERNATIONAL SMALL CAP FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

JUNE 30, 2019

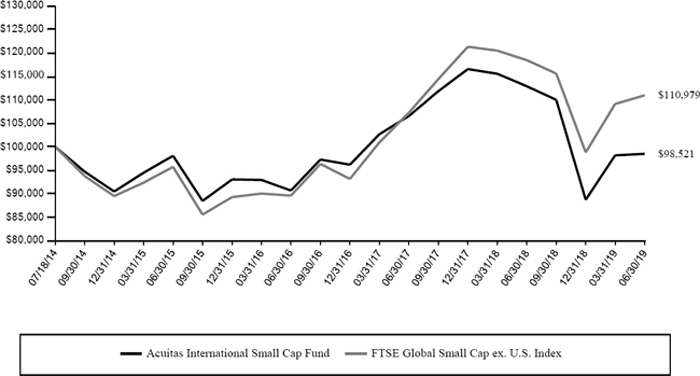

The following chart reflects the change in the value of a hypothetical $100,000 investment in Institutional Shares, including reinvested dividends and distributions, in Acuitas International Small Cap Fund (the “Fund”) compared with the performance of the benchmark, FTSE Global Small Cap ex. U.S. Index (“FTSE Global Ex-US”), since inception. The FTSE Global Ex-US is a market-capitalization weighted index representing the performance of small cap stocks in developed and emerging markets excluding the U.S. The total return of the FTSE Global Ex-US includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the FTSE Global Ex-US does not include expenses. The Fund is professionally managed, while the FTSE Global Ex-US is unmanaged and is not available for investment.

Comparison of Change in Value of a $100,000 Investment

Acuitas International Small Cap Fund vs. FTSE Global Small Cap ex. U.S. Index

| Average Annual Total Returns Periods Ended June 30, 2019 | One Year | Three Year | Since Inception 07/18/14 |

| Acuitas International Small Cap Fund | -12.76% | 2.81% | -0.30% |

| FTSE Global Small Cap ex. U.S. Index | -6.33% | 7.40% | 2.13% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratios (gross) for Institutional and Investor Shares are 1.99% and 2.24%, respectively. However, the Fund’s adviser has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.50% and 1.75% for Institutional and Investor Shares, respectively, through November 1, 2019 (the “Expense Cap”). The Expense Cap may be raised or eliminated only with the consent of the Board of Trustees. The adviser may be reimbursed by the Fund for fees waived and expenses reimbursed by the adviser pursuant to the Expense Cap if such payment is approved by the Board, made within three years of the fee waiver or expense reimbursement and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current Expense Cap and (ii) the Expense Cap in place at the time the fees/expenses were waived/reimbursed. Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement will increase if exclusions from the Expense Cap apply. Shares redeemed or exchanged within 60 days of purchase will be charged a 1.00% redemption fee. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (844) 805-5628.

ACUITAS INTERNATIONAL SMALL CAP FUND

SCHEDULE OF INVESTMENTS

JUNE 30, 2019

| Shares | Security Description | Value | |||||

| Common Stock - 80.9% | |||||||

| Australia - 6.8% | |||||||

| 1,381 | ARB Corp., Ltd. | $ | 17,646 | ||||

| 13,174 | Duxton Water, Ltd. | 12,393 | |||||

| 5,250 | MNF Group, Ltd. | 14,190 | |||||

| 3,685 | SmartGroup Corp., Ltd. | 21,576 | |||||

| 8,243 | Western Areas, Ltd. | 11,372 | |||||

| 77,177 | |||||||

| Austria - 4.5% | |||||||

| 906 | FACC AG | 12,713 | |||||

| 828 | Palfinger AG | 25,421 | |||||

| 152 | Schoeller-Bleckmann Oilfield Equipment AG | 12,894 | |||||

| 51,028 | |||||||

| Belgium - 1.9% | |||||||

| 307 | Akka Technologies | 22,097 | |||||

| Canada - 4.7% | |||||||

| 3,900 | Alithya Group, Inc., Class A (a) | 10,572 | |||||

| 5,352 | EXFO, Inc. (a) | 20,557 | |||||

| 1,593 | Extendicare, Inc. | 10,206 | |||||

| 8,783 | Horizon North Logistics, Inc. | 12,475 | |||||

| 53,810 | |||||||

| China - 1.4% | |||||||

| 73,228 | Goodbaby International Holdings, Ltd. (a) | 16,592 | |||||

| Cyprus - 1.3% | |||||||

| 5,714 | Atalaya Mining PLC (a) | 14,840 | |||||

| Finland - 0.7% | |||||||

| 690 | Ferratum OYJ | 8,081 | |||||

| France - 4.3% | |||||||

| 168 | Albioma SA | 4,451 | |||||

| 90 | Devoteam SA | 10,766 | |||||

| 1,048 | FIGEAC-AERO (a) | 13,705 | |||||

| 835 | Maisons du Monde SA (b) | 19,901 | |||||

| 48,823 | |||||||

| Germany - 2.4% | |||||||

| 1,261 | FinTech Group AG (a) | 27,932 | |||||

| Ireland - 1.4% | |||||||

| 9,721 | Hibernia REIT PLC | 16,028 | |||||

| Italy - 1.1% | |||||||

| 949 | doValue SpA (b) | 12,604 | |||||

| Japan - 26.4% | |||||||

| 107 | Digital Arts, Inc. | 9,428 | |||||

| 321 | Hirata Corp. | 18,608 | |||||

| 1,627 | Internet Initiative Japan, Inc. | 30,483 | |||||

| 300 | Katitas Co., Ltd. | 11,144 | |||||

| 495 | Makino Milling Machine Co., Ltd. | 19,949 | |||||

| 700 | Metaps, Inc. (a) | 7,960 | |||||

| 518 | Milbon Co., Ltd. | 25,080 | |||||

| 972 | Nihon Chouzai Co., Ltd. | 30,067 | |||||

| 752 | Nippon Ceramic Co., Ltd. | 20,144 | |||||

| 1,031 | Optex Group Co., Ltd. | 12,948 | |||||

| 1,939 | Poletowin Pitcrew Holdings, Inc. | 20,412 | |||||

| 271 | Rakus Co., Ltd. | 6,555 | |||||

| 765 | Taiyo Holdings Co., Ltd. | 23,060 | |||||

| 192 | V Technology Co., Ltd. | 8,762 | |||||

| 3,101 | Yonex Co., Ltd. | 17,804 | |||||

| 3,877 | Yumeshin Holdings Co., Ltd. | 27,653 | |||||

| 1,055 | Zojirushi Corp. | 11,243 | |||||

| 301,300 | |||||||

| Shares | Security Description | Value | |||||

| Luxembourg - 1.3% | |||||||

| 1,500 | Solutions 30 SE (a) | $ | 15,010 | ||||

| New Zealand - 2.6% | |||||||

| 7,288 | Vista Group International, Ltd. | 29,621 | |||||

| Norway - 2.2% | |||||||

| 1,190 | Norway Royal Salmon ASA | 25,263 | |||||

| Sweden - 4.4% | |||||||

| 516 | BioGaia AB | 23,866 | |||||

| 2,758 | Humana AB | 16,662 | |||||

| 915 | Troax Group AB | 9,360 | |||||

| 49,888 | |||||||

| United Kingdom - 13.5% | |||||||

| 1,857 | accesso Technology Group PLC (a) | 16,272 | |||||

| 5,918 | Biffa PLC (b) | 15,482 | |||||

| 8,380 | Clipper Logistics PLC | 30,064 | |||||

| 2,435 | CVS Group PLC | 22,373 | |||||

| 1,350 | OneSavings Bank PLC | 6,217 | |||||

| 2,292 | Safestore Holdings PLC REIT | 17,857 | |||||

| 937 | Savills PLC | 10,674 | |||||

| 6,560 | The Gym Group PLC (b) | 20,411 | |||||

| 3,543 | Urban & Civic PLC | 14,893 | |||||

| 154,243 | |||||||

| Total Common Stock (Cost $924,584) | 924,337 | ||||||

| Exchange Traded Funds - 6.9% | |||||||

| 893 | iShares MSCI Emerging Markets Small-Cap ETF | 39,622 | |||||

| 874 | SPDR S&P Emerging Markets SmallCap ETF | 39,068 | |||||

| Total Exchange Traded Funds (Cost $78,490) | 78,690 | ||||||

| Money Market Fund - 8.1% | |||||||

| 93,196 | BlackRock Liquidity Funds FedFund Portfolio, Institutional Shares, 2.26% (c) | ||||||

| (Cost $93,196) | 93,196 | ||||||

| Investments, at value - 95.9% (Cost $1,096,270) | $ | 1,096,223 | |||||

| Other Assets & Liabilities, Net - 4.1% | 46,284 | ||||||

| Net Assets - 100.0% | $ | 1,142,507 | |||||

| ETF | Exchange Traded Fund |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Security exempt from registration under Rule 144A under the Securities Act of 1933. At the period end, the value of these securities amounted to $68,398 or 6.0% of net assets. |

| (c) | Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of June 30, 2019. |

The following is a summary of the inputs used to value the Fund's investments as of June 30, 2019.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

See Notes to Financial Statements.

ACUITAS INTERNATIONAL SMALL CAP FUND

SCHEDULE OF INVESTMENTS

JUNE 30, 2019

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Investments at Value | ||||||||||||||||

| Common Stock | ||||||||||||||||

| Australia | $ | 77,177 | $ | – | $ | – | $ | 77,177 | ||||||||

| Austria | 51,028 | – | – | 51,028 | ||||||||||||

| Belgium | 22,097 | – | – | 22,097 | ||||||||||||

| Canada | 53,810 | – | – | 53,810 | ||||||||||||

| China | 16,592 | – | – | 16,592 | ||||||||||||

| Cyprus | 14,840 | – | – | 14,840 | ||||||||||||

| Finland | 8,081 | – | – | 8,081 | ||||||||||||

| France | 48,823 | – | – | 48,823 | ||||||||||||

| Germany | 27,932 | – | – | 27,932 | ||||||||||||

| Ireland | 16,028 | – | – | 16,028 | ||||||||||||

| Italy | 12,604 | – | – | 12,604 | ||||||||||||

| Japan | 301,300 | – | – | 301,300 | ||||||||||||

| Luxembourg | 15,010 | – | – | 15,010 | ||||||||||||

| New Zealand | 29,621 | – | – | 29,621 | ||||||||||||

| Norway | 25,263 | – | – | 25,263 | ||||||||||||

| Sweden | 49,888 | – | – | 49,888 | ||||||||||||

| United Kingdom | 154,243 | – | – | 154,243 | ||||||||||||

| Exchange Traded Funds | 78,690 | – | – | 78,690 | ||||||||||||

| Money Market Fund | – | 93,196 | – | 93,196 | ||||||||||||

| Investments at Value | $ | 1,003,027 | $ | 93,196 | $ | – | $ | 1,096,223 | ||||||||

| PORTFOLIO HOLDINGS (Unaudited) | |

| % of Total Investments | |

| Australia | 7.0% |

| Austria | 4.7% |

| Belgium | 2.0% |

| Canada | 4.9% |

| China | 1.5% |

| Cyprus | 1.4% |

| Finland | 0.7% |

| France | 4.5% |

| Germany | 2.5% |

| Ireland | 1.5% |

| Italy | 1.1% |

| Japan | 27.5% |

| Luxembourg | 1.4% |

| New Zealand | 2.7% |

| Norway | 2.3% |

| Sweden | 4.5% |

| United Kingdom | 14.1% |

| Exchange Traded Funds | 7.2% |

| Money Market Fund | 8.5% |

| 100.0% |

See Notes to Financial Statements.

ACUITAS INTERNATIONAL SMALL CAP FUND

STATEMENT OF ASSETS AND LIABILITIES

JUNE 30, 2019

| ASSETS | ||||

| Investments, at value (Cost $1,096,270) | $ | 1,096,223 | ||

| Foreign currency (Cost $1,520) | 1,525 | |||

| Receivables: | ||||

| Dividends | 39,349 | |||

| From investment adviser | 39,197 | |||

| Prepaid expenses | 18,087 | |||

| Total Assets | 1,194,381 | |||

| LIABILITIES | ||||

| Payables: | ||||

| Fund shares redeemed | 10,225 | |||

| Accrued Liabilities: | ||||

| Trustees’ fees and expenses | 23 | |||

| Fund services fees | 4,167 | |||

| Other expenses | 37,459 | |||

| Total Liabilities | 51,874 | |||

| NET ASSETS | $ | 1,142,507 | ||

| COMPONENTS OF NET ASSETS | ||||

| Paid-in capital | $ | 5,891,525 | ||

| Distributable earnings | (4,749,018 | ) | ||

| NET ASSETS | $ | 1,142,507 | ||

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | ||||

| Institutional Shares | 130,775 | |||

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE* | ||||

| Institutional Shares (based on net assets of $1,142,507) | $ | 8.74 | ||

| * | Shares redeemed or exchanged within 60 days of purchase are charged a 1.00% redemption fee. |

See Notes to Financial Statements.

ACUITAS INTERNATIONAL SMALL CAP FUND

STATEMENT OF OPERATIONS

YEAR ENDED JUNE 30, 2019

| INVESTMENT INCOME | ||||

| Dividend income (Net of foreign withholding taxes of $54,225) | $ | 362,376 | ||

| Total Investment Income | 362,376 | |||

| EXPENSES | ||||

| Investment adviser fees | 343,449 | |||

| Fund services fees | 132,193 | |||

| Shareholder service fees | 27,982 | |||

| Custodian fees | 58,419 | |||

| Registration fees | 19,720 | |||

| Professional fees | 55,317 | |||

| Trustees' fees and expenses | 3,729 | |||

| Other expenses | 54,025 | |||

| Total Expenses | 694,834 | |||

| Fees waived | (265,598 | ) | ||

| Net Expenses | 429,236 | |||

| NET INVESTMENT LOSS | (66,860 | ) | ||

| NET REALIZED AND UNREALIZED GAIN (LOSS) | ||||

| Net realized loss on: | ||||

| Investments (Net of foreign withholding taxes of $795) | (3,875,978 | ) | ||

| Foreign currency transactions | (16,531 | ) | ||

| Net realized loss | (3,892,509 | ) | ||

| Net change in unrealized appreciation (depreciation) on: | ||||

| Investments | (2,068,939 | ) | ||

| Foreign currency translations | 15,459 | |||

| Net change in unrealized appreciation (depreciation) | (2,053,480 | ) | ||

| NET REALIZED AND UNREALIZED LOSS | (5,945,989 | ) | ||

| DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (6,012,849 | ) | |

See Notes to Financial Statements.

ACUITAS INTERNATIONAL SMALL CAP FUND

STATEMENTS OF CHANGES IN NET ASSETS

| For the Years Ended June 30, | ||||||||

| 2019 | 2018 | |||||||

| OPERATIONS | ||||||||

| Net investment income (loss) | $ | (66,860 | ) | $ | 380,066 | |||

| Net realized gain (loss) | (3,892,509 | ) | 4,676,716 | |||||

| Net change in unrealized appreciation (depreciation) | (2,053,480 | ) | (2,320,959 | ) | ||||

| Increase (Decrease) in Net Assets Resulting from Operations | (6,012,849 | ) | 2,735,823 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Institutional Shares | (532,942 | ) | (2,541,258 | )* | ||||

| Total Distributions Paid | (532,942 | ) | (2,541,258 | ) | ||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

| Sale of shares: | ||||||||

| Institutional Shares | 2,914,159 | 4,867,589 | ||||||

| Reinvestment of distributions: | ||||||||

| Institutional Shares | 532,942 | 2,541,258 | ||||||

| Redemption of shares: | ||||||||

| Institutional Shares | (43,757,828 | ) | (5,944,619 | ) | ||||

| Redemption fees: | ||||||||

| Institutional Shares | 11 | 43 | ||||||

| Increase (Decrease) in Net Assets from Capital Share Transactions | (40,310,716 | ) | 1,464,271 | |||||

| Increase (Decrease) in Net Assets | (46,856,507 | ) | 1,658,836 | |||||

| NET ASSETS | ||||||||

| Beginning of Year | 47,999,014 | 46,340,178 | ||||||

| End of Year | $ | 1,142,507 | $ | 47,999,014 | ** | |||

| SHARE TRANSACTIONS | ||||||||

| Sale of shares: | ||||||||

| Institutional Shares | 316,012 | 459,848 | ||||||

| Reinvestment of distributions: | ||||||||

| Institutional Shares | 68,151 | 242,950 | ||||||

| Redemption of shares: | ||||||||

| Institutional Shares | (4,974,594 | ) | (566,179 | ) | ||||

| Increase (Decrease) in Shares | (4,590,431 | ) | 136,619 | |||||

| * | Distribution was the result of net investment income as of June 30, 2018. |

| ** | Includes distributions in excess of net investment income of $(15,461) at June 30, 2018. The requirement to disclose the corresponding amount as of June 30, 2019 was eliminated. |

See Notes to Financial Statements.

ACUITAS INTERNATIONAL SMALL CAP FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

| July 18, 2014 (a) | ||||||||||||||||||||

| For the Years Ended June 30, | Through | |||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | June 30, 2015 | ||||||||||||||||

| INSTITUTIONAL SHARES | ||||||||||||||||||||

| NET ASSET VALUE, Beginning of Period | $ | 10.17 | $ | 10.11 | $ | 8.78 | $ | 9.79 | $ | 10.00 | ||||||||||

| INVESTMENT OPERATIONS | ||||||||||||||||||||

| Net investment income (loss) (b) | (0.02 | ) | 0.08 | 0.09 | 0.12 | 0.08 | ||||||||||||||

| Net realized and unrealized gain (loss) | (1.29 | ) | 0.54 | 1.43 | (0.85 | ) | (0.27 | ) | ||||||||||||

| Total from Investment Operations | (1.31 | ) | 0.62 | 1.52 | (0.73 | ) | (0.19 | ) | ||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | ||||||||||||||||||||

| Net investment income | (0.12 | ) | (0.56 | ) | (0.19 | ) | (0.28 | ) | (0.02 | ) | ||||||||||

| Total Distributions to Shareholders | (0.12 | ) | (0.56 | ) | (0.19 | ) | (0.28 | ) | (0.02 | ) | ||||||||||

| REDEMPTION FEES(b) | 0.00 | (c) | 0.00 | (c) | 0.00 | (c) | 0.00 | (c) | 0.00 | (c) | ||||||||||

| NET ASSET VALUE, End of Period | $ | 8.74 | $ | 10.17 | $ | 10.11 | $ | 8.78 | $ | 9.79 | ||||||||||

| TOTAL RETURN | (12.76 | )% | 5.94 | % | 17.57 | % | (7.57 | )% | (1.91 | )%(d) | ||||||||||

| RATIOS/SUPPLEMENTARY DATA | ||||||||||||||||||||

| Net Assets at End of Period (000s omitted) | $ | 1,143 | $ | 47,999 | $ | 46,340 | $ | 42,674 | $ | 46,653 | ||||||||||

| Ratios to Average Net Assets: | ||||||||||||||||||||

| Net investment income (loss) | (0.23 | )% | 0.77 | % | 0.91 | % | 1.35 | % | 0.91 | %(e) | ||||||||||

| Net expenses | 1.50 | % | 1.50 | % | 1.50 | % | 1.50 | % | 1.50 | %(e) | ||||||||||

| Gross expenses (f) | 2.43 | % | 1.99 | % | 2.04 | % | 2.15 | % | 2.40 | %(e) | ||||||||||

| PORTFOLIO TURNOVER RATE | 105 | % | 144 | % | 105 | % | 104 | % | 112 | %(d) | ||||||||||

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during each period. |

| (c) | Less than $0.01 per share. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements.

ACUITAS US MICROCAP FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

JUNE 30, 2019

Dear Shareholders:

As of June 30, 2019, the Acuitas US Microcap Fund’s (the “Fund”) net asset value was $10.05 per share. Calendar year-to-date, the Fund returned 11.05%, compared to 14.15% for the Russell Microcap Index (the “Index”). This represents 310 basis points of underperformance vs. the Index so far in 2019. Since the July 18, 2014 inception, the Fund has returned an annualized 6.89%, outperforming the Index return of 6.49% by 40 basis points over the same time period. The Fund’s gross expense ratio, gross of any fee or expense waivers, is 1.80% and 2.05% for Institutional and Investor Shares, respectively. For the most recent month-end performance, please call (844) 805-5628.

Performance data quoted represents past performance, which does not guarantee future results. Investment return and principal value will fluctuate, so that an investor’s shares, when redeemed, may be worth more or less than their original cost; and the current performance may be lower or higher than the performance data quoted.

The Acuitas U.S. Microcap Fund uses a multi-manager structure to invest in publicly traded domestic microcap companies. We tend to think of microcaps as stocks with market caps of $1 billion or less. The Fund invests in equity securities and does not use derivative instruments.

With the recent rally of U.S. equities, especially compared to that of their international counterparts, valuations are looking less attractive, especially for large stocks. In spite of strong gains throughout 2019 so far, steady growth will likely continue, and economic data remains mixed. As businesses postpone investments due to trade uncertainty, manufacturing growth has continued to stall, growing at a slower pace for the third month in a row. Companies also continue to slash second quarter earnings, and the speed of recent downgrades has been notable, with analysts cutting forecasts at the fastest pace in nearly three years. On top of this, after two consecutive months of improvement, consumer confidence declined in June although levels still remain at historical highs. In contrast to these signs of weakness, payroll growth rebounded sharply, with the U.S. economy adding 224,000 jobs in June, the best gain since January which helps assuage worries that both the employment picture and overall growth are beginning to weaken. Despite low unemployment levels, rising wages, and low inflation, investors worry about the sustainability of growth and gains in the market.

From a sector standpoint, the biggest contributors to the Fund over the last 12 months were technology, producer durables and consumer discretionary. Stock selection within technology had the most notable positive impact with the overweight positively contributing as well. Stock selection within financials was a drag on performance and detracted from the Fund’s relative performance versus the Index. The Fund’s significant underweight to financial services also detracted from performance over the last 12 months.

As of June 30, 2019, the Fund’s sector allocation, as a percentage of common stock, were:

|

Acuitas US Microcap Fund |

Russell Microcap® Index |

|

| Producer Durables | 23.0% | 11.1% |

| Health Care | 20.7% | 25.7% |

| Financial Services | 18.9% | 29.6% |

| Technology | 14.0% | 10.0% |

| Materials & Processing | 8.0% | 4.5% |

| Energy | 7.2% | 3.5% |

| Consumer Discretionary | 6.9% | 11.6% |

| Utilities | 1.1% | 1.9% |

| Consumer Staples | 0.2% | 2.1% |

ACUITAS US MICROCAP FUND

A MESSAGE TO OUR SHAREHOLDERS (Unaudited)

JUNE 30, 2019

As of June 30, 2019, the 10 largest positions in the Fund, as a percentage of common stock, were:

| Name | Weight |

| UFP Technologies, Inc. | 2.2% |

| Great Lakes Dredge & Dock Corp. | 1.8% |

| Winmark Corp. | 1.8% |

| Par Pacific Holdings, Inc. | 1.7% |

| IES Holdings, Inc. | 1.6% |

| SIGA Technologies, Inc. | 1.5% |

| Northrim BanCorp, Inc. | 1.4% |

| Argan, Inc. | 1.3% |

| STAAR Surgical Co. | 1.2% |

| Bryn Mawr Bank Corp. | 1.2% |

Despite market concerns about tariffs and trade, stocks have continued to rise dramatically despite a brief but dramatic dip during the fourth quarter of 2018. Unfortunately, microcap has lagged the pack in this respect, and we believe a reversal in the future is possible. As we look into earnings season early signs indicate that we are seeing companies reign in expectations and post more sobering results. Looking at valuations relative to historical levels, microcap appears inexpensive. This isn’t just on a forecasted basis but based on last twelve months (“LTM”) earnings as well which is new and indicates that the market isn’t just less expensive because people are getting bullish and raising forward earnings expectations. That said, the indications from the Fed continue to fuel markets forward, especially the more expensive large cap stocks and it isn’t clear when the fuel will run out. While we welcome rising markets, the length of the recovery makes us nervous and we look forward to smaller stocks leading the market and the market aligning more with our strengths. An optimal environment for Acuitas on a relative basis would include a market that rewards quality, shows some volatility and generates flat to down returns. In our view there is higher probability that we will see this within the next few quarters. Regardless of the environment, we look forward to a longer period of time where fundamentals are rewarded and there is greater differentiation between active investment managers as we think this will help drive the relative returns of our Fund.

We thank you for your continued support.

Best Regards,

Christopher Tessin

IMPORTANT RISKS AND DISCLOSURE:

Equity stocks of microcap companies carry greater risk, and more volatility than equity stocks of larger, more established companies. There can be no guarantee that any strategy (risk management or otherwise) will be successful. All investing involves risk, including potential loss of principal.

The views in this report were those of the Fund managers as of June 30, 2019 and may not reflect their views on the date this report is first published or any time thereafter. These views are intended to assist shareholders in understanding their investment in the International Fund and do not constitute investment advice. This letter may contain discussions about certain investments both held and not held in the portfolio. All current and future holdings are subject to risk and to change.

ACUITAS US MICROCAP FUND

PERFORMANCE CHART AND ANALYSIS (Unaudited)

JUNE 30, 2019

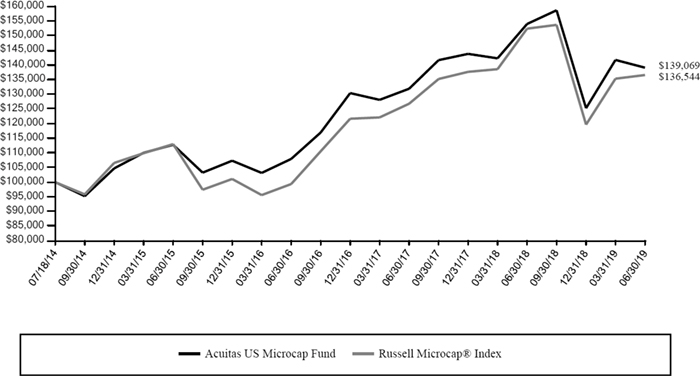

The following chart reflects the change in the value of a hypothetical $100,000 investment in Institutional Shares, including reinvested dividends and distributions, in Acuitas US Microcap Fund (the “Fund”) compared with the performance of the benchmark, Russell Microcap® Index (“Russell Microcap”), since inception. The Russell Microcap is an unmanaged index that measures the performance of the microcap segment of the US equity market, which consists of the smallest 1,000 securities in the Russell 2000® Index and the next 1,000 smallest eligible securities by market capitalization. The total return of the Russell Microcap includes the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the Russell Microcap does not include expenses. The Fund is professionally managed, while the Russell Microcap is unmanaged and is not available for investment.

Comparison of Change in Value of a $100,000 Investment

Acuitas US Microcap Fund vs. Russell Microcap Index

|

Average Annual Total Returns Periods Ended June 30, 2019 |

One Year | Three Year | Since Inception 07/18/14 |

| Acuitas US Microcap Fund | -9.68% | 8.83% | 6.89% |

| Russell Microcap® Index | -10.39% | 11.19% | 6.49% |

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratios (gross) for Institutional and Investor Shares are 1.80% and 2.05%, respectively. However, the Fund’s adviser has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.70% and 1.95% for Institutional and Investor Shares, respectively, through November 1, 2019 (the “Expense Cap”). The Expense Cap may be raised or eliminated only with the consent of the Board of Trustees. The adviser may be reimbursed by the Fund for fees waived and expenses reimbursed by the adviser pursuant to the Expense Cap if such payment is approved by the Board, made within three years of the fee waiver or expense reimbursement and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current Expense Cap and (ii) the Expense Cap in place at the time the fees/expenses were waived/reimbursed. Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement will increase if exclusions from the Expense Cap apply. Shares redeemed or exchanged within 60 days of purchase will be charged a 1.00% redemption fee. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (844) 805-5628.

ACUITAS US MICROCAP FUND

SCHEDULE OF INVESTMENTS

JUNE 30, 2019

| Shares | Security Description | Value | |||||

| Common Stock - 97.9% | |||||||

| Consumer Discretionary - 6.7% | |||||||

| 61,536 | Aspen Group, Inc. (a) | $ | 233,837 | ||||

| 20,790 | Carriage Services, Inc. | 395,218 | |||||

| 22,410 | Chuy's Holdings, Inc. (a) | 513,637 | |||||

| 13,442 | Conn's, Inc. (a) | 239,537 | |||||

| 17,483 | CRA International, Inc. | 670,123 | |||||

| 63,200 | Fluent, Inc. (a) | 340,016 | |||||

| 18,800 | Fossil Group, Inc. (a) | 216,200 | |||||

| 12,900 | Points International, Ltd. (a) | 159,315 | |||||

| 31,079 | QuinStreet, Inc. (a) | 492,602 | |||||

| 103,471 | TravelCenters of America, LLC (a) | 374,565 | |||||

| 17,200 | Vera Bradley, Inc. (a) | 206,400 | |||||

| 7,952 | Winmark Corp. | 1,376,889 | |||||

| 5,218,339 | |||||||

| Consumer Staples - 0.2% | |||||||

| 5,700 | Seneca Foods Corp., Class A (a) | 158,631 | |||||

| Energy - 7.0% | |||||||

| 6,638 | CONSOL Energy, Inc. (a) | 176,637 | |||||

| 272,608 | HighPoint Resources Corp. (a) | 496,147 | |||||

| 87,704 | Midstates Petroleum Co., Inc. (a) | 516,577 | |||||

| 20,400 | Montage Resources Corp. (a) | 124,440 | |||||

| 51,127 | Natural Gas Services Group, Inc. (a) | 843,595 | |||||

| 21,700 | North American Construction Group, Ltd. | 234,360 | |||||

| 92,700 | Northern Oil and Gas, Inc. (a) | 178,911 | |||||

| 62,420 | Par Pacific Holdings, Inc. (a) | 1,280,858 | |||||

| 204,787 | Rosehill Resources, Inc. (a) | 757,712 | |||||

| 14,900 | SandRidge Energy, Inc. (a) | 103,108 | |||||

| 28,500 | SunCoke Energy, Inc. (a) | 253,080 | |||||

| 21,478 | Unit Corp. (a) | 190,939 | |||||

| 58,800 | W&T Offshore, Inc. (a) | 291,648 | |||||

| 5,448,012 | |||||||

| Financial Services - 18.5% | |||||||

| 64,900 | Ashford Hospitality Trust, Inc. REIT | 192,753 | |||||

| 36,310 | B. Riley Financial, Inc. | 757,427 | |||||

| 18,326 | Braemar Hotels & Resorts, Inc. REIT | 181,427 | |||||

| 25,680 | Bryn Mawr Bank Corp. | 958,378 | |||||

| 33,300 | Capstead Mortgage Corp. REIT | 278,055 | |||||

| 10,500 | Central Valley Community Bancorp | 225,435 | |||||

| 12,600 | ConnectOne Bancorp, Inc. | 285,516 | |||||

| 60,680 | Donnelley Financial Solutions, Inc. (a) | 809,471 | |||||

| 10,700 | Ellington Financial, Inc. | 192,279 | |||||

| 12,800 | Enterprise Financial Services Corp. | 532,480 | |||||

| 21,500 | Everi Holdings, Inc. (a) | 256,495 | |||||

| 6,800 | Federal Agricultural Mortgage Corp., Class C | 494,088 | |||||

| 13,400 | Financial Institutions, Inc. | 390,610 | |||||

| 19,900 | First Defiance Financial Corp. | 568,543 | |||||

| 11,900 | First Internet Bancorp | 256,326 | |||||

| 9,100 | Flushing Financial Corp. | 202,020 | |||||

| 39,550 | Fortress Transportation & Infrastructure Investors, LLC | 597,205 | |||||

| 7,500 | FS Bancorp, Inc. | 389,025 | |||||

| 34,100 | Global Medical REIT, Inc. | 358,050 | |||||

| 65,367 | Great Elm Capital Corp. | 568,693 | |||||

| 23,200 | Hallmark Financial Services, Inc. (a) | 330,136 | |||||

| 20,050 | Horizon Bancorp | 327,617 | |||||

| 20,600 | Luther Burbank Corp. | 224,334 | |||||

| 9,600 | Methode Electronics, Inc. | 274,272 | |||||

| 22,665 | Midland States Bancorp, Inc. | 605,609 | |||||

| 12,726 | NMI Holdings, Inc., Class A (a) | 361,291 | |||||

| 30,820 | Northrim BanCorp, Inc. | 1,099,041 | |||||

| 23,900 | OFG Bancorp | 568,103 | |||||

| 9,100 | Old Line Bancshares, Inc. | 242,151 | |||||

| Shares | Security Description | Value | ||||||

| Financial Services - 18.5% (continued) | ||||||||

| 33,400 | On Deck Capital, Inc. (a) | $ | 138,610 | |||||

| 25,600 | OP Bancorp | 277,504 | ||||||

| 2,321 | Plymouth Industrial REIT, Inc. | 43,960 | ||||||

| 13,987 | Premier Financial Bancorp, Inc. | 209,805 | ||||||

| 38,949 | Pzena Investment Management, Inc., Class A | 334,572 | ||||||

| 12,954 | Ready Capital Corp. REIT | 193,015 | ||||||

| 59,438 | Syncora Holdings, Ltd. (a) | 304,322 | ||||||

| 16,100 | The First of Long Island Corp. | 323,288 | ||||||

| 14,351,906 | ||||||||

| Health Care - 20.3% | ||||||||

| 36,600 | Akebia Therapeutics, Inc. (a) | 177,144 | ||||||

| 16,748 | Aldeyra Therapeutics, Inc. (a) | 100,488 | ||||||

| 10,900 | AngioDynamics, Inc. (a) | 214,621 | ||||||

| 5,900 | Anika Therapeutics, Inc. (a) | 239,658 | ||||||

| 28,143 | Apollo Endosurgery, Inc. (a) | 91,465 | ||||||

| 21,822 | AtriCure, Inc. (a) | 651,168 | ||||||

| 14,886 | Avedro, Inc. (a) | 292,361 | ||||||

| 167,547 | Avid Bioservices, Inc. (a) | 938,263 | ||||||

| 117,500 | BioDelivery Sciences International, Inc. (a) | 546,375 | ||||||

| 14,618 | BioLife Solutions, Inc. (a) | 247,775 | ||||||

| 3,600 | BioSpecifics Technologies Corp. (a) | 214,956 | ||||||

| 5,357 | BioTelemetry, Inc. (a) | 257,939 | ||||||

| 24,100 | Calithera Biosciences, Inc. (a) | 93,990 | ||||||

| 16,501 | Cardiovascular Systems, Inc. (a) | 708,388 | ||||||

| 41,350 | Castlight Health, Inc., Class B (a) | 133,560 | ||||||

| 57,000 | Catalyst Pharmaceuticals, Inc. (a) | 218,880 | ||||||

| 15,200 | Champions Oncology, Inc. (a) | 119,016 | ||||||

| 16,400 | ChemoCentryx, Inc. (a) | 152,520 | ||||||

| 12,200 | Codexis, Inc. (a) | 224,846 | ||||||

| 14,600 | Collegium Pharmaceutical, Inc. (a) | 191,990 | ||||||

| 32,173 | Cutera, Inc. (a) | 668,555 | ||||||

| 20,300 | Dicerna Pharmaceuticals, Inc. (a) | 319,725 | ||||||

| 22,959 | Electromed, Inc. (a) | 125,126 | ||||||

| 38,000 | Fluidigm Corp. (a) | 468,160 | ||||||

| 131,216 | Harvard Bioscience, Inc. (a) | 262,432 | ||||||

| 32,316 | IntriCon Corp. (a) | 754,902 | ||||||

| 9,700 | Kura Oncology, Inc. (a) | 190,993 | ||||||

| 25,100 | Lannett Co., Inc. (a) | 152,106 | ||||||

| 8,300 | MacroGenics, Inc. (a) | 140,851 | ||||||

| 55,400 | MEI Pharma, Inc. (a) | 138,500 | ||||||

| 23,659 | MiMedx Group, Inc. (a) | 95,819 | ||||||

| 23,142 | NeoGenomics, Inc. (a) | 507,735 | ||||||

| 69,468 | Pfenex, Inc. (a) | 468,214 | ||||||

| 58,879 | Quotient, Ltd. (a) | 550,519 | ||||||

| 47,774 | R1 RCM, Inc. (a) | 600,997 | ||||||

| 7,700 | Ra Pharmaceuticals, Inc. (a) | 231,539 | ||||||

| 10,500 | RadNet, Inc. (a) | 144,795 | ||||||

| 4,747 | Repligen Corp. (a) | 408,005 | ||||||

| 41,385 | SeaSpine Holdings Corp. (a) | 548,351 | ||||||

| 60,985 | Sientra, Inc. (a) | 375,668 | ||||||

| 202,260 | SIGA Technologies, Inc. (a) | 1,148,837 | ||||||

| 32,971 | STAAR Surgical Co. (a) | 968,688 | ||||||

| 3,400 | Surmodics, Inc. (a) | 146,778 | ||||||

| 6,160 | Veracyte, Inc. (a) | 175,622 | ||||||

| 2,295 | Vericel Corp. (a) | 43,353 | ||||||

| 15,832 | ViewRay, Inc. (a) | 139,480 | ||||||

| 17,203 | Xenon Pharmaceuticals, Inc. (a) | 169,622 | ||||||

| 15,760,775 | ||||||||

| Materials & Processing - 7.8% | ||||||||

| 23,519 | AdvanSix, Inc. (a) | 574,569 | ||||||

| 19,600 | American Vanguard Corp. | 302,036 | ||||||

| 21,592 | BlueLinx Holdings, Inc. (a) | 427,738 | ||||||

See Notes to Financial Statements.

ACUITAS US MICROCAP FUND

SCHEDULE OF INVESTMENTS

JUNE 30, 2019

| Shares | Security Description | Value | ||||||

| Materials & Processing - 7.8% (continued) | ||||||||

| 9,600 | Caesarstone, Ltd. | $ | 144,288 | |||||

| 7,980 | Chase Corp. | 858,967 | ||||||

| 17,700 | Foundation Building Materials, Inc. (a) | 314,706 | ||||||

| 14,483 | Insteel Industries, Inc. | 301,536 | ||||||

| 20,352 | Interface, Inc. | 311,996 | ||||||

| 101,969 | Landec Corp. (a) | 955,450 | ||||||

| 4,900 | Lawson Products, Inc./DE (a) | 179,977 | ||||||

| 9,400 | LB Foster Co., Class A (a) | 256,996 | ||||||

| 16,531 | Northern Technologies International Corp. | 404,183 | ||||||

| 13,174 | Northwest Pipe Co. (a) | 339,626 | ||||||

| 26,300 | PGT Innovations, Inc. (a) | 439,736 | ||||||

| 49,318 | Venator Materials PLC (a) | 260,892 | ||||||

| 6,072,696 | ||||||||

| Producer Durables - 22.6% | ||||||||

| 17,064 | Allied Motion Technologies, Inc. | 646,726 | ||||||

| 14,500 | American Outdoor Brands Corp. (a) | 130,645 | ||||||

| 24,300 | Argan, Inc. | 985,608 | ||||||

| 12,000 | Atkore International Group, Inc. (a) | 310,440 | ||||||

| 7,400 | Canadian Solar, Inc. (a) | 161,542 | ||||||

| 10,500 | Columbus McKinnon Corp. | 440,685 | ||||||

| 27,700 | Commercial Vehicle Group, Inc. (a) | 222,154 | ||||||

| 39,900 | DHT Holdings, Inc. | 235,809 | ||||||

| 6,000 | DXP Enterprises, Inc./TX (a) | 227,340 | ||||||

| 13,148 | GP Strategies Corp. (a) | 198,272 | ||||||

| 125,375 | Great Lakes Dredge & Dock Corp. (a) | 1,384,140 | ||||||

| 15,434 | Hamilton Beach Brands Holding Co., Class A | 294,018 | ||||||

| 7,254 | ICF International, Inc. | 528,091 | ||||||

| 66,224 | IES Holdings, Inc. (a) | 1,248,322 | ||||||

| 26,366 | Kornit Digital, Ltd. (a) | 834,748 | ||||||

| 23,700 | Limbach Holdings, Inc. (a) | 215,670 | ||||||

| 6,700 | Movado Group, Inc. | 180,900 | ||||||

| 8,300 | Napco Security Technologies, Inc. (a) | 246,344 | ||||||

| 18,008 | Patriot Transportation Holding, Inc. (a) | 305,596 | ||||||

| 41,967 | Perceptron, Inc. (a) | 186,753 | ||||||

| 8,600 | Powell Industries, Inc. | 326,800 | ||||||

| 49,525 | Radiant Logistics, Inc. (a) | 304,083 | ||||||

| 27,460 | Rosetta Stone, Inc. (a) | 628,285 | ||||||

| 12,400 | Select Interior Concepts, Inc., Class A (a) | 144,460 | ||||||

| 8,500 | SP Plus Corp. (a) | 271,405 | ||||||

| 166,307 | Sportsman's Warehouse Holdings, Inc. (a) | 628,640 | ||||||

| 19,444 | Systemax, Inc. | 430,879 | ||||||

| 25,525 | The Hackett Group, Inc. | 428,565 | ||||||

| 29,147 | The Manitowoc Co., Inc. (a) | 518,817 | ||||||

| 23,300 | Titan Machinery, Inc. (a) | 479,514 | ||||||

| 40,982 | UFP Technologies, Inc. (a) | 1,705,261 | ||||||

| 9,100 | Vectrus, Inc. (a) | 369,096 | ||||||

| 9,962 | Vishay Precision Group, Inc. (a) | 404,756 | ||||||

| 4,900 | VSE Corp. | 140,581 | ||||||

| 13,100 | Wabash National Corp. | 213,137 | ||||||

| 11,736 | WageWorks, Inc. (a) | 596,071 | ||||||

| 53,600 | Westport Fuel Systems, Inc. (a) | 145,256 | ||||||

| 214,804 | Yatra Online, Inc. (a) | 803,367 | ||||||

| 17,522,776 | ||||||||

| Technology - 13.7% | ||||||||

| 13,000 | Agilysys, Inc. (a) | 279,110 | ||||||

| 11,530 | AstroNova, Inc. | 297,935 | ||||||

| 12,758 | CalAmp Corp. (a) | 149,013 | ||||||

| 35,977 | Carbon Black, Inc. (a) | 601,535 | ||||||

| 89,400 | Digital Turbine, Inc. (a) | 447,000 | ||||||

| 19,207 | eGain Corp. (a) | 156,345 | ||||||

| 8,957 | Five9, Inc. (a) | 459,405 | ||||||

| 30,158 | Ichor Holdings, Ltd. (a) | 712,935 | ||||||

| Shares | Security Description | Value | ||||||

| Technology - 13.7% (continued) | ||||||||

| 19,700 | Kimball Electronics, Inc. (a) | $ | 319,928 | |||||

| 59,263 | Leaf Group, Ltd. (a) | 439,139 | ||||||

| 63,077 | Limelight Networks, Inc. (a) | 170,308 | ||||||

| 44,534 | MiX Telematics, Ltd., ADR | 669,346 | ||||||

| 14,853 | Monotype Imaging Holdings, Inc. | 250,124 | ||||||

| 23,138 | Perficient, Inc. (a) | 794,096 | ||||||

| 91,801 | Photronics, Inc. (a) | 752,768 | ||||||

| 26,967 | PlayAGS, Inc. (a) | 524,508 | ||||||

| 21,204 | QAD, Inc., Class A | 852,613 | ||||||

| 32,300 | Sapiens International Corp. NV | 536,826 | ||||||

| 72,100 | The Meet Group, Inc. (a) | 250,908 | ||||||

| 48,500 | The Rubicon Project, Inc. (a) | 308,460 | ||||||

| 34,662 | TrueCar, Inc. (a) | 189,255 | ||||||

| 18,900 | Ultra Clean Holdings, Inc. (a) | 263,088 | ||||||

| 14,271 | Upland Software, Inc. (a) | 649,759 | ||||||

| 13,000 | Veeco Instruments, Inc. (a) | 158,860 | ||||||

| 42,200 | Zix Corp. (a) | 383,598 | ||||||

| 10,616,862 | ||||||||

| Utilities - 1.1% | ||||||||

| 12,600 | AquaVenture Holdings, Ltd. (a) | 251,622 | ||||||

| 94,100 | Atlantic Power Corp. (a) | 227,722 | ||||||

| 22,578 | Boingo Wireless, Inc. (a) | 405,727 | ||||||

| 885,071 | ||||||||

| Total Common Stock (Cost $72,822,599) | 76,035,068 | |||||||

| Money Market Fund - 2.0% | ||||||||

| 1,522,145 | BlackRock Liquidity Funds FedFund Portfolio, Institutional Shares, 2.26% (b) | |||||||

| (Cost $1,522,145) | 1,522,145 | |||||||

| Investments, at value - 99.9% (Cost $74,344,744) | $ | 77,557,213 | ||||||

| Other Assets & Liabilities, Net - 0.1% | 105,906 | |||||||

| Net Assets - 100.0% | $ | 77,663,119 | ||||||

| ADR | American Depositary Receipt |

| LLC | Limited Liability Company |

| PLC | Public Limited Company |

| REIT | Real Estate Investment Trust |

| (a) | Non-income producing security. |

| (b) | Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of June 30, 2019. |

The following is a summary of the inputs used to value the Fund's investments as of June 30, 2019.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

| Valuation Inputs | Investments in Securities | |||

| Level 1 - Quoted Prices | $ | 76,035,068 | ||

| Level 2 - Other Significant Observable Inputs | 1,522,145 | |||

| Level 3 - Significant Unobservable Inputs | – | |||

| Total | $ | 77,557,213 | ||

The Level 1 value displayed in this table is Common Stock. The Level 2 value displayed in this table is a Money Market Fund. Refer to this Schedule of Investments for a further breakout of each security by industry.

See Notes to Financial Statements.

ACUITAS US MICROCAP FUND

SCHEDULE OF INVESTMENTS

JUNE 30, 2019

| PORTFOLIO HOLDINGS (Unaudited) | |

| % of Total Investments | |

| Consumer Discretionary | 6.7% |

| Consumer Staples | 0.2% |

| Energy | 7.0% |

| Financial Services | 18.5% |

| Health Care | 20.3% |

| Materials & Processing | 7.8% |

| Producer Durables | 22.6% |

| Technology | 13.7% |

| Utilities | 1.2% |

| Money Market Fund | 2.0% |

| 100.0% |

See Notes to Financial Statements.

ACUITAS US MICROCAP FUND

STATEMENT OF ASSETS AND LIABILITIES

JUNE 30, 2019

| ASSETS | ||||

| Investments, at value (Cost $74,344,744) | $ | 77,557,213 | ||

| Receivables: | ||||

| Fund shares sold | 158,979 | |||

| Investment securities sold | 430,942 | |||

| Dividends | 47,544 | |||

| Prepaid expenses | 25,129 | |||

| Total Assets | 78,219,807 | |||

| LIABILITIES | ||||

| Payables: | ||||

| Investment securities purchased | 432,240 | |||

| Accrued Liabilities: | ||||

| Investment adviser fees | 68,325 | |||

| Trustees’ fees and expenses | 1,481 | |||

| Fund services fees | 14,209 | |||

| Other expenses | 40,433 | |||

| Total Liabilities | 556,688 | |||

| NET ASSETS | $ | 77,663,119 | ||

| COMPONENTS OF NET ASSETS | ||||

| Paid-in capital | $ | 77,710,665 | ||

| Distributable earnings | (47,546 | ) | ||

| NET ASSETS | $ | 77,663,119 | ||

| SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED) | ||||

| Institutional Shares | 7,730,001 | |||

| NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE* | ||||

| Institutional Shares (based on net assets of $77,663,119) | $ | 10.05 | ||

| * | Shares redeemed or exchanged within 60 days of purchase are charged a 1.00% redemption fee. |

See Notes to Financial Statements.

ACUITAS US MICROCAP FUND

STATEMENT OF OPERATIONS

YEAR ENDED JUNE 30, 2019

| INVESTMENT INCOME | ||||

| Dividend income (Net of foreign withholding taxes of $3,211) | $ | 851,814 | ||

| Total Investment Income | 851,814 | |||

| EXPENSES | ||||

| Investment adviser fees | 1,295,098 | |||

| Fund services fees | 199,285 | |||

| Shareholder service fees | 92,373 | |||

| Custodian fees | 26,073 | |||

| Registration fees | 18,141 | |||

| Professional fees | 44,330 | |||

| Trustees' fees and expenses | 9,509 | |||

| Other expenses | 47,245 | |||

| Total Expenses | 1,732,054 | |||

| Fees waived | (159,221 | ) | ||

| Net Expenses | 1,572,833 | |||

| NET INVESTMENT LOSS | (721,019 | ) | ||

| NET REALIZED AND UNREALIZED GAIN (LOSS) | ||||

| Net realized gain (loss) on: | ||||

| Investments | 6,624,148 | |||

| Foreign currency transactions | (3 | ) | ||

| Net realized gain | 6,624,145 | |||

| Net change in unrealized appreciation (depreciation) on: | ||||

| Investments | (17,327,023 | ) | ||

| Foreign currency translations | 9 | |||

| Net change in unrealized appreciation (depreciation) | (17,327,014 | ) | ||

| NET REALIZED AND UNREALIZED LOSS | (10,702,869 | ) | ||

| DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | (11,423,888 | ) | |

See Notes to Financial Statements.

ACUITAS US MICROCAP FUND

STATEMENTS OF CHANGES IN NET ASSETS

| For the Years Ended June 30, | ||||||||

| 2019 | 2018 | |||||||

| OPERATIONS | ||||||||

| Net investment loss | $ | (721,019 | ) | $ | (888,475 | ) | ||

| Net realized gain | 6,624,145 | 10,834,970 | ||||||

| Net change in unrealized appreciation (depreciation) | (17,327,014 | ) | 5,420,770 | |||||

| Increase (Decrease) in Net Assets Resulting from Operations | (11,423,888 | ) | 15,367,265 | |||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Institutional Shares | (16,940,075 | ) | (3,399,933 | )* | ||||

| Total Distributions Paid | (16,940,075 | ) | (3,399,933 | ) | ||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

| Sale of shares: | ||||||||

| Institutional Shares | 17,861,183 | 14,489,617 | ||||||

| Reinvestment of distributions: | ||||||||

| Institutional Shares | 16,893,918 | 3,399,574 | ||||||

| Redemption of shares: | ||||||||

| Institutional Shares | (37,069,514 | ) | (9,207,906 | ) | ||||

| Redemption fees: | ||||||||

| Institutional Shares | 2,330 | 219 | ||||||

| Increase (Decrease) in Net Assets from Capital Share Transactions | (2,312,083 | ) | 8,681,504 | |||||

| Increase (Decrease) in Net Assets | (30,676,046 | ) | 20,648,836 | |||||

| NET ASSETS | ||||||||

| Beginning of Year | 108,339,165 | 87,690,329 | ||||||

| End of Year | $ | 77,663,119 | $ | 108,339,165 | ** | |||

| SHARE TRANSACTIONS | ||||||||

| Sale of shares: | ||||||||

| Institutional Shares | 1,699,846 | 1,094,290 | ||||||

| Reinvestment of distributions: | ||||||||

| Institutional Shares | 1,799,139 | 257,543 | ||||||

| Redemption of shares: | ||||||||

| Institutional Shares | (3,412,468 | ) | (686,187 | ) | ||||

| Increase in Shares | 86,517 | 665,646 | ||||||

| * | Distribution was the result of net realized gains at June 30, 2018. |

| ** | Includes accumulated net investment loss of $(47,511) at June 30, 2018. The requirement to disclose the corresponding amount as of June 30, 2019 was eliminated. |

See Notes to Financial Statements.

ACUITAS US MICROCAP FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

| July 18, 2014 (a) | ||||||||||||||||||||

| For the Years Ended June 30, | Through | |||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | June 30, 2015 | ||||||||||||||||

| INSTITUTIONAL SHARES | ||||||||||||||||||||

| NET ASSET VALUE, Beginning of Period | $ | 14.17 | $ | 12.57 | $ | 10.38 | $ | 11.27 | $ | 10.00 | ||||||||||

| INVESTMENT OPERATIONS | ||||||||||||||||||||

| Net investment loss (b) | (0.09 | ) | (0.12 | ) | (0.09 | ) | (0.08 | ) | (0.07 | ) | ||||||||||

| Net realized and unrealized gain (loss) | (1.46 | ) | 2.19 | 2.39 | (0.41 | ) | 1.34 | |||||||||||||

| Total from Investment Operations | (1.55 | ) | 2.07 | 2.30 | (0.49 | ) | 1.27 | |||||||||||||

| DISTRIBUTIONS TO SHAREHOLDERS FROM | ||||||||||||||||||||

| Net realized gain | (2.57 | ) | (0.47 | ) | (0.11 | ) | (0.40 | ) | – | |||||||||||

| Total Distributions to Shareholders | (2.57 | ) | (0.47 | ) | (0.11 | ) | (0.40 | ) | – | |||||||||||

| REDEMPTION FEES(b) | 0.00 | (c) | 0.00 | (c) | 0.00 | (c) | 0.00 | (c) | 0.00 | (c) | ||||||||||

| NET ASSET VALUE, End of Period | $ | 10.05 | $ | 14.17 | $ | 12.57 | $ | 10.38 | $ | 11.27 | ||||||||||

| TOTAL RETURN | (9.68 | )% | 16.77 | % | 22.21 | % | (4.27 | )% | 12.70 | %(d) | ||||||||||

| RATIOS/SUPPLEMENTARY DATA | ||||||||||||||||||||

| Net Assets at End of Period (000s omitted) | $ | 77,663 | $ | 108,339 | $ | 87,690 | $ | 66,156 | $ | 37,823 | ||||||||||

| Ratios to Average Net Assets: | ||||||||||||||||||||

| Net investment loss | (0.78 | )% | (0.91 | )% | (0.78 | )% | (0.80 | )% | (0.74 | )%(e) | ||||||||||

| Net expenses | 1.70 | % | 1.70 | % | 1.70 | % | 1.70 | % | 1.70 | %(e) | ||||||||||

| Gross expenses (f) | 1.87 | % | 1.80 | % | 1.86 | % | 2.04 | % | 2.37 | %(e) | ||||||||||

| PORTFOLIO TURNOVER RATE | 108 | % | 48 | % | 50 | % | 52 | % | 58 | %(d) | ||||||||||

| (a) | Commencement of operations. |

| (b) | Calculated based on average shares outstanding during each period. |

| (c) | Less than $0.01 per share. |

| (d) | Not annualized. |

| (e) | Annualized. |

| (f) | Reflects the expense ratio excluding any waivers and/or reimbursements. |

See Notes to Financial Statements.

ACUITAS FUNDS

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2019

Note 1. Organization

Acuitas International Small Cap Fund and Acuitas US Microcap Fund (individually, a “Fund” and collectively, the “Funds”) are diversified portfolios of Forum Funds II (the “Trust”). The Trust is a Delaware statutory trust that is registered as an open-end, management investment company under the Investment Company Act of 1940, as amended (the “Act”). Under its Trust Instrument, the Trust is authorized to issue an unlimited number of each Fund’s shares of beneficial interest without par value. Each Fund currently offers two classes of shares: Institutional Shares and Investors Shares. As of June 30, 2019, Investor Shares had not commenced operations. Each Fund seeks capital appreciation. Each Fund commenced operations on July 18, 2014.

Note 2. Summary of Significant Accounting Policies

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies.” These financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent liabilities at the date of the financial statements, and the reported amounts of increases and decreases in net assets from operations during the fiscal year. Actual amounts could differ from those estimates. The following summarizes the significant accounting policies of each Fund:

Security Valuation – Securities are valued at market prices using the last quoted trade or official closing price from the principal exchange where the security is traded, as provided by independent pricing services on each Fund business day. In the absence of a last trade, securities are valued at the mean of the last bid and ask price provided by the pricing service. Forward currency contracts are generally valued based on interpolation of forward curve data points obtained from major banking institutions that deal in foreign currencies and currency dealers. Exchange-traded options for which the last quoted sale price is outside the closing bid and ask price will be valued at the mean of the closing bid and ask price. Shares of non-exchange traded open-end mutual funds are valued at net asset value (“NAV”). Short-term investments that mature in sixty days or less may be valued at amortized cost.

Each Fund values its investments at fair value pursuant to procedures adopted by the Trust’s Board of Trustees (the“Board”) if (1) market quotations are not readily available or (2) the Adviser, as defined in Note 3, believes that the values available are unreliable. The Trust’s Valuation Committee, as defined in each Fund’s registration statement, performs certain functions as they relate to the administration and oversight of each Fund’s valuation procedures. Under these procedures, the Valuation Committee convenes on a regular and ad hoc basis to review such investments and considers a number of factors, including valuation methodologies and significant unobservable inputs, when arriving at fair value.

The Valuation Committee may work with the Adviser to provide valuation inputs. In determining fair valuations, inputs may include market-based analytics that may consider related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant investment information. Adviser inputs may include an income-based approach in which the anticipated future cash flows of the investment are discounted in determining fair value. Discounts may also be applied based on the nature or duration of any restrictions on the disposition of the investments. The Valuation Committee performs regular reviews of valuation methodologies, key inputs and assumptions, disposition analysis and market activity.

Fair valuation is based on subjective factors and, as a result, the fair value price of an investment may differ from the security’s market price and may not be the price at which the asset may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotes.

GAAP has a three-tier fair value hierarchy. The basis of the tiers is dependent upon the various “inputs” used to determine the value of each Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1 - Quoted prices in active markets for identical assets and liabilities.

Level 2 - Prices determined using significant other observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Short-term securities with maturities of sixty days or less are valued at amortized cost, which approximates market value, and are categorized as Level 2 in the hierarchy. Municipal securities, long-term U.S. government obligations and corporate debt securities are valued in accordance with the evaluated price supplied by a pricing service and

ACUITAS FUNDS

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2019

generally categorized as Level 2 in the hierarchy. Other securities that are categorized as Level 2 in the hierarchy include, but are not limited to, warrants that do not trade on an exchange, securities valued at the mean between the last reported bid and ask quotation and international equity securities valued by an independent third party with adjustments for changes in value between the time of the securities’ respective local market closes and the close of the U.S. market.

Level 3 - Significant unobservable inputs (including each Fund’s own assumptions in determining the fair value of investments).

The aggregate value by input level, as of June 30, 2019, for each Fund’s investments is included at the end of each Fund’s Schedule of Investments.

Security Transactions, Investment Income and Realized Gain and Loss – Investment transactions are accounted for on the trade date. Dividend income is recorded on the ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as possible after determining the existence of a dividend declaration after exercising reasonable due diligence. Income and capital gains on some foreign securities may be subject to foreign withholding taxes, which are accrued as applicable. Interest income is recorded on an accrual basis. Premium is amortized and discount is accreted using the effective interest method. Identified cost of investments sold is used to determine the gain and loss for both financial statement and federal income tax purposes.

Foreign Currency Translations – Foreign currency amounts are translated into U.S. dollars as follows: (1) assets and liabilities at the rate of exchange at the end of the respective period; and (2) purchases and sales of securities and income and expenses at the rate of exchange prevailing on the dates of such transactions. The portion of the results of operations arising from changes in the exchange rates and the portion due to fluctuations arising from changes in the market prices of securities are not isolated. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Foreign Currency Transactions – The Acuitas International Small Cap Fund may enter into transactions to purchase or sell foreign currency contracts and options on foreign currency. Forward currency contracts are agreements to exchange one currency for another at a future date and at a specified price. A fund may use forward currency contracts to facilitate transactions in foreign securities, to manage a fund’s foreign currency exposure and to protect the U.S. dollar value of its underlying portfolio securities against the effect of possible adverse movements in foreign exchange rates. These contracts are intrinsically valued daily based on forward rates, and a fund’s net equity therein, representing unrealized gain or loss on the contracts as measured by the difference between the forward foreign exchange rates at the dates of entry into the contracts and the forward rates at the reporting date, is recorded as a component of NAV. These instruments involve market risk, credit risk, or both kinds of risks, in excess of the amount recognized in the Statements of Assets and Liabilities. Risks arise from the possible inability of counterparties to meet the terms of their contracts and from movement in currency and securities values and interest rates. Due to the risks associated with these transactions, a fund could incur losses up to the entire contract amount, which may exceed the net unrealized value included in its NAV.

Distributions to Shareholders – Each Fund declares any dividends from net investment income and pays them annually. Any net capital gains realized by the Funds are distributed at least annually. Distributions to shareholders are recorded on the ex-dividend date. Distributions are based on amounts calculated in accordance with applicable federal income tax regulations, which may differ from GAAP. These differences are due primarily to differing treatments of income and gain on various investment securities held by each Fund, timing differences and differing characterizations of distributions made by each Fund.

Federal Taxes – Each Fund intends to continue to qualify each year as a regulated investment company under Subchapter M of Chapter 1, Subtitle A, of the Internal Revenue Code of 1986, as amended (“Code”), and to distribute all of its taxable income to shareholders. In addition, by distributing in each calendar year substantially all of its net investment income and capital gains, if any, the Funds will not be subject to a federal excise tax. Therefore, no federal income or excise tax provision is required. Each Fund files a U.S. federal income and excise tax return as required. Each Fund’s federal income tax returns are subject to examination by the Internal Revenue Service for a period of three fiscal years after they are filed. As of June 30, 2019, there are no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure.

Income and Expense Allocation – The Trust accounts separately for the assets, liabilities and operations of each of its investment portfolios. Expenses that are directly attributable to more than one investment portfolio are allocated among the respective investment portfolios in an equitable manner.

ACUITAS FUNDS

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2019

Redemption Fees – A shareholder who redeems or exchanges shares within 60 days of purchase will incur a redemption fee of 1.00% of the current NAV of shares redeemed or exchanged, subject to certain limitations. The fee is charged for the benefit of the remaining shareholders and will be paid to each Fund to help offset transaction costs. The fee is accounted for as an addition to paid-in capital. Each Fund reserves the right to modify the terms of or terminate the fee at any time. There are limited exceptions to the imposition of the redemption fee. Redemption fees incurred for the Funds, if any, are reflected on the Statements of Changes in Net Assets.

Commitments and Contingencies – In the normal course of business, each Fund enters into contracts that provide general indemnifications by each Fund to the counterparty to the contract. Each Fund’s maximum exposure under these arrangements is dependent on future claims that may be made against each Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote. Each Fund has determined that none of these arrangements requires disclosure on each Fund’s balance sheet.

Note 3. Fees and Expenses

Investment Adviser – Acuitas Investments, LLC (the “Adviser”) is the investment adviser to the Funds. Pursuant to an investment advisory agreement, the Adviser receives an advisory fee, payable monthly, at an annual rate of 1.20% and 1.40% of the average daily net assets of Acuitas International Small Cap Fund and Acuitas US Microcap Fund, respectively.

Each sub-advisory fee, calculated as a percentage of each Fund’s average daily net assets managed by each subadviser, is paid by the Adviser.

Distribution – Foreside Fund Services, LLC serves as each Fund’s distributor (the “Distributor”). The Funds have adopted a Distribution Plan (the “Plan”) for Investor Shares in accordance with Rule 12b-1 of the Act. Under the Plan, the Funds pay the Distributor and/or any other entity as authorized by the Board a fee of up to 0.25% of the average daily net assets of Investor Shares. The Distributor is not affiliated with the Adviser or Atlantic Fund Administration, LLC, a wholly owned subsidiary of Apex US Holdings, LLC (d/b/a Apex Fund Services) (“Apex”) or their affiliates.

Other Service Providers – Apex provides fund accounting, fund administration, compliance and transfer agency services to each Fund. The fees related to these services are included in Fund services fees within the Statements of Operations. Apex also provides certain shareholder report production and EDGAR conversion and filing services. Pursuant to an Apex services agreement, each Fund pays Apex customary fees for its services. Apex provides a Principal Executive Officer, a Principal Financial Officer, a Chief Compliance Officer and an Anti-Money Laundering Officer to each Fund, as well as certain additional compliance support functions.

Trustees and Officers – The Trust pays each Independent Trustee an annual fee of $16,000 ($21,000 for the Chairman) for service to the Trust. The Independent Trustees and Chairman may receive additional fees for special Board meetings. The Independent Trustees are also reimbursed for all reasonable out-of-pocket expenses incurred in connection with their duties as Trustees, including travel and related expenses incurred in attending Board meetings. The amount of Independent Trustees’ fees attributable to each Fund is disclosed in the Statements of Operations. Certain officers of the Trust are also officers or employees of the above named service providers, and during their terms of office received no compensation from each Fund.

Note 4. Expense Reimbursement and Fees Waived

The Adviser has contractually agreed to waive its fee and/or reimburse expenses to limit total annual fund operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) of Institutional Shares to 1.50% and Investor Shares to 1.75% through November 1, 2019, for Acuitas International Small Cap Fund. The Adviser has also contractually agreed to waive its fees and/or reimburse expenses to limit total annual operating expenses (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) of Institutional Shares to 1.70% and Investor Shares to 1.95% through November 1, 2019, for Acuitas US Microcap Fund. Other fund service providers have voluntarily agreed to waive a portion of their fees. Voluntary fee waivers may be reduced or eliminated at any time. For the year ended June 30, 2019, the fees waived and/or reimbursed expenses were as follows:

ACUITAS FUNDS

NOTES TO FINANCIAL STATEMENTS

JUNE 30, 2019

| Investment Adviser Fees Waived |

Other Waivers | Total Fees Waived and Expenses Reimbursed |

||||||||||

| Acuitas International Small Cap Fund | $ | 239,191 | $ | 26,407 | $ | 265,598 | ||||||

| Acuitas US Microcap Fund | 136,804 | 22,417 | 159,221 | |||||||||

The Adviser may be reimbursed by each Fund for fees waived and expenses reimbursed by the Adviser pursuant to the Expense Cap if such payment is approved by the Board, made within three years of the fee waiver or expense reimbursement, and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap and (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. As of June 30, 2019, $690,799 and $329,194 are subject to recapture by the Adviser for the Acuitas International Small Cap Fund and the Acuitas US Microcap Fund, respectively. Other waivers are not eligible for recoupment.

Note 5. Security Transactions

The cost of purchases and proceeds from sales of investment securities (including maturities), other than short-term investments during the year ended June 30, 2019, were as follows:

| Purchases | Sales | |||||||

| Acuitas International Small Cap Fund | $ | 27,670,816 | $ | 67,804,599 | ||||

| Acuitas US Microcap Fund | 98,597,431 | 117,287,851 | ||||||

Note 6. Federal Income Tax

As of June 30, 2019, the cost for federal income tax purposes and the components of net unrealized appreciation (depreciation) were as follows:

| Tax Cost of Investments |

Gross Unrealized Appreciation |

Gross Unrealized Depreciation |

Net Unrealized Appreciation (Depreciation) |

|||||||||||||

| Acuitas International Small Cap Fund | $ | 1,160,426 | $ | 84,188 | $ | (148,391 | ) | $ | (64,203 | ) | ||||||

| Acuitas US Microcap Fund | 75,312,123 | 10,184,508 | (7,939,418 | ) | 2,245,090 | |||||||||||

Distributions paid during the fiscal years ended as noted were characterized for tax purposes as follows:

| Ordinary Income | Long-Term Capital Gain | Total | |||||||||||

| Acuitas International Small Cap Fund | |||||||||||||

| 2019 | $ | 532,942 | $ | – | $ | 532,942 | |||||||

| 2018 | 2,541,258 | 2,541,258 | |||||||||||

| Acuitas US Microcap Fund | – | ||||||||||||

| 2019 | 335,697 | 16,604,378 | 16,940,075 | ||||||||||

| 2018 | – | 3,399,933 | 3,399,933 | ||||||||||

As of June 30, 2019, distributable earnings on a tax basis were as follows:

| Undistributed Long-Term Gain |

Capital and Other Losses |

Unrealized Appreciation (Depreciation) |

Total | |||||||||||||

| Acuitas International Small Cap Fund | $ | – | $ | (4,685,120 | ) | $ | (63,898 | ) | $ | (4,749,018 | ) | |||||