As filed with the Securities and Exchange Commission on June 1, 2018

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22842

FORUM FUNDS II

Three Canal Plaza, Suite 600

Portland, Maine 04101

Jessica Chase, Principal Executive Officer

Three Canal Plaza, Suite 600

Portland, Maine 04101

207-347-2000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2017 – March 31, 2018

ITEM 1. REPORT TO STOCKHOLDERS.

|

|

Semi-Annual Report

March 31, 2018

(Unaudited)

Advised by:

SKBA Capital Management, LLC

|

BAYWOOD VALUEPLUS FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2018

Dear Shareholders,

During the six months ended March 31, 2018, the Baywood ValuePlus Fund (the “Fund”) meaningfully outperformed its primary benchmarks. The period was divided by market strength in the fourth quarter of 2017 and market correction in the first quarter of 2018; yet the Fund outperformed the benchmark in each quarter, holding up better during the stock market’s recent weakness.

Sector selection accounted from approximately one third of the Fund’s excess return, and our decision to underweight consumer staples, telecom and utilities accounted for nearly two thirds of this outperformance during the period. The reason for our aversion to those sectors has neither been thematic nor “macro”. It has simply been based on a combination of poor fundamentals and elevated valuations, the latter of which are as ambitious as they had been in decades. Paying high prices for struggling businesses is rarely a recipe for success and is not an activity we care to partake in. Our viewpoint was significantly out of favor when we first raised this issue a few years ago. As many of these companies increased in value in the face of deteriorating fundamentals, we held to our outlook despite criticism; our cautious viewpoints fell mostly on deaf ears. This, in and of itself helped confirm our belief that we were correct in our assessment. More recently, however, perceptions appear to have changed as it has become broadly accepted that middling fundamentals within these groups do not warrant recent valuations. Given the recent valuation compression, when we now look back a few years, consumer staples, utilities, telecom and REIT’s have been significant underperformers. One thing we know for certain, whether looking at this example or prior ones, is that overvalued businesses rarely remain so forever. It is our job, desire and responsibility to not put our shareholders’ capital (of which we count ourselves) at risk in such securities.

About two thirds of the strategy’s overall excess returns also resulted from security selection. Some of the largest contributors included Tapestry (up 32%), WalMart (up 15%), Encompass Health (up 24%), Conoco Phillips (up 20%), Boeing (up 30%) and Abbvie (up 8%). In a strong market we also had a few disappointments that included Nielsen Holdings (down 22%), Met Life (down 10%) and USBancorp (down 5%).

During the period a number of new securities were purchased. The common thread within these additions is that they have all performed poorly of late despite what we believe to be sustainable if not improving fundamentals over our time horizon. Some of them clearly have issues they need to work through—if they did not, we wouldn’t be able to buy them at good prices!

Firstly, many of the areas we generally avoided are no longer as exorbitantly priced as they had been. Within consumer staples, we eliminated Procter & Gamble yet initiated a position in Kimberly Clark. The latter has a global dominant franchise within diapers and incontinence products. Incontinence may be inconvenient for many, but as the global population ages, it is a boon for Kimberly Clark. We are aware of input and transportation cost pressures which may continue to pressure margins somewhat, an issue not unique to Kimberly Clark. Yet there is a price for everything. The company’s stock is priced at levels similar to 2013 while earnings and dividends have increased between 6-7% per year. As a result, valuation has declined significantly to levels we are finding attractive. Because of its high returns on capital, it has excess funds with which to support and grow its dividend as well as to repurchase its own shares, a feat it has accomplished for years. We love “dividend aristocrats”; it’s just that we prefer to pay “pauper” prices. We may be somewhat early (although we’ve been waiting at least five years!) however its attractive and sustainable fundamentals and financials will only make us want to purchase more should shares continue to decline. We have owned Kimberly Clark numerous times in the past, an investment which has proved to be profitable. We expect the same this time around.

REIT’s (Real Estate Investment Trust), another area we’ve avoided for years also due to valuation and fundamental concerns, became much more attractive over the last few months. In particular, for being supposedly defensive stocks, mall REIT’s have not acted as such whatsoever. For years we have believed that the U.S. has been “over-malled”. Based on changing consumer purchasing habits, many lower class malls have struggled for at least a decade with abysmal occupancy rates. Retail has been under the greatest assault ever with more bankruptcies than during most downturns, despite the U.S. not being in a recession. These are some of the reasons, all rational, for the decline in the prices of mall REIT’s. The pendulum never stops swinging at fair value, however, and in this case as well, valuations now appear attractive for some companies with few significant tenant issues. We purchased Taubman Centers, one of the largest Class A mall owners during the period. Shares have declined for at least six years finally rendering its 4.5% dividend yield attractive based on our belief that funds from operations will be able to sustain such a payout. While the retail landscape is changing rapidly, certain high foot-traffic properties will always be more desirable to rent from than others. Taubman is one such company, though we cannot say the same for all mall operators. We also initiated a position in Weyerhaeuser, a company we’ve owned in the past prior to it becoming a REIT. Weyerhaeuser is heavily exposed to the housing market, which we believe will continue to improve over the next few years. At current prices, we are receiving 3.6% in dividends for the privilege of owning its shares. Weyerhaeuser belongs in the desirable and rare category of having its tangible assets increase in value over time. Should housing and construction slow, its timberlands will only become more valuable. We are happy to be paid to wait while either outcome is realized.

1

BAYWOOD VALUEPLUS FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2018

Secondly, other decidedly out-of-favor additions include Medtronic, AIG, Target, Nutrien, Johnson Controls and General Electric. While we don’t always seek near term catalysts in order to make an investment, many of these have experienced recent changes that should improve our odds of being correct in our fair value estimations. Due to recent struggles, AIG, GE and Johnson Controls have each experienced management changes that are likely to heighten operational focus. Each owns and runs leading businesses within their respective areas and in all cases we believe that an emphasis on improving asset productivity will result in greater recognition of fair value.

Nutrien, the former Potash, effected a name change subsequent to acquiring Agrium, another fertilizer company. Fertilizers, as with many commodities, have gone through the downturn of last decade’s super cycle. By definition, however, cyclical industries do experience upturns, not simply downturns. Nutrien is consolidating within its industry at what we believe to be close to the bottom of the cycle. By next year, its earning power should be significantly greater than its recently reported earnings. It is also in process of shedding non-core assets that will result in cash proceeds with which to reward shareholders. We expect much of these actions to take place at some point this year.

These positions are examples of purchasing companies with low expectations priced into their stocks. When combined with above average return to shareholders in the form of dividends and sometimes share buybacks, we believe this is a recipe for continuing to achieve desirable if not better than benchmark returns with lower levels of risk (as defined by permanent loss of capital).

As we enter the second half of the fund’s fiscal year during 2018, it is evident that recent benign levels of volatility are unlikely to continue. Following so many consecutive years of strong returns and investor complacency, expecting the same environment to continue would seem foolhardy. Our expectations going into 2018 were that market returns could be only half what they had been until recently. We might once again cut our expectations in half for the overall market but have positioned the portfolio in a way that expectations for our holdings are already low and likely to surprise to the upside. As active managers, we are more interested in what opportunities we may find in individual securities as a result of this change in market conditions. We are just as focused on companies that we should own as we are on those we shouldn’t. As evidenced by the last few months, it’s not simply what you own but also what you don’t own that makes the record. We are not fearful of heightened volatility. While it may be unpleasant, it is precisely this lack of comfort that creates opportunities for us to purchase companies at attractive prices with excess cash to reward shareholders.

In a way, we look forward to a less comfortable market environment as it will, as it has many times in the past, enable us to build a portfolio with attractive through cycle return characteristics.

We look forward to reporting to you in another six months.

Current and future portfolio holdings are subject to change and risk.

The Morningstar category is used to compare fund performance to its peers. It is not possible to invest directly into an index or category. Past performance is no guarantee of future results.

Risk Considerations: Mutual fund investing involves risk, including the possible loss of principal. The Fund primarily invests in undervalued securities, which may not appreciate in value as anticipated by the Advisor or remain undervalued for longer than anticipated. The Fund may invest in American Depositary Receipts (ADRs), which involves risks relating to political, economic or regulatory conditions in foreign countries and may cause greater volatility and less liquidity. The Fund may also invest in convertible securities and preferred stock, which may be adversely affected as interest rates rise.

2

BAYWOOD VALUEPLUS FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2018

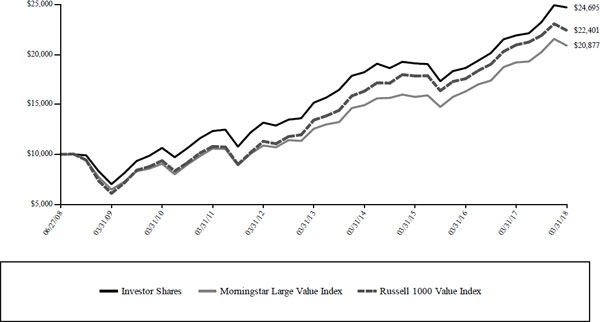

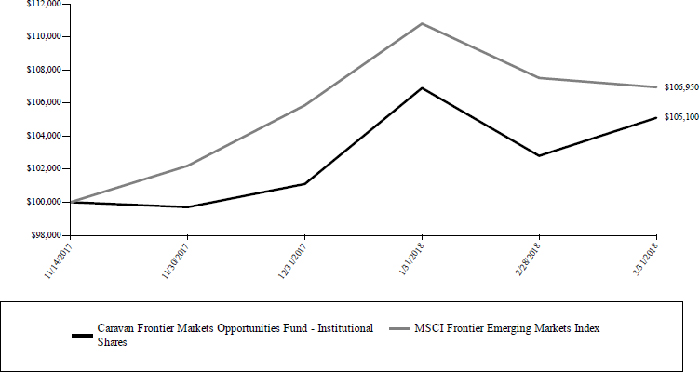

The following charts reflect the change in the value of a hypothetical $10,000 investment in Investor Shares and a hypothetical $100,000 investment in Institutional Shares, including reinvested dividends and distributions, in the Baywood ValuePlus Fund (the “Fund”) compared with the performance of the benchmarks, Morningstar Large Value Index, and the secondary benchmark, Russell 1000 Value Index (the “indices”), since inception. On September 29, 2017, Morningstar Large Value Index replaced Russell 1000 Value Index as the Fund's primary benchmark. The Investment Adviser believes that the Morningstar Large Value Index more accurately represents the types of securities in which the Fund invests.The Morningstar Large Value Index measures the performance of large-cap stocks with relatively low prices given anticipated per share earnings, book value, cash flow, sales and dividends. The Russell 1000 Value Index is an unmanaged index which measures the performance of the large-cap value segment of the Russell 1000 companies (that is, the 1,000 largest U.S. companies in terms of market capitalization) with lower price-to-book ratios and lower forecasted growth values. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $10,000 Investment

Investor Shares vs. Morningstar Large Value Index and Russell 1000 Value Index

|

Average Annual Total Returns

Periods Ended March 31, 2018

|

One Year

|

Five Years

|

Since Inception (06/27/08)

|

|

Baywood ValuePlus Fund - Investor Shares*

|

12.76%

|

10.24%

|

9.71%

|

|

Morningstar Large Value Index

|

8.76%

|

10.69%

|

7.83%

|

|

Russell 1000 Value Index

|

6.95%

|

10.78%

|

8.62%

|

|

*

|

The Fund’s Investor Shares performance for periods prior to the commencement of operations (12/2/13) is that of a collective investment trust managed by the Fund’s Advisor and portfolio management team. The Investor Shares of the collective investment trust commenced operations on June 27, 2008.

|

3

BAYWOOD VALUEPLUS FUND

PERFORMANCE CHART AND ANALYSIS

MARCH 31, 2018

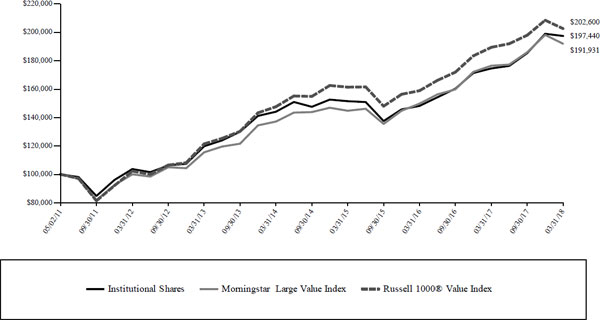

Comparison of Change in Value of a $100,000 Investment

Institutional Shares vs. Morningstar Large Value Index and Russell 1000 Value Index

|

Average Annual Total Returns

Periods Ended March 31, 2018

|

One Year

|

Five Years

|

Since Inception (05/02/11)

|

|

Baywood ValuePlus Fund - Institutional Shares*

|

13.11%

|

10.52%

|

9.90%

|

|

Morningstar Large Value Index

|

8.76%

|

10.69%

|

9.89%

|

|

Russell 1000® Value Index

|

6.95%

|

10.78%

|

10.75%

|

|

*

|

The Fund’s Institutional Shares performance for periods prior to the commencement of operations (12/2/13) is that of a collective investment trust managed by the Fund’s Advisor and portfolio management team. The Institutional Shares of the collective investment trust commenced operations on May 2, 2011.

|

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratios (gross) for Investor Shares and Institutional Shares are 7.67% and 11.16%, respectively. However, the Fund’s advisor has contractually agreed to waive its fee and/ or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 0.95% and 0.70% for Investor Shares and Institutional Shares, respectively, through at least January 31, 2019 (the “Expense Cap”). The advisor may be reimbursed by the Fund for fees waived and expenses reimbursed by the advisor pursuant to the Expense Cap if such payment is approved by the Board, made within three years of the fee waiver or expense reimbursement, and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap, or (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (855) 409-2297.

4

BAYWOOD VALUEPLUS FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2018

| Shares |

Security Description

|

Value

|

|||||

| Common Stock - 93.8% | |||||||

| Basic Materials - 4.6% | |||||||

|

500

|

DowDuPont, Inc.

|

$

|

31,855

|

||||

|

1,360

|

Nutrien, Ltd.

|

64,273

|

|||||

|

400

|

WestRock Co.

|

25,668

|

|||||

|

121,796

|

|||||||

| Capital Goods / Industrials - 7.4% | |||||||

|

500

|

Eaton Corp. PLC

|

39,955

|

|||||

|

1,900

|

General Electric Co.

|

25,612

|

|||||

|

1,500

|

Johnson Controls International PLC

|

52,860

|

|||||

|

1,000

|

Nielsen Holdings PLC

|

31,790

|

|||||

|

100

|

Stanley Black & Decker, Inc.

|

15,320

|

|||||

|

100

|

The Boeing Co.

|

32,788

|

|||||

|

198,325

|

|||||||

| Consumer Cyclicals - 1.6% | |||||||

|

1,100

|

L Brands, Inc.

|

42,031

|

|||||

| Consumer Discretionary - 3.2% | |||||||

|

1,100

|

Tapestry, Inc.

|

57,871

|

|||||

|

400

|

Target Corp.

|

27,772

|

|||||

|

85,643

|

|||||||

| Consumer Staples - 6.3% | |||||||

|

400

|

Kimberly-Clark Corp.

|

44,052

|

|||||

|

400

|

PepsiCo., Inc.

|

43,660

|

|||||

|

900

|

Walmart, Inc.

|

80,073

|

|||||

|

167,785

|

|||||||

| Energy - 14.6% | |||||||

|

900

|

BP PLC, ADR

|

36,486

|

|||||

|

600

|

Chevron Corp.

|

68,424

|

|||||

|

1,700

|

ConocoPhillips

|

100,793

|

|||||

|

300

|

Helmerich & Payne, Inc.

|

19,968

|

|||||

|

900

|

Occidental Petroleum Corp.

|

58,464

|

|||||

|

800

|

Schlumberger, Ltd.

|

51,824

|

|||||

|

600

|

Valero Energy Corp.

|

55,662

|

|||||

|

391,621

|

|||||||

| Financials - 21.0% | |||||||

|

1,200

|

American International Group, Inc.

|

65,304

|

|||||

|

500

|

BB&T Corp.

|

26,020

|

|||||

|

600

|

BOK Financial Corp.

|

59,394

|

|||||

|

340

|

Chubb, Ltd.

|

46,502

|

|||||

|

900

|

FNF Group

|

36,018

|

|||||

|

500

|

JPMorgan Chase & Co.

|

54,985

|

|||||

|

400

|

M&T Bank Corp.

|

73,744

|

|||||

|

1,100

|

MetLife, Inc.

|

50,479

|

|||||

|

1,400

|

Morgan Stanley

|

75,544

|

|||||

|

1,500

|

U.S. Bancorp

|

75,750

|

|||||

|

563,740

|

|||||||

| Health Care - 14.5% | |||||||

|

300

|

AbbVie, Inc.

|

28,394

|

|||||

|

300

|

Amgen, Inc.

|

51,144

|

|||||

|

800

|

AstraZeneca PLC, ADR

|

27,976

|

|||||

|

400

|

Cardinal Health, Inc.

|

25,072

|

|||||

|

700

|

Encompass Health Corp.

|

40,019

|

|||||

|

700

|

Gilead Sciences, Inc.

|

52,773

|

|||||

|

2,000

|

Koninklijke Philips NV, ADR

|

76,620

|

|||||

|

600

|

Medtronic PLC

|

48,132

|

|||||

|

800

|

Novo Nordisk A/S, ADR

|

39,400

|

|||||

|

389,530

|

|||||||

| Real Estate - 2.7% | |||||||

|

600

|

Taubman Centers, Inc. REIT

|

34,146

|

|||||

|

1,100

|

Weyerhaeuser Co. REIT

|

38,500

|

|||||

|

72,646

|

|||||||

| Technology - 14.7% | |||||||

|

2,500

|

Cisco Systems, Inc.

|

107,225

|

|||||

|

200

|

Harris Corp.

|

32,256

|

|||||

|

2,100

|

HP, Inc.

|

46,032

|

|||||

| Shares |

Security Description

|

Value

|

|||||

| Technology - 14.7% (continued) | |||||||

|

1,600

|

Intel Corp.

|

$

|

83,328

|

||||

|

500

|

International Business Machines Corp.

|

76,715

|

|||||

|

300

|

Microsoft Corp.

|

27,381

|

|||||

|

200

|

Texas Instruments, Inc.

|

20,778

|

|||||

|

393,715

|

|||||||

| Telecommunications - 0.7% | |||||||

|

400

|

Verizon Communications, Inc.

|

19,128

|

|||||

| Transportation - 1.5% | |||||||

|

300

|

Union Pacific Corp.

|

40,329

|

|||||

| Utilities - 1.0% | |||||||

|

700

|

Exelon Corp.

|

27,307

|

|||||

| Total Common Stock (Cost $2,126,857) |

2,513,596

|

||||||

| Money Market Fund - 5.3% | |||||||

|

143,824

|

Federated Government Obligations Fund, Institutional Class, 1.51% (a) (Cost $143,824) |

143,824

|

|||||

| Investments, at value - 99.1% (Cost $2,270,681) |

$

|

2,657,420

|

|||||

| Other Assets & Liabilities, Net - 0.9% |

22,899

|

||||||

| Net Assets - 100.0% |

$

|

2,680,319

|

|||||

|

ADR

|

American Depositary Receipt

|

|

PLC

|

Public Limited Company

|

|

REIT

|

Real Estate Investment Trust

|

|

(a)

|

Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of March 31, 2018.

|

The following is a summary of the inputs used to value the Fund's instruments as of March 31, 2018.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

|

Valuation Inputs

|

Investments in Securities

|

|||

|

Level 1 - Quoted Prices

|

$

|

2,513,596

|

||

|

Level 2 - Other Significant Observable Inputs

|

143,824

|

|||

|

Level 3 - Significant Unobservable Inputs

|

–

|

|||

|

Total

|

$

|

2,657,420

|

||

The Level 1 value displayed in this table is Common Stock. The Level 2 value displayed in this table is a Money Market Fund. Refer to this Schedule of Investments for a further breakout of each security by industry.

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the period ended March 31, 2018.

See Notes to Financial Statements.

5

BAYWOOD VALUEPLUS FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2018

|

PORTFOLIO HOLDINGS

|

||||

|

% of Total Investments

|

||||

|

Basic Materials

|

4.6

|

%

|

||

|

Capital Goods / Industrials

|

7.5

|

%

|

||

|

Consumer Cyclicals

|

1.6

|

%

|

||

|

Consumer Discretionary

|

3.2

|

%

|

||

|

Consumer Staples

|

6.3

|

%

|

||

|

Energy

|

14.8

|

%

|

||

|

Financials

|

21.2

|

%

|

||

|

Health Care

|

14.7

|

%

|

||

|

Real Estate

|

2.7

|

%

|

||

|

Technology

|

14.8

|

%

|

||

|

Telecommunications

|

0.7

|

%

|

||

|

Transportation

|

1.5

|

%

|

||

|

Utilities

|

1.0

|

%

|

||

|

Money Market Fund

|

5.4

|

%

|

||

|

100.0

|

%

|

|||

See Notes to Financial Statements.

6

BAYWOOD VALUEPLUS FUND

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2018

|

ASSETS

|

||||

|

Investments, at value (Cost $2,270,681)

|

$

|

2,657,420

|

||

|

Cash

|

2,041

|

|||

|

Receivables:

|

||||

|

Dividends

|

5,693

|

|||

|

From investment advisor

|

12,290

|

|||

|

Prepaid expenses

|

16,776

|

|||

|

Total Assets

|

2,694,220

|

|||

|

LIABILITIES

|

||||

|

Accrued Liabilities:

|

||||

|

Trustees’ fees and expenses

|

107

|

|||

|

Fund services fees

|

5,338

|

|||

|

Other expenses

|

8,456

|

|||

|

Total Liabilities

|

13,901

|

|||

|

NET ASSETS

|

$

|

2,680,319

|

||

|

COMPONENTS OF NET ASSETS

|

||||

|

Paid-in capital

|

$

|

2,186,508

|

||

|

Undistributed net investment income

|

2,599

|

|||

|

Accumulated net realized gain

|

104,473

|

|||

|

Net unrealized appreciation

|

386,739

|

|||

|

NET ASSETS

|

$

|

2,680,319

|

||

|

SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED)

|

||||

|

Investor Shares

|

103,247

|

|||

|

Institutional Shares

|

47,863

|

|||

|

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE

|

||||

|

Investor Shares (based on net assets of $1,828,594)

|

$

|

17.71

|

||

|

Institutional Shares (based on net assets of $851,725)

|

$

|

17.80

|

||

See Notes to Financial Statements.

7

BAYWOOD VALUEPLUS FUND

STATEMENTS OF OPERATIONS

SIX MONTHS ENDED MARCH 31, 2018

|

INVESTMENT INCOME

|

||||

|

Dividend income (Net of foreign withholding taxes of $228)

|

$

|

35,457

|

||

|

Total Investment Income

|

35,457

|

|||

|

EXPENSES

|

||||

|

Investment advisor fees

|

6,570

|

|||

|

Fund services fees

|

32,027

|

|||

|

Transfer agent fees:

|

||||

|

Investor Shares

|

9,261

|

|||

|

Institutional Shares

|

9,639

|

|||

|

Distribution fees:

|

||||

|

Investor Shares

|

2,275

|

|||

|

Custodian fees

|

2,578

|

|||

|

Registration fees:

|

||||

|

Investor Shares

|

8,884

|

|||

|

Institutional Shares

|

9,245

|

|||

|

Professional fees

|

10,628

|

|||

|

Trustees' fees and expenses

|

1,042

|

|||

|

Other expenses

|

11,998

|

|||

|

Total Expenses

|

104,147

|

|||

|

Fees waived and expenses reimbursed

|

(92,674

|

)

|

||

|

Net Expenses

|

11,473

|

|||

|

NET INVESTMENT INCOME

|

23,984

|

|||

|

NET REALIZED AND UNREALIZED GAIN (LOSS)

|

||||

|

Net realized gain on investments

|

109,199

|

|||

|

Net change in unrealized appreciation (depreciation) on investments

|

23,452

|

|||

|

NET REALIZED AND UNREALIZED GAIN

|

132,651

|

|||

|

INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

156,635

|

||

See Notes to Financial Statements.

8

BAYWOOD VALUEPLUS FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

For the Six

Months Ended

March 31,

2018

|

For the

Year Ended

September 30,

2017

|

|||||||

|

OPERATIONS

|

||||||||

|

Net investment income

|

$

|

23,984

|

$

|

48,347

|

||||

|

Net realized gain

|

109,199

|

93,135

|

||||||

|

Net change in unrealized appreciation (depreciation)

|

23,452

|

192,429

|

||||||

|

Increase in Net Assets Resulting from Operations

|

156,635

|

333,911

|

||||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM

|

||||||||

|

Net investment income:

|

||||||||

|

Investor Shares

|

(15,476

|

)

|

(32,969

|

)

|

||||

|

Institutional Shares

|

(8,021

|

)

|

(13,855

|

)

|

||||

|

Net realized gain:

|

||||||||

|

Investor Shares

|

(51,277

|

)

|

(29,530

|

)

|

||||

|

Institutional Shares

|

(22,602

|

)

|

(9,288

|

)

|

||||

|

Total Distributions to Shareholders

|

(97,376

|

)

|

(85,642

|

)

|

||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Sale of shares:

|

||||||||

|

Investor Shares

|

3,041

|

38,459

|

||||||

|

Institutional Shares

|

98,602

|

94,402

|

||||||

|

Reinvestment of distributions:

|

||||||||

|

Investor Shares

|

66,728

|

62,499

|

||||||

|

Institutional Shares

|

30,622

|

23,143

|

||||||

|

Redemption of shares:

|

||||||||

|

Investor Shares

|

(519

|

)

|

(265,416

|

)

|

||||

|

Institutional Shares

|

(5,267

|

)

|

(7,818

|

)

|

||||

|

Increase (Decrease) in Net Assets from Capital Share Transactions

|

193,207

|

(54,731

|

)

|

|||||

|

Increase in Net Assets

|

252,466

|

193,538

|

||||||

|

NET ASSETS

|

||||||||

|

Beginning of Period

|

2,427,853

|

2,234,315

|

||||||

|

End of Period (Including line (a))

|

$

|

2,680,319

|

$

|

2,427,853

|

||||

|

SHARE TRANSACTIONS

|

||||||||

|

Sale of shares:

|

||||||||

|

Investor Shares

|

155

|

2,354

|

||||||

|

Institutional Shares

|

5,479

|

5,685

|

||||||

|

Reinvestment of distributions:

|

||||||||

|

Investor Shares

|

3,748

|

3,784

|

||||||

|

Institutional Shares

|

1,712

|

1,392

|

||||||

|

Redemption of shares:

|

||||||||

|

Investor Shares

|

(29

|

)

|

(16,185

|

)

|

||||

|

Institutional Shares

|

(294

|

)

|

(474

|

)

|

||||

|

Increase (Decrease) in Shares

|

10,771

|

(3,444

|

)

|

|||||

|

(a) Undistributed net investment income

|

$

|

2,599

|

$

|

2,112

|

||||

See Notes to Financial Statements.

9

BAYWOOD VALUEPLUS FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

|

For the

Six Months

Ended

March 31,

2018

|

For the

Year Ended

September 30,

2018

|

For the

Period

Ended

September 30,

2016 (a)

|

For the

Year Ended

November 30,

2015

|

December 2,

2013 (b)

Through

November 30,

2014

|

||||||||||||||||

|

INVESTOR SHARES

|

||||||||||||||||||||

|

NET ASSET VALUE, Beginning of Period

|

$

|

17.28

|

$

|

15.52

|

$

|

16.90

|

$

|

19.28

|

$

|

17.47

|

||||||||||

|

INVESTMENT OPERATIONS

|

||||||||||||||||||||

|

Net investment income (c)

|

0.16

|

0.33

|

0.26

|

0.34

|

0.36

|

|||||||||||||||

|

Net realized and unrealized gain (loss)

|

0.94

|

2.02

|

0.93

|

(1.06

|

)

|

1.49

|

||||||||||||||

|

Total from Investment Operations

|

1.10

|

2.35

|

1.19

|

(0.72

|

)

|

1.85

|

||||||||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM

|

||||||||||||||||||||

|

Net investment income

|

(0.15

|

)

|

(0.32

|

)

|

(2.20

|

)

|

(0.26

|

)

|

(0.04

|

)

|

||||||||||

|

Net realized gain

|

(0.52

|

)

|

(0.27

|

)

|

(0.37

|

)

|

(1.40

|

)

|

– | |||||||||||

|

Total Distributions to Shareholders

|

(0.67

|

)

|

(0.59

|

)

|

(2.57

|

)

|

(1.66

|

)

|

(0.04

|

)

|

||||||||||

|

NET ASSET VALUE, End of Period

|

$

|

17.71

|

$

|

17.28

|

$

|

15.52

|

$

|

16.90

|

$

|

19.28

|

||||||||||

|

TOTAL RETURN

|

6.35

|

%(d)

|

15.32

|

%

|

8.40

|

%(d)

|

(3.86

|

)%

|

10.59

|

%(d)

|

||||||||||

|

RATIOS/SUPPLEMENTARY DATA

|

||||||||||||||||||||

|

Net Assets at End of Year (000s omitted)

|

$

|

1,829

|

$

|

1,717

|

$

|

1,699

|

$

|

1,362

|

$

|

1,471

|

||||||||||

|

Ratios to Average Net Assets:

|

||||||||||||||||||||

|

Net investment income

|

1.74

|

%(e)

|

2.03

|

%

|

2.07

|

%(e)

|

1.97

|

%

|

1.98

|

%(e)

|

||||||||||

|

Net expenses

|

0.95

|

%(e)

|

0.95

|

%

|

0.95

|

%(e)

|

0.95

|

%

|

0.95

|

%(e)

|

||||||||||

|

Gross expenses (f)

|

7.12

|

%(e)

|

7.67

|

%

|

9.43

|

%(e)

|

5.80

|

%

|

4.54

|

%(e)

|

||||||||||

|

PORTFOLIO TURNOVER RATE

|

19

|

%(d)

|

48

|

%

|

22

|

%(d)

|

32

|

%

|

35

|

%(d)

|

||||||||||

|

(a)

|

Effective March 24, 2016, the Fund changed its fiscal year end from November 30 to September 30. The information presented is for the period December 1, 2015 through September 30, 2016.

|

|

(b)

|

Commencement of operations.

|

|

(c)

|

Calculated based on average shares outstanding during each period.

|

|

(d)

|

Not annualized.

|

|

(e)

|

Annualized.

|

|

(f)

|

Reflects the expense ratio excluding any waivers and/or reimbursements.

|

See Notes to Financial Statements.

10

BAYWOOD VALUEPLUS FUND

FINANCIAL HIGHLIGHTS

These financial highlights reflect selected data for a share outstanding throughout each period.

|

For the

Six Months

Ended

March 31,

2018

|

For the

Year Ended

September 30,

2017

|

For the

Period Ended

September 30,

2016 (a)

|

For the

Year Ended

November 30,

2015

|

December 2,

2013 (b)

Through

November 30,

2014

|

||||||||||||||||

|

INSTITUTIONAL SHARES

|

||||||||||||||||||||

|

NET ASSET VALUE, Beginning of Period

|

$

|

17.36

|

$

|

15.59

|

$

|

17.00

|

$

|

19.42

|

$

|

17.56

|

||||||||||

|

INVESTMENT OPERATIONS

|

||||||||||||||||||||

|

Net investment income (c)

|

0.18

|

0.38

|

0.29

|

0.39

|

0.41

|

|||||||||||||||

|

Net realized and unrealized gain (loss)

|

0.95

|

2.02

|

0.94

|

(1.06

|

)

|

1.50

|

||||||||||||||

|

Total from Investment Operations

|

1.13

|

2.40

|

1.23

|

(0.67

|

)

|

1.91

|

||||||||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM

|

||||||||||||||||||||

|

Net investment income

|

(0.17

|

)

|

(0.36

|

)

|

(2.27

|

)

|

(0.35

|

)

|

(0.05

|

)

|

||||||||||

|

Net realized gain

|

(0.52

|

)

|

(0.27

|

)

|

(0.37

|

)

|

(1.40

|

)

|

– | |||||||||||

|

Total Distributions to Shareholders

|

(0.69

|

)

|

(0.63

|

)

|

(2.64

|

)

|

(1.75

|

)

|

(0.05

|

)

|

||||||||||

|

NET ASSET VALUE, End of Period

|

$

|

17.80

|

$

|

17.36

|

$

|

15.59

|

$

|

17.00

|

$

|

19.42

|

||||||||||

|

TOTAL RETURN

|

6.51

|

%(d)

|

15.60

|

%

|

8.65

|

%(d)

|

(3.58

|

)%

|

10.87

|

%(d)

|

||||||||||

|

RATIOS/SUPPLEMENTARY DATA

|

||||||||||||||||||||

|

Net Assets at End of Period (000s omitted)

|

$

|

852

|

$

|

711

|

$

|

536

|

$

|

426

|

$

|

11,067

|

||||||||||

|

Ratios to Average Net Assets:

|

||||||||||||||||||||

|

Net investment income

|

2.01

|

%(e)

|

2.28

|

%

|

2.30

|

%(e)

|

2.23

|

%

|

2.26

|

%(e)

|

||||||||||

|

Net expenses

|

0.70

|

%(e)

|

0.70

|

%

|

0.70

|

%(e)

|

0.70

|

%

|

0.70

|

%(e)

|

||||||||||

|

Gross expenses (f)

|

9.75

|

%(e)

|

11.16

|

%

|

14.43

|

%(e)

|

2.09

|

%

|

2.50

|

%(e)

|

||||||||||

|

PORTFOLIO TURNOVER RATE

|

19

|

%(d)

|

48

|

%

|

22

|

%(d)

|

32

|

%

|

35

|

%(d)

|

||||||||||

|

(a)

|

Effective March 24, 2016, the Fund changed its fiscal year end from November 30 to September 30. The information presented is for the period December 1, 2015 through September 30, 2016.

|

|

(b)

|

Commencement of operations.

|

|

(c)

|

Calculated based on average shares outstanding during each period.

|

|

(d)

|

Not annualized.

|

|

(e)

|

Annualized.

|

|

(f)

|

Reflects the expense ratio excluding any waivers and/or reimbursements.

|

See Notes to Financial Statements.

11

BAYWOOD SOCIALLYRESPONSIBLE FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2018

MARCH 31, 2018

Dear Shareholder,

We are pleased to report our economic and financial market perspectives and the investment activities for the Baywood SociallyResponsible Fund (the “Fund”) for the six months ended March, 2018. The Fund is a mid-to-large capitalization value-oriented portfolio of stock holdings selected from a universe of stocks created through the application of inclusionary and exclusionary social screens and assessments of the ESG profile of each company. Among these stocks, we further evaluate and assess each prospective holding’s valuation and fundamental business attraction to determine the current portfolio holdings. In selecting investments, we consider social criteria such as an issuer’s community relations, corporate governance, employee diversity, employee relations, environmental impact and sustainability, human rights record and product safety. Using both quantitative and qualitative data, we also evaluate an issuer’s involvement in specific revenue generating activities to determine whether the issuer’s involvement was meaningful or incidental with respect to that activity.

For the six month period ending March 31, 2018 the Baywood SociallyResponsible Fund outperformed both of its benchmarks. Upon review of the period, the two quarters were like opposite sides of a coin. The fourth quarter of 2017 witnessed robust returns due to optimism from the passage of the tax reform act, yet this was almost offset by negative returns in the first quarter, which was marked by a level of volatility in the overall market we haven’t experienced in a couple of years. The tax reform has clear positive economic implications as it increases the incentives to work, invest and save in the United States. Despite the robust returns in the fourth quarter, we believe the rally did not fully capture the implications of the increased rate of growth due to the tax reform. On the opposite end, the volatility and ensuing market sell-off in the first quarter of 2018 appears to us a little overdone. Trade wars are not good, let us be clear; no one wins a trade war. However, it is our opinion that much of the effect from a trade war will not completely offset the growth from the tax reform. Further, if the outlandish remarks made by the President and his administration are merely anchoring points for negotiation, which it appears may be the case, then the market sell-off in the first quarter will have proven to be temporary. However, we will pay close attention to developments and adjust our forecasts accordingly.

The positioning of the portfolio during this period is a result of what we consider a wide opportunity set which began to build in 2015. At times the positioning had detracted from returns as the market doesn’t always agree with our ideas, at least not from a timing point of view. However, in most cases our conviction grows stronger the worse a stock or sector performs as long as our views about fundamentals don’t waver. The research we perform, which informs our view, allows us to be comfortable adding to positions that haven’t worked out in a short period of time if our conviction is high. At times, “good” companies (from an ESG perspective) can perform poorly, but in the period, many “good” companies demonstrated they can be good investments as well. Our conviction and the positioning of the strategy, which was held and reinforced over the period, helped generate excess returns.

We also have long held convictions about certain sectors, which aren’t always those in which to buy but also those in which to avoid. This may sound like a broken record but we have chosen to avoid investing in sectors that we feel are overvalued. Overvaluation can look different, however, depending on a number of factors. In our view it is a combination of two very simple ideas: fundamentals and valuation. Exercises like this, which inform us of whether or not individual companies and sectors are truly attractive, have given us the comfort to avoid over-investing in utilities, consumer staples, real estate and telecom, sectors that for the most part, exhibit neither fundamental nor valuation attraction. During the period, avoiding these sectors added nearly 200bp of excess returns over the primary benchmark.

Similarly, avoiding these sectors freed up the resources to invest in sectors which exhibit characteristics we seek: fundamental attraction, valuation attraction and strong governance. Our two largest overweight sectors for the period are health care and consumer discretionary. The rout in the health care sector that started in 2016 due to bi-partisan support to lower the cost of health care prompted investors to treat all stocks like the few really bad actors which provided a wide opportunity set for investment. As the period progressed and the market became overly pessimistic, we increased our attention towards companies within the sector that maintained good governance practices yet were unduly punished by association. This provided the opportunity to purchase good health care companies at good prices, fulfilling our desire to have both fundamental and valuation attraction. In the period our overweight position in health care detracted from returns, however, our stock selection more than offset the effect and contributions from the sector were the highest in the period. Encompass Health, Abbvie, Becton Dickinson and Novo Nordisk all contributed positively to returns.

Stocks that detracted from returns include Corning, Lions Gate Entertainment and Nielsen. We exited Nielsen as we found opportunities for other investments that were more attractive. Corning’s fundamentals are currently being pressured by an increase in investments to support future growth and to continue diversify its product mix away from displays. We view this as a temporary investment that will reward patient, long-term investors like us.

12

BAYWOOD SOCIALLYRESPONSIBLE FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2018

MARCH 31, 2018

In the period we initiated a position in Weyerhaeuser, the largest supplier of lumber in the U.S. All of its forests are sustainably managed and by nature of its size it is also the largest tree planter in the U.S. The market for new houses remains constrained. Since the financial crisis the impediment to building new houses in the U.S. has created a supply-demand imbalance, driving up the cost of living. We believe the constraints will elongate the cycle, one in which Weyerhaeuser will benefit from, yet its valuation is not reflective of it. Our investment in Weyerhaeuser and another new addition, Brookfield Property Managers, represents a departure of sorts from our view that asset-sensitive sectors are over-valued. We do note, however, that not all real estate is created equal. Brookfield Property is a relatively new company spun out of well pedigreed asset manager: Brookfield Asset Management. Majority of its profits are generated by its high-performing office properties, yet its valuation is similar to that of a mall REIT. While it does own mall properties, its portfolio of office properties is being entirely ignored in the valuation. Over the next 3-5 years as mall owners repurpose the properties and concerns about the health of the industry fade away, it is likely that its valuation will revert to be in-line with its fundamentals.

Over the last several years we have not held many food companies. The prospect of increasing input costs and the preference shift towards more healthy and fresh food make it difficult for incumbent food manufacturers traditionally focused on shelf-stable food products to grow revenues profitably. Furthermore, with few exceptions, valuations did not reflect this fundamental shift and we have stayed away. However, over the last year the market has begun to price the fundamental shift as it has become painfully clear that profits are going to be depressed, or at a new lower level. As valuations decreased we were able to purchase Mondelez International, the former Kraft snack brand company at a significant discount to its intrinsic value. Mondelez stands apart from its competitors as a strong global franchise that is growing revenues profitably, yet its valuation has experienced similar compression as those that aren’t. It has done so by creating new, healthier products, limited calorie packs while focusing on sustainable sourcing.

Kimberly-Clark was also a recent addition to the portfolio yet it is a company we have owned in the past and are familiar with its keen management and business strategy. Management at Kimberly-Clark is a good steward of capital with sound governance practices. As the consumer staples sector underperformed over the last year we were once again provided the opportunity to purchase a company with positive fundamental attributes at a reasonable price.

Several other new additions to the portfolio are Moller-Maersk, the largest shipping company in the world; Nutrien (formerly Potash), a fertilizer company with improving fundamentals and a basement bargain price and Tapestry, formerly Coach (and Kate Spade), which was a top contributor to returns in the period.

In favor of our new investments we exited Qualcomm, MetLife, Cardinal Health, Nielsen, Procter & Gamble, National Oilwell Varco and Pentair. With the exception of Cardinal and Nielsen, all investments were successful and are exiting in favor of other investments with higher fundamental-valuation attractiveness. Cardinal Health was initiated and eliminated during the year as we changed our opinion of the pharmaceutical distributors when it became clear that it will likely be facing headwinds from a fierce competitor for years to come: Amazon. Although the stock appeared to exhibit both fundamental and valuation attraction at the beginning of the holding period, its fundamentals have deteriorated to a point where we no longer believe they will support the valuation.

In addition to those previously mentioned, during the quarter we added to AIG, Radian, Medtronic, Johnson Controls, IBM, Mosaic, AstraZeneca, Encompass Health and Nutrien, all of which we have increased our confidence in either its fundamentals or valuation. In favor of these we reduced Cabot, AbbVie, Royal Phillips and M&T Bank.

The conviction in our positioning and the individual companies we own that has helped generate excess returns in the period comes only from gaining an understanding of the companies and industries in which they operate. This is the value we hope to provide to our shareholders over the long-term and is generated from the research we perform. One cannot have conviction without it. Our focus on purchasing companies with positive fundamental and valuation attributes is reinforced by the strategy’s focus on governance. It is the intersection of these three attributes that inform our opinions to buy and sell and creates the characteristics that our Socially Responsible clients and shareholders desire.

Current and future portfolio holdings are subject to change and risk.

The MSCI KLD 400 Social Index and the Morningstar Category are used to compare fund performance to its peers. It is not possible to invest directly into an index or category. Past performance is no guarantee of future results.

Risk Considerations: Mutual fund investing involves risk, including the possible loss of principal. Socially responsible investment criteria may limit the number of investment opportunities available to the Fund or it may invest a larger portion of its assets in certain sectors which could be more sensitive to market conditions, economic, regulatory and environmental developments. These factors

13

BAYWOOD SOCIALLYRESPONSIBLE FUND

A MESSAGE TO OUR SHAREHOLDERS

MARCH 31, 2018

MARCH 31, 2018

could negatively impact the Fund’s returns. The Fund primarily invests in undervalued securities, which may not appreciate in value as anticipated by the Advisor or remain undervalued for longer than anticipated. The Fund may invest in American Depositary Receipts (ADRs), which involves risks relating to political, economic or regulatory conditions in foreign countries and may cause greater volatility and less liquidity. The Fund may also invest in convertible securities and preferred stock, which may be adversely affected as interest rates rise.

14

|

BAYWOOD SOCIALLYRESPONSIBLE FUND

PERFORMANCE CHART AND ANALYSIS MARCH 31, 2018 |

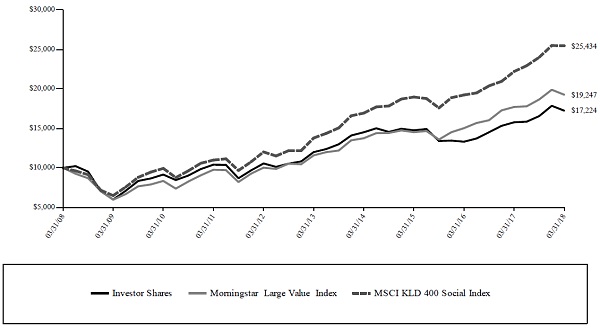

The following charts reflect the change in the value of a hypothetical $10,000 investment in Investor Shares and a hypothetical $100,000 investment in Institutional Shares, including reinvested dividends and distributions, in the Baywood SociallyResponsible Fund (the “Fund”) compared with the performance of the primary benchmark, Morningstar Large Value Index, and the secondary benchmark, MSCI KLD 400 Social Index (the “indices”), over the past ten fiscal years. The Morningstar Large Value Index measures the performance of large-cap stocks with relatively low prices given anticipated per share earnings, book value, cash flow, sales and dividends. The MSCI KLD 400 Social Index is a capitalization weighted index of 400 US securities that provides exposure to companies with outstanding Environmental, Social and Governance ratings and excludes companies whose products have negative social or environmental impacts. The total return of the indices include the reinvestment of dividends and income. The total return of the Fund includes operating expenses that reduce returns, while the total return of the indices do not include expenses. The Fund is professionally managed, while the indices are unmanaged and are not available for investment.

Comparison of Change in Value of a $10,000 Investment

Investor Shares vs. Morningstar Large Value Index and MSCI KLD 400 Social Index

|

Average Annual Total Returns

Periods Ended March 31, 2018 |

One Year

|

Five Years

|

Ten Years

|

|

Baywood SociallyResponsible Fund - Investor Shares*

|

9.24%

|

7.52%

|

5.59%

|

|

Morningstar Large Value Index

|

8.76%

|

10.69%

|

6.77%

|

|

MSCI KLD 400 Social Index

|

14.67%

|

13.05%

|

9.78%

|

|

*

|

Performance for Investor Shares for periods prior to January 8, 2016, reflects the performance and expenses of City National Rochdale Socially Responsible Equity Fund, a series of City National Rochdale Funds (the “Predecessor Fund”).

|

15

|

BAYWOOD SOCIALLYRESPONSIBLE FUND

PERFORMANCE CHART AND ANALYSIS MARCH 31, 2018 |

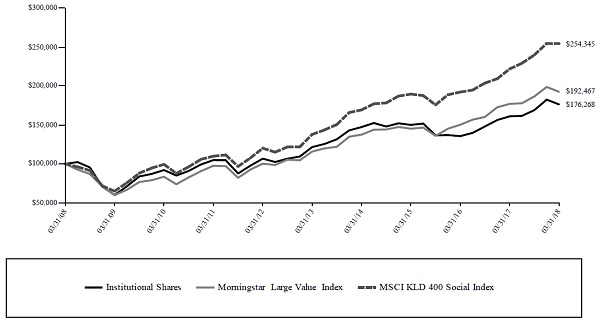

Comparison of Change in Value of a $100,000 Investment

Institutional Shares vs. Morningstar Large Value Index and MSCI KLD 400 Social Index

|

Average Annual Total Returns

Periods Ended March 31, 2018 |

One Year

|

Five Years

|

Ten Years

|

|

Baywood SociallyResponsible Fund - Institutional Shares*

|

9.45%

|

7.73%

|

5.83%

|

|

Morningstar Large Value Index

|

8.76%

|

10.69%

|

6.77%

|

|

MSCI KLD 400 Social Index

|

14.67%

|

13.05%

|

9.78%

|

|

*

|

Performance for Institutional Shares for periods prior to January 8, 2016, reflects the performance and expenses of City National Rochdale Socially Responsible Equity Fund, a series of City National Rochdale Funds (the “Predecessor Fund”).

|

Performance data quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than original cost. As stated in the Fund’s prospectus, the annual operating expense ratios (gross) for Investor Shares and Institutional Shares are 2.64% and 2.64%, respectively. However, the Fund’s advisor has contractually agreed to waive its fee and/or reimburse Fund expenses to limit Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement (excluding all taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, proxy expenses and extraordinary expenses) to 1.14% and 0.89% for Investor Shares and Institutional Shares, respectively, through at least January 31, 2019 (the “Expense Cap”) (the “Expense Cap”). The advisor may be reimbursed by the Fund for fees waived and expenses reimbursed by the advisor pursuant to the Expense Cap if such payment is approved by the Board, made within three years of the fee waiver or expense reimbursement, and does not cause the Total Annual Fund Operating Expenses After Fee Waiver and/or Expense Reimbursement to exceed the lesser of (i) the then-current expense cap, or (ii) the expense cap in place at the time the fees/expenses were waived/reimbursed. During the period, certain fees were waived and/or expenses reimbursed; otherwise, returns would have been lower. The performance table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns greater than one year are annualized. For the most recent month-end performance, please call (855) 409-2297.

16

|

BAYWOOD SOCIALLYRESPONSIBLE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2018

|

|

Shares

|

Security Description

|

Value

|

||||

|

Common Stock - 93.0%

|

||||||

|

Basic Materials - 4.3%

|

||||||

|

3,500

|

Nutrien, Ltd.

|

$

|

165,410

|

|||

|

7,900

|

The Mosaic Co.

|

191,812

|

||||

|

357,222

|

||||||

|

Capital Goods / Industrials - 4.3%

|

||||||

|

5,538

|

Johnson Controls International PLC

|

195,159

|

||||

|

3,000

|

Sensata Technologies Holding PLC (a)

|

155,490

|

||||

|

350,649

|

||||||

|

Consumer Cyclicals - 5.8%

|

||||||

|

3,900

|

L Brands, Inc.

|

149,019

|

||||

|

1,100

|

Lithia Motors, Inc., Class A

|

110,572

|

||||

|

13,300

|

TRI Pointe Group, Inc. (a)

|

218,519

|

||||

|

478,110

|

||||||

|

Consumer Discretionary - 6.7%

|

||||||

|

2,800

|

AutoNation, Inc. (a)

|

130,984

|

||||

|

9,300

|

Discovery Communications, Inc., Class C (a)

|

181,536

|

||||

|

3,700

|

Lions Gate Entertainment Corp., Class B

|

89,096

|

||||

|

2,800

|

Tapestry, Inc.

|

147,308

|

||||

|

548,924

|

||||||

|

Consumer Staples - 2.7%

|

||||||

|

700

|

Kimberly-Clark Corp.

|

77,091

|

||||

|

1,300

|

PepsiCo., Inc.

|

141,895

|

||||

|

218,986

|

||||||

|

Consumer, Non-cyclical - 0.5%

|

||||||

|

1,000

|

Mondelez International, Inc., Class A

|

41,730

|

||||

|

Energy - 5.2%

|

||||||

|

5,400

|

Cabot Oil & Gas Corp.

|

129,492

|

||||

|

4,700

|

Centennial Resource Development, Inc., Class A (a)

|

86,245

|

||||

|

6,600

|

Devon Energy Corp.

|

209,814

|

||||

|

425,551

|

||||||

|

Financials - 23.0%

|

||||||

| 6,100 | Air Lease Corp. |

259,982

|

||||

|

2,900

|

American Express Co.

|

270,512

|

||||

|

3,400

|

American International Group, Inc.

|

185,028

|

||||

|

11,400

|

Bank of America Corp.

|

341,886

|

||||

|

2,200

|

BOK Financial Corp.

|

217,778

|

||||

|

5,750

|

Brookfield Asset Management, Inc., Class A

|

224,250

|

||||

|

1,300

|

M&T Bank Corp.

|

239,668

|

||||

|

7,600

|

Radian Group, Inc.

|

144,704

|

||||

|

1,883,808

|

||||||

|

Health Care - 16.4%

|

||||||

|

1,000

|

AbbVie, Inc.

|

94,650

|

||||

|

4,700

|

AstraZeneca PLC, ADR

|

164,359

|

||||

|

1,100

|

Becton Dickinson and Co.

|

238,370

|

||||

|

2,200

|

Encompass Health Corp.

|

125,774

|

||||

|

7,400

|

Koninklijke Philips NV, ADR

|

283,494

|

||||

|

700

|

Laboratory Corp. of America Holdings (a)

|

113,225

|

||||

|

3,100

|

Medtronic PLC

|

248,682

|

||||

|

1,500

|

Novo Nordisk A/S, ADR

|

73,875

|

||||

|

1,342,429

|

||||||

|

Real Estate - 3.8%

|

||||||

|

8,100

|

Brookfield Property Partners LP

|

155,439

|

||||

|

4,400

|

Weyerhaeuser Co. REIT

|

154,000

|

||||

|

309,439

|

||||||

|

Technology - 15.4%

|

||||||

|

7,500

|

Cisco Systems, Inc.

|

321,675

|

||||

|

5,600

|

Corning, Inc.

|

156,128

|

||||

|

5,400

|

HP, Inc.

|

118,368

|

||||

|

6,100

|

Intel Corp.

|

317,688

|

||||

|

1,500

|

International Business Machines Corp.

|

230,145

|

||||

|

Shares

|

Security Description

|

Value

|

||||

|

Technology - 15.4% (continued)

|

||||||

|

1,300

|

Microsoft Corp.

|

$

|

118,651

|

|||

|

1,262,655

|

||||||

|

Transportation - 4.9%

|

||||||

|

13,600

|

AP Moller - Maersk A/S, ADR

|

106,352

|

||||

|

1,200

|

Kansas City Southern

|

131,820

|

||||

|

1,200

|

Union Pacific Corp.

|

161,316

|

||||

|

399,488

|

||||||

|

Total Common Stock (Cost $6,409,443)

|

7,618,991

|

|||||

|

Money Market Fund - 7.7%

|

||||||

|

633,380

|

Morgan Stanley Institutional Liquidity | |||||

|

Funds Government Portfolio, Institutional

|

||||||

|

Class, 1.59% (b)

|

||||||

|

(Cost $633,380)

|

633,380

|

|||||

|

Investments, at value - 100.7% (Cost $7,042,823)

|

$

|

8,252,371

|

||||

|

Other Assets & Liabilities, Net - (0.7)%

|

(58,033

|

)

|

||||

|

Net Assets - 100.0%

|

$

|

8,194,338

|

||||

|

ADR

|

American Depositary Receipt

|

|

LP

|

Limited Partnership

|

|

PLC

|

Public Limited Company

|

|

REIT

|

Real Estate Investment Trust

|

|

(a)

|

Non-income producing security.

|

|

(b)

|

Dividend yield changes daily to reflect current market conditions. Rate was the quoted yield as of March 31, 2018.

|

The following is a summary of the inputs used to value the Fund's instruments as of March 31, 2018.

The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. For more information on valuation inputs, and their aggregation into the levels used in the table below, please refer to the Security Valuation section in Note 2 of the accompanying Notes to Financial Statements.

|

Valuation Inputs

|

Investments in Securities

|

|||

|

Level 1 - Quoted Prices

|

$

|

7,618,991

|

||

|

Level 2 - Other Significant Observable Inputs

|

633,380

|

|||

|

Level 3 - Significant Unobservable Inputs

|

– | |||

|

Total

|

$

|

8,252,371

|

||

The Level 1 value displayed in this table is Common Stock. The Level 2 value displayed in this table is a Money Market Fund. Refer to this Schedule of Investments for a further breakout of each security by industry.

The Fund utilizes the end of period methodology when determining transfers. There were no transfers among Level 1, Level 2 and Level 3 for the period ended March 31, 2018.

See Notes to Financial Statements.

17

|

BAYWOOD SOCIALLYRESPONSIBLE FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2018

|

|

PORTFOLIO HOLDINGS

|

||||

|

% of Total Investments

|

||||

|

Basic Materials

|

4.3

|

%

|

||

|

Capital Goods / Industrials

|

4.2

|

%

|

||

|

Consumer Cyclicals

|

5.8

|

%

|

||

|

Consumer Discretionary

|

6.7

|

%

|

||

|

Consumer Staples

|

2.7

|

%

|

||

|

Consumer, Non-cyclical

|

0.5

|

%

|

||

|

Energy

|

5.2

|

%

|

||

|

Financials

|

22.8

|

%

|

||

|

Health Care

|

16.3

|

%

|

||

|

Real Estate

|

3.7

|

%

|

||

|

Technology

|

15.3

|

%

|

||

|

Transportation

|

4.8

|

%

|

||

|

Money Market Fund

|

7.7

|

%

|

||

|

100.0

|

%

|

|||

See Notes to Financial Statements.

18

BAYWOOD SOCIALLY RESPONSIBLE FUND

STATEMENT OF ASSETS AND LIABILITIES

MARCH 31, 2018

MARCH 31, 2018

|

ASSETS

|

||||

|

Investments, at value (Cost $7,042,823)

|

$

|

8,252,371

|

||

|

Cash

|

8,218

|

|||

|

Receivables:

|

||||

|

Dividends

|

11,414

|

|||

|

From investment advisor

|

6,468

|

|||

|

Prepaid expenses

|

13,999

|

|||

|

Total Assets

|

8,292,470

|

|||

|

LIABILITIES

|

||||

|

Payables:

|

||||

|

Investment securities purchased

|

72,769

|

|||

|

Fund shares redeemed

|

12,092

|

|||

|

Accrued Liabilities:

|

||||

|

Trustees’ fees and expenses

|

86

|

|||

|

Fund services fees

|

5,430

|

|||

|

Other expenses

|

7,755

|

|||

|

Total Liabilities

|

98,132

|

|||

|

NET ASSETS

|

$

|

8,194,338

|

||

|

COMPONENTS OF NET ASSETS

|

||||

|

Paid-in capital

|

$

|

7,074,641

|

||

|

Undistributed net investment income

|

1,669

|

|||

|

Accumulated net realized loss

|

(91,520

|

)

|

||

|

Net unrealized appreciation

|

1,209,548

|

|||

|

NET ASSETS

|

$

|

8,194,338

|

||

|

SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED)

|

||||

|

Investor Shares

|

227,828

|

|||

|

Institutional Shares

|

471,568

|

|||

|

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE

|

||||

|

Investor Shares (based on net assets of $2,672,794)

|

$

|

11.73

|

||

|

Institutional Shares (based on net assets of $5,521,544)

|

$

|

11.71

|

||

See Notes to Financial Statements.

19

BAYWOOD SOCIALLY RESPONSIBLE FUND

STATEMENTS OF OPERATIONS

SIX MONTHS ENDED MARCH 31, 2018

SIX MONTHS ENDED MARCH 31, 2018

|

INVESTMENT INCOME

|

||||

|

Dividend income (Net of foreign withholding taxes of $780)

|

$

|

77,436

|

||

|

Total Investment Income

|

77,436

|

|||

|

EXPENSES

|

||||

|

Investment advisor fees

|

29,759

|

|||

|

Fund services fees

|

36,542

|

|||

|

Transfer agent fees:

|

||||

|

Investor Shares

|

8,931

|

|||

|

Institutional Shares

|

9,215

|

|||

|

Distribution fees:

|

||||

|

Investor Shares

|

3,534

|

|||

|

Custodian fees

|

2,508

|

|||

|

Registration fees:

|

||||

|

Investor Shares

|

7,536

|

|||

|

Institutional Shares

|

7,796

|

|||

|

Professional fees

|

10,431

|

|||

|

Trustees' fees and expenses

|

1,136

|

|||

|

Other expenses

|

13,535

|

|||

|

Total Expenses

|

130,923

|

|||

|

Fees waived and expenses reimbursed

|

(89,551

|

)

|

||

|

Net Expenses

|

41,372

|

|||

|

NET INVESTMENT INCOME

|

36,064

|

|||

|

NET REALIZED AND UNREALIZED GAIN (LOSS)

|

||||

|

Net realized gain on investments

|

325,866

|

|||

|

Net change in unrealized appreciation (depreciation) on investments

|

(617

|

)

|

||

|

NET REALIZED AND UNREALIZED GAIN

|

325,249

|

|||

|

INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

361,313

|

||

See Notes to Financial Statements.

20

BAYWOOD SOCIALLYRESPONSIBLE FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

For the

Six Months

Ended

March 31, 2018

|