NWS INTERNATIONAL PROPERTY FUND

|

●

|

Demand for real estate is well-supported. Recent surveys of institutional investors suggest that the future appetite for real estate is increasing despite expectations for lower returns. This is in addition to the current surfeit of capital already committed but not yet invested.

|

|

●

|

Attractive relative valuation. As compared with other asset classes, real estate securities in particular are trading at levels that are appreciably lower in terms of multiples/valuations. As compared with private real estate, we believe the public companies are priced from 10-50% below the value of their underlying assets.

|

|

●

|

Retail-oriented companies are oversold. While it is difficult to assess the ultimate impact of ecommerce and Millennial buying habits, all companies that are engaged in the retail sector worldwide are not homogeneous and yet they are priced as if they were.

|

|

●

|

Dispersion in performance will likely continue, providing opportunities for active management to continue to outperform.

|

|

●

|

Supply largely in check but pockets of oversupply need to be monitored. Property types with the lowest reproduction costs and fastest time to market like warehouses, self-storage, apartments and retail centers (excluding malls) should be most at risk.

|

|

●

|

Interest rate increases continue to weigh on the sector. As has been the case in the past, REITs in the US and Australia in particular will trade down as rates are rising – which has been occurring during the past 2 years – and then recover when either economic growth drives rents higher and/or it becomes clear that the rise in interest rates has peaked.

|

NWS INTERNATIONAL PROPERTY FUND

NWS INTERNATIONAL PROPERTY FUND

|

Average Annual Total Returns

Periods Ended February 28, 2018

|

One Year

|

Since Inception 03/31/15

|

|

NWS International Property Fund

|

23.69%

|

5.84%

|

|

FTSE EPRA/NAREIT Developed ex-US Total Return Index

|

13.50%

|

4.36%

|

|

Shares

|

Security Description

|

Value

|

||||

|

Common Stock - 95.2%

|

||||||

|

Australia - 9.6%

|

||||||

|

100,500

|

Mirvac Group REIT

|

$

|

165,484

|

|||

|

57,070

|

Stockland REIT

|

179,078

|

||||

|

36,270

|

The GPT Group REIT

|

134,094

|

||||

|

46,400

|

Vicinity Centres REIT

|

89,376

|

||||

|

568,032

|

||||||

|

Belgium - 2.1%

|

||||||

|

1,580

|

VGP NV (a)

|

123,366

|

||||

|

China - 8.4%

|

||||||

|

58,000

|

China Overseas Land & Investment, Ltd.

|

203,810

|

||||

|

46,000

|

China Resources Land, Ltd.

|

164,288

|

||||

|

91,992

|

KWG Property Holding, Ltd.

|

129,068

|

||||

|

497,166

|

||||||

|

France - 5.3%

|

||||||

|

6,800

|

Carmila SA REIT

|

198,275

|

||||

|

2,760

|

Klepierre SA REIT

|

114,249

|

||||

|

312,524

|

||||||

|

Germany - 3.4%

|

||||||

|

3,880

|

ADO Properties SA (b)

|

202,503

|

||||

|

Hong Kong - 16.0%

|

||||||

|

81,800

|

Hang Lung Properties, Ltd.

|

195,461

|

||||

|

13,500

|

Hongkong Land Holdings, Ltd.

|

93,015

|

||||

|

47,000

|

Hysan Development Co., Ltd.

|

272,358

|

||||

|

42,000

|

Kerry Properties, Ltd.

|

190,790

|

||||

|

131,245

|

New World Development Co., Ltd.

|

199,906

|

||||

|

951,530

|

||||||

|

Indonesia - 1.2%

|

||||||

|

868,100

|

Summarecon Agung Tbk PT

|

70,087

|

||||

|

Ireland - 2.0%

|

||||||

|

62,100

|

Green REIT PLC

|

116,370

|

||||

|

Japan - 18.0%

|

||||||

|

5,500

|

Aeon Mall Co., Ltd.

|

115,315

|

||||

|

6,000

|

Daiwa House Industry Co., Ltd.

|

223,647

|

||||

|

11,000

|

Mitsui Fudosan Co., Ltd.

|

265,785

|

||||

|

8,000

|

Sumitomo Realty & Development Co., Ltd.

|

292,497

|

||||

|

23,000

|

Tokyu Fudosan Holdings Corp.

|

170,730

|

||||

|

1,067,974

|

||||||

|

Netherlands - 6.5%

|

||||||

|

1,650

|

Unibail-Rodamco SE REIT

|

385,993

|

||||

|

Singapore - 6.6%

|

||||||

|

68,000

|

CapitaLand, Ltd.

|

186,330

|

||||

|

21,600

|

City Developments, Ltd.

|

208,051

|

||||

|

394,381

|

||||||

|

Spain - 2.6%

|

||||||

|

10,766

|

Merlin Properties Socimi SA REIT

|

154,528

|

||||

|

Sweden - 3.0%

|

||||||

|

8,200

|

Fabege AB

|

178,104

|

||||

|

Thailand - 3.7%

|

||||||

|

32,300

|

Central Pattana PCL, NVDR

|

86,692

|

||||

|

371,200

|

Land & Houses PCL, NVDR

|

130,080

|

||||

|

216,772

|

||||||

|

United Kingdom - 6.8%

|

||||||

|

16,063

|

Great Portland Estates PLC REIT

|

138,875

|

||||

|

7,781

|

Land Securities Group PLC REIT

|

99,301

|

||||

|

10,000

|

The UNITE Group PLC REIT

|

104,836

|

||||

|

15,100

|

Urban & Civic PLC

|

63,404

|

||||

|

406,416

|

||||||

|

Total Common Stock (Cost $4,815,038)

|

5,645,746

|

|||||

|

Investments, at value - 95.2% (Cost $4,815,038)

|

$

|

5,645,746

|

||||

|

Other Assets & Liabilities, Net - 4.8%

|

283,944

|

|||||

|

Net Assets - 100.0%

|

$

|

5,929,690

|

||||

| NVDR |

Non-Voting Depositary Receipt

|

| PCL |

Public Company Limited

|

| PLC |

Public Limited Company

|

| REIT |

Real Estate Investment Trust

|

| (a) |

Non-income producing security.

|

| (b) |

Security exempt from registration under Rule 144A under the Securities Act of 1933. At the period end, the value of these securities amounted to $202,503 or 3.4% of net assets.

|

|

Valuation Inputs

|

Investments in Securities

|

|||

|

Level 1 - Quoted Prices

|

$

|

5,645,746

|

||

|

Level 2 - Other Significant Observable Inputs

|

–

|

|||

|

Level 3 - Significant Unobservable Inputs

|

–

|

|||

|

Total

|

$

|

5,645,746

|

||

|

% of Total Net Assets

|

|

|

Australia

|

9.6%

|

|

Belgium

|

2.1%

|

|

China

|

8.4%

|

|

France

|

5.3%

|

|

Germany

|

3.4%

|

|

Hong Kong

|

16.0%

|

|

Indonesia

|

1.2%

|

|

Ireland

|

2.0%

|

|

Japan

|

18.0%

|

|

Netherlands

|

6.5%

|

|

Singapore

|

6.6%

|

|

Spain

|

2.6%

|

|

Sweden

|

3.0%

|

|

Thailand

|

3.7%

|

|

United Kingdom

|

6.8%

|

|

Other Assets & Liabilities, Net

|

4.8%

|

|

|

100.0 %

|

NWS INTERNATIONAL PROPERTY FUND

|

ASSETS

|

||||

|

Investments, at value (Cost $4,815,038)

|

$

|

5,645,746

|

||

|

Cash

|

310,255

|

|||

|

Receivables:

|

||||

|

Dividends and interest

|

5,683

|

|||

|

From investment adviser

|

1,968

|

|||

|

Prepaid expenses

|

7,865

|

|||

|

Total Assets

|

5,971,517

|

|||

|

LIABILITIES

|

||||

|

Payables:

|

||||

|

Foreign capital gains tax payable

|

8,029

|

|||

|

Accrued Liabilities:

|

||||

|

Fund services fees

|

7,101

|

|||

|

Other expenses

|

26,697

|

|||

|

Total Liabilities

|

41,827

|

|||

|

NET ASSETS

|

$

|

5,929,690

|

||

|

COMPONENTS OF NET ASSETS

|

||||

|

Paid-in capital

|

$

|

5,959,338

|

||

|

Distributions in excess of net investment income

|

(544,611

|

)

|

||

|

Accumulated net realized loss

|

(308,107

|

)

|

||

|

Net unrealized appreciation

|

823,070

|

|||

|

NET ASSETS

|

$

|

5,929,690

|

||

|

SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED)

|

638,904

|

|||

|

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE*

|

$

|

9.28

|

||

| * |

Shares redeemed or exchanged within 90 days of purchase are charged a 1.50% redemption fee.

|

NWS INTERNATIONAL PROPERTY FUND

|

INVESTMENT INCOME

|

||||

|

Dividend income (Net of foreign withholding taxes of$13,754)

|

$

|

162,787

|

||

|

Interest income

|

1,621

|

|||

|

Total Investment Income

|

164,408

|

|||

|

EXPENSES

|

||||

|

Investment adviser fees

|

41,679

|

|||

|

Fund services fees

|

98,337

|

|||

|

Custodian fees

|

10,417

|

|||

|

Registration fees

|

10,018

|

|||

|

Professional fees

|

25,157

|

|||

|

Trustees’ fees and expenses

|

2,199

|

|||

|

Other expenses

|

20,167

|

|||

|

Total Expenses

|

207,974

|

|||

|

Fees waived and expenses reimbursed

|

(152,401

|

)

|

||

|

Net Expenses

|

55,573

|

|||

|

NET INVESTMENT INCOME

|

108,835

|

|||

|

NET REALIZED AND UNREALIZED GAIN (LOSS)

|

||||

|

Net realized gain on:

|

||||

|

Investments (Net of foreign withholding taxes of $6,646)

|

289,625

|

|||

|

Foreign currency transactions

|

523

|

|||

|

Net realized gain

|

290,148

|

|||

|

Net change in unrealized appreciation (depreciation) on:

|

||||

|

Investments

|

772,432

|

|||

|

Deferred foreign capital gains taxes

|

(4,208

|

)

|

||

|

Foreign currency translations

|

323

|

|||

|

Net change in unrealized appreciation (depreciation)

|

768,547

|

|||

|

NET REALIZED AND UNREALIZED GAIN

|

1,058,695

|

|||

|

INCREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

1,167,530

|

||

NWS INTERNATIONAL PROPERTY FUND

|

For the

Year Ended February 28, 2018 |

For the

Year Ended February 28, 2017 |

|||||||

|

OPERATIONS

|

||||||||

|

Net investment income

|

$

|

108,835

|

$

|

82,168

|

||||

|

Net realized gain (loss)

|

290,148

|

(193,324

|

)

|

|||||

|

Net change in unrealized appreciation (depreciation)

|

768,547

|

507,855

|

||||||

|

Increase in Net Assets Resulting from Operations

|

1,167,530

|

396,699

|

||||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM

|

||||||||

|

Net investment income

|

(670,176

|

)

|

(339,897

|

)

|

||||

|

Total Distributions to Shareholders

|

(670,176

|

)

|

(339,897

|

)

|

||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Reinvestment of distributions

|

670,176

|

336,010

|

||||||

|

Redemption of shares

|

(222,268

|

)

|

(318,151

|

)

|

||||

|

Increase in Net Assets from Capital Share Transactions

|

447,908

|

17,859

|

||||||

|

Increase in Net Assets

|

945,262

|

74,661

|

||||||

|

NET ASSETS

|

||||||||

|

Beginning of Year

|

4,984,428

|

4,909,767

|

||||||

|

End of Year (Including line (a))

|

$

|

5,929,690

|

$

|

4,984,428

|

||||

|

SHARE TRANSACTIONS

|

||||||||

|

Reinvestment of distributions

|

73,646

|

42,532

|

||||||

|

Redemption of shares

|

(22,497

|

)

|

(40,069

|

)

|

||||

|

Increase in Shares

|

51,149

|

2,463

|

||||||

|

(a) Distributions in excess of net investment income

|

$

|

(544,611

|

)

|

$

|

(270,300

|

)

|

||

NWS INTERNATIONAL PROPERTY FUND

|

For the Years Ended February 28,

|

March 31,

2015 (a) Through |

|||||||||||

|

2018

|

2017

|

February 29, 2016

|

||||||||||

|

INSTITUTIONAL SHARES

|

||||||||||||

|

NET ASSET VALUE, Beginning of Period

|

$

|

8.48

|

$

|

8.39

|

$

|

10.00

|

||||||

|

INVESTMENT OPERATIONS

|

||||||||||||

|

Net investment income (b)

|

0.18

|

0.14

|

0.05

|

|||||||||

|

Net realized and unrealized gain (loss)

|

1.81

|

0.53

|

(1.23

|

)

|

||||||||

|

Total from Investment Operations

|

1.99

|

0.67

|

(1.18

|

)

|

||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM

|

||||||||||||

|

Net investment income

|

(1.19

|

)

|

(0.58

|

)

|

(0.43

|

)

|

||||||

|

Total Distributions to Shareholders

|

(1.19

|

)

|

(0.58

|

)

|

(0.43

|

)

|

||||||

|

NET ASSET VALUE, End of Period

|

$

|

9.28

|

$

|

8.48

|

$

|

8.39

|

||||||

|

TOTAL RETURN

|

23.69

|

%

|

8.50

|

%

|

(12.09

|

)%(c)

|

||||||

|

RATIOS/SUPPLEMENTARY DATA

|

||||||||||||

|

Net Assets at End of Period (000s omitted)

|

$

|

5,930

|

$

|

4,984

|

$

|

4,910

|

||||||

|

Ratios to Average Net Assets:

|

||||||||||||

|

Net investment income

|

1.96

|

%

|

1.59

|

%

|

0.55

|

%(d)

|

||||||

|

Net expenses

|

1.00

|

%

|

1.00

|

%

|

1.00

|

%(d)

|

||||||

|

Gross expenses (e)

|

3.74

|

%

|

4.41

|

%

|

8.26

|

%(d)

|

||||||

|

PORTFOLIO TURNOVER RATE

|

38

|

%

|

30

|

%

|

17

|

%(c)

|

||||||

|

(a)

|

Commencement of operations.

|

|

(b)

|

Calculated based on average shares outstanding during each period.

|

|

(c)

|

Not annualized.

|

|

(d)

|

Annualized.

|

|

(e)

|

Reflects the expense ratio excluding any waivers and/or reimbursements.

|

NWS GLOBAL PROPERTY FUND

NWS GLOBAL PROPERTY FUND

| • |

Demand for real estate is well-supported. Recent surveys of institutional investors suggest that the future appetite for real estate is increasing despite expectations for lower returns. This is in addition to the current surfeit of capital already committed but not yet invested.

|

| • |

Attractive relative valuation. As compared with other asset classes, real estate securities in particular are trading at levels that are appreciably lower in terms of multiples/valuations. As compared with private real estate, we believe the public companies are priced from 10-50% below the value of their underlying assets.

|

| • |

Retail-oriented companies are oversold. While it is difficult to assess the ultimate impact of ecommerce and Millennial buying habits, all companies that are engaged in the retail sector worldwide are not homogeneous and yet they are priced as if they were.

|

| • |

Dispersion in performance will likely continue, providing opportunities for active management to continue to outperform.

|

| • |

Supply largely in check but pockets of oversupply need to be monitored. Property types with the lowest reproduction costs and fastest time to market like warehouses, self-storage, apartments and retail centers (excluding malls) should be most at risk.

|

| • |

Interest rate increases continue to weigh on the sector. As has been the case in the past, REITs in the US and Australia in particular will trade down as rates are rising - which has been occurring during the past 2 years - and then recover when either economic growth drives rents higher and/or it becomes clear that the rise in interest rates has peaked.

|

NWS GLOBAL PROPERTY FUND

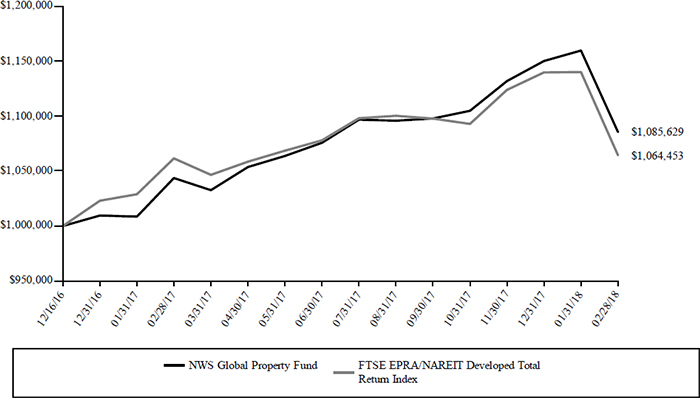

NWS Global Property Fund vs. FTSE EPRA/NAREIT Developed Total Return Index

|

Average Annual Total Returns

Periods Ended February 28, 2018

|

One Year

|

Since Inception 12/16/16

|

|

NWS Global Property Fund

|

4.02%

|

7.07%

|

|

FTSE EPRA/NAREIT Developed Total Return Index

|

0.27%

|

5.33%

|

NWS GLOBAL PROPERTY FUND

|

Shares

|

Security Description | Value | ||||

|

Common Stock - 90.7%

|

||||||

|

Australia - 4.6%

|

||||||

|

66,900

|

Mirvac Group REIT

|

$

|

110,158

|

|||

|

34,800

|

Stockland REIT

|

109,198

|

||||

|

56,900

|

Vicinity Centres REIT

|

109,601

|

||||

|

328,957

|

||||||

|

Belgium - 1.3%

|

||||||

|

1,220

|

VGP NV (a)

|

95,258

|

||||

|

China - 4.1%

|

||||||

|

41,000

|

China Overseas Land & Investment, Ltd.

|

144,073

|

||||

|

42,000

|

China Resources Land, Ltd.

|

150,002

|

||||

|

294,075

|

||||||

|

France - 2.3%

|

||||||

|

5,760

|

Carmila SA REIT

|

167,950

|

||||

|

Germany - 2.4%

|

||||||

|

3,330

|

ADO Properties SA (b)

|

173,798

|

||||

|

Hong Kong - 5.7%

|

||||||

|

24,000

|

Hysan Development Co., Ltd.

|

139,077

|

||||

|

30,000

|

Kerry Properties, Ltd.

|

136,278

|

||||

|

90,531

|

New World Development Co., Ltd.

|

137,892

|

||||

|

413,247

|

||||||

|

Ireland - 1.4%

|

||||||

|

52,800

|

Green REIT PLC

|

98,943

|

||||

|

Japan - 8.9%

|

||||||

|

6,400

|

Aeon Mall Co., Ltd.

|

134,184

|

||||

|

4,200

|

Daiwa House Industry Co., Ltd.

|

156,553

|

||||

|

7,000

|

Mitsui Fudosan Co., Ltd.

|

169,136

|

||||

|

5,000

|

Sumitomo Realty & Development Co., Ltd.

|

182,811

|

||||

|

642,684

|

||||||

|

Netherlands - 2.8%

|

||||||

|

860

|

Unibail-Rodamco SE REIT

|

201,184

|

||||

|

Singapore - 2.2%

|

||||||

|

16,300

|

City Developments, Ltd.

|

157,002

|

||||

|

Spain - 1.6%

|

||||||

|

7,800

|

Merlin Properties Socimi SA REIT

|

111,956

|

||||

|

Sweden - 2.0%

|

||||||

|

6,570

|

Fabege AB

|

142,700

|

||||

|

United Kingdom - 3.9%

|

||||||

|

8,984

|

Great Portland Estates PLC REIT

|

77,673

|

||||

|

4,911

|

Land Securities Group PLC REIT

|

62,674

|

||||

|

6,690

|

The UNITE Group PLC REIT

|

70,135

|

||||

|

15,997

|

Urban & Civic PLC

|

67,170

|

||||

|

277,652

|

||||||

|

United States - 47.5%

|

||||||

|

2,850

|

Agree Realty Corp. REIT

|

134,235

|

||||

|

870

|

AvalonBay Communities, Inc. REIT

|

135,737

|

||||

|

7,750

|

CareTrust REIT, Inc.

|

102,687

|

||||

|

17,440

|

Cousins Properties, Inc. REIT

|

145,450

|

||||

|

2,660

|

DCT Industrial Trust, Inc. REIT

|

147,231

|

||||

|

17,960

|

DDR Corp. REIT

|

140,088

|

||||

|

3,770

|

Douglas Emmett, Inc. REIT

|

134,777

|

||||

|

3,900

|

Education Realty Trust, Inc. REIT

|

121,446

|

||||

|

2,030

|

Equity LifeStyle Properties, Inc. REIT

|

171,758

|

||||

|

1,570

|

Extra Space Storage, Inc. REIT

|

133,529

|

||||

|

7,880

|

Healthcare Trust of America, Inc., Class A REIT

|

195,818

|

||||

|

2,830

|

Highwoods Properties, Inc. REIT

|

121,718

|

||||

|

1,280

|

Life Storage, Inc. REIT

|

100,557

|

||||

|

1,570

|

Mid-America Apartment Communities, Inc. REIT

|

134,737

|

||||

|

2,150

|

National Health Investors, Inc. REIT

|

139,471

|

||||

|

Shares

|

Security Description | Value | |||||

|

United States - 47.5% (continued)

|

|||||||

|

5,306

|

NexPoint Residential Trust, Inc. REIT

|

$

|

127,928

|

||||

|

9,240

|

Paramount Group, Inc. REIT

|

128,898

|

|||||

|

2,615

|

Regency Centers Corp. REIT

|

151,958

|

|||||

|

1,160

|

Simon Property Group, Inc. REIT

|

178,072

|

|||||

|

9,040

|

Summit Hotel Properties, Inc. REIT

|

119,057

|

|||||

|

1,740

|

Sun Communities, Inc. REIT

|

152,354

|

|||||

|

7,690

|

Sunstone Hotel Investors, Inc. REIT

|

110,967

|

|||||

|

3,880

|

Taubman Centers, Inc. REIT

|

226,825

|

|||||

|

4,700

|

Terreno Realty Corp. REIT

|

156,557

|

|||||

|

|

3,411,855

|

||||||

| Total Common Stock (Cost $6,629,170) |

6,517,261

|

||||||

| Investments, at value - 90.7% (Cost $6,629,170) |

$

|

6,517,261

|

|||||

| Other Assets & Liabilities, Net - 9.3% |

665,232

|

||||||

|

Net Assets - 100.0%

|

$

|

7,182,493

|

|||||

|

PLC

|

Public Limited Company

|

|

REIT

|

Real Estate Investment Trust

|

|

(a)

|

Non-income producing security.

|

|

(b)

|

Security exempt from registration under Rule 144A under the Securities Act of 1933. At the period end, the value of these securities amounted to $173,798 or 2.4% of net assets.

|

|

Valuation Inputs

|

Investments in Securities

|

|||

|

Level 1 - Quoted Prices

|

$

|

6,517,261

|

||

|

Level 2 - Other Significant Observable Inputs

|

–

|

|||

|

Level 3 - Significant Unobservable Inputs

|

–

|

|||

|

Total

|

$

|

6,517,261

|

||

|

PORTFOLIO HOLDINGS (Unaudited)

|

|

|

% of Total Net Assets

|

|

|

Australia

|

4.6%

|

|

Belgium

|

1.3%

|

|

China

|

4.1%

|

|

France

|

2.3%

|

|

Germany

|

2.4%

|

|

Hong Kong

|

5.7%

|

|

Ireland

|

1.4%

|

|

Japan

|

8.9%

|

|

Netherlands

|

2.8%

|

|

Singapore

|

2.2%

|

|

Spain

|

1.6%

|

|

Sweden

|

2.0%

|

|

United Kingdom

|

3.9%

|

|

United States

|

47.5%

|

|

Other Assets & Liabilities, Net

|

9.3%

|

|

100.0%

|

|

ASSETS

|

||||

|

Investments, at value (Cost $6,629,170)

|

$

|

6,517,261

|

||

|

Cash

|

1,916,605

|

|||

|

Receivables:

|

||||

|

Fund shares sold

|

985

|

|||

|

Dividends and interest

|

816

|

|||

|

From investment adviser

|

12,269

|

|||

|

Prepaid expenses

|

5,725

|

|||

|

Total Assets

|

8,453,661

|

|||

|

LIABILITIES

|

||||

|

Payables:

|

||||

|

Investment securities purchased

|

1,237,660

|

|||

|

Accrued Liabilities:

|

||||

|

Fund services fees

|

6,150

|

|||

|

Other expenses

|

27,358

|

|||

|

Total Liabilities

|

1,271,168

|

|||

|

NET ASSETS

|

$

|

7,182,493

|

||

|

COMPONENTS OF NET ASSETS

|

||||

|

Paid-in capital

|

$

|

7,334,143

|

||

|

Distributions in excess of net investment income

|

(39,684

|

)

|

||

|

Accumulated net realized loss

|

(354

|

)

|

||

|

Net unrealized depreciation

|

(111,612

|

)

|

||

|

NET ASSETS

|

$

|

7,182,493

|

||

|

SHARES OF BENEFICIAL INTEREST AT NO PAR VALUE (UNLIMITED SHARES AUTHORIZED)

|

701,091

|

|||

|

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE*

|

$

|

10.24

|

||

|

*

|

Shares redeemed or exchanged within 90 days of purchase are charged a 1.50% redemption fee.

|

|

INVESTMENT INCOME

|

||||

|

Dividend income (Net of foreign withholding taxes of $1,458)

|

$

|

30,131

|

||

|

Interest income

|

415

|

|||

|

Total Investment Income

|

30,546

|

|||

|

EXPENSES

|

||||

|

Investment adviser fees

|

7,927

|

|||

|

Fund services fees

|

84,663

|

|||

|

Custodian fees

|

10,174

|

|||

|

Registration fees

|

4,889

|

|||

|

Professional fees

|

30,607

|

|||

|

Trustees' fees and expenses

|

2,011

|

|||

|

Offering costs

|

22,436

|

|||

|

Other expenses

|

18,575

|

|||

|

Total Expenses

|

181,282

|

|||

|

Fees waived and expenses reimbursed

|

(170,943

|

)

|

||

|

Net Expenses

|

10,339

|

|||

|

NET INVESTMENT INCOME

|

20,207

|

|||

|

NET REALIZED AND UNREALIZED GAIN (LOSS)

|

||||

|

Net realized gain on:

|

||||

|

Investments

|

5,728

|

|||

|

Foreign currency transactions

|

694

|

|||

|

Net realized gain

|

6,422

|

|||

|

Net change in unrealized appreciation (depreciation) on:

|

||||

|

Investments

|

(139,353

|

)

|

||

|

Foreign currency translations

|

286

|

|||

|

Net change in unrealized appreciation (depreciation)

|

(139,067

|

)

|

||

|

NET REALIZED AND UNREALIZED LOSS

|

(132,645

|

)

|

||

|

DECREASE IN NET ASSETS RESULTING FROM OPERATIONS

|

$

|

(112,438

|

)

|

|

|

For the

Year Ended February 28, 2018 |

December 16,

2016* Through February 28, 2017 |

|||||||

|

OPERATIONS

|

||||||||

|

Net investment income

|

$

|

20,207

|

$

|

2,885

|

||||

|

Net realized gain

|

6,422

|

1,333

|

||||||

|

Net change in unrealized appreciation (depreciation)

|

(139,067

|

)

|

27,455

|

|||||

|

Increase (Decrease) in Net Assets Resulting from Operations

|

(112,438

|

)

|

31,673

|

|||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM

|

||||||||

|

Net investment income

|

(67,043

|

)

|

(2,554

|

)

|

||||

|

Net realized gain

|

(1,288

|

)

|

–

|

|||||

|

Total Distributions to Shareholders

|

(68,331

|

)

|

(2,554

|

)

|

||||

|

CAPITAL SHARE TRANSACTIONS

|

||||||||

|

Sale of shares

|

6,548,542

|

718,161

|

||||||

|

Reinvestment of distributions

|

65,075

|

2,365

|

||||||

|

Increase in Net Assets from Capital Share Transactions

|

6,613,617

|

720,526

|

||||||

|

Increase in Net Assets

|

6,432,848

|

749,645

|

||||||

|

NET ASSETS

|

||||||||

|

Beginning of Year

|

749,645

|

–

|

||||||

|

End of Year (Including line (a))

|

$

|

7,182,493

|

$

|

749,645

|

||||

|

SHARE TRANSACTIONS

|

||||||||

|

Sale of shares

|

623,045

|

71,816

|

||||||

|

Reinvestment of distributions

|

5,992

|

238

|

||||||

|

Increase in Shares

|

629,037

|

72,054

|

||||||

|

(a) Undistributed (distributions in excess of ) net investment income

|

$

|

(39,684

|

)

|

$

|

355

|

|||

|

*

|

Commencement of operations.

|

|

For the

Year Ended February 28, 2018 |

December 16,

2016 (a) Through February 28, 2017 |

|||||||

|

INSTITUTIONAL SHARES

|

||||||||

|

NET ASSET VALUE, Beginning of Period

|

$

|

10.40

|

$

|

10.00

|

||||

|

INVESTMENT OPERATIONS

|

||||||||

|

Net investment income (b)

|

0.20

|

0.04

|

||||||

|

Net realized and unrealized gain

|

0.25

|

(c)

|

0.40

|

|||||

|

Total from Investment Operations

|

0.45

|

0.44

|

||||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM

|

||||||||

|

Net investment income

|

(0.60

|

)

|

(0.04

|

)

|

||||

|

Net realized gain

|

(0.01

|

)

|

–

|

|||||

|

Total Distributions to Shareholders

|

(0.61

|

)

|

(0.04

|

)

|

||||

|

NET ASSET VALUE, End of Period

|

$

|

10.24

|

$

|

10.40

|

||||

|

TOTAL RETURN

|

4.02

|

%

|

4.37

|

%(d)

|

||||

|

RATIOS/SUPPLEMENTARY DATA

|

||||||||

|

Net Assets at End of Period (000s omitted)

|

$

|

7,182

|

$

|

750

|

||||

|

Ratios to Average Net Assets:

|

||||||||

|

Net investment income

|

1.91

|

%

|

1.98

|

%(e)

|

||||

|

Net expenses

|

0.98

|

%

|

1.00

|

%(e)

|

||||

|

Gross expenses (f)

|

17.15

|

%

|

33.40

|

%(e)

|

||||

|

PORTFOLIO TURNOVER RATE

|

27

|

%

|

17

|

%(d)

|

||||

|

(a)

|

Commencement of operations.

|

|

(b)

|

Calculated based on average shares outstanding during each period.

|

|

(c)

|

Per share amount does not accord with the amount reported in the statement of operations due to the timing of Fund share sales and the amount per share of realized and unrealized gains and losses at such time.

|

|

(d)

|

Not annualized.

|

|

(e)

|

Annualized.

|

|

(f)

|

Reflects the expense ratio excluding any waivers and/or reimbursements.

|

NWS FUNDS

NWS FUNDS

NWS FUNDS

NWS FUNDS

|

Investment

Adviser Fees Waived |

Investment

Adviser Expenses Reimbursed |

Other Waivers

|

Total Fees Waived and Expenses Reimbursed

|

|||||||||||||

|

NWS International Property Fund

|

$

|

41,679

|

$

|

98,722

|

$

|

12,000

|

$

|

152,401

|

||||||||

|

NWS Global Property Fund

|

7,927

|

151,016

|

12,000

|

170,943

|

||||||||||||

|

Purchases

|

Sales

|

|||||||

|

NWS International Property Fund

|

$

|

1,990,528

|

$

|

2,050,752

|

||||

|

NWS Global Property Fund

|

6,323,773

|

369,887

|

||||||

|

Tax Cost of Investments

|

Gross Unrealized Appreciation

|

Gross Unrealized Depreciation

|

Net Unrealized Appreciation(Depreciation)

|

|||||||||||||

|

NWS International Property Fund

|

$

|

5,575,940

|

$

|

220,387

|

$

|

(150,581

|

)

|

$

|

69,806

|

|||||||

|

NWS Global Property Fund

|

6,691,882

|

97,399

|

(272,020

|

)

|

(174,621

|

)

|

||||||||||

|

|

Ordinary Income

|

Long-Term

Capital Gain |

Total

|

|||||||||

| NWS International Property Fund | ||||||||||||

|

2018

|

$

|

670,176

|

$

|

-

|

$

|

670,176

|

||||||

|

2017

|

339,897

|

-

|

339,897

|

|||||||||

|

NWS Global Property Fund

|

||||||||||||

|

2018

|

68,155

|

176

|

68,331

|

|||||||||

|

2017

|

2,554

|

-

|

2,554

|

|||||||||

NWS FUNDS

|

Undistributed Ordinary Income

|

Capital and Other Losses

|

Unrealized Appreciation(Depreciation)

|

Total

|

|||||||||||||

|

NWS International Property Fund

|

$

|

198,949

|

$

|

(290,765

|

)

|

$

|

62,168

|

$

|

(29,648

|

)

|

||||||

|

NWS Global Property Fund

|

24,953

|

(1,513

|

)

|

(175,090

|

)

|

(151,650

|

)

|

|||||||||

|

Undistributed Net Investment Income

|

Accumulated Net Realized Loss

|

|||||||

|

NWS International Property Fund

|

$

|

287,030

|

$

|

(287,030

|

)

|

|||

|

NWS Global Property Fund

|

6,797

|

(6,797

|

)

|

|||||

NWS FUNDS

NWS FUNDS

NWS FUNDS

|

Beginning

Account Value September 1, 2017 |

Ending

Account Value February 28, 2018 |

Expenses Paid

During Period* |

Annualized

Expense Ratio* |

|

|

NWS International Property Fund

|

||||

|

Actual

|

$1,000.00

|

$1,082.46

|

$5.16

|

1.00%

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,019.84

|

$5.01

|

1.00%

|

|

NWS Global Property Fund

|

||||

|

Actual

|

$1,000.00

|

$990.63

|

$4.74

|

0.96%

|

|

Hypothetical (5% return before expenses)

|

$1,000.00

|

$1,020.03

|

$4.81

|

0.96%

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (181) divided by 365 to reflect the half-year period.

|

NWS FUNDS

|

Name and

Year of Birth |

Position with

the Trust |

Length of

Time Served |

Principal Occupation(s)

During Past Five Years |

Number of Series in Fund Complex Overseen By Trustee

|

Other Directorships Held By Trustee During Past Five Years

|

|

Independent Trustees

|

|||||

|

David Tucker

Born: 1958

|

Chairman of the Board; Trustee; Chairman, Nominating Committee and Qualified Legal Compliance Committee

|

Since 2013

|

Director, Blue Sky Experience (a charitable endeavor), since 2008; Senior Vice President & General Counsel, American Century Companies (an investment management firm), 1998-2008.

|

2

|

Trustee, Forum Funds; Trustee, Forum ETF Trust; Trustee, U.S. Global Investors Funds.

|

|

Mark D. Moyer

Born: 1959

|

Trustee; Chairman Audit

Committee

|

Since 2013

|

Chief Financial Officer, Freedom House (a NGO advocating political freedom and democracy), since 2017; independent consultant providing interim CFO services, principally to non-profit organizations, 2011-2017; Chief Financial Officer, Institute of International Education (a NGO administering international educational exchange programs), 2008-2011;

Chief Financial Officer and Chief Restructuring Officer, Ziff Davis Media Inc. (an integrated media company), 2005-2008; Adjunct Professor of Accounting, Fairfield University from 2009-2012.

|

2

|

Trustee, Forum Funds; Trustee, Forum ETF Trust; Trustee, U.S. Global Investors Funds.

|

|

Jennifer

Brown-Strabley

Born: 1964

|

Trustee

|

Since 2013

|

Principal, Portland Global Advisors 1996-2010.

|

2

|

Trustee, Forum Funds; Trustee, Forum ETF Trust; Trustee, U.S. Global Investors Funds.

|

|

Interested Trustees(1)

|

|||||

|

Stacey E. Hong

Born: 1966

|

Trustee

|

Since 2013

|

President, Atlantic since 2008

|

2

|

Trustee, Forum Funds, Trustee, U.S. Global Investors Funds.

|

|

John Y. Keffer

Born: 1942

|

Trustee

|

Since 2013

|

Chairman, Atlantic since 2008; Chairman, Forum Investment Advisors, LLC since 2011; President, Forum Foundation (a charitable organization) since 2005; President, Forum Trust, LLC (a non-depository trust company chartered in the State of Maine) since 1997.

|

2

|

Trustee Forum ETF Trust; Trustee U.S. Global Investors Funds; Director, Wintergreen Fund, Inc.

|

|

(1)

|

Stacey E. Hong and John Y. Keffer are currently treated as an interested persons of the Trust, as defined in the 1940 Act, due to their affiliations with Atlantic. Atlantic and Forum Investment Advisors, LLC are subsidiaries of Forum Holdings Corp. I, a Delaware corporation that is wholly owned by Mr. Keffer.

|

NWS FUNDS

|

Name and Year of Birth

|

Position with the Trust

|

Length of

Time Served |

Principal Occupation(s)

During Past 5 Years |

|

Officers

|

|||

|

Jessica Chase

Born: 1970

|

President; Principal Executive Officer

|

Since 2015

|

Senior Vice President, Atlantic since 2008.

|

|

Karen Shaw

Born: 1972

|

Treasurer; Principal Financial Officer

|

Since 2013

|

Senior Vice President, Atlantic since 2008.

|

|

Zachary Tackett

Born: 1988

|

Vice President; Secretary and Anti- Money Laundering Compliance Officer

|

Since 2014

|

Counsel, Atlantic since 2014; Intern Associate, Coakley & Hyde, PLLC, 2010-2013.

|

|

Timothy Bowden

Born: 1969

|

Vice President

|

Since 2013

|

Manager, Atlantic since 2008.

|

|

Michael J. McKeen

Born: 1971

|

Vice President

|

Since 2013

|

Senior Vice President, Atlantic since 2008.

|

|

Geoffrey Ney

Born: 1975

|

Vice President

|

Since 2013

|

Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013.

|

|

Todd Proulx

Born: 1978

|

Vice President

|

Since 2013

|

Manager, Atlantic since 2013; Senior Fund Accountant, Atlantic, 2008-2013.

|

|

Carlyn Edgar

Born: 1963

|

Chief Compliance Officer

|

Since 2013

|

Senior Vice President, Atlantic since 2008.

|

NWS GLOBAL PROPERTY FUND

|

(a)

|

As of the end of the period covered by this report, Forum Funds II (the "Registrant") has adopted a code of ethics, which applies to its Principal Executive Officer and Principal Financial Officer (the "Code of Ethics").

|

| (c) |

There have been no amendments to the Registrant's Code of Ethics during the period covered by this report.

|

|

(a)

|

Included as part of report to shareholders under Item 1.

|

|

(b)

|

Not applicable.

|

|

By

|

/s/ Jessica Chase | |

|

Jessica Chase, Principal Executive Officer

|

||

|

Date

|

April 26, 2018 |

|

By

|

/s/ Jessica Chase | |

|

Jessica Chase, Principal Executive Officer

|

||

|

Date

|

April 26, 2018 |

|

By

|

/s/ Karen Shaw | |

|

Karen Shaw, Principal Financial Officer

|

||

|

Date

|

April 26, 2018 |