UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| WHO WE ARE |  | ||

| SiriusPoint is a global underwriter of insurance and reinsurance, headquartered in Bermuda. Our common shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “SPNT.” As of December 31, 2023, we had common shareholders’ equity of $2.3 billion, total capital of $3.3 billion and total assets of $12.9 billion. Our operating companies have a financial strength rating of A- (Stable) from AM Best, A- (Stable) from Standard & Poor's and A- (Stable) from Fitch. On March 22, 2023, Fitch Ratings revised our outlook from negative to stable and on November 9, 2023, Standard & Poor’s revised our outlook from negative to stable as both rating agencies highlighted improvement in underwriting performance. For more information, please visit www.siriuspt.com. | |||

OUR PURPOSE • Providing security and resilience in an uncertain world |

OUR VISION • Being a best-in-class insurer and re-insurer utilizing deep risk expertise to protect our customers. • Blending our talent, expertise, and data to provide intelligent risk solutions. |

OUR VALUES • Integrity: Integrity, respect and trust are our core principles • Customer-Focused: Our customers are the reason we exist • Solutions Driven: Creating solutions is our mindset • Diversity: Diversity makes us stronger • Collaboration: Collaboration drives out-performance | |||||||||||||||

Our 2024 Annual General Meeting

Dear Fellow Shareholders,

On behalf of the Board of Directors, it is my pleasure to invite you to attend the 2024 Annual General Meeting (the “Annual General Meeting”) of SiriusPoint Ltd. The meeting will be held in a virtual format on Monday, May 20, 2024, beginning at 10:00 a.m. (Atlantic Daylight Time). The meeting will be conducted via a live audio webcast at www.meetnow.global/MAHXJL7, where you will be able to vote electronically and submit questions during the meeting.

Your vote is important, and all shareholders are cordially invited to attend the Annual General Meeting virtually. Details are in the attached proxy statement. Whether or not you plan to attend the Annual General Meeting, you are encouraged to submit your proxy as soon as possible.

Our Board is deeply committed to the company, its shareholders, and enhancing shareholder value. We look forward to your participation at the Annual General Meeting. Thank you for your support of SiriusPoint Ltd.

Sincerely,

/s/ SCOTT EGAN Chief

Executive Officer & |

April 9, 2024

Safe Harbor Statement Regarding Forward-Looking Statements

This letter and the accompanying proxy statement include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding future plans and profitability and environmental, social and governance plans and goals. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. We caution you that forward-looking information is not a guarantee of future events, and that actual events may differ materially from those made in or suggested by the forward-looking information contained in this letter and the accompanying proxy statement. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “plan,” “objective,” “seek,” “will,” “expect,” “intend,” “estimate,” “target,” “aim,” “anticipate,” “believe” or “continue” or the negative thereof or variations thereon or similar terminology. Actual events, results and outcomes may differ materially from our expectations due to a variety of known and unknown risks, uncertainties and other factors. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements are the risk factors listed in our most recent Annual Report on Form 10-K and subsequent periodic and current disclosures filed with the Securities and Exchange Commission. All forward-looking statements speak only as of the date made and we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information or otherwise.

SiriusPoint Ltd. | Point Building | 3 Waterloo Lane | Pembroke HM 08, Bermuda

1 (441) 542-3333 | siriuspt.com

| NOTICE OF 2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS OF SIRIUSPOINT LTD. | |||||||||

|

WHEN |  |

VIRTUAL WEBCAST |  |

RECORD DATE | ||||

Monday, May 20, 2024 10:00 a.m. Atlantic Daylight Time |

Via live audio webcast at www.meetnow.global/MAHXJL7 | Thursday, April 4, 2024 | |||||||

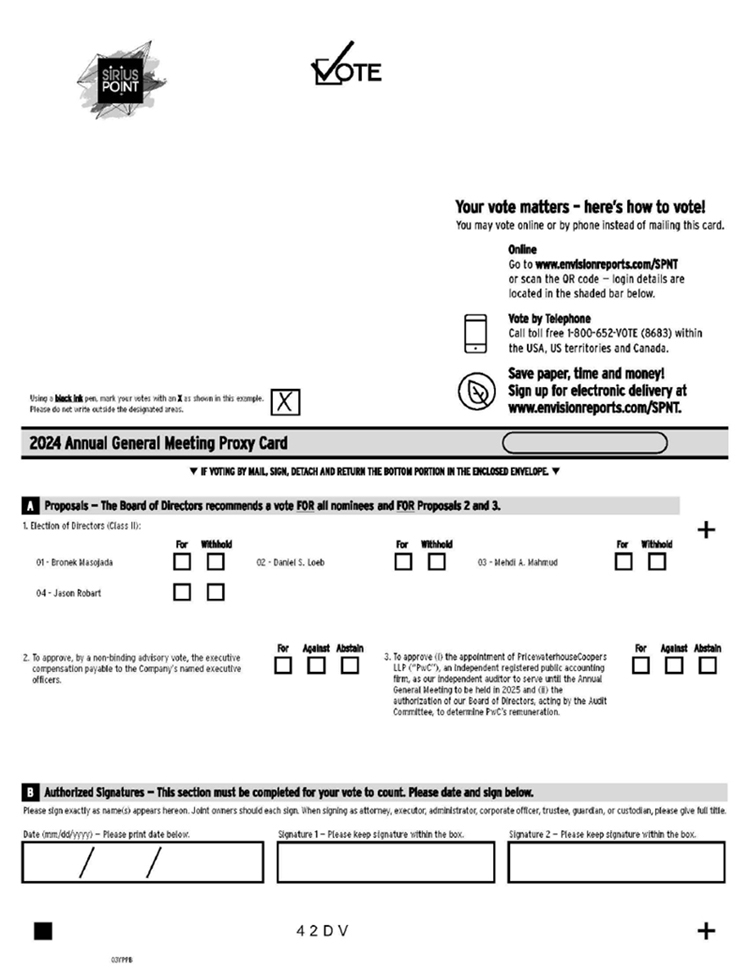

| ITEMS OF BUSINESS | BOARD RECOMMENDATIONS | |||||||

| 1 | Election of four Class II director nominees named in this proxy statement for election to a 3-year term, expiring in 2027: |  |

FOR | each nominee | ||||

● Bronek Masojada ● Daniel S.

Loeb |

||||||||

| 2 | Approval, by a non-binding advisory vote, of the executive compensation payable to the Company’s NEOs (Say-on-Pay) |  |

FOR | |||||

| 3 | Approval of: (i)

the appointment of PwC as our independent auditor, to serve until the Annual General Meeting to be held in 2025; and |

|

FOR | |||||

| 4 | Transaction of any other business as may properly come before the Annual General Meeting and any adjournments or postponements thereof |

|||||||

Our audited financial statements as of and for the year ended December 31, 2023, as approved by our Board of Directors, will be presented at the 2024 Annual General Meeting, pursuant to the provisions of the Companies Act 1981 of Bermuda, as amended, and the Bye-laws of SiriusPoint Ltd. (the “Company,” “SiriusPoint,” “we,” “our” or “us”).

Shareholders of record at the close of business on April 4, 2024, are entitled to notice of and to vote at the Annual General Meeting and any adjournments or postponements thereof.

Even if you plan to attend the Annual General Meeting virtually, you are encouraged to submit your proxy as soon as possible. You may vote your shares by internet, telephone or mail pursuant to the instructions included in the proxy card or voting instruction form. If you attend the Annual General Meeting virtually and want to revoke your previously submitted proxy, you may do so as described in the accompanying proxy statement and vote during the meeting on all matters properly brought before the Annual General Meeting.

If you hold shares beneficially in street name, you may direct your vote in the manner prescribed by your broker, bank or other nominee or you may vote during the Annual General Meeting. Please refer to the voting instruction form included by your broker, bank or nominee.

| NOTICE OF 2024 ANNUAL GENERAL MEETING OF SHAREHOLDERS OF SIRIUSPOINT LTD. | ||

You can find detailed information regarding voting in the section entitled “General Information” in the accompanying proxy statement.

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 20, 2024 |

By Order of the Board of Directors,

/s/ LINDA S. LIN Chief Legal Officer and Corporate Secretary April 9, 2024 Pembroke, Bermuda | |

| The Company’s notice of the Annual General Meeting, proxy statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2023, are available on: www.edocumentview.com/SPNT. |

| TABLE OF CONTENTS | ||

TABLE OF CONTENTS

| PROXY SUMMARY | ||

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information you should consider before voting. You should read the entire proxy statement carefully for a full understanding of the matters to be presented at the upcoming Annual General Meeting. Please note that information available on our website is not incorporated by reference into this proxy statement. We mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) to each shareholder entitled to vote at the Annual General Meeting on or about April 9, 2024. The Notice contains instructions on how to access the proxy materials on the internet, how to vote online or by telephone and, if desired, how to receive a printed set of the proxy materials.

2024 ANNUAL GENERAL MEETING

|

WHEN |

|

VIRTUAL WEBCAST |

|

RECORD DATE | ||||||||||||||||||

| Monday,

May 20, 2024 10:00 a.m., Atlantic Daylight Time |

Via live audio webcast at www.meetnow.global/MAHXJL7 |

April 4, 2024 | |||||||||||||||||||||

| 1 | Election of four Class II director nominees named in this proxy statement for election to a 3-year term, expiring in 2027: |

|

FOR

each

|

11 | ||||||||||||||||||||||

• Bronek Masojada • Daniel S. Loeb • Mehdi A. Mahmud • Jason Robart |

||||||||||||||||||||||||||

| 2 | Approval, by a non-binding advisory vote, of the executive compensation payable to the Company’s NEOs (Say-on-Pay) |

|

FOR | 52 | ||||||||||||||||||||||

| 3 | Approval of: (i) the appointment of PwC as our independent auditor, to serve until the Annual General Meeting to be held in 2025; and (ii) the authorization of our Board of Directors, acting by the Audit Committee, to determine PwC’s remuneration |

|

FOR | 98 | ||||||||||||||||||||||

| 4 | Transaction of any other business as may properly come before the Annual General Meeting and any adjournments or postponements thereof |

|

FOR | 100 | ||||||||||||||||||||||

1

|

HOW TO VOTE |

Your vote is important. Even if you plan to attend the meeting virtually, we encourage you to vote as soon as possible using one of the following methods. Have your proxy card or voting instruction form with the control number provided and follow the instructions.

| INTERNET | TELEPHONE | MOBILE DEVICE | AT THE MEETING | ||

| Registered Holders (your shares are held directly with our transfer agent, Computershare) | envisionreports.com/SPNT 24/7 |

Within the United States and Canada, 1-800-652-VOTE (8683) (toll-free, 24/7) |

Scan the QR code on page 115 of this Proxy Statement | Return a properly executed proxy card | Attend the Annual General Meeting virtually and cast your ballot |

| Beneficial

Owners (holders in street name) |

www.proxyvote.com 24/7 |

Within

the United States and Canada, 1-800-454-8683 (toll-free, 24/7) |

Scan the QR code on page 115 of this Proxy Statement | Return a properly executed voting instruction form, depending upon the method(s) your broker, bank or other nominee makes available | To attend the annual general meeting virtually, you will need proof of ownership and a legal proxy from your broker, bank or other nominee |

2

ABOUT SIRIUSPOINT

| We are a global underwriter of insurance and reinsurance, headquartered in Bermuda. Our common shares are listed on the New York Stock Exchange (“NYSE”) under the symbol “SPNT.” As of December 31, 2023, we had common shareholders’ equity of $2.3 billion, total capital of $3.3 billion and total assets of $12.9 billion. |

| Our operating companies have a financial strength rating of A- (Stable) from AM Best, Standard & Poor’s (“S&P”) and Fitch. During the fiscal year ended December 31, 2023, both Fitch Ratings and S&P revised our outlook from negative to stable, highlighting our improvement in underwriting performance. AM Best affirmed our financial strength rating and outlook on April 19, 2023. On January 29, 2024, S&P removed our holding company, SiriusPoint Ltd., from CreditWatch. On March 19, 2024, Moody’s Ratings (“Moody’s”) has assigned A3 insurance financial strength (IFS) ratings to the Company’s principal operating subsidiaries and affirmed that the outlook for the SiriusPoint entities is stable. |

| We have licenses to write property, casualty and accident & health insurance and reinsurance globally, including admitted & non-admitted licensed companies in the United States, a Bermuda Class 4 company, a Lloyd’s of London syndicate and managing agency, and an internationally licensed company domiciled in Sweden. |

| Our business model remains unique and diversified as we continue to benefit from three earnings sources: (i) underwriting results; (ii) services fee income from the Managing General Agents (“MGAs”) we consolidate; and (iii) investment results. |

| Our approach is to be nimble and reactive to market opportunities within our segments of Insurance & Services and Reinsurance, allocating capital where we see profitable opportunity, while remaining disciplined and consistent within our specified risk tolerances and areas of expertise. |

| Our vision for SiriusPoint is to be recognized as a best-in-class insurer and reinsurer, utilizing deep risk capabilities to protect our customers, and blending our talent, expertise and data to provide intelligent risk solutions. |

| Integrity, respect and trust are our core principles. |

| We are customer focused because they are the reason we exist and we are solution driven; creating solutions is our mindset. |

| Diversity and collaboration are part of our core values. We believe that diversity makes us stronger and collaboration drives outperformance. |

3

OUR BUSINESS SEGMENTS

SiriusPoint reports on two operating segments: Reinsurance and Insurance & Services. Within our segments, we underwrite a variety of (re)insurance products. These are:

| Reinsurance | |

| Casualty | The Company provides reinsurance to casualty insurers who underwrite a diverse range of casualty classes. The Company works with clients all over the world, including multi-national, nationwide and regional carriers, as well as risk retention groups and captives. The Company also partners with managing general agents (“MGAs”) and sponsor cover holders. The Company’s underwriting focus is on proportional transactions covering all major commercial casualty lines, as well professional liability with an emphasis on specialty niche classes of business, including personal lines. |

| Property | The Company works with leading global brokers as well as large national writers and regional companies. Underwriting is focused on providing critical catastrophe protection and worldwide coverage for natural perils, underwriting residential, commercial, and industrial risks in the United States, Europe and Asia. The Company’s property reinsurance offering includes: property catastrophe protection, risk excess of loss, cannabis - pro rata, building risk and structured property specifically in the United States. In 2023, as a part of its International Reorganization, the Company significantly reduced its in international property catastrophe premiums written, with reinsurance protection purchased at similar costs but with lower attachment points to further protect the balance sheet. |

| Specialty | SiriusPoint’s business encompasses a broad range of worldwide reinsurance coverages, including proportional and excess of loss, treaty and facultative. Specialty business lines in the Reinsurance segment include Aviation & Space, Marine & Energy and Credit. |

| Insurance & Services | |

| Accident

& Health |

The Company provides flexible insurance products to meet the risk management needs of diverse populations in select markets. This includes employer groups, associations, affinity groups, higher education and other niche markets. The Company also owns 100% of IMG and Armada, who receive fees for services provided within Insurance & Services and to third parties. IMG offers a full line of international medical insurance products, trip cancellation programs, medical management services and 24/7 emergency medical and travel assistance. Armada operates as a supplemental medical insurance MGA. |

| Property

& Casualty |

The Company is a leading carrier for program administrators and managing general agents. The majority of its insurance business is written through partners in the property and casualty space, covering professional liability, workers’ compensation, and commercial auto lines in Bermuda, London, Europe, North America and round the world. |

| Specialty | SiriusPoint’s business encompasses a broad range of worldwide insurance coverages. Specialty business lines in the Insurance & Services segment include Aviation & Space, Marine & Energy, Credit and Mortgage. |

4

BOARD OF DIRECTORS OVERVIEW

| COMMITTEE MEMBERSHIP | ||||||||||||||||||

| GOVERNANCE | ||||||||||||||||||

| DIRECTOR AND | DIRECTOR | & | RISK & CAPITAL | |||||||||||||||

| PRINCIPAL OCCUPATION | AGE | SINCE | INDEPENDENT | AUDIT | COMPENSATION | NOMINATING | INVESTMENT | MANAGEMENT | ||||||||||

| CLASS II DIRECTORS, NOMINEES FOR ELECTION, TERMS EXPIRING IN 2027 | ||||||||||||||||||

|

Daniel S. Loeb | |||||||||||||||||

| Chief Executive | ||||||||||||||||||

| Officer, Third Point LLC | 62 | 2022 | ||||||||||||||||

|

Mehdi A. Mahmud |  |

|

|

|

|||||||||||||

| President and CEO, | ||||||||||||||||||

| First Eagle Investment | 51 | 2020 | ||||||||||||||||

| Management; and | ||||||||||||||||||

| President, First Eagle | ||||||||||||||||||

| Funds | ||||||||||||||||||

|

Jason Robart |  |

|

|

|

|||||||||||||

| Co-Founder and | ||||||||||||||||||

| Managing Partner of | 58 | 2022 | ||||||||||||||||

| Seae Ventures | ||||||||||||||||||

|

Bronek Masojada

|

|

|

|

| |||||||||||||

| Chair, Saltus Group | ||||||||||||||||||

| 62 | 2023 | |||||||||||||||||

| CLASS III DIRECTORS, TERMS EXPIRING 2025 | ||||||||||||||||||

|

Scott Egan | |||||||||||||||||

| Chief Executive | ||||||||||||||||||

| Officer, SiriusPoint | 52 | 2022 | ||||||||||||||||

|

Rafe de la Gueronniere |  |

|

|

||||||||||||||

| Former Vice Chair, | ||||||||||||||||||

| New Providence Asset | 71 | 2013 | ||||||||||||||||

| Management | ||||||||||||||||||

|

Sharon M. Ludlow |  |

|

|

| |||||||||||||

| Former President, | ||||||||||||||||||

| Aviva Insurance | 57 | 2021 | ||||||||||||||||

| Company of Canada | ||||||||||||||||||

| CLASS I DIRECTORS, TERMS EXPIRING IN 2026 | ||||||||||||||||||

|

Franklin (Tad) |  |

|

|

| |||||||||||||

| Montross IV | ||||||||||||||||||

| Former Chairman and | 68 | 2021 | ||||||||||||||||

| CEO, General Re | ||||||||||||||||||

| Corporation | ||||||||||||||||||

|

Peter Wei Han Tan |  |

| |||||||||||||||

| Chairman, Skandia | ||||||||||||||||||

| Mexico and Columbia | 51 | 2021 | ||||||||||||||||

|

Committee Chair |

|

Committee Member |

|

Chair

of the Board |

|

Independent Director |

|

Audit

Committee financial expert |

5

DIRECTOR ATTRIBUTES

Our board of directors (the “Board”) is comprised of nine directors, six of whom are independent. We believe our Board is well-balanced, reflecting diversity by age, gender, viewpoints, work experience, skills and expertise and race/ethnicity, including one director that identifies as African-American, two directors that identify as Asian, and one woman director. Our directors come from a variety of industries and have served in senior management and leadership positions, such as founders of companies, CEOs, CFOs, chief strategy officers and insurance industry executives. The Board has focused on identifying and appointing new directors with diverse skill sets to advise the Company as it focuses on creating a fully integrated, globally connected “One SiriusPoint”.

BOARD REFRESHMENT

We have added seven new directors to our Board since 2021, including one woman and three diverse men. Our annual Board evaluation process and director retirement policy at age 75 facilitates regular Board refreshment. On June 2, 2023, Bronek Masojada was appointed Chair of our Board. Mr Masojada, who joined the Board on May 2, 2023, is an insurance market veteran with over 30 years’ leadership experience in the industry.

| 2023 | 2022 | 2021 |

|

|

|

| 1 new director joined | 3 new directors joined | 3 new directors joined |

| ● Bronek Masojada | ● Scott Egan ● Daniel S. Loeb ● Jason Robart |

● Franklin (Tad) Montross IV ● Sharon M. Ludlow ● Peter Wei Han Tan |

6

CORPORATE GOVERNANCE HIGHLIGHTS

CORPORATE GOVERNANCE POLICIES AND PRACTICES

CORPORATE GOVERNANCE BEST PRACTICES

| Board Structure and Independence | |

|

Six of our nine directors are independent, including all committee chairs |

|

33% of our directors are women or ethnically/racially diverse |

|

Balance of new and experienced directors and elected three new directors in 2021, three new directors in 2022 and one new director in 2023 |

|

Highly skilled directors with diverse experience and backgrounds that provide a range of viewpoints and |

|

The Compensation Committee oversees the Company’s strategies related to diversity, equity and inclusion initiatives and key talent metrics |

|

Regular executive sessions of independent directors at each regularly scheduled Board meeting without management present |

|

Annual director self-evaluation and committee assessment to ensure Board effectiveness |

|

Annual Board evaluation and external Board assessment every third year |

|

In 2023, all directors attended 100% of Board and committee meetings |

| Board Oversight | |

|

Oversees the Company’s annual business plan and corporate strategy |

|

Director access to experts and advisors, both internal and external |

|

Strong risk management overseen by a separate Risk & Capital Management Committee |

|

Dedicated oversight over cybersecurity risk by Risk & Capital Management Committee |

|

Proactive, comprehensive and strategic Board and senior management succession planning |

|

The Governance and Nominating Committee oversees Sustainability matters |

|

Annual dedicated meeting focused on Company strategy |

|

Annual review of all corporate governance policies and committee charters to include best practices |

| Strong Corporate Governance Practices | |

|

Prohibition on hedging and pledging transactions by executive officers and directors |

|

Policy on public company board service resulting in no overboarded directors |

|

Code of Business Conduct and Ethics with annual certification requirement |

|

Director continuing education opportunities |

|

Director retirement policy at age 75 |

|

Active and ongoing shareholder engagement |

|

Clawback policy for senior executives |

|

Risk assessment of executive compensation program, policies and practices |

|

Commitment to Sustainability |

|

Share ownership requirements for senior executives and directors |

| Our corporate governance documents, including charters of our Audit, Compensation, Governance and Nominating, Risk and Capital Management and Investment Committees, Code of Business Conduct and Ethics, Corporate Governance Guidelines, Board of Directors Communications Policy, Environmental Policy Statement, Related Person Transaction Policy, Vendor Code of Conduct and Whistleblower Polices are available on our website: investors.siriuspt.com/governance/governance-documents. |

7

CORPORATE SOCIAL RESPONSIBILITY AND SUSTAINABILITY

At SiriusPoint, our purpose is to provide security and resilience in an uncertain world. We aim to be a best-in-class insurer and reinsurer, utilizing deep risk expertise to protect our customers, and blending our talent, expertise and data to provide intelligent risk solutions. As we work to create value, making a positive social and environmental impact is important to us. We aim to reflect sound risk management, good governance and environmental and social responsibility throughout our company culture and operations. The Governance and Nominating Committee oversees our policies, practices and disclosures relating to sustainability and receives regular updates on sustainability developments.

The Company’s sustainability journey is discussed further on page 35 For more information about our sustainability initiatives, please see our website, www.siriuspt.

8

EXECUTIVE COMPENSATION HIGHLIGHTS

Our executive compensation program is designed to support the longevity and stability of the Company by driving long-term business outcomes, promoting strong governance practices and encouraging responsible risk-taking. This is achieved by linking individual pay with the Company’s performance on a diverse set of measures, including financial and strategic goals. Most senior executives’ compensation is variable and covers annual and multi-year performance periods. Long-term incentive awards are designed to align executives with the Company’s long-term performance through the use of performance-based restricted share units and time-based restricted share units. Our executive compensation program, including our compensation principles and strategy, is discussed in detail under the Compensation Discussion and Analysis section of this proxy statement.

9

| BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

| PROPOSAL 1 | ELECTION OF DIRECTORS |

| TO ELECT FOUR CLASS II DIRECTORS TO OUR BOARD OF DIRECTORS TO HOLD OFFICE UNTIL THE ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD IN 2027 OR UNTIL THEIR OFFICE SHALL OTHERWISE BE VACATED PURSUANT TO OUR BYE-LAWS | |

Messrs. Bronek Masojada, Daniel S. Loeb, Mehdi A. Mahmud, and Jason Robart have been nominated for election as Class II directors to serve until the annual general meeting of shareholders to be held in 2027. Each director will hold his respective office until his successor has been elected and qualified or until the director’s office shall otherwise be vacated pursuant to our Bye-laws. The proxy will be voted in accordance with the directions thereon or, if no directions are indicated, the proxy will be voted for the election of the four director nominees named above. The Board has proposed and recommended that each nominee be elected to hold office as described above. If any nominee shall, prior to the Annual General Meeting, become unavailable for election as a director, the persons named in the accompanying proxy will vote in their discretion for such nominee, if any, as may be recommended by the Board, or the Board may reduce the number of directors to eliminate the vacancy.

If a quorum is present at the Annual General Meeting, each director will be elected by a plurality of the votes cast in the election of directors at the Annual General Meeting, either in person or represented by properly authorized proxy. This means that the nominees who receive the largest number of “FOR” votes cast will be elected as a director. For further information, see the answers to the questions “What is the quorum requirement for the Annual General Meeting?” and “What is the voting requirement to approve each of the proposals?”

The age, business experience, qualifications and directorships in other companies of each nominee for election are set forth herein under the section entitled “Information Regarding the Class II Director Nominees for Election to the Board.”

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMEND THAT YOU VOTE FOR THE ELECTION OF EACH OF THE CLASS II DIRECTOR NOMINEES TO THE BOARD. |

10

BOARD OF DIRECTORS

Our business and affairs are managed under the direction of the Board which is the Company’s ultimate decision-making body, other than those matters reserved for the Company’s shareholders.

The Board also oversees the Company’s business strategy and planning, as well as the performance of the Company’s management in executing the Company’s business strategy, assessing and managing risks and managing the Company’s day-to-day operations. The size of the Board may be fixed from time to time by our Board as provided in our Bye-laws. The Board currently consists of nine directors. See “―Election and Classification of Directors.”

ELECTION AND CLASSIFICATION OF DIRECTORS

Four Class II directors will be elected at this year’s Annual General Meeting. The Class II directors elected at the Annual General Meeting will serve until the annual general meeting of shareholders to be held in 2027 when each such director’s successor is duly elected and qualified, or any such director’s earlier death, disability, disqualification, resignation or removal.

In accordance with our Bye-laws, the Board is divided into three classes, Class I, Class II and Class III, with members of each class serving staggered three-year terms. At each annual general meeting of shareholders, upon the expiration of the term of a class of directors, the successor to each such director in the class will be elected to serve for a three-year term until the third annual general meeting following his or her election and until his or her successor is duly elected and qualified, in accordance with the Bye-laws. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. For information regarding the applicable voting standards for the election of directors, see the section entitled “Information About the Annual General Meeting and Voting—What is the voting requirement to approve each of the proposals?”

The Board feels strongly that a stable and consistent Board that understands the Company is vital to its transformation and turnaround. The classified board, a feature of corporate governance that has been common for nearly a century, provides enhanced continuity and stability in the Board’s oversight of the implementation of the Company’s new strategy. During this period of transformation, two-thirds of the directors will have had prior experience and familiarity with oversight of the Company’s business and affairs while still annually providing an opportunity for the election of one-third of the Board with new or continuing directors. This structure enables the Board to build on past experience and plan for the transformation and turnaround during a reasonable period into the future. Further, a classified board encourages a long-term focus in overseeing the management of the strategy, business and affairs of the Company, and allows our directors to focus their attention on long-term shareholder value. If directors were up for election every year, they could feel pressure to generate short-term returns, which could be counter-productive in an environment where the Company is focused on a multi-year transformation strategy.

A classified board also fosters board independence as independent board members are provided with time to cultivate an understanding of the Company’s business and operations, making them less reliant on management’s perspective.

11

In addition to providing stability among the directors, a classified board helps the Company attract and retain highly qualified individuals willing to commit the time and resources necessary to understand the Company and its management, operations and competitive environment. In addition, in the event that the Company becomes subject to an unsolicited takeover proposal, a classified board permits greater time and a more orderly process for directors to consider any takeover bids and to explore all alternatives to maximize shareholder value. A classified board also makes it more likely that persons who may seek to acquire control of the Company will initiate such action through negotiations with the Board. By reducing the threat of an abrupt change in the composition of the entire Board, classification of directors provides the Board with an adequate opportunity to fulfill its duties to the Company’s shareholders to review any takeover proposal, study appropriate alternatives and act in the best interests of the Company and its shareholders.

As a result of these factors, the Board has determined that maintaining a classified Board is in the best interests of the Company, its shareholders, clients and employees at this time.

BOARD OF DIRECTORS FOLLOWING THE ANNUAL GENERAL MEETING

Subject to the election of the nominees for Class II directors set forth in Proposal 1, the following table sets forth information regarding individuals who will serve as members of the Board following the Annual General Meeting.

| CLASS I | CLASS II | CLASS III | ||

TERMS EXPIRING AT 2026 ANNUAL GENERAL MEETING |

NOMINEES FOR ELECTION TO TERMS EXPIRING AT THE 2027 ANNUAL GENERAL MEETING |

TERMS EXPIRING AT THE 2025 ANNUAL GENERAL MEETING | ||

| ● Franklin (Tad) Montross IV | ● Bronek Masojada | ● Scott Egan* | ||

| ● Peter Wei Hei Tan | ● Daniel S. Loeb | ● Rafe de la Geuronierre | ||

| ● Mehdi A. Mahmud | ● Sharon Ludlow | |||

| ● Jason Robart | ||||

| * Chief Executive Officer |

12

QUALIFICATIONS

In considering candidates for the Board of Directors, the Governance and Nominating Committee takes into account the Company’s Corporate Governance Guidelines and all other factors deemed appropriate by the Governance and Nominating Committee. The Board seeks members from diverse professional backgrounds who combine a broad spectrum of experience and expertise with a reputation for integrity. The Governance and Nominating Committee will recommend to the Board appropriate criteria for the selection of new directors in accordance with New York Stock Exchange listing standards and based on the strategic needs of the Company and the Board. In evaluating suitability of director candidates and when considering whether to nominate a director for re-election as appropriate, the Governance and Nominating Committee and the Board take into account many factors as approved by the Board from time to time, such as general understanding of various business disciplines (i.e., finance, technology), tenure on the Company’s Board, experience in the Company’s business (reinsurance/ insurance), educational and professional background, analytical ability, independence, diversity of experience, viewpoints and backgrounds, willingness to devote adequate time to Board duties and ability to act in and represent the balanced best interests of the Company and its shareholders as a whole, rather than special constituencies. In selecting directors, the Board requires a diverse candidate pool (including at least two diverse candidates) for all director searches and evaluates a nominee’s experience, gender, race, age, ethnicity, national origin, sexual orientation, skills and other qualities. The Board evaluates each director candidate in the context of the Board as a whole with the objective of retaining a group that is best equipped to help ensure the Company’s success and represent shareholders’ interests through sound judgment. The Governance and Nominating Committee periodically reviews the criteria adopted by the Board and, if deemed desirable, recommends to the Board changes to such criteria.

Our Board exhibits the right skills to constructively challenge management and guide us on our strategy. The chart below highlights the skills and experience of each our highly qualified directors.

13

BOARD SKILLS AND EXPERIENCE

| DIRECTOR QUALIFICATIONS, SKILLS AND EXPERIENCE | |||||||||||

| DIRECTOR | Board of Directors Service | CEO/ Head |

Corporate Governance | Financial Literacy/ |

Financial Services Industry | International/ Business |

Investment Industry | Regulatory/ Government |

(Re)insurance Industry | Risk Management |

Digital Strategy |

| Bronek Masojada ☆ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ |

| Rafe de la Gueronniere | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | |||

| Sharon M. Ludlow | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ |

| Mehdi A. Mahmud | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ||

| Franklin (Tad) Montross IV | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ||

| Jason Robart | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | |

| Daniel S. Loeb | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | |

| Peter Wei Han Tan | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ |

| Scott Egan | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ | ■ |

| Totals | 9/9 | 9/9 | 8/9 | 8/9 | 9/9 | 9/9 | 8/9 | 7/9 | 7/9 | 9/9 | 6/9 |

☆ Chair of the Board

INFORMATION REGARDING THE CLASS II DIRECTOR NOMINEES FOR ELECTION TO THE BOARD

Set forth below is biographical information concerning the nominees standing for election at the Annual General Meeting. Included in the biographical information for the nominee is a description of each nominee’s specific experience, qualifications, attributes and skills that the Governance and Nominating Committee and the Board considered in determining whether to recommend the nominee for election to the Board. Our director nominees hold and have held senior positions as leaders of various large, complex businesses and organizations, demonstrating their ability to develop and execute significant policy and operational objectives at the highest levels. Our nominees include current and former chief executive officers, chief financial officers, founders and members of senior management of large, global businesses. Our Board considered all of the aforementioned attributes when deciding to re-nominate the following directors.

14

| MEHDI A. MAHMUD | KEY EXPERIENCE AND QUALIFICATIONS

The Board considered Mr. Mahmud’s extensive leadership, digital strategy and investment experience and his qualification as an independent director, and concluded that Mr. Mahmud should continue to serve as a director because he brings significant experience in managing investment portfolios to the Board.

CAREER HIGHLIGHTS • First Eagle Investment Management, an investment management company and adviser to First Eagle Funds ◦ President and Chief Executive Officer (March 2016 to present) • First Eagle Funds, an investment fund ◦ President (March 2016 to present) • Jennison Associates ◦ CEO and Chairman of the Board (2003 to 2016)

|

• Jennison Associates (continued) ◦ Held several senior management positions relating to: ▪ product and business strategy ▪ investment supervision of the firm’s value, small-cap, opportunistic and income-equity capabilities ▪ oversight of key support areas, including institutional, retail and sub-advisory client activities • J.P. Morgan Investment Management and Credit Suisse Asset Management ◦ Served in a variety of investment and management roles

EDUCATION • BS in Electrical Engineering, Yale University

| |||||

| |||||||

CLASS II

Age 51

Independent Director since August 2020

Committees • Compensation • Governance

and Nominating • Investment | |||||||

| JASON ROBART | KEY EXPERIENCE AND QUALIFICATIONS The Board considered Mr. Robart’s extensive experience as an accomplished executive and substantial experience in a range of areas including business strategy, healthcare, venture investing, digital strategy and human capital management. The Board concluded that he should serve on the Board because he brings extensive leadership experience in developing early stage growth and health insurance companies to the Board and his deep experience in human capital management.

CAREER HIGHLIGHTS • Seae Ventures, a healthcare service and technology venture fund ◦ Co-Founder and Managing Director (2019 to present) • Blue Cross Blue Shield Massachusetts, an insurance company ◦ Chief Strategy Officer (2011 to 2018) • Zaffre Investments, a wholly-owned subsidiary of Blue Cross Blue Shield Massachusetts ◦ President and Chief Executive Officer (2014 to 2018)

|

• Mercer Human Resources Consulting ◦ Principal (2003 to 2009) • Ceridian Performance Partners, Canada ◦ President

OTHER DIRECTORSHIPS AND ENGAGEMENTS • Blue Cross Blue Shield, Vermont • Several Seae Ventures companies, including Hurdle, Kiyatec, MyMeds and Moving Analytics

EDUCATION • BA in Political Science, Middlebury College

| |||||

| |||||||

CLASS II

Age 58

Independent Director since March 2022

Committees • Audit • Compensation • Investment | |||||||

15

| DANIEL S. LOEB | KEY EXPERIENCE AND QUALIFICATIONS The Board considered Mr. Loeb’s extensive qualifications and experience as the Chief Executive Officer and Chief Investment Officer of Third Point LLC, and concluded that he should continue to serve on the Board because he brings experience in investment management, legal and regulatory matters, corporate governance, risk management and business development to the Board.

CAREER HIGHLIGHTS • Third Point LLC, an investment adviser based in New York ◦ Chief Executive Officer and Chief Investment Officer (1995 to present) |

PRIOR PUBLIC COMPANY BOARDS • Sotheby’s, Director

EDUCATION • A.B., Columbia University

| |||||

| |||||||

CLASS II

Age 62

Director since May 2022 | |||||||

| BRONEK MASOJADA | KEY EXPERIENCE AND QUALIFICATIONS The Board considered Mr. Masojada’s extensive experience and qualifications as Chair of Placing Platform Ltd. and who is an insurance market veteran of over 30 years’ leadership experience in the industry.

CAREER HIGHLIGHTS • Saltus Group, Financial Advisory & Investment Management group ◦ Chair (2023 to Present) • Brown & Brown, a US listed insurance broker ◦ Director (2023-Present) • Sheriff of the City of London ◦ (2023-Present)

|

CURRENT DIRECTORSHIPS AND ENGAGEMENTS • Saltus Group - Chair • Brown & Brown - Director • East End Community Foundation - Chair • Alderman for the Ward of Billingsgate • Hepgtagon Assets Ltd.-Director • Bajka Investments Ltd.-Director

EDUCATION • BS in Civil Engineering, University of KwaZulu Natal • MPhil. in Management Studies, University of Oxford

| |||||

| |||||||

CLASS II

Age 62

Independent Director since March 2023

Committees • Risk and Capital Management • Investment • Governance and Nominating | |||||||

16

CONTINUING DIRECTORS

The biographical information for the directors whose terms will continue after the Annual General Meeting and will expire at the annual general meeting to be held in 2025 (Class III) or the annual general meeting to be held in 2026 (Class I) are listed below.

CLASS III DIRECTORS, SERVING IN OFFICE UNTIL THE 2025 ANNUAL GENERAL MEETING

| SCOTT EGAN | KEY EXPERIENCE AND QUALIFICATIONS

The Board considered Mr. Egan’s over 25 years of industry experience and service as the Chief Executive Officer of Royal Sun Alliance (RSA) UK & International, and Mr. Egan’s experience as CEO of the Company, and concluded that Mr. Egan should continue to serve as a director because he brings a diverse set of skills, breadth of knowledge and valuable financial, strategic and risk management experience to our Board.

CAREER HIGHLIGHTS • SiriusPoint Ltd. ◦ CEO (September 2022 to present) • Royal Sun Alliance (RSA) UK & International, a multinational general insurance company ◦ Chief Executive Officer (January 2019 to December 2021) ◦ Group Chief Financial Officer (September 2015 to December 2018) |

• Towergate Insurance Limited, a European insurance intermediary ◦ Interim Chief Executive Officer and Chief Financial Officer (April 2012 to September 2015)

EDUCATION • Masters Business Administration, Cranfield School of Management • Chartered Institute of Management Accountants, Member

| |||||

| |||||||

CLASS III

Age 52

Director since September 2022 | |||||||

17

RAFE DE LA GUERONNIERE |

KEY EXPERIENCE AND QUALIFICATIONS The Board considered Mr. de la Gueronniere’s more than 40 years’ experience in the investment and banking industries and his qualification as an independent director and concluded that Mr. de la Gueronniere should continue to serve as a director given his deep understanding of SiriusPoint and because he brings his expertise and extensive knowledge in fixed income, equity investing and foreign exchange trading to our Board.

CAREER HIGHLIGHTS

• New Providence Asset Management, founded in 2003 ◦ Vice Chair and Co-Founder (2003 to 2015)

• Mariner Investment Group ◦ Principal (1999 to 2003) • Discount Corporation of New York ◦ Chairman • J.P. Morgan & Co. ◦ Senior Vice President, responsible for the fixed income and precious metals businesses

|

• He has more than 40 years of experience in fixed income, equity investing, foreign exchange and the precious metals business

PRIOR PUBLIC COMPANY BOARDS • Paine Webber, Inc., member of the Management Committee • Fusion Connect, Inc., Director

PRIOR DIRECTORSHIPS AND ENGAGEMENTS • John D. and Catherine T. MacArthur Foundation, member of the Investment Committee • Taft School, Trustee and Investment Committee Chair • Far Hills Country Day School, Trustee and Investment Committee Chair • U.S. Treasury Debt Management Advisory Committee, longstanding member

EDUCATION • BA in English, Brown University

| |||||

| |||||||

CLASS III

Age 71

Independent Director since November 2013

Lead Independent Director until May 2022

Committees • Governance and Nominating •

Investment

| |||||||

| SHARON M. LUDLOW |

KEY EXPERIENCE AND QUALIFICATIONS The Board concluded that Ms. Ludlow should continue to serve as a director because of her more than 25 years of experience in the life & health and property & casualty re-insurance industries and her qualification as an independent director and as a financial expert.

CAREER HIGHLIGHTS • OMERS, one of Canada’s largest defined benefit pension plans ◦ Head of Insurance Investment Strategy (2016 to 2018) • Aviva Insurance Company of Canada ◦ President (2014 to 2016) • Swiss Re Canada ◦ President & CEO (2010 to 2014)

|

OTHER CURRENT PRIVATE COMPANY DIRECTORSHIPS AND ENGAGEMENTS • Green Shield Canada, Director and Chair of the Audit and Risk Committee • EIS Group, Director and Chair of the Audit Committee • Tradex/Saturn Finance Holdings Limited, Director and Chair of the Audit and Risk Committee • Lombard International Group, Director and Chair of the Audit and Risk Committee

EDUCATION • Institute of Corporate Directors designation (ICD.D) • Graduate of the Corporate Directors program, Rotman School of Management, University of Toronto • Fellow Chartered Professional Accountant/Chartered Accountant (FCPA, FCA Canada) • Bachelor of Commerce, University of Toronto

| |||||

| |||||||

|

CLASS III

Age 57

Independent Director since February 2021

Interim Chair of the Board since May 2022

Committees • Audit • Risk and Capital Management • Governance and Nominating

| |||||||

18

CLASS I DIRECTORS, SERVING IN OFFICE UNTIL THE 2026 ANNUAL GENERAL MEETING

FRANKLIN (TAD) MONTROSS IV |

KEY EXPERIENCE AND QUALIFICATIONS The Board concluded that Mr. Montross should continue to serve as a director because of his extensive experience in the property & casualty insurance industries and his qualification as an independent director.

CAREER HIGHLIGHTS

• General Re Corporation ◦ Chairman and CEO (April 2009 to December 2016) ◦ Member of Gen Re’s Executive Committee and the group’s President and Chief Underwriting Officer, with responsibilities including treaty underwriting, actuarial and claims (2001)

|

• General Re Corporation (continued) ◦ Held a number of positions of increasing responsibility, both in the U.S. and internationally, including Chief Underwriter for the treaty business

◦ Began his career as a Casualty Facultative Underwriter (1978)

EDUCATION • BA in Economics, Harvard College

| |||||

| |||||||

CLASS I

Age 68

Independent Director since February 2021

Committees • Audit • Compensation •

Risk and Capital Management

| |||||||

| PETER WEI HAN TAN |

KEY EXPERIENCE AND QUALIFICATIONS The Board concluded that Mr. Tan should continue to serve as a director because of his extensive investment experience working with over 40 investments in China, 12 of which eventually publicly listed on international stock exchanges.

CAREER HIGHLIGHTS • Skandia Mexico & Columbia ◦ Chairman • CMIG International Holding (“CMIG International”), an investment services company ◦ Former Chairman (through December 2023) • CM Bermuda Ltd. (“CM Bermuda”), an investment services company ◦ Former Chairman (through December 2023) • IDI, Inc. ◦ Chief Executive Officer (2012)

|

• White & Case LLP - Attorney (2003) • Perkins Coie LLP - Attorney (1997)

OTHER CURRENT DIRECTORSHIPS AND ENGAGEMENTS • Skandia Holding de Colombia, S.A., Non-Executive Director • LuxAviation Group, Director

PRIOR DIRECTORSHIPS AND ENGAGEMENTS • Chongqing Zongjin Investment Co., Ltd, the financial arm of Zongshen Industrial Group, Chairman • Israel Infinity Agriculture, Director • Harbour Air, Non-executive Director • Mr. Tan formerly served on the board of multiple companies prior to their U.S. listing, including: ◦ Home Inns (NASDAQ: HMIN) ◦ E-House (NYSE: EJ) ◦ Bona Entertainment Group (NASDAQ: BONA)

EDUCATION • LL.B Honors, the National University of Singapore

| |||||

| |||||||

|

CLASS I

Age 51

Director since February 2021

Committees • Investment • Risk and Capital Management

| |||||||

19

CORPORATE GOVERNANCE FRAMEWORK

Our Corporate Governance Guidelines, the charters of the standing committees of the Board (Audit, Compensation, Governance and Nominating, Investment, and Risk and Capital Management) and our Code of Business Conduct and Ethics provide the foundation of our governance framework. Key governance policies and processes also include our Whistleblower Policy, our comprehensive Enterprise Risk Management Program, our commitment to transparent financial reporting and our systems of internal checks and balances. Comprehensive management policies, many of which are approved at the Board and/or committee level, guide the Company’s operations. Our Board, along with management, regularly reviews our Corporate Governance Guidelines and practices to ensure that they are appropriate and reflect our Company’s mission, vision and values. In reviewing our Corporate Governance Guidelines and other key governance policies and practices, the Governance and Nominating Committee considers regulatory developments and trends in corporate governance.

These Corporate Governance Guidelines address, among other things:

| ● | the composition and functions of the Board, |

| ● | director independence, |

| ● | compensation of directors, |

| ● | management succession and review, |

| ● | Board committees, and |

| ● | selection of new directors. |

The Code of Business Conduct and Ethics applies to our Board and all of our employees, including our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions in carrying out their responsibilities to, and on behalf of, SiriusPoint Ltd. If we make any amendments to the Code of Business Conduct and Ethics or grant any waiver that we are required to disclose, we will disclose the nature of such amendments or waiver on our website.

Director Resignation Policy

Under the Company’s Bye-laws, a nominee for director to SiriusPoint’s Board in an uncontested election is elected if he or she receives the most votes (up to the number of directors to be elected). Following a review of the Company corporate governance policies and Bye-laws, the Board determined to adopt a director resignation policy in the event a nominee for SiriusPoint’s Board receives a plurality of votes cast, but less than an absolute majority of votes cast in an uncontested election. By accepting a nomination to stand for election or re-election as a director of the Company or an appointment as a director to fill a vacancy or new directorship, each candidate, nominee or appointee agrees that if, in an uncontested election of directors, he or she receives less than a majority of votes cast, the director shall promptly tender a written offer of resignation to the Chair of the Board following certification of the shareholder vote from the meeting at which the election occurred. For purposes of this guideline, an “uncontested election of directors” is any election of directors in which the number of nominees for election does not exceed the number of directors to be elected.

The Governance and Nominating Committee of the Board will promptly consider the director’s offer of resignation and recommend to the Board whether to accept the tendered resignation or to take some other action, such as rejecting the tendered resignation and addressing the apparent underlying causes of the less than majority vote. In making this recommendation, the Governance and Nominating Committee will consider all factors deemed relevant by its members, including, without limitation, the stated reason or reasons why the shareholders cast

20

“withhold” votes for the director (if ascertainable), the qualifications of the director whose resignation has been tendered, the director’s contributions to SiriusPoint, the overall composition of the Board, and whether by accepting such resignation, SiriusPoint will no longer be in compliance with any applicable law, rule, regulation or governing document (including New York Stock Exchange (“NYSE”) listing standards, federal securities laws or the Corporate Governance Guidelines), and whether or not accepting the resignation is in the best interests of SiriusPoint and its shareholders. The Board will act on the Governance and Nominating Committee’s recommendation within 90 days following certification of the shareholders’ vote. In considering the Governance and Nominating Committee’s recommendation, the Board will consider the information, factors and alternatives considered by the Governance and Nominating Committee and such additional information, factors and alternatives as the Board believes to be relevant.

Following the Board’s decision, SiriusPoint will promptly publicly disclose the Board’s decision (by press release, filing with the SEC or other public means of disclosure deemed appropriate).

Any director who tenders his or her offer of resignation pursuant to this policy shall not participate in any deliberations or actions by the Governance and Nominating Committee or the Board regarding his or her resignation, but shall otherwise continue to serve as a director during this period.

If the majority of members of the Governance and Nominating Committee receive less than a majority vote in the same uncontested election of directors, so that a quorum of the Governance and Nominating Committee cannot be achieved, then the other independent directors on the Board will consider and decide what action to take regarding the resignation of each director who received less than a majority of votes. If the only directors who did not receive less than a majority in the same election constitute three or fewer independent directors, then all independent directors on the Board shall participate in deliberations and actions regarding director resignations, except that no director can participate in the vote on his or her own resignation.

Director Retirement Age Policy

Directors are required to retire from the Board when they reach the age of 75; however, the full Board may nominate candidates aged 75 or older if it believes that nomination is in the best interests of the Company and its shareholders. A director elected to the Board prior to his or her 75th birthday may continue to serve until the end of his or her three-year term.

Director Membership on Other Boards

Our Board expects individual directors to allot significant time and attention to Company matters and to use their judgment and consider all of their commitments when accepting additional directorships of other corporations or charitable organizations. Specifically, our Corporate Governance Guidelines provide that a director should not serve on the boards of more than four other public companies (in addition to the Company’s Board). In addition, the Company’s CEO should not serve on more than one other public company board in addition to the Company’s Board.

Additionally, our Corporate Governance Guidelines provide that a director who serves on the Audit Committee should not serve on more than two other public company audit committees.

21

All of our current directors comply with our policies set forth above. However, we are aware that some of our shareholders have their own board membership policies that are more restrictive than our policy. All of our directors are required to obtain approval prior to agreeing to serve on the board of any other public company to allow the Board to consider whether such director has sufficient time to be a productive member of our Board. Our Board believes that this policy strikes the right balance by allowing for the experience gained through membership on other boards and the time commitment needed for engaged board service.

Trading in Company Securities

We prohibit hedging and pledging transactions in Company securities by executive officers, directors and employees. Hedging transactions are transactions designed to insulate the holder of securities from upside or downside price movement in Company shares. Executive officers, directors and employees are prohibited from entering into hedging or monetization transactions or similar arrangements with respect to Company shares, including the purchase or sale of puts or calls or the use of any other derivative instruments, or selling “short” Company shares. Executive officers, directors and employees may not hold Company securities in a margin account or pledge Company securities as collateral for a loan.

Director Share Ownership

The Board believes that an ownership stake in the Company strengthens the alignment of interests between directors and shareholders. Our Director and Executive Officers Share Ownership Guidelines provide that directors are required to own common shares having a value of at least three times the annual retainer fee within five years of becoming a director, which shall be maintained through the director’s term of service. In the event that the annual retainer fee is increased, directors have three years to meet the new ownership guidelines. The Board will evaluate whether exceptions should be made for any director on whom these guidelines would impose a financial hardship. All independent directors have achieved or are on track to achieve this requirement during the required time period.

Director and Officer Liability Insurance

We have an insurance program in place to provide coverage for director and officer liability. The coverage provides that, subject to the policy terms and conditions, the insurers will: (i) reimburse us when we are legally permitted to indemnify our directors and officers; (ii) pay losses, including settlements, judgments and legal fees, on behalf of our directors and officers when we cannot indemnify them; and (iii) pay our losses resulting from certain securities claims. The insurance program is effective from April 1, 2024 to May 1, 2024, and is provided by a consortium of insurers. Allianz Global Corporate and Specialty SE is the lead insurer with various other insurers providing excess coverage. We expect to obtain similar coverage upon expiration of the current insurance program.

22

DIRECTOR INDEPENDENCE

| 67% | Independent Directors | ||

| Non-Independent Directors | Independent | • Bronek Masojada | |

| • Scott Egan | • Rafe de la Gueronniere | ||

| • Daniel S. Loeb |

|

• Sharon M. Ludlow | |

| • Peter Wei Han Tan | • Mehdi A. Mahmud | ||

| • Jason Robart | |||

Under the NYSE listing standards and our Corporate Governance Guidelines, in order to consider a director as independent, the board of directors must affirmatively determine that he or she has no material relationship with the Company. In making its annual independence determinations, the Board considers transactions between each director nominee and the Company including among other items, employment and compensatory relationships, relationships with our auditors, customer and business relationships, and contributions to nonprofit organizations.

The Board undertook its annual review of director independence in March 2024. As a result of this review, the Board affirmatively determined that Rafe de la Gueronniere, Bronek Masojada, Sharon M. Ludlow, Franklin (Tad) Montross IV, Mehdi A. Mahmud and Jason Robart are “independent” as defined in the federal securities laws and applicable NYSE rules.

Mr. Egan is not considered an independent director because he currently serves as CEO of the Company.

Mr. Tan was determined to not be an independent due to the recency of his resignation as Chairman of CMIG International in December 2023, and additionally, given the recency of Mr. Tan no longer serving as a representative of CMIG International. CMIG International owns 100% of CM Bermuda, a holder of more than 10% of the shares of the Company. Mr. Tan resigned from his Chairmanship in December 2023. Mr. Tan is no longer a representative of CMIG International on the Board as of April 5, 2024.

Mr. Loeb was determined to not be an independent director due to his employment by Third Point LLC, a related party (owned by a greater than 5% shareholder) and one of the Company’s investment managers. For more information regarding the ownership of our capital stock, see “Security Ownership of Certain Beneficial Owners and Management,” and for more information about Third Point LLC’s relationship with the Company, see “Certain Relationships and Related Party Transactions.”

The Company’s Audit, Compensation, and Governance and Nominating Committees are currently composed of independent directors only. See the “Committees of the Board of Directors” section of this proxy statement for further information.

23

BOARD MEETINGS AND DIRECTOR ATTENDANCE, ATTENDANCE AT THE ANNUAL GENERAL MEETING AND EXECUTIVE SESSIONS

Board Meetings and Director Attendance

Our director meeting attendance policy is set forth in our Corporate Governance Guidelines. In addition to our attendance policy, our Bye-laws generally prohibit directors from participating in meetings of the Board or its committees while present in the United States or its territories, whether in person, via teleconference or otherwise. We held three of our meetings in Bermuda during 2023.

Our directors discharged their oversight and fiduciary duties over the past fiscal year, including by holding regular, robust, virtual informational sessions designed to cover the same information normally covered at Board and committee meetings, supplemented by additional informational calls and reports. When action requiring a formal Board or committee resolution was necessary, the Board or relevant committee acted by unanimous written resolutions in order to comply with our Bye-laws and operating guidelines. We believe we maintained good governance practices while complying with Bermuda law, as well as with our Bye-laws. All directors attended 100% of the meetings of the Board and Board committees on which they served in 2023.

| Governance | Risk and Capital | |||||

| Audit | Compensation | and Nominating | Investment | Management | ||

| Board | Committee | Committee | Committee | Committee | Committee | |

Formal Meetings |

3 | 3 | 3 | 3 | 3 | 3 |

Informational Sessions |

9 | 5 | 3 | 1 | 1 | 1 |

Action

by Resolution |

8 | 3 | 6 | 4 | 1 | 1 |

Attendance at Annual General Meeting

All of our directors serving on our Board at the time of our 2023 Annual General Meeting of Shareholders held virtually attended the meeting. Our Board strongly encourages all of its members to attend the Annual General Meeting of Shareholders.

Executive Sessions

Executive sessions of independent directors enable the Board to discuss matters, such as strategy, the performance and compensation of the CEO and senior management, succession planning and Board effectiveness, without management present. Any director may request additional executive sessions of independent directors. During 2023, our independent directors met in executive sessions at regularly scheduled Board meetings and/or

24

informational calls. The rules of the NYSE also require the non-management directors of the Company to regularly meet in executive session without management, and the non-management directors met in four executive sessions at regularly scheduled Board meetings and/or informational calls. Either our Interim Chair or, after his appointment, the Board Chair, presided at the executive sessions of independent directors and non-management directors.

BOARD LEADERSHIP STRUCTURE

The Board believes that the decision of whether to combine or separate the positions of CEO and Chair varies from company to company and depends upon a company’s particular circumstances at a given point in time. The Board believes that separating the CEO and Chair positions is the appropriate leadership structure for our Company and is in the best interests of our shareholders at this time. Mr. Masojada serves as the Chair of the Board, while Mr. Egan serves as our CEO and Director. Our Board believes that this structure best encourages the free and open dialogue of alternative views and provides for strong checks and balances. Additionally, the Chair’s attention to Board and committee matters allows Mr. Egan to focus more specifically on overseeing the Company’s day-to-day operations and underwriting activities, as well as strategic opportunities and planning.

The Board recognizes that, depending on the circumstances, other leadership structures might be appropriate and in the best interest of the Company. Accordingly, the Board intends to regularly review its governance structure and has the discretion to modify its leadership structure in the future if it deems it in the best interest of the Company to do so. In the event the Board decides to combine the role of CEO and Chair, the Board is required to appoint a Lead Independent Director under the Company’s Corporate Governance Guidelines. Currently, the Board has an independent Chair so the Board is not required to have a Lead Independent Director.

25

BOARD AND BOARD COMMITTEE PERFORMANCE EVALUATIONS

Our Board continually seeks to improve its performance. Throughout the year, our Chair, Chief Legal Officer and Secretary each routinely communicate with our Board members to obtain real-time feedback. We believe that this continuous feedback cycle along with our formal annual evaluation process helps to ensure the continued effectiveness of our Board.

Our Governance and Nominating Committee oversees the formal annual evaluation process of the effectiveness of our Board and its standing committees.

Our annual Board evaluations cover the following areas:

| ● | Board efficiency and overall effectiveness | ● | Board and committee information needs and meeting cadence | ||

| ● | Board and committee structure | ● | Satisfaction with Board agendas and the frequency, duration and format of meetings and time allocations | ||

| ● | Board leadership and succession planning | ● | Areas where directors want to increase their focus | ||

| ● | Board and committee composition | ● | Board dynamics and culture | ||

| ● | Satisfaction with the performance of the Chair | ● | Strategy and Crisis Preparedness | ||

| ● | Board member access to the CEO and other members of senior management | ● | Board alignment with the Company’s mission, vision, ethics, values, long-term goals and strategy | ||

| ● | Quality of Board discussions and balance between presentations and discussion | ● | Other areas directors would like to have greater focus or oversight | ||

| ● | Quality and clarity of materials presented to directors |

26

| 1 | ||||

| ANNUAL BOARD AND COMMITTEE EVALUATIONS | ||||

The Governance and Nominating Committee oversees the annual self-evaluation process. The process, including the evaluation method, is reviewed annually by the Governance and Nominating Committee and presented to the Board for discussion prior to implementing the process during the fourth quarter. Written questionnaires used for the Board and each standing committee are annually reviewed by the Governance and Nominating Committee and are updated and tailored each year to address the significant processes that drive Board effectiveness. Each director completes a written questionnaire on an unattributed basis for the Board and committees. The questionnaires include open-ended questions and space for candid commentary. Our processes enable directors to provide anonymous and confidential feedback, which is then reviewed and addressed by the Chair of the Governance and Nominating Committee. In addition, each committee’s chair reviews the feedback with respect to their respective committee.

When appropriate, and at least every third year, our Board engages a third-party evaluation firm to independently assess the Board’s performance. The third-party evaluation firm conducts confidential interviews with each director that includes discussions of the overall functioning and effectiveness of the Board and its standing committees, the leadership structure of the Board as well as a peer review. The evaluation firm presents the findings to the Board for consideration and feedback. Our Board believes that employing an independent third-party evaluation firm every third year to assist in the evaluation process provides valuable insights and will contribute to the overall functioning and ongoing effectiveness of the Board. |

||||

| 2 | ||||

| SUMMARY OF THE EVALUATION | ||||

A written report is produced summarizing the written questionnaires, which include all responses. |

||||

| 3 | ||||

| BOARD AND COMMITTEE REVIEW | ||||

The Chair of the Governance and Nominating Committee leads a discussion of the written Board and committee evaluation results at the Board level during an executive session. Directors also deliver feedback to the Interim Chair of the Board and suggest changes and areas for improvement. |

||||

| 4 | ||||

| ACTIONS | ||||

Following the review, changes in practices or procedures are considered and implemented, as appropriate. The Board finds that this process generates robust comments and provides the Board the opportunity to make changes that are designed to increase Board effectiveness and efficiency. Actions taken in response to the evaluation process over the years have included: |

||||

| • | Initiating a search for an additional qualified financial expert director; | |||

| • | Re-evaluating all governing documents, including delegations of authority and board and committee charters for effectiveness; | |||

| • | Initiating executive sessions between the Board and CEO prior to board meetings; and | |||

| • | Conducting a board informational session on fiduciary duties of the Board, roles of special committees and observers, and other board education matters. | |||

27

Board’s Primary Role and Responsibilities, Structure and Processes

Our Board bears the responsibility for the oversight of management on behalf of our shareholders in order to ensure long-term value creation. In that regard, the primary responsibilities of our Board include, but are not limited to (i) oversight of the Company’s strategic direction and business plan, (ii) ongoing succession planning and talent management, and (iii) risk management and oversight.

Oversight of Strategic Direction and Business Plan

Our Board oversees our strategic direction and business plan. At the beginning of each year, our senior management presents our consolidated annual business plan to the Board, and the Board discusses the Company’s results relative to the plan periodically throughout the year. Each year, the Board typically engages in a full-day strategy meeting with management where it conducts a comprehensive review and discussion of the Company’s strategic goals over the short-, medium- and long-term, as well as management’s plans to achieve such goals.

Succession Planning and Talent Management

Our Compensation Committee is responsible for overseeing our executive compensation program to support our ability to attract and retain the right management talent to pursue our strategies successfully.

The Compensation Committee is involved in the critical aspects of the CEO succession planning process, including establishing selection criteria that reflect our business strategies, identifying and evaluating potential internal candidates and making key management succession decisions. Succession and development plans are regularly discussed with the CEO, as well as without the CEO present in executive sessions of the Board. The Compensation Committee makes sure that it has adequate opportunities to meet with and assess development plans for potential CEO and senior management successors to address identified gaps in skills and attributes. This occurs through various means, including informal meetings, Board dinners, presentations to the Board and committees, attendance at Board meetings and the comprehensive annual talent review. The Compensation Committee also oversees management’s succession planning for other key executive positions. Our Board calendar includes at least one meeting each year at which the Board conducts a detailed talent review which includes a review of the Company’s talent strategies, leadership pipeline and succession plans for key executive positions.

28

Risk Management and Oversight

OUR BOARD TAKES AN ENTERPRISE-WIDE APPROACH TO RISK MANAGEMENT WHICH SEEKS TO COMPLEMENT OUR ORGANIZATIONAL OBJECTIVES, STRATEGIC OBJECTIVES, LONG-TERM PERFORMANCE AND THE OVERALL ENHANCEMENT OF SHAREHOLDER VALUE.

FULL BOARD | |

Our Board assesses and considers the risks we face on an ongoing basis, including risks that are associated with:

• our financial position, • our competitive position, • underwriting results, • investment performance, • cybersecurity vulnerabilities, • catastrophic events, and • other risks germane to the insurance and reinsurance industry. |

Our Board determines the appropriate levels of risk for the Company generally, assesses the specific risks faced by us, and reviews the steps taken by management to manage those risks. While our Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas. |

29

AUDIT COMMITTEE |

COMPENSATION COMMITTEE |

GOVERNANCE AND NOMINATING COMMITTEE |

INVESTMENT COMMITTEE |

RISK AND CAPITAL MANAGEMENT COMMITTEE | ||||

Our Audit Committee is responsible for overseeing: • Management’s assessment of the Company’s internal control over financial reporting, • The Company’s financial statements and disclosures, • Quarterly reports on legal and regulatory matters, • The Company’s annual internal audit plan, audit findings and recommendations, and • The Company’s compliance with legal and regulatory requirements. |

Our Compensation Committee is responsible for overseeing: • The Company’s general compensation philosophy, including the development and implementation of our compensation program, • Our executive compensation plans and arrangements, • Succession planning, • Diversity and talent management, and • Incentive compensation risk oversight. |

Our Governance and Nominating Committee is responsible for: • Identifying, evaluating, and recommending to the Board individuals qualified and suitable to become board members, • Developing and recommending to the Board a set of corporate governance guidelines applicable to the Company, • Overseeing the annual performance evaluation of the Board and its committees, • Recommending directors to serve on the various committees of the Board, and • Reviewing and considering the Company’s position, strategy and policies that relate to current and emerging ESG matters. |

Our Investment Committee is responsible for: • Overseeing the performance of the Company’s investment portfolio, • Establishing the investment policy and guidelines, • Receiving reports from the Chief Investment Officer on the performance and asset allocation of the Company’s investments, and • Reviewing quarterly the compliance with the investment guidelines. |