Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

As filed with the Securities and Exchange Commission on June 25, 2014

Registration Statement No. 333-196662

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Gaming and Leisure Properties, Inc.

(Exact name of registrant as specified in its charter)

| Pennsylvania (State or other jurisdiction of incorporation or organization) |

6798 (Primary Standard Industrial Classification Code Number) |

46-2116489 (I.R.S. Employer Identification No.) |

SEE TABLE OF ADDITIONAL REGISTRANTS BELOW

825 Berkshire Blvd., Suite 400

Wyomissing, Pennsylvania 19610

(610) 401-2900

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

William J. Clifford

Chief Financial Officer

825 Berkshire Blvd., Suite 400

Wyomissing, Pennsylvania 19610

(610) 401-2900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| Copies of all communications to: | ||

P. Michelle Gasaway, Esq. Skadden, Arps, Slate, Meagher & Flom LLP 300 South Grand Avenue, Suite 3400 Los Angeles, California 90071 (213) 687-5000 (213) 687-5600 (facsimile) |

John P. Duke Pepper Hamilton LLP 400 Berwyn Park 899 Cassatt Road Berwyn, Pennsylvania 19312-1183 (610) 640-7800 (610) 640-7835 (facsimile) |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "larger accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross Border Issuer Tender Offer) o

Exchange Act Rule 14d-1(d) (Cross Border Third-Party Tender Offer) o

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

Name of Additional Registrant*

|

State or Other Jurisdiction of Incorporation or Formation |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

||||||

|---|---|---|---|---|---|---|---|---|---|

GLP Capital, L.P.(1) |

Pennsylvania | 6798 | 46-2322388 | ||||||

GLP Financing II, Inc.(1) |

Delaware | 6798 | 46-3866595 | ||||||

- *

- The

4.375% Senior Notes due 2018, the 4.875% Senior Notes due 2020 and the 5.375% Senior Notes due 2023 were issued by the additional registrants, GLP

Capital, L. P. and GLP Financing, II, Inc. Gaming and Leisure Properties, Inc. is the guarantor of the notes.

- (1)

- The address and telephone number of each of these additional registrants' principal executive offices is the same as Gaming and Leisure Properties, Inc.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated June 25, 2014

PROSPECTUS

GLP Capital, L.P.

GLP Financing II, Inc.

Offer to Exchange

$550,000,000 aggregate principal amount of 4.375% Senior Notes due 2018

(CUSIPs 361841 AA7 and U34073 AA1)

for $550,000,000 aggregate principal amount of 4.375% Senior Notes due 2018

(CUSIP 361841 AB5)

which have been registered under the Securities Act of 1933, as amended.

$1,000,000,000 aggregate principal amount of 4.875% Senior Notes due 2020

(CUSIPs 361841 AC3 and U34073 AB9)

for $1,000,000,000 aggregate principal amount of 4.875% Senior Notes due 2020

(CUSIP 361841 AD1)

which have been registered under the Securities Act of 1933, as amended.

$500,000,000 aggregate principal amount of 5.375% Senior Notes due 2023

(CUSIPs 361841 AE9 and U34073 AC7)

for $500,000,000 aggregate principal amount of 5.375% Senior Notes due 2023

(CUSIP 361841 AF6)

which have been registered under the Securities Act of 1933, as amended.

Each of the exchange offers will expire at 5:00 p.m., New York City time, on , 2014, unless we extend or earlier terminate such exchange offer.

We hereby offer, on the terms and subject to the conditions set forth in this prospectus and in the accompanying letter of transmittal (which together constitute the "exchange offers"), to exchange up to $550,000,000 aggregate outstanding principal amount of our 4.375% Senior Notes due 2018 (including the guarantee with respect thereto, the "new 2018 notes") that have been registered under the Securities Act of 1933, as amended (the "Securities Act"), $1,000,000,000 aggregate outstanding principal amount of our 4.875% Senior Notes due 2020 (including the guarantee with respect thereto, the "new 2020 notes") that have been registered under the Securities Act and $500,000,000 aggregate outstanding principal amount of our 5.375% Senior Notes due 2023 (including the guarantee with respect thereto, the "new 2023 notes," and together with the new 2018 notes and the new 2020 notes, the "new notes") that have been registered under the Securities Act, for a corresponding like aggregate principal amount of our outstanding 4.375% Senior Notes due 2018 (including the guarantee with respect thereto, the "old 2018 notes"), our 4.875% Senior Notes due 2020 (including the guarantee with respect thereto, the "old 2020 notes") and our 5.375% Senior Notes due 2023 (including the guarantee with respect thereto, the "old 2023 notes," and together with the old 2018 notes and the old 2020 notes, the "old notes"), respectively.

Terms of the exchange offer for each series of old notes:

- •

- On the terms and subject to the conditions of the exchange offer, we will exchange the respective series of new notes for

all outstanding old notes of the corresponding series that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer for such series.

- •

- You may withdraw tenders of old notes at any time prior to the expiration of the exchange offer for such series.

- •

- The terms of the new notes are substantially identical to those of the old notes of the corresponding series, except that

the transfer restrictions, registration rights and liquidated damages provisions described in the registration rights agreements relating to such old notes will not apply to such new notes.

- •

- The exchange of old notes for new notes will not be a taxable transaction for United States federal income tax purposes,

but you should see the discussion under the heading "Certain U.S. Federal Income Tax Considerations" for more information.

- •

- We will not receive any proceeds from the exchange offers.

- •

- We issued the old notes in a transaction not requiring registration under the Securities Act, and as a result, the transfer of the old notes is restricted under the securities laws. We are making the exchange offer with respect to each series of old notes to satisfy your registration rights as a holder of old notes of such series.

There is no established trading market for the new notes.

Each broker-dealer that receives new notes for its own account pursuant to the exchange offers must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities.

See "Risk Factors" beginning on page 20 for a discussion of risks you should consider prior to tendering your outstanding old notes for exchange.

Neither the Securities and Exchange Commission (the "SEC") nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

No gaming or regulatory agency has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014

We have not authorized any dealer, salesperson or other person to give any information or represent anything to you other than the information contained in this prospectus. You must not rely on unauthorized information or representations.

This prospectus does not offer to sell or ask for offers to buy any of the securities in any jurisdiction where it is unlawful, where the person making the offer is not qualified to do so, or to any person who cannot legally be offered the securities.

The information in this prospectus is current as of the date on its cover, and may change after that date. For any time after the cover date of this prospectus, we do not represent that our affairs are the same as described or that the information in this prospectus is correct, nor do we imply those things by delivering this prospectus or selling securities to you.

This prospectus contains summaries of the material terms of certain documents. Copies of these documents, except for certain exhibits and schedules, will be made available to you without charge upon written or oral request to us. Requests for documents or other additional information should be directed to Gaming and Leisure Properties, Inc., 825 Berkshire Boulevard, Suite 400, Wyomissing, PA 19610, Attention: Chief Financial Officer, Telephone: (610) 401-2900. To obtain timely delivery of documents or information, we must receive your request no later than five (5) business days before the expiration date of the exchange offer.

i

In this prospectus, unless otherwise stated or unless the context otherwise requires, "GLPI," "the Company," "we," "our," and "us" refer to Gaming and Leisure Properties, Inc. and its subsidiaries.

This prospectus includes information with respect to market share and industry conditions, which are based upon internal estimates and various third party sources. While management believes that such data is reliable, we have not independently verified any of the data from third party sources nor have we ascertained the underlying assumptions relied upon therein. Similarly, our internal research is based upon management's understanding of industry conditions, and such information has not been verified by any independent sources. Accordingly, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" in this prospectus.

Forward-looking statements in this prospectus are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. With respect to this section, "Forward-Looking Statements," references to "GLPI" are to Gaming and Leisure Properties, Inc. and references to the "Company" are to Gaming and Leisure Properties, Inc. and its subsidiaries. Forward-looking statements include information concerning the Company's business strategy, plans, and goals and objectives.

Statements preceded by, followed by or that otherwise include the words "believes," "expects," "anticipates," "intends," "projects," "estimates," "plans," "may increase," "may fluctuate," and similar expressions or future or conditional verbs such as "will," "should," "would," "may" and "could" are generally forward-looking in nature and not historical facts. You should understand that the following important factors could affect future results and could cause actual results to differ materially from those expressed in such forward-looking statements:

- •

- the ability to receive, or delays in obtaining, the regulatory approvals required to own, develop and/or operate our

properties, or other delays or impediments to completing our planned acquisitions or projects;

- •

- our ability to maintain our status as a real estate investment trust and there being no need for any further dividend of

historical accumulated earnings and profits in order to qualify as a real estate investment trust in 2014;

- •

- the ability and willingness of our tenants, operators and other third parties to meet and/or perform their obligations

under their respective contractual arrangements with us, including, in some cases, their obligations to indemnify, defend and hold us harmless from and against various claims, litigation and

liabilities;

- •

- the ability of our tenants and operators to maintain the financial strength and liquidity necessary to satisfy their

respective obligations and liabilities to third parties, including without limitation obligations under their existing credit facilities and other indebtedness;

- •

- the ability of our tenants and operators to comply with laws, rules and regulations in the operation of our properties, to

deliver high quality services, to attract and retain qualified personnel and to attract customers;

- •

- the availability and the ability to identify suitable and attractive acquisition and development opportunities and the

ability to acquire and lease the respective properties on favorable terms;

- •

- the degree and nature of our competition;

ii

- •

- the ability to generate sufficient cash flows to service our outstanding indebtedness;

- •

- the access to debt and equity capital markets;

- •

- fluctuating interest rates;

- •

- the availability of qualified personnel and our ability to retain our key management personnel;

- •

- GLPI's duty to indemnify Penn National Gaming, Inc. and subsidiaries ("Penn") in certain circumstances if the

completed Spin-Off (as defined below) fails to be tax-free;

- •

- changes in the United States tax law and other state, federal or local laws, whether or not specific to real estate, real

estate investment trusts or to the gaming, lodging or hospitality industries;

- •

- changes in accounting standards;

- •

- the impact of weather events or conditions, natural disasters, acts of terrorism and other international hostilities, war

or political instability;

- •

- other risks inherent in the real estate business, including potential liability relating to environmental matters and

illiquidity of real estate investments; and

- •

- additional factors discussed in the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in this prospectus.

Certain of these factors and other factors, risks and uncertainties are discussed in the "Risk Factors" section of this prospectus. Other unknown or unpredictable factors may also cause actual results to differ materially from those projected by the forward-looking statements. Most of these factors are difficult to anticipate and are generally beyond the control of the Company.

You should consider the areas of risk described above, as well as those set forth under the heading "Risk Factors," in connection with considering any forward-looking statements that may be made by the Company generally. Except for the ongoing obligations of the Company to disclose material information under the federal securities laws, the Company does not undertake any obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events unless required to do so by law.

FINANCIAL AND OTHER INFORMATION

This prospectus includes historical consolidated financial statements and information of GLPI and its subsidiaries for periods and dates prior to the consummation of the Spin-Off. GLPI and its subsidiaries are newly formed companies and, accordingly, GLPI and its consolidated subsidiaries have minimal historical operations. Because the notes will be guaranteed by GLPI on a senior unsecured basis, we present in this prospectus historical and pro forma financial information of, and other information with respect to, GLPI and its consolidated subsidiaries, which include GLP Capital L.P. and GLP Financing II, Inc. as well as other subsidiaries.

Our historical financial statements and information for periods prior to the consummation of the Spin-Off are not indicative of, or comparable to, our results of operations or financial position for periods or dates following the Spin-Off. Although we include in this prospectus pro forma financial information giving effect to the Spin-Off and related transactions as described under "GLPI Unaudited Pro Forma Consolidated Income Statement," this information is presented for illustrative purposes and is based on assumptions, some of which may not materialize, and actual results reported in periods following the Spin-Off may differ significantly from those reflected in the historical and pro forma financial information for a number of reasons.

iii

Accordingly, our historical consolidated financial statements and information for periods prior to the consummation of the Spin-Off and related transactions and the historical and pro forma financial information included in this prospectus should not be relied upon as being indicative of future results and, therefore, readers of this prospectus are cautioned not to place undue reliance on this financial information.

iv

This summary highlights information contained elsewhere in this prospectus and may not contain all of the information that you should consider before making a decision to tender old notes in exchange for new notes. We urge you to read the entire prospectus carefully, including the financial statements and notes to those financial statements incorporated by reference in this prospectus. Please read "Risk Factors" for more information about important risks that you should consider before tendering old notes for exchange. In this prospectus, references to the "issuers" are to GLP Capital, L.P. (the "Operating Partnership" or "GLP Capital") and GLP Financing II, Inc. ("Capital Corp."). With respect to the discussion of the terms of the notes on the cover page, in the section entitled "Summary—The Exchange Offer" and "—Summary Description of the New Notes" and in the section entitled "Description of the New Notes," "we," "our," and "us" refer only to the issuers. Except with respect to discussions of income tax consequences and unless the context otherwise requires, references to the "notes" include the new notes and the old notes.

Overview

On November 15, 2012, Penn announced that it intended to pursue a plan to separate the majority of its operating assets and real property assets into two publicly traded companies including an operating entity, and, through a tax-free spin-off of its real estate assets to holders of its common and preferred stock, a newly formed publicly traded real estate investment trust ("REIT"), GLPI (the "Spin-Off").

In connection with the Spin-Off, which was completed on November 1, 2013, Penn contributed to GLPI through a series of internal corporate restructurings substantially all of the assets and liabilities associated with Penn's real property interests and real estate development business, as well as the assets and liabilities of Hollywood Casino Baton Rouge and Hollywood Casino Perryville, which are referred to as the "TRS Properties," in a tax-free distribution. As a result of the Spin-Off, GLPI owns substantially all of Penn's former real property assets and leases back most of those assets to Penn for use by its subsidiaries, pursuant to a master lease (the "Master Lease"). The Master Lease is a "triple-net" operating lease with an initial term of 15 years with no purchase option, followed by four 5-year renewal options (exercisable by Penn) on the same terms and conditions. GLPI also owns and operates the TRS Properties through its taxable REIT subsidiaries ("TRS").

GLPI's primary business consists of acquiring, financing, and owning real estate property to be leased to gaming operators in "triple net" lease arrangements. As of March 31, 2014, GLPI's portfolio consisted of 22 gaming and related facilities, including the TRS Properties, the real property associated with 19 gaming and related facilities operated by Penn (including two properties under development in Dayton, Ohio and Youngstown, Ohio) and the real property associated with the Casino Queen in East St. Louis, Illinois that was acquired in January 2014, that are geographically diversified across 13 states. We expect to grow our portfolio by pursuing opportunities to acquire additional gaming facilities to lease to gaming operators under prudent terms, which may or may not include Penn.

In connection with the Spin-Off, Penn allocated its accumulated earnings and profits (as determined for United States ("U.S.") federal income tax purposes) for periods prior to the consummation of the Spin-Off between Penn and GLPI. In connection with its election to be taxed as a REIT for U.S. federal income tax purposes for the year ending December 31, 2014, GLPI declared a special dividend to its shareholders to distribute any accumulated earnings and profits relating to the real property assets and attributable to any pre-REIT years, including any earnings and profits allocated to GLPI in connection with the Spin-Off, to comply with certain REIT qualification requirements (the "Purging Distribution"). The Purging Distribution, which was paid on February 18, 2014, totaled $1.05 billion and was comprised of cash and GLPI common stock. Shareholders were given the option to elect either an all-cash or all-stock dividend, subject to a total cash limitation of

1

$210 million. Of 88,691,827 million shares of common stock outstanding on the record date, approximately 54.3% elected the cash distribution and approximately 45.7% elected a stock distribution or made no election. Shareholders electing cash received $4.358049 plus 0.195747 additional GLPI shares per common share held on the record date. Shareholders electing stock received 0.309784 additional GLPI shares per common share held on the record date. Stock dividends were paid based on the volume weighted average price for the three trading days ended February 13, 2014 of $38.2162 per share. Approximately 22.0 million shares were issued in connection with this dividend payment.

Tax Status

We intend to elect on our U.S. federal income tax return for our taxable year beginning on January 1, 2014 to be treated as a REIT and intend to continue to be organized and to operate in a manner that will permit us to qualify as a REIT. To qualify as a REIT, we must meet certain organizational and operational requirements, including a requirement to distribute at least 90% of our annual REIT taxable income to shareholders. As a REIT, we generally will not be subject to federal income tax on income that we distribute as dividends to our shareholders. If we fail to qualify as a REIT in any taxable year, we will be subject to U.S. federal income tax, including any applicable alternative minimum tax, on our taxable income at regular corporate income tax rates, and dividends paid to our shareholders would not be deductible by us in computing taxable income. Any resulting corporate liability could be substantial and could materially and adversely affect our net income and net cash available for distribution to shareholders. Unless we were entitled to relief under certain Code provisions, we also would be disqualified from re-electing to be taxed as a REIT for the four taxable years following the year in which we failed to qualify to be taxed as a REIT.

Our TRS Properties are able to engage in activities resulting in income that is not qualifying income for a REIT. As a result, certain activities of the Company which occur within our TRS Properties are subject to federal and state income taxes.

Tenants

As of March 31, 2014, all of the Company's properties with the exception of the TRS Properties and the Casino Queen property were leased to a wholly owned subsidiary of Penn under the Master Lease.

Penn is a leading, diversified, multi-jurisdictional owner and manager of gaming and pari-mutuel properties, and an established gaming provider with strong financial performance. The obligations under the Master Lease are guaranteed by Penn and by all Penn subsidiaries that occupy and operate the facilities leased under the Master Lease, or that own a gaming license, other license or other material asset necessary to operate any portion of the facilities. A default by Penn or its subsidiaries with regard to any facility will cause a default with regard to the entire portfolio.

We will seek to cultivate our relationships with tenants and gaming providers in order to expand the mixture of tenants operating our properties and, in doing so, to reduce our dependence on Penn. We expect that this objective will be achieved over time as part of our overall strategy to acquire new properties and further diversify our overall portfolio of gaming properties. For instance, in January 2014, GLPI closed on an agreement to acquire the real estate assets associated with the Casino Queen in East St. Louis, Illinois. The Casino Queen property is operated by the former owners pursuant to a long-term lease with terms and conditions similar to the Master Lease.

2

The following table summarizes certain features of our properties as of March 31, 2014:

| |

Location | Type of Facility | Approx. Property Square Footage(1) |

Owned Acreage |

Leased Acreage(2) |

Hotel Rooms |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Tenants |

|||||||||||||||||

Hollywood Casino Lawrenceburg |

Lawrenceburg, IN | Dockside gaming | 634,000 | 74.1 | 32.1 | 295 | |||||||||||

Hollywood Casino Aurora |

Aurora, IL | Dockside gaming | 222,189 | 0.4 | 2.1 | — | |||||||||||

Hollywood Casino Joliet |

Joliet, IL | Dockside gaming | 322,446 | 276.4 | — | 100 | |||||||||||

Argosy Casino Alton |

Alton, IL | Dockside gaming | 241,762 | 0.2 | 3.6 | — | |||||||||||

Hollywood Casino Toledo |

Toledo, OH | Land-based gaming | 285,335 | 44.3 | — | — | |||||||||||

Hollywood Casino Columbus |

Columbus, OH | Land-based gaming | 354,075 | 116.2 | — | — | |||||||||||

Hollywood Casino at Charles Town Races |

Charles Town, WV | Land-based gaming/Thoroughbred racing | 511,249 | 298.6 | — | 153 | |||||||||||

Hollywood Casino at Penn National Race Course |

Grantville, PA | Land-based gaming/Thoroughbred racing | 451,758 | 573.7 | — | — | |||||||||||

M Resort |

Henderson, NV | Land-based gaming | 910,173 | 87.6 | — | 390 | |||||||||||

Hollywood Casino Bangor |

Bangor, ME | Land-based gaming/Harness racing | 257,085 | 6.7 | 27.0 | 152 | |||||||||||

Zia Park Casino |

Hobbs, NM | Land-based gaming/Thoroughbred racing | 109,067 | 317.4 | — | — | |||||||||||

Hollywood Casino Bay St. Louis |

Bay St. Louis, MS | Land-based gaming | 425,920 | 579.9 | — | 291 | |||||||||||

Argosy Casino Riverside |

Riverside, MO | Dockside gaming | 450,397 | 41 | — | 258 | |||||||||||

Hollywood Casino Tunica |

Tunica, MS | Dockside gaming | 315,831 | — | 67.7 | 494 | |||||||||||

Boomtown Biloxi |

Biloxi, MS | Dockside gaming | 134,800 | 1.6 | 26.6 | — | |||||||||||

Argosy Casino Sioux City(3) |

Sioux City, IA | Dockside gaming | 73,046 | — | 4.6 | — | |||||||||||

Hollywood Casino St. Louis |

Maryland Heights, MO | Land-based gaming | 645,270 | 247.8 | — | 502 | |||||||||||

Casino Queen |

East St. Louis, IL | Land-based gaming | 330,502 | 70 | — | 157 | |||||||||||

Under Development |

|

|

|||||||||||||||

Hollywood Gaming at Dayton Raceway |

Dayton, OH | Land-based gaming/Harness racing | — | 119.4 | — | — | |||||||||||

Hollywood Gaming at Mahoning Valley Race Course |

Youngstown, OH | Land-based gaming/Thoroughbred racing | — | 193.4 | — | — | |||||||||||

| | | | | | | | | | | | | | | | | | |

|

6,674,905 | 3,048.7 | 163.7 | 2,792 | |||||||||||||

| | | | | | | | | | | | | | | | | | |

TRS Properties |

|||||||||||||||||

Hollywood Casino Baton Rouge |

Baton Rouge, LA | Dockside gaming | 120,517 | 28.9 | — | — | |||||||||||

Hollywood Casino Perryville |

Perryville, MD | Land-based gaming | 97,961 | 36.4 | — | — | |||||||||||

| | | | | | | | | | | | | | | | | | |

|

218,478 | 65.3 | — | — | |||||||||||||

| | | | | | | | | | | | | | | | | | |

Total |

6,893,383 | 3,114.0 | 163.7 | 2,792 | |||||||||||||

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

- (1)

- Square

footage includes conditioned space and excludes parking garages and barns.

- (2)

- Leased

acreage reflects land subject to leases with third parties and includes land on which certain of the current facilities and ancillary supporting

structures are located as well as parking lots and access rights.

- (3)

- In April 2014, the Iowa Racing and Gaming Commission (the "IRGC") ruled that the Argosy Casino Sioux City must cease operations by July 1, 2014.

Hollywood Casino Lawrenceburg

We own 74.1 acres and lease 32.1 acres in Lawrenceburg, Indiana, a portion of which serves as the dockside embarkation for the gaming vessel, and includes a Hollywood-themed casino riverboat, an entertainment pavilion, a 295-room hotel, two parking garages and an adjacent surface lot, with the other portion used for remote parking.

3

Hollywood Casino Aurora

We own a dockside barge structure and land-based pavilion in Aurora, Illinois. We own the land, which is approximately 0.4 acres, on which the pavilion is located and a pedestrian walkway bridge. The property also includes a parking lot under an operating lease agreement and two parking garages under capital lease agreements, together comprising over 2 acres.

Hollywood Casino Joliet

We own 276 acres in Joliet, Illinois, which includes a barge-based casino, land-based pavilion, a 100-room hotel, a 1,100 space parking garage, surface parking areas and a recreational vehicle park.

Argosy Casino Alton

We lease 3.6-acres in Alton, Illinois, a portion of which serves as the dockside boarding for the Alton Belle II, a riverboat casino. The dockside facility includes an entertainment pavilion and office space, as well as surface parking areas with 1,341 spaces. In addition, we own an office building property consisting of 0.2 acres.

Hollywood Casino Toledo

We own a 44-acre site in Toledo, Ohio, where Penn opened Hollywood Casino Toledo on May 29, 2012. The property includes the casino as well as structured and surface parking.

Hollywood Casino Columbus

We own 116 acres of land in Columbus, Ohio, where Penn opened Hollywood Casino Columbus on October 8, 2012. The property includes the casino as well as structured and surface parking.

Hollywood Casino at Charles Town Races

We own 300 acres on various parcels in Charles Town and Ranson, West Virginia of which 155 acres comprise Hollywood Casino at Charles Town Races. The facility includes a 153-room hotel and a 3/4-mile all-weather lighted thoroughbred racetrack, a training track, two parking garages, an employee parking lot, an enclosed grandstand/clubhouse and housing facilities for over 1,300 horses.

Hollywood Casino at Penn National Race Course

We own 574 acres in Grantville, Pennsylvania, where Penn National Race Course is located on 181 acres. The facility includes a one-mile all-weather lighted thoroughbred racetrack and a 7/8-mile turf track, a parking garage and surface parking spaces. The property also includes approximately 393 acres surrounding the Penn National Race Course that are available for future expansion or development.

M Resort

We own 88 acres on the southeast corner of Las Vegas Boulevard and St. Rose Parkway in Henderson, Nevada, where the M Resort is located. The M Resort property includes a 390-room hotel, a 4,700 space parking facility, and other facilities.

Hollywood Casino Bangor

We own and lease the land on which the Hollywood Casino Bangor facility is located in Bangor, Maine, which consists of just over 9 acres, and includes a 152-room hotel and four-story parking. In addition, we lease 25 acres located at historic Bass Park, which is adjacent to the facility, which includes

4

a one-half mile standard bred racetrack and a grandstand with over 12,000 square feet and seating for 3,500 patrons.

Zia Park Casino

The casino adjoins the racetrack and is located on 317 acres that we own in Hobbs, New Mexico. The property includes a one-mile quarter/thoroughbred racetrack. In September 2013, Penn began construction of a new hotel, budgeted at $26.2 million which will include 150 rooms, six suites, a board/meeting room, exercise/fitness facilities and a breakfast venue.

Hollywood Casino Bay St. Louis

We own 580 acres in the city of Bay St. Louis, Mississippi, including a 20-slip marina. The property includes a land-based casino, 18-hole golf course, a 291-room hotel, and other facilities.

Argosy Casino Riverside

We own 41 acres in Riverside, Missouri, which includes a barge-based casino, a 258-room luxury hotel, an entertainment/banquet facility and a parking garage.

Hollywood Casino Tunica

We lease 68 acres of land in Tunica, Mississippi. The property includes a single-level casino, a 494-room hotel, surface parking and other land-based facilities.

Boomtown Biloxi

We lease 18.2 acres, most of which is utilized for the gaming location. We also lease 5 acres of submerged tidelands at the casino site from the State of Mississippi, lease 3.6 acres for parking, own 1.2 acres of land mostly used for parking and welcome center, and own 0.4 acres of undeveloped land. We own the barge on which the casino is located and all of the land-based facilities.

Argosy Casino Sioux City

We lease 4.1 acres, for the landing rights and parking, which includes the dockside embarkation for the Argosy IV, a riverboat casino. We own the Argosy IV and adjacent barge facilities. We also lease 0.4 acres primarily used for employee parking. In April 2014, the IRGC ruled that the Argosy Casino Sioux City must cease operations by July 1, 2014. This will result in a reduction of approximately $6.2 million in annual rental revenue under the Master Lease.

Hollywood Casino St. Louis

We own 248 acres along the Missouri River in Maryland Heights, Missouri, which includes a 502-room hotel and structure and surface parking.

Casino Queen

We own 70 acres along the Mississippi River in East St. Louis, Illinois, which includes a single level casino, a 157-room hotel, an RV park as well as surface parking areas.

Properties Under Development

Hollywood Gaming at Dayton Raceway

We own 119 acres in Dayton, Ohio, where we are developing a new integrated racing and gaming facility, which we anticipate completing in the fall of 2014 at which time it will be leased to Penn.

5

Hollywood Gaming at Mahoning Valley Race Course

We own 193 acres in Youngstown, Ohio, where we are developing a new integrated racing and gaming facility, which we anticipate completing in the fall of 2014 at which time it will be leased to Penn.

TRS Properties

Hollywood Casino Baton Rouge

Hollywood Casino Baton Rouge is a dockside riverboat gaming facility operating in Baton Rouge, Louisiana. The riverboat features approximately 28,000 square feet of gaming space with 943 gaming machines and 18 table games. The facility also includes a two-story, 58,000 square foot dockside building featuring a variety of amenities, including a steakhouse, a 268-seat buffet, a deli, a premium players' lounge, a nightclub, a lobby bar, a public atrium, two meeting rooms and 1,490 parking spaces.

Hollywood Casino Perryville

Hollywood Casino Perryville is located directly off Interstate 95 in Cecil County, Maryland just 35 miles northeast of Baltimore and 70 miles from Washington, D.C. Hollywood Casino Perryville is a Hollywood-themed facility which offers 34,329 square feet of gaming space with 1,158 slot machines. On March 5, 2013, table games were opened at Hollywood Casino Perryville following a November 2012 referendum authorizing the ability to add table games to Maryland's five existing and planned casinos. At December 31, 2013, Hollywood Casino Perryville had 12 table games and 10 poker tables. The facility also offers various food and beverage options, including a bar and grill, a gift shop and 1,600 parking spaces with valet and self-parking.

Our Competitive Strengths

We believe the following competitive strengths will contribute significantly to our success:

Geographically Diverse Property Portfolio

As of March 31, 2014, our portfolio consists of 22 gaming and related facilities, which included the TRS properties, the real property associated with 19 gaming and related facilities operated by Penn (including two properties under development in Dayton, OH and Youngstown, OH) and the real property associated with the Casino Queen in East St. Louis, Illinois, that was acquired in January 2014. Our portfolio comprises approximately 6.9 million property square footage and approximately 3,200 acres of owned and leased land and is broadly diversified by location across 13 states. Our geographic diversification will limit the effect of a decline in any one regional market on our overall performance.

Financially Secure Tenants

As of March 31, 2014, substantially all of the Company's real estate properties were leased to a wholly owned subsidiary of Penn, and most of the Company's rental revenues were derived from the Master Lease. Penn is a leading, diversified, multi-jurisdictional owner and manager of gaming and pari-mutuel properties, and an established gaming provider with strong financial performance. Penn is a publicly traded company that is subject to the informational filing requirements of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and is required to file periodic reports on Form 10-K and Form 10-Q with the SEC. Penn's net revenues were $2.9 billion for each of the years ended December 31, 2013 and 2012.

6

Long-Term, Triple-Net Lease Structure

Most of our real estate properties are leased under the Master Lease, a "triple-net" operating lease guaranteed by the tenant with a term of 15 years (in addition to four 5 year renewals at the tenant's option), pursuant to which the tenant is responsible for all facility maintenance, insurance required in connection with the leased properties and the business conducted on the leased properties, taxes levied on or with respect to the leased properties and all utilities and other services necessary or appropriate for the leased properties and the business conducted on the leased properties. The Casino Queen property is leased back to Casino Queen on a "triple net" basis on terms similar to those in the Master Lease. Upon the opening of the video lottery terminal facilities at Hollywood Gaming at Dayton Raceway and Hollywood Gaming at Mahoning Valley Race Course, which are expected to commence operations in the fall of 2014, the annual rental revenue related to the Master Lease is anticipated to increase by approximately $19 million, which approximates ten percent of the real estate construction costs paid for by GLPI related to these facilities.

Flexible UPREIT Structure

We have the flexibility to operate through an umbrella partnership, commonly referred to as an UPREIT structure, in which substantially all of our properties and assets are held by GLP Capital or by subsidiaries of GLP Capital. Conducting business through GLP Capital allows us flexibility in the manner in which we structure and acquire properties. In particular, an UPREIT structure enables us to acquire additional properties from sellers in exchange for limited partnership units, which provides property owners the opportunity to defer the tax consequences that would otherwise arise from a sale of their real properties and other assets to us. As a result, this structure potentially may facilitate our acquisition of assets in a more efficient manner and may allow us to acquire assets that the owner would otherwise be unwilling to sell because of tax considerations. We believe that this flexibility will provide us an advantage in seeking future acquisitions.

Experienced and Committed Management Team

Although our management team has limited experience in operating a REIT, it has extensive gaming and real estate experience. Peter M. Carlino, chief executive officer of GLPI, has more than 30 years of experience in the acquisition and development of gaming facilities and other real estate projects. William J. Clifford, chief financial officer of GLPI, is a finance professional with more than 30 years of experience in the gaming industry including four years of gaming regulatory experience, sixteen years of casino property operations, and twelve years of corporate experience. Through years of public company experience, our management team also has extensive experience accessing both debt and equity capital markets to fund growth and maintain a flexible capital structure.

Ability to Identify Attractive Real Estate Investments

As a result of our management team's operating experience, network of relationships and industry insight, we expect to be able to identify attractive real estate investments within the gaming industry. We will seek operators for these real estate investments who possess local market knowledge, demonstrate hands-on management and have proven track records. We believe our management team's experience gives us a key competitive advantage in objectively evaluating an operator's financial position and operating efficiency in order for us to make prudent real estate investments.

GLPI was incorporated in Pennsylvania on February 13, 2013. The Operating Partnership, a Pennsylvania limited partnership, and Capital Corp., a Delaware corporation, are indirect wholly owned subsidiaries of GLPI.

7

The common stock of GLPI is quoted on the NASDAQ Global Select Market under the symbol "GLPI." Our principal executive offices are located at 825 Berkshire Boulevard, Suite 400, Wyomissing, PA 19610, and our telephone number is (610) 401-2900.

Our internet address is www.glpropinc.com. The information contained on or that can be accessed through our website is not incorporated by reference in, and is not part of, this prospectus, and you should not rely on any such information in connection with your investment decision exchange your outstanding old notes for new notes.

On May 13, 2014, GLPI entered into an agreement to purchase the entity owning The Meadows Racetrack and Casino (the "Casino") located in Washington, Pennsylvania. GLPI has begun a search for a third party operator for the Casino, to whom GLPI expects to sell the entities holding the licenses and operating assets, while retaining ownership of the land and buildings.

8

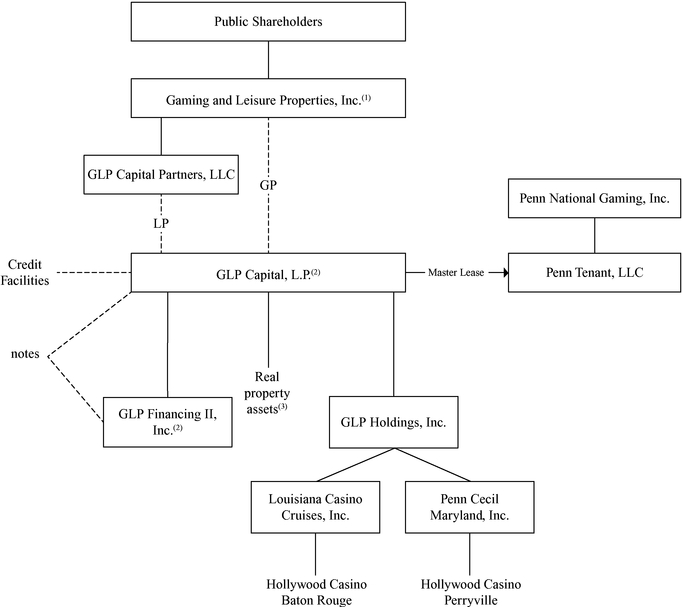

The following diagram shows our corporate structure:

- (1)

- Guarantor

of the notes and our Credit Facilities.

- (2)

- Co-obligor

under the notes.

- (3)

- Real property assets and entities owning real property assets, including the Casino Queen property.

9

Old 2018 Notes |

4.375% Senior Notes due 2018, which we issued on October 30, 2013. $550,000,000 aggregate principal amount of old 2018 notes were issued under the indenture, dated as of October 30, 2013 (the "indenture"). | |

Old 2020 Notes |

4.875% Senior Notes due 2020, which we issued on October 31, 2013. $1,000,000,000 aggregate principal amount of old 2020 notes were issued under the indenture. |

|

Old 2023 Notes |

5.375% Senior Notes due 2023, which we issued on October 30, 2013. $500,000,000 aggregate principal amount of old 2023 notes were issued under the indenture. |

|

New 2018 Notes |

4.375% Senior Notes due 2018, the issuance of which has been registered under the Securities Act. The form and the terms of the new 2018 notes are substantially identical to those of the old 2018 notes, except that the transfer restrictions, registration rights and liquidated damages provisions relating to the old 2018 notes described in the registration rights agreement related thereto do not apply to the new 2018 notes. |

|

New 2020 Notes |

4.875% Senior Notes due 2020, the issuance of which has been registered under the Securities Act. The form and the terms of the new 2020 notes are substantially identical to those of the old 2020 notes, except that the transfer restrictions, registration rights and liquidated damages provisions relating to the old 2020 notes described in the registration rights agreement related thereto do not apply to the new 2020 notes. |

|

New 2023 Notes |

5.375% Senior Notes due 2023, the issuance of which has been registered under the Securities Act. The form and the terms of the new 2023 notes are substantially identical to those of the old 2023 notes, except that the transfer restrictions, registration rights and liquidated damages provisions relating to the old 2023 notes described in the registration rights agreement related thereto do not apply to the new 2023 notes. |

|

Exchange Offers for Notes |

We are offering to issue up to $550,000,000 aggregate principal amount of new 2018 notes, $1,000,000,000 aggregate principal amount of new 2020 notes and $500,000,000 aggregate principal amount of new 2023 notes in exchange for a corresponding like principal amount of old 2018 notes, old 2020 notes and old 2023 notes, respectively, to satisfy our obligations under the registration rights agreements that we entered into when the old notes were issued in transactions consummated in reliance upon the exemption from registration provided by Rule 144A and Regulation S under the Securities Act. |

10

Expiration Date; Tenders |

Each of the exchange offers will expire at 5:00 p.m., New York City time, on , 2014, unless we extend or earlier terminate such exchange offer. By tendering your old notes, you represent to us that: |

|

|

• you are neither our "affiliate," as defined in Rule 405 under the Securities Act, nor a broker-dealer tendering notes acquired directly from us for your own account; |

|

|

• any new notes you receive in the applicable exchange offer are being acquired by you in the ordinary course of your business; |

|

|

• at the time of the commencement of the applicable exchange offer, neither you nor, to your knowledge, anyone receiving new notes from you, has any arrangement or understanding with any person to participate in the distribution, as defined in the Securities Act, of the new notes in violation of the Securities Act; |

|

|

• if you are a broker-dealer, you will receive the new notes for your own account in exchange for old notes that were acquired by you as a result of your market-making or other trading activities and that you will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the new notes you receive; for further information regarding resales of the new notes by participating broker-dealers, see the discussion under the caption "Plan of Distribution"; and |

|

|

• if you are not a broker-dealer, you are not engaged in, and do not intend to engage in, the distribution, as defined in the Securities Act, of the new notes. |

|

Withdrawal; Non-Acceptance |

You may withdraw any old notes tendered in each of the exchange offers at any time prior to 5:00 p.m., New York City time, on , 2014, unless we extend or earlier terminate such exchange offer. If we decide for any reason not to accept any old notes tendered for exchange, the old notes will be returned to the registered holder at our expense promptly after the expiration or termination of the applicable exchange offer. In the case of old notes tendered by book-entry transfer into the exchange agent's account at The Depository Trust Company ("DTC"), any withdrawn or unaccepted old notes will be credited to the tendering holder's account at DTC. For further information regarding the withdrawal of tendered old notes, see "The Exchange Offers—Terms of the Exchange Offers; Period for Tendering Old Notes" and "The Exchange Offers—Withdrawal Rights." |

11

Conditions to the Exchange Offers |

We are not required to accept for exchange or to issue new notes in exchange for any old notes, and we may terminate or amend the applicable exchange offer, if any of the following events occur prior to the expiration of such exchange offer: |

|

|

• such exchange offer violates any applicable law or applicable interpretation of the staff of the SEC; |

|

|

• an action or proceeding shall have been instituted or threatened in any court or by any governmental agency that might materially impair our ability to proceed with such exchange offer; |

|

|

• we do not receive all the governmental approvals that we deem necessary to consummate such exchange offer; or |

|

|

• there has been proposed, adopted, or enacted any law, statute, rule or regulation that, in our reasonable judgment, would materially impair our ability to consummate such exchange offer. |

|

|

We may waive any of the above conditions in our reasonable discretion. See the discussion below under the caption "The Exchange Offers—Conditions to the Exchange Offers" for more information regarding the conditions to the exchange offers. |

|

Procedures for Tendering Old Notes |

Unless you comply with the procedure described below under the caption "The Exchange Offers—Guaranteed Delivery Procedures," you must do one of the following on or prior to the expiration of the applicable exchange offer to participate in such exchange offer: |

|

|

• tender your old notes by sending (i) the certificates for your old notes (in proper form for transfer), (ii) a properly completed and duly executed letter of transmittal and (iii) all other documents required by the letter of transmittal to Wells Fargo Bank, National Association, as exchange agent, at one of the addresses listed below under the caption "The Exchange Offers—Exchange Agent"; or |

12

|

• tender your old notes by using the book-entry transfer procedures described below and transmitting a properly completed and duly executed letter of transmittal, or an agent's message instead of the letter of transmittal, to the exchange agent. For a book-entry transfer to constitute a valid tender of your old notes in the exchange offer, Wells Fargo Bank, National Association, as exchange agent, must receive a confirmation of book-entry transfer of your old notes into the exchange agent's account at DTC prior to the expiration or termination of such exchange offer. For more information regarding the use of book-entry transfer procedures, including a description of the required agent's message, see the discussion below under the caption "The Exchange Offers—Book-Entry Transfers." As used in this prospectus, the term "agent's message" means a message, transmitted by DTC to and received by the exchange agent and forming a part of a book-entry confirmation, which states that DTC has received an express acknowledgment from the tendering participant stating that such participant has received and agrees to be bound by the letter of transmittal and that we may enforce such letter of transmittal against such participant. |

|

Guaranteed Delivery Procedures |

If you are a registered holder of old notes and wish to tender your old notes in the applicable exchange offer, but: |

|

|

• the old notes are not immediately available; |

|

|

• time will not permit your old notes or other required documents to reach the exchange agent before the expiration or termination of such exchange offer; or |

|

|

• the procedure for book-entry transfer cannot be completed prior to the expiration or termination of such exchange offer; |

|

|

then you may tender old notes by following the procedures described below under the caption "The Exchange Offers—Guaranteed Delivery Procedures." |

|

Special Procedures for Beneficial Owners |

If you are a beneficial owner whose old notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your old notes in the applicable exchange offer, you should promptly contact the person in whose name the old notes are registered and instruct that person to tender them on your behalf. If you wish to tender such old notes in the applicable exchange offer on your own behalf, prior to completing and executing the letter of transmittal and delivering your old notes, you must either make appropriate arrangements to register ownership of the old notes in your name, or obtain a properly completed bond power from the person in whose name the old notes are registered. |

13

Certain U.S. Federal Income Tax Considerations |

The exchange of old notes for new notes in the exchange offers will not be a taxable transaction for United States federal income tax purposes. See the discussion below under the caption "Certain U.S. Federal Income Tax Considerations" for more information regarding the United States federal income tax consequences to you of the exchange offers. |

|

Use of Proceeds |

We will not receive any proceeds from the exchange offers. |

|

Exchange Agent |

Wells Fargo Bank, National Association, is the exchange agent for the exchange offers. You can find the address and telephone number of the exchange agent below under the caption, "The Exchange Offers—Exchange Agent." |

|

Resales |

Based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties, we believe that the new notes issued in the exchange offers may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act as long as: |

|

|

• you are acquiring the new notes in the ordinary course of your business; |

|

|

• you are not participating, do not intend to participate and have no arrangement or understanding with any person to participate, in a distribution of the new notes; and |

|

|

• you are neither an affiliate of ours nor a broker-dealer tendering notes acquired directly from us for your own account. |

|

|

If you are an affiliate of ours, are engaged in or intend to engage in or have any arrangement or understanding with any person to participate in, the distribution of new notes: |

|

|

• you cannot rely on the applicable interpretations of the staff of the SEC; |

|

|

• you will not be entitled to tender your old notes in the exchange offers; and |

|

|

• you must comply with the registration requirements of the Securities Act in connection with any resale transaction. |

|

|

Each broker or dealer that receives new notes for its own account in exchange for old notes that were acquired as a result of market-making or other trading activities must acknowledge that it will comply with the registration and prospectus delivery requirements of the Securities Act in connection with any offer, resale or other transfer of the new notes issued in the exchange offers, including information with respect to any selling holder required by the Securities Act in connection with any resale of the new notes. |

14

|

Furthermore, any broker-dealer that acquired any of its old notes directly from us: |

|

|

• may not rely on the applicable interpretation of the staff of the SEC's position contained in Exxon Capital Holdings Corp., SEC no-action letter (publicly available May 13, 1988), Morgan Stanley & Co. Incorporated, SEC no-action letter (publicly available June 5, 1991) and Shearman & Sterling, SEC no-action letter (publicly available July 2, 1993); and |

|

|

• must also be named as a selling noteholder in connection with the registration and prospectus delivery requirements of the Securities Act relating to any resale transaction. |

|

Broker-Dealers |

Each broker-dealer that receives new notes for its own account pursuant to the exchange offers must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of such new notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for old notes which were received by the broker-dealer as a result of market-making or other trading activities. See "Plan of Distribution" for more information. |

|

Registration Rights Agreements for the Old Notes |

When we issued the old 2018 notes and the old 2023 notes on October 30, 2013 and the old 2020 notes on October 31, 2013, we entered into registration rights agreements with GLPI and a representative of the initial purchasers of the old notes. Under the terms of the registration rights agreements, we agreed to: |

|

|

• file the registration statement for the exchange offers with the SEC on or prior to July 28, 2014; |

|

|

• use reasonable best efforts to cause the registration statement for the exchange offers to be declared effective no later than September 25, 2014, in the case of the old 2018 notes and the old 2013 notes, and September 26, 2014, in the case of the old 2020 notes; |

|

|

• commence the exchange offers and use reasonable best efforts to issue on or prior to October 30, 2014, in the case of the old 2018 notes and the old 2013 notes, and October 31, 2014, in the case of the old 2020 notes, new notes in exchange for all old notes validly tendered (and not withdrawn) prior thereto in the applicable exchange offer; |

15

|

• use reasonable best efforts to file a shelf registration statement for the resale of the old notes if we cannot effect an exchange offer for such old notes within the time periods listed above and in certain other circumstances; and |

|

|

• if we fail to meet our registration obligations under the registration rights agreements, pay additional interest at a rate of 0.25% per annum for the first 90-day period immediately following the occurrence of such default, to be increased by an additional 0.25% per annum with respect to each subsequent 90-day period until all such defaults have been cured, up to a maximum additional interest rate of 0.5% per annum. |

Consequences of Not Exchanging Old Notes

If you do not exchange your old notes in the applicable exchange offer, you will continue to be subject to the restrictions on transfer described in the legend on the certificate for your old notes. In general, you may offer or sell your old notes only:

- •

- if they are registered under the Securities Act and applicable state securities laws;

- •

- if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities

laws; or

- •

- if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws.

We do not intend to register the old notes under the Securities Act, and holders of old notes that do not exchange old notes for new notes in the applicable exchange offer will no longer have registration rights with respect to the old notes except in the limited circumstances provided in the applicable registration rights agreement. Under some circumstances, as described in the applicable registration rights agreement, holders of the old notes, including holders who are not permitted to participate in the applicable exchange offer or who may not freely sell new notes received in such exchange offer, may require us to use our reasonable best efforts to file, and to cause to become effective, a shelf registration statement covering resales of the applicable series of old notes by such holders. For more information regarding the consequences of not tendering your old notes and our obligations to file a shelf registration statement, see "The Exchange Offers—Consequences of Exchanging or Failing to Exchange Old Notes."

Summary Description of the New Notes

The terms of the new notes of each series and those of the old notes of the corresponding series are substantially identical, except that the transfer restrictions, registration rights and liquidated damages provisions relating to the old notes described in the registration rights agreement for such series do not apply to the new notes. For a more complete understanding of the new notes, see "Description of the New Notes" in this prospectus.

Issuers |

GLP Capital, L.P. and GLP Financing II, Inc. | |

Securities Offered |

$550,000,000 principal amount of 4.375% Senior Notes due 2018, $1,000,000,000 principal amount of 4.875% Senior Notes due 2020, and $500,000,000 principal amount of 5.375% Senior Notes due 2023. |

16

Maturity |

November 1, 2018 for the new 2018 notes, November 1, 2020 for the new 2020 notes, and November 1, 2023 for the new 2023 notes. |

|

Interest Rate |

4.375% per year for the new 2018 notes, 4.875% per year for the new 2020 notes, and 5.375% per year for the new 2023 notes (each calculated using a 360-day year). |

|

Interest Payment Dates |

May 1 and November 1. |

|

Guarantees |

The new notes will be guaranteed on a senior unsecured basis by GLPI. The new notes will not be guaranteed by any of our subsidiaries, except in the event that we issue in the future certain subsidiary-guaranteed debt securities. |

|

Ranking |

The new notes will be the issuers' senior unsecured obligations. As of March 31, 2014, GLPI and its subsidiaries on a consolidated basis had $2.50 billion of debt, including $2.05 billion representing the old notes and approximately $450.0 million outstanding under our credit facilities ("Credit Facilities"), and we had $550.0 million available for borrowing under our revolving credit facility based on a $700.0 million revolving credit facility. |

|

|

GLPI's guarantee of the new notes will be its general senior unsecured obligation and will: |

|

|

• rank equally in right of payment with all of GLPI's senior unsecured indebtedness, including GLPI's guarantee of our Credit Facilities; |

|

|

• rank senior in right of payment to all of GLPI's subordinated indebtedness; |

|

|

• be effectively subordinated to all of GLPI's secured indebtedness to the extent of the value of the collateral securing such indebtedness; and |

|

|

• be structurally subordinated to all indebtedness and other liabilities of any of GLPI's subsidiaries that is not an issuer of the notes. |

17

|

In addition, because the new notes are not guaranteed by our subsidiaries, creditors of our subsidiaries (including lenders under our Credit Facilities, as certain of our subsidiaries may in the future elect to guarantee our Credit Facilities) and holders of any of our debt that is guaranteed by our subsidiaries have a prior claim, ahead of the new notes, on all of our subsidiaries' assets. Other than guarantees of our Credit Facilities, the liabilities of our subsidiaries currently consist primarily of payables, deferred taxes, intercompany debt and other ordinary course liabilities. |

|

Optional Redemption |

The issuers may redeem all or part of the new notes at any time at their option at a redemption price of 100% of the principal amount thereof plus accrued and unpaid interest, if any, to, but not including, the redemption date, plus a "make-whole" premium, as described under the section captioned "Description of the New Notes—Redemption—Optional Redemption." |

|

Redemption Based Upon Gaming Laws |

The new notes are subject to redemption requirements imposed by gaming laws and regulations of gaming authorities in jurisdictions in which we conduct gaming operations. See "Description of the New Notes—Redemption—Gaming Redemption." |

|

Change of Control Offer |

If we experience a change of control accompanied by a decline in the rating of the new notes, we must give holders of the new notes the opportunity to sell us their new notes at 101% of their principal amount, plus accrued and unpaid interest, if any, to, but not including, the redemption date. |

|

Certain Indenture Provisions |

The indenture governing the new notes contains covenants limiting the issuers' ability to: |

|

|

• incur additional indebtedness and use their assets to secure our indebtedness; |

|

|

• amend or terminate the Master Lease; and |

|

|

• merge, consolidate or transfer all or substantially all of our assets. |

|

|

These covenants are subject to a number of important and significant limitations, qualifications and exceptions. |

18

Risk Factors |

Investing in the notes involves substantial risks. See "Risk Factors" for a description of certain of the risks involved in investing in the notes and tendering your old notes in the exchange offers. |

For additional information regarding the notes, see the "Description of the New Notes" section of this prospectus.

19

You should carefully consider the risks and all the other information contained in this prospectus before making a decision as to whether to exchange your old notes in the applicable exchange offer.

Risk Factors Relating to Our Spin-Off from Penn

We may be unable to achieve some or all the benefits that we expect to achieve from the Spin-Off.

We believe that, as a publicly traded company independent from Penn, GLPI will have the ability to pursue transactions with other gaming operators that would not pursue transactions with Penn as a current competitor, to fund acquisitions with its equity on significantly more favorable terms than those that would be available to Penn, to diversify into different businesses in which Penn, as a practical matter, could not diversify, such as hotels, entertainment facilities and office space, and to pursue certain transactions that Penn otherwise would be disadvantaged by or precluded from pursuing due to regulatory constraints. However, we may not be able to achieve some or all of the benefits that we expect to achieve as a company independent from Penn in the time we expect, if at all.

If the Spin-Off, together with certain related transactions, does not qualify as a transaction that is generally tax-free for U.S. federal income tax purposes, GLPI could be subject to significant tax liabilities and, in certain circumstances, GLPI could be required to indemnify Penn for material taxes pursuant to indemnification obligations under a tax matters agreement (the "Tax Matters Agreement").

Penn has received a private letter ruling (the "IRS Ruling") from the Internal Revenue Service (the "IRS") substantially to the effect that, among other things, the Spin-Off, together with the required compliance exchanges and certain related transactions, will qualify as a transaction that is generally tax-free for U.S. federal income tax purposes under Sections 355 and/or 368(a)(1)(D) of the Internal Revenue Code (the "Code"). The IRS Ruling does not address certain requirements for tax-free treatment of the Spin-Off under Section 355, and Penn received from its tax advisors a tax opinion substantially to the effect that, with respect to such requirements on which the IRS will not rule, such requirements have been satisfied. The IRS Ruling, and the tax opinions that Penn received from its tax advisors, relied on, among other things, certain representations, assumptions and undertakings, including those relating to the past and future conduct of GLPI's business, and the IRS Ruling and the opinions would not be valid if such representations, assumptions and undertakings were incorrect in any material respect.

Notwithstanding the IRS Ruling and the tax opinions, the IRS could determine the Spin-Off should be treated as a taxable transaction for U.S. federal income tax purposes if it determines any of the representations, assumptions or undertakings that were included in the request for the IRS Ruling are false or have been violated or if it disagrees with the conclusions in the opinions that are not covered by the IRS Ruling.

Under a Tax Matters Agreement that GLPI entered into with Penn, GLPI generally is required to indemnify Penn against any tax resulting from the Spin-Off to the extent that such tax resulted from (i) an acquisition of all or a portion of the equity securities or assets of GLPI, whether by merger or otherwise, (ii) other actions or failures to act by GLPI, or (iii) any of GLPI's representations or undertakings being incorrect or violated. GLPI's indemnification obligations to Penn and its subsidiaries, officers and directors will not be limited by any maximum amount. If GLPI is required to indemnify Penn or such other persons under the circumstance set forth in the Tax Matters Agreement, GLPI may be subject to substantial liabilities.

20

GLPI may not be able to engage in desirable strategic or capital-raising transactions following the Spin-Off. In addition, GLPI could be liable for adverse tax consequences resulting from engaging in significant strategic or capital-raising transactions.

To preserve the tax-free treatment to Penn of the Spin-Off, for the two-year period following the Spin-Off, GLPI may be prohibited, except in specific circumstances, from: (1) entering into any transaction pursuant to which all or a portion of GLPI's stock would be acquired, whether by merger or otherwise, (2) issuing equity securities beyond certain thresholds, (3) repurchasing GLPI common stock, (4) ceasing to actively conduct the business of operating Hollywood Casino Baton Rouge or Hollywood Casino Perryville, or (5) taking or failing to take any other action that prevents the Spin-Off and related transactions from being tax-free. These restrictions may limit GLPI's ability to pursue strategic transactions or engage in new business or other transactions that may maximize the value of GLPI's business.

The Spin-Off agreements are not the result of negotiations between unrelated third parties.

The agreements that we entered into with Penn in connection with the Spin-Off, including a Separation and Distribution Agreement (the "Separation and Distribution Agreement"), Master Lease, Tax Matters Agreement, an agreement relating to employee matters (the "Employee Matters Agreement"), and Transition Services Agreement, have been negotiated in the context of the Spin-Off while we were still a wholly owned subsidiary of Penn. Accordingly, during the period in which the terms of those agreements were negotiated, we did not have an independent board of directors or a management team independent of Penn. As a result, although those agreements are generally intended to reflect arm's-length terms, the terms of those agreements may not reflect terms that would have resulted from arm's-length negotiations between unaffiliated third parties. Accordingly, there can be no assurance that the terms of these agreements will be as favorable for GLPI as would have resulted from negotiations with one or more unrelated third parties.

We may be unable to make, on a timely or cost-effective basis, the changes necessary to operate as a separate publicly traded company primarily focused on owning a portfolio of gaming properties.

GLPI has no significant historical operations as an independent company and does not currently have the infrastructure and personnel necessary to operate as a separate publicly traded company without relying on Penn to provide certain services on a transitional basis. Penn is obligated to provide such transition services pursuant to the terms of a Transition Services Agreement (the "Transition Services Agreement") that GLPI entered into with Penn, to allow GLPI time, if necessary, to build the infrastructure and retain the personnel necessary to operate as a separate publicly traded company without relying on such services. Following the expiration of the Transition Services Agreement, Penn will be under no obligation to provide further assistance to GLPI. As a separate public entity, we are subject to, and responsible for, regulatory compliance, including (a) periodic public filings with the SEC, (b) compliance with NASDAQ's continued listing requirements, (c) compliance with applicable state gaming rules and regulations and (d) compliance with generally applicable tax and accounting rules. Because GLPI's business historically has not been operated as a separate publicly traded company, GLPI cannot assure you that it will be able to successfully implement the infrastructure or retain the personnel necessary to operate as a separate publicly traded company or that GLPI will not incur costs in excess of anticipated costs to establish such infrastructure and retain such personnel.

The historical and pro forma financial information included in this prospectus may not be a reliable indicator of future results.

The historical consolidated financial statements included in this prospectus include the combined historical financial data of Louisiana Casino Cruises, Inc. and Penn Cecil Maryland, Inc., which were acquired by a subsidiary of GLPI called GLP Holdings, Inc., and which operate the TRS Properties,

21

which combined financial statements only reflect the historical operation of these two facilities as of and for the period specified.

The historical consolidated financial statements and the pro forma financial information included in this prospectus do not reflect what the business, financial position or results of operations of GLPI will be in the future. Prior to the Spin-Off, the business of GLPI was operated by Penn as part of one corporate organization and not operated as a stand-alone company. Because GLPI has no significant historical operations and did not acquire the real estate ownership and development business of Penn until immediately prior to the Spin-Off, there are no historical financial statements for GLPI as it existed prior to the Spin-Off. Significant changes will occur in the cost structure, financing and business operations of GLPI as a result of its operation as a stand-alone company and the entry into transactions with Penn (and its subsidiaries) that have not existed historically, including the Master Lease.