☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material pursuant to §240.14a-12 | |

☒ |

No fee required. | |

☐ |

Fee paid previously with preliminary materials. | |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

April 10, 2023 |

| Dear Sprouts Stockholders:

You are cordially invited to attend the 2023 Annual Meeting of

Proxy Voting At the Annual Meeting, we will ask you to elect three members of

Proxy Materials and Availability |

|

We have elected to provide access to proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rules to reduce the environmental impact and cost of our Annual Meeting. However, if you prefer to receive paper copies of our proxy materials, please follow the instructions included in the Notice of Internet Availability.

How to Vote

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the meeting. Therefore, we urge you to promptly vote and submit your proxy via the Internet, by telephone, or by mail, in accordance with the instructions included in the proxy statement.

On behalf of our board of directors, we would like to thank you for your continued interest and investment in Sprouts Farmers Market.

Sincerely,

|

| Jack Sinclair Director and Chief Executive Officer |

SPROUTS FARMERS MARKET, INC.

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

| Time and Date: |

Wednesday, May 24, 2023 at 8:00 a.m. Pacific time. |

| Place: |

Via webcast at www.virtualshareholdermeeting.com/SFM2023 |

| Items of Business: |

(1) | To elect three Class I directors to serve until the 2026 annual meeting of stockholders or until their successors are duly elected and qualified; |

| (2) | To vote on a non-binding advisory resolution to approve the compensation paid to our named executive officers for fiscal 2022 (“say-on-pay”); |

| (3) | To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and |

| (4) | To consider such other business as may properly come before the meeting or any adjournment or postponement thereof. |

Adjournments and

| Postponements: |

Any action on the items of business described above may be considered at the Annual Meeting at the time and on the date specified above or at any time and date to which the Annual Meeting may be properly adjourned or postponed. |

| Record Date: |

Holders of record of our common stock as of the close of business on March 27, 2023 are entitled to notice of, and to vote at, the Annual Meeting. |

| Voting: |

Your vote is very important. To ensure your representation at the Annual Meeting, we urge you to vote by proxy as promptly as possible over the Internet or by phone as instructed in the Notice of Internet Availability of Proxy Materials or, if you receive paper copies of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card. All stockholders as of the record date are invited to attend the Annual Meeting. You may vote at the Annual Meeting even if you have previously returned a proxy. |

By Order of the Board of Directors,

Brandon F. Lombardi

Chief Legal Officer and Corporate Secretary

This notice of Annual Meeting and proxy statement and form of proxy are being distributed and made available on or about April 10, 2023.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on May 24, 2023.

This proxy statement and our 2022 Annual Report to Stockholders, which includes our Annual Report on Form 10-K for the fiscal year ended January 1, 2023, are available at www.proxyvote.com and at investors.sprouts.com.

TABLE OF CONTENTS

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 6 | ||||

| 11 | ||||

| 11 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 25 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 31 | ||||

| 34 | ||||

| 37 | ||||

| 39 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

| 46 | ||||

| 46 | ||||

| 49 | ||||

| 49 | ||||

| 49 | ||||

| 51 | ||||

| 54 | ||||

| 55 | ||||

| Proposal 2: Advisory Vote on Executive Compensation (“Say-on-Pay”) |

57 | |||

| Proposal 3: Ratification of Appointment of Independent Registered Public Accounting Firm |

59 | |||

| Security Ownership of Certain Beneficial Owners and Management |

60 | |||

| 62 | ||||

| 63 | ||||

| 63 | ||||

| Director Nominations for Inclusion in our 2024 Proxy Materials (Proxy Access) |

63 | |||

| 63 | ||||

| A-1 | ||||

| This proxy statement contains forward-looking statements regarding Sprouts Farmers Market, Inc.’s current expectations within the meaning of the applicable securities laws and regulations. These statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from expectations. These risks and uncertainties include, but are not limited to, the risks detailed in the company filings with the Securities and Exchange Commission, including the Risk Factors section of Sprouts Farmers Market, Inc.’s Annual Report on Form 10-K for the fiscal year ended January 1, 2023. We assume no obligation to update any of these forward-looking statements. |

| Proxy Statement Summary |

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should review all of the information contained in the proxy statement before voting.

Annual Meeting of Stockholders

| Date: | Wednesday, May 24, 2023 |

| Time: | 8:00 a.m., Pacific time |

| Location: | Via webcast at www.virtualshareholdermeeting.com/SFM2023 |

| Record Date: | March 27, 2023 |

| Voting: | Stockholders as of the record date are entitled to vote. Each share of common stock is entitled to one vote. |

Proposals and Voting Recommendations

| Board Recommendation |

Page | |||

| Election of Directors |

||||

| Joel D. Anderson |

For | 22 | ||

| Terri Funk Graham |

For | 22 | ||

| Doug G. Rauch |

For | 22 | ||

| Advisory vote on the compensation paid to our named executive officers for fiscal 2022 |

For | 57 | ||

| Ratification of our independent registered public accounting firm |

For | 59 |

Voting Methods

You can vote in one of four ways:

|

|

Visit www.proxyvote.com to vote VIA THE INTERNET | |

|

|

Call 1-800-690-6903 to vote BY TELEPHONE | |

|

|

Sign, date and return your proxy card in the prepaid enclosed envelope to vote BY MAIL | |

|

|

Attend the virtual meeting to vote DURING THE WEBCAST. |

To reduce our administrative and postage costs and the environmental impact of the Annual Meeting, we encourage stockholders to vote via the Internet or by telephone, both of which are available 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on May 23, 2023. Stockholders may revoke their proxies at the times and in the manners described on page 8 of this proxy statement.

If your shares are held in “street name” through a bank, broker or other holder of record, you will receive voting instructions from the holder of record that you must follow in order for your shares to be voted. If you wish to vote in person at the meeting, you must obtain a legal proxy from the bank, broker or other holder of record that holds your shares.

As used in this proxy statement, unless the context otherwise requires, references to the “company,” “Sprouts,” “we,” “us” and “our” refer to Sprouts Farmers Market, Inc. and, where appropriate, its subsidiaries.

| Sprouts Farmers Market | 1 | Proxy Statement 2023 |

| Business Summary |

BUSINESS SUMMARY

True to our farm-stand heritage, Sprouts Farmers Market offers a unique grocery experience featuring an open layout with fresh produce at the heart of the store. Sprouts inspires wellness naturally with a carefully curated assortment of better-for-you products paired with purpose-driven people. We continue to bring the latest in wholesome, innovative products made with lifestyle-friendly ingredients such as organic, plant-based and gluten-free. Headquartered in Phoenix, and one of the largest and fastest growing specialty retailers of fresh, natural and organic food in the United States, Sprouts employs approximately 31,000 team members and operated 386 stores in 23 states nationwide as of January 1, 2023.

2022 was another year of meaningful accomplishments for our company as we navigated a very challenging retail environment due largely to elevated inflationary conditions and continued supply chain difficulties. Despite these challenges, we achieved the following accomplishments during fiscal 2022, including:

| • | Opened 16 new stores, representing unit growth of over 3% from year-end 2021 store count; |

| • | Launched approximately 8,400 new products in our stores; |

| • | Net sales of $6.4 billion, a 5% increase from 2021; |

| • | Comparable store sales growth of 2.2%; |

| • | Net income of $261 million compared to net income of $244 million in 2021; |

| • | Diluted earnings per share of $2.39 compared to $2.10 diluted earnings per share in 2021; |

| • | Generated cash flow from operations of $371 million; and |

| • | Repurchased 6.9 million shares of common stock for a total investment of $200 million. |

| Sprouts Farmers Market | 2 | Proxy Statement 2023 |

| Our Growth Strategy |

OUR GROWTH STRATEGY

Since 2020, we have focused on a long-term growth strategy that we believe is transforming our company and driving profitable growth. We continue to execute on this strategy, focusing on the following areas:

| • | Win with Target Customers. We are focusing attention on our target customers, identified through research as ‘health enthusiasts’ and ‘selective shoppers’, where there is ample opportunity to gain share within these customer segments. We believe our business can continue to grow by leveraging existing strengths in a unique assortment of better-for-you, quality products and by providing a full omnichannel offering through delivery or pickup via our website or the Sprouts app. |

| • | Refine Brand and Marketing Approach. We believe we are elevating our national brand recognition and positioning by telling our unique brand story rooted in product innovation and differentiation. We are investing savings from largely removing our weekly promotional print ad into increasing engagement and personalization with our target customers through digital and social connections, driving additional sales growth and loyalty. |

| • | Update Format and Expand in Select Markets. We are delivering unique smaller stores with expectations of stronger returns, while maintaining the approachable, fresh-focused farmer’s market heritage Sprouts is known for. In 2021, we opened three stores and remodeled one store featuring our new format, and in 2022, we opened nine new format stores. Our geographic store expansion and new store placement will intersect where our target customers live, in markets with growth potential and supply chain support, which we believe will provide a long runway of at least 10% annual unit growth beginning in 2024. |

| • | Create an Advantaged Supply Chain. We believe our network of fresh distribution centers can drive efficiencies across the chain and support growth plans. To further deliver on our fresh commitment and reputation, as well as to increase our local offerings and improve financial results, we aspire to ultimately position fresh distribution centers within a 250-mile radius of stores. With the opening of two fresh distribution centers in 2021, we now have more than 85% of our stores within 250 miles of a distribution center. |

| • | Inspire and Engage Our Talent to Create a Best Place to Work. Subsequent to the initial launch of our long-term growth strategy, we have added the focus area of inspiring and engaging our talent through our culture, acquisition and development and total rewards program to attract and retain the talent we believe we need to execute on our strategic goals and transform our company into a premier place to work. |

| • | Deliver on Financial Targets. We are measuring and reporting on the success of this strategy against a number of long-term financial and operational targets. With the implementation of our strategy beginning in 2020, we have significantly improved our margin structure above our 2019 baseline. |

| (1) | 10% unit growth starting in 2024. |

| Sprouts Farmers Market | 3 | Proxy Statement 2023 |

| Environmental, Social and Governance Highlights |

ENVIRONMENTAL, SOCIAL AND GOVERNANCE HIGHLIGHTS

Sprouts continues to care for our customers, team members, and the planet by integrating environmental, social and governance (ESG) considerations throughout our business and long-term strategy. As one of the largest and fastest growing specialty retailers of fresh, natural and organic food in the United States, we owe our success to our passionate team members and loyal customers. We are dedicated to educating the public about healthy living, improving the communities in which we operate, and conserving the planet’s natural resources. By living our values, we take great pride in our ESG accomplishments during 2022.

Environmental

From lowering greenhouse gas emissions and diverting landfill waste to recycling plastics and sustainably sourcing products, we are committed to environmental sustainability and achieved the following during 2022:

| • | Generated nearly 26% of our 2022 sales from organic products; |

| • | Achieved $145 million in local produce sales; |

| • | Increased sales of less carbon intensive plant-based products by 21% from the prior year; |

| • | Recovered 87% of our food waste, resulting in the donation of the equivalent of over 27 million meals to those in need; and |

| • | Recycled over 800,000 pounds of plastic from customer returned bags and product shipping wrap. |

Social

Our top priority is the health and well-being of our customers, team members, and the communities we serve. We collaborate with our partners across our supply chain to source responsibly, provide safe and healthy work conditions in our stores, promote diversity and inclusivity, and enrich our communities. During 2022, we made the following strides:

| • | Created 1,600 new jobs, promoted over 7,300 team members and filled 64% of store manager positions with internal candidates; |

| • | Invested over $3.2 million into programs through the Sprouts Healthy Communities Foundation to provide an estimated three million students with school garden and nutrition education programming; |

| Sprouts Farmers Market | 4 | Proxy Statement 2023 |

| Environmental, Social and Governance Highlights |

| • | Reduced non-COVID worker compensation claims by 12% and general liability claims by 15% from the prior year; and |

| • | Sold approximately $200 million of products from women, minority, veteran or LGBTQ-owned suppliers. |

Governance

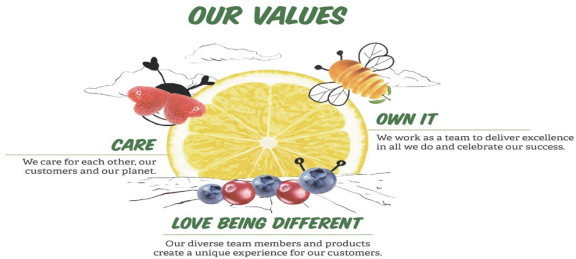

We pride ourselves in living our values of caring, loving being different and owning it. Our ESG goals are integrated throughout our business. Strong oversight by our executive leadership and board of directors ensures that the interests of our stakeholders are integrated into our strategy, goals and decision making. Among our governance highlights in 2022, we:

| • | Established the Sprouts Commitment to Human Rights with board oversight that sets forth our commitment and the steps we plan to take to ensure alignment with the United Nations Guiding Principles on Business and Human Rights and leading human rights frameworks; |

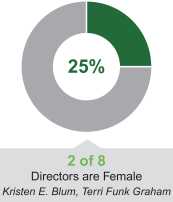

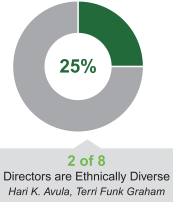

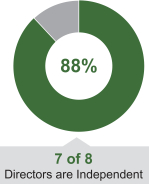

| • | Maintained our board that is 88% independent, 25% female and 25% ethnically diverse; and |

| • | Closed on a new credit facility in March 2022 with interest rate reductions tied to the achievement of ESG metrics. |

As our many environmental and social responsibility initiatives have advanced, so has our ability to accumulate, track, analyze and report on our accomplishments. In 2022, we maintained our AAA rating from MSCI, a leading global ESG rating agency. This AAA rating is the highest on the MSCI scale and signifies a company leading its industry in managing the most significant ESG risks and opportunities. We were also once again honored by the Corporate Knights as one of the Global 100 most sustainable corporations in the world. Both of these designations highlight the work we have done in improving our disclosures and making a positive impact on the environment, our team members and the communities we serve.

For more information on our ESG efforts and reporting, including our most recent ESG reports, please visit our website at about.sprouts.com/sustainability. The inclusion of our website address in this proxy statement does not include or incorporate by reference the information on or accessible through our website into this proxy statement.

| Sprouts Farmers Market | 5 | Proxy Statement 2023 |

| General Information |

SPROUTS FARMERS MARKET, INC.

5455 East High Street, Suite 111

Phoenix, Arizona 85054

2023 ANNUAL MEETING OF STOCKHOLDERS

GENERAL INFORMATION

This proxy statement is provided, and the enclosed form of proxy is solicited, on behalf of Sprouts Farmers Market, Inc., a Delaware corporation, by our board of directors for use at the 2023 Annual Meeting of Stockholders (referred to as the “Annual Meeting”) and any postponements or adjournments thereof. The Annual Meeting will be held via webcast at www.virtualshareholdermeeting.com/SFM2023 on Wednesday, May 24, 2023 at 8:00 a.m. Pacific time.

Internet Availability of Proxy Materials

In accordance with rules adopted by the Securities and Exchange Commission (referred to as the “SEC”) that allow companies to furnish their proxy materials over the Internet, we are mailing a Notice of Internet Availability of Proxy Materials instead of a paper copy of our proxy statement and our 2022 Annual Report to most of our stockholders. The Notice of Internet Availability of Proxy Materials contains instructions on how to access those documents and vote over the Internet. The Notice of Internet Availability of Proxy Materials also contains instructions on how to request a paper copy of our proxy materials, including this proxy statement, our 2022 Annual Report, and a form of proxy card. We believe this process will allow us to provide our stockholders the information they need in a more timely manner, while reducing the environmental impact and lowering our costs of printing and delivering the proxy materials.

These proxy solicitation materials are being first provided on or about April 10, 2023 to all stockholders entitled to vote at the Annual Meeting.

Record Date

Stockholders of record at the close of business on the record date of March 27, 2023 are entitled to notice of and to vote at the Annual Meeting.

Number of Outstanding Shares

On the record date, there were 103,708,199 outstanding shares of our common stock, par value $0.001 per share.

Requirements for a Quorum

The holders of a majority of the issued and outstanding shares of common stock entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum for the transaction of business at the Annual Meeting. Each stockholder voting at the Annual Meeting, either in person or by proxy, may cast one vote per share of common stock held on all matters to be voted on at the Annual Meeting.

Votes Required for Each Proposal

Assuming that a quorum is present, directors shall be elected by a plurality of the votes cast by shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. Therefore, the three nominees who receive the greatest number of votes cast shall be elected as directors. Our stockholders do not have cumulative voting rights for the election of directors.

| Sprouts Farmers Market | 6 | Proxy Statement 2023 |

| General Information |

The advisory vote on the compensation of our named executive officers for fiscal 2022 (commonly referred to as a “say-on-pay” proposal), and the proposal to ratify PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 shall each be decided by the affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote thereon.

Although the say-on-pay vote is non-binding, the result will provide information to our compensation committee and our board of directors regarding investor sentiment about our executive compensation philosophy, policies and practices, which our compensation committee and our board of directors will consider when determining executive compensation for the years to come.

The vote on each matter submitted to stockholders is tabulated separately. Broadridge Financial Solutions, or a representative thereof, will tabulate the votes.

Our Board’s Recommendation for Each Proposal

Our board of directors recommends that you vote your shares:

| • | “FOR” each of the three Class I director nominees; |

| • | “FOR” the say-on-pay proposal; and |

| • | “FOR” the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. |

Voting Instructions

You may vote your shares by proxy by doing any one of the following: vote via the Internet at www.proxyvote.com; call 1-800-690-6903 to vote by telephone; sign, date and return your proxy or voting instruction card in the prepaid enclosed envelope to vote by mail; or attend the Annual Meeting to vote during the webcast. When a proxy is properly executed and returned, the shares it represents will be voted at the Annual Meeting as directed.

If a proxy card is properly executed and returned and no voting specification is indicated, the shares will be voted:

(1) “for” the election of each of the three nominees for director set forth in this proxy statement,

(2) “for” the non-binding advisory resolution to approve the compensation paid to our named executive officers for fiscal 2022,

(3) “for” the proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal 2023, and

(4) as the persons specified in the proxy deem advisable in their discretion on such other matters as may properly come before the Annual Meeting.

As of the date of this proxy statement, we have received no notice of any such other matters.

If you virtually attend the Annual Meeting, you may vote during the webcast using the 16-digit voting control number found on your proxy card, voting instruction form or notice of internet availability of proxy materials, even if you have previously voted via the Internet or by phone or returned a proxy or voting instruction card by mail, and your vote during the webcast will supersede any vote previously cast.

| Sprouts Farmers Market | 7 | Proxy Statement 2023 |

| General Information |

Broker Non-Votes and Abstentions

If you are a beneficial owner of shares held in “street name” and do not provide the broker, bank, or other nominee that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote your shares on routine matters but cannot vote on non-routine matters. If the broker, bank or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, your shares will not be voted on that matter. This is commonly referred to as a “broker non-vote.”

The election of directors (referred to as “Proposal 1”) and the say-on-pay proposal (referred to as “Proposal 2”) are matters considered non-routine under applicable rules. A broker, bank or other nominee cannot vote without your instructions on non-routine matters; as a result, there may be broker non-votes on Proposals 1 and 2. For your vote to be counted on the above proposals, you will need to communicate your voting decisions to your broker, bank or other nominee before the date of the Annual Meeting using the voting instruction form provided by your broker, bank or other nominee.

The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal 2023 (referred to as “Proposal 3”) is a matter considered routine under applicable rules. A broker, bank or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected in connection with Proposal 3.

Broker non-votes and abstentions each are counted for determining the presence of a quorum. The election of directors requires a plurality of votes cast. Neither broker non-votes nor any withhold votes in the election of directors will have any effect thereon. Because they represent shares present and entitled to vote that are not cast in favor of a proposal, abstentions will have the same effect as votes “against” Proposal 2 and Proposal 3. Broker non-votes, however, do not represent shares present and entitled to vote on non-routine matters, and therefore, will have no effect on Proposal 2. As discussed above, no broker non-votes are expected in connection with Proposal 3.

Revoking Proxies

Any stockholder giving a proxy may revoke the proxy at any time before its use by furnishing to us either a written notice of revocation or a duly executed proxy (via Internet, telephone or mail) bearing a later date, or by attending the Annual Meeting and voting during the webcast. Attendance at the Annual Meeting webcast will not cause your previously granted proxy to be revoked unless you specifically so request.

Election Inspector

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the election inspector appointed for the meeting, who will determine whether a quorum is present. The election inspector will treat broker non-votes and abstentions as shares that are present and entitled to vote for purposes of determining the presence of a quorum, and as described in the “Broker Non-Votes and Abstentions” section of this proxy statement for purposes of determining the approval of any matter submitted to stockholders for a vote. The election inspector need not be a stockholder, and any of our directors or officers may be an inspector on any question other than a vote for or against his or her election to any position with our company or on any other matter in which he or she may be directly interested.

Voting Results

The final voting results from the Annual Meeting will be publicly disclosed in a Current Report on Form 8-K to be filed with the SEC within four business days of the Annual Meeting.

| Sprouts Farmers Market | 8 | Proxy Statement 2023 |

| General Information |

Costs of Solicitation of Proxies

We will bear the cost of this solicitation. In addition, we may reimburse brokerage firms and other persons representing beneficial owners of shares for expenses incurred in forwarding solicitation materials to such beneficial owners. Proxies also may be solicited by certain of our directors and officers, personally or by telephone or e-mail, without additional compensation. We have also retained Saratoga Proxy Consulting LLC to assist in the solicitation of proxies at an estimated cost of $10,000 plus expenses.

Householding

We are required to provide an Annual Report to all stockholders who receive this proxy statement. To reduce future costs to our company, if you are a stockholder of record and have more than one account in your name, or reside at the same address as other stockholders of record, you may authorize us to discontinue duplicate mailings of future Annual Reports and proxy statements, commonly referred to as “householding.” To do so, mark the designated box on each proxy card for which you wish to discontinue receiving an Annual Report and proxy statement. If you are voting via the Internet or by telephone, you can either follow the prompts when you vote or give instructions to discontinue duplicate mailings of future Annual Reports and proxy statements. Street name stockholders who wish to discontinue receiving duplicate mailings of future Annual Reports should review the information provided in the proxy materials mailed to them by their bank or broker. If, now or in the future, you wish to receive a separate copy of the Annual Report or proxy statement, please notify us by sending a written request to our Corporate Secretary at our principal executive offices, 5455 East High Street, Suite 111, Phoenix, Arizona 85054, and we will deliver a separate copy.

Attending the Annual Meeting

We will hold the Annual Meeting in a virtual meeting format only via the internet site set forth above. Stockholders will not be able to attend the Annual Meeting physically.

To be admitted to the Annual Meeting webcast, stockholders must enter the 16-digit voting control number found on their proxy card, voting instruction form or notice of internet availability of proxy materials. Once properly admitted, stockholders may listen to the meeting, vote their shares and submit questions during the meeting through the meeting’s website. Questions that meet the board’s guidelines and rules of conduct for the Annual Meeting will be addressed by the board or management during the meeting. Technical support will be available to stockholders prior to and during the Annual Meeting by accessing the internet site set forth above.

Availability of our Filings with the SEC

Our 2022 Annual Report to Stockholders, which was made available to stockholders with or preceding this proxy statement, contains financial and other information about our company, but is not incorporated into this proxy statement and is not to be considered a part of these proxy materials or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The information contained in the “Compensation Committee Report” and the “Report of the Audit Committee” shall not be deemed “filed” with the SEC or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act.

Through our investor relations website, investors.sprouts.com, we make available free of charge all of our SEC filings, including our proxy statements, our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, and our Current Reports on Form 8-K, as well as Form 3, Form 4 and Form 5 reports of our directors, officers, and principal stockholders, together with amendments to these reports filed or furnished pursuant to Sections 13(a), 15(d), or 16 of the Exchange Act. We will also provide upon written request, without charge to each stockholder of record as of the record date, a copy of our Annual Report on

| Sprouts Farmers Market | 9 | Proxy Statement 2023 |

| General Information |

Form 10-K for the fiscal year ended January 1, 2023 as filed with the SEC. Any exhibits listed in the Form 10-K report also will be furnished upon request at the actual expense we incur in furnishing such exhibits. Any such requests should be directed to our Corporate Secretary at our principal executive offices set forth in this proxy statement.

Other Information

We report our results of operations on a 52- or 53-week fiscal year ending on the Sunday closest to December 31. Our last three completed fiscal years ended on January 3, 2021 (53 weeks), January 2, 2022 (52 weeks) and January 1, 2023 (52 weeks). For ease of reference, we identify our fiscal years in this proxy by reference to the calendar year ending closest to the last day of such fiscal year. For example, we refer to our fiscal years ended January 3, 2021, January 2, 2022 and January 1, 2023 and our fiscal year ending December 31, 2023 as “fiscal 2020,” “fiscal 2021,” “fiscal 2022” and “fiscal 2023,” respectively.

| Sprouts Farmers Market | 10 | Proxy Statement 2023 |

| Corporate Governance |

CORPORATE GOVERNANCE

Our Board

Our business and affairs are overseen by our board of directors, which currently consists of eight members.

| Joseph Fortunato

Chairman of the Board

Age: 70 Director since: 2013 Chairman since: 2017 |

Career Highlights Mr. Fortunato has served as an Operating Partner at Prospect Hill Growth Partners, L.P., an operationally focused private equity firm, since January 2017. Mr. Fortunato serves on the board of directors of a number of Prospect Hill Growth Partners private portfolio companies, including Fitness Ventures LLC (as Chairman since June 2020), Comoto Holdings, Inc. (as Chairman since January 2016), Honors Holdings, LLC (since January 2018), EbLens LLC (as Chairman since March 2017) and Shoe Sensation (since August 2015). Mr. Fortunato previously served as Chairman of the Board, Chief Executive Officer and President of General Nutrition Companies, Inc. (NYSE: GNC; predecessor to GNC Holdings, Inc.), a global specialty retailer of health and wellness products, from November 2005 to August 2014 and was a consultant from September 2014 through December 2016. From 1990 to November 2005, Mr. Fortunato served in various executive roles with GNC, including Senior EVP and Chief Operating Officer, EVP of Retail Operations and Store Development and SVP of Financial Operations. Mr. Fortunato served on the board of directors of Mattress Firm Holding Corp., a retailer of mattresses and bedding-related products, from October 2012 until September 2016.

Key Board Skills and Qualifications • Record as an executive of a successful international retail company • Years of financial and operational experience • Experience on the boards of directors of public companies

Favorite Sprouts Brand Product Organic Himalayan Pink Salt and Coconut Oil Popcorn

|

| Joel D. Anderson

Independent Director

Age: 58 Director since: 2019 Committees: Audit Compensation, Chairperson |

Career Highlights Mr. Anderson has served as President, Chief Executive Officer and a Director of Five Below, Inc. (NASDAQ: FIVE), a leading high-growth value retailer offering trend-right, high-quality products, since February 2015, having previously served as President and Chief Operating Officer of Five Below from July 2014 to January 2015. Prior to joining Five Below, Mr. Anderson served as President and Chief Executive Officer of Walmart.com from 2011 until 2014 and as the Divisional Senior Vice President of the Northern Plains division of Walmart, Inc. (NYSE: WMT) from 2007 to 2011. Prior to joining Walmart, Mr. Anderson was President of the retail and direct business units for Lenox Group, Inc., a leader in quality tabletop and giftware, and served in various executive positions at Toys “R” Us, Inc. over a 14-year period.

Key Board Skills and Qualifications • Record as a chief executive officer of a publicly traded company • Over 25 years of retail industry experience, including ecommerce leadership • Experience as a high-growth retail executive at companies of scale

Favorite Sprouts Brand Product Kung Pao Sauce

|

| Sprouts Farmers Market | 11 | Proxy Statement 2023 |

| Corporate Governance |

| Hari K. Avula

Independent Director

Age: 57 Director since: 2022 Committees: Audit Risk |

Career Highlights Mr. Avula served as Chief Financial and Strategic Officer of Clif Bar & Company from May 2021 through February 2023, where he led the financial management and enterprise strategy functions for the nutritious and organic food company prior to its acquisition by Mondelēz International, Inc. Mr. Avula joined Clif Bar from Walgreens Boots Alliance Inc., (NASDAQ: WBA) where he served as Chief Financial Officer of global business transformation and digital/IT from 2020 to 2021 and Chief Financial Officer of retail pharmacy USA from 2017 to 2020. While at Walgreens, Mr. Avula represented the company on the boards of two private entities, AllianceRx Walgreens Prime, a specialty and home delivery pharmacy joint venture, from April 2018 to December 2019 and BrightSprings Health Services, a leading provider of home and community-based health and pharmacy services for high-need and medically complex populations, from March 2018 to December 2020. Prior to joining Walgreens, Mr. Avula spent over 22 years at PepsiCo, Inc. (NASDAQ: PEP) in a variety of financial and strategic roles, culminating as Chief Financial Officer for Frito Lay North America from 2015 to 2017.

Key Board Skills and Qualifications • Over 20 years as a senior financial leader, culminating in chief financial officer roles at multi-national companies • Extensive enterprise-wide strategic leadership • Management experience with multiple retail and consumer goods companies

Favorite Sprouts Brand Product Taboule Salad

|

| Kristen E. Blum

Independent Director

Age: 57 Director since: 2016 Committees: Audit Nominating and Risk, Chairperson |

Career Highlights Ms. Blum served as SVP and Chief Information Officer of PepsiCo – Latin America from January 2018 to April 2019. In January 2019, Ms. Blum was appointed as Chairperson of The Sprouts Healthy Communities Foundation, our non-profit foundation focused on health and wellness related causes. Ms. Blum also has served as a Director of GuideWell Mutual Holding Corp., a not-for-profit mutual holding company focused on transforming health care, since May 2018, and an Advisory Board member of Verneek, an AI software development startup, since June 2022. Ms. Blum previously served PepsiCo (NASDAQ: PEP) as SVP and Chief Information Officer of Global IT Transformation from November 2017 to April 2018, SVP and Chief Information Officer of Frito-Lay from September 2015 to December 2017 and SVP and Chief Information Officer of Commercial Solutions, Innovation, Data and Analytics from July 2013 to September 2015, as well as SVP and Chief Information Officer of Enterprise Solutions from December 2010 to January 2012. Ms. Blum served as EVP and Chief Technology Officer of J.C. Penney Co. Inc. from January 2012 to June 2013 and SVP and Chief Information Officer of Abercrombie & Fitch (NYSE: ANF) from March 2006 to October 2010.

Key Board Skills and Qualifications • Over 30 years of experience in developing strategies and designing IT solutions in the retail, consumer goods and high-tech industries • Cybersecurity, technology functional leadership and digital transformation • Numerous premier directorship certifications and designations, including: | |||

| • NACD Certified Director |

• NACD Board Leadership Fellow | |||

| • NACD Cybersecurity Oversight • Berkeley Law/Ceres ESG Certification |

• NACD Risk Committee Oversight Advisory Council | |||

|

Favorite Sprouts Brand Product 100% Italian Extra Virgin Olive Oil

| ||||

| Sprouts Farmers Market | 12 | Proxy Statement 2023 |

| Corporate Governance |

| Terri Funk Graham

Independent Director

Age: 57 Director since: 2013 Committees: Compensation Nominating and Corporate Governance, Chairperson Risk |

Career Highlights Ms. Graham is a Branding Strategy Consultant, having most recently served as interim Chief Marketing Officer of Origin Entertainment, Inc., a film and television production company, from March 2016 to September 2017. Ms. Graham has served on the board of directors of LL Flooring Holdings, Inc. (NYSE: LL), a specialty retailer of hardwood flooring, since October 2018 and served on the board of directors of CV Sciences, Inc. (OTCQB: CVSI), a consumer products and specialty pharmaceutical company, from August 2019 to May 2022, and 1-800 Contacts, an online retailer of contact lenses, from July 2015 to January 2016. Ms. Graham previously served as Chief Marketing Officer – Red Envelope for Provide Commerce, Inc., an e-commerce gifting company from July 2013 to September 2014. Ms. Graham served on the board of Hot Topic, Inc., a formerly publicly traded mall and web-based specialty retailer from June 2012 to June 2013. From September 2007 to December 2012, Ms. Graham served as SVP and Chief Marketing Officer at Jack in the Box Inc. (NASDAQ: JACK), a restaurant company that operates and franchises Jack in the Box restaurants, having served in various marketing leadership roles subsequent to joining Jack in the Box Inc. in 1990.

Key Board Skills and Qualifications • Over 30 years of branding and marketing experience in the retail and restaurant industries, including extensive knowledge of digital and e-commerce • Public company board experience • Well-versed in corporate governance • NACD Board Leadership Fellow

Favorite Sprouts Brand Product Carne Asada Seasoned Beef Skirt Steak

|

| Joseph D. O’Leary

Independent Director

Age: 64 Director since: 2017 Committees: Compensation Nominating and Corporate Governance |

Career Highlights Mr. O’Leary has served as a Director of Edgewell Personal Care Co. (NYSE: EPC), a leading consumer products company, since October 2018, and Targeted PetCare, a manufacturer of specialty pet products, since December 2019. Mr. O’Leary also served as a director of Francesca’s Holdings Corp. (NASDAQ: FRAN), a nationwide specialty boutique retailer, from April 2013 to February 2021, PetSmart, Inc., a formerly publicly traded specialty pet retailer, from May 2015 to November 2019 and Big Heart Pet Brands from August 2014 to March 2015. Mr. O’Leary served PetSmart as President and COO from June 2013 to April 2014, EVP of Merchandising, Marketing, Supply Chain and Strategic Planning from January 2011 to June 2013, SVP of Merchandising from March 2010 to January 2011, SVP of Merchandising and Supply Chain from October 2008 to March 2010, and SVP of Supply Chain from September 2006 to October 2008. Before joining PetSmart, Mr. O’Leary served as COO of Human Touch, LLC, and various logistics leadership roles with Gap Inc. (NYSE: GPS), a leading global clothing retailer, from 1999 to 2005, culminating as SVP, Supply Chain Strategy and Global Logistics. Prior to 1999, Mr. O’Leary held positions at Mothercare plc, Coopers & Lybrand LLP, and BP International.

Key Board Skills and Qualifications • Public company board and executive officer experience • Deep merchandising, supply chain and logistics experience with successful growth-oriented retailers • Strategic and operational acumen with international experience on multiple continents

Favorite Sprouts Brand Product Herb Seasoned Roasted Chicken

|

| Sprouts Farmers Market | 13 | Proxy Statement 2023 |

| Corporate Governance |

| Doug G. Rauch

Independent Director

Age: 71 Director since: 2020 Committee: Audit, Chairperson |

Career Highlights Mr. Rauch served as a division and later company president of Trader Joe’s Company, a chain of neighborhood grocery stores, from 1995 until his retirement from the company in 2008 following a 30-year career. In June 2012, Mr. Rauch founded and has since served as President of Daily Table, an innovative retail concept designed to bring affordable nutrition to the food insecure in Boston’s inner city. In January 2010, Mr. Rauch was also a founding board member and Chief Executive Officer of Conscious Capitalism Inc., an organization dedicated to the practice of business as a force for good, where he served as a board member through December 2021 and continues to serve as a board emeritus member. Mr. Rauch has served on the board of directors of PAR Technology Corporation (NYSE: PAR), a leading provider of point-of-sale technology solutions to restaurants and retail outlets, since November 2017, and Imperfect Foods, a grocery delivery service with a mission to eliminate food waste, since March 2019. Mr. Rauch also served a ten-year term as a Trustee at the Olin College of Engineering from October 2009 to October 2019.

Key Board Skills and Qualifications • Extensive knowledge and operational experience from over 35 years in the grocery industry • Strategic implementation and leadership skills • In-depth understanding of sustainability in operations

Favorite Sprouts Brand Product Lemon Herb Pita Chips

|

| Jack L. Sinclair

Director

Age: 62 Director since: 2019 |

Career Highlights Mr. Sinclair has served as our Chief Executive Officer since June 2019. Mr. Sinclair has served as a board member of FMI – The Food Industry Association since 2020 and was appointed to the Los Angeles branch board of directors of the Federal Reserve Bank of San Francisco in January 2021, where he has served as Chair of the Board since January 2023. Previously, Mr. Sinclair served as Chief Executive Officer of 99 Cents Only Stores LLC, a premier discount retailer, from February 2018 to June 2019, and prior to that was its Chief Merchandising Officer from July 2015 to February 2018. From December 2007 to April 2015, Mr. Sinclair was the Executive Vice President of the U.S. Grocery Division of Walmart, Inc. (NYSE: WMT), where he led all aspects of Walmart’s U.S. grocery business for its more than 4,000 stores. Prior to joining Walmart, Mr. Sinclair spent 14 years at Safeway PLC in London from 1990 to 2004, where he held several senior management positions that included responsibility for operations, merchandising and marketing for over 450 Safeway supermarket and convenience store locations throughout the United Kingdom. Mr. Sinclair served on the board of directors of The Hain Celestial Group (NASDAQ: HAIN), a leading marketer, manufacturer and seller of organic and natural products, from September 2017 to June 2019.

Key Board Skills and Qualifications • Extensive knowledge of all aspects of our business, vision, strategy, people and leadership • Service as our Chief Executive Officer • Over 30 years of grocery and retail experience

Favorite Sprouts Brand Product Rosemary Croccantes Italian Crackers

|

| Sprouts Farmers Market | 14 | Proxy Statement 2023 |

| Corporate Governance |

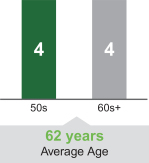

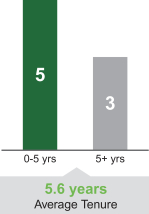

Board Diversity

Our directors represent a range of backgrounds and experiences. 25% of our directors are female and 25% are ethnically diverse, including the most recent addition to our board, Mr. Avula. Our board is committed to improving its gender and ethnic diversity and will continue to make appointing diverse board members a priority going forward. While we do not have a formal policy outlining the diversity standards to be considered when evaluating director candidates, our objective is to foster diversity of thought and experience on our board of directors. To accomplish that objective, the nominating and corporate governance committee, which is chaired by Ms. Graham and includes Ms. Blum, considers ethnic and gender diversity, as well as differences in perspective, professional experience, education, skill and other qualities in the context of the needs of our board of directors. Nominees are not discriminated against on the basis of age, race, ethnicity, religion, national origin, sex, sexual orientation, disability or any other basis. The nominating and corporate governance committee evaluates its effectiveness in achieving diversity on the board of directors through its annual review of board member composition. Our current directors reflect these efforts and the importance of diversity to the board. Ms. Blum and Ms. Graham each serve in leadership roles on our board as committee chairs and have previously served as director coaches for 50/50 Women on Boards™, the leading global education and advocacy campaign driving the movement toward gender balance and diversity on corporate boards.

|

|

|

|

|

| Sprouts Farmers Market | 15 | Proxy Statement 2023 |

| Corporate Governance |

The following chart provides certain demographic information with respect to our Board of Directors as required by the rules of the NASDAQ Global Select Market:

| Sprouts Farmers Market, Inc. Board Diversity Matrix (as of April 10, 2023) | ||||||||

| Total Number of Directors: 8 | ||||||||

| Part I: Gender Identity | ||||||||

|

|

Female | Male | Non-Binary | Did Not | ||||

| Directors

|

2

|

6

|

—

|

—

| ||||

| Part II: Demographic Background

| ||||||||

| African American or Black

|

—

|

—

|

—

|

—

| ||||

| Alaskan Native or Native American

|

—

|

—

|

—

|

—

| ||||

| Asian

|

—

|

1

|

—

|

—

| ||||

| Hispanic or Latinx

|

1

|

—

|

—

|

—

| ||||

| Native Hawaiian or Pacific Islander

|

—

|

—

|

—

|

—

| ||||

| White

|

1

|

5

|

—

|

—

| ||||

| Two or More Races or Ethnicities

|

—

|

—

|

—

|

—

| ||||

| LGBTQ+

|

—

| |||||||

| Did Not Disclose Demographic Background

|

—

| |||||||

Board Structure

Our certificate of incorporation and bylaws provide for a classified board of directors with staggered three-year terms, consisting of three classes as follows:

| Class |

Director | Independent | ||

| Class I (term expires at 2023 annual meeting) |

Joel D. Anderson Terri Funk Graham Doug G. Rauch |

Yes Yes Yes | ||

| Class II (term expires at 2024 annual meeting) |

Hari K. Avula Joseph Fortunato Joseph D. O’Leary |

Yes Yes Yes | ||

| Class III (term expires at 2025 annual meeting) |

Kristen E. Blum Jack L. Sinclair |

Yes No |

Our board of directors has determined that all of our current directors, except for Mr. Sinclair, are “independent,” as defined in the corporate governance rules of the NASDAQ Stock Market. There are no family relationships among any of our directors, director nominees or executive officers.

Only one class of directors will be elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective three-year terms. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. Our directors may be removed for cause by the affirmative vote of the holders of a majority of our voting stock.

The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our company.

| Sprouts Farmers Market | 16 | Proxy Statement 2023 |

| Corporate Governance |

Board Leadership Structure

Our board of directors has no policy with respect to the separation of the offices of Chief Executive Officer and Chairman of the Board. It is the board’s view that rather than having a rigid policy, the board, with the advice and assistance of the nominating and corporate governance committee, and upon consideration of all relevant factors and circumstances, will determine, as and when appropriate, whether to institute a formal policy. Currently, our leadership structure separates these roles, with Mr. Fortunato serving as our Chairman of the Board and Mr. Sinclair serving as our Chief Executive Officer.

Our board believes that separating these roles provides the appropriate balance between strategy development, flow of information between management and the board of directors and oversight of management. We believe this provides guidance for our board of directors, while also positioning our Chief Executive Officer as the leader of the company in the eyes of our customers, team members and other stakeholders. As Chairman, Mr. Fortunato, among other responsibilities, oversees planning of the annual board calendar and develops meeting agendas, presides over regularly scheduled board meetings and executive sessions of the independent members of the board, serves as a liaison between the directors, consults with major stockholders, as appropriate, and performs such additional duties as our board of directors may otherwise determine and delegate. By having Mr. Fortunato serve as Chairman of the Board, Mr. Sinclair is better able to focus his attention on running our company.

The Board’s Role in ESG and Risk Oversight

Our board is highly engaged in our ESG matters given that many of our ESG initiatives are built into and complement our long-term growth strategy. While our full board reviews ESG matters on at least an annual basis, each board committee has been delegated oversight responsibility for various aspects of our ESG program within their purview. Our nominating and corporate governance committee is primarily responsible for oversight of our ESG activities, in particular our corporate governance policies and practices. Our audit committee oversees and reviews our ESG disclosures included in our financial statements and the adequacy and effectiveness of internal controls related to such disclosures. Our compensation committee periodically reviews our strategies related to human capital management, including talent acquisition, development and retention, and diversity, equity and inclusion initiatives. Our risk committee oversees and reviews risks related to our ESG actions, reporting and disclosures.

Since 2021, our board has had a risk committee that is primarily responsible for overseeing our risk management processes. We have an enterprise risk management program designed to identify, prioritize and assess a broad range of risks that may affect our ability to execute our corporate strategy and fulfill our business objectives, and formulate plans to mitigate their effects. The risk committee will review our enterprise risk management program and specific risks we face (including risks related to cybersecurity and critical systems and ESG matters among others), provide input on the appropriate level of risk for our company and review management’s strategies for adequately mitigating and managing the identified risks. The risk committee receives quarterly updates on information security risk matters and annual updates on ESG risk matters, or more frequently if circumstances dictate. Although the risk committee administers this general risk management oversight function, our audit, compensation and nominating and corporate governance committees support our board in discharging its oversight duties and addressing risks inherent in their respective areas, and our board of directors as a whole receives regular updates on our enterprise risk management program and retains oversight responsibility over our key strategic risks.

We believe these divisions of responsibilities are an effective approach for overseeing our ESG activities and addressing the risks we face and that our board committee structure supports this approach.

Board Participation

Our board of directors held five formal meetings in fiscal 2022 and took action by unanimous written consent once. During fiscal 2022, each of our directors attended at least 75% of the total number of meetings of our board of directors and of the committees on which they serve held during the period in

| Sprouts Farmers Market | 17 | Proxy Statement 2023 |

| Corporate Governance |

which they served as directors. We regularly schedule executive sessions at each formal meeting of the board during which the independent directors meet without the presence or participation of management.

We encourage our directors to attend each annual meeting of stockholders. To that end, and to the extent reasonably practical, we generally schedule a meeting of our board of directors on or around the same day as our annual meeting of stockholders. Each of our directors at the time attended our 2022 virtual annual meeting of stockholders.

Board Committees

Our board of directors has the authority to appoint committees to perform certain oversight and administration functions. Our board of directors has an audit committee, a compensation committee, a nominating and corporate governance committee and a risk committee. The composition and responsibilities of each committee are described below. Members will serve on these committees until their resignation or until otherwise determined by the board of directors.

Audit Committee

Our audit committee consists of Doug G. Rauch, Chairperson, Joel D. Anderson, Hari K. Avula and Kristen E. Blum. Our board of directors has determined that each such individual is independent under the rules of the SEC and the NASDAQ Stock Market. Our board has also determined that each of Messrs. Anderson and Avula is an “audit committee financial expert” within the meaning of SEC regulations, and that each member of our audit committee can read and understand fundamental financial statements in accordance with audit committee requirements. In arriving at this determination, the board has examined each audit committee member’s scope of experience in financial roles and the nature of their employment.

The audit committee has the following responsibilities, among other things, as set forth in the audit committee charter:

| • | reviewing and pre-approving the engagement of our independent registered public accounting firm to perform audit services and any permissible non-audit services; |

| • | evaluating the performance of our independent registered public accounting firm; |

| • | monitoring the rotation of partners of our independent registered public accounting firm on our engagement team as required by law; |

| • | reviewing our annual and quarterly financial statements and reports filed with the SEC and discussing the statements and reports with our independent registered public accounting firm and management, including a review of disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations;” |

| • | reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls, and compliance with legal and regulatory requirements; |

| • | considering and approving or disapproving all related party transactions and discussing such transactions that are significant to our company with our independent registered public accounting firm; |

| • | preparing the audit committee report required by the SEC to be included in our annual proxy statement; |

| • | conducting an annual assessment of the performance of the audit committee and its members, and the adequacy of its charter; |

| • | establishing procedures for the receipt, retention, and treatment of complaints received by us regarding financial controls, accounting or auditing matters; |

| Sprouts Farmers Market | 18 | Proxy Statement 2023 |

| Corporate Governance |

| • | overseeing and reviewing our ESG disclosures included in our financial statements and the adequacy and effectiveness of internal controls related to such disclosures; and |

| • | reviewing and evaluating, at least annually, the performance of the audit committee and the adequacy of its charter. |

Our audit committee formally met four times during fiscal 2022.

Compensation Committee

Our compensation committee consists of Joel D. Anderson, Chairperson, Terri Funk Graham and Joseph O’Leary. Our board of directors has determined that each such individual is independent under NASDAQ Stock Market listing standards and a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act.

The compensation committee has the following responsibilities, among other things, as set forth in the compensation committee’s charter:

| • | reviewing, modifying and approving (or if it deems appropriate, recommending to the full board of directors regarding) our overall compensation strategy and policies and discussing such compensation with our independent registered public accounting firm; |

| • | reviewing (or if it deems appropriate, recommending to the full board of directors regarding) performance goals and objectives relevant to the compensation of our executive officers and assessing their performance against these goals and objectives; |

| • | reviewing and recommending to the full board of directors the compensation of our directors; |

| • | evaluating, adopting and administering (or if it deems appropriate, making recommendations to the full board of directors regarding) the 2013 Incentive Plan (as defined below), the 2022 Incentive Plan (as defined below), other compensation plans and similar programs advisable for us, as well as modification or termination of existing plans and programs; |

| • | establishing policies with respect to equity compensation arrangements; |

| • | reviewing and discussing annually with management our “Compensation Discussion and Analysis;” |

| • | preparing the compensation committee report required by the SEC to be included in our annual proxy statement; |

| • | reviewing periodically our strategies related to human capital management, including talent acquisition, development and retention, and diversity, equity and inclusion initiatives; and |

| • | reviewing and evaluating, at least annually, the performance of the compensation committee and the adequacy of its charter. |

Our compensation committee formally met four times during fiscal 2022.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Terri Funk Graham, Chairperson, Kristen E. Blum and Joseph O’Leary. Our board of directors has determined that each such individual is independent under the rules of the NASDAQ Stock Market.

The nominating and corporate governance committee has the following responsibilities, among other things, as set forth in the nominating and corporate governance committee’s charter:

| • | reviewing periodically and evaluating director performance on our board of directors and its applicable committees, and recommending to our board of directors and management areas for improvement; |

| Sprouts Farmers Market | 19 | Proxy Statement 2023 |

| Corporate Governance |

| • | establishing criteria and qualifications for membership on the board of directors and its committees; |

| • | interviewing, evaluating, nominating and recommending individuals for membership on our board of directors; |

| • | overseeing our company’s ESG activities; |

| • | reviewing and recommending to our board of directors any amendments to our corporate governance policies; and |

| • | reviewing and assessing, at least annually, the performance of the nominating and corporate governance committee and the adequacy of its charter. |

Our nominating and corporate governance committee formally met two times during fiscal 2022.

Risk Committee

Our risk committee consists of Kristen E. Blum, Chairperson, Hari K. Avula and Terri Funk Graham. Our board of directors has determined that each such individual is independent under the rules of the NASDAQ Stock Market.

The risk committee has the following responsibilities, among other things, as set forth in the risk committee’s charter:

| • | providing oversight of our management in its development and administration of our enterprise risk management program; |

| • | monitoring our risk profile and our ongoing potential exposure to risks of various types, including risks related to cybersecurity and critical systems and environmental and social matters among others; |

| • | providing input to management regarding risk events or circumstances relevant to our strategic objectives and our risk appetite and tolerance; |

| • | evaluating periodically and reviewing the enterprise risk management program and its effectiveness and provide updates thereon to the board of directors; |

| • | overseeing and reviewing risks related to our ESG actions, reporting and disclosures; and |

| • | reviewing and assessing, at least annually, the performance of the risk committee and the adequacy of its charter. |

Our risk committee formally met four times during fiscal 2022.

Board Evaluations

Our board believes that a robust annual evaluation process is a critical part of its governance practices. Accordingly, the nominating and corporate governance committee oversees an annual evaluation of the performance of the board of directors. The committee approves written evaluation questionnaires that are distributed to each director. The results of each written evaluation are provided to, and compiled by, an outside law firm. The chair of the nominating and corporate governance committee discusses the results of the performance evaluations with the full board. Our board utilizes the results of these evaluations in making decisions on director nominees, board agendas, board structure, composition and effectiveness and committee assignments. As a result of past board evaluations, we have made changes to board meeting agendas and the form and scope of materials provided to directors.

Identifying and Evaluating Director Candidates

Director candidates are evaluated in light of the then-existing composition of the board, diversity considerations and the background and areas of expertise of existing directors and potential nominees. The

| Sprouts Farmers Market | 20 | Proxy Statement 2023 |

| Corporate Governance |

nominating and corporate governance committee also considers the specific needs of the various board committees. In the case of Mr. Avula, the most recent addition to our board in 2022, the committee considered, among other factors, his strong financial acumen from serving as chief financial officer and strategic experience at companies of scale, among other factors.

Our nominating and corporate governance committee will consider persons recommended by stockholders for inclusion as nominees for election to our board of directors. Stockholders wishing to recommend director candidates for consideration by the nominating and corporate governance committee may do so by writing to our Corporate Secretary at our principal executive offices set forth in this proxy statement, and giving the recommended nominee’s name, biographical data and qualifications, accompanied by the written consent of the recommended nominee.

The evaluation process for director nominees who are recommended by our stockholders is the same as for any other nominee and is based on numerous factors that our nominating and corporate governance committee considers appropriate, some of which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity reflecting ethnic background, gender and professional experience, and the extent to which the nominee would fill a present need on our board of directors. We typically engage search firms to engage in national searches for prospective board candidates, and we instruct these search firms with which we work to identify potential board candidates that would, in addition to bringing particular skills and experience to the board, also add to the gender and/or ethnic diversity on the board.

Availability of Corporate Governance Information

Our board of directors has adopted charters for our audit, compensation, nominating and corporate governance and risk committees describing the authority and responsibilities delegated to each committee by our board of directors. Our board of directors has also adopted corporate governance guidelines, a code of conduct and ethics that applies to all of our team members, a code of ethics that applies to members of our board of directors and a code of ethics that applies to our principal executive officer and senior financial officers, including those officers responsible for financial reporting. We post on our website, at investors.sprouts.com, the charters of our audit, compensation, nominating and corporate governance and risk committees, our corporate governance guidelines and the codes of conduct and ethics referenced above. The inclusion of our website address in this proxy statement does not include or incorporate by reference the information on or accessible through our website into this proxy statement. These documents are also available in print to any stockholder requesting a copy in writing from our Corporate Secretary at our principal executive offices set forth in this proxy statement. We intend to disclose any amendments to these codes, or any waivers of their requirements, on our website to the extent required by applicable SEC or NASDAQ Stock Market rules.

Communications with our Board of Directors

Stockholders or other interested persons wishing to communicate with our board of directors or with an individual member of our board of directors may do so by writing to our board of directors or to the particular member of our board of directors and mailing the correspondence to our Corporate Secretary at 5455 East High Street, Suite 111, Phoenix, Arizona 85054. All such communications will be forwarded to the appropriate member or members of our board of directors, or if none is specified, to the Chairman of our board of directors.

Proxy Access

Our bylaws allow an eligible stockholder to include director nominees in our proxy materials for election at our annual meeting of stockholders. Such nominations must comply with all applicable conditions in our bylaws and be directed to the attention of our Corporate Secretary at 5455 East High Street, Suite 111, Phoenix, Arizona 85054. See “Director Nominations for Inclusion in our 2024 Proxy Materials (Proxy Access)” below.

| Sprouts Farmers Market | 21 | Proxy Statement 2023 |

| Proposal 1: Election of Directors |

PROPOSAL 1: ELECTION OF DIRECTORS

Nominees

Our nominating and corporate governance committee recommended, and the board of directors nominated:

| • | Joel D. Anderson |

| • | Terri Funk Graham |

| • | Doug G. Rauch |

as nominees for election as Class I members of our board of directors. Each nominee is presently a Class I director of our company and has consented to serve a three-year term if elected, concluding at the 2026 annual meeting of stockholders. Each of these nominees was previously elected as a director by the stockholders at the 2020 annual meeting. Biographical information about each of our directors is contained in the “Our Board” section above. At the Annual Meeting, three directors will be elected to our board of directors.

Required Vote

The three nominees receiving the highest number of affirmative “FOR” votes shall be elected as directors. Unless marked to the contrary, proxies received will be voted “FOR” each of the three above-named nominees.

Recommendation of the Board

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ELECTION OF EACH OF THE THREE ABOVE-NAMED NOMINEES.

| Sprouts Farmers Market | 22 | Proxy Statement 2023 |

| Director Compensation |

DIRECTOR COMPENSATION

Our directors that are considered “independent” under applicable SEC and NASDAQ stock market rules receive consideration for service on our board of directors. Directors who are Sprouts employees receive no additional compensation for their services as directors. In 2022, our independent directors received the following cash compensation (all payable quarterly):

| • | Annual retainer of $75,000; |

| • | Annual committee retainer fees of $10,000 per committee assignment; |

| • | Annual committee chairperson retainer fees in the following amounts: |

| - | $25,000 for the chairperson of our audit committee; |

| - | $20,000 for the chairperson of our compensation committee; |

| - | $20,000 for the chairperson of our nominating and corporate governance committee; |

| - | $20,000 for the chairperson of our risk committee; and |

| • | Annual retainer for our chairman of the board of $90,000. |

In addition to the cash compensation discussed above, our independent directors also received equity compensation for 2022 equal to $140,000 in the form of restricted stock units (referred to as “RSUs”) vesting on the one-year anniversary of the grant date. The chairman of the board also received additional equity compensation of $60,000 in the form of RSUs vesting on the one-year anniversary of the grant date. The number of RSUs granted to each independent director was determined using the 20-day trailing average closing price of our common stock as reported on the grant date. We also pay for or reimburse directors for approved board governance educational seminars and for travel expenses related to attending board and committee meetings.

Our board of directors recognizes that stock ownership by directors may strengthen their commitment to the long-term success of our company and further align their interests with those of our stockholders. In accordance with our corporate governance guidelines, our independent directors are expected over a five-year period to beneficially own shares of our common stock (including shares owned outright, unvested shares, and stock options or other equity grants) having a value of at least five times their annual cash retainer until he/she leaves the board.

Our compensation committee periodically engages its independent compensation consultant, Korn Ferry, to review our company’s independent director compensation against peer and market data. In 2022, our compensation committee reviewed the position of our independent director compensation program relative to market data and our peer group discussed below, based on data provided by Korn Ferry, and determined to increase the annual equity compensation from $140,000 to $160,000 beginning in 2023 to position the total compensation closer to the median of our peer group. For 2023, our compensation committee also approved allowing our independent directors to elect to receive all or any portion of their annual cash compensation in the form of RSUs vesting on the one-year anniversary of the grant date.

| Sprouts Farmers Market | 23 | Proxy Statement 2023 |

| Director Compensation |

Director Compensation Table

The following table sets forth a summary of the compensation earned by our directors in fiscal 2022.

| Name |

Fees Earned or Paid in Cash |

Stock Awards(1) |

All Other Compensation |

Total | ||||||||||||

| Joel D. Anderson |

$ | 115,000 | $ | 149,284 | — | $ | 264,284 | |||||||||

| Hari K. Avula(2) |

$ | 63,333 | $ | 149,284 | — | $ | 212,617 | |||||||||

| Kristen E. Blum |

$ | 125,000 | $ | 149,284 | — | $ | 274,284 | |||||||||

| Joseph Fortunato |

$ | 165,000 | $ | 213,244 | — | $ | 378,244 | |||||||||

| Terri Funk Graham |

$ | 125,000 | $ | 149,284 | — | $ | 274,284 | |||||||||

| Joseph D. O’Leary |

$ | 95,000 | $ | 149,284 | — | $ | 244,284 | |||||||||

| Doug G. Rauch |

$ | 110,000 | $ | 149,284 | — | $ | 259,284 | |||||||||

| (1) | The amounts in this column reflect the aggregate grant date fair value of each RSU award granted during the fiscal year, computed in accordance with ASC 718. The valuation assumptions used in determining such amounts are described in Note 26 to our consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended January 1, 2023. The grant date for the RSUs for all independent directors was June 7, 2022. |

| (2) | Mr. Avula joined the board of directors effective May 24, 2022 and received a prorated portion of the annual director cash compensation. |

The following table lists outstanding equity awards held by our current non-employee directors as of January 1, 2023.

|

|

|

Stock Awards | ||||||||||

| Name | Date of Grant |

Number of Shares or Units of Stock That Have Not Vested(1) |

Market Value of Shares or Units of Stock That Have Not Vested(2) |

|||||||||

| Joel D. Anderson |

June 7, 2022 | 5,527 | $ | 178,909 | ||||||||

| Hari K. Avula |

June 7, 2022 | 5,527 | $ | 178,909 | ||||||||

| Kristen E. Blum |

June 7, 2022 | 5,527 | $ | 178,909 | ||||||||

| Joseph Fortunato |

June 7, 2022 | 7,895 | $ | 255,561 | ||||||||

| Terri Funk Graham |

June 7, 2022 | 5,527 | $ | 178,909 | ||||||||

| Joseph D. O’Leary |

June 7, 2022 | 5,527 | $ | 178,909 | ||||||||

| Doug G. Rauch |

June 7, 2022 | 5,527 | $ | 178,909 | ||||||||

| (1) | Stock awards represent RSUs which cliff vest on the first anniversary of the grant date, in each case assuming continued service through the vesting date. |

| (2) | The market value of unvested RSUs was calculated by multiplying the number of unvested RSUs held by the applicable named director by the closing market price of our common stock on the NASDAQ Global Select Market on the last trading day of fiscal 2022, December 30, 2022, which was $32.37 per share. |

| Sprouts Farmers Market | 24 | Proxy Statement 2023 |

| Executive Officers |

EXECUTIVE OFFICERS

The following table sets forth information regarding our executive officers as of April 10, 2023:

| Name | Age | Position | ||

| Jack L. Sinclair |