cinr-2022123100015750512022FYFALSEP5YP1YP2YP1Yhttp://fasb.org/us-gaap/2022#OtherAssetsCurrent http://fasb.org/us-gaap/2022#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2022#OtherAssetsCurrent http://fasb.org/us-gaap/2022#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2022#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2022#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2022#OtherLiabilitiesNoncurrent00015750512022-01-012022-12-3100015750512022-06-30iso4217:USD0001575051cinr:CommonUnitsMember2023-03-28xbrli:shares0001575051us-gaap:GeneralPartnerMember2023-03-2800015750512022-12-3100015750512021-12-3100015750512021-01-012021-12-3100015750512020-01-012020-12-31iso4217:USDxbrli:shares00015750512020-12-3100015750512019-12-310001575051us-gaap:CapitalUnitsMembercinr:CommonUnitholdersMember2019-12-310001575051us-gaap:CapitalUnitsMemberus-gaap:GeneralPartnerMember2019-12-310001575051us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001575051us-gaap:ParentMember2019-12-310001575051us-gaap:NoncontrollingInterestMember2019-12-310001575051us-gaap:CapitalUnitsMembercinr:CommonUnitholdersMember2020-01-012020-12-310001575051us-gaap:CapitalUnitsMemberus-gaap:GeneralPartnerMember2020-01-012020-12-310001575051us-gaap:ParentMember2020-01-012020-12-310001575051us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001575051us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001575051us-gaap:CapitalUnitsMembercinr:CommonUnitholdersMember2020-12-310001575051us-gaap:CapitalUnitsMemberus-gaap:GeneralPartnerMember2020-12-310001575051us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001575051us-gaap:ParentMember2020-12-310001575051us-gaap:NoncontrollingInterestMember2020-12-310001575051us-gaap:CapitalUnitsMembercinr:CommonUnitholdersMember2021-01-012021-12-310001575051us-gaap:CapitalUnitsMemberus-gaap:GeneralPartnerMember2021-01-012021-12-310001575051us-gaap:ParentMember2021-01-012021-12-310001575051us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001575051us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001575051us-gaap:CapitalUnitsMembercinr:CommonUnitholdersMember2021-12-310001575051us-gaap:CapitalUnitsMemberus-gaap:GeneralPartnerMember2021-12-310001575051us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001575051us-gaap:ParentMember2021-12-310001575051us-gaap:NoncontrollingInterestMember2021-12-310001575051us-gaap:CapitalUnitsMembercinr:CommonUnitholdersMember2022-01-012022-12-310001575051us-gaap:CapitalUnitsMemberus-gaap:GeneralPartnerMember2022-01-012022-12-310001575051us-gaap:ParentMember2022-01-012022-12-310001575051us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001575051us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001575051us-gaap:CapitalUnitsMembercinr:CommonUnitholdersMember2022-12-310001575051us-gaap:CapitalUnitsMemberus-gaap:GeneralPartnerMember2022-12-310001575051us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001575051us-gaap:ParentMember2022-12-310001575051us-gaap:NoncontrollingInterestMember2022-12-310001575051cinr:SisecamChemicalsMembercinr:SisecamChemicalsUSAIncMember2022-12-31xbrli:pure0001575051cinr:SisecamChemicalsMembercinr:CinerEnterprisesMember2022-12-310001575051cinr:SisecamParentMembercinr:TurkiyeIsBankasiTurkiyeIsBankasiMember2022-12-310001575051cinr:CinerEnterprisesMemberus-gaap:OtherOwnershipInterestMember2021-12-212021-12-210001575051cinr:CinerEnterprisesMemberus-gaap:GeneralPartnerMember2021-12-212021-12-210001575051cinr:SisecamChemicalsUSAIncMember2021-11-200001575051cinr:SisecamChemicalsUSAIncMember2021-11-202021-11-200001575051cinr:SisecamUSAMember2021-11-20cinr:director0001575051cinr:CinerEnterprisesMember2021-11-200001575051us-gaap:GeneralPartnerMembercinr:SisecamUSAMember2021-11-20cinr:designee0001575051us-gaap:GeneralPartnerMembercinr:CinerEnterprisesMember2021-11-200001575051us-gaap:GeneralPartnerMember2021-11-200001575051cinr:SisecamWyomingMember2021-11-20cinr:manager0001575051cinr:SisecamChemicalsWyomingLLCMemberus-gaap:GeneralPartnerMember2022-01-012022-12-310001575051cinr:SisecamChemicalsWyomingLLCMemberus-gaap:OtherOwnershipInterestMember2022-01-012022-12-310001575051cinr:SisecamWyomingMembercinr:SisecamResourcesLPMember2022-12-310001575051cinr:SisecamWyomingMembercinr:NRPTronaLLCMember2022-12-31cinr:segment0001575051us-gaap:LandAndLandImprovementsMember2022-01-012022-12-310001575051us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMembersrt:MinimumMember2022-01-012022-12-310001575051us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMembersrt:MaximumMember2022-01-012022-12-310001575051us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2022-01-012022-12-310001575051srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2022-01-012022-12-310001575051us-gaap:SoftwareDevelopmentMembersrt:MinimumMember2022-01-012022-12-310001575051srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2022-01-012022-12-310001575051us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2022-01-012022-12-310001575051srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2022-01-012022-12-310001575051us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2022-01-012022-12-310001575051srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001575051us-gaap:AssetRetirementObligationCostsMemberus-gaap:MiningPropertiesAndMineralRightsMember2022-01-012022-12-310001575051us-gaap:AssetRetirementObligationCostsMemberus-gaap:MiningPropertiesAndMineralRightsMember1996-01-011996-12-310001575051us-gaap:AssetRetirementObligationCostsMemberus-gaap:MeasurementInputRiskFreeInterestRateMember2022-12-310001575051us-gaap:AssetRetirementObligationCostsMemberus-gaap:LandMember2022-01-012022-12-310001575051us-gaap:AssetRetirementObligationCostsMemberus-gaap:MeasurementInputRiskFreeInterestRateMemberus-gaap:LandMember2022-12-310001575051us-gaap:GeneralPartnerMember2022-01-012022-12-310001575051us-gaap:GeneralPartnerMember2021-01-012021-12-310001575051us-gaap:GeneralPartnerMember2020-01-012020-12-310001575051us-gaap:LimitedPartnerMember2022-01-012022-12-310001575051us-gaap:LimitedPartnerMember2021-01-012021-12-310001575051us-gaap:LimitedPartnerMember2020-01-012020-12-310001575051us-gaap:SubsequentEventMember2023-02-232023-02-230001575051us-gaap:GeneralPartnerMembercinr:CinerResourcePartnersLLCMember2022-01-012022-12-310001575051us-gaap:GeneralPartnerMembercinr:SecondTargetDistributionMember2022-01-012022-12-310001575051us-gaap:GeneralPartnerMembercinr:ThirdTargetDistributionMember2022-01-012022-12-310001575051us-gaap:GeneralPartnerMembercinr:AfterThirdTargetDistributionMember2022-01-012022-12-310001575051cinr:MinimumQuarterlyDistributionMember2022-01-012022-12-310001575051us-gaap:LimitedPartnerMembercinr:MinimumQuarterlyDistributionMember2022-01-012022-12-310001575051us-gaap:GeneralPartnerMembercinr:MinimumQuarterlyDistributionMember2022-01-012022-12-310001575051cinr:FirstTargetDistributionMember2022-01-012022-12-310001575051cinr:FirstTargetDistributionMemberus-gaap:LimitedPartnerMember2022-01-012022-12-310001575051us-gaap:GeneralPartnerMembercinr:FirstTargetDistributionMember2022-01-012022-12-310001575051cinr:SecondTargetDistributionMember2022-01-012022-12-310001575051cinr:SecondTargetDistributionMemberus-gaap:LimitedPartnerMember2022-01-012022-12-310001575051cinr:ThirdTargetDistributionMember2022-01-012022-12-310001575051cinr:ThirdTargetDistributionMemberus-gaap:LimitedPartnerMember2022-01-012022-12-310001575051cinr:AfterThirdTargetDistributionMember2022-01-012022-12-310001575051cinr:AfterThirdTargetDistributionMemberus-gaap:LimitedPartnerMember2022-01-012022-12-310001575051cinr:MinimumQuarterlyDistributionMember2021-10-012021-12-310001575051cinr:FirstTargetDistributionMember2021-10-012021-12-310001575051cinr:SecondTargetDistributionMember2021-10-012021-12-310001575051cinr:ThirdTargetDistributionMember2021-10-012021-12-310001575051cinr:AfterThirdTargetDistributionMember2021-10-012021-12-3100015750512021-10-012021-12-310001575051us-gaap:LandAndLandImprovementsMember2022-12-310001575051us-gaap:LandAndLandImprovementsMember2021-12-310001575051us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-12-310001575051us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2021-12-310001575051us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001575051us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001575051us-gaap:SoftwareDevelopmentMember2022-12-310001575051us-gaap:SoftwareDevelopmentMember2021-12-310001575051us-gaap:MachineryAndEquipmentMember2022-12-310001575051us-gaap:MachineryAndEquipmentMember2021-12-310001575051us-gaap:MiningPropertiesAndMineralRightsMember2022-12-310001575051us-gaap:MiningPropertiesAndMineralRightsMember2021-12-310001575051us-gaap:ConstructionInProgressMember2022-12-310001575051us-gaap:ConstructionInProgressMember2021-12-310001575051us-gaap:PropertyPlantAndEquipmentMember2022-01-012022-12-310001575051us-gaap:PropertyPlantAndEquipmentMember2021-01-012021-12-310001575051us-gaap:PropertyPlantAndEquipmentMember2020-01-012020-12-310001575051us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MinimumMember2022-01-012022-12-310001575051srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-01-012022-12-310001575051us-gaap:SecuredDebtMembercinr:SisecamWyomingEquipmentFinancingArrangementSecurityNoteNumber001Member2021-12-310001575051us-gaap:SecuredDebtMembercinr:SisecamWyomingEquipmentFinancingArrangementSecurityNoteNumber001Member2022-12-310001575051us-gaap:SecuredDebtMembercinr:SisecamWyomingEquipmentFinancingArrangementSecurityNoteNumber002Member2022-12-310001575051us-gaap:SecuredDebtMembercinr:SisecamWyomingEquipmentFinancingArrangementSecurityNoteNumber002Member2021-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMember2022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMember2021-12-310001575051us-gaap:SecuredDebtMembercinr:SisecamWyomingEquipmentFinancingArrangementSecurityNoteNumber001Membersrt:MinimumMember2022-12-31cinr:installment0001575051us-gaap:SecuredDebtMembercinr:SisecamWyomingEquipmentFinancingArrangementSecurityNoteNumber001Member2022-01-012022-12-310001575051us-gaap:SecuredDebtMembercinr:SisecamWyomingEquipmentFinancingArrangementSecurityNoteNumber002Member2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMember2021-10-280001575051us-gaap:StandbyLettersOfCreditMembercinr:SisecamWyomingCreditFacilityMember2021-10-280001575051us-gaap:BridgeLoanMembercinr:SisecamWyomingCreditFacilityMember2021-10-280001575051us-gaap:RevolvingCreditFacilityMembercinr:SisecamWyomingCreditFacilityMember2021-10-280001575051us-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMember2021-10-280001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:FederalFundsEffectiveSwapRateMembercinr:SisecamWyomingCreditFacilityMember2021-10-282021-10-280001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:BloombergShortTermBankYieldIndexMembercinr:SisecamWyomingCreditFacilityMember2021-10-282021-10-280001575051us-gaap:RevolvingCreditFacilityMembercinr:ApplicableMarginRangeMembercinr:SisecamWyomingCreditFacilityMembersrt:MinimumMember2021-10-282021-10-280001575051srt:MaximumMemberus-gaap:RevolvingCreditFacilityMembercinr:ApplicableMarginRangeMembercinr:SisecamWyomingCreditFacilityMember2021-10-282021-10-280001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:BloombergShortTermBankYieldIndexMembercinr:SisecamWyomingCreditFacilityMembersrt:MinimumMember2021-10-282021-10-280001575051srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:BloombergShortTermBankYieldIndexMembercinr:SisecamWyomingCreditFacilityMember2021-10-282021-10-280001575051srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:DebtInstrumentPricingTierOneMembercinr:SisecamWyomingCreditFacilityMember2022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:DebtInstrumentPricingTierOneMembercinr:BloombergShortTermBankYieldIndexMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:DebtInstrumentPricingTierOneMemberus-gaap:BaseRateMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:DebtInstrumentPricingTierOneMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051cinr:DebtInstrumentPricingTierTwoMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMembersrt:MinimumMember2022-12-310001575051srt:MaximumMembercinr:DebtInstrumentPricingTierTwoMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMember2022-12-310001575051cinr:DebtInstrumentPricingTierTwoMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:BloombergShortTermBankYieldIndexMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051cinr:DebtInstrumentPricingTierTwoMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051cinr:DebtInstrumentPricingTierTwoMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:DebtInstrumentPricingTierThreeMembercinr:SisecamWyomingCreditFacilityMembersrt:MinimumMember2022-12-310001575051srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:DebtInstrumentPricingTierThreeMembercinr:SisecamWyomingCreditFacilityMember2022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:BloombergShortTermBankYieldIndexMembercinr:DebtInstrumentPricingTierThreeMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:DebtInstrumentPricingTierThreeMemberus-gaap:BaseRateMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:DebtInstrumentPricingTierThreeMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051cinr:DebtInstrumentPricingTierFourMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMembersrt:MinimumMember2022-12-310001575051srt:MaximumMembercinr:DebtInstrumentPricingTierFourMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMember2022-12-310001575051cinr:DebtInstrumentPricingTierFourMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:BloombergShortTermBankYieldIndexMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051cinr:DebtInstrumentPricingTierFourMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMembercinr:DebtInstrumentPricingTierFourMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMembercinr:DebtInstrumentPricingTierFiveMembersrt:MinimumMember2022-12-310001575051srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMembercinr:DebtInstrumentPricingTierFiveMember2022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:BloombergShortTermBankYieldIndexMembercinr:SisecamWyomingCreditFacilityMembercinr:DebtInstrumentPricingTierFiveMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembercinr:SisecamWyomingCreditFacilityMembercinr:DebtInstrumentPricingTierFiveMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMembercinr:DebtInstrumentPricingTierFiveMember2022-01-012022-12-310001575051srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMembercinr:DebtInstrumentPricingTierSixMember2022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:BloombergShortTermBankYieldIndexMembercinr:SisecamWyomingCreditFacilityMembercinr:DebtInstrumentPricingTierSixMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembercinr:SisecamWyomingCreditFacilityMembercinr:DebtInstrumentPricingTierSixMember2022-01-012022-12-310001575051us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembercinr:SisecamWyomingCreditFacilityMembercinr:DebtInstrumentPricingTierSixMember2022-01-012022-12-310001575051us-gaap:PensionPlansDefinedBenefitMember2022-12-310001575051us-gaap:PensionPlansDefinedBenefitMember2021-12-310001575051us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001575051us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001575051us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001575051us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-01-012022-12-310001575051us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2021-01-012021-12-310001575051us-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2020-01-012020-12-3100015750512017-01-022022-12-31cinr:age0001575051us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001575051us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310001575051us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310001575051us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-12-310001575051us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-01-012020-12-310001575051cinr:CommonUnitsMembercinr:DirectorNonEmployeeMember2022-01-012022-12-310001575051cinr:CommonUnitsMembercinr:DirectorNonEmployeeMember2021-01-012021-12-310001575051srt:DirectorMembercinr:CommonUnitsMember2021-01-012021-12-310001575051srt:DirectorMembercinr:CommonUnitsMember2022-01-012022-12-310001575051us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2022-01-012022-12-310001575051srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001575051us-gaap:RestrictedStockUnitsRSUMember2021-12-310001575051us-gaap:RestrictedStockUnitsRSUMember2020-12-310001575051us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001575051us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001575051us-gaap:RestrictedStockUnitsRSUMember2022-12-310001575051us-gaap:PerformanceSharesMembersrt:MinimumMember2022-01-012022-12-310001575051srt:MaximumMemberus-gaap:PerformanceSharesMember2022-01-012022-12-310001575051cinr:TotalReturnPerformanceUnitAwardsMemberus-gaap:PerformanceSharesMember2021-12-310001575051cinr:TotalReturnPerformanceUnitAwardsMemberus-gaap:PerformanceSharesMember2020-12-310001575051cinr:TotalReturnPerformanceUnitAwardsMemberus-gaap:PerformanceSharesMember2022-01-012022-12-310001575051cinr:TotalReturnPerformanceUnitAwardsMemberus-gaap:PerformanceSharesMember2021-01-012021-12-310001575051cinr:TotalReturnPerformanceUnitAwardsMemberus-gaap:PerformanceSharesMember2022-12-310001575051us-gaap:PerformanceSharesMembercinr:A2019PerformanceUnitAwardsMember2022-01-012022-12-310001575051us-gaap:PerformanceSharesMembercinr:A2019PerformanceUnitAwardsMembersrt:MinimumMember2022-01-012022-12-310001575051srt:MaximumMemberus-gaap:PerformanceSharesMembercinr:A2019PerformanceUnitAwardsMember2022-01-012022-12-310001575051cinr:A2019PerformanceUnitAwardsMember2022-12-310001575051cinr:A2019PerformanceUnitAwardsMember2022-01-012022-12-310001575051cinr:A2019PerformanceUnitAwardsMember2021-12-310001575051cinr:A2019PerformanceUnitAwardsMember2020-12-310001575051cinr:A2019PerformanceUnitAwardsMember2021-01-012021-12-310001575051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2019-12-310001575051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001575051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-12-310001575051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001575051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001575051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001575051us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001575051us-gaap:InterestRateSwapMember2022-01-012022-12-310001575051us-gaap:InterestRateSwapMember2021-01-012021-12-310001575051us-gaap:InterestRateSwapMember2020-01-012020-12-310001575051us-gaap:CommodityContractMember2022-01-012022-12-310001575051us-gaap:CommodityContractMember2021-01-012021-12-310001575051us-gaap:CommodityContractMember2020-01-012020-12-310001575051us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMember2022-01-012022-12-310001575051us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMember2021-01-012021-12-310001575051us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateSwapMember2020-01-012020-12-310001575051us-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001575051us-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-01-012021-12-310001575051us-gaap:CommodityContractMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2020-01-012020-12-310001575051us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001575051us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001575051us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001575051cinr:WatcoCompaniesLLCMember2011-12-010001575051cinr:RockSpringsGrazingAssociationMember2022-12-310001575051cinr:RockSpringsGrazingAssociationMember2022-01-012022-12-310001575051cinr:WatcoCompaniesLLCMember2021-12-010001575051srt:MinimumMember2022-12-310001575051srt:MaximumMember2022-12-310001575051cinr:RailCarLeaseMember2022-12-310001575051us-gaap:CommodityMember2022-12-310001575051us-gaap:CommodityMember2022-01-012022-12-310001575051cinr:SelfBondAgreementforReclamationCostsMember2022-12-310001575051cinr:SelfBondAgreementforReclamationCostsMember2021-12-310001575051srt:AffiliatedEntityMember2022-01-012022-12-310001575051cinr:CinerCorporationMember2022-01-012022-12-310001575051cinr:CinerCorporationMember2021-01-012021-12-310001575051cinr:CinerCorporationMember2020-01-012020-12-310001575051cinr:AmericanNaturalSodaAshCorporationMember2020-01-012020-12-310001575051cinr:SisecamResourcesMember2022-12-310001575051cinr:SisecamResourcesMember2021-12-310001575051cinr:OtherRelatedPartiesMember2022-12-310001575051cinr:OtherRelatedPartiesMember2021-12-310001575051country:US2022-01-012022-12-310001575051country:US2021-01-012021-12-310001575051country:US2020-01-012020-12-310001575051us-gaap:NonUsMember2022-01-012022-12-310001575051us-gaap:NonUsMember2021-01-012021-12-310001575051us-gaap:NonUsMember2020-01-012020-12-310001575051us-gaap:CustomerConcentrationRiskMembercinr:TwoCustomersMemberus-gaap:SalesRevenueNetMember2022-01-012022-12-310001575051us-gaap:CustomerConcentrationRiskMembercinr:TwoCustomersMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001575051us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercinr:OneCustomerMember2020-01-012020-12-310001575051us-gaap:CustomerConcentrationRiskMembercinr:AccountsReceivableBenchmarkMembercinr:TwoCustomersMember2022-12-310001575051us-gaap:CustomerConcentrationRiskMembercinr:AccountsReceivableBenchmarkMembercinr:TwoCustomersMember2021-12-310001575051us-gaap:FairValueMeasurementsRecurringMembercinr:InterestRateSwapOneMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001575051us-gaap:FairValueMeasurementsRecurringMembercinr:InterestRateSwapTwoMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001575051us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2022-12-310001575051cinr:InterestRateSwapThreeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001575051us-gaap:FairValueMeasurementsRecurringMembercinr:InterestRateSwapFourMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001575051us-gaap:FairValueMeasurementsRecurringMembercinr:InterestRateSwapFiveMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001575051us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2021-12-310001575051us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2022-12-310001575051us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2021-12-310001575051us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2022-12-310001575051us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwapMember2021-12-310001575051us-gaap:FairValueMeasurementsRecurringMember2022-12-310001575051us-gaap:FairValueMeasurementsRecurringMember2021-12-310001575051us-gaap:SecuredDebtMembercinr:SisecamWyomingEquipmentFinancingArrangementSecurityNoteNumber002Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001575051us-gaap:SecuredDebtMembercinr:SisecamWyomingEquipmentFinancingArrangementSecurityNoteNumber002Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001575051us-gaap:SubsequentEventMember2023-02-092023-02-090001575051cinr:SisecamResourcesLPMemberus-gaap:SubsequentEventMembersrt:ScenarioForecastMembercinr:SisecamChemicalsWyomingLLCAndSisecamChemicalsNewcoLLCMember2023-02-010001575051cinr:SisecamChemicalsWyomingLLCMemberus-gaap:SubsequentEventMemberus-gaap:OtherOwnershipInterestMember2023-02-012023-02-01

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K | | | | | |

| (Mark One) | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2022 | | | | | |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from _______ to ________ |

Commission file number: 001-36062

Sisecam Resources LP

(Exact name of registrant as specified in its charter) | | | | | |

Delaware (State or other jurisdiction of Incorporation or Organization) | 46-2613366 (I.R.S. Employer Identification No.) |

Five Concourse Parkway

Suite 2500

Atlanta, Georgia 30328

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (770) 375-2300

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common units representing limited partnership interests | SIRE | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer ☐ | Accelerated filer ☒ | Non-accelerated filer ☐

| Smaller reporting company ☐ |

| | | Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ☐ No ☒

The aggregate market value, as of June 30, 2022, of the common units held by non-affiliates of the registrant, based on the reported closing price of such units on the New York Stock Exchange on such date ($17.30 per common unit), was approximately $88.7 million.

The registrant had 19,799,791 common units and 399,000 general partner units outstanding at March 28, 2023, the most recent practicable date.

Documents Incorporated by Reference: None

SISECAM RESOURCES LP

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

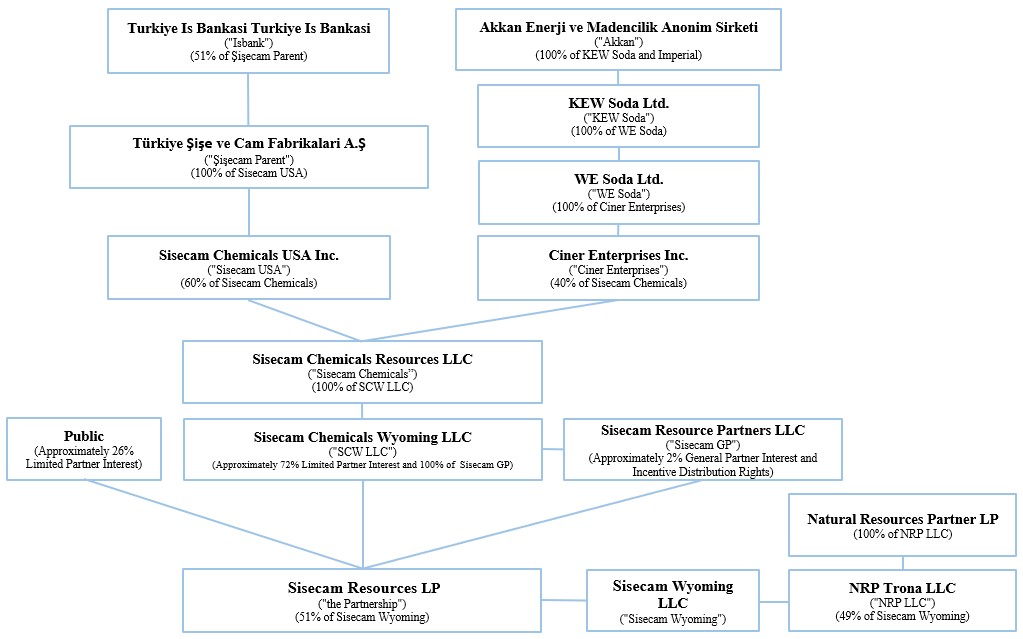

References in this Annual Report on Form 10-K (“Report”) to the “Partnership,” “SIRE,” “we,” “our,” “us,” or like terms refer to Sisecam Resources LP (formerly known as Ciner Resources LP) and its subsidiary, Sisecam Wyoming LLC (formerly known as Ciner Wyoming LLC), which is the consolidated subsidiary of the Partnership and referred to herein as “Sisecam Wyoming.” Sisecam Chemicals Resources LLC ("Sisecam Chemicals" formerly known as Ciner Resources Corporation) is 60% owned by Sisecam Chemicals USA Inc. ("Sisecam USA") and 40% owned by Ciner Enterprises Inc. (“Ciner Enterprises”). References to “our general partner” or “Sisecam GP” refer to Sisecam Resource Partners LLC (formerly known as Ciner Resource Partners LLC), the general partner of Sisecam Resources LP and a direct wholly owned subsidiary of Sisecam Chemicals Wyoming LLC ("SCW LLC" formerly known as Ciner Wyoming Holding Co.), which is a direct wholly owned subsidiary of Sisecam Chemicals. Sisecam Chemicals is a 60%-owned subsidiary of Sisecam USA, which is a direct wholly owned subsidiary of Türkiye Şişe ve Cam Fabrikalari A.Ş, a Turkish corporation ("Şişecam Parent") which is an approximately 51%-owned subsidiary of Turkiye Is Bankasi Turkiye Is Bankasi ("Isbank"). Şişecam Parent is a global company operating in soda ash, chromium chemicals, flat glass, auto glass, glassware glass packaging and glass fiber sectors. Şişecam Parent was founded over 87 years ago, is based in Turkey and is one of the largest industrial publicly listed companies on the Istanbul exchange. With production facilities in four continents and in 14 countries, Sisecam is one of the largest glass and chemicals producers in the world. Ciner Enterprises Inc. is a direct wholly owned subsidiary of WE Soda Ltd., a U.K. Corporation (“WE Soda”). WE Soda is a direct wholly owned subsidiary of KEW Soda Ltd., a U.K. corporation (“KEW Soda”), which is a direct wholly owned subsidiary of Akkan Enerji ve Madencilik Anonim Şirketi (“Akkan”). Akkan is directly and wholly owned by Turgay Ciner, the Chairman of the Ciner Group (“Ciner Group”), a Turkish conglomerate of companies engaged in energy and mining (including soda ash mining), media and shipping markets. All of our soda ash processed is sold to various domestic and international customers.

We include cross references to captions elsewhere in this Report where you can find related additional information. The following table of contents tells you where to find these captions.

| | | | | | | | |

| | Page Number |

| | |

| | |

| | |

| | |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

| | |

| | |

| | |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Report contains, and our other public filings and oral and written statements by us and our management may include statements that constitute “forward-looking statements” within the meaning of the United States securities laws. Forward-looking statements include the information concerning our possible or assumed future results of operations, reserve estimates, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance, the effects of competition and the effects of future legislation or regulations. Forward-looking statements include all statements that are not historical facts and in some cases may be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “seek,” “anticipate,” “estimate,” “predict,” “forecast,” “project,” “potential,” “continue,” “may,” “will,” “could,” “should” or the negative of these terms or similar expressions. Examples of forward-looking statements include, but are not limited to, statements concerning cash available for distribution and future distributions, if any, and such distributions are subject to the approval of the board of directors of our general partner and will be based upon circumstances then existing. We have based our forward-looking statements on management’s beliefs and assumptions and on information currently available to us.

Forward-looking statements involve risks, uncertainties and assumptions. You should not put undue reliance on any forward-looking statements. After the date of this Report, we do not have any intention or obligation to update any forward-looking statement, whether as a result of new information or future events, and expressly disclaim any obligation to do so except as required by applicable law.

The risk factors discussed in Item 1A. “Risk Factors” and the factors discussed in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” could cause our actual results to differ materially from those expressed in forward-looking statements. These factors should not be construed as exhaustive and there may also be other risks that we are unable to predict at this time. All forward-looking statements included in this Report are expressly accompanied and qualified in their entirety by these cautionary statements.

PART I

Item 1. Business

Overview

The Partnership was formed in April 2013 by SCW LLC. The Partnership owns a controlling interest comprised of 51.0% membership interest in Sisecam Wyoming, which is one of the largest and lowest cost producers of natural soda ash in the world, serving a global market from our facility in the Green River Basin of Wyoming. Our facility has been in operation for more than 60 years.

The following table sets forth certain operating data regarding our business: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2022 | | 2021 | | 2020 | | 2019 | | 2018 |

| Operating and Other Data: | (thousands of short tons, except for ratio data) |

| Trona ore consumed | 4,373.7 | | | 4,251.2 | | | 3,653.8 | | | 4,157.0 | | | 4,018.3 | |

Ore to ash ratio (1) | 1.58: 1.0 | | 1.56: 1.0 | | 1.60: 1.0 | | 1.51: 1.0 | | 1.54: 1.0 |

Ore grade (2) | 86.8 | % | | 86.3 | % | | 86.6 | % | | 86.6 | % | | 85.8 | % |

| Soda ash volume produced | 2,760.7 | | | 2,720.5 | | | 2,279.3 | | | 2,752.0 | | | 2,613.4 | |

| Soda ash volume sold | 2,660.1 | | | 2,813.5 | | | 2,221.9 | | | 2,759.1 | | | 2,613.2 | |

(1)Ore to ash ratio expresses the number of short tons of trona ore used to produce one short ton of soda ash and liquor and includes our deca rehydration recovery process. In general, a lower ore to ash ratio results in lower costs and improved efficiency.

(2)Ore grade is the percentage of raw trona ore that is recoverable as soda ash free of impurities. A higher ore grade will produce more soda ash than a lower ore grade.

Trona, a naturally occurring soft mineral, is also known as sodium sesquicarbonate and consists primarily of sodium carbonate, or soda ash, sodium bicarbonate and water. We process trona ore into soda ash, which is an essential raw material in flat glass, container glass, detergents, chemicals, paper and other consumer and industrial products. The vast majority of the world’s accessible trona reserves are located in the Green River Basin. According to historical production statistics, approximately 30% of global soda ash is produced by processing trona, with the remainder being produced synthetically through chemical processes. The processing of soda ash from trona is the cheapest manner in which to produce soda ash. The costs associated with procuring the materials needed for synthetic production are greater than the costs associated with mining trona for trona-based production. In addition, trona-based production consumes less energy and produces fewer undesirable by-products than synthetic production.

Our principal executive offices are located at Five Concourse Parkway, Suite 2500, Atlanta, Georgia 30328, and our telephone number is (770) 375-2300. We make available, free of charge on our website at www.sisecamusa.com our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, as soon as reasonably practicable after we electronically file such material with, or furnish such material to, the U.S. Securities and Exchange Commission (“SEC”). A hard copy of this annual report on Form 10-K may also be requested free of charge by emailing scus-ir@sisecam.com.

Our website also includes certain governance documents and policies such as our Code of Conduct, our Supplier Code of Conduct, our Corporate Governance Guidelines, our Internal Reporting and Whistleblower Protection Policy, our Insider Trading Policy and the charters of our Audit Committee and Conflicts Committee. The information on our website, or information about us on any other website, is not incorporated by reference into this Report. The SEC maintains an internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Take Private Transaction

On February 1, 2023, the Partnership, our general partner, SCW LLC and Sisecam Chemicals Newco LLC, a Delaware limited liability company and a wholly owned subsidiary of SCW LLC (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which Merger Sub will merge with and into the Partnership, with the Partnership surviving as a direct wholly owned subsidiary of our general partner and SCW LLC (the “Merger”). Under the terms of the Merger Agreement, at the effective time of the Merger, each issued and outstanding common unit of the Partnership, other than those held by SCW LLC and its permitted transferees, will be converted into the right to receive $25.00 per common unit in cash without any interest thereon. Immediately following the execution of the Merger Agreement, SCW LLC, which indirectly owns approximately 74% of our common units, delivered to us an irrevocable written consent adopting the Merger Agreement and approving the transactions contemplated thereby, including the Merger. As a result, we are not soliciting approval of the transaction by any other holders of our common units. Instead, we will distribute an information statement to our unitholders describing the terms and conditions of the transaction. Upon closing of the transaction, our common units will cease to be listed on the New York Stock Exchange and will be subsequently deregistered under the Securities Exchange Act of 1934, as amended.

Change in Control of Sisecam Chemicals

On December 21, 2021, Ciner Enterprises (which was the indirect owner of approximately 74% of the common units in the Partnership and 100% of the general partner) completed the following transactions pursuant to the definitive agreement which Ciner Enterprises entered into with Sisecam USA, a direct subsidiary of Sisecam Parent on November 20, 2021 (“Purchase Agreement”):

•Ciner Enterprises converted Ciner Resources Corporation into Sisecam Chemicals Resources LLC, a Delaware limited liability company (“Sisecam Chemicals”), and Ciner Wyoming Holding Co., a direct wholly owned subsidiary of Sisecam Chemicals, into Sisecam Chemicals Wyoming LLC (“SCW LLC”), with SCW LLC in turn then directly owning approximately 74% of the common units in the Partnership and 100% of the general partner (collectively, the “Reorganization Transactions”);

•subsequent to the Reorganization Transactions, Ciner Enterprises sold to Sisecam USA, and Sisecam USA purchased, 60% of the outstanding units of Sisecam Chemicals owned by Ciner Enterprises for a purchase price of $300 million (the “Sisecam Chemicals Sale”); and

•at the closing of the Sisecam Chemicals Sale, Sisecam Chemicals, Ciner Enterprises, and Sisecam USA entered into a unitholders and operating agreement (the “Sisecam Chemicals Operating Agreement”) (collectively such transactions, the “CoC Transaction”).

Pursuant to the terms of the Sisecam Chemicals Operating Agreement, Sisecam USA and Ciner Enterprises have a right to designate six directors and four directors, respectively, to the board of directors of Sisecam Chemicals. In addition, the Sisecam Chemicals Operating Agreement provides that (i) the board of directors of the general partner (the “MLP Board”) shall consist of six designees from Sisecam USA, two designees from Ciner Enterprises and three independent directors for as long as the general partner is legally required to appoint such independent directors and (ii) the Partnership’s right to appoint four managers to the board of managers of Sisecam Wyoming (the “Wyoming Board”) shall be comprised of three designees from Sisecam USA and one designee from Ciner Enterprises. Each of Sisecam USA and Ciner Enterprises shall vote all units over which such unitholder has voting control in Sisecam Chemicals to elect to the board of directors any individual designated by Sisecam USA and Ciner Enterprises. The Sisecam Chemicals Operating Agreement also requires the board of directors of Sisecam Chemicals to unanimously approve certain actions and commitments, including without limitation taking any action that would have an adverse effect on the master limited partnership status of the Partnership or any of its subsidiaries. As a result of Sisecam USA’s and Ciner Enterprise’s respective interests in Sisecam Chemicals and their respective rights under the Sisecam Chemicals Operating Agreement, each of Ciner Enterprises and Sisecam USA and their respective beneficial owners may be deemed to share beneficial ownership of the approximate 2% general partner interest in the Partnership and approximately 74% of the common units in the Partnership owned directly by SCW LLC and indirectly by Sisecam Chemicals as parent entity of SCW LLC.

In 2022, the Partnership obtained the right to appoint an additional Sisecam USA designee to the Wyoming Board and the Ciner Enterprises designee on the Wyoming Board was eliminated.

Our Competitive Strengths

We believe that the following competitive strengths better enable us to execute our business strategies and to achieve our objective of generating and growing cash available for distribution to our unitholders:

Safety Is a Value and the Most Important Part of Our Business. We pride ourselves on our safety record, and we are continually one of the leaders in the U.S. mining industry in relation to low incident rates and workplace injuries. We maintain a rigorous safety program, which includes training, site audits and hazard identification. Sisecam Chemicals and its affiliates, our employees and all contractors who operate our assets or work at our facility are involved in our safety programs. As a direct result of this commitment, we have achieved many recognitions such as the Sentinels of Safety by the National Mining Association, the Industrial Minerals Association-North America Safety Achievement Award (Large Category) six times, most recently in May 2022 at the Spring Industrial Minerals Association-North America Conference, Safe Sam Award by the Wyoming Mining Association two times, most recently in June 2021, and the Wyoming State Mine Inspector’s Large Mine award multiple times, most recently at the summer 2022 annual conference. We also boast and support some of the best rescue teams in the country. In 2022, our two Mine Rescue teams competed in the National Mine Rescue Contest in Lexington, Kentucky. With 25 teams in attendance, Sisecam’s Mine Rescue team represented well in placing first in team tech, and first and third in bench. During the year ended December 31, 2022, our facility had two lost workday injuries and four recordable injuries as reported by Mine Safety and Health Administration (“MSHA”).

Cost Advantages of Producing Soda Ash from Trona. We believe that as a producer of soda ash from trona, we have a significant competitive advantage compared to the synthetically produced soda ash manufactured in other parts of the world. The manufacturing and processing costs for producing soda ash from trona are lower than other manufacturing techniques partly because the costs associated with procuring the materials needed for synthetic production are greater than the costs associated with mining

trona for trona-based production. In addition, trona-based production consumes less energy per ton of soda ash produced and generates fewer undesirable by-products than synthetic production. We believe the average cost of production per short ton of soda ash (before freight and logistics costs) from trona, directly in relationship with the production methods, has a significant cost advantage when compared to synthetic production. In addition, synthetic producers of soda ash incur additional costs associated with storing or disposing of, or attempting to resell, the by-products the synthetic processes produce. Even after taking into account the higher freight costs associated with our soda ash exports, we believe we can be cost competitive with synthetic soda ash operations in most parts of the world, which are typically located closer to customers than we are. Today, we estimate that roughly 30% of global production is produced from trona-based sources, while the remainder is produced using various synthetic methods.

Manufacturing natural soda ash in the United States has the benefit of relatively stable energy prices, for both internal generation using natural gas as well as energy purchased from the power grid which is attributed to multiple sources. The recent conflict in Ukraine has revealed vulnerabilities of producing soda ash in regions of the world where energy is far more volatile. Other manufacturing technologies including synthetic and solution mining have greater dependency of energy per ton of soda ash produced than the energy required for trona based soda ash, which is mechanically mined.

Synergies created with Sisecam Group. Sisecam Group has undertaken major efforts to become an international company with its growing production power, reputable brand image, high product quality and value-creating sustainable growth approach. Sisecam Group is currently one of the world's leading glass and soda ash producers with production operations located in 14 countries on four continents and more than 20,000 employees. Sisecam Group records sales in over 150 countries around the globe.

In 1969, Sisecam Group began producing soda ash and has made significant inroads to expand its investment portfolio in existing and adjacent markets ever since. Today, Sisecam Group has 2.5 million tons of soda production capacity excluding the Partnership. Sisecam Group has more than 50 years of soda production experience and nearly 85 years of industrial mining experience. It also has more than 16 years of cogeneration plant knowledge. Research and development activities conducted by Sisecam Group regarding soda and its derivatives can be utilized in the Partnership, and we believe those efforts could provide a competitive advantage for our U.S. operations. We also believe that the lean operations and continuous improvement activities of Sisecam Group can create synergies and opportunities for further optimization in the U.S.

Sisecam Group has long-standing relationships with many global customers and regional partners as an established seller of soda ash from its three plants located in Bosnia, Bulgaria and Turkey. Sisecam Group generates 70% of its soda ash revenue, excluding from the Partnership, through international sales of soda ash and soda ash derivatives such as glass and chromates. With such extensive access to global soda markets and downstream segments, we believe Sisecam Group will significantly contribute to building and amplifying the sales capabilities of the Partnership. The Partnership’s customer relationships can be expanded by leveraging Sisecam Group’s existing sales networks and customer portfolios, which we believe will facilitate securing and servicing accounts, especially those in the international market.

With its extensive experience in the soda market and technical fields, along with the Sisecam Group’s significant investment history in various forms (e.g., greenfield, joint venture and sole ownership), we believe that Sisecam Group will positively contribute to the U.S. operations.

Substantial Reserve Life from Significant Reserves. Our reserve estimate, as of December 31, 2022, was prepared by Hollberg Professional Group (“HPG”), an independent mining and geological consulting firm. As of December 31, 2022, HPG estimated we had proven and probable reserves of approximately 215.6 million short tons of trona (of which the Partnership’s interest is 110.0 million short tons), which is equivalent to 116.7 million short tons of soda ash (of which the Partnership’s interest is 59.5 million short tons of soda ash). Based on our current mining rate of approximately 4 million short tons of trona per year, we believe we have enough proven and probable trona reserves to continue mining trona using current methods for approximately 50 years. Please see Item 1, Business, “Summary of Trona Resources and Trona Reserves” and “Risk Factors-Risks Inherent in our Business and Industry - Our reserve and resource data are estimates based on assumptions that may be inaccurate and are based on existing economic and operating conditions that may change in the future, which could materially and adversely affect the quantities and value of our reserves and resources” for more information.

Certain Operational Advantages Compared to Other U.S-Based Trona Producers. We believe we have certain operational advantages over other soda ash producers in the Green River Basin due to the operational characteristics of our facilities as described below. These advantages are manifested in our high productivity and efficiency rates.

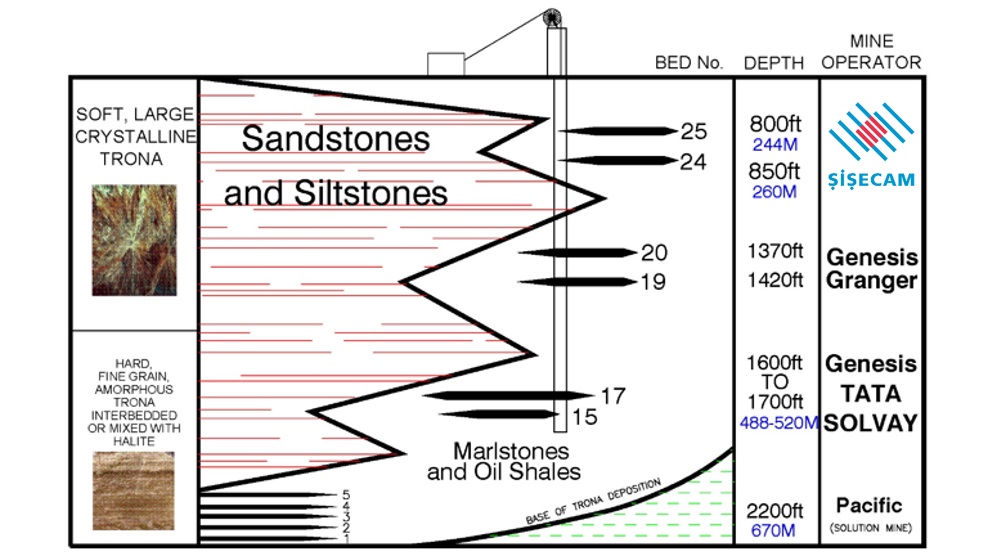

•Location of our mining beds and high purity trona. Our mining beds are located 800 to 850 feet below the surface near our shaft locations, which is significantly closer to the surface than the mining beds of other operators in the Green River Basin. The relatively shallow depth of our beds compared to other Green River Basin trona mines contributes to favorable ground conditions and improved mining efficiency. We have a competitive advantage because we can mine the trona and roof bolt simultaneously on our continuous miner equipment. In addition, the trona in our mining beds has a higher concentration of soda ash as compared to the trona mined at other locations in the Green River Basin, which is typically embedded or mixed with greater amounts of halite and other impurities. Our trona ore is generally composed of approximately 80% to 89% pure trona.

•Advantageous facility layout. Our surface site includes a high-capacity network of ponds that we use to recapture soda ash lost in processing trona through a process we introduced in 2009 called deca rehydration (“deca”). While other producers in the Green River Basin also utilize deca rehydration, our pond complex enables us to spread deca-saturated water over a large surface area, which facilitates evaporation and access to the resulting deca. Additionally, we can transfer water from one pond to another, a process we call “de-watering,” leaving the first pond dry. De-watering enables us to use front loaders and other hauling equipment to move dry deca from that “de-watered” pond to our processing facility. Other producers in the area instead need to utilize costly dredging techniques to extract deca from their ponds, and the recovered deca is wet, and therefore requires more energy to process than dry deca. Introducing dry deca into our process has also reduced our energy consumption per short ton of soda ash produced. At our current utilization rates, we will deplete our deca supply in 2024. Please read “Risk Factors-Risks Inherent in Our Business and Industry-Our deca stockpiles will substantially deplete by 2024 and our production rates will decline approximately 200,000 short tons per year if we do not make further investments or otherwise execute on one or more initiatives to prevent such decline” for more information about this process.

Partly due to these operational advantages over other domestic producers, we believe we have the most efficient soda ash production facility in the Green River Basin both in terms of short tons of soda ash produced per employee and in energy consumed per short ton of soda ash produced. In 2022, we used approximately 4.0 MMBtus of energy per short ton of soda ash processed, as compared to an average of 5.5 MMBtus of energy for the other three operators in the Green River Basin according to the Wyoming Department of Environmental Quality (“WDEQ”) and our internal estimates. For the year ended December 31, 2022, we produced approximately 6,037 short tons of soda ash per employee.

Stable Domestic Customer Relationships. We have more than 80 domestic customers in industries such as flat glass, container glass, detergents, chemicals and other consumer and industrial products. We have long-term relationships with many of our customers due to our competitive pricing, reliable shipping and high-quality soda ash. For the year ended December 31, 2022, the majority of our domestic net sales were made to customers with whom we have done business for over ten years and their contracts are typically for one to three year periods. We believe that these relationships promote more stable cash flows.

Experienced Management and Workforce. Our facility has been in continuous operation for more than 60 years. We are able to build on the collective knowledge gained from our experience during this period to continually improve our operations and introduce innovative processes. In addition, many members of Sisecam Wyoming’s senior management team have more than 15 years of relevant industry experience. Our executives lead a highly productive workforce with an average tenure of approximately 9 years. We believe our institutional knowledge, coupled with the relative seniority of our workforce, engenders a strong sense of teamwork and collegiality, which has led to one of the safest and most efficient operations in the industry today.

Our Business Strategies

Our primary business objective is to generate stable cash flows through consistent growth in the production of soda ash, allowing us to make quarterly cash distributions to our common unitholders while growing our business. To achieve our objective, we intend to execute the following key business strategies:

Capitalize on Expected Growth in Demand for Soda Ash. Since 2013, we have invested just over $79.3 million for debottlenecking projects that have improved our annual production capacity by approximately 320,000 tons of soda ash per year. In connection with the CoC Transaction, we believe we have further opportunities to debottleneck our facility. We believe that as one of the leading low-cost producers of trona-based soda ash, we are well-positioned to capitalize on the expected worldwide growth of soda ash. While consumption of soda ash within the United States is expected to remain relatively flat in the near future, overall worldwide demand for soda ash, based on third-party historical production statistics and estimates, was 64.6 million metric tons (equivalent to approximately 71.2 million short tons) in 2022 and was forecasted to be 66.1 million metric tons (equivalent to approximately 69.1 million short tons) in 2023. Despite concerns of recessionary pressures in the near term, the soda ash market is expected to grow to almost 72.0 million metric tons (equivalent to approximately 79.4 million short tons) in 2026, which represents a compounded annual growth rate of 2.8%. Sisecam Chemicals continues to recognize additional benefits since departing ANSAC with improved access to customers and control over placement of its sales in the international marketplace. This enhanced view of the global market allows Sisecam Chemicals to better understand supply and demand fundamentals thus allowing better decision making for its business. Sisecam Chemicals continues to optimize its distribution network leveraging strengths of existing distribution partners while expanding as our business requires in certain target areas. Please read “Customers” below for a discussion about the evolution of our international sales since withdrawing from ANSAC.

Continuous Improvement Initiatives to Lower our Operating Expenses and Increase Utilization. We have been building a culture of continuous improvement. For example, several initiatives have been undertaken to reduce our overall costs to produce soda ash and increase the overall output of the facility. In 2022, the continuous improvement initiatives were able to transform ideas from employees into multiple projects throughout the site that resulted in an overall savings of approximately $2.9 million.

Leverage Sisecam Group and Ciner Group (collectively, “Sponsors”) Capability to Build a Global Soda Ash Brand. Both of our Sponsors’ platforms include unique low cost technology, logistics assets including ports and bulk ships, and world class cost competitive production assets geographically located to serve most key markets around the world. In addition, upon Sisecam

Chemicals’ termination from ANSAC (as discussed further under “Customers” below), Sisecam Chemicals is marketing soda ash directly into international markets that are currently being served by ANSAC and is utilizing the logistics expertise and extensive global presence and network that has already been established by the Sponsors.

Build a Global Soda Ash Brand. Sisecam Chemicals’ distribution network continues to develop since the ANSAC exit at the end of 2020. Sisecam Chemicals adopted a model to best serve its own requirements in the target markets of our soda ash sales. Sisecam Chemicals built relationships and established its own reputation as a seller in these markets by negotiating agreements and demonstrating supply capabilities with large and midsize consumers directly selling through distribution. These direct relationships allowed Sisecam Chemicals to establish its customer base for current and future sales.

Maintain Financial Flexibility. We intend to maintain a disciplined financial policy and conservative capital structure by balancing the funding of expansion capital expenditures and acquisitions with internally generated operating cash flows and external financing sources, including commercial bank borrowings. See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources - Debt” for additional information.

Expand Operations Strategically. In addition to capacity expansions and process improvements at our current facility, we plan to grow our business through various methods as they become available to us. This would include acquisitions of other businesses that are involved in mining and processing minerals, such as soda ash, and logistics assets that could improve our efficiencies and grow our cash flows.

We can provide no assurance that we will be able to utilize our strengths described above. For further discussion of the risks that we face, see Item 1A, “Risk Factors.”

Our Organizational Structure

The following chart depicts our ownership structure as of March 31, 2023 and approximate ownership percentages:

Our Operations

Our Green River Basin surface operations are situated on approximately 2,360 acres in Wyoming (of which, 880 acres are owned), and our mining operations consist of approximately 24,000 acres of leased and licensed subsurface mining area. Our facility is accessible by both road and rail. We use seven large continuous mining machines and fourteen underground shuttle cars in our mining operations. Our processing assets consist primarily of material sizing units, conveyors, calciners, dissolver circuits, thickener tanks, drum filters, evaporators and rotary dryers.

Wyoming is a split estate state. In relation to the 2,360 acres of surface operations, we own the surface 880-acres in fee, and we have surface rights from the other owners (Bureau of Land Management (“BLM”) and Rock Springs Grazing Association) for the balance of those surface operations. This is a different right and acreage number from the subsurface mineral acreage.

The following map provides an aerial overview of our surface operations:

The following map shows the known sodium leasing area within the Green River Basin, including the boundaries of our leased and licensed subsurface mining area:

The Green River Basin geological formation holds the largest, and one of the highest purity, known deposits of trona ore in the world. Our reserves contain trona deposits having a purity between 80% to 89% by weight, which means that insoluble impurities and water make up approximately 11% to 20% of our trona.

Our mining leases and license are located in two mining beds, designated by the U.S. Geological Survey as beds 24 and 25, at depths of 850 to 800 feet near our shaft locations, respectively, below the surface. Mining these beds affords us several competitive

advantages. First, the depth of our beds is shallower than other actively mined beds in the Green River Basin, which allows us to use a continuous mining technique to mine trona and roof bolt the ceiling simultaneously. In addition, mining two beds that are on top of one another allows for production efficiencies because we are able to use a single hoisting shaft to service both beds.

The following graphic shows a cross-section of the strategic areas of the Green River Basin where we mine trona:

Source: Management.

We remove insoluble materials and other impurities by thickening and filtering the liquor. We then add activated carbon to our filters to remove organic impurities, which can cause color contamination in the final product. The resulting clear liquid is then crystallized in evaporators, producing sodium carbonate monohydrate. The crystals are then drawn off and passed through a centrifuge to remove excess water. We then dry the resulting material in a product dryer to form anhydrous sodium carbonate, or soda ash. The resulting processed soda ash is then stored in on-site storage silos to await shipment by bulk rail or truck to distributors and end customers. Our storage silos can hold up to 58,900 short tons of processed soda ash at any given time. Our facility is in good working condition and has been in service for more than 60 years.

Deca Rehydration. The evaporation stage of our trona ore processing produces a precipitate and natural by-product called deca. Deca, short for sodium carbonate decahydrate, is one part soda ash and ten parts water. Solar evaporation causes deca to crystallize and precipitate to the bottom of the four main surface ponds at our Green River Basin facility. In 2009, we implemented a process called deca rehydration, which enables us to recover soda ash from the deca-rich purged liquor as a by-product of our refining process. We capture the soda ash contained in deca by allowing the deca crystals to evaporate in the sun and separating the dehydrated crystals from the soda ash. We then blend the separated deca crystals with partially processed trona ore at the dissolving stage of our production process described above. This process enables us to reduce our waste storage needs and convert what is typically a waste product into a usable raw material. Please read “Risk Factor-Risks Inherent in Our Business and Industry-Our deca stockpiles will substantially deplete by 2024 and our production rates will decline approximately 200,000 short tons per year if we do not make further investments or otherwise execute on one or more initiatives to prevent such decline” for more information about this process.

Energy Consumption. We believe we have one of the most efficient mining and soda ash production surface operations in the world. During 2022, we used approximately 4 MMBtus of energy in the form of electricity and natural gas to produce each short ton of soda ash. In addition, we believe this to be the lowest energy consumption of any soda ash producer in North America. We and other producers of soda ash in the Green River Basin benefit from relatively low cost and stable supply of natural gas in Wyoming, which further enhances our competitive cost advantage over other regions of the world. To reduce the impact of the volatility in natural gas prices, we hedge a portion of our natural gas consumption requirements, which enables us to set the price for a portion of our forecasted natural gas purchases. The Partnership utilizes a natural gas-fired turbine co-generation facility that is capable of providing roughly one-third of our electricity and steam demands at our mine in the Green River Basin. This co-generation facility

provided approximately 175 million kWh of electricity which saved the Partnership approximately $4 million in 2022 based on average purchased electricity costs and gas costs. In a normal production environment, the facility is expected to provide us over 180.0 million kWh of electricity annually.

Shipping and Logistics. For the year ended December 31, 2022, we assisted the majority of our domestic customers in arranging their freight services. All of our soda ash is shipped by rail or truck from our Green River Basin operations. For the year ended December 31, 2022, we shipped over 90% of our soda ash to our customers initially via a single rail line owned and controlled by Union Pacific Railroad Company (“Union Pacific”), and our plant receives rail service exclusively from Union Pacific. Our agreement with Union Pacific expires on December 31, 2025 and there can be no assurance that it will be renewed on terms favorable to us or at all. If we do not ship at least a significant portion of our soda ash production on the Union Pacific rail line during a twelve-month period, we must pay Union Pacific a shortfall payment under the terms of our transportation agreement. During 2022, we had no shortfall payments and do not expect to make any such payments in the future. Sisecam Chemicals leases a fleet of more than 2,200 hopper cars that serve as dedicated modes of shipment to our domestic and international customers. The railcar expense is allocated and directly charged to the Partnership. For exports, we ship our soda ash on unit trains primarily out of Longview, Washington for bulk shipments. We have contracts securing our export capacity in bulk vessels and container vessels. From these ports, our soda ash is loaded onto ships for delivery to ports all over the world. We ship to customers on Cost and Freight (“CFR”) and Cost, Insurance, and Freight (“CIF”) basis where we pay for the ocean freight and charge the customer directly for these freight costs. We have yearly and multiyear contracts for a portion of our ocean freight with vessel owners and carriers securing capacity and reducing market risk fluctuation.

Customers

We generate approximately half of our gross revenue from export sales, which consist of both consumers as well as distributors who serve as our channel partners in certain markets. The two largest customers in our portfolio are distributors in our export network who, on a combined basis, make up 26% of our total gross revenue.

For customers in North America, Sisecam Chemicals, on our behalf, typically enters into contracts, having terms ranging from one to three years. Under these contracts, our customers generally agree to purchase either minimum estimated volumes of soda ash or a certain percentage of their estimated soda ash requirements at a fixed price for a given calendar year. Although we do not have a “take or pay” arrangement with our customers, substantially all of our sales are made pursuant to written agreements and not through spot sales. In 2022, we had more than 80 domestic customers and in general, we have long-term relationships with the majority of our customers, meaning we have been a supplier to them for more than ten years.

Our customers consist primarily of:

•Glass manufacturing companies, which account for 50% or more of the consumption of soda ash around the world; and

•The majority of the remainder is comprised of chemical and detergent manufacturing companies.

Sisecam Chemicals has now completed two full years directly managing its international sales, marketing and logistics activities since exiting ANSAC at the end of 2020. Sisecam Chemicals took direct control of these activities to improve access to customers and gain control over placement of its sales in the international marketplace. This enhanced view of the global market allows Sisecam Chemicals to better understand supply/demand fundamentals thus allowing better decision making for its business. Sisecam Chemicals continues to optimize its distribution network leveraging strengths of existing distribution partners while expanding as our business requires in certain target areas.

Leases and License

We are party to several mining leases and one license, as noted in the table below, which give us subsurface mining rights. Some of our leases are renewable at our option upon expiration. We pay royalties to the State of Wyoming, the U.S. Bureau of Land Management and Sweetwater Royalties LLC, a subsidiary of Sweetwater Trona OpCo LLC and the successor in interest to the license with the Rock Spring Royalty Company, LLC (“RSRC”), an affiliate of Occidental Petroleum Corporation (formerly an affiliate of Anadarko Petroleum Corporation). The royalties are calculated based upon a percentage of the value of soda ash and related products sold at a certain stage in the mining process. These royalty payments may be subject to a minimum domestic production volume from our Green River Basin facility. We are also obligated to pay annual rentals to our lessors and licensor regardless of actual sales. In addition, we pay a production tax to Sweetwater County, and trona severance tax to the State of Wyoming that is calculated based on a formula that utilizes the volume of trona ore mined and the value of the soda ash produced. We have a perpetual right to continue operating under these leases and license as long as we maintain continuous mining operations and we intend to continue renewing the leases and license as has been historical practice.

The royalty rates we pay to our lessors and licensor may change upon our renewal or renegotiation of such leases and license. Sisecam Wyoming’s License Agreement, dated July 18, 1961 and amended June 28, 2018, with Sweetwater Royalties LLC (the “License Agreement”), provides among other things, (i) the term of the License Agreement through July 18, 2061 and for so long

thereafter as Sisecam Wyoming continuously conducts operations to mine and remove sodium minerals from the licensed premises in commercial quantities; and (ii) the production royalty rate for each sale of sodium mineral products produced from ore extracted from the licensed premises at eight percent (8%) of the net sales of such sodium mineral products. Any increase in the royalty rates we are required to pay to our lessors and licensor, or any failure by us to renew any of our leases and license, could have a material adverse impact on our results of operations, financial condition or liquidity, and, therefore, may affect our ability to distribute cash to unitholders. On December 11, 2020, the Secretary of the Interior authorized an industry-wide royalty reduction from currently set rates by establishing a 2% federal royalty rate for a period of ten years for all existing and future federal soda ash or sodium bicarbonate leases. This change by the Secretary of the Interior reduced the rates on our mineral leases with the U.S. Government from 6% to 2% as of January 1, 2021 and for the following ten years. This 4% rate reduction saved over $10.2 million in royalty fees based on our mining operations on U.S. Government leases in 2022.

The following is a summary of the material terms of our leases and our license as of December 31, 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name of Lessor or

Licensor | | Number of

Leases or

Licenses as of

December 31,2022 | | Total

Approximate

Acreage as of

December 31,

2022 | | Expiration

Date Range | | Renewals (1) | | Year of

Commencement | | Royalty Rate |

License with Sweetwater Royalties LLC | | 1 | | 12,439 acres | | 2061 | | License will renew so long as we continuously conduct operations to mine and remove sodium minerals from the licensed premises in commercial quantities. | | 1961 | | 8% of net sales |

| Leases with the U.S. Government | | 4 | | 7,934 acres | | 2027-2028 | | These leases will renew so long as we file an application for renewal with the Department of the Interior, Bureau of Land Management, within 90 days of expiration of the leases (1) | | 1961 | | 2% of gross output |

| Leases with the State of Wyoming | | 5 | | 3,079 acres | | 2029 | | No contractual right to renewal, but leases have been historically renewed for consecutive 10-year periods | | 1969 | | 6% of gross value |

| Other small leases | | 3 | | 640 acres | | Various | | Various | | 2022 | | <1% |

(1)Renewals are typically for ten-year periods.

The foregoing descriptions of the material terms of our leases and our license do not purport to be complete descriptions of our leases and our license, and are qualified in their entirety by reference to the full text of the leases and license, as amended copies of which have been filed or incorporated by reference as exhibits to this Report. See Part IV, Item 15, “Exhibits and Financial Statement Schedules— Exhibit Index” for more information.

Trona Resources and Trona Reserves