UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 26, 2020

BMC STOCK HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 1-36050 | 26-4687975 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

4800 Falls of Neuse Road, Suite 400

Raleigh, North Carolina 27609

(Address of Principal Executive Offices) (Zip Code)

(919) 431-1000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Securities registered pursuant to Section 12(b) of the Act: | ||||

| Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered | ||

| Common stock, par value $0.01 per share | BMCH | The Nasdaq Stock Market LLC | ||

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 8.01 | Other Events. |

On August 27, 2020, BMC Stock Holdings, Inc., a Delaware corporation (“BMC”), and Builders FirstSource, Inc., a Delaware corporation (“Builders FirstSource”), issued a joint press release announcing their entry into an Agreement and Plan of Merger, dated as of August 26, 2020 (the “Merger Agreement”), pursuant to which BMC and Builders FirstSource will combine in an all-stock merger transaction. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated into this Item 8.01 by reference.

In addition, on August 27, 2020, BMC and Builders FirstSource held a conference call and made a joint presentation to investors to discuss the transaction. A copy of the investor presentation is attached hereto as Exhibit 99.2 and is incorporated into this Item 8.01 by reference.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | The following Exhibits are filed herewith. |

| Exhibit No. |

Description | |

| 99.1 | Press Release, dated August 27, 2020 | |

| 99.2 | Investor Presentation, dated August 27, 2020 | |

| 104 | Cover Page Interactive Date File (embedded within the Inline XBRL document). | |

* * *

Cautionary Notice Regarding Forward-Looking Statements

This communication, in addition to historical information, contains “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995) regarding, among other things, future events or the future financial performance of BMC and Builders FirstSource. Words such as “may,” “will,” “should,” “plans,” “estimates,” “predicts,” “potential,” “anticipate,” “expect,” “project,” “intend,” “believe,” or the negative of these terms, and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. Any forward-looking statements involve risks and uncertainties that are difficult to predict or quantify, and such risks and uncertainties could cause actual events or results to differ materially from the events or results described in the forward-looking statements, including risks, or uncertainties related to the novel coronavirus disease 2019 (also known as “COVID-19”) pandemic and its impact on the business operations of BMC and Builders FirstSource and on local, national and global economies, the growth strategies of BMC and Builders FirstSource, fluctuations of commodity prices and prices of the products of BMC and Builders FirstSource as a result of national and international economic and other conditions, or the significant dependence of both companies’ revenues and operating results on, among other things, the state of the homebuilding industry and repair and remodeling activity, lumber prices and the economy. Neither BMC nor Builders FirstSource may succeed in addressing these and other risks or uncertainties.

Forward-looking statements relating to the proposed business combination between BMC and Builders FirstSource include, but are not limited to: statements about the benefits of the proposed business combination between BMC and Builders FirstSource, including future financial and operating results; the plans, objectives, expectations and intentions of BMC and Builders FirstSource; the expected timing of completion of the proposed business combination; and other statements relating to the proposed merger that are not historical facts. Forward-looking statements are based on information currently available to BMC and Builders FirstSource and involve estimates, expectations and projections. Investors are cautioned that all such forward-looking statements are subject to risks and uncertainties, and important factors could cause actual events or results to differ materially from those indicated by such forward-looking statements. With respect to the proposed business combination between BMC and Builders FirstSource, these factors could include, but are not limited to: the risk that BMC and Builders FirstSource may be unable to obtain governmental and regulatory approvals required for the business combination, or that required governmental and regulatory approvals may delay the business combination or result in the imposition of conditions

that could reduce the anticipated benefits from the proposed business combination or cause the parties to abandon the proposed business combination; the risk that a condition to closing of the business combination may not be satisfied, including as a result of the failure to obtain approval of stockholders of BMC and Builders FirstSource on the expected terms and schedule or at all; the length of time necessary to consummate the proposed business combination, which may be longer than anticipated for various reasons; the risk that the businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the proposed business combination may not be fully realized or may take longer to realize than expected; the assumptions on which the parties’ estimates of future results of the combined business have been based may prove to be incorrect in a number of material ways, which could result in an inability to realize the expected benefits of the proposed business combination or exposure to material liabilities; the diversion of management time on issues related to the business combination; the effect of future regulatory or legislative actions on the companies or the industries in which they operate; the risk that the credit ratings of the combined company may be different from what the parties expect; economic and foreign exchange rate volatility; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potential effect of the announcement or consummation of the proposed business combination on relationships with customers, suppliers, competitors, lenders, landlords, management and other employees; the ability to attract new customers and retain existing customers in the manner anticipated or at all; the ability to hire and retain key personnel; reliance on and integration of information technology systems; the risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; certain restrictions during the pendency of the business combination that may affect the ability of BMC and Builders FirstSource to pursue certain business opportunities or strategic transactions; and the potential of international unrest, economic downturn or effects of anticipated tax rates, raw material costs or availability, benefit or retirement plan costs, or other regulatory compliance costs.

Additional information concerning other risk factors pertaining to BMC and Builders FirstSource is also contained in the parties’ respective most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other information filed with the Securities and Exchange Commission (the “SEC”). Many of these risks and uncertainties are beyond BMC’s or Builders FirstSource’s ability to control or predict. Because of these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Furthermore, neither BMC nor Builders FirstSource undertakes any obligation to update publicly or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this communication. Nothing in this communication is intended, or is to be construed, as a profit forecast or to be interpreted to mean that the earnings per share of the common stock of BMC or of the common stock of Builders FirstSource for the current or any future financial years, or the earnings per share of the common stock of the combined company, will necessarily match or exceed the historical published earnings per share of the common stock of BMC or Builders FirstSource, as applicable. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. All subsequent written and oral forward-looking statements concerning BMC, Builders FirstSource, the proposed business combination, the combined company or other matters and attributable to BMC, Builders FirstSource or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

Additional Information and Where to Find It

In connection with the proposed business combination, Builders FirstSource intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include a prospectus with respect to the shares of common stock to be issued by Builders FirstSource in the business combination and a joint proxy statement for BMC’s and Builders FirstSource’s respective stockholders (the “Joint Proxy Statement”). Each of BMC and Builders FirstSource will send the Joint Proxy Statement to its stockholders and may file other documents regarding the business combination with the SEC. This communication is not a substitute for the Registration Statement, the Joint Proxy Statement, or any other document that BMC or Builders FirstSource may send to its stockholders in connection with the proposed business combination. This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. INVESTORS AND SECURITY HOLDERS OF BMC AND BUILDERS FIRSTSOURCE ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT, AND ANY OTHER RELEVANT DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BMC, BUILDERS FIRSTSOURCE, THE PROPOSED BUSINESS COMBINATION AND RELATED MATTERS. Investors and security holders of BMC and Builders FirstSource will be able to obtain free copies of the Registration Statement, the Joint Proxy Statement, and other documents (including any amendments

or supplements thereto) containing important information about BMC and Builders FirstSource once those documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. BMC and Builders FirstSource make available free of charge at ir.buildwithbmc.com and investors.bldr.com, respectively, copies of materials they file with, or furnish to, the SEC.

Participants in the Solicitation

BMC, Builders FirstSource, and their respective directors, executive officers, and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of BMC and Builders FirstSource in connection with the proposed business combination.

The identity of BMC’s directors and executive officers and their ownership of BMC’s common stock is set forth in BMC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on February 27, 2020, and its proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on March 27, 2020.

The identity of Builders FirstSource’s directors and executive officers and their ownership of the common stock of Builders FirstSource is set forth in Builders FirstSource’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on February 21, 2020, and its proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2020.

Investors may obtain additional information regarding the interest of such participants and a description of their direct and indirect interests, by security holdings or otherwise, by reading the Registration Statement, the Joint Proxy Statement, and other materials to be filed with the SEC in connection with the proposed business combination when they become available. You may obtain these documents free of charge through the website maintained by the SEC at www.sec.gov and from the websites of BMC or Builders FirstSource as described above.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BMC STOCK HOLDINGS, INC. | ||||||

| (Registrant) | ||||||

| Date: August 27, 2020 | By: | /s/ Timothy D. Johnson | ||||

| (Signature) | ||||||

| Name: | Timothy D. Johnson | |||||

| Title: | Executive Vice President, General Counsel and Corporate Secretary | |||||

Exhibit 99.1

|

|

Builders FirstSource to Combine with BMC Stock Holdings,

Creating the Nation’s Premier Supplier of Building

Materials and Services

Combined Company Will Deliver a Full Suite of Products, Services and Solutions

Nationally with Over $11 Billion in Annual Sales

Expands Geographic Reach and Value-added Offerings, Accelerating Customer-

centric Growth Strategy

Anticipates Annual Cost Synergies of $130 Million to $150 Million by Year Three

Accretive to Adjusted EPS in First Year Post-Closing

Compelling Financial Profile and Robust Free Cash Flow Generation to Invest in

Growth and Additional Value Creation

August 27, 2020 (Dallas, TX and Raleigh, NC) – Builders FirstSource, Inc. (Nasdaq: BLDR) (“Builders FirstSource”) and BMC Stock Holdings, Inc. (NASDAQ: BMCH) (“BMC”), today announced that they have entered into a definitive merger agreement under which Builders FirstSource and BMC will combine in an all-stock merger transaction to create the nation’s premier supplier of building materials and services. The companies will host a joint conference call today at 7:30 a.m. Central Time (8:30 a.m. Eastern Time) to discuss the transaction.

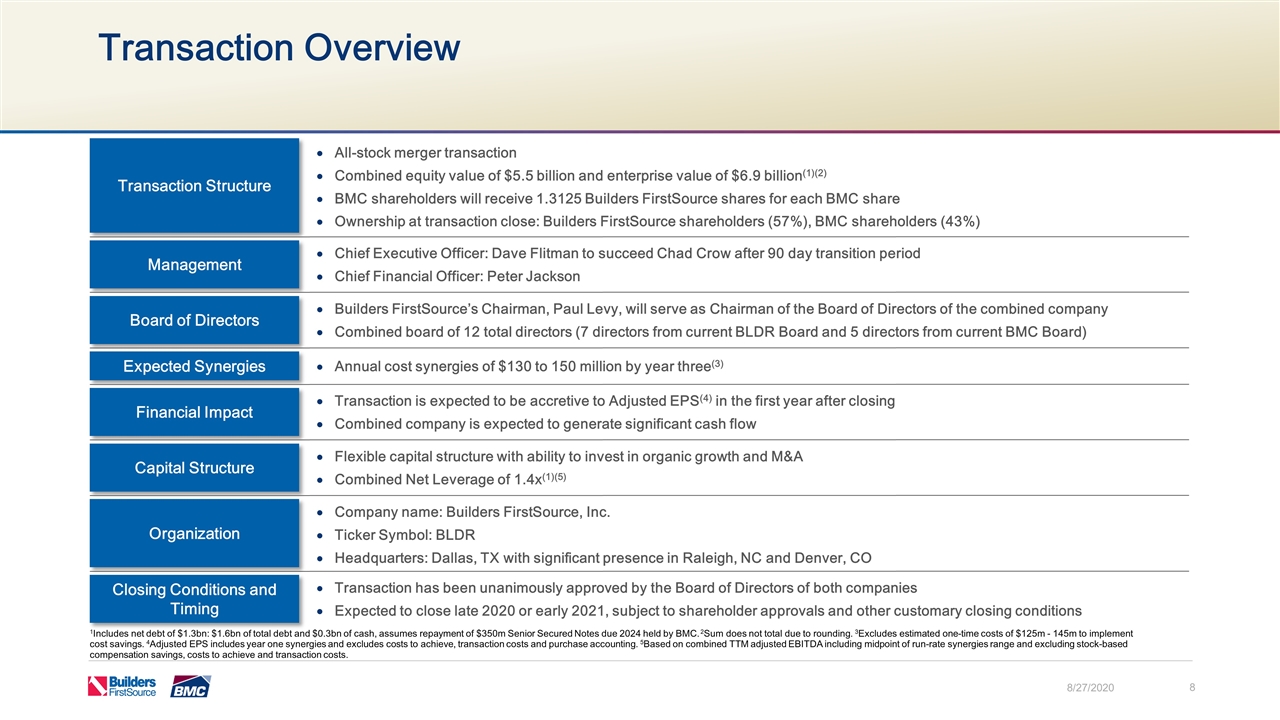

Under the terms of the agreement, which has been unanimously approved by the Boards of Directors of both companies, BMC shareholders will receive a fixed exchange ratio of 1.3125 shares of Builders FirstSource common stock for each share of BMC common stock. Upon completion of the merger, existing Builders FirstSource shareholders will own approximately 57% and existing BMC shareholders will own approximately 43% of the combined company on a fully diluted basis. The merger is expected to be tax free for U.S. federal income tax purposes.

After a 90-day transition period following the completion of the merger, Chad Crow, current Chief Executive Officer of Builders FirstSource, will retire as previously announced and will be succeeded as Chief Executive Officer of the combined company by Dave Flitman, current Chief Executive Officer of BMC. Thereafter, Mr. Crow will continue to be available on a consulting basis to the combined company for a period of time to support the integration execution and to ensure an orderly transition.

1

Mr. Crow said, “This is a transformational opportunity that unites two outstanding and complementary companies, providing enhanced scale and superior returns as we build upon a new, larger platform. Builders FirstSource and BMC together will have a very diverse portfolio of value-added offerings and greater resources to more closely partner with and serve customers. The transaction is expected to produce tremendous value for the shareholders of both companies through the realization of significant cost synergies, the realization of attractive growth opportunities and the acceleration of technological innovation. Similar to the success of our prior acquisition of ProBuild, we will be poised to capitalize on the strength of our combined platform and the significant upside potential in our key end markets to increase sales, reduce costs and improve cash flow. We are excited about the opportunities ahead and look forward to quickly realizing the benefits of this transaction.”

Mr. Flitman stated, “We believe this strategic combination of two great organizations is an exciting step forward for both BMC and Builders FirstSource, as well as for our associates, our customers and other key stakeholders. As we accomplished in our prior combination with Stock Building Supply, this transformational merger will enable BMC to further accelerate our profitable growth strategy with a company that also focuses on providing a broad product portfolio and differentiated capabilities deployed through a customer-focused service model. Our customers and associates will benefit from the strengths of our exceptional teams, who share common values and a dedication to providing innovative services and solutions. We believe this compelling combination will enhance our ability to deliver outstanding customer service, generate attractive financial returns and create shareholder value. I look forward to working closely with Chad and the collective management teams of both companies to complete the transaction and further advance our next chapter of profitable growth.”

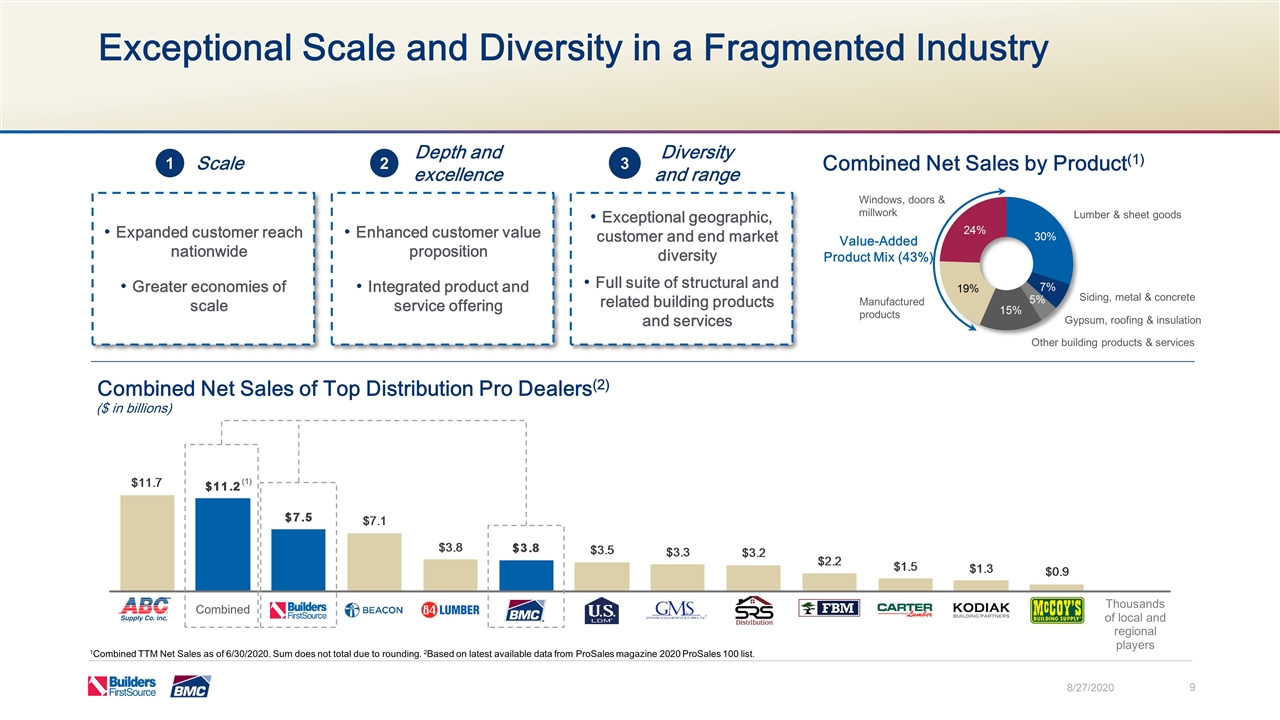

Strategic Rationale and Financial Benefits of Winning Combination

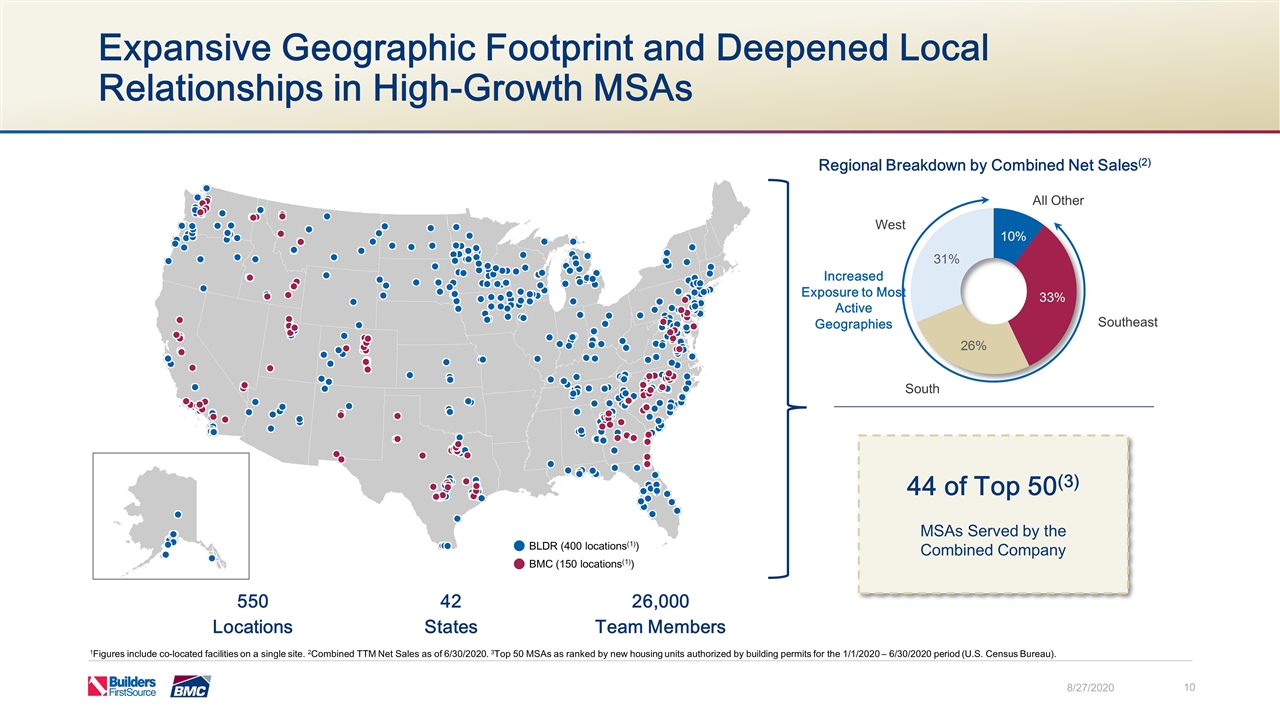

| • | Leading Supplier of Building Materials and Services: The combined company will become the nation’s premier supplier of building materials and services, with combined sales in excess of $11 billion and approximately 26,000 team members. The combined company, operating a leading network of 550 distribution and manufacturing locations, will have a presence in 42 states, including 44 of the top 50 metropolitan statistical areas, covering most of the nation’s fastest growing regions. |

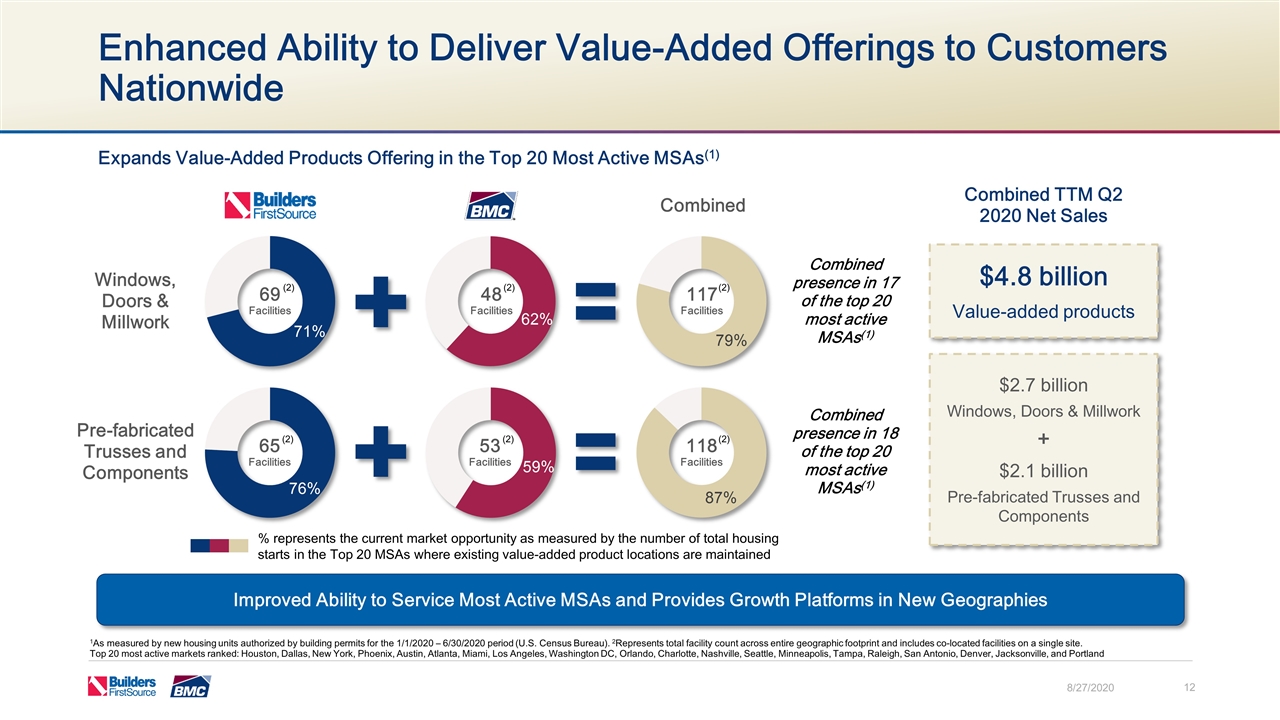

| • | Enhanced Value-added Offerings: Benefitting from the focus on value-added product and service capabilities that both Builders FirstSource and BMC have long shared, these offerings will represent approximately 43% of the combined company’s sales. BMC’s distinct millwork capability, READY-FRAME® offerings and other manufactured products will complement Builders FirstSource’s strengths in trusses and manufactured components, among other offerings, to enable further penetration of key segments through the delivery of value-enhancing efficiencies to customers and superior solutions across a broader platform. |

| • | Expanded Geographic Footprint and Strengthened Distribution Network: The combined company’s increased geographic reach and diversity will provide a wider set of opportunities and deeper resources for organic and inorganic growth to meet the needs of more customers in the highly fragmented professional building materials industry nationwide. |

2

| • | Significant Synergy Opportunities and Earnings Accretion: In addition to expanded top-line growth opportunities, the combination is expected to generate approximately $130 million to $150 million in annual run-rate cost savings within three years. Key drivers of these synergies include procurement, SG&A savings and expanded operational excellence through the adoption of best practices from each company. The transaction is expected to be accretive to adjusted earnings per share in the first year after closing. |

| • | Strong Financial Profile and Capital Flexibility: The combined company will be supported by a strong financial profile, with combined Adjusted EBITDA(1) of approximately $950 million for the trailing twelve-month period ended June 30, 2020, including annual run-rate synergies, and combined net debt-to-Adjusted EBITDA(2) of 1.4x. The combined company will remain operationally and financially disciplined with a focus on driving robust free cash flow, preserving its strong balance sheet and flexible capital structure to pursue a wide range of capital deployment strategies and deliver additional value to shareholders. |

| • | Accelerated Innovation: The combined company will have far greater resources to invest in innovation and develop targeted solutions, which is expected to accelerate the next generation of growth and deliver value on behalf of our customers. |

| • | Complementary Cultures: The combined company will bring together two strong performance-based cultures focused on people, safety, innovation, collaboration, integrity, diversity and corporate social responsibility. The collective workforce of highly skilled team members will benefit from expanded opportunities for career development and be empowered to provide best-in-class service to customers and communities. |

Leadership and Governance

Following the transaction closing, the combined company will operate under the name Builders FirstSource, Inc. and will be headquartered in Dallas, TX, while maintaining key functional corporate centers of excellence in both Raleigh, NC and Denver, CO.

In addition to the succession of Dave Flitman as Chief Executive Officer of the combined company, the management team will be comprised of leaders from both organizations. Peter Jackson, Chief Financial Officer of Builders FirstSource, will serve as Chief Financial Officer of the combined company. The transition and integration of the combined company will be led by Dave Rush, Chief Operating Officer of Builders FirstSource’s East Region, who led the integration team for Builders FirstSource in its ProBuild acquisition, and Jim Major, Chief Financial Officer of BMC.

3

Upon closing, the combined company’s Board of Directors will have 12 directors, consisting of seven members from the Builders FirstSource Board of Directors and five members from the BMC Board of Directors. Paul S. Levy, Co-Founder and current Chairman of the Board of Builders FirstSource, will serve as Chairman of the Board of Directors of the combined company.

Mr. Levy commented, “We are excited to join forces with BMC. We started Builders FirstSource in 1998 with an ambitious vision, and the combination of these two exceptional companies represents another significant milestone, further enhancing value for all stakeholders. Our ability to continue to build our world-class organization exists because of the extraordinary commitment of our many teammates, led through many incredibly dynamic periods by Chad Crow and our prior CEO, Floyd Sherman, and we look forward to continuing that strong legacy of leadership under Dave Flitman. I have full confidence in the unified team to accelerate the success of this larger platform and continue building upon our powerful momentum into 2021 and beyond.”

Timeline and Approvals

The transaction is expected to close in late 2020 or early 2021, subject to, among other things, the expiration or termination of the applicable waiting periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, as well as other customary closing conditions. The transaction requires the approval of shareholders of both Builders FirstSource and BMC.

Advisors

Rothschild & Co and Morgan Stanley & Co. LLC are serving as financial advisors to Builders FirstSource and Skadden, Arps, Slate, Meagher & Flom LLP is serving as its legal advisor. Moelis & Company is serving as financial advisor to BMC and Simpson Thacher & Bartlett LLP is serving as its legal advisor.

Conference Call and Presentation

Builders FirstSource and BMC will host a joint conference call to discuss the transaction today, August 27, 2020, at 7:30 a.m. Central Time (8:30 a.m. Eastern Time), To access the live webcast and presentation go to www.bldr.com or www.buildwithbmc.com. To participate in the teleconference, please dial into the call a few minutes before the start time: 800-367-2403 (U.S. and Canada) and 334-777-6978 (international), Conference ID: 1235969. To access the replay, please dial 888-203-1112 (U.S. and Canada) and 719-457-0820 (international) and refer to the pass code 1235969. The archived webcast will be available on the respective company’s websites.

(1) Combined Adjusted EBITDA for the trailing twelve month period ended June, 30, 2020 for the combined companies was $811.6 million, and adjusted for the mid-point of combined annual run-rate synergies of $140 million and excluding stock-based compensation savings, estimated costs to achieve synergies and transaction costs, approximates $950 million. Combined Adjusted EBITDA for the combined companies is defined as GAAP net income (loss) before depreciation

4

and amortization, interest expense, income taxes, gain (loss) on sale of assets, (income) loss from closed locations, and other non-cash or special items including asset impairments, facility closure costs, acquisition costs, severance, conversion, transaction and integration costs, and stock compensation expense.

(2) Combined net debt-to-Adjusted EBITDA for the combined companies compares combined net debt outstanding as of June 30, 2020 of $1,343.0 million to combined adjusted EBITDA, defined above.

Note: Additional information pertaining to detailed explanations by each of Builders FirstSource and BMC of their respective use of non-GAAP financial measures and reconciliation to the most comparable GAAP measures is also contained in the parties’ filings with the Securities and Exchange Commission (the “SEC”).

About Builders FirstSource

Headquartered in Dallas, Texas, Builders FirstSource is the largest U.S. supplier of building products, prefabricated components, and value-added services to the professional market segment for new residential construction and repair and remodeling. We provide customers an integrated homebuilding solution, offering manufacturing, supply, delivery and installation of a full range of structural and related building products. We operate in 40 states with approximately 400 locations and have a market presence in 77 of the top 100 Metropolitan Statistical Areas, providing geographic diversity and balanced end market exposure. We service customers from strategically located distribution and manufacturing facilities (certain of which are co-located) that produce value-added products such as roof and floor trusses, wall panels, stairs, vinyl windows, custom millwork and pre-hung doors. Builders FirstSource also distributes dimensional lumber and lumber sheet goods, millwork, windows, interior and exterior doors, and other building products. For more information about Builders FirstSource, visit the Company’s website at www.bldr.com.

About BMC Stock Holdings

With $3.6 billion in 2019 net sales, BMC is one of the nation’s leading providers of diversified building materials and solutions to new construction builders and professional remodelers in the U.S. Headquartered in Raleigh, North Carolina, the Company’s comprehensive portfolio of products and services spans building materials, including millwork and structural component manufacturing capabilities, consultative showrooms and design centers, value-added installation management and an innovative eBusiness platform. BMC serves 45 metropolitan areas across 18 states, principally in the South and West regions.

Cautionary Notice Regarding Forward-Looking Statements

This communication, in addition to historical information, contains “forward-looking statements” (as defined in the Securities Litigation Reform Act of 1995) regarding, among other things, future events or the future financial performance of Builders FirstSource, Inc. (“Builders FirstSource”)

5

and BMC Stock Holdings, Inc. (“BMC”). Words such as “may,” “will,” “should,” “plans,” “estimates,” “predicts,” “potential,” “anticipate,” “expect,” “project,” “intend,” “believe,” or the negative of these terms, and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. Any forward-looking statements involve risks and uncertainties that are difficult to predict or quantify, and such risks and uncertainties could cause actual events or results to differ materially from the events or results described in the forward-looking statements, including risks, or uncertainties related to the novel coronavirus disease 2019 (also known as “COVID-19”) pandemic and its impact on the business operations of Builders FirstSource and BMC and on local, national and global economies, the growth strategies of Builders FirstSource and BMC, fluctuations of commodity prices and prices of the products of Builders FirstSource and BMC as a result of national and international economic and other conditions, or the significant dependence of both companies’ revenues and operating results on, among other things, the state of the homebuilding industry and repair and remodeling activity, lumber prices and the economy. Neither Builders FirstSource nor BMC may succeed in addressing these and other risks or uncertainties.

Forward-looking statements relating to the proposed business combination between Builders FirstSource and BMC include, but are not limited to: statements about the benefits of the proposed business combination between Builders FirstSource and BMC, including future financial and operating results; the plans, objectives, expectations and intentions of Builders FirstSource and BMC; the expected timing of completion of the proposed business combination; and other statements relating to the proposed merger that are not historical facts. Forward-looking statements are based on information currently available to Builders FirstSource and BMC and involve estimates, expectations and projections. Investors are cautioned that all such forward-looking statements are subject to risks and uncertainties, and important factors could cause actual events or results to differ materially from those indicated by such forward-looking statements. With respect to the proposed business combination between Builders FirstSource and BMC, these factors could include, but are not limited to: the risk that Builders FirstSource and BMC may be unable to obtain governmental and regulatory approvals required for the business combination, or that required governmental and regulatory approvals may delay the business combination or result in the imposition of conditions that could reduce the anticipated benefits from the proposed business combination or cause the parties to abandon the proposed business combination; the risk that a condition to closing of the business combination may not be satisfied, including as a result of the failure to obtain approval of stockholders of Builders FirstSource and BMC on the expected terms and schedule or at all; the length of time necessary to consummate the proposed business combination, which may be longer than anticipated for various reasons; the risk that the businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the proposed business combination may not be fully realized or may take longer to realize than expected; the assumptions on which the parties’ estimates of future results of the combined business have been based may prove to be incorrect in a number of material ways, which could result in an inability to realize the expected benefits of the proposed business combination or exposure to material liabilities; the diversion of management time on issues related to the business combination; the effect of future regulatory or legislative actions on the companies or the industries in which they operate; the risk that the credit ratings of the combined company may be different from what the parties expect; economic and foreign exchange rate volatility; changes in the general economic environment, or social or political conditions, that could affect the businesses; the

6

potential effect of the announcement or consummation of the proposed business combination on relationships with customers, suppliers, competitors, lenders, landlords, management and other employees; the ability to attract new customers and retain existing customers in the manner anticipated or at all; the ability to hire and retain key personnel; reliance on and integration of information technology systems; the risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; certain restrictions during the pendency of the business combination that may affect the ability of Builders FirstSource and BMC to pursue certain business opportunities or strategic transactions; and the potential of international unrest, economic downturn or effects of anticipated tax rates, raw material costs or availability, benefit or retirement plan costs, or other regulatory compliance costs.

Additional information concerning other risk factors pertaining to Builders FirstSource and BMC is also contained in the parties’ respective most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other information filed with the Securities and Exchange Commission (the “SEC”). Many of these risks and uncertainties are beyond Builders FirstSource’s or BMC’s ability to control or predict. Because of these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Furthermore, neither Builders FirstSource nor BMC undertakes any obligation to update publicly or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this communication. Nothing in this communication is intended, or is to be construed, as a profit forecast or to be interpreted to mean that the earnings per share of the common stock of Builders FirstSource or of the common stock of BMC for the current or any future financial years, or the earnings per share of the common stock of the combined company, will necessarily match or exceed the historical published earnings per share of the common stock of Builders FirstSource or BMC, as applicable. All subsequent written and oral forward-looking statements concerning Builders FirstSource, BMC, the proposed business combination, the combined company or other matters and attributable to Builders FirstSource, BMC or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above.

Additional Information and Where to Find It

In connection with the proposed business combination, Builders FirstSource intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include a prospectus with respect to the shares of common stock to be issued by Builders FirstSource in the business combination and a joint proxy statement for Builders FirstSource’s and BMC’s respective stockholders (the “Joint Proxy Statement”). Each of Builders FirstSource and BMC will send the Joint Proxy Statement to its stockholders and may file other documents regarding the business combination with the SEC. This communication is not a substitute for the Registration Statement, the Joint Proxy Statement, or any other document that Builders FirstSource or BMC may send to its stockholders in connection with the proposed business combination. This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the

7

requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. INVESTORS AND SECURITY HOLDERS OF BUILDERS FIRSTSOURCE AND BMC ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT, AND ANY OTHER RELEVANT DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BUILDERS FIRSTSOURCE, BMC, THE PROPOSED BUSINESS COMBINATION AND RELATED MATTERS. Investors and security holders of Builders FirstSource and BMC will be able to obtain free copies of the Registration Statement, the Joint Proxy Statement, and other documents (including any amendments or supplements thereto) containing important information about Builders FirstSource and BMC once those documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Builders FirstSource and BMC make available free of charge at investors.bldr.com and ir.buildwithbmc.com, respectively, copies of materials they file with, or furnish to, the SEC.

Participants in the Solicitation

Builders FirstSource, BMC, and their respective directors, executive officers, and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Builders FirstSource and BMC in connection with the proposed business combination.

The identity of Builders FirstSource’s directors and executive officers and their ownership of the common stock of Builders FirstSource is set forth in Builders FirstSource’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on February 21, 2020, and its proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2020.

The identity of BMC’s directors and executive officers and their ownership of BMC’s common stock is set forth in BMC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on February 27, 2020, and its proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on March 27, 2020.

Investors may obtain additional information regarding the interest of such participants and a description of their direct and indirect interests, by security holdings or otherwise, by reading the Registration Statement, the Joint Proxy Statement, and other materials to be filed with the SEC in connection with the proposed business combination when they become available. You may obtain these documents free of charge through the website maintained by the SEC at www.sec.gov and from the websites of Builders FirstSource or BMC as described above.

8

No Offer or Solicitation

This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities of Builders FirstSource Inc. or any other issuer, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Contacts

Builders FirstSource Investors:

Binit Sanghvi

VP Investor Relations

214-765-3804

Builders FirstSource Media:

ICR

Phil Denning and Dan McDermott

646-277-1258

BLDRPR@icrinc.com

BMC Stock Holdings Investors:

Michael Neese

SVP, Strategy & Investor Relations

919-431-1796

BMC Stock Holdings Media:

Leigh Parrish / Sharon Stern / Clayton Erwin

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

Source: Builders FirstSource, Inc.

9

Builders FirstSource + BMC Stock Holdings Accelerating Growth, Building Value August 27, 2020 Exhibit 99.2

Cautionary Notice This communication, in addition to historical information, contains “forward-looking statements” (as defined in the Securities Litigation Reform Act of 1995) regarding, among other things, future events or the future financial performance of Builders FirstSource, Inc. (“Builders FirstSource”) and BMC Stock Holdings, Inc. (“BMC”). Words such as “may,” “will,” “should,” “plans,” “estimates,” “predicts,” “potential,” “anticipate,” “expect,” “project,” “intend,” “believe,” or the negative of these terms, and words and terms of similar substance used in connection with any discussion of future plans, actions or events identify forward-looking statements. Any forward-looking statements involve risks and uncertainties that are difficult to predict or quantify, and such risks and uncertainties could cause actual events or results to differ materially from the events or results described in the forward-looking statements, including risks, or uncertainties related to the novel coronavirus disease 2019 (also known as “COVID-19”) pandemic and its impact on the business operations of Builders FirstSource and BMC and on local, national and global economies, the growth strategies of Builders FirstSource and BMC, fluctuations of commodity prices and prices of the products of Builders FirstSource and BMC as a result of national and international economic and other conditions, or the significant dependence of both companies’ revenues and operating results on, among other things, the state of the homebuilding industry and repair and remodeling activity, lumber prices and the economy. Neither Builders FirstSource nor BMC may succeed in addressing these and other risks or uncertainties. Forward-looking statements relating to the proposed business combination between Builders FirstSource and BMC include, but are not limited to: statements about the benefits of the proposed business combination between Builders FirstSource and BMC, including future financial and operating results; the plans, objectives, expectations and intentions of Builders FirstSource and BMC; the expected timing of completion of the proposed business combination; and other statements relating to the proposed merger that are not historical facts. Forward-looking statements are based on information currently available to Builders FirstSource and BMC and involve estimates, expectations and projections. Investors are cautioned that all such forward-looking statements are subject to risks and uncertainties, and important factors could cause actual events or results to differ materially from those indicated by such forward-looking statements. With respect to the proposed business combination between Builders FirstSource and BMC, these factors could include, but are not limited to: the risk that Builders FirstSource and BMC may be unable to obtain governmental and regulatory approvals required for the business combination, or that required governmental and regulatory approvals may delay the business combination or result in the imposition of conditions that could reduce the anticipated benefits from the proposed business combination or cause the parties to abandon the proposed business combination; the risk that a condition to closing of the business combination may not be satisfied, including as a result of the failure to obtain approval of stockholders of Builders FirstSource and BMC on the expected terms and schedule or at all; the length of time necessary to consummate the proposed business combination, which may be longer than anticipated for various reasons; the risk that the businesses will not be integrated successfully; the risk that the cost savings, synergies and growth from the proposed business combination may not be fully realized or may take longer to realize than expected; the parties’ diligence into their respective businesses has been limited and, as a result, the assumptions on which their estimates of future results of the combined business have been based may prove to be incorrect in a number of material ways, which could result in an inability to realize the expected benefits of the proposed business combination or exposure to material liabilities; the diversion of management time on transaction-related issues; the diversion of management time on issues related to the business combination; the effect of future regulatory or legislative actions on the companies or the industries in which they operate; the risk that the credit ratings of the combined company may be different from what the parties expect; economic and foreign exchange rate volatility; changes in the general economic environment, or social or political conditions, that could affect the businesses; the potential effect of the announcement or consummation of the proposed business combination on relationships with customers, suppliers, competitors, lenders, landlords, management and other employees; the ability to attract new customers and retain existing customers in the manner anticipated or at all; the ability to hire and retain key personnel; reliance on and integration of information technology systems; the risks associated with assumptions the parties make in connection with the parties’ critical accounting estimates and legal proceedings; certain restrictions during the pendency of the business combination that may affect the ability of Builders FirstSource and BMC to pursue certain business opportunities or strategic transactions; and the potential of international unrest, economic downturn or effects of anticipated tax rates, raw material costs or availability, benefit or retirement plan costs, or other regulatory compliance costs. Additional information concerning other risk factors pertaining to Builders FirstSource and BMC is also contained in the parties’ respective most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other information filed with the Securities and Exchange Commission (the “SEC”). Many of these risks and uncertainties are beyond Builders FirstSource’s or BMC’s ability to control or predict. Because of these risks and uncertainties, you should not place undue reliance on these forward-looking statements. Furthermore, neither Builders FirstSource nor BMC undertakes any obligation to update publicly or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this communication. Nothing in this communication is intended, or is to be construed, as a profit forecast or to be interpreted to mean that the earnings per share of the common stock of Builders FirstSource or of the common stock of BMC for the current or any future financial years, or the earnings per share of the common stock of the combined company, will necessarily match or exceed the historical published earnings per share of the common stock of Builders FirstSource or BMC, as applicable. All subsequent written and oral forward-looking statements concerning Builders FirstSource, BMC, the proposed business combination, the combined company or other matters and attributable to Builders FirstSource, BMC or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Safe Harbor & Non-GAAP Financial Measures 8/27/2020

Additional Information and Where to Find It In connection with the proposed business combination, Builders FirstSource intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include a prospectus with respect to the shares of common stock to be issued by Builders FirstSource in the business combination and a joint proxy statement for Builders FirstSource’s and BMC’s respective stockholders (the “Joint Proxy Statement”). Each of Builders FirstSource and BMC will send the Joint Proxy Statement to its stockholders and may file other documents regarding the business combination with the SEC. This communication is not a substitute for the Registration Statement, the Joint Proxy Statement, or any other document that Builders FirstSource or BMC may send to its stockholders in connection with the proposed business combination. This communication is for informational purposes only and does not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or an offer to buy or the solicitation of an offer to buy any securities, and there shall be no sale of securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. INVESTORS AND SECURITY HOLDERS OF BUILDERS FIRSTSOURCE AND BMC ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT, AND ANY OTHER RELEVANT DOCUMENTS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BUILDERS FIRSTSOURCE, BMC, THE PROPOSED BUSINESS COMBINATION AND RELATED MATTERS. Investors and security holders of Builders FirstSource and BMC will be able to obtain free copies of the Registration Statement, the Joint Proxy Statement, and other documents (including any amendments or supplements thereto) containing important information about Builders FirstSource and BMC once those documents are filed with the SEC, through the website maintained by the SEC at www.sec.gov. Builders FirstSource and BMC make available free of charge at investors.bldr.com and ir.buildwithbmc.com, respectively, copies of materials they file with, or furnish to, the SEC. Participants in the Solicitation Builders FirstSource, BMC, and their respective directors, executive officers, and other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders of Builders FirstSource and BMC in connection with the proposed business combination. The identity of Builders FirstSource’s directors and executive officers and their ownership of the common stock of Builders FirstSource is set forth in Builders FirstSource’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on February 21, 2020, and its proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on April 28, 2020. The identity of BMC’s directors and executive officers and their ownership of BMC’s common stock is set forth in BMC’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, which was filed with the SEC on February 27, 2020, and its proxy statement for its 2020 Annual Meeting of Stockholders, which was filed with the SEC on March 27, 2020. Investors may obtain additional information regarding the interest of such participants and a description of their direct and indirect interests, by security holdings or otherwise, by reading the Registration Statement, the Joint Proxy Statement, and other materials to be filed with the SEC in connection with the proposed business combination when they become available. You may obtain these documents free of charge through the website maintained by the SEC at www.sec.gov and from the websites of Builders FirstSource or BMC as described above. Safe Harbor & Non-GAAP Financial Measures 8/27/2020

Today’s Presenters Chad Crow Builders FirstSource President & Chief Executive Officer David Flitman BMC Stock Holdings President & Chief Executive Officer Peter Jackson Builders FirstSource Chief Financial Officer Jim Major BMC Stock Holdings Chief Financial Officer 8/27/2020

Highly Compelling Strategic Combination Creates the Premier Supplier of Building Materials and Services Substantial Value Creation Through Targeted Synergies and Accretive to Earnings in Year One Enhanced and Expanded Suite of Value-Added Offerings Strong Financial Profile with Robust Free Cash Flow Generation to Invest in Growth Investment in Innovation to Accelerate Next Generation of Growth for Customers Highly Complementary Cultures focused on People, Safety, Innovation, and Corporate Social Responsibility Increased Geographic Reach to Meet the Needs of Customers in a Highly Fragmented Industry 8/27/2020

Creating the Nation’s Premier Supplier of Building Materials and Services Operations Market Capitalization(3) MSAs Served Synergies Adj. EBITDA(4) Adj. EBITDA Margin(4) $2.2 billion 101 Value-Added Product Facilities(1) 109 LBM Facilities(2) 45 7.5% $283 million 134 Value-Added Product Facilities(1) 343 LBM Facilities(2) $3.3 billion 201 7.1% $529 million $5.5 billion 214 235 Value-Added Product Facilities(1) 452 LBM Facilities(2) Combined $140 million(6) 8.4% ~$950 million(7) 1Combined value-added facilities include co-located facilities on a single site. 2LBM defined as Lumber & Building Materials. 3As of 8/26/2020 close. 4Financial metrics TTM as of 6/30/2020. 5Sum does not total due to rounding. 6Midpoint of $130m - $150m range. 7Adjustments include midpoint of run-rate synergies range and excludes estimated $6m of stock-based compensation savings, $125 - $145m costs to achieve and transaction costs. Net Sales(4) $3.8 billion $7.5 billion $11.2 billion(5) Note: Additional information pertaining to detailed explanations by each of Builders FirstSource and BMC of their respective use of non-GAAP financial measures and reconciliation to the most comparable GAAP measures is also contained in the parties’ filings with the Securities and Exchange Commission (the “SEC”). 8/27/2020

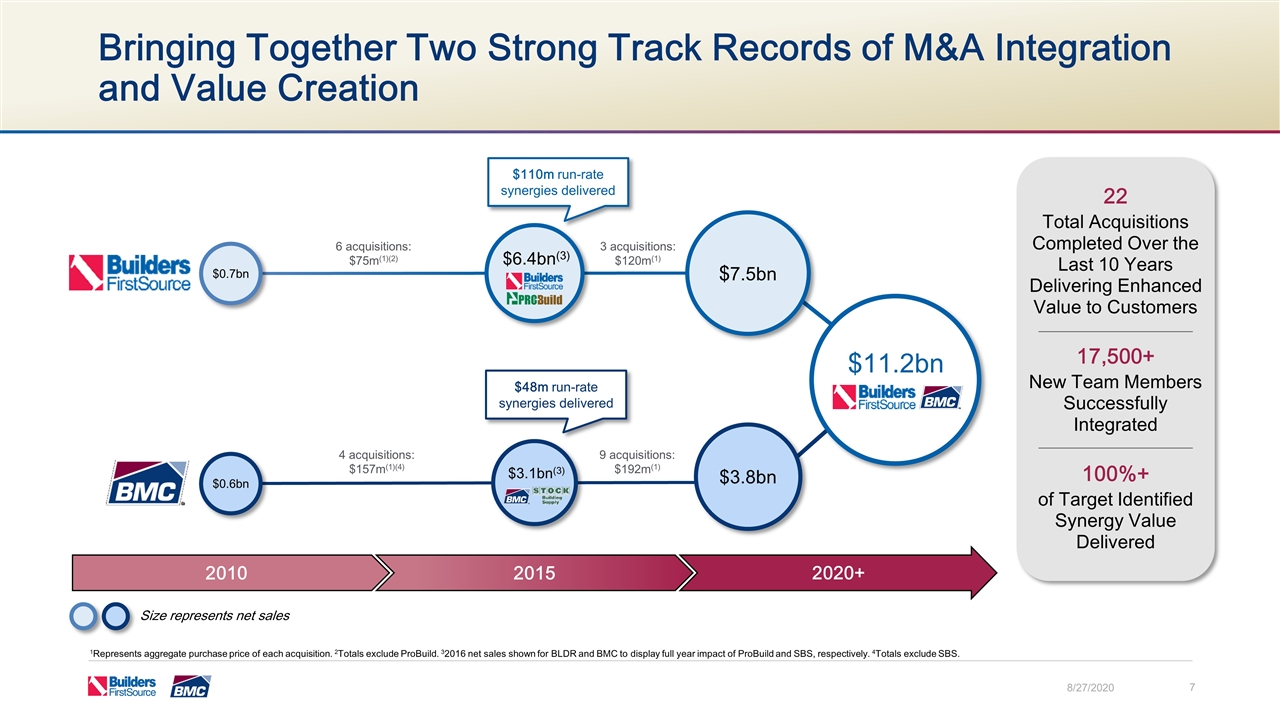

Bringing Together Two Strong Track Records of M&A Integration and Value Creation 2020+ 2010 2015 22 Total Acquisitions Completed Over the Last 10 Years Delivering Enhanced Value to Customers 17,500+ New Team Members Successfully Integrated 100%+ of Target Identified Synergy Value Delivered $110m run-rate synergies delivered Size represents net sales 1Represents aggregate purchase price of each acquisition. 2Totals exclude ProBuild. 32016 net sales shown for BLDR and BMC to display full year impact of ProBuild and SBS, respectively. 4Totals exclude SBS. $0.7bn $7.5bn $3.8bn $0.6bn 9 acquisitions: $192m(1) 4 acquisitions: $157m(1)(4) 3 acquisitions: $120m(1) 6 acquisitions: $75m(1)(2) $48m run-rate synergies delivered $6.4bn(3) $3.1bn(3) 8/27/2020 $11.2bn

Transaction Overview All-stock merger transaction Combined equity value of $5.5 billion and enterprise value of $6.9 billion(1)(2) BMC shareholders will receive 1.3125 Builders FirstSource shares for each BMC share Ownership at transaction close: Builders FirstSource shareholders (57%), BMC shareholders (43%) Transaction Structure Annual cost synergies of $130 to 150 million by year three(3) Expected Synergies Transaction is expected to be accretive to Adjusted EPS(4) in the first year after closing Combined company is expected to generate significant cash flow Financial Impact Flexible capital structure with ability to invest in organic growth and M&A Combined Net Leverage of 1.4x(1)(5) Capital Structure Transaction has been unanimously approved by the Board of Directors of both companies Expected to close late 2020 or early 2021, subject to shareholder approvals and other customary closing conditions Closing Conditions and Timing Management Chief Executive Officer: Dave Flitman to succeed Chad Crow after 90 day transition period Chief Financial Officer: Peter Jackson Builders FirstSource’s Chairman, Paul Levy, will serve as Chairman of the Board of Directors of the combined company Combined board of 12 total directors (7 directors from current BLDR Board and 5 directors from current BMC Board) Board of Directors 1Includes net debt of $1.3bn: $1.6bn of total debt and $0.3bn of cash, assumes repayment of $350m Senior Secured Notes due 2024 held by BMC. 2Sum does not total due to rounding. 3Excludes estimated one-time costs of $125m - 145m to implement cost savings. 4Adjusted EPS includes year one synergies and excludes costs to achieve, transaction costs and purchase accounting. 5Based on combined TTM adjusted EBITDA including midpoint of run-rate synergies range and excluding stock-based compensation savings, costs to achieve and transaction costs. Company name: Builders FirstSource, Inc. Ticker Symbol: BLDR Headquarters: Dallas, TX with significant presence in Raleigh, NC and Denver, CO Organization 8/27/2020

1Combined TTM Net Sales as of 6/30/2020. Sum does not total due to rounding. 2Based on latest available data from ProSales magazine 2020 ProSales 100 list. Exceptional Scale and Diversity in a Fragmented Industry Manufactured products Other building products & services Windows, doors & millwork Lumber & sheet goods Siding, metal & concrete Gypsum, roofing & insulation Combined Net Sales of Top Distribution Pro Dealers(2) Combined Thousands of local and regional players ($ in billions) Expanded customer reach nationwide Greater economies of scale Enhanced customer value proposition Integrated product and service offering Exceptional geographic, customer and end market diversity Full suite of structural and related building products and services Scale 1 Depth and excellence 2 Diversity and range 3 Combined Net Sales by Product(1) Value-Added Product Mix (43%) (1) 8/27/2020

Expansive Geographic Footprint and Deepened Local Relationships in High-Growth MSAs 550 Locations 42 States 26,000 Team Members Regional Breakdown by Combined Net Sales(2) 1Figures include co-located facilities on a single site. 2Combined TTM Net Sales as of 6/30/2020. 3Top 50 MSAs as ranked by new housing units authorized by building permits for the 1/1/2020 – 6/30/2020 period (U.S. Census Bureau). All Other Southeast West BMC (150 locations(1)) BLDR (400 locations(1)) Increased Exposure to Most Active Geographies South 44 of Top 50(3) MSAs Served by the Combined Company 8/27/2020

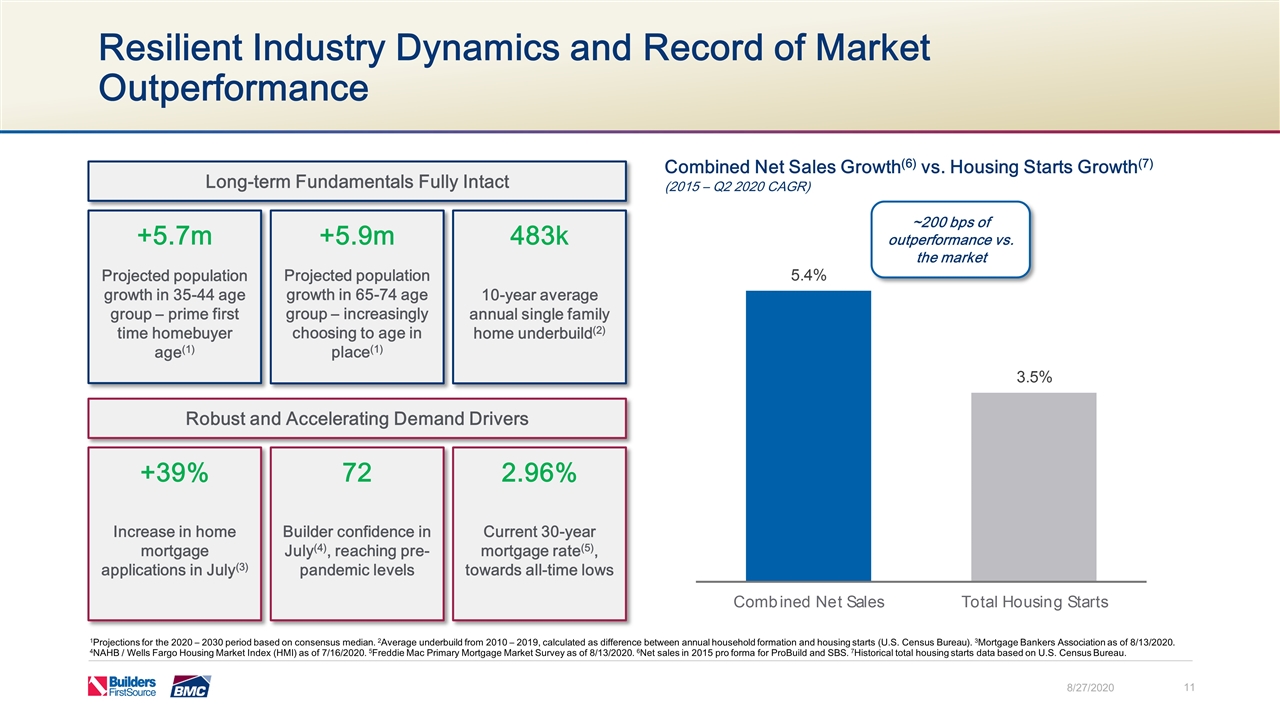

Resilient Industry Dynamics and Record of Market Outperformance (2015 – Q2 2020 CAGR) Combined Net Sales Growth(6) vs. Housing Starts Growth(7) 1Projections for the 2020 – 2030 period based on consensus median. 2Average underbuild from 2010 – 2019, calculated as difference between annual household formation and housing starts (U.S. Census Bureau). 3Mortgage Bankers Association as of 8/13/2020. 4NAHB / Wells Fargo Housing Market Index (HMI) as of 7/16/2020. 5Freddie Mac Primary Mortgage Market Survey as of 8/13/2020. 6Net sales in 2015 pro forma for ProBuild and SBS. 7Historical total housing starts data based on U.S. Census Bureau. Long-term Fundamentals Fully Intact Robust and Accelerating Demand Drivers Increase in home mortgage applications in July(3) +39% Projected population growth in 35-44 age group – prime first time homebuyer age(1) +5.7m Projected population growth in 65-74 age group – increasingly choosing to age in place(1) +5.9m Current 30-year mortgage rate(5), towards all-time lows 2.96% Builder confidence in July(4), reaching pre-pandemic levels 72 10-year average annual single family home underbuild(2) 483k ~200 bps of outperformance vs. the market 8/27/2020

53 Facilities Enhanced Ability to Deliver Value-Added Offerings to Customers Nationwide Expands Value-Added Products Offering in the Top 20 Most Active MSAs(1) 1As measured by new housing units authorized by building permits for the 1/1/2020 – 6/30/2020 period (U.S. Census Bureau). 2Represents total facility count across entire geographic footprint and includes co-located facilities on a single site. Top 20 most active markets ranked: Houston, Dallas, New York, Phoenix, Austin, Atlanta, Miami, Los Angeles, Washington DC, Orlando, Charlotte, Nashville, Seattle, Minneapolis, Tampa, Raleigh, San Antonio, Denver, Jacksonville, and Portland Improved Ability to Service Most Active MSAs and Provides Growth Platforms in New Geographies Combined Windows, Doors & Millwork 117 Facilities 48 Facilities 69 Facilities Combined presence in 17 of the top 20 most active MSAs(1) Combined presence in 18 of the top 20 most active MSAs(1) Pre-fabricated Trusses and Components 118 Facilities 65 Facilities $4.8 billion Value-added products Combined TTM Q2 2020 Net Sales % represents the current market opportunity as measured by the number of total housing starts in the Top 20 MSAs where existing value-added product locations are maintained $2.7 billion Windows, Doors & Millwork + $2.1 billion Pre-fabricated Trusses and Components (2) (2) (2) (2) (2) (2) 8/27/2020

Platform and Resources to Accelerate Innovation and Integrate Even Further with Customers Foundational Automation and Technology Capabilities Today… Integrated design, component selection and quotation Front-to-back project management Targeted digital marketing Fully-enabled online ordering platform …To Innovate Future Technology-enabled Platforms and Capabilities for Tomorrow Fully-automated manufacturing Customer order tracking Optimized logistics & delivery systems Best-in-class pricing & design software E-commerce platform Computerized pre-cut framing technology 8/27/2020

Energy Efficient Products Delivery Optimization System Unified Mission and Purpose to Better Serve Customers and Communities Environmental Stewardship is a Priority for the Combined Company Helping Our Customers Achieve Various Green Building and Environmental Standards Elimination of Jobsite Waste Dedicated Health and Safety Team Preferred Supplier to Customers Responsible Corporate Citizen Continue to Serve Our Communities Safe, Diverse & Inclusive Workforce Responsible Supply Chain Policy Wood Waste Recycling Fleet Monitoring / Fuel Efficiency 8/27/2020

Selling, General & Administrative(2) Clearly identified cost savings opportunities Primary rationalization of suppliers, overhead expenses and facility footprint Integration plan in place with measurable objectives Experienced team with proven integration record to achieve full run-rate synergies within three years Breakdown of Synergy Opportunity Estimated Run-Rate Cost Savings of $130 - $150 million(1) ($ in millions) 1Excludes $125m - $145m costs to achieve. 2Includes indirect procurement. 3Adjusted EPS includes year one synergies and excludes costs to achieve, transaction costs and purchase accounting. Incremental Upside Accelerating value-added capabilities expansion Cross-deploying and accelerating technology utilization and advancement Distribution Network Direct Procurement Substantial Value Creation Through Targeted Synergies $130 - $150 million(1) Transaction Expected to be Accretive to Adjusted EPS(3) in the First Year After Closing $100m - $120m $70m - $90m $130m - $150m 8/27/2020

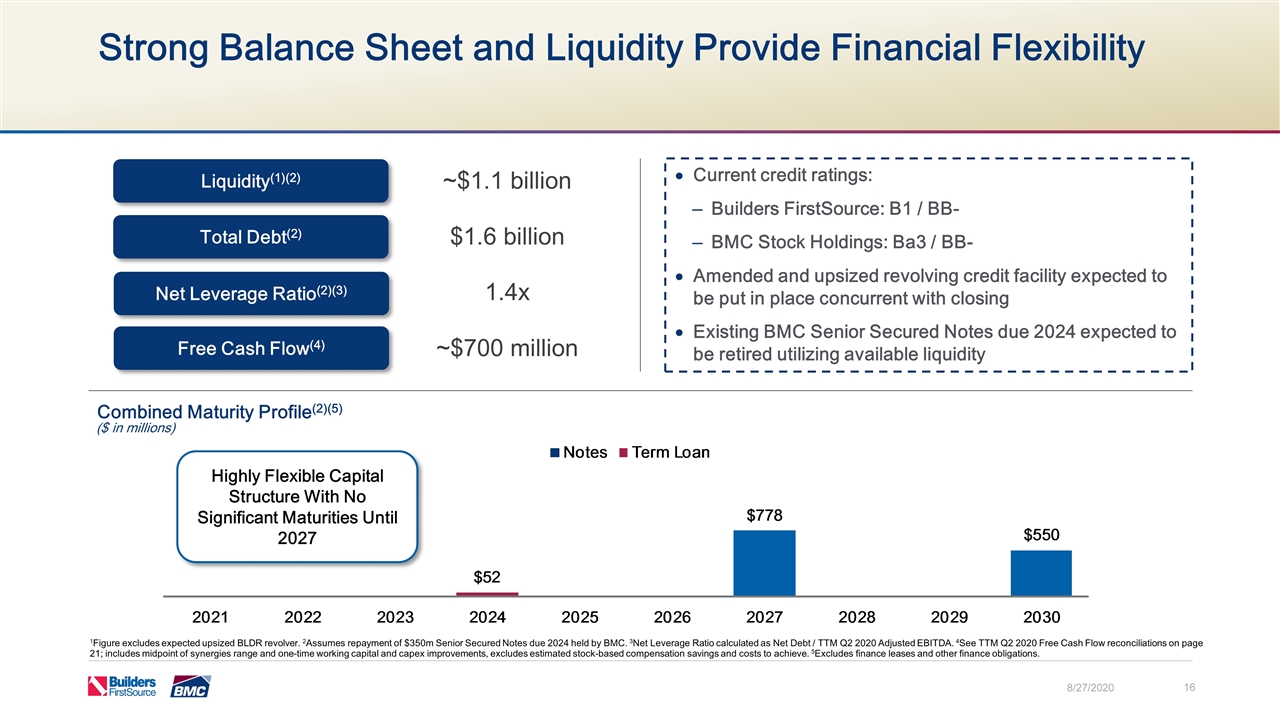

Strong Balance Sheet and Liquidity Provide Financial Flexibility Combined Maturity Profile(2)(5) 1Figure excludes expected upsized BLDR revolver. 2Assumes repayment of $350m Senior Secured Notes due 2024 held by BMC. 3Net Leverage Ratio calculated as Net Debt / TTM Q2 2020 Adjusted EBITDA. 4See TTM Q2 2020 Free Cash Flow reconciliations on page 21; includes midpoint of synergies range and one-time working capital and capex improvements, excludes estimated stock-based compensation savings and costs to achieve. 5Excludes finance leases and other finance obligations. Current credit ratings: Builders FirstSource: B1 / BB- BMC Stock Holdings: Ba3 / BB- Amended and upsized revolving credit facility expected to be put in place concurrent with closing Existing BMC Senior Secured Notes due 2024 expected to be retired utilizing available liquidity Liquidity(1)(2) ~$1.1 billion Free Cash Flow(4) $1.6 billion Net Leverage Ratio(2)(3) ~$700 million Total Debt(2) 1.4x Highly Flexible Capital Structure With No Significant Maturities Until 2027 ($ in millions) 8/27/2020

Attractive Combination for All Stakeholders Combination to create nation’s premier supplier of building materials and services Complementary footprint with enhanced ability to service customers Scaled platform providing greater opportunities to team members Strong financial position with robust free cash flow generation Enhanced ability to invest in business and accelerate growth Unique opportunity to drive substantial value creation Unified leadership team with proven record of integration success 8/27/2020

Appendix 8/27/2020

Reconciliation of Non-GAAP Financial Measures Builders FirstSource Adj. EBITDA 1Costs associated with issuing and extinguishing long term debt in 2020 and 2019. 2Primarily relates to severance and one time cost. 3Sum may not total due to rounding. 8/27/2020 (3)

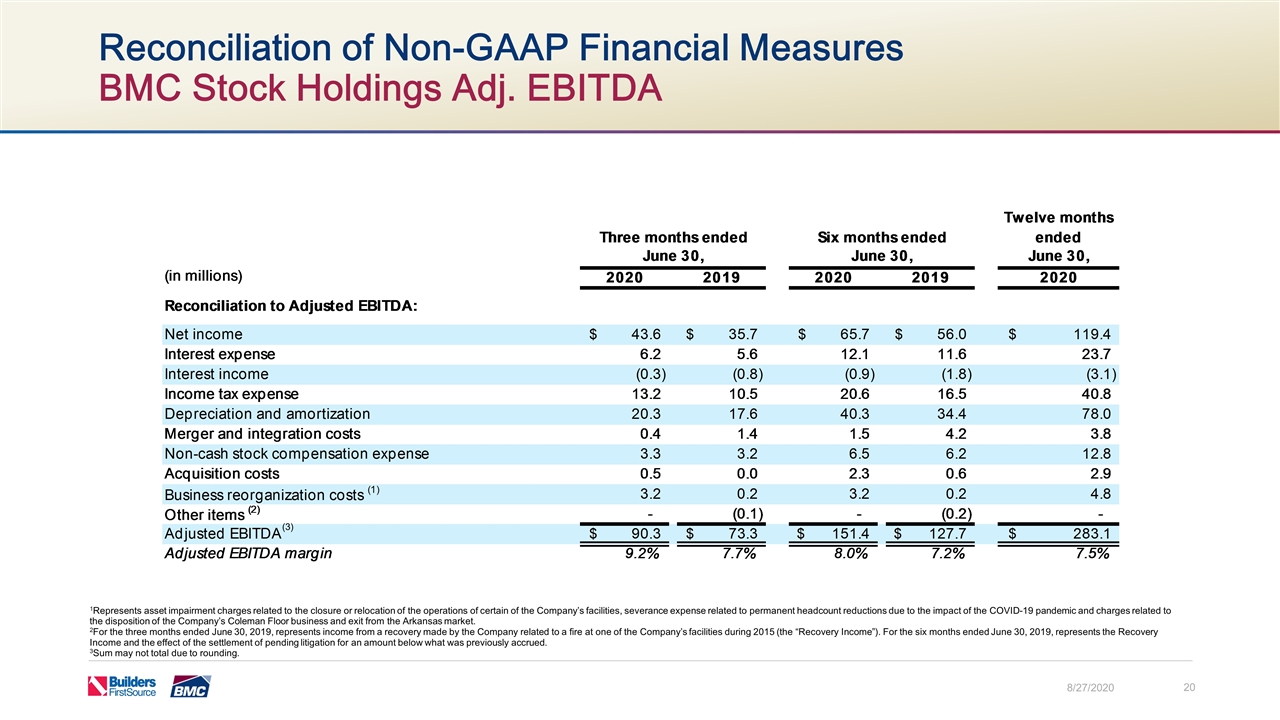

Reconciliation of Non-GAAP Financial Measures BMC Stock Holdings Adj. EBITDA 1Represents asset impairment charges related to the closure or relocation of the operations of certain of the Company’s facilities, severance expense related to permanent headcount reductions due to the impact of the COVID-19 pandemic and charges related to the disposition of the Company’s Coleman Floor business and exit from the Arkansas market. 2For the three months ended June 30, 2019, represents income from a recovery made by the Company related to a fire at one of the Company’s facilities during 2015 (the “Recovery Income”). For the six months ended June 30, 2019, represents the Recovery Income and the effect of the settlement of pending litigation for an amount below what was previously accrued. 3Sum may not total due to rounding. (3) 8/27/2020

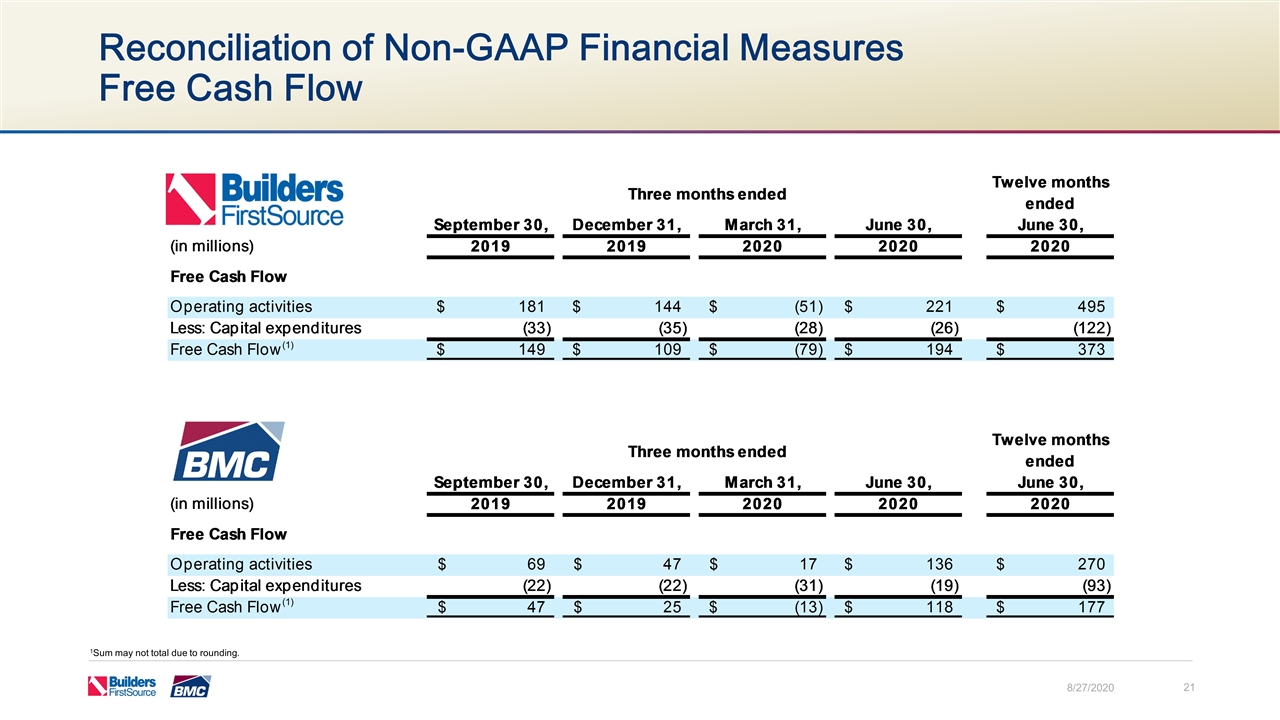

Reconciliation of Non-GAAP Financial Measures Free Cash Flow (1) (1) 1Sum may not total due to rounding. 8/27/2020