Table of Contents

As submitted confidentially to the Securities and Exchange Commission on May 7, 2013 pursuant to the Jumpstart Our Business Startups Act

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

STOCK BUILDING SUPPLY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5211 | 26-4687975 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

8020 Arco Corporate Drive, Suite 400

Raleigh, North Carolina 27617

Phone: (919) 431-1000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Bryan J. Yeazel

Executive Vice President, Chief Administrative Officer and General Counsel

8020 Arco Corporate Drive, Suite 400

Raleigh, North Carolina 27617

Phone: (919) 431-1000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

| Carol Anne Huff Kirkland & Ellis LLP 300 North LaSalle Chicago, Illinois 60654 (312) 862-2000 |

Michael Kaplan Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated , 2013.

Shares

Stock Building Supply Holdings, Inc.

Common Stock

This is an initial public offering of shares of common stock of Stock Building Supply Holdings, Inc. We are offering shares of common stock. The selling stockholders identified in this prospectus are selling an additional shares of common stock. We will not receive any proceeds from the sale of shares of common stock by the selling stockholders.

Prior to this offering, there has been no public market for the common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We intend to list the common stock on under the symbol “ .”

We are an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act of 1933, as amended, and, as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify. In addition, for so long as we remain an emerging growth company, we will qualify for certain limited exceptions from investor protection laws such as the Sarbanes-Oxley Act of 2002. Please read “Risk Factors—Risks Related to this Offering and Our Common Stock—We are an ‘emerging growth company’ and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.”

See “Risk Factors” on page 17 to read about factors you should consider before buying shares of the common stock.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| Proceeds, before expenses, to the selling stockholders |

$ | $ | ||||||

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option to purchase up to an additional shares from us and the selling stockholders at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2013.

| Goldman, Sachs & Co. | ||||||||||

| Barclays | ||||||||||

| Citigroup | ||||||||||

Prospectus dated , 2013.

Table of Contents

| 1 | ||||

| 17 | ||||

| 36 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

48 | |||

| 74 | ||||

| 91 | ||||

| 98 | ||||

| 108 | ||||

| 110 | ||||

| 115 | ||||

| 120 | ||||

| CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS TO NON-U.S. HOLDERS |

122 | |||

| 126 | ||||

| 131 | ||||

| 131 | ||||

| 131 | ||||

| F-1 |

Through and including , 2013 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Persons who come into possession of this prospectus and any such free writing prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

i

Table of Contents

Market and industry data

We obtained the industry, market and competitive position data used throughout this prospectus from our own internal estimates and research as well as from industry publications and research, surveys and studies conducted by third-parties. Third-party industry publications include the Home Improvement Research Institute’s (“HIRI”) Home Improvement Products Market Forecast Update (published in March 2013), the National Association of Homebuilders’ (“NAHB”) Housing and Interest Rate Forecast (published in April 2013), the Harvard Joint Center for Housing Studies’ (“HJCHS”) The U.S. Housing Stock: Ready for Renewal (published in January 2013), McGraw-Hill Construction’s (“McGraw-Hill Construction”) Market Forecasting Service Report (published in January 2013), Random Lengths’ Yardstick (published in December 2012), as well as data published by Standard & Poor’s Financial Services LLC as of February 2013, the Bureau of Labor Statistics as of December 2012 and January 2013, and the U.S. Census Bureau as of December 2012 and March 2013. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. The information derived from the sources cited in this prospectus represents the most recently available data and, therefore, we believe such data remain reliable. While we believe our internal company research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. It does not contain all of the information that may be important to you and your investment decision. You should carefully read the following summary together with the entire prospectus. In this prospectus, unless the context otherwise requires, references to the “Company,” “we,” “us” and “our” refer to Stock Building Supply Holdings, Inc., together with its consolidated subsidiaries.

Overview

We are a large, diversified lumber and building materials (“LBM”) distributor and solutions provider that sells to new construction and repair and remodel contractors. We carry a broad line of products and have operations throughout the United States. Our primary products are lumber & lumber sheet goods, millwork, doors, flooring, windows, structural components, such as engineered wood products (“EWP”), trusses, wall panels and other exterior products. Additionally, we provide solution-based services to our customers, including design, product specification and installation management services. We serve a broad customer base, including large-scale production homebuilders, custom homebuilders and repair and remodeling contractors, and we believe we are among the top three LBM suppliers for residential construction in 80% of the geographic markets in which we operate. We offer over 39,000 products sourced through our strategic network of suppliers, which together with our various solution-based services, represent approximately 50% of the construction cost of a typical new home. By enabling our customers to source a significant portion of their materials and services from one supplier, we have positioned ourselves as the supply partner of choice for many of our customers.

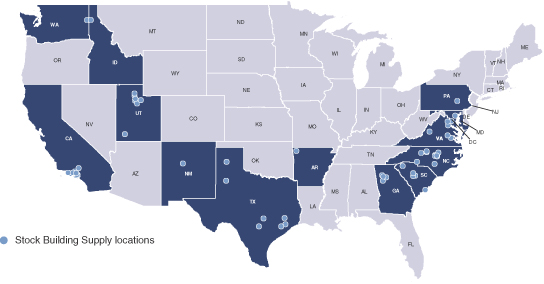

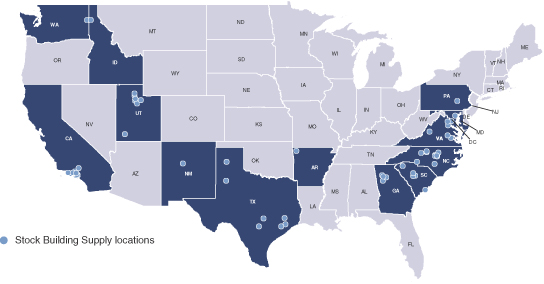

We have operations in 13 states that accounted for approximately 48% of 2012 U.S. single-family housing permits according to the U.S. Census Bureau. Following our acquisition by an affiliate of The Gores Group, LLC (“Gores”) in 2009, we aggressively and strategically reduced our footprint to improve our profitability. Today, our facilities are strategically located in 20 metropolitan areas in these 13 states that we believe have an attractive potential for economic growth based on population trends, increasing business activity and above-average employment growth. The following map shows our current operating footprint.

1

Table of Contents

We serve our customers from 64 locations within our markets, which include 48 distribution and retail operations, 19 millwork fabrication operations, 14 structural components fabrication operations and 13 flooring operations. Given the local nature of our business, we locate our facilities in close proximity to our key customers and often co-locate multiple operations in one facility to increase customer service and efficiency.

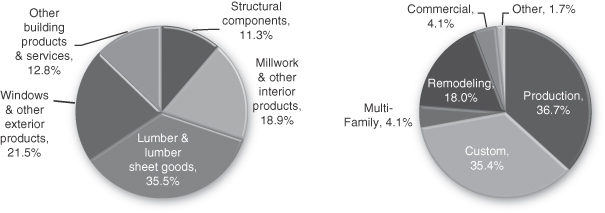

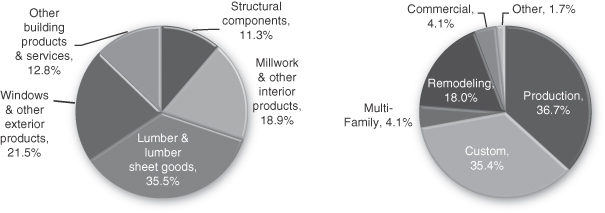

We provide a balanced mix of products and services to U.S. production and custom homebuilders and repair and remodel, multi-family and commercial contractors. The charts below summarize our 2012 revenues by product category and customer segment.

| 2012 revenues |

2012 revenues |

2

Table of Contents

The following table demonstrates the favorable demographic trends in the metropolitan areas in which we operate and the capabilities of our facilities.

| Market |

2012 single family permits |

Year over year single family permit change |

December 2012 unemployment rate |

2012 total employment year over year change |

Distribution & retail operations |

Millwork fabrication |

Structural components fabrication |

Flooring operations |

||||||||||||||||||||||||

| Houston, TX |

28,628 | 25.1 | % | 6.0 | % | 4.0 | % | 4 | 1 | 2 | ||||||||||||||||||||||

| Washington, DC |

10,980 | 13.9 | % | 5.3 | % | 1.1 | % | 3 | 2 | 3 | (7) | |||||||||||||||||||||

| Atlanta, GA |

9,167 | 47.5 | % | 8.4 | % | 2.3 | % | 3 | 2 | 2 | ||||||||||||||||||||||

| Austin, TX |

8,229 | 32.1 | % | 5.0 | % | 3.9 | % | 1 | 1 | 1 | ||||||||||||||||||||||

| Raleigh-Durham, |

8,020 | 27.7 | % | 7.4 | % | 2.8 | % | 4 | 1 | 1 | 3 | (8) | ||||||||||||||||||||

| Charlotte, NC |

6,703 | 36.5 | % | 9.4 | % | 3.2 | % | 1 | 2 | 1 | ||||||||||||||||||||||

| Eastern PA(2) |

5,956 | 14.8 | % | 8.2 | % | 1.0 | % | 1 | 1 | 1 | ||||||||||||||||||||||

| San Antonio, TX |

5,102 | 15.7 | % | 5.7 | % | 2.6 | % | 1 | ||||||||||||||||||||||||

| Salt Lake City, UT(3) |

5,052 | 40.6 | % | 4.9 | % | 4.4 | % | 5 | 3 | 2 | ||||||||||||||||||||||

| Los Angeles, CA |

4,946 | 20.7 | % | 9.4 | % | 2.2 | % | 11 | 2 | 1 | ||||||||||||||||||||||

| Richmond, VA |

2,840 | 20.7 | % | 6.0 | % | 1.1 | % | 1 | 1 | 1 | ||||||||||||||||||||||

| Columbia, SC |

2,791 | 16.8 | % | 7.5 | % | 1.2 | % | 2 | 1 | 2 | (9) | |||||||||||||||||||||

| Greenville, SC |

2,246 | 37.0 | % | 7.0 | % | 1.4 | % | 1 | 1 | |||||||||||||||||||||||

| Greensboro, NC(4) |

2,014 | 2.0 | % | 9.4 | % | 0.9 | % | 1 | 1 | |||||||||||||||||||||||

| Northwest AR(5) |

1,763 | 52.2 | % | 5.1 | % | 3.3 | % | 1 | 1 | 1 | ||||||||||||||||||||||

| Southern Utah(6) |

1,317 | 54.2 | % | 6.6 | % | 5.1 | % | 1 | 1 | |||||||||||||||||||||||

| Albuquerque, NM |

1,259 | (7.0 | %) | 6.7 | % | 0.2 | % | 1 | 1 | 1 | ||||||||||||||||||||||

| Spokane, WA |

963 | 30.1 | % | 8.4 | % | 1.9 | % | 2 | 1 | |||||||||||||||||||||||

| Lubbock, TX |

752 | 8.7 | % | 4.7 | % | 1.6 | % | 2 | 1 | |||||||||||||||||||||||

| Amarillo, TX |

653 | (0.5 | %) | 4.3 | % | 0.4 | % | 2 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total for Stock Building Supply markets |

109,381 | 25.3 | % | 7.5 | % | 2.2 | % | 48 | 19 | 14 | 13 | |||||||||||||||||||||

| U.S. Total |

518,695 | 23.9 | % | 7.8 | % | 1.7 | % | |||||||||||||||||||||||||

Source: U.S. Census Bureau and Bureau of Labor Statistics

| (1) | Durham-Chapel Hill, NC and Raleigh-Cary, NC metropolitan statistical areas (“MSAs”) |

| (2) | Philadelphia-Camden-Wilmington, PA-NJ-DE-MD and Lancaster, PA MSAs |

| (3) | Salt Lake City, UT and Provo-Orem, UT MSAs |

| (4) | Greensboro-High Point, NC and Winston-Salem, NC MSAs |

| (5) | Fayetteville-Springdale-Rogers, AR-MO MSA |

| (6) | St. George, UT MSA |

| (7) | Includes flooring location in Baltimore, MD |

| (8) | Includes flooring location in Fayetteville, NC |

| (9) | Includes flooring location in Charleston, SC |

We continue to make capital investments in our local businesses to bolster our market share, expand our distribution network, improve our service offerings and streamline our business processes. Since 2010, we have acquired four businesses and, through investments in a proprietary information technology (“IT”) and operational platform, have improved our distribution service capability. We have also integrated each of our local branches with our headquarters in Raleigh, North Carolina, which provides value-added support to our local businesses, including accounting, IT and a central sourcing and procurement function. Additionally, we have undertaken efforts to streamline and improve significantly our business processes by adopting a “LEAN” business philosophy to reduce waste and add value. These initiatives allowed us to reduce selling, general and administrative expense by $25.7 million while net sales increased 25.4% from 2010 to 2012. We believe that, as we continue to pursue these initiatives, we will further improve the service and support we provide to our customers, increase the effectiveness of our employees and contractors and improve efficiency across all aspects of our business.

3

Table of Contents

In 2006, our current footprint of facilities generated approximately $1.8 billion in net sales, and we believe that we will achieve attractive growth as our markets recover to normalized levels of new home construction. From 2010 to 2012, our net sales increased $190.7 million, from $751.7 million to $942.4 million. Over the same period, our Adjusted EBITDA increased $60.0 million, from $(58.0) million to $2.0 million. For a reconciliation of net loss to Adjusted EBITDA, see “—Summary consolidated financial data.” We believe that the housing recovery in our markets will continue to drive significant increases in demand for our products and the significant growth in net sales and Adjusted EBITDA that we have experienced since 2010.

Our industry

The LBM distribution industry in the United States is highly competitive, with a number of retailers and distributors offering a broad range of products and services. Demand for our products is principally influenced by new residential construction and residential repair and remodeling activity. Following several challenging years, single-family housing starts increased in 2012 to 0.54 million and, as a result, demand for the products we distribute and for our services has also increased. From 2005 to 2011, single-family housing starts in the United States declined by approximately 75%. According to the U.S. Census Bureau, single-family housing starts in 2009, 2010 and 2011 were 0.44 million, 0.47 million and 0.43 million, respectively, which are significantly less than the 50-year average rate of 1.0 million. Many economists expect housing starts to continue to increase, and recent national housing statistics confirm that a robust housing recovery is already underway. For example, U.S. single-family housing starts increased 28.6% year-over-year in March 2013. Additionally, the Case-Shiller Index, a leading measure of pricing for the U.S. residential housing market, has increased for 13 straight months and is at its highest levels since December 2008.

We believe that these trends are supported by the following positive economic and demographic indicators, which are typically indicative of housing market strength:

| Ÿ | declining unemployment rates; |

| Ÿ | rising home values and improving household finances; |

| Ÿ | increases in total households; |

| Ÿ | improving sentiment towards ownership of residential real estate; |

| Ÿ | declining levels of new and existing for-sale home inventory; and |

| Ÿ | a favorable consumer interest rate environment supporting affordability and home ownership. |

We believe that there is considerable growth potential in the U.S. housing sector. As of February 2013, McGraw-Hill Construction forecasts that U.S. single-family housing starts will increase to 1.1 million by 2015. Many publicly-traded homebuilders, including some of our largest customers, have reported strong earnings results and positive financial outlooks in the near-term, confirming the momentum of the housing recovery. For example, net new orders for publicly-traded homebuilders increased 33% year-over-year in the three months ended December 31, 2012, with some publicly-traded homebuilders reporting order increases of over 60%.

The products we distribute are also used in professional remodeling projects. According to the HJCHS, the U.S. remodeling market reached a peak of $328 billion in 2007 before declining approximately 16% to $275 billion in 2011. Despite this decline, factors, including the overall age of the U.S. housing stock, heightened focus on energy efficiency, rising home prices and availability of consumer capital at low interest rates, are expected to drive long-term growth in repair and remodeling

4

Table of Contents

expenditures. As of March 2013, HIRI estimates that total U.S. sales of home maintenance, repair and improvement products to the professional market will grow at a rate of 5.0% in 2013, 6.2% in 2014 and 4.9% in 2015.

Our competitive strengths

We believe the following key competitive strengths have contributed to our success and will position us for significant growth as part of a multi-year recovery in our end markets.

Leading distributor of building products to U.S. residential construction markets

We believe we are one of the leading LBM distributors in the United States. We serve all segments of the residential construction industry, including large-scale production homebuilders, custom homebuilders and repair and remodeling contractors. Our portfolio of 64 strategically-located facilities supplies products and services to many major markets in the United States and provides us with significant scale and capacity for growth. We believe that scale, strong customer relationships, and superior product and service offerings in each of our markets provide competitive advantages, enabling us to drive market share gains over time. We believe that we are among the top three LBM participants in 80% of the geographic markets in which we operate based on net sales. Because of our leading market position, we believe we are well-positioned to take advantage of the projected recovery in the residential construction market.

Low cost distribution platform with strong operating leverage

Through aggressive cost management and strategic restructuring activities implemented during the global economic downturn, we have driven significant productivity gains and positioned our company for profitable growth. Since 2009, we have closed or sold over 100 facilities in locations that we determined would not provide us with sufficient scale, or where we would otherwise not be able to compete effectively and profitably.

Beginning in 2011, our management team began implementing LEAN business practices to improve customer service, reduce waste and increase productivity. These LEAN initiatives have improved our sourcing practices and streamlined our supply chain and, along with other cost reduction efforts, have reduced our selling, general and administrative expenses as a percent of net sales from 32.8% for the fiscal year ended December 31, 2010 to 23.4% for the fiscal year ended December 31, 2012. Over the same period we have significantly increased productivity and operating leverage as net sales increased by $190.7 million, while selling, general and administrative expenses decreased by $25.7 million. We believe that our current low fixed cost position will help us to generate increased profitability as the market continues to recover.

We have also developed several innovative and proprietary eBusiness systems. Stock Logistics Solutions, a system designed to enhance the customer experience and reduce waste, was implemented in 2011, and Stock Installation Solutions, a system designed to improve the execution and customer communication of our installation services, is scheduled for implementation in 2013. Due to the implementation of Stock Logistics Solutions, we have reduced our shipping and handling costs as a percent of net sales from 6.6% in 2010 to 5.4% in 2012. These services have enabled us to track our supply chain more accurately, significantly improve customer service and reduce waste. Due in part to our LEAN initiatives and focus on efficiency, our Adjusted EBITDA has increased $60.0 million from ($58.0) million in 2010 to $2.0 million in 2012. We believe that our Adjusted EBITDA will continue to increase as a percent of net sales as the residential construction sector rebounds.

5

Table of Contents

Leading local businesses in attractive geographic markets

We operate in 20 metropolitan areas in 13 states that we believe have attractive potential for economic growth, with strong LBM product capabilities in each market we serve. We believe we are one of the top three LBM suppliers in 80% of these markets, based on net sales, with strong customer relationships and a professional team to serve our customers as they grow. Today, we serve our customers from 64 locations, which include 48 distribution and retail operations, 19 millwork fabrication operations, 14 structural components fabrication operations and 13 flooring operations. We often co-locate multiple operations in one facility to increase customer service and efficiency. Our primary operating regions include the South and West regions of the United States (as defined by the U.S. Census Bureau), which we believe are markets that are well-positioned to grow as the residential construction market recovers. McGraw-Hill Construction forecasts that the compounded annual growth rate for single-family housing starts in our 20 markets will be 23.8% from 2012 to 2015.

Proven ability to acquire and integrate complementary businesses

Our management has demonstrated a core competency in identifying, acquiring and successfully integrating businesses to provide us greater scale in our current markets and opportunities to grow in new markets. Since 2010, we have acquired the assets of four businesses with core LBM capabilities, three of which were in our current markets and one of which provided us with a strategic position in a new market.

| Ÿ | Bison Building Materials, LLC (“Bison”), which we acquired in 2010, is located in Houston, Texas and enhanced our scale in the attractive Texas Gulf Coast market; |

| Ÿ | National Home Centers, Inc. (“NHC”), which we acquired in 2010, is located in Northwest Arkansas and established a strong position in the Arkansas market; |

| Ÿ | Total Building Services Group, LLC (“TBSG”), which we acquired in December 2012, is located in Marietta, Georgia and is a provider of residential structural solutions and provided us with greater scale in the local Atlanta market, which is expected to grow significantly as the residential construction market recovers; and |

| Ÿ | Chesapeake Structural Systems, Inc. (“Chesapeake”), which we acquired in April 2013, is located outside Richmond, Virginia, and provides us with component manufacturing capability to serve our customers in our Central and Northern Virginia markets. |

While we have significant growth potential in our current operational footprint, we plan to continue to evaluate and acquire attractive businesses in our current geographic markets as well as new geographies to expand service capabilities and customer share to accelerate increases in profitability.

Extensive offering of building materials and services

We offer a comprehensive line of residential building products that are used in the construction of homes, including windows, doors and trim, and many of the products used in the interior and exterior finishing of homes. We also provide manufactured products such as roof and floor trusses, wall panels and various millwork products. We offer over 39,000 different products sourced through our strategic network of suppliers and have access to a wide range of special order products. Additionally, we provide solution-based services to our customers as needed, including design, product specification and installation management services. Furthermore, many of our facilities include product showrooms, which customers use to develop a better appreciation for our product and service offerings. Products and services that we offer represent approximately 50% of the cost of a typical new home. Because of our ability to supply a significant share of the building materials for a new home, customers look to us

6

Table of Contents

for both new construction and remodeling solutions. We believe that the breadth of the products we offer our customers provides us with a strategic advantage and enables us to forge deeper relationships with customers than smaller competitors who may be unable to supply a similar product range and lack access to the broad resources of a national company.

Superior customer service and value-added capabilities

We complement our line of building products with superior customer service and value-added capabilities. Our experienced customer service professionals provide a full range of services, including customized design and installation services specific to each job site and type. Installation services are managed by our employees, but are normally provided by third parties. Other services that we provide include job estimating, take-off, structural components or millwork design, product selection and customization. We also provide order management services for in-stock and special order products or services, manage inventory, deliver and/or load materials, and provide building products and construction trend insights for our customers. We believe that the breadth of our services, our focus on individual customer needs and the integration of our supply chain and fulfillment capabilities set us apart from many of our competitors.

We offer training programs and advanced service tools for our employees in order to assist them in providing solutions for our customers. Our innovative Stock Logistics Solutions capability, in which we provide real-time delivery information and confirmation via the Internet and to mobile devices, is one example of customer service capabilities that have increased customer loyalty and helped us drive growth in our markets.

Integrated supply chain that increases efficiency and benefits customers and suppliers

Although we operate facilities in 20 metropolitan areas across 13 states, we maintain an integrated, national supply chain that we believe enables us to provide our customers with superior services, timely delivery and more favorable pricing. We have integrated our sourcing and purchasing operations into a central procurement function. Over the last ten years, we have invested in an Enterprise Resource Planning (“ERP”) system that integrates each of our local branches with our headquarters operation. Our ERP system allows us to manage customer orders and deliver efficiently across our entire organization. It also enables central product replenishment and optimizes inventory management to improve working capital requirements. Through Stock Logistics Solutions, which includes a mobile Global Positioning System (“GPS”) application on our delivery trucks that is integrated with our ERP software, our sales and service professionals can better schedule, dispatch and manage customer deliveries.

Our integrated sourcing and purchasing operations have enabled us to develop cost-effective national sourcing agreements with key suppliers that provide us with product delivery certainty and favorable terms. We believe our suppliers value our extensive footprint, experienced sales force and advanced service capabilities and, as a result of these operational strengths, often consider us to be a preferred distribution partner. We believe that customers also benefit greatly from our ability to source products on a national level through improved pricing and availability. Through these sourcing agreements we are also able to realize stronger gross margins and achieve superior inventory management, especially during periods of market growth as product supply in the industry becomes more limited. Additionally, our broad reach, efficient operations and significant growth potential offer our suppliers an opportunity to strategically partner with us for growth, which further strengthens their loyalty to us.

7

Table of Contents

Experienced management team and principal equity holder

Our senior management team has more than 120 years of combined experience in manufacturing and distribution with a track record of financial and operational excellence in both favorable and challenging market conditions. Since 2010, our management team has successfully acquired and integrated businesses that have helped us gain scale in our current markets. Since 1987, our equity sponsor Gores has successfully acquired and operated more than 80 companies while employing a consistent, operationally-oriented approach to create value in its businesses.

Our strategy

We intend to capitalize on our strong market position in LBM distribution to increase revenues and profits and maximize operating cash flow as the U.S. housing market recovers. We seek to achieve this by executing on the following strategies:

Expand our business with existing customers by offering additional value

We plan to continue to grow our net sales by increasing our share of our existing customers’ business. By growing our scale and expanding the products and services we offer in each of our local markets, we believe that we can continue to enhance the value offering for, and relationships with, our existing customers and grow our revenues and profitability. Several of our existing facilities provide only a portion of the value-added solutions our customers need to optimize their construction projects. Products and services we intend to expand organically include millwork and structural components manufacturing, enhanced specification and design services, and additional LEAN eBusiness solutions for our customers and our sales and service professionals. By continuing to invest systematically in our core LBM capabilities and in technologies that streamline our processes and improve customer service, we believe we can provide a broader range of products and services at each of our locations and that more customers will look to us as the key solution provider for their building needs.

Expand in existing, adjacent and new geographies

We plan to expand our business through organic and acquisitive means in order to take advantage of our national supply chain and broad LBM capabilities. We intend to expand our reach and service capabilities in our current metropolitan areas by opening new locations, relocating facilities as needed and increasing capacity at existing facilities. In addition, while we have operations in 13 states that accounted for approximately 48% of 2012 U.S. single-family housing permits, our markets within those states accounted for less than half of those permits according to the U.S. Census Bureau, providing significant opportunity for growth into adjacent markets. We believe that our scale, integrated supply chain, product knowledge, eBusiness solutions and professional customer service will enable us to grow significantly as we expand into existing, adjacent and new geographies. We believe that our balance sheet and liquidity position will support our growth strategy.

Deliver leading customer service, productivity and operational excellence as our business grows

We strive for continued operational excellence. We have implemented a talent training and development program focused on specific skills training, business development and LEAN initiatives. Using these skills, our branch managers, regional management and senior leadership team continually

8

Table of Contents

examine customer service, operating and financial metrics and use this information to optimize regional and local strategies to increase customer service and operating expense productivity. Our management team has also implemented, and will continue to pursue, LEAN business practices to increase productivity. We believe that the customer service and productivity gains we realized from these initiatives will continue to improve as they are implemented more broadly across our organization.

We completed an ERP implementation across all branches, and our proprietary eBusiness system, which includes Stock Logistics Solutions, will provide the platform for continued service improvements. In addition, we intend to implement our Stock Installation Solutions system in 2013, which is designed to track the timing and completion of installation work and will provide further enhancements to our customer service. We will continue to leverage operational best practices and optimize our supplier network in order to improve efficiency and profitability. We believe that there is an opportunity for further margin improvement as we expand our business and continue to implement LEAN initiatives that bring value to our customers.

Selectively pursue strategic acquisitions

Our industry remains highly fragmented. We believe a significant number of small and larger acquisition opportunities will offer attractive growth characteristics and favorable synergy potential. We intend to focus on using our operating platform and proven integration capabilities to pursue additional acquisition opportunities while minimizing execution risk. We will focus on investments in markets adjacent to our existing operations or acquisitions that enhance our presence and capabilities in our 20 existing metropolitan areas. Additionally, we will consider acquiring operations or companies to enter new geographic regions. We believe our planned capital structure positions us to acquire businesses we find strategically attractive.

Selected risks associated with our business

There are a number of risks and uncertainties that may affect our financial and operating performance and our growth prospects. You should carefully consider all of the risks discussed in “Risk Factors” before investing in our common stock. These risks include, but are not limited to, the following:

| Ÿ | the state of the homebuilding industry and repair and remodeling activity; |

| Ÿ | seasonality and cyclicality of the building products supply and services industry; |

| Ÿ | competitive industry pressures and competitive pricing pressure from our customers; |

| Ÿ | inflation or deflation of commodity prices; |

| Ÿ | litigation or warranty claims relating to our products and services; |

| Ÿ | our ability to maintain profitability; |

| Ÿ | our ability to attract and retain key employees; and |

| Ÿ | product shortages and relationships with key suppliers. |

Corporate changes

On May 2, 2013, we converted from a Delaware limited liability company into a Delaware corporation by filing a certificate of conversion in Delaware and changed our name from Saturn Acquisition Holdings, LLC to Stock Building Supply Holdings, Inc.

9

Table of Contents

Upon consummation of this offering and the effectiveness of our amended and restated certificate of incorporation, our authorized capital stock will consist of shares of preferred stock and shares of a single class of common stock. At such time, all outstanding shares of our convertible Class C preferred stock will convert into an aggregate of shares of common stock, all outstanding shares of our Class A voting common stock and Class B non-voting common stock will convert into an aggregate of shares of a single class of common stock, and all outstanding options to purchase Class B non-voting common stock held by certain members of our management will convert into options to purchase common stock. See “—The offering” and “Capitalization.”

In addition, we will use a portion of the net proceeds from this offering to redeem all outstanding shares of our redeemable Class A junior preferred stock and Class B senior preferred stock. See “Use of Proceeds.”

Company background and corporate information

The Company’s predecessor was founded as Carolina Builders Corporation in Raleigh, North Carolina in 1922 and began operating under the Stock Building Supply name in 2003.

In May 2009, Gores Building Holdings, LLC (“Gores Holdings”), an affiliate of Gores, acquired 51% of the voting interests of our subsidiary, Stock Building Supply Holdings, LLC through a newly formed subsidiary, Saturn Acquisition Holdings, LLC from an affiliate of Wolseley plc (“Wolseley”) and we immediately entered a prepackaged reorganization. In November 2011, Gores Holdings purchased the remaining minority interest in us from Wolseley. On May 2, 2013, Saturn Acquisition Holdings, LLC converted to a corporation and changed its name to Stock Building Supply Holdings, Inc. We are currently owned by Gores Holdings and its affiliates and members of our senior management.

Our principal executive offices are located at 8020 Arco Corporate Drive, Suite 400, Raleigh, North Carolina 27617. Our telephone number at that location is (919) 431-1000. Our website address is www.stockbuildingsupply.com. The reference to our website is a textual reference only. We do not incorporate the information on or accessible through our website into this prospectus and you should not consider any information on, or that can be accessed through our website as part of this prospectus.

Our equity sponsor

Gores is a control oriented private equity firm specializing in acquiring and partnering with businesses that can benefit from its operational expertise and flexible capital base. Gores combines the operational and due diligence capabilities of a strategic buyer with the seasoned mergers and acquisitions team of a traditional financial buyer. Since 1987, Gores has successfully acquired and operated more than 80 companies while employing a consistent, operationally-oriented approach to create value in its businesses alongside management. Its current portfolio includes companies across diverse industries in which its partners have considerable experience, including technology, telecommunications, business services, industrial, healthcare, media and entertainment, and consumer products. Headquartered in Los Angeles, as of December 31, 2012, Gores had approximately $3.6 billion in assets under management.

10

Table of Contents

The offering

| Common stock offered by us |

shares | |

| Common stock offered by the selling stockholders |

shares | |

| Common stock outstanding immediately after this offering |

shares | |

| Option to purchase additional shares |

We and the selling stockholders have agreed to allow the underwriters to purchase up to an additional shares, at the public offering price, less the underwriting discount, within 30 days of the date of this prospectus. | |

| Use of proceeds |

We expect to receive net proceeds from this offering of approximately $ million, based upon an assumed initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover of this prospectus, and after deducting underwriting discounts and estimated offering expenses payable by us. We will not receive any of the proceeds from the sale of shares of our common stock by the selling stockholders.

We intend to use a portion of the net proceeds from this offering to redeem all outstanding shares of our redeemable Class A junior preferred stock and Class B senior preferred stock for an aggregate of approximately $ . We intend to use a portion of the net proceeds to pay a portion of the outstanding balances under our revolving line of credit (the “Revolver”) under our secured credit agreement (the “Credit Agreement”) and for working capital and general corporate purposes. We have not allocated the remainder of the net proceeds from this offering for any specific purpose at this time. See “Use of Proceeds.” | |

| Dividend policy |

We do not plan to pay dividends on our common stock. The declaration and payment of all future dividends, if any, will be at the discretion of our board of directors and will depend upon our financial condition, earnings, contractual conditions, restrictions imposed by our Credit Agreement and other factors that our board of directors may deem relevant. See “Dividend Policy.” | |

11

Table of Contents

| Risk factors |

See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before you decide to invest in our common stock. | |

| Directed share program |

At our request, the underwriters have reserved up to % of the shares for sale at the initial public offering price to persons who are directors, officers or other employees, or who are otherwise associated with us, through a directed share program. The number of shares available for sale to the general public will be reduced by the number of directed shares purchased by participants in the program. See “Underwriting.” | |

| Proposed symbol for trading on |

We intend to apply to list our common stock on under the symbol “ .” | |

Unless otherwise indicated, all information in this prospectus relating to the number of shares of our common stock to be outstanding immediately after this offering:

| Ÿ | gives effect to the conversion of Saturn Acquisition Holdings, LLC into Stock Building Supply Holdings, Inc. on May 2, 2013; |

| Ÿ | assumes the effectiveness of our amended and restated certificate of incorporation, which we will adopt in connection with the completion of this offering; |

| Ÿ | gives effect to the conversion of all outstanding shares of our convertible Class C preferred stock into an aggregate of shares of common stock upon the completion of this offering; |

| Ÿ | gives effect to the conversion of all outstanding shares of our Class A voting common stock and Class B non-voting common stock into an aggregate of shares of a single class of common stock upon the completion of this offering; |

| Ÿ | gives effect to the redemption of all outstanding shares of our redeemable Class A junior preferred stock and Class B senior preferred stock upon the completion of this offering; |

| Ÿ | assumes (i) no exercise of the underwriters of their option to purchase up to additional shares and (ii) an initial public offering price of $ per share, which is the midpoint of the price range set forth on the cover of this prospectus; and |

| Ÿ | excludes options to purchase shares of common stock that will be outstanding upon completion of this offering and excludes an aggregate of shares of our common stock reserved for issuance under the new management equity incentive plan we intend to adopt in connection with this offering (the “2013 Incentive Plan”) as described in “Executive Compensation—2013 Incentive Plan.” |

12

Table of Contents

Summary consolidated financial data

The following tables set forth our summary consolidated financial data. The summary consolidated financial data as of December 31, 2011 and 2012 and for the years ended December 31, 2010, 2011 and 2012 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated financial data as of December 31, 2010 have been derived from our audited consolidated financial statements, which are not included in this prospectus.

You should read the information set forth below in conjunction with “Use of Proceeds,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and notes thereto included elsewhere in this prospectus. Our historical consolidated financial data may not be indicative of our future performance.

| Year ended December 31, | ||||||||||||

| (in thousands, except shares and per share data) | 2010 | 2011 | 2012 | |||||||||

| Statement of operations information: |

||||||||||||

| Net sales |

$ | 751,706 | $ | 759,982 | $ | 942,398 | ||||||

| Cost of goods sold(1) |

587,692 | 591,017 | 727,670 | |||||||||

|

|

|

|

|

|

|

|||||||

| Gross profit |

164,014 | 168,965 | 214,728 | |||||||||

| Operating expenses: |

||||||||||||

| Selling, general and administrative expenses(2) |

246,338 | 213,036 | 220,686 | |||||||||

| Depreciation expense |

29,337 | 11,844 | 7,759 | |||||||||

| Amortization expense |

1,140 | 1,457 | 1,470 | |||||||||

| Impairment of assets held for sale(3) |

2,944 | 580 | 361 | |||||||||

| Restructuring expense(4) |

7,089 | 1,349 | 2,853 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loss from operations |

(122,834 | ) | (59,301 | ) | (18,401 | ) | ||||||

| Other income (expenses): |

||||||||||||

| Bargain purchase gain(5) |

11,223 | — | — | |||||||||

| Interest expense, net |

(1,575 | ) | (2,842 | ) | (4,037 | ) | ||||||

| Other income (expense), net(6) |

(57 | ) | (2,120 | ) | 278 | |||||||

|

|

|

|

|

|

|

|||||||

| Loss from continuing operations before income taxes |

(113,243 | ) | (64,263 | ) | (22,160 | ) | ||||||

| Income tax benefit(6) |

47,463 | 22,332 | 7,907 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loss from continuing operations |

(65,780 | ) | (41,931 | ) | (14,253 | ) | ||||||

| Income (loss) from discontinued operations, net of tax benefit (provision) of $4,038, $(658) and $(52), respectively(7) |

(4,214 | ) | (202 | ) | 49 | |||||||

|

|

|

|

|

|

|

|||||||

| Net loss |

(69,994 | ) | (42,133 | ) | (14,204 | ) | ||||||

| Redeemable Class B Senior Preferred stock dividend |

(5,079 | ) | (4,188 | ) | (4,480 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Loss attributable to common shareholders |

$ | (75,073 | ) | $ | (46,321 | ) | $ | (18,684 | ) | |||

|

|

|

|

|

|

|

|||||||

| Basic and diluted loss per common share(8): |

||||||||||||

| Loss from continuing operations |

$ | (78.67 | ) | $ | (54.48 | ) | $ | (37.77 | ) | |||

| Income (loss) from discontinued operations |

(4.68 | ) | (0.24 | ) | 0.10 | |||||||

|

|

|

|

|

|

|

|||||||

| Net loss |

$ | (83.35 | ) | $ | (54.72 | ) | $ | (37.67 | ) | |||

|

|

|

|

|

|

|

|||||||

| Weighted average number of common shares outstanding, basic and diluted(8) |

900,738 | 846,469 | 496,002 | |||||||||

| Statements of cash flows data: |

||||||||||||

| Net cash provided by (used in): |

||||||||||||

| Operating activities |

$ | (57,999 | ) | $ | (7,001 | ) | $ | (12,243 | ) | |||

| Investing activities |

8,093 | 7,322 | (4,861 | ) | ||||||||

| Financing activities |

(20,415 | ) | 138 | 14,838 | ||||||||

13

Table of Contents

| Year ended December 31, | ||||||||||||

| (in thousands, except shares and per share data) | 2010 | 2011 | 2012 | |||||||||

| Other financial data: |

||||||||||||

| Depreciation and amortization |

$ | 36,149 | $ | 16,188 | $ | 11,718 | ||||||

| Capital expenditures |

2,506 | 1,339 | 2,741 | |||||||||

| EBITDA(9) |

(79,733 | ) | (45,435 | ) | (6,356 | ) | ||||||

| Adjusted EBITDA(9) |

(57,987 | ) | (30,799 | ) | 1,993 | |||||||

| Balance sheet data (at period end): |

||||||||||||

| Cash and cash equivalents |

$ | 4,498 | $ | 4,957 | $ | 2,691 | ||||||

| Total current assets |

188,227 | 155,455 | 194,345 | |||||||||

| Property and equipment, net of accumulated depreciation |

72,821 | 57,759 | 55,076 | |||||||||

| Total assets |

294,970 | 254,641 | 286,012 | |||||||||

| Total debt |

15,174 | 35,915 | 79,182 | |||||||||

| Redeemable preferred stock |

50,809 | 54,997 | 41,477 | |||||||||

| Total stockholders’ equity(8) |

122,229 | 51,426 | 33,987 | |||||||||

| (1) | Includes depreciation expense of $5.7 million, $2.9 million and $2.5 million for the years ended December 31, 2010, 2011 and 2012, respectively. |

| (2) | Includes severance expense of $1.6 million, $2.0 million and $0.5 million for the years ended December 31, 2010, 2011 and 2012, respectively. |

| (3) | Impairment of assets held for sale represents the write down of such assets to the lower of depreciated cost or estimated fair value less expected disposition costs. See note (8) to our audited financial statements included elsewhere in this prospectus. |

| (4) | Relates to store closures and workforce reductions in continuing markets. |

| (5) | Represents the excess of the net assets acquired over the purchase price of certain assets and liabilities of NHC in April 2010. See note (3) to our audited financial statements included elsewhere in this prospectus. |

| (6) | Includes $3.1 million, $1.9 million and $0.4 million of expense related to the reduction of a tax indemnification asset, with a corresponding increase in income tax benefit, for the years ended December 31, 2010, 2011 and 2012, respectively. This indemnification asset corresponds to the long-term liability related to uncertain tax positions for which Wolseley had indemnified the Company, which was reduced upon the expiration of the statute of limitations for certain tax periods. See note (14) to our audited financial statements included elsewhere in this prospectus. |

| (7) | During the years ended December 31, 2010, 2011 and 2012, we ceased operations in certain geographic markets due to declines in residential homebuilding throughout the United States. The cessation of operations in these markets has been treated as discontinued operations as the markets had distinguishable cash flows and operations that have been eliminated from ongoing operations. See note (4) to our audited financial statements included elsewhere in this prospectus. |

| (8) | We have adjusted our historical financial statements to retroactively reflect the conversion from a limited liability company to a corporation and the change of members’ equity to stockholders’ equity. |

| (9) | EBITDA is defined as net loss before interest, income taxes and depreciation and amortization. Adjusted EBITDA is defined as EBITDA plus impairment of assets held for sale, restructuring, severance and other expenses related to store closures and business optimization, bargain purchase gain, discontinued operations, management fees, non-cash compensation, acquisition costs, other expense resulting from the reduction of a tax indemnification asset and certain other items. Adjusted EBITDA is intended as a supplemental measure of our performance that is not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). We believe that EBITDA and Adjusted EBITDA provide useful |

14

Table of Contents

| information to management and investors regarding certain financial and business trends relating to our financial condition and operating results. Our management uses EBITDA and Adjusted EBITDA to compare the Company’s performance to that of prior periods for trend analyses, for purposes of determining management incentive compensation, and for budgeting and planning purposes. These measures are used in monthly financial reports prepared for management and our board of directors. We believe that the use of EBITDA and Adjusted EBITDA provides an additional tool for investors to use in evaluating ongoing operating results and trends and in comparing the Company’s financial measures with other distribution and retail companies, which may present similar non-GAAP financial measures to investors. Our management does not consider EBITDA or Adjusted EBITDA in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of EBITDA and Adjusted EBITDA is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. Some of these limitations are: (i) EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; (ii) EBITDA and Adjusted EBITDA do not reflect our interest expense, or the requirements necessary to service interest or principal payments on our debt; (iii) EBITDA and Adjusted EBITDA do not reflect our income tax expenses or the cash requirements to pay our taxes; (iv) EBITDA and Adjusted EBITDA do not reflect historical cash expenditures or future requirements for capital expenditure or contractual commitments; and (v) although depreciation and amortization charges are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements. In order to compensate for these limitations, management presents EBITDA and Adjusted EBITDA in connection with GAAP results. You should review the reconciliation of net loss to EBITDA and Adjusted EBITDA below, and not rely on any single financial measure to evaluate our business. |

The following is a reconciliation of net loss to EBITDA and Adjusted EBITDA:

| Year ended December 31, | ||||||||||||

| (dollars in thousands) | 2010 | 2011 | 2012 | |||||||||

| Net loss |

$ | (69,994 | ) | $ | (42,133 | ) | $ | (14,204 | ) | |||

| Interest expense |

1,575 | 2,842 | 4,037 | |||||||||

| Income tax benefit |

(47,463 | ) | (22,332 | ) | (7,907 | ) | ||||||

| Depreciation and amortization |

36,149 | 16,188 | 11,718 | |||||||||

|

|

|

|

|

|

|

|||||||

| EBITDA |

$ | (79,733 | ) | $ | (45,435 | ) | $ | (6,356 | ) | |||

| Impairment of assets held for sale(a) |

2,944 | 580 | 361 | |||||||||

| Restructuring, severance, other expense related to store closures and business optimization(b) |

19,731 | 8,110 | 5,228 | |||||||||

| Bargain purchase gain(c) |

(11,223 | ) | — | — | ||||||||

| Discontinued operations, net of tax benefit(d) |

4,214 | 202 | (49 | ) | ||||||||

| Management fees(e) |

2,597 | 2,406 | 1,379 | |||||||||

| Non-cash compensation expense |

288 | 384 | 799 | |||||||||

| Acquisition costs(f) |

4,086 | 1,017 | 284 | |||||||||

| Reduction of tax indemnification asset(g) |

3,056 | 1,937 | 347 | |||||||||

| Other items(h) |

(3,947 | ) | — | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted EBITDA |

$ | (57,987 | ) | $ | (30,799 | ) | $ | 1,993 | ||||

|

|

|

|

|

|

|

|||||||

| (a) | See note (3) above. |

| (b) | See notes (2) and (4) above. Also includes (i) $7.7 million, $3.9 million and $1.8 million for the year ended December 31, 2010, 2011 and 2012, respectively, related to closed |

15

Table of Contents

| locations, consisting of pre-tax losses incurred during closure and post-closure expenses, (ii) a $1.4 million loss on the sale of land and buildings in the year ended December 31, 2010, and (iii) $1.9 million, $0.9 million and $0 of business optimization expenses, primarily consulting fees related to cost saving initiatives, for the years ended December 31, 2010, 2011 and 2012, respectively. |

| (c) | See note (5) above. |

| (d) | See note (7) above. |

| (e) | Represents the expense for management services provided by Gores and its affiliates and by Wolseley through November 2011, other than $0.5 million that is included in income (loss) from discontinued operations the year ended December 31, 2010. |

| (f) | Represents (i) $2.1 million and $2.0 million in the year ended December 31, 2010 related to the acquisition of NHC and Bison, respectively, (ii) $0.8 million and $0.2 million in the year ended December 31, 2011 related to an abandoned acquisition and the acquisition of Bison, respectively, and (iii) $0.2 million and $0.1 million in the year ended December 31, 2012 related to the acquisitions of TBSG and Chesapeake, respectively. |

| (g) | See note (6) above. |

| (h) | Represents (i) $0.7 million of expenses related to the Company’s prepackaged reorganization and (ii) $4.6 million received as proceeds from the settlement of a legal proceeding. |

16

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition and operating results could be materially and adversely affected. In that event, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks related to our business

The industry in which we operate is dependent upon the homebuilding industry and repair and remodeling activity, the economy, the credit markets and other important factors.

The building products supply and services industry is highly dependent on new home construction and repair and remodeling activity, which in turn are dependent upon a number of factors, including interest rates, consumer confidence, employment rates, foreclosure rates, housing inventory levels, housing demand, the availability of land, the availability of construction financing and the health of the economy and mortgage markets. Unfavorable changes in demographics, credit markets, consumer confidence, health care costs, housing affordability, housing inventory levels, a weakening of the national economy or of any regional or local economy in which we operate, and other factors beyond our control could adversely affect consumer spending, result in decreased demand for homes, and adversely affect our business. Changes in federal income tax laws may also affect demand for new homes. Various proposals have been publicly discussed to limit mortgage interest deductions and to limit the exclusion of gain from the sale of a principal residence. Enactment of such proposals may have an adverse effect on the homebuilding industry in general. No meaningful prediction can be made as to whether any such proposals will be enacted and, if enacted, the particular form such laws would take. Because we have substantial fixed costs, relatively modest declines in our customers’ production levels could have a significant adverse effect on our financial condition, operating results and cash flows.

The homebuilding industry underwent a significant downturn that began in mid-2006 and began to stabilize in late 2011. The downturn in the homebuilding industry resulted in a substantial reduction in demand for our products and services, which in turn had a significant adverse effect on our business during fiscal years 2007 through 2012 and led to our filing for bankruptcy in 2009. The NAHB is forecasting approximately 664,000 U.S. single-family housing starts for 2013, which is an increase of 24% from 2012, but still well below historical averages. There is significant uncertainty regarding the timing and extent of any recovery in construction and repair and remodel activity and resulting product demand levels. The positive impact of a recovery on our business may also be dampened to the extent the average selling price or average size of new single family homes decreases, which could cause homebuilders to decrease spending on our products and services.

In addition, beginning in 2007, the mortgage markets experienced substantial disruption due to increased defaults, primarily as a result of credit quality deterioration. The disruption resulted in a stricter regulatory environment and reduced availability of mortgages for potential home buyers due to a tight credit market and stricter standards to qualify for mortgages. Mortgage financing and commercial credit for smaller homebuilders, as well as for the development of new residential lots, continue to be constrained. As the housing industry is dependent upon the economy and employment levels as well as potential home buyers’ access to mortgage financing and homebuilders’ access to commercial credit, it is likely that the housing industry will not fully recover until conditions in the economy and the credit markets improve and unemployment rates decline. Prolonged weakness in the homebuilding industry would have a significant adverse effect on our business, financial condition and operating results.

17

Table of Contents

In addition, as a result of the homebuilding industry downturn, there has been a trend of significant consolidation as smaller, private homebuilders have gone out of business. We refer to the large homebuilders as “production homebuilders.” While we generate significant business from these homebuilders, our margins on sales to them tend to be lower than our margins on sales to other market segments. This could impact our margins as homebuilding recovers if the market share held by the production homebuilders increases.

The building products supply and services industry is seasonal and cyclical.

Our industry is seasonal. Although weather patterns affect our operating results throughout the year, our first and fourth quarters have historically been, and are generally expected to continue to be, adversely affected by weather patterns in some of our markets, causing reduced construction activity. To the extent that hurricanes, severe storms, earthquakes, floods, fires, other natural disasters or similar events occur in the markets in which we operate, our business may be adversely affected.

The building products supply and services industry is also subject to cyclical market pressures. Quarterly results historically have reflected, and are expected to continue to reflect, fluctuations from period to period arising from the following: the volatility of lumber prices; the cyclical nature of the homebuilding industry; general economic conditions in the markets in which we compete; the pricing policies of our competitors; and the production schedules of our customers.

Our industry is highly fragmented and competitive, and increased competitive pressure may adversely affect our results.

The building products supply and services industry is highly fragmented and competitive. We face significant competition from local, regional and national building materials chains, as well as from privately-owned single site enterprises. Any of these competitors may (i) foresee the course of market development more accurately than we do, (ii) provide superior service and sell superior products, (iii) have the ability to produce or supply similar products and services at a lower cost, (iv) develop stronger relationships with our customers, (v) adapt more quickly to new technologies or evolving customer requirements than we do, (vi) develop a superior branch network in our markets or (vii) have access to financing on more favorable terms that we can obtain. As a result, we may not be able to compete successfully with them. In addition, home center retailers, which have historically concentrated their sales efforts on retail consumers and small contractors, may in the future intensify their marketing efforts to professional homebuilders. Furthermore, certain product manufacturers sell and distribute their products directly to production homebuilders. The volume of such direct sales could increase in the future. Additionally, manufacturers and specialty distributors who sell products to us may elect to sell and distribute directly to homebuilders in the future or enter into exclusive supplier arrangements with other distributors. Consolidation of production homebuilders may result in increased competition for their business. Finally, we may not be able to maintain our operating costs or product prices at a level sufficiently low for us to compete effectively. If we are unable to compete effectively, our financial condition, operating results and cash flows may be adversely affected.

Certain of our products are commodities and fluctuations in prices of these commodities could affect our operating results.

Many of the building products we distribute, including oriented strand board (“OSB”), plywood, lumber and particleboard, are commodities that are widely available from other manufacturers or distributors with prices and volumes determined frequently based on participants’ perceptions of short-term supply and demand factors. A shortage of capacity or excess capacity in the industry can result in significant increases or declines in market prices for those products, often within a short period of time.

18

Table of Contents

Prices of commodity products can also change as a result of national and international economic conditions, labor and freight costs, competition, market speculation, government regulation, and trade policies, as well as from periodic delays in the delivery of lumber and other products. Short-term changes in the cost of these materials, some of which are subject to significant fluctuations, are sometimes passed on to our customers, but our pricing quotation periods and pricing pressure from our competitors may limit our ability to pass on such price changes. For example, we frequently enter into extended pricing commitments, which may compress our margins in periods of inflation. At times, the price at which we can charge our customers for any one or more products may even fall below the price at which we can purchase such products, requiring us to incur short-term losses on product sales. We may also be limited in our ability to pass on increases in freight costs on our products due to the price of fuel.

Periods of generally increasing prices provide the opportunity for higher sales and increased gross profit (subject to the extended pricing commitments described above), while generally declining price environments may result in declines in sales and profitability. In particular, low market prices for wood products over a sustained period can adversely affect our financial condition, operating results and cash flows, as can excessive spikes in market prices. We have generally experienced increasing prices as the homebuilding market has recovered. For the year ended December 31, 2012, average composite framing lumber prices and average composite structural panel prices (a composite calculation based on index prices for OSB and plywood) as reflected by Random Lengths were 18% and 32% higher than the prior year. Our lumber & lumber sheet goods product category represented 35.5% of net sales for that period. However, if lumber or structural panel prices were to decline significantly from current levels, our sales and profits would be negatively affected.

We are exposed to product liability, product warranty, casualty, construction defect and other claims and legal proceedings related to our products and services as well as services provided for us through third parties.

We are from time to time involved in product liability, product warranty, casualty, construction defect, and other claims relating to the products we manufacture, distribute or install, and services we provide, either directly or through third parties, that, if adversely determined, could adversely affect our financial condition, operating results and cash flows if we were unable to seek indemnification for such claims or were not adequately insured for such claims. We rely on manufacturers and other suppliers to provide us with many of the products we sell, distribute or install. Because we do not have direct control over the quality of such products manufactured or supplied by such third-party suppliers, we are exposed to risks relating to the quality of such products. In addition, we are exposed to potential claims arising from the conduct of our employees, homebuilders and their subcontractors, and third-party installers for which we may be liable. We and they are subject to regulatory requirements and risks applicable to general contractors, which include management of licensing, permitting and quality of our third-party installers. If we fail to manage these processes effectively or provide proper oversight of these services, we could suffer lost sales, fines and lawsuits, as well as damage to our reputation, which could adversely affect our business.

Although we currently maintain what we believe to be suitable and adequate insurance in excess of our self-insured amounts, there can be no assurance that we will be able to maintain such insurance on acceptable terms or that such insurance will provide adequate protection against potential liabilities. Product liability, product warranty, casualty, construction defect, and other claims can be expensive to defend and can divert the attention of management and other personnel for significant periods, regardless of the ultimate outcome. Claims of this nature could also have a negative impact on customer confidence in our products and our Company. We cannot assure you that any current or future claims will not adversely affect our financial condition, operating results and cash flows.

19

Table of Contents

Pursuant to the restructuring and investment agreement, Wolseley agreed to indemnify us for, among other things, losses arising from any third-party claim (i) existing as of May 5, 2009 or (ii) brought or asserted against the Company arising from actions taken by Wolseley or the Company prior to May 5, 2009. In the event Wolseley is unable or unwilling to satisfy its indemnification obligations to us, we would be responsible for any liabilities arising from actions taken prior to May 5, 2009 and the costs of defending claims related thereto. The resulting increase in our liabilities or litigation expenses could have a material adverse effect on our financial results.

We may be unable to achieve or maintain profitability.

We have set goals to progressively improve our profitability over time by growing our sales, increasing our gross margin and reducing our expenses as a percentage of sales. For the fiscal years 2011 and 2012 we had net losses of $42.1 million and $14.2 million, respectively, and used cash from operations of $7.0 million and $12.2 million, respectively. There can be no assurance that we will achieve our enhanced profitability goals. Factors that could significantly adversely affect our efforts to achieve these goals include, but are not limited to, the failure to:

| Ÿ | grow our revenue through organic growth or through acquisitions; |

| Ÿ | improve our revenue mix by investing (including through acquisitions) in businesses that provide higher margins than we have been able to generate historically; |

| Ÿ | achieve improvements in purchasing or to maintain or increase our rebates from suppliers through our supplier consolidation and/or low-cost country initiatives; |

| Ÿ | improve our gross margins through the utilization of improved pricing practices and technology and sourcing savings; |

| Ÿ | maintain or reduce our overhead and support expenses as we grow; |

| Ÿ | effectively evaluate future inventory reserves; |

| Ÿ | collect monies owed from customers; |

| Ÿ | maintain relationships with our significant customers; and |

| Ÿ | integrate any businesses acquired. |

Any of these failures or delays may adversely affect our ability to increase our profitability.

Residential renovation and improvement activity levels may not return to historic levels which may negatively impact our business, liquidity and results of operations.

Our business relies on residential renovation and improvement (including repair and remodeling) activity levels. Unlike most previous cyclical declines in new home construction in which we did not experience comparable declines in our sales related to home improvement, the recent economic decline adversely affected our home improvement business as well. According to the U.S. Census Bureau, residential improvement project spending in the United States increased 10% in 2012, but remains 14% below its peak in 2007. Continued high unemployment levels, high mortgage delinquency and foreclosure rates, limitations in the availability of mortgage and home improvement financing and significantly lower housing turnover, may continue to limit consumers’ spending, particularly on discretionary items, and affect their confidence level leading to continued reduced spending on home improvement projects.

We cannot predict the timing or strength of a significant recovery, if any, in these markets. Continued depressed activity levels in consumer spending for home improvement and new home construction will continue to adversely affect our results of operations and our financial position.

20

Table of Contents

Furthermore, continued economic weakness may cause unanticipated shifts in consumer preferences and purchasing practices and in the business models and strategies of our customers. Such shifts may alter the nature and prices of products demanded by the end consumer and our customers and could adversely affect our operating performance.