UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

For the fiscal year ended December 31, 2019

OR

For the transition period from _______ to _______

Commission file number: 000-55039

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

(Address of principal executive offices) | (Zip Code) | ||

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

☒ | Accelerated filer | ☐ | Emerging growth company | ||

Non-accelerated filer | ☐ | Smaller reporting company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ý

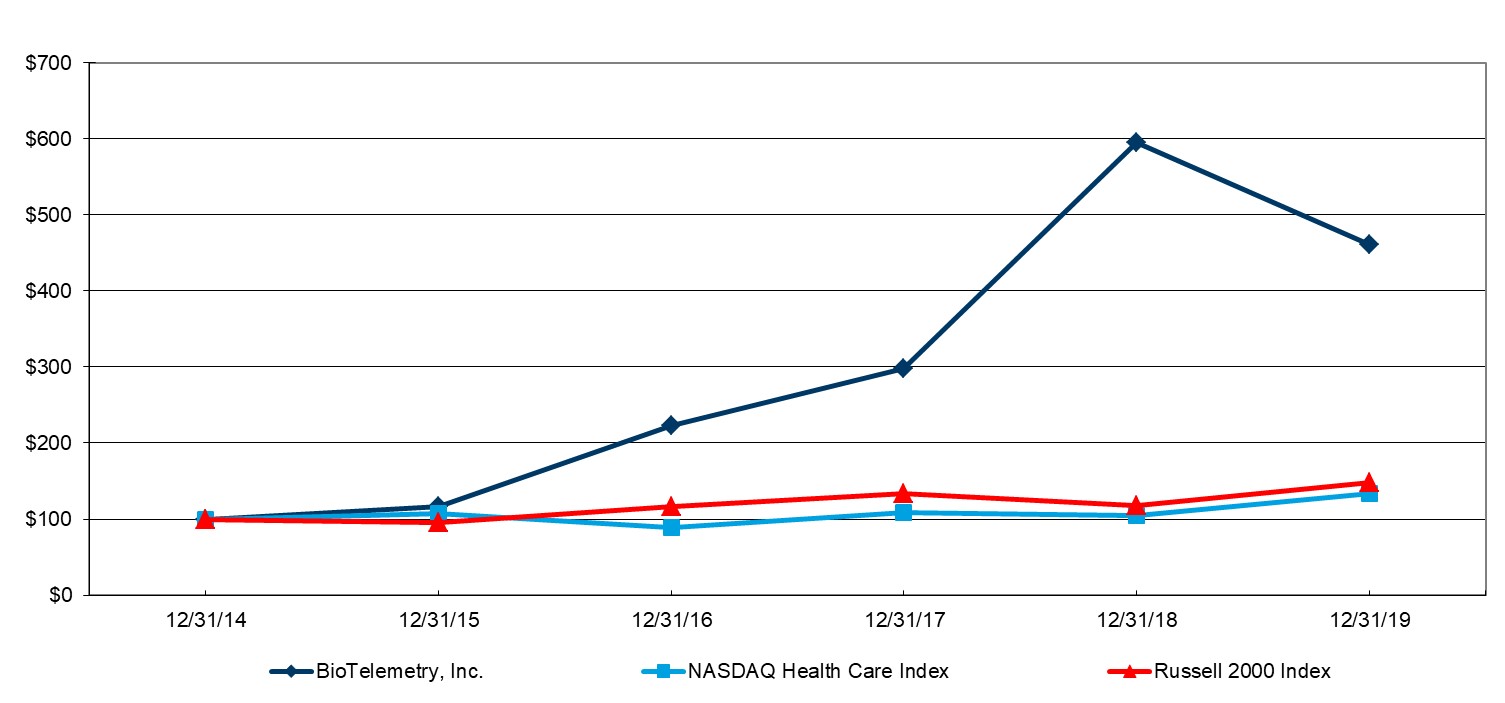

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $1.6 billion based on the closing sale price of the registrant’s common stock as reported by the NASDAQ Global Select Market on the last business day of the registrant’s most recently completed second fiscal quarter ended June 30, 2019. As of February 17, 2020, 34,023,053 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2020 annual meeting of stockholders, which will be filed no later than 120 days after the close of the registrant’s fiscal year ended December 31, 2019, are incorporated by reference into Part III of this Annual Report on Form 10-K to the extent stated herein.

BioTelemetry, Inc.

Annual Report on Form 10-K

For The Fiscal Year Ended December 31, 2019

TABLE OF CONTENTS

Page | ||

Item 16. | Form 10-K Summary | |

2

Unless the context otherwise indicates or requires, the terms “we,” “our,” “us,” “BioTelemetry” and the “Company,” as used in this Annual Report on Form 10-K, refer to BioTelemetry, Inc. and its directly and indirectly owned subsidiaries as a combined entity, except where otherwise stated or where it is clear that the terms mean only BioTelemetry, Inc. exclusive of its subsidiaries. We do not use the ® or ™ symbol in each instance in which one of our registered or common law trademarks appears in this Annual Report on Form 10-K, but this should not be construed as any indication that we will not assert our rights thereto to the fullest extent permissible under applicable law.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document includes certain forward-looking statements within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995 regarding, among other things, our growth prospects, the prospects for our products and our confidence in our future. These statements may be identified by words such as “expect,” “anticipate,” “estimate,” “intend,” “plan,” “believe,” “promises” and other words and terms of similar meaning. Examples of forward-looking statements include statements we make regarding our ability to increase demand for our products and services, to leverage our Mobile Cardiac Outpatient Telemetry platform, to expand into new markets, to grow our market share, our expectations regarding revenue trends in our segments and the achievement of cost efficiencies through process improvement. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including important factors that could delay, divert or change any of these expectations, and could cause actual outcomes and results to differ materially from current expectations. These factors include, among other things:

• | our ability to identify acquisition candidates, acquire them on attractive terms and integrate their operations into our business; |

• | our ability to educate physicians and continue to obtain prescriptions for our products and services; |

• | changes to insurance coverage and reimbursement levels by Medicare and commercial payors for our products and services; |

• | our ability to attract and retain talented executive management and sales personnel; |

• | the commercialization of new competitive products; |

• | acceptance of our new products and services, such as our mobile cardiac telemetry (“MCT”) patch; |

• | the impact of the October 2019 information technology incident; |

• | our ability to obtain and maintain required regulatory approvals for our products, services and manufacturing facilities; |

• | changes in governmental regulations and legislation; |

• | adverse regulatory action; |

• | our ability to obtain and maintain adequate protection of our intellectual property; |

• | interruptions or delays in the telecommunications systems and/or information technology systems that we use; |

3

• | our ability to successfully resolve outstanding legal proceedings; and |

• | the other factors that are described in “Part I; Item 1A. Risk Factors” of this Annual Report on Form 10-K. |

We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as may be required by law.

PART I

Item 1. Business

Overview

BioTelemetry, Inc. is the leading remote medical technology company focused on delivery of health information to improve quality of life and reduce cost of care. We provide remote cardiac monitoring, centralized core laboratory services for clinical trials, remote blood glucose monitoring, and original equipment manufacturing that serves both healthcare and clinical research customers.

With over 30,000 unique referring physicians per month, we provide cardiac monitoring and reporting for over one million patients per year, processing over four billion heart beats per day. More information can be found at www.gobio.com. Information on our website or linked to our website is not incorporated by reference into this Annual Report on Form 10-K.

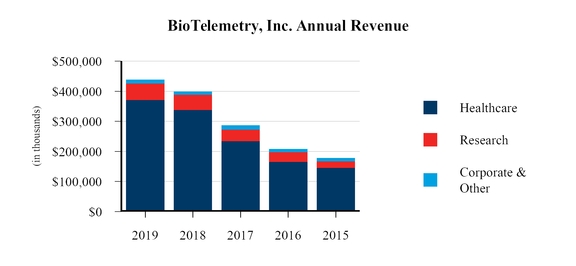

BioTelemetry operates under two reportable segments: Healthcare and Research. Our smaller brands are aggregated in the Corporate and Other category.

The Healthcare segment, which generated 85% of our revenue in 2019, is focused on remote cardiac monitoring to identify cardiac arrhythmias or heart rhythm disorders and to monitor the functionality of implantable cardiac devices. Since focusing on cardiac monitoring in 1999, we have developed a proprietary integrated patient management platform that incorporates wireless data transmission, U.S. Food and Drug Administration (“FDA”) cleared algorithms, medical devices and 24-hour monitoring service centers. We offer cardiologists, electrophysiologists, neurologists and primary care physicians a full spectrum of solutions, which provides them with a single source of remote cardiac monitoring services. These services

4

include MCT, event, traditional Holter, extended Holter, Pacemaker, International Normalized Ratio (“INR”), implantable loop recorder (“ILR”) and other implantable cardiac device monitoring. The majority of our Healthcare revenue is derived from the monitoring of devices that BioTelemetry has developed, manufactured and marketed. The Research segment, which generated 12% of our revenue in 2019, is engaged in centralized core laboratory services providing cardiac monitoring, imaging services, scientific consulting and data management services for drug and medical device trials.

During the first quarter of 2018, as part of the LifeWatch AG (“LifeWatch”) integration, our forward-looking integration and rebranding plans, as well as re-evaluating the significance and materiality of our segments, we aggregated our Technology operating segment into the Corporate and Other category. Included in the Corporate and Other category is the manufacturing, testing and marketing of cardiac and blood glucose monitoring devices to medical companies, clinics and hospitals and corporate overhead and other items not allocated to any of our reportable segments. See “Part II; Item 8. Financial Statements and Supplementary Data; Notes to Consolidated Financial Statements; Note 18. Segment Information” of this Annual Report on Form 10-K for further discussions related to our segments.

Our common stock is traded on the NASDAQ Global Select Market under our symbol: “BEAT.”

Business Strategy

Our goals are to solidify our position as the leading provider of outpatient cardiac monitoring services, expand our presence in the research market and leverage our monitoring platform in new markets. The key elements of the business strategy by which we intend to achieve these goals include:

• | Increase Overall Demand for Our Cardiac Monitoring Services. We believe that we can increase demand for our comprehensive portfolio of cardiac monitoring solutions by educating cardiologists, electrophysiologists, neurologists and primary care physicians on the benefits of using our services, including MCT, to meet their arrhythmia monitoring needs, stressing the increased diagnostic yield and their ability to use the clinically significant data to make timely interventions and guide more effective treatments. We also believe we can become further incorporated into the medical practices’ workflow by remotely monitoring patients with implanted devices, such as pacemakers, defibrillators and loop recorders, and by offering solutions such as the bi-directional integration of our data into Electronic Medical Record systems. |

• | Expand Our Presence in the Clinical Research Market. We continue to focus our efforts on increasing our presence in the clinical research market, diversifying our service offerings and expanding our preferred global provider relationships with clinical trial sponsors. We have experienced an increase in dual-service studies that require both cardiac and imaging service, which we see as a key element of our strategic growth plan. We have had success incorporating our proprietary ePatch™ extended-wear monitor as an element of our new cardiac studies creating cross-segment, top-line synergies. |

• | Leverage Our Core Competencies to New Market Opportunities. We believe our core competencies can be leveraged for applications in multiple markets. While our initial focus has been on remote cardiac monitoring to identify cardiac arrhythmias or heart rhythm disorders and to monitor the functionality of implantable cardiac devices, we intend to expand into new market areas that require outpatient or ambulatory monitoring and management. During the second quarter of 2018, we announced the commercial introduction of our latest generation |

5

wireless Blood Glucose Monitoring (“BGM”) system, increasing our presence in the large and rapidly growing digital population health management market. This wireless BGM system transmits real-time results to a cloud-based analytical engine, which synthesizes the data, monitors trends and provides caregivers with critical information about a patient’s health status and the potential need to intervene. We have been leveraging our wireless platform and proprietary technology to develop new opportunities for growth in the digital population health management business through key partnerships and internal investments. We continue to evaluate numerous connected health technologies and solutions to better understand where we can best leverage our capabilities.

Healthcare |  |

The Healthcare segment, or BioTel Heart®, is focused on remote cardiac monitoring to identify cardiac arrhythmias or heart rhythm disorders and to monitor the functionality of implantable cardiac devices. We offer cardiologists, electrophysiologists, neurologists and primary care physicians a full spectrum of solutions, which provides them with a single source of remote cardiac monitoring services. These services include MCT, event, traditional Holter, extended Holter, Pacemaker, INR, ILR and other implantable cardiac device monitoring. The majority of our Healthcare revenue is derived from the monitoring of devices that BioTelemetry has developed, manufactured and marketed.

MCT

Our MCT services incorporate a lightweight patient-worn sensor attached to electrodes that capture two-channel electrocardiogram (“ECG”) data, measuring electrical activity of the heart, on a compact wireless handheld monitor. The monitor analyzes incoming heartbeat-by-heartbeat information from the sensor on a real-time basis by applying proprietary algorithms designed to detect arrhythmias. The monitor can detect an arrhythmic event even in the absence of symptoms noticed by the patient. When the monitor detects an arrhythmic event, it automatically transmits the ECG to our monitoring centers. At our 24/7 monitoring centers, trained cardiac technicians analyze the data, respond to urgent events and report results in the manner prescribed by the physician. The MCT devices employ two-way wireless communications, enabling continuous transmission of patient data to the monitoring centers and permitting physicians to remotely adjust monitoring parameters and request previous ECG data from the memory stored in the monitor. The MCT devices have the capability of storing 30 days of continuous ECG data, in contrast to a maximum of 10 minutes for a typical event monitor and a maximum of 24 hours for a typical Holter monitor.

In 2016, we obtained FDA approval of our next generation MCT device, in a patch form factor. The MCT patch is a four-lead, two-channel system that provides the same best-in-class technology as our traditional MCT devices, in a more convenient form factor. The MCT patch was commercially launched in limited accounts during 2017, with a full launch in the first quarter of 2018. |  | |

6

Event

Our event monitoring services provide physicians with the flexibility to prescribe wireless event monitors, digital loop event monitors, memory loop event monitors and non-loop event monitors. Event data is transmitted, either through automatic transmission of event data with wireless event monitors or through telephonic transmission of stored event data with our traditional event monitors, to one of our 24/7 monitoring centers where our trained cardiac technicians analyze the data.

Holter

Traditional Holter and extended Holter monitors locally store, on a compact memory card, ECG data of every heartbeat or irregularity. At the end of service, the device is returned. Our trained cardiac technicians then analyze the data. Our next generation Holter monitors, the CardioKey® and ePatch™ are small, lightweight cardiac monitors, which can continuously store up to 14 days of ECG data. |  | |

Geneva

Our Geneva platform is a cloud-based solution for point of care and remote monitoring data that consolidates and manages information from ILRs and other implantable cardiac devices of several manufacturers into a single workflow. When combined with Geneva’s cardiac monitoring services, our trained cardiac technicians analyze and report the data. |  | |

We market our services generally throughout the United States and receive reimbursement for the monitoring provided to patients from government and commercial payors.

Research |  |

The Research segment, or BioTel Research™, is engaged in centralized core laboratory services providing cardiac monitoring, imaging services, scientific consulting and data management services for drug and medical device trials. The centralized services include ECG, Holter monitoring, ambulatory blood pressure monitoring, echocardiography, multigated acquisition scan (“MUGA”), a full range of imaging services, protocol development, expert reporting and statistical analysis. Our imaging service offerings were bolstered by our 2016 acquisition of VirtualScopics, Inc. (“VirtualScopics”), a leading provider of clinical trial imaging solutions and services in the cardiac, oncology, metabolic, musculoskeletal and neurologic therapeutic areas. We provide a full range of support services in Phase I-IV trials and Thorough QT Trials, that include project coordination, setup and management, equipment rental, data transfer, processing, analysis and 24/7 customer support and site training. Our data management systems enable

7

complete customization for sponsors’ preferred data specifications, and our web service, CardioPortal™, provides access to data from any web browser. Our primary customers in this segment are pharmaceutical companies and contract research organizations (“CROs”).

In late 2017, we collaborated with Apple, Stanford Medicine and American Well in the Apple Heart Study, to improve the technology used to identify irregular heart rhythms and advance heart science. The study enrolled over 400,000 participants and was expected to discover undiagnosed irregular heart rhythms, such as AFib, using the Apple Watch and dedicated “Apple Heart Study” App. As part of the study, participants who experienced an irregular pulse received BioTelemetry’s ePatch™ for additional monitoring. In November 2019, Stanford Medicine published its findings, “Large-Scale Assessment of a Smartwatch to Identify Atrial Fibrillation” in the New England Journal of Medicine, which confirmed that wearable technology can safely identify heart rate irregularities that subsequent clinical evaluations confirmed to be AFib. This is an example of a customer outside the traditional CRO or pharmaceutical company utilizing our services.

Other Businesses |  |  |

The Corporate and Other category contains our other operating business brands: BioTel Alliance™, which focuses on manufacturing, testing and marketing of cardiac devices to medical companies, clinics and hospitals, and BioTel Care®, which manufactures blood glucose monitoring devices and is actively working to expand our position in the digital population health management space. We have been able to build successful customer relationships by providing reliable, quality products and engineering services. We offer contract manufacturing services, developing and producing devices to the specific requirements set by customers.

We manufacture various devices, including MCT, event and Holter monitors utilized by our Healthcare and Research segments. Our facilities located in San Diego, CA, and Concord, MA, are responsible for research and product development under FDA guidelines. Manufacturing of devices is performed in part in our Eagan, MN, facility. We believe that our manufacturing capacity will be sufficient to meet our manufacturing needs for the foreseeable future.

We believe our manufacturing operations are in compliance with regulations mandated by the applicable regulatory governing bodies. We are subject to unannounced inspections by the FDA, and we successfully completed routine inspections in recent years with no significant findings noted or warnings issued. Our Eagan, MN, San Diego, CA, and Concord, MA, facilities are ISO 13485-certified and registered with the FDA. ISO 13485 is an international quality system standard used by medical device manufacturing companies and is the basis for acquiring European Conformity Marking (“CE Marking”) for medical device product distribution in the European Union. In addition to FDA clearance, many of our devices also carry a CE Marking, which is a certification mark that indicates conformity with health, safety and environmental protection standards for products used and sold within the European Economic Area (“EEA”).

There are a number of critical components and sub-assemblies in the devices. The vendors for these materials are qualified through stringent evaluation and testing of their performance. We implement a strict no-change policy with our contract manufacturers to ensure that no components are changed without our approval.

8

Research and Development

We make significant investments in research and development activities focused on developing new products and enhancements to our existing products. We intend to continue to develop proof of superiority of our technology through clinical data. Our aim is to create products that are smaller, faster, more efficient and that provide more useful and relevant information to physicians on a more timely basis. We employ a dedicated internal core research and development team, primarily based in San Diego. We have been consolidating parts of the process across the organization to bring cross-company synergies and benefits. Our San Diego location also houses our rapid prototype lab, which has 3-D printing capability. In addition, we consult with external consultants and partners on certain projects or prototype work.

The three primary sources of clinical data that we have used to date to illustrate the clinical value of MCT include: (i) a randomized 300-patient clinical study; (ii) our cumulative actual monitoring experience from our databases; and (iii) numerous other published studies.

We sponsored and completed a 17-center, 300-patient randomized clinical trial in March 2007 - Steven A. Rothman M.D. et al. “The Diagnosis of Cardiac Arrhythmias: A Prospective Multi-Center Randomized Study Comparing Mobile Cardiac Outpatient Telemetry Versus Standard Loop Event Monitoring,” Journal of Cardiovascular Electrophysiology. We believe this study represented the largest randomized study comparing two non-invasive arrhythmia monitoring methods. The study was designed to evaluate patients who were suspected to have an arrhythmic cause underlying their symptoms but who were a diagnostic challenge given that they had already had a non-diagnostic 24-hour Holter monitoring session or four hours of telemetry monitoring within 45 days prior to enrollment. Patients were randomized to either MCT or to a loop event monitor for up to 30 days. Of the 300 patients who were randomized, 266 patients who completed a minimum of 25 days of monitoring were analyzed (134 patients using MCT and 132 patients using loop event monitors).

The study specifically compared the success of MCT against loop event monitors in detecting patients with clinically significant arrhythmias and demonstrated the superiority of MCT for confirming the diagnosis of these types of arrhythmias. The study also demonstrated the advantage of using MCT compared to the loop event monitor in the detection of asymptomatic atrial fibrillation (“AFib”) or flutter. Diagnosis and treatment of AFib is important because it can lead to many other medical problems, including stroke. The study concluded that MCT provided a significantly higher diagnostic yield, in detecting an arrhythmic event in patients with symptoms of cardiac arrhythmia, compared to traditional loop event monitoring, including such monitoring designed to automatically detect certain arrhythmias.

In addition to the aforementioned 300-patient randomized clinical trial, MCT has been cited and referenced in over 40 publications and abstracts, which lends support to its clinical efficacy.

In 2016, we obtained FDA approval of our next generation MCT device, in a patch form factor. The MCT patch is a four-lead, two-channel system that provides the same best-in-class technology as our traditional MCT devices, in a more convenient form factor. We continue to explore unique designs to improve patient experience while maintaining clinical efficacy.

We also continue to research study setup automation and workflow management for use in our Research segment. Our continued efforts to integrate machine learning and artificial intelligence to improve our automated patient management tracking in our Research segment services will drive efficiencies, and we believe it will help us acquire more dual-service studies from our partners.

9

Additionally, we continue to build out our coaching platform for our wireless BGM, through patient and third-party feedback. We are analyzing data to determine where machine learning can provide additional technological leverage and efficiencies to the physician and the patient.

Sales and Marketing

We market our cardiac monitoring solutions in our Healthcare segment through our direct sales force primarily to cardiologists, electrophysiologists, neurologists and primary care physicians who most commonly diagnose and treat patients with arrhythmias. We differentiate ourselves through our clinical efficacy and the seamless integration of our data in the practice’s electronic medical records.

We are the leading member of the Remote Cardiac Service Provider Group (“RCSPG”), with our Senior Vice President of Medical Affairs being the current President of the RCSPG. The RCSPG collaborates with physician specialty societies as well as the American Telemedicine Association to advocate to the Centers for Medicare and Medicaid Services (“CMS”) and Congress for appropriate valuation of remote diagnostic services that the RCSPG members provide.

We market our Research segment services to pharmaceutical companies, medical device companies, CROs and academic research organizations. We are a founding member and the first cardiac core laboratory to join the Cardiac Safety Research Consortium (“CSRC”). Through the CSRC, we are able to network with key thought leaders and decision makers of major pharmaceutical companies, as well as discuss key cardiac safety issues during the drug development process. Through our integration of VirtualScopics, we have experienced an increase in acquiring studies that include both cardiac and imaging requirements. Expanding our research service offerings is a key element of our strategic growth plan, allowing us to more favorably compete for research studies requiring a wider range of research services. Our team has also had success incorporating our proprietary ePatch™ monitor as a critical element of new cardiac studies creating cross-segment, top-line synergies.

Our BioTel Alliance™ brand, currently included in the Corporate and Other category, markets our manufactured products to physicians, hospitals and other cardiac monitoring providers. BioTel Care® is actively working to expand our position in the digital population health space, and continues to evaluate numerous connected health technologies and solutions to better understand where we can best leverage our capabilities. Specifically, we are engaged in increasing awareness and utilization of our wireless BGM and our diabetes management platform. Our commercial team is primarily focused on securing contracted relationships for our diabetes management services with:

• | commercial managed care plans; |

• | accountable care organizations; |

• | integrated delivery networks; |

• | physicians groups; |

• | durable medical equipment distributors; and |

• | employer groups. |

We attend trade shows and medical conferences to promote our various product and service offerings. The trade shows and conferences we attend are related to organizations such as: the Heart Rhythm Society,

10

American College of Cardiology, American Telemedicine Association, Society of Thoracic Surgeons, American Heart Association and the European Society of Cardiology. We also attend the Medica, Drug Information Association and Partnerships in Clinical Trials trade shows, as well as the annual Boston Atrial Fibrillation Symposium. We have had limited product and service-based advertising in certain national newspapers and medical journals.

Seasonality

Our Healthcare segment experiences some seasonality during the third quarter as well as during the year-end holiday season. We believe that this is the result of patients electing to delay our monitoring services during the summer months or holidays.

Healthcare Reimbursement

In the Healthcare segment, services are billed to government and commercial payors using specific codes describing the services. Those codes are part of the Current Procedural Terminology (“CPT”) coding system, which was established by the American Medical Association to describe services provided by physicians and other suppliers. Physicians select the code that best describes the medical services being prescribed. Approximately 35% of our total revenue is subject to reimbursement directly from the Medicare program, a federal government health insurance program administered by CMS, at rates that are set nationally and adjusted for certain regional indices.

In addition to receiving reimbursement from government payors, we enter into contracts with commercial payors to receive reimbursement at specified rates for our services. Such contracts typically provide for an initial term of between one and three years and provide for automatic renewal thereafter. Either party can typically terminate these contracts by providing between 30 and 180 days’ prior notice to the other party at any time following the end of the initial term of the agreement. The contracts provide for an agreed upon reimbursement rate, which in some instances is tied to the rate of reimbursement we receive from Medicare.

In addition to receiving reimbursement from government and commercial payors, we have direct arrangements with physicians who may purchase our monitoring services and then submit claims for these services directly to government and commercial payors. In some cases, patients pay for their service out-of-pocket.

Competition

Although we believe that we have a leading position in mobile cardiac monitoring in the U.S., the industry in which our Healthcare segment operates is fragmented and characterized by a number of smaller regional service providers.

Our Research segment competes directly with other core labs as well as CROs that offer centralized core laboratory services. We believe that we compete favorably based on our comprehensive cardiac and imaging service offerings, the scale of our operation and our ability to support the entire life cycle of new drug development.

We also compete directly with other original diagnostic equipment manufacturers.

11

We believe that the principal competitive factors that impact the success of our businesses include some or all of the following:

• | quality of algorithms used to detect arrhythmias; |

• | quality and accuracy of clinical data; |

• | turnaround times; |

• | ease of use and reliability of cardiac monitoring solutions for patients and physicians; |

• | technology performance, innovation, flexibility and range of application generating the highest yields; |

• | timeliness and clinical relevance of new product introductions; |

• | quality and availability of superior customer support services; |

• | size, experience, knowledge and training of sales and marketing staff; |

• | reputation; |

• | relationships with referring physicians, hospitals, managed care organizations and other third-party payors; |

• | reporting capabilities; |

• | providing a full spectrum of remote cardiac monitoring solutions, including MCT, event, traditional Holter, extended Holter, Pacemaker, INR, ILR and other implantable cardiac device monitoring; |

• | a widening range of clinical cardiac and imaging services and best-in-class solutions; |

• | perceived value; and |

• | extensive industry expertise. |

We believe that we compete favorably based on the factors described above. However, our industry is evolving rapidly and is becoming increasingly competitive, and the basis on which we compete may change over time. In addition, if companies with substantially greater resources than ours enter our market, we will face increased competition.

Charitable Giving

In recent years, we have supported the American Heart Association through sponsorship and employee fund-raising at local Heart Walk events in the Philadelphia area as well as at various other locations across the U.S. as a way to share a portion of our success. In 2019, we began our “Heart for Hope” initiative, whereby we committed to fund life-saving heart procedures for children in need. To date, we have funded 200 surgeries for children from parts of Southeast Asia whose families do not have the resources to do so. That funding also includes the follow-up care after the surgery is completed. More information about “Heart for Hope” can be found at www.gobio.com/heartforhope.

12

Intellectual Property

We rely on a combination of intellectual property laws, non-disclosure agreements and other measures to protect our proprietary rights. We attempt to protect our intellectual property rights by filing patent applications for new features and products we develop. In addition, we also seek to maintain certain intellectual property and proprietary know-how as trade secrets, and generally require our partners to execute non-disclosure agreements prior to any substantive discussions or disclosures of our technology or business plans. Our business and competitive positions are dependent in part upon our ability to protect our proprietary technology and our ability to avoid infringing the patents or proprietary rights of others.

We hold patents in the United States as well as many international jurisdictions on our products, processes and related technologies. In furtherance of our overall global intellectual property strategy, we also have patent applications currently on file in the United States and internationally. While we have several patents expiring through 2032, including patents that relate, in part, to our key products, we do not believe such expirations will have a material impact on our ability to compete in the short term since our technology is typically covered by several patents, creating a system of protected technology.

Our trademarks, certain of which are material to our business, are registered or otherwise legally protected in the United States and in certain international jurisdictions and include, among others, the registered trademarks BioTelemetry®, BioTel Heart®, Geneva Healthcare®, BioTel Care®, and BioTel Europe® and the unregistered trademarks Mobile Cardiac Outpatient Telemetry™, MCOT™, ePatch™, CardioPortal™, BioTel Research™ and BioTel Alliance™. We also have a significant amount of copyright-protected materials.

Government Regulation

The healthcare industry is highly regulated, with no guarantee that the regulatory environment in which we operate will not change significantly and adversely in the future. We believe that healthcare legislation, rules, regulations and interpretations will change, and we expect we will have to modify our agreements and operations in response to these changes.

U.S. Food and Drug Administration

The medical devices that we use to provide patient monitoring services are regulated by the FDA under the Federal Food, Drug, and Cosmetic Act (“FDCA”). Unless exempt, medical devices distributed in the United States must receive marketing authorization by the FDA through either a full Premarket Approval (“PMA”) or the Premarket Notification 510(k) process. Based on the classification and characteristics of a medical device, it may receive marketing authorization through a PMA pathway, which requires the demonstration of safety and effectiveness through adequate and well-controlled clinical studies, or receive clearance under the 510(k) pathway after demonstrating substantial equivalence to a predicate device. In addition to marketing authorization requirements, device manufacturers must also comply generally with establishment registration, medical device listing, quality system regulation, labeling and medical device reporting requirements, and any special controls specific to a particular device and used to support reclassification.

The algorithms we use in the MCT service maintain FDA 510(k) clearance as a Class II device. On October 28, 2003, the FDA issued a guidance document entitled: “Class II Special Controls Guidance Document: Arrhythmia Detector and Alarm.” In addition to conforming to the general requirements of the FDCA, including the Premarket Notification requirements described above, all of our cardiac related

13

510(k) submissions address the specific issues covered in this special controls guidance document. The algorithms we use in the BGM service also maintain FDA 510(k) clearance as a Class II device.

Failure to comply with applicable regulatory requirements can result in enforcement action by the FDA, including certain sanctions, such as fines, penalties or injunctions; recall or seizure of our devices and intellectual property; operating restrictions; partial suspension or total shutdown of production; withdrawal of 510(k) clearance of new components or algorithms; withdrawal of 510(k) clearance already granted to one or more of our existing components or algorithms; and criminal prosecution.

CE Marking

Medical devices distributed within the EEA require the CE Marking, which is a certification mark that indicates conformity with health, safety, and environmental protection standards for products sold within the EEA. The CE Marking is also found on products sold outside the EEA that are manufactured in, or designed to be sold in, the EEA. Although ISO 13485 certification is not a direct requirement for CE Marking medical devices under the European Medical Device Directives, it is recognized as a harmonized standard by the European Commission. ISO 13485 is aligned with the three European medical device directives that are applicable to different types of medical devices in Europe. Failure to maintain appropriate CE Marking could have an adverse effect on our ability to use or sell our devices within the European Union.

Healthcare, Fraud, Waste and Abuse

In the United States, state and federal laws and regulations restrict healthcare providers from billing and collecting for products or services connected with fraudulent, wasteful or abusive conduct. These state and federal laws include civil and criminal false claims provisions, health fraud and false statements provisions, anti-kickback provisions, physician self-referral provisions, and more, violation of which may subject us to criminal penalties as well as potential exclusion from federal healthcare programs and civil monetary penalties.

Federal and state anti-kickback laws generally prohibit the payment or receipt of anything of value to induce prescription or referral of reimbursed products or services. Stark law limits certain relationships between referring physicians and providers of certain designated healthcare services. Anti-kickback laws restrict financial arrangements with certain healthcare professionals in a position to purchase, recommend or refer patients for our cardiac monitoring services or other products or services we may develop and commercialize. Due to the breadth of some of these laws, it is possible that some of our current or future practices might be challenged under these laws.

Federal and state false claims laws prohibit anyone from presenting, or causing to be presented, claims for payment to third-party payors that are false or fraudulent. Violations may result in substantial civil penalties including treble damages, as well as criminal penalties, including imprisonment, fines and exclusion from participation in federal health care programs. The False Claims Act (“FCA”) also contains “whistleblower” or “qui tam” provisions that allow private individuals to bring actions on behalf of the government alleging false claims and potentially other violations of fraud and abuse laws. Various states have enacted laws modeled after the FCA, including “qui tam” provisions, and some of these laws apply to claims filed with commercial insurers. Violation of federal and state fraud and abuse laws could have a material adverse effect on our business, financial condition and results of operations.

14

The Patient Protection and Affordable Care Act

On March 23, 2010, the Patient Protection and Affordable Care Act was signed into law, and on March 30, 2010, the Health Care and Education Reconciliation Act of 2010 was signed into law. Together, the two measures, collectively known as the Affordable Care Act (“ACA”), made fundamental changes to the United States healthcare system. The ACA expanded Medicaid eligibility, required most individuals to have health insurance or pay a penalty, imposed new requirements for health plans and insurance policy standards, established health insurance exchanges, changed Medicare payment systems to encourage more cost-effective care and newly expanded tools to address fraud and abuse and required manufacturers of medical devices and other products reimbursed by Medicare to report annually to the government certain payments to physicians and teaching hospitals. In 2018, certain provisions of the ACA were modified and repealed effective 2019 and beyond, and in December 2019, the medical device excise tax was permanently repealed.

Health Insurance Portability and Accountability Act of 1996

The Health Insurance Portability and Accountability Act was enacted in 1996, amended by the Health Information Technology for Economic and Clinical Health (“HITECH”) Act in 2009, and implemented through regulation (collectively, “HIPAA”). HIPAA, together with other data privacy and security laws such as the General Data Protection Regulations (“GDPR”) in Europe, dictate privacy and security standards governing the collection, storage, maintenance, dissemination, use and confidentiality of individually identifiable patient health information and other personal information. HIPAA applies directly to “covered entities,” which include health plans, healthcare clearinghouses and many healthcare providers, who electronically transmit health information and thereby engage in HIPAA “covered transactions.” HIPAA also applies to “business associates,” individuals who perform certain functions or activities for or on behalf of covered entities that require the individuals to create, receive, maintain, or transmit protected health information (“PHI”). HIPAA is concerned primarily with the privacy of PHI when it is used and/or disclosed; the confidentiality, integrity and availability of electronic PHI; notifying federal regulators and impacted patients in the event of a breach of unsecured PHI; and the content and format of certain identified electronic healthcare transactions. The laws governing healthcare information privacy and security impose civil and criminal penalties for their violation. Compliance with these laws requires substantial expenditures of financial and other resources for information technology system compliance, maintenance, monitoring, validation and evaluation. Historically, state law has governed confidentiality issues, and HIPAA preserves these laws to the extent they are more protective of a patient’s privacy or provide the patient with greater access to his or her health information. Many states continue to consider revisions to their existing laws and regulations that may or may not be more stringent or burdensome than the federal HIPAA provisions.

Medicare

Medicare is a federal program administered by CMS and its Medicare Administrative Contractors (“MAC”). The Medicare program provides qualified persons with healthcare benefits that cover the major costs of medical care within prescribed limits, subject to certain deductibles and co-payments. The Medicare program has established guidelines for local and national coverage determinations and reimbursement of certain equipment, supplies and services, which are subject to change. The methodology for determining coverage status and the basis and amount of Medicare reimbursement varies based upon, among other factors, the location in which a Medicare beneficiary receives healthcare items and services, the type of items and services provided, and the benefits available to individual beneficiaries.

15

The Medicare program is subject to statutory and regulatory changes, retroactive and prospective rate adjustments, administrative rulings, interpretations of policy, billing guidelines, MAC contractor local coverage determinations and government funding restrictions. All of these policies may materially increase or decrease the rate of program payments to healthcare facilities and other healthcare suppliers and practitioners, including those paid for our cardiac monitoring or other services. Other regulations such as facility standards, billing requirements, rules of participation and other regulations affecting the provision of and reimbursement for products and services also affect the ability to provide, bill and receive reimbursement for services or products provided under the program. Any changes in federal legislation, regulations or other policies affecting Medicare coverage, reimbursement or eligibility relative to our cardiac monitoring or other services could have an adverse effect on our performance.

Certain of our facilities are enrolled in Medicare as Independent Diagnostic Testing Facilities (“IDTFs”). An IDTF is defined by CMS as an entity independent of a hospital or physician’s office in which diagnostic tests are performed, often by licensed or certified non-physician personnel, and under appropriate physician supervision. Medicare prescribes detailed certification standards that every IDTF must meet in order to obtain or maintain its billing privileges, including requirements to, among other things, operate in compliance with all applicable federal and state licensure and regulatory requirements for the health and safety of patients; maintain a physical facility on an appropriate site meeting specific criteria; have a comprehensive liability insurance policy of at least $0.3 million per location; disclose certain ownership information; have its testing equipment calibrated and maintained in accordance with specific standards; have technical staff on duty with the appropriate credentials to perform tests; and permit on-site inspections. These requirements are subject to change. Our IDTF facilities are periodically inspected by CMS to confirm our compliance with the IDTF standards, and we believe that our facilities are in compliance with these standards.

Environmental Regulation

We use materials and products regulated under environmental laws, primarily in the manufacturing and sterilization processes. While it is difficult to quantify, we believe the ongoing cost of compliance with environmental protection laws and regulations will not have a material impact on our business, financial position or results of operations.

Liability and Insurance

The design, manufacture and marketing of medical devices and services of the types we produce entail an inherent risk of liability claims. In addition, we provide information to healthcare providers and payors upon which determinations affecting medical care are made, and claims may be made against us resulting from adverse medical consequences to patients allegedly resulting from the information we provide. To protect ourselves from liability claims, we maintain professional liability and general liability insurance on a “claims made” basis. Insurance coverage under such policies is contingent upon a policy being in effect when a claim is made, regardless of when the event(s) that caused the claim occurred. While, as of the date of this Annual Report on Form 10-K, a material claim has never been made against us and we believe our insurance policies are adequate in amount and coverage for our current operations, there can be no assurance that the coverage maintained by us is sufficient to cover all future claims. In addition, there can be no assurance that we will be able to obtain such insurance on commercially reasonable terms in the future.

16

Employees

As of December 31, 2019, we had approximately 1,700 employees. None of our employees are represented by a collective bargaining agreement. We consider our relationship with our employees to be good.

Available Information

We file electronically with the SEC our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (“Exchange Act”). We make these reports available on our website at www.gobio.com, free of charge. Copies of these reports are made available as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains a website that contains reports, proxy and information statements, and other information regarding our filings, at www.sec.gov. We do not utilize social media platforms as our primary means of distributing material company information.

Item 1A. Risk Factors

The risk factors discussed below identify important factors and risks that could cause actual results to differ materially from those anticipated by the forward-looking statements described under “Cautionary Note Regarding Forward-Looking Statements” contained in this Annual Report on Form 10-K. You should carefully consider the risks and uncertainties described below, together with all of the other information included in this Annual Report on Form 10-K, in considering our business and prospects as the occurrence of any of the following risks could affect our business, liquidity, results of operations, financial condition or cash flows. The risks and uncertainties described below are not the only ones facing BioTelemetry. Additional risks and uncertainties not presently known to us may also impair our business operations.

Reimbursement by Medicare is highly regulated, and subject to change and our failure to comply with applicable regulations could decrease our revenue, subject us to penalties or adversely affect our results of operations.

The Medicare program is administered by CMS, which imposes extensive and detailed requirements on medical product and services providers, including, but not limited to, rules that govern how we structure our relationships with physicians, how and when we submit reimbursement claims, how we operate our monitoring centers and how and where we provide our arrhythmia monitoring solutions. Our failure to comply with applicable Medicare rules could result in the discontinuation of our reimbursement under the Medicare payment program, a requirement to return funds already paid to us, civil monetary penalties, criminal penalties and/or exclusion from the Medicare program.

Changes in the reimbursement rate that commercial payors and Medicare will pay for our products and services could adversely affect our operating performance.

Reductions in reimbursement rates from consolidation of, or contract negotiations with, commercial payors could adversely affect our operating performance. When commercial payors combine their operations, the combined company may decide to reimburse for our products and services at the lowest rate paid by any of the participants in the consolidation. If one of the payors participating in the consolidation

17

does not reimburse for one of our products or services, the combined company may decide not to reimburse for such product or service.

Additionally, our agreements with commercial payors typically allow either party to the contract to terminate the contract by providing between 30 and 180 days’ prior written notice to the other party at any time following the end of the initial term of the contract. Our commercial payors may elect to terminate or not to renew their contracts with us for any reason. A commercial payor who terminates or does not renew their contract with us may, or may not, alter their coverage for the type of services we provide. In the event any of our key commercial payors terminate their agreements with us, elect not to renew or enter into new agreements with us upon expiration of their current agreements, or do not renew or establish new agreements on terms as favorable as are currently contracted, our business, operating results and prospects would be adversely affected.

In addition, CMS may reduce the reimbursement rate for our services, as it has in the past. CMS updates the reimbursement rate via the Medicare physician fee schedule annually. Furthermore, CMS has adopted a complex new system for reimbursing Medicare physician services as required by the Medicare Access and CHIP Reauthorization Act of 2015. Under the new program, which began January 1, 2017, physicians will either report under the Merit-based Incentive Payment System or an Advanced Alternative Payment Model, and their past performance will impact future rates. The rule designates use of certain patient-generated health data with an active feedback loop as a “high” weighted activity for purposes of the Advancing Care Information bonus. We cannot predict the impact of this new framework or potential future revisions to physician payment policy on reimbursement for our services. A decrease in Medicare or commercial reimbursement rates or termination of commercial payor contracts would adversely affect our financial results.

Finally, patients may continue to move to Medicare Advantage plans from traditional Medicare plans, which may change the nature of the reimbursements received by us from traditional Medicare programs and may negatively affect our revenue.

Our revenues could be affected by third-party reimbursement policies and potential cost constraints.

In the United States, we receive reimbursement for our products and services from commercial payors and from the MAC with jurisdiction in the state where the services are performed. In addition, our prescribing physicians or other health care providers receive reimbursement for professional interpretation of the information provided by our products and services from commercial payors or Medicare. The overall escalating cost of medical products and services has led to, and will continue to lead to, increased pressures on the healthcare industry, both foreign and domestic, to reduce the cost of products and services. Currently available levels of reimbursement may not continue to be available in the future for our existing products and services or products or services under development. Third-party reimbursement and coverage may not be available or adequate in either the United States or international markets, current reimbursement amounts may be decreased in the future and future legislation, and regulation or reimbursement policies of third-party payors may reduce the demand for our products or our ability to sell our products on a profitable basis.

Our operations and our interactions with our physicians and patients are subject to regulation aimed at preventing healthcare fraud and abuse and, if we are unable to fully comply with such laws, we could face substantial penalties.

Our operations may be directly or indirectly affected by various broad state and federal healthcare fraud and abuse laws, including the Federal Healthcare Programs’ Anti-Kickback Statute and the FCA. For

18

some of our services, we directly bill physicians or other healthcare entities, that, in turn, bill payors. Although we believe such payments and practices are proper and in compliance with laws and regulations, we may be subject to claims asserting that we have violated these laws and regulations. If our past or present operations are found to be in violation of these laws, we or our officers may be subject to civil or criminal penalties, including large monetary penalties, damages, fines, imprisonment and exclusion from Medicare and Medicaid program participation. Furthermore, if we knowingly file, or “cause” the filing of, false claims for reimbursement with government programs such as Medicare and Medicaid, we may be subject to substantial civil penalties, including treble damages. The FCA also contains “whistleblower” or “qui tam” provisions that allow private individuals to bring actions on behalf of the government alleging that the defendant has defrauded the government. In recent years, the number of suits brought in the medical industry by private individuals has increased dramatically. Various states have enacted laws modeled after the FCA, including “qui tam” provisions, and some of these laws apply to claims filed with commercial insurers. Even if we are not found to have violated any of these federal or state anti-fraud or false claims acts, the costs of defending these claims could adversely affect our results of operations.

The operation of our monitoring centers is subject to rules and regulations governing IDTFs and state licensure requirements; failure to comply with these rules could prevent us from receiving reimbursement from Medicare and some commercial payors.

We have several monitoring centers throughout the United States that analyze the data obtained from cardiac monitors and report the results to physicians. In order for us to receive reimbursement from Medicare and some commercial payors, our monitoring centers must be certified as IDTFs. Certification as an IDTF requires that we follow strict regulations governing how our monitoring centers operate, such as requirements regarding qualifications of the technicians who review data transmitted from our monitors. These rules can vary from location to location and are subject to change. If they change, we may have to change the operating procedures at our monitoring centers, which could increase our costs significantly. If we fail to obtain and maintain IDTF certification, our services may no longer be reimbursed by Medicare and some commercial payors, which could have a material adverse impact on our business.

Our failure to maintain accreditation could impact our DMEPOS operations.

Accreditation is required by most of our managed care payors and became a mandatory requirement for all Medicare durable medical equipment, prosthetics, orthotics and supplies (“DMEPOS”) providers effective October 1, 2009. In 2017, we completed a nationwide accreditation renewal process conducted by the Healthcare Quality Association on Accreditation, which renewed our accreditation for another three years. We will undergo the next survey cycle in 2020. If we lose accreditation, our failure to maintain accreditation could have an adverse effect on our business, financial condition, results of operations, cash flow, capital resources and liquidity.

Billing for our products and service is complex, and we must dedicate substantial time and resources to the billing process.

Billing for our products and services is complex, time consuming and expensive. Depending on the billing arrangement and applicable law, we bill several types of payors, including CMS, third-party commercial payors, institutions and patients, which may have different billing requirements procedures or expectations. We also must bill patient co-payments, co-insurance and deductibles. We face risk in our collection efforts, including potential write-offs of doubtful accounts and long collection cycles, which could adversely affect our business, financial condition and results of operations.

19

Several factors make the billing and collection process uncertain, including: differences between the submitted price for our products and services and the reimbursement rates of payors; compliance with complex federal and state regulations related to billing CMS; differences in coverage among payors and the effect of patient co-payments, co-insurance and deductibles; differences in information and billing requirements among payors; and incorrect or missing patient history, indications or billing information.

Additionally, our billing activities require us to implement compliance procedures and oversight, train and monitor our employees and undertake internal review procedures to evaluate compliance with applicable laws, regulations and internal policies. Payors also conduct audits to evaluate claims, which may add further cost and uncertainty to the billing process. These billing complexities, and the related uncertainty in obtaining payment for our products and services, could negatively affect our revenue and cash flow, our ability to achieve profitability, and the consistency and comparability of our results of operations.

Failure to appropriately track and report certain payments to physicians and teaching hospitals may violate certain federal reporting laws and subject us to fines and penalties.

Section 6002 of the ACA requires certain medical device manufacturers that produce devices covered by the Medicare and Medicaid programs to report annually to the government certain payments and transfers of value to physicians and teaching hospitals. If we fail to appropriately track and report such payments to the government, we could be subject to civil fines and penalties, which could adversely affect the results of our operations.

Audits or denials of our claims by government agencies and commercial payors could reduce our revenue and have an adverse effect on our results of operations.

As part of our business operations, we submit claims on behalf of patients directly to, and receive payments from, Medicare, Medicaid and other third-party payors. We are subject to extensive government regulation, including requirements for submitting reimbursement claims under appropriate codes and maintaining certain documentation to support our claims. Medicare contractors and Medicaid state agencies periodically conduct pre-and post-payment reviews and other audits of claims and are under increasing pressure to more closely scrutinize healthcare claims and supporting documentation. The Medicare and Medicaid programs also have broad authority to impose payment suspensions and supplier number revocations when they believe credible allegations of fraud or other supplier standard noncompliance issues exist. We have previously been subject to pre-and post-payment reviews as well as audits of claims under CMS’ Recovery Audit Program and may experience such reviews and audits of claims in the future. Such reviews and similar audits of our claims could result in restrictions on our ability to bill for our services, material delays in payment, as well as material recoupments or denials, which would reduce our net sales and profitability, or result in our exclusion from participation in the Medicare or Medicaid programs. We are also subject to similar review and audits from commercial payors, which may result in material delays in payment and material recoupments and denials. In addition, state agencies may conduct investigations or submit requests for information relating to claims data submitted to commercial payors.

We have a concentrated number of payors and losing one of them would reduce our sales and adversely affect our business and operating results.

Medicare, our largest payor, represents a significant percentage of our revenue. For the year ended December 31, 2019, Medicare (exclusive of Medicare Advantage) accounted for approximately 35% of our total revenue. No other payor accounted for more than 6% of total revenue. Our agreements with commercial payors typically allow either party to the contract to terminate the contract by providing between

20

30 and 180 days’ prior written notice to the other party at any time following the end of the initial term of the contract. Our commercial payors may elect to terminate or not to renew their contracts with us for any reason. A commercial payor who terminates or does not renew their contract with us may, or may not, alter their coverage for the type of services we provide. In the event any of our key commercial payors terminate their agreements with us, elect not to renew or enter into new agreements with us upon expiration of their current agreements, or do not renew or establish new agreements on terms as favorable as are currently contracted, our business, operating results and prospects would be adversely affected.

Our cardiac monitoring and INR testing businesses are dependent upon physicians prescribing our services and failure to obtain those prescriptions may adversely affect our revenue.

The success of our cardiac monitoring and INR testing businesses are dependent upon physicians prescribing our services. Our success in obtaining prescriptions will be directly influenced by a number of factors, including:

• | the ability of the physicians with whom we work to obtain sufficient reimbursement and be paid in a timely manner for the professional services they provide in connection with the use of our cardiac monitoring solutions; |

• | our ability to continue to establish ourselves as a comprehensive cardiac monitoring and INR services provider; |

• | our ability to educate physicians regarding the benefits of our services over alternative diagnostic monitoring solutions; and |

• | the clinical efficacy of our devices. |

If we are unable to educate physicians regarding the benefits of our products and obtain sufficient prescriptions for our services, revenue from the provision of our cardiac monitoring and INR solutions could potentially decrease.

If we are unable to provide service in a timely manner, physicians may elect not to prescribe our services, and our revenue and growth prospects may be adversely affected.

While our goal is to provide each patient with the appropriate device in a timely manner, we have experienced, and may in the future experience, service delays or delays due to the availability of devices. This can occur when converting to a new generation of device or in connection with the increase in prescriptions following acquisitions of other companies.

We may also experience shortages of devices due to manufacturing difficulties. Multiple suppliers provide the components used in our devices, but our Minnesota and Massachusetts facilities are registered and approved by the FDA as the manufacturer of record of our devices. Our manufacturing operations could be disrupted by fire, earthquake or other natural disaster, a labor-related disruption, failure in supply or other logistical channels, network or electrical outages or other reasons. If there were a disruption to our facilities in Minnesota or Massachusetts, we would be unable to manufacture devices until we have restored and re-qualified our manufacturing capability or developed alternative manufacturing facilities.

Our success in obtaining future cardiac monitor prescriptions from physicians is dependent upon our ability to promptly deliver devices to our patients, and a failure in this regard would have an adverse effect on our revenue and growth prospects.

21

Cost-containment efforts of group purchasing organizations could adversely affect our selling prices, financial position and results of operations.

Some of our existing and potential customers may become members of group purchasing organizations (“GPOs”) and integrated delivery network (“IDN”) in an effort to reduce costs. GPOs and IDNs negotiate pricing arrangements with healthcare suppliers and distributors and offer the negotiated prices to affiliated hospitals and other members. GPOs and IDNs typically award contracts on a category-by-category basis through a competitive bidding process. Bids are generally solicited from multiple vendors with the intention of driving down pricing. Due to the highly competitive nature of the GPO and IDN contracting processes, we may not be able to obtain market prices for our products or obtain or maintain contract positions with major GPOs and IDNs, which could adversely impact our profitability. Also, sales through a GPO or IDN can be significant to our business and if we are unable to retain contracts with our customers, or acquire additional contracts, our financial results may be negatively impacted.

We are increasingly dependent on sophisticated information technology systems to operate our business, and if we fail to properly maintain the integrity of our data or if our products do not operate as intended or we experience a cyber-attack or other breach of these systems, our business could be materially affected.

We are increasingly dependent on sophisticated information technology for our products and infrastructure. We rely on information technology systems to process, transmit and store electronic information in our day-to-day operations. The size and complexity of our information technology systems makes them vulnerable to increasingly sophisticated cyber-attacks, malicious intrusion, breakdown, destruction, loss of data privacy or other significant disruption. For example, in October 2019, we detected suspicious activity on our information technology network, which required services and systems to be taken offline for a period of time. Our information systems require an ongoing commitment of significant resources to maintain, protect and enhance existing systems and develop new systems to keep pace with continuing changes in information processing technology, evolving systems and regulatory standards, the increasing need to protect patient and customer information and changing customer patterns. As a result of technology initiatives, recently enacted regulations, changes in our system platforms and integration of new business acquisitions, we have been consolidating and integrating the number of systems we operate and have upgraded and expanded our information systems capabilities.

In addition, third parties may attempt to hack into our products or systems and may obtain data relating to patients with our products or our proprietary information. If we fail to maintain or protect our information systems and data integrity effectively, we could lose existing customers, have difficulty attracting new customers, have problems in determining product cost estimates and establishing appropriate pricing, have difficulty preventing, detecting and controlling fraud, have disputes with customers, physicians and other healthcare professionals, have regulatory sanctions or penalties imposed, have increases in operating expenses, incur expenses or lose revenue as a result of a data privacy breach or suffer other adverse consequences. There can be no assurance that our process of consolidating the number of systems we operate, upgrading and expanding our information systems capabilities, protecting and enhancing our systems and developing new systems to keep pace with continuing changes in information processing technology will be successful or that additional systems issues will not arise in the future. Any significant breakdown, intrusion, interruption, corruption or destruction of these systems, as well as any data breaches, could have a material adverse effect on our business.

22

Violation of federal and state laws regarding privacy and security of patient information or other personal information may adversely affect our business, financial condition or operations.

The use and disclosure of certain healthcare information by HIPAA-covered entities and their business associates have come under increased public scrutiny. Federal standards under HIPAA establish rules concerning how individually-identifiable health information may be used, disclosed and protected. Historically, state law had governed confidentiality issues, and HIPAA preserves these laws to the extent they are more protective of a patient’s privacy or provide the patient with more access to his or her health information. Additionally, amendments to HIPAA (e.g. HITECH) impose additional requirements relating to the privacy, security and transmission of individually identifiable health information. Further, certain personal information that is not regulated by HIPAA may instead be subject to other state privacy laws, such as the California Consumer Protection Act. We must operate our business in a manner that complies with all applicable laws, both federal and state, and that does not jeopardize the ability of our customers to comply with all applicable laws. We believe that our operations are consistent with these legal standards. Nevertheless, these laws and regulations present risks for covered entities and their business associates that provide services to patients in multiple states. As we continue to see how government regulators and courts interpret and enforce HIPAA and other state law requirements, we may need to adjust our interpretations of these laws and regulations over time. If a challenge to our activities is successful, it could have an adverse effect on our operations, may require us to forgo relationships with customers in certain states and may restrict the territory available to us to expand our business. In addition, even if our interpretations of HIPAA and other federal and state laws and regulations are correct, we could be held liable for unauthorized uses or disclosures of patient information as a result of inadequate systems and controls to protect this information or as a result of the theft of information by unauthorized computer programmers who penetrate our network security.

Violation of these laws against us could have a material adverse effect on our business, financial condition and results of operations. For example, in 2011, we experienced the theft of two unencrypted laptop computers and, as a result, were required to provide notices under the HIPAA Breach Notification Rule and were subsequently investigated by the United States Department of Health and Human Services’ (“HHS”) Office for Civil Rights (“OCR”). Although we have been in compliance with our obligations stemming from these incidents, and believe that our operations are consistent with the legal standards imposed by HIPAA, to avoid the uncertainty of administrative enforcement proceedings or protracted litigation, we elected to settle the investigation by OCR in April 2017 by paying $2.5 million and entering into a three-year corrective action plan. This settlement did not contain any admission of liability by us.

The FDA may recommend a different approach to measuring the cardiac impact and safety of drugs as part of the approval process. Such changes could make the systems and processes of our research segment obsolete and adversely affect revenue and profitability.

As part of its approval process, the FDA has provided guidance reinforcing the need for cardiac safety testing of all compounds entering the blood stream. The requirements vary based on the type and history of each compound. This testing is accomplished by different methods, including cardiac imaging such as MUGA and ECG analysis, which involves measuring the QT/QTc interval for prolongation. We function as a core lab and have developed proprietary systems and processes to receive cardiac imaging studies and ECGs for analysis. It is possible that, in the future, the FDA may recommend a different approach for evaluating the cardiac impact and safety of compounds which may diminish the need for a core lab. This would considerably reduce the value of our existing systems and processes and would substantially decrease our revenue and profitability in our Research segment.

23

In December 2015, the FDA published a report which called into question the need for certain QT studies. In a series of public meetings throughout 2016 discussing the report, FDA speakers indicated that certain studies were no longer mandatory and that future regulations will include some combination of traditional study types along with early phase Exposure Response modeling. Further guidance around the performance of QT studies from the FDA is expected. We cannot assess the impact of this expected guidance at this time, but it may substantially decrease our revenue and profitability in our Research segment.

We are subject to numerous FDA regulations and decisions, and it may be costly to comply with these regulations and decisions and to develop compliant products and processes.

The devices that we manufacture are classified as medical devices and are subject to extensive regulation by the FDA. Further, we maintain establishment registration with the FDA as a distributor of medical devices. FDA regulations govern manufacturing, labeling, promotion, distribution, importing, exporting, shipping, advertising, promotion and sale of these devices. Our devices and our arrhythmia detection algorithms have 510(k) clearance status from the FDA. Modifications to our devices or our algorithms that could significantly affect safety or effectiveness, or that could constitute a significant change in intended use, would require a new clearance from the FDA. If in the future we make changes to our devices or our algorithms, the FDA could determine that such modifications require new FDA clearance, and we may not be able to obtain such FDA clearances timely, or at all.