|

|

SIDLEY AUSTIN LLP | BEIJING | HONG KONG | SHANGHAI | ||||||

| 787 SEVENTH AVENUE | BOSTON | HOUSTON | SINGAPORE | |||||||

| NEW YORK, NY 10019 | BRUSSELS | LONDON | SYDNEY | |||||||

| (212) 839 5300 | CHICAGO | LOS ANGELES | TOKYO | |||||||

| (212) 839 5599 FAX | DALLAS | NEW YORK | WASHINGTON, D.C. | |||||||

| FRANKFURT | PALO ALTO | |||||||||

| GENEVA | SAN FRANCISCO | |||||||||

| jcummins@sidley.com | ||||||||||

| (212) 839-5374 | FOUNDED 1866 | |||||||||

June 14, 2013

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

| Attn: | Jay Ingram |

| Alfred Pavot |

| Tracey Smith |

| Asia Timmons-Pierce |

| Re: | The New Home Company LLC |

| Amendment No. 1 to Draft Registration Statement on Form S-1 |

| Submitted May 24, 2013 |

| CIK No. 0001574596 |

Ladies and Gentlemen:

The New Home Company LLC (to be converted into a Delaware corporation prior to the completion of the offering to which the Registration Statement referred to below relates) (the “Company”) has today electronically transmitted, pursuant to Regulation S-T, a Registration Statement on Form S-1 (including exhibits thereto) of the Company (the “Registration Statement”) for filing under the Securities Act of 1933, as amended (the “Securities Act”). On behalf of the Company, we hereby respond to the comments of the staff (the “Staff”) of the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”) with respect to Amendment No. 1 to a draft registration statement on Form S-1 in a letter dated June 7, 2013 from Mr. Jay Ingram, Legal Branch Chief. For your convenience, the Staff’s comments are included in this letter and are followed by the applicable responses. We will also provide courtesy copies of the Registration Statement, as filed and marked with the changes made from the submission of Amendment No. 1 to the Draft Registration Statement, as submitted to the Commission on May 24, 2013.

General

| 1. | It appears that the disclaimer on page ii was not deleted. We reissue comment 9 of our letter dated May 15, 2013. |

Response: The requested deletion has been made.

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 2

| 2. | We note your response to comment 11 in our letter dated May 15, 2013, that you do not believe pro forma financial statements are required. It remains unclear how you arrived at this conclusion, especially in light of the pro forma balance sheet presentation you have included on pages 22 and 57, in which total assets increased by 13%. We note that you have increased your investment in a joint venture and formed three new joint ventures subsequent to March 31, 2013. Article 11-01(a)(1) of Regulation S-X requires pro forma presentation for investments in equity method investees. Article 11-01(a)(8) requires pro forma presentation for the consummation of other events or transactions that have occurred or is probable of occurring and would be material to investors. Considering the change in your capital structure and the granting of equity instruments that is being completed in connection with the IPO, it would appear that inclusion of these two items would be material to an investor in your IPO. As such, we continue to request that you provide pro forma financial statements prepared in accordance with Article 11-02 of Regulation S-X. Your pro forma financial information should include a pro forma balance sheet, pro forma statements of operations, and accompanying explanatory notes. Please clearly show how you arrive at each pro forma adjustment, including pro forma earnings per share amounts, with a discussion of any significant assumptions and estimates used to arrive at the adjustment amounts. If you believe in accordance with Article 11-02(b)(1) of Regulation S-X that the subsequent events and the transactions to be completed in connection with your IPO will result in a limited number of adjustments that are easily understood, please provide the required narrative descriptions in the Summary of Selected Financial Data and Selected Financial Data sections. |

Response: The requested pro forma financial statements have been included in the Registration Statement.

Summary, page 1

Our Company, page 1

| 3. | We note that in response to comment 10 in our letter dated May 15, 2013, you discontinued presenting financial information related to your homebuilding operations and unconsolidated joint ventures’ homebuilding operations on a combined basis, except for the cancellation rate. Please revise your disclosures throughout the filing to either provide disaggregated cancellation rates, or include disclosure that explains the benefits and limitations of the combined presentation to investors. |

Response: The requested change has been made.

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 3

Project Sales by Market, page 10

| 4. | As previously requested in comment 16 in our letter dated May 15, 2013, please expand your disclosure to state the percentage of your economic interests in each of your joint ventures. |

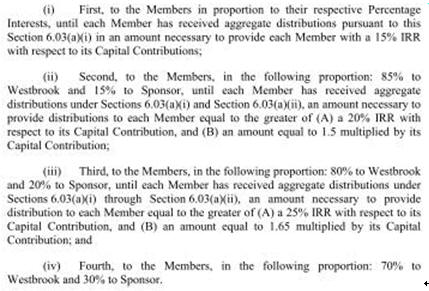

Response: The percentage of the Company’s economic interest in its joint ventures consists of its percentage capital interest, plus a share of distributions in excess of such percentage, which varies among the joint ventures. Such share of distributions is not a specific percentage, but is typically expressed in a distribution “waterfall” pursuant to which, for example, the Company and its joint venture partner are entitled to receive distributions in proportion to their capital interests until the Company’s joint venture partner receives a return of the capital it contributed to the joint venture plus a specified return on such capital, after which the Company is entitled to receive a percentage of distributions that exceeds its percentage capital interest. In several instances, the distribution waterfall is even more complicated and detailed, and in each case, a description of the Company’s economic interest requires several lines of text to describe. As a result, on page 10 and elsewhere, we have provided disclosure explaining this and referencing the specific descriptions of the distribution “waterfalls” that have been added in the description of each joint venture under “Our Business—Joint Ventures.” With regard to such descriptions, prior to the commencement of the roadshow for the offering, the Company intends to fill in the blank percentages currently included therein.

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 59

Year Ended December 31, 2012 Compared to Year Ended December 31, 2011, page 67

| 5. | As previously requested in comment 26 in our letter dated May 15, 2013, please expand your disclosures to include a discussion and analysis of the material costs included in cost of sales for home sales, fee building and land sales along with the material factors impacting these costs. Please note that it should be clear from your discussion and analysis of the cost of sales for fee building why these costs exceed the amount of revenues recognized excluding the management fees received from unconsolidated joint ventures. Please refer to Item 303(a)(3) of Regulation S-K and Section 501.12 of the Financial Reporting Codification for guidance. Please also address this comment in your interim period discussion and analysis. |

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 4

Response: The Registration Statement has been revised in several places to provide expanded disclosures in accordance with the Staff’s comment. Please see pages 62, 63, 71, 72, 90 and 91.

Liquidity and Capital Resources, page 81

| 6. | We note the additional disclosures you provided on pages 81 and 82 in response to comment 31 in our letter dated May 15, 2013. However, it appears as though your disclosures for the changes in net cash provided by (used in) operating activities for each period presented continues to provide a discussion and analysis that repeats the information easily obtainable from your consolidated statements of cash flows rather than an analysis of your operating cash flows. It should be clear to investors from your analysis how you were able to conclude that you have sufficient cash and liquidity resources to meet your obligations for the next 12 months. Please refer to Item 303(a)(1) of Regulation S-K and Section 501.13.b.1 of the Financial Reporting Codification for guidance. |

Response: The Company has revised its disclosure on page 86 in accordance with the Staff’s comment.

Critical Accounting Policies, page 88

| 7. | We note your response to comment 32 in our letter dated May 15, 2013, in which you indicate that you revised your critical accounting policies disclosures. However, it is unclear how the changes, if any, address this comment, except for your real estate inventories and warranty reserves. As previously requested, please revise the disclosures for each of your critical estimates made in preparing your consolidated financial statements to comply with the guidance in Section 501.14 of the Financial Reporting Codification, except for your real estate inventories and warranty reserves sections. Please ensure your disclosures sufficiently explain to investors what the critical estimate is; the uncertainties associated with the critical estimates; the methods and assumptions used the make the critical estimates, including an explanation as to how you arrived at the assumptions used; the events or transactions that could materially impact the assumptions made; and how reasonably likely changes to those assumptions could impact your consolidated financial statements. Please provide investors with quantified information to the extent meaningful and available. If you believe your current disclosures already provide the requested information, please tell us how your current disclosure addresses the requirements in Section 501.14 of the Financial Reporting Codification for each critical estimate (i.e., capitalization of interest, revenue recognition, variable interest entities, acquired intangible assets, contracts and accounts receivable, and income taxes). |

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 5

Response: The Company has revised its critical accounting policies disclosures for variable interest entities, acquired intangible assets, and income taxes. We respectfully submit to the Staff that disclosures on key judgments and assumptions related to revenue recognition and contracts and accounts receivable had been updated with the following disclosures in the previous submission:

“We generally utilize a cost-to-cost approach in applying the percentage-of-completion method of revenue recognition for our fee build projects, under which revenue is earned in proportion to total costs incurred, divided by total costs expected to be incurred. Recognition of revenue and profit under this method is dependent upon a number of factors, including the accuracy of a variety of estimates, including construction progress, material quantities, the achievement of milestones, penalty provisions, labor productivity and cost estimates. Due to uncertainties inherent in the estimation process, it is possible that actual completion costs may vary from estimates.”

“We also enter into fee build and management contracts, including with our unconsolidated joint ventures, where we provide construction supervision services and do not bear risks for any services outside of our own. Revenues from these services are recognized over a proportional performance method. Under this approach, revenue is earned in proportion to total estimated efforts, generally direct labor hours, expected to be provided to the client. The estimated total efforts require a substantial degree of judgment by management.”

“Contracts and accounts receivable primarily represents the fees earned but not collected, and reimbursable project costs incurred in connection with fee building agreements. We and our Predecessor periodically evaluate the collectability of its contracts receivable, and if it is determined that a receivable might not be fully collectible, an allowance is recorded for the amount deemed uncollectible. This allowance for doubtful accounts is estimated based on management’s evaluation of the contracts involved and the financial condition of its clients. Factors considered in evaluations include, but are not limited to:

| • | client type; |

| • | historical contract performance; |

| • | historical collection and delinquency trends; |

| • | client credit worthiness; and |

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 6

| • | general economic conditions.” |

We have removed the capitalization of interest disclosure as it does not involve significant judgments or estimates made by management.

Real Estate Inventories and Cost of Sales, page 89

| 8. | Please revise the date the sale closed for the finished lots not under construction. |

Response: The requested change has been made.

2013 Long-Term Incentive Plan, page 171

Initial Awards, page 172

| 9. | We note your disclosure that in determining the initial awards to be granted, consideration was given to the recommendations of Semler, Brossy Consulting Group, LLC, a compensation consultant that has been retained to assist us in making such determinations. Please describe in greater detail the nature and the scope of the Semler, Brossy Consulting Group’s assignment and the material elements of the instructions and directions given to the consultants with respect to the performance of their duties under the engagement. Please refer to Item 407(e)(3)(iii) of Regulation S-K. |

Response: Additional disclosure concerning the nature and scope of Semler, Brossy’s assignment and the material elements of the instructions and directions given to Semler, Brossy has been added on page 174.

The New Home Company LLC and The New Home Company Predecessor Financial Statements

1. Organization and Summary of Significant Accounting Policies, page F-7 Organization, page F-7

| 10. | Please note that we are continuing to evaluate your response to comment 49 in our letter dated May 15, 2013. To help us better understand the analysis you provided, please file as an exhibit and/or provide us supplementally the entire Operating Agreement that explains the rights and obligations of TNHC Partners LLC, Watt/TNHC LLC, and IHP Capital Partners VI, LLC as it relates to the operations and governance of the Company as of August 18, 2010. To the extent that there are additional rights and/or obligations disclosed in the Operating Agreement that you did not address in your analysis, please update your analysis. In addition, please provide us with the following additional information: |

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 7

| • | the impact of the push down accounting to your balance sheet as of August 18, 2010 and subsequent statements of operations; |

| • | any prior business relationships between these three entities; |

| • | how the time span between TNHC Partners LLC’s investment in the Company and Watt/TNHC LLC and IHP Capital Partners VI, LLC’s investment in the Company impacted your analysis; |

| • | the broader strategic initiative the three investors were pursuing together, if any; and |

| • | the types of transactions and activities that the members vote on with TNHC Partners LLC having a 50% voting interest. |

Once we receive this additional information, please note that we may have further comments.

Response: As requested by the Staff, we have supplementally included the Company’s operating agreement. Further, as requested, following is our response to additional inquiries:

| • | The Company applied provisions of ASC 805, Business Combinations, to all assets and liabilities as of August 18, 2010. This did not result in a significant impact to any assets and liabilities, except for an intangible asset described below, since the carrying value approximated the fair value. Specifically, the real estate inventory held by the Company as of August 18, 2010 had been recently purchased and had not been developed since the purchase date. The Company recognized an intangible asset of approximately $0.5 million related to a fee building contract on August 18, 2010. This intangible asset was amortized over its economic life, which was approximately 16 months. |

| • | The Company confirms that TNHC Partners LLC (“TNHCP”), Watt/TNHC LLC (“Watt”) and IHP Capital Partners VI, LLC (“IHP”) did not have any pre-existing relationships with each other. |

| • | The Company’s Predecessor, as defined in the Registration Statement, was formed on August 26, 2009 (“Inception Date”). As of the Inception Date, the Company’s Predecessor has contemplated seeking capital from potential investors, but did not have a term sheet, memorandum of understanding, or letter of intent from any potential investors. Ultimately, Watt and IHP were selected from the various investor groups evaluated subsequent to the Inception Date. The Company’s Predecessor finalized its negotiations with Watt and IHP mid-2010. |

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 8

| • | The key strategic initiative pursued by TNHCP, Watt, and IHP were acquisitions of land for residential real estate development, including designing, constructing and selling homes for profit and capital appreciation through a liquidation event in the future. |

| • | Although TNHCP has a 50% economic interest in the Company, all key and significant decisions essentially require unanimous approval from all members. We respectfully refer the Staff to pages 2 through 9 of the Change in Control memo (provided supplementally to the Staff in response to question 49 of the Staff’s letter dated May 15, 2013 and attached hereto), which has specific details on all key and significant decisions. |

Revenue Recognition, page F-10

Fee Building, page F-10

| 11. | We note your response to comment 51 in our letter dated May 15, 2013. Please remove your reference to contracts in which you provide services to build homes and also market and sell the homes, if you believe these contracts are immaterial to your operating results. Otherwise, we continue to request that you provide your accounting policy for these contracts and provide us with your comprehensive analysis for your accounting policy, including the specific references to the accounting literature that supports your accounting. |

Response: References to contracts in which the Company provides services to build homes and also market and sell the homes have been deleted, as the Company has determined that such contracts are immaterial to its operating results.

Investments in Unconsolidated Joint Ventures, page F-12

| 12. | We note your response to comment 54 in our letter dated May 15, 2013. It is unclear how the analysis you provided sufficiently explains your assessment of the facts and circumstances applicable to LR8 Investors, LLC (LR8) and the guidance in ASC 810-10- 15-14 and ASC 810-10-25-22 – 25-37. Please provide us with your step-by-step analysis that supports your conclusion that LR8 is a VIE. Please then provide us with an analysis of all of the material facts and circumstances specific to your investment in LR8, including any guarantees you provide to LR8 and the management contracts, as compared to the guidance in ASC 810-10-25-38 – 25-59. Please also provide us with your step-by-step analysis that supports your conclusion that you are not LR8’s primary beneficiary. It should be clear from your analysis your consideration of the factors that would indicate that you are the primary beneficiary with those factors that would indicate that you are not the primary beneficiary and how those second set of factors out-weighed the first set of factors. |

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 9

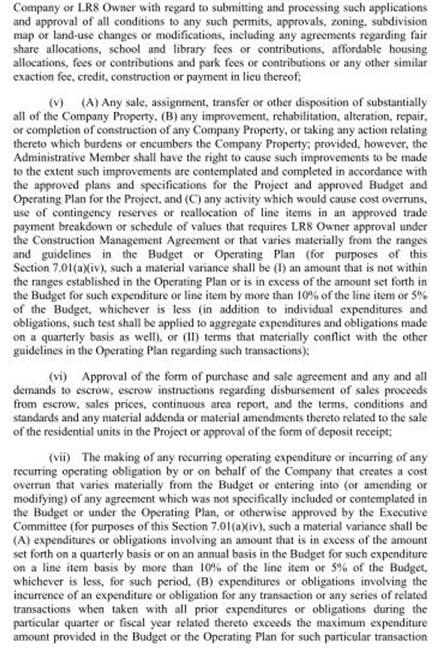

Response: As requested by the Staff, we have supplementally submitted our step by step consolidation and primary beneficiary analysis of LR8 Investors LLC (“LR8”). Further, we respectfully submit to the Staff the following key considerations, also included in our analysis:

| • | Westbrook Partners and the Company are the sole members of LR8. |

| • | Westbrook Partners has a 95% capital interest and majority of the expected economic interest in LR8; we have a 5% capital interest and only a minority of the expected economic interest. |

| • | Westbrook Partners is the managing member of LR8. |

| • | Westbrook Partners controls two of the three executive committee members. The executive committee is responsible for making decisions on all key and significant matters that can have a significant economic impact on LR8. Further, Westbrook Partners has the power to unilaterally approve any and all decisions impacting LR8 through its control of the executive committee as defined in section 7.02(f) of the LR8 operating agreement. |

| • | The Company has provided a limited loan-to-value guarantee for a portion of the debt recorded by LR8. However, Westbrook Partners has provided an indemnity to the Company whereby our exposure is limited to our respective capital interest in LR8. |

| • | The Company is the administrative member of LR8 and can be removed by the executive committee as its discretion. As noted above, Westbrook Partners controls the executive committee. |

| • | The Company receives a fee from LR8 for providing services as a general contractor. The Company can be removed as the general contractor by the executive committee at its discretion. Further, the Company believes that the fees earned by the Company are materially consistent with amounts that would be paid to an independent general contractor. |

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 10

8. Accrued Expenses and Other Liabilities, page F-18

| 13. | We note your response to comment 59 in our letter dated May 15, 2013. Please include the information provided to us regarding the nature of the completion reserve in your footnote disclosure. |

Response: The requested disclosure has been provided on page F-24 of the Registration Statement.

| 14. | We note your response to comment 60 in our letter dated May 15, 2013. To help us better understand your accounting, please provide us with the journal entries you record when you recognize a warranty reserve for your fee building activity, the journal entries you record when clients submit warranty payments to you, the journal entries you record when you incur warranty-related costs for your fee building activities, and the journal entry you recorded to reduce the warranty reserve for your fee building activities for the excess reserve amount. |

Response: As requested by the Staff, following are the journal entries the Company records related to its fee building warranty accrual:

| 1. | The Company enters into a contract which has a specified payment it will receive to undertake warranty risks. The stated amount is recorded as warranty accrual at the date the payment is received. The entry recorded is: |

Debit – Cash $X

Credit – Warranty accrual $X

| 2. | Warranty costs are not incurred on straight line basis. Accordingly, the Company prepares a forecast of total warranty related activity it expects to incur over the warranty period. Revenue is recognized as actual effort is expended and costs are incurred by the Company. The amount of revenue to be recognized is based on the percentage of actual activity and related costs incurred in the period compared to that previously forecasted. All costs related to warranty are expensed in the period incurred. The entries recorded are: |

Debit – Warranty accrual $X

Credit – Fee building revenue $X

Debit – Cost of fee building $X

Credit – Accrual/cash $X

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 11

| 3. | As disclosed to the Staff in response to the previous letter, the Company assesses the adequacy of its warranty reserves every period. During fiscal 2012, the Company noted that the total forecasted warranty efforts would not be realized, which resulted in an adjustment to the warranty reserves based on the actual efforts incurred to date. This adjustment recorded was: |

Debit – Warranty accrual $X

Credit – Fee building revenue $X

| 15. | We note that in response to comment 61 in our letter dated May 15, 2013, you separately presented the components that impact your warranty reserve. Please expand your disclosure to state the portion of the warranty reserve that relates to your homebuilding activities and your fee building activities for each period presented. As previously noted, there appears to be a disparity in the risks associated with warranty claims for your homebuilding activities from your fee building activities. Only presenting the activity during the period between homebuilding activities and fee building activities does not provide investors with context as to how much the total reserve relates to each activity. Once you provide this disclosure, we may have further questions about the reasonableness of your warranty reserves. |

Response: The Company has expanded the disclosure on page F-24 of the Registration Statement in accordance with the Staff’s comment.

LR8 Investors, LLC Financial Statements

7. Commitments and Contingencies, page F-39

| 16. | We note the revised disclosure you provided in response to comment 70 in our letter dated May 15, 2013. Please expand your revised disclosure to clearly state that LR8 has no material loss contingencies that are probable or reasonably possible, or revise your current disclosure to include cash flows in addition to financial position and results of operations. Please refer to ASC 450-20-50 for guidance. |

Response: The Company has expanded the disclosure on page F-44 of the Registration Statement in accordance with the Staff’s comment.

* * * * *

Securities and Exchange Commission

Division of Corporation Finance

June 14, 2013

Page 12

In connection with this filing and as discussed with the Staff, the Company is supplementally submitting the materials referenced in our letter dated May 24, 2013 in response to questions 7, 38 and 49 of the Staff’s letter dated May 15, 2013.

We believe that the proposed modifications to the Registration Statement, and the supplemental information provided herewith, are responsive to the Staff’s comments. Please direct any further communications relating to this filing to the undersigned at (212) 839-5374 or Istvan Hajdu at (212) 839-5651.

Very truly yours,

/s/ J. Gerard Cummins

J. Gerard Cummins

| cc: | H. Lawrence Webb |

| Edward F. Petrosky |

| Casey T. Fleck |

| Julian Kleindorfer |

COMMENT 7

to the Staff’s letter of May 15, 2013

MARKET OPPORTUNITY*

National Housing Market

The U.S. housing market continues to improve from the cyclical low points reached during the 2008 – 2009 national recession. Between the 2005 market peak and 2011, new single-family housing sales declined 76%, according to data compiled by the U.S. Census Bureau, and median home prices declined 34%, as measured by the S&P Case-Shiller Index. In 2011, early signs of a recovery began to materialize in many markets around the country as a result of an improving macroeconomic backdrop and excellent housing affordability. In the twelve months ended December 31, 2012, homebuilding permits increased 29% and the median single-family home price increased 6.6% year-over-year. Growth in new home sales has outpaced growth in existing home sales over the same period, increasing 20% versus 9% for existing homes (which were propped up by foreclosure-related sales).

Historically, strong housing markets have been associated with great affordability, a healthy domestic economy, positive demographic trends such as population growth and household formation, falling mortgage rates, increases in renters that qualify as homebuyers, and locally based dynamics such as housing demand relative to housing supply. Many markets across the U.S. are exhibiting most of these positive characteristics. Relative to long-term historical averages, the U.S. economy is creating more jobs than homebuilding permits issued, the inventory of resale and new unsold homes is well below average, and affordability is near its best level in more than 30 years, as measured by the ratio of homeownership costs to household income.

Despite recent momentum, the U.S. housing market has not fully recovered from the 2008 – 2009 recession as consumer confidence remains below average levels, mortgage underwriting standards have tightened, and the number of delinquent homes remains elevated relative to historical averages. Additionally, real estate is a local industry and not all markets exhibit the same trends.

The U.S. housing market is in the beginning of phase three of a three-phase supply-constrained housing recovery, as described below:

| • | Phase 1—job growth begins. |

| • | Phase 2—price appreciation occurs among low-priced homes in foreclosure, increasing resale prices to the point that purchasing a new home provides a good value compared to purchasing an existing home. Reduced resale inventory and great affordability are fueling a surge in demand for new homes in this recovery. |

| • | Phase 3—strong demand and limited supply lead to considerable price appreciation in land-constrained markets, and a resurgence in construction activity in markets with sufficient land supplies. Price appreciation allows discretionary buyers to sell their existing homes and potentially purchase a new home. |

While conditions are improving, significant future growth is required to return to pre-recession housing market conditions.

| • | Construction starts, as measured by the U.S. Census Bureau through January 2013, are at 890,000 units per year. This represents 40% of a recovery to a level of 1.5 million annual starts, which is comparable to housing starts in the year 2000, a period that is reflective of a more stable market. Permits issued through January 2013 are nearly twice the level of the low of 478,000 annual starts in April 2009. |

| • | Existing home sales, as measured by the National Association of Realtors, are at 4,920,000 annualized transactions through January 2013, which is in line with what JBREC estimates to be a stable level based on a ratio of existing home sales activity per household during the late 1980s and 1990s, when the housing market was in a more balanced environment and many economic variables were near historical averages. Existing home sales had fallen to an annualized rate of 3,300,000 transactions in July 2010. |

| • | New home sales are at 473,000 annualized transactions through January 2013, as measured by the U.S. Census Bureau, representing 31% of a recovery to a level of 800,000 annual transactions, which JBREC estimates to be a stable level based on new home sales activity during the late 1990s, when the housing market was in a more balanced environment and many economic variables were near historical averages. New home sales had fallen to 273,000 annualized transactions in February 2011. |

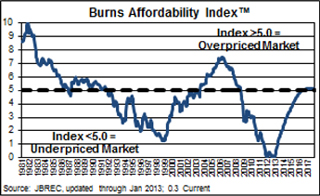

| • | Home affordability for the nation reached its most favorable levels during the housing downturn as prices and mortgage rates declined. A combination of rising prices and mortgage rates is likely to increase the cost of housing relative to incomes for U.S. homebuyers over the next five years, bringing affordability measures closer to the historical median level measured from 1981 to 2012. |

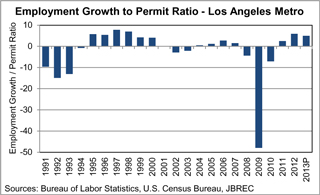

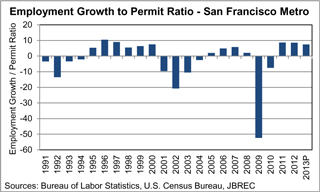

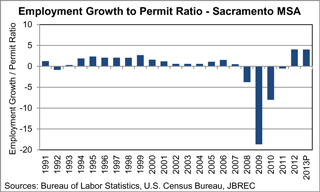

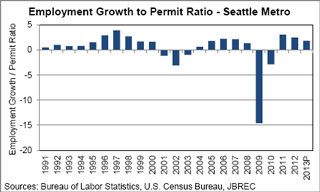

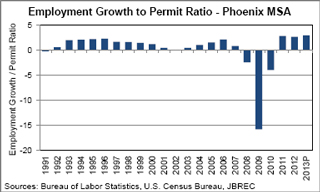

The average employment growth to homebuilding permit ratio for the country was 2.5 as of December 31, 2012. A balanced ratio in a stable market is 1.2 to 1.3. This ratio has been above a stable market ratio for several quarters, due to a rise in employment growth coupled with historically low homebuilding permit levels. Eventually, the relative excess job growth to homebuilding permit growth should lead to improving consumer confidence and new home sales, which will drive increased construction activity.

Household formations are expected to average 1.36 million per year through 2017, based on population growth that averages 0.9% per year and headship rates (which is the percentage of people in an age group that head a household) that return to levels that are more consistent with historical trends by 2025. The reduction in headship rates for nearly all age groups from 2000 to 2010 was caused primarily by the economic distress in the late 2000s.

Immigration is expected to add to the household and population growth as well, occurring at approximately 0.3% per year, and mostly concentrated in the 20 to 40 year old demographic.

A lack of inventory is limiting sales activity in the existing home market, but sales are expected to grow through 2016, in part, due to continued investor activity. After decreasing to 4.1 million transactions in 2008 from a peak of nearly 7.1 million transactions three years prior, existing home sales transactions are currently just over 4.9 million, hampered by a large decrease in the supply of homes on the market. JBREC forecasts that sales will rise to 5.5 million transactions in 2016, which would be slightly higher than the sales activity in 2001, and will decline in 2017 when rates are assumed to exceed 5.5% and the economy is assumed to slow. The share of sales that were for investment purposes rose to 27% in 2011, which was the highest rate since 2005. An elevated share of distressed sales is expected to keep investor activity above normal levels in the near term. Many investors are converting distressed inventory to rentals for a long-term hold, which is aiding the recovery process as they are removing marginal inventory that otherwise depresses prices.

The number of existing homes available for sale (not including “shadow inventory,” which is the number of homes with a mortgage that are in some form of distress but that are not currently for sale) continues its general downward trend after peaking in 2007. As of January 31, 2013, there were 4.2 months of inventory supply on the market, which is well below the peak level and below the average of 7.2 months of supply over the past 30 years.

The excess of vacant homes in the United States has been reduced significantly to an estimated 52,000 units as of February 28, 2013, according to JBREC. The vacant housing inventory had accumulated as investors and second-home buyers purchased homes for profit and personal use, and again as the severe recession significantly reduced household formations. As household growth outpaces construction, the excess vacancy is clearing and housing vacancy is stabilizing nationally, although this will vary by local market.

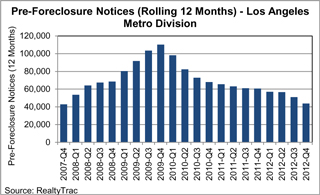

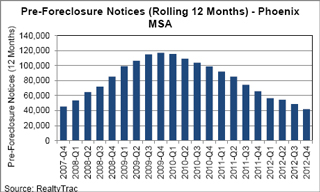

While the number of homes entering the foreclosure process is declining, the overall volume is still quite high relative to historical levels. Approximately 11.3% of all mortgages are delinquent as of the fourth quarter of 2012 – nearly twice the pre-2008 level. The shadow inventory is still substantial. This supply is likely to be sold or liquidated over the next several years. JBREC believes that banks will dispose of many of these distressed loans through either short sales or foreclosures and will do so at a moderate rate so as to limit the downward pressure on home prices resulting from the liquidation. One risk is that banks change their philosophy and decide to dispose of these distressed loans at a more rapid pace.

The media has made much of the distress in the market, focusing on the homes that are in some form of delinquency or foreclosure. However, only 9% of the total housing units in the United States have some sort of distress; the remaining 91% do not, as estimated by JBREC as of February 2013.

Increasing home price appreciation will be supported by low mortgage rates, which remain historically favorable and are expected to remain low in the near term due to low inflation and global economic uncertainty. JBREC assumes that average 30-year fixed mortgage rates will rise gradually to 5.7% by 2017, as increasing inflation and an improving economy drive rates higher after this period of very low inflation. This assumption has a very high level of risk as interest rates can change quickly.

There is a strong case for solid price appreciation:

| • | Demand—demand is growing much faster than the new home supply being added to the market, which is helping to reduce the excess existing supply in the market. With a lower level of excess supply, prices will rise as there will be multiple buyers for every house on the market for sale. |

| • | Affordability—the most favorable affordability in decades will make it easier for buyers to pay higher prices for homes. |

| • | Investment—hard assets, such as real estate, are broadly considered an inflation hedge, and many investors will focus on inflation once the current deflation concerns subside. International investors sense a fantastic opportunity to buy U.S. real estate, partially thanks to favorable exchange rates. Also, large institutional investors as well as local investment groups see a great opportunity to buy homes at below replacement cost or below the historical price/income ratio, and have been driving prices up. |

The Bear Case. While the fundamentals are in place for a recovery in the housing market, there are a number of factors that are slowing the recovery, including the following.

| • | The market is experiencing a low level of activity from entry-level buyers due to a lack of savings, challenges with back-end debt-to-income ratios and credit, and uncertainty about the housing market and the economy. |

| • | A low level of home purchases by current homeowners is occurring due to the high loan-to-value ratios of many existing homeowners. |

| • | The economy could still experience slow and volatile growth in the years to come, and even a recession. Recessions caused by excess leverage, such as the recent recession, usually resolve over many years and the path is typically very volatile. |

| • | A large number of mortgaged homes will continue to go through the foreclosure process and will be sold under duress. |

| • | Mortgage rates could rise. |

| • | The implementation of qualified mortgage and qualified residential mortgage rules proposed in the Dodd Frank Wall Street Reform and Consumer Protection Act could make mortgages more difficult to obtain. The recent qualified mortgage definition recommended a 43% backend debt-to-income ratio, which is generally more accommodative than the early 1990s. |

| • | Development and building costs are rising, which could negatively impact homebuilder margins. |

In addition, the government deficit is substantial, and the United States will be subject to further credit rating downgrades until political leadership develops and executes a plan to address the deficit. A lack of fiscal accountability could cause U.S. economic problems for years to come.

Conclusion. In summary, housing is a risky asset class, but JBREC believes the outlook for the housing market is very favorable as a result of several factors, including the following:

| • | Demand is strong. The number of adults finding employment is exceeding new home supply by a ratio of 2.5 to 1. |

| • | Supply is low. Resale inventory is well below the historical average months of supply, new home inventory is near an all-time low, and new construction is well below historical averages. |

| • | Affordability is historically favorable. With mortgage rates at 3.5%+, and home prices in many markets back to levels last seen in 2003, homeownership is an attractive financial option. |

JBREC forecasts that the excesses of the recent downturn will clear and that home prices and construction will increase for the foreseeable future.

The following table provides a summary of actual economic data and estimates, forecasts and projections for the seven primary markets for the most recent data available as of March 2013.

| Market | 2012 Data | |||||||||||||||||||

| Forecasted 2013 Home Value Appreciation |

Job Growth | Permits | Job Growth / Permit Ratio |

Months of Resale Supply* |

||||||||||||||||

| Orange County |

12.2 | % | 31,600 | 6,109 | 5.2 | 2.1 | ||||||||||||||

| San Diego |

11.3 | % | 25,400 | 5,687 | 4.5 | 2.5 | ||||||||||||||

| Ventura |

9.7 | % | 4,000 | 526 | 7.6 | 2.6 | ||||||||||||||

| Los Angeles |

9.0 | % | 67,200 | 11,295 | 5.9 | 2.8 | ||||||||||||||

| San Francisco |

12.9 | % | 38,100 | 4,429 | 8.6 | 2.0 | ||||||||||||||

| San Jose |

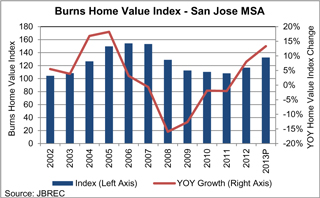

13.3 | % | 28,800 | 5,661 | 5.1 | 1.4 | ||||||||||||||

| Sacramento |

12.7 | % | 13,900 | 3,420 | 4.1 | 0.9 | ||||||||||||||

| Seattle |

8.5 | % | 37,600 | 15,010 | 2.5 | 1.9 | ||||||||||||||

| Phoenix |

18.0 | % | 41,500 | 15,882 | 2.6 | 2.2 | ||||||||||||||

| * | Estimated months of supply as of December 31, 2012 |

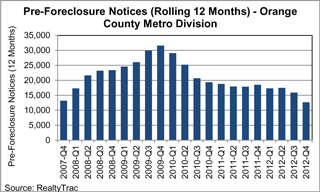

Orange County, CA Housing Market Overview

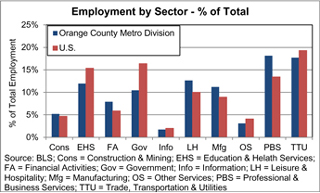

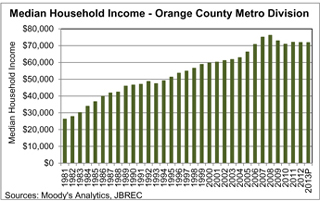

Orange County, California, also referred to as the Santa Ana-Anaheim-Irvine metropolitan division, is a part of a single MSA which consists of Los Angeles and Orange Counties together. Orange County has nearly 3.1 million people and 1.0 million households, making it the third-most populous county in California. Considered to be a set of suburban commuter cities several decades ago, Orange County now has its own vibrant economy and employment centers, and stands on its own identity as a mature community and culture independent of the larger Los Angeles County to its north. Because of its coastal location and its status as a thriving employment center, Orange County is a “first choice” region within the greater Southern California real estate market.

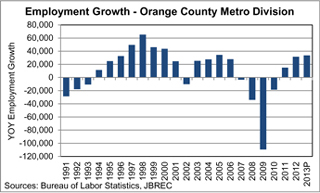

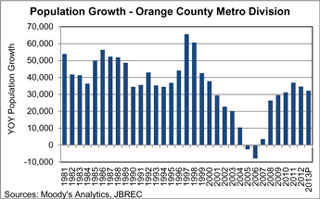

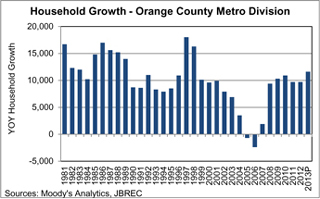

While Orange County lost 0.4% of its population in 2005 and 2006, it has gained population every year since then, adding a total of 162,200 people (5.4%) from 2007 through 2012. JBREC assumes population growth of 32,200 people (1.0% growth) and household growth of 11,600 (1.1% growth) in 2013.

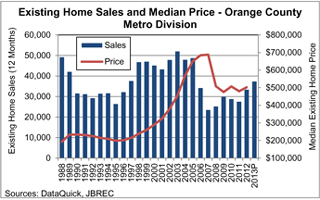

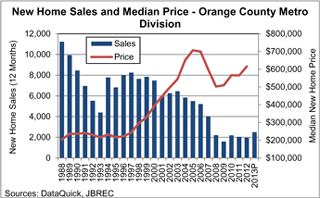

In summary, the housing fundamentals in Orange County are solid. Job growth is positive for housing demand in this market, particularly as job growth outpaces the supply of new homes being added to the market. Low levels of existing home listings are creating a more competitive resale market, which should influence future home price appreciation. Prices are at low levels not seen since 2003-2004, in a time when mortgage rates are also at historic lows. The combination of low prices and low mortgage rates in a county of high-income jobs suggests a rebound in the form of rising construction activity and home prices.

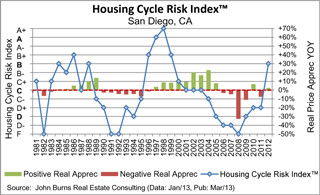

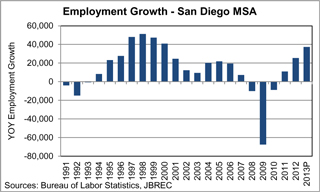

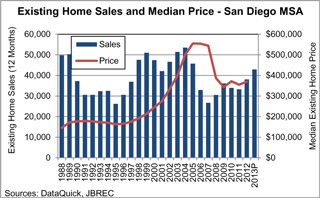

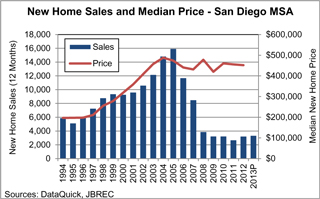

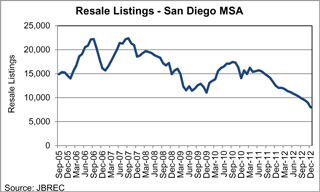

San Diego, CA Housing Market Overview

The San Diego-Carlsbad-San Marcos, California MSA consists of San Diego County. San Diego is the second-most populous county in the State of California, with nearly 3.2 million people and more than 1.1 million households, which is slightly larger than neighboring Orange County. The coastal county is known for its defense/military bases, high-tech industry, and tourism, as well as manufacturing and research. The majority of demand for housing is generated by growth in the region’s diverse economy, but San Diego has also attracted certain affluent second-home buyers and retirees for quality of life reasons.

Population and household growth in San Diego have rebounded after slowing in the early- to mid-2000s. From 2007 to 2011, population growth averaged 39,000 people (1.3%) per year and household growth averaged 12,300 (1.2%) per year. JBREC assumes population growth of 44,500 people (1.4% growth) and household growth of 16,400 households (1.5% growth) in 2013.

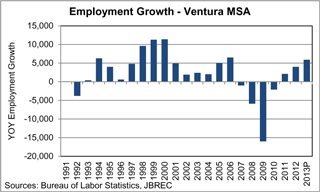

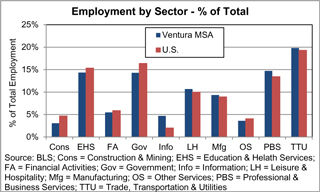

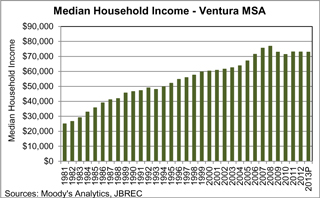

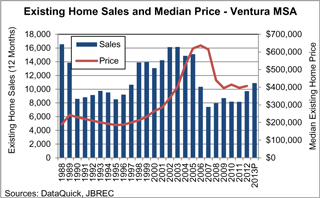

Ventura, CA Housing Market Overview

The Ventura MSA, also referred to as the Oxnard-Thousand Oaks-Ventura MSA, consists of Ventura County. The county is home to more than 840,000 people and more than 275,000 households. The coastal county has a rich history, while simultaneously providing amenities found in much more urban settings. Although Ventura lives in the large shadow of Los Angeles County to the south, it has a vibrant economy in its own right, and household income levels are significantly higher than surrounding metros. Limited land supply and a tough land planning and approval environment will continue to restrict the supply of new homes over the next few years.

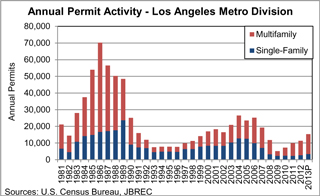

Los Angeles, CA Housing Market Overview

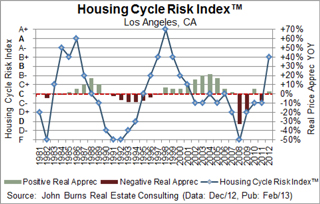

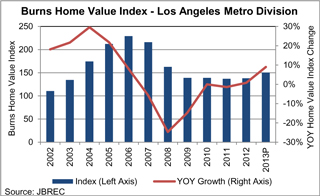

The Los Angeles metropolitan division is a part of a single MSA which consists of Los Angeles and Orange Counties together; the Los Angeles division represents Los Angeles County only. This county has nearly 10.1 million people and 3.3 million households, making it the most populous county in the entire nation as well as in California, representing slightly less than 30% of the state population and about 3% of the population of the entire nation. Owing to its size, this market has a wide diversity of submarkets and demographics, which make it critical for builders and developers to understand the local consumer. A large percentage of new homebuilding activity will likely occur in either infill locations close to job growth or in more distant areas where land is available for traditional single-family detached home development.

Los Angeles County lost a little less than one percent of its population in the three years from 2005 through 2007, but has added 301,000 people from 2008 through 2012 (3.1% cumulative growth). JBREC assumes population growth of approximately 99,700 people (1.0% growth) and household growth of approximately 37,500 households (1.1% growth) in 2013.

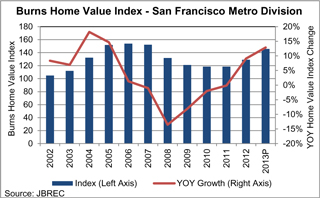

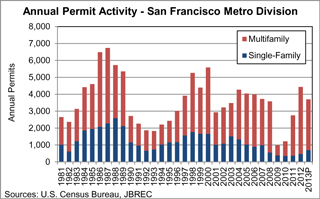

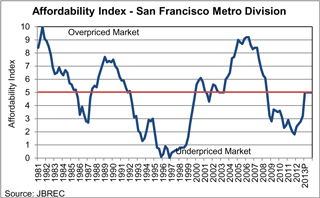

San Francisco, CA Housing Market Overview

The San Francisco Metropolitan Division consists of three counties: San Francisco, San Mateo and Marin. It is part of the larger San Francisco-Oakland-Hayward MSA, which also includes the East Bay counties of Alameda and Contra Costa. All three counties in the San Francisco Metropolitan Division are affluent and housing there tends to be expensive. Combined, the three counties have a population of more than 1.8 million. The San Francisco metro is mature and largely developed in core locations. Limited land supply and a tough land planning and approval environment restrict the supply of new homes. Homebuyers typically evaluate opportunities to buy higher density product closer-in, or commute to outlying locations for relative affordability and detached homes. Like many other markets, the San Francisco Metro experienced a housing correction; however, a major reason is that San Francisco’s economy was still struggling from the technology correction during the early parts of the national housing boom.

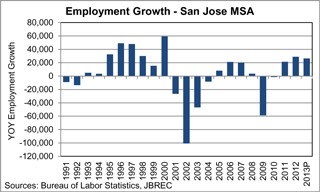

San Jose, CA Housing Market Overview

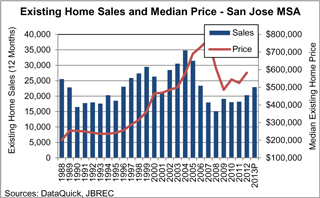

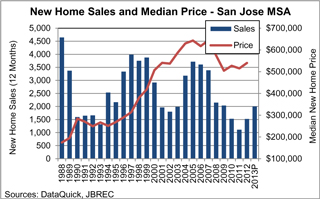

The San Jose MSA consists of Santa Clara and San Benito counties. With nearly 1.9 million people and 636,000 households, San Jose is one of the larger markets in the state of California. Widely regarded as a leading technology center, the metro area is home to many of the world’s foremost technology companies. The job growth from this South Bay market has a ripple effect on regional housing demand. The mix of housing in San Jose is shifting from a fairly balanced split between attached homes and single-family detached homes to a more attached-dominated market as the availability of land for detached housing is diminished, as well as political and environmental challenges.

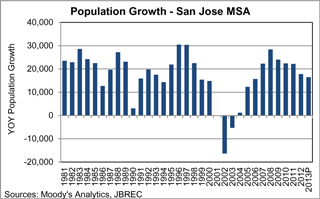

Unlike the years that followed the dot com bust in the early 2000s, San Jose has not witnessed a drop in population or households in the recent downturn. Growth has remained strong, with an average of 23,900 people (1.3% growth) added each year from 2007 through 2011, and an average of 8,400 households (1.4% growth) added annually. JBREC assumes population growth of approximately 16,500 people (0.9% growth) and household growth of approximately 7,100 households (1.1% growth) in 2013.

In summary, the housing fundamentals in San Jose are improving. The combination of solid job growth and a high-income employment base are positive for housing demand in this market, particularly as job growth outpaces the supply of new homes being added to the market. Low levels of existing home listings are creating a more competitive resale market, which should influence future home price appreciation.

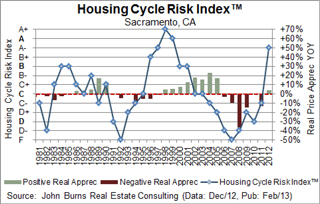

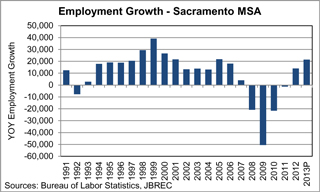

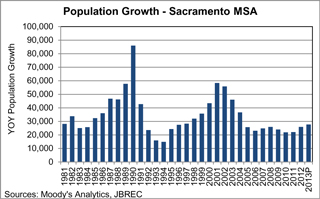

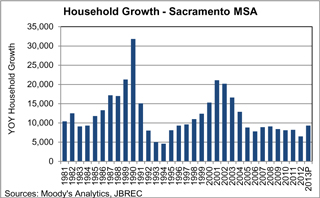

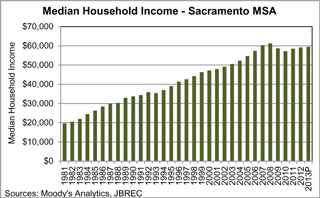

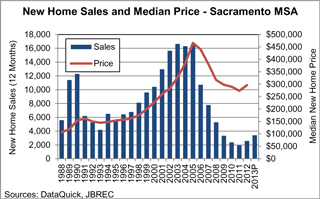

Sacramento, CA Housing Market Overview

The Sacramento-Arden-Arcade-Roseville metro consists of four counties: El Dorado, Placer, Sacramento and Yolo counties. Sacramento’s status as the capital of California provides a large employment basis for solid middle-class households. This is a major metro area with more than 2 million residents and more than 800,000 jobs, comparable to, for instance, greater Portland or Charlotte. Because of the relative availability of land and the low prices for housing in the area, this region experienced a great deal of construction and rapidly rising prices during the boom of the last decade. Sacramento has long been impacted by Bay Area commuters and relocations. High prices and a lack of developable land in the Bay Area traditionally push buyers into the greater Sacramento area, although that impact was muted during the housing downturn.

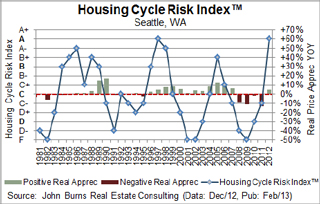

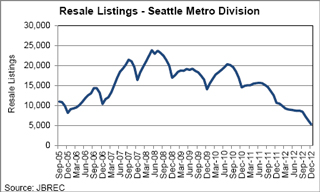

Seattle, WA Housing Market Overview

The Seattle metro division consists of King and Snohomish counties. With 2.73 million people and 1.09 million households, Seattle is the largest market in the state of Washington. The local economy is driven by a number of industries, including aerospace, as Boeing is headquartered in the metro division, and the high-tech sector, with companies such as Microsoft and Amazon.com located in the region.

Seattle has witnessed solid population and household growth, with an average of 39,600 people (1.5% growth) and 15,000 households (1.4% growth) added annually from 2008 through 2012. JBREC assumes slower population growth of approximately 34,100 people (1.2% growth) and slightly stronger household growth of 15,200 households (1.4% growth) in 2013.

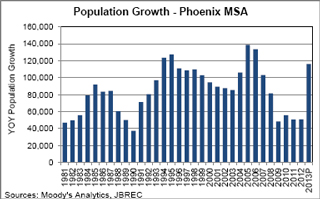

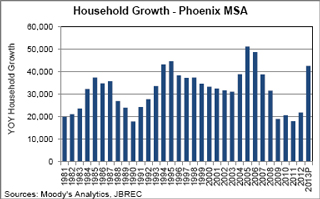

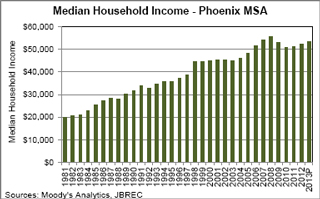

Phoenix, AZ Housing Market Overview

The Phoenix-Mesa-Glendale Metropolitan Area consists of Maricopa and Pinal counties. With 4.3 million people and 1.6 million households, Phoenix is the largest market in the state of Arizona. Phoenix is well-known as a retirement mecca and enjoys plenty of tourism, but is also ranked second in the country for solar power installations and is a manufacturing and distribution hub that operates at a 40% savings from California locations. Key cities in the MSA include Phoenix, Mesa, Scottsdale and Tempe.

Metro leaders are focused on development or expansion of several industry clusters, including renewable energy, biomedical/personalized medicine, advanced business services, manufacturing and distribution, data centers, emerging technology and aerospace and aviation. Several of these sectors capitalize on the many sunny, clear days each year and lower cost of doing business, which is reportedly 40% lower than California. Top employers include city, county and state government, Bank of America, Wells Fargo, Raytheon, Arizona State University and Apollo Group, which is the parent company for Phoenix University and many other accessible education programs.

Population and household growth slowed in Phoenix during the recession, with an average of 57,500 people (1.0% growth) and 22,240 households (1.5% growth) added annually from 2008 through 2012. JBREC assumes a return to strong population growth of approximately 116,300 people (2.7% growth) and strong household growth of 42,500 households (2.7% growth) in 2013.

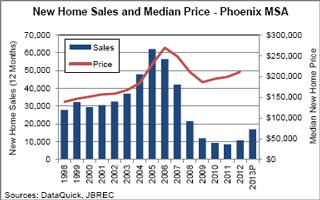

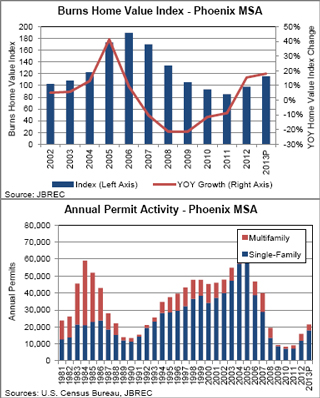

as consumers want to take advantage of low mortgage rates and great affordability. New homes typically have a pricing premium over resale homes, and that gap is growing again as housing recovers. DataQuick indicates the 2012 median price for new homes was $210,963. The median new home price rose 6.0% in 2012 after declining from the peak of $269,300 in 2006. The median new home price can be heavily influenced by the mix of home types being sold and, as a result, resale home prices are a better indication of market trends.

In summary, the Phoenix metropolitan area is recovering, with strong job growth that is fueling housing demand. Additional demand for homes by retirees and second-home buyers isn’t captured in the job growth metrics, which serve as a proxy for demand. Investors have also been active buyers in recent years, helping to clear much of the distress. Because resale and new home inventories are very limited, home prices are appreciating. Homebuilders are reporting very strong sales and improving pricing power, leading many to intentionally slow sales while working to open new sections or communities. Lot and land prices are escalating quickly.

| * | This market study was prepared for The New Home Company in connection with its initial public offering by John Burns Real Estate Consulting, LLC (“JBREC”) in March 2013 based on the most recent data available at that time. Founded in 2001, JBREC is an independent research provider and consulting firm focused on the housing industry. The market study contains forward-looking statements which are subject to uncertainty. |

The estimates, forecasts and projections prepared by JBREC are based upon numerous assumptions and may not prove to be accurate. This market study contains estimates, forecasts and projections that were prepared by JBREC, a real estate consulting firm. The estimates, forecasts and projections relate to, among other things, home value indices, payroll employment growth, median household income, housing permits and household formation. No assurance can be given that these estimates are, or that the forecasts and projections will prove to be, accurate. These estimates, forecasts and projections are based on data (including third-party data), significant assumptions, proprietary methodologies and the experience and judgment of JBREC. No assurance can be given regarding the accuracy or appropriateness of the assumptions and judgments made, or the methodologies used, by JBREC. The application of alternative assumptions, judgments or methodologies could result in materially less favorable estimates, forecasts and projections than those contained in this market study. Other real estate experts have different views regarding these forecasts and projections that may be more positive or negative, including in terms of the timing, magnitude and direction of future changes.

The forecasts and projections are forward-looking statements and involve risks and uncertainties that may cause actual results to be materially different from the projections. JBREC has made these forecasts and projections based on studying the historical and current performance of the residential housing market and applying JBREC’s qualitative knowledge about the residential housing market. The future is difficult to predict, particularly given that the economy and housing markets can be cyclical, subject to changing consumer and market psychology, and governmental policies related to mortgage regulations and interest rates. There will usually be differences between projected and actual outcomes, because events and circumstances frequently do not occur as expected, and the differences may be material. Accordingly, the forecasts and projections included in this market study might not occur or might occur to a different extent or at a different time. For the foregoing reasons, JBREC cannot provide any assurance that the estimates, forecasts and projections contained in this market study are accurate, actual outcomes may vary significantly from those contained or implied by the forecasts and projections, and you should not place undue reliance on these estimates, forecasts and projections.

SEPARATION PAGE

| Company Name |

2012 Cancellation Rate |

|||

| KB Home |

31.0 | % | ||

| Beazer Homes USA, Inc. |

27.3 | % | ||

| D.R. Horton, Inc. |

24.3 | % | ||

| M.D.C. Holdings, Inc. |

22.8 | % | ||

| Hovnanian Enterprises, Inc. |

20.4 | % | ||

| The Ryland Group, Inc. |

19.0 | % | ||

| Lennar Corporation |

17.7 | % | ||

| M/I Homes Inc. |

17.2 | % | ||

| PulteGroup, Inc |

15.4 | % | ||

| NVR, Inc. |

14.4 | % | ||

| Meritage Homes Corp |

13.5 | % | ||

| Standard Pacific Corp. |

13.3 | % | ||

| Toll Brothers Inc. |

4.2 | % | ||

|

|

|

|||

| Average |

18.5 | % | ||

|

|

|

|||

Source: Company Filings

1/1

COMMENT 38

to the Staff’s letter of May 15, 2013

and

COMMENT 10

to the Staff’s letter of June 7, 2013

AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT

OF

THE NEW HOME COMPANY LLC

TABLE OF CONTENTS

| ARTICLE I. DEFINITIONS |

1 | |||||||

| 1.1 |

Certain Definitions |

1 | ||||||

| 1.2 |

Terms Generally |

10 | ||||||

| ARTICLE II. THE COMPANY AND ITS BUSINESS |

11 | |||||||

| 2.1 |

Company Name |

11 | ||||||

| 2.2 |

Term |

11 | ||||||

| 2.3 |

Filing of Certificate and Amendments |

11 | ||||||

| 2.4 |

Purpose and Business; Powers; Scope of Members’ Authority |

11 | ||||||

| 2.5 |

Principal Office; Registered Agent |

12 | ||||||

| 2.6 |

Names and Addresses of Members |

12 | ||||||

| 2.7 |

Representation and Warranty |

12 | ||||||

| ARTICLE III. MANAGEMENT OF COMPANY BUSINESS; MAJOR DECISIONS |

13 | |||||||

| 3.1 |

Management and Control |

13 | ||||||

| 3.2 |

Decisions Requiring Approval of the Board of Managers |

13 | ||||||

| 3.3 |

Board of Managers |

19 | ||||||

| 3.4 |

Members Shall Not Have Power to Bind Company |

20 | ||||||

| ARTICLE IV. RIGHTS AND DUTIES OF MEMBERS/TAX MATTERS MEMBER/PURCHASE OPTION |

21 | |||||||

| 4.1 |

Use of Company Property |

21 | ||||||

| 4.2 |

Member Voting Rights |

21 | ||||||

| 4.3 |

Member Meetings |

21 | ||||||

| 4.4 |

Exculpation and Indemnification |

22 | ||||||

| 4.5 |

Competing Activities |

23 | ||||||

| 4.6 |

Designation of Tax Matters Partner |

23 | ||||||

i

| 4.7 |

Insurance Requirements |

24 | ||||||

| 4.8 |

Purchase Option |

24 | ||||||

| ARTICLE V. CAPITAL CONTRIBUTIONS AND MEMBER LOANS |

26 | |||||||

| 5.1 |

Previous Capital Contributions of TNHC Partners |

26 | ||||||

| 5.2 |

Required Capital Contributions of TNHC Partners, IHP and Watt |

26 | ||||||

| 5.3 |

Additional Capital Contributions |

28 | ||||||

| 5.4 |

No Interest |

28 | ||||||

| 5.5 |

Member Loans |

28 | ||||||

| 5.6 |

Liability of Members |

29 | ||||||

| 5.7 |

Return of Capital Contribution |

29 | ||||||

| ARTICLE VI. CAPITAL ACCOUNTS, PROFITS AND LOSSES AND ALLOCATIONS |

29 | |||||||

| ARTICLE VII. DISTRIBUTIONS OF AVAILABLE CASH |

29 | |||||||

| 7.1 |

Distributions of Available Cash from Extraordinary Transactions |

29 | ||||||

| 7.2 |

Distributions of Available Cash other than Available Cash arising from Extraordinary Transactions |

29 | ||||||

| 7.3 |

Minimum Distributions |

30 | ||||||

| ARTICLE VIII. TRANSFER OF COMPANY INTERESTS |

30 | |||||||

| 8.1 |

Limitations on Assignments of Interests by Members |

30 | ||||||

| 8.2 |

Assignment Binding on Company |

31 | ||||||

| 8.3 |

Substituted Members |

31 | ||||||

| 8.4 |

Acceptance of Prior Acts |

32 | ||||||

| 8.5 |

Additional Limitations |

32 | ||||||

| ARTICLE IX. TERMINATION OF COMPANY; LIQUIDATION AND DISTRIBUTION OF ASSETS |

32 | |||||||

| 9.1 |

Dissolution and Termination |

32 | ||||||

| 9.2 |

Distribution Upon Liquidation |

33 | ||||||

ii

| 9.3 |

Sale of Company Assets |

33 | ||||||

| ARTICLE X. RECAPITALIZATION AND LIQUIDITY EVENTS |

34 | |||||||

| 10.1 |

Admission of Initial New Member |

34 | ||||||

| 10.2 |

Recapitalization |

34 | ||||||

| 10.3 |

Liquidity Events |

35 | ||||||

| ARTICLE XI. BOOKS, RECORDS AND REPORTS |

35 | |||||||

| 11.1 |

Books of Account |

35 | ||||||

| 11.2 |

Monthly Reporting |

35 | ||||||

| 11.3 |

Financial Reports and Statements |

36 | ||||||

| 11.4 |

Accounting Expenses |

36 | ||||||

| 11.5 |

Bank Accounts |

36 | ||||||

| ARTICLE XII. EVENTS OF DEFAULT; REMEDIES; ADJUSTMENT TO “PROMOTE” |

36 | |||||||

| 12.1 |

Default |

36 | ||||||

| 12.2 |

Remedies |

37 | ||||||

| 12.3 |

Adjustment to TNHC Partners “Promote” |

37 | ||||||

| ARTICLE XIII. INVESTMENT REPRESENTATIONS |

38 | |||||||

| 13.1 |

Representations |

38 | ||||||

| ARTICLE XIV. GENERAL |

39 | |||||||

| 14.1 |

Further Assurances |

39 | ||||||

| 14.2 |

Notices |

39 | ||||||

| 14.3 |

Headings and Captions |

40 | ||||||

| 14.4 |

Variance of Pronouns |

40 | ||||||

| 14.5 |

Counterparts |

40 | ||||||

| 14.6 |

Governing Law; Choice of Forum |

40 | ||||||

| 14.7 |

Partition |

40 | ||||||

iii

| 14.8 |

Invalidity |

40 | ||||||

| 14.9 |

Successors and Assigns |

40 | ||||||

| 14.10 |

Legal Representation and Construction |

41 | ||||||

| 14.11 |

Amendment |

41 | ||||||

| 14.12 |

Entire Agreement |

41 | ||||||

| 14.13 |

Confidentiality |

41 | ||||||

| 14.14 |

Time of the Essence |

42 | ||||||

| 14.15 |

No Third Party Beneficiaries |

42 | ||||||

| 14.16 |

Exculpation |

42 | ||||||

| 14.17 |

Public Announcements |

42 | ||||||

| EXHIBIT A |

CAPITAL STRUCTURE | |

| EXHIBIT B |

EXISTING OFFICERS | |

| EXHIBIT C |

INSURANCE REQUIREMENTS | |

| EXHIBIT D |

FORM OF ASSIGNMENT OF MEMBERSHIP INTEREST | |

| EXHIBIT E |

FORM OF CERTIFICATE OF REPRESENTATIONS AND WARRANTIES | |

| APPENDIX “1” |

TAX APPENDIX | |

| SCHEDULE 1 |

APPRAISAL PROCEDURES | |

iv

AMENDED AND RESTATED

LIMITED LIABILITY COMPANY AGREEMENT

OF

THE NEW HOME COMPANY LLC

This Amended and Restated Limited Liability Company Agreement (this “Agreement”) of The New Home Company LLC, a Delaware limited liability company (the “Company”), is entered into as of August 18, 2010 by TNHC Partners LLC, a Delaware limited liability company (“TNHC Partners”), IHP Capital Partners VI, LLC, a Delaware limited liability company (“IHP”), and Watt/TNHC LLC, a California limited liability company (“Watt”) as the members (each a “Member” and collectively the “Members”) of the Company, with reference to the following facts:

A. The Certificate of Formation (the “Certificate”) of the Company was filed on June 25, 2009 with the Delaware Secretary of State.

B. The Limited Liability Company of The New Home Company LLC (the “Original Agreement”) was entered into as of August 26, 2009 by TNHC Partners as the sole Member.

C. Concurrently with the execution hereof, IHP and Watt are admitted as Members of the Company.

D. The Members now desire to amend and restate in its entirety the Original Agreement.

NOW, THEREFORE, in order to carry out their intent as expressed above and in consideration of the mutual agreements hereinafter contained, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby covenant and agree, and amend and restate the Original Agreement in its entirety, as follows:

ARTICLE I.

DEFINITIONS

1.1 Certain Definitions. As used in this Agreement and the Exhibits hereto, the following terms shall have the meanings set forth below:

“Act” shall mean the Delaware Limited Liability Company Act (6 Del. C. §18- 101 et seq.), as amended from time to time.

“Affiliate” shall mean with respect to any Person (i) any other Person that directly or indirectly through one or more intermediaries controls or is controlled by or is under common control with such Person, (ii) any other Person owning or controlling 10% or more of the outstanding voting securities of, or other ownership interests in, such Person, (iii) any officer, director or member of such Person and (iv) if such Person is an officer, director or member of any. company, the company (other than the Company and the Subsidiaries) for which such

Person acts in any such capacity. For purposes of this definition, “control,” when used with respect to any Person, means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

“Appraisal Notice” shall have the meaning set forth in Section 4.8.

“Appraised Value” shall mean the value of the Company assets as determined pursuant to the procedures set forth in Schedule 1 attached hereto less all Assumed Transaction Costs.

“Appraised Value Price” shall mean the amount of cash (which may not be less than zero) that would be distributed on account of the Departing Member’s Interest if the Company were dissolved and liquidated in accordance with this Agreement as if the Company assets were sold for their Appraised Value on the applicable Value Date.

“Appraised Value Sale Price Notice” shall mean a notice delivered by the Company to the Members setting forth the Appraised Value Price for the sale of any Interest in accordance with Section 4.8 of this Agreement.

“Approved Environmental Parameters” means that, subject to the following provisions and restrictions, the Company will prudently accept environmental exposure and potential liability in a manner consistent with overall industry standards applicable to homebuilders acting in a like manner under similar circumstances. Further, “Approved Environmental Parameters” means that the Company will not make investments in Properties with adverse environmental conditions unless: (i) the dollar value of the environmental risk associated with such environmental condition has been quantified (the parties acknowledging that any such quantification shall only be a good faith estimate and may not ultimately prove accurate); (ii) the cost of the Environmental Remediation of such environmental condition has been quantified (the parties acknowledging that any such quantifications shall only be good faith estimates and may not ultimately prove accurate); (iii) the environmental liability can be mitigated with measures already in place or to be implemented by the Company to effectively mitigate the risks to the Company associated with such environmental condition and projected to result in risk-adjusted rates of return contemplated by the Property’s proforma (the parties acknowledging that any such projections shall only be good faith estimates and may not ultimately prove accurate); (iv) any such potential environmental liability associated with such environmental condition is structured to be limited to only the entity holding title to the Property affected by such environmental condition, provided, however, that the Company and/or any Subsidiary may indemnify lenders, master developers and landowners against environmental liability in connection with the acquisition and financing of Properties; and (v) investing in the Property affected by such environmental condition does not expose the Company or any of its other assets to any potential liability beyond its investment (including without limitation equity, debt and related obligations such as guarantor liability and indemnitor liability) in the entity holding title to the Property affected by such environmental condition. In addition, “Approved Environmental Parameters” means that all environmental risks associated with such environmental condition will be appropriately mitigated by factors that may include, but are not

2

limited to, specific Environmental Remediation, environmental insurance, indemnifications by creditworthy indemnitors, agreements with regulatory authorities, and the legal structure of ownership, all as determined by the Board of Managers. The appropriate level of environmental risks to be assumed and the appropriate mitigation measures to be employed shall be detailed in environmental guidelines and procedures to be adopted and maintained by the Board of Managers.

“Assumed Transaction Costs” shall mean the costs related to a customary and ordinary closing and related transaction costs that would normally be incurred in a sale of the Company assets. The Assumed Transaction Costs may include, to the extent applicable, brokers’ commissions, attorneys’ and accountants’ fees, escrow fees, and transfer taxes; provided, however, that in no event shall the Assumed Transaction Costs exceed two percent (2%) of the Current Book Value or Appraised Value, as applicable, of the Company prior to subtracting the Assumed Transaction Costs.

“Available Cash” shall mean, for any fiscal period, the excess, if any, of:

(A) the sum of (i) the amount of all cash receipts of the Company during such period from whatever source and (ii) any cash reserves of the Company existing at the start of such period over

(B) the sum of (x) all cash amounts paid or payable (without duplication) in such period on account of expenses and capital expenditures incurred in connection with the operation of the Company’s business (including, without limitation, general operating expenses, taxes and then due principal, amortization, fees, costs or interest on any debt of the Company, and (y) such cash reserves which may be required for the working capital and future needs of the Company in an amount approved by the Board of Managers.

“Bankruptcy” shall mean, with respect to the affected party, (i) the adjudication that such party is bankrupt or insolvent, or the entry of a final and nonappealable order for relief under the United States Code or any other applicable federal or state bankruptcy or insolvency law, (ii) the admission by such party of its inability to pay its debts as they mature, (iii) the making by it of an assignment for the benefit of creditors, (iv) the filing by it of a petition in bankruptcy or a petition for relief under the United States Code or any other applicable federal or state bankruptcy or insolvency law, (v) the expiration of sixty (60) days after the filing of an involuntary petition under of the United States Code, an application for the appointment of a receiver for the assets of such party, or an involuntary petition seeking liquidation, reorganization, arrangement or readjustment of its debts under any other federal or state insolvency law, provided that the same shall not have been vacated, set aside or stayed within such sixty (60)-day period, (vi) the imposition of a judicial or statutory lien on all or a substantial part of its assets unless such lien is discharged or vacated or the enforcement thereof stayed within sixty (60) days after its effective date, (vii) the filing by such party of an answer or other pleading admitting or failing to contest the material allegations of a petition filed against it in any proceeding of the nature described in clause (v) above, and (viii) the expiration of sixty (60) days after the commencement of any stay referred to in clause (v) or (vi) above, provided that the subject of such stay shall not have been vacated or set aside within such sixty (60)-day period.

3

“Board of Managers” shall mean, collectively, the Appointed Representatives appointed pursuant to Section 3.3.

“Board of Managers Impasse” shall exist if the Appointed Representative(s) of any Member (the “Impasse Member”) shall block the Required Board Approval of one or more of the Major Decisions set forth in Sections 3.2(b)(v)-(ix) and/or (xi)-(xxx) on three (3) or more occasions during any twelve (12) consecutive month period by voting no when all of the other Members entitled to vote thereon vote affirmatively.

“Book Value Price” shall mean the amount of cash (which may not be less than zero) that would be distributed on account of the Departing Member’s Interest if the Company were dissolved and liquidated in accordance with this Agreement as if the Company was sold for its then Current Book Value on the applicable Value Date.

“Book Value Sale Price Notice” shall mean a notice delivered by the Company to the Members setting forth the Book Value Price for the sale of any Interest in accordance with Section 4.8 of this Agreement.

“Breach of Due Care” means a failure to act in good faith, in the best interests of the Company, for the exclusive benefit of the Company, in compliance with the terms of this Agreement, without fraud, gross negligence or willful misconduct, and with the care, skill, prudence and diligence (including diligent inquiry) under the circumstances then prevailing that a prudent real estate professional experienced in such matters would use in the conduct of an enterprise of like character with like aims, which failure (except in the case of fraud or willful misconduct which are not subject to cure rights) has not been cured prior to the expiration of thirty (30) days from receipt of written notice of such default from the Company, and provided, further, that if such default is of a nature that cannot be cured within such thirty (30) day period that the cure is commenced within such thirty (30) day period and is diligently and continuously pursued to completion, such additional period for completion not to exceed sixty (60) days.

“Budget Year” shall mean each of a period beginning on January 1, 2010 and ending on December 31, 2010 and any successive calendar period thereafter.

“Business Day” shall mean any day other than a Saturday, Sunday or any other day on which banks in California are required or permitted to be closed.

“Business Plan” shall mean the annual master business plan for the Company which shall include the following:

(a) a narrative description of the Company’s anticipated business activities for the Budget Year and the following three (3) calendar years thereafter;

(b) a consolidated projection of net income and cash flow of the Company for the Budget Year and the following three (3) calendar years thereafter along with a projected balance sheet as of the end of the Budget Year and the end of the following three (3) calendar years thereafter, together with schedules summarizing projected unit activity for each respective year;

4

(c) for each Property, a projection of net income and cash flow for the Budget Year through the projected completion of the development and sale of the Property with a projected balance sheet as of the end of the Budget Year and the end of the following three (3) calendar years thereafter; and

(c) for the headquarters office and each Subsidiary of the Company, a schedule of projected general and administrative expenses and a schedule of projected capital expenditures.

Each new Business Plan for each Budget Year shall be submitted to the Board of Managers no later than November 15 of the year preceding each calendar year. The Business Plan may be amended or replaced from time to time with the approval of the Board of Managers. The Members acknowledge that the Company’s Business Plan for 2010 has been approved.

The Company shall not materially deviate from the approved Business Plan without approval of the Board of Managers; provided that if a Major Decision approved by the Board of Managers constitutes a material deviation from the existing approved Business Plan, no further approval shall be required for such deviation.

“Capital Contribution” when used with respect to any Member shall mean the amount of capital contributed by such Member to the Company in accordance with Sections 5.1 and 5.2.

“Capital Percentages” means the respective proportionate capital percentages of the Members set forth on Exhibit A attached hereto, that is, 33 1/3% with respect to TNHC Partners, 33 1/3% with respect to IHP and 33 1/3% with respect to Watt, subject to adjustment as set forth herein.

“Certificate of Formation” shall mean the Certificate of Formation of the Company which has been filed with the State of Delaware, as the same may hereafter be amended and/or restated from time to time.

“Chief Executive Officer” shall mean Mr. H. Lawrence Webb in his capacity as Chief Executive Officer of the Company, and any successor(s) to Mr. Webb appointed by the Board of Managers in accordance with the terms of this Agreement.

“Closing” shall have the meaning set forth in Section 4.8.

“Closing Date” shall have the meaning set forth in Section 4.8.

“Code” shall have the meaning ascribed thereto by the Tax Appendix attached hereto as Appendix “1”.

“Company Assets” shall mean all right, title and interest of the Company in and to the assets of the Company and any property (real or personal) or estate acquired in exchange therefor or in connection therewith.

5