December 12, 2016

Dear Evogene Shareholders:

You are cordially invited to attend a Special General Meeting of Shareholders, or the Meeting, which will be held at 3:00 p.m. (Israel time) on Tuesday, January 17, 2017, at our offices at 13 Gad Feinstein Street, Park Rehovot, Rehovot 7612002, Israel. At the Meeting, the following proposals will be on the agenda:

(1) To re-elect Ms. Sarit Firon to serve as a member of the board of directors of the Company, or the Board, until the 2017 annual general meeting of shareholders of the Company, and until her successor is duly qualified.

(2) To approve an updated compensation policy for the directors and other office holders of our Company, or the Compensation Policy, in accordance with the requirements of the Israeli Companies Law, 5759-1999, or the Companies Law.

(3) To approve an initial grant of options to purchase 10,000 of our ordinary shares, par value NIS 0.02 per share, or ordinary shares, and subsequent annual grants of options to purchase 2,500 of our ordinary shares, to Ms. Sarit Firon (subject to her re-election pursuant to Proposal 1), in accordance with the grant mechanism described in the Compensation Policy and subject to the terms thereof (including continued service by her on the Board).

The Board has unanimously approved the above proposals, and recommends that you vote in favor thereof.

Approval of each proposal above requires the affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting on the proposal. In addition, the approval of Proposal 2 is subject to satisfaction of one of the following, additional voting requirements:

|

· |

the majority voted in favor of the proposal must include a majority of the shares held by non-controlling shareholders who do not have a conflict of interest (referred to as a “personal interest” under the Companies Law) in the approval of the proposal that are voted at the Meeting, excluding abstentions; or

|

|

· |

the total number of shares held by non-controlling, non-conflicted shareholders (as described in the previous bullet-point) voted against the proposal must not exceed two percent (2%) of the aggregate voting rights in the Company.

|

For purposes of the above special voting requirements, to the best of our knowledge, there are no shareholders who would be deemed “controlling shareholders” of our Company under the Companies Law.

The attached proxy statement further describes the proposals to be considered at the Meeting. That proxy statement and the enclosed proxy card are being furnished to the Securities and Exchange Commission, or the SEC, in a Report of Foreign Private Issuer on Form 6-K, which may be obtained for free from the SEC’s website at www.sec.gov and from our website at http://investors.evogene.com/sec-filings.aspx. The proxy statement and proxy card are also available on MAGNA, the distribution site of the Israeli Securities Authority, at www.magna.isa.gov.il, and may furthermore be obtained by contacting our company at 13 Gad Feinstein Street, Park Rehovot, P.O.B. 2100, Rehovot 7612002, Israel, Attention: Merav Shaul Shalem, Legal Advisor and Sassi Masliah, Company Secretary, facsimile number 972-8-9466724, e-mail address: meravs@evogene.com.

Your vote is important to us. If you are unable to attend the Meeting in person, we request that you submit your vote in one of the manners described in the attached proxy statement.

If you are a shareholder of record and vote via a proxy card that you mail to our United States transfer agent, American Stock Transfer & Trust Company, if you properly execute it, it will be voted in the manner directed by you. If no direction is made, your proxy will be voted “FOR” Proposals 1 and 3 on the agenda, but will not be voted with respect to Proposal 2 (due to the special voting requirements related to that proposal). If you attend the Meeting, you may vote in person and may cancel your proxy. Detailed proxy voting instructions are provided both in the enclosed proxy statement and on the enclosed proxy card.

| |

By order of the Board of Directors,

|

| |

|

| |

/s/ Martin S. Gerstel

|

| |

Martin S. Gerstel

|

| |

Chairman of the Board

|

EVOGENE LTD.

13 Gad Feinstein St.

Park Rehovot P.O.B 2100

Rehovot 7612002, Israel

__________________________

PROXY STATEMENT

_________________________

SPECIAL GENERAL MEETING OF SHAREHOLDERS

This Proxy Statement is being furnished in connection with the solicitation of proxies on behalf of the Board of Directors, or the Board, of Evogene Ltd., to which we refer as Evogene or the Company, to be voted at a Special General Meeting of Shareholders of the Company, or the Meeting, and at any adjournment thereof, pursuant to the Notice of Special General Meeting of Shareholders that was published by the Company on December 12, 2016. The Meeting will be held at 3:00 p.m. (Israel time) on Tuesday, January 17, 2017 at our offices at 13 Gad Feinstein Street, Park Rehovot, Rehovot 7612002, Israel.

This Proxy Statement, the attached cover letter from our Chairman of the Board, and the enclosed proxy card or voting instruction form are being distributed to holders of Evogene ordinary shares, par value NIS 0.02 per share, or ordinary shares, on or about December 21, 2016.

You are entitled to vote at the Meeting if you held ordinary shares as of the close of business on Friday, December 16, 2016, the record date for the Meeting (to which we sometimes refer as the Record Date). You can vote your shares by attending the Meeting or by following the instructions under “How You Can Vote” below. Our Board urges you to vote your ordinary shares so that they will be counted at the Meeting or at any postponements or adjournments of the Meeting.

Agenda Items

The following proposals are on the agenda for the Meeting:

(1) Re-election of Ms. Sarit Firon to serve as director of the Company until the 2017 annual general meeting of shareholders of the Company, and until her successor is duly qualified.

(2) Approval of an updated compensation policy for the directors and other office holders of our Company, or the Compensation Policy, in accordance with the requirements of the Israeli Companies Law, 5759-1999, or the Companies Law.

(3) Approval of an initial grant of options to purchase 10,000 of our ordinary shares, and subsequent annual grants of options to purchase 2,500 of our ordinary shares, to Ms. Sarit Firon (subject to her re-election pursuant to Proposal 1), in accordance with the grant mechanism described in the Compensation Policy and subject to the terms thereof (including continued service by her on the Board).

We will also transact such other business as may properly come before the Meeting or any postponement or adjournment thereof.

Board Recommendation

Our Board unanimously recommends that you vote “FOR” each of the above proposals.

Quorum

As of the close of business on December 8, 2016 we had 25,480,809 ordinary shares issued and outstanding. Each ordinary share outstanding as of the Record Date is entitled to one vote upon each of the proposals to be presented at the Meeting. Under our Articles of Association, as amended, or the Articles, the Meeting will be properly convened if at least two shareholders attend the Meeting in person or submit proxies, provided that they hold shares representing at least twenty-five percent (25%) of the voting power in the Company. If such quorum is not present within one-half hour from the time scheduled for the Meeting, the Meeting will be adjourned for one week, to the same day, time and place, or to such other date, time and place that may be determined by our Board and for which notice is provided to our shareholders. If shares possessing 25% of the voting power in the Company are not present for the adjourned meeting, any one shareholder attending in person or by proxy will constitute a quorum, regardless of the number of shares held, or voting power possessed, by such shareholder.

Vote Required for Approval of the Proposals

The affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon (which excludes abstentions) is necessary for the approval of each proposal.

In addition, the approval of Proposal 2 is subject to satisfaction of one of the following, additional voting requirements:

|

· |

the majority voted in favor of the proposal must include a majority of the shares held by non-controlling shareholders who do not have a conflict of interest (referred to under the Companies Law as a personal interest) in the approval of the proposal that are voted at the Meeting, excluding abstentions; or

|

|

· |

the total number of shares held by non-controlling, non-conflicted shareholders (as described in the previous bullet-point) voted against the proposal must not exceed two percent (2%) of the aggregate voting rights in the Company.

|

Under the Companies Law, a “controlling shareholder” is any shareholder that has the ability to direct a company’s activities (other than by means of being a director or other office holder of the company). A person is presumed to be a controlling shareholder if it holds or controls, by itself or together with others, one-half or more of any one of the “means of control” of a company. “Means of control” is defined as any one of the following: (i) the right to vote at a general meeting of the company, or (ii) the right to appoint directors of the company or its chief executive officer. For purposes of the above special voting requirements, to the best of our knowledge, there are no shareholders who would be deemed “controlling shareholders” of our Company.

A “personal interest” of a shareholder under the Companies Law (i) includes an interest of any member of the shareholder’s immediate family (i.e., spouse, sibling, parent, parent’s parent, descendent, the spouse’s descendent, sibling or parent, and the spouse of any of those) or an interest of an entity with respect to which the shareholder (or such a family member thereof) serves as a director or the chief executive officer, owns at least 5% of the shares or its voting rights or has the right to appoint a director or the chief executive officer; and (ii) excludes an interest arising solely from the ownership of shares of the Company. In determining whether a vote cast by proxy is disinterested, the “personal interest” of the proxy holder is also considered and will cause that vote to be excluded from the disinterested vote, even if the shareholder granting the proxy does not have a personal interest in the matter being voted upon.

A controlling shareholder and a shareholder that has a conflict of interest are qualified to participate in the vote on Proposal 2; however, the vote of such shareholders may not be counted towards the majority requirement described in the first bullet point above and will not count towards the 2% threshold described in the second bullet point above.

A shareholder must inform our Company before the vote (or if voting by proxy, indicate on the proxy card) whether or not such shareholder has a conflict of interest, and failure to do so disqualifies the shareholder from participating in the vote on Proposal 2. In order to confirm that you lack a conflict of interest in the approval of such proposal and in order to therefore be counted towards the special majority required for the approval of such proposal, you must check the box for Item 2A on the accompanying proxy card when you record your vote on Proposal 2.

If you believe that you, or a related party of yours, is a controlling shareholder or has such a conflict of interest and you wish to participate in the vote on Proposal 2, you should not check the box for Item 2A on the enclosed proxy card and you should not vote on Proposal 2 via the proxy card. Instead, you should contact our Company’s Corporate Secretary at +972-8-9311971 or fax: +972-8-9466724, who will provide you with a separate proxy card that is designed for you so that you can submit your vote on Proposal 2. In that case, your vote will be counted towards the ordinary majority required for the approval of Proposal 2, but will not be counted towards the special majority required for approval of that proposal. If you hold your shares in “street name” (i.e., shares that are held through a bank, broker or other nominee) and believe that you, or a related party of yours, is a controlling shareholder or has a conflict of interest in the approval of either such proposal, you should contact the representative managing your account, who should then contact our Corporate Secretary on your behalf.

Who Can Vote

You are entitled to vote at the Meeting if you are a shareholder of record at the close of business on Friday, December 16, 2016, the Record Date. You are also entitled to vote at the Meeting if you held ordinary shares through a bank, broker or other nominee that is one of our shareholders of record at the close of business on December 16, 2016, or which appear in the participant listing of a securities depository on that date.

Shareholders of Record

If you are a shareholder of record (that is, you hold a share certificate that is registered in your name or your shares are registered in your name in book-entry form in the Direct Registration System), you can submit your vote by completing, signing and submitting (in the enclosed envelope) a proxy card, which has or will be sent to you and which will be accessible at the “Investor Relations” portion of the Company’s website, as described below under “Availability of Proxy Materials”. You may change your mind and cancel your proxy card by sending us written notice, by signing and returning a proxy card with a later date, or by voting in person or by proxy at the Meeting. Except if the Chairman of the Meeting determines otherwise, we will not be able to count a proxy card unless we receive it at our principal executive offices at the above address office at least four hours prior to the appointed time of the Meeting (that is, by 11:00 a.m., Israel time, on Tuesday, January 17, 2017). If you mail your proxy card to our registrar and transfer agent in the enclosed envelope, it must be received by it by midnight, Eastern time, on Monday, January 16, 2017 (which is 7:00 a.m., Israel time, on Tuesday, January 17, 2017) to be validly included in the tally of ordinary shares voted at the Meeting.

Please follow the instructions on the proxy card. If you provide specific instructions (by marking a box) with regard to the proposals, your shares will be voted as you instruct. If you sign and return your proxy card without giving specific instructions with respect to Proposals 1 or 3, your shares will be voted in accordance with the recommendation of the Board in favor of those proposals. The persons named as proxies in the enclosed proxy card will furthermore vote in accordance with the recommendation of the Board on any other matters that properly come before the Meeting. If no direction is made with respect to Proposal 2, your proxy will not be voted on that proposal (due to the special voting requirements for that proposal under Israeli law).

Shareholders Holding in “Street Name” in the United States

If you hold ordinary shares in “street name” in the United States, that is, you are an underlying beneficial holder who holds ordinary shares through a bank, broker or other nominee, the voting process will be based on your directing the bank, broker or other nominee to vote the ordinary shares in accordance with your voting instructions (by completing and mailing the enclosed proxy card or voting instruction form). If no instructions are received by the bank, broker or other nominee from you with respect to Proposals 1, 2 or 3 on or before the date established for such purpose, the bank, broker or other nominee will not vote your ordinary shares (commonly referred to as a “broker non-vote”).

Where a beneficial owner has executed and returned a proxy card, but has not provided voting instructions with respect to any proposals, and the broker, trustee or nominee may not cast a vote with respect to particular proposals (which is also referred to as a “broker non-vote”), the shares held by the beneficial owner will be included in determining the presence of a quorum at the Meeting, but are not considered “present” for the purpose of voting on those particular proposals. Such shares therefore have no impact on the outcome of the voting on those particular proposals.

Shareholders Holding in “Street Name,” Through the TASE

If you hold ordinary shares in “street name” in Israel, that is, through a bank, broker or other nominee that is admitted as a member of the Tel-Aviv Stock Exchange, or the TASE, your shares will only be voted if you provide instructions to the bank, broker or other nominee as to how to vote, or if you attend the Meeting in person.

If voting by mail, you must sign and date a proxy card in the form filed by us on MAGNA on December 12, 2016 and attach to it a proof of ownership certificate (“ishur ba’alut”) from the TASE Clearing House member through which the shares are held indicating that you were the beneficial owner of the shares on the Record Date (December 16, 2016). Please then deliver or mail (via registered mail) your completed proxy and proof of ownership certificate to our offices at 13 Gad Feinstein St, Park Rehovot P.O.B 2100, Rehovot 7612002, Israel, Attention: Merav Shaul Shalem, Legal Advisor.

If you choose to attend the Meeting (where ballots will be provided), you must bring the proof of ownership certificate. If you seek to change or revoke your voting instructions, you must contact the broker.

In the alternative, you may vote via the electronic voting system established by the Israel Securities Authority for shareholder meetings of Israeli companies whose shares are listed on the TASE via its MAGNA online platform. Shareholders are able to vote their shares through the system, following a registration process, no later than six hours before the time fixed for the Meeting (that is, by 9:00 a.m., Israel time, on January 17, 2017). Shareholders may revoke any electronic vote by voting through the electronic voting system on a later date (such later date must precede the date of the Meeting), or by voting in person at the Meeting.

Multiple Record Shareholders or Accounts

You may receive more than one set of voting materials, including multiple copies of this document and multiple proxy cards or voting instruction forms. For example, shareholders who hold ordinary shares in more than one brokerage account will receive a separate proxy card or voting instruction form for each brokerage account in which shares are held. Shareholders of record whose shares are registered in more than one name will receive more than one proxy card. You should complete, sign, date and return each proxy card or voting instruction form that you receive in order to ensure that all shares that you own are voted.

Solicitation of Proxies

Proxies are being distributed to shareholders on or about December 21, 2016. Certain officers, directors, employees, and agents of the Company, none of whom will receive additional compensation therefor, may solicit proxies by telephone, emails, or other personal contact. We will bear the cost for the solicitation of the proxies, including postage, printing, and handling, and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of shares.

Availability of Proxy Materials

Copies of the proxy card, the notice of the Meeting, and this Proxy Statement (including the cover letter hereto) are available at the “Investor Relations” portion of our Company’s website, http://investors.evogene.com/sec-filings.aspx. The contents of that website are not a part of this Proxy Statement.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our ordinary shares as of December 12, 2016 by:

| |

●

|

each person or entity known by us to own beneficially more than 5% of our outstanding shares

|

| |

●

|

each of our directors and executive officers individually; and

|

| |

●

|

all of our executive officers and directors as a group.

|

The beneficial ownership of ordinary shares is determined in accordance with the rules of the U.S. Securities and Exchange Commission, or SEC, and generally includes any ordinary shares over which a person exercises sole or shared voting or investment power, or the right to receive the economic benefit of ownership. For purposes of the table below, we deem shares subject to options that are currently exercisable or exercisable within 60 days of December 12, 2016 to be outstanding and to be beneficially owned by the person holding the options or warrants for the purposes of computing the percentage ownership of that person but we do not treat them as outstanding for the purpose of computing the percentage ownership of any other person. The percentage of shares beneficially owned is based on 25,480,809 ordinary shares outstanding as of December 12, 2016.

Unless otherwise noted below, each shareholder’s address, for this purpose, is c/o Evogene Ltd., 13 Gad Feinstein Street, Park Rehovot, P.O.B 2100, Rehovot 7612002, Israel.

|

|

Shares Beneficially Held

|

|

|

Name of Beneficial Owner

|

|

Number

|

|

|

Percentage of Class

|

|

|

Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

Ofer Haviv (1)

|

|

|

742,500

|

|

|

|

2.91

|

%

|

|

Yuval Ben-Galim (2)

|

|

|

0

|

|

|

|

*

|

|

|

Ido Dor (3)

|

|

|

72,558

|

|

|

|

*

|

|

|

Dr. Eyal Emmanuel (4)

|

|

|

138,692

|

|

|

|

*

|

|

|

Dr. Hagai Karchi (5)

|

|

|

421,875

|

|

|

|

1.66

|

%

|

|

Eran Kosover (6)

|

|

|

55,617

|

|

|

|

*

|

|

|

Eyal Leibovitz (7)

|

|

|

32,500

|

|

|

|

*

|

|

|

Assaf Oron (8)

|

|

|

143,750

|

|

|

|

*

|

|

|

Sarit Firon (9)

|

|

|

1,250

|

|

|

|

*

|

|

|

Martin S. Gerstel (10)

|

|

|

416,506

|

|

|

|

1.63

|

%

|

|

Ziv Kop (11)

|

|

|

7,500

|

|

|

|

*

|

|

|

Dr. Adina Makover (12)

|

|

|

15,174

|

|

|

|

*

|

|

|

Leon Y. Recanati (13)

|

|

|

865,110

|

|

|

|

3.40

|

%

|

|

Dr. Kinneret Livnat Savitsky (14)

|

|

|

15,000

|

|

|

|

*

|

|

|

All executive officers and directors as a group (14 persons)

|

|

|

2,928,032

|

|

|

|

11.49

|

%

|

| |

|

|

|

|

|

|

|

|

|

Principal Shareholders

|

|

|

|

|

|

|

|

|

|

Entities affiliated with Psagot Investment House Ltd. (15)

|

|

|

2,368,318

|

|

|

|

9.29

|

%

|

|

Monsanto Company (16)

|

|

|

1,636,364

|

|

|

|

6.42

|

%

|

|

Entities affiliated with Waddell & Reed Financial, Inc. (17)

|

|

|

3,220,797

|

|

|

|

12.64

|

%

|

|

Entities affiliated with Migdal Insurance & Financial Holdings Ltd. (18)

|

|

|

2,127,548

|

|

|

|

8.34

|

%

|

|

Entities affiliated with Harel Insurance, Investments & Financial Services Ltd. (19)

|

|

|

1,444,556

|

|

|

|

5.66

|

%

|

_______________________________

* Less than 1%.

|

(1)

|

Consists entirely of ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(2)

|

None of the options to purchase ordinary shares held by Mr. Ben-Galim will be vested and exercisable within 60 days of December 12, 2016.

|

|

(3)

|

Consists entirely of ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(4)

|

Consists entirely of ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

| |

|

|

(5)

|

Consists of 90,000 ordinary shares and ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(6)

|

Consists entirely of ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(7)

|

Consists entirely of ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(8)

|

Consists entirely of ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(9)

|

Consists entirely of ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(10)

|

Consists of (i) 349,006 ordinary shares held by Martin S. Gerstel and by Shomar Corporation, over which Martin S. Gerstel and his wife Mrs. Shoshana Gerstel possess voting and investment power and (ii) ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(11)

|

Consists entirely of ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(12)

|

Consists of 1,424 ordinary shares and ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(13)

|

Consists of 838,860 ordinary shares and ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

| |

|

|

(14)

|

Consists entirely of ordinary shares underlying options to purchase ordinary shares exercisable within 60 days of December 12, 2016.

|

|

(15)

|

This information is based upon a Schedule 13G/A filed by Psagot Investment House Ltd. with the SEC on February 16, 2016. These ordinary shares are held for members of the public through, among others, portfolio accounts managed by Psagot Securities Ltd., Psagot Exchange Traded Notes Ltd., mutual funds managed by Psagot Mutual Funds Ltd., and provident funds and pension funds managed by Psagot Provident Funds and Pension Ltd., according to the following segmentation: (i) 730,956 ordinary shares beneficially owned by portfolio accounts managed by Psagot Securities Ltd.; (ii) 583,523 ordinary shares beneficially owned by Psagot Exchange Traded Notes Ltd.; (iii) 120,742 ordinary shares beneficially owned by mutual funds managed by Psagot Mutual Funds Ltd. (of this amount, 11,929 ordinary shares may also be considered beneficially owned by Psagot Securities Ltd., but are not included in the shares beneficially owned by Psagot Securities Ltd.); (iv) 927,700 ordinary shares beneficially owned by provident funds managed by Psagot Provident Funds and Pension Ltd; and (v) 5,395 ordinary shares beneficially owned by managed savings managed by Psagot Insurance Company Ltd. Each of the foregoing companies is a wholly-owned subsidiary of Psagot Investment House Ltd. The subsidiaries operate under independent management and make their own independent voting and investment decisions. Any economic interest or beneficial ownership in any of the securities covered by this report is held for the benefit of owners of the portfolio accounts, holders of the exchange-traded notes, or for the benefit of the members of the mutual funds, provident funds, or pension funds, as the case may be. The principal address of Psagot Investment House Ltd. is 14 Ahad Ha’am Street, Tel Aviv 65142, Israel.

|

|

(16)

|

This information is based upon a Schedule 13G/A filed by Monsanto Company with the SEC on February 12, 2016. Monsanto Company is a Delaware corporation and is listed on the NYSE and possesses voting and dispositive investment power over these ordinary shares. The principal address for Monsanto Company is 800 North Lindbergh Boulevard, St. Louis, Missouri 63167, USA.

|

|

(17)

|

This information is based upon a Schedule 13G/A filed jointly with the SEC on February 12, 2016 by (i) Waddell & Reed Financial, Inc., or WRF; (ii) Waddell & Reed Financial Services, Inc., or WRFSI, a subsidiary of WRF; (iii) Waddell & Reed Inc., or WRI, a broker-dealer and subsidiary of WRFSI; (iv) Waddell & Reed Investment Management Company, or WRIMCO, an investment advisory subsidiary of WRI; and (v) Ivy Investment Management Company, or IICO, an investment advisory subsidiary of WRF. According to this Schedule 13G/A, the investment advisory contracts grant IICO and WRIMCO investment power over securities owned by their advisory clients and the investment sub-advisory contracts grant IICO and WRIMCO investment power over securities owned by their sub-advisory clients and, in most cases, voting power. Any investment restriction of a sub-advisory contract does not restrict investment discretion or power in a material manner. Therefore, IICO and/or WRIMCO may be deemed the beneficial owner of the securities covered by this statement under Rule 13d-3 of the Securities Exchange Act of 1934, or the Exchange Act. These ordinary shares are held according to the following segmentation with direct or indirect voting and dispositive power as indicated: WDR: 3,220,747 (indirect); WRFSI: 1,330,502 (indirect); WRI: E1,330,502 (indirect); WRIMCO: 1,330,502 (direct); and IICO: 1,890,295 (direct). The principal address for these entities is 6300 Lamar Avenue, Overland Park, KS 66202.

|

|

(18)

|

This information is based upon a Schedule 13G filed by Migdal Insurance & Financial Holdings Ltd., or Migdal, with the SEC on February 10, 2016. According to this Schedule 13G, 2,127,548 ordinary shares are held for members of the public through, among others, provident funds, mutual funds, pension funds and insurance policies, which are managed by subsidiaries of Migdal, according to the following segmentation: (i) 1,113,585 ordinary shares are held by Profit participating life assurance accounts; (ii) 769,547 ordinary shares are held by Provident funds and companies that manage provident funds and (iii) 115,035 ordinary shares are held by companies for the management of funds for joint investments in trusteeship, each of which subsidiaries operates under independent management and makes independent voting and investment decisions. Finally, 129,381 ordinary shares are beneficially held for their own account (Nostro account). The principal address of Migdal is 4 Efal Street; P.O. Box 3063; Petach Tikva 49512, Israel.

|

|

(19)

|

This information is based upon a Schedule 13G/A filed by Harel Insurance Investments & Financial Services Ltd., or Harel, with the SEC on January 10, 2016. According to this Schedule 13G/A (i) 1,374,430 ordinary shares are held for members of the public through, among others, provident funds, mutual funds, pension funds and insurance policies, which are managed by subsidiaries of Harel, (ii) 66,653 ordinary shares are held by third party client accounts managed by a subsidiary of Harel as portfolio managers, which subsidiary operates under independent management and makes independent investment decisions and has no voting power in the securities held in such client accounts, and (iii) 473 ordinary shares are beneficially held for Harel's own account (Nostro account). The principal address of Harel is Harel House, 3 Abba Hillel Street, Ramat Gan 52118, Israel.

|

PROPOSAL 1

RE-ELECTION OF MS. SARIT FIRON TO SERVE AS A DIRECTOR

Background

Under our Articles, our Board must consist of not less than three and no more than seven directors (excluding any External Directors (as defined under the Companies Law)). As we reported in a Report of Foreign Private Issuer on Form 6-K that we furnished to the SEC on May 19, 2016 our Board adopted exemptions recently promulgated under the Companies Law that exempt certain Israeli companies whose shares are traded on certain U.S. stock exchanges from the requirements under the Companies Law to appoint External Directors and from related requirements as to the composition of the audit and compensation committees of the board of directors. In order to be eligible for these exemptions, we currently comply, and will be required to continue to comply, with (i) the majority board independence requirement of the New York Stock Exchange, or the NYSE, and (ii) the audit and compensation committee composition requirements imposed by the NYSE and the SEC. Following adjustments that have occurred to our Board’s composition after adoption of those exemptions, our Board currently consists of a total of six directors, none of whom is an External Director.

As we previously announced (in a press release annexed as Exhibit 99.1 to a Report of Foreign Private Issuer on Form 6-K that we furnished to the SEC on August 11, 2016 (the third Form 6-K that we furnished that day)), our Board appointed Ms. Sarit Firon as a director on August 10, 2016. Under our Articles, because she was initially appointed by the Board, Ms. Firon is subject to re-election by our shareholders (assuming that she was to be nominated by our compensation and nominating committee) at the first annual or special meeting of shareholders following her appointment, for a term that will last until the next annual general meeting of shareholders.

Our compensation and nominating committee has recommended the nomination by the Board, and the reelection by our shareholders at the Meeting, of Ms. Sarit Firon as a director for a term that concludes at our 2017 annual general meeting of shareholders. Our Board approved that recommendation and has, in turn, nominated Ms. Firon and recommended to our shareholders to elect her at the Meeting to serve as a director for the foregoing term.

Set forth below is certain biographical information regarding the background and experience of Ms. Firon:

Sarit Firon has served as a director of our Company since she was appointed by the Board on August 10, 2016. Ms. Firon is the Managing Partner of Cerca Partners, a Venture Capital, co-investment fund. Previously, Ms. Firon was the Chief Executive Officer of Extreme Reality (XTR3D), a company that provides real time software-based, 3D motion capture technology, using a single standard webcam. Prior to her role at Extreme Reality (XTR3D), Ms. Firon held roles as Chief Financial Officer at each of Kenshoo, MediaMind (NSDQ: MDMD, acquired by DG corp.), OLIVE SOFTWARE, P-CUBE (acquired by Cisco) and RADCOM, LTD. (NSDQ: RDCM). Ms. Firon serves as the Chairperson of myThings, a global leader in customized programmatic ad solutions, which runs personalized retargeting campaigns on desktop, mobile and Facebook, since July 2015. Ms. Firon also holds other board positions at DTORAMA, MediWound and Protected Media. Ms. Firon holds a Bachelor’s degree in accounting and economics, and a Diploma in Accounting Advanced Studies, both from Tel Aviv University.

Proposed Resolution

We are proposing the adoption by our shareholders of the following resolution at the Meeting:

“RESOLVED, that Ms. Sarit Firon be, and hereby is, re-elected to serve as a director of Evogene, effective from the date hereof, until the 2017 annual general meeting of shareholders of Evogene, and until her successor is duly qualified.”

Required Vote

Shareholders may vote for or against, or may abstain from voting, in connection with the re-election of Ms. Firon. As described above (under “Vote Required for Approval of the Proposals”), the approval of Proposal 1 at the Meeting requires the affirmative vote of holders present in person or by proxy and holding ordinary shares representing a majority of the votes cast with respect to the proposal (which excludes abstentions and broker non-votes).

Board Recommendation

Our Board of Directors unanimously recommends a vote FOR the re-election of Ms. Sarit Firon as a director until our 2017 annual general meeting of shareholders.

PROPOSAL 2

APPROVAL OF UPDATED COMPENSATION POLICY

Background

As required under the Companies Law, we adopted, in March 2014, the Evogene Ltd. Officers’ Compensation Policy, or our Compensation Policy, which provides guidelines as to the terms of service and employment, and the compensation arrangements, of all of our “office holders”, which, as defined in the Companies Law, includes our executive officers and directors.

Under the Companies Law, our Compensation Policy must be reviewed by the Compensation and Nominating Committee of our Board, in its role as our compensation committee under the Companies Law, and by our Board, from time to time. In addition, the Compensation and Nominating Committee, followed by the Board (based on the recommendation of the Compensation and Nominating Committee, in its role as our compensation committee under the Companies Law), followed by our shareholders, are each required to re-approve the Compensation Policy once every three years.

Our Compensation and Nominating Committee and Board of Directors have reviewed our Compensation Policy, in light of the experience that they have gained while applying it over the course of the last three years to the terms of service of our office holders. Based on that review, they have updated the Compensation Policy in the manner shown in Appendix A to this Proxy Statement.

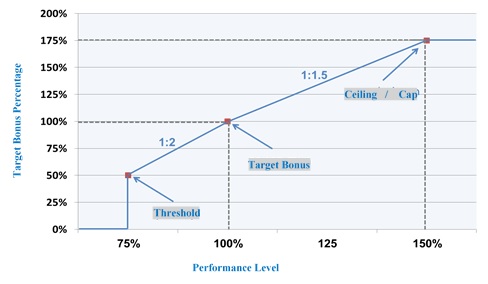

The key substantive proposed updates to our current Compensation Policy, which are reflected in the updated Compensation Policy, are summarized as follows (the sections of the Compensation Policy in which such updates appear are set forth in brackets):

|

§ |

The ratio between the fixed components (25%-55% of the overall compensation package) and the variable components (45%-75% of the overall compensation package) of our officers’ compensation package has been revised. [Section 4.1.1]

|

|

§ |

The updated policy defines an “Industry Expert Director” and sets a framework for the fees to be paid to such director. [Section 5.1.1.4]

|

|

§ |

The relative weight given to each of the categories of measures and goals for the annual bonus plan in determining overall annual bonus has been modified (Company-based measures for officers, including our chief executive officer, or CEO: 30%-50%; personal/business unit measures: 30%-50%; and manager evaluation: up to 20%). [Section 5.2.1.2]

|

|

§ |

In line with a resent amendment to the Companies Law, the updated policy includes a provision, which alleviates the determination of annual bonuses for officers who are subordinate to the CEO from the requirement that variable compensation be based on measurable criteria, and instead allows our Company to determine, in advance within the framework of our annual bonus plan, that such officers’ bonus (excluding our CEO) shall not be based on measurable criteria. [Section 5.2.1.7]

|

|

§ |

The updated policy adds a framework that allows our Company to grant equity awards other than options. [Section 5.2.3]

|

|

§ |

The maximum number of options that may be granted to directors under the annual grant mechanism may be up to double of what they were under the current Compensation Policy. [Section 5.2.3.4]

|

In addition to key substantive proposed updates that are summarized above, there are various revisions that are meant to clarify non-substantive compensatory matters, which are also reflected in the copy of the updated Compensation Policy that is appended as Appendix A.

The foregoing description is merely a summary of the updates to our Compensation Policy. We urge you to review Appendix A in its entirety for the complete text of the updated Compensation Policy.

If the Compensation Policy is not approved by our shareholders in accordance with the required special majority under the Companies Law, our Board may nevertheless approve it, provided that the Compensation and Nominating Committee (acting as our compensation committee) and the Board determine, after additional discussions concerning the Compensation Policy, and for specified reasons, that the approval of the Compensation Policy is beneficial to our Company.

Proposed Resolution

We are proposing the adoption by our shareholders of the following resolution at the Meeting:

“RESOLVED, that the updated Compensation Policy of the Company, as set forth in Appendix A to the Proxy Statement, dated December 12, 2016, with respect to the Meeting, as approved by the Board of Directors of the Company, following the recommendation of its Compensation and Nominating Committee, be, and hereby is, approved and adopted in all respects.”

Required Vote

Shareholders may vote for or against, or may abstain from voting, in connection with the approval of the updated Compensation Policy.

As described above (under “Vote Required for Approval of the Proposals”), the approval of the updated Compensation Policy of the Company requires the affirmative vote of shareholders present in person or by proxy and holding ordinary shares representing a majority of the votes cast with respect to this proposal. Furthermore, under the Companies Law, the approval of this proposal requires that either: (i) such majority includes at least a majority of the voting power of the non-controlling and non-conflicted shareholders (i.e., shareholders who lack a “personal interest” as defined under the Companies Law) who are present in person or by proxy and who vote on the proposal; or (ii) the total votes cast in opposition to the proposal by the non-controlling and non-conflicted shareholders does not exceed 2% of all of the voting power in our Company.

A shareholder must inform our Company before the vote (or if voting by proxy or voting instruction form, indicate on the proxy card or voting instruction form) whether or not such shareholder is a controlling shareholder or has a conflict of interest in approval of this proposal, and failure to do so disqualifies the shareholder from participating in the vote. In order to confirm that you are not a controlling shareholder and that you have no conflict of interest in the approval of this proposal, and to therefore be counted towards the special majority required under this proposal, you must check the box for Item 2A on the accompanying proxy card. If you believe that you, or a related party of yours, is a controlling shareholder or has such a conflict of interest and you wish to participate in the vote on this proposal, you should not check the box for Item 2A on the enclosed proxy card and you should not vote on this proposal via the proxy card. Instead, please contact our Company’s Corporate Secretary at +972-8-9311971 or Fax; +972-8-9466724, who will provide you with a separate proxy card so that you may submit your vote on this proposal. If you hold your shares in “street name” and believe that you, or a related party of yours, are a controlling shareholder or have a conflict of interest in the approval of this proposal, you should contact the representative managing your account, who should then contact our Corporate Secretary on your behalf.

Board Recommendation

Our Board of Directors unanimously recommends a vote FOR the foregoing resolution approving the updated Compensation Policy.

PROPOSAL 3

APPROVAL OF INITIAL AND SUBSEQUENT OPTION GRANTS

TO MS. SARIT FIRON (A DIRECTOR)

Background

Under the Companies Law, the compensation of directors of a public company requires approval by the compensation committee of the board of directors, the Board, and the shareholders of the company (in that order). The Compensation and Nominating Committee of our Board (in its role as compensation committee) and our Board have approved, the grant to our director— Ms. Sarit Firon (subject to her re-election as a director pursuant to Proposal 1 at the Meeting)— of options to purchase 10,000 ordinary shares of our Company, on a one-time basis, and subsequent annual grants of options, each to purchase 2,500 ordinary shares, in accordance with the grant mechanism described in the Compensation Policy, subject to the continued service by Mrs. Firon on our Board.

In so approving the proposed grants to Ms. Firon, the Compensation and Nominating Committee and the Board each considered the factors enumerated in the updated Compensation Policy. Our Compensation and Nominating Committee and the Board each expressed the view that the terms and conditions of the grants: (i) are appropriate, given the background and experience of Ms. Firon, (ii) are aligned with market conditions for companies of similar position and size, and for directors of similar experience level, and (iii) are consistent with the Compensation Policy.

Shareholders are being asked to approve the foregoing option grants at the Meeting.

Proposed Resolution

We are proposing the adoption by our shareholders of the following resolutions at the Meeting:

“RESOLVED, that an initial grant of options to purchase 10,000 ordinary shares and subsequent annual grants of options to purchase 2,500 ordinary shares, to Ms. Sarit Firon (assuming that she is re-elected as a director pursuant to Proposal 1 at the Meeting), in accordance with the grant mechanism described in the Compensation Policy (but regardless of whether the update to the Compensation Policy itself is approved at the Meeting), subject to the continued service by Mrs. Firon on our Board, be, and hereby is, approved in all respects.”

Required Vote

As described above (under “Vote Required for Approval of the Proposals”), the approval of the foregoing option grants to Mrs. Firon requires, in each case, the affirmative vote of shareholders present in person or by proxy and holding ordinary shares representing a majority of the votes cast with respect to this proposal.

Board Recommendation

Our Board of Directors unanimously recommends a vote FOR the foregoing resolution approving the initial and subsequent annual grants of options to purchase ordinary shares of our Company to Ms. Firon.

OTHER MATTERS

Our Board does not intend to bring any matter before the Meeting other than that specifically set forth in the Notice of Special General Meeting of Shareholders and knows of no matters to be brought before the Meeting by others. If any other matters properly come before the Meeting, it is the intention of the persons named in the accompanying proxy to vote such proxy in accordance with the judgment and recommendation of our Board.

WHERE YOU CAN FIND MORE INFORMATION

We report in an ongoing manner to the SEC. This Proxy Statement (including the cover letter hereto) and the proxy card with respect to the proposals to be voted upon at the Meeting are being attached as Exhibits 99.1 and 99.2, respectively to a Report of Foreign Private Issuer on Form 6-K that is being furnished to the SEC and that is available for viewing through the EDGAR website of the SEC at www.sec.gov, at the Magna website of the Israel Securities Authority (www.magna.isa.gov.il), and at the Investor Relations portion of our corporate website, at http://investors.evogene.com/sec-filings.aspx. None of such websites is a part of this Proxy Statement.

| |

By Order of the Board of Directors,

|

| |

/s/ Eyal Leibovitz

|

| |

Mr. Eyal Leibovitz

|

| |

Chief Financial Officer

|

Dated: December 12, 2016