UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20541

FORM 10-K

|

x |

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2013 |

|

o |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

Commission file number: 001-36007

PHYSICIANS REALTY TRUST

(Exact Name of Registrant as Specified in Its Charter)

|

Maryland |

|

46-2519850 |

|

(State or Other Jurisdiction |

|

(I.R.S. Employer |

|

|

|

|

|

735 N. Water Street Suite 1000 Milwaukee, Wisconsin |

|

53202 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(414) 978-6494

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange On Which Registered |

|

Common shares, $0.01 par value |

|

New York Stock Exchange |

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer x (Do not check if a smaller reporting company) |

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

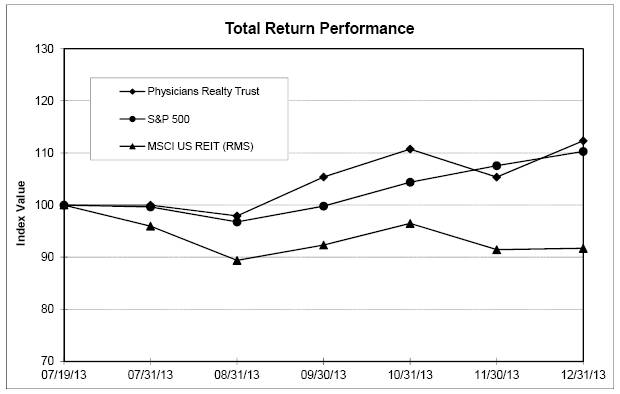

As of June 28, 2013, the last business day of the Registrant’s most recently completed second fiscal quarter, there was no public market for the Registrant’s common shares. The Registrant’s common shares began trading on the New York Stock Exchange on July 19, 2013.

As of December 31, 2013, the aggregate market value of the Registrant’s common shares held by non-affiliates of the Registrant (assuming for these purposes, but without conceding, that all executive officers and trustees are “affiliates” of the Registrant) was approximately $270.7 million based on the closing price of the Registrant’s common shares as reported on the New York Stock Exchange on such date.

As of March 17, 2014, the number of the Registrant’s common shares outstanding was 21,632,863.

Physicians Realty Trust and Subsidiaries

Annual Report on Form 10-K for the Year Ended December 31, 2013

Forward-Looking Statements

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Report on Form 10-K contains forward-looking statements made pursuant to safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts may be forward-looking statements. In particular, statements pertaining to our capital resources, property performance and results of operations contain forward-looking statements. Likewise, all of our statements regarding anticipated growth in our funds from operations and anticipated market conditions, demographics and results of operations are forward-looking statements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

· general economic conditions;

· adverse economic or real estate developments, either nationally or in the markets in which our properties are located;

· our failure to generate sufficient cash flows to service our outstanding indebtedness;

· fluctuations in interest rates and increased operating costs;

· the availability, terms and deployment of debt and equity capital;

· our ability to make distributions on our shares of beneficial interest;

· general volatility of the market price of our common shares;

· our limited operating history;

· our increased vulnerability economically due to the concentration of our investments in healthcare properties;

· a substantial portion of our revenue is derived from our five largest tenants and thus, the bankruptcy, insolvency or weakened financial position of any one of them could seriously harm our operating results and financial condition;

· our geographic concentrations in El Paso and Plano, Texas and Atlanta, Georgia causes us to be particularly exposed to downturns in these local economies or other changes in local real estate market conditions;

· changes in our business or strategy;

· our dependence upon key personnel whose continued service is not guaranteed;

· our ability to identify, hire and retain highly qualified personnel in the future;

· the degree and nature of our competition;

· changes in governmental regulations, tax rates and similar matters;

· defaults on or non-renewal of leases by tenants;

· decreased rental rates or increased vacancy rates;

· difficulties in identifying healthcare properties to acquire and completing acquisitions;

· competition for investment opportunities;

· our failure to successfully develop, integrate and operate acquired properties and operations;

· the impact of our investment in joint ventures;

· the financial condition and liquidity of, or disputes with, joint venture and development partners;

· our ability to operate as a public company;

· changes in accounting principles general accepted in the United States of America (“GAAP”);

· lack of or insufficient amounts of insurance;

· other factors affecting the real estate industry generally;

· our failure to qualify and maintain our qualification as a real estate investment trust (“REIT”) for U.S. federal income tax purposes;

· limitations imposed on our business and our ability to satisfy complex rules in order for us to qualify as a REIT for U.S. federal income tax purposes; and

· changes in governmental regulations or interpretations thereof, such as real estate and zoning laws and increases in real property tax rates and taxation of REITs.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. You should not place undue reliance on any forward-looking statements, which speak only as of the date of this report. We disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes after the date of this prospectus, except as required by applicable law. For a further discussion of these and other factors that could impact our future results, performance or transactions, see “Part I, Item 1A. Risk Factors.”

In this report, the terms “we,” “us,” “our,” “our company,” the “Trust,” the “Company,” and “Physicians Realty” refer to Physicians Realty Trust, a Maryland real estate investment trust, together with its consolidated subsidiaries, including Physicians Realty L.P., a Delaware limited partnership, which we refer to in this report as our “operating partnership,” and the historical business and operations of four healthcare real estate funds that we have classified for accounting purposes as our “Predecessor” and which we sometimes refer to as the “Ziegler Funds.”

Overview

We are a self-managed healthcare real estate company organized in April 2013 to acquire, selectively develop, own and manage healthcare properties that are leased to physicians, hospitals and healthcare delivery systems. We invest in real estate that is integral to providing high quality healthcare services. Our properties are typically located on a campus with a hospital or other healthcare facilities or strategically located and affiliated with a hospital or other healthcare facilities. We believe the impact of government programs and continuing trends in the healthcare industry create attractive opportunities for us to invest in health care related real estate. Our management team has significant public healthcare REIT experience and has long established relationships with physicians, hospitals and healthcare delivery system decision makers that we believe will provide quality investment and growth opportunities. Our principal investments include medical office buildings, outpatient treatment facilities, acute and post-acute care hospitals, as well as other real estate integral to health care providers. We seek to generate attractive risk-adjusted returns for our shareholders through a combination of stable and increasing dividends and potential long-term appreciation in the value of our properties and our common shares.

We completed our initial public offering (“IPO”), in July 2013, issuing an aggregate of 11,753,597 common shares and receiving approximately $123.7 million of net proceeds, including shares issued upon exercise of the underwriters’ over-allotment option. Simultaneously with the closing of our IPO, we completed a series of related formation transactions pursuant to which we acquired 19 medical office buildings located in ten states with approximately 524,048 net leasable square feet in exchange for 2,744,000 common units in our operating partnership (“OP Units”), and the assumption of approximately $84.3 million of debt related to such properties. We used a portion of the proceeds from the IPO to repay approximately $36.9 million of such debt. Since the completion of our IPO, we have acquired eight additional properties for an aggregate of approximately $132.4 million, including the issuance of 954,877 OP Units and acquired approximately 40% and 35% of the joint venture interests we did not own with respect to two of our existing properties, which resulted in our 100.0% ownership of these properties. As of December 31, 2013, our portfolio was approximately 91.1% leased with a weighted average remaining lease term of 9.3 years and approximately 60.2% of the net leasable square footage of our portfolio was affiliated with a healthcare delivery system and approximately 48.4% of the net leasable square footage of our properties is located within approximately 1/4 mile of a hospital campus. Approximately 98.4% of our annualized base rent payments as of December 31, 2013 is from triple net leases, pursuant to which our tenants are responsible for all operating expenses relating to the property, including but not limited to real estate taxes, utilities, property insurance, routine maintenance and repairs, and property management. This structure helps insulate us from increases in certain operating expenses and provides more predictable cash flow. Our leases typically include rent escalation provisions designed to provide us with annual growth in our rental revenues. As of December 31, 2013, leases representing 3.2%, 1.4% and 4.8% of leasable square feet in our portfolio will expire in 2014, 2015 and 2016, respectively.

In December 2013, we completed a public offering of 9,545,000 common shares of beneficial interest, including 1,245,000 shares issued pursuant to the exercise of an option to purchase additional shares granted to the underwriters to cover over-allotments, at a price to the public of $11.50 per share. We raised approximately $109.8 million in gross proceeds, resulting in net proceeds to us of approximately $103.1 million after deducting approximately $5.8 million in underwriting discounts and approximately $0.9 million in other expenses relating to the public offering. We contributed the net proceeds of this offering to our operating partnership in exchange for OP Units, and our operating partnership used the net proceeds of the public offering to repay borrowings under our senior secured revolving credit facility and for general corporate and working capital purposes, funding possible future acquisitions, including our pending acquisitions, and development activities.

We had no business operations prior to completion of the IPO and the formation transactions on July 24, 2013. Our Predecessor, which is not a legal entity, is comprised of the four healthcare real estate funds managed by B.C. Ziegler & Company (“Ziegler”), which we refer to as the Ziegler Funds, that owned directly or indirectly interests in entities that owned the initial properties we acquired on July 24, 2013 in connection with completion of our IPO and related formation transactions.

We are a Maryland real estate investment trust and intend to elect to be taxed as a REIT for U.S. federal income tax purposes beginning with our short taxable year ending December 31, 2013. We conduct our business through an UPREIT structure in which our properties are owned by our operating partnership directly or through limited partnerships, limited liability companies or other subsidiaries. We are the sole general partner of our operating partnership and, as of December 31, 2013 own approximately 85.3% of the partnership interests in our operating partnership.

Our Objectives and Growth Strategy

Our principal business objective is to provide attractive risk-adjusted returns to our shareholders through a combination of (i) sustainable and increasing rental income and cash flow that generates reliable, increasing dividends, and (ii) potential long-term appreciation in the value of our properties and common shares. Our primary strategies to achieve our business objective are to invest in, own and manage a diversified portfolio of high quality healthcare properties and pay careful attention to our tenants’ real estate strategies, which we believe will drive high retention, high occupancy and reliable, increasing rental revenue and cash flow.

We intend to grow our portfolio of high-quality healthcare properties leased to physicians, hospitals, healthcare delivery systems and other healthcare providers primarily through acquisitions of existing healthcare facilities that provide stable revenue growth and predictable long-term cash flows. We may also selectively finance the development of new healthcare facilities through joint venture or fee arrangements with premier healthcare real estate developers. Generally, we only expect to make investments in new development properties when approximately 70% or more of the development property has been pre-leased before construction commences. We seek to invest in properties where we can develop strategic alliances with financially sound healthcare providers and healthcare delivery systems that offer need-based healthcare services in sustainable healthcare markets. We focus our investment activity on the following types of healthcare properties:

· medical office buildings

· outpatient treatment and diagnostic facilities

· physician group practice clinics

· ambulatory surgery centers

· specialty hospitals and treatment centers

· acute care hospitals

· post-acute care hospitals and long-term care facilities

We may opportunistically invest in life science facilities, senior housing properties, including skilled nursing, assisted living and independent senior living facilities. Consistent with our intent to qualify as a REIT, we may also opportunistically invest in companies that provide healthcare services, in joint venture entities with operating partners, structured to comply with the REIT Investment Diversification Act of 2007 (“RIDEA”).

In connection with our review and consideration of healthcare real estate investment opportunities, we generally take into account a variety of market considerations, including:

· whether the property is anchored by a financially-sound healthcare delivery system or whether tenants have strong affiliation to a healthcare delivery system;

· the performance of the local healthcare delivery system and its future prospects;

· property location, with a particular emphasis on proximity to healthcare delivery systems;

· demand for medical office buildings and healthcare related facilities, current and future supply of competing properties, and occupancy and rental rates in the market;

· population density and growth potential;

· ability to achieve economies of scale with our existing medical office buildings and healthcare related facilities or anticipated investment opportunities; and

· existing and potential competition from other healthcare real estate owners and operators.

Employees

At December 31, 2013, we had 5 full-time employees, none of whom are subject to a collective bargaining agreement.

Portfolio Summary

Please see “Item 2. Properties” for a table that summarizes our portfolio as of December 31, 2013.

Geographic Concentration

Of our 27 properties as of December 31, 2013, approximately 42% of our total annualized rent was derived from properties located in Texas (26%) and Atlanta, Georgia (16%). The Texas properties are concentrated in El Paso and Plano. Further, through our operating partnership, we closed on the acquisitions of the Eagles Landing Family Practice medical office buildings, a total of four properties, located in McDonough, Jackson and Conyers, Georgia on February 19, 2014. Also on February 19, 2014, through our operating partnership, we closed on the acquisition of a hospital located in San Antonio, Texas. On February 28, 2014, we closed on two separate acquisitions of a medical office building located in San Antonio, Texas and a medical office building located in Atlanta, Georgia. See “Part I, Item 1. Business - Recent Developments” for a further discussion of these acquisitions.

As a result of this geographic concentration, we are particularly exposed to downturns in these local economies or other changes in local real estate market conditions. Any material change in the current payment programs or regulatory, economic, environmental or competitive conditions in either of these areas could have a disproportionate effect on our overall business results. In the event of negative economic or other changes in either of these markets, our business, financial condition and results of operations, our ability to make distributions to our shareholders and the trading price of our common shares may be adversely affected. See each of the discussion under Item 1A, “Risk Factors,” under the caption “Economic and other conditions that negatively affect geographic areas to which a greater percentage of our revenue is attributed could materially adversely affect our business, results of operations and financial condition.”

Customer Concentration

We receive substantially all of our revenue as rent payments from tenants under leases of space in our healthcare properties, with our five largest tenants based upon rental revenue representing approximately $9.9 million, or 46.7%, of the annualized rent from our initial properties as of December 31, 2013. For the year ended December 31, 2013, East El Paso Physicians Medical Center and Crescent City Surgical Centre accounted for 15.6% and 14.2%, respectively, of our total annualized rent. We have no control over the success or failure of our tenants’ businesses and, at any time, any of our tenants may experience a downturn in its business that may weaken its financial condition.

Recent Developments

On January 2, 2014, we closed our previously announced mezzanine loan in the approximate amount of $6.9 million (“Mezzanine Loan”) to entities controlled by MedProperties, L.L.C., a Dallas, Texas based private investor in medical facilities (“MedProperties”). The Mezzanine Loan is secured by MedProperties’ ownership interest in two special purpose entities that own a surgical hospital located in San Antonio, Texas (the “Surgical Hospital”) and an inpatient rehabilitation facility located in Scottsdale, Arizona (the “Rehab Hospital,” and together with the Surgical Hospital, the “Hospitals”). The Surgical Hospital is leased to a joint venture owned by National Surgical Hospitals, Inc. and a group of physicians under an absolute net lease with the current term expiring in 2028. The Rehab Hospital, constructed in 2013, is leased to a joint venture owned by Scottsdale Healthcare and Select Medical, Inc. (NYSE: SEM) under an absolute net lease with the current term expiring in 2028. The Mezzanine Loan has a five year term, is interest only during the term and bears interest at a 9% fixed annual interest rate. A small portion of the interest on the Mezzanine Loan may be made in the form of payment-in-kind, or PIK. As part of the consideration for providing the Mezzanine Loan, the Company has an option to acquire the property leased to the Hospitals at a formula purchase price during year 4 of the Mezzanine Loan based on a fixed capitalization rate.

On January 10, 2014, we completed a $7.8 million mortgage financing on Foundation Surgical Affiliates Medical Care Building in Oklahoma City, Oklahoma, which property was acquired in September 2013. The loan has a seven year term, monthly interest and principal payments of $0.05 million, and bears interest at a rate of 4.71% per annum.

On January 14, 2014, we completed a $18.8 million mortgage financing on Crescent City Surgical Centre in New Orleans, Louisiana, which property was acquired in September 2013. The loan has a five year term, interest only payments and bears interest at a rate of 5.0% per annum. Also, we completed the acquisition of a 40% ownership interest in the entity that owns the land under Crescent City Surgical

Centre for $1.3 million on February 21, 2014. Such land is leased to us pursuant to a long-term ground lease.

On January 29, 2014, through our operating partnership, we entered into an Agreement of Sale and Purchase with Octopods, LLC to purchase an approximately 45,200 square foot medical official building known as the South Bend Orthopaedics Medical Office Building, located in Mishawaka, Indiana for $14.9 million payable in cash less approximately $8.5 million in assumed debt. The closing is subject to customary conditions, including accuracy of representations, satisfaction of a due diligence investigation and consent of the lender to assumption of the debt.

On February 19, 2014, through our operating partnership, we closed on the acquisition of the Eagles Landing Family Practice medical office buildings located in McDonough, Jackson and Conyers, Georgia. The four medical office buildings occupy approximately 68,711 square feet, are 100% occupied as of February 19, 2014 and were acquired for approximately $20.8 million in cash. The properties were acquired pursuant to an Agreement of Sale and Purchase, dated as of November 7, 2013 (the “Eagles Landing Agreement”), by and among Steele Properties I, LLC, Collyn Williams and our operating partnership. The foregoing is only a summary of certain provisions of the Eagles Landing Agreement and is qualified in its entirety by the terms of the Eagles Landing Agreement, a copy of which is filed as Exhibit 10.21 to this report.

On February 19, 2014, through our operating partnership, we entered into and closed an Agreement of Sale and Purchase with Foundation Bariatric Real Estate of San Antonio, LLLP to purchase a surgical hospital located in San Antonio, Texas. The hospital occupies approximately 46,000 square feet, is 100% occupied as of February 19, 2014 and was acquired for approximately $18.9 million in cash minus an amount equal to the principal balance, accrued interest and fees related to certain indebtedness with respect the surgical hospital to be assumed by the Company at the closing. As of February 19, 2014, the principal balance of such debt was approximately $10.8 million. The surgical hospital is leased to Foundation Bariatric Hospital of San Antonio, L.L.C. In addition, on February 28, 2014, through our operating partnership, we acquired a medical office building nearby the hospital in San Antonio, Texas for $6.8 million in cash from an affiliate of the seller of the hospital. The building is 100% occupied as of February 28, 2014.

On February 21, 2014, through our operating partnership, as borrower, and we and certain of our subsidiaries, as guarantors, entered into the Second Incremental Commitment Agreement and Third Amendment to the existing Credit Agreement dated August 29, 2013 with Regions Bank, as Administrative Agent, Regions Capital Markets, as Sole Lead Arranger and Sole Book Runner, and various other lenders (the “Credit Agreement”), pursuant to which we agreed with the lenders to increase the borrowing capacity under the senior secured revolving credit facility from $90 million to $140 million. All other material terms of the Credit Agreement remain substantially unchanged. Subject to satisfaction of certain conditions, including additional lender commitments, we have the option to increase the borrowing capacity under the senior secured revolving credit facility to up to $250 million.

On February 26, 2014, through our operating partnership, we closed on the acquisition of four medical office buildings located in Sarasota, Venice, Engelwood and Port Charlotte, Florida from entities primarily owned by Dr. Alan Porter. The buildings total approximately 44,295 square feet, are 100% occupied as of February 26, 2014 and were acquired for approximately $17.5 million in cash. The buildings are leased to 21st Century Oncology, the nation’s largest provider of Advanced Oncology Radiation Therapy and other integrated cancer care services. The buildings were acquired pursuant to an Agreement of Sale and Purchase, dated as of February 10, 2014, by and between those Sellers set forth in Exhibit A thereto, and our operating partnership.

On February 28, 2014, through a our operating partnership, we entered into and closed an Agreement of Sale and Purchase with North American Property Corporation to acquire an approximately 131,000 square foot medical office building known as the Peachtree Dunwoody Medical Center, located in Atlanta, Georgia for approximately $36.6 million in cash and payment of approximately $3 million in prepayment penalties related to the prepayment of the seller’s indebtedness secured by the property.

Competition

We compete with many other entities engaged in real estate investment activities for acquisitions of healthcare properties, including national, regional and local operators, acquirers and developers of healthcare-related real estate properties. The competition for healthcare-related real estate properties may significantly increase the price that we must pay for healthcare properties or other assets that we seek to acquire, and our competitors may succeed in acquiring those properties or assets themselves. In addition, our potential acquisition targets may find our competitors to be more attractive because they may have greater resources, may be willing to pay more for the properties or may have a more compatible operating philosophy. In particular, larger REITs that target healthcare properties may enjoy significant competitive advantages that result from, among other things, a lower cost of capital, enhanced operating efficiencies, more personnel and

market penetration and familiarity with markets. In addition, the number of entities and the amount of funds competing for suitable investment properties may increase. Increased competition would result in increased demand for the same assets and therefore increase prices paid for them. Those higher prices for healthcare properties or other assets may adversely affect our returns from our investments.

Credit Facility

On August 29, 2013, our operating partnership, as borrower, and we, as parent guarantor, and certain subsidiaries of the operating partnership, as guarantors, entered into a senior secured revolving credit facility in the maximum principal amount of $75 million with Regions Bank, as Administrative Agent, Regions Capital Markets, as Sole Lead Arranger and Sole Book Runner, and various other lenders (the “senior secured revolving credit facility”). On November 8, 2013, we agreed with the lenders to increase the total amount available under our senior secured revolving credit facility from $75 million to $90 million. On February 21, 2014, we agreed with the lenders to increase the total amount available under our senior secured revolving credit facility from $90 million to $140 million. Subject to satisfaction of certain conditions, including additional lender commitments, we have the option to increase the borrowing capacity under the revolving credit facility to up to $250 million. The amount available to us under the senior secured revolving credit facility is subject to certain limitations including, but not limited to, the appraised value of the pledged properties that comprise the borrowing base of the credit facility.

The senior secured revolving credit facility has a three-year term with an initial maturity date of August 29, 2016. Subject to the terms of the senior secured revolving credit facility, we have the option to extend the term of the senior secured revolving credit facility to August 29, 2017.

Base Rate Loans, Adjusted LIBOR Rate Loans and Letters of Credit (each, as defined in the senior secured revolving credit facility) are subject to interest rates, based upon our consolidated leverage ratio as follows:

|

Consolidated Leverage Ratio |

|

Adjusted LIBOR Rate Loans |

|

Base Rate Loans |

|

<35% |

|

LIBOR + 2.65% |

|

Base Rate + 1.65% |

|

>35% and <45% |

|

LIBOR + 2.85% |

|

Base Rate + 1.85% |

|

>45% and <50% |

|

LIBOR + 2.95% |

|

Base Rate + 1.95% |

|

>50% |

|

LIBOR + 3.40% |

|

Base Rate + 2.40% |

We may, at any time, voluntarily prepay any loan under the senior secured revolving credit facility in whole or in part without premium or penalty.

The senior secured revolving credit facility contains financial covenants that, among other things, require compliance with loan-to-value, leverage and coverage ratios and maintenance of minimum tangible net worth, as well as covenants that may limit our ability to incur additional debt or make distributions. The senior secured revolving credit facility also contains customary events of default. Any event of default, if not cured or waived, could result in the acceleration of any outstanding indebtedness under the senior secured revolving credit facility.

As of December 31, 2013, there were no borrowings outstanding under our senior secured revolving credit facility and $68.3 million is available for us to borrow without adding additional properties to the borrowing base securing the senior secured revolving credit facility.

Seasonality

Our business has not been and we do not expect it to become subject to material seasonal fluctuations.

Environmental Matters

As an owner of real estate, we are subject to various federal, state and local environmental laws, regulations and ordinances and also could be liable to third parties as a result of environmental contamination or noncompliance at our properties even if we no longer own such properties. See the discussion under Item 1A, “Risk Factors,” under the caption “Environmental compliance costs and liabilities associated with owning, leasing, developing and operating our properties may affect our results of operations.”

Certain Government Regulations

Overview

Our tenants and operators are typically subject to extensive and complex federal, state and local healthcare laws and regulations relating to fraud and abuse practices, government reimbursement, licensure and certificate of need and similar laws governing the operation of healthcare facilities, and we expect that the healthcare industry, in general, will continue to face increased regulation and pressure in the areas of fraud, waste and abuse, cost control, healthcare management and provision of services, among others. These regulations are wide-ranging and can subject our tenants and operators to civil, criminal and administrative sanctions. Affected tenants and operators may find it increasingly difficult to comply with this complex and evolving regulatory environment because of a relative lack of guidance in many areas as certain of our healthcare properties are subject to oversight from several government agencies and the laws may vary from one jurisdiction to another. Changes in laws and regulations, reimbursement enforcement activity and regulatory non-compliance by our tenants and operators can all have a significant effect on their operations and financial condition, which in turn may adversely impact us, as detailed below and set forth under Item 1A, “Risk Factors,” under the caption “The healthcare industry is heavily regulated, and new laws or regulations, changes to existing laws or regulations, loss of licensure or failure to obtain licensure could adversely impact our company and result in the inability of our tenants to make rent payments to us.”

Based on information primarily provided by our tenants and operators, excluding our medical office properties, as of December 31, 2013 we estimate that approximately 38% of our tenants’ and operators’ revenues were dependent on Medicare and Medicaid reimbursement.

The following is a discussion of certain laws and regulations generally applicable to our operators, and in certain cases, to us.

Fraud and Abuse Enforcement

There are various extremely complex federal and state laws and regulations governing healthcare providers’ relationships and arrangements and prohibiting fraudulent and abusive practices by such providers. These laws include (i) federal and state false claims acts, which, among other things, prohibit providers from filing false claims or making false statements to receive payment from Medicare, Medicaid or other federal or state healthcare programs, (ii) federal and state anti-kickback and fee-splitting statutes, including the Medicare and Medicaid anti-kickback statute, which prohibit the payment or receipt of remuneration to induce referrals or recommendations of healthcare items or services, (iii) federal and state physician self-referral laws (commonly referred to as the “Stark Law”), which generally prohibit referrals by physicians to entities with which the physician or an immediate family member has a financial relationship, (iv) the federal Civil Monetary Penalties Law, which prohibits, among other things, the knowing presentation of a false or fraudulent claim for certain healthcare services and (v) federal and state privacy laws, including the privacy and security rules contained in the Health Insurance Portability and Accountability Act of 1996, which provide for the privacy and security of personal health information. Violations of healthcare fraud and abuse laws carry civil, criminal and administrative sanctions, including punitive sanctions, monetary penalties, imprisonment, denial of Medicare and Medicaid reimbursement and potential exclusion from Medicare, Medicaid or other federal or state healthcare programs. These laws are enforced by a variety of federal, state and local agencies and can also be enforced by private litigants through, among other things, federal and state false claims acts, which allow private litigants to bring qui tam or “whistleblower” actions. Many of our operators and tenants are subject to these laws, and some of them may in the future become the subject of governmental enforcement actions if they fail to comply with applicable laws.

Reimbursement

Sources of revenue for many of our tenants and operators include, among other sources, governmental healthcare programs, such as the federal Medicare program and state Medicaid programs, and non-governmental payors, such as insurance carriers and HMOs. As federal and state governments focus on healthcare reform initiatives, and as the federal government and many states face significant budget deficits, efforts to reduce costs by these payors will likely continue, which may result in reduced or slower growth in reimbursement for certain services provided by some of our tenants and operators.

Healthcare Licensure and Certificate of Need

Certain healthcare facilities in our portfolio are subject to extensive federal, state and local licensure, certification

and inspection laws and regulations. In addition, various licenses and permits are required to dispense narcotics, operate pharmacies, handle radioactive materials and operate equipment. Many states require certain healthcare providers to obtain a certificate of need, which requires prior approval for the construction, expansion and closure of certain healthcare facilities. The approval process related to state certificate of need laws may impact some of our tenants’ and operators’ abilities to expand or change their businesses.

Taxation

This section summarizes the material U.S. federal income tax considerations that a shareholder may consider relevant in connection with the purchase, ownership and disposition of our common shares. Because this section is a summary, it does not address all aspects of taxation that may be relevant to particular shareholders in light of their personal investment or tax circumstances, or to certain types of shareholders that are subject to special treatment under the U.S. federal income tax laws, such as:

· insurance companies;

· tax-exempt organizations (except to the limited extent discussed in “—Taxation of Tax-Exempt Shareholders” below);

· financial institutions or broker-dealers;

· non-U.S. individuals and foreign corporations (except to the limited extent discussed in “—Taxation of Non-U.S. Shareholders” below);

· U.S. expatriates;

· persons who mark-to-market our common shares;

· subchapter S corporations;

· U.S. shareholders (as defined below) whose functional currency is not the U.S. dollar;

· regulated investment companies and REITs;

· trusts and estates;

· persons who receive our common shares through the exercise of employee shares options or otherwise as compensation;

· persons holding our common shares as part of a “straddle,” “hedge,” “conversion transaction,” “synthetic security” or other integrated investment;

· persons subject to the alternative minimum tax provisions of the Internal Revenue Code of 1986 (the “Code”); and

· persons holding our common shares through a partnership or similar pass-through entity.

This summary assumes that shareholders hold our shares as capital assets for U.S. federal income tax purposes, which generally means property held for investment.

The statements in this section are not intended to be, and should not be construed as, tax advice. The statements in this section are based on the Code, final, temporary and proposed regulations promulgated by the U.S. Treasury Department (“Treasury Regulations”), the legislative history of the Code, current administrative interpretations and practices of the IRS, and court decisions. The reference to IRS interpretations and practices includes the IRS practices and policies endorsed in private letter rulings, which are not binding on the IRS except with respect to the taxpayer that receives the ruling. In each case, these sources are relied upon as they exist on the date of this report. Future legislation, Treasury Regulations, administrative interpretations and court decisions could change the current law or adversely affect existing interpretations of current law on which the information in this section is based. Any such change could apply retroactively. We have not

received any rulings from the IRS concerning our qualification as a REIT. Accordingly, even if there is no change in the applicable law, no assurance can be provided that the statements made in the following discussion, which do not bind the IRS or the courts, will not be challenged by the IRS or will be sustained by a court if so challenged.

Taxation of our Company

We were organized on April 9, 2013 as a Maryland real estate investment trust. We intend to elect to be taxed as a REIT for U.S. federal income tax purposes commencing with our taxable year ending December 31, 2013. We believe that, commencing with such taxable year, we will be organized and will operate in such a manner as to qualify for taxation as a REIT under the U.S. federal income tax laws, and we intend to continue to operate in such a manner, but no assurances can be given that we will operate in a manner so as to qualify or remain qualified as a REIT. This section discusses the laws governing the U.S. federal income tax treatment of a REIT and its shareholders. These laws are highly technical and complex.

Our qualification and taxation as a REIT will depend upon our ability to meet on a continuing basis, through actual results, certain qualification tests set forth in the U.S. federal income tax laws. Those qualification tests involve the percentage of income that we earn from specified sources, the percentage of our assets that falls within specified categories, the diversity of ownership of shares of our beneficial interest, and the percentage of our earnings that we distribute. Accordingly, no assurance can be given that our actual results of operations for any particular taxable year will satisfy such requirements. While we intend to operate so that we will continue to qualify as a REIT, given the highly complex nature of the rules governing REITs, the ongoing importance of factual determinations, and the possibility of future changes in our circumstances, no assurance can be given by tax counsel or by us that we will qualify as a REIT for any particular year.

If we qualify as a REIT, we generally will not be subject to U.S. federal income tax on the taxable income that we distribute to our shareholders. The benefit of that tax treatment is that it avoids the “double taxation,” or taxation at both the corporate and shareholder levels, that generally results from owning shares in a corporation. However, we will be subject to U.S. federal tax in the following circumstances:

· We will pay U.S. federal income tax on any taxable income, including undistributed net capital gain, that we do not distribute to shareholders during, or within a specified time period after, the calendar year in which the income is earned.

· We may be subject to the “alternative minimum tax” on any items of tax preference, including any deductions of net operating losses.

· We will pay income tax at the highest corporate rate on:

· net income from the sale or other disposition of property acquired through foreclosure (“Foreclosure Property”) that we hold primarily for sale to customers in the ordinary course of business, and

· other non-qualifying income from Foreclosure Property.

· We will pay a 100% tax on net income from sales or other dispositions of property, other than Foreclosure Property Foreclosure Property, that we hold primarily for sale to customers in the ordinary course of business.

· If we fail to satisfy one or both of the 75% gross income test or the 95% gross income test, as described below under “Part I, Item 1. Business — Taxation — Requirements for Qualification — Gross Income Tests,” and nonetheless continue to qualify as a REIT because we meet other requirements, we will pay a 100% tax on:

· the gross income attributable to the greater of the amount by which we fail the 75% gross income test or the 95% gross income test, in either case, multiplied by

· a fraction intended to reflect our profitability.

· If, during a calendar year, we fail to distribute at least the sum of (1) 85% of our REIT ordinary income for the year, (2) 95% of our REIT capital gain net income for the year, and (3) any undistributed taxable

income required to be distributed from earlier periods, we will pay a 4% nondeductible excise tax on the excess of the required distribution over the amount we actually distributed.

· We may elect to retain and pay income tax on our net long-term capital gain. In that case, a shareholder would be taxed on its proportionate share of our undistributed long-term capital gain (to the extent that we made a timely designation of such gain to the shareholders) and would receive a credit or refund for its proportionate share of the tax we paid.

· We will be subject to a 100% excise tax on any transactions between us and a TRS that are not conducted on an arm’s-length basis.

· If we fail to satisfy any of the asset tests, other than a de minimis failure of the 5% asset test, the 10% vote test or 10% value test, as described below under “Part I, Item 1. Business — Taxation — Asset Tests,” as long as the failure was due to reasonable cause and not to willful neglect, we file a schedule with the IRS describing each asset that caused such failure, and we dispose of the assets causing the failure or otherwise comply with the asset tests within six months after the last day of the quarter in which we identify such failure, we will pay a tax equal to the greater of $50,000 or the highest U.S. federal income tax rate then applicable to U.S. corporations (currently 35%) on the net income from the nonqualifying assets during the period in which we failed to satisfy the asset tests.

· If we fail to satisfy one or more requirements for REIT qualification, other than the gross income tests and the asset tests, and such failure is due to reasonable cause and not to willful neglect, we will be required to pay a penalty of $50,000 for each such failure.

· If we acquire any asset from an entity treated as a C corporation, or a corporation that generally is subject to full corporate-level tax, in a merger or other transaction in which we acquire a basis in the asset that is determined by reference either to such entity’s basis in the asset or to another asset, we will pay tax at the highest applicable regular corporate rate (currently 35%) if we recognize gain on the sale or disposition of the asset during the 10-year period after we acquire the asset provided no election is made for the transaction to be taxable on a current basis. The amount of gain on which we will pay tax is the lesser of:

· the amount of gain that we recognize at the time of the sale or disposition, and

· the amount of gain that we would have recognized if we had sold the asset at the time we acquired it.

· We may be required to pay monetary penalties to the IRS in certain circumstances, including if we fail to meet record-keeping requirements intended to monitor our compliance with rules relating to the composition of a REIT’s shareholders, as described below in “—Recordkeeping Requirements.”

· The earnings of our lower-tier entities that are treated as C corporations, including any TRS we may form and any taxable REIT subsidiaries we form in the future, will be subject to U.S. federal corporate income tax.

In addition, notwithstanding our qualification as a REIT, we may also have to pay certain state and local income taxes because not all states and localities treat REITs in the same manner that they are treated for U.S. federal income tax purposes. Moreover, as further described below, any TRS we may form and any other taxable REIT subsidiaries we form in the future will be subject to federal, state and local corporate income tax on their taxable income.

Requirements for Qualification

A REIT is a corporation, trust, or association that meets each of the following requirements:

1. It is managed by one or more trustees or directors.

2. Its beneficial ownership is evidenced by transferable shares, or by transferable certificates of beneficial interest.

3. It would be taxable as a domestic corporation, but for the REIT provisions of the U.S. federal income tax laws.

4. It is neither a financial institution nor an insurance company subject to special provisions of the U.S. federal income tax laws.

5. At least 100 persons are beneficial owners of its shares or ownership certificates.

6. Not more than 50% in value of its outstanding shares or ownership certificates is owned, directly or indirectly, by five or fewer individuals, which the Code defines to include certain entities, during the last half of any taxable year.

7. It elects to be a REIT, or has made such election for a previous taxable year, and satisfies all relevant filing and other administrative requirements established by the IRS that must be met to elect and maintain REIT status.

8. It meets certain other qualification tests, described below, regarding the nature of its income and assets and the amount of its distributions to shareholders.

9. It uses a calendar year for U.S. federal income tax purposes and complies with the recordkeeping requirements of the U.S. federal income tax laws.

We must meet requirements 1 through 4, 8 and 9 during our entire taxable year and must meet requirement 5 during at least 335 days of a taxable year of 12 months, or during a proportionate part of a taxable year of less than 12 months. Requirements 5 and 6 will apply to us beginning with our 2014 taxable year. If we comply with all the requirements for ascertaining the ownership of our outstanding shares in a taxable year and we do not know, or would not have reason to know after exercising reasonable diligence that we violated requirement 6, we will be deemed to have satisfied requirement 6 for that taxable year. For purposes of determining shares ownership under requirement 6, an “individual” generally includes a supplemental unemployment compensation benefits plan, a private foundation, or a portion of a trust permanently set aside or used exclusively for charitable purposes. An “individual,” however, generally does not include a trust that is a qualified employee pension or profit sharing trust under the U.S. federal income tax laws, and beneficiaries of such a trust will be treated as holding our shares in proportion to their actuarial interests in the trust for purposes of requirement 6.

Our declaration of trust provides restrictions regarding the transfer and ownership of shares of beneficial interest. See “Part I, Item 1A. Risk Factors.” The restrictions in our declaration of trust are intended (among other things) to assist us in continuing to satisfy requirements 5 and 6 above. These restrictions, however, may not ensure that we will, in all cases, be able to satisfy such share ownership requirements. If we fail to satisfy these share ownership requirements, our qualification as a REIT may terminate.

Qualified REIT Subsidiaries.

A corporation that is a “qualified REIT subsidiary” is not treated as a corporation separate from its parent REIT. All assets, liabilities, and items of income, deduction, and credit of a “qualified REIT subsidiary” are treated as assets, liabilities, and items of income, deduction, and credit of the REIT. A “qualified REIT subsidiary” is a corporation, all of the shares of which are owned by the REIT and for which no election has been made to treat such corporation as a “taxable REIT subsidiary.” Thus, in applying the requirements described herein, any “qualified REIT subsidiary” that we own will be ignored, and all assets, liabilities, and items of income, deduction, and credit of such subsidiary will be treated as our assets, liabilities, and items of income, deduction, and credit.

Other Disregarded Entities and Partnerships.

An unincorporated domestic entity, such as a partnership or limited liability company that has a single owner, generally is not treated as an entity separate from its owner for U.S. federal income tax purposes. An unincorporated domestic entity with two or more owners is generally treated as a partnership for U.S. federal income tax purposes. In the case of a REIT that is a partner in a partnership that has other partners, the REIT is treated as owning its proportionate share of the assets of the partnership and as earning its allocable share of the gross income of the partnership for purposes of the applicable REIT qualification tests. Our proportionate share for purposes of the 10% value test (see “Part I, Item 1. Business — Taxation — Asset Tests”) will be based on our proportionate interest in the equity interests and certain debt securities

issued by the partnership, and, for purposes of the gross income tests (see “Part I, Item 1. Business — Taxation — Requirements for Qualification — Gross Income Tests”) we will be deemed to be entitled to the income of the partnership attributable to such share. For all of the other asset tests, our proportionate share will be based on our capital interest in the partnership. Our proportionate share of the assets, liabilities, and items of income of any partnership, joint venture, or limited liability company that is treated as a partnership for U.S. federal income tax purposes in which we acquire an equity interest, directly or indirectly, will be treated as our assets and gross income for purposes of applying the various REIT qualification requirements.

We have control of our operating partnership and intend to control any subsidiary partnerships and limited liability companies, and we intend to operate them in a manner consistent with the requirements for our qualification as a REIT. We may from time to time be a limited partner or non-managing member in some of our partnerships and limited liability companies. If a partnership or limited liability company in which we own an interest takes or expects to take actions that could jeopardize our status as a REIT or require us to pay tax, we may be forced to dispose of our interest in such entity. In addition, it is possible that a partnership or limited liability company could take an action which could cause us to fail a gross income or asset test, and that we would not become aware of such action in time to dispose of our interest in the partnership or limited liability company or take other corrective action on a timely basis. In that case, we could fail to qualify as a REIT unless we were entitled to relief, as described below.

Taxable REIT Subsidiaries.

A REIT may own up to 100% of the shares of one or more taxable REIT subsidiaries. A taxable REIT subsidiary is a fully taxable corporation that may earn income that would not be qualifying income if earned directly by the parent REIT. Both the subsidiary and the REIT must jointly elect to treat the subsidiary as a taxable REIT subsidiary. A corporation of which a taxable REIT subsidiary directly or indirectly owns more than 35% of the voting power or value of the securities will automatically be treated as a taxable REIT subsidiary. We will not be treated as holding the assets of a taxable REIT subsidiary or as receiving any income that the taxable REIT subsidiary earns. Rather, the shares issued by a taxable REIT subsidiary to us will be an asset in our hands, and we will treat the distributions paid to us from such taxable REIT subsidiary, if any, as income. This treatment may affect our compliance with the gross income and asset tests. Because we will not include the assets and income of taxable REIT subsidiaries in determining our compliance with the REIT requirements, we may use such entities to undertake activities indirectly, such as earning fee income, that the REIT rules might otherwise preclude us from doing directly or through pass-through subsidiaries. Overall, no more than 25% of the value of a REIT’s assets may consist of shares or securities of one or more taxable REIT subsidiaries.

A taxable REIT subsidiary pays income tax at regular corporate rates on any income that it earns. In addition, the taxable REIT subsidiary rules limit the deductibility of interest paid or accrued by a taxable REIT subsidiary to its parent REIT to assure that the TRS is subject to an appropriate level of corporate taxation. Further, the rules impose a 100% excise tax on transactions between a taxable REIT subsidiary and its parent REIT or the REIT’s tenants that are not conducted on an arm’s-length basis.

A TRS may not directly or indirectly operate or manage any health care facilities or lodging facilities or provide rights to any brand name under which any health care facility or lodging facility is operated. A TRS is not considered to operate or manage a “qualified health care property” or “qualified lodging facility” solely because the TRS directly or indirectly possesses a license, permit, or similar instrument enabling it to do so.

Rent that we receive from a TRS will qualify as “rents from real property” under two scenarios. Under the first scenario, rent we receive from a TRS will qualify as “rents from real property” as long as (1) at least 90% of the leased space in the property is leased to persons other than TRSs and related-party tenants, and (2) the amount paid by the TRS to rent space at the property is substantially comparable to rents paid by other tenants of the property for comparable space, as described in further detail below under “Part I, Item 1. Business — Taxation — Requirements for Qualification — Gross Income Tests—Rents from Real Property.” If we lease space to a TRS in the future, we will seek to comply with these requirements. Under the second scenario, rents that we receive from a TRS will qualify as “rents from real property” if the TRS leases a property from us that is a “qualified health care property” and such property is operated on behalf of the TRS by a person who qualifies as an “independent contractor” and who is, or is related to a person who is, actively engaged in the trade or business of operating “qualified health care properties” for any person unrelated to us and the TRS (an “eligible independent contractor”). A “qualified health care property” includes any real property and any personal property that is, or is necessary or incidental to the use of, a hospital, nursing facility, assisted living facility, congregate care facility, qualified continuing care facility, or other licensed facility which extends medical or nursing or ancillary services to patients and which is operated by a provider of such services which is eligible for participation in the Medicare program with respect to such facility. Our initial properties generally will not be treated as “qualified health care properties.” Accordingly, we do not

currently intend to lease our properties to a TRS. However, to the extent we acquire or own “qualified health care properties” in the future, we may lease such properties to a TRS.

Gross Income Tests

We must satisfy two gross income tests annually to maintain our qualification as a REIT. First, at least 75% of our gross income for each taxable year must consist of defined types of income that we derive, directly or indirectly, from investments relating to real property or mortgages on real property or qualified temporary investment income. Qualifying income for purposes of that 75% gross income test generally includes:

· rents from real property;

· interest on debt secured by mortgages on real property, or on interests in real property;

· dividends or other distributions on, and gain from the sale of, shares in other REITs;

· gain from the sale of real estate assets, other than property held primarily for sale to customers in the ordinary course of business;

· income derived from the operation, and gain from the sale of, certain property acquired at or in lieu of foreclosure on a lease of, or indebtedness secured by, such Foreclosure Property; and

· income derived from the temporary investment of new capital that is attributable to the issuance of our shares of beneficial interest or a public offering of our debt with a maturity date of at least five years and that we receive during the one-year period beginning on the date on which we received such new capital.

Second, in general, at least 95% of our gross income for each taxable year must consist of income that is qualifying income for purposes of the 75% gross income test, other types of interest and dividends, gain from the sale or disposition of shares or securities, or any combination of these. Cancellation of indebtedness income and gross income from our sale of property that we hold primarily for sale to customers in the ordinary course of business is excluded from both the numerator and the denominator in both gross income tests. In addition, income and gain from “hedging transactions” that we enter into to hedge indebtedness incurred or to be incurred to acquire or carry real estate assets and that are clearly and timely identified as such will be excluded from both the numerator and the denominator for purposes of the 75% and 95% gross income tests. In addition, certain foreign currency gains will be excluded from gross income for purposes of one or both of the gross income tests. See “Part I, Item 1. Business — Taxation — Requirements for Qualification — Foreign Currency Gain.” The following paragraphs discuss the specific application of the gross income tests to us.

Rents from Real Property.

Rent that we receive from real property that we own and lease to tenants will qualify as “rents from real property,” which is qualifying income for purposes of the 75% and 95% gross income tests, only if each of the following conditions is met:

· First, the rent must not be based, in whole or in part, on the income or profits of any person, but may be based on a fixed percentage or percentages of receipts or sales.

· Second, neither we nor a direct or indirect owner of 10% or more of our shares may own, actually or constructively, 10% or more of a tenant from whom we receive rent, other than a TRS.

· Third, if the rent attributable to personal property leased in connection with a lease of real property is 15% or less of the total rent received under the lease, then the rent attributable to personal property will qualify as rents from real property. The allocation of rent between real and personal property is based on the relative fair market values of the real and personal property. However, if the 15% threshold is exceeded, the rent attributable to personal property will not qualify as rents from real property.

· Fourth, we generally must not operate or manage our real property or furnish or render services to our tenants, other than through an “independent contractor” who is adequately compensated and from whom we do not derive revenue. However, we need not provide services through an “independent contractor,” but instead may provide services directly to our tenants, if the services are “usually or customarily rendered” in

connection with the rental of space for occupancy only and are not considered to be provided for the tenants’ convenience. In addition, we may provide a minimal amount of “noncustomary” services to the tenants of a property, other than through an independent contractor, as long as our income from the services (valued at not less than 150% of our direct cost of performing such services) does not exceed 1% of our income from the related property. Furthermore, we may own up to 100% of the shares of a taxable REIT subsidiary which may provide customary and noncustomary services to our tenants without tainting our rental income from the related properties.

If a portion of the rent that we receive from a property does not qualify as “rents from real property” because the rent attributable to personal property exceeds 15% of the total rent for a taxable year, the portion of the rent that is attributable to personal property will not be qualifying income for purposes of either the 75% or 95% gross income test. Thus, if such rent attributable to personal property, plus any other income that is nonqualifying income for purposes of the 95% gross income test, during a taxable year exceeds 5% of our gross income during the year, we would lose our REIT qualification. If, however, the rent from a particular property does not qualify as “rents from real property” because either (1) the rent is considered based on the income or profits of the related tenant, (2) the tenant either is a related party tenant or fails to qualify for the exceptions to the related party tenant rule for qualifying taxable REIT subsidiaries or (3) we furnish noncustomary services to the tenants of the property in excess of the one percent threshold, or manage or operate the property, other than through a qualifying independent contractor or a taxable REIT subsidiary, none of the rent from that property would qualify as “rents from real property.”

We do not anticipate leasing significant amounts of personal property pursuant to our leases. Moreover, we do not intend to perform any services other than customary ones for our tenants, unless such services are provided through independent contractors from whom we do not receive or derive income or a TRS. Accordingly, we anticipate that our leases will generally produce rent that qualifies as “rents from real property” for purposes of the 75% and 95% gross income tests.

In addition to the rent, the tenants may be required to pay certain additional charges. To the extent that such additional charges represent reimbursements of amounts that we are obligated to pay to third parties such charges generally will qualify as “rents from real property.” To the extent such additional charges represent penalties for nonpayment or late payment of such amounts, such charges should qualify as “rents from real property.” However, to the extent that late charges do not qualify as “rents from real property,” they instead will be treated as interest that qualifies for the 95% gross income test.

As described above, we may own up to 100% of the shares of one or more TRSs. There are two exceptions to the related-party tenant rule described in the preceding paragraph for TRSs. Under the first exception, rent that we receive from a TRS will qualify as “rents from real property” as long as (1) at least 90% of the leased space in the property is leased to persons other than TRSs and related-party tenants, and (2) the amount paid by the TRS to rent space at the property is substantially comparable to rents paid by other tenants of the property for comparable space. The “substantially comparable” requirement must be satisfied when the lease is entered into, when it is extended, and when the lease is modified, if the modification increases the rent paid by the TRS. If the requirement that at least 90% of the leased space in the related property is rented to unrelated tenants is met when a lease is entered into, extended, or modified, such requirement will continue to be met as long as there is no increase in the space leased to any TRS or related party tenant. Any increased rent attributable to a modification of a lease with a TRS in which we own directly or indirectly more than 50% of the voting power or value of the stock (a “controlled TRS”) will not be treated as “rents from real property.” If in the future we receive rent from a TRS, we will seek to comply with this exception.

Under the second exception, a TRS is permitted to lease health care properties from the related REIT as long as it does not directly or indirectly operate or manage any health care facilities or provide rights to any brand name under which any health care facility is operated. Rent that we receive from a TRS will qualify as “rents from real property” as long as the “qualified health care property” is operated on behalf of the TRS by an “independent contractor” who is adequately compensated, who does not, directly or through its shareholders, own more than 35% of our shares, taking into account certain ownership attribution rules, and who is, or is related to a person who is, actively engaged in the trade or business of operating “qualified health care properties” for any person unrelated to us and the TRS (an “eligible independent contractor”). A “qualified health care property” includes any real property and any personal property that is, or is necessary or incidental to the use of, a hospital, nursing facility, assisted living facility, congregate care facility, qualified continuing care facility, or other licensed facility which extends medical or nursing or ancillary services to patients and which is operated by a provider of such services which is eligible for participation in the Medicare program with respect to such facility. Our properties generally will not be treated as “qualified health care properties.” Accordingly, we do not currently intend to lease properties to a TRS. However, to the extent we acquire or own “qualified health care properties” in the future, we may lease such properties to a TRS.

Interest.

The term “interest” generally does not include any amount received or accrued, directly or indirectly, if the determination of such amount depends in whole or in part on the income or profits of any person. However, interest generally includes the following:

· an amount that is based on a fixed percentage or percentages of receipts or sales; and

· an amount that is based on the income or profits of a debtor, as long as the debtor derives substantially all of its income from leasing substantially all of its interest in the real property securing the debt, and only to the extent that the amounts received by the debtor would be qualifying “rents from real property” if received directly by a REIT.

If a loan contains a provision that entitles a REIT to a percentage of the borrower’s gain upon the sale of the real property securing the loan or a percentage of the appreciation in the property’s value as of a specific date, income attributable to that loan provision will be treated as gain from the sale of the property securing the loan, which generally is qualifying income for purposes of both gross income tests.

Interest on debt secured by a mortgage on real property or on interests in real property generally is qualifying income for purposes of the 75% gross income test. However, if a loan is secured by real property and other property and the highest principal amount of a loan outstanding during a taxable year exceeds the fair market value of the real property securing the loan as of the date the REIT agreed to originate or acquire the loan (or, if the loan has experienced a “significant modification” since its origination or acquisition by the REIT, then as of the date of that “significant modification”), a portion of the interest income from such loan will not be qualifying income for purposes of the 75% gross income test, but will be qualifying income for purposes of the 95% gross income test. The portion of the interest income that will not be qualifying income for purposes of the 75% gross income test will be equal to the interest income attributable to the portion of the principal amount of the loan that is not secured by real property, that is, the amount by which the loan exceeds the value of the real estate that is security for the loan.

Dividends.

Our share of any dividends received from any corporation (including any TRS, but excluding any REIT) in which we own an equity interest will qualify for purposes of the 95% gross income test but not for purposes of the 75% gross income test. Our share of any dividends received from any other REIT in which we own an equity interest, if any, will be qualifying income for purposes of both gross income tests.

Prohibited Transactions.

A REIT will incur a 100% tax on the net income (including foreign currency gain) derived from any sale or other disposition of property, other than Foreclosure Property, that the REIT holds primarily for sale to customers in the ordinary course of a trade or business. We believe that none of our properties will be held primarily for sale to customers and that a sale of any of our properties will not be in the ordinary course of our business. Whether a REIT holds a property “primarily for sale to customers in the ordinary course of a trade or business” depends, however, on the facts and circumstances in effect from time to time, including those related to a particular property. A safe harbor to the characterization of the sale of property by a REIT as a prohibited transaction and the 100% prohibited transaction tax is available if the following requirements are met:

· the REIT has held the property for not less than two years;

· the aggregate expenditures made by the REIT, or any partner of the REIT, during the two-year period preceding the date of the sale that are includable in the basis of the property do not exceed 30% of the selling price of the property;

· either (1) during the year in question, the REIT did not make more than seven sales of property other than Foreclosure Property or sales to which Section 1033 of the Code applies, (2) the aggregate adjusted bases of all such properties sold by the REIT during the year did not exceed 10% of the aggregate bases of all of the assets of the REIT at the beginning of the year or (3) the aggregate fair market value of all such

properties sold by the REIT during the year did not exceed 10% of the aggregate fair market value of all of the assets of the REIT at the beginning of the year;

· in the case of property not acquired through foreclosure or lease termination, the REIT has held the property for at least two years for the production of rental income; and

· if the REIT has made more than seven sales of non-Foreclosure Property during the taxable year, substantially all of the marketing and development expenditures with respect to the property were made through an independent contractor from whom the REIT derives no income.

We will attempt to comply with the terms of the safe-harbor provisions in the U.S. federal income tax laws prescribing when a property sale will not be characterized as a prohibited transaction. We cannot assure you, however, that we can comply with the safe-harbor provisions or that we will avoid owning property that may be characterized as property that we hold “primarily for sale to customers in the ordinary course of a trade or business.” The 100% tax will not apply to gains from the sale of property that is held through a taxable REIT subsidiary or other taxable corporation, although such income will be taxed to the corporation at regular corporate income tax rates.

Fee Income.

Fee income generally will not be qualifying income for purposes of either the 75% or 95% gross income tests. Any fees earned by any TRS we form, such as fees for providing asset management and construction management services to third parties, will not be included for purposes of the gross income tests.

Foreclosure Property.

We will be subject to tax at the maximum corporate rate on any income from Foreclosure Property, which includes certain foreign currency gains and related deductions, other than income that otherwise would be qualifying income for purposes of the 75% gross income test, less expenses directly connected with the production of that income. However, gross income from Foreclosure Property will qualify under the 75% and 95% gross income tests. Foreclosure Property is any real property, including interests in real property, and any personal property incident to such real property:

· that is acquired by a REIT as the result of the REIT having bid on such property at foreclosure, or having otherwise reduced such property to ownership or possession by agreement or process of law, after there was a default or when default was imminent on a lease of such property or on indebtedness that such property secured;

· for which the related loan was acquired by the REIT at a time when the default was not imminent or anticipated; and

· for which the REIT makes a proper election to treat the property as Foreclosure Property.

Foreclosure Property also includes certain “qualified health care properties” (as defined above under “—Rents from Real Property”) acquired by a REIT as a result of the termination or expiration of a lease of such property (other than by reason of a default, or the imminence of a default, on the lease).