As filed with the Securities and Exchange Commission on October 15, 2013

| Registration Statement No. 333-190476 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

RUTHIGEN, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 46-1821392 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification

Number) |

2455 Bennett Valley Rd., Suite C116

Santa Rosa, California 95404

(707) 525-9900

(Address and telephone number of registrant’s principal executive offices)

Hojabr Alimi

Chief Executive Officer

Ruthigen, Inc.

2455 Bennett Valley Rd., Suite C116

Santa Rosa, California 95404

(707) 525-9900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Ivan K. Blumenthal, Esq. | Jeffrey J. Fessler, Esq. |

| Lewis J. Geffen, Esq. | Stephen A. Cohen, Esq. |

| Linda K. Rockett, Esq. | Sichenzia Ross Friedman Ference LLP |

| Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. | 61 Broadway, 32nd Floor |

| Chrysler Center | New York, New York 10006 |

| 666 Third Avenue | (212) 930-9700 |

| New York, New York 10017 | |

| (212) 935-3000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

The registrant is an “emerging growth company,” as defined in Section 2(a) of the Securities Act. This registration statement complies with the requirements that apply to an issuer that is an emerging growth company.

___________________________________

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED OCTOBER 15, 2013 |

1,500,000 Shares

Common Stock

This is the initial public offering of our common stock. We are offering all of the shares of common stock offered by this prospectus. We expect the initial public offering price of our shares of common stock will be between $12.00 and $14.00 per share. Ruthigen, Inc. is currently a wholly-owned subsidiary of Oculus Innovative Sciences, Inc.

We have applied to have our shares of common stock listed for trading on The NASDAQ Capital Market under the symbol “RTGN.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, as such, will be subject to reduced public company reporting requirements. Investing in our common stock involves a high degree of risk.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus for a discussion of information that should be considered in connection with an investment in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1) | $ | $ | ||||||

| Offering proceeds to us, before expenses | $ | $ | ||||||

(1) Does not include a non-accountable expense allowance equal to 1% of the gross proceeds of this offering payable to Aegis Capital Corp., the representative of the underwriters. See “Underwriting” beginning on page 80.

We have granted a 45-day option to the representative of the underwriters to purchase up to 225,000 additional shares of common stock solely to cover over-allotments, if any.

The underwriters expect to deliver our shares to purchasers in this offering on or about , 2013.

Sole Book - Running Manager

Aegis Capital Corp.

Co-Managers

| Dawson James Securities, Inc. | Chardan Capital Markets LLC |

RUT58-60 has the potential to be used as a prophylactic therapy to prevent and treat infections, and may accelerate patient discharge from the hospital and ultimately lead to an overall reduction in hospital readmission rates. Using a novel formulation of hypochlorous acid, HOCl, RUT58-60 has been shown to have activity against a wide range of pathogens including several antibiotic resistant strains of bacteria.

Methicillin-resistant Staphylococcus aureus (MRSA)

Escherichia coli (E. coli)

TABLE OF CONTENTS

| PROSPECTUS SUMMARY | 1 |

| THE OFFERING | 6 |

| RISK FACTORS | 8 |

| CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS | 30 |

| USE OF PROCEEDS | 32 |

| DIVIDEND POLICY | 32 |

| CAPITALIZATION | 33 |

| DILUTION | 34 |

| SELECTED FINANCIAL DATA | 36 |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 37 |

| BUSINESS | 44 |

| MANAGEMENT | 67 |

| EXECUTIVE AND DIRECTOR COMPENSATION | 70 |

| CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | 73 |

| PRINCIPAL STOCKHOLDERS | 74 |

| DESCRIPTION OF CAPITAL STOCK | 75 |

| SHARES ELIGIBLE FOR FUTURE SALE | 78 |

| UNDERWRITING | 80 |

| LEGAL MATTERS | 87 |

| EXPERTS | 87 |

| WHERE YOU CAN FIND MORE INFORMATION | 87 |

| INDEX TO FINANCIAL STATEMENTS | F-1 |

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock.

Unless the context requires otherwise: (a) references to “Ruthigen,” our “company,” “we,” “us” or “our” refer to Ruthigen, Inc., a Delaware corporation; (b) references to “Oculus” refer to Oculus Innovative Sciences, Inc., a Delaware corporation, and its subsidiaries; and (c) references to our company and our business assume that the separation transactions described in this prospectus have been consummated.

| i |

PROSPECTUS SUMMARY

The following information is a summary of the prospectus and it does not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus carefully, including the “Risk Factors” section and our financial statements and the notes relating to the financial statements, before making an investment decision. We reincorporated from Nevada to Delaware on September 25, 2013. Except where otherwise expressly stated, no distinction is made in this prospectus between historic activities and results of the Nevada and Delaware corporations.

Overview

We are a biopharmaceutical company focused on the discovery, development, and commercialization of pharmaceutical-grade hypochlorous acid, or HOCl, based therapeutics designed to prevent and treat infection in invasive applications. Our lead drug candidate, RUT58-60, is a broad spectrum anti-infective that we are developing for the prevention and treatment of infection in surgical and trauma procedures. We are focusing RUT58-60 for use initially to prevent infections in abdominal surgery due to the large addressable market, high rate of post-surgical infection associated with abdominal surgery, the high-impact opportunity that abdominal surgery offers us in the clinical trial setting to expose multiple internal organs to RUT58-60 at one time, and feedback from surgeons identifying post-surgical infection in abdominal surgery (relative to other surgeries) as a significant unmet medical need. We were incorporated in January 2013 as a wholly-owned subsidiary of Oculus Innovative Sciences, Inc., or Oculus, and until the closing of this offering, we will be operated as a wholly-owned subsidiary of Oculus. We currently have no products approved for sale and we cannot guarantee that we will ever have marketable products. We plan to file our Investigational New Drug Application, or IND, for RUT58-60 in the fourth quarter of 2013.

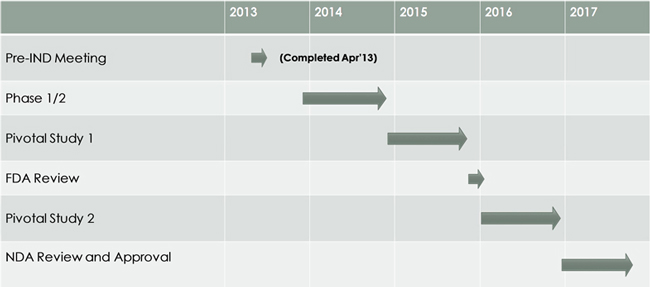

Our goal is to become the first company to market RUT58-60 as a drug containing hypochlorous acid for the prevention and treatment of infection in invasive surgeries in the United States. We believe that RUT58-60 has the potential to significantly reduce the rate of post-surgical infections, reduce the use of systemic antibiotics that have proven to be ineffective against certain common resistant strains of bacteria, including methicillin-resistant staphylococcus aureus, or MRSA, and vancomycin-resistant enterococcus, or VRE, reduce the negative side effects associated with the increasingly widespread use of antibiotics, accelerate post-surgical healing which should lead to quicker patient discharge from the hospital, and ultimately reduce hospital readmission rates. We plan to initiate patient enrollment for our Phase 1/2 clinical trial for RUT58-60 in the United States in the first quarter of 2014 and pending the successful completion of that trial and our planned pivotal clinical trials, we plan to submit our new drug application, or NDA, to the FDA in 2017.

We believe that RUT58-60 will complement the paid for performance paradigm and it is designed to reduce the overall healthcare costs associated with post-surgical infections and improve hospital economics. We believe the benefits of RUT58-60 will be significant:

| · | RUT58-60 mimics the human body’s own infection-fighting mechanism, | |

| · | RUT58-60 has not shown evidence of toxicity or other negative side effects in our animal and other preclinical studies, | |

| · | preclinical studies of RUT58-60 conducted by us have not produced resistant bacteria, and | |

| · | RUT58-60 appears to provide broad spectrum anti-microbial effect with significant pro-healing attributes. |

We believe that RUT58-60 has the potential to be used as a prophylactic therapy to prevent and treat infections, and may accelerate patient discharge from the hospital and ultimately lead to an overall reduction in hospital readmission rates.

The benefits of hypochlorous acid in preventing infection have been well-demonstrated in products with lower concentrations of hypochlorous acid than RUT58-60. To date, hypochlorous acid based products have only been cleared for use as medical devices for topical applications in the United States, Europe and certain other countries. Earlier formulations have not been able to achieve therapeutic indication status, primarily due to their lack of stability and therefore have been limited for use as topical applications. Historically, the lack of stability has posed a vexing problem to companies hoping to pursue hypochlorous acid products for therapeutic indications in invasive applications and has prevented these companies from being able to conduct the clinical trials necessary to prove whether HOCl is safe and effective for use as a therapeutic.

Hypochlorous acid based products have been used successfully to prevent infection in topical applications and have been sold commercially since at least 2005 by other companies, generally as medical devices or for the disinfection of medical devices. Several of these hypochlorous acid based products have been commercialized as medical devices by Oculus Innovative Sciences, Inc., or Oculus, our parent company and the licensor of our technology. Through our license and supply agreement with Oculus that will take effect upon the completion of this offering, we have obtained exclusive rights to the RUT58-60 technology, as well as a proprietary method of manufacturing and producing hypochlorous acid with pharmaceutical potential by incorporating additional small molecules, such as magnesium, without sodium hypochlorite, the result of which increases the compound’s stability and biocompatibility, or the compound’s ability to remain in direct contact with internal tissues and organs. We believe our recent enhancements to the stability and biocompatibility of the compound will allow us to expand the use of hypochlorous acid so that it may be used in direct contact with internal organs and thus, for invasive applications, including surgical and trauma procedures, as well as additional clinical indications. With these enhancements, we believe our lead product candidate will be able to meet the safety and efficacy standards that the FDA requires for the approval of a new drug. Obtaining approval of new drug by the FDA is a lengthy, expensive and uncertain process, and we may not be successful in obtaining approval. The FDA review processes can take years to complete and approval is never guaranteed. If we are successful obtaining FDA approval of RUT58-60 as a drug, we plan to commercialize it for invasive applications.

| 1 |

There are approximately 30 million surgical and trauma procedures in the United States per year, approximately 7 million of which are abdominal surgeries. Our initial goal is to obtain FDA approval for RUT58-60 for the prevention of infection associated with abdominal surgery and thereafter we plan to pursue FDA approval for RUT58-60 for use in other types of surgical procedures as well as additional clinical indications. We expect to commence patient enrollment for our Phase 1/2 clinical trial in the first quarter of 2014. Pending the successful completion of that trial, we plan to conduct the pivotal clinical trials necessary to obtain regulatory approval in the United States. Our goal is to obtain regulatory approval from the FDA and begin marketing RUT58-60 for the prevention of infection associated with abdominal surgery as early as 2017.

If we are successful in receiving FDA approval for RUT58-60 for the prevention of infection in abdominal surgery, we plan to pursue other types of surgeries, including cardiac, pulmonary and spinal, among others. Based upon data from preclinical studies conducted by us and data reported in third party publications, we believe that the safety and tolerability profile of RUT58-60, combined with its broad-range antimicrobial potency without specificity, offer a practical and unique approach to stem the high rate of hospital acquired infections and infections resulting from complications in surgeries and the increasing emergence of new antibiotic resistant bacteria that pose a significant risk to public health. We believe that RUT58-60 represents a significant innovation over existing uses of hypochlorous acid in topical applications and over systemic antibiotics, which are the current standard of care for the prevention and treatment of infection in surgical and other invasive applications, and has the potential to raise the clinical bar for anti-infective products generally in the face of increasing headwinds.

In addition to the United States, we plan to seek regulatory approval to commercialize RUT58-60 in Canada, Europe and Japan. Under our license and supply agreement with Oculus that will take effect upon the completion of this offering, we have exclusively licensed the hypochlorous acid technology relating to RUT58-60 for commercialization in the United States, Europe, Japan and Canada. Together, these markets represented approximately 70% of the global medicines market in 2011. In parallel with our clinical development activities for RUT58-60, we have commenced discussions with various pharmaceutical companies for potential partnership and collaboration activities for RUT58-60 in the United States, Canada, Europe and Japan. To date, we have not entered into any partnerships or collaborations for RUT58-60 and we cannot guarantee that we will be successful entering into any such arrangements on terms favorable to us, or at all.

Our Strategy

Our goal is to be the first company to market hypochlorous acid based drugs for the prevention and treatment of infection in invasive procedures. By doing so, we hope to be able to reduce the number of post-surgical infections, reduce the increasingly widespread use of systemic antibiotics and the negative side effects associated with them, accelerate post-surgical healing which should lead to quicker patient discharge from the hospital, and reduce hospital readmission rates. The key elements of our strategy to achieve this goal are listed below.

| · | Initiate and complete clinical trials for our lead drug candidate, RUT58-60, for the first indication (abdominal surgery) and obtain regulatory approval to market as a drug in the United States. | |

| · | Establish our own research and development (R&D) manufacturing facility that is in compliance with the FDA’s cGMP requirements for manufacturing drugs. | |

| · | Commercialize RUT58-60 in the United States either through a direct sales force or with a partner. | |

| · | Engage strategic partners to develop, obtain regulatory approval for, and commercialize RUT58-60 for invasive use in Europe and Japan. | |

| · | Expand the use of, and obtain regulatory approval for, RUT58-60 for use in other types of surgeries and traumatic procedures. | |

| · | Leverage our proprietary hypochlorous acid chemistry technology to develop a pipeline of innovative drugs for the prevention and treatment of infection in surgical and other invasive applications. |

Our Solution

We believe that hypochlorous acid, the active pharmaceutical ingredient in RUT58-60 and other drug candidates that we plan to develop in the future, has several potential benefits over systemic antibiotics, which are the current standard of care for the prevention of infection associated with surgical and trauma procedures, as described below.

| · | Broad Spectrum Activity. RUT58-60 has been shown in non-clinical studies to kill bacteria, viruses, spores, and fungi. We believe this can be achieved through common mechanisms of action, including by denaturation, a process in which the structure of surface proteins on the microorganism is irreversibly changed or damaged, which results in the destruction of pathogen. |

| 2 |

| · | Effective Against Existing Antibiotic Resistant Strains of Bacteria. RUT58-60 has been shown in non-clinical studies to eradicate MRSA, VRE, and other antibiotic resistant microorganisms. RUT58-60’s biologic activity is localized and fast-acting, which results in rapid bacterial destruction; in vitro studies have demonstrated potent 30-second kill times against several commonly found, clinically relevant, aggressive treatment-resistant bacteria. |

| · | Multi-targeted; Does Not Promote Emergence of Superbugs. We believe that RUT58-60 has the potential to be used broadly as a prophylactic agent to prevent infections in surgical patients because, in pre-clinical studies, it has not been shown to promote resistance to bacteria and therefore does not increase the emergence of drug-resistant pathogens. RUT58-60 does not target specific strains or receptor targets that the microorganism can then quickly mutate to induce resistance. Further, exposure to hypochlorous acid causes irreversible destabilization of protein structures necessary for continued metabolism for bacteria and other microbes. |

| · | Pro-healing Potential. Hypochlorous acid products have demonstrated faster tissue healing in studies published in peer-reviewed journals and other publications. Although the mechanism of action for incision site healing has not been formally established in RUT58-60, we believe that incision sites will heal quicker, resulting in faster patient recovery and discharge from the hospital. |

| · | Mimics Body’s Natural Microbe-Fighting Mechanism. Human bodies have evolved over thousands of years to produce hypochlorous acid naturally to kill infection-causing microbes quickly and without creating the opportunity for microbes to mutate and become resistant. We believe that we have chemically engineered RUT58-60 to mimic the body’s natural response to unfamiliar and unwanted organisms, without the undesirable side effects resulting from the proliferation and overuse of antibiotics. |

| · | No Change to Surgeon Behavior Required. Sterile saline is currently the most commonly used irrigation solution to prevent infection during and following surgery when lavage is used to wash the surgical site following surgical and trauma procedures, but it does not contain the antiseptic benefits traditionally associated with antibiotics to prevent post-surgical infection. The use of a lavage wash in surgeries is not new and therefore, we believe that the replacement of saline (or other currently used post-operative irrigation solutions) with RUT58-60 in surgical settings will be an easy and logical transition for surgeons and will not require additional training, time, education, ramp up or behavior changes by surgeons. |

| · | Prepackaged, Sterilized, Ready to Use. We believe that RUT58-60, if approved by the FDA, will be the only prepackaged, sterilized, ready-to-use hypochlorous acid based drug designed to prevent infection following surgery. We intend to package RUT58-60 in convenient, sterile packaging that will not require mixing or solution preparation prior to use, thereby reducing the need for human intervention and further minimizing opportunities to introduce other organisms that may cause infection and the risk of medical error. |

| · | Stable Formulation. RUT58-60 is not expected to require special handling precautions or storage requirements beyond those typically required for similar sterile products found in hospital and other indoor settings. Laboratory tests suggest that RUT58-60 may have a shelf life ranging from one to two years depending on the size and type of packaging. We believe that RUT58-60 is a unique, shelf stable form of hypochlorous acid that has the potential to meet the FDA’s requirements for a drug. |

| · | Enhanced Biocompatibility for Internal Use. We believe RUT58-60 is the first and only form of hypochlorous acid based drug designed for internal use. We believe RUT58-60 represents an innovative way to improve the potential pharmaceutical properties of hypochlorous acid by incorporating additional small molecules, such as magnesium, without sodium hypochlorite, the result of which enhances the biocompatibility of the compound in a manner that allows the compound to remain in direct contact with internal tissues and organs. |

| · | Hospital Cost Savings Potential. We believe that RUT58-60 has the potential to improve surgical outcomes and lower hospital costs by preventing infection, decreasing the time to patient discharge and reducing hospital readmission rates. Post-surgical infections are costly and, under new government regulations and payor policies, these infections are increasingly not covered for reimbursement. High patient costs associated with the treatment of infections may be related to longer hospitalizations and extended care, patient isolation due to the high rates of infection transmission, and the use of expensive systemic antibiotics used to target infection. Post-surgical infection may also undermine the healing process, prolong healing time and increase hospital readmissions after initial discharge. Eventually, we believe that RUT58-60 may also help reduce the use of systemic antibiotics, thereby lowering overall cost of the hospital visit. |

| 3 |

Our Relationship with Oculus

We are currently a wholly-owned subsidiary of Oculus. Upon completion of this offering, we estimate Oculus will own 57% of our outstanding shares of common stock. We have entered into a license and supply agreement, a shared services agreement and a separation agreement with Oculus, which will take effect upon the completion of this offering, that govern certain aspects of our relationship with Oculus. The license and supply agreement covers our exclusive rights to the license, development and manufacturing of our lead drug candidate, RUT58-60. The shared services agreement covers certain transitional services to be provided by Oculus following completion of this offering. We entered into the separation agreement with Oculus in order to maximize our ability to operate as independently as possible from Oculus in order to unlock the value proposition of RUT58-60, notwithstanding Oculus’ majority ownership of us following the offering, and therefore the separation agreement contains certain limitations on Oculus’ ability to control various aspects of our business and operations. In addition, upon completion of the offering, the members of Ruthigen’s board of directors who are also members of Oculus’ board of directors have agreed to step down from Oculus’ board and plan to continue their service on Ruthigen’s board. Each of these agreements has been entered into in the overall context of our separation from Oculus. We refer to these agreements and the series of transactions that will take effect upon the completion of this offering, collectively, as the “Separation.”

We believe that a distribution of Ruthigen shares by Oculus to Oculus shareholders would be advantageous to the market for our shares by increasing liquidity, would accelerate our ability to become independent from Oculus by decreasing Oculus’ ownership of our common stock and would be beneficial for Oculus’ stockholders who would have a direct opportunity to participate in the Ruthigen value proposition. Oculus has advised us that, following the completion of this offering and subject to the expiration of any applicable lock-up periods or other agreements we have or may have with Oculus described herein, it does not have any near term plans to distribute our shares held by Oculus to the Oculus stockholders. The decision to conduct any such distribution is at the sole discretion of Oculus’ board of directors. There is no assurance that the Distribution will ever occur. However, pursuant to the separation agreement, Oculus has agreed, from time to time, to retain investment bankers and tax advisors to re-evaluate the advisability of conducting a plan of distribution of the Ruthigen shares Oculus owns and we have agreed to register any shares that Oculus may distribute in the future. Presently, it is expected that any potential distribution will be taxable to Oculus and its stockholders. We refer to any such potential distribution as the “Distribution.”

Management

We are led by a team with extensive experience in managing biopharmaceutical companies, including:

| · | Our Chairman, Chief Executive Officer and Chief Science Officer, Hojabr Alimi, who held the position of Chief Executive Officer and President from 1999 to February 2013 of Oculus, a company which he co-founded, prior to this offering. Mr. Alimi is currently serving as Chairman of the board of directors of Oculus, a position he has held since 1999. Prior to that time, he was a corporate microbiologist and Senior Quality Assurance Manager for Arterial Vascular Engineering, Medtronic. Mr. Alimi received a B.A. in biology from Sonoma State University. |

| · | Our Chief Financial Officer, Sameer Harish, has been principal of Harish Life Science Advisors since December 2011, an independent consulting firm which he founded that provides financial, strategic, and market research advisory services to life science companies. Mr. Harish has held several analyst positions focused on medical device, biotech, and diagnostic companies. Mr. Harish has also held research and laboratory positions at Guidant (now part of Abbott Laboratories) and Synteni (acquired by Incyte Corporation). |

Risks Relating to Our Business

We are a development stage biopharmaceutical company, and our business and ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our common stock. In particular, you should consider the following risks, which are discussed more fully in the section entitled “Risk Factors”:

| · | we currently do not have regulatory approval for our lead drug candidate, RUT58-60, or any other product candidates, in the United States or elsewhere, although we plan to conduct clinical trials in the United States for RUT58-60 and other product candidates in the future, there is no assurance that we will be successful in our clinical trials or receive regulatory approval in a timely manner, or at all; |

| · | our business is substantially dependent upon the intellectual property rights that we license from Oculus; the intellectual property underlying those rights serves as collateral under certain loan and security agreements between Oculus and its lenders and could be foreclosed upon by Oculus’ lenders if Oculus were to breach the loan and security agreements; |

| · | we have never been profitable, have not generated any revenue and we expect to incur additional losses to fund our clinical trials; |

| · | we will require substantial additional funding beyond the offering to which this prospectus relates to complete the development and commercialization of RUT58-60 and/or any other potential product candidates, and such funding may not be available on acceptable terms or at all; |

| 4 |

| · | we currently depend entirely on our ability to develop and commercialize RUT58-60, and our ability to generate product revenues in the future will depend heavily on the successful development and commercialization of RUT58-60; |

| · | the assets and resources that we acquire from Oculus in the Separation may not be sufficient for us to operate as a stand-alone company, and we may experience difficulty in separating our assets and resources from Oculus; |

| · | we and our stockholders may not achieve some or all of the expected benefits of the separation agreement, which imposes certain limitations on Oculus’ ability to control various aspects of our business and operations in order to maximize our ability to operate as independently as possible from Oculus; |

| · | the ownership by our chief executive officer and our directors of shares of Oculus common stock and rights to purchase Oculus common stock may create, or may create the appearance of, conflicts of interest; |

| · | we and our stockholders may not achieve some or all of the expected benefits of the Separation; |

| · | we have not submitted an application for or obtained any FDA, approval for any product through the NDA, process, which may impede our ability to obtain FDA approval in a timeframe that is consistent with our expectations and plans that we have previously communicated with our stockholders, or at all; |

| · | we may be subject to delays in our clinical trials, which could result in increased costs and delays or limit our ability to obtain regulatory approval for RUT58-60 and/or any other potential product candidates; |

| · | we have never commercialized any of our product candidates and RUT58-60 and/or any other potential product candidates, even if approved, may not be accepted by healthcare providers or healthcare payors; |

| · | substantial sales of our common stock may occur following this offering, as well as following the potential distribution of our common stock by Oculus, which could cause the price of our common stock to decline; |

| · | the failure of Oculus or any third parties to perform their respective obligations under any manufacturing and/or supply agreement(s) may delay or otherwise harm the development and commercialization of RUT58-60 and/or any other potential product candidates; and |

| · | we may be unable to maintain and protect our intellectual property assets, which could impair the advancement of our pipeline and commercial opportunities. |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

| · | requirement to provide only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| · | reduced disclosure about our executive compensation arrangements; |

| · | no non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| · | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company on the date that is the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the completion of this offering; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission.

| 5 |

To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including: (1) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; (2) scaled executive compensation disclosures; and (3) the requirement to provide only two years of audited financial statements, instead of three years.

Our Corporate Information

We incorporated under the laws of the State of Nevada on January 18, 2013 as a wholly-owned subsidiary of Oculus Innovative Sciences, Inc. and we reincorporated from Nevada to Delaware on September 25, 2013. Our fiscal year end is March 31. Our principal executive offices are located at 2455 Bennett Valley Rd., Suite C116, Santa Rosa, California 95404. Our telephone number is (707) 525-9900. Our website address is www.ruthigen.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

THE OFFERING

| Common stock offered by us | 1,500,000 shares | |

| Common stock held by Oculus as of October 1, 2013 | 2,000,000 shares | |

| Common stock to be outstanding immediately after this offering | 3,500,000 shares | |

| Over-allotment option | The underwriters have an option for a period of 45 days to purchase up to 225,000 additional shares of our common stock to cover over-allotments, if any. | |

| Common stock to be held by Oculus immediately after this offering | 2,000,000 shares | |

| Use of proceeds | We estimate that the net proceeds from this offering will be approximately $16.8 million, or approximately $19.5 million if the underwriters exercise their over-allotment option in full, at an assumed initial public offering price of $13.00 per share, the midpoint of the range set forth on the cover page of this prospectus, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering to fund our planned Phase 1/2 clinical trial of RUT58-60 and costs associated with the preparation of our first pivotal trial; to establish and validate an independent R&D and cGMP manufacturing facility; to satisfy certain milestone payments under our license and supply agreement; and for general corporate purposes, including working capital. See “Use of Proceeds” for a more complete description of the intended use of proceeds from this offering. | |

| Risk Factors | You should read the “Risk Factors” section starting on page 8 for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. | |

| Proposed NASDAQ Capital Market symbol | We have applied to have our shares of common stock listed for trading on The NASDAQ Capital Market under the symbol “RTGN.” No assurance can be given that such listing will be approved. |

Unless otherwise indicated, the information presented in this prospectus gives effect to the Separation as described in this prospectus.

The number of shares of our common stock outstanding after this offering excludes:

| · | 751,450 shares of our common stock reserved for future issuance under our 2013 Employee, Director and Consultant Equity Incentive Plan, or 2013 Plan, of which restricted stock units for up to 436,450 shares of our common stock are intended to be granted to our employees and directors on the 46th day after the completion of this offering; and |

| 6 |

| · | 75,000 shares of our common stock underlying the warrants to be issued to the representative of the underwriters in connection with this offering. |

Unless otherwise indicated, all information in this prospectus assumes:

| · | no exercise of the representative’s warrants described above; | |

| · | a 1-for-2.5 reverse stock split of our common stock on September 25, 2013; and |

| · | no exercise by the underwriters of their option to purchase up to 225,000 additional shares of our common stock to cover over-allotments, if any. |

Summary Financial Information

You should read the following summary financial data together with our financial statements and the related notes included elsewhere in this prospectus and the “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus. We are a wholly-owned subsidiary of Oculus Innovative Sciences, Inc. and were incorporated under the laws of the State of Nevada on January 18, 2013. We were reincorporated from Nevada to Delaware on September 25, 2013. Financial statements for periods prior to January 18, 2013 reflect carve-out financial information from Oculus Innovative Sciences, Inc. The selected statements of operations data for the period from October 20, 2011 ("inception") to June 30, 2013, the three months ended June 30, 2012 and 2013, and the selected balance sheet data as of June 30, 2013 are derived from our unaudited financial statements and related notes included elsewhere in this prospectus. We have derived the statements of operations data for the period from October 20, 2011 (inception) to the years ended March 31, 2012 and March 31, 2013, and the balance sheet data as of March 31, 2012 and 2013, from our audited financial statements included elsewhere in this prospectus. Our financial status creates substantial doubt about our ability to continue as a going concern. Our historical results for any prior period are not necessarily indicative of results to be expected in any future period.

| Period from October 20, 2011 (inception) to March 31, | Year Ended March 31, | Three Months Ended June 30, | Three Months Ended June 30, | Period from October 20, 2011 (inception) to June 30, | ||||||||||||||||

| 2012 | 2013 | 2012 | 2013 | 2013 | ||||||||||||||||

| Statement of Operations Data: | (unaudited) | (unaudited) | (unaudited) | |||||||||||||||||

| Revenues | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

| Operating expenses | ||||||||||||||||||||

| Research and development | 24,000 | 258,000 | 10,000 | 175,000 | 457,000 | |||||||||||||||

| Selling, general and administrative | 4,000 | 265,000 | 3,000 | 302,000 | 571,000 | |||||||||||||||

| Total operating expenses | 28,000 | 523,000 | 13,000 | 477,000 | 1,028,000 | |||||||||||||||

| Net loss | $ | (28,000 | ) | $ | (523,000 | ) | $ | (13,000 | ) | $ | (477,000 | ) | $ | (1,028,000 | ) | |||||

| Net loss per share: basic and diluted | $ | (0.01 | ) | $ | (0.26 | ) | $ | (0.01 | ) | $ | (0.24 | ) | ||||||||

| Weighted-average number of shares used in per common share calculations: | ||||||||||||||||||||

| Basic and diluted | 2,000,000 | 2,000,000 | 2,000,000 | 2,000,000 | ||||||||||||||||

| As of June 30, 2013 | ||||||||

| Actual | As Adjusted (1) | |||||||

| Balance Sheet Data: | ||||||||

| Cash (2) | $ | 53,000 | $ | 16,811,000 | ||||

| Total assets (2) | 712,000 | 16,917,000 | ||||||

| Total liabilities | 900,000 | 347,000 | ||||||

| Total stockholder's (deficiency) equity(2) | (188,000 | ) | 16,570,000 | |||||

| Working capital (deficit)(2) | $ | (744,000 | ) | $ | 16,567,000 | |||

| (1) | Our as adjusted balance sheet data as of June 30, 2013 gives effect to the issuance and sale of the number of shares offered by us, as set forth on the cover page of this prospectus, assuming an initial offering public offering price of $13.00 per share (the midpoint of our expected offering range on the cover of this prospectus), after deducting the estimated underwriting discounts and commissions and our estimated offering expenses, which are estimated to be approximately $2,742,000. |

| (2) | A $1.00 increase or decrease in the assumed initial public offering price of $13.00 per share (the midpoint of our expected offering range on the cover of this prospectus) would increase (decrease) the amounts representing cash, working capital (deficiency), total assets and total stockholder's equity by $1,380,000. |

| 7 |

RISK FACTORS

An investment in our common stock involves a high degree of risk. Before making an investment decision, you should give careful consideration to the following risk factors, in addition to the other information included in this prospectus, including our financial statements and related notes, before deciding whether to invest in shares of our common stock. The occurrence of any of the adverse developments described in the following risk factors could materially and adversely harm our business, financial condition, results of operations or prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business

We are a development stage company with no commercial products.

We are developing RUT58-60, our lead drug candidate, initially for the prevention of infection associated with abdominal surgery. Currently, we have no product candidates in our clinical development pipeline other than RUT58-60 and have no products approved for sale. We plan to file our IND for RUT58-60 with the FDA in the fourth quarter of 2013. Thereafter, we expect to commence our initial clinical trials for RUT58-60 in abdominal surgery. Although we have begun pre-clinical and in vitro studies, we have not yet begun human clinical trials, and therefore, we are still many years from beginning to commercialize and market RUT58-60 or any other product candidate, if ever. We expect the clinical development of RUT58-60 will require significant additional effort, resources, time, and expenses prior to seeking FDA approval. RUT58-60 is not expected to be commercially available in the United States or outside the United States for several years, if ever.

We are heavily dependent on the success of our lead drug candidate, RUT58-60, and we cannot provide any assurance that our lead drug candidate or other product candidates we may have in the future will be commercialized.

We intend to invest the vast majority of our time and financial resources in the development and commercialization of our lead drug candidate, RUT58-60, which is currently in clinical development. We plan to file our IND with the FDA in the fourth quarter of 2013 and expect to commence patient enrollment for our Phase 1/2 clinical trial in the first quarter of 2014. Our future success depends heavily on our ability to successfully develop, obtain regulatory approval for, and commercialize our lead drug candidate, which may never occur. We currently generate no revenues and incur substantial losses, and we may never be able to develop or commercialize a marketable drug.

Before we generate any revenues from product sales, we must complete preclinical studies and clinical trials for RUT58-60, establish manufacturing capabilities that comply with the FDA’s cGMP requirements for manufacturing sterile drugs, receive approval from the FDA in the United States and other regulatory agencies in foreign jurisdictions, build a commercial organization, make substantial investments and undertake significant marketing efforts ourselves or in partnership with others. We will not be permitted to market or promote RUT58-60 or any other product candidates we may have in the future, before we receive regulatory approval from the FDA or comparable foreign regulatory authorities, and we may never receive such regulatory approval for any of our other product candidates.

We have not previously submitted a biologics license application, or BLA, or a new drug application, or NDA, to the FDA, or similar drug approval filings to comparable foreign authorities, for any product candidate. We cannot be certain that our lead drug candidate or any other product candidate will be successful in clinical trials or receive regulatory approval. Further, our lead drug candidate or any other product candidate may not receive regulatory approval even if our clinical trials are successful. If we do not receive regulatory approvals for our lead drug candidate or any other product candidate, we may not be able to continue our operations. Even if we successfully obtain regulatory approvals to market our lead drug candidate or any other product candidate, our revenues will be dependent, in part, upon the size of the markets in the territories for which we gain regulatory approval and have commercial rights. If the markets for patient subsets that we are targeting are not as significant as we estimate, we may not generate significant revenues from sales of such products, if approved.

| 8 |

We plan to seek regulatory approval to commercialize RUT58-60 in the United States, Canada, Europe and Japan. While the scope of regulatory approval is similar in other countries, to obtain separate regulatory approval in many other countries we must comply with numerous and varying regulatory requirements of such countries regarding safety and efficacy, clinical trials and commercial sales, pricing and distribution of our lead drug candidate or any other product candidate, and we cannot predict success in these jurisdictions.

Clinical trials involve a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results.

RUT58-60 and any future product candidate that we pursue will be subject to extensive regulation by the FDA in the United States and other regulatory agencies in foreign jurisdictions, including activities related to preclinical studies, human clinical trials, manufacturing, labeling, packaging and sterilization, storage, recordkeeping, advertising, promotion, export, import, marketing and distribution and other possible activities.

Our lead drug candidate, RUT58-60, is a proprietary formulation of hypochlorous acid, and, we believe, it has unique features and properties that will differentiate it from other hypochlorous acid formulations that are marketed as topical products and regulated by the FDA as medical devices under 510(k) clearances. We expect to pursue FDA drug approval for RUT58-60 as a new chemical entity. There may be other hypochlorous acid drug candidates in development by other companies and these candidates may gain FDA drug approval prior to RUT58-60. We are conducting pre-clinical testing to support our Investigational New Drug Application, or IND, for RUT58-60, and we have received feedback from the FDA to our proposed Phase 1/2 clinical trial protocol. Based on the feedback we received from the FDA, we expect to submit the IND to the FDA in the fourth quarter of 2013 and commence patient enrollment for our Phase 1/2 clinical trial in the first quarter of 2014. As we move through the regulatory process, the FDA may make other suggestions that may impact our ability to complete our clinical trials within the timeframe or budget that we are anticipating, which could impact investors’ interest in our business and our stock price.

The results of preclinical studies and clinical trials of previously published hypochlorous acid based products may not necessarily be indicative of the results of our future clinical trials. The design of our clinical trials is based on many assumptions about the expected effects of hypochlorous acid used historically in the industry and if those assumptions are incorrect, the trials may not produce statistically significant results. Preliminary results may not be confirmed upon full analysis of the detailed results of an early clinical trial. Product candidates in later stages of clinical trials may fail to show safety and efficacy sufficient to support intended use claims despite having progressed through initial clinical trials. The data collected from clinical trials of our product candidates may not be sufficient to obtain regulatory approval in the United States or elsewhere. Because of the uncertainties associated with drug development and regulatory approval, we cannot determine if, or when, we may have an approved product for commercialization or whether we will ever achieve sales or profits of RUT58-60 or other product candidates we may pursue in the future.

We may be subject to extensive regulations and may not obtain marketing approvals for products in Europe and other jurisdictions.

In addition to regulations in the United States, should we or our collaborators pursue marketing approvals for RUT58-60 internationally, we and our collaborators will be subject to a variety of regulations in other jurisdictions governing, among other things, clinical trials and any commercial sales and distribution of our products. Whether or not we, or our collaborators, obtain FDA approval for a product, we must obtain the requisite approvals from regulatory authorities in foreign countries prior to the commencement of clinical trials or marketing of the product in those countries. The requirements and process governing the conduct of clinical trials, product licensing, pricing and reimbursement vary from country to country.

We expect to pursue marketing approvals for RUT58-60 in Europe and other jurisdictions outside the United States with collaborative partners. The time and process required to obtain regulatory approvals and reimbursement in Europe and other jurisdictions may be different from those in the United States regulatory and approval in one jurisdiction does not ensure approvals in any other jurisdiction; however, negative regulatory decisions in any jurisdiction may have a negative impact the regulatory process in other jurisdictions.

If we, or our collaborators, fail to comply with applicable foreign regulatory requirements, we may be subject to, among other things, fines, suspension or withdrawal of regulatory approvals, product recalls, seizure of products, operating restrictions and criminal prosecution.

| 9 |

We have limited knowledge and experience with NDA studies and product applications and we may not be successful in obtaining FDA approvals for our lead drug candidate, RUT58-60.

Currently, we have no products approved for sale. We plan to file our IND with the FDA in the fourth quarter of 2013. Thereafter, we expect to commence patient enrollment for our Phase 1/2 clinical trial in the first quarter of 2014 and then we plan to conduct the pivotal clinical trials necessary to support an NDA filing with the FDA. However, we have not submitted an application for, or obtained any FDA approval for, any product through the NDA process. This lack of previous experience with NDA processes and requirements may impede our ability to obtain FDA approval in a timeframe consistent with our expectations and plans, or at all, for RUT58-60. Failure to comply with FDA and other applicable regulatory requirements, either before or after product approval, may subject us to sanctions, including: warning letters, deficiency notifications, application denials, approval denials, requirements for additional pre-clinical and/or clinical studies, civil and/or criminal penalties, injunctions or suspensions of production, black box warnings and other product label requirements, loss of product approvals, product seizures, or recalls.

If our products do not gain market acceptance, our business will suffer because we might not be able to fund future operations.

A number of factors may affect the market acceptance of our products or any other products we develop or acquire, including, among others:

| · | the price of our products relative to other products for the same or similar treatments; | |

| · | the perception by patients, physicians and other members of the health care community of the effectiveness and safety of our products for their indicated applications and treatments; | |

| · | our ability to fund our sales and marketing efforts; and | |

| · | the effectiveness of our sales and marketing efforts. |

If our products do not gain market acceptance, we may not be able to fund future operations, including developing, testing and obtaining regulatory approval for new product candidates and expanding our sales and marketing efforts for our approved products, which would cause our business to suffer.

Our research and development program for drug candidates other than RUT58-60 is at an early stage, and we cannot be certain our program will result in the commercialization of any drug.

Except for our development program for RUT58-60, our research and development program targeting non-infectious open surgery indications are at an early stage and, to date, we have not developed any other product candidates generated in our research program. Any product candidates we develop will require significant additional research and development efforts prior to commercial sale, including extensive pre-clinical and clinical testing and regulatory approval. This may require increases in spending on internal projects, the acquisition of third party technologies or products, and other types of investments. We cannot be sure that our approach to drug discovery, acting independently or with partners, will be effective or will result in the development of any drug. We cannot expect that any drug candidates that do result from our research and development efforts will be commercially available for many years.

We have limited experience in conducting pre-clinical testing and clinical trials. Even if we receive initially positive clinical trial results, those results will not mean that similar results will be obtained in the later stages of drug development. Our current lead drug candidate and all of our potential drug candidates are prone to the risks of failure inherent in pharmaceutical product development, including the possibility that none of our drug candidates will be:

| · | safe, non-toxic and effective; | |

| · | approved by regulatory authorities; | |

| · | developed into a commercially viable drug; | |

| · | manufactured or produced economically; | |

| · | successfully marketed; or | |

| · | accepted widely by customers. |

We depend on Oculus to manufacture RUT58-60, and our development of RUT58-60 could be stopped or delayed, and our commercialization of RUT58-60, if and when RUT58-60 receives regulatory approval, could be stopped or delayed or made less profitable if those third parties fail to provide us with sufficient quantities at acceptable prices.

The manufacture of biotechnology and pharmaceutical products is complex and requires significant expertise, capital investment, process controls and know-how. Common difficulties in biotechnology and pharmaceutical manufacturing may include: sourcing and producing raw materials, transferring technology from chemistry and development activities to production activities, validating initial production designs, scaling manufacturing techniques, improving costs and yields, establishing and maintaining quality controls and stability requirements, eliminating contaminations and operator errors, and maintaining compliance with regulatory requirements. We currently rely on Oculus to manufacture RUT58-60 for testing purposes and we have no independent experience in manufacturing and cannot assure you that any clinical-grade product will ever be produced or that we, Oculus or our other third party manufacturers on which we may rely in the future will maintain operations necessary to continue to produce clinical-grade product for us. We lack the facilities and personnel to manufacture products in accordance with the Current Good Manufacturing Practices (cGMP) prescribed by the FDA or to produce an adequate supply of compounds to meet future requirements for clinical trials and commercialization of RUT58-60. Drug manufacturing facilities are subject to inspection before the FDA will issue an approval to market a new drug product, and all of the manufacturers that we intend to use must adhere to the cGMP regulations prescribed by the FDA.

| 10 |

We have entered into a shared services agreement with Oculus that will take effect upon the completion of this offering and covers our manufacturing arrangement with Oculus. We are currently dependent on Oculus to manufacture RUT58-60, out of its Petaluma, California, facility for our preclinical studies and planned clinical trials and to prepare our products for shipping. If Oculus is unable to fulfill its obligations under the shared services agreement, we may not be able to develop and conduct the planned clinical trials for RUT58-60. We do not control the manufacturing processes of Oculus and are currently dependent on Oculus for the production of RUT58-60 in accordance with cGMPs, which include, among other things, quality control, quality assurance and the maintenance of records and documentation.

We may choose, or be forced, to terminate our manufacturing arrangement with Oculus for the following reasons in an effort to gain direct control over manufacturing processes, or to manage costs associated with manufacturing:

| · | Oculus may not perform as agreed; |

| · | Oculus may not be capable of producing or processing quantities of the drug candidate; |

| · | Oculus may not be able to manufacture materials that conform to our specifications; |

| · | Oculus may not be able to hire or retain the necessary employees; and |

| · | Oculus may be unable to comply with these cGMP requirements and with FDA, state and foreign regulatory requirements, and may not pass regulatory inspections. |

Manufacturers are periodically subject to inspections by various regulatory agencies, some of which may be unannounced. The FDA and other regulatory agencies have the ability to issue warning letters and sanctions against manufacturers based upon deficiencies noted during inspections of facilities or based upon material defects in the product label, design, production, or distribution. In addition, we have no control over the ability or willingness of our third party manufacturer to comply with regulatory requirements, maintain adequate quality controls and processes, or maintain qualified personnel. Loss of our third party manufacturer may adversely affect our ability to meet our requirements to conduct clinical trials, secure and maintain regulatory approvals, and meet commercialization targets that we may establish in the future.

We will rely on Oculus to manufacture our Phase 1/2 clinical trial supplies of RUT58-60. However, we plan to establish an independent manufacturing facility prior to the initiation of our planned pivotal clinical trials. Our ability to transfer manufacturing from Oculus to us or another third-party manufacturer is dependent on our ability to establish and maintain a viable manufacturing facility, acquire and transfer technology and know-how to us and our employees as needed, pass regulatory inspections, and gain the necessary certifications and clearances. We can give no assurances that we will be able to establish and maintain a self-directed manufacturing facility. In the event we are not able to establish in-house manufacturing and, instead, elect to engage another third party manufacturer, we would be required to transfer manufacturing processes, equipment, and know-how as required to satisfy various regulatory requirements, and thus we could experience significant disruptions in supply. We can offer no assurances that we would be able to enter into any definitive agreements on acceptable terms for the expanded development and commercial scale manufacturing of RUT58-60 with any other third party manufacturers. Any supply disruptions may cause significant delays in clinical trials and negatively impact commercial efforts, which may have an adverse effect on the shares of our common stock.

Oculus, we and/or our third party manufacturers may be adversely affected by developments outside of our control, and these developments may delay or prevent further manufacturing of our products. Adverse developments may include labor disputes, resource constraints, shipment delays, inventory shortages, lot failures, unexpected sources of contamination, lawsuits related to our manufacturing techniques, equipment used during manufacturing, or composition of matter, unstable political environments, acts of terrorism, war, natural disasters, and other natural and man-made disasters. If Oculus, we or our third party manufacturers were to encounter any of the above difficulties, or otherwise fail to comply with contractual obligations, our ability to provide any product for clinical trial or commercial purposes would be jeopardized. This may increase the costs associated with completing our clinical trials and commercial production. Further, production disruptions may cause us to terminate ongoing clinical trials and/or commence new clinical trials at additional expense. We may also have to take inventory write-offs and incur other charges and expenses for products that fail to meet specifications or pass safety inspections. If production difficulties cannot be solved with acceptable costs, expenses, and timeframes, we may be forced to abandon our clinical development and commercialization plans, which could have a material adverse effect on our business, prospects, financial condition, and shares of our common stock.

| 11 |

We may be unable to maintain sufficient clinical trial liability insurance.

Our inability to obtain and retain sufficient clinical trial liability insurance at an acceptable cost to protect against potential liability claims could prevent or inhibit our ability to conduct clinical trials for product candidates we develop. We are currently a wholly-owned subsidiary of Oculus and until the closing of this offering, we will be operated as a wholly-owned subsidiary of Oculus, and we are covered under Oculus’ insurance policies. However, pursuant to the terms of our license and supply agreement with Oculus, we may have to obtain and maintain a policy or policies of insurance relating to our development and commercialization of the products covered by the license and supply agreement. We currently do not have clinical trial liability insurance and would need to secure coverage before commencing patient enrollment for our Phase 1/2 clinical trials in the United States, which we currently expect to occur in the first quarter of 2014. Any claim that may be brought against us could result in a court judgment or settlement in an amount that is not covered, in whole or in part, by our insurance or that is in excess of the limits of our insurance coverage. We expect we will supplement our clinical trial coverage with product liability coverage in connection with the commercial launch of RUT58-60 or other product candidates we develop in the future; however, we may be unable to obtain such increased coverage on acceptable terms or at all. If we are found liable in a clinical trial lawsuit or a product liability lawsuit in the future, we will have to pay any amounts awarded by a court or negotiated in a settlement that exceed our coverage limitations or that are not covered by our insurance, and we may not have, or be able to obtain, sufficient capital to pay such amounts.

We will need to increase the size of our organization and the scope of our outside vendor relationships, and we may experience difficulties in managing growth.

As of October 1, 2013, we employed a total of six full-time employees and two part-time consultants, and we will have access to certain of Oculus’ employees and resources through the various agreements we have entered into with Oculus that will take effect upon the completion of this offering. Our current internal departments include finance, research and development and administration. We are led by a team that includes two executives, a Director of Regulatory and Quality Assurance, two operations specialists, and an administrative assistant. We intend to expand our management team to include an operation ramp up of additional technical staff required to achieve our business objectives. In addition, we periodically engage individuals employed by Oculus, on a part-time basis, to assist us with establishing and maintaining accounting systems, managing vendors and CROs, project management, research and development, chemistry and toxicology, manufacturing, human resources, and other general and administrative activities. We will need to expand our managerial, operational, technical and scientific, financial and other resources in order to manage our operations and clinical trials, establish independent manufacturing, continue our research and development activities, and commercialize our product candidate. Our management and scientific personnel, systems and facilities currently in place may not be adequate to support our future growth.

Our need to effectively manage our operations, growth and various projects requires that we:

| · | manage our clinical trials effectively, including our planned Phase 1/2 clinical trials of RUT58-60; |

| · | manage our internal development efforts effectively while carrying out our contractual obligations to licensors, contractors and other third parties; |

| · | continue to improve our operational, financial and management controls and reporting systems and procedures; and |

| · | attract and retain sufficient numbers of talented employees. |

We may utilize the services of third party vendors to perform tasks including pre-clinical and clinical trial management, statistics and analysis, regulatory affairs, medical advisory, market research, formulation development, chemistry, manufacturing and control (CMC) activities, other drug development functions, legal, auditing, financial advisory, and investor relations. Our growth strategy may also entail expanding our group of contractors or consultants to implement these and other tasks going forward. Because we rely on numerous consultants, to outsource many key functions of our business, we will need to be able to effectively manage these consultants to ensure that they successfully carry out their contractual obligations and meet expected deadlines. However, if we are unable to effectively manage our outsourced activities or if the quality or accuracy of the services provided by consultants is compromised for any reason, our clinical trials may be extended, delayed or terminated, and we may not be able to obtain regulatory approval for our product candidate or otherwise advance our business. There can be no assurance that we will be able to manage our existing consultants or find other competent outside contractors and consultants on economically reasonable terms, or at all. If we are not able to effectively expand our organization by hiring new employees and expanding our groups of consultants and contractors, we may be unable to successfully implement the tasks necessary to further develop and commercialize our product candidate and, accordingly, may not achieve our research, development and commercialization goals.

If we are unable to develop satisfactory sales and marketing capabilities, we may not succeed in commercializing RUT58-60 or any other product candidate.

We have no experience in marketing and selling drug products. We have not entered into arrangements for the sale and marketing of RUT58-60 or any other product. We are developing RUT58-60 for large patient populations served by surgeons. These patient populations may number in the millions. Typically, pharmaceutical companies would employ groups of sales representatives and associated sales and marketing staff numbering in the hundreds to thousands of individuals to call on this large number of physicians and hospitals. We may seek to collaborate with a third party to market our drugs or may seek to market and sell our drugs by ourselves. If we seek to collaborate with a third party, we cannot be sure that a collaborative agreement can be reached on terms acceptable to us. If we seek to market and sell our drugs directly, we will need to hire additional personnel skilled in marketing and sales. We cannot be sure that we will be able to acquire, or establish third party relationships to provide, any or all of these marketing and sales capabilities. The establishment of a direct sales force or a contract sales force or a combination direct and contract sales force to market our products will be expensive and time-consuming and could delay any product launch. Further, we can give no assurances that we may be able to maintain a direct and/or contract sales force for any period of time or that our sales efforts will be sufficient to grow our revenues or that our sales efforts will ever lead to profits.

| 12 |

Even if we obtain regulatory approvals to commercialize RUT58-60 or any other drug, our drug candidates may not be accepted by physicians or the medical community in general.

There can be no assurance that RUT58-60 or any other product candidate successfully developed by us, independently or with partners, will be accepted by physicians, hospitals and other health care facilities. RUT58-60 and any future product candidates we develop will compete with a number of anti-infective drugs and antiseptic and cleansing products manufactured and marketed by major pharmaceutical and medical technology companies. The degree of market acceptance of any drugs we develop depends on a number of factors, including:

| · | our demonstration of the clinical efficacy and safety of RUT58-60; |

| · | timing of market approval and commercial launch of RUT58-60; |

| · | the clinical indication(s) for which RUT58-60 is approved; |

| · | product label and package insert requirements; |

| · | advantages and disadvantages of our product candidates compared to existing therapies; |

| · | continued interest in and growth of the market for anti-infective drugs; |

| · | strength of sales, marketing, and distribution support; |

| · | product pricing in absolute terms and relative to alternative treatments; |

| · | future changes in health care laws, regulations, and medical policies; and |

| · | availability of reimbursement codes and coverage in select jurisdictions, and future changes to reimbursement policies of government and third party payors. |

Significant uncertainty exists as to the coverage and reimbursement status of any product candidate for which we obtain regulatory approval. In the United States and markets in other countries, sales of any products for which we receive regulatory approval for commercial sale will depend in part on the availability of reimbursement from third-party payors. Third-party payors include government health administrative authorities, managed care providers, private health insurers and other organizations.

Our failure to successfully acquire, develop and market additional drug candidates or approved drug products could impair our ability to grow.

As part of our growth strategy, we may evaluate, acquire, license, develop and/or market additional product candidates and technologies. These investments will not constitute a significant portion of our business. However, our internal research capabilities are limited, we may be dependent upon pharmaceutical and biotechnology companies, academic scientists and other researchers to sell or license products or technology to us. The success of this strategy depends partly upon our ability to identify, select and acquire promising pharmaceutical product candidates and products. The process of proposing, negotiating and implementing a license or acquisition of a product candidate or approved product is lengthy and complex. Other companies, including some with substantially greater financial, marketing and sales resources, may compete with us for the license or acquisition of product candidates and approved products. We have limited resources to identify and execute the acquisition or in-licensing of third party products, businesses and technologies and integrate them into our current infrastructure. Moreover, we may devote resources to potential acquisitions or in-licensing opportunities that are never completed, or we may fail to realize the anticipated benefits of such efforts. We may not be able to acquire the rights to additional product candidates on terms that we find acceptable, or at all.

In addition, future acquisitions may entail numerous operational and financial risks, including:

| · | exposure to unknown liabilities; |

| · | disruption of our business and diversion of our management’s and technical personnel’s time and attention to develop acquired products or technologies; |

| · | incurrence of substantial debt or dilutive issuances of securities to pay for acquisitions; |

| 13 |

| · | higher than expected acquisition and integration costs; |

| · | increased amortization expenses; |

| · | difficulty and cost in combining the operations and personnel of any acquired businesses with our operations and personnel; |

| · | impairment of relationships with key suppliers or customers of any acquired businesses due to changes in management and ownership; and |

| · | inability to retain key employees of any acquired businesses. |

Any product candidate that we acquire may require additional development efforts prior to commercial sale, including extensive clinical testing and approval by the FDA and applicable foreign regulatory authorities. All product candidates are prone to risks of failure typical of pharmaceutical product development, including the possibility that a product candidate will not be shown to be sufficiently safe and effective for approval by regulatory authorities. In addition, we cannot provide assurance that any products that we develop or approved products that we acquire will be manufactured profitably or achieve market acceptance.

We may not be able to attract, retain, or manage highly qualified personnel, which could adversely impact our business.