fph-20240331false2024Q10001574197--12-3110010075.037.5http://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrent http://fasb.org/us-gaap/2023#OtherLiabilitieshttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrent http://fasb.org/us-gaap/2023#OtherLiabilities00015741972024-01-012024-03-310001574197us-gaap:CommonClassAMember2024-04-12xbrli:shares0001574197us-gaap:CommonClassBMember2024-04-1200015741972024-03-31iso4217:USD00015741972023-12-310001574197us-gaap:RelatedPartyMember2024-03-310001574197us-gaap:RelatedPartyMember2023-12-310001574197us-gaap:NonrelatedPartyMember2024-03-310001574197us-gaap:NonrelatedPartyMember2023-12-310001574197us-gaap:CommonClassAMember2024-03-310001574197us-gaap:CommonClassAMember2023-12-310001574197us-gaap:CommonClassBMember2024-03-310001574197us-gaap:CommonClassBMember2023-12-310001574197us-gaap:NonrelatedPartyMemberus-gaap:LandMember2024-01-012024-03-310001574197us-gaap:NonrelatedPartyMemberus-gaap:LandMember2023-01-012023-03-310001574197us-gaap:RelatedPartyMemberus-gaap:LandMember2024-01-012024-03-310001574197us-gaap:RelatedPartyMemberus-gaap:LandMember2023-01-012023-03-310001574197us-gaap:ManagementServiceMemberus-gaap:RelatedPartyMember2024-01-012024-03-310001574197us-gaap:ManagementServiceMemberus-gaap:RelatedPartyMember2023-01-012023-03-310001574197us-gaap:NonrelatedPartyMemberfph:OperatingPropertiesMember2024-01-012024-03-310001574197us-gaap:NonrelatedPartyMemberfph:OperatingPropertiesMember2023-01-012023-03-3100015741972023-01-012023-03-310001574197us-gaap:LandMember2024-01-012024-03-310001574197us-gaap:LandMember2023-01-012023-03-310001574197us-gaap:ManagementServiceMember2024-01-012024-03-310001574197us-gaap:ManagementServiceMember2023-01-012023-03-310001574197fph:OperatingPropertiesMember2024-01-012024-03-310001574197fph:OperatingPropertiesMember2023-01-012023-03-310001574197us-gaap:CommonClassAMember2024-01-012024-03-31iso4217:USDxbrli:shares0001574197us-gaap:CommonClassAMember2023-01-012023-03-310001574197us-gaap:CommonClassBMember2024-01-012024-03-310001574197us-gaap:CommonClassBMember2023-01-012023-03-310001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-12-310001574197us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310001574197us-gaap:AdditionalPaidInCapitalMember2023-12-310001574197us-gaap:RetainedEarningsMember2023-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001574197us-gaap:ParentMember2023-12-310001574197us-gaap:NoncontrollingInterestMember2023-12-310001574197us-gaap:RetainedEarningsMember2024-01-012024-03-310001574197us-gaap:ParentMember2024-01-012024-03-310001574197us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001574197us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-01-012024-03-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2024-03-310001574197us-gaap:CommonClassBMemberus-gaap:CommonStockMember2024-03-310001574197us-gaap:AdditionalPaidInCapitalMember2024-03-310001574197us-gaap:RetainedEarningsMember2024-03-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001574197us-gaap:ParentMember2024-03-310001574197us-gaap:NoncontrollingInterestMember2024-03-310001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-12-310001574197us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001574197us-gaap:AdditionalPaidInCapitalMember2022-12-310001574197us-gaap:RetainedEarningsMember2022-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001574197us-gaap:ParentMember2022-12-310001574197us-gaap:NoncontrollingInterestMember2022-12-3100015741972022-12-310001574197us-gaap:RetainedEarningsMember2023-01-012023-03-310001574197us-gaap:ParentMember2023-01-012023-03-310001574197us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001574197us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-01-012023-03-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001574197us-gaap:CommonClassAMemberus-gaap:CommonStockMember2023-03-310001574197us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-03-310001574197us-gaap:AdditionalPaidInCapitalMember2023-03-310001574197us-gaap:RetainedEarningsMember2023-03-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001574197us-gaap:ParentMember2023-03-310001574197us-gaap:NoncontrollingInterestMember2023-03-3100015741972023-03-310001574197fph:GreatParkVentureMember2024-01-012024-03-310001574197fph:GreatParkVentureMember2023-01-012023-03-310001574197fph:ValenciaLandbankVentureMember2024-01-012024-03-310001574197fph:ValenciaLandbankVentureMember2023-01-012023-03-31fph:vote0001574197us-gaap:CommonClassBMember2024-01-012024-03-31xbrli:pure0001574197fph:FivePointOperatingCompanyLLCMemberfph:FivePointOperatingCompanyLLCMembersrt:ParentCompanyMemberus-gaap:RelatedPartyMember2024-01-012024-03-310001574197fph:FivePointOperatingCompanyLLCMembersrt:ParentCompanyMemberus-gaap:RelatedPartyMember2024-01-012024-03-310001574197us-gaap:SubsequentEventMember2024-04-120001574197fph:FivePointOperatingCompanyLLCMembersrt:ParentCompanyMemberus-gaap:RelatedPartyMemberus-gaap:SubsequentEventMember2024-04-120001574197fph:TheSanFranciscoVentureMemberfph:FivePointOperatingCompanyLLCMemberus-gaap:RelatedPartyMember2024-03-310001574197fph:TheSanFranciscoVentureMemberfph:FivePointOperatingCompanyLLCMemberus-gaap:RelatedPartyMember2024-01-012024-03-310001574197us-gaap:SubsidiaryOfCommonParentMemberfph:FivePointLandLLCMember2024-01-012024-03-310001574197fph:ContingentPaymentsDuefromRelatedPartiesMemberfph:GreatParkVentureMemberus-gaap:EquityMethodInvesteeMember2024-03-310001574197fph:ContractAssetsLegacyIncentiveCompensationReceivableMemberus-gaap:SubsequentEventMemberfph:GreatParkVentureMemberus-gaap:EquityMethodInvesteeMember2024-04-120001574197fph:HeritageFieldsLLCMember2024-03-310001574197fph:GreatParkVentureMember2024-03-31fph:member0001574197fph:FivePointOfficeVentureHoldingsILLCAcquisitionMemberfph:FPOVHIMemberLLCMember2024-03-310001574197us-gaap:SubsidiaryOfCommonParentMemberfph:SanFranciscoVentureMember2024-01-012024-03-310001574197fph:FPOVHIMemberLLCMemberfph:FivePointOfficeVentureHoldingsILLCAcquisitionMember2024-03-310001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2024-03-310001574197fph:ValenciaMemberus-gaap:LandMember2024-01-012024-03-310001574197fph:SanFranciscoMemberus-gaap:LandMember2024-01-012024-03-310001574197fph:GreatParkVentureMemberus-gaap:LandMember2024-01-012024-03-310001574197fph:CommercialLeasingMemberus-gaap:LandMember2024-01-012024-03-310001574197us-gaap:ManagementServiceMemberfph:ValenciaMember2024-01-012024-03-310001574197fph:SanFranciscoMemberus-gaap:ManagementServiceMember2024-01-012024-03-310001574197fph:GreatParkVentureMemberus-gaap:ManagementServiceMember2024-01-012024-03-310001574197fph:CommercialLeasingMemberus-gaap:ManagementServiceMember2024-01-012024-03-310001574197fph:OperatingPropertiesMemberfph:ValenciaMember2024-01-012024-03-310001574197fph:SanFranciscoMemberfph:OperatingPropertiesMember2024-01-012024-03-310001574197fph:GreatParkVentureMemberfph:OperatingPropertiesMember2024-01-012024-03-310001574197fph:CommercialLeasingMemberfph:OperatingPropertiesMember2024-01-012024-03-310001574197fph:ValenciaMember2024-01-012024-03-310001574197fph:SanFranciscoMember2024-01-012024-03-310001574197fph:GreatParkVentureMember2024-01-012024-03-310001574197fph:CommercialLeasingMember2024-01-012024-03-310001574197fph:ValenciaMemberus-gaap:LandMember2023-01-012023-03-310001574197fph:SanFranciscoMemberus-gaap:LandMember2023-01-012023-03-310001574197fph:GreatParkVentureMemberus-gaap:LandMember2023-01-012023-03-310001574197fph:CommercialLeasingMemberus-gaap:LandMember2023-01-012023-03-310001574197us-gaap:ManagementServiceMemberfph:ValenciaMember2023-01-012023-03-310001574197fph:SanFranciscoMemberus-gaap:ManagementServiceMember2023-01-012023-03-310001574197fph:GreatParkVentureMemberus-gaap:ManagementServiceMember2023-01-012023-03-310001574197fph:CommercialLeasingMemberus-gaap:ManagementServiceMember2023-01-012023-03-310001574197fph:OperatingPropertiesMemberfph:ValenciaMember2023-01-012023-03-310001574197fph:SanFranciscoMemberfph:OperatingPropertiesMember2023-01-012023-03-310001574197fph:GreatParkVentureMemberfph:OperatingPropertiesMember2023-01-012023-03-310001574197fph:CommercialLeasingMemberfph:OperatingPropertiesMember2023-01-012023-03-310001574197fph:ValenciaMember2023-01-012023-03-310001574197fph:SanFranciscoMember2023-01-012023-03-310001574197fph:GreatParkVentureMember2023-01-012023-03-310001574197fph:CommercialLeasingMember2023-01-012023-03-310001574197us-gaap:RelatedPartyMemberfph:GreatParkVentureMember2024-01-012024-03-310001574197us-gaap:RelatedPartyMember2022-12-310001574197us-gaap:RelatedPartyMember2023-03-310001574197fph:GreatParkVentureMember2024-01-012024-03-310001574197fph:GreatParkVentureMemberus-gaap:RelatedPartyMemberus-gaap:LandMember2024-01-012024-03-310001574197fph:GreatParkVentureMemberus-gaap:NonrelatedPartyMemberus-gaap:LandMember2024-01-012024-03-310001574197fph:GreatParkVentureMemberus-gaap:RelatedPartyMemberus-gaap:LandMember2023-01-012023-03-310001574197fph:GreatParkVentureMemberus-gaap:NonrelatedPartyMemberus-gaap:LandMember2023-01-012023-03-310001574197fph:LandSalesAffiliatedEntityAndThirdPartyMemberfph:GreatParkVentureMember2024-01-012024-03-310001574197fph:LandSalesAffiliatedEntityAndThirdPartyMemberfph:GreatParkVentureMember2023-01-012023-03-310001574197fph:GreatParkVentureMemberfph:LandSalesMember2024-01-012024-03-310001574197fph:GreatParkVentureMemberfph:LandSalesMember2023-01-012023-03-310001574197fph:GreatParkVentureMember2023-01-012023-03-310001574197fph:GreatParkVentureMember2024-03-310001574197fph:GreatParkVentureMember2023-12-310001574197fph:GreatParkVentureMember2023-12-310001574197fph:FivePointOfficeVentureHoldingsILLCAcquisitionMemberfph:GatewayCommercialVentureLLCAMember2024-03-31fph:individualfph:buildingutr:acre0001574197fph:GatewayCommercialVentureLLCAMember2024-03-31utr:sqft0001574197fph:GatewayCommercialVentureLLCAMemberfph:RentalRevenueMember2024-01-012024-03-310001574197fph:GatewayCommercialVentureLLCAMemberfph:RentalRevenueMember2023-01-012023-03-310001574197fph:GatewayCommercialVentureLLCAMember2024-01-012024-03-310001574197fph:GatewayCommercialVentureLLCAMember2023-01-012023-03-310001574197fph:GatewayCommercialVentureLLCAMember2024-01-012024-03-310001574197fph:GatewayCommercialVentureLLCAMember2023-01-012023-03-310001574197fph:GatewayCommercialVentureLLCAMember2023-12-310001574197fph:GatewayCommercialVentureLLCAMember2024-03-310001574197fph:GatewayCommercialVentureLLCAMember2023-12-310001574197fph:ValenciaLandbankVentureMember2024-03-310001574197fph:ValenciaLandbankVentureMember2023-12-310001574197fph:FivePointOperatingCompanyLLCMemberus-gaap:CapitalUnitClassAMemberus-gaap:RelatedPartyMember2024-03-310001574197us-gaap:CapitalUnitClassBMemberfph:FivePointOperatingCompanyLLCMemberus-gaap:RelatedPartyMember2024-03-310001574197fph:FivePointOperatingCompanyLLCMember2024-03-310001574197fph:ConversionofClassBCommonSharesIntoClassACommonSharesMember2024-01-012024-03-310001574197fph:FivePointOperatingCompanyLLCMemberfph:ManagementPartnerMember2024-01-012024-03-310001574197fph:FivePointOperatingCompanyLLCMemberfph:ManagementPartnerMember2023-01-012023-03-310001574197fph:FivePointOperatingCompanyLLCMemberfph:OtherPartnersMember2024-01-012024-03-310001574197fph:FivePointOperatingCompanyLLCMemberfph:OtherPartnersMember2023-01-012023-03-310001574197fph:FivePointOperatingCompanyLLCMember2024-01-012024-03-310001574197fph:FivePointOperatingCompanyLLCMember2023-01-012023-03-310001574197fph:TheSanFranciscoVentureMember2024-01-012024-03-31fph:class0001574197fph:SanFranciscoVentureMember2019-01-012019-12-310001574197fph:SanFranciscoVentureMembersrt:MaximumMember2019-01-012019-12-310001574197fph:SanFranciscoVentureMember2024-01-012024-03-310001574197us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberfph:SanFranciscoVentureMember2024-03-310001574197us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:RelatedPartyMemberfph:SanFranciscoVentureMember2024-03-310001574197us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberfph:SanFranciscoVentureMember2023-12-310001574197us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:RelatedPartyMemberfph:SanFranciscoVentureMember2023-12-310001574197us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberfph:FPLPAndFPLMember2024-03-310001574197us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:RelatedPartyMemberfph:FPLPAndFPLMember2024-03-310001574197us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberfph:FPLPAndFPLMember2023-12-310001574197us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberus-gaap:RelatedPartyMemberfph:FPLPAndFPLMember2023-12-310001574197us-gaap:RelatedPartyMemberfph:ContractAssetsMember2024-03-310001574197us-gaap:RelatedPartyMemberfph:ContractAssetsMember2023-12-310001574197fph:OperatingLeaseMemberus-gaap:RelatedPartyMember2024-03-310001574197fph:OperatingLeaseMemberus-gaap:RelatedPartyMember2023-12-310001574197fph:OtherMemberus-gaap:RelatedPartyMember2024-03-310001574197fph:OtherMemberus-gaap:RelatedPartyMember2023-12-310001574197fph:ReimbursementObligationMemberus-gaap:RelatedPartyMember2024-03-310001574197fph:ReimbursementObligationMemberus-gaap:RelatedPartyMember2023-12-310001574197fph:PayableToHoldersOfManagementCompanysClassBInterestsMemberus-gaap:RelatedPartyMember2024-03-310001574197fph:PayableToHoldersOfManagementCompanysClassBInterestsMemberus-gaap:RelatedPartyMember2023-12-310001574197fph:AccruedAdvisoryFeesMemberus-gaap:RelatedPartyMember2024-03-310001574197fph:AccruedAdvisoryFeesMemberus-gaap:RelatedPartyMember2023-12-310001574197fph:ContractAssetsLegacyIncentiveCompensationReceivableMemberfph:GreatParkVentureMemberus-gaap:EquityMethodInvesteeMember2024-01-012024-03-310001574197fph:ContractAssetsLegacyIncentiveCompensationReceivableMemberus-gaap:EquityMethodInvesteeMember2024-01-012024-03-310001574197fph:ContractAssetsNonLegacyIncentiveCompensationReceivableMemberus-gaap:EquityMethodInvesteeMember2024-01-012024-03-310001574197us-gaap:EquityMethodInvesteeMember2024-03-310001574197fph:ContractAssetsLegacyIncentiveCompensationReceivableMemberus-gaap:RelatedPartyMember2024-03-310001574197fph:ContractAssetsLegacyIncentiveCompensationReceivableMemberus-gaap:RelatedPartyMember2023-12-310001574197us-gaap:ManagementServiceMemberus-gaap:RelatedPartyMemberfph:DevelopmentManagementAgreementMember2024-01-012024-03-310001574197us-gaap:ManagementServiceMemberus-gaap:RelatedPartyMemberfph:DevelopmentManagementAgreementMember2023-01-012023-03-310001574197us-gaap:SeniorNotesMemberfph:SeniorNotesDue202810.500Member2024-03-310001574197us-gaap:SeniorNotesMemberfph:SeniorNotesDue202810.500Member2023-12-310001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2023-12-310001574197us-gaap:SeniorNotesMemberfph:SeniorNotesDue202810.500Member2024-01-160001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2024-01-160001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2024-01-162024-01-160001574197us-gaap:SeniorNotesMember2024-01-162024-01-160001574197us-gaap:SeniorNotesMemberfph:January162024ToNovember142025Memberfph:SeniorNotesDue202810.500Member2024-01-160001574197fph:November152025ToNovember142026Memberus-gaap:SeniorNotesMemberfph:SeniorNotesDue202810.500Member2024-01-160001574197us-gaap:SeniorNotesMemberfph:SeniorNotesDue202810.500Memberfph:November152026ToJanuary142028Member2024-01-160001574197us-gaap:UnsecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2024-03-310001574197fph:SecuredOvernightFinancingRateSOFRMemberus-gaap:UnsecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2024-01-012024-03-310001574197fph:SecuredOvernightFinancingRateSOFRMembersrt:MinimumMemberus-gaap:UnsecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2024-01-012024-03-310001574197fph:SecuredOvernightFinancingRateSOFRMembersrt:MaximumMemberus-gaap:UnsecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2024-01-012024-03-310001574197us-gaap:SuretyBondMember2024-03-310001574197us-gaap:SuretyBondMember2023-12-310001574197fph:TheSanFranciscoVentureMember2023-12-310001574197fph:TheSanFranciscoVentureMember2024-03-310001574197us-gaap:AssetPledgedAsCollateralMember2024-03-310001574197us-gaap:AssetPledgedAsCollateralMember2023-12-310001574197fph:GatewayCommercialVentureLLCAMember2024-03-310001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2024-01-012024-03-310001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2023-01-012023-03-310001574197fph:SanFranciscoMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001574197fph:SanFranciscoMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001574197fph:GreatParkVentureMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310001574197fph:GreatParkVentureMemberus-gaap:OperatingSegmentsMember2023-01-012023-03-310001574197us-gaap:OperatingSegmentsMemberfph:GatewayCommercialVentureLLCAMember2024-01-012024-03-310001574197us-gaap:OperatingSegmentsMemberfph:GatewayCommercialVentureLLCAMember2023-01-012023-03-310001574197us-gaap:OperatingSegmentsMember2024-01-012024-03-310001574197us-gaap:OperatingSegmentsMember2023-01-012023-03-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2024-01-012024-03-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2023-01-012023-03-310001574197us-gaap:MaterialReconcilingItemsMemberfph:GatewayCommercialVentureLLCAMember2024-01-012024-03-310001574197us-gaap:MaterialReconcilingItemsMemberfph:GatewayCommercialVentureLLCAMember2023-01-012023-03-310001574197fph:GatewayCommercialVentureLLCAMember2024-01-012024-03-310001574197fph:GatewayCommercialVentureLLCAMember2023-01-012023-03-310001574197us-gaap:CorporateNonSegmentMember2024-01-012024-03-310001574197us-gaap:CorporateNonSegmentMember2023-01-012023-03-310001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2024-03-310001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2023-12-310001574197fph:SanFranciscoMemberus-gaap:OperatingSegmentsMember2024-03-310001574197fph:SanFranciscoMemberus-gaap:OperatingSegmentsMember2023-12-310001574197fph:GreatParkVentureMemberus-gaap:OperatingSegmentsMember2024-03-310001574197fph:GreatParkVentureMemberus-gaap:OperatingSegmentsMember2023-12-310001574197us-gaap:OperatingSegmentsMemberfph:GatewayCommercialVentureLLCAMember2024-03-310001574197us-gaap:OperatingSegmentsMemberfph:GatewayCommercialVentureLLCAMember2023-12-310001574197us-gaap:OperatingSegmentsMember2024-03-310001574197us-gaap:OperatingSegmentsMember2023-12-310001574197fph:ConsolidationEliminationsGreatParkMember2024-03-310001574197fph:ConsolidationEliminationsGreatParkMember2023-12-310001574197fph:ConsolidationEliminationsGatewayMember2024-03-310001574197fph:ConsolidationEliminationsGatewayMember2023-12-310001574197us-gaap:IntersegmentEliminationMember2024-03-310001574197us-gaap:IntersegmentEliminationMember2023-12-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2024-03-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2023-12-310001574197us-gaap:MaterialReconcilingItemsMemberfph:GatewayCommercialVentureLLCAMember2024-03-310001574197us-gaap:MaterialReconcilingItemsMemberfph:GatewayCommercialVentureLLCAMember2023-12-310001574197us-gaap:CorporateNonSegmentMember2024-03-310001574197us-gaap:CorporateNonSegmentMember2023-12-310001574197us-gaap:RestrictedStockMember2023-12-310001574197us-gaap:RestrictedStockMember2024-01-012024-03-310001574197us-gaap:RestrictedStockMember2024-03-310001574197us-gaap:RestrictedStockMember2023-01-012023-03-310001574197us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2024-03-310001574197us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-03-310001574197us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2023-12-310001574197us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001574197us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001574197us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001574197fph:PerformanceRestrictedStockUnitsRSUsMember2024-01-012024-03-310001574197fph:PerformanceRestrictedStockUnitsRSUsMember2023-01-012023-03-310001574197us-gaap:RestrictedStockMember2024-01-012024-03-310001574197us-gaap:RestrictedStockMember2023-01-012023-03-310001574197us-gaap:CommonClassAMember2024-01-012024-03-310001574197us-gaap:CommonClassAMember2023-01-012023-03-310001574197us-gaap:AociAttributableToNoncontrollingInterestMember2024-03-310001574197us-gaap:AociAttributableToNoncontrollingInterestMember2023-12-310001574197us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2024-01-012024-03-310001574197us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-01-012023-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-38088

Five Point Holdings, LLC

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | |

| Delaware | | 27-0599397 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2000 FivePoint | 4th Floor | Irvine | California | | 92618 |

(Address of Principal Executive Offices) | | (Zip code) |

(949) 349-1000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address, and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common shares | FPH | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

Large accelerated filer | ☐ | | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | | Smaller reporting company | ☒ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 12, 2024, 69,358,504 Class A common shares and 79,233,544 Class B common shares were outstanding.

FIVE POINT HOLDINGS, LLC

TABLE OF CONTENTS

FORM 10-Q

| | | | | | | | |

| | Page |

| PART I. FINANCIAL INFORMATION | |

ITEM 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

ITEM 2. | | |

ITEM 3. | | |

ITEM 4. | | |

| | |

| PART II. OTHER INFORMATION | |

ITEM 1. | | |

ITEM 1A. | | |

ITEM 2. | | |

ITEM 3. | | |

ITEM 4. | | |

ITEM 5. | | |

ITEM 6. | | |

| | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that are subject to risks and uncertainties. These statements concern expectations, beliefs, projections, plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. When used, the words “anticipate,” “believe,” “expect,” “intend,” “may,” “might,” “plan,” “estimate,” “project,” “should,” “will,” “would,” “result” and similar expressions that do not relate solely to historical matters are intended to identify forward-looking statements. This report may contain forward-looking statements regarding: our expectations of our future revenues, costs and financial performance; the impact of inflation and interest rates; future demographics and market conditions, including housing supply levels, in the areas where our communities are located; the outcome of pending litigation and its effect on our operations; the timing of our development activities; and the timing of future real estate purchases or sales, including anticipated deliveries of homesites and anticipated amenities in our communities.

We caution you that any forward-looking statements presented in this report are based on our current views and information currently available to us. Forward-looking statements are subject to risks, trends, uncertainties and factors that are beyond our control. We believe these risks and uncertainties include, but are not limited to, the following:

•uncertainties and risks related to public health issues such as a major epidemic or pandemic;

•risks associated with the real estate industry;

•downturns in economic conditions or demographic changes at the national, regional or local levels, particularly in the areas where our properties are located;

•uncertainty and risks related to zoning and land use laws and regulations, including environmental planning and protection laws;

•risks associated with development and construction projects;

•adverse developments in the economic, political, competitive or regulatory climate of California;

•loss of key personnel;

•uncertainties and risks related to adverse weather conditions, natural disasters and climate change;

•fluctuations in interest rates;

•the availability of cash for distribution and debt service and exposure to risk of default under debt obligations;

•exposure to liability relating to environmental and health and safety matters;

•exposure to litigation or other claims;

•insufficient amounts of insurance or exposure to events that are either uninsured or underinsured;

•intense competition in the real estate market and our ability to sell properties at desirable prices;

•fluctuations in real estate values;

•changes in property taxes;

•risks associated with our trademarks, trade names and service marks;

•conflicts of interest with our directors;

•general volatility of the capital and credit markets and the price of our Class A common shares; and

•risks associated with public or private financing or the unavailability thereof.

Please see Part I, Item 1A, “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023, as well as other risks and uncertainties detailed from time to time in our subsequent Quarterly Reports on Form 10-Q and other filings with the Securities and Exchange Commission, for a more detailed discussion of these and other risks.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. We caution you therefore against relying on any of these forward-looking statements.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. They are based on estimates and assumptions only as of the date of this report. We undertake no obligation to update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by applicable law.

PART I. FINANCIAL INFORMATION

ITEM 1. Financial Statements

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except shares)

(Unaudited)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

ASSETS | | | |

INVENTORIES | $ | 2,250,070 | | | $ | 2,213,479 | |

INVESTMENT IN UNCONSOLIDATED ENTITIES | 246,406 | | | 252,816 | |

PROPERTIES AND EQUIPMENT, NET | 29,104 | | | 29,145 | |

| | | |

INTANGIBLE ASSET, NET—RELATED PARTY | 23,190 | | | 25,270 | |

CASH AND CASH EQUIVALENTS | 232,684 | | | 353,801 | |

RESTRICTED CASH AND CERTIFICATES OF DEPOSIT | 992 | | | 992 | |

RELATED PARTY ASSETS | 81,759 | | | 83,970 | |

OTHER ASSETS | 7,528 | | | 9,815 | |

TOTAL | $ | 2,871,733 | | | $ | 2,969,288 | |

| | | |

LIABILITIES AND CAPITAL | | | |

LIABILITIES: | | | |

Notes payable, net | $ | 523,321 | | | $ | 622,186 | |

Accounts payable and other liabilities | 77,853 | | | 81,649 | |

| | | |

Related party liabilities | 76,128 | | | 78,074 | |

Deferred income tax liability, net | 7,975 | | | 7,067 | |

Payable pursuant to tax receivable agreement | 173,351 | | | 173,208 | |

Total liabilities | 858,628 | | | 962,184 | |

| | | |

| COMMITMENTS AND CONTINGENT LIABILITIES (Note 11) | | | |

REDEEMABLE NONCONTROLLING INTEREST | 25,000 | | | 25,000 | |

CAPITAL: | | | |

Class A common shares; No par value; Issued and outstanding: March 31, 2024—69,358,504 shares; December 31, 2023—69,199,938 shares | | | |

Class B common shares; No par value; Issued and outstanding: March 31, 2024—79,233,544 shares; December 31, 2023—79,233,544 shares | | | |

Contributed capital | 592,227 | | | 591,606 | |

Retained earnings | 91,106 | | | 88,780 | |

Accumulated other comprehensive loss | (2,327) | | | (2,332) | |

Total members’ capital | 681,006 | | | 678,054 | |

Noncontrolling interests | 1,307,099 | | | 1,304,050 | |

Total capital | 1,988,105 | | | 1,982,104 | |

TOTAL | $ | 2,871,733 | | | $ | 2,969,288 | |

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

REVENUES: | | | | | | | |

Land sales | $ | 535 | | | $ | (25) | | | | | |

Land sales—related party | (3) | | | 624 | | | | | |

Management services—related party | 8,726 | | | 4,236 | | | | | |

Operating properties | 677 | | | 866 | | | | | |

Total revenues | 9,935 | | | 5,701 | | | | | |

COSTS AND EXPENSES: | | | | | | | |

Land sales | — | | | — | | | | | |

Management services | 3,896 | | | 2,366 | | | | | |

Operating properties | 990 | | | 1,172 | | | | | |

Selling, general, and administrative | 12,916 | | | 13,752 | | | | | |

| | | | | | | |

| | | | | | | |

Total costs and expenses | 17,802 | | | 17,290 | | | | | |

| OTHER INCOME (EXPENSE): | | | | | | | |

| | | | | | | |

Interest income | 3,225 | | | 836 | | | | | |

| | | | | | | |

Miscellaneous | (5,907) | | | (21) | | | | | |

| Total other (expense) income | (2,682) | | | 815 | | | | | |

| EQUITY IN EARNINGS FROM UNCONSOLIDATED ENTITIES | 17,586 | | | 1,048 | | | | | |

| INCOME (LOSS) BEFORE INCOME TAX PROVISION | 7,037 | | | (9,726) | | | | | |

| INCOME TAX PROVISION | (954) | | | (8) | | | | | |

| NET INCOME (LOSS) | 6,083 | | | (9,734) | | | | | |

| LESS NET INCOME (LOSS) ATTRIBUTABLE TO NONCONTROLLING INTERESTS | 3,757 | | | (5,198) | | | | | |

| NET INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY | $ | 2,326 | | | $ | (4,536) | | | | | |

| | | | | | | |

| NET INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY PER CLASS A SHARE | | | | | | | |

| Basic | $ | 0.03 | | | $ | (0.07) | | | | | |

Diluted | $ | 0.03 | | | $ | (0.07) | | | | | |

WEIGHTED AVERAGE CLASS A SHARES OUTSTANDING | | | | | | | |

| Basic | 69,058,585 | | | 68,705,223 | | | | | |

Diluted | 145,876,835 | | | 68,706,164 | | | | | |

| NET INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY PER CLASS B SHARE | | | | | | | |

Basic and diluted | $ | 0.00 | | | $ | (0.00) | | | | | |

WEIGHTED AVERAGE CLASS B SHARES OUTSTANDING | | | | | | | |

| Basic and diluted | 79,233,544 | | | 79,233,544 | | | | | |

| | | | | | | |

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| NET INCOME (LOSS) | $ | 6,083 | | | $ | (9,734) | | | | | |

OTHER COMPREHENSIVE INCOME: | | | | | | | |

| Reclassification of actuarial loss on defined benefit pension plan included in net income (loss) | 14 | | | 41 | | | | | |

Other comprehensive income before taxes | 14 | | | 41 | | | | | |

INCOME TAX PROVISION RELATED TO OTHER COMPREHENSIVE INCOME | (2) | | | — | | | | | |

OTHER COMPREHENSIVE INCOME—Net of tax | 12 | | | 41 | | | | | |

| COMPREHENSIVE INCOME (LOSS) | 6,095 | | | (9,693) | | | | | |

| LESS COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO NONCONTROLLING INTERESTS | 3,762 | | | (5,183) | | | | | |

| COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO THE COMPANY | $ | 2,333 | | | $ | (4,510) | | | | | |

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF CAPITAL

(In thousands, except share amounts)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A Common Shares | | Class B Common Shares | | Contributed Capital | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total Members’ Capital | | Noncontrolling Interests | | Total Capital |

| BALANCE - December 31, 2023 | 69,199,938 | | | 79,233,544 | | | $ | 591,606 | | | $ | 88,780 | | | $ | (2,332) | | | $ | 678,054 | | | $ | 1,304,050 | | | $ | 1,982,104 | |

| Net income | — | | | — | | | — | | | 2,326 | | | — | | | 2,326 | | | 3,757 | | | 6,083 | |

Share-based compensation expense | — | | | — | | | 832 | | | — | | | — | | | 832 | | | — | | | 832 | |

| Reacquisition of share-based compensation awards for tax-withholding purposes | (282,883) | | | — | | | (823) | | | — | | | — | | | (823) | | | — | | | (823) | |

| Issuance of share-based compensation awards | 158,940 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Settlement of restricted share units for Class A common shares | 282,509 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Other comprehensive income—net of tax of $2 | — | | | — | | | — | | | — | | | 7 | | | 7 | | | 5 | | | 12 | |

| | | | | | | | | | | | | | | |

Adjustment to liability recognized under tax receivable agreement—net of tax of $40 | — | | | — | | | (103) | | | — | | | — | | | (103) | | | — | | | (103) | |

Adjustment of noncontrolling interest in the Operating Company | — | | | — | | | 715 | | | — | | | (2) | | | 713 | | | (713) | | | — | |

| BALANCE - March 31, 2024 | 69,358,504 | | | 79,233,544 | | | $ | 592,227 | | | $ | 91,106 | | | $ | (2,327) | | | $ | 681,006 | | | $ | 1,307,099 | | | $ | 1,988,105 | |

| | | | | | | | | | | | | | | |

| BALANCE - December 31, 2022 | 69,068,354 | | | 79,233,544 | | | $ | 587,733 | | | $ | 33,386 | | | $ | (2,988) | | | $ | 618,131 | | | $ | 1,249,916 | | | $ | 1,868,047 | |

| Net loss | — | | | — | | | — | | | (4,536) | | | — | | | (4,536) | | | (5,198) | | | (9,734) | |

Share-based compensation expense | — | | | — | | | 763 | | | — | | | — | | | 763 | | | — | | | 763 | |

| Reacquisition of share-based compensation awards for tax-withholding purposes | (83,660) | | | — | | | (202) | | | — | | | — | | | (202) | | | — | | | (202) | |

| Issuance of share-based compensation awards, net of forfeitures | 215,244 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

Other comprehensive income—net of tax of $0 | — | | | — | | | — | | | — | | | 26 | | | 26 | | | 15 | | | 41 | |

| Tax distributions to noncontrolling interests | — | | | — | | | — | | | — | | | — | | | — | | | (1,974) | | | (1,974) | |

Adjustment to liability recognized under tax receivable agreement—net of tax of $0 | — | | | — | | | (140) | | | — | | | — | | | (140) | | | — | | | (140) | |

Adjustment of noncontrolling interest in the Operating Company | — | | | — | | | 550 | | | — | | | (2) | | | 548 | | | (548) | | | — | |

| BALANCE - March 31, 2023 | 69,199,938 | | | 79,233,544 | | | $ | 588,704 | | | $ | 28,850 | | | $ | (2,964) | | | $ | 614,590 | | | $ | 1,242,211 | | | $ | 1,856,801 | |

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited) | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net income (loss) | $ | 6,083 | | | $ | (9,734) | |

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | |

| Equity in earnings from unconsolidated entities | (17,586) | | | (1,048) | |

| Return on investment from Great Park Venture | 17,657 | | | — | |

| Deferred income taxes | 946 | | | — | |

| Depreciation and amortization | 2,870 | | | 2,018 | |

| | | |

| | | |

| | | |

| | | |

| Share-based compensation | 832 | | | 763 | |

| Changes in operating assets and liabilities: | | | |

| Inventories | (35,358) | | | (20,999) | |

| Related party assets | 1,598 | | | (575) | |

| Other assets | 2,145 | | | 2,996 | |

| Accounts payable and other liabilities | (3,665) | | | 5,951 | |

| Related party liabilities | (1,946) | | | (1,010) | |

| Net cash used in operating activities | (26,424) | | | (21,638) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Return of investment from Great Park Venture | 6,226 | | | — | |

| Return of investment from Valencia Landbank Venture | 113 | | | 68 | |

| | | |

| | | |

| | | |

| | | |

| Purchase of properties and equipment | (92) | | | — | |

| Net cash provided by investing activities | 6,247 | | | 68 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| | | |

| Payment of financing costs | (117) | | | — | |

| | | |

| | | |

| Related party reimbursement obligation | — | | | (1,448) | |

| | | |

| | | |

| Reacquisition of share-based compensation awards for tax-withholding purposes | (823) | | | (202) | |

| Repayments of notes payable | (100,000) | | | — | |

| Tax distributions to noncontrolling interests | — | | | (1,974) | |

| | | |

| Net cash used in financing activities | (100,940) | | | (3,624) | |

| NET DECREASE IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH | (121,117) | | | (25,194) | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH—Beginning of period | 354,793 | | | 132,763 | |

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH—End of period | $ | 233,676 | | | $ | 107,569 | |

SUPPLEMENTAL CASH FLOW INFORMATION (Note 12)

See accompanying notes to unaudited condensed consolidated financial statements.

FIVE POINT HOLDINGS, LLC

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. BUSINESS AND ORGANIZATION

Five Point Holdings, LLC, a Delaware limited liability company (the “Holding Company” and, together with its consolidated subsidiaries, the “Company”), is an owner and developer of mixed-use planned communities in California. The Holding Company owns all of its assets and conducts all of its operations through Five Point Operating Company, LP, a Delaware limited partnership (the “Operating Company”), and its subsidiaries.

The Company has two classes of shares outstanding: Class A common shares and Class B common shares. Holders of Class A common shares and holders of Class B common shares are entitled to one vote for each share held of record on all matters submitted to a vote of shareholders, and are both entitled to receive distributions at the same time. However, the distributions paid to holders of Class B common shares are in an amount per share equal to 0.0003 multiplied by the amount paid per Class A common share.

The Company presents noncontrolling interests on the Company’s condensed consolidated balance sheet and classifies such interests within capital but separate from the Company’s Class A and Class B members’ capital. Noncontrolling interests represent equity interests in the Company’s consolidated subsidiaries held by partners in the Operating Company, excluding the Holding Company, and members in The Shipyard Communities, LLC (the “San Francisco Venture”), excluding the Operating Company (see Note 5).

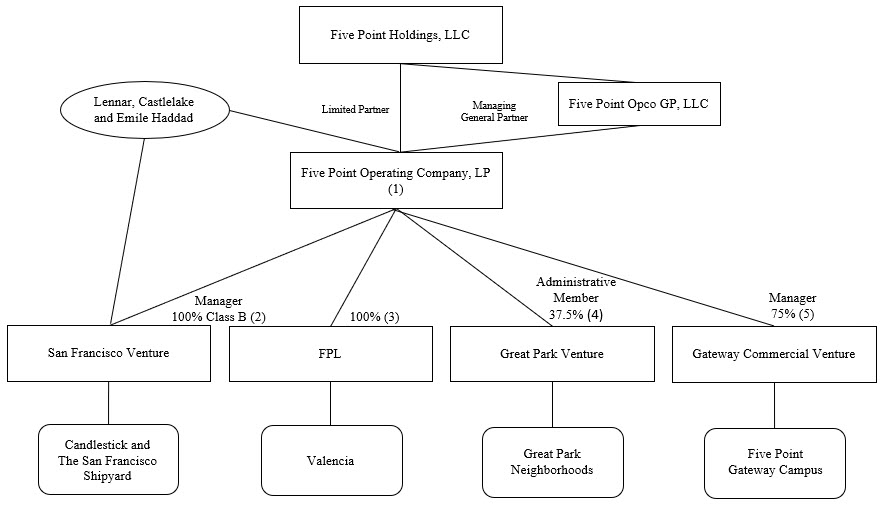

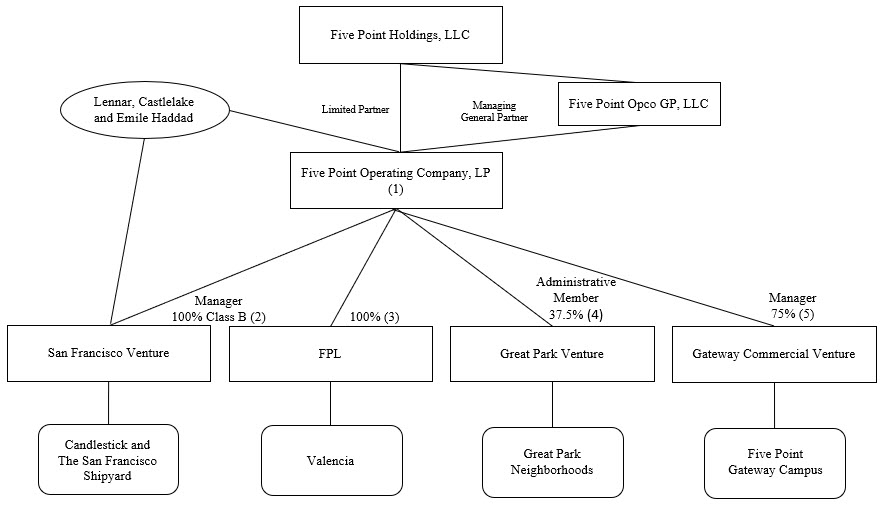

The Company has an entity structure in which the Company’s two largest equity owners, Lennar Corporation (“Lennar”) and Castlelake, LP (“Castlelake”), and the Company’s founder and Chairman Emeritus, Emile Haddad, separately hold, in addition to interests in the Company’s common shares, equity interests in either or both the Operating Company or the San Francisco Venture that can be exchanged for, at the Company’s option, either the Company’s Class A common shares or cash. The diagram below presents a simplified depiction of the Company’s organizational structure as of March 31, 2024:

(1) A wholly owned subsidiary of the Holding Company serves as the sole managing general partner of the Operating Company. As of March 31, 2024, the Company owned approximately 62.6% of the outstanding Class A Common Units of the Operating Company. After a one year holding period, a holder of Class A Common Units of the Operating Company can exchange the units for, at the Company’s option, either Class A common shares of the Holding Company, on a one-for-one basis, or cash equal to the fair market value of such shares. Until Class A Common Units of the Operating Company are exchanged or redeemed, the capital associated with Class A Common Units of the Operating Company not held by the Holding Company is presented within “noncontrolling interests” on the Company’s condensed consolidated balance sheet. Assuming the exchange of all outstanding Class A Common Units of the Operating Company and all outstanding Class A units of the San Francisco Venture (see (2)

below), that are not held by the Company, based on the closing price of the Company’s Class A common shares on April 12, 2024 ($3.17), the equity market capitalization of the Company was approximately $471.1 million.

(2) The Operating Company owns all of the outstanding Class B units of the San Francisco Venture, the entity developing the Candlestick and The San Francisco Shipyard communities. The Class A units of the San Francisco Venture, which the Operating Company does not own, are intended to be economically equivalent to Class A Common Units of the Operating Company. As the holder of all outstanding Class B units of the San Francisco Venture, the Operating Company is entitled to receive 99% of available cash from the San Francisco Venture after the holders of Class A units in the San Francisco Venture have received distributions equivalent to the distributions, if any, paid on Class A Common Units of the Operating Company. Class A units of the San Francisco Venture can be exchanged, on a one-for-one basis, for Class A Common Units of the Operating Company (See Note 5). Until exchanged or redeemed through the Operating Company, the capital associated with Class A units of the San Francisco Venture is presented within “noncontrolling interests” on the Company’s condensed consolidated balance sheet.

(3) Together, the Operating Company, Five Point Communities, LP, a Delaware limited partnership (“FP LP”), and Five Point Communities Management, Inc., a Delaware corporation (“FP Inc.” and together with FP LP, the “Management Company”) own 100% of Five Point Land, LLC, a Delaware limited liability company (“FPL”), the entity developing Valencia, a mixed-use planned community located in northern Los Angeles County, California. The Operating Company has a controlling interest in the Management Company.

(4) Interests in Heritage Fields LLC, a Delaware limited liability company (the “Great Park Venture”), are either “Percentage Interests” or “Legacy Interests.” Holders of the Legacy Interests were entitled to receive priority distributions up to an aggregate amount of $565.0 million, of which $554.4 million had been distributed as of April 12, 2024 (See Note 4). The Company owns a 37.5% Percentage Interest in the Great Park Venture and serves as its administrative member. However, management of the Great Park Venture is vested in the four voting members, who have a total of five votes. Major decisions generally require the approval of at least 75% of the votes of the voting members. The Company has two votes, and the other three voting members each have one vote, so the Company is unable to approve any major decision without the consent or approval of at least two of the other voting members. The Company does not include the Great Park Venture as a consolidated subsidiary, but rather as an equity method investee, in its condensed consolidated financial statements.

(5) The Company owns a 75% interest in Five Point Office Venture Holdings I, LLC, a Delaware limited liability company (the “Gateway Commercial Venture”). The Company manages the Gateway Commercial Venture, however, the manager’s authority is limited. Major decisions by the Gateway Commercial Venture generally require unanimous approval by an executive committee composed of two people designated by the Company and two people designated by another investor. Some decisions require approval by all of the members of the Gateway Commercial Venture. The Company does not include the Gateway Commercial Venture as a consolidated subsidiary, but rather as an equity method investee, in its condensed consolidated financial statements.

2. BASIS OF PRESENTATION

Principles of consolidation—The accompanying condensed consolidated financial statements include the accounts of the Holding Company and the accounts of all subsidiaries in which the Holding Company has a controlling interest and the consolidated accounts of variable interest entities (“VIEs”) in which the Holding Company is deemed to be the primary beneficiary. All intercompany transactions and balances have been eliminated in consolidation.

Unaudited interim financial information—The accompanying condensed consolidated financial statements are unaudited and have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) for interim financial information, the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by U.S. GAAP for complete financial statements. These condensed consolidated financial statements should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. In the opinion of management, all adjustments (including normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results and cash flows for the three months ended March 31, 2024 are not necessarily indicative of the operating results and cash flows that may be expected for the full year.

Use of estimates—The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenues and expenses during the reporting periods. Management evaluates its estimates on an ongoing basis and makes revisions to these estimates and related disclosures as experience develops or new information becomes known. Actual results could differ from those estimates.

Miscellaneous other expense—Miscellaneous other expense consisted of the following (in thousands): | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Net periodic pension benefit (cost) | $ | 24 | | | $ | (21) | | | | | |

Other(1) | (5,931) | | | — | | | | | |

| | | | | | | |

| Total miscellaneous other expense | $ | (5,907) | | | $ | (21) | | | | | |

(1) In January 2024, the Company settled an exchange offer on its $625.0 million 7.875% Senior Notes (see Note 9). For the three months ended March 31, 2024, the Company incurred $5.9 million in third party costs related to the debt modification, which is included in other in the table above.

Recently issued accounting pronouncements—In November 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which primarily requires expanded disclosure of significant segment expenses and other segment items on an annual and interim basis. The standard is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. The standard will be applied retrospectively to all prior periods presented in the financial statements. The Company is currently evaluating the effect of this update on the Company’s financial statement disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which primarily requires expanded disclosures for income taxes paid and the effective tax rate reconciliation. The standard is effective for fiscal years beginning after December 15, 2024, with early adoption permitted and can be applied on either a prospective or retrospective basis. The Company is currently evaluating the effect of this update on the Company’s financial statement disclosures.

3. REVENUES

The following tables present the Company’s consolidated revenues disaggregated by revenue source and reporting segment (in thousands): | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 | | |

| Valencia | | San Francisco | | Great Park(1) | | Commercial(1) | | Total | | | | | | | | | | |

Land sales and land sales—related party | $ | 532 | | | $ | — | | | $ | — | | | $ | — | | | $ | 532 | | | | | | | | | | | |

Management services—related party | — | | | — | | | 8,613 | | | 113 | | | 8,726 | | | | | | | | | | | |

| Operating properties | 75 | | | — | | | — | | | — | | | 75 | | | | | | | | | | | |

| 607 | | | — | | | 8,613 | | | 113 | | | 9,333 | | | | | | | | | | | |

| Operating properties leasing revenues | 434 | | | 168 | | | — | | | — | | | 602 | | | | | | | | | | | |

| $ | 1,041 | | | $ | 168 | | | $ | 8,613 | | | $ | 113 | | | $ | 9,935 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 | | |

| Valencia | | San Francisco | | Great Park(1) | | Commercial(1) | | Total | | | | | | | | | | |

Land sales and land sales—related party | $ | 599 | | | $ | — | | | $ | — | | | $ | — | | | $ | 599 | | | | | | | | | | | |

Management services—related party | — | | | — | | | 4,129 | | | 107 | | | 4,236 | | | | | | | | | | | |

| Operating properties | 358 | | | — | | | — | | | — | | | 358 | | | | | | | | | | | |

| 957 | | | — | | | 4,129 | | | 107 | | | 5,193 | | | | | | | | | | | |

| Operating properties leasing revenues | 346 | | | 162 | | | — | | | — | | | 508 | | | | | | | | | | | |

| $ | 1,303 | | | $ | 162 | | | $ | 4,129 | | | $ | 107 | | | $ | 5,701 | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(1) The tables above do not include revenues of the Great Park Venture and the Gateway Commercial Venture, which are included in the Company’s reporting segment totals (see Notes 4 and 13).

The opening and closing balances of the Company’s contract assets for the three months ended March 31, 2024 were $72.1 million ($69.1 million related party, see Note 8) and $69.7 million ($67.5 million related party, see Note 8), respectively. The decrease of $2.4 million for the three months ended March 31, 2024 between the opening and closing balances of the Company’s contract assets primarily resulted from the receipt of marketing fees from homebuilders from prior period land sales and the receipt of $7.2 million in incentive compensation payments from the Great Park Venture partially offset by additional incentive compensation revenue earned during the period from the Company's amended and restated development management agreement (“A&R DMA”) with the Great Park Venture (see Note 8).

The opening and closing balances of the Company’s contract assets for the three months ended March 31, 2023 were $86.5 million ($79.9 million related party, see Note 8) and $86.0 million ($80.4 million related party, see Note 8), respectively. The decrease of $0.5 million for the three months ended March 31, 2023 between the opening and closing balances of the Company’s contract assets primarily resulted from the receipt of marketing fees from homebuilders from prior period land sales offset by additional incentive compensation revenue earned during the period from the Company's A&R DMA with the Great Park Venture (see Note 8).

The opening and closing balances of the Company’s other receivables from contracts with customers and contract liabilities for the three months ended March 31, 2024 and 2023 were insignificant.

4. INVESTMENT IN UNCONSOLIDATED ENTITIES

Great Park Venture

The Great Park Venture has two classes of membership interests—“Percentage Interests” and “Legacy Interests.” The Operating Company owned 37.5% of the Great Park Venture’s Percentage Interests as of March 31, 2024. During the three months ended March 31, 2024, the Great Park Venture made aggregate distributions of $7.5 million to holders of Legacy Interests and $63.7 million to holders of Percentage Interests. The Company received $23.9 million for its 37.5% Percentage Interest. As of March 31, 2024, Legacy Interest holders were entitled to receive a maximum of $10.6 million in distributions to be paid pro-rata with Percentage Interest holders. Approximately 10% of future distributions will be paid to the Legacy Interest holders until such time as the remaining balance has been fully paid. The holders of the Percentage Interests will receive all other distributions.

The Great Park Venture is the owner of Great Park Neighborhoods, a mixed-use planned community located in Orange County, California. The Company, through the A&R DMA, as amended, manages the planning, development and sale of land at the Great Park Neighborhoods and supervises the day-to-day affairs of the Great Park Venture. The Great Park Venture is governed by an executive committee of representatives appointed by only the holders of Percentage Interests. The Company serves as the administrative member but does not control the actions of the executive committee. The Company accounts for its investment in the Great Park Venture using the equity method of accounting.

The carrying value of the Company’s investment in the Great Park Venture is higher than the Company’s underlying share of equity in the carrying value of net assets of the Great Park Venture, resulting in a basis difference. The Company’s earnings or losses from the equity method investment are adjusted by amortization and accretion of the basis differences as the assets (mainly inventory) and liabilities that gave rise to the basis difference are sold, settled or amortized.

During the three months ended March 31, 2024, the Great Park Venture recognized $11.9 million in land sale revenues to related parties of the Company and $80.8 million in land sale revenues to third parties.

During the three months ended March 31, 2023, the Great Park Venture recognized $5.5 million in land sale revenues to related parties of the Company and $3.1 million in land sale revenues to third parties.

The following table summarizes the statements of operations of the Great Park Venture for the three months ended March 31, 2024 and 2023 (in thousands): | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Land sale and related party land sale revenues | $ | 92,709 | | | $ | 8,600 | |

| | | |

Cost of land sales | (29,958) | | | — | |

| | | |

Other costs and expenses | (9,622) | | | (5,857) | |

| Net income of Great Park Venture | $ | 53,129 | | | $ | 2,743 | |

| The Company’s share of net income | $ | 19,923 | | | $ | 1,029 | |

| Basis difference (amortization) accretion, net | (2,266) | | | 133 | |

| | | |

| Equity in earnings from Great Park Venture | $ | 17,657 | | | $ | 1,162 | |

The following table summarizes the balance sheet data of the Great Park Venture and the Company’s investment balance as of March 31, 2024 and December 31, 2023 (in thousands):

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

Inventories | $ | 373,386 | | | $ | 391,352 | |

Cash and cash equivalents | 52,546 | | | 61,054 | |

| Contract assets, receivables and other assets, net | 164,949 | | | 166,793 | |

Total assets | $ | 590,881 | | | $ | 619,199 | |

Accounts payable and other liabilities | $ | 174,552 | | | $ | 184,847 | |

| | | |

Redeemable Legacy Interests | 10,612 | | | 18,075 | |

Capital (Percentage Interest) | 405,717 | | | 416,277 | |

Total liabilities and capital | $ | 590,881 | | | $ | 619,199 | |

The Company’s share of capital in Great Park Venture | $ | 152,144 | | | $ | 156,105 | |

Unamortized basis difference | 55,416 | | | 57,681 | |

The Company’s investment in the Great Park Venture | $ | 207,560 | | | $ | 213,786 | |

Gateway Commercial Venture

The Company owned a 75% interest in the Gateway Commercial Venture as of March 31, 2024. The Gateway Commercial Venture is governed by an executive committee in which the Company is entitled to appoint two individuals. One of the other members of the Gateway Commercial Venture is also entitled to appoint two individuals to the executive committee. The unanimous approval of the executive committee is required for certain matters, which limits the Company’s ability to control the Gateway Commercial Venture, however, the Company is able to exercise significant influence and therefore accounts for its investment in the Gateway Commercial Venture using the equity method. The Company is the manager of the Gateway Commercial Venture, with responsibility to manage and administer its day-to-day affairs and implement a business plan approved by the executive committee.

The Gateway Commercial Venture owns one commercial office building and approximately 50 acres of commercial land with additional development rights at a 73 acre office, medical, research and development campus located within the Great Park Neighborhoods (the “Five Point Gateway Campus”). The Five Point Gateway Campus consists of four buildings totaling approximately one million square feet. The Company and a subsidiary of Lennar lease portions of the building owned by the Gateway Commercial Venture, and during the three months ended March 31, 2024 and 2023, the Gateway Commercial Venture recognized $2.5 million and $2.2 million, respectively, in rental revenues from those leasing arrangements.

The following table summarizes the statements of operations of the Gateway Commercial Venture for the three months ended March 31, 2024 and 2023 (in thousands): | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Rental revenues | $ | 2,549 | | | $ | 2,154 | |

| Rental operating and other expenses | (968) | | | (910) | |

| Depreciation and amortization | (1,003) | | | (994) | |

| | | |

| Interest expense | (694) | | | (533) | |

| Net loss of Gateway Commercial Venture | $ | (116) | | | $ | (283) | |

| Equity in loss from Gateway Commercial Venture | $ | (87) | | | $ | (212) | |

The following table summarizes the balance sheet data of the Gateway Commercial Venture and the Company’s investment balance as of March 31, 2024 and December 31, 2023 (in thousands): | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Real estate and related intangible assets, net | $ | 75,715 | | | $ | 76,719 | |

| Cash and restricted cash | 5,716 | | | 5,574 | |

| Other assets | 4,418 | | | 3,554 | |

| Total assets | $ | 85,849 | | | $ | 85,847 | |

| Notes payable, net | $ | 28,797 | | | $ | 28,850 | |

| Other liabilities | 6,794 | | | 6,623 | |

| Members’ capital | 50,258 | | | 50,374 | |

| Total liabilities and capital | $ | 85,849 | | | $ | 85,847 | |

| The Company’s investment in the Gateway Commercial Venture | $ | 37,694 | | | $ | 37,781 | |

In August 2023, the Gateway Commercial Venture refinanced its mortgage note, extending the maturity date to August 2025. As a condition of the refinancing, the Company is subject to certain guaranties of the Gateway Commercial Venture's mortgage note, including an interest and carry guaranty along with a springing guaranty of 50% of the outstanding balance in the event the Gateway Commercial Venture's leases with either the Company or the affiliate of Lennar are no longer in effect and the Gateway Commercial Venture is unable to meet certain financial covenants.

Valencia Landbank Venture

As of March 31, 2024, the Company owned a 10% interest in the Valencia Landbank Venture, an entity organized in December 2020 for the purpose of taking assignment from homebuilders of purchase and sale agreements for the purchase of residential lots within the Valencia community. The Valencia Landbank Venture concurrently enters into option and development agreements with homebuilders pursuant to which the homebuilders retain the option to purchase the land to construct and sell homes. The Company does not have a controlling financial interest in the Valencia Landbank Venture, however, the Company has the ability to significantly influence the Valencia Landbank Venture’s operating and financial policies, and most major decisions require the Company’s approval in addition to the approval of the Valencia Landbank Venture’s other unaffiliated member, and therefore the Company accounts for its investment in the Valencia Landbank Venture using the equity method. At each of March 31, 2024 and December 31, 2023, the Company’s investment in the Valencia Landbank Venture was $1.2 million, and the Company recognized $16.0 thousand and $0.1 million in equity in earnings for the three months ended March 31, 2024 and 2023, respectively.

5. NONCONTROLLING INTERESTS

The Operating Company

The Holding Company’s wholly owned subsidiary is the managing general partner of the Operating Company, and at March 31, 2024, the Holding Company and its wholly owned subsidiary owned approximately 62.6% of the outstanding Class A Common Units and 100% of the outstanding Class B Common Units of the Operating Company. The Holding Company consolidates

the financial results of the Operating Company and its subsidiaries and records a noncontrolling interest for the remaining 37.4% of the outstanding Class A Common Units of the Operating Company that are owned separately by affiliates of Lennar, affiliates of Castlelake and an entity controlled by Emile Haddad, the Company’s Chairman Emeritus of the Board of Directors (the “Management Partner”).

After a 12 month holding period, holders of Class A Common Units of the Operating Company may exchange their units for, at the Company’s option, either (i) Class A common shares on a one-for-one basis (subject to adjustment in the event of share splits, distributions of shares, warrants or share rights, specified extraordinary distributions and similar events), or (ii) cash in an amount equal to the market value of such shares at the time of exchange. In either situation, an equal number of that holder’s Class B common shares will automatically convert into Class A common shares, at a ratio of 0.0003 Class A common shares for each Class B common share. This exchange right is currently exercisable by all holders of outstanding Class A Common Units of the Operating Company.

With each exchange of Class A Common Units of the Operating Company for Class A common shares, the Holding Company’s percentage ownership interest in the Operating Company and its share of the Operating Company’s cash distributions and profits and losses will increase. Additionally, other issuances of common shares of the Holding Company or common units of the Operating Company result in changes to the noncontrolling interest percentage. Such equity transactions result in an adjustment between members’ capital and the noncontrolling interest in the Company’s condensed consolidated balance sheet and statement of capital to account for the changes in the noncontrolling interest ownership percentage as well as any change in total net assets of the Company.

During the three months ended March 31, 2024 and 2023, the Holding Company’s ownership interest in the Operating Company changed as a result of net equity transactions related to the Company’s share-based compensation plan.

The terms of the Operating Company's Limited Partnership Agreement (“LPA”) provide for the payment of tax distributions to the Operating Company's partners in an amount equal to the estimated income tax liabilities resulting from taxable income or gain allocated to those parties. The tax distribution provisions in the LPA were included in the Operating Company's governing documents adopted prior to the Company’s initial public offering and were designed to provide funds necessary to pay tax liabilities for income that might be allocated, but not paid, to the partners.

Tax distributions to the partners of the Operating Company for the three months ended March 31, 2024 and 2023, were as follows (in thousands): | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Management Partner | $ | — | | | $ | 1,974 | | | | | |

| Other partners (excluding the Holding Company) | — | | | — | | | | | |

| Total tax distributions | $ | — | | | $ | 1,974 | | | | | |

Generally, tax distributions are treated as advance distributions under the LPA and are taken into account when determining the amounts otherwise distributable under the LPA.

The San Francisco Venture

The San Francisco Venture has three classes of units—Class A, Class B and Class C units. The Operating Company owns all of the outstanding Class B units of the San Francisco Venture. All of the outstanding Class A units are owned by Lennar and Castlelake. The Class A units of the San Francisco Venture are intended to be substantially economically equivalent to the Class A Common Units of the Operating Company. The Class A units of the San Francisco Venture represent noncontrolling interests to the Operating Company.

Holders of Class A units of the San Francisco Venture can redeem their units at any time and receive Class A Common Units of the Operating Company on a one-for-one basis (subject to adjustment in the event of share splits, distributions of shares, warrants or share rights, specified extraordinary distributions and similar events). If a holder requests a redemption of Class A units of the San Francisco Venture that would result in the Holding Company’s ownership of the Operating Company falling below 50.1%, the Holding Company has the option of satisfying the redemption with Class A common shares instead. The Company also has the option, at any time, to acquire outstanding Class A units of the San Francisco Venture in exchange for Class A Common Units of the Operating Company. The 12 month holding period for any Class A Common Units of the Operating Company issued in exchange for Class A units of the San Francisco Venture is calculated by including the period that such Class A units of the San Francisco Venture were owned. This exchange right is currently exercisable by all holders of outstanding Class A units of the San Francisco Venture.

Redeemable Noncontrolling Interest

In 2019, the San Francisco Venture issued 25.0 million Class C units to an affiliate of Lennar in exchange for a contribution of $25.0 million to the San Francisco Venture. Provided that Lennar completes the construction of a certain number of new homes in Candlestick as contemplated under purchase and sale agreements with the Company, the San Francisco Venture is required to redeem the Class C units if and when the Company receives reimbursements from the Mello-Roos community facilities district formed for the

development, in an aggregate amount equal to 50% of any reimbursements received up to a maximum amount of $25.0 million. The San Francisco Venture also maintains the ability to redeem the then outstanding balance of Class C units for cash at any time. Upon a liquidation of the San Francisco Venture, the holders of Class C Units are entitled to a liquidation preference. The maximum amount payable by the San Francisco Venture pursuant to redemptions or liquidation of the Class C units is $25.0 million. The holders of Class C units are not entitled to receive any other forms of distributions and are not entitled to any voting rights. In connection with the issuance of the Class C units, the San Francisco Venture agreed to spend $25.0 million on the development of infrastructure and/or parking facilities at the Company’s Candlestick development. At March 31, 2024 and December 31, 2023, $25.0 million of Class C units were outstanding and included in redeemable noncontrolling interest on the condensed consolidated balance sheets.

6. CONSOLIDATED VARIABLE INTEREST ENTITY

The Holding Company conducts all of its operations through the Operating Company, a consolidated VIE, and as a result, substantially all of the Company’s assets and liabilities represent the assets and liabilities of the Operating Company, other than items attributed to income taxes and the payable pursuant to a tax receivable agreement (“TRA”). The Operating Company has investments in and consolidates the assets and liabilities of the San Francisco Venture, FP LP and FPL, all of which have also been determined to be VIEs.

The San Francisco Venture is a VIE as the other members of the venture, individually or as a group, are not able to exercise kick-out rights or substantive participating rights. The Company applied the variable interest model and determined that it is the primary beneficiary of the San Francisco Venture and, accordingly, the San Francisco Venture is consolidated in the Company’s results. In making that determination, the Company evaluated that the Operating Company has unilateral and unconditional power to make decisions in regards to the activities that significantly impact the economics of the VIE, which are the development of properties, marketing and sale of properties, acquisition of land and other real estate properties and obtaining land ownership or ground lease for the underlying properties to be developed. The Company is determined to have more-than-insignificant economic benefit from the San Francisco Venture because, excluding Class C units, the Operating Company can prevent or cause the San Francisco Venture from making distributions on its units, and the Operating Company would receive 99% of any such distributions made (assuming no distributions had been paid on the Class A Common Units of the Operating Company). In addition, the San Francisco Venture is only allowed to make a capital call on the Operating Company and not any other interest holders, which could be a significant financial risk to the Operating Company.

As of March 31, 2024, the San Francisco Venture had total combined assets of $1.38 billion, primarily comprised of $1.37 billion of inventories and $0.9 million in related party assets, and total combined liabilities of $66.7 million, including $60.0 million in related party liabilities.

As of December 31, 2023, the San Francisco Venture had total combined assets of $1.36 billion, primarily comprised of $1.36 billion of inventories and $0.9 million in related party assets, and total combined liabilities of $61.9 million, including $59.4 million in related party liabilities.

Those assets are owned by, and those liabilities are obligations of, the San Francisco Venture, not the Company. The San Francisco Venture’s operating subsidiaries are not guarantors of the Company’s obligations, and the assets held by the San Francisco Venture may only be used as collateral for the San Francisco Venture’s obligations. The creditors of the San Francisco Venture do not have recourse to the assets of the Operating Company, as the VIE’s primary beneficiary, or of the Holding Company.

The Company and the other members do not generally have an obligation to make capital contributions to the San Francisco Venture. In addition, there are no liquidity arrangements or agreements to fund capital or purchase assets that could require the Company to provide financial support to the San Francisco Venture. The Company does not guarantee any debt of the San Francisco Venture. However, the Operating Company has guaranteed the performance of payment by the San Francisco Venture in accordance with the redemption terms of the Class C units of the San Francisco Venture (see Note 5).

FP LP and FPL are VIEs because the other partners or members have disproportionately fewer voting rights, and substantially all of the activities of the entities are conducted on behalf of the other partners or members and their related parties. The Operating Company, or a wholly owned subsidiary of the Operating Company, is the primary beneficiary of FP LP and FPL.

As of March 31, 2024, FP LP and FPL had combined assets of $1.0 billion, primarily comprised of $877.3 million of inventories, $23.2 million of intangibles and $67.5 million in related party assets, and total combined liabilities of $56.0 million, including $54.1 million in accounts payable and other liabilities and $1.9 million in related party liabilities.

As of December 31, 2023, FP LP and FPL had combined assets of $1.0 billion, primarily comprised of $855.6 million of inventories, $25.3 million of intangibles and $69.1 million in related party assets, and total combined liabilities of $60.0 million, including $57.3 million in accounts payable and other liabilities and $2.7 million in related party liabilities.

The Company evaluates its primary beneficiary designation on an ongoing basis and assesses the appropriateness of the VIE’s status when events have occurred that would trigger such an analysis. During the three months ended March 31, 2024 and 2023, there were no VIEs that were deconsolidated.

7. INTANGIBLE ASSET, NET—RELATED PARTY

The intangible asset relates to the contract value of the incentive compensation provisions of the A&R DMA with the Great Park Venture. The intangible asset will be amortized over the expected contract period based on the pattern in which the economic benefits are expected to be received.

The carrying amount and accumulated amortization of the intangible asset as of March 31, 2024 and December 31, 2023 were as follows (in thousands): | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Gross carrying amount | $ | 129,705 | | | $ | 129,705 | |

| Accumulated amortization | (106,515) | | | (104,435) | |

| Net book value | $ | 23,190 | | | $ | 25,270 | |

Intangible asset amortization expense, as a result of revenue recognition attributable to incentive compensation, was $2.1 million and $0.6 million for the three months ended March 31, 2024 and 2023, respectively. Amortization expense is included in the cost of management services in the accompanying condensed consolidated statements of operations and is included in the Great Park segment.

8. RELATED PARTY TRANSACTIONS

Related party assets and liabilities included in the Company’s condensed consolidated balance sheets as of March 31, 2024 and December 31, 2023 consisted of the following (in thousands): | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

Related Party Assets: | | | |

Contract assets (see Note 3) | $ | 67,470 | | | $ | 69,068 | |

| Operating lease right-of-use asset (corporate office lease at Five Point Gateway Campus) | 13,427 | | | 14,040 | |

Other | 862 | | | 862 | |

| $ | 81,759 | | | $ | 83,970 | |

Related Party Liabilities: | | | |

Reimbursement obligation | $ | 60,047 | | | $ | 59,378 | |

| | | |

Payable to holders of Management Company’s Class B interests | 1,073 | | | 1,828 | |

| Operating lease liability (corporate office lease at Five Point Gateway Campus) | 10,564 | | | 10,974 | |

| Accrued advisory fees | 3,275 | | | 4,725 | |

Other | 1,169 | | | 1,169 | |

| $ | 76,128 | | | $ | 78,074 | |

Development Management Agreement with the Great Park Venture (Incentive Compensation Contract Asset)