fph-20221231false2022FY0001574197P2YP2Yhttp://fasb.org/us-gaap/2022#DueFromRelatedParties http://fasb.org/us-gaap/2022#OtherAssetshttp://fasb.org/us-gaap/2022#DueFromRelatedParties http://fasb.org/us-gaap/2022#OtherAssetshttp://fasb.org/us-gaap/2022#AccountsPayableAndOtherAccruedLiabilities http://fasb.org/us-gaap/2022#DueToRelatedPartiesCurrentAndNoncurrenthttp://fasb.org/us-gaap/2022#AccountsPayableAndOtherAccruedLiabilities http://fasb.org/us-gaap/2022#DueToRelatedPartiesCurrentAndNoncurrent00015741972022-01-012022-12-3100015741972022-06-30iso4217:USD0001574197us-gaap:CommonClassAMember2023-02-28xbrli:shares0001574197us-gaap:CommonClassBMember2023-02-2800015741972022-12-3100015741972021-12-310001574197us-gaap:CommonClassAMember2022-12-310001574197us-gaap:CommonClassAMember2021-12-310001574197us-gaap:CommonClassBMember2022-12-310001574197us-gaap:CommonClassBMember2021-12-310001574197us-gaap:LandMember2022-01-012022-12-310001574197us-gaap:LandMember2021-01-012021-12-310001574197us-gaap:LandMember2020-01-012020-12-310001574197fph:LandSalesAffiliatedEntityMember2022-01-012022-12-310001574197fph:LandSalesAffiliatedEntityMember2021-01-012021-12-310001574197fph:LandSalesAffiliatedEntityMember2020-01-012020-12-310001574197fph:ManagementServicesAffiliatedEntityMember2022-01-012022-12-310001574197fph:ManagementServicesAffiliatedEntityMember2021-01-012021-12-310001574197fph:ManagementServicesAffiliatedEntityMember2020-01-012020-12-310001574197fph:OperatingPropertiesMember2022-01-012022-12-310001574197fph:OperatingPropertiesMember2021-01-012021-12-310001574197fph:OperatingPropertiesMember2020-01-012020-12-3100015741972021-01-012021-12-3100015741972020-01-012020-12-310001574197us-gaap:ManagementServiceMember2022-01-012022-12-310001574197us-gaap:ManagementServiceMember2021-01-012021-12-310001574197us-gaap:ManagementServiceMember2020-01-012020-12-310001574197us-gaap:CommonClassAMember2022-01-012022-12-31iso4217:USDxbrli:shares0001574197us-gaap:CommonClassAMember2021-01-012021-12-310001574197us-gaap:CommonClassAMember2020-01-012020-12-310001574197us-gaap:CommonClassBMember2022-01-012022-12-310001574197us-gaap:CommonClassBMember2021-01-012021-12-310001574197us-gaap:CommonClassBMember2020-01-012020-12-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassAMember2019-12-310001574197us-gaap:CommonClassBMemberus-gaap:CommonStockMember2019-12-310001574197us-gaap:AdditionalPaidInCapitalMember2019-12-310001574197us-gaap:RetainedEarningsMember2019-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001574197us-gaap:ParentMember2019-12-310001574197us-gaap:NoncontrollingInterestMember2019-12-3100015741972019-12-310001574197srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2019-12-310001574197us-gaap:ParentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001574197srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:NoncontrollingInterestMember2019-12-310001574197srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001574197us-gaap:RetainedEarningsMember2020-01-012020-12-310001574197us-gaap:ParentMember2020-01-012020-12-310001574197us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001574197us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-01-012020-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-12-310001574197us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-12-310001574197us-gaap:AdditionalPaidInCapitalMember2020-12-310001574197us-gaap:RetainedEarningsMember2020-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001574197us-gaap:ParentMember2020-12-310001574197us-gaap:NoncontrollingInterestMember2020-12-3100015741972020-12-310001574197us-gaap:RetainedEarningsMember2021-01-012021-12-310001574197us-gaap:ParentMember2021-01-012021-12-310001574197us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001574197us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-01-012021-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001574197us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310001574197us-gaap:AdditionalPaidInCapitalMember2021-12-310001574197us-gaap:RetainedEarningsMember2021-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001574197us-gaap:ParentMember2021-12-310001574197us-gaap:NoncontrollingInterestMember2021-12-310001574197us-gaap:RetainedEarningsMember2022-01-012022-12-310001574197us-gaap:ParentMember2022-01-012022-12-310001574197us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001574197us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001574197us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001574197us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001574197us-gaap:AdditionalPaidInCapitalMember2022-12-310001574197us-gaap:RetainedEarningsMember2022-12-310001574197us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001574197us-gaap:ParentMember2022-12-310001574197us-gaap:NoncontrollingInterestMember2022-12-310001574197fph:GreatParkVentureMember2022-01-012022-12-310001574197fph:GreatParkVentureMember2021-01-012021-12-310001574197fph:GreatParkVentureMember2020-01-012020-12-310001574197fph:GatewayCommercialVentureLLCAMember2022-01-012022-12-310001574197fph:GatewayCommercialVentureLLCAMember2021-01-012021-12-310001574197fph:GatewayCommercialVentureLLCAMember2020-01-012020-12-310001574197fph:ValenciaLandbankVentureMember2022-01-012022-12-310001574197fph:ValenciaLandbankVentureMember2021-01-012021-12-310001574197fph:ValenciaLandbankVentureMember2020-01-012020-12-31fph:vote0001574197us-gaap:CommonClassBMember2022-01-012022-12-31xbrli:pure0001574197us-gaap:BuildingMembersrt:MinimumMember2022-01-012022-12-310001574197us-gaap:LandImprovementsMembersrt:MinimumMember2022-01-012022-12-310001574197us-gaap:BuildingMembersrt:MaximumMember2022-01-012022-12-310001574197srt:MaximumMemberus-gaap:LandImprovementsMember2022-01-012022-12-310001574197srt:MinimumMemberus-gaap:EquipmentMember2022-01-012022-12-310001574197srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001574197srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001574197srt:MaximumMemberus-gaap:EquipmentMember2022-01-012022-12-310001574197fph:GreatParkVentureMemberus-gaap:LandMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:GreatParkVentureMemberus-gaap:LandMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:GreatParkVentureMemberus-gaap:LandMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:FormerOfficerMemberfph:AdvisoryAgreementMemberfph:EmileHaddadMember2021-08-232021-08-230001574197fph:LynnJochimMemberfph:FormerOfficerMemberfph:AdvisoryAgreementMember2022-02-092022-02-090001574197fph:AdvisoryAgreementMember2022-02-090001574197us-gaap:RestructuringChargesMember2022-01-012022-12-310001574197us-gaap:EmployeeSeveranceMember2022-01-012022-12-310001574197srt:AffiliatedEntityMember2022-01-012022-12-310001574197srt:AffiliatedEntityMember2021-01-012021-12-310001574197srt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:ValenciaMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:SanFranciscoMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:GreatParkVentureMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:CommercialLeasingMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:ValenciaMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:SanFranciscoMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:GreatParkVentureMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:CommercialLeasingMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:ManagementServicesMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:ValenciaMemberfph:OperatingPropertiesMember2022-01-012022-12-310001574197fph:SanFranciscoMemberfph:OperatingPropertiesMember2022-01-012022-12-310001574197fph:GreatParkVentureMemberfph:OperatingPropertiesMember2022-01-012022-12-310001574197fph:CommercialLeasingMemberfph:OperatingPropertiesMember2022-01-012022-12-310001574197fph:ValenciaMember2022-01-012022-12-310001574197fph:SanFranciscoMember2022-01-012022-12-310001574197fph:GreatParkVentureMember2022-01-012022-12-310001574197fph:CommercialLeasingMember2022-01-012022-12-310001574197fph:ValenciaMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:SanFranciscoMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:GreatParkVentureMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:CommercialLeasingMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:ValenciaMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:SanFranciscoMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:GreatParkVentureMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:CommercialLeasingMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:ManagementServicesMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:ValenciaMemberfph:OperatingPropertiesMember2021-01-012021-12-310001574197fph:SanFranciscoMemberfph:OperatingPropertiesMember2021-01-012021-12-310001574197fph:GreatParkVentureMemberfph:OperatingPropertiesMember2021-01-012021-12-310001574197fph:CommercialLeasingMemberfph:OperatingPropertiesMember2021-01-012021-12-310001574197fph:ValenciaMember2021-01-012021-12-310001574197fph:SanFranciscoMember2021-01-012021-12-310001574197fph:GreatParkVentureMember2021-01-012021-12-310001574197fph:CommercialLeasingMember2021-01-012021-12-310001574197fph:ValenciaMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:SanFranciscoMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:GreatParkVentureMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:CommercialLeasingMemberfph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:LandSalesAffiliatedEntityAndThirdPartyMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:ValenciaMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:SanFranciscoMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:GreatParkVentureMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:CommercialLeasingMemberfph:ManagementServicesMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:ManagementServicesMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:ValenciaMemberfph:OperatingPropertiesMember2020-01-012020-12-310001574197fph:SanFranciscoMemberfph:OperatingPropertiesMember2020-01-012020-12-310001574197fph:GreatParkVentureMemberfph:OperatingPropertiesMember2020-01-012020-12-310001574197fph:CommercialLeasingMemberfph:OperatingPropertiesMember2020-01-012020-12-310001574197fph:ValenciaMember2020-01-012020-12-310001574197fph:SanFranciscoMember2020-01-012020-12-310001574197fph:GreatParkVentureMember2020-01-012020-12-310001574197fph:CommercialLeasingMember2020-01-012020-12-310001574197srt:AffiliatedEntityMemberfph:GreatParkVentureMember2022-01-012022-12-310001574197srt:AffiliatedEntityMember2021-12-310001574197srt:AffiliatedEntityMember2022-12-310001574197srt:AffiliatedEntityMember2020-12-310001574197srt:AffiliatedEntityMemberfph:GreatParkVentureMember2021-01-012021-12-310001574197fph:GreatParkVentureMember2022-12-310001574197fph:GreatParkVentureMember2022-01-012022-12-310001574197fph:GreatParkVentureMember2021-01-012021-12-310001574197fph:GreatParkVentureMember2021-12-310001574197us-gaap:LandMemberfph:GreatParkVentureMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197us-gaap:LandMemberfph:GreatParkVentureMember2022-01-012022-12-310001574197us-gaap:LandMemberfph:GreatParkVentureMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197us-gaap:LandMemberfph:GreatParkVentureMember2021-01-012021-12-310001574197fph:GreatParkVentureMemberfph:HomesitesSoldMember2021-01-012021-12-310001574197us-gaap:LandMemberfph:GreatParkVentureMemberfph:GreatParkLandbankVentureMember2021-01-012021-12-310001574197us-gaap:LandMemberfph:GreatParkVentureMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197us-gaap:LandMemberfph:GreatParkVentureMember2020-01-012020-12-310001574197fph:GreatParkVentureMemberfph:LandSalesAffiliatedEntityAndThirdPartyMember2022-01-012022-12-310001574197fph:GreatParkVentureMemberfph:LandSalesAffiliatedEntityAndThirdPartyMember2021-01-012021-12-310001574197fph:GreatParkVentureMemberfph:LandSalesAffiliatedEntityAndThirdPartyMember2020-01-012020-12-310001574197fph:HomeSalesMemberfph:GreatParkVentureMember2022-01-012022-12-310001574197fph:HomeSalesMemberfph:GreatParkVentureMember2021-01-012021-12-310001574197fph:HomeSalesMemberfph:GreatParkVentureMember2020-01-012020-12-310001574197fph:GreatParkVentureMember2020-01-012020-12-310001574197fph:GreatParkVentureMember2022-12-310001574197fph:GreatParkVentureMember2021-12-310001574197us-gaap:LandMemberfph:GreatParkVentureMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:GreatParkVentureMembersrt:MinimumMember2020-03-012020-03-310001574197srt:MaximumMemberfph:GreatParkVentureMember2020-03-012020-03-310001574197fph:GreatParkVentureMember2020-03-012020-03-31fph:homesite0001574197fph:GatewayCommercialVentureLLCAMember2022-12-310001574197fph:GatewayCommercialVentureLLCAMemberfph:FivePointOfficeVentureHoldingsILLCAcquisitionMember2022-12-31fph:individual0001574197fph:GatewayCommercialVentureLLCAMember2022-12-31fph:building0001574197fph:GatewayCommercialVentureLLCAMemberfph:CommercialLandMember2022-12-31utr:acre0001574197srt:OfficeBuildingMemberfph:GatewayCommercialVentureLLCAMember2022-12-31utr:sqft0001574197fph:GatewayCommercialVentureLLCAMember2020-05-010001574197fph:FivePointOfficeVentureHoldingsILLCAcquisitionMemberfph:GatewayCommercialVentureLLCAMember2020-08-310001574197fph:FivePointOfficeVentureHoldingsILLCAcquisitionMemberfph:GatewayCommercialVentureLLCAMember2020-08-012020-08-310001574197fph:FivePointOfficeVentureHoldingsILLCAcquisitionMemberfph:GatewayCommercialVentureLLCAMember2020-08-012020-08-310001574197fph:FivePointOfficeVentureHoldingsILLCAcquisitionMemberfph:GatewayCommercialVentureLLCAMember2020-05-310001574197fph:FivePointOfficeVentureHoldingsILLCAcquisitionMemberfph:GatewayCommercialVentureLLCAMember2020-05-012020-05-310001574197fph:FivePointOfficeVentureHoldingsILLCAcquisitionMemberfph:GatewayCommercialVentureLLCAMember2020-05-012020-05-310001574197fph:RentalRevenueMemberfph:GatewayCommercialVentureLLCAMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:RentalRevenueMemberfph:GatewayCommercialVentureLLCAMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:RentalRevenueMemberfph:GatewayCommercialVentureLLCAMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:GatewayCommercialVentureLLCAMember2022-01-012022-12-310001574197fph:GatewayCommercialVentureLLCAMember2021-01-012021-12-310001574197fph:GatewayCommercialVentureLLCAMember2020-01-012020-12-310001574197fph:GatewayCommercialVentureLLCAMember2021-12-310001574197fph:GatewayCommercialVentureLLCAMember2021-12-310001574197fph:FivePointOfficeVentureHoldingsILLCAcquisitionMemberfph:GatewayCommercialVentureLLCAMember2022-01-012022-12-310001574197fph:ValenciaLandbankVentureMemberfph:ValenciaMember2022-12-310001574197fph:ValenciaMemberfph:ValenciaLandbankVentureMemberfph:ValenciaLandbankVentureMember2021-01-012021-12-310001574197fph:ValenciaMemberfph:ValenciaLandbankVentureMemberfph:ValenciaLandbankVentureMember2020-01-012020-12-310001574197fph:ValenciaLandbankVentureMember2022-12-310001574197fph:ValenciaLandbankVentureMember2021-12-310001574197fph:FivePointOperatingCompanyLLCMemberus-gaap:CapitalUnitClassAMembersrt:AffiliatedEntityMember2022-12-310001574197fph:FivePointOperatingCompanyLLCMemberus-gaap:CapitalUnitClassBMembersrt:AffiliatedEntityMember2022-12-310001574197fph:FivePointOperatingCompanyLLCMember2022-12-310001574197fph:ConversionofClassBCommonSharesIntoClassACommonSharesMember2022-01-012022-12-310001574197fph:FivePointOperatingCompanyLLCMemberfph:ManagementPartnerMember2022-01-012022-12-310001574197fph:FivePointOperatingCompanyLLCMemberfph:ManagementPartnerMember2021-01-012021-12-310001574197fph:FivePointOperatingCompanyLLCMemberfph:ManagementPartnerMember2020-01-012020-12-310001574197fph:FivePointOperatingCompanyLLCMemberfph:OtherPartnersMember2022-01-012022-12-310001574197fph:FivePointOperatingCompanyLLCMemberfph:OtherPartnersMember2021-01-012021-12-310001574197fph:FivePointOperatingCompanyLLCMemberfph:OtherPartnersMember2020-01-012020-12-310001574197fph:FivePointOperatingCompanyLLCMember2022-01-012022-12-310001574197fph:FivePointOperatingCompanyLLCMember2021-01-012021-12-310001574197fph:FivePointOperatingCompanyLLCMember2020-01-012020-12-310001574197us-gaap:SubsequentEventMemberfph:FivePointOperatingCompanyLLCMemberfph:ManagementPartnerMember2023-01-012023-01-310001574197fph:TheSanFranciscoVentureMember2022-01-012022-12-31fph:class0001574197fph:SanFranciscoVentureMember2019-01-012019-12-310001574197fph:SanFranciscoVentureMembersrt:MaximumMember2019-01-012019-12-310001574197fph:TheSanFranciscoVentureMember2022-01-012022-12-310001574197fph:SanFranciscoVentureMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001574197fph:SanFranciscoVentureMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001574197fph:FPLPAndFPLMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001574197fph:FPLPAndFPLMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001574197fph:AgricultureOperatingPropertiesandEquipmentMember2022-12-310001574197fph:AgricultureOperatingPropertiesandEquipmentMember2021-12-310001574197us-gaap:FurnitureAndFixturesMember2022-12-310001574197us-gaap:FurnitureAndFixturesMember2021-12-310001574197fph:ReimbursementObligationMembersrt:AffiliatedEntityMember2022-12-310001574197fph:ReimbursementObligationMembersrt:AffiliatedEntityMember2021-12-310001574197fph:PayableToHoldersOfManagementCompanysClassBInterestsMembersrt:AffiliatedEntityMember2022-12-310001574197fph:PayableToHoldersOfManagementCompanysClassBInterestsMembersrt:AffiliatedEntityMember2021-12-310001574197fph:AccruedAdvisoryFeesMembersrt:AffiliatedEntityMember2022-12-310001574197fph:AccruedAdvisoryFeesMembersrt:AffiliatedEntityMember2021-12-310001574197fph:LegacyIncentiveCompensationReceivableMemberfph:GreatParkVentureMemberus-gaap:EquityMethodInvesteeMember2022-12-310001574197fph:LegacyIncentiveCompensationReceivableMemberfph:GreatParkVentureMemberus-gaap:EquityMethodInvesteeMember2022-01-012022-12-310001574197fph:LegacyIncentiveCompensationReceivableMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:NonLegacyIncentiveCompensationMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197fph:LegacyIncentiveCompensationReceivableMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197fph:NonLegacyIncentiveCompensationMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197srt:AffiliatedEntityMemberfph:DevelopmentManagementAgreementMember2022-01-012022-12-310001574197srt:AffiliatedEntityMemberfph:DevelopmentManagementAgreementMember2021-01-012021-12-310001574197srt:AffiliatedEntityMemberfph:DevelopmentManagementAgreementMember2020-01-012020-12-310001574197fph:LegacyIncentiveCompensationReceivableMembersrt:AffiliatedEntityMember2022-12-310001574197fph:LegacyIncentiveCompensationReceivableMembersrt:AffiliatedEntityMember2021-12-310001574197srt:AffiliatedEntityMemberfph:DevelopmentManagementAgreementMember2021-12-310001574197fph:OtherRelatedPartyAssetsMemberfph:GreatParkVentureMember2021-01-012021-12-310001574197fph:ReimbursementObligationMemberus-gaap:LimitedLiabilityCompanyMember2022-12-310001574197fph:ReimbursementObligationMemberus-gaap:LimitedLiabilityCompanyMember2021-12-310001574197fph:ReimbursementObligationMemberus-gaap:LimitedLiabilityCompanyMember2022-01-012022-12-310001574197fph:ReimbursementObligationMemberus-gaap:LimitedLiabilityCompanyMember2021-01-012021-12-310001574197fph:ReimbursementObligationMemberus-gaap:LimitedLiabilityCompanyMember2020-01-012020-12-310001574197fph:FormerOfficerMemberfph:AdvisoryAgreementMemberfph:EmileHaddadMember2022-12-310001574197fph:LynnJochimMemberfph:FormerOfficerMemberfph:AdvisoryAgreementMember2022-12-310001574197fph:ValenciaMemberfph:ValenciaLandbankVentureMemberfph:ValenciaLandbankVentureMember2021-12-310001574197fph:ValenciaMemberfph:ValenciaLandbankVentureMemberfph:ValenciaLandbankVentureMember2020-12-310001574197fph:LandBankingEntityMemberfph:ValenciaMember2021-12-310001574197fph:LandBankingEntityMemberfph:ValenciaMember2021-01-012021-12-310001574197srt:AffiliatedEntityMemberfph:GatewayCommercialVentureLLCAMember2021-01-012021-12-310001574197srt:AffiliatedEntityMemberfph:GatewayCommercialVentureLLCAMember2020-01-012020-12-310001574197srt:AffiliatedEntityMemberfph:GatewayCommercialVentureLLCAMember2022-01-012022-12-310001574197fph:SanFranciscoBayAreaDevelopmentManagementAgreementsMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2022-12-310001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2021-12-310001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2017-11-300001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2017-11-012017-11-300001574197fph:AddOnSeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2019-07-310001574197fph:AddOnSeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2019-07-012019-07-310001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2020-01-012020-12-310001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2022-01-012022-12-310001574197fph:SeniorNotesDue20257.875Memberus-gaap:SeniorNotesMember2021-01-012021-12-310001574197us-gaap:UnsecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001574197srt:MinimumMemberus-gaap:UnsecuredDebtMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-12-310001574197srt:MaximumMemberus-gaap:UnsecuredDebtMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2022-01-012022-12-3100015741972016-05-020001574197srt:MinimumMember2022-12-310001574197srt:MaximumMember2022-12-310001574197fph:WaterPurchaseAgreementMember2022-01-012022-12-310001574197fph:WaterPurchaseAgreementMember2022-12-310001574197fph:LosAngelesCountyMember2012-01-310001574197fph:LosAngelesCountyMember2022-01-012022-12-310001574197fph:LosAngelesCountyMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-12-310001574197fph:LosAngelesCountyMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2021-12-310001574197fph:TheSanFranciscoVentureMember2021-12-310001574197fph:TheSanFranciscoVentureMember2022-12-310001574197us-gaap:AssetPledgedAsCollateralMember2021-12-310001574197us-gaap:AssetPledgedAsCollateralMember2022-12-310001574197fph:HuntersPointLitigationMember2022-03-012022-03-310001574197fph:GatewayCommercialVentureLLCAMember2022-12-310001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2022-01-012022-12-310001574197us-gaap:OperatingSegmentsMemberfph:SanFranciscoMember2022-01-012022-12-310001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2022-01-012022-12-310001574197us-gaap:OperatingSegmentsMemberfph:CommercialLeasingMember2022-01-012022-12-310001574197us-gaap:OperatingSegmentsMember2022-01-012022-12-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2022-01-012022-12-310001574197us-gaap:IntersegmentEliminationMember2022-01-012022-12-310001574197us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2022-12-310001574197us-gaap:OperatingSegmentsMemberfph:SanFranciscoMember2022-12-310001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2022-12-310001574197us-gaap:OperatingSegmentsMemberfph:CommercialLeasingMember2022-12-310001574197us-gaap:OperatingSegmentsMember2022-12-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2022-12-310001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2022-12-310001574197us-gaap:IntersegmentEliminationMember2022-12-310001574197us-gaap:CorporateNonSegmentMember2022-12-310001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2021-01-012021-12-310001574197us-gaap:OperatingSegmentsMemberfph:SanFranciscoMember2021-01-012021-12-310001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2021-01-012021-12-310001574197us-gaap:OperatingSegmentsMemberfph:CommercialLeasingMember2021-01-012021-12-310001574197us-gaap:OperatingSegmentsMember2021-01-012021-12-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2021-01-012021-12-310001574197us-gaap:IntersegmentEliminationMember2021-01-012021-12-310001574197us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2021-12-310001574197us-gaap:OperatingSegmentsMemberfph:SanFranciscoMember2021-12-310001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2021-12-310001574197us-gaap:OperatingSegmentsMemberfph:CommercialLeasingMember2021-12-310001574197us-gaap:OperatingSegmentsMember2021-12-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2021-12-310001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2021-12-310001574197us-gaap:IntersegmentEliminationMember2021-12-310001574197us-gaap:CorporateNonSegmentMember2021-12-310001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2020-01-012020-12-310001574197us-gaap:OperatingSegmentsMemberfph:SanFranciscoMember2020-01-012020-12-310001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2020-01-012020-12-310001574197us-gaap:OperatingSegmentsMemberfph:CommercialLeasingMember2020-01-012020-12-310001574197us-gaap:OperatingSegmentsMember2020-01-012020-12-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2020-01-012020-12-310001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2020-01-012020-12-310001574197us-gaap:IntersegmentEliminationMember2020-01-012020-12-310001574197us-gaap:CorporateNonSegmentMember2020-01-012020-12-310001574197us-gaap:OperatingSegmentsMemberfph:ValenciaMember2020-12-310001574197us-gaap:OperatingSegmentsMemberfph:SanFranciscoMember2020-12-310001574197us-gaap:OperatingSegmentsMemberfph:GreatParkVentureMember2020-12-310001574197us-gaap:OperatingSegmentsMemberfph:CommercialLeasingMember2020-12-310001574197us-gaap:OperatingSegmentsMember2020-12-310001574197fph:GreatParkVentureMemberus-gaap:MaterialReconcilingItemsMember2020-12-310001574197fph:GatewayCommercialVentureLLCAMemberus-gaap:MaterialReconcilingItemsMember2020-12-310001574197us-gaap:IntersegmentEliminationMember2020-12-310001574197us-gaap:CorporateNonSegmentMember2020-12-310001574197us-gaap:OperatingSegmentsMemberfph:NewhallMember2022-01-012022-12-310001574197us-gaap:OperatingSegmentsMemberfph:NewhallMember2021-01-012021-12-310001574197us-gaap:SalesRevenueNetMemberfph:OneRelatedPartyCustomerMemberfph:ValenciaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:LandMembersrt:AffiliatedEntityMember2022-01-012022-12-310001574197us-gaap:SalesRevenueNetMemberfph:ValenciaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:LandMemberfph:ValenciaLandbankVentureMembersrt:AffiliatedEntityMember2021-01-012021-12-310001574197us-gaap:SalesRevenueNetMemberfph:ValenciaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:LandMemberfph:ValenciaLandbankVentureMembersrt:AffiliatedEntityMember2020-01-012020-12-310001574197us-gaap:SalesRevenueNetMemberfph:ValenciaMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:LandMemberfph:ThirdPartyHomeBuilderAMember2021-01-012021-12-310001574197us-gaap:SalesRevenueNetMemberfph:ValenciaMemberus-gaap:CustomerConcentrationRiskMemberfph:ThirdPartyHomeBuilderBMemberus-gaap:LandMember2021-01-012021-12-310001574197us-gaap:SalesRevenueNetMemberfph:ValenciaMemberfph:ThirdPartyHomeBuilderCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:LandMember2020-01-012020-12-310001574197us-gaap:SalesRevenueNetMemberfph:ValenciaMemberfph:LandBankingEntityMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:LandMember2021-01-012021-12-310001574197us-gaap:SalesRevenueNetMemberfph:GreatParkVentureMemberus-gaap:CustomerConcentrationRiskMemberfph:GreatParkVentureMember2022-01-012022-12-310001574197us-gaap:SalesRevenueNetMemberfph:GreatParkVentureMemberus-gaap:CustomerConcentrationRiskMemberfph:GreatParkVentureMember2021-01-012021-12-310001574197us-gaap:SalesRevenueNetMemberfph:GreatParkVentureMemberus-gaap:CustomerConcentrationRiskMemberfph:GreatParkVentureMember2020-01-012020-12-310001574197srt:MinimumMemberus-gaap:CommonClassAMember2022-01-012022-12-310001574197srt:MaximumMemberus-gaap:CommonClassAMember2022-01-012022-12-310001574197srt:DirectorMemberus-gaap:CommonClassAMember2022-01-012022-12-310001574197us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001574197us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001574197us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001574197us-gaap:RestrictedStockUnitsRSUMember2019-12-310001574197us-gaap:RestrictedStockUnitsRSUMember2020-12-310001574197us-gaap:RestrictedStockUnitsRSUMember2021-12-310001574197us-gaap:RestrictedStockUnitsRSUMember2022-12-310001574197us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001574197fph:RestrictedStockUnitsandRestrictedSharesMember2022-12-310001574197us-gaap:PensionPlansDefinedBenefitMember2021-12-310001574197us-gaap:PensionPlansDefinedBenefitMember2020-12-310001574197us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001574197us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001574197us-gaap:PensionPlansDefinedBenefitMember2022-12-310001574197us-gaap:PensionPlansDefinedBenefitMember2020-01-012020-12-310001574197us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001574197us-gaap:FixedIncomeFundsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001574197us-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001574197us-gaap:DefinedBenefitPlanEquitySecuritiesLargeCapMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001574197us-gaap:DefinedBenefitPlanEquitySecuritiesMidCapMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001574197us-gaap:DefinedBenefitPlanEquitySecuritiesMidCapMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001574197us-gaap:DefinedBenefitPlanEquitySecuritiesSmallCapMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001574197us-gaap:DefinedBenefitPlanEquitySecuritiesSmallCapMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001574197us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-310001574197us-gaap:DefinedBenefitPlanEquitySecuritiesNonUsMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001574197us-gaap:FixedIncomeFundsMemberus-gaap:PensionPlansDefinedBenefitMember2021-12-310001574197us-gaap:DomesticCountryMember2022-12-310001574197us-gaap:StateAndLocalJurisdictionMember2022-12-310001574197us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2022-12-310001574197us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001574197us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Member2021-12-310001574197us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310001574197fph:PerformanceRestrictedStockUnitsRSUsMember2022-01-012022-12-310001574197fph:PerformanceRestrictedStockUnitsRSUsMember2021-01-012021-12-310001574197fph:PerformanceRestrictedStockUnitsRSUsMember2020-01-012020-12-310001574197us-gaap:RestrictedStockMember2022-01-012022-12-310001574197us-gaap:RestrictedStockMember2021-01-012021-12-310001574197us-gaap:RestrictedStockMember2020-01-012020-12-310001574197fph:PerformanceRestrictedStockUnitsRSUsWeightedAverageMember2022-01-012022-12-310001574197fph:PerformanceRestrictedStockUnitsRSUsWeightedAverageMember2021-01-012021-12-310001574197fph:PerformanceRestrictedStockUnitsRSUsWeightedAverageMember2020-01-012020-12-310001574197us-gaap:CommonClassAMember2022-01-012022-12-310001574197us-gaap:CommonClassAMember2021-01-012021-12-310001574197us-gaap:CommonClassAMember2020-01-012020-12-310001574197us-gaap:AociAttributableToNoncontrollingInterestMember2022-01-012022-12-310001574197us-gaap:AociAttributableToNoncontrollingInterestMember2021-01-012021-12-310001574197us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2022-01-012022-12-310001574197us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2021-01-012021-12-310001574197us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-01-012020-12-310001574197fph:NewhallRanchLandUnderDevelopmentMember2022-12-310001574197fph:SanFranciscoShipyardandCandlestickPointMember2022-12-310001574197fph:AgricultureOperatingPropertyMember2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 001-38088

Five Point Holdings, LLC

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | | | | |

| Delaware | | 27-0599397 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2000 FivePoint | 4th Floor | Irvine | California | | 92618 |

(Address of Principal Executive Offices) | | (Zip code) |

(949) 349-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common shares | FPH | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | |

Large accelerated filer | ☐ | | Accelerated filer | ☒ |

Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

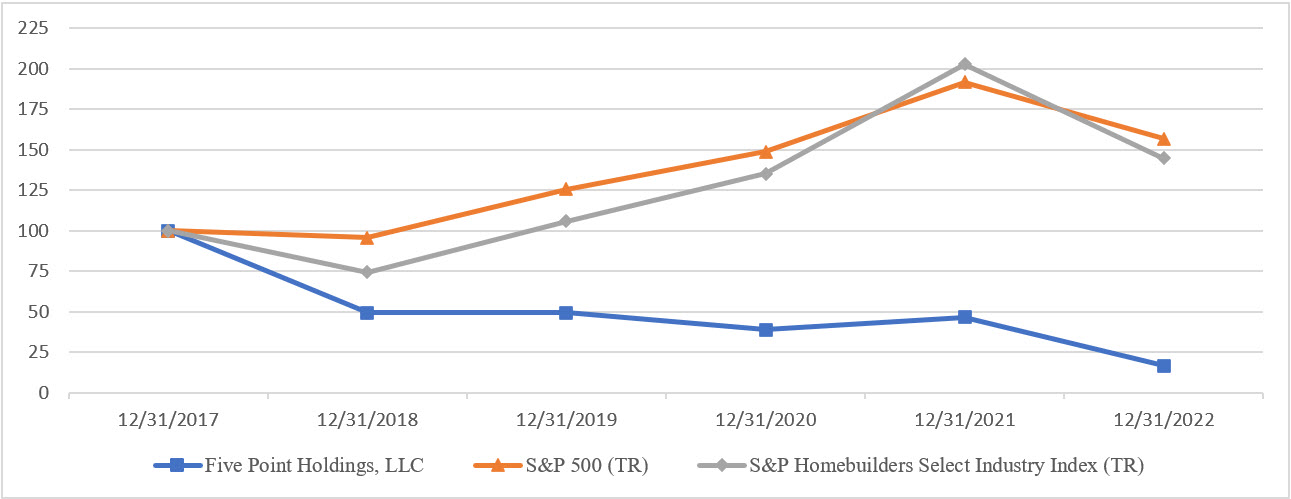

The aggregate market value of common shares held by non-affiliates of the registrant as of June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing sale price per share as reported by the New York Stock Exchange on such date, was approximately $230.8 million.

As of February 28, 2023, 68,984,694 Class A common shares and 79,233,544 Class B common shares were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement for the 2023 Annual Meeting of Shareholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant's fiscal year ended December 31, 2022.

FIVE POINT HOLDINGS, LLC

TABLE OF CONTENTS

FORM 10-K

| | | | | | | | |

| | Page |

PART I. | | |

ITEM 1. | | |

ITEM 1A. | | |

ITEM 1B. | | |

ITEM 2. | | |

ITEM 3. | | |

ITEM 4. | | |

PART II. | | |

ITEM 5. | | |

ITEM 6. | | |

ITEM 7. | | |

ITEM 7A. | | |

ITEM 8. | | |

ITEM 9. | | |

ITEM 9A. | | |

ITEM 9B. | | |

ITEM 9C. | | |

PART III. | | |

ITEM 10. | | |

ITEM 11. | | |

ITEM 12. | | |

ITEM 13. | | |

ITEM 14. | | |

PART IV. | | |

ITEM 15. | | |

ITEM 16. | | |

| | |

| Signatures | |

| Financial Statement Schedules | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements that are subject to risks and uncertainties. These statements concern expectations, beliefs, projections, plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. When used, the words “anticipate,” “believe,” “expect,” “intend,” “may,” “might,” “plan,” “estimate,” “project,” “should,” “will,” “would,” “result” and similar expressions that do not relate solely to historical matters are intended to identify forward-looking statements. This report may contain forward-looking statements regarding: our expectations of our future revenues, costs and financial performance; future demographics and market conditions in the areas where our communities are located; the outcome of pending litigation and its effect on our operations; the timing of our development activities; and the timing of future real estate purchases or sales, including anticipated deliveries of homesites and anticipated amenities in our communities.

We caution you that any forward-looking statements presented in this report are based on our current views and information currently available to us. Forward-looking statements are subject to risks, trends, uncertainties and factors that are beyond our control. We believe these risks and uncertainties include, but are not limited to, the following:

•uncertainties and risks related to public health issues such as a major epidemic or pandemic, including COVID-19;

•risks associated with the real estate industry;

•downturns in economic conditions or demographic changes at the national, regional or local levels, particularly in the areas where our properties are located;

•uncertainty and risks related to zoning and land use laws and regulations, including environmental planning and protection laws;

•risks associated with development and construction projects;

•adverse developments in the economic, political, competitive or regulatory climate of California;

•loss of key personnel;

•uncertainties and risks related to adverse weather conditions, natural disasters and climate change;

•fluctuations in interest rates;

•the availability of cash for distribution and debt service and exposure to risk of default under debt obligations;

•exposure to liability relating to environmental and health and safety matters;

•exposure to litigation or other claims;

•insufficient amounts of insurance or exposure to events that are either uninsured or underinsured;

•intense competition in the real estate market and our ability to sell properties at desirable prices;

•fluctuations in real estate values;

•changes in property taxes;

•risks associated with our trademarks, trade names and service marks;

•conflicts of interest with our directors;

•general volatility of the capital and credit markets and the price of our Class A common shares; and

•risks associated with public or private financing or the unavailability thereof.

Please see the “Risk Factors” under Part I, Item 1A of this report for a more detailed discussion of these and other risks.

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. We caution you therefore against relying on any of these forward-looking statements.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. They are based on estimates and assumptions only as of the date of this report. We undertake no obligation to update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, new information, data or methods, future events or other changes, except as required by applicable law.

DEFINITIONS

In this report:

•“acres” refers to gross acres, which includes unsaleable land, such as land on which major roads will be constructed, public parks, water quality basins, public school sites and open space;

•“Castlelake” refers to Castlelake, L.P.;

•“company,” “our company,” “us,” “we,” and “our” refer to Five Point Holdings, LLC, together with its consolidated subsidiaries;

•“CPHP” refers to CPHP Development, LLC and its subsidiaries, the entities that acquired certain assets, and assumed certain liabilities, from the San Francisco Venture immediately prior to the formation transactions;

•“Five Point Gateway Campus” refers to approximately 73 acres of commercial land in the Great Park Neighborhoods, on which four buildings have been constructed with an aggregate of one million square feet of research and development, medical and office space;

•“formation transactions” refers to the transactions effected on May 2, 2016, in which, among other things, (1) we acquired an interest in, and became the managing member of, the San Francisco Venture, (2) the limited liability company agreement of the San Francisco Venture was amended and restated to provide for the possible future exchange of the remaining interests in the San Francisco Venture for interests in our operating company, (3) we acquired a 37.5% percentage interest in the Great Park Venture, and became the administrative member of the Great Park Venture, and (4) we acquired the management company. See “Part I, Item 1. Business—Structure and Formation of Our Company”;

•“FP LP” refers to Five Point Communities, LP, a Delaware limited partnership;

•“FP LP Class B partnership interests” or “Class B partnership interests in FP LP” refer to partnership interests in FP LP owned by Lennar and FPC-HF that are entitled to receive distributions equal to the amount of any incentive compensation payments under the amended and restated development management agreement that are attributable to payments on legacy interests in the Great Park Venture;

•“FP Inc.” refers to Five Point Communities Management, Inc., a Delaware corporation, which is the general partner of, and owns a 0.5% Class A limited partnership interest in, FP LP;

•“FPC-HF” refers to FPC-HF Venture I, LLC, a Delaware limited liability company, which is owned, directly or indirectly, by an affiliate of Castlelake, an affiliate of Lennar and certain employees of the management company;

•“FPL” refers to our subsidiary, Five Point Land, LLC, a Delaware limited liability company, which owns Newhall Land & Farming;

•“fully exchanged basis” assumes (1) the exchange of all outstanding Class A units of the operating company for our Class A common shares on a one-for-one basis, (2) the exchange of all outstanding Class A units of the San Francisco Venture for our Class A common shares on a one-for-one basis and (3) the conversion of all of our outstanding Class B common shares into Class A common shares;

•“Gateway Commercial Venture” refers to Five Point Office Venture Holdings I, LLC, a Delaware limited liability company, which owns portions of the Five Point Gateway Campus;

•“Great Park Venture” refers to Heritage Fields LLC, a Delaware limited liability company, which is developing Great Park Neighborhoods;

•“homes” includes single-family detached homes, single-family attached homes and apartments for rent;

•“homesite” refers to a residential lot or a portion thereof on which a home will be built;

•“legacy interests” refers to membership interests in the Great Park Venture, which are currently held by the entities that owned the Great Park Venture immediately prior to the formation transactions, and entitle them to receive priority distributions from the Great Park Venture in an aggregate amount equal to $565 million ($499 million of which has been paid as of the date of this report);

•“Lennar” refers to Lennar Corporation and its subsidiaries;

•“management company” refers, collectively, to FP LP and FP Inc., which have historically managed the development of Great Park Neighborhoods and Valencia;

•“Newhall Land & Farming” refers to The Newhall Land and Farming Company, a California limited partnership, which is developing Valencia;

•“operating company” refers to Five Point Operating Company, LP, a Delaware limited partnership;

•“our communities” refers to the communities that we are developing, including Valencia in Los Angeles County, Candlestick and The San Francisco Shipyard in the City of San Francisco, and Great Park Neighborhoods in Orange County;

•“percentage interests” refers to membership interests in the Great Park Venture that entitle the holders to receive all distributions from the Great Park Venture after priority distributions have been paid to the holders of the legacy interests in the Great Park Venture; and

•“San Francisco Venture” refers to The Shipyard Communities, LLC, a Delaware limited liability company, which is developing Candlestick and The San Francisco Shipyard.

PART I

ITEM 1. Business

We are an owner and developer of mixed-use planned communities in California. Our three existing communities have the general plan and zoning approvals necessary for the construction of thousands of homesites and millions of square feet of commercial space, and they represent a significant portion of the real estate available for development in three major markets in California—Los Angeles County, San Francisco County and Orange County. In total, our communities consist of approximately 23 million square feet of built or planned commercial space and approximately 40,000 homes built or planned.

Structure and Formation of Our Company

In 2009, our company was formed as a limited liability company to acquire ownership through the operating company of Newhall Land & Farming, which is developing our Valencia community. In May 2016, we completed the formation transactions in which we acquired an interest in the San Francisco Venture, which is developing our Candlestick and The San Francisco Shipyard communities, a 37.5% percentage interest in the Great Park Venture, which is developing Great Park Neighborhoods, and the management company that has been the development manager of Great Park Neighborhoods since 2010. In August 2017, we acquired a 75% interest in the Gateway Commercial Venture, the entity that owns portions of the Five Point Gateway Campus.

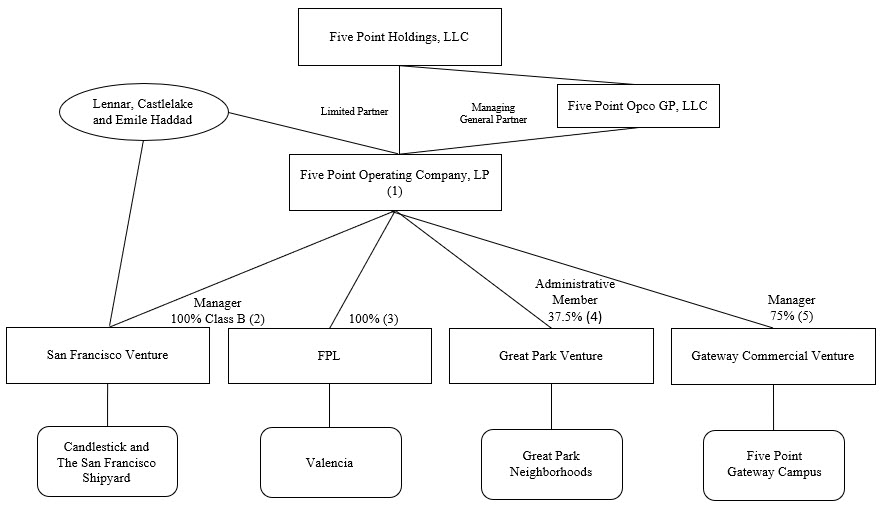

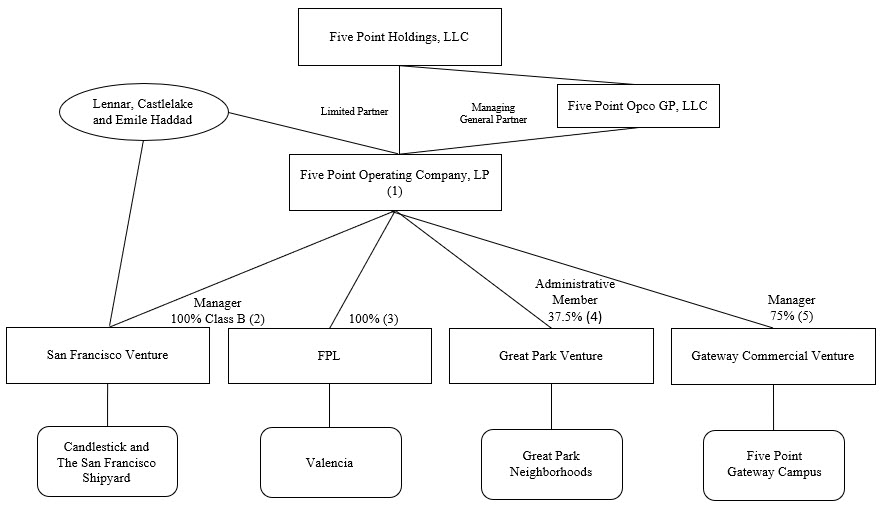

Our company has an entity structure in which our two largest equity owners, Lennar and Castlelake, and our founder and Chairman Emeritus, Emile Haddad, separately hold, in addition to interests in our common shares, equity interests in either or both the operating company or the San Francisco Venture that can be exchanged for, at our option, either our Class A common shares or cash. The diagram below presents a simplified depiction of our current organizational structure.

(1) Through a wholly owned subsidiary, we serve as sole managing general partner of the operating company, and as of December 31, 2022, we owned approximately 62.5% of the outstanding Class A units of the operating company. We conduct all of our businesses in or through the operating company, which owns, directly or indirectly, equity interests in, and controls the management of FPL, the San Francisco Venture and the management company. Class A units of the operating company that we do not own are held by affiliates of Lennar, Castlelake, and Mr. Haddad and can be exchanged on a one-for-one basis, at our option, for either Class A common shares or cash equal to the fair market value of such shares. Until Class A units of the operating company are exchanged or redeemed, the capital associated with Class A units of the operating company not held by us is presented within "noncontrolling interests" on our consolidated balance sheet. Based on the closing price of our Class A common shares on February 28, 2023 ($2.19), our market capitalization on a fully exchanged basis was approximately $324.6 million.

(2) The operating company owns all of the outstanding Class B units of the San Francisco Venture. The Class A units of the San Francisco Venture, which are owned by affiliates of Lennar and Castlelake, are intended to be economically equivalent to Class A

units of the operating company. As the holder of all outstanding Class B units of the San Francisco Venture, the operating company is entitled to receive 99% of available cash from the San Francisco Venture after the holders of Class A units in the San Francisco Venture have received distributions equivalent to the distributions, if any, paid on Class A units of the operating company. Class A units of the San Francisco Venture can be exchanged, on a one-for-one basis, for Class A units of the operating company. Until exchanged or redeemed through the operating company, the capital associated with Class A units of the San Francisco Venture is presented within "noncontrolling interests" on our consolidated balance sheet.

(3) We hold our interest in FPL directly and indirectly through the operating company and the management company.

(4) Through a wholly owned subsidiary, the operating company owns a 37.5% percentage interest in the Great Park Venture. Holders of legacy interests in the Great Park Venture were entitled to receive priority distributions up to an aggregate amount of $565.0 million, of which $498.7 million has been distributed as of February 28, 2023. We are the administrative member of the Great Park Venture. However, management of the Great Park Venture is vested in the four voting members, who have a total of five votes. Major decisions generally require the approval of at least 75% of the votes of the voting members. We have two votes, and the other three voting members each have one vote, so we are unable to approve any major decision without the consent or approval of at least two of the other voting members. We do not include the Great Park Venture as a consolidated subsidiary, but rather as an equity method investee, in our consolidated financial statements.

(5) Through a wholly owned subsidiary, the operating company owns a 75% interest in the Gateway Commercial Venture and serves as its manager. However, the manager’s authority is limited. Major decisions by the Gateway Commercial Venture generally require unanimous approval by an executive committee composed of two people designated by us and two people designated by another investor. Some decisions require approval by all of the members of the Gateway Commercial Venture. The Gateway Commercial Venture owns one of the four buildings and approximately 50 acres of commercial land with additional development rights at the Five Point Gateway Campus. We do not include the Gateway Commercial Venture as a consolidated subsidiary, but rather as an equity method investee, in our consolidated financial statements.

Tax Classification

We have elected to be treated as a corporation for U.S. federal income tax purposes. As a result, an owner of our shares will not report our items of income, gain, loss and deduction on its U.S. federal income tax return, nor will an owner of our shares receive a Schedule K-1. Our shareholders also will not be subject to state income tax filings in the various states in which we conduct operations as a result of owning our shares. Distributions on our shares will be treated as dividends on corporate stock for U.S. federal income tax purposes to the extent of our current and accumulated earnings and profits and will be reported on Form 1099, to the extent applicable.

Our Business

We are primarily engaged in the business of planning and developing our three mixed-use planned communities, and our principal source of revenue is the sale of residential and commercial land sites to homebuilders, commercial developers and commercial buyers. We may also retain a portion of the commercial and multi-family properties in our communities as income-producing assets.

Our planning and development process involves the following components:

Mixed-use planning. We design all aspects of our communities, creating highly desirable places to live, work, shop and enjoy an active lifestyle. Our designs include a wide range of amenities, such as high quality public schools, parks and recreational areas, entertainment venues and walking and biking trails. Each community is comprised of several villages or neighborhoods, each of which offers a range of housing types, sizes and prices. In addition to the mixed-use land planning we undertake for each community, we typically create the floorplans and elevations for each home, as well as the landscape design for each neighborhood, considering each neighborhood’s individual character within the context of the overall plan for the community. For the commercial aspects of our communities, we look for commercial enterprises that will best add value to the community by providing needed services, additional amenities or local jobs. In designing the overall program at each community, we consider the appropriate balance of housing and employment opportunities, access to transportation, resource conservation and enhanced public open spaces and wildlife habitats. We continually evaluate our plans for each community and make adjustments that we deem appropriate based on changes in local economic factors and other market dynamics.

Entitlements. We typically obtain all discretionary entitlements and approvals necessary to develop the infrastructure within our communities and prepare our residential and commercial lots for construction. We also typically obtain all discretionary entitlements and approvals that the homebuilder or commercial builder will need to build homes or commercial buildings on our lots, although we may from time to time allocate responsibility for obtaining certain discretionary entitlements to a homebuilder or commercial builder. Although we have general plan and zoning approvals for our communities, individual development areas within our communities are at various stages of planning and development and have received different levels of discretionary entitlements and approvals. For additional information, see “—Our Communities” below.

Horizontal development (infrastructure). We refer to the process of preparing the land for construction of homes or commercial buildings as “horizontal development.” This involves significant investments in a community’s infrastructure and common improvements, including grading and installing roads, sidewalks, gutters, utility improvements (such as storm drains, water, gas, sewer, power and communications), landscaping and shared amenities (such as community buildings, neighborhood parks, trails and open spaces) and other actions necessary to prepare residential and commercial lots for vertical development.

Land sales. After horizontal development for a given development area or parcel is completed, graded lots are typically sold to homebuilders, commercial builders or commercial buyers. We typically sell homesites to a diverse group of high-quality homebuilders in a competitive process, although in some cases we may negotiate directly with a single homebuilder. In addition to the base purchase price, our residential land sales typically involve participation provisions that allow us to share in the profits realized by the homebuilders. We sell commercial lots to developers through a competitive process or negotiate directly with the buyer. We also regularly assess our development plan and may retain a portion of the commercial and multi-family properties within our communities as income-producing assets.

Vertical development (construction). We refer to the process of building structures (buildings or houses) and preparing them for occupancy as “vertical development.” Single-family residences in our communities are built by third-party homebuilders. Commercial buildings in our communities are usually built by a third-party developer or the buyer. For commercial or multi-family properties that we retain, we may construct the building ourselves or enter into a joint venture with an established developer to construct a particular property.

Community programming. Our community building efforts go beyond development and construction. We offer numerous community programs, including music, food and art events, educational programs, gardening and cooking lessons and various holiday festivities. We plan and program all of our events with a goal of building a community that transcends the physical features of our development and connects neighbors through their interests. We believe community building efforts create loyal residents that can become repeat customers within our multi-generational communities.

Sequencing. In order to balance the timing of our revenues and expenditures, we typically sequence the development of individual neighborhoods or villages within our communities. As a result, many of the mixed-use planning, entitlement, development, sales and other activities described above may occur at the same time in different locations within a single community. Further, depending on the specific plans for each community and market conditions, we may vary the timing of certain of these activities. Throughout this process, we continually analyze each community relative to its market to determine which portions to sell, which portions to build and then sell, and which portions that we might retain as part of a portfolio of commercial and multi-family properties.

Our Segments

We have organized our operations into four reportable segments, three of which are tied to our communities (our Valencia, San Francisco and Great Park segments) and one relating to our commercial operations (our Commercial segment). Our operations relating to these segments are discussed in more detail below in the sections titled “Our Communities” and “Commercial.”

Our Communities

Valencia

Valencia is a mixed-use planned community in Los Angeles County that spans approximately 15,000 acres and is designed to include approximately 21,500 homesites, approximately 11.5 million square feet of commercial space, approximately 50 miles of trails, approximately 275 acres of community parks and approximately 10,000 acres of protected open space. The actual commercial square footage and number of homesites are subject to change based on ultimate use and land planning.

Valencia is located in an unincorporated portion of Los Angeles County along the Santa Clara River in the western portion of the Santa Clarita Valley. The property is located approximately 35 miles northwest of downtown Los Angeles, 15 miles north of the San Fernando Valley and is adjacent to the City of Santa Clarita. Valencia is adjacent to Interstate 5 and State Highway 126. Valencia is also approximately 45 miles north of the Los Angeles International Airport (LAX) and 21 miles northwest of the Hollywood Burbank (Bob Hope) Airport (BUR) in Burbank.

In December 2019, we completed our first residential land sales in the first development area at Valencia. As of December 31, 2022, we had sold 1,866 homesites, and builders had sold 940 homes to homebuyers since home sales commenced in May 2021.

Candlestick and The San Francisco Shipyard

Candlestick and The San Francisco Shipyard, located on approximately 800 acres of bayfront property in the City of San Francisco, is designed to include approximately 12,000 homesites, approximately 6.3 million square feet of commercial space,

approximately 100,000 square feet of community space, artist studios and approximately 355 acres of parks and open space. The actual commercial square footage and number of homesites are subject to change based on ultimate use and land planning.

The Candlestick and The San Francisco Shipyard communities are located almost equidistant between downtown San Francisco and the San Francisco International Airport (SFO). They consist of two distinct, but contiguous, parcels of real estate. Candlestick, the southern parcel, consists of approximately 280 acres on San Francisco’s waterfront. This nationally recognized site was the location of Candlestick Park stadium, former home of the San Francisco 49ers and the San Francisco Giants. The San Francisco Shipyard, the northern parcel, consists of approximately 495 acres on the former site of the Hunters Point Navy Shipyard. We commenced horizontal development activities at Candlestick in 2015.

In October 2019, we received approval from the City of San Francisco on a revised development plan for the first phase of Candlestick that is currently planned to include approximately 750,000 square feet of office space, 1,600 homes, and 300,000 square feet of lifestyle amenities centered around retail and entertainment. As currently planned, Candlestick ultimately is expected to include approximately 7,000 homes.

At The San Francisco Shipyard, approximately 408 acres are still owned by the U.S. Navy and will not be conveyed to us until the U.S. Navy satisfactorily completes its finding of suitability to transfer, or “FOST,” process, which involves multiple levels of environmental and governmental investigation, analysis, review, comment and approval. Based on our discussions with the U.S. Navy, we had previously expected the U.S. Navy to deliver this property between 2019 and 2022. However, allegations that Tetra Tech, Inc. and Tetra Tech EC, Inc. (collectively, “Tetra Tech”), contractors hired by the U.S. Navy, misrepresented sampling results at The San Francisco Shipyard have resulted in data reevaluation, governmental investigations, criminal proceedings, lawsuits, and a determination by the U.S. Navy and other regulatory agencies to undertake additional sampling. As part of the 2018 Congressional spending bill, the U.S. Department of Defense allocated $36.0 million to help fund resampling efforts at The San Francisco Shipyard. An additional $60.4 million to fund resampling efforts was approved as part of a 2019 military construction spending bill. These activities have delayed the remaining land transfers from the U.S. Navy and could lead to additional legal claims or government investigations, all of which could in turn further delay or impede our future development of such parcels. Our development plans were designed with the flexibility to adjust for potential land transfer delays, and we have the ability to shift the phasing of our development activities to account for potential delays caused by U.S. Navy retesting, but there can be no assurance that these matters and other related matters that may arise in the future will not materially impact our development plans. Accordingly, our immediate development focus is on our Candlestick community that is not subject to land transfers from the U.S. Navy. For additional information about the finding of suitability to transfer process, see “—Regulation—FOST Process.”

Great Park Neighborhoods

Great Park Neighborhoods, located in Irvine, California, is an approximately 2,100 acre mixed-use planned community that is being developed on the former site of the U.S. Marine Corp’s El Toro Air base (“El Toro Base”) in Orange County. Great Park Neighborhoods is designed to include approximately 10,500 homesites (including up to 1,056 affordable homesites), approximately 4.9 million square feet of commercial space, approximately 61 acres of parks and approximately 138 acres of trails and open space. The actual commercial square footage and number of homesites are subject to change based on ultimate use and land planning.

Great Park Neighborhoods is approximately seven miles from the Pacific Ocean, approximately nine miles from the University of California, Irvine (UCI) and approximately 17 miles from Disneyland. It is adjacent to the Orange County Great Park, a metropolitan public park that will be nearly twice the size of New York’s Central Park upon completion. Great Park Neighborhoods is close to Interstate 5, Interstate 405, State Route 133 and John Wayne Airport (SNA) in Orange County.

The first homesites at the Great Park Neighborhoods were sold in April 2013 and, as of December 31, 2022, the Great Park Venture had sold 7,326 homesites (including 853 affordable homesites) and 115 acres of commercial land, including the Five Point Gateway Campus, allowing for development of up to approximately 2.8 million square feet of commercial office and research and development space. As of December 31, 2022, builder sales totaled 5,748 market rate homes at the Great Park Neighborhoods (including 38 homes under a fee build arrangement). The Great Park Venture reacquired the development rights equivalent to approximately one million square feet that had been previously sold with the Five Point Gateway Campus. For additional information about the Five Point Gateway Campus commercial land sale, see “—Commercial” below.

Commercial

We currently expect to develop and operate certain commercial properties within our existing mixed-use planned communities. We may develop and operate these properties on our own, or we may choose from time to time to develop and/or operate a particular property or properties in a strategic joint venture or other financing or entity structure with a third-party.

Factors we consider in determining whether or not to proceed with a particular commercial investment include (1) our existing knowledge of the mixed-use planned communities we are currently developing and understanding their respective needs, (2) whether, in our judgment, a particular commercial property or investment will create additional value for our remaining land within the community, in addition to achieving desired investment returns on such property or investment on a stand-alone basis, (3) existing entitlements and our ability to change them, (4) compatibility of the physical site with our proposed uses, and (5) environmental considerations, traffic patterns and access to the site.

In August 2017, the Gateway Commercial Venture, in which we own a 75% interest, acquired the Five Point Gateway Campus, consisting of approximately 73 acres of commercial land in the Great Park Neighborhoods that the Great Park Venture previously sold to a third party. The Five Point Gateway Campus currently includes approximately one million square feet planned for research and development, medical and office space in four buildings, which are designed to accommodate thousands of employees. In May 2020, the Gateway Commercial Venture closed on the sale of one building including approximately 11 acres of land within the campus to City of Hope. City of Hope operates the building as a comprehensive cancer care center and is currently constructing a hospital adjacent to the cancer care center. In August 2020, the Gateway Commercial Venture closed on the sale of two buildings to a real estate management company and operator. Our corporate headquarters are located in the fourth building, which remains owned by the Gateway Commercial Venture. In addition to the fourth building, the Gateway Commercial Venture owns approximately 50 acres of commercial land with additional development rights at the campus.

Other Properties

We own approximately 16,000 acres adjacent to our Valencia community in Ventura County that are primarily used for agriculture and energy operations. We also own approximately 500 acres of remnant commercial, residential and open space land in Los Angeles County that is planned to be sold or deeded to third parties as we develop our Valencia community.

Development Management Services

Through the management company, we receive fees for providing development management services for Great Park Neighborhoods and for providing property management services to the Gateway Commercial Venture.

Competition

We compete with other residential, retail and commercial property developers in the development of properties in the Northern and Southern California markets. Significant factors that we believe allow us to compete effectively in this business include:

•the size and scope of our mixed-use planned communities located in desirable and supply constrained California coastal markets;

•the recreational and cultural amenities available within our communities;

•the commercial centers in our communities;

•our relationships with homebuilders;

•the proximity of our communities to major metropolitan areas;

•experienced and proven leadership with expertise in partnering with governmental entities;

•significant discretion in timing and amount of land development expenditures; and

•flexible capital structure with a conservative operating philosophy.

Seasonality

Our business and results of operations are not materially impacted by seasonality, however, we have historically experienced, and expect to continue to experience, variability in results of operations between comparable periods as a result of the sequencing of the development of our communities.

Regulation

Entitlement Process

Land use and zoning authority is exercised by local municipalities through the adoption of ordinances, regulations or zoning codes to direct the use and development of private property by controlling the use, size, density and location of and access to developments on private land. Such ordinances, regulations or codes typically divide uses of land into two categories—permitted uses and discretionary uses. Permitted uses are presumptively permitted, while discretionary uses are subject to a discretionary approval process, usually involving an application, an environmental review and a public hearing with input from other locally affected

property owners and stake holders. In order to grant a discretionary use entitlement, the municipality must find that the use does not negatively impact surrounding properties and may condition such an entitlement with special requirements or limitations unique to each individual case. We typically obtain all discretionary entitlements and approvals necessary to develop the infrastructure within our communities and prepare our residential and commercial lots for construction. We also typically obtain all discretionary entitlements and approvals that the homebuilder or commercial builder will need to build homes or commercial buildings on our lots, although we may from time to time allocate responsibility for obtaining certain discretionary entitlements to a homebuilder or commercial builder.

We have incurred significant costs and expenses over the last 10 to 15 years in order to obtain the primary entitlements (general plan and zoning approvals) for our communities. Once these primary entitlements are obtained, we continue to refine the mixed-use plan for each community by planning specific development areas and obtaining the necessary governmental approvals for a development area. Among other things, we typically need to obtain the following approvals for each development area: (1) approval of the subdivision maps (such as vesting tentative tract maps and parcel maps) that allow the land to be divided into separate legal lots for residential, commercial and other improvements; (2) approval of the improvement plans that set forth certain design, engineering and other elements of infrastructure, parks, homes, commercial buildings and other improvements; (3) approval of the final map that allows for the conveyance of individual homesites and commercial lots; and (4) any other discretionary approvals needed to construct, finance, sell, lease or maintain the homes or commercial buildings within a development area.

We may also need to obtain state and federal permits for land development activities in certain development areas, including, for example, permits and approvals issued by state and federal resource agencies authorizing impacts to species covered by endangered species acts or impacts to state and federal waters or wetlands.

Development areas within our communities are at various stages of planning and development and, therefore, have received different levels of discretionary entitlements and approvals. In some cases, development areas have obtained entitlements and approvals allowing homes and commercial buildings to be built and sold, and in other cases development areas require further discretionary entitlements or approvals prior to the commencement of construction. In the past, our approvals have been challenged by third parties.

Environmental Matters

Under various federal, state and local laws and regulations relating to the environment, as a current or former owner or operator of real property, we may be liable for costs and damages resulting from the presence or discharge of hazardous or toxic substances, waste or petroleum products at, on, in, under or migrating from such property, including costs to investigate and clean up such contamination and liability for damage to natural resources. Such laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of such contamination, and the liability may be joint and several. These liabilities could be substantial and the cost of any required remediation, removal, fines or other costs could exceed the value of the property or our aggregate assets. In addition, the presence of contamination or the failure to remediate contamination at our properties may expose us to third-party liability for costs of remediation or personal or property damage or materially adversely affect our ability to sell, lease or develop our properties or to borrow using the properties as collateral. In addition, environmental laws may create liens on contaminated sites in favor of the government for damages and costs it incurs to address such contamination. Moreover, if contamination is discovered on our properties, environmental laws may impose restrictions on the manner in which property may be used or businesses may be operated, and these restrictions may require substantial expenditures. Such remaining contamination encountered during our construction and development activities also may require investigation or remediation, and we could incur costs or experience construction delays as a result of such discoveries.