Table of Contents

As filed with the Securities and Exchange Commission on June 10, 2013

Registration No. 333-188855

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Prosensa Holding B.V.(1)

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

| The Netherlands | 2834 | NOT APPLICABLE | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

J.H. Oortweg 21

2333 CH Leiden, the Netherlands,

+31 (0)71 33 22 100

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

National Corporate Research, Ltd.

10 East 40th Street

New York, New York 10016

(212) 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Richard D. Truesdell, Jr. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 |

Richard B. Aftanas Andrea L. Nicolas Skadden, Arps, Slate, Meagher & Flom LLP 4 Times Square New York, NY 10036 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee(2) | ||

| Ordinary shares, nominal value €0.01 per share |

$60,000,000 | $8,184 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457 under the Securities Act of 1933. |

| (2) | Previously Paid. |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Commission, acting pursuant to such Section 8(a), may determine.

| (1) | We intend to change our name from Prosensa Holding B.V. to Prosensa Holding N.V. prior to the consummation of this offering. |

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated June 10, 2013

Prospectus

ordinary shares

This is an initial public offering of ordinary shares by Prosensa Holding B.V. We are selling of our ordinary shares. The estimated initial public offering price is between $ and $ per share.

We intend to apply to have our ordinary shares listed on the Nasdaq Global Market under the symbol “RNA.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for future filings.

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

| (1) | See “Underwriting” for additional compensation payable to participating members. |

We have granted the underwriters an option for a period of 30 days to purchase up to an additional of our ordinary shares to cover over-allotments.

Delivery of the ordinary shares will be made on or about , 2013.

Investing in our ordinary shares involves a high degree of risk. See “Risk factors” beginning on page 9.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Joint book-running managers

| J.P. Morgan | Citigroup |

Lead manager

Leerink Swann

Co-managers

| Wedbush PacGrow Life Sciences | KBC Securities |

, 2013

Table of Contents

| Page | ||||

| 1 | ||||

| 5 | ||||

| 7 | ||||

| 9 | ||||

| 45 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

55 | |||

| 81 | ||||

| 122 | ||||

| 135 | ||||

| 138 | ||||

| 141 | ||||

| 158 | ||||

| 160 | ||||

| 169 | ||||

| 175 | ||||

| 176 | ||||

| 176 | ||||

| 177 | ||||

| 178 | ||||

| F-1 | ||||

Unless otherwise indicated or the context otherwise requires, all references in this prospectus to “Prosensa Holding B.V.,” “Prosensa Holding N.V.” or “Prosensa,” the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to (i) Prosensa Holding B.V., together with its subsidiaries prior to the conversion of Prosensa Holding B.V. into Prosensa Holding N.V. and (ii) Prosensa Holding N.V., together with its subsidiaries, after giving effect to the conversion of Prosensa Holding B.V. into Prosensa Holding N.V., which is expected to occur immediately prior to the consummation of this offering. The trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

i

Table of Contents

We have not authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We and the underwriters have not authorized any other person to provide you with different or additional information. Neither we nor the underwriters are making an offer to sell the ordinary shares in any jurisdiction where the offer or sale is not permitted. This offering is being made in the United States and elsewhere solely on the basis of the information contained in this prospectus. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of the ordinary shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

ii

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary may not contain all the information that may be important to you, and we urge you to read this entire prospectus carefully, including the “Risk factors,” “Business” and “Management’s discussion and analysis of financial condition and results of operations” sections and our consolidated audited and condensed consolidated unaudited financial statements, including the notes thereto, included in this prospectus, before deciding to invest in our ordinary shares.

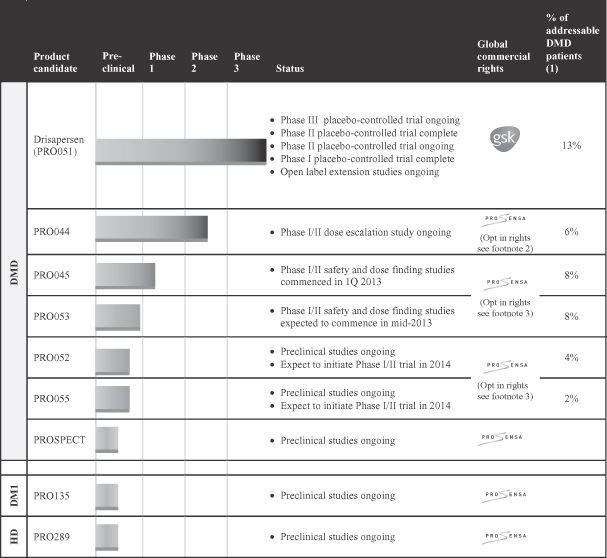

Our company

We are an innovative biotechnology company engaged in the discovery and development of ribonucleic acid-modulating, or RNA-modulating, therapeutics for the treatment of genetic disorders. Our primary focus is on rare neuromuscular and neurodegenerative disorders with a large unmet medical need, including Duchenne muscular dystrophy, myotonic dystrophy and Huntington’s disease. Our clinical portfolio of RNA-based product candidates is focused on the treatment of Duchenne muscular dystrophy, or DMD. Each of our DMD compounds has been granted orphan drug status in the United States and the European Union.

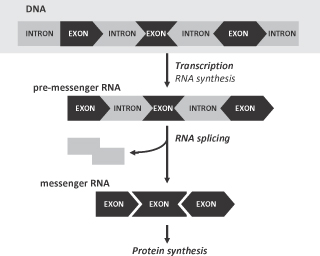

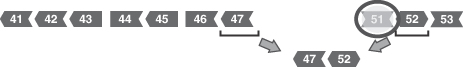

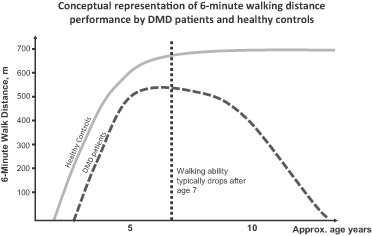

DMD is one of the most prevalent rare genetic diseases globally affecting up to 1 in 3,500 boys and is invariably fatal. There is currently no approved disease-modifying therapy for DMD. The progressive muscle-wasting that characterizes this disease is caused by inadequate production of dystrophin, a protein necessary for muscle function, as a result of mutations in the dystrophin gene. The different mutations, which are mostly deletions of one or more exons, found in the dystrophin gene result in distinct sub-populations of DMD patients. We are designing product candidates to address several sub-populations using our platform technology. Our first product candidate, drisapersen, can address a variety of mutations in the dystrophin gene, such as a deletion of exon 50 or exons 48 to 50.

We started operations in 2002 and are located in Leiden, the Netherlands. We work closely with Leiden University Medical Center, or LUMC, with whom we entered into an exclusive licensing agreement in 2003 for LUMC’s proprietary RNA modulation exon-skipping technology to develop treatments for DMD, other neuromuscular disorders and indications outside the field of neuromuscular disorders. Since 2002, we have raised €56.4 million from private placements of equity securities, including to a number of venture capital firms. In addition, we have received grants and loans from several DMD-focused patient advocacy organizations to support our research of therapies for DMD. As of March 31, 2013, we had €36.1 million in cash and cash equivalents.

Clinical development of our lead product candidate, drisapersen, in DMD

Drisapersen is being developed in collaboration with GlaxoSmithKline, or GSK. Drisapersen aims to restore dystrophin expression and improve muscle condition and function in the largest known sub-population of DMD patients. In clinical trials, drisapersen has been shown to produce dystrophin expression and have a beneficial therapeutic effect on DMD patients. A Phase II placebo-controlled study of drisapersen in 53 DMD patients was completed and demonstrated a statistically significant and clinically important difference in the primary endpoint, which was the

1

Table of Contents

distance walked in the six minute walk test, or 6MWD, between the placebo group and the continuous active-treatment group at a dose of 6 mg/kg/week after 24 weeks. This clinically meaningful benefit was maintained after 48 weeks of treatment, and drisapersen was well tolerated throughout the duration of this study. Preliminary results suggest that treatment with drisapersen was in general associated with increased levels of dystrophin expression when compared with pre-treatment levels.

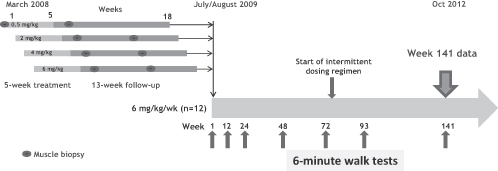

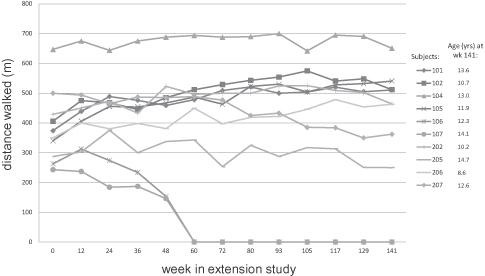

Drisapersen successfully completed a twelve-patient Phase I/II study, and all patients were enrolled in an open-label extension study which has been ongoing since August 2009. The results indicate that drisapersen may lead to stabilization of the disease, as evidenced by an improvement or a slower than expected decline in the 6MWD, and the ongoing study continues to provide safety and tolerability data.

A pivotal Phase III study of drisapersen was initiated in December 2010, and results are expected in the fourth quarter of 2013. This study is a randomized, double-blind and placebo-controlled trial, assessing drisapersen at a dose of 6 mg/kg/week in 186 boys. The primary endpoint is the 6MWD at 48 weeks.

To date, over 300 patients have participated in clinical studies of drisapersen at more than 50 trial sites in 25 countries, and patient retention rates through March 2013 averaged 96% across all drisapersen clinical studies.

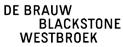

Our follow-on DMD compounds

PRO044, our next most advanced product candidate, addresses a separate sub-population of DMD patients. We developed PRO044 using our exon-skipping technology to generate a product candidate with the same mechanism of action that is used by drisapersen. PRO044 is currently in a Phase I/II study in Europe, which we expect to complete in the second half of 2013. We have four additional earlier-stage compounds that address other distinct sub-populations of DMD patients. Of these, PRO045 entered clinical trials in the first quarter of 2013, and we anticipate that PRO053 will enter clinical trials in mid-2013. PRO052 and PRO055 are in advanced preclinical development. We have also started a research program, PROSPECT, which includes a new and innovative application of our exon-skipping technology platform to specifically target rarer mutations in the dystrophin gene.

Our collaboration with GlaxoSmithKline

In 2009, we entered into an exclusive worldwide collaboration with GSK for the development and commercialization of RNA-based therapeutics for DMD, with GSK exclusively licensing worldwide rights to develop and commercialize drisapersen and obtaining an option to exclusively license PRO044.

In addition, GSK has the option to exclusively license either PRO045 or PRO053 and the further option to exclusively license either PRO052 or PRO055. PRO045 is paired with PRO053, and PRO052 is paired with PRO055, because each product candidate in the respective pairings addresses a similar-sized patient sub-population and is at a comparable stage of development. We will retain the full rights to the product candidates that are not licensed by GSK, and for each product candidate licensed by GSK from each of the pairings of product candidates described

2

Table of Contents

above, we will retain the option to certain commercial rights in a selected European territory. All of our other DMD compounds fall outside of the scope of this agreement, and we intend to develop and commercialize them ourselves or consider partnerships.

Upon entering into the agreement with GSK, we received a £16 million (€17.2 million) nonrefundable upfront payment from GSK and have received £41.5 million (€47.4 million) in total under the agreement. Including amounts already paid, we are eligible for up to £428 million (€505 million) in total milestone payments under the agreement. We are also entitled to receive percentage royalties in the low tens on future global sales of drisapersen and each of the other compounds that GSK licenses and successfully commercializes.

Our RNA modulation technology platform

Our DMD programs are part of our broader RNA modulation platform technology, which in addition to exon skipping, is focused on reducing mutant RNA associated with trinucleotide repeat expansion diseases. Our current programs in this area are PRO135 for myotonic dystrophy (DM1) and PRO289 for Huntington’s disease (HD). Both DM1 and HD are rare diseases with a severe impact on patients, and currently no disease-modifying therapies exist for either.

Our business strategy

Our goal is to become a leader in the rare genetic disease field, with a particular focus on DMD. Over time, we intend to mature into a fully integrated biopharmaceutical company focused on the discovery, development and commercialization of our products.

The key components of our business objectives are:

| • | Collaborate with our partner, GSK, to rapidly advance drisapersen, our lead DMD candidate; |

| • | Leverage our know-how from drisapersen to accelerate and reduce development risk of our earlier-stage DMD products; |

| • | Independently commercialize our proprietary products in DMD; |

| • | Leverage our proprietary RNA modulation and exon-skipping drug discovery platform; and |

| • | Continue to invest in and strengthen our intellectual property portfolio. |

We may also enter into strategic collaborations that deliver additional expertise and enhance implementation of our strategy.

Corporate information

We are a Dutch private company with limited liability, and prior to the consummation of this offering we intend to convert to a Dutch public company with limited liability. Our principal executive offices are located at J.H. Oortweg 21, 2333 CH Leiden, the Netherlands. Our telephone number at this address is +31 (0)71 33 22 100.

Investors should contact us for any inquiries at the address and telephone number of our principal executive office. Our principal website is www.prosensa.com. The information contained on our website is not a part of this prospectus.

3

Table of Contents

Risks associated with our business

Our business is subject to a number of risks of which you should be aware before making an investment decision. These risks are discussed more fully in the “Risk factors” section of this prospectus immediately following this prospectus summary. These risks include the following:

| • | We currently have no commercial products, and we have not received regulatory approval for, nor have we generated commercial revenue from, any of our product candidates. |

| • | We depend heavily on the success of drisapersen. Our ability to generate royalty and product revenues will depend heavily on the successful development of drisapersen and our other product candidates, which may not occur for several years, if ever. |

| • | Our financial prospects for the next several years are substantially dependent on the development and marketing efforts of our partner GSK for drisapersen and the other product candidates that it may license under our collaboration. |

| • | Drisapersen and our other product candidates are in clinical and preclinical development, and clinical trials of these product candidates may not be successful. If GSK or we are unable to obtain marketing approvals for, or successfully commercialize, drisapersen or our other product candidates, our ability to generate revenue may be materially impaired. |

| • | We have a history of operating losses and anticipate that we will continue to incur losses for the foreseeable future. As of March 31, 2013, we had an accumulated deficit of €44.2 million. We may need additional funding, and such funding may cause substantial dilution to our shareholders. |

| • | We may be unable to maintain and protect our intellectual property assets, which could harm our ability to compete and impair our business. |

Implications of being an emerging growth company

We qualify as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| • | the ability to include only two years of audited financial statements and only two years of related management’s discussion and analysis of financial condition and results of operations disclosure; and |

| • | an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1.0 billion in annual revenue, have more than $700 million in market value of our ordinary shares held by non-affiliates or issue more than $1.0 billion of non-convertible debt over a three-year period.

4

Table of Contents

| Ordinary shares offered by us |

ordinary shares. | |

| Ordinary shares to be outstanding after this offering |

ordinary shares. | |

| Over-allotment option |

We have granted the underwriters the right to purchase up to an additional ordinary shares from us within 30 days of the date of this prospectus, to cover over-allotments, if any, in connection with the offering. | |

| Use of proceeds |

We estimate that the net proceeds to us from the offering will be approximately $ (€ ). We currently expect that we will use the net proceeds from this offering, together with our cash and cash equivalents on hand, as follows:

• approximately € million to fund our current DMD development portfolio for which we bear expenses (PRO045, PRO053, PRO052 and PRO055), PROSPECT and DMD-support projects, including our DMD natural history study;

• approximately € million to fund non-DMD projects, including DM1 and HD; and

• the remainder for working capital and other general corporate purposes.

See “Use of proceeds.” | |

| Dividend policy |

We have never paid or declared any cash dividends on our ordinary shares, and we do not anticipate paying any cash dividends on our ordinary shares in the foreseeable future. | |

| Risk factors |

See “Risk factors” and the other information included in this prospectus for a discussion of factors you should consider before deciding to invest in our ordinary shares. | |

| Listing |

We intend to apply to list our ordinary shares on the Nasdaq Global Market, or Nasdaq, under the symbol “RNA.” | |

The number of our ordinary shares to be outstanding after this offering is based on 3,491,058 of our ordinary shares outstanding as of May 31, 2013 and 25,511,240 additional ordinary shares issuable upon the automatic conversion of all of our outstanding preferred shares into ordinary shares

5

Table of Contents

immediately prior to the consummation of this offering (the Share Conversion) pursuant to our shareholders’ agreement, as described under “Related party transactions—Shareholders’ agreement.”

The number of our ordinary shares to be outstanding after this offering excludes:

| • | 2,207,707 of our ordinary shares issuable upon the exercise of options outstanding as of May 31, 2013 at a weighted average exercise price of €0.34 per share; and |

| • | 352,370 additional options for depositary receipts in respect of our ordinary shares, restricted shares and restricted share units for depositary receipts in respect of our ordinary shares available for future issuance as of May 31, 2013 under our 2010 equity incentive plan. |

Unless otherwise indicated, all information contained in this prospectus:

| • | gives effect to the conversion of all of our outstanding preferred shares into an aggregate of 25,511,240 ordinary shares immediately prior to the consummation of this offering, which we refer to as the Share Conversion; |

| • | gives effect to the amendment of our articles of association as adopted by our general meeting of shareholders in connection with the consummation of this offering; and |

| • | assumes no exercise of the option granted to the underwriters to purchase up to additional ordinary shares to cover over-allotments, if any, in connection with the offering. |

6

Table of Contents

The summary income statement and balance sheet data for the years ended and as of December 31, 2012 and 2011 of Prosensa Holding B.V. are derived from the consolidated financial statements included in this prospectus. The summary income statement and balance sheet data for the three months ended and as of March 31, 2013 and 2012 are derived from the unaudited condensed consolidated financial statements included in this prospectus. We maintain our books and records in euros (€), and we prepare our financial statements under International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or the IASB.

This financial information should be read in conjunction with “Presentation of financial and other information,” “Management’s discussion and analysis of financial condition and results of operations” and our consolidated audited and unaudited financial statements, including the notes thereto, included in this prospectus.

Consolidated statement of comprehensive income data

| Year ended December 31, | Three months

ended March 31, |

|||||||||||||||

| (€ in thousands) | 2011 | 2012 | 2012 | 2013 | ||||||||||||

|

|

|

|

|

|

||||||||||||

| License revenue |

€ | 6,510 | € | 5,726 | € | 1,385 | € | 1,407 | ||||||||

| Collaboration revenue |

2,179 | 2,127 | 589 | 993 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

8,689 | 7,853 | 1,974 | 2,400 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other income |

36 | 174 | 0 | 1 | ||||||||||||

| Research and development expense |

(15,348 | ) | (14,393 | ) | (3,781 | ) | (4,060 | ) | ||||||||

| General and administrative expense |

(5,203 | ) | (4,023 | ) | (1,061 | ) | (1,795 | ) | ||||||||

| Other gains/(losses)—net |

22 | 49 | 3 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating loss |

(11,804 | ) | (10,340 | ) | (2,865 | ) | (3,453 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Finance income |

434 | 796 | 212 | 192 | ||||||||||||

| Finance costs |

(209 | ) | (348 | ) | (82 | ) | (188 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Finance income—net |

225 | 448 | 130 | 4 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other comprehensive income |

0 | 0 | 0 | 0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total comprehensive loss |

€ | (11,579 | ) | € | (9,892 | ) | € | (2,735 | ) | € | (3,449 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per share |

||||||||||||||||

| Basic and diluted(1) |

(0.60 | ) | (0.37 | ) | (0.12 | ) | (0.12 | ) | ||||||||

| Weighted-average shares outstanding(2) |

||||||||||||||||

| Basic |

19,240,137 | 26,574,570 | 23,145,096 | 29,002,298 | ||||||||||||

| Diluted |

20,656,759 | 28,110,543 | 24,562,830 | 31,210,005 | ||||||||||||

| Pro forma net loss per share (unaudited)(3) |

€ | (0.37 | ) | € | (0.12 | ) | € | (0.12 | ) | |||||||

|

|

|

|

|

|

||||||||||||

| (1) | Basic and diluted net loss per share are the same in these periods because outstanding options and restricted shares would be anti-dilutive due to our net loss in these periods. |

| (2) | Includes preferred shares. |

| (3) | The unaudited pro forma net loss per share data give effect to the automatic conversion of all of our preferred shares into an aggregate of 25,511,240 shares of our ordinary shares immediately prior to the consummation of this offering (the Share Conversion as described under “Related party transactions—Shareholders’ agreement”). The pro forma information is presented for informational purposes only and is not necessarily indicative of what our results would have been had the Share Conversion actually occurred on such date nor is it indicative of our future performance. |

7

Table of Contents

Consolidated balance sheet data

| As of December 31, 2012 | As of March 31, 2013 | |||||||||

| (€ in thousands) | Actual | Actual | Pro forma(1) | |||||||

|

|

| |||||||||

| Cash and cash equivalents |

40,738 | 36,115 | ||||||||

| Working capital (deficit)(2) |

(2,353 | ) | (2,349 | ) | ||||||

| Total assets |

47,329 | 43,360 | ||||||||

| Long-term debt, including current portion |

6,541 | 6,682 | ||||||||

| Accumulated (deficit) |

(40,834 | ) | (44,225 | ) | ||||||

| Total shareholders’ equity |

15,574 | 12,183 | ||||||||

|

|

| |||||||||

| (1) | The unaudited pro forma balance sheet data give effect to the Share Conversion upon the consummation of this offering and to the issuance and sale of ordinary shares in this offering by us at an assumed initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, and the application of the net proceeds of the offering, after deducting estimated underwriting discounts and commissions and offering expenses payable by us, as set forth under “Use of proceeds.” Because the conversion of our preferred shares into ordinary shares will occur on a one-to-one basis, the Share Conversion will have no impact on total shareholders’ equity. See “Use of proceeds” and “Capitalization.” The pro forma information is presented for informational purposes only and is not necessarily indicative of what our results would have been had these transactions actually occurred on such date nor is it indicative of our future performance. |

| (2) | Working capital (deficit) is calculated as current assets excluding cash and cash equivalents less trade and other payables. |

8

Table of Contents

You should carefully consider the risks and uncertainties described below and the other information in this prospectus before making an investment in our ordinary shares. Our business, financial condition or results of operations could be materially and adversely affected if any of these risks occurs, and as a result, the market price of our ordinary shares could decline and you could lose all or part of your investment. This prospectus also contains forward-looking statements that involve risks and uncertainties. See “Cautionary statement regarding forward-looking statements.” Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors.

Risks related to our business and industry

We depend heavily on the success of drisapersen. Drisapersen and all of our other product candidates are still in preclinical and clinical development. Clinical trials of our product candidates may not be successful. If we and GlaxoSmithKline are unable to commercialize drisapersen and our other product candidates, or experience significant delays in doing so, our business, financial condition and results of operations will be materially adversely affected.

We have invested a significant portion of our efforts and financial resources in the development of drisapersen and our other five product candidates, all targeting patients with Duchenne muscular dystrophy, or DMD. All of our product candidates are still in preclinical and clinical development. Our ability to generate royalty and product revenues, which we do not expect will occur for at least the next several years, if ever, will depend heavily on the successful development and eventual commercialization of these product candidates, particularly drisapersen. The success of drisapersen and our product candidates will depend on several factors, including the following:

| • | for drisapersen and the other product candidates that GlaxoSmithKline, or GSK, licenses under our collaboration, the successful efforts of GSK in completing clinical trials of, receipt of regulatory approval for and commercialization of such product candidates; |

| • | for the product candidates to which we retain rights under the collaboration, completion of preclinical studies and clinical trials of, receipt of marketing approvals for, establishment of commercial manufacturing capabilities of and successful commercialization of such product candidates; and |

| • | for all of our product candidates, acceptance of our product candidates by patients, the medical community and third-party payors, effectively competing with other therapies, a continued acceptable safety profile following approval, and qualifying for, maintaining, enforcing and defending our intellectual property rights and claims. |

If we or GSK, as applicable, do not achieve one or more of these factors in a timely manner or at all, we could experience significant delays or an inability to successfully commercialize drisapersen and our other product candidates, which would materially adversely affect our business, financial condition and results of operations.

9

Table of Contents

Because we are developing product candidates for the treatment of diseases in which there is little clinical experience and, in some cases, using new endpoints or methodologies, there is more risk that the outcome of our clinical trials will not be favorable.

There is currently no approved disease-modifying therapy for DMD. In addition, there has been limited historical clinical trial experience generally for the development of drugs to treat the underlying cause of DMD. As a result, the design and conduct of clinical trials for this disease, particularly for drugs to address the underlying cause of this disease, is subject to increased risk. In particular, regulatory authorities in the United States and European Union have not issued definitive guidance as to how to measure and achieve efficacy.

In the last several years, the six minute walk test, or 6MWT, has been used in several trials of product candidates for patients with DMD, and is accepted by U.S. and European regulators to be an appropriate primary outcome measure for DMD trials. We may nonetheless experience setbacks with the Phase III clinical trial or any other clinical trial for drisapersen or the clinical trials for our other product candidates because of the limited clinical experience in this indication. For example, regulators have not yet established what difference in the distance walked in the 6MWT, or 6MWD, is required to be demonstrated in a clinical trial of a DMD therapy in order to signify a clinically meaningful result and/or obtain regulatory approvals. As a result, we may not achieve the pre-specified endpoint with statistical significance in the trials of drisapersen or of our other product candidates, which would decrease the chance of obtaining marketing approval for drisapersen or our other product candidates for DMD. We could also face similar challenges in designing clinical trials and obtaining regulatory approval for future product candidates, including any that we may develop for myotonic dystrophy (DM1) or Huntington’s disease (HD) because there is also limited historical clinical trial experience for the development of drugs to treat these diseases.

Our financial prospects for the next several years are substantially dependent upon the development and marketing efforts of GSK for our lead candidate drisapersen and the other DMD product candidates that it may license under our collaboration, and our continuing strategic relationship with GSK. GSK may act in its best interest rather than in our best interest, which could materially adversely affect our business, financial condition and results of operations.

We rely on GSK to fund and conduct the clinical development and commercialization of drisapersen and the other product candidates GSK may license under our collaboration, and GSK has complete control over such activities. Our ability to generate revenue in the near term will depend primarily on the successful development, regulatory approval, marketing and commercialization of drisapersen by GSK. Such success is subject to significant uncertainty, and we have limited control over the resources, time and effort that GSK may devote to drisapersen. Any of several events or factors could have a material adverse effect on our ability to generate revenue from GSK’s potential commercialization of drisapersen. For example, GSK:

| • | may be unable to successfully complete the clinical development of drisapersen; |

| • | may have to comply with additional requests and recommendations from the European Medicines Agency, or EMA, the U.S. Food and Drug Administration, or FDA, or other similar regulatory agencies, including requests or recommendations for additional clinical trials; |

| • | may not make all regulatory filings and obtain all necessary approvals from the EMA, the FDA and similar regulatory agencies; |

10

Table of Contents

| • | may not commit sufficient resources to the development, regulatory approval, marketing and distribution of drisapersen, whether for strategic reasons or otherwise due to a change in business priorities; |

| • | may unilaterally terminate our collaboration agreement on specified prior notice without any reason and without any further commitment to continue development of any of our product candidates; |

| • | may not be able to manufacture drisapersen in compliance with requirements of the EMA, the FDA and similar regulatory agencies in commercial quantities sufficient to meet market demand; |

| • | may not achieve market acceptance of drisapersen by physicians, patients and third-party payors; |

| • | may not achieve sufficient pricing for drisapersen to compensate for development, post-licensing and commercialization costs, or GSK may underestimate such post-licensing and commercialization costs; |

| • | may not compete successfully with any alternative therapies for DMD; and |

| • | may independently develop products that compete with drisapersen or our other product candidates in the treatment of DMD. |

Pursuant to our collaboration with GSK, GSK will fund all our costs and expenses associated with the further clinical development of, and has sole decision-making authority and is responsible for all research, development, regulatory, manufacturing, marketing, advertising, promotional, launch and sales and other commercial activities in connection with drisapersen and each other compound that it receives a license for under the collaboration. In return, we are to receive milestone payments upon successful compound development and percentage royalties in the low tens on product sales. The milestones generally relate to development and regulatory achievements, and a portion of the milestone payments relate to drisapersen. If we fail to maintain this relationship with GSK, or GSK fails to honor its agreements under the collaboration, our business and results of operations could be materially and adversely affected.

In addition, GSK has the right to make decisions regarding the development and commercialization of product candidates under the collaboration without consulting us and may make decisions with which we do not agree. Conflicts between GSK and us may arise if there is a dispute about the progress of the clinical development of a product candidate, the achievement and payment of a milestone amount or the ownership of intellectual property developed during the course of our collaboration agreement. It may be necessary for us to assume responsibility at our own expense for the development of drisapersen or our other product candidates subject to the GSK collaboration. In that event, we would likely be required to limit the size and scope of one or more of our programs or increase our expenditures and seek additional funding, which may not be available on acceptable terms or at all, which would materially adversely affect our business, financial condition and results of operations.

11

Table of Contents

We do not and will not have access to all information regarding the product candidates we license to GSK. Consequently, our ability to inform our shareholders about the status of such product candidates, and to make informed operational and investment decisions about the product candidates to which we have retained development and commercialization rights, may be limited.

We do not and will not have access to all information regarding the products being developed and potentially commercialized by GSK, including potentially material information about clinical trial design and execution, safety reports from clinical trials, spontaneous safety reports if the product is later approved and marketed, regulatory affairs, process development, manufacturing, marketing and other areas known by GSK. In addition, we have confidentiality obligations under our agreement with GSK. Thus, our ability to keep our shareholders informed about the status of product candidates under our collaboration will be limited by the degree to which GSK keeps us informed and allows us to disclose such information to the public. If GSK fails to keep us informed about the clinical development and regulatory approval of our collaboration and product candidates licensed to it, we may make operational and investment decisions that we would not have made had we been fully informed, which may materially and adversely affect our business and operations.

We have a history of operating losses, and we may not achieve or sustain profitability. We anticipate that we will continue to incur losses for the foreseeable future. If we fail to obtain additional funding to conduct our planned research and development effort, we could be forced to delay, reduce or eliminate our product development programs or commercial development efforts.

We incurred net losses of €9.9 million and €11.6 million for the years ended December 31, 2012 and 2011, respectively, and net losses of €3.4 million and €2.7 million for the three months ended March 31, 2013 and 2012, respectively. As of March 31, 2013, we had an accumulated deficit of €44.2 million. Our losses have resulted principally from expenses incurred in research and development of our product candidates and from general and administrative expenses that we have incurred while building our business infrastructure. We expect to continue to incur significant operating losses in the future as we continue our research and development efforts and seek to obtain regulatory approval and commercialization of our product candidates. In our fiscal year ending December 31, 2013, we expect to incur in the range of €20-25 million of costs associated with research and development, which amount is exclusive of costs incurred by GSK in developing our licensed product candidate drisapersen and other amounts received from GSK under the collaboration in connection with the development of our other DMD product candidates.

To date, we have financed our operations through private placements of equity securities, upfront, milestone and expense reimbursement payments received from GSK under our collaboration and funding from patient organizations, governmental bodies and bank loans. To date we have not generated any revenues from product sales. Based on our current plans, we do not expect to generate significant royalty or product revenues unless and until GSK or we obtain marketing approval for, and commercialize, drisapersen or any of our product candidates for which we have retained commercialization rights. We believe that the net proceeds of this offering, together with our existing cash and cash equivalents and anticipated milestone payments under the GSK Agreement, will enable us to fund our operating expenses and capital expenditure requirements for at least the next months. We have based this estimate on

12

Table of Contents

assumptions that may prove to be wrong, and we could use our capital resources sooner than we currently expect.

We may have to seek additional funding. Additional funds may not be available on a timely basis, on favorable terms, or at all, and such funds, if raised, may not be sufficient to enable us to continue to implement our long-term business strategy. In addition, we may not be able to obtain further funding from patient organizations or governmental bodies.

Even if we do generate product royalties or product sales, we may never achieve or sustain profitability on a quarterly or annual basis. Our failure to sustain profitability would depress the market price of our ordinary shares and could impair our ability to raise capital, expand our business, diversify our product offerings or continue our operations. A decline in the market price of our ordinary shares also could cause you to lose all or a part of your investment.

Raising additional capital may cause dilution to our shareholders, including purchasers of ordinary shares in this offering, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of the net proceeds of this offering, together with our existing cash and cash equivalents and anticipated milestone payments under our collaboration with GSK. In the event we need to seek additional funds, however, we may raise additional capital through the sale of equity or convertible debt securities. In such an event, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a holder of our ordinary shares. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends.

If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams or product candidates or to grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

Exchange rate fluctuations or abandonment of the euro currency may materially affect our results of operations and financial condition.

Due to the international scope of our operations, fluctuations in exchange rates, particularly between the euro, the British pound and the U.S. dollar, may adversely affect us. Although we are based in the Netherlands, we source research and development, manufacturing, consulting and other services from several countries. In addition, our arrangements with GSK are denominated in British pounds. Further, potential future revenue may be derived from abroad, particularly from the United States. As a result, our business and share price may be affected by fluctuations in foreign exchange rates between the euro and these other currencies, which may also have a significant impact on our reported results of operations and cash flows from period to period. Currently, we do not have any exchange rate hedging arrangements in place.

13

Table of Contents

In addition, the possible abandonment of the euro by one or more members of the European Union could materially affect our business in the future. Despite measures taken by the European Union to provide funding to certain E.U. member states in financial difficulties and by a number of European countries to stabilize their economies and reduce their debt burdens, it is possible that the euro could be abandoned in the future as a currency by countries that have adopted its use. This could lead to the re-introduction of individual currencies in one or more E.U. member states, or in more extreme circumstances, the dissolution of the European Union. The effects on our business of a potential dissolution of the European Union, the exit of one or more E.U. member states from the European Union or the abandonment of the euro as a currency, are impossible to predict with certainty, and any such events could have a material adverse effect on our business, financial condition and results of operations.

Risks related to the development and clinical testing of our product candidates

Clinical drug development involves a lengthy and expensive process with uncertain timelines and uncertain outcomes. If clinical trials of our product candidates are prolonged or delayed, we or our collaborator may be unable to obtain required regulatory approvals, and therefore be unable to commercialize our product candidates on a timely basis or at all.

To obtain the requisite regulatory approvals to market and sell any of our product candidates, we or our collaborator for such candidate must demonstrate through extensive preclinical and clinical trials that our products are safe and effective in humans. The process for obtaining governmental approval to market our products is rigorous, time-consuming and costly. It is impossible to predict the extent to which this process may be affected by legislative and regulatory developments. Due to these and other factors, such as the fact that no product using antisense oligonucleotides, or AONs, for systemic use has been approved for sale in the European Union and only one AON is approved for systemic use in the United States, our current product candidates or any of our other future product candidates could take a significantly longer time to gain regulatory approval than expected or may never gain regulatory approval. This could delay or eliminate any potential product revenue by delaying or terminating the potential commercialization of our product candidates.

Clinical trials must be conducted in accordance with EMA, FDA and other applicable regulatory authorities’ legal requirements, regulations or guidelines, and are subject to oversight by these governmental agencies and Institutional Review Boards, or IRBs, at the medical institutions where the clinical trials are conducted. In addition, clinical trials must be conducted with supplies of our product candidates produced under current good manufacturing practices, or cGMP, and other requirements. We depend on GSK (for drisapersen and other licensed product candidates) and on medical institutions and clinical research organizations, or CROs (for our other compounds), to conduct our clinical trials in compliance with Good Clinical Practice, or GCP. To the extent GSK and or the CROs fail to enroll participants for our clinical trials, fail to conduct the study to GCP standards or are delayed for a significant time in the execution of trials, including achieving full enrollment, we may be affected by increased costs, program delays or both, which may harm our business. In addition, clinical trials are conducted in countries outside the European Union and the United States, which may subject us to further delays and expenses as a result of increased shipment costs, additional regulatory requirements and the engagement of non-E.U. and non-U.S. CROs, as well as expose us to risks associated with clinical investigators who are unknown to the EMA or the FDA, and different standards of diagnosis, screening and medical care.

14

Table of Contents

To date, we have not completed all clinical trials required for the approval of any of our product candidates. Our lead compound drisapersen is in Phase III trials. The trials of our other compounds are less advanced or have not yet started. The commencement and completion of clinical trials for our products may be delayed, suspended or terminated as a result of many factors, including but not limited to:

| • | negative or inconclusive results, which may require us or GSK, as applicable, to conduct additional preclinical or clinical trials or to abandon projects that we expect to be promising; |

| • | safety or tolerability concerns could cause us or GSK, as applicable, to suspend or terminate a trial if we or GSK find that the participants are being exposed to unacceptable health risks; |

| • | the delay or refusal of regulators or IRBs to authorize us or GSK to commence a clinical trial at a prospective trial site and changes in regulatory requirements, policies and guidelines; |

| • | regulators or IRBs requiring that we or our investigators suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements; |

| • | delays or failure to reach agreement on acceptable clinical trial contracts or clinical trial protocols with prospective trial sites; |

| • | delays in patient enrollment and variability in the number and types of patients available for clinical trials; |

| • | the inability to enroll a sufficient number of patients in trials to ensure adequate statistical power to detect statistically significant treatment effects; |

| • | lower than anticipated retention rates of patients and volunteers in clinical trials; |

| • | our third-party research contractors failing to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all; |

| • | difficulty in maintaining contact with patients after treatment, resulting in incomplete data; |

| • | delays in establishing the appropriate dosage levels; |

| • | the difficulty in certain countries in identifying the sub-populations that we are trying to treat in a particular trial, which may delay enrollment and reduce the power of a clinical trial to detect statistically significant results; |

| • | the quality or stability of the product candidate falling below acceptable standards; |

| • | the inability to produce or obtain sufficient quantities of the product candidate to complete clinical trials; and |

| • | exceeding budgeted costs due to difficulty in predicting accurately costs associated with clinical trials. |

Since we have adopted a platform technology approach and all of our current clinical development candidates use similar process technology and are similarly applied to DMD, any of the above unforeseen difficulties that arises with one of our clinical development candidates may negatively affect all of our product candidates.

Positive or timely results from preclinical trials do not ensure positive or timely results in late stage clinical trials or product approval by the EMA, the FDA or other regulatory authorities.

15

Table of Contents

Products that show positive preclinical or early clinical results may not show sufficient safety or efficacy to obtain regulatory approvals and therefore fail in later stage clinical trials. The EMA, the FDA and other regulatory authorities have substantial discretion in the approval process, and determining when or whether regulatory approval will be obtained for any of our product candidates. Even if we believe the data collected from clinical trials of our product candidates are promising, such data may not be sufficient to support approval by the EMA, the FDA or any other regulatory authority.

Any delay in commencing or completing clinical trials for our products could increase our product development costs and delay marketing approval and commercialization of our products. For instance, in 2009 we held a pre-IND meeting with the FDA to discuss PRO044 clinical studies, and the FDA determined that we had insufficient data at that time to support the initiation of a clinical trial of PRO044 in the United States. PRO044 continues to be on clinical hold in the United States pending the results of long-term preclinical safety studies that we anticipate will be completed in the fourth quarter of 2013. In addition, in 2010, the FDA determined that inadequate data had been presented to support long-term studies of drisapersen and requested additional safety data. Upon submission of additional data, the FDA lifted the clinical hold on drisapersen in 2011.

In addition, it is possible that the FDA may not consider the results of GSK’s Phase III clinical trial of drisapersen, once completed, to be sufficient for the approval of drisapersen for DMD patients. In general, the FDA has usually suggested two adequately designed and powered and well-controlled trials to demonstrate effectiveness. Even if favorable results are achieved in the Phase III trial of drisapersen, the FDA may nonetheless require that GSK conduct additional clinical trials, possibly using a different design.

It is also possible that none of our products will complete clinical trials in any of the markets in which we intend to sell those products. If this were to happen, we would not receive the regulatory approvals needed and neither we nor our collaborator would be able to market our products. Significant clinical trial delays could also allow our competitors to bring products to market before we do or shorten any periods during which we have the exclusive right to commercialize our product candidates and impair our ability to commercialize our product candidates and may harm our business and results of operations.

Failure to obtain marketing authorization for our product candidates will result in our being unable to market and sell such products, which would materially adversely affect our business, financial conditional and results of operation. Approval by one regulatory authority does not ensure approval by regulatory authorities in other jurisdictions. If we fail to obtain approval in any jurisdiction, the geographic market for our product candidates could be limited. Similarly, regulatory agencies may not approve the labeling claims that are necessary or desirable for the successful commercialization of our product candidates.

If serious adverse, undesirable or unacceptable side effects are identified during the development of our product candidates, we may need to abandon our development of such product candidates.

If our product candidates are associated with serious adverse, undesirable or unacceptable side effects, we may need to abandon their development or limit development to certain uses or sub-populations in which such side effects are less prevalent, less severe or more acceptable from a risk-benefit perspective. Many compounds that initially showed promise in early-stage or clinical

16

Table of Contents

testing have later been found to cause side effects that prevented further development of the compound.

Transient proteinuria (protein in the urine) was observed in all twelve patients in our Phase I/II study of drisapersen, and eleven patients demonstrated signs of proteinuria at week twelve of the extension phase of this trial. Other reported adverse events from this study included injection site reactions, which were seen to varying degrees of severity in all subjects, raised cystatin C (a protein indicative of kidney function), decreased C3 (a protein indicating immunological activity), low platelet counts and raised liver enzymes, including GLDH and gamma GT, which may indicate abnormal liver function. In addition, clinical trial experience to date with drisapersen in trials that GSK is conducting indicates adverse events that include proteinuria, local injection site reactions (pain, bruising, erythema, induration, pigmentation), thrombocytopenia (decrease in the amount of platelets in the blood) and increases in certain liver enzymes. In addition to the adverse events noted above, single reports have been received of the following clinical conditions: intracranial venous sinus thrombosis (blood clot), extramembranous glomerulonephritis (inflammation affecting part of the kidney) and nephrotic-linked proteinuria. Such side effects could be raised by the FDA, the EMA and other regulatory authorities and could be an impediment to receipt of marketing approval or physician or patient acceptance of drisapersen or our other product candidates because of concerns related to safety.

We depend on enrollment of patients in our clinical trials for our product candidates. If we are unable to enroll patients in our clinical trials, our research and development efforts and business, financial condition and results of operations could be materially adversely affected.

Successful and timely completion of clinical trials will require that we enroll a sufficient number of patient candidates. Trials may be subject to delays as a result of patient enrollment taking longer than anticipated or patient withdrawal. Patient enrollment depends on many factors, including the size of the patient population, eligibility criteria for the trial, the proximity of patients to clinical sites, the nature of the trial protocol, competing clinical trials and the availability of new drugs approved for the indication the clinical trial is investigating.

The successful completion of our clinical trials for our DMD product candidates is dependent upon our ability to enroll a sufficient number of patients in the sub-populations of DMD patients that our particular product candidates target. Our product candidates focus on the treatment of DMD, which is a rare disease with a small patient population. As our products target sub-populations of DMD patients and trial enrollment is limited to boys in a certain age range only, the number of patients eligible for our trials is even smaller. Further, there are only a limited number of specialist physicians and major clinical centers are concentrated in a few geographic regions. In addition, other companies are conducting clinical trials and have announced plans for future clinical trials that are seeking, or are likely to seek, to enroll patients with the same conditions that we are studying and patients are generally only able to enroll in one single trial at a time. The small population of patients, competition for these patients and the limited trial sites may make it difficult for us to enroll enough patients to complete our clinical trials in a timely and cost-effective manner.

17

Table of Contents

We may become exposed to costly and damaging liability claims, either when testing our product candidates in the clinic or at the commercial stage; and our product liability insurance may not cover all damages from such claims.

We are exposed to potential product liability and professional indemnity risks that are inherent in the research, development, manufacturing, marketing and use of pharmaceutical products. Currently we have no products that have been approved for commercial sale; however, the current and future use of product candidates by us and our corporate collaborators in clinical trials, and the sale of any approved products in the future, may expose us to liability claims. These claims might be made by patients that use the product, healthcare providers, pharmaceutical companies, our corporate collaborators or others selling such products. Any claims against us, regardless of their merit, could be difficult and costly to defend and could materially adversely affect the market for our product candidates or any prospects for commercialization of our product candidates.

Although the clinical trial process is designed to identify and assess potential side effects, it is always possible that a drug, even after regulatory approval, may exhibit unforeseen side effects. If any of our product candidates were to cause adverse side effects during clinical trials or after approval of the product candidate, we may be exposed to substantial liabilities. Physicians and patients may not comply with any warnings that identify known potential adverse effects and patients who should not use our product candidates.

Although we maintain limited product liability insurance for our product candidates, it is possible that our liabilities could exceed our insurance coverage. We intend to expand our insurance coverage to include the sale of commercial products if we obtain marketing approval for any of our product candidates. However, we may not be able to maintain insurance coverage at a reasonable cost or obtain insurance coverage that will be adequate to satisfy any liability that may arise. If a successful product liability claim or series of claims is brought against us for uninsured liabilities or in excess of insured liabilities, our assets may not be sufficient to cover such claims and our business operations could be impaired.

Should any of the events described above occur, this could have a material adverse effect on our business, financial condition and results of operations.

Even if our product candidates obtain regulatory approval, they will be subject to continual regulatory review.

If marketing authorization is obtained for any of our product candidates, the product will remain subject to continual review and therefore authorization could be subsequently withdrawn or restricted. We will be subject to ongoing obligations and oversight by regulatory authorities, including adverse event reporting requirements, marketing restrictions and, potentially, other post-marketing obligations, all of which may result in significant expense and limit our ability to commercialize such products.

If there are changes in the application of legislation or regulatory policies, or if problems are discovered with a product or our manufacture of a product, or if we or one of our distributors, licensees or co-marketers fails to comply with regulatory requirements, the regulators could take various actions. These include imposing fines on us, imposing restrictions on the product or its manufacture and requiring us to recall or remove the product from the market. The regulators could also suspend or withdraw our marketing authorizations, requiring us to conduct additional

18

Table of Contents

clinical trials, change our product labeling or submit additional applications for marketing authorization. If any of these events occurs, our ability to sell such product may be impaired, and we may incur substantial additional expense to comply with regulatory requirements, which could materially adversely affect our business, financial condition and results of operations.

Due to our limited resources and access to capital, we must and have in the past decided to prioritize development of certain product candidates; these decisions may prove to have been wrong and may adversely affect our revenues.

Because we have limited resources and access to capital to fund our operations, we must decide which product candidates to pursue and the amount of resources to allocate to each. Our decisions concerning the allocation of research, collaboration, management and financial resources toward particular compounds, product candidates or therapeutic areas may not lead to the development of viable commercial products and may divert resources away from better opportunities. Similarly, our decisions to delay, terminate or collaborate with third parties in respect of certain product development programs may also prove not to be optimal and could cause us to miss valuable opportunities. If we make incorrect determinations regarding the market potential of our product candidates or misread trends in the biopharmaceutical industry, in particular for DMD therapies, our business, financial condition and results of operations could be materially adversely affected.

Because we are subject to environmental, health and safety laws and regulations, we may become exposed to liability and substantial expenses in connection with environmental compliance or remediation activities which may adversely affect our business and financial condition.

Our operations, including our research, development, testing and manufacturing activities, are subject to numerous environmental, health and safety laws and regulations. These laws and regulations govern, among other things, the controlled use, handling, release and disposal of, and the maintenance of a registry for, hazardous materials and biological materials, such as chemical solvents, human cells, carcinogenic compounds, mutagenic compounds and compounds that have a toxic effect on reproduction, laboratory procedures and exposure to blood-borne pathogens. If we fail to comply with such laws and regulations, we could be subject to fines or other sanctions.

As with other companies engaged in activities similar to ours, we face a risk of environmental liability inherent in our current and historical activities, including liability relating to releases of or exposure to hazardous or biological materials. Environmental, health and safety laws and regulations are becoming more stringent. We may be required to incur substantial expenses in connection with future environmental compliance or remediation activities, in which case, our production and development efforts may be interrupted or delayed and our financial condition and results of operations may be materially adversely affected.

Our research and development activities could be affected or delayed as a result of possible restrictions on animal testing.

Certain laws and regulations require us to test our product candidates on animals before initiating clinical trials involving humans. Animal testing activities have been the subject of controversy and adverse publicity. Animal rights groups and other organizations and individuals

19

Table of Contents

have attempted to stop animal testing activities by pressing for legislation and regulation in these areas and by disrupting these activities through protests and other means. To the extent the activities of these groups are successful, our research and development activities may be interrupted, delayed or become more expensive.

Risks related to regulatory approval of our product candidates

Our ability to obtain marketing approval for the product candidates to which we have retained commercialization rights depends on GSK obtaining marketing approval for drisapersen and the success of our regulatory strategy for our candidates that target ultra-orphan sub-populations of DMD patients. If either is not successful, we may not obtain marketing approvals for our product candidates.

GSK controls the regulatory approval application process for drisapersen, including how it communicates with regulators and makes the case for marketing approval. If GSK is not successful in obtaining marketing approval for drisapersen, or does so in a way that is limiting with respect to our other DMD product candidates, our ability to obtain regulatory approval for such product candidates, and consequently our business and results of operations, could be adversely affected.

Our regulatory strategy for obtaining approval for the product candidates to which we have retained commercialization rights depends on the acceptance of our proposed extrapolation principle that if exon skipping works for one AON compound that is shown to be safe and effective, then the principle should to a certain extent also apply to subsequent compounds for rarer sub-populations. Because DMD is a rare disease and our product candidates after drisapersen target smaller sub-populations for which it is less feasible to conduct placebo-controlled studies, our ability to obtain marketing approval may be dependent on regulators’ acceptance of this extrapolation principle. If regulators do not accept this principle, we may be delayed in or prevented from obtaining marketing approval.

No exon-skipping therapies using AONs for systemic use have yet been approved or marketed in the European Union, and only one AON for systemic use has been approved in the United States.

Our exon-skipping therapy using AONs is intended to correct genetic defects that cause disease in humans, and our current product candidates target DMD. Our compounds have not yet been incorporated into a commercial product and are still in development. To date, no product using AONs for systemic use has been approved for sale in the European Union. In the United States currently only one AON is approved by the FDA for systemic use. Therefore, we are not certain that our technology will meet the applicable safety and efficacy standards of the regulatory authorities. In addition, any regulatory setbacks faced by third parties developing similar compounds could affect the receptiveness of regulators to our compounds.

Any failures or setbacks involving our therapy, including adverse effects resulting from the use of this therapy in humans, could have a detrimental impact on our internal product candidate pipeline and our ability to maintain and/or enter into new corporate collaborations regarding these technologies, which would materially adversely affect our business, financial position and results of operations.

20

Table of Contents

Enacted and future legislation may increase the difficulty and cost for us to obtain marketing approval of and commercialize our product candidates and may affect the prices we may set.

In the United States, the European Union and some other foreign jurisdictions, there have been a number of legislative and regulatory changes and proposed changes regarding the healthcare system. These changes could prevent or delay marketing approval of our product candidates, restrict or regulate post-approval activities and affect our ability to profitably sell any products for which we obtain marketing approval.

In the United States, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, or the Medicare Modernization Act, changed the way Medicare covers and pays for pharmaceutical products. The legislation expanded Medicare coverage for drug purchases by the elderly and introduced a new reimbursement methodology based on average sale prices for physician-administered drugs. In addition, this legislation provided authority for limiting the number of drugs that will be covered in any therapeutic class. Cost-reduction initiatives and other provisions of this legislation could decrease the coverage and price that we receive for any approved products. While the Medicare Modernization Act applies only to drug benefits for Medicare beneficiaries, private payors often follow Medicare coverage policy and payment limitations in setting their own reimbursement rates. Therefore, any reduction in reimbursement that results from the Medicare Modernization Act may result in a similar reduction in payments from private payors.

More recently, in March 2010, President Obama signed into law the Health Care Reform Law, a sweeping law intended to broaden access to health insurance, reduce or constrain the growth of healthcare spending, enhance remedies against fraud and abuse, add new transparency requirements for health care and health insurance industries, impose new taxes and fees on the health industry and impose additional health policy reforms. Effective October 1, 2010, the Health Care Reform Law revises the definition of “average manufacturer price” for reporting purposes, which could increase the amount of Medicaid drug rebates to states. Further, the new law imposes a significant annual fee on companies that manufacture or import branded prescription drug products. Substantial new provisions affecting compliance have also been enacted, which may affect our business practices with health care practitioners. We will not know the full effects of the Health Care Reform Law until applicable federal and state agencies issue regulations or guidance under the new law. Although it is too early to determine the effect of the Health Care Reform Law, the new law appears likely to continue the pressure on pharmaceutical pricing, especially under the Medicare program, and may also increase our regulatory burdens and operating costs.

Both in the US and in the EU, legislative and regulatory proposals have been made to expand post-approval requirements and restrict sales and promotional activities for pharmaceutical products. We are not sure whether additional legislative changes will be enacted, or whether the regulations, guidance or interpretations will be changed, or what the impact of such changes on the marketing approvals of our product candidates, if any, may be.

In the area of companion diagnostics, FDA officials indicated in 2010 that the agency planned to issue two guidances in this area. The FDA issued one draft guidance in July 2011, and the FDA plans to finalize this guidance in 2013. The FDA has yet to issue a second draft guidance and may decide not to issue a second draft guidance or finalize the existing draft guidance. The FDA’s issuance of a final guidance, or issuance of additional draft guidance, could affect our development of in vitro companion diagnostics and the applicable regulatory requirements. In

21

Table of Contents

addition, increased scrutiny by the U.S. Congress of the FDA’s approval process may significantly delay or prevent marketing approval, as well as subject us to more stringent product labeling and post-marketing testing and other requirements.

In the EU, Regulation (EC) 1901/2006, the so called Paediatric Regulation, came into force in January 2007 and introduced considerable changes into the regulatory environment for pediatric medicines. The effects of this regulation are still not fully known. Additionally, an official guideline is being developed which addresses the development of medicinal products for the treatment of Duchenne and Becker muscular dystrophy. This guideline is planned to be adopted during the development of our compounds and may have an effect on the regulatory process for gaining market access in the EU.

Our relationships with customers and payors will be subject to applicable anti-kickback, fraud and abuse and other healthcare laws and regulations, which could expose us to criminal sanctions, civil penalties, contractual damages, reputational harm and diminished profits and future earnings.