UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| (Mark One) | ||

| [ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| OR | ||

| [X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

for the fiscal year ended December 31, 2013

|

||

| OR | ||

| [ ] |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from ________________ to ________________

|

||

| OR | ||

| [ ] |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

Date of event requiring this shell company report

|

||

Commission file number: 001-35990

PROSENSA HOLDING N.V.

(Exact name of Registrant as specified in its charter)

The Netherlands

(Jurisdiction of incorporation)

J.H. Oortweg 21

2333 CH Leiden, the Netherlands,

+31 (0)71 33 22 100

(Address of principal executive offices)

Berndt Modig

Tel: +31 61 47 90 201

J.H. Oortweg 21

2333 CH Leiden, the Netherlands

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Copies to:

Richard D. Truesdell Jr.

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

Phone: (212) 450 4000

Fax: (212) 701 5800

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Ordinary Shares, nominal value €0.01 per share

|

The NASDAQ Stock Market LLC

|

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital stock or common stock as of the close of business covered by the annual report.

Common shares: 35,932,792

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [ x ] No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

[ ] Yes [ x ] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[ x ] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[ ] Yes [ x ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

Non-accelerated filer [x]

|

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

US GAAP [ ]

|

International Financial Reporting Standards as issued

by the International Accounting Standards Board [x]

|

Other [ ]

|

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 [ ] Item 18 [ ]

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [x]

PROSENSA HOLDING N.V.

TABLE OF CONTENTS

____________________

Page

|

FORWARD-LOOKING STATEMENTS

|

iii | |

|

PART I

|

4

|

|

|

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

4

|

|

|

A.

|

Directors and senior management

|

4

|

|

B.

|

Advisers

|

4

|

|

C.

|

Auditors

|

4

|

|

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

|

4

|

|

|

A.

|

Offer statistics

|

4

|

|

B.

|

Method and expected timetable

|

4

|

|

ITEM 3. KEY INFORMATION

|

5

|

|

|

A.

|

Selected Financial Data

|

5

|

|

B.

|

Capitalization and indebtedness

|

7

|

|

C.

|

Reasons for the offer and use of proceeds

|

7

|

|

D.

|

Risk factors

|

7

|

|

ITEM 4. INFORMATION ON THE COMPANY

|

33

|

|

|

A.

|

History and development of the company

|

33

|

|

B.

|

Business overview

|

34

|

|

C.

|

Organizational structure

|

62

|

|

D.

|

Property, plant and equipment

|

62

|

|

ITEM 4A. UNRESOLVED STAFF COMMENTS

|

62

|

|

|

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

|

62

|

|

|

A.

|

Operating results

|

62

|

|

B.

|

Liquidity and capital resources

|

76

|

|

C.

|

Research and development, patents and licenses, etc.

|

78

|

|

D.

|

Trend information

|

79

|

|

E.

|

Off-balance sheet arrangements

|

79

|

|

F.

|

Tabular disclosure of contractual obligations

|

79

|

|

G.

|

Safe harbor

|

79

|

|

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

|

79 | |

|

A.

|

Directors and senior management

|

79

|

|

B.

|

Compensation

|

82

|

|

C.

|

Board practices

|

86

|

|

D.

|

Employees

|

88

|

|

E.

|

Share ownership

|

88

|

|

ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS

|

89 | |

|

A.

|

Major shareholders

|

89

|

|

B.

|

Related party transactions

|

91

|

|

C.

|

Interests of Experts and Counsel

|

92

|

|

ITEM 8. FINANCIAL INFORMATION

|

93 | |

|

A.

|

Consolidated statements and other financial information

|

93

|

|

B.

|

Significant changes

|

93

|

|

ITEM 9. THE OFFER AND LISTING

|

93 | |

|

A.

|

Offering and listing details

|

93

|

|

B.

|

Plan of distribution

|

93

|

|

C.

|

Markets

|

93

|

|

D.

|

Selling shareholders

|

93

|

|

E.

|

Dilution

|

93

|

|

F.

|

Expenses of the issue

|

94

|

|

ITEM 10. ADDITIONAL INFORMATION

|

94 | |

|

A.

|

Share capital

|

94

|

|

B.

|

Memorandum and articles of association

|

94

|

i

|

C.

|

Material contracts

|

94

|

|

D.

|

Exchange controls

|

94

|

|

E.

|

Taxation

|

94

|

|

F.

|

Dividends and paying agents

|

101

|

|

G.

|

Statement by experts

|

101

|

|

H.

|

Documents on display

|

101

|

|

I.

|

Subsidiary information

|

101

|

|

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT RISK

|

101 | |

|

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES

|

102 | |

|

A.

|

Debt securities

|

102

|

|

B.

|

Warrants and rights

|

102

|

|

C.

|

Other securities

|

102

|

|

D.

|

American Depositary Shares

|

102

|

|

PART II

|

103 | |

|

ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES

|

103 | |

|

A.

|

Defaults

|

103

|

|

B.

|

Arrears and delinquencies

|

103

|

|

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS

|

103 | |

|

ITEM 15. CONTROLS AND PROCEDURES

|

103 | |

|

A.

|

Disclosure Controls and Procedures

|

103

|

|

B.

|

Management’s Annual Report on Internal Control over Financial Reporting

|

103

|

|

C.

|

Attestation Report of the Registered Public Accounting Firm

|

103

|

|

D.

|

Changes in Internal Control over Financial Reporting

|

103

|

|

ITEM 16. [RESERVED]

|

103 | |

|

ITEM 16A. Audit committee financial expert

|

103 | |

|

ITEM 16B. Code of ethics

|

103 | |

|

ITEM 16C. Principal Accountant Fees and Services

|

103 | |

|

ITEM 16D. Exemptions from the listing standards for audit committees

|

104 | |

|

ITEM 16E. Purchases of equity securities by the issuer and affiliated purchasers

|

104 | |

|

ITEM 16F. Change in registrant’s certifying accountant

|

104 | |

|

ITEM 16G. Corporate governance

|

104 | |

|

ITEM 16H. Mine safety disclosure

|

104 | |

|

PART III

|

105 | |

|

ITEM 17. Financial statements

|

105 | |

|

ITEM 18. Financial statements

|

105 | |

|

ITEM 19. Exhibits

|

105 | |

Unless otherwise indicated or the context otherwise requires, all references in this Annual Report on Form 20-F (the “Annual Report”) to “Prosensa Holding N.V.” or “Prosensa,” the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to Prosensa Holding N.V., together with its subsidiaries. The trademarks, trade names and service marks appearing in this Annual Report are the property of their respective owners.

____________________

ii

FORWARD-LOOKING STATEMENTS

This Annual Report contains statements that constitute forward-looking statements. Many of the forward-looking statements contained in this Annual Report can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “will,” “estimate” and “potential,” among others.

Forward-looking statements appear in a number of places in this Annual Report and include, but are not limited to, statements regarding our intent, belief or current expectations. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to various factors, including, but not limited to, those identified under the section “Item 3. Key Information—D. Risk factors” in this Annual Report.

Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events.

iii

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and senior management

Not applicable.

B. Advisers

Not applicable.

C. Auditors

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

A. Offer statistics

Not applicable.

B. Method and expected timetable

Not applicable.

4

ITEM 3. KEY INFORMATION

A. Selected Financial Data

The summary income statement data for the years ended December 31, 2011, 2012 and 2013 of Prosensa Holding N.V. are derived from the consolidated financial statements included in this Annual Report. We maintain our books and records in euros, and we prepare our financial statements under International Financial Reporting Standars (“IFRS”) as issued by the International Accounting Standards Board (“IASB”).

This financial information should be read in conjunction with “Item 5—Operating and Financial Review and Prospects” and our consolidated audited financial statements, including the notes thereto, included in this Annual Report.

|

For the years ended December 31,

|

|||||||||||

|

2011

|

2012

|

2013

|

|||||||||

| (€ in thousands) | |||||||||||

|

License revenue

|

6,510 | 5,726 | 5,626 | ||||||||

|

Collaboration revenue

|

2,179 | 2,127 | 3,312 | ||||||||

|

Total revenue

|

8,689 | 7,853 | 8,938 | ||||||||

|

Other income

|

36 | 174 | 560 | ||||||||

|

Research and development expense

|

(15,348 | ) | (14,393 | ) | (18,460 | ) | |||||

|

General and administrative expense

|

(5,203 | ) | (4,023 | ) | (7,734 | ) | |||||

|

Other gains/(losses) - net

|

22 | 49 | 112 | ||||||||

|

Operating (loss)/gain

|

(11,804 | ) | (10,340 | ) | (16,584 | ) | |||||

|

Finance income

|

434 | 796 | 645 | ||||||||

|

Finance costs

|

(209 | ) | (348 | ) | (665 | ) | |||||

|

Finance income – net

|

225 | 448 | (20 | ) | |||||||

|

Net Loss

|

(11,579 | ) | (9,892 | ) | (16,604 | ) | |||||

|

Other comprehensive income

|

– | – | – | ||||||||

|

Total comprehensive loss(1)

|

(11,579 | ) | (9,892 | ) | (16,604 | ) | |||||

|

Loss per share from operations attributable to the equity holders of the company during the year (in EUR per share)

|

|||||||||||

|

Basic and diluted loss per share (2)

|

(0.60 | ) | (0.37 | ) | (0.51 | ) | |||||

(1) Total comprehensive loss is fully attributable to equity holders of the Company

(2) Share count at December 31, 2011, 2012 and 2013 was 19,463,777, 29,002,298 and 35,932,792, respectively. Basic and diluted figures are the same because of loss position.

5

|

|

Exchange Rate Information

|

Our business is primarily conducted in the European Union, and we maintain our books and records in euros. We have presented results of operations in euros. In this Annual Report, translations from euros to U.S. dollars were made at the rate of €0.725 to $1.00, the official exchange rate quoted as of December 31, 2013 by the European Central Bank. Such U.S. dollar amounts are not necessarily indicative of the amounts of U.S. dollars that could actually have been purchased upon exchange of euros at the dates indicated. All amounts paid to us under the agreement with GlaxoSmithKline (GSK) are paid in British pounds. Translation of British pounds to euros in this annual report were made at the rate in effect at the time of the relevant payment.

The following table presents information on the exchange rates between the euro and the U.S. dollar for the periods indicated:

|

Period-end

|

Average for

period

|

Low

|

High

|

|||||||||||||

|

(€ per U.S. dollar)

|

||||||||||||||||

|

Year Ended December 31:

|

||||||||||||||||

|

2009

|

0.694 | 0.717 | 0.661 | 0.796 | ||||||||||||

|

2010

|

0.748 | 0.754 | 0.687 | 0.837 | ||||||||||||

|

2011

|

0.773 | 0.718 | 0.672 | 0.776 | ||||||||||||

|

2012

|

0.758 | 0.778 | 0.743 | 0.827 | ||||||||||||

|

2013

|

0.725 | 0.753 | 0.724 | 0.783 | ||||||||||||

|

Month Ended:

|

||||||||||||||||

|

January 31, 2013

|

0.738 | 0.753 | 0.738 | 0.769 | ||||||||||||

|

February 28, 2013

|

0.762 | 0.749 | 0.738 | 0.765 | ||||||||||||

|

March 31, 2013

|

0.781 | 0.771 | 0.764 | 0.783 | ||||||||||||

|

April 30, 2013

|

0.765 | 0.768 | 0.762 | 0.780 | ||||||||||||

|

May 31, 2013

|

0.769 | 0.770 | 0.761 | 0.778 | ||||||||||||

|

June 30, 2013

|

0.765 | 0.758 | 0.746 | 0.768 | ||||||||||||

|

July 31, 2013

|

0.753 | 0.765 | 0.753 | 0.780 | ||||||||||||

|

August 31, 2013

|

0.756 | 0.751 | 0.747 | 0.757 | ||||||||||||

|

September 30, 2013

|

0.740 | 0.749 | 0.738 | 0.762 | ||||||||||||

|

October 31, 2013

|

0.733 | 0.733 | 0.724 | 0.741 | ||||||||||||

|

November 30, 2013

|

0.735 | 0.741 | 0.735 | 0.748 | ||||||||||||

|

December 31, 2013

|

0.725 | 0.730 | 0.724 | 0.739 | ||||||||||||

6

B. Capitalization and indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk factors

Our business, financial condition or results of operations could be materially and adversely affected if any of these risks occurs, and as a result, the market price of our ordinary shares could decline. This Annual Report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors.

Risks related to our business and industry

We depend heavily on the success of drisapersen. Drisapersen and all of our other product candidates are still in preclinical and clinical development and clinical trials of our product candidates may not be successful. If we are unable to commercialize drisapersen and our other product candidates, or experience significant delays in doing so, our business, financial condition and results of operations will be materially adversely affected.

We have invested a significant portion of our efforts and financial resources in the development of drisapersen and our other product candidates targeting patients with Duchenne muscular dystrophy, or DMD. All of our product candidates are still in preclinical and clinical development. Our ability to generate royalty and product revenues, which we do not expect will occur for at least the next several years, if ever, will depend heavily on the successful development and eventual commercialization of these product candidates, particularly drisapersen.

In connection with obtaining marketing approval from regulatory authorities for the sale of any product candidate, we must complete preclinical development and conduct extensive clinical trials to demonstrate the safety and efficacy of our product candidates in humans. Clinical testing is expensive, difficult to design and implement, can take many years to complete and is uncertain as to outcome. A failure of one or more clinical trials can occur at any stage of testing. The outcome of preclinical testing and early clinical trials may not be predictive of the success of later clinical trials, and interim results of a clinical trial do not necessarily predict final results. In September 2013, we announced that the Phase III clinical trial of drisapersen did not meet its primary endpoint. Although we believe that the collective data from our various Phase II and Phase III clinical trials of drisapersen, including retrospective and subgroup analyses, provide strong support for concluding that drisapersen showed clinically meaningful improvements over placebo in these trials, we cannot be sure that our data will be sufficient to satisfy the European Medicines Agency, or EMA, or the U.S. Food and Drug Administration, or FDA. We may need to conduct additional clinical trials at significant delay and cost or abandon development of drisapersen altogether.

Even if we receive regulatory approval for and are able to commercialize drisapersen and our other product candidates, our success will be subject to the following risks:

|

·

|

we may not achieve market acceptance of drisapersen by physicians, patients and third-party payors;

|

|

·

|

drisapersen and our other product candidates may not have an acceptable safety profile following approval;

|

|

·

|

we may not be able to manufacture drisapersen in compliance with requirements of the EMA, the FDA and similar regulatory agencies in commercial quantities sufficient to meet market demand;

|

|

·

|

we may not achieve sufficient pricing for drisapersen to compensate for development, post-licensing and commercialization costs;

|

|

·

|

we may not compete successfully with any alternative therapies for DMD; and

|

|

·

|

we may not successfully enforce and defend our intellectual property rights and claims.

|

The occurrence of any of these events could materially adversely affect our business, financial condition and results of operations.

7

Our conclusions regarding the efficacy of drisapersen are based on retrospective analyses of the results of our clinical trials, these analyses may be considered less reliable indicators of efficacy than pre-specified analyses.

After determining that we did not achieve the primary efficacy endpoint in the completed Phase III clinical trial of drisapersen, we performed retrospective and subgroup analyses of the Phase III clinical trial and prior Phase II clinical trials of drisapersen that we believe provide strong support for concluding that drisapersen showed clinically meaningful improvements over placebo in these trials. Although we believe that these additional analyses were warranted, a retrospective analysis performed after unblinding trial results can result in the introduction of bias if the analysis is inappropriately tailored or influenced by knowledge of the data and actual results. Because of these limitations, regulatory authorities typically give greatest weight to results from pre-specified analyses and less weight to results from post-hoc, retrospective analyses. Thus, this increases the likelihood that we will have to conduct an additional clinical trial or trials of drisapersen before we can apply for marketing approval.

Because we are developing product candidates for the treatment of diseases in which there is little clinical experience and, in some cases, using new endpoints or methodologies, there is more risk that the outcome of our clinical trials will not be favorable.

There is currently no approved disease-modifying therapy for DMD. In addition, there has been limited historical clinical trial experience generally for the development of drugs to treat the underlying cause of DMD. As a result, the design and conduct of clinical trials for this disease, particularly for drugs to address the underlying cause of this disease, is subject to increased risk. In particular, regulatory authorities in the United States and European Union have not issued definitive guidance as to how to measure and achieve efficacy.

In the last several years, the six minute walk test, or 6MWT, has been used in several trials of product candidates for patients with DMD, and is accepted by U.S. and European regulators to be an appropriate primary outcome measure for DMD trials. Because of the limited clinical experience in this indication however, regulators have not yet established what difference in the distance walked in the 6MWT, or 6MWD, is required to be demonstrated in a clinical trial of a DMD therapy in order to signify a clinically meaningful result and/or obtain regulatory approvals. As a result, it is not clear what is required in terms of 6MWD or other end points to obtain regulatory approval for drisapersen and our other product candidates. If we are required to conduct additional clinical trials of drisapersen, the design of such trials could be subject to such uncertainties.

We could also face similar challenges in designing clinical trials and obtaining regulatory approval for future product candidates, including any that we may develop for myotonic dystrophy (DM1) or Huntington’s disease (HD) because there is also limited historical clinical trial experience for the development of drugs to treat these diseases.

The termination of our collaboration with GSK requires that we quickly expand our development, regulatory and potentially sales and marketing capabilities and take over sponsorship of clinical trials, and as a result, we may encounter difficulties in managing our growth, which could disrupt our operations.

In January 2014, we and GSK mutually terminated our collaboration for the development of drisapersen and our other DMD product candidates. Under the termination agreement, GSK will transfer to us data and other intellectual property, inventory, regulatory filings and clinical trial sponsorships, clinical trial reports, material agreements and biological materials as soon as practicable and within 120 days of the effective date of the agreement. We will have to quickly and greatly expand our capabilities to achieve a smooth transition of the development of drisapersen from GSK to us, and we may be unable to do so effectively or at all. In the future we will be entirely responsible for managing our clinical trials. We may not have the resources or expertise to support the clinical trials needed to develop our product candidates, and we may not be able obtain those resources and expertise efficiently or at all. We may also be the subject to litigation in connection with our clinical sponsorship. Although GSK has agreed to indemnify us in certain circumstances, we may not be able to recoup any such expenses in a timely matter, or at all.

We will also be fully responsible for obtaining regulatory approvals for drisapersen and our other product candidates. We have never successfully obtained regulatory approvals for a product candidate and we may not have the expertise to do so. If drisapersen or another product candidate receives marketing approval, we will be solely responsible for commercializing it. We have never commercialized a product and may not be successful in doing so. We may enter into future collaborations with respect to these operations, and any future collaboration would be subject to numerous execution risks.

8

We expect to experience significant growth in the number of our employees and the scope of our operations, particularly in the areas of drug development, regulatory affairs and sales and marketing. To manage our anticipated future growth, we must continue to implement and improve our managerial, operational and financial systems, expand our facilities and continue to recruit and train additional qualified personnel. Due to our limited financial resources and the limited experience of our management team in managing a company with such anticipated growth, we may not be able to effectively manage the expansion of our operations or recruit and train additional qualified personnel. The expansion of our operations may lead to significant costs and may divert our management and business development resources. Any inability to manage growth could delay the execution of our business plans or disrupt our operations.

We have a history of operating losses, and we may not achieve or sustain profitability. We anticipate that we will continue to incur losses for the foreseeable future. If we fail to obtain additional funding to conduct our planned research and development effort, we could be forced to delay, reduce or eliminate our product development programs or commercial development efforts.

We incurred net losses of €16.6 million for the year ended December 31, 2013 (2012: €9.9 million, 2011: €11.6 million). Our losses have resulted principally from expenses incurred in research and development of our product candidates and from general and administrative expenses that we have incurred while building our business infrastructure. We expect to continue to incur significant operating losses in the future as we continue our research and development efforts and seek to obtain regulatory approval and commercialization of our product candidates. We are currently conducting a full evaluation of the benefit-to-risk profile of drisapersen; and until we conclude our analysis, we will not be able to estimate our near-to-medium term research and development budget.

To date, we have financed our operations through offerings of equity securities, upfront, milestone and expense reimbursement payments received from GSK under our collaboration and funding from patient organizations, governmental bodies and bank loans. Funding from GSK under our collaboration agreement comprised a significant portion of our revenue, and we will not receive any such additional funds now that the collaboration has terminated. To date we have not generated any revenues from product sales. Based on our current plans, we do not expect to generate significant product revenues unless we obtain marketing approval for, and commercialize, drisapersen or any of our other product candidates. We believe that our existing cash and cash equivalents will enable us to fund our operating expenses and capital expenditure requirements for at least the next 12 months. We have based this estimate on assumptions that may prove to be wrong, and we could use our capital resources sooner than we currently expect.

We will need to seek additional funding. Additional funds may not be available on a timely basis, on favorable terms, or at all, and such funds, if raised, may not be sufficient to enable us to continue to implement our long-term business strategy.

Even if we do generate product revenues, we may never achieve or sustain profitability on a quarterly or annual basis. Our failure to sustain profitability would depress the market price of our ordinary shares and could impair our ability to raise capital, expand our business, diversify our product offerings or continue our operations. A decline in the market price of our ordinary shares also could cause you to lose all or a part of your investment.

We will need substantial additional funding. If we are unable to raise capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

Until recently we collaborated with GSK on the development of the products in our DMD portfolio, and the funding we received from GSK covered a substantial portion of our development costs. Now that the GSK collaboration has been terminated, we will be responsible for all of the research and development costs for our product candidates going forward. In addition, the Phase III trial of drisapersen that was completed in September 2013 did not meet its primary endpoint; and consequently regulators may require that we conduct additional trials of drisapersen in order to apply for regulatory approvals. Such trials would be costly. As a result, we expect our research and development expenses to increase significantly. We are currently conducting a full evaluation of the benefit-to-risk profile of drisapersen; and until we conclude our analysis, we will not be able to estimate our near-to-medium term research and development budget. If we obtain regulatory approval for drisapersen or any of our other product candidates, we expect to incur significant commercialization expenses related to product sales, marketing, distribution and manufacturing. Accordingly, we will need to obtain substantial additional funding in connection with our continuing operations. If we are unable to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our product development programs or commercialization efforts.

9

Raising additional capital may cause dilution to our shareholders, restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our cash needs through a combination of equity offerings, debt financings, collaborations, grants and clinical trial support from governmental and philanthropic organizations and patient advocacy groups, or marketing, distribution or licensing arrangements with third parties. In the event we need to seek additional funds through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect your rights as a holder of our ordinary shares. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends.

If we raise additional funds through collaborations, strategic alliances or marketing, distribution or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams or product candidates or to grant licenses on terms that may not be favorable to us. If we are unable to raise additional funds when needed, we may be required to delay, limit, reduce or terminate our product development or future commercialization efforts or grant rights to develop and market product candidates that we would otherwise prefer to develop and market ourselves.

Exchange rate fluctuations or abandonment of the euro currency may materially affect our results of operations and financial condition.

Due to the international scope of our operations, fluctuations in exchange rates, particularly between the euro, and the U.S. dollar, may adversely affect us. Although we are based in the Netherlands, we source research and development, manufacturing, consulting and other services from several countries. Further, potential future revenue may be derived from abroad, particularly from the United States. As a result, our business and share price may be affected by fluctuations in foreign exchange rates between the euro and these other currencies, which may also have a significant impact on our reported results of operations and cash flows from period to period. Currently, we do not have any exchange rate hedging arrangements in place.

In addition, the possible abandonment of the euro by one or more members of the European Union could materially affect our business in the future. Despite measures taken by the European Union to provide funding to certain E.U. member states in financial difficulties and by a number of European countries to stabilize their economies and reduce their debt burdens, it is possible that the euro could be abandoned in the future as a currency by countries that have adopted its use. This could lead to the re-introduction of individual currencies in one or more E.U. member states, or in more extreme circumstances, the dissolution of the European Union. The effects on our business of a potential dissolution of the European Union, the exit of one or more E.U. member states from the European Union or the abandonment of the euro as a currency, are impossible to predict with certainty, and any such events could have a material adverse effect on our business, financial condition and results of operations.

Risks related to the development and clinical testing of our product candidates

Clinical drug development involves a lengthy and expensive process with uncertain timelines and uncertain outcomes. If clinical trials of our product candidates are prolonged or delayed or unsuccessful, we may be unable to obtain required regulatory approvals, and therefore be unable to commercialize our product candidates on a timely basis or at all.

To obtain the requisite regulatory approvals to market and sell any of our product candidates, we must demonstrate through extensive preclinical and clinical trials that our products are safe and effective in humans. The process for obtaining governmental approval to market our products is rigorous, time-consuming and costly. It is impossible to predict the extent to which this process may be affected by legislative and regulatory developments. Due to these and other factors, such as the fact that no product using antisense oligonucleotides, or AONs, for systemic use has been approved for sale in the European Union and only one AON is approved for systemic use in the United States, our current product candidates or any of our other future product candidates could take a significantly longer time to gain regulatory approval than expected or may never gain regulatory approval. This could delay or eliminate any potential product revenue by delaying or terminating the potential commercialization of our product candidates.

Clinical trials must be conducted in accordance with EMA, FDA and other applicable regulatory authorities’ legal requirements, regulations or guidelines, and are subject to oversight by these governmental agencies and Institutional Review Boards, or IRBs, at the medical institutions where the clinical trials are conducted. In addition, clinical trials must be conducted with supplies of our product candidates produced under

10

current good manufacturing practices, or cGMP, and other requirements. We depend on medical institutions and clinical research organizations, or CROs , to conduct our clinical trials in compliance with Good Clinical Practice, or GCP. To the extent the CROs fail to enroll participants for our clinical trials, fail to conduct the studies to GCP standards or are delayed for a significant time in the execution of trials, including achieving full enrollment, we may be affected by increased costs, program delays or both, which may harm our business. In addition, clinical trials are conducted in countries outside the European Union and the United States, which may subject us to further delays and expenses as a result of increased shipment costs, additional regulatory requirements and the engagement of non-E.U. and non-U.S. CROs, as well as expose us to risks associated with clinical investigators who are unknown to the EMA or the FDA, and different standards of diagnosis, screening and medical care.

Our lead compound drisapersen completed a Phase III clinical trial in September 2013 but failed to meet its primary endpoint. The trials of our other compounds are less advanced or have not yet started. The commencement and completion of clinical trials for our products may be delayed, suspended or terminated as a result of many factors, including but not limited to:

|

·

|

negative or inconclusive results, such as the Phase III clinical trial of drisapersen, which may require us to conduct additional preclinical or clinical trials or to abandon projects that we expect to be promising;

|

|

·

|

safety or tolerability concerns could cause us to suspend or terminate a trial if we find that the participants are being exposed to unacceptable health risks;

|

|

·

|

the delay or refusal of regulators or IRBs to authorize us to commence a clinical trial at a prospective trial site and changes in regulatory requirements, policies and guidelines;

|

|

·

|

regulators or IRBs requiring that we or our investigators suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements;

|

|

·

|

delays or failure to reach agreement on acceptable clinical trial contracts or clinical trial protocols with prospective trial sites;

|

|

·

|

delays in patient enrollment and variability in the number and types of patients available for clinical trials;

|

|

·

|

the inability to enroll a sufficient number of patients in trials to ensure adequate statistical power to detect statistically significant treatment effects;

|

|

·

|

lower than anticipated retention rates of patients and volunteers in clinical trials;

|

|

·

|

our third-party research contractors failing to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all;

|

|

·

|

difficulty in maintaining contact with patients after treatment, resulting in incomplete data;

|

|

·

|

delays in establishing the appropriate dosage levels;

|

|

·

|

the difficulty in certain countries in identifying the sub-populations that we are trying to treat in a particular trial, which may delay enrollment and reduce the power of a clinical trial to detect statistically significant results;

|

|

·

|

the quality or stability of the product candidate falling below acceptable standards;

|

|

·

|

the inability to produce or obtain sufficient quantities of the product candidate to complete clinical trials; and

|

|

·

|

exceeding budgeted costs due to difficulty in predicting accurately costs associated with clinical trials.

|

Since we have adopted a platform technology approach and all of our current clinical development candidates use similar process technology and are similarly applied to DMD, any of the above unforeseen difficulties that arise with one of our clinical development candidates may negatively affect all of our product candidates.

11

The EMA, the FDA and other regulatory authorities have substantial discretion in the approval process, and determining when or whether regulatory approval will be obtained for any of our product candidates. Even if we believe the data collected from clinical trials of our product candidates are promising, such data may not be sufficient to support approval by the EMA, the FDA or any other regulatory authority. In general, the FDA has usually suggested two adequately designed and powered and well-controlled trials to demonstrate effectiveness, and the FDA may require additional clinical trials, possibly using a different design, before it will consider granting approval to drisapersen.

Any delay in commencing or completing clinical trials for our products could increase our product development costs and delay marketing approval and commercialization of our products. For instance, in 2009 we held a pre-IND meeting with the FDA to discuss PRO044 clinical studies, and the FDA determined that we had insufficient data at that time to support the initiation of a clinical trial of PRO044 in the United States. PRO044 continues to be on clinical hold in the United States pending the results of long-term preclinical safety studies which are expected to be completed in the first half of 2014. In addition, in 2010, the FDA determined that inadequate data had been presented to support long-term studies of drisapersen and requested additional safety data. Upon submission of additional data, the FDA lifted the clinical hold on drisapersen in 2011.

It is also possible that none of our products will complete clinical trials in any of the markets in which we intend to sell those products. If this were to happen, we would not receive the regulatory approvals needed and we would not be able to market our products. Significant clinical trial delays could also allow our competitors to bring products to market before we do or shorten any periods during which we have the exclusive right to commercialize our product candidates and impair our ability to commercialize our product candidates and may harm our business and results of operations.

Failure to obtain marketing authorization for our product candidates will result in our being unable to market and sell such products, which would materially adversely affect our business, financial conditional and results of operation. Approval by one regulatory authority does not ensure approval by regulatory authorities in other jurisdictions. If we fail to obtain approval in any jurisdiction, the geographic market for our product candidates could be limited. Similarly, regulatory agencies may not approve the labeling claims that are necessary or desirable for the successful commercialization of our product candidates.

If serious adverse, undesirable or unacceptable side effects are identified during the development of our product candidates, we may need to abandon our development of such product candidates; and will not have a complete picture of the benefit-to-risk profile of drisapersen until GSK completes the transfer to us of drisapersen safety data.

If our product candidates are associated with serious adverse, undesirable or unacceptable side effects, we may need to abandon their development or limit development to certain uses or sub-populations in which such side effects are less prevalent, less severe or more acceptable from a risk-benefit perspective. Many compounds that initially showed promise in early-stage or clinical testing have later been found to cause side effects that prevented further development of the compound.

Transient proteinuria (protein in the urine) was observed in all twelve patients in our Phase I/II study of drisapersen, and eleven patients demonstrated signs of proteinuria at week twelve of the extension phase of this trial. Other reported adverse events from this study included injection site reactions, which were seen to varying degrees of severity in all subjects, raised cystatin C (a protein indicative of kidney function), decreased C3 (a protein indicating immunological activity), low platelet counts and raised liver enzymes, including GLDH and gamma GT, which may indicate abnormal liver function. In addition, clinical trial experience to date with drisapersen indicates adverse events that include proteinuria, local injection site reactions (pain, bruising, erythema, induration, pigmentation), thrombocytopenia (decrease in the amount of platelets in the blood) and increases in certain liver enzymes. In addition to the adverse events noted above, single reports have been received of the following clinical conditions: intracranial venous sinus thrombosis (blood clot), extramembranous glomerulonephritis (inflammation affecting part of the kidney) and nephrotic-linked proteinuria. Such side effects could be raised by the FDA, the EMA and other regulatory authorities and could be an impediment to receipt of marketing approval or physician or patient acceptance of drisapersen or our other product candidates because of concerns related to safety.

In January 2014, we and GSK mutually terminated our collaboration for the development of drisapersen and our other DMD product candidates. Under the termination agreement, GSK agreed to transfer to us, inter alia, data and clinical trial reports as soon as practicable and within 120 days of the effective date of the agreement. As of the date of this Annual Report, the transition is still in process. In particular, GSK has not yet transferred to us certain data and safety data for various clinical trials conducted by GSK for which dosing has

12

been suspended but safety data is still being collected. Therefore, as of the date of this Annual Report we may not have complete information regarding the safety profile of drisapersen. Information we receive from GSK in the future may affect our evaluation of the benefit-to-risk profile of drisapersen and our future development plans for it.

We depend on enrollment of patients in our clinical trials for our product candidates. If we are unable to enroll patients in our clinical trials, our research and development efforts and business, financial condition and results of operations could be materially adversely affected.

Successful and timely completion of clinical trials will require that we enroll a sufficient number of patient candidates. Trials may be subject to delays as a result of patient enrollment taking longer than anticipated or patient withdrawal. Patient enrollment depends on many factors, including the size of the patient population, eligibility criteria for the trial, the proximity of patients to clinical sites, the nature of the trial protocol, competing clinical trials and the availability of new drugs approved for the indication the clinical trial is investigating.

The successful completion of our clinical trials for our DMD product candidates is dependent upon our ability to enroll a sufficient number of patients in the sub-populations of DMD patients that our particular product candidates target. Our product candidates focus on the treatment of DMD, which is a rare disease with a small patient population. As our products target sub-populations of DMD patients and trial enrollment is limited to boys in a certain age range only, the number of patients eligible for our trials is even smaller. Further, there are only a limited number of specialist physicians and major clinical centers are concentrated in a few geographic regions. In addition, other companies are conducting clinical trials and have announced plans for future clinical trials that are seeking, or are likely to seek, to enroll patients with the same conditions that we are studying and patients are generally only able to enroll in one single trial at a time. The small population of patients, competition for these patients. Limited trial sites and past clinical trial results may make it difficult for us to enroll enough patients to complete our clinical trials in a timely and cost-effective manner.

We may become exposed to costly and damaging liability claims, either when testing our product candidates in the clinic or at the commercial stage; and our product liability insurance may not cover all damages from such claims.

We are exposed to potential product liability and professional indemnity risks that are inherent in the research, development, manufacturing, marketing and use of pharmaceutical products. Currently we have no products that have been approved for commercial sale; however, the current and future use of product candidates by us in clinical trials, and the sale of any approved products in the future, may expose us to liability claims. These claims might be made by patients that use the product, healthcare providers, pharmaceutical companies, our collaborators or others selling such products. Any claims against us, regardless of their merit, could be difficult and costly to defend and could materially adversely affect the market for our product candidates or any prospects for commercialization of our product candidates.

Although the clinical trial process is designed to identify and assess potential side effects, it is always possible that a drug, even after regulatory approval, may exhibit unforeseen side effects. If any of our product candidates were to cause adverse side effects during clinical trials or after approval of the product candidate, we may be exposed to substantial liabilities. Physicians and patients may not comply with any warnings that identify known potential adverse effects and patients who should not use our product candidates.

Although we maintain limited product liability insurance for our product candidates, it is possible that our liabilities could exceed our insurance coverage. We intend to expand our insurance coverage to include the sale of commercial products if we obtain marketing approval for any of our product candidates. However, we may not be able to maintain insurance coverage at a reasonable cost or obtain insurance coverage that will be adequate to satisfy any liability that may arise. If a successful product liability claim or series of claims is brought against us for uninsured liabilities or in excess of insured liabilities, our assets may not be sufficient to cover such claims and our business operations could be impaired.

Should any of the events described above occur, this could have a material adverse effect on our business, financial condition and results of operations.

Even if our product candidates obtain regulatory approval, they will be subject to continual regulatory review.

If marketing authorization is obtained for any of our product candidates, the product will remain subject to continual review and therefore authorization could be subsequently withdrawn or restricted. We will be subject to ongoing obligations and oversight by regulatory authorities, including adverse event reporting requirements, marketing restrictions and, potentially, other post-marketing obligations, all of which may result in significant expense and limit our ability to commercialize such products.

13

If there are changes in the application of legislation or regulatory policies, or if problems are discovered with a product or our manufacture of a product, or if we or one of our distributors, licensees or co-marketers fails to comply with regulatory requirements, the regulators could take various actions. These include imposing fines on us, imposing restrictions on the product or its manufacture and requiring us to recall or remove the product from the market. The regulators could also suspend or withdraw our marketing authorizations, requiring us to conduct additional clinical trials, change our product labeling or submit additional applications for marketing authorization. If any of these events occurs, our ability to sell such product may be impaired, and we may incur substantial additional expense to comply with regulatory requirements, which could materially adversely affect our business, financial condition and results of operations.

Due to our limited resources and access to capital, we must and have in the past decided to prioritize development of certain product candidates; these decisions may prove to have been wrong and may adversely affect our revenues.

Because we have limited resources and access to capital to fund our operations, we must decide which product candidates to pursue and the amount of resources to allocate to each. Our decisions concerning the allocation of research, collaboration, management and financial resources toward particular compounds, product candidates or therapeutic areas may not lead to the development of viable commercial products and may divert resources away from better opportunities. Similarly, our decisions to delay, terminate or collaborate with third parties in respect of certain product development programs may also prove not to be optimal and could cause us to miss valuable opportunities. If we make incorrect determinations regarding the market potential of our product candidates or misread trends in the biopharmaceutical industry, in particular for DMD therapies, our business, financial condition and results of operations could be materially adversely affected.

Because we are subject to environmental, health and safety laws and regulations, we may become exposed to liability and substantial expenses in connection with environmental compliance or remediation activities which may adversely affect our business and financial condition.

Our operations, including our research, development, testing and manufacturing activities, are subject to numerous environmental, health and safety laws and regulations. These laws and regulations govern, among other things, the controlled use, handling, release and disposal of, and the maintenance of a registry for, hazardous materials and biological materials, such as chemical solvents, human cells, carcinogenic compounds, mutagenic compounds and compounds that have a toxic effect on reproduction, laboratory procedures and exposure to blood-borne pathogens. If we fail to comply with such laws and regulations, we could be subject to fines or other sanctions.

As with other companies engaged in activities similar to ours, we face a risk of environmental liability inherent in our current and historical activities, including liability relating to releases of or exposure to hazardous or biological materials. Environmental, health and safety laws and regulations are becoming more stringent. We may be required to incur substantial expenses in connection with future environmental compliance or remediation activities, in which case, our production and development efforts may be interrupted or delayed and our financial condition and results of operations may be materially adversely affected.

Our research and development activities could be affected or delayed as a result of possible restrictions on animal testing.

Certain laws and regulations require us to test our product candidates on animals before initiating clinical trials involving humans. Animal testing activities have been the subject of controversy and adverse publicity. Animal rights groups and other organizations and individuals have attempted to stop animal testing activities by pressing for legislation and regulation in these areas and by disrupting these activities through protests and other means. To the extent the activities of these groups are successful, our research and development activities may be interrupted, delayed or become more expensive.

14

Risks related to regulatory approval of our product candidates

Our ability to obtain marketing approval for the product candidates for which we have retained commercialization rights depends on obtaining marketing approval for drisapersen and the success of our regulatory strategy for our candidates that target ultra-orphan sub-populations of DMD patients. If either is not successful, we may not obtain marketing approvals for our product candidates.

If we are not successful in obtaining marketing approval for drisapersen, or we do so in a way that is limiting with respect to our other DMD product candidates, our ability to obtain regulatory approval for such product candidates, and consequently our business and results of operations, could be adversely affected.

Our regulatory strategy for obtaining approval for the product candidates to which we have retained commercialization rights depends on the acceptance of our proposed extrapolation principle that if exon skipping works for one AON compound that is shown to be safe and effective, then the principle should to a certain extent also apply to subsequent compounds for rarer sub-populations. Because DMD is a rare disease and our product candidates after drisapersen target smaller sub-populations for which it is less feasible to conduct placebo-controlled studies, our ability to obtain marketing approval may be dependent on regulators’ acceptance of this extrapolation principle. If regulators do not accept this principle, we may be delayed in or prevented from obtaining marketing approval.

No exon-skipping therapies using AONs for systemic use have yet been approved or marketed in the European Union, and only one AON for systemic use has been approved in the United States.

Our exon-skipping therapy using AONs is intended to correct genetic defects that cause disease in humans, and our current product candidates target DMD. Our compounds have not yet been incorporated into a commercial product and are still in development. To date, no product using AONs for systemic use has been approved for sale in the European Union. In the United States currently only one AON is approved by the FDA for systemic use. Therefore, we are not certain that our technology will meet the applicable safety and efficacy standards of the regulatory authorities. In addition, any regulatory setbacks faced by third parties developing similar compounds could affect the receptiveness of regulators to our compounds.

Any failures or setbacks involving our therapy, including adverse effects resulting from the use of this therapy in humans, could have a detrimental impact on our internal product candidate pipeline and our ability to maintain and/or enter into new corporate collaborations regarding these technologies, which would materially adversely affect our business, financial position and results of operations.

The breakthrough therapy designation for drisapersen may not actually lead to a faster development or regulatory review or approval process.

In June 2013, drisapersen was granted breakthrough therapy designation by the FDA. The breakthrough therapy designation is a program designed to expedite the development and review of drugs for serious or life-threatening conditions. However, we may not experience a faster development or review process compared to conventional FDA procedures. In addition, there is no guarantee of approval, and the FDA may withdraw our breakthrough therapy designation if the FDA believes that the designation is no longer supported by clinical data.

Enacted and future legislation may increase the difficulty and cost for us to obtain marketing approval of and commercialize our product candidates and may affect the prices we may set.

In the United States, the European Union and some other foreign jurisdictions, there have been a number of legislative and regulatory changes and proposed changes regarding the healthcare system. These changes could prevent or delay marketing approval of our product candidates, restrict or regulate post-approval activities and affect our ability to profitably sell any products for which we obtain marketing approval.

In the United States, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, or the Medicare Modernization Act, changed the way Medicare covers and pays for pharmaceutical products. The legislation expanded Medicare coverage for drug purchases by the elderly and introduced a new reimbursement methodology based on average sale prices for physician-administered drugs. In addition, this legislation provided authority for limiting the number of drugs that will be covered in any therapeutic class. Cost-reduction initiatives and other provisions of this legislation could decrease the coverage and price that we receive for any approved products. While the Medicare Modernization Act applies only to drug benefits for Medicare beneficiaries, private payors often follow Medicare coverage policy and payment limitations in setting their own reimbursement rates. Therefore, any reduction in reimbursement that results from the Medicare Modernization Act may result in a similar reduction in payments from private payors.

15

More recently, in March 2010, President Obama signed into law the Health Care Reform Law, a sweeping law intended to broaden access to health insurance, reduce or constrain the growth of healthcare spending, enhance remedies against fraud and abuse, add new transparency requirements for health care and health insurance industries, impose new taxes and fees on the health industry and impose additional health policy reforms. Effective October 1, 2010, the Health Care Reform Law revises the definition of “average manufacturer price” for reporting purposes, which could increase the amount of Medicaid drug rebates to states. Further, the new law imposes a significant annual fee on companies that manufacture or import branded prescription drug products. Substantial new provisions affecting compliance have also been enacted, which may affect our business practices with health care practitioners. We will not know the full effects of the Health Care Reform Law until applicable federal and state agencies issue regulations or guidance under the new law. Although it is too early to determine the effect of the Health Care Reform Law, the new law appears likely to continue the pressure on pharmaceutical pricing, especially under the Medicare program, and may also increase our regulatory burdens and operating costs.

Both in the US and in the EU, legislative and regulatory proposals have been made to expand post-approval requirements and restrict sales and promotional activities for pharmaceutical products. We are not sure whether additional legislative changes will be enacted, or whether the regulations, guidance or interpretations will be changed, or what the impact of such changes on the marketing approvals of our product candidates, if any, may be.

In the area of companion diagnostics, FDA officials indicated in 2010 that the agency planned to issue two guidances in this area. The FDA issued a first draft guidance in July 2011, and the FDA plans to finalize this guidance in 2014. The FDA has yet to issue a second draft guidance, and may decide not to issue a second draft guidance or finalize the existing draft guidance. The FDA’s issuance of a final guidance, or issuance of additional draft guidance, could affect our development of in vitro companion diagnostics and the applicable regulatory requirements. In addition, increased scrutiny by the U.S. Congress of the FDA’s approval process may significantly delay or prevent marketing approval, as well as subject us to more stringent product labeling and post-marketing testing and other requirements.

In the EU, Regulation (EC) 1901/2006, the so called Paediatric Regulation, came into force in January 2007 and introduced considerable changes into the regulatory environment for pediatric medicines. The effects of this regulation are still not fully known. Additionally, an official guideline is being developed which addresses the development of medicinal products for the treatment of Duchenne and Becker muscular dystrophy. This guideline is planned to be adopted during the development of our compounds and may have an effect on the regulatory process for gaining market access in the EU.

Our relationships with customers and payors will be subject to applicable anti-kickback, fraud and abuse and other healthcare laws and regulations, which could expose us to criminal sanctions, civil penalties, contractual damages, reputational harm and diminished profits and future earnings.

Healthcare providers, physicians and others play a primary role in the recommendation and prescription of any products for which we obtain marketing approval. Our future arrangements with third-party payors and customers may expose us to broadly applicable fraud and abuse and other healthcare laws and regulations, primarily in the United States, that may constrain the business or financial arrangements and relationships through which we market, sell and distribute our products for which we obtain marketing approval. Restrictions under applicable healthcare laws and regulations, include the following:

|

·

|

the U.S. healthcare anti-kickback statute prohibits, among other things, persons from knowingly and willfully soliciting, offering, receiving or providing remuneration, directly or indirectly, in cash or in kind, to induce or reward either the referral of an individual for, or the purchase, order or recommendation of, any good or service, for which payment may be made under U.S. healthcare programs such as Medicare and Medicaid;

|

|

·

|

the U.S. False Claims Act imposes criminal and civil penalties, including civil whistleblower or qui tam actions, against individuals or entities for knowingly presenting, or causing to be presented, to the U.S. government, claims for payment that are false or fraudulent or making a false statement to avoid, decrease or conceal an obligation to pay money to the federal government;

|

|

·

|

the U.S. Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act, imposes criminal and civil liability for executing a scheme to defraud any healthcare benefit program and also imposes obligations, including mandatory contractual terms, with respect to safeguarding the privacy, security and transmission of individually identifiable health information;

|

16

|

·

|

the U.S. false statements statute prohibits knowingly and willfully falsifying, concealing or covering up a material fact or making any materially false statement in connection with the delivery of or payment for healthcare benefits items or services;

|

|

·

|

the transparency requirements under the Health Care Reform Law require manufacturers of drugs, devices, biologics and medical supplies to report to the U.S. Department of Health and Human Services information related to physician payments and other transfers of value and physician ownership and investment interests; and

|

|

·

|

analogous laws and regulations, such as state anti-kickback and false claims laws, may apply to sales or marketing arrangements and claims involving healthcare items or services reimbursed by non-governmental third-party payors, including private insurers, and some state laws require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government in addition to requiring manufacturers to report information related to payments to physicians and other health care providers or marketing expenditures.

|

Efforts to ensure that our business arrangements with third parties will comply with applicable healthcare laws and regulations will involve substantial costs. It is possible that governmental authorities will conclude that our business practices may not comply with current or future statutes, regulations or case law involving applicable fraud and abuse or other healthcare laws and regulations. If our operations are found to be in violation of any of these laws or any other governmental regulations that may apply to us, we may be subject to significant civil, criminal and administrative penalties, damages, fines, exclusion from U.S. government funded healthcare programs, such as Medicare and Medicaid, and the curtailment or restructuring of our operations. If any of the physicians or other providers or entities with whom we expect to do business with are found to be not in compliance with applicable laws, they may be subject to criminal, civil or administrative sanctions, including exclusions from government funded healthcare programs.

Risks related to commercialization of our product candidates

We operate in highly competitive and rapidly changing industries, which may result in others discovering, developing or commercializing competing products before or more successfully than we do.

The biopharmaceutical and pharmaceutical industries are highly competitive and subject to significant and rapid technological change. Our success is highly dependent on our ability to discover, develop and obtain marketing approval for new and innovative products on a cost-effective basis and to market them successfully. In doing so, we face and will continue to face intense competition from a variety of businesses, including large, fully integrated pharmaceutical companies, specialty pharmaceutical companies and biopharmaceutical companies, academic institutions, government agencies and other private and public research institutions in Europe, the United States and other jurisdictions. These organizations may have significantly greater resources than we do and conduct similar research, seek patent protection and establish collaborative arrangements for research, development, manufacturing and marketing of products that compete with our product candidates.

We believe that our key competitor in DMD is Sarepta Therapeutics, Inc., or Sarepta, a U.S. Company focused on the development of their lead product candidate eteplirsen. Eteplirsen is currently in Phase II trials in DMD and employs the same exon 51 skipping approach as drisapersen. Sarepta may be in discussions with the FDA for accelerated approval of eteplirsen, which if granted, could place us at a competitive disadvantage. Even without accelerated approval, depending on the overall clinical profile, efficacy and commercialization of eteplirsen, Sarepta may render our development and discovery efforts in the area of DMD uncompetitive. Other companies are also developing alternative therapeutic approaches to the treatment of DMD. These approaches may be used as complementary to our products targeting DMD, but they could also be competitive.

The highly competitive nature of and rapid technological changes in the biotechnology and pharmaceutical industries could render our product candidates or our technology obsolete or non-competitive. Our competitors may, among other things:

|

·

|

develop and commercialize products that are safer, more effective, less expensive, or more convenient or easier to administer;

|

17

|

·

|

obtain quicker regulatory approval;

|

|

·

|

establish superior proprietary positions;

|

|

·

|

have access to more manufacturing capacity;

|

|

·

|

implement more effective approaches to sales and marketing; or

|

|

·

|

form more advantageous strategic alliances.

|

Should any of these factors occur, our business, financial condition and results of operations could be materially adversely affected.

We rely on obtaining and maintaining orphan drug status for market exclusivity. Orphan drug status may not ensure that we have market exclusivity in a particular market, and we could lose orphan market exclusivity if another drug is approved first using the same method of action or demonstrates clinical superiority.

All of our DMD compounds have been granted orphan drug status by the FDA and EMA. If drisapersen or our other product candidates were to lose orphan drug status or the marketing exclusivity that it provides, our business and results of operations could be materially adversely affected. In the United States, a product candidate with orphan drug status qualifies for market exclusivity for seven years after FDA approval, unless a chemically identical competing product for the same indication is proved to be “clinically superior,” that is, safer, more effective or significantly more convenient. Thus, if drisapersen is granted regulatory approval in the United States, the FDA may not approve a competing generic product during the market exclusivity period; however, a chemically dissimilar product such as Sarepta’s eteplirsen would not be affected by drisapersen’s U.S. market exclusivity and could similarly obtain market exclusivity in the United States if it were to receive FDA approval.

In Europe, EMA regulations provide ten-year marketing exclusivity in Europe for orphan drugs, subject to certain exceptions, including the demonstration of “clinically relevant superiority” by a similar medicinal product. EMA orphan marketing exclusivity applies to drug products for the same indication that use the same method of action but can be chemically dissimilar. Eteplirsen has been granted orphan drug designation in the European Union. If Sarepta were to obtain marketing approval from the EMA for eteplirsen before drisapersen is approved by the EMA, Sarepta could have the benefit of orphan drug marketing exclusivity to our detriment because both products use the same method of action (exon skipping) for patients with DMD. Drisapersen would have to demonstrate a clinically relevant advantage over eteplirsen (in efficacy, safety and/or pharmacokinetics) in order to defeat such market exclusivity in Europe. If drisapersen is approved by the EMA before eteplirsen, eteplirsen could defeat drisapersen’s market exclusivity in Europe by demonstrating a clinically relevant advantage.

The successful commercialization of our product candidates will depend in part on the extent to which governmental authorities and health insurers establish adequate reimbursement levels and pricing policies.

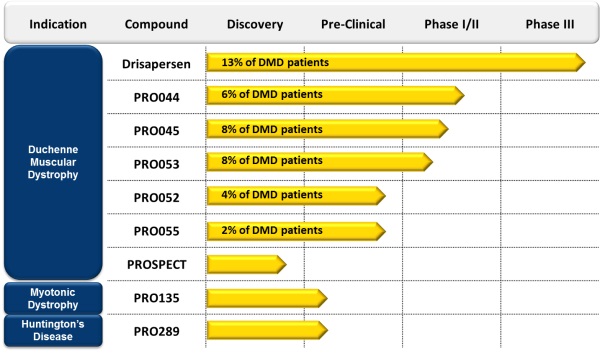

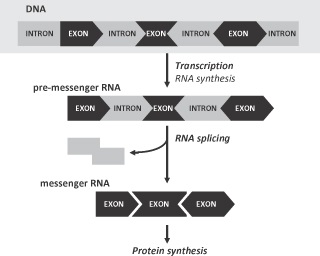

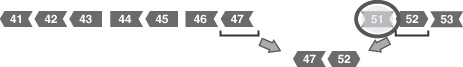

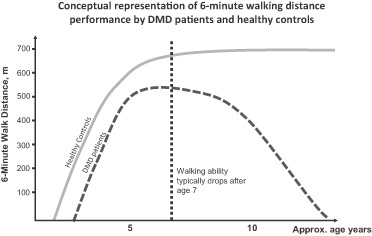

The successful commercialization of our product candidates will depend, in part, on the extent to which third-party coverage and reimbursement for our products will be available from government and health administration authorities, private health insurers and other third-party payors.