PRER14Afalse000157408500015740852023-01-012023-12-31iso4217:USD00015740852022-01-012022-12-3100015740852021-01-012021-12-3100015740852020-01-012020-12-31000157408512023-01-012023-12-310001574085bhr:SCTReversalMemberecd:PeoMember2023-01-012023-12-310001574085ecd:NonPeoNeoMemberbhr:SCTReversalMember2023-01-012023-12-310001574085bhr:NewAwardsOutstandingMemberecd:PeoMember2023-01-012023-12-310001574085ecd:NonPeoNeoMemberbhr:NewAwardsOutstandingMember2023-01-012023-12-310001574085bhr:ChangeInValueOfPriorYearMemberecd:PeoMember2023-01-012023-12-310001574085ecd:NonPeoNeoMemberbhr:ChangeInValueOfPriorYearMember2023-01-012023-12-310001574085bhr:NewAwardsVestedDuringTheYearMemberecd:PeoMember2023-01-012023-12-310001574085ecd:NonPeoNeoMemberbhr:NewAwardsVestedDuringTheYearMember2023-01-012023-12-310001574085bhr:VestedPriorYearAwardsMemberecd:PeoMember2023-01-012023-12-310001574085bhr:VestedPriorYearAwardsMemberecd:NonPeoNeoMember2023-01-012023-12-310001574085bhr:ForfeituresMemberecd:PeoMember2023-01-012023-12-310001574085ecd:NonPeoNeoMemberbhr:ForfeituresMember2023-01-012023-12-310001574085bhr:DividendsMemberecd:PeoMember2023-01-012023-12-310001574085ecd:NonPeoNeoMemberbhr:DividendsMember2023-01-012023-12-31000157408522023-01-012023-12-31000157408532023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. 2)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

☒ | Preliminary Proxy Statement |

| | | | | |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | | |

| ☐ | Definitive Proxy Statement |

| | | | | |

☐ | Definitive Additional Materials |

| | | | | |

☐ | Soliciting Material under §240.14a-12 |

Braemar Hotels & Resorts Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | | | | | | | | | | | | | |

Payment of Filing Fee (Check the appropriate box): |

☒ | | | No fee required. |

☐ | | | Fee paid previously with preliminary materials. |

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a–6(i)(1) and 0–11 |

PRELIMINARY PROXY STATEMENT, DATED APRIL 25, 2024

SUBJECT TO COMPLETION

2024 Proxy Statement Annual Meeting of Stockholders

Tuesday, July 30, 2024

9:00 A.M., Central Daylight Time

Braemar Hotels & Resorts Inc.

14185 Dallas Parkway, Suite 1200

Dallas, Texas 75254

[ ], 2024

Dear Stockholders of Braemar Hotels & Resorts Inc.:

On behalf of the Board of Directors of Braemar Hotels & Resorts Inc., I cordially invite you to attend the 2024 annual meeting of stockholders of the Company, which will be held at 9:00 A.M., Central Daylight Time, on Tuesday, July 30, 2024 at our offices located at 14185 Dallas Parkway, Suite 1200, Dallas, Texas 75254.

The year started with an unsettling fear of recession hanging over the industry. However, with the support of full employment, our economy continued to demonstrate growth. The recession never came. But the Fed remained hawkish and pushed up interest rates to quell inflation. And it worked. The COVID-inspired inflation started to subside and soon we were talking about a pivot to lower interest rates in 2024.

Early in 2023 global travel restrictions were lifted, and Americans started traveling internationally again. Unfortunately, this resulted in some softening of demand for domestic resorts. But conventions and meetings were back on the calendar as companies started to insist that their employees spend at least some of their time back in the office. But unfortunately, the work from home trend started a malaise within the office property sector, which now looks to be with us for many years to come. Values are down as much as 40% and refinancing is proving difficult and costly. Fortunately, these loans do not comprise a high proportion of the book within our money center banks. Nevertheless, some regional banks will be more acutely impacted. For the lodging industry, the result of this trend has been slightly lower occupancies, but higher average daily rates, placing RevPAR for the industry solidly above 2019 levels.

In 2023 our portfolio fared well, albeit generating RevPAR and EBITDA results below 2022. 2024 looks to be shaping up nicely, with very strong group pace and an industry forecast of 4% RevPAR growth across the industry and over 5% for the luxury segment. Expenses continue to be in focus, but will be very manageable, with unemployment ticking up slightly and having already booked significant increases in property taxes and insurance over the past two years.

Looking at our balance sheet, we have already addressed all of our 2024 debt maturities through a combination of extensions, refinancings and planned repayments. As we look forward, we anticipate more constructive debt capital markets for lodging, including lower interest costs in the form of lower base rates and credit spreads.

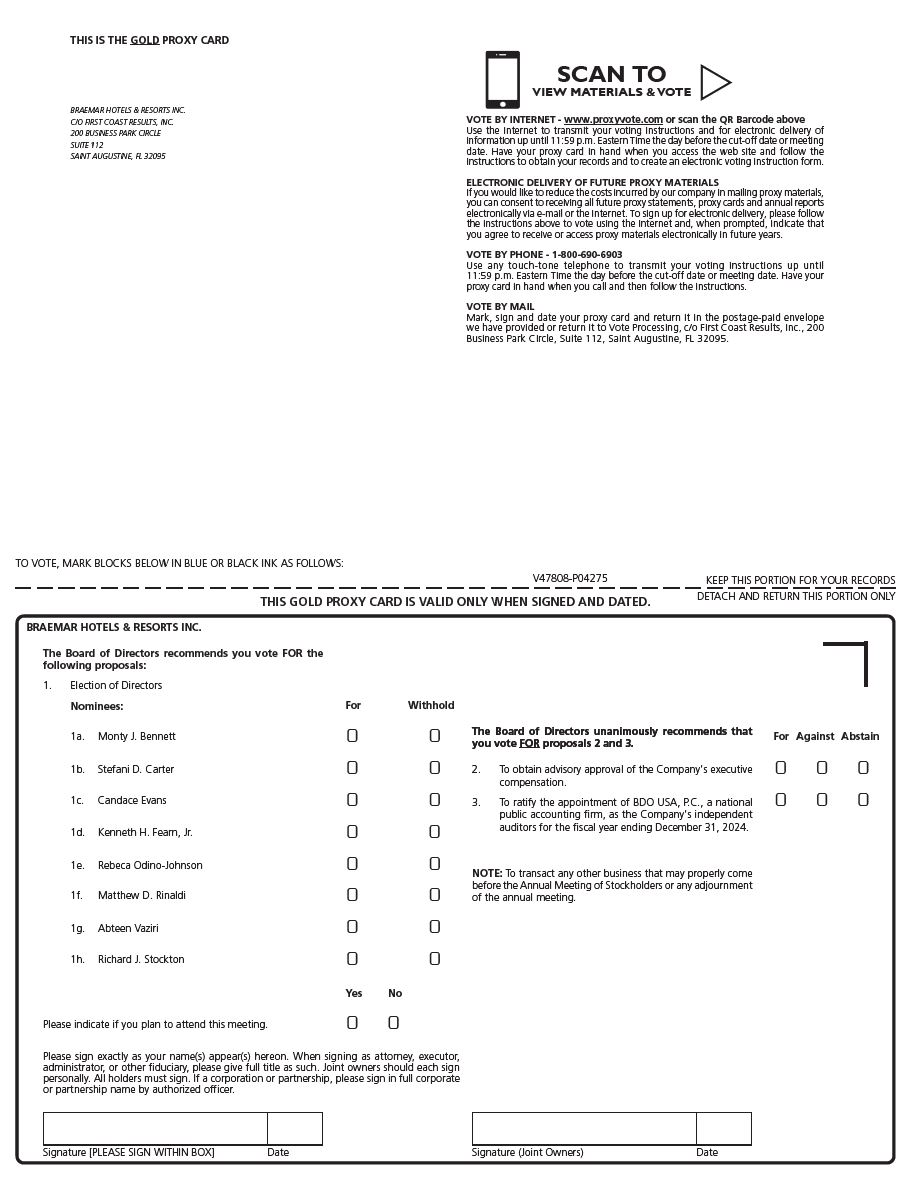

Your vote will be especially important this year. Blackwells Capital LLC and certain of its affiliates (collectively, “Blackwells”) have purported to nominate a slate of four nominees for election as directors at the meeting in opposition to the nominees recommended by your board of directors and have presented other non-binding business proposals. You may receive a proxy statement, WHITE proxy card and other solicitation materials from Blackwells. As further described herein, we believe that the purported nominees and proposals set forth in Blackwells’ proxy materials cannot properly be brought before the annual meeting. We do not intend to count any stockholder votes for Blackwells’ purported nominees and proposals. Further, we believe that any proxies granted in connection with Blackwells’ solicitation will be invalid with respect to Blackwells’ purported nominees and non-binding business proposals and will be disregarded.

As always, we will continue to look at ways to fulfill our mission to create and protect stockholder value. Thank you for your continued interest in Braemar. We encourage you to read this proxy statement carefully and to vote your gold proxy as soon as possible so that your shares will be represented at the meeting.

Sincerely,

Monty J. Bennett

Founder and Chairman of the Board

Notice of 2024 Annual Meeting of Stockholders

| | | | | | | | |

| Meeting Date: | | Tuesday, July 30, 2024 |

| | | |

| Meeting Time: | | 9:00 A.M., Central Daylight Time |

| | | |

| Location: | | Braemar Hotels & Resorts Inc.

14185 Dallas Parkway, Suite 1200

Dallas, Texas 75254 |

Agenda

1.Election of eight directors;

2.Advisory approval of our executive compensation;

3.Ratification of the appointment of BDO USA, P.C. as our independent auditor for 2024; and

4.Transaction of any other business that may properly come before the annual meeting.

Record Date

You may vote at the 2024 annual meeting of stockholders the shares of common stock, Series E Preferred Stock and Series M Preferred Stock of which you were a holder of record at the close of business on May 2, 2024.

Review your proxy statement and vote in one of four ways

•In person: Attend the annual meeting and vote by ballot.

•By telephone: Call the telephone number and follow the instructions on your gold proxy card.

•Via the internet: Go to the website address shown on your gold proxy card and follow the instructions on the website.

•By mail: Mark, sign, date and return the enclosed gold proxy card in the postage paid envelope.

Vote only the GOLD Proxy Card and Disregard Proxy Materials (including the White Proxy Card) distributed by Blackwells

Your vote will be especially important this year. As you may be aware, on March 10, 2024, Blackwells Capital LLC and certain of its affiliates (collectively, “Blackwells”) submitted materials to the Company purporting to provide notice (the “Purported Nominating Notice”) of Blackwells’ intent to nominate four individuals for election to our Board and submit non-binding business proposals for stockholder consideration at the Annual Meeting. After reviewing the Purported Nominating Notice, the Board determined that the Purported Nominating Notice failed to comply with the advance notice provisions under the Company's Bylaws (including among other reasons Blackwells’ failure to disclose its continued interest in acquiring the Company) and, as a result, determined Blackwells’ nominations to be invalid. On March 22, 2024, Blackwells filed a preliminary proxy statement with the Securities and Exchange Commission to solicit proxies on the WHITE proxy card in support of its purported nominees and business proposals set forth in the Purported Nominating Notice. On March 24, 2024, the Company brought suit against Blackwells in the United States District Court for the Northern District of Texas, seeking injunctive relief against the solicitation of proxies by Blackwells and a declaratory judgment that Blackwells’ nomination is invalid and, as a result, that Blackwells’ slate of purported nominees is invalid and ineligible to stand for election by the Company’s stockholders.

As previously disclosed, the Company has postponed the Annual Meeting, previously scheduled to be held on May 15, 2024, to July 30, 2024, and the record date for the 2024 Annual Meeting will be May 2, 2024. The litigation between the Company and Blackwells is currently stayed.

We believe that the purported nominees and non-binding business proposals set forth in Blackwells’ proxy materials cannot properly be brought before the Annual Meeting and, unless ordered to do so by a court of competent jurisdiction (a “Valid Court Order”), the Company will not recognize or tabulate any proxies or votes in favor of Blackwells purported nominees or non-binding business proposals at the Annual Meeting. As a result of the foregoing, the GOLD proxy card accompanying this proxy statement does not

include the names of Blackwells’ purported nominees or non-binding business proposals on a “universal proxy card.” OUR BOARD URGES YOU TO VOTE ONLY ON THE GOLD PROXY CARD (1) “FOR” ALL OF OUR BOARD’S NOMINEES (MONTY J. BENNETT, STEFANI D. CARTER, CANDACE EVANS, KENNETH H. FEARN, JR., REBECA ODINO-JOHNSON, MATTHEW D. RINALDI, RICHARD J. STOCKTON AND ABTEEN VAZIRI) ON PROPOSAL 1, (2) “FOR” PROPOSAL 2 AND (3) “FOR” PROPOSAL 3.

OUR BOARD FURTHER URGES YOU TO DISREGARD ANY MATERIALS SENT TO YOU BY OR ON BEHALF OF BLACKWELLS, AND NOT TO SIGN, RETURN, OR VOTE THE WHITE PROXY CARD SENT TO YOU BY OR ON BEHALF OF BLACKWELLS. ABSENT A VALID COURT ORDER, THE COMPANY WILL DISREGARD VOTES ON THE WHITE PROXY CARD.

In the event a Valid Court Order is issued, the Company will amend this proxy statement and furnish to stockholders a new GOLD universal proxy card which will include Blackwells’ director candidates and non-binding business proposals, and the Company will provide stockholders with sufficient time to receive such proxy materials and cast their votes on such new GOLD universal proxy card prior to the Annual Meeting (or any postponement or adjournment thereof). We expect if a Valid Court Order is issued and an ongoing proxy contest between the Company and Blackwells occurs, such contest will divert significant financial and operational resources from the Company and may negatively affect our stock price and overall financial and operational performance.

In addition, if a Valid Court Order is issued, no proxies or votes received on the Company’s previously circulated GOLD proxy card will be recognized or tabulated at the Annual Meeting. Accordingly, if you vote on the Company’s GOLD proxy card accompanying this proxy statement and a Valid Court Order is issued, your votes will not be recognized or tabulated, and you will have to vote again on the universal proxy card for your vote to be counted.

If you vote, or have previously voted, using a WHITE proxy card sent to you by or on behalf of Blackwells, you can subsequently revoke that proxy by following the instructions on the GOLD proxy card to vote via the Internet or by telephone or by completing, signing and dating the GOLD proxy card and mailing it in the postage-paid envelope provided. Only your latest dated vote will count. Any proxy may be revoked prior to its exercise at the Annual Meeting as described in this proxy statement.

Whether or not you attend the Annual Meeting, it is important that your shares be represented at the Annual Meeting. We encourage you to please vote TODAY to ensure your voice is heard. You may vote by marking, signing, and dating the enclosed GOLD proxy card and returning it in the postage-paid envelope. Stockholders may also vote via the Internet or by telephone.

For more information and up-to-date postings, please go to www.bhrreit.com. Information on our website is not, and will not be deemed to be, a part of this proxy statement or incorporated into any of our other filings with the SEC. If you need assistance with voting or have any questions, please contact Morrow Sodali LLC (“Morrow Sodali”), our proxy solicitor assisting us in connection with the Annual Meeting. Stockholders may call toll free at (800) 662-5200 or at (203) 658-9400 or by email at BHR@info.morrowsodali.com.

Regardless of the number of shares of the Company’s common stock that you own, your vote is important. Thank you for your continued support, interest, and investment in the Company.

By order of the Board of Directors,

Deric S. Eubanks

Chief Financial Officer

14185 Dallas Parkway, Suite 1200

Dallas, Texas 75254

[ ], 2024

This Notice of the Annual Meeting of Stockholders and the accompanying proxy statement are first being made available to stockholders of record as of May 2, 2024, on or about [ ], 2024.

If you have any questions or require any assistance in voting your shares, please contact our proxy solicitor:

430 Park Avenue

New York, NY 10022

Stockholders Call (800) 662-5200 Toll Free

or (203) 658-9400

Email: BHR@info.morrowsodali.com

| | |

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held at 9:00 a.m., Central Daylight Time on Tuesday, July 30, 2024.

This proxy statement, the accompanying GOLD proxy card and our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are available at https://www.bhrreit.com

|

| | | | | |

| |

| |

| ANNEX B ADDITIONAL INFORMATION REGARDING PARTICIPANTS IN THE SOLICITATION | |

| |

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 30, 2024. |

| |

The Company's Proxy Statement for the 2024 Annual Meeting of Stockholders and the Annual Report to Stockholders for the fiscal year ended December 31, 2023, including the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are available at www.bhrreit.com by clicking the "INVESTOR" tab, then the "FINANCIALS & SEC FILINGS" tab and then the "Annual Meeting Material" link. |

PRELIMINARY PROXY STATEMENT, DATED APRIL 25, 2024

SUBJECT TO COMPLETION

INTRODUCTION

This proxy statement is furnished to stockholders in connection with the solicitation of proxies by the Board of Directors of Braemar Hotels & Resorts Inc. for use at its 2024 Annual Meeting of Stockholders.

SUMMARY

This summary highlights selected information contained in this proxy statement, but it does not contain all the information you should consider in determining how to vote your shares of our common stock, Series E Redeemable Preferred Stock ("Series E Preferred Stock") or Series M Redeemable Preferred Stock ("Series M Preferred Stock") at the 2024 annual meeting of stockholders of the Company. We urge you to read the entire proxy statement before you vote. This proxy statement or the Notice of Internet Availability of Proxy Materials was first made available to stockholders on or about [ ], 2024.

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Braemar Hotels & Resorts Inc. of proxies to be voted at our 2024 annual meeting of stockholders.

In this proxy statement:

•"we," "our," "us," "Braemar" and the "Company" each refers to Braemar Hotels & Resorts Inc., a Maryland corporation and real estate investment trust ("REIT"), which has shares of its common stock, par value $0.01 per share, listed for trading on the New York Stock Exchange ("NYSE") under the ticker symbol "BHR";

•"Annual Meeting" refers to the 2024 annual meeting of stockholders of the Company;

•"Ashford Trust" refers to Ashford Hospitality Trust, Inc. (NYSE: AHT), a Maryland corporation and REIT from which we were spun off in November 2013;

•"Ashford Inc." refers to Ashford Inc. (NYSE American: AINC), a Nevada corporation;

•"Ashford LLC" refers to Ashford Hospitality Advisors LLC, a Delaware limited liability company and a subsidiary of Ashford Inc.;

•"Board" or "Board of Directors" refers to the Board of Directors of Braemar Hotels & Resorts Inc.;

•"Bylaws" refers to the Fifth Amended and Restated Bylaws, as amended, of the Company;

•"Exchange Act" refers to the Securities Exchange Act of 1934, as amended;

•"Premier" refers to Premier Project Management LLC, a Maryland limited liability company and a subsidiary of Ashford LLC. On August 8, 2018, Ashford Inc. completed its acquisition of Premier, the business of which was formerly owned by Remington Lodging (as defined below). As a result, Ashford Inc. (through its indirect subsidiary, Premier) provides us with construction management, interior design, architecture, and the purchasing, expediting, warehousing, freight management, installation and supervision of property and equipment and related services;

•"Remington Lodging" refers to Remington Lodging & Hospitality, LLC, a Delaware limited liability company and hotel management company that was owned by Mr. Monty J. Bennett, our Chairman of the Board, and his father, Mr. Archie Bennett, Jr., Chairman Emeritus of Ashford Trust, before its acquisition by Ashford Inc. on November 6, 2019. "Remington Hospitality" refers to the same entity after the acquisition was completed, resulting in Remington Lodging & Hospitality, LLC becoming a subsidiary of Ashford Inc.;

•"SEC" refers to the U.S. Securities and Exchange Commission;

•"Securities Act" refers to the Securities Act of 1933, as amended; and

•"stockholders" refers to holders of our common stock, par value $0.01 per share, holders of our Series E Preferred Stock and Series M Preferred Stock, collectively, or as the context may require, individually.

Ashford Inc. and Ashford LLC together serve as our external advisor. In this proxy statement, we refer to Ashford Inc. and Ashford LLC collectively as our "advisor."

Annual Meeting of Stockholders

| | | | | | | | |

| Time and Date | | Record Date |

| 9:00 A.M. Central Daylight Time, July 30, 2024 | | May 2, 2024 |

| | | | | | | | |

| Place | | Number of Common Shares, Series E Preferred Stock and Series M Preferred Stock Eligible to Vote at the Annual Meeting as of the Record Date |

Braemar Hotels & Resorts Inc. 14185 Dallas Parkway, Suite 1200 Dallas, Texas 75254 | | [ ] |

Voting Matters

| | | | | | | | | | | | | | |

| Matter | | Board Recommendation | | Page Reference (for more detail) |

| Election of Directors | | ✔ For each of the Company's director nominees | | |

| Advisory Approval of Our Executive Compensation | | ✔ For | | |

Ratification of Appointment of BDO USA, P.C. | | ✔ For | | |

Board Nominees

The following table provides summary information about each of the Company's director nominees. All directors of the Company are elected annually. Directors will be elected by a plurality of the votes cast at the Annual Meeting.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name; Age | | Director Since | | Principal Occupation | | Committee Memberships* | | Other U.S. Public Company Boards |

| A | | CC | | NCG | | RPT | |

Monty J. Bennett, 58 | | 2013 | | Chairman and CEO of Ashford Inc.; Chairman of Ashford Trust | | | | | | | | | | Ashford Inc.; Ashford Trust |

Stefani D. Carter, 46 (L) | | 2013 | | Attorney; President of Dallas HERO | | | | | | | | | | Wheeler Real Estate Investment Trust, Inc.; Axos Bank and Axos Financial, Inc. |

Candace Evans, 69 | | 2019 | | Founder and Publisher of CandysDirt.com and SecondShelters.com | | | | | | | | | | |

Kenneth H. Fearn, Jr., 58 (F) | | 2016 | | Founder and Managing Partner of Integrated Capital LLC | | | | | | | | | | |

Rebeca Odino-Johnson, 68 | | 2022 | | National Senior Vice-President of Direct Marketing and Donor Experience at the American Heart Association | | | | | | | | | | |

Matthew D. Rinaldi, 48 | | 2013 | | General Counsel of Farjo Holdings, LP | | | | | | | | | | |

Richard J. Stockton, 53 | | 2020 | | CEO and President of Braemar Hotels & Resorts Inc. | | | | | | | | | | |

Abteen Vaziri, 45 (F) | | 2017 | | Chief Investment Officer and President of Uptown Companies, Inc. | | | | | | | | | | |

* Reflects current committee membership of current directors standing for re-election only and is not intended to imply any future committee membership after the election of our directors at the Annual Meeting. The Board, in consultation with the Nominating and Corporate Governance Committee, will determine the appropriate committee membership for the forthcoming year after the completion of the Annual Meeting.

A: Audit Committee

CC: Compensation Committee

NCG: Nominating and Corporate Governance Committee

RPT: Related Party Transactions Committee

(L): Lead Director

(F): Audit Committee financial expert

(C): Chairperson

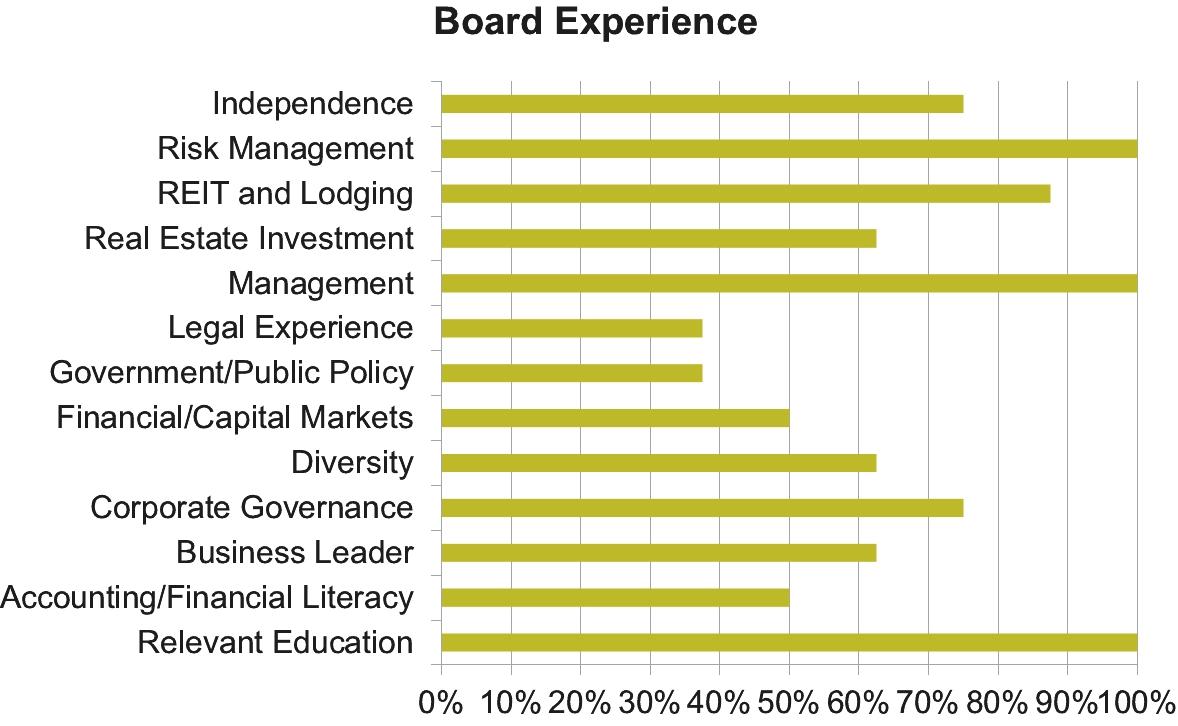

Summary of Director Diversity and Experience

Our Board embodies a broad and diverse set of experiences, qualifications, attributes and skills. Below is a brief summary of some of the attributes, skills and experience of our director nominees. For a more complete description of each director nominee's qualifications, please see their biographies starting on page 6.

Corporate Governance Highlights

We are committed to the values of effective corporate governance and high ethical standards. Our Board believes that these values are conducive to the strong performance of the Company and creating long-term stockholder value. Our governance framework gives our independent directors the structure necessary to provide oversight, direction, advice and counsel to the management of the Company. This framework is described in more detail in our Corporate Governance Guidelines and codes of conduct, which can be found on our website at www.bhrreit.com by clicking the "INVESTOR" tab, then the "CORPORATE GOVERNANCE" tab and then the "Governance Documents" link.

Set forth below is a summary of our corporate governance framework.

| | | | | | | | | | | |

| Board Independence |

| • | | | All directors except Mr. Monty J. Bennett, our Chairman, and Mr. Richard J. Stockton, our President and Chief Executive Officer, are independent |

| | | | | | | | | | | | | | | | | |

| Board Committees |

| • | | We have four standing Board committees: |

| | • | | | Audit Committee |

| | • | | | Compensation Committee |

| | • | | | Nominating and Corporate Governance Committee |

| | • | | | Related Party Transactions Committee |

| • | | All committees are composed entirely of independent directors |

| • | | Two of our three Audit Committee members are "financial experts" |

| | | | | | | | | | | |

| Leadership Structure |

| • | | | Chairman of the Board separate from CEO |

| • | | | Independent and empowered lead independent director ("Lead Director") with broadly defined authority and responsibilities |

| | | | | | | | | | | |

| Risk Oversight |

| • | | | Regular Board review of enterprise risk management and related policies, processes and controls |

| • | | | Board committees exercise oversight of risk for matters within their purview |

| | | | | | | | | | | |

| Open Communication |

| • | | | We encourage open communication and strong working relationships among the Lead Director, Chairman, CEO and other directors and officers |

| • | | | Our directors have direct access to our officers and management and employees of our advisor |

| | | | | | | | | | | | | | | | | | | | |

| Stock Ownership |

| • | | | Stock ownership and equity award retention guidelines for directors and executives |

| | | • | | | Our directors should own shares of granted common stock in excess of 3x his or her annual cash Board retainer fee in effect at the time of such director's election to the Board |

| | | • | | | Our CEO should own shares of granted common stock in excess of 3x his annual base salary from our advisor in effect at the time of his appointment as CEO |

| | | • | | | Our other executive officers should own shares of granted common stock in excess of 1.5x his or her annual base salary from our advisor in effect at the time of his or her appointment to office |

| | | • | | | Our directors and executive officers are permitted to sell vested stock awards only if the required ownership levels described above have been met and only to the extent thereof |

| • | | | Comprehensive insider trading policy |

| • | | | Prohibitions on hedging and pledging transactions |

| | | | | | | | | | | |

| Accountability to Stockholders |

| • | | | Directors elected by majority vote in uncontested director elections |

| • | | | We have a non-classified Board and elect every director annually |

| • | | | We have adopted proxy access (stockholders may include nominees in our proxy materials) |

| • | | | We do not have a stockholder rights plan |

| • | | | We have opted out of the Maryland Business Combination Act and Maryland Control Share Acquisition Act (which had provided certain takeover defenses) |

| • | | | We have not elected to be subject to the provisions of the Maryland Unsolicited Takeover Act which would permit our Board to classify itself without a stockholder vote |

| • | | | Stockholders holding a stated percentage of our outstanding voting shares may call special meetings of stockholders |

| • | | | Board receives regular updates from management regarding interaction with stockholders and prospective investors |

| | | | | | | | | | | |

| Board Practices |

| • | | | Robust annual Board and committee self-evaluation process |

| • | | | Balanced and diverse board composition |

| • | | | Limits on outside public company board service |

| | | | | | | | | | | |

| Conflicts of Interest |

| • | | | Matters relating to our advisor or any other related party are subject to the approval of the majority of our independent directors upon the recommendation of our Related Party Transactions Committee |

Vote only the GOLD Proxy Card and Disregard Proxy Materials (including the White Proxy Card) distributed by Blackwells

Your vote will be especially important this year. As you may be aware, on March 10, 2024, Blackwells Capital LLC and certain of its affiliates (collectively, “Blackwells”) submitted materials to the Company purporting to provide notice (the “Purported Nominating Notice”) of Blackwells’ intent to nominate four individuals for election to our Board and submit non-binding business proposals for stockholder consideration at the Annual Meeting. After reviewing the Purported Nominating Notice, the Board determined that the Purported Nominating Notice failed to comply with the advance notice provisions under the Company's Bylaws (including among other reasons Blackwells’ failure to disclose its continued interest in acquiring the Company) and, as a result, determined Blackwells’ nominations to be invalid. On March 22, 2024, Blackwells filed a preliminary proxy statement with the Securities and Exchange Commission to solicit proxies on the WHITE proxy card in support of its purported nominees and business proposals set forth in the Purported Nominating Notice. On March 24, 2024, the Company brought suit against Blackwells in the United States District Court for the Northern District of Texas, seeking injunctive relief against the solicitation of proxies by Blackwells and a declaratory judgment that Blackwells’ nomination is invalid and, as a result, that Blackwells’ slate of purported nominees is invalid and ineligible to stand for election by the Company’s stockholders.

As previously disclosed, the Company has postponed the Annual Meeting, previously scheduled to be held on May 15, 2024, to July 30, 2024, and the record date for the 2024 Annual Meeting will be May 2, 2024. The litigation between the Company and Blackwells is currently stayed.

We believe that the purported nominees and non-binding business proposals set forth in Blackwells’ proxy materials cannot properly be brought before the Annual Meeting and, unless ordered to do so by a court of competent jurisdiction (a “Valid Court Order”), the Company will not recognize or tabulate any proxies or votes in favor of Blackwells' purported nominees or non-binding business proposals at the Annual Meeting. As a result of the foregoing, the GOLD proxy card accompanying this proxy statement does not include the names of Blackwells’ purported nominees or non-binding business proposals on a “universal proxy card.” OUR BOARD URGES YOU TO VOTE ONLY ON THE GOLD PROXY CARD (1) “FOR” ALL OF OUR BOARD’S NOMINEES (MONTY J. BENNETT, STEFANI D. CARTER, CANDACE EVANS, KENNETH H. FEARN, JR., REBECA ODINO-JOHNSON, MATTHEW D. RINALDI, RICHARD J. STOCKTON AND ABTEEN VAZIRI) ON PROPOSAL 1, (2) “FOR” PROPOSAL 2 AND (3) “FOR” PROPOSAL 3.

OUR BOARD FURTHER URGES YOU TO DISREGARD ANY MATERIALS SENT TO YOU BY OR ON BEHALF OF BLACKWELLS, AND NOT TO SIGN, RETURN, OR VOTE THE WHITE PROXY CARD SENT TO YOU BY OR ON BEHALF OF BLACKWELLS. ABSENT A VALID COURT ORDER, THE COMPANY WILL DISREGARD VOTES ON THE WHITE PROXY CARD.

In the event a Valid Court Order is issued, the Company will amend this proxy statement and furnish to stockholders a new GOLD universal proxy card which will include Blackwells’ director candidates and non-binding business proposals, and the Company will provide stockholders with sufficient time to receive such proxy materials and cast their votes on such new GOLD universal proxy card prior to the Annual Meeting (or any postponement or adjournment thereof). We expect if a Valid Court Order is issued and an ongoing proxy contest between the Company and Blackwells occurs, such contest will divert significant financial and operational resources from the Company and may negatively affect our stock price and overall financial and operational performance.

In addition, if a Valid Court Order is issued, no proxies or votes received on the Company’s previously circulated GOLD proxy card will be recognized or tabulated at the Annual Meeting. Accordingly, if you vote on the Company’s GOLD proxy card accompanying this

proxy statement and a Valid Court Order is issued, your votes will not be recognized or tabulated, and you will have to vote again on the universal proxy card for your vote to be counted.

If you vote, or have previously voted, using a WHITE proxy card sent to you by or on behalf of Blackwells, you can subsequently revoke that proxy by following the instructions on the GOLD proxy card to vote via the Internet or by telephone or by completing, signing and dating the GOLD proxy card and mailing it in the postage-paid envelope provided. Only your latest dated vote will count. Any proxy may be revoked prior to its exercise at the Annual Meeting as described in this proxy statement.

Whether or not you attend the Annual Meeting, it is important that your shares be represented at the Annual Meeting. We encourage you to please vote TODAY to ensure your voice is heard. You may vote by marking, signing, and dating the enclosed GOLD proxy card and returning it in the postage-paid envelope. Stockholders may also vote via the Internet or by telephone.

For more information and up-to-date postings, please go to www.bhrreit.com. Information on our website is not, and will not be deemed to be, a part of this proxy statement or incorporated into any of our other filings with the SEC. If you need assistance with voting or have any questions, please contact Morrow Sodali LLC (“Morrow Sodali”), our proxy solicitor assisting us in connection with the Annual Meeting. Stockholders may call toll free at (800) 662-5200 or at (203) 658-9400 or by email at BHR@info.morrowsodali.com.

Regardless of the number of shares of the Company’s common stock that you own, your vote is important. Thank you for your continued support, interest, and investment in the Company.

BACKGROUND OF THE SOLICITATION

The following is a chronology of the material contacts and events leading up to the filing of this preliminary proxy statement:

•Braemar has continually sought, and continues to seek, directors with a diverse set of experiences, qualifications, attributes, and skills. As part of our efforts to generate attractive returns for stockholders, we strive to identify experienced and capable director nominees in advance of each annual meeting.

•On October 21, 2023, Blackwells, through its counsel at Vinson & Ekins LLP, sent a letter to Braemar purporting to demand that the Board investigate “potential breaches of fiduciary duty and/or other wrongdoing related to mismanagement or self-dealing by members of the Board and/or management in connection with the Company’s relationship with Mr. Bennett and Ashford.”

•On November 1, 2023, the Board established a Review Committee consisting of two independent directors (Kenneth H. Fearn, Jr. and Rebeca Odino-Johnson) by unanimous consent (“Review Committee Resolution”). The Review Committee Resolution delegated to the Review Committee full authority of the Board to investigative, review, and analyze the facts and circumstances forming the basis for Blackwells’ October 21 letter and make a recommendation to the full Board as to whether to pursue any claims implied or asserted in the letter. The Review Committee retained a nationally recognized law firm as external counsel to fulfill its mandate. The Review Committee was also assisted by a nationally recognized financial advisory firm with respect to benchmarking and analyzing the performance of the Company. After undertaking a full investigation with the assistance of the law firm and financial advisory firm, the Review Committee recommended that the Board not take the actions set forth in Blackwells’ letter. The Board followed that recommendation and resolved not to pursue the proposed actions. That decision and the bases for reaching it were communicated to Blackwells, via letter, on January 9, 2024.

•On December 1, 2023, Blackwells sent a letter to the Board, with the header “Proposal for Acquisition of Braemar,” containing a “preliminary proposal for the negotiated acquisition” of the Company. By way of its letter, Blackwells proposed to acquire 100% of the outstanding equity interests in the Company for $4.50 per share in cash. The letter enclosed a 12-page due diligence request list, as well as a proposed form of exclusivity agreement. The letter noted that Blackwells “would expect to finance the Transaction with a combination of debt and equity,” including, with respect to equity, funding from “Blackwells’ internal resources, as well as LP commitments.”

•On December 6, 2023, Braemar’s counsel sent Blackwells a letter acknowledging receipt of the December 1 acquisition proposal. The letter noted that, in its October 21 letter, Blackwells presented itself as acting on behalf of all shareholders in demanding the Company pursue its directors for alleged breach of fiduciary duty, but in its December 1 letter, Blackwells presented itself as acting in its own interest, making a proposal to acquire the entire Company and requesting exclusivity, to the detriment of all other shareholders. The December 6 letter requested that, prior to the Board and management expending further time and resources, Blackwells answer certain threshold questions so that the Board could appropriately assess the credibility of Blackwells’ interest. In particular, the letter noted concern expressed by the Company’s advisors that Blackwells would have difficulty securing strong third-party committed financing. To assist the Board in assessing Blackwells’ interest, the December 6 letter invited Blackwells to provide certain information, including:

•Blackwells’ aggregate beneficial ownership interest in the Company, including any derivative interests;

•Blackwells’ acquisition experience, including whether it had ever consummated the acquisition of a public company;

•Blackwells’ ability to obtain financing, including debt commitment letters, evidence of Blackwells’ internal resources, information with respect to proposed equity funding, and the identity and domicile of any offshore financing sources so the Board could assess any potential political, national security, or regulatory risks; and

•Blackwells’ advisors, including financial advisors, accounting firm, and other advisors engaged to assist with the proposal.

•On December 22, 2023, Blackwells, through its counsel, sent a response stating that “Blackwells would finance the Transaction with a combination of debt and equity from internal and external sources.” Blackwells offered to provide “additional confidential information” regarding its “financing sources,” only “after Blackwells receives confirmation that the Board is interested in engaging in a discussion regarding Blackwells’ proposal.”

•On December 28, 2023, Blackwells and Jason Aintabi, through counsel at Quinn Emanuel Urquhart & Sullivan, LLP, sent a letter to Braemar’s counsel purporting to raise “concerns” regarding “potential violations of the federal securities laws” by Braemar, allegedly resulting from an article “Vinson & Elkins Helps New York Activist Investor Invade Texas” published in The Dallas Express, of which Mr. Bennett is the publisher. The December 28 letter stated that, absent a response by January 5, 2024, “court intervention will be necessary to resolve this matter.”

•On January 2, 2024, Braemar’s counsel sent an email to Blackwells’ counsel acknowledging that the December 22 letter had been shared with the Company’s Board. In the email, Braemar’s counsel noted that the purpose of the questions posed in the December 6 letter was to evaluate Blackwells’ ability to complete its proposed transaction, including its ability to obtain fully committed financing for all necessary funds. Braemar’s counsel stated that the Board remained fully committed to doing what was in the best interests of the Company and its stockholders, and reiterated the request for the information presented in the December 6 letter.

•On January 2, 2024, Blackwells sent a letter to the Company requesting a written questionnaire required under the Company’s bylaws to nominate candidates for election to the Board.

•On January 9, 2024, the Board approved the Fifth Amended and Restated Bylaws of the Company, effective immediately. The Fifth Amended and Restated Bylaws included enhancements to certain advance notice and disclosure requirements

that had been set forth in the Fourth Amended and Restated Bylaws, as amended, with respect to stockholder nomination of directors and submission of proposals for consideration at annual meetings of stockholders, as well as certain other technical, clarifying, and conforming changes.

•On February 27, 2024, the Board approved Amendment No. 1 to the Bylaws for purposes of reducing the quorum required for any matter proposed by the Board at an annual meeting of stockholders called by the Board from a majority to at least one-third of all votes entitled to be cast at such meeting, as permitted under the Maryland General Corporation Law.

•On March 10, 2024, one day before the deadline for stockholders to nominate candidates for election to the Board at the Company’s Annual Meeting, Blackwells delivered by email to Braemar the Purported Nominating Notice. A physical copy was delivered to the Company’s principal executive office, as required by the Bylaws, on the deadline date: March 11, 2024. The Purported Nominating Notice purported to nominate four individuals, Michael Cricenti, Jennifer M. Hill, Betsy L. McCoy, and Steven J. Pully (the “Proposed Nominees”), for election to the Board at the Annual Meeting. Additionally, the Purported Nominating Notice proposed to bring certain non-binding business proposals before the Annual Meeting, including proposals to amend the Bylaws and the Corporate Governance Guidelines.

•Upon receipt, the Purported Nominating Notice was provided to the Board for review. In consultation with its legal advisors, the Board carefully reviewed the Purported Nominating Notice and found it to be deficient because it contained material misstatements, inaccuracies, and omissions, and therefore, was not provided in accordance with advance notice requirements set forth in the Company’s Bylaws. Among the deficiencies identified by the Board, the Purported Nominating Notice asserted that Blackwells had “withdrawn” any interest in an acquisition of the Company or any similar transaction, despite substantial evidence—including a March 2024 investor presentation premised on taking Braemar “private” attached to the Purported Nominating Notice—indicating that Blackwells had ongoing interest in an acquisition, and that its interest was a motivation for its proxy campaign. In addition, the Board identified additional defects in the Purported Nominating Notice, including failure to disclose in multiple instances information required of “Stockholder Associated Persons,” such as purported sources of financing with whom Blackwells had acted in concert in connection with its acquisition proposal. Accordingly, the Board determined that Blackwells’ refusal to comply with the Bylaws’ advance notice requirements rendered its Proposed Nominees ineligible to stand for election and barred Blackwells from bringing other business before the Annual Meeting.

•In reviewing the Purported Nominating Notice, in an exercise of its business judgment, the Board also considered additional factors bearing on Blackwells’ and Mr. Aintabi’s character and past dealings, including lack of candor, reputation in the business community, and personal history. Based on these factors, the Board determined that it would not be in the best interest of the Company and its stockholders for it to waive Blackwells’ non-compliance with the advance notice requirements and permit the Proposed Nominees for election.

•On March 22, 2024, Blackwells, Blackwells Onshore I LLC (“Blackwells Onshore”), Mr. Aintabi, and the Proposed Nominees filed a Preliminary Proxy Statement, Schedule 14A, with the SEC. The proxy statement announced that they “are soliciting proxies from the Corporation’s stockholders” on multiple matters, including “[t]he election of each of our director nominees,” the Proposed Nominees, and multiple stockholder proposals described as the “Blackwells Proposals.”

•On March 24, 2024, the Company, through counsel, notified Blackwells of the Board’s decision to reject the Purported Nominating Notice and requested that Blackwells immediately cease and desist any attempts to solicit proxies in support of the Proposed Nominees or any other business proposals set forth in the Notice. This communication further identified that one of Blackwells' nominees had failed to accurately respond to a question with respect to their previous personal bankruptcy, as required by the Company's questionnaire.

•On March 24, 2024, the Company commenced litigation against Blackwells, Blackwells Onshore, Blackwells Holding Co. LLC, Vandewater Capital Holdings, LLC, Blackwells Asset Management LLC, BW Coinvest Management I LLC, Mr. Aintabi, and the Proposed Nominees (collectively, “Defendants”) in the U.S. District Court for the Northern District of Texas in an action captioned Braemar Hotels & Resorts Inc. v. Blackwells Capital LLC, et al., case number 3:24-cv-707 (N.D. Tex.) (the “Action”). The complaint asserts a claim for injunctive relief pursuant to Section 14(a) of the Securities Exchange Act of 1934 and the rules and regulations thereunder, enjoining Defendants from soliciting proxies or distributing proxy materials to Braemar’s stockholders in connection with the Annual Meeting. The complaint also asserts claims for declaratory judgment that Blackwells’ slate of Proposed Nominees is invalid due to Blackwells’ violations of Braemar’s Bylaws, and that Blackwells cannot cure its violations and is barred from nominating director candidates or bringing other business before the 2024 Annual Meeting. Also on March 24, 2024, the Company filed a motion for preliminary injunction in the Action, seeking to preliminarily enjoin Defendants from soliciting proxies or distributing proxy materials to Braemar’s stockholders pending resolution of the Action. The case has been assigned to the Hon. Sam A. Lindsay, United States District Judge.

•On March 26, 2024, Blackwells’ counsel hand-delivered to Braemar and emailed to its counsel a “Supplement” to its Nomination Notice. The “Supplement” purports to make certain amendments to its March 10 Nomination Notice, including noting that “[i]n the process of preparing the Nomination Notice, the date listed on the first page of the presentation . . . was inadvertently changed from ‘December 2024’ to ‘March 2024,” as well as additional disclosures as to one of the Blackwells' nominee's previous bankruptcy filing, which such nominee had failed to report in its executed written questionnaire.

•On March 27, 2024, Blackwells’ counsel emailed to Braemar’s counsel a “Second Supplement” to its Nomination Notice. The Second Supplement disclosed that Blackwells Onshore purchased 10,000 shares of common stock on March 4, 2024 and Blackwells purchased 656,161 additional shares of common stock on March 26, 2024. According to the Second Supplement, Blackwells, its affiliates, and the Proposed Nominees beneficially owned in the aggregate approximately 666,261 shares of the Company’s common stock, par value $0.01 per share.

•On March 28, 2024, Blackwells’ counsel emailed to Braemar’s counsel a “Third Supplement” to its Nomination Notice. The Third Supplement disclosed that Blackwells purchased an additional 36,447 shares of common stock on March 27, 2024. According to the Third Supplement, Blackwells, its affiliates, and the Proposed Nominees now beneficially own in the aggregate approximately 692,708 shares of the Company’s common stock, par value $0.01 per share.

•On March 28, 2024, Braemar filed definitive proxy materials with the SEC with the EDGAR code "DEF14A", announcing that the Annual Meeting would be held on May 15, 2024, at 9:00 A.M. CDT at 14185 Dallas Parkway, Suite 1200, Dallas, Texas 75254. After discussions with the SEC, Braemar refiled its proxy materials as preliminary proxy materials with the SEC under the EDGAR Code "PREC14A".

•On April 11, 2024, Blackwells Capital LLC commenced litigation against the Company and directors Montgomery J. Bennett, Stefani Danielle Carter, Richard J. Stockton, Kenneth H. Fearn, Jr., Abteen Vaziri, Mary Candace Evans, Matthew D. Rinaldi, and Rebeca Odino-Johnson in the U.S. District Court for the Northern District of Texas in an action captioned Blackwells Capital LLC v. Braemar Hotels & Resorts Inc, et al., case number 3:24-cv-894 (N.D. Tex.) (the “Blackwells Action”). The complaint brings claims for declaratory and injunctive relief, breach of contract, breach of common law duties, and violations of Section 14(a) of the Securities Exchange Act of 1934 and the rules and regulations thereunder, asserting that Blackwells’ nomination of director candidates was valid, the Company’s bylaws are invalid and unenforceable, and that the Company committed substantive and procedural violations of the securities laws in connection with the ongoing proxy contest.

•On April 17, 2024, to facilitate ongoing settlement discussions, the parties filed an agreed motion to stay all proceedings (the "Agreed Motion") in both the Action and the Blackwells Action. The Agreed Motion requested that the court stay all proceedings in both the Action and the Blackwells Action until June 17, 2024 and vacate all pending deadlines until further ordered by the court.

•On April 18, 2024, the court sua sponte ordered the Action and the Blackwells Action consolidated into a consolidated case captioned Braemar Hotels & Resorts Inc. v. Blackwells Capital LLC, et al., case number 3:24-CV-707-L (consolidated with 3:24-CV-894-L) (N.D. Tex.) (the “Consolidated Action”). On the same date, the court granted the parties’ Agreed Motion and issued an order staying all proceedings in the Consolidated Action and vacating all pending deadlines until further ordered by the court. The court directed the parties to file a joint status report by June 17, 2024, unless dismissal papers are filed by that date.

•On April 22, 2024, the Company announced that it had postponed the Annual Meeting, previously scheduled to be held on May 15, 2024, to July 30, 2024, and that the record date for the Annual Meeting will be May 2, 2024.

OUR BOARD URGES YOU TO VOTE ONLY ON THE GOLD PROXY CARD FOR ALL OF OUR BOARD’S HIGHLY QUALIFIED AND VERY EXPERIENCED NOMINEES (MONTY J. BENNETT, STEFANI D. CARTER, CANDACE EVANS, KENNETH H. FEARN, JR., REBECA ODINO-JOHNSON, MATTHEW D. RINALDI, RICHARD J. STOCKTON AND ABTEEN VAZIRI), TO DISREGARD ANY MATERIALS SENT TO YOU BY OR ON BEHALF OF BLACKWELLS, AND NOT TO SIGN, RETURN, OR VOTE THE WHITE PROXY CARD SENT TO YOU BY OR ON BEHALF OF BLACKWELLS.

PROPOSAL NUMBER ONE-ELECTION OF DIRECTORS

The size of our Board is currently set at eight (8) directors. All of our directors are elected annually by our stockholders and serve until the next annual meeting of stockholders and until his or her successor is duly elected and qualified.

At the Annual Meeting, eight (8) directors are to be elected to the Board. Our Nominating and Corporate Governance Committee has recommended, and our Board has nominated, for election the following eight (8) persons: Monty J. Bennett, Stefani D. Carter, Candace Evans, Kenneth H. Fearn, Jr., Rebeca Odino-Johnson, Matthew D. Rinaldi, Richard J. Stockton and Abteen Vaziri. All of our nominees currently serve as directors of the Company. In selecting the director nominees that we are proposing for election, our Board has focused on selecting experienced board candidates who will work together constructively with a focus on operational excellence, financial strength, and the growth of stockholder value. All directors except Mr. Monty J. Bennett, our Chairman, and Mr. Richard J. Stockton, our President and Chief Executive Officer, are independent.

Unless otherwise specified, if you sign and return the enclosed GOLD proxy card, it will be voted in favor of the election of each of the Board’s eight (8) director nominees: Monty J. Bennett, Stefani D. Carter, Candace Evans, Kenneth H. Fearn, Jr., Rebeca Odino-Johnson, Matthew D. Rinaldi, Richard J. Stockton and Abteen Vaziri.

Each of the nominees recommended by our Board has consented to serving as nominees for election to our Board, to being named as a nominee of the Board in a proxy statement, and to serving as a member of the Board if elected by the Company’s stockholders.

If any nominee becomes unable to stand for election as a director, an event that the Board does not presently expect, the Board reserves the right to nominate substitute nominees prior to the Annual Meeting. In such a case, the Company will file an amended proxy statement that will identify each substitute nominee, disclose whether such nominee has consented to being named in such revised proxy statement and to serve, if elected, and include such other disclosure relating to such nominee as may be required under the Exchange Act.

Our Board recommends using the enclosed GOLD proxy card to vote FOR all eight (8) of the Board’s nominees for director. Blackwells has notified the Company that it intends to seek your proxy to vote in favor of Blackwells’ purported nominees. Accordingly, you may receive solicitation materials from Blackwells seeking your proxy to vote in favor of Blackwells’ purported nominees.

The Company has provided you with the enclosed GOLD proxy card. Our Board unanimously recommends that you vote FOR all eight (8) of the Board’s highly qualified and very experienced nominees. If you receive any proxy materials other than from the Company, our Board strongly recommends that you DISREGARD any such materials. If you vote, or have already voted, using a proxy card sent to you by or on behalf of Blackwells, you have every right to change your vote and we urge you to revoke that proxy by voting FOR all eight (8) of our Board’s nominees by submitting the enclosed GOLD proxy card. Only your latest dated proxy will be counted.

Set forth below are the names, principal occupations, committee memberships, ages, directorships held with other companies, and other biographical data for each of the eight nominees for director, as well as the month and year each nominee first began his or her service on the Board, if applicable. For a discussion of such person's beneficial ownership of our common stock, see the "Security Ownership of Management and Certain Beneficial Owners" section of this proxy statement.

| | | | | | | | |

| The Board unanimously recommends a vote FOR all nominees. | |

Nominees for Election as Directors

| | | | | | | | |

| MONTY J. BENNETT |

Age: 58 Chairman since 2013 | | Mr. Bennett has served as Chairman of the Board of Directors since April 2013 and served as Chief Executive Officer of the Company from April 2013 to November 2016. Mr. Bennett is the Founder, Chairman & Chief Executive Officer of Ashford Inc. (NYSE American: AINC) and is also the Founder & Chairman of both Ashford Hospitality Trust, Inc. (NYSE: AHT) and Braemar Hotels & Resorts Inc. (NYSE: BHR). Mr. Bennett has over 26 years of experience in the hotel industry and has experience in virtually all aspects of the hospitality industry, including hotel ownership, finance, operations, development, asset management and project management. In addition to his roles at Ashford, over his career Mr. Bennett has been a member and leader in numerous industry associations. Mr. Bennett is a lifelong advocate of civic engagement and takes pride in giving back to the Dallas-Fort Worth community. Together with the Ashford companies, he supports numerous charitable organizations including Alzheimer’s Association, Habitat for Humanity, North Texas Food Bank, the S.M. Wright Foundation and the Special Olympics. He holds a Master's degree in Business Administration from Cornell's S.C. Johnson Graduate School of Management and received a Bachelor of Science degree with distinction from the School of Hotel Administration also at Cornell. He is a life member of the Cornell Hotel Society. Experience, Qualifications, Attributes and Skills: Mr. Bennett's extensive industry experience as well as the strong and consistent leadership qualities he has displayed in his role as Chairman, his prior role as the Chief Executive Officer of the Company and his experience with, and knowledge of, the Company and its operations gained in those roles and in his role as Chairman and Chief Executive Officer of Ashford Inc., his prior role as Chief Executive Officer and his current role as the Chairman of Ashford Trust, are vital qualifications and skills that make him uniquely qualified to serve as a director of the Company and as the Chairman of the Board. |

| | | | | | | | |

| STEFANI D. CARTER |

Age: 46 Director since 2013 Independent Lead Director Committees: • Nominating and Corporate Governance (chair) • Related Party Transactions | | Ms. Carter has served as a member of the Board of Directors since November 2013 and currently serves as our Lead Director. She serves as chair of our Nominating and Corporate Governance Committee and as a member of our Related Party Transactions Committee. She also serves as a member and chair of the Board of Directors of Wheeler Real Estate Investment Trust (NASDAQ: WHLR), a commercial real estate investment company, and as a member of the Board of Directors of Axos Bank and Axos Financial, Inc. (NYSE: AX). Ms. Carter has been a practicing attorney since 2005, specializing in civil litigation, contractual disputes and providing general counsel and advice to small businesses and individuals. Ms. Carter currently serves as the President of Dallas HERO, a Texas non-profit corporation. She is also principal of two entities, Stefani Carter & Associates, LLC, a consulting and legal services firm she founded in 2011, and Stable Realty, LLC, a real estate investments firm. From October 2020 to February 2023, Ms. Carter served as a litigation shareholder at Ferguson Braswell Fraser Kubasta PC (“FBFK”), a full-service law firm. Prior to FBFK, Ms. Carter served as senior counsel at the law firm of Estes Thorne & Carr PLLC for three years. In addition, Ms. Carter served as an elected representative of House District 102 in the Texas House of Representatives between 2011 and 2015. From 2008 to 2011, Ms. Carter was employed as an associate attorney at the law firm of Sayles Werbner, PC and from 2007 to 2008 was a prosecutor in the Collin County District Attorney's Office. Prior to joining the Collin County District Attorney's Office, Ms. Carter was an associate attorney at Vinson & Elkins LLP from 2005 to 2007. Ms. Carter has a Juris Doctor from Harvard Law School, a Master's in Public Policy from Harvard University's John F. Kennedy School of Government and a Bachelor of Arts in Government as well as a Bachelor of Journalism in News/Public Affairs from the University of Texas at Austin. Experience, Qualifications, Attributes and Skills: Ms. Carter brings her extensive legal experience in advising and counseling clients in civil litigation and contractual disputes, as well as her many experiences as an elected official, to the Board of Directors. In addition, Ms. Carter brings her experience with, and knowledge of, the Company and its operations gained as a director of the Company since November 2013 to her role as a director of the Company. |

| | | | | | | | |

| CANDACE EVANS |

Age: 69 Director since 2019 Independent Committees: • Compensation | | Ms. Evans has served as a member of the Board of Directors since July 2019. She currently serves as a member of our Compensation Committee. Ms. Evans has been an award-winning business journalist, entrepreneur, and editor since 1980 and is the Founder & Publisher of CandysDirt.com and SecondShelters.com, vertical business-to-business websites devoted to the North Texas real estate industry and vacation home sales market. Her unique sites, founded in 2011, are among the highest read in Texas for local real estate & breaking news. The award-winning content is published daily by a staff of editors, with a subscription base of over 33,000. Banner, display and native ad sales have increased more than 10% per year since the sites were founded. She holds an active Texas real estate license. Ms. Evans is also an expert contributor to Forbes.com focusing on real estate. Ms. Evans has worked as an editor for DMagazine Partners, where she helped found the award-winning DHome Magazine in 2000. In addition, she conceived and created a successful real estate blog on the DMagazine URL in 2007-2010, DallasDirt.com. Prior to her long tenure at DMagazine, Ms. Evans worked for CBS News in New York, WBBM-TV in Chicago, KDFW-TV in Dallas, and has written for many publications in print and online, including Newsweek, Home, The Dallas Morning News, The Dallas Business Journal, D CEO, Modern Luxury Dallas, AOL Real Estate, Joel Kotkin's The New Geography, Medical Economics, The Fort Worth Star Telegram, Adweek, Texas Business, and others. Ms. Evans also currently serves on the Board of Directors of Preservation Dallas, a non-profit devoted to architectural preservation in North Texas. Ms. Evans earned her M.S.J. from the Columbia University Graduate School of Journalism and her undergraduate degree at Wheaton College, and studied at Dartmouth College. She holds an active Texas real estate license. Experience, Qualifications, Attributes and Skills: Ms. Evans brings her real estate marketing expertise and knowledge, and her experience with the rapidly changing world of online journalism, social media, and real estate marketing, as well as her extensive research into luxury hotels and the high-end luxury vacation home market, to the Board of Directors. |

| | | | | | | | |

| KENNETH H. FEARN, JR. |

Age: 58 Director since 2016 Independent Audit Committee Financial Expert Committees: • Audit (chair) | | Mr. Fearn joined the Board of Directors in August 2016. He currently serves as chair of our Audit Committee. Mr. Fearn is Founder and Managing Partner of Integrated Capital LLC, a private equity real estate firm with a focus on hospitality assets in markets across the United States. Prior to founding Integrated Capital in 2004, Mr. Fearn was Managing Director and Chief Financial Officer of Maritz, Wolff & Co., a private equity firm engaged in real estate acquisition and development from 1995 to 2004. Maritz, Wolff & Co. managed three private equity investment funds totaling approximately $500 million focused on acquiring luxury hotels and resorts. Prior to his tenure at Maritz, Wolff & Co., from 1993 to 1995, Mr. Fearn was with McKinsey & Company, a strategy management consulting firm, resident in the Los Angeles office, where he worked with Fortune 200 companies to address issues of profitability and develop business strategies. Prior to McKinsey & Company, he worked at JP Morgan & Company where he was involved with corporate merger and acquisition assignments. Mr. Fearn received a Bachelor of Arts in Political Science from the University of California, Berkeley and a Master of Business Administration from the Harvard University Graduate School of Business. Mr. Fearn serves on the Community Advisory Board for the Los Angeles Convention Center and Tourism Board, and he previously served on the Marriott International Owner Advisory Board and has twice served as an Entrepreneur in Residence at the Leland C. and Mary M. Pillsbury Institute for Hospitality Entrepreneurship at Cornell University. He also previously served as Chairman of the Board of Commissioners of the Community Redevelopment Agency of the City of Los Angeles as well as the board of directors of the Los Angeles Area Chamber of Commerce, where he was a member of the Executive Committee and the Finance Committee from 2005 to 2014. Experience, Qualifications, Attributes and Skills: Mr. Fearn brings over 24 years of real estate and hospitality experience to the Board of Directors. During his career at Maritz, Wolff & Co. and Integrated Capital, he was involved in the acquisition of approximately $2 billion in hospitality assets and secured in excess of $2.5 billion in debt financing for hospitality asset acquisitions. His extensive contacts in the hospitality and commercial real estate lending industries will be beneficial in his service on the Board of Directors. |

| | | | | | | | |

| REBECA ODINO-JOHNSON |

Age: 68 Director since 2022 Independent Committees: • Audit • Compensation | | Ms. Odino-Johnson has served as a member of the Board of Directors since May 2022 and currently serves as a member of our Audit Committee and Compensation Committee. Ms. Odino-Johnson is the National Senior Vice-President of Direct Marketing and Donor Experience at the American Heart Association, a position she has held since April 2018. Previously, Ms. Odino-Johnson served as Main Event Entertainment, LP's Chief Marketing and Sales Officer, from December 2015 to March 2018. Ms. Odino-Johnson served as the Chief Marketing and Culinary Officer of Bob Evans Farms from December 2013 to October 2015. Additionally, Ms. Odino-Johnson served as Senior Vice President and Chief Marketing and Culinary Officer at Dine Brands Global Inc. from November 2008 to July 2013, where she led marketing efforts for restaurant brands such as Applebees. From January 2004 to February 2008, Ms. Odino-Johnson served as Executive Vice President, Senior Vice President and Chief Marketing and Global Branding Officer for Brinker International, Inc. Ms. Odino-Johnson spent 16 years at PepsiCo, Inc. in various marketing and sales positions including General Manager and Vice-President of Marketing for Frito-Lay North America, with direct financial and strategic planning responsibility for the profitable growth of the $3.8 billion Doritos and Cheetos business unit, representing 30% of Frito-Lay North America. She grew the Cheetos brand from $500 million to $1 billion and launched Baked Lay’s, resulting in $250 million in sales in the first year, representing Frito-Lay’s most successful launch. Ms. Odino-Johnson received a Bachelor of Business Administration in Marketing and Finance from Dallas Baptist University, from which she graduated magna cum laude. She also graduated from the Harvard Business School Advanced Management Program and has received a Master’s Degree in Digital Marketing and Analytics from Wake Forest University. Ms. Odino-Johnson has served on the Alex Lee Family of Companies board of directors since February 2016. She has served on the Advisory Board of Data Axie since July 2020 and The North Texas Food Bank since October 2023. She previously served on PepsiCo’s Latino/Hispanic Advisory Board. Ms. Odino-Johnson is a member of the NACD. Experience, Qualifications, Attributes and Skills: Ms. Odino-Johnson brings extensive experience as a marketing executive, counseling companies and organizations on strategic and digital marketing strategies, to the Board of Directors. |

| | | | | | | | |

| MATTHEW D. RINALDI |

Age: 48 Director since 2013 Independent Committees: • Compensation (chair) • Related Party Transactions | | Mr. Rinaldi has served as a member of the Board of Directors since November 2013 and currently serves as chair of our Compensation Committee and as a member of our Related Party Transactions Committee. Mr. Rinaldi is a licensed attorney whose practice has focused on in-house corporate and real estate matters and representing businesses in a broad range of complex commercial litigation and appellate matters, including securities class action lawsuits, director and officer liability, real estate, antitrust, insurance and intellectual property litigation. Mr. Rinaldi is the General Counsel of Farjo Holdings, LP, a position he has held since June 2023. Previously, Mr. Rinaldi was General Counsel of Quantas Healthcare Management, LLC and its affiliated medical facilities from June 2017 to June 2023. Mr. Rinaldi also served as an elected representative of Texas House District 115 in the Texas House from 2014 to 2019. Mr. Rinaldi served as Senior Counsel with the law firm of Dykema from July 2014 through June 2017. Mr. Rinaldi practiced law as a solo practitioner from November 2013 to July 2014 and served as counsel with the law firm of Miller, Egan, Molter & Nelson, LLP from 2009 to November 2013. Prior to joining Miller, Egan, Molter & Nelson, LLP, Mr. Rinaldi was an associate attorney at the law firm of K&L Gates LLP from 2006 to 2009 and an associate attorney at the law firm of Gibson, Dunn and Crutcher, LLP from 2001 to 2006, where he defended corporate officers and accounting firms in securities class action lawsuits and assisted with SEC compliance issues. Mr. Rinaldi has extensive experience in corporate and real estate law, in federal, state and appellate courts, and has represented and counseled a broad spectrum of clients, including Fortune 500 companies, "Big Four" accounting firms and insurance companies, healthcare companies and real estate developers, as well as small businesses and individuals. Mr. Rinaldi has a Juris Doctor, cum laude, from Boston University and a Bachelor of Business Administration in Economics, cum laude, from James Madison University. Experience, Qualifications, Attributes and Skills: Mr. Rinaldi brings his extensive legal experience advising and counseling corporate officers of public companies and independent auditors in matters involving SEC compliance, director and officer liability and suits brought by stockholders and bondholders, as well as his experience in real estate, employment, insurance and intellectual property-related legal matters, to the Board of Directors. In addition, Mr. Rinaldi brings his experience with, and knowledge of, the Company and its operations gained as a director of the Company since November 2013 to his role as a director of the Company. |

| | | | | | | | |

RICHARD J. STOCKTON |

President and Chief Executive Officer Age: 53 Director since 2020 | | Mr. Stockton was appointed to the Board of Directors in July 2020. He has served as our Chief Executive Officer since November 2016 and as President since April 2017. He has also served as the Lead Independent Director of Spirit MTA REIT (NYSE: SMTA) and Trustee of its successor entity, SMTA Liquidating Trust, since 2018. Prior to joining our Company, Mr. Stockton served as Global Co-Head and Global Chief Operating Officer for Real Estate at CarVal Investors, a subsidiary of Cargill Inc., with real estate investments in the United States, Canada, the United Kingdom and France. He also previously served as President & CEO-Americas for OUE Limited, a publicly listed Singaporean property company, where he established the business that acquired and refurbished the US Bank Tower in Los Angeles in 2013. The majority of his career, over 16 years, was spent at Morgan Stanley in real estate investment banking in various roles including Head of EMEA Real Estate Banking in London, where he was responsible for business across Europe, the Middle East and Africa and Co-Head of Asia Pacific Real Estate Banking, where he was responsible for a team across Hong Kong, Singapore, Sydney and Mumbai. He is also a member of the Board of the American Hotel and Lodging Association. Mr. Stockton is a frequent speaker and panelist at industry conferences and events, including NAREIT, the NYU International Hospitality Industry Investment Conference, and the Americas Lodging Investment Summit. He is a dual citizen of the United States and the United Kingdom. Mr. Stockton received a Master's of Business Administration degree in Finance and Real Estate from The Wharton School, University of Pennsylvania, and a Bachelor of Science degree from Cornell University, School of Hotel Administration. Experience, Qualifications, Attributes and Skills: Mr. Stockton's extensive industry experience as well as the strong and consistent leadership qualities he has displayed in his role as President and Chief Executive Officer of the Company and his experience with, and knowledge of, the Company and its operations gained in such role are vital qualifications and skills that make him uniquely qualified to serve as a director of the Company. |

| | | | | | | | |

| ABTEEN VAZIRI |

Age: 45 Director since 2017 Independent Audit Committee Financial Expert Committees: • Related Party Transactions (chair) • Audit • Nominating and Corporate Governance | | Mr. Vaziri has served as a member of the Board of Directors since October 2017. He currently serves as chair of our Related Party Transactions Committee and as a member of our Audit Committee and our Nominating and Corporate Governance Committee. Mr. Vaziri has worked in all aspects of evaluating hotel assets, from evaluating investments in the hospitality, gaming, and lodging industries to analyzing the development of hotels, the evaluation of hotel F&B operations and analyzing and executing traditional and EB-5 hotel financings. Mr. Vaziri currently serves as Chief Investment Officer and President of Uptown Companies, Inc. Previously, Mr. Vaziri was a Managing Director at Brevet Capital Management, a position he held from June 2018 to August 2023 where he was in charge of originating and the payback of over $500 million of real estate assets, and built Brevet’s EB-5 and real estate practices. Mr. Vaziri served as a director at Greystone & Co, an institutional real estate lender, where Mr. Vaziri helped build Greystone's EB-5 real estate financing platform. Mr. Vaziri earned a Bachelor of Science in Computer Science at the University of Texas at Dallas and a Masters of Business Administration in Finance from the Cox School of Business at Southern Methodist University. Mr. Vaziri also obtained a Juris Doctor degree from Fordham University School of Law with a concentration in Finance and Business Law. He is licensed to practice law in the states of New York and Texas. Experience, Qualifications, Attributes and Skills: Mr. Vaziri brings his in-depth knowledge of financing, evaluating and managing hotel assets, his real estate experience, and his experience as a director of an institutional real estate lender, and managing director of a mezzanine lender, and EB-5 fundraising expertise to the Board. He also has significant experience in strategic planning, accounting, finance and risk management. |

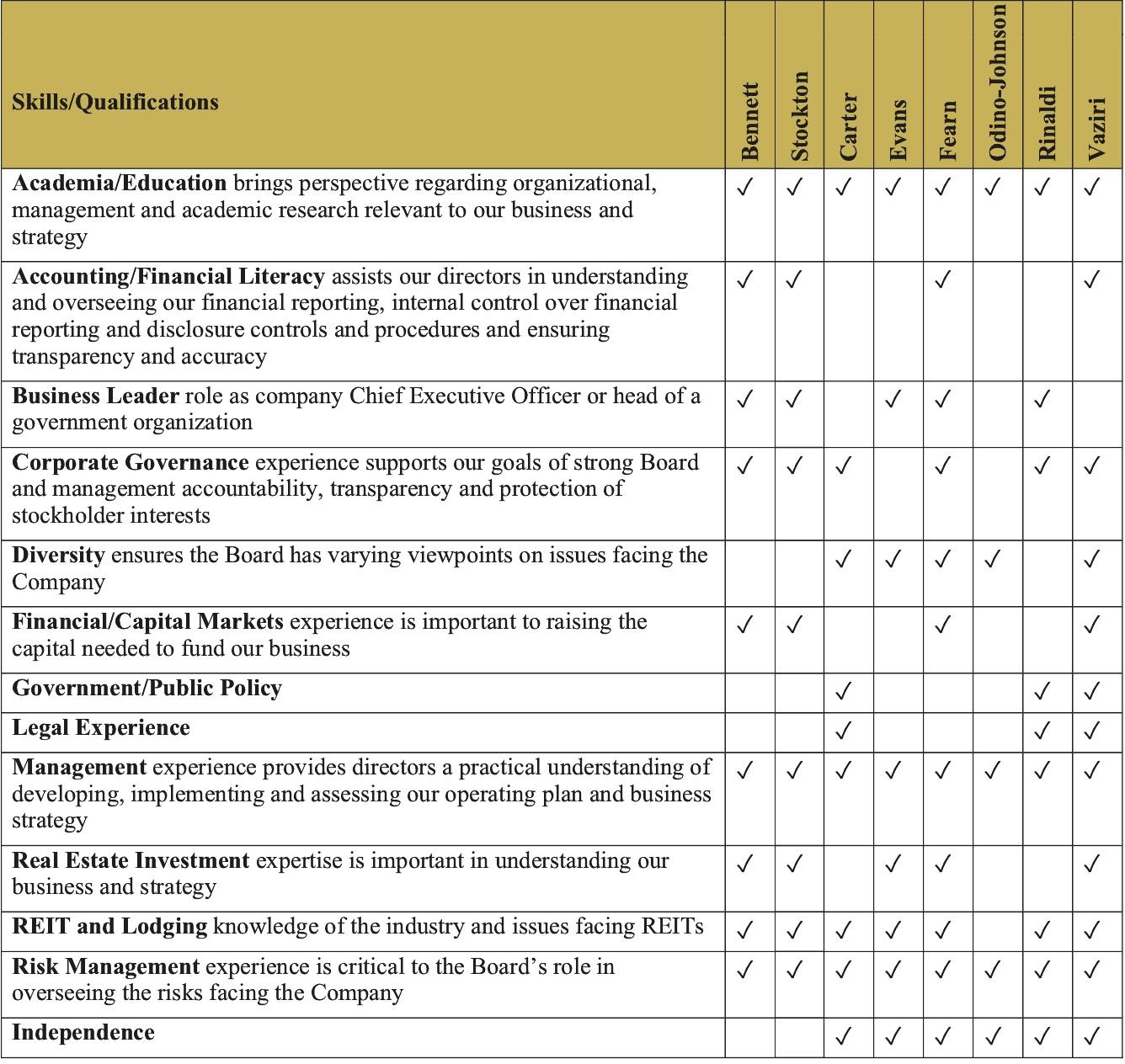

Summary of Director Qualifications, Skills, Attributes and Experience

Our Nominating and Corporate Governance Committee and the full Board believe a complementary mix of diverse qualifications, skills, attributes and experiences will best serve the Company and its stockholders. The summary of our director nominees' qualifications, skills, attributes and experiences that appears below, and the related narrative for each director nominee appearing in the directors' biographies above, notes some of the specific experience, qualifications, attributes and skills for each director that the Board considers important in determining that each nominee should serve on the Board in light of the Company's business, structure and strategic direction. The absence of a checkmark for a particular skill does not mean the director in question is unable to contribute to the decision-making process in that area.

CORPORATE GOVERNANCE

The Board is committed to corporate governance practices that promote the long-term interests of our stockholders. The Board regularly reviews developments in corporate governance and updates the Company's corporate governance framework, including its corporate governance policies and guidelines, as it deems necessary and appropriate. Our policies and practices reflect corporate governance initiatives that comply with the listing requirements of the NYSE and the corporate governance requirements of the Sarbanes-Oxley Act of 2002. We maintain a corporate governance section on our website, which includes key information about our corporate governance initiatives including our Corporate Governance Guidelines, charters for the committees of the Board, our Code of Business Conduct and Ethics and our Code of Ethics for the Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. The corporate governance section can be found on our website at www.bhrreit.com by clicking the "INVESTOR" tab, then the "CORPORATE GOVERNANCE" tab and then the "Governance Documents" link.

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics applies to each of our directors and officers and employees. The term "officers and employees" includes individuals who: (i) are employed directly by us, if any (we do not currently employ any employees); or (ii) are employed by our advisor or its subsidiaries and: (a) have been named one of our officers by our Board; or (b) have been designated as subject to the Code of Business Conduct and Ethics by the legal department of our advisor. Among other matters, our Code of Business Conduct and Ethics is designed to deter wrongdoing and to promote:

•honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest;

•full, fair, accurate, timely and understandable disclosure in our reports filed with the SEC and our other public communications;

•compliance with applicable governmental laws, rules and regulations;

•prompt internal reporting of violations of the code to appropriate persons identified in the code;

•protection of Company assets, including corporate opportunities and confidential information; and

•accountability for compliance to the code.

Any waiver of the Code of Business Conduct and Ethics for our executive officers or directors may be made only by the Board or one of the Board committees and will be promptly disclosed if and to the extent required by law or stock exchange regulations.

Board Leadership Structure

The Board regularly considers the optimal leadership structure for the Company and its stockholders. In making decisions related to our leadership structure, the Board considers many factors, including the specific needs of the Company in light of its current strategic initiatives and the best interests of stockholders.

To further minimize the potential for future conflicts of interest, our bylaws and our Corporate Governance Guidelines, as well as the NYSE rules applicable to its listed companies, require that the Board must maintain a majority of independent directors at all times, and our Corporate Governance Guidelines require that if the Chairman of the Board is not an independent director, at least two-thirds of the directors must be independent. Currently, all of our directors other than Messrs. Monty J. Bennett and Richard J. Stockton are independent directors. The Board must also comply with each of our conflict of interest policies discussed in "Certain Relationships and Related Person Transactions-Conflict of Interest Policies." Our bylaw provisions, governance policies and conflicts of interest policies are designed to provide a strong and independent Board and ensure independent director input and control over matters involving potential conflicts of interest.