As filed with the Securities and Exchange Commission on June 29, 2023.

Registration No. 333-270486

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

AMENDMENT NO. 4

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

__________________________________________

Origin Life Sciences, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________

|

Delaware |

3845 |

27-3705184 |

||

|

(State or other jurisdiction of |

(Primary Standard Industrial |

(I.R.S. Employer |

2 Research Way, Third Floor

Princeton, NJ 08540

(609) 250-6000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

__________________________________________

Michael Preston

Chief Executive Officer

Origin Life Sciences, Inc.

2 Research Way, Third Floor

Princeton, NJ 08540

(609) 250-6000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

__________________________________________

With Copies To:

|

Leslie Marlow, Esq. |

Spencer G. Feldman, Esq. |

__________________________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|||

|

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|||

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED JUNE 29, 2023 |

Origin Life Sciences, Inc.

3,000,000 Shares

Common Stock

This is the initial public offering of our common stock. We are offering 3,000,000 shares of our common stock, par value $0.01 per share, at the assumed public offering price of $5.00 per share.

No public market currently exists for our common stock. We have applied to list our common stock for trading on NYSE American LLC (“NYSE American”) under the symbol “OLSI.” This offering is contingent upon receiving approval of our listing from NYSE American.

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See “Prospectus Summary — Implications of Being an Emerging Growth Company” for additional information.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page 17 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Per Share |

Total |

|||||

|

Public offering price |

$ |

$ |

||||

|

Underwriting discounts and commissions(1) |

$ |

$ |

||||

|

Proceeds, before expenses, to Origin Life Sciences, Inc. |

$ |

$ |

||||

____________

(1) We have agreed to pay the underwriters a cash fee equal to 7.0% of the aggregate gross proceeds from the sale of the common stock in this offering. Additionally, we have agreed to pay a non-accountable expense allowance and to reimburse the underwriters for certain expenses incurred by them in connection with this offering. See “Underwriting” beginning on page 140 of this prospectus for more information about the compensation payable to the underwriters, including warrants to purchase shares of our common stock.

We have granted the underwriters an option for a period of 45 days to purchase up to an additional 450,000 shares of common stock. If the underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be $1,207,500, and the total proceeds to us, before expenses, will be $16,042,500.

Delivery of the shares is expected to be made on or about , 2023.

Sole Book-Running Manager

Boustead Securities, LLC

Prospectus dated , 2023

Prototype of the U.S. version of our therapy delivery platform that was used in our dose-ranging clinical trial and in our proof-of-concept studies. THIS DEVICE IS CURRENTLY UNDER DEVELOPMENT. THE PROTOTYPE DEPICTED ABOVE IS IN THE PROCESS OF BEING REENGINEERED AND, THEREFORE, IS NOT THE DEVICE WE INTEND TO USE IN OUR PIVOTAL CLINICAL TRIAL.

|

Page |

||

|

1 |

||

|

12 |

||

|

15 |

||

|

17 |

||

|

57 |

||

|

58 |

||

|

59 |

||

|

61 |

||

|

62 |

||

|

65 |

||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

69 |

|

|

80 |

||

|

106 |

||

|

112 |

||

|

121 |

||

|

124 |

||

|

127 |

||

|

137 |

||

|

140 |

||

|

143 |

||

|

143 |

||

|

143 |

||

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES |

143 |

|

|

F-1 |

i

ABOUT THIS PROSPECTUS

We have not, and the underwriters have not, authorized anyone to provide any information to you or to make any representations other than those contained in this prospectus, any amendment or supplement to this prospectus, or in any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, and only under circumstances and in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date on the front cover of this prospectus regardless of the time of delivery of this prospectus or of any sale of common stock. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

Neither we nor the underwriters have taken any action to permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States.

For investors outside the United States: We have not, and the underwriters have not, done anything that would permit this offering or possession or distribution of this prospectus or any applicable free writing prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus and any applicable free writing prospectus must inform themselves, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus outside the United States.

This prospectus contains trade names, trademarks and service marks of other companies that are the property of their respective owners. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and TM symbols, but those references are not intended to indicate that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owners will not assert their rights, to these trademarks and trade names. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship by us of, these other companies.

ii

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before deciding to invest in our common stock, you should read this entire prospectus carefully, including the sections of this prospectus entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes included elsewhere in this prospectus.

Unless the context otherwise requires, references in this prospectus to the “Company,” “Origin,” “we,” “us” and “our” refer to Origin Life Sciences, Inc.

Our Business

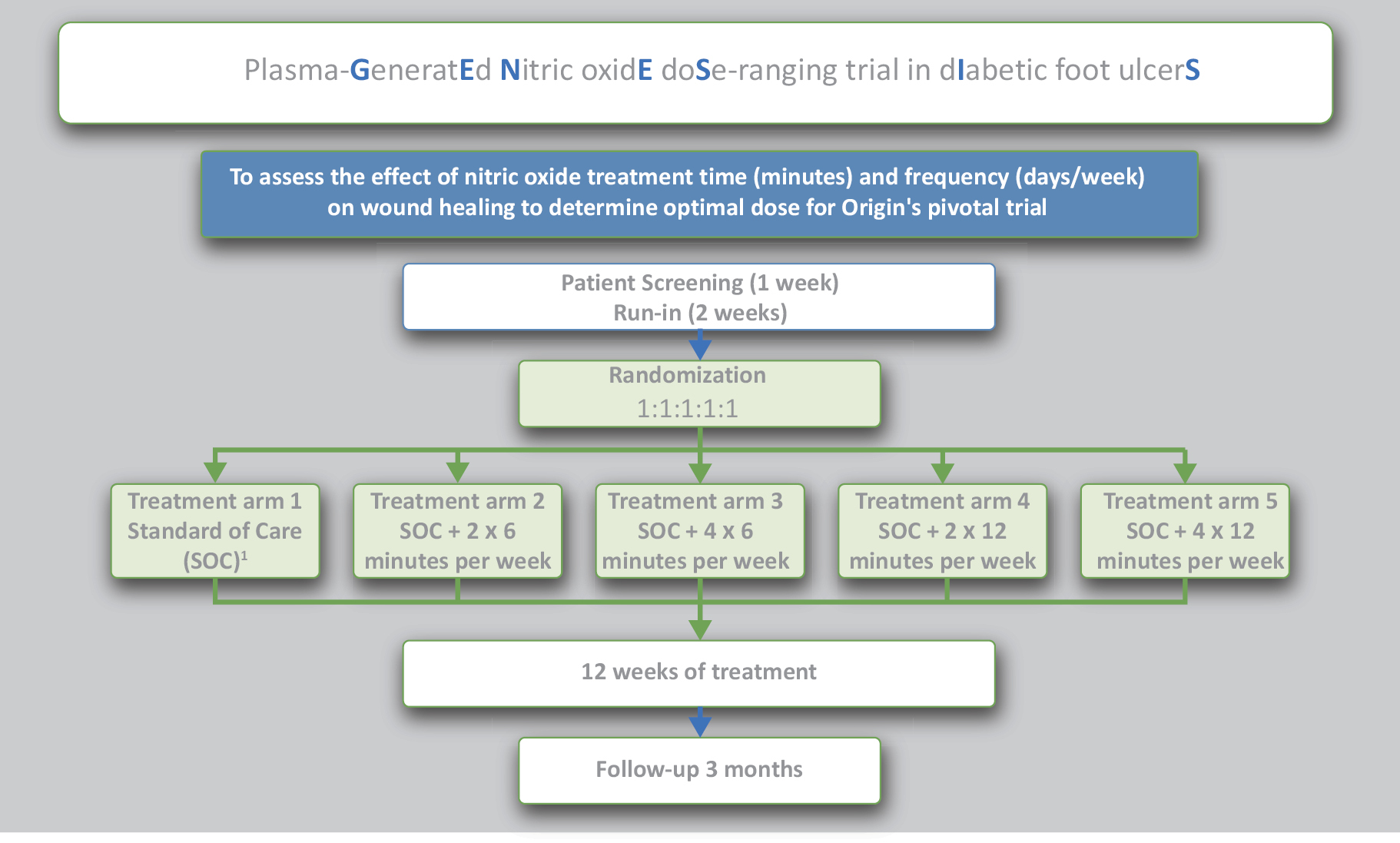

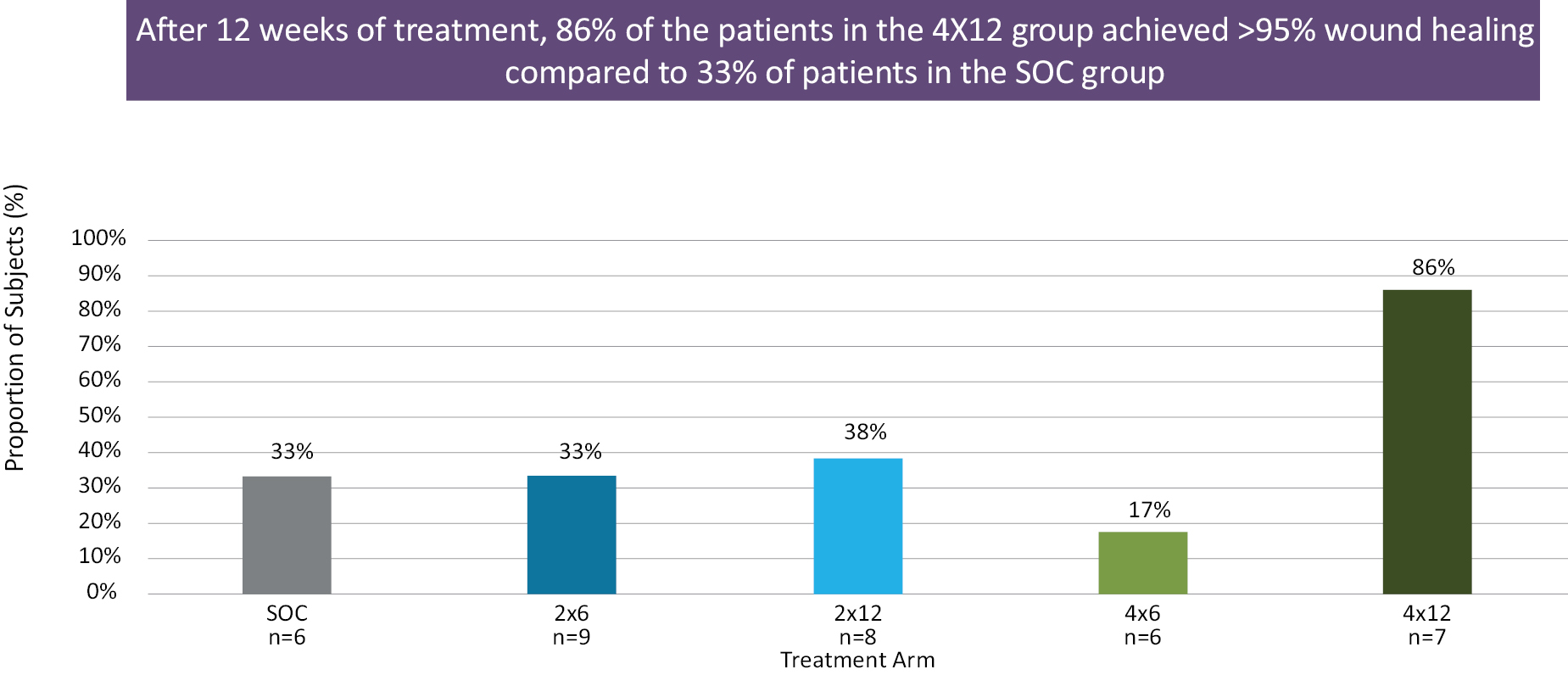

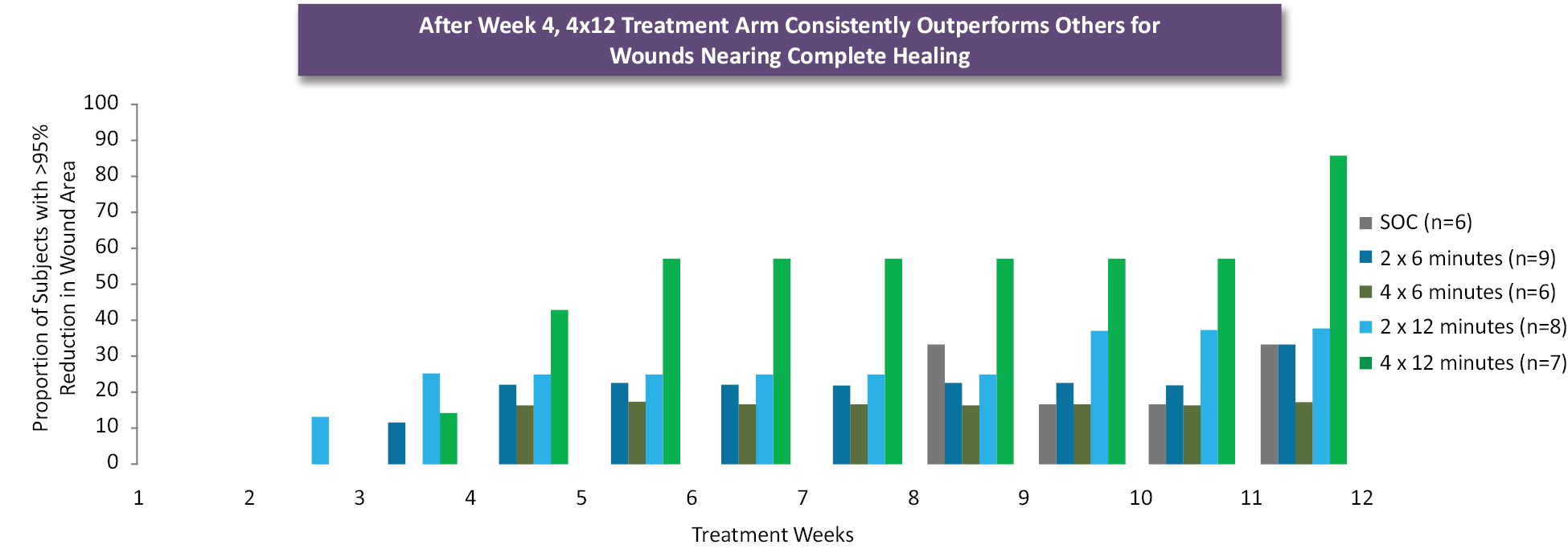

We are a clinical-stage biotechnology company that has been developing a proprietary patented high-energy plasma device that generates nitric oxide (“NO”) in the form of a plasma/NO stream and delivers it to targeted locations of the body. The stream can potentially be used for various therapeutic purposes, including as an anti-infective, anti-inflammatory and tissue-regenerative therapy for chronic wounds and skin and soft tissue infections (“SSTIs”). The U.S. Food and Drug Administration (the “FDA”) previously determined that our product will be a Class III medical device reviewed under a premarket approval (“PMA”) application with the FDA’s Center for Devices and Radiological Health (“CDRH”) consulting with the Center for Drug Evaluation and Research (“CDER”) as necessary. The cornerstone of the plasma/NO therapy is our patented delivery platform named “Ionojet” which allows us to turn atmospheric air into a plasma/NO stream that has been shown in investigations: (i) to be non-toxic, (ii) to generate NO activity up to 3 cm below the skin, and (iii) to stimulate sustained biological activity in tissue for up to an hour after delivery of the therapy. To date, our clinical activities have been focused on the clinical trials described below, including our dose-ranging feasibility clinical trial for the treatment of diabetic foot ulcers completed in 2018 using the plasma/NO stream generated from our Ionojet, and the preparation for our planned pivotal clinical trial, including finalization of the prototype of the Ionojet that we intend to use in our pivotal trial.

When used in this prospectus, the term “pivotal” trial is the clinical investigation intended to gather additional information about the safety and effectiveness of the Ionojet device that we believe will be the final clinical trial that will be required to support approval of a PMA for the device by the FDA for the treatment of diabetic foot ulcers. However, if the FDA should determine that such clinical trial (that we refer to as the pivotal trial) has not demonstrated reasonable assurance of the safety and effectiveness of the device, we may be required to conduct a further clinical trial to support approval of a PMA. Reference in this prospectus to the term “feasibility” trial refers to all clinical studies that precede the pivotal trial. Prior to commencing our pivotal trial in diabetic foot ulcers, we will need to submit, and receive approval of, a new Investigational Device Exemption (“IDE”) filing, permitting the use of the reengineered design of the Ionojet in a new clinical study. We anticipate that we will be able to submit the new IDE approximately six months after consummation of this offering and that it will take approximately three months after submission of the IDE to receive approval thereof from the FDA. After receiving approval of the new IDE, we expect that it will take approximately three months to commence the pivotal trial, which will require Institutional Review Board (“IRB”) approval of the study, identification and initiation of clinical trial sites and patient recruitment activities. We do not believe that the modifications to the device or the requirement to submit, and receive approval of, a new IDE has had, or will have, an effect on our expected timeline for commencement of the pivotal trial.

We plan to seek premarket approval of the Ionojet from the FDA as a Class III medical device, assuming we are able to complete our pivotal trial and the data are favorable. If we are unable to complete our pivotal trial or, upon completion of the trial, the outcomes of the trial design are not met, we may not be able to seek premarket approval of the Ionojet. We expect to submit our PMA application in the second quarter of 2024 and the FDA’s review of the PMA can range from 6 to 15 months depending on whether the FDA raises significant issues, including the need for additional trials, during its interactive review. There is no assurance that the FDA will approve a PMA in our anticipated timeline after completion of the planned pivotal trial, if at all. If we receive premarket approval from the FDA of our technology for the treatment of diabetic foot ulcers, our goal is to market our technology to hospitals, wound clinics and private podiatrist offices to treat diabetic foot ulcers and to generate revenue by charging for the device on a usage basis. We do not intend to generate revenue from the sale of the Ionojet device, of which we intend to retain ownership. In addition to wound healing, we believe that our technology has application in many additional indications including dermatology, infection control, podiatry, dentistry, pain and inflammation and cosmetics, as well as potentially in certain respiratory infections, both viral and bacterial, oral infections, dental indications, ophthalmic

1

and facial applications and in topical indications, although to date the only pre-clinical and clinical studies we have conducted with our Ionojet device have been with regard to wound healing, and our pivotal clinical trial will focus solely on diabetic foot ulcers.

The plasma/NO stream generated by our device has the potential to promote healing in various ways as a result of the effect that NO has on immune system regulation, blood vessel regulation, tissue regeneration and defending against infection. In particular, NO represents a potential wound therapeutic agent due to its ability to regulate inflammation, increase blood flow, decrease blood pressure, eradicate bacterial infections, and promote the growth and activity of immune cells. Since the plasma/NO stream has been shown in investigations to generate NO activity up to 3 cm below the skin, we believe that the delivery of the NO via plasma energy allows the NO to pass through the skin and locally saturate the tissue and that this saturation enhances the NO pathways already present in the human body.

We believe that our therapy is novel in that it is intended to simultaneously both disinfect and promote the healing of infected wounds. We also are not aware of any currently approved technology to deliver site-specific and therapeutically relevant concentrations of NO to skin and soft tissue, as well as to joints and muscles, leading to significantly-increased levels of NO as much as three centimeters beneath the skin. We believe we are the furthest along in the clinical development of a therapy of this kind. We are continuing to explore and effect functional and aesthetic improvements to the device to meet the expectations of the U.S. market prior to commercial deployment and intend to use a portion of the proceeds of this offering to implement such improvements to our Ionojet technology and prepare for the submission of a new IDE for our pivotal trial in diabetic foot ulcers. However, the FDA may require additional trials, and there is no assurance that the FDA will approve a PMA in our anticipated timeline after completion of the planned pivotal trial, if at all.

We are a clinical-stage biotechnology company with a limited operating history. We also have a history of operating losses and expect to continue to incur substantial losses for the foreseeable future. Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern. Our cash and the proceeds of this offering will only fund our operations for a limited time. The proceeds from this offering will be insufficient to allow us to fully fund completion of our pivotal clinical trial and the premarket approval process, which we estimate will cost $30 million in total. In addition, the FDA may require additional trials which will require additional funding. We will need to raise additional capital to commence and complete the pivotal clinical trial.

The following is a summary of the medical fields within which we intend to explore the use of the therapy generated by the Ionojet device, or in certain fields, by adaptations to the reengineered Ionojet. It is anticipated that for all of the fields set forth below our reengineered Ionojet device will be used to generate a plasma/NO stream to be delivered topically to the patient, with the exception of the treatment of dental infections and upper respiratory infections, which will require adaptations to the reengineered Ionojet.

• Wounds — Our initial objective is to seek regulatory approvals for the use of our therapy to treat patients suffering from diabetic foot ulcers. At this time, we have completed the feasibility studies for the treatment of diabetic foot ulcers. An IRB approved observational study evaluating the promotion of wound-healing and control of infection in the treatment of various chronic wounds, including diabetic foot ulcers, was completed in 2013. We intend to evaluate the possible use of our therapy to treat other wounds including but not limited to acute wounds, venous leg ulcers, pressure ulcers, post-surgical wounds, thermal burns and radiation burns.

• Anti-infective — We believe that our therapy has the potential to be used as an anti-infective and we plan to investigate the treatment of various infected conditions including but not limited to onychomycosis (toenail fungus), surgical site infections and chronic infections. Infected pacemaker and defibrillator implant wounds and infected orthopaedic implant wounds were the subject of two IRB approved observational studies to examine the effect of plasma/NO in treating these infections.

• Dermal Therapeutics — We believe that our therapy has the potential to be used as a treatment for various dermatological conditions, including but not limited to chronic papulopustular and conglobate acne, cellulitis and plantar and viral warts. At this time, we have not completed any feasibility studies for such treatment, but we anticipate that we will be able to rely upon the safety and early feasibility studies that have been conducted to date using the Ionojet device, assuming that the Ionojet device is approved by the FDA for the treatment of diabetic foot ulcers.

2

• Musculoskeletal — We intend to explore the treatment of various musculoskeletal conditions, including but not limited to rheumatoid arthritis, an autoimmune and inflammatory disease, osteo-arthritis, tendinitis, fasciitis and sports injuries. At this time, we have not completed any feasibility studies for such treatment, but we anticipate that we will be able to rely upon the safety and early feasibility studies that have been conducted to date using the Ionojet device, assuming that the Ionojet device is approved by the FDA for the treatment of diabetic foot ulcers.

• Cosmetic — We intend to explore the use of our therapy for various cosmetic applications, including but not limited to treatment of alopecia. At this time, we have not completed any feasibility studies for such treatment, but we anticipate that we will be able to rely upon the safety and early feasibility studies that have been conducted to date using the Ionojet device, assuming that the Ionojet device is approved by the FDA for the treatment of diabetic foot ulcers.

• Dental Infections — We intend to explore the use of our therapy, employing an adaptation of the reengineered Ionojet device, for various dental indications, including but not limited to periodontitis, gingivitis, implantitis and surgical extraction infections. At this time, we have not completed any feasibility studies for such treatment.

• Respiratory Tract Infections — We intend to explore the treatment of various viral and bacterial upper respiratory infections using an adaptation of the reengineered Ionojet device. At this time, we have not completed any feasibility studies for such treatment.

To market additional indications, we will need to obtain a new premarket authorization from the FDA specific to each indication. At this time, we are unable to determine the device class or regulatory pathway for each indication. The type of FDA authorization required for each indication — i.e., 510(k) clearance, de novo classification, a PMA, or a supplement to our original PMA — will depend on factors such as the risk classification of the new indication and the classification of previously authorized technologies. We anticipate that the pilot studies and studies for safety that we have conducted to date for the Ionojet device will be applicable to each of the indications in the chart above. Therefore, subject to the availability of additional financing, we intend to commence feasibility studies to evaluate the effectiveness of the plasma/NO stream for the treatment of each of these indications, assuming we receive FDA approval of our Ionojet device for the treatment of diabetic foot ulcers.

Planned Pivotal Clinical Trial

We have been working on preparations for our planned pivotal trial in diabetic foot ulcers, upon which FDA approval will primarily be based. While we believe this will be the final clinical trial that will be required to support approval of a PMA for the Ionojet device by the FDA for the treatment of diabetic foot ulcers, we may be required to conduct additional trials to support approval of a PMA if the FDA should determine that the results of our planned pivotal trial have not demonstrated reasonable assurance of the safety and effectiveness of the device. These preparations fall into three areas: (i) modifications to the Ionojet technology, (ii) medical, and (iii) administrative. The following is a summary:

(i) One of the purposes of a feasibility trial is to determine what modifications need to be made to a device prior to a pivotal trial, since the pivotal trial should be carried out with the form of the device that will be marketed post-approval. From clinician feedback and our own observations, we were able to identify several desirable changes that we believe will enhance commercial adoption, and we have been working on the reengineered design of our device in our own facility. We have made what we believe are significant improvements to our Ionojet technology, all of which we are seeking to protect with new U.S. and international patent filings. When these improvements have been completed, which is expected in mid-2023, and subject to the availability of adequate funding and FDA approval of a new IDE for our pivotal trial in diabetic foot ulcers for the device with the modifications, we will look to commence the production of devices for our planned pivotal trial.

(ii) Medically, we have started work on the study design and protocol for our pivotal trial. There are several important decisions to be made about the design of the study, including the dose or doses to be studied. Subject to FDA approval of our protocol, we intend to employ an adaptive study design for the pivotal trial, under which our targeted delta, or superiority over standard of care (“SoC”) will not be finalized until we have seen the early results from the treatment arms.

3

(iii) Administratively, we expect to begin identifying clinical sites and investigators for the pivotal trial and assembling the appropriate advisory and review panels in early 2023. The timing of the pivotal trial is dependent on the availability of adequate financing and regulatory approval to conduct the study.

Market Opportunity

Current Indications

Our initial objective is to seek regulatory approvals for our therapy to address the unmet needs of patients suffering from chronic wounds and SSTIs. As discussed, the observational, IRB approved study conducted by Dr. Treadwell in 2013 evaluated the promotion of wound-healing and control of infection in the treatment of various chronic wounds. Dr. Treadwell is a qualified wound surgeon who is expected to serve as our Chief Clinical Officer commencing at some time shortly prior to or upon the consummation of this offering. According to an article published by Fortune Business Insights entitled Chronic Wound Care Market Size, Share & COVID-19 Impact Analysis (March 2022), the chronic wound care market was estimated at $11.61 billion in 2021, of which an estimated $4.4 billion was attributable to North America. The global chronic wound care market is projected to grow from $12.36 billion in 2022 to $19.52 billion by 2029, exhibiting a compound annual growth rate (“CAGR”) of 6.7% during the forecast period. Diabetic foot ulcers comprise 43.1% of the global chronic wound care market, as reported by the same article.

In the United States, the treatment market size for SSTIs, also referred to as acute bacterial skin and skin structure infections (ABSSSI) by the FDA, was valued at $7.3 billion in 2018 and is projected to reach $14.9 billion by 2026, exhibiting a CAGR of 9.5%, as reported by Fortune Business Insights in an article entitled Acute Bacterial Skin and Skin Structure Infections (ABSSSI) Treatment Market Size, Share and Industry Analysis (July 2019).

We initially plan to focus on the diabetic foot ulcer treatment market. According to a report published by GlobeNewswire on July 20, 2022, the global diabetic foot ulcer treatment market was valued at $8.6 billion in 2021 and is projected to reach $14.8 billion by 2030. The North American diabetic foot ulcer treatment market reached $3.8 billion in 2021, contributing to the highest market share that year. In due course we may also look to secure regulatory approval and market our therapy for chronic wounds outside the United States in partnership with local organizations. In the meantime, and in parallel with our pivotal trial on diabetic foot ulcers, we plan, subject to available capital resources, to broaden our approach into other therapeutic areas and, prior to that, to conduct confirmatory pre-clinical studies into blood-flow and infection-control.

The cost of the therapy to the patient is expected to be based upon the dose administered, as measured by frequency and duration of administration. Based upon the current costs associated with advanced wound therapy, we estimate that the reimbursed cost of the therapy administered using our Ionojet technology for diabetic foot ulcers will be approximately $10,000 per patient.

Our strategy is to undertake proof-of-concept work in other wound-healing indications as well as non-wound-healing areas. For the latter, we are looking at target indications in other treatment areas (known as verticals) such as dermatology, infection control, podiatry, dentistry, pain and inflammation and cosmetics, as we believe NO may have clinical relevance to all these verticals. By demonstrating our clinical relevance outside diabetic foot ulcers, we believe we can add greater shareholder value in a shorter timeframe. Selection of target indications will be made on the basis of such factors as market size, regulatory constraint, estimate of likely success and time to completion.

Initial proof-of-concept studies have been carried out under IRB approval in two important indications — infected pacemaker and defibrillator implant wounds (n=7) and infected orthopaedic implant wounds (n=8). Each study has been conducted by Dr. Treadwell as an observer initiated, open, non-controlled observational, IRB approved study to examine the effect of plasma/NO in treating patients with these conditions. Each study was the subject of a poster presented at conferences of the Symposium on Advanced Wound Care, one of the world’s leading wound care education organizations, in San Antonio, Texas in 2021, in Las Vegas, Nevada in 2022, and in National Harbor, Maryland in 2023. In the pacemaker and defibrillator study, seven patients were referred to Dr. Treadwell with infected pacemaker pockets. The therapy generated by the device was well-tolerated, and there were no adverse events reported during the study. All seven patients completed the protocol (clearance of the infection), with an average of ten weekly treatments, without removal of the implant.

4

This trial remains open for additional qualified patients.

In the orthopaedic implant study, eight patients were seen by Dr. Treadwell because of infected implanted orthopaedic hardware. The therapy generated by the device was well-tolerated, and there were no adverse events reported during the study. All eight patients completed the protocol (clearance of the infection), with an average of 22 weekly treatments, without removal of the hardware. This trial remains open for additional qualified patients. Additional studies are planned in onychomycosis (toenail fungus), radiation burns and sickle cell ulcers subject to available funding.

Future Indications

In addition, we intend to conduct clinical trials and seek regulatory approval for the use of the plasma/NO therapy generated by our device in the treatment of the indications listed below, each of which would increase our market opportunity, and, collectively, would increase our market opportunity even more. Although we have not conducted clinical trials for any of the following indications, we anticipate that we will be able to rely upon the safety and early feasibility studies that have been conducted to date using the Ionojet device for our clinical studies in the following indications, assuming that the Ionojet device is approved by the FDA for the treatment of diabetic foot ulcers.

Onychomycosis is a fungal infection that occurs in the fingernails or toenails. According to Verified Market Research, the U.S. onychomycosis market size was valued $2.9 billion in 2021 and is projected to reach $5.5 billion by 2023, growing at a CAGR of 8.6% from 2022 to 2030.

Surgical Site Infection — The global surgical site infection control market was valued at $4.2 billion in 2021 and is expected to reach a value of $5.51 billion by 2027, exhibiting a CAGR of 4.63% from 2021 to 2027, as reported by Research and Markets. It is estimated that 35% of the market’s growth will originate from North America during the forecasted period.

Acne — The United States acne treatment market was valued at $4.27 billion in 2021 and is projected to grow to $6.12 billion by 2029, exhibiting a CAGR of 4.5%, according to Fortune Business Insights.

Rheumatoid arthritis is an autoimmune and inflammatory disease, which means that your immune system attacks healthy cells in your body by mistake, causing inflammation in the affected parts of the body. Joints in the hands, wrists and knees are commonly affected by rheumatoid arthritis. An article by Persistence Market Research reports that the global revenue from the rheumatoid arthritis treatment market is valued at $42.9 billion in 2022, with the global market expected to grow at a CAGR of 5.7% to reach a value of approximately $79.1 billion by the end of 2033. The United States market accounts for approximately 39.8% (or approximately $17 billion) of the global market.

Tendonitis — According to a report by Grandview Research, the global market size for tendonitis, a condition when a tendon is inflamed, was valued at $199.6 billion in 2021 and is projected to grow at a CAGR of 2.7% from 2022 to 2030. In 2021, North America dominated the global market, accounting for the largest share of 43.4% of the overall revenue, or approximately $86.6 billion.

Alopecia is a disease that develops when the body attacks its own hair follicles (where hair grows from), which can cause hair loss anywhere on the body, although it often causes hair loss on the scalp. The global alopecia market revenue was valued at $8.379 billion in 2021, with more than 36.4% being attributed to North America, according to a report by Acumen Research and Consulting. The global alopecia market is expected to grow at a CAGR of 8.2% from 2022 to 2030, achieving a market size of $16.76 billion by 2030.

Periodontal diseases are mainly the result of infections and inflammation of the gums and bone that surround and support the teeth. In its early stage, called gingivitis, the gums can become swollen and red, and they may bleed. In its more serious form, called periodontitis, the gums can pull away from the tooth, bone can be lost, and the teeth may loosen or even fall out. Transparency Market Research reported that the global periodontal treatment market size was valued at $7.6 billion in 2021 and North America held the major market share in 2021.

Respiratory tract infection — The United States respiratory tract infection therapeutic market size was estimated at $9 billion in 2022 and is expected to reach $9.9 billion in 2023, projecting a growth at a CAGR of 8.42% to reach $17 billion by 2030, according to an article by Report Linker. Estimated annual costs for viral upper respiratory infections in the United States, not related to influenza, exceeds $22 billion.

5

Our Strategy

Our goal is to become the leading provider of topical NO treatments using our proprietary Ionojet device for various therapeutic purposes, including as an anti-infective, anti-inflammatory and tissue-regenerative therapy for chronic wounds and SSTIs.

Key elements of our strategy are as follows:

• Complete the final prototype of our Ionojet device. Based upon clinician feedback and the results of our feasibility trial, we were able to identify several desirable changes that we believe will enhance commercial adoption of the Ionojet, and we have been working on the reengineered design of our device in our own facility. We have made what we believe are significant improvements to our Ionojet technology, all of which we are seeking to protect with new U.S. and international patent filings, and which will require FDA approval of an IDE to initiate our pivotal clinical trial.

• Pivotal trial. Complete a pivotal clinical trial in diabetic foot ulcers and seek premarket approval of Ionojet from the FDA as a Class III medical device, utilizing a portion of the net proceeds of this offering and securing additional funding. The pivotal trial data, if favorable, will be the primary basis for FDA approval. Conversely, if the data are not favorable, then FDA approval is unlikely. However, the FDA may require additional trials, and there is no assurance that the FDA will approve a PMA in our anticipated timeline after completion of the planned pivotal trial, if at all.

• Create a commercial infrastructure for our product candidates. If the Ionojet is approved as a Class III medical device, we intend to hire and train a focused and dedicated team to launch the marketing of our product to hospitals, wound clinics and private podiatrist offices for the treatment of diabetic foot ulcers. We also intend to use a trained and dedicated team, and/or to enter into marketing partnerships, to launch the marketing of our Ionojet technology for any additional indications that may receive regulatory approval and any of our future product candidates.

• Expand indications for use. We believe that our technology has application in many indications in wound healing, as well as in dermatology, infection control, podiatry, dentistry, pain and inflammation and cosmetics. We believe that our technology could also have value in respiratory infections, both viral and bacterial, oral infections, dental indications, ophthalmic and facial applications and in topical indications where the modified stream allows greater comfort to the patient.

• Strategic Partnerships. We are exploring the possibility of entering into strategic partnering arrangements to provide further financing for our pivotal clinical trial and for formal clinical studies into other pipeline indications, to supplement the proceeds of this offering.

Competition

While we believe that our proprietary patented high-energy plasma device that generates NO in the form of a plasma/NO stream is the first technology of its kind in the United States market, we believe other companies developing different forms of NO therapies to treat diabetic foot ulcers to be our closest competitors. One such competitor, SaNOtize Research and Development Corp., based in Vancouver, Canada, is recruiting patients for a Phase I/II efficacy study to evaluate its NO releasing footbath as a treatment for diabetic foot ulcer. Edixomed Ltd., a United Kingdom company, is developing a NO generating gel wound dressing to treat diabetic foot ulcers.

Recent Developments

First Private Placement

On June 20, 2022, we commenced a private placement (the “Private Placement”) of up to $5,000,000 of convertible promissory notes, pursuant to which we issued: (i) convertible promissory notes in the principal aggregate amount of $450,000 on June 30, 2022; (ii) convertible promissory notes in the principal aggregate amount of $60,000 on August 16, 2022; (iii) convertible promissory notes in the principal aggregate amount of $725,000 on September 23, 2022; (iv) convertible promissory notes in the principal aggregate amount of $315,000 on October 25, 2022; (v) convertible promissory notes in the principal aggregate amount of $288,000 on November 30, 2022; and (vi) a convertible promissory note in the principal amount of $101,749.70 on December 21, 2022 (collectively, the “Private Placement Notes”). The promissory note issued

6

in December 2022 was pursuant to a Subscription Agreement that was executed on or before November 30, 2022. In total, the aggregate principal amount of the Private Placement Notes issued in the Private Placement is $1,939,749.70, pursuant to which we received net proceeds of approximately $1,600,000. The Private Placement has terminated. The Private Placement Notes bear interest at 6% per annum and mature three years from the date of issuance. The principal amount due under the Private Placement Notes will be automatically converted into shares of our common stock upon the effectiveness of the registration statement of which this prospectus is a part, with all accrued interest under the Private Placement Notes waived upon conversion pursuant to the terms thereof. The Private Placement Notes are convertible into shares of common stock at a conversion price equal to the quotient obtained by dividing (i) the entire principal amount of the Private Placement Notes plus (if applicable) any accrued but unpaid interest under the Private Placement Notes by (ii) 50% of the initial offering price per share. The holders of the Private Placement Notes are prohibited from converting the Private Placement Notes if such conversion would result in a holder owning in excess of 4.99% of our outstanding common stock. The holders of the Private Placement Notes have agreed not to publicly sell or assign such common stock for a period of 180 days following completion of this offering.

Boustead Securities, LLC, the sole book-running manager of this offering, acted as the placement agent for the Private Placement and received a placement fee equal to 7.0% of the gross proceeds received by us from the sale of the Private Placement Notes, a non-accountable expense allowance equal to 1.0% of the gross proceeds received by us from the sale of the Private Placement Notes and five-year warrants to purchase shares of our common stock at an exercise price of $7.50 per share in an amount equal to 7.0% of the shares of common stock underlying the Private Placement Notes. See “Underwriting — Prior Relationship with Boustead Securities, LLC” for more information.

Second Private Placement

In May 2023, we commenced a private placement offering of up to 425,000 shares of our common stock at a purchase price of $2.00 per share (the “Second Private Placement”). As of June 29, 2023, nine accredited investors, all of whom had a pre-existing relationship with us and/or Boustead Securities, LLC, purchased an aggregate of 397,300 shares of common stock in the Second Private Placement for gross proceeds to us of $794,600 (net proceeds of $706,032). We have received indications of interest from an additional two accredited investors, both of whom had a pre-existing relationship with us, pursuant to which we will issue an aggregate of 27,500 shares upon receipt of subscription proceeds in the aggregate amount of $55,000.

Boustead Securities, LLC, the sole book-running manager of this offering, acted as the placement agent for the Second Private Placement and received a placement fee equal to 7.0% of the gross proceeds received by us from the sale of the shares of common stock and a non-accountable expense allowance equal to 1.0% of the gross proceeds received by us. See “Underwriting — Prior Relationship with Boustead Securities, LLC” for more information.

Amendments to Certificate of Incorporation

On March 1, 2023, we filed a certificate of revival (the “Certificate of Revival”) to reinstate our amended and restated certificate of incorporation, as amended (the “Amended and Restated Certificate of Incorporation”), and to change the name of our corporation to Origin Life Sciences, Inc.

On March 8, 2023, we filed a certificate of amendment (the “March Certificate of Amendment”) to our Amended and Restated Certificate of Incorporation for purposes of providing for the conversion of all outstanding shares of our special voting common stock (the terms of which are described under “Description of Securities — Summary of Charter and Bylaws In Effect Prior to Completion of this Offering — Common Stock and Special Voting Common Stock”) to common stock effective immediately upon filing thereof. Upon filing of the March Certificate of Amendment, all 8,936,000 outstanding shares of our special voting common stock were converted into 8,936,000 shares of our common stock.

On March 8, 2023, we filed a certificate of elimination (the “Certificate of Elimination”) of our Series A 8% Convertible Preferred Stock (the “Series A Preferred Stock”), at which time the 30,000 shares that had been designated as Series A Preferred Stock were returned to the status of authorized but unissued shares of our preferred stock.

On April 28, 2023, we filed a certificate of amendment to our Amended and Restated Certificate of Incorporation for purposes of increasing the authorized shares of our common stock to two hundred million (200,000,000) and, immediately thereafter, we filed another certificate of amendment to our Amended and Restated Certificate of Incorporation for purposes of effecting a two hundred (200) for one (1) forward stock split of our outstanding shares of common stock such that, upon the filing thereof, each issued and outstanding share of our common stock was subdivided and reclassified into two hundred (200) validly issued, fully paid and non-assessable shares of our common stock.

7

Financial Advisor Retention

The Life Sciences Division Ltd, a financial institution regulated by the Financial Conduct Authority in the United Kingdom, has been retained by us to provide advisory services. The Life Sciences Division Ltd, may be paid advisory fees in connection with this offering in the total amount of 5% of the gross proceeds received from investors in this offering referred by The Life Sciences Division Ltd. The Life Sciences Division Ltd is not a member of the Financial Industry Regulatory Authority. A portion of the advisory fees payable to The Life Sciences Division Ltd (2% of the gross proceeds received from investors in this offering referred by The Life Sciences Division Ltd) will be paid out of the underwriting commissions payable to the underwriters for this offering and 3% of the gross proceeds received from investors in this offering referred by The Life Sciences Division Ltd will be paid by us.

Summary of Risks Associated with Our Business

Our business is subject to numerous risks and uncertainties, including those highlighted in the section entitled “Risk Factors” immediately following this prospectus summary. These risks include, among others, the following:

Risks Related to Our Financial Position and Need for Capital

• We are a clinical-stage biotechnology company that has generated losses from operations;

• We are a clinical-stage company and to date we have not commercialized our medical technology;

• We have a history of operating losses;

• We have a relatively limited operating history and may not be able to execute on our business strategy;

• Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern;

• We believe that the proceeds of this offering, combined with our very limited funds currently on hand, will only be sufficient for us to operate for a relatively limited amount of time; and

• We expect to derive all our revenues from our principal technology.

Risks Related to Product Development, Regulatory Approval, Manufacturing and Commercialization

• The regulatory approval process is expensive, time-consuming and uncertain;

• We may be unable to complete our clinical trials, and the data generated may not support FDA approval;

• We may fail to obtain and maintain necessary marketing authorizations from regulatory authorities;

• New or reformed legislation and regulations may make it difficult to obtain marketing authorization;

• After approval of Ionojet, Ionojet will remain subject to ongoing regulatory obligations and review;

• The device used in our clinical trials is not the same device that we plan to use in our pivotal trial;

• Modifications to our products may require new marketing authorizations;

• Environmental and health safety laws may result in liabilities, expenses and restrictions on our operations;

• Delays or failures in our clinical trials or investigations may prevent us from commercializing products;

• Our facilities are subject to regulation under the FDCA and FDA implementing regulations;

• We and our manufacturers are subject to extensive post-market regulation;

• Disruptions at the regulatory agencies could negatively impact our business;

• If we are found to have improperly promoted off-label uses, we may become subject to significant liability;

• Our business is subject to U.S. and foreign laws and regulations regarding privacy and data protection;

• If the third-parties or consultants do not successfully carry out their contractual duties, we may be unable to obtain regulatory approval for our product candidates;

• Data obtained from clinical trials are susceptible to varying interpretations or may be unfavorable;

• If the third-parties we rely upon fail to comply with stringent regulations, we may face delays;

• We may be required to redesign the device, and we may have insufficient resources to do so;

• Our Ionojet platform may contain undetected errors;

• We face intense competition, and we may not be able to compete in our industry;

• The continuing development of our products depends upon strong working relationships with physicians;

• It may be difficult for us to establish market acceptance of our therapy;

• If we fail to respond quickly to technological developments, our therapy may become uncompetitive;

• Developing medical technology entails significant technical, regulatory and business risks;

• Complaints or negative reviews about us or our technology could harm our reputation and brand;

• Healthcare regulatory reform may affect our ability to sell our products profitably;

8

• Product liability suits could be brought against us;

• Delays in the enrollment of patients in our clinical trials could increase costs and cause delays;

• If serious adverse effects are identified with respect to any of our product candidates or any of our approved products, we may need to modify or abandon our development of that product candidate;

• If we violate healthcare fraud and abuse laws we may be subject to penalties;

• Our ability to generate revenue will be diminished if we are unable to obtain adequate prices for the therapy; and

• The size and expected growth of our available market has not been established with precision.

Risks Related to Our Intellectual Property

• Our failure to maintain intellectual property would materially impact our business plan;

• Costly litigation may be necessary to protect our intellectual property rights;

• Involvement in opposition proceedings in foreign countries, may require spending of substantial sums and management resources; and

• Confidentiality agreements may not adequately prevent disclosure of trade secrets.

Risks Related to Our Industry

• We intend to utilize third-party providers which could delay or limit our ability to generate revenue;

• Our employees, independent contractors, consultants, commercial partners and vendors may engage in misconduct or other improper activities;

• If we are unsuccessful in establishing a marketing team for Ionojet, our revenue and profits will be limited;

• We may rely on collaborations and license arrangements with third parties to commercialize, market and promote our marketed products which may limit our ability to generate revenue;

• Our reliance on vendors in foreign countries, including China, subjects us to risks and uncertainties;

• International trade disputes could result in tariffs and other protectionist measures;

• The COVID-19 global health crisis may impact our planned operations, including our pivotal clinical trial;

• Our actual or perceived failure to comply with consumer protection laws could harm our business;

• Technological change may adversely affect commercialization of our products; and

• Consolidation in the medical device industry could have an adverse effect on our business.

Risks Related to Ownership of Our Common Stock

• An active public trading market for our common stock may not develop or be sustained;

• We cannot be assured that we will be able to maintain our listing on NYSE;

• Our stock price may be extremely volatile;

• Stock prices in recent initial public offerings have been volatile;

• If analysts do not publish favorable reports about us, our stock price could decline;

• After this offering, our officers, directors, and principal stockholders will continue to exercise significant control over our Company;

• Future sales of common stock could depress the market price of our common stock;

• The offering price of the shares and the other terms of the initial public offering have been determined through negotiations between us and the underwriter;

• New investors will experience dilution;

• Our ability to use our net operating losses and carryforwards may be limited;

• Our second amended and restated charter documents, to be in effect prior to the effectiveness of this offering, will have anti-takeover provisions and provide for Delaware Chancery Court as the exclusive forum;

• Our management has broad discretion in the use of the net proceeds from this offering;

• Certain of our related parties will directly benefit from the proceeds of this offering;

• Claims for indemnification by our directors and officers may reduce our available funds;

• We do not intend to pay dividends in the foreseeable future;

• We will incur significant increased costs as a result of operating as a public company; and

• We are an emerging growth company and smaller reporting company and as such we have reduced disclosure requirements, which may make our common stock less attractive to investors.

9

General Risk Factors

• Our performance will depend on the continued engagement of key members of our management team;

• If we are not able to attract and retain highly-skilled personnel our business could be harmed;

• We may experience difficulties in managing the growth of our organization;

• If product liability lawsuits are brought against us, we may incur substantial liabilities;

• Our business and operations would suffer in the event of computer system failures;

• Any failure to maintain the information security could expose us to litigation or government action;

• Joint ventures or investments in other companies or technologies could harm our business; and

• Declining general economic or business conditions may have a negative impact on our business.

Corporate History and Information

We were incorporated as a Delaware corporation on June 14, 2010 under the name Plasma Jet Technologies, Inc. and on September 18, 2014 we changed our name to Advanced Plasma Therapies, Inc. pursuant to an amended and restated certificate of incorporation. On October 8, 2015, we filed a certificate of amendment changing our name to Origin, Inc. On March 1, 2023, we filed a Certificate of Revival to reinstate our Amended and Restated Certificate of Incorporation and to change the name of our corporation to Origin Life Sciences, Inc. References to Origin Life Sciences, Inc. also include references to our wholly owned subsidiaries: (i) Advanced Plasma Therapies, Inc., incorporated in Delaware; (ii) Origin Life Sciences Limited, incorporated in England and Wales; and (iii) Origin Agribusiness Limited, incorporated in England and Wales. On April 28, 2023, we increased the authorized shares of our common stock to two hundred million (200,000,000) and, immediately thereafter, effected a two hundred (200) for one (1) forward stock split of our outstanding shares of common stock, pursuant to the filing of two certificates of amendment to our Amended and Restated Certificate of Incorporation.

Our principal executive offices are located at 2 Research Way, Third Floor, Princeton, NJ 08540, and our telephone number is 610-250-6000. Our website address is www.originww.com. The information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock.

Implications of Being an Emerging Growth Company and a Smaller Reporting Company

We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). For as long as we remain an emerging growth company, we may take advantage of specified reduced reporting requirements and other burdens that are otherwise applicable generally to other public companies. These provisions include, but are not limited to:

• Reduced obligations with respect to financial data, including presenting only two years of audited financial statements and selected financial data, and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure in our initial registration statement;

• an exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act of 2002, as amended (“SOX”);

• reduced disclosure about executive compensation arrangements in our periodic reports, registration statements and proxy statements; and

• exemptions from the requirements to seek non-binding advisory votes on executive compensation or stockholder approval of any golden parachute arrangements.

We may take advantage of some or all of these provisions until we are no longer an emerging growth company. We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year following the fifth anniversary of the completion of this offering, (ii) the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion, (iii) the date on which we have, during the immediately preceding three-year period, issued more than $1.0 billion in non-convertible debt securities and (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission (the “SEC”). We may choose to take advantage of some but not all of these reduced burdens. For example, we have taken advantage of the reduced reporting requirements with respect to disclosure regarding our executive compensation arrangements, have presented only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure in this

10

prospectus, and have taken advantage of the exemption from auditor attestation on the effectiveness of our internal control over financial reporting. To the extent that we take advantage of these reduced burdens, the information that we provide stockholders may be different than you might obtain from other public companies in which you hold equity interests.

In addition, the JOBS Act permits emerging growth companies to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to use this extended transition period. As a result of this election, our timeline to comply with new or revised accounting standards will in many cases be delayed as compared to other public companies that are not eligible to take advantage of this election or have not made this election. Therefore, our financial statements may not be comparable to those of companies that comply with the public company effective dates for these accounting standards.

We are also a “smaller reporting company” as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and have elected to take advantage of certain of the scaled disclosures available to smaller reporting companies. To the extent that we continue to qualify as a “smaller reporting company” as such term is defined in Rule 12b-2 under the Exchange Act, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an “emerging growth company” may continue to be available to us as a “smaller reporting company,” including exemption from compliance with the auditor attestation requirements pursuant to SOX and reduced disclosure about our executive compensation arrangements. We will continue to be a “smaller reporting company” until we have $250 million or more in public float (based on our common stock) measured as of the last business day of our most recently completed second fiscal quarter or, in the event we have no public float (based on our common stock) or a public float (based on our common stock) that is less than $700 million, annual revenues of $100 million or more during the most recently completed fiscal year.

11

Share information presented below reflects a 200-for-1 forward stock split of our common stock, which was effected on April 28, 2023.

|

Common stock offered by us |

3,000,000 shares |

|

|

Common stock outstanding immediately before this offering |

39,993,900 shares (as of June 29, 2023) |

|

|

Common stock to be outstanding immediately after this offering |

|

|

|

Option to purchase additional shares |

We have granted the underwriters an option for a period of 45 days from the date of this prospectus to purchase up to 450,000 additional shares of common stock from us. |

|

|

Use of proceeds |

We estimate that the net proceeds to us from this offering before making the payments set forth below will be approximately $12.8 million, or approximately $14.9 million if the underwriters exercise in full their option to purchase additional shares of common stock, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, based on an assumed initial public offering price of $5.00 per share. |

|

|

We intend to use a portion of the net proceeds from this offering as follows: (i) approximately $3,000,000 to fund our ongoing clinical program for Ionojet, of which approximately $2,200,000 will be used for completion of the reengineered design of the Ionojet technology and submission of a new IDE for our pivotal trial in diabetic foot ulcers; (ii) $1,699,452 for the redemption of all outstanding shares of the Series B Preferred Stock, including accumulated dividends calculated through June 30, 2023, which amount may be increased by a premium payment up to an additional $1 million pursuant to the terms of an agreement with the holder of the Series B Preferred Stock if the net proceeds of the initial public offering exceed $15 million; (iii) $399,383 in full satisfaction of the amount owed under the LFEIF Note, including interest calculated through June 30, 2023, the terms of which are described under “Description of Securities — Convertible Promissory Notes”; (iv) approximately $135,000 in repayment of loans which will be repaid to related parties; (v) approximately $937,000 in payment of deferred salaries in cash, calculated through June 30, 2023, over the 18 months subsequent to this offering, of which approximately $405,500 will be paid to related parties; (vi) approximately $300,000 in advisory fees to be paid in connection with this offering (see “Advisors”), which represents 3% of the gross proceeds expected to be raised by the Advisors; (vii) approximately $613,000 of prior periods’ accounts payable; and (viii) the balance for working capital, research and development and other general corporate purposes, which may include the acquisition or licensing of other products, businesses or technologies. See “Use of Proceeds” for additional information. |

12

|

Representative’s warrants |

The registration statement of which this prospectus is a part also registers for sale warrants (the “Representative’s Warrants”) to purchase shares of our common stock that we will issue to Boustead Securities, LLC, as the representative of the underwriters (the “Representative”), as a portion of the underwriting compensation payable to the underwriters in connection with this offering. The Representative’s Warrants are exercisable commencing six months after the date of effectiveness of the registration statement of which this prospectus forms a part and will be exercisable for a period of five years from such effective date at an exercise price equal to 125% of the initial public offering price of the common stock. Please see “Underwriting — Representative’s Warrants” for a description of the Representative’s Warrants. |

|

|

Risk factors |

See “Risk Factors” beginning on page 17 and the other information included in this prospectus for a discussion of factors you should consider carefully before deciding to invest in our common stock. |

|

|

Proposed NYSE American symbol |

We have applied to list our common stock for trading on NYSE American under the symbol “OLSI.” This offering will not be consummated until we have received NYSE American’s approval of our application for the listing of our common stock. No assurance can be given that our application will be approved. |

Unless otherwise stated in this prospectus, the number of shares of common stock to be outstanding after this offering, is based on 39,993,900 shares of common stock outstanding as of June 29, 2023, and includes:

• the conversion of the remaining outstanding Private Placement Notes, in the principal amount of $1,939,749.70, into an aggregate of 775,900 shares of common stock at a conversion price of $2.50 per share, which is 50% of the assumed initial public offering price of $5.00 per share, upon the effectiveness of the registration statement of which this prospectus is a part;

• the sale of 3,000,000 shares of common stock in this offering, assuming an initial public offering price of $5.00 per share of common stock;

• the issuance of 91,880 shares of common stock in repayment of an aggregate of $459,400 of outstanding loans pursuant to agreements with the holders of such loans upon consummation of this offering; and

• the issuance of 62,400 shares of common stock in consideration for $312,000 of outstanding accounts payable upon consummation of this offering;

and such number of shares to be outstanding after this offering excludes the following:

• 4,585,200 shares of common stock issuable upon the exercise of outstanding stock options at a weighted-average exercise price of $2.28 per share;

• 2,866,600 shares of common stock issuable upon the exercise of outstanding warrants at a weighted-average exercise price of $2.62 per share;

• 1,990,400 shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan (the “2014 Plan”), which shares will no longer be available for future issuance upon the effectiveness of the 2023 Stock Incentive Plan (the “2023 Plan”);

• 5,000,000 shares of common stock, which will be reserved for future issuance under the 2023 Plan upon the effectiveness thereof;

13

• 18,104 shares of common stock issuable upon exercise of outstanding warrants issued to Boustead Securities, LLC, as placement agent for the Private Placement;

• 180,000 shares of common stock (or 207,000 shares of common stock if the underwriters exercise their over-allotment option in full) issuable upon exercise of the Representative’s Warrants, which are expected to be issued to the Representative in connection with this offering;

• 1,174,379 shares of common stock issuable upon the exercise of warrants to be issued in exchange for deferred salaries and bonuses to officers and current and former employees in the aggregate amount of $5,871,884 upon consummation of this offering;

• 225,810 shares of common stock issuable upon the exercise of warrants to be issued in exchange for accrued consulting fees and commissions in the aggregate amount of $1,129,049 upon consummation of this offering;

• 72,000 shares of common stock issuable upon the exercise of warrants to be issued in exchange for $360,000 of deferred director fees upon consummation of this offering;

• 10,000 shares of common stock issuable upon the exercise of a warrant to be issued in exchange for $50,000 of outstanding accounts payable upon consummation of this offering; and

• 27,500 shares of common stock to be issued in the Second Private Placement upon receipt by us of an aggregate of $55,000 of subscription proceeds for which we have received indications of interest.

Unless otherwise indicated, all information in this prospectus assumes and reflects the following:

• The automatic conversion of the Private Placement Notes upon the effectiveness of the registration statement of which this prospectus is a part, in the amount of $1,939,749.70, into an aggregate of 775,900 shares of our common stock, at a conversion price of $2.50 per share, which is 50% of the assumed initial public offering price of $5.00 per share;

• The redemption of 10,000 shares of Series B 20% Preferred Stock (the “Series B Preferred Stock”) outstanding, at the price of $100 per share, plus accumulated dividends, pursuant to an agreement with the holder of the Series B Preferred Stock, which shall be paid out of the proceeds of this offering;

• The repayment of the LFEIF Note, which shall become due and payable thirty (30) days after the closing of this offering if not earlier converted at the direction of LFEIF;

• No exercise of the underwriters’ option to purchase up to an additional 450,000 shares of common stock;

• No exercise of the Representative’s Warrants to be issued to the Representative upon completion of this offering;

• No exercise of any other outstanding warrants or stock options; and

• The filing and effectiveness of our second amended and restated certificate of incorporation and the effectiveness of our second amended and restated bylaws, which will occur prior to the effectiveness of this offering.

In addition, unless otherwise indicated, all share information reflects a 200-for-1 forward stock split of our common stock, which was effected on April 28, 2023. The share and per share information in the financial statements and the related notes thereto included elsewhere in this prospectus have been adjusted to reflect the 200-for-1 forward stock split of our common stock.

14

The following table summarizes the relevant financial data for our business and should be read with our financial statements, which are included in this prospectus. We have derived the summary financial data for the years ended December 31, 2022 and 2021 from our audited consolidated financial statements and related notes and for the three months ended March 31, 2023 and 2022 from our unaudited condensed consolidated interim financial statements, each included elsewhere in this prospectus. Our historical results are not necessarily indicative of results that may be expected in the future. You should read the following summary consolidated financial data together with our financial statements, and the related notes, included elsewhere in this prospectus and the information in the sections titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

Year ended |

Three Months Ended |

|||||||||||||||

|

2022 |

2021 |

2023 |

2022 |

|||||||||||||

|

Operating Expenses |

|

|

|

|

|

|

|

|

||||||||

|

Salaries & benefits (including share-based compensation) |

$ |

1,954,851 |

|

$ |

4,322,259 |

|

$ |

566,828 |

|

$ |

652,775 |

|

||||

|

Consulting (including share-based compensation) |

$ |

521,297 |

|

$ |

1,624,709 |

|

$ |

58,279 |

|

$ |

141,495 |

|

||||

|

Other general and administrative |

$ |

403,407 |

|

$ |

433,929 |

|

$ |

169,254 |

|

$ |

94,859 |

|

||||

|

Research and development |

$ |

52,139 |

|

$ |

9,848 |

|

$ |

9,177 |

|

$ |

— |

|

||||

|

Amortization |

$ |

93,023 |

|

$ |

93,023 |

|

$ |

23,256 |

|

$ |

23,256 |

|

||||

|

Total Operating Expenses |

$ |

3,024,717 |

|

$ |

6,483,768 |

|

$ |

826,794 |

|

$ |

912,385 |

|

||||

|

Forgiveness of paycheck protection program loan |

$ |

183,737 |

|

$ |

201,250 |

|

$ |

— |

|

$ |

183,737 |

|

||||

|

Warrant Expense |

$ |

(5,886,390 |

) |

$ |

— |

|

$ |

— |

|

$ |

(2,799,981 |

) |

||||

|

Interest Expense |

$ |

(112,981 |

) |

$ |

(50,123 |

) |

$ |

(72,485 |

) |

$ |

(12,500 |

) |

||||

|

Loss before Taxation |

$ |

(8,840,351 |

) |

$ |

(6,332,641 |

) |

$ |

(899,279 |

) |

$ |

(3,541,129 |

) |

||||

|

Provision for Taxation |

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

— |

|

||||

|

Net loss |

$ |

(8,840,351 |

) |

$ |

(6,332,641 |

) |

$ |

(899,279 |

) |

$ |

(3,541,129 |

) |

||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Net loss per common share – basic and |

$ |

(0.31 |

) |

$ |

(0.23 |

) |

$ |

(0.03 |

) |

$ |

(0.12 |

) |

||||

|

Pro forma net loss per common share, basic and diluted (unaudited) |

$ |

(0.25 |

) |

$ |

(0.12 |

) |

$ |

(0.03 |

) |

$ |

(0.12 |

) |

||||

|

Balance Sheet Data: |

March 31, |

Pro Forma(1) |

Pro Forma, |

||||||||

|

Working capital |

$ |

(10,611,560 |

) |

$ |

(9,498,028 |

) |

$ |

9,074,724 |

|||

|

Total assets |

$ |

1,606,587 |

|

$ |

2,312,619 |

|

$ |

13,013,784 |

|||

|

Total liabilities |

$ |

15,553,046 |

|

$ |

15,145,456 |

|

$ |

4,926,016 |

|||

|

Stockholder’s (deficit)/equity |

$ |

(14,946,459 |

) |

$ |

(13,832,927 |

) |

$ |

8,787,211 |

|||

____________

(1) The pro forma balance sheet data in the table above gives effect to: (i) on April 6, 2023, the issuance of 81,600 shares of common stock in consideration for $407,500 of accrued consulting fees; and (ii) between May 30, 2023 and June 29, 2023, the issuance of 397,300 shares of common stock to investors in the Second Private Placement and the receipt of $706,032 in net cash proceeds. It does not include $55,000 in subscription payments to be received by us from investors in the Second Private Placement for which we have received indications of interest and the issuance of 27,500 shares of common stock upon receipt of such subscription proceeds.

(2) The pro forma, as adjusted balance sheet data in the table above reflects the items described in footnote (1) above and gives effect to: (i) the sale and issuance by us of shares of our common stock in this offering, based upon the assumed initial public offering price of $5.00, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us; (ii) conversion of the Private Placement Notes upon the effectiveness of the registration statement of which this prospectus is a part into an aggregate of 775,900 shares of our common stock, at a conversion price of $2.50 per share, which is 50% of the assumed initial public offering price of $5.00 per share; (iii) the payment of $1,699,452 upon the redemption of 10,000 shares of Series B Preferred Stock currently outstanding, at the price of $100 per share, including accumulated dividends calculated through June 30, 2023, pursuant to an agreement with the holder of the Series B Preferred Stock;

15