UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal period ended March 31, 2016

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to ________

Commission File Number: 000-54748

EBULLION, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 46-2323674 | |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

eBullion, Inc.

80 Broad Street, 5th Floor

New York, New York 10004

(Address of principal executive offices) (Zip Code)

(212) 837-7858

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

| Securities

registered pursuant to Section 12(b) of the Act: |

Name of each exchange on which registered | |

| (Title of Class) | ||

| None |

Securities registered pursuant to Section 12 (g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the issuer: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of issuer’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every interactive data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated file, a non-accelerated file, or a smaller reporting company. See the definitions of “large accelerated filer, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ | |

| (Do not check if a smaller reporting company) | ||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock presently held by non-affiliates as of September 30, 2015, the last business day of the Registrant’s recently completed second quarter was approximately $9,587,152, based on 239,678,800 shares held by non-affiliates. These shares were valued at the last trade of the Registrant’s common stock on the OTCBB on September 30, 2015, of $0.04 per share.

As of June 29, 2016, the issuer had 512,600,000 shares of common stock outstanding.

Documents incorporated by reference: None

FORM 10-K

TABLE OF CONTENTS

Forward-Looking Statements

Many of the matters discussed within this report include forward-looking statements on our current expectations and projections about future events. In some cases you can identify forward-looking statements by terminology such as “may,” “should,” “potential,” “continue,” “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” and similar expressions. These statements are based on our current beliefs, expectations, and assumptions and are subject to a number of risks and uncertainties, many of which are difficult to predict and generally beyond our control, that could cause actual results to differ materially from those expressed, projected or implied in or by the forward-looking statements. Such risks and uncertainties include the risks noted under “Item 1A Risk Factors.” We do not undertake any obligation to update any forward-looking statements. Unless the context requires otherwise, references to “we,” “us,” “our,” and “eBullion,” refer to eBullion, Inc. and its subsidiaries.

| Item 1. | Business |

Overview

Since April 3, 2013, through our subsidiary Man Loong Bullion Company Limited, a Hong Kong limited liability company (“Man Loong”), we have been an electronic trading member of the Chinese Gold and Silver Exchange Society (“CGSE”), a self-regulatory organization registered in Hong Kong which acts as an exchange for the trading of gold and silver. Man Loong holds a Type AA License with the CGSE, which it uses to provide an electronic trading platform which customers of its agents can use to place trades in a CGSE price contract for Kilo Gold and Loco London Gold and Silver via the electronic trading platform or a telephonic transaction system. The agents’ customers can access their account to check their gain/loss on their trading position 24 hours a day 7 days a week through Man Loong’s electronic trading platform. Man Loong contracts with independent agents, each with their own customers that seek to place trades for gold and silver price contracts with the CGSE using Man Loong’s electronic trading platform, which is linked to the CGSE’s electronic trading platform by reason of Man Loong’s membership in the CGSE. All transactions and technologies used to execute trades are consummated and located at Man Loong’s principal offices in Hong Kong. The various independent sales agents who use Man Loong’s services, together with the agents’ customer base, are located in Hong Kong and in the People’s Republic of China. Neither we, nor Man Loong, conducts business in the United States or has agents, or any agreements with agents, or facilitate trades with any customers of agents that reside in the United States.

The electronic trading platform, which is located in Hong Kong, is licensed by Man Loong from True Technology Company Limited (“True Technology”), a company organized under the laws of Hong Kong, and owned by Mr. Kee Yuen Choi, our Chief Executive Officer and 49.5% stockholder and Mr. Hak Yim Wong, one of our directors and stockholders. The electronic trading platform provides the various independent sales agents and their customers with CGSE price quotations on gold and silver price contracts, on a Loco London basis, as well as information updates on the gold and silver market, based on an evaluation of third-party market pricing sources such as Reuters or Bloomberg. The electronic trading platform also provides an agent’s customers with up-to-date market data, trade reports and gain/ loss reports to assist them in evaluating their portfolio and effecting trades. In addition, the electronic trading platform communicates and confirms all of the trades that are placed by Man Loong agents and their customers with the CGSE and provides the agents and their customers with confirmation codes which confirm execution of the trades.

Man Loong’s membership in the CGSE allows it to provide its electronic trading platform to facilitate trades on behalf of the agents’ customers and/or the agents themselves, who can purchase trading positions in gold and/or silver on the CGSE, without Man Loong being required to become a counterparty to the trade or having to purchase or sell, as principal, any of the gold or silver subject to the price contract being traded. Man Loong merely operates an electronic trading platform which it licenses from True Technology that allows agents’ customers to directly place trades and become the actual counterparty to the trade for a price contract, which is a product created by the CGSE for electronic trading that does not involve the physical transfer or delivery of any actual gold or silver.

All of Man Loong’s revenue is derived from the commissions it receives on each trade for which it processes through the electronic trading platform it licenses from True Technology. For our fiscal years ended March 31, 2016 and 2015, Man Loong’s revenue was approximately $1.8 million and $3.0 million, respectively, and its net income (loss) was approximately $(0.51) million and $0.54 million, respectively.

Man Loong has 3 agents in Hong Kong which cover three main geographic areas, including Hong Kong Island, Kowloon and the New Territories. In mainland China, we have 10 agents located in Shanghai and Guangdong and Fujian provinces. Each of our agents in Hong Kong have between 100 – 150 customers and our agents in China each have between 100 and 600 customers.

The process for effectuating trades on Man Loong’s platform are as follows: (i) orders are placed by the agents’ customers on the trading platform; (ii) the platform, which has a direct connection with the GCSE, communicates the order to the CGSE; (iii) the GCSE matches the trade with a counterparty in the market, which counterparty is unknown to Man Loong, its agents’ and their customers; (iv) the CGSE then confirms the trade and returns an official confirmation number to the customer through Man Loong’s trading platform. The customer can use the confirmation code to verify on the CGSE website the completion of its trade. The trading position represented by the gold or silver price contract remains open until the customer places a trade order using the same procedures set forth in the preceding sentence, to close the open position. Man Loong, through its platform helps facilitate the trade as an official member of the CGSE and earns a commission for its services. Moreover, the gold or silver price contracts do not involve the physical transfer or delivery of any actual gold or silver as there is no physical asset securing the price contract.

| 1 |

Man Loong enters into an agency agreement with each agent for which it processes trades pursuant to which the agent agrees to pay a commission to Man Loong for each trade that Man Loong processes and the agent acknowledges that Man Loong has no responsibility for any trading losses suffered by it or its customers for the trades executed on their behalf. Man Loong does not accept customers directly without an agent representative and does not enter into agreements directly with customers for the placement of trades. Although the agent remains directly responsible to Man Loong for any trading losses, to help ensure that the respective agent’s customers understand: (i) their assumption of trading risk; (ii) their obligations to their respective agents and (iii) that Man Loong does not have any responsibility for any of their trading losses, Man Loong requires that each agent representative’s client for whom Man Loong is requested to process a trade to complete and sign a form acknowledging these risks and obligations prior to commencing trading activity. Any customer that seeks to open a trading account directly with Man Loong is assigned to an agent and is required to execute an agreement with an agent prior to placing a trade. Man Loong receives a commission from the agents ranging from $20 to $40 per trade processed by it regardless of the purchase price paid or received for the gold or silver contract and the agent assumes the sole responsibility to Man Loong and the CGSE for payment of the purchase price of the gold or silver contract traded by it or its customers and for any loss recognized on those trades.

Man Loong’s agents require that all of its customers maintain accounts with the agent or Man Loong with a deposit a minimum of $1,289 USD in such bank account, which ensures that agents can fund their customer’s trading losses, if any, on contracts that are executed on Man Loong’s trading platform. Each of the agent’s customers enter into an agreement with the agent that directs the agent to either deposit funds into an account maintained by the agent or Man Loong’s segregated bank account and authorizes the agent to withdraw money from such accounts as needed to cover losses and pay associated fees. Often the customers of the agents prefer to maintain accounts with Man Loong due to its independent nature and affiliation with the CGSE and Man Loong will maintain and monitor such bank accounts in a segregated bank account as an accommodation to its agents. If a customer does not maintain an initial margin deposit with Man Loong, the customer will make their initial margin deposit payment directly to their agent’s account and prior to processing any trades on behalf of such customer, Man Loong requires confirmation of such deposit from the agent. For those customers that maintain initial margin deposits with their agent’s, trade processing fees are billed by Man Loong to the agent at the end of the month.

As an accommodation to its agents, Man Loong also monitors the customer’s total net trading position regardless of whether or not the deposit is placed with its bank. At any time that a price contract is open, and the agent’s customer’s unrealized trading losses are 80% or more of the deposit balance, Man Loong’s system alerts Man Loong to request an increase in the customer’s deposit balance. Typically, the agent’s customer’s trading account is frozen until the deposit balance is increased. In the event the unrealized trading losses equals the deposit balance, the agent’s customer’s trading account is immediately frozen and closed, the system then closes the trading positions with the CGSE and the deposit balance is paid to the agent so that the agent can fund the trading losses with the CGSE. With respect to bank accounts held by the agent’s bank as opposed to the bank accounts which Man Loong’s maintains, the agent provides Man Loong with the customer’s deposit balance so that Man Loong can alert the agent and customer when unrealized trading losses are 80% of the customer’s account balance; and Man Loong freezes the customer’s trading account until the agent confirms that the deposit balance has been increased. Although Man Loong monitors customer accounts, Man Loong’s agreements with its agents provide that the agent is responsible for all losses of customers and therefore, the agent and not Man Loong bears the risk that the customer’s net trading position is closed when losses exceed the customer’s deposit balance.

The agents often use Man Loong’s offices and conference rooms as a physical place to meet with existing and potential customers, and Man Loong provides a dedicated investment center where agents and their customers can access the electronic trading platform to place and process price contract orders for gold, and silver and obtain up-to-date market data, trade reports and gain/ loss reports to assist them in evaluating their portfolio and effecting trades.

The CGSE acts as a central clearing agency for all gold and silver price contracts traded in Hong Kong. The CGSE locates matching counterparties for all trades in precious metals submitted to it and then confirms the trades through a member firm, like Man Loong, with the actual parties to the price contract. Man Loong is registered with and licensed by the CGSE, a registered self-regulatory society in Hong Kong which also acts as an exchange for gold and silver. The CGSE has been in existence since 1910 and as of June 1, 2016 has 171 licensed members, 72 of the licensed members are engaged in electronic trading transactions.

CGSE members must conduct themselves in accordance with a code of conduct which is regulated by the CGSE. Applicants to the CGSE must apply for and/or purchase membership and licensing from the CGSE or from existing members, and the CGSE has the power to suspend and/or revoke membership for breach of its rules and regulations. The CGSE’s constitution limits CGSE membership to 192 members, all of whom must have a minimum required working capital, defined as cash plus precious metals, of approximately $193,000 and minimum required assets of $643,000. The CGSE requires its members to submit a quarterly liquidity capital report, in order to ensure that the bank balances exceed or equal the balance of customer deposits. Man Loong was in compliance with these requirements as of March 31, 2016 and 2015.

As of March 31, 2016 and 2015, Man Loong had $1.1 million and $2.5 million, respectively, in cash and $2.7 million and 3.2 million, respectively, in total assets.

| 2 |

Recent Developments

In April 2016, Man Loong received a license from the CGSE to trade gold and silver contracts in the new Qian Hai trade zone in Shenzhen, PRC. The new license allows Man Loong to trade gold and silver contracts with its existing and new customers who are citizens of the PRC. Man Loong intends to operate its electronic trading platform for the processing of trades placed in Qian Hai through the CGSE on behalf of its agents’ customers in China, and such operations are expected to commence in approximately the fourth quarter of 2016. No assurance can be given however, that Man Loong will be successful in deriving revenue from operations in Qian Hai.

Our Growth Strategy

We believe that the precious metals market creates a significant growth opportunity on which we intend to capitalize by utilizing the following strategies:

| ● | Customer service and trading platform capabilities. We believe that in order to compete effectively in our product market, we must constantly improve the quality of our customer service and our electronic trading platform capabilities as demanded by agents and their customers and as driven by technological change. Man Loong has established a strong team of IT specialists to help ensure that the trading platform functions without disruption and error. Man Loong has entered into licensing agreements with an affiliated company engaged in hosting its servers and the development and enhancement of its trading platform which allows Man Loong to continually improve the functionality of the trading platform in response to customer demands. In Man Loong’s offices in Hong Kong, Man Loong provides a 115 workstation trading floor where agents and their customers can access our trading platform to execute trades and obtain research information on precious metals prices and price trends. Beginning in 2016, Man Loong’s trading platform allows its agents’ customers to place trades on the trading platform directly from their Android or IPhone mobile devices. |

| ● | Brand Recognition. We also plan on developing our brand recognition. In addition to providing high quality products and effective access to the bullion market through Man Loong’s electronic trading platform. Customers can access their account to check their gain/ loss position 24 hours a day 7 days a week through Man Loong’s electronic trading platform. We believe that in order to promote our brand recognition, strengthen the management of our distribution network and improve our sales revenue and market share, we will also need to continue expanding our sales channels in Hong Kong, China, Singapore and India. With adequate funding, we plan to acquire a number of local and overseas foreign exchange providers as well as precious metals and commodities brokers that can complement our strengths in services, integration, and implementation. We expect that this strategy will result in expanding our services to a wider customer base. In April 2015, Man Loong loaned $773,793 (HKD $6,000,000) to Global Long Inc. Limited (“Global Long”), a company engaged in trading silver contracts as an electronic trading member of the Guangdong Precious Metals Exchange through its subsidiary in the PRC, eBullion Trade Company Limited. The purpose of the loan was to establish a relationship with Global Long with the intent of becoming their first choice for Global Long’s customers who wish to trade gold trading positions through the CGSE. In April 2016, Man Loong received a license from the CGSE to trade gold contracts in the new Qian Hai trade zone in Shenzhen, China. Concurrent with receiving the license, Man Loong registered a new subsidiary, Shenzhen Qian Hai Man Loong Bullion Company Ltd. (“Shenzhen Qian Hai”) organized as a Wholly Foreign Owned Enterprise under PRC law. The new license will allow Man Loong to provide its trading platform and trading services to its existing and new customers who are citizens of the PRC to trade gold contracts through Shenzhen Qian Hai. Man Loong is in the process of defining its business and marketing strategies and processes for trades placed through Shenzhen Qian Hai. Man Loong intends to charge a fee to facilitate such trades placed in Qian Hai, and such operations are expected to begin in approximately the fourth quarter of 2016. No assurance can be given however, that Man Loong will be successful in deriving revenue from operations in Qian Hai. |

Sales and Marketing

Man Loong’s website is its main sales and marketing tool. In addition to its expertise in technology, Man Loong has employed a team of seasoned marketing staff to update and maintain its website, which is readily available to access from major search engines. Man Loong’s marketing team also designs online promotions that are intended to increase the volume of trade and frequency of visits by targeted groups of customers.

| 3 |

Man Loong uses its independent agents, instead of salaried employees, as its representatives to promote its product and services and provide customer support at Man Loong’s trading center located in its offices in Hong Kong. These agents are engaged on an “at will” basis and are compensated commensurate with their performance. These arrangements are not in writing, but are based on oral agreements and on-going business relationships. The compensation to the agents is recorded as a marketing expense.

Man Loong maintains a Q&A section on its website, which serves as a platform for agents and their customers to communicate with it. The forum administrators gather the customer comments and suggestions for its consideration when preparing its annual business plan. Additionally, Man Loong uses this feedback to determine which enhancements to the trading platform would be of greatest service to its agents and their customers.

Man Loong now has one investment center open in Hong Kong, where its current and potential agents and their customers may access Man Loong’s online trading platform and market research tools or meet its customer service representatives and other professional staff to discuss issues and answer questions.

Man Loong intends to expand the market for its principal operations beyond its investment center in Hong Kong by exploring the opening of additional investment centers in major cities or other localities in China, such as Qian Hai, and by promoting the Man Loong brand. Man Loong believes that interest in the electronic trading of gold and silver contracts is increasing in Asia’s emerging markets both in and outside of China as income and living standards increase, and that these emerging markets could provide Man Loong with significant new market opportunities to build its customer base and its brand.

Competition

The retail market for facilitating trades in gold and silver contracts is fragmented and highly competitive. Our competitors in the retail market can be grouped into several broad categories based on size, business model, product offerings, target customers and geographic scope of operations. These include international retail precious metals brokers, international multi-product trading firms, other electronic trading firms and international banks and other financial institutions with significant precious metals operations. We expect competition to continue to remain competitive and strong for the foreseeable future.

Our Competitive Strengths

We attribute our success to date and potential for future growth to a combination of strengths, including the following:

| ● | Man Loong’s Trading Platform Technology is Regularly Updated to Meet Evolving Customer Needs. Man Loong continuously carries out research and gathers data on customer behavior and trends so that it may seek to provide the best technology to meet the evolving requirements of its agents and their customers. Man Loong views itself primarily as an e-commerce trading platform provider enabling its customers to acquire and/or dispose of precious metals and precious metals contracts, at their own market risk. |

| ● | Experienced Management Team. Man Loong’s key employees have significant experience and expertise in the application of technology and automation systems and, as significant equity owners of our Company, are heavily committed to our success. Its senior management team, in particular, has substantial experience of operating electronic trading platform an average of 10 years’ experience in the gold and silver industry between them. |

| ● | Low Cost Structure through Automation. Man Loong's focus on automation and expense management practices enables it to operate with a low cost structure. |

| ● | Provide 24 Hour Customer Service. We view ourselves not only as a product provider but also as a company that competes as a service provider. As such, we strive to provide first-class customer service, with a 24-hour online customer service desk to respond to customer inquiries. In addition, Man Loong’s technical response team is on standby 24 hours a day, 7 days a week to provide technology assistance to agents and their customers, if and as needed. |

| 4 |

Research and Development

Man Loong has a dedicated marketing team devoted to determining its agents’ and their customers’ demands for capability enhancements of our electronic trading platform and working with True Technology, an affiliated IT services provider owned by Mr. Choi, our Chief Executive Officer and a 49.5% stockholder and Mr. Wong, a director and a stockholder, for the development and implementation of improvements. During the years ended March 31, 2016 and 2015, Man Loong did not incur any research and development expenses as very few software enhancements were made to the electronic platform during those years other than basic software enhancements services, for which Man Loong was not charged any fee other than its monthly license fee to True Technology. For the years ended March 31, 2016 and 2015, Man Loong paid True Technology $46,412 and $46,430, respectively for the use of the platform.

Intellectual Property

We believe our intellectual property is important to our success. The intellectual property rights of an owner are not automatically protected by the laws of Hong Kong if the trademark or proprietary technology is not registered with the Trade Marks Registry of Hong Kong. Man Loong relies on Hong Kong’s intellectual property laws, where applicable, and on contractual restrictions to protect its trademark or proprietary technology from parties who infringe on its trademarks and its affiliate’s proprietary technology. In September 2012, Man Loong registered its trademark with the Intellectual Property Department of Hong Kong for marketing and brand recognition.

Man Loong does not own the software that is used for the operation of its electronic trading platform, but rather Man Loong licenses it from True Technology. The license agreement, with True Technology provides that True Technology will not license the customized software that Man Loong licenses to any third parties. In April 2013, Man Loong entered into a Software Development License and Maintenance Agreement with True Technology (the “License Agreement”). In April, 2015, the trading platform lease with True Technology was renewed for 2 years with monthly payment of approximately $3,868 until March 31, 2017. The License Agreement provides that True Technology grants a non-exclusive license to use the software developed by True Technology that we currently use in our business and the provision of hosting services. True Technology has agreed not to license or sublicense the software to third parties without Man Loong’s prior consent. True Technology has modified the licensed technology at the request of Man Loong to fit Man Loong’s specifications. The License Agreement provides that all enhancements or modifications to the software requested by us and developed by True Technology shall be the proprietary property of Man Loong and Man Loong is required to pay an additional hourly fee for the development of such enhancements and modifications; however, the basic technology upon which the enhancements are made is owned by True Technology. In addition, True Technology may license or sublicense the underlying software, without Man Loong’s enhancements or modifications that are used for the operation of the electronic trading platform, to third parties without the consent of Man Loong.

Employees

As of June 1, 2016, Man Loong employed a total of 18 full time employees. The following table sets forth the number of our full time employees by function.

| Number of | ||||

| Function | Employees | |||

| Senior Management | 2 | |||

| Operations | 7 | |||

| Sales and Marketing | 2 | |||

| Finance | 3 | |||

| Technology, Research and Development | 2 | |||

| Human Resource & Administration | 2 | |||

| Total | 18 | |||

| 5 |

Regulations

Because our primary operating subsidiary is located in Hong Kong, we are regulated by Hong Kong law. We believe that we are in material compliance with all registrations and requirements for the issuance and maintenance of all licenses required by the governing bodies, and that all license fees and filings are current. The Hong Kong government and other regulatory agencies may block or suspend our internet transmission capabilities if we are deemed to be in violation of the following content regulations for online services:

| ● | Securities and Futures Ordinance (Cap. 571 of the Laws of Hong Kong) – Man Loong is subject to the laws, rules and regulations regarding trading. The Securities and Futures Commission is responsible for: maintaining and promoting the fairness, efficiency, competitiveness, transparency and orderliness of the securities and futures industry. The Commission may suppress illegal, dishonorable and improper practices in the securities and futures industry; to take appropriate steps in relation to the securities and futures industry. Regardless of the communication or delivery medium used, the Commission will continue to apply the general anti-fraud and anti-manipulation provisions of the relevant Ordinances in its enforcement actions. If any person responsible for activities over the Internet is found to have acted in contravention of the provisions of the Ordinances or appears to have been involved in any misconduct whether in Hong Kong or elsewhere, the Commission may exercise its regulatory powers (including prosecution or taking other disciplinary actions as may be required); and when necessary, the Commission may consider other regulatory means available to it including seeking cooperation from foreign regulators and law enforcement agencies to take joint enforcement action, if necessary. We are prohibited from carrying on any regulated activity, as defined under the Securities and Futures Ordinance, such as dealing in securities and/or futures contracts, unless we have been granted the appropriate license(s) from the Commission. |

| ● | Personal Data (Privacy) Ordinance (Cap. 486 of the Laws of Hong Kong) – Man Loong is subject to data privacy laws, rules and regulations that regulate the use of customer data. In Hong Kong we are governed by the Personal Data (Privacy) Ordinance and as a data user we are prohibited from doing or engaging in any practice that contravenes the data protection principles set out therein. |

| ● | Telecommunications Ordinance (Cap. 106 of the Laws of Hong Kong), Crimes Ordinance (Cap. 200 of the Laws of Hong Kong) and Theft Ordinance (Cap. 210 of the Laws of Hong Kong) – Provisions under the Telecommunications Ordinance, Crimes Ordinance and Theft Ordinance make it an offense for unauthorized access to computers by telecommunication, to access a computer with criminal or dishonest intent, and extend the meaning of criminal damage to include misuse of computer programs or data, and burglary to include unlawfully causing a computer to function other than as it has been established and altering, erasing or adding any computer program or data. In this respect, any of the above mentioned computer related crimes committed by any staff, employees or agents, will subject us to possible criminal charges and/or investigations. |

These rules and regulations are administered by the three branches of Hong Kong’s Commerce and Economic Development Bureau: (i) the Commerce, Industry and Tourism Branch (responsible for policy matters on Hong Kong’s external commercial relations, inward investment promotion, intellectual property protection, industry and business support, tourism, consumer protection and competition), (ii) the Communications and Technology Branch (responsible for policy matters on broadcasting, film-related issues, overall view of creative (including film) industry, development of telecommunications, innovation and technology, and control of obscene and indecent articles); and (iii) the Office of the Government Chief Information Officer (responsible for policy, strategy and execution of information technology programs and initiatives).

Our Corporate History and Background

We were incorporated under the laws of the State of Delaware on January 28, 2013. We were initially formed to develop software for use in on-line trading of gold and silver contracts. Since the acquisition of Man Loong, our business development focus has been, and we expect will continue to be, solely on increasing Man Loong’s market share for the on-line trading of gold and silver contracts within the Hong Kong market while developing a business model for the on-line trading of gold and silver contracts by Man Loong in the PRC.

| 6 |

In April 2016, Man Loong received a license from the CGSE to trade gold contracts in the new Qian Hai trade zone in Shenzhen, China. Concurrent with receiving the license, Man Loong registered a new subsidiary, Shenzhen Qian Hai Man Loong Bullion Company Ltd. (“Shenzhen Qian Hai”) organized as a Wholly Foreign Owned Enterprise under PRC law. The new license will allow Man Loong to provide its trading platform and trading services to its existing and new customers who are citizens of the PRC to trade gold contracts through Shenzhen Qian Hai. Man Loong is in the process of defining its business and marketing strategies and processes for trades placed through Shenzhen Qian Hai. Man Loong intends to charge a fee to facilitate such trades placed in Qian Hai, and such operations are expected to begin in approximately the fourth quarter of 2016. No assurance can be given however, that Man Loong will be successful in deriving revenue from operations in Qian Hai.

Acquisition of Man Loong

On April 3, 2013, we entered into a Contribution Agreement with the shareholders of Man Loong, whereby we acquired 100% of the issued and outstanding capital stock of Man Loong from its stockholders, in exchange for 507,600,000 newly issued shares of our common stock, par value $0.0001. After the transaction, Man Loong became our wholly owned subsidiary.

In March 2015, we increased the number of our authorized shares from 500,000,000 to 1,000,000,000. The par value of our shares remained unchanged at $.0001. We also effected a 10 for 1 stock split, whereby we exchanged 10 of our shares for every 1 share issued at outstanding before the split. Following the share split, we have 512,600,000 shares issued and outstanding.

As a result of the acquisition, we have assumed the business and operations of Man Loong. Man Loong, which was incorporated in 1974 in Hong Kong and was re-registered in 2007 under Hong Kong law as a limited liability company, was organized to facilitate the trading of precious metals contracts. Man Loong initially provided an electronic trading platform that offered one-stop electronic trading in Hong Kong, and in 2010, expanded its services to include the trading for its agent’s customers and not as principal, of gold and silver contracts in mainland China. Man Loong currently has one office in Hong Kong and 10 independent agents in mainland China located in Shanghai, Guangdong and Fujian provinces.

The acquisition of Man Loong was treated for accounting purposes as a reverse merger with eBullion acquiring 100% of the outstanding common stock of Man Loong in exchange for 507,600,000 newly issued shares of our common stock, par value $.0001. Unless the context suggests otherwise, when we refer in this prospectus to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Man Loong. For accounting purposes, the reverse merger of eBullion, Inc. with Man Loong has been treated as a recapitalization with no adjustment to the historical book and tax basis of either companies’ assets or liabilities.

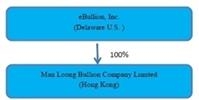

Our Corporate Structure Our primary business operations are conducted through our Hong Kong operating subsidiary, Man Loong. For ease of reference, below is a chart that presents our current corporate structure.

| 7 |

Our principal executive offices are located at 80 Broad Street, New York, New York 10004 and Man Loong’s principal offices are located at 18/F, Tower 6, China Hong Kong City, 33 Canton Road, Tsim Sha Tsui, Hong Kong. The telephone number at our principal executive offices is (212) 837-7858 and Man Loong’s principal executive office is +852-2155-3999. All of our transactions and the technologies, including the servers that carry out these transactions, are all executed and located in Hong Kong.

Our website address is http://www.ebulliongroup.com. The information contained in, and that can be accessed through, our website is not incorporated into and is not part of this annual report. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports are filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. and are available free of charge through the investor relations page of our internet relations page of our internet website as soon as practicable after those reports are electronically filed or furnished with the SEC.

| Item 1A. | Risk Factors |

Investing in our common stock involves a high degree of risk. In addition to the risks related to our business set forth in this Form 10-K and the other information included and incorporated by reference in this Form 10-K, you should carefully consider the risks described below before purchasing our common stock. Additional risks, uncertainties and other factors not presently known to us or that we currently deem immaterial may also impair our business operations.

RISKS RELATED TO OUR BUSINESS

Restricted access to Man Loong’s website, could lead to significant operating disruptions, a negative customer experience or the loss of agents and their customers.

If any enterprises or professional organizations, including governmental agencies, blocked access to Man Loong’s website or the Internet generally for a number of reasons including due to security or confidentiality concerns or regulatory reasons, or if any government of any jurisdiction in which we or Man Loong are considered to be carrying on business in may block or suspend internet transmission capabilities, Man Loong’s business would experience significant operating disruptions because our revenues are generated through the commissions Man Loong receives for the trades placed through the electronic trading platform it licenses from True Technology which requires internet transmission capabilities to operate. If these entities were to block or limit access to Man Loong’s website or adopt policies restricting its ability to provide its agents’ customers accurate and up-to-date information, the functionality of Man Loong’s electronic trading platform could be negatively impacted, which could adversely affect its ability to retain and attract commission business from agents and their customers.

All of our revenue is based upon Man Loong’s trade commissions which are themselves influenced by trading volume and volatility and economic conditions that are beyond our control.

Any volatility in the global financial markets has an impact on Man Loong’s commissions and therefore its revenue. Our revenue is influenced by the general level of trading activity in the gold and silver market because all of our revenue is derived from the commission Man Loong receives on each trade that it facilitates, which is a fixed commission of $20-40 per trade. Our revenue and operating results may vary significantly from period to period primarily due to movements and trends in the world’s currency markets, volatility in the market price of gold and silver and fluctuations in trading levels. Man Loong has generally experienced greater trading volume in periods of volatile markets as during such periods there tends to be increased trading. Recently, Man Loong experienced lower levels of trading volume due to a reduction in the short term volatility of gold and silver prices, and its commission revenues were negatively affected. Like other financial services firms, our business and profitability and Man Loong’s are directly affected by elements that are beyond our and its control, such as economic and political conditions, broad trends in business and finance, changes in the volume of transactions, changes in supply and demand for precious metals, movements in currency exchange rates, changes in the financial strength of market participants, legislative and regulatory changes, changes in the markets in which such transactions occur, changes in how such transactions are processed and disruptions due to terrorism, war or extreme weather events. Any one or more of these factors, or other factors, may adversely affect our business and results of operations and cash flows. As a result, period-to-period comparisons of our operating results may not be meaningful and our future operating results may be subject to significant fluctuations or declines.

| 8 |

Competitive trading systems could force Man Loong to reduce its commissions and negatively impact revenue.

Any increased competition to Man Loong’s platform through the development of faster or more capable execution programs could reduce the volume of trades or force Man Loong to reduce its commission on each trade to continue to attract commission business from the various sales agents seeking to use Man Loong to process their customers' trades on the CGSE. In addition, new and enhanced alternative trading systems have emerged as an option for individual and institutional investors to carry out proprietary trades, which also could result in reduced commissions.

All of our revenue and operating profits are derived from Man Loong’s role as a service provider. In its role as a service provider, Man Loong derives a fixed amount of commission from each trade that it facilitates.

Man Loong may also experience reduced trade volumes from competition from computer-generated buy and sell programs and other technological advances and regulatory changes in the precious metals market that may continue to tighten spreads on precious metals transactions. In addition, new and enhanced alternative trading systems have emerged as an option for individual and institutional investors to avoid directing their trades through retail trade facilitators, which could result in reduced revenue derived from our precious metal trade facilitation business. Man Loong may also face price competition from its competitors.

Man Loong may be exposed to unidentified or unexpected risks if its risk management policies and procedures are not effective.

Man Loong relies on a combination of technical and human controls and supervision to protect it against certain risks. Man Loong’s policies, procedures and practices are used to identify, monitor and control a variety of risks, including risks related to human error, hardware and software errors, market movements, fraud and money-laundering, are established and reviewed by its management. Man Loong’s approach is discretionary by nature and applied on a case by case basis and developed internally by Man Loong based on historical market behavior and standard industry practices. These risk management methods may not adequately prevent losses and may not protect Man Loong against all risks or less than anticipated, in which case our business, financial condition and results of operations and cash flows may be materially adversely affected.

These methods may also be subject to error and failure and therefore may not adequately prevent losses due to technical errors or if testing and quality control practices are not effective in preventing software or hardware failures. Additionally, although Man Loong has risk-management policies, control systems and compliance manuals set in place, there can be no guarantee given that such policies, systems, and manuals will be effectively applied in every circumstance by our staff. These methods include the installation of technology that rejects trades from the customers of agents unless they maintain a minimum amount of cash on deposit with the agent or Man Loong in their bank accounts in order to ensure settlement of the purchase price of gold or silver price contracts and the payment of their trading losses, if any, to the customer’s agent who is counterparty to the trade. For example, employees could override the system and either reduce minimum account balances to an insufficient amount or theoretically waive such requirement, thereby exposing our agents to the risk of nonpayment of the purchase price of gold or silver price contracts and their customers trading losses, if any, and exposing us to a claim by the agent based on our failure to follow our own risk management guidelines. Under certain circumstances Man Loong may elect, in consultation with the affected agents, to adjust its risk-management policies to allow for an increase in risk tolerance such as reduction of minimum account balances, especially with long term customers, which could expose its agents to the risk of greater losses. The agents typically require that all of their customers maintain a minimum balance of USD$1,289 in the agents’ or Man Loong’s segregated bank account and, as an accommodation to its agents, Man Loong monitors the customer’s total net trading position. Each of the agents’ customers enter into an agreement with their agent that directs the agent to either deposit funds into an account maintained by the agent or Man Loong’s segregated bank account and authorizes the agent to withdraw money from such accounts as needed to cover losses and pay associated fees. If at any time the agent’s customer’s unrealized trading losses are 80% or more of the deposit balance in the customer’s account, Man Loong’s system alerts Man Loong to request an increase in the agent’s customer’s deposit balance. Typically, the agent’s customer’s trading account is frozen until the deposit balance is increased. In the event the unrealized trading losses equal the deposit balance, the agent’s customer’s trading account is immediately frozen and closed, the system closes the trading positions with the CGSE and the deposit balance maintained in Man Loong’s account is paid to the agent so that the agent can fund any trading losses with the CGSE. If the agent does not cover its customer’s trading losses with the CGSE, Man Loong will still not be responsible for any trading losses and the agent will likely lose its right to engage in future trading through the CGSE pending funding of the open loss position. Deviations from such policies could subject Man Loong’s agents to risk.

| 9 |

We do not own the trading platform upon which our business operates and if the license was terminated our business would experience significant operating disruptions.

Man Loong licenses the software that is utilized to run its electronic trading platform from True Technology, an entity owned by our Chief Executive Officer and one of our directors and shareholders pursuant to the terms of a license agreement that can be terminated by True Technology at any time. Although Man Loong’s agreement with True Technology prohibits True Technology from licensing the technology that it develops for Man Loong to any other third party and we believe that we could take the customized version of the technology and migrate it to another platform or that alternative software programs are available or could be developed by other third parties or eventually by Man Loong in house, such migration or the development of any such programs would be costly and may not be available in a timely manner. In addition, True Technology can license or sublicense the underlying software, without the enhancements or modifications to third parties without the consent of Man Loong. The termination of the license agreement would likely result in suspension of Man Loong’s internet transmission capabilities and its business would experience significant operating disruptions if the license agreement were terminated.

Man Loong also relies on True Technology’s computer systems or third-party service and software providers, including trading platforms, back-office systems, internet service providers and communications facilities. Deterioration in the performance or quality of work from third party service providers, could adversely affect Man Loong’s business. If Man Loong’s arrangement with any third party is terminated, it may not be able to find an alternative systems or a services provider on a timely basis or on commercially reasonable terms. This could have a material adverse effect on our business, financial condition and results of operations and cash flows.

Our business is substantially dependent upon our licensed trading platform. Any disruption or corruption of the trading platform or our inability to maintain technological superiority in our industry could have a material adverse effect on our business, financial condition and results of operations and cash flows.

Our business is substantially dependent upon Man Loong’s licensed electronic trading platform, which Man Loong relies upon to accurately and timely receive and process internal and external data. If the trading platform were to fail to function properly for any reason, Man Loong could suffer from trade errors and therefore it would be forced to suspend operations until such time as the disruptions were fixed. Man Loong’s ability to facilitate transactions successfully and provide high quality customer service depends on the efficient and uninterrupted operation of its computer and communications hardware and software systems. Computer systems are vulnerable to damage or interruption from human error, natural disasters, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism, computer denial-of-service attacks and other similar events. If Man Loong’s systems fail to perform, it could experience periodic interruptions and disruptions in operations, slower response times or decreased customer satisfaction.

In order to remain competitive, Man Loong’s electronic trading platform is under continuous development and redesign. However, with any newly developed technology Man Loong runs the ongoing risk that failures may occur and result in service interruptions or other negative consequences such as slower quote aggregation, slower trade execution, erroneous trades, or mistaken risk-management information.

| 10 |

We believe Man Loong’s technology has provided Man Loong with a competitive advantage relative to many of its competitors. If its competitors develop more advanced technologies, it may be required to devote substantial resources to the development of more advanced technology to remain competitive. The gold and silver market is characterized by rapidly changing technology, evolving industry standards and changing trading systems, practices and techniques. Man Loong may not be able to keep up with these rapid changes in the future, develop new technology, realize a return on amounts invested in developing new technologies or remain competitive in the future.

Man Loong’s systems have in the past experienced disruptions in operations, which it believes will continue to occur from time to time. As of the date hereof, we have not been notified of any claim against Man Loong alleging harm caused to third parties by this disruption and customers of its agents have continued to actively place precious metals trading orders through their respective trading accounts. However, we can provide no assurance that we will not receive any claims in the future in connection with this disruption.

To mitigate the risk of trading disruptions, Man Loong has a mirror server setup in a secured server room in its headquarters office in Hong Kong. The mirror server has the same trading software installed as the production server. If there are any network problems with the production server, the network connection will be switched to the mirror server to minimize, if not avoid entirely any downtime of the trading systems. In addition, Man Loong has two IT specialists and one operations manager to continuously monitor the server status and ensure the resumption of operations should it ever become necessary.

Man Loong’s IT department is working with IT security consultants to strengthen and protect its network from intentional attacks. Man Loong has also established a separate department to monitor its networks and to identify and minimize human errors, such as clerical mistakes and incorrectly placed trades, as well as intentional misconduct, such as unauthorized trading, mischief and fraud. Despite any precautions it may take, any systems failure that causes an interruption in its services or decreases the responsiveness of its services could, among other consequences, impair its reputation, damage its brand name and materially adversely affect its and our business, financial condition and results of operations and cash flows.

Due to the fact that Man Loong’s cost structure is largely fixed, it may not be able to respond to changes in revenue.

A substantial portion of Man Loong’s expenses are fixed expenses for which it has payment commitments regardless of its revenue. These expenses include office lease costs, trade platform rent, hosting facilities and security and staffing costs. If demand for Man Loong’s services declines and, as a result, its revenues decline, it may not be able to adjust its cost structure on a timely basis and its profitability and cash flows may be materially adversely affected.

Our revenue is dependent upon Man Loong’s ability to attract and retain the agents with whom its customers have accounts.

Our revenue is dependent upon Man Loong’s ability to retain and attract agents. Man Loong’s customer base is primarily comprised of agents who have been retained by individual customers who trade in gold and silver price contracts. Although Man Loong offers products and tailored services designed to educate, support and retain its agents, its efforts to attract new agents, and those agents’ ability to attract new customers or reduce the attrition rate of its existing agents and their customers may not be successful. If Man Loong is unable to maintain or increase its agent retention rates or generate a substantial number of new agents in a cost-effective manner, its business, financial condition and results of operations and cash flows would likely be adversely affected. The number of agents and their customers remained substantially unchanged during the years ended March 31, 2016 and 2015. The number of agent customers decreased by 2 during 2016 however those 2 customers historically accounted for more than 10% of commission revenue. Although Man Loong has spent significant financial resources on support services for agents and their customers, marketing expenses and related expenses and plans to continue to do so, these efforts may not be cost-effective at attracting new agents. In particular, we believe that costs for customer support services and rates for desirable advertising and marketing placements, including online, search engine, print and television advertising, are likely to increase in the foreseeable future, and Man Loong may be disadvantaged relative to its larger competitors in its ability to expand or maintain its customer support capabilities, and advertising and marketing commitments.

| 11 |

Man Loong currently has 3 agents in Hong Kong which cover three main geographic areas, including Hong Kong Island, Kowloon and the New Territories. In mainland China, Man Loong has 10 agents located in Shanghai and Guangdong and Fujian provinces. Each of Man Loong’s agents in Hong Kong have between 100 – 150 customers and its agents in China each have between 100 and 600 customers.

Any future expansion or acquisitions may result in significant transaction expenses, integration and consolidation risks and risks associated with entering new markets, and we may be unable to profitably operate our consolidated company.

Our growth strategy includes the penetration of new markets in the future. Any future markets that we enter may result in significant transaction expenses and present new risks associated with entering additional markets or offering new products and integrating the acquired companies. We may not have sufficient management, financial and other resources to integrate our operations in the new markets with our current operations and we may be unable to profitably operate our expanded company. Additionally, any new businesses that we may acquire, once integrated with our existing operations, may not produce expected or intended results.

Some of the new markets may be in emerging growth countries. To compete successfully in these emerging markets, we must continue to design, develop, and sell new and enhanced precious metals electronic trading programs and services that are culturally acceptable to these emerging markets. Any emerging market that we attempt to penetrate will have risks of potential entrenched local competition, higher credit risks, cultural differences, less developed and established local financial and banking infrastructure, reduced protection of intellectual rights, inability to enforce contracts in some jurisdictions, difficulties and costs associated with staffing and managing foreign operations, including reliance on newly hired local personnel, currency and tax laws that may prevent or restrict the transfer of capital and profits among our various operations around the world; and time zone, language and cultural differences among personnel in different areas of the world. We may also have difficulty in complying with the diverse regulatory requirements of multiple jurisdictions, which may be more burdensome, not clearly defined, and subject to unexpected changes, potentially exposing us to significant compliance costs and regulatory penalties

Our Hong Kong operating subsidiary, Man Loong, facilitates the trading of gold and silver price contracts in Hong Kong and China. Price contracts in gold and silver are not and may not be offered in the U.S. by us, including by our non-U.S. subsidiary, and are not eligible for resale to U.S. residents. Neither we, nor Man Loong, conducts business in the United States or has agents, or any agreements with agents, or facilitate trades with customers of agents that reside in the United States.

In April 2016, Man Loong received a license from the CGSE to trade gold contracts in the new Qian Hai trade zone in Shenzhen, China. Concurrent with receiving the license, Man Loong registered a new subsidiary, Shenzhen Qian Hai Man Loong Bullion Company Ltd. (“Shenzhen Qian Hai”) organized as a Wholly Foreign Owned Enterprise under PRC law. The new license will allow Man Loong to provide its trading platform and trading services to its existing and new customers who are citizens of the PRC to trade gold contracts through Shenzhen Qian Hai. Man Loong is in the process of defining its business and marketing strategies and processes for trades placed through Shenzhen Qian Hai. Man Loong intends to charge a fee to facilitate such trades placed in Qian Hai, and such operations are expected to begin in approximately the fourth quarter of 2016. We have little experience with the regulatory and compliance requirements of operating a company in the PRC. These risks may expose us to regulatory penalties and significant compliance costs.

| 12 |

Man Loong may be unable to respond to agents and their customers’ demands for new services and products and our business, financial condition and results of operations and cash flows may be materially adversely affected.

Man Loong’s agents and their customers may demand new services provided by Man Loong’s electronic trading platform. If Man Loong fails to identify these demands from agents and their customers or update its services accordingly, any new services and products provided by its competitors may render its existing services and products less competitive. Man Loong is currently dependent upon a third party for the development of enhancements to its trading platform. The software developer is not our employee and we cannot control the timing or amount of resources they devote to our programs. Our future success will depend, in part, on Man Loong’s ability to respond to agents’ and their customers’ demands for new services and products on a timely and cost-effective basis and to adapt to address the increasingly sophisticated requirements and varied needs of our agents’ customers and prospective customers. We may not be successful in developing, introducing or marketing new services and products. In addition, Man Loong’s new service and product enhancements may not achieve market acceptance. Any failure on our part or Man Loong’s to anticipate or respond adequately to customer requirements, or any significant delays in the development, introduction or availability of new services, products or service or product enhancements could have a material adverse effect on our business, financial condition and results of operations and cash flows.

We depend on our key personnel, the loss of whom would impair our ability to compete.

We and Man Loong are highly dependent on the employment services of Kee Yuen Choi, our and Man Loong’s Chief Executive Officer. The loss of Mr. Choi’s services could adversely affect us. We and Man Loong are also dependent on the other members of our management. The loss of the service of any of these persons could seriously harm our product development and commercialization efforts. In addition, research, product development and commercialization will require additional skilled personnel in areas such as software and electronic technical support, customer support and marketing and retention of personnel, particularly for employees with technical expertise, is uncertain. If we are unable to hire, train and retain a sufficient number of qualified employees, our ability to conduct and expand our business could be seriously reduced. The inability to retain and hire qualified personnel could also hinder the planned expansion of our business and may result in us relocating some or all of our operations.

We have identified material weaknesses in our internal controls, and we cannot provide assurances that these weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future.

If our internal control over financial reporting or our disclosure controls and procedures are not effective, we may not be able to accurately report our financial results, prevent fraud, or file our periodic reports in a timely manner, which may cause investors to lose confidence in our reported financial information and may lead to a decline in our stock price. Our most recent evaluation of our internal controls resulted in our conclusion that our disclosure controls and procedures and that our internal controls over financial reporting were not effective. Effective internal controls are necessary for us to provide reliable financial reports. All internal control systems, no matter how well designed, have inherent limitations. Even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. In our case, our failure to achieve and maintain an effective internal control environment could cause us to be unable to produce reliable financial reports or prevent fraud. This may cause investors to lose confidence in our reported financial information, which could in turn have a material adverse effect on our stock price.

Our Chief Executive Officer beneficially owns and controls a substantial portion of our outstanding common stock, which may limit your ability and the ability of our other stockholders, whether acting alone or together, to propose or direct the management or overall direction of our Company.

Mr. Choi, acts as our Chief Executive Officer and Chairman of our Board of Directors, and through his control of approximately 49.5% of our outstanding common stock, controls the Company and important matters relating to us. As a result of his positions and his control of our common stock, Mr. Choi controls the outcome of all matters submitted to our shareholders for approval, including the election of our directors, our business strategy and our day-to-day operations. In addition, Mr. Choi’s ownership of our common stock and control of the Company could discourage the acquisition of our common stock by potential investors and could have an anti-takeover effect, preventing a change in control of the Company and possibly depressing the trading price of our common stock. There can be no assurance that conflicts of interest will not arise with respect to Mr. Choi’s ownership and control of the Company or that any conflicts will be resolved in a manner favorable to the other shareholders of the Company.

| 13 |

Man Loong’s operations will be dependent upon its ability to protect our intellectual property, which could be costly.

Our success will depend in part upon protecting any technology we or Man Loong uses or may develop from infringement, misappropriation, duplication and discovery, and avoiding infringement and misappropriation of third party rights. Man Loong’s intellectual property is essential to its business, and its ability to compete effectively with other companies depends on the proprietary nature of its technologies. Man Loong does not have patent protection for its electronic trading platform. Man Loong relies upon trade secrets, know-how, continuing technological innovations and licensing opportunities to develop, maintain and strengthen its competitive position. Although Man Loong has confidentiality provisions in the agreements with our employees and independent contractors, there can be no assurance that that such agreements can fully protect its intellectual property, be enforced in a timely manner or that any such employees or consultants will not violate their agreements with Man Loong.

Furthermore, Man Loong may have to take legal action in the future to protect its trade secrets or know-how, or to defend them against claimed infringement of the rights of others. Any legal action of that type could be costly and time-consuming to Man Loong, and there can be no assure that such actions will be successful. The invalidation of key proprietary rights which we or Man Loong own or unsuccessful outcomes in lawsuits to protect our of Man Loong’s intellectual property may have a material adverse effect on our or Man Loong’s business, financial condition and results of operations.

If we or Man Loong cannot adequately protect our or its intellectual property rights, our or its competitors may be able to compete more directly with us or Man Loong, which could adversely affect our or Man Loong’s competitive position and, as a result, our and Man Loong’s business, financial condition and results of operations.

We may incur substantial liabilities and may be required to limit commercialization of our electronic trading platform in response to product liability lawsuits.

We or Man Loong could be the subject of complaints or litigation from agents or their customers alleging product quality or operational concerns. Litigation or adverse publicity resulting from these allegations could materially and adversely affect our business, regardless of whether the allegations are valid or whether we are liable. Neither we nor Man Loong currently have product liability insurance coverage, and even if there was such coverage, there would be no assurance that such coverage would be sufficient to properly protect us. Further, claims of this type, whether substantiated or not, may divert our financial and management resources from revenue generating activities and the business operation.

We are an “emerging growth company,” and any decision on our part to comply with certain reduced disclosure requirements applicable to emerging growth companies could make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act enacted in April 2012, and, for as long as we continue to be an emerging growth company, we may choose to take advantage of exemptions from various reporting requirements applicable to other public companies including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We could remain an emerging growth company until the earliest of : (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of our first sale of common equity securities pursuant to an effective registration statement; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer. We cannot predict if investors will find our common stock less attractive if we choose to rely on these exemptions. If some investors find our common stock less attractive as a result of any choices to reduce future disclosure, there may be a less active trading market for our common stock and our stock price may be more volatile.

| 14 |

Under Section 107(b) of the Jumpstart Our Business Startups Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

As a result of us becoming a public company, we are subject to additional reporting and corporate governance requirements that will require additional management time, resources and expense.

We are obligated to file with the U.S. Securities and Exchange Commission annual and quarterly information and other reports that are specified in the U.S. Securities Exchange Act of 1934. We are also subject to other reporting and corporate governance requirements under the Sarbanes-Oxley Act of 2002, as amended, and the rules and regulations promulgated thereunder, all of which will impose significant compliance and reporting obligations upon us.

Our internal controls over financial reporting may not be effective and our independent registered public accounting firm may not be able to certify as to their effectiveness, which could have a significant and adverse effect on our business and reputation.

As a newly public reporting company, we will be in a continuing process of developing, establishing, and maintaining internal controls and procedures that will allow our management to report on, and our independent registered public accounting firm to attest to, our internal controls over financial reporting if and when required to do so under Section 404 of the Sarbanes-Oxley Act of 2002. Our independent registered public accounting firm is not required to attest to the effectiveness of our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act until the later of the year following our first annual report required to be filed with the SEC, or the date we are no longer an emerging growth company. If we fail to achieve and maintain the adequacy of our internal controls, we would not be able to conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with Section 404. At such time, our independent registered public accounting firm may issue a report that is adverse in the event it is not satisfied with the level at which our controls are documented, designed or operating. Moreover, our testing, or the subsequent testing by our independent registered public accounting firm, that must be performed may reveal other material weaknesses or that the material weaknesses described above have not been fully remediated. If we do not remediate the material weaknesses described above, or if other material weaknesses are identified or we are not able to comply with the requirements of Section 404 in a timely manner, our reported financial results could be materially misstated or could subsequently require restatement, we could receive an adverse opinion regarding our internal controls over financial reporting from our independent registered public accounting firm and we could be subject to investigations or sanctions by regulatory authorities, which would require additional financial and management resources, and the market price of our stock could decline.

Future sales of our common stock by our existing shareholders could cause our stock price to decline.

All of our outstanding shares of common stock are eligible for resale under Rule 144, subject to certain restrictions. If our shareholders sell substantial amounts of our common stock in the public market at the same time, the market price of our common stock could decrease significantly due to an imbalance in the supply and demand of our common stock. Even if they do not actually sell the stock, the perception in the public market that our shareholders might sell significant shares of our common stock could also depress the market price of our common stock.

A decline in the price of shares of our common stock might impede our ability to raise capital through the issuance of additional shares of our common stock or other equity securities, and may cause you to lose part or all of your investment in our shares of common stock.

| 15 |

Shareholders do not have pre-emptive rights, which will cause them to experience dilution if we issue additional securities.

We may issue and sell additional shares of our authorized but previously unissued shares of common stock, preferred stock, or common stock warrants on such terms and conditions as our Board of Directors, in its sole discretion, may determine without consent of our shareholders. Our shareholders do not have pre-emptive rights to acquire additional shares should we in the future issue or sell additional securities. Thus, we are not required to offer any existing shareholder the right to purchase his or her pro rata portion of any future issuance of securities and, therefore, upon the issuance of any additional securities by us hereafter, our shareholders will not be able to maintain their then existing pro rata ownership in our outstanding shares of common stock, preferred stock, or common stock warrants without additional purchases of securities at the price then set internally by us.

In March 2015, we increased the number of our authorized shares from 500,000,000 to 1,000,000,000. The par value of our shares remained unchanged at $.0001. We also effected a 10 for 1 stock split, whereby we exchanged 10 of our shares for every 1 share issued at outstanding before the split. Following the share split, we have 512,600,000 shares issued and outstanding.

Effecting a forward stock split and an increase in our authorized number of shares of common stock may not result in increased liquidity in the trading of our stock and could have certain anti-takeover effects.

There is no guarantee that the liquidity in the trading of our common stock after our forward stock split will increase. In addition, any additional issuance of common stock could, under certain circumstances, have the effect of delaying or preventing a change in control by increasing the number of outstanding shares entitled to vote and by increasing the number of votes required to approve a change in control. The issuance of the additional authorized shares recently approved by our board of directors and shareholders could render more difficult or discourage an attempt to obtain control of eBullion by means of a tender offer, proxy contest, merger or otherwise. The ability of the board of the directors to issue such additional shares of common stock could discourage an attempt by a party to acquire control of our company by tender offer or other means. Such issuances could therefore deprive stockholders of benefits that could result from such an attempt, such as the realization of a premium over the market price that such an attempt could cause.

In the event of a breach of law by us or a breach of a contractual obligation our shareholders will have little or no recourse because all of our assets, as well as our officers and directors, are located in Hong Kong.