KP Funds

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22838

The KP Funds

(Exact name of

registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

Michael Beattie

c/o SEI

Corporation

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-342-5734

Date of fiscal year end: December 31, 2014

Date of reporting period: June 30, 2014

| Item 1. |

Reports to Stockholders. |

|

|

|

| The KP Funds |

|

|

KP Retirement Path 2015 Fund: KPRAX

KP Retirement Path 2020 Fund: KPRBX

KP Retirement Path 2025 Fund:

KPRCX

KP Retirement Path 2030 Fund: KPRDX

KP Retirement Path 2035 Fund: KPREX

KP Retirement Path 2040 Fund:

KPRFX

KP Retirement Path 2045 Fund: KPRGX

KP Retirement Path 2050 Fund: KPRHX

KP Retirement Path 2055 Fund: KPRIX

KP Retirement Path 2060 Fund:

KPRJX

KP Large Cap Equity Fund: KPLCX

KP Small Cap Equity Fund: KPSCX

KP International Equity Fund: KPIEX

KP Fixed Income Fund: KPFIX

Semi-Annual Report

June 30, 2014

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

The Funds file their complete schedules of investments with

the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after period end. The Funds’ Forms N-Q are available on the Commission’s website at

http://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, as well as information relating

to how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling

855-457-3637 (855-4KPFNDS); and (ii) on the Commission’s website at http://www.sec.gov.

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

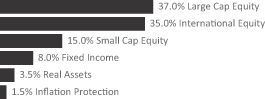

| KP Retirement Path 2015 Fund |

|

|

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| AFFILIATED REGISTERED INVESTMENT COMPANIES — 63.0% |

|

| KP Fixed Income Fund* |

|

|

18,181,447 |

|

|

$ |

184,905 |

|

| KP International Equity Fund* |

|

|

3,885,303 |

|

|

|

40,951 |

|

| KP Large Cap Equity Fund* |

|

|

9,303,970 |

|

|

|

97,971 |

|

| KP Small Cap Equity Fund* |

|

|

2,074,874 |

|

|

|

21,496 |

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Registered Investment Companies

(Cost $328,697) (000) |

|

|

|

345,323 |

|

|

|

|

|

|

|

|

|

|

| UNAFFILIATED REGISTERED INVESTMENT COMPANIES — 37.0% |

|

| DFA Commodity Strategy Portfolio |

|

|

602,554 |

|

|

|

5,465 |

|

| DFA International Real Estate Securities Portfolio |

|

|

960,954 |

|

|

|

5,487 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Lazard Global Listed Infrastructure Portfolio |

|

|

369,297 |

|

|

$ |

5,458 |

|

| T Rowe Price Institutional Floating Rate Fund |

|

|

532,561 |

|

|

|

5,480 |

|

| T Rowe Price New Era Fund |

|

|

108,601 |

|

|

|

5,543 |

|

| Vanguard Inflation-Protected Securities Fund |

|

|

7,308,021 |

|

|

|

79,511 |

|

| Vanguard REIT Index Fund |

|

|

665,804 |

|

|

|

10,933 |

|

| Vanguard Short-Term Bond Index Fund |

|

|

8,046,442 |

|

|

|

84,729 |

|

|

|

|

|

|

|

|

|

|

| Total Unaffiliated Registered Investment Companies

(Cost $197,392) (000) |

|

|

|

202,606 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.0%

(Cost $526,089) (000) |

|

|

|

|

|

$ |

547,929 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $547,960 (000).

| * |

Non-income producing security. |

REIT — Real Estate

Investment Trust

As of June 30, 2014, all of the Fund’s investments were considered Level 1 in accordance with the authoritative

guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended June 30, 2014,

there were no transfers between Level 1 and Level 2 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. As of June 30, 2014, there were no Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended June 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Value

1/10/2014*

(000) |

|

|

Purchases

at Cost

(000) |

|

|

Proceeds

from Sales

(000) |

|

|

Unrealized

Appreciation

(000) |

|

|

Realized

Gain

(000) |

|

|

Value

6/30/2014

(000) |

|

|

Dividend

Income

(000) |

|

| KP Fixed Income Fund |

|

$ |

— |

|

|

$ |

192,408 |

|

|

$ |

(11,853 |

) |

|

$ |

4,310 |

|

|

$ |

40 |

|

|

$ |

184,905 |

|

|

$ |

— |

|

| KP International Equity Fund |

|

|

— |

|

|

|

43,939 |

|

|

|

(6,873 |

) |

|

|

3,601 |

|

|

|

284 |

|

|

|

40,951 |

|

|

|

— |

|

| KP Large Cap Equity Fund |

|

|

— |

|

|

|

107,529 |

|

|

|

(17,728 |

) |

|

|

7,481 |

|

|

|

689 |

|

|

|

97,971 |

|

|

|

— |

|

| KP Small Cap Equity Fund |

|

|

— |

|

|

|

24,307 |

|

|

|

(4,174 |

) |

|

|

1,234 |

|

|

|

129 |

|

|

|

21,496 |

|

|

|

— |

|

| * |

The Fund commenced operations on January 10, 2014. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying

notes are an integral part of the financial statements.

1

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

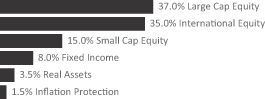

| KP Retirement Path 2020 Fund |

|

|

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| AFFILIATED REGISTERED INVESTMENT COMPANIES — 70.3% |

|

| KP Fixed Income Fund* |

|

|

18,924,016 |

|

|

$ |

192,457 |

|

| KP International Equity Fund* |

|

|

8,203,802 |

|

|

|

86,468 |

|

| KP Large Cap Equity Fund* |

|

|

13,255,758 |

|

|

|

139,583 |

|

| KP Small Cap Equity Fund* |

|

|

4,389,760 |

|

|

|

45,478 |

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Registered Investment Companies

(Cost $438,575) (000) |

|

|

|

463,986 |

|

|

|

|

|

|

|

|

|

|

| UNAFFILIATED REGISTERED INVESTMENT COMPANIES — 29.7% |

|

| DFA Commodity Strategy Portfolio |

|

|

705,133 |

|

|

|

6,396 |

|

| DFA International Real Estate Securities Portfolio |

|

|

1,184,932 |

|

|

|

6,766 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Lazard Global Listed Infrastructure Portfolio |

|

|

446,942 |

|

|

$ |

6,606 |

|

| T Rowe Price Institutional Floating Rate Fund |

|

|

639,991 |

|

|

|

6,586 |

|

| T Rowe Price New Era Fund |

|

|

131,495 |

|

|

|

6,712 |

|

| Vanguard Inflation-Protected Securities Fund |

|

|

7,197,374 |

|

|

|

78,307 |

|

| Vanguard REIT Index Fund |

|

|

809,918 |

|

|

|

13,299 |

|

| Vanguard Short-Term Bond Index Fund |

|

|

6,753,959 |

|

|

|

71,118 |

|

|

|

|

|

|

|

|

|

|

| Total Unaffiliated Registered Investment Companies

(Cost $189,872) (000) |

|

|

|

195,790 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.0%

(Cost $628,447) (000) |

|

|

|

|

|

$ |

659,776 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $659,793 (000).

| * |

Non-income producing security. |

REIT — Real Estate

Investment Trust

As of June 30, 2014, all of the Fund’s investments were considered Level 1 in accordance with the authoritative

guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended June 30, 2014,

there were no transfers between Level 1 and Level 2 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. As of June 30, 2014, there were no Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended June 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Value

1/10/2014*

(000) |

|

|

Purchases

at Cost

(000) |

|

|

Proceeds

from Sales

(000) |

|

|

Unrealized

Appreciation

(000) |

|

|

Realized

Gain

(000) |

|

|

Value

6/30/2014

(000) |

|

|

Dividend

Income

(000) |

|

| KP Fixed Income Fund |

|

$ |

— |

|

|

$ |

192,368 |

|

|

$ |

(4,337 |

) |

|

$ |

4,425 |

|

|

$ |

1 |

|

|

$ |

192,457 |

|

|

$ |

— |

|

| KP International Equity Fund |

|

|

— |

|

|

|

85,855 |

|

|

|

(7,243 |

) |

|

|

7,588 |

|

|

|

268 |

|

|

|

86,468 |

|

|

|

— |

|

| KP Large Cap Equity Fund |

|

|

— |

|

|

|

139,185 |

|

|

|

(10,777 |

) |

|

|

10,805 |

|

|

|

370 |

|

|

|

139,583 |

|

|

|

— |

|

| KP Small Cap Equity Fund |

|

|

— |

|

|

|

48,611 |

|

|

|

(5,990 |

) |

|

|

2,593 |

|

|

|

264 |

|

|

|

45,478 |

|

|

|

— |

|

| * |

The Fund commenced operations on January 10, 2014. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying

notes are an integral part of the financial statements.

2

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

| KP Retirement Path 2025 Fund |

|

|

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| AFFILIATED REGISTERED INVESTMENT COMPANIES — 78.7% |

|

| KP Fixed Income Fund* |

|

|

14,196,488 |

|

|

$ |

144,378 |

|

| KP International Equity Fund* |

|

|

12,049,860 |

|

|

|

127,006 |

|

| KP Large Cap Equity Fund* |

|

|

14,907,251 |

|

|

|

156,974 |

|

| KP Small Cap Equity Fund* |

|

|

5,985,642 |

|

|

|

62,011 |

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Registered Investment Companies

(Cost $460,432) (000) |

|

|

|

490,369 |

|

|

|

|

|

|

|

|

|

|

| UNAFFILIATED REGISTERED INVESTMENT COMPANIES — 21.3% |

|

| DFA Commodity Strategy Portfolio |

|

|

657,017 |

|

|

|

5,959 |

|

| DFA International Real Estate Securities Portfolio |

|

|

1,116,633 |

|

|

|

6,376 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Lazard Global Listed Infrastructure Portfolio |

|

|

420,140 |

|

|

$ |

6,209 |

|

| T Rowe Price Institutional Floating Rate Fund |

|

|

594,649 |

|

|

|

6,119 |

|

| T Rowe Price New Era Fund |

|

|

124,666 |

|

|

|

6,363 |

|

| Vanguard Inflation-Protected Securities Fund |

|

|

4,499,923 |

|

|

|

48,959 |

|

| Vanguard REIT Index Fund |

|

|

772,831 |

|

|

|

12,690 |

|

| Vanguard Short-Term Bond Index Fund |

|

|

3,839,286 |

|

|

|

40,428 |

|

|

|

|

|

|

|

|

|

|

| Total Unaffiliated Registered Investment Companies

(Cost $128,124) (000) |

|

|

|

133,103 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.0%

(Cost $588,556) (000) |

|

|

|

|

|

$ |

623,472 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $623,466 (000).

| * |

Non-income producing security. |

REIT — Real Estate

Investment Trust

As of June 30, 2014, all of the Fund’s investments were considered Level 1 in accordance with the authoritative

guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended June 30, 2014,

there were no transfers between Level 1 and Level 2 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. As of June 30, 2014, there were no Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended June 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Value

1/10/2014*

(000) |

|

|

Purchases

at Cost

(000) |

|

|

Proceeds

from Sales

(000) |

|

|

Unrealized

Appreciation

(000) |

|

|

Realized

Gain

(000) |

|

|

Value

6/30/2014

(000) |

|

|

Dividend

Income

(000) |

|

| KP Fixed Income Fund |

|

$ |

— |

|

|

$ |

142,170 |

|

|

$ |

(1,070 |

) |

|

$ |

3,274 |

|

|

$ |

4 |

|

|

$ |

144,378 |

|

|

$ |

— |

|

| KP International Equity Fund |

|

|

— |

|

|

|

120,125 |

|

|

|

(4,320 |

) |

|

|

11,116 |

|

|

|

85 |

|

|

|

127,006 |

|

|

|

— |

|

| KP Large Cap Equity Fund |

|

|

— |

|

|

|

151,179 |

|

|

|

(6,430 |

) |

|

|

12,018 |

|

|

|

207 |

|

|

|

156,974 |

|

|

|

— |

|

| KP Small Cap Equity Fund |

|

|

— |

|

|

|

63,188 |

|

|

|

(4,867 |

) |

|

|

3,529 |

|

|

|

161 |

|

|

|

62,011 |

|

|

|

— |

|

| * |

The Fund commenced operations on January 10, 2014. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying

notes are an integral part of the financial statements.

3

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

| KP Retirement Path 2030 Fund |

|

|

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| AFFILIATED REGISTERED INVESTMENT COMPANIES — 86.8% |

|

| KP Fixed Income Fund* |

|

|

9,765,695 |

|

|

$ |

99,317 |

|

| KP International Equity Fund* |

|

|

14,424,637 |

|

|

|

152,036 |

|

| KP Large Cap Equity Fund* |

|

|

15,543,084 |

|

|

|

163,668 |

|

| KP Small Cap Equity Fund* |

|

|

6,865,012 |

|

|

|

71,122 |

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Registered Investment Companies

(Cost $454,143) (000) |

|

|

|

486,143 |

|

|

|

|

|

|

|

|

|

|

| UNAFFILIATED REGISTERED INVESTMENT COMPANIES — 13.2% |

|

| DFA Commodity Strategy Portfolio |

|

|

580,699 |

|

|

|

5,267 |

|

| DFA International Real Estate Securities Portfolio |

|

|

922,294 |

|

|

|

5,266 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Lazard Global Listed Infrastructure Portfolio |

|

|

352,906 |

|

|

$ |

5,216 |

|

| T Rowe Price Institutional Floating Rate Fund |

|

|

508,312 |

|

|

|

5,231 |

|

| T Rowe Price New Era Fund |

|

|

105,987 |

|

|

|

5,410 |

|

| Vanguard Inflation-Protected Securities Fund |

|

|

2,168,705 |

|

|

|

23,595 |

|

| Vanguard REIT Index Fund |

|

|

642,714 |

|

|

|

10,553 |

|

| Vanguard Short-Term Bond Index Fund |

|

|

1,271,442 |

|

|

|

13,388 |

|

|

|

|

|

|

|

|

|

|

| Total Unaffiliated Registered Investment Companies

(Cost $70,199) (000) |

|

|

|

73,926 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.0%

(Cost $524,342) (000) |

|

|

|

|

|

$ |

560,069 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $560,046 (000).

| * |

Non-income producing security. |

REIT — Real Estate

Investment Trust

As of June 30, 2014, all of the Fund’s investments were considered Level 1 in accordance with the authoritative

guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended June 30, 2014,

there were no transfers between Level 1 and Level 2 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. As of June 30, 2014, there were no Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended June 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Value

1/10/2014*

(000) |

|

|

Purchases

at Cost

(000) |

|

|

Proceeds

from Sales

(000) |

|

|

Unrealized

Appreciation

(000) |

|

|

Realized

Gain

(000) |

|

|

Value

6/30/2014

(000) |

|

|

Dividend

Income

(000) |

|

| KP Fixed Income Fund |

|

$ |

— |

|

|

$ |

99,109 |

|

|

$ |

(2,035 |

) |

|

$ |

2,242 |

|

|

$ |

1 |

|

|

$ |

99,317 |

|

|

$ |

— |

|

| KP International Equity Fund |

|

|

— |

|

|

|

142,475 |

|

|

|

(3,602 |

) |

|

|

13,113 |

|

|

|

50 |

|

|

|

152,036 |

|

|

|

— |

|

| KP Large Cap Equity Fund |

|

|

— |

|

|

|

153,756 |

|

|

|

(2,704 |

) |

|

|

12,580 |

|

|

|

36 |

|

|

|

163,668 |

|

|

|

— |

|

| KP Small Cap Equity Fund |

|

|

— |

|

|

|

71,734 |

|

|

|

(4,836 |

) |

|

|

4,065 |

|

|

|

159 |

|

|

|

71,122 |

|

|

|

— |

|

| * |

The Fund commenced operations on January 10, 2014. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying

notes are an integral part of the financial statements.

4

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

| KP Retirement Path 2035 Fund |

|

|

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| AFFILIATED REGISTERED INVESTMENT COMPANIES — 91.9% |

|

| KP Fixed Income Fund* |

|

|

8,063,334 |

|

|

$ |

82,004 |

|

| KP International Equity Fund* |

|

|

17,416,262 |

|

|

|

183,567 |

|

| KP Large Cap Equity Fund* |

|

|

18,580,423 |

|

|

|

195,652 |

|

| KP Small Cap Equity Fund* |

|

|

8,208,206 |

|

|

|

85,037 |

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Registered Investment Companies

(Cost $508,771) (000) |

|

|

|

546,260 |

|

|

|

|

|

|

|

|

|

|

| UNAFFILIATED REGISTERED INVESTMENT COMPANIES — 8.1% |

|

| DFA Commodity Strategy Portfolio |

|

|

478,937 |

|

|

|

4,344 |

|

| DFA International Real Estate Securities Portfolio |

|

|

775,415 |

|

|

|

4,428 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Lazard Global Listed Infrastructure Portfolio |

|

|

295,704 |

|

|

$ |

4,371 |

|

| T Rowe Price Institutional Floating Rate Fund |

|

|

427,437 |

|

|

|

4,398 |

|

| T Rowe Price New Era Fund |

|

|

88,931 |

|

|

|

4,539 |

|

| Vanguard Inflation-Protected Securities Fund |

|

|

1,221,831 |

|

|

|

13,294 |

|

| Vanguard REIT Index Fund |

|

|

540,650 |

|

|

|

8,877 |

|

| Vanguard Short-Term Bond Index Fund |

|

|

393,040 |

|

|

|

4,139 |

|

|

|

|

|

|

|

|

|

|

| Total Unaffiliated Registered Investment Companies

(Cost $45,442) (000) |

|

|

|

48,390 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.0%

(Cost $554,213) (000) |

|

|

|

|

|

$ |

594,650 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $594,618 (000).

| * |

Non-income producing security. |

REIT — Real Estate

Investment Trust

As of June 30, 2014, all of the Fund’s investments were considered Level 1 in accordance with the authoritative

guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended June 30, 2014,

there were no transfers between Level 1 and Level 2 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. As of June 30, 2014, there were no Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended June 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Value

1/10/2014*

(000) |

|

|

Purchases

at

Cost

(000) |

|

|

Proceeds

from Sales

(000) |

|

|

Unrealized

Appreciation

(000) |

|

|

Realized

Gain

(000) |

|

|

Value

6/30/2014

(000) |

|

|

Dividend

Income

(000) |

|

| KP Fixed Income Fund |

|

$ |

— |

|

|

$ |

81,641 |

|

|

$ |

(1,481 |

) |

|

$ |

1,837 |

|

|

$ |

7 |

|

|

$ |

82,004 |

|

|

$ |

— |

|

| KP International Equity Fund |

|

|

— |

|

|

|

171,567 |

|

|

|

(3,829 |

) |

|

|

15,808 |

|

|

|

21 |

|

|

|

183,567 |

|

|

|

— |

|

| KP Large Cap Equity Fund |

|

|

— |

|

|

|

183,568 |

|

|

|

(2,941 |

) |

|

|

14,973 |

|

|

|

52 |

|

|

|

195,652 |

|

|

|

— |

|

| KP Small Cap Equity Fund |

|

|

— |

|

|

|

84,909 |

|

|

|

(4,897 |

) |

|

|

4,871 |

|

|

|

154 |

|

|

|

85,037 |

|

|

|

— |

|

| * |

The Fund commenced operations on January 10, 2014. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying

notes are an integral part of the financial statements.

5

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

| KP Retirement Path 2040 Fund |

|

|

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| AFFILIATED REGISTERED INVESTMENT COMPANIES — 94.3% |

|

| KP Fixed Income Fund* |

|

|

5,130,996 |

|

|

$ |

52,182 |

|

| KP International Equity Fund* |

|

|

15,642,392 |

|

|

|

164,871 |

|

| KP Large Cap Equity Fund* |

|

|

18,236,457 |

|

|

|

192,031 |

|

| KP Small Cap Equity Fund* |

|

|

7,494,925 |

|

|

|

77,647 |

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Registered Investment Companies

(Cost $452,388) (000) |

|

|

|

486,731 |

|

|

|

|

|

|

|

|

|

|

| UNAFFILIATED REGISTERED INVESTMENT COMPANIES — 5.7% |

|

| DFA Commodity Strategy Portfolio |

|

|

324,835 |

|

|

|

2,946 |

|

| DFA International Real Estate Securities Portfolio |

|

|

517,553 |

|

|

|

2,955 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Lazard Global Listed Infrastructure Portfolio |

|

|

200,623 |

|

|

$ |

2,965 |

|

| T Rowe Price Institutional Floating Rate Fund |

|

|

284,349 |

|

|

|

2,926 |

|

| T Rowe Price New Era Fund |

|

|

58,855 |

|

|

|

3,004 |

|

| Vanguard Inflation-Protected Securities Fund |

|

|

815,074 |

|

|

|

8,868 |

|

| Vanguard REIT Index Fund |

|

|

360,459 |

|

|

|

5,919 |

|

|

|

|

|

|

|

|

|

|

| Total Unaffiliated Registered Investment Companies

(Cost $27,638) (000) |

|

|

|

29,583 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.0%

(Cost $480,026) (000) |

|

|

|

|

|

$ |

516,314 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $516,283 (000).

| * |

Non-income producing security. |

REIT — Real Estate

Investment Trust

As of June 30, 2014, all of the Fund’s investments were considered Level 1 in accordance with the authoritative

guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended June 30, 2014,

there were no transfers between Level 1 and Level 2 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. As of June 30, 2014, there were no Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended June 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Value

1/10/2014*

(000) |

|

|

Purchases

at Cost

(000) |

|

|

Proceeds

from Sales

(000) |

|

|

Unrealized

Appreciation

(000) |

|

|

Realized

Gain

(000) |

|

|

Value

6/30/2014

(000) |

|

|

Dividend

Income

(000) |

|

| KP Fixed Income Fund |

|

$ |

— |

|

|

$ |

52,285 |

|

|

$ |

(1,278 |

) |

|

$ |

1,169 |

|

|

$ |

6 |

|

|

$ |

52,182 |

|

|

$ |

— |

|

| KP International Equity Fund |

|

|

— |

|

|

|

156,597 |

|

|

|

(5,886 |

) |

|

|

14,126 |

|

|

|

34 |

|

|

|

164,871 |

|

|

|

— |

|

| KP Large Cap Equity Fund |

|

|

— |

|

|

|

180,234 |

|

|

|

(2,940 |

) |

|

|

14,702 |

|

|

|

35 |

|

|

|

192,031 |

|

|

|

— |

|

| KP Small Cap Equity Fund |

|

|

— |

|

|

|

79,815 |

|

|

|

(6,726 |

) |

|

|

4,346 |

|

|

|

212 |

|

|

|

77,647 |

|

|

|

— |

|

| * |

The Fund commenced operations on January 10, 2014. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying

notes are an integral part of the financial statements.

6

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

| KP Retirement Path 2045 Fund |

|

|

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| AFFILIATED REGISTERED INVESTMENT COMPANIES — 95.0% |

|

| KP Fixed Income Fund* |

|

|

2,584,737 |

|

|

$ |

26,287 |

|

| KP International Equity Fund* |

|

|

10,908,730 |

|

|

|

114,978 |

|

| KP Large Cap Equity Fund* |

|

|

11,573,306 |

|

|

|

121,867 |

|

| KP Small Cap Equity Fund* |

|

|

4,790,485 |

|

|

|

49,629 |

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Registered Investment Companies

(Cost $290,584) (000) |

|

|

|

312,761 |

|

|

|

|

|

|

|

|

|

|

| UNAFFILIATED REGISTERED INVESTMENT COMPANIES — 5.0% |

|

| DFA Commodity Strategy Portfolio |

|

|

178,823 |

|

|

|

1,622 |

|

| DFA International Real Estate Securities Portfolio |

|

|

291,713 |

|

|

|

1,666 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Lazard Global Listed Infrastructure Portfolio |

|

|

112,209 |

|

|

$ |

1,658 |

|

| T Rowe Price Institutional Floating Rate Fund |

|

|

159,830 |

|

|

|

1,645 |

|

| T Rowe Price New Era Fund |

|

|

32,627 |

|

|

|

1,665 |

|

| Vanguard Inflation-Protected Securities Fund |

|

|

456,867 |

|

|

|

4,971 |

|

| Vanguard REIT Index Fund |

|

|

202,164 |

|

|

|

3,319 |

|

|

|

|

|

|

|

|

|

|

| Total Unaffiliated Registered Investment Companies

(Cost $15,477) (000) |

|

|

|

|

|

|

16,546 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.0%

(Cost $306,061) (000) |

|

|

|

|

|

$ |

329,307 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $329,287 (000).

| * |

Non-income producing security. |

REIT — Real Estate

Investment Trust

As of June 30, 2014, all of the Fund’s investments were considered Level 1 in accordance with the authoritative

guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended June 30, 2014,

there were no transfers between Level 1 and Level 2 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. As of June 30, 2014, there were no Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended June 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Value

1/10/2014*

(000) |

|

|

Purchases

at Cost

(000) |

|

|

Proceeds

from Sales

(000) |

|

|

Unrealized

Appreciation

(000) |

|

|

Realized

Gain

(000) |

|

|

Value

6/30/2014

(000) |

|

|

Dividend

Income

(000) |

|

| KP Fixed Income Fund |

|

$ |

— |

|

|

$ |

26,557 |

|

|

$ |

(858 |

) |

|

$ |

582 |

|

|

$ |

6 |

|

|

$ |

26,287 |

|

|

$ |

— |

|

| KP International Equity Fund |

|

|

— |

|

|

|

107,541 |

|

|

|

(2,249 |

) |

|

|

9,658 |

|

|

|

28 |

|

|

|

114,978 |

|

|

|

— |

|

| KP Large Cap Equity Fund |

|

|

— |

|

|

|

115,574 |

|

|

|

(2,899 |

) |

|

|

9,158 |

|

|

|

34 |

|

|

|

121,867 |

|

|

|

— |

|

| KP Small Cap Equity Fund |

|

|

— |

|

|

|

50,330 |

|

|

|

(3,558 |

) |

|

|

2,779 |

|

|

|

78 |

|

|

|

49,629 |

|

|

|

— |

|

| * |

The Fund commenced operations on January 10, 2014. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying

notes are an integral part of the financial statements.

7

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

| KP Retirement Path 2050 Fund |

|

|

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| AFFILIATED REGISTERED INVESTMENT COMPANIES — 95.0% |

|

| KP Fixed Income Fund* |

|

|

832,412 |

|

|

$ |

8,466 |

|

| KP International Equity Fund* |

|

|

3,501,475 |

|

|

|

36,905 |

|

| KP Large Cap Equity Fund* |

|

|

3,709,392 |

|

|

|

39,059 |

|

| KP Small Cap Equity Fund* |

|

|

1,529,298 |

|

|

|

15,844 |

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Registered Investment Companies

(Cost $93,647) (000) |

|

|

|

100,274 |

|

|

|

|

|

|

|

|

|

|

| UNAFFILIATED REGISTERED INVESTMENT COMPANIES — 5.0% |

|

| DFA Commodity Strategy Portfolio |

|

|

57,543 |

|

|

|

522 |

|

| DFA International Real Estate Securities Portfolio |

|

|

93,603 |

|

|

|

535 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Lazard Global Listed Infrastructure Portfolio |

|

|

35,539 |

|

|

$ |

525 |

|

| T Rowe Price Institutional Floating Rate Fund |

|

|

50,829 |

|

|

|

523 |

|

| T Rowe Price New Era Fund |

|

|

10,467 |

|

|

|

534 |

|

| Vanguard Inflation-Protected Securities Fund |

|

|

145,706 |

|

|

|

1,585 |

|

| Vanguard REIT Index Fund |

|

|

64,647 |

|

|

|

1,062 |

|

|

|

|

|

|

|

|

|

|

| Total Unaffiliated Registered Investment Companies

(Cost $4,947) (000) |

|

|

|

5,286 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.0%

(Cost $98,594) (000) |

|

|

|

|

|

$ |

105,560 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $105,551 (000).

| * |

Non-income producing security. |

REIT — Real Estate

Investment Trust

As of June 30, 2014, all of the Fund’s investments were considered Level 1 in accordance with the authoritative

guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended June 30, 2014,

there were no transfers between Level 1 and Level 2 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. As of June 30, 2014, there were no Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended June 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Value

1/10/2014*

(000) |

|

|

Purchases

at Cost

(000) |

|

|

Proceeds

from Sales

(000) |

|

|

Unrealized

Appreciation

(000) |

|

|

Realized

Gain

(000) |

|

|

Value

6/30/2014

(000) |

|

|

Dividend

Income

(000) |

|

| KP Fixed Income Fund |

|

$ |

— |

|

|

$ |

8,580 |

|

|

$ |

(293 |

) |

|

$ |

177 |

|

|

$ |

2 |

|

|

$ |

8,466 |

|

|

$ |

— |

|

| KP International Equity Fund |

|

|

— |

|

|

|

35,247 |

|

|

|

(1,219 |

) |

|

|

2,863 |

|

|

|

14 |

|

|

|

36,905 |

|

|

|

— |

|

| KP Large Cap Equity Fund |

|

|

— |

|

|

|

37,659 |

|

|

|

(1,360 |

) |

|

|

2,735 |

|

|

|

25 |

|

|

|

39,059 |

|

|

|

— |

|

| KP Small Cap Equity Fund |

|

|

— |

|

|

|

16,710 |

|

|

|

(1,736 |

) |

|

|

853 |

|

|

|

17 |

|

|

|

15,844 |

|

|

|

— |

|

| * |

The Fund commenced operations on January 10, 2014. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying

notes are an integral part of the financial statements.

8

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

| KP Retirement Path 2055 Fund |

|

|

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| AFFILIATED REGISTERED INVESTMENT COMPANIES — 95.1% |

|

| KP Fixed Income Fund* |

|

|

69,416 |

|

|

$ |

706 |

|

| KP International Equity Fund* |

|

|

293,000 |

|

|

|

3,088 |

|

| KP Large Cap Equity Fund* |

|

|

310,514 |

|

|

|

3,270 |

|

| KP Small Cap Equity Fund* |

|

|

128,197 |

|

|

|

1,328 |

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Registered Investment Companies

(Cost $8,014) (000) |

|

|

|

8,392 |

|

|

|

|

|

|

|

|

|

|

| UNAFFILIATED REGISTERED INVESTMENT COMPANIES — 5.0% |

|

| DFA Commodity Strategy Portfolio |

|

|

4,774 |

|

|

|

43 |

|

| DFA International Real Estate Securities Portfolio |

|

|

7,828 |

|

|

|

45 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Lazard Global Listed Infrastructure Portfolio |

|

|

3,011 |

|

|

$ |

44 |

|

| T Rowe Price Institutional Floating Rate Fund |

|

|

4,278 |

|

|

|

44 |

|

| T Rowe Price New Era Fund |

|

|

877 |

|

|

|

45 |

|

| Vanguard Inflation-Protected Securities Fund |

|

|

12,284 |

|

|

|

134 |

|

| Vanguard REIT Index Fund |

|

|

5,425 |

|

|

|

89 |

|

|

|

|

|

|

|

|

|

|

| Total Unaffiliated Registered Investment Companies

(Cost $418) (000) |

|

|

|

444 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.1%

(Cost $8,432) (000) |

|

|

|

|

|

$ |

8,836 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $8,831 (000).

| * |

Non-income producing security. |

REIT — Real Estate

Investment Trust

As of June 30, 2014, all of the Fund’s investments were considered Level 1 in accordance with the authoritative

guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended June 30, 2014,

there were no transfers between Level 1 and Level 2 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. As of June 30, 2014, there were no Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended June 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Value

1/10/2014*

(000) |

|

|

Purchases

at

Cost

(000) |

|

|

Proceeds

from Sales

(000) |

|

|

Unrealized

Appreciation

(000) |

|

|

Realized

Gain

(000) |

|

|

Value

6/30/2014

(000) |

|

|

Dividend

Income

(000) |

|

| KP Fixed Income Fund |

|

$ |

— |

|

|

$ |

725 |

|

|

$ |

(31 |

) |

|

$ |

12 |

|

|

$ |

— |

|

|

$ |

706 |

|

|

$ |

— |

|

| KP International Equity Fund |

|

|

— |

|

|

|

3,116 |

|

|

|

(185 |

) |

|

|

155 |

|

|

|

2 |

|

|

|

3,088 |

|

|

|

— |

|

| KP Large Cap Equity Fund |

|

|

— |

|

|

|

3,293 |

|

|

|

(185 |

) |

|

|

160 |

|

|

|

2 |

|

|

|

3,270 |

|

|

|

— |

|

| KP Small Cap Equity Fund |

|

|

— |

|

|

|

1,409 |

|

|

|

(133 |

) |

|

|

51 |

|

|

|

1 |

|

|

|

1,328 |

|

|

|

— |

|

| * |

The Fund commenced operations on January 10, 2014. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying

notes are an integral part of the financial statements.

9

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

| KP Retirement Path 2060 Fund |

|

|

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| AFFILIATED REGISTERED INVESTMENT COMPANIES — 95.1% |

|

| KP Fixed Income Fund* |

|

|

20,261 |

|

|

$ |

206 |

|

| KP International Equity Fund* |

|

|

85,529 |

|

|

|

901 |

|

| KP Large Cap Equity Fund* |

|

|

90,503 |

|

|

|

954 |

|

| KP Small Cap Equity Fund* |

|

|

37,292 |

|

|

|

386 |

|

|

|

|

|

|

|

|

|

|

| Total Affiliated Registered Investment Companies

(Cost $2,369) (000) |

|

|

|

|

|

|

2,447 |

|

|

|

|

|

|

|

|

|

|

| UNAFFILIATED REGISTERED INVESTMENT COMPANIES — 5.1% |

|

| DFA Commodity Strategy Portfolio |

|

|

1,420 |

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| DFA International Real Estate Securities Portfolio |

|

|

2,255 |

|

|

$ |

13 |

|

| Lazard Global Listed Infrastructure Portfolio |

|

|

871 |

|

|

|

13 |

|

| T Rowe Price Institutional Floating Rate Fund |

|

|

1,256 |

|

|

|

13 |

|

| T Rowe Price New Era Fund |

|

|

252 |

|

|

|

13 |

|

| Vanguard Inflation-Protected Securities Fund |

|

|

3,579 |

|

|

|

39 |

|

| Vanguard REIT Index Fund |

|

|

1,569 |

|

|

|

25 |

|

|

|

|

|

|

|

|

|

|

| Total Unaffiliated Registered Investment

Companies

(Cost $125) (000) |

|

|

|

129 |

|

|

|

|

|

|

|

|

|

|

| Total Investments — 100.2%

(Cost $2,494) (000) |

|

|

|

|

|

$ |

2,576 |

|

|

|

|

|

|

|

|

|

|

Percentages are based on Net Assets of $2,572 (000).

| * |

Non-income producing security. |

REIT — Real Estate

Investment Trust

As of June 30, 2014, all of the Fund’s investments were considered Level 1 in accordance with the authoritative

guidance on fair value measurements and disclosure under U.S. generally accepted accounting principles.

For the period ended June 30, 2014,

there were no transfers between Level 1 and Level 2 assets and liabilities. All transfers, if any, are recognized by the Fund at the end of the period. As of June 30, 2014, there were no Level 3 investments.

The following is a summary of the transactions with affiliates for the period ended June 30, 2014:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Value

1/10/2014*

(000) |

|

|

Purchases

at Cost

(000) |

|

|

Proceeds

from Sales

(000) |

|

|

Unrealized

Appreciation

(000) |

|

|

Realized

Gain

(000) |

|

|

Value

6/30/2014

(000) |

|

|

Dividend

Income

(000) |

|

| KP Fixed Income Fund |

|

$ |

— |

|

|

$ |

653 |

|

|

$ |

(447 |

) |

|

$ |

2 |

|

|

$ |

(2 |

) |

|

$ |

206 |

|

|

$ |

— |

|

| KP International Equity Fund |

|

|

— |

|

|

|

2,849 |

|

|

|

(1,926 |

) |

|

|

28 |

|

|

|

(50 |

) |

|

|

901 |

|

|

|

— |

|

| KP Large Cap Equity Fund |

|

|

— |

|

|

|

3,003 |

|

|

|

(2,042 |

) |

|

|

32 |

|

|

|

(39 |

) |

|

|

954 |

|

|

|

— |

|

| KP Small Cap Equity Fund |

|

|

— |

|

|

|

1,217 |

|

|

|

(833 |

) |

|

|

16 |

|

|

|

(14 |

) |

|

|

386 |

|

|

|

— |

|

| * |

The Fund commenced operations on January 10, 2014. |

Amounts designated as “—” are $0 or have been rounded to $0.

The accompanying

notes are an integral part of the financial statements.

10

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

| † |

Percentages based on total investments. |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| COMMON STOCK — 98.4% |

|

| Consumer Discretionary — 15.8% |

|

| Advance Auto Parts |

|

|

14,440 |

|

|

$ |

1,948 |

|

| Amazon.com* |

|

|

55,196 |

|

|

|

17,927 |

|

| AutoNation* |

|

|

1,413 |

|

|

|

84 |

|

| AutoZone* |

|

|

809 |

|

|

|

434 |

|

| Bed Bath & Beyond* |

|

|

17,004 |

|

|

|

976 |

|

| Best Buy |

|

|

6,477 |

|

|

|

201 |

|

| BorgWarner |

|

|

5,897 |

|

|

|

384 |

|

| Cablevision Systems, Cl A |

|

|

5,073 |

|

|

|

90 |

|

| CarMax* |

|

|

42,689 |

|

|

|

2,220 |

|

| Carnival |

|

|

11,264 |

|

|

|

424 |

|

| CBS, Cl B |

|

|

13,473 |

|

|

|

837 |

|

| Chipotle Mexican Grill, Cl A* |

|

|

6,364 |

|

|

|

3,771 |

|

| Coach |

|

|

7,389 |

|

|

|

253 |

|

| Comcast, Cl A |

|

|

135,264 |

|

|

|

7,237 |

|

| Ctrip.com International ADR* |

|

|

47,500 |

|

|

|

3,042 |

|

| Darden Restaurants |

|

|

3,728 |

|

|

|

172 |

|

| Delphi Automotive |

|

|

76,898 |

|

|

|

5,286 |

|

| DIRECTV* |

|

|

11,952 |

|

|

|

1,016 |

|

| Discovery Communications, Cl A* |

|

|

5,193 |

|

|

|

386 |

|

| Dollar General* |

|

|

7,814 |

|

|

|

448 |

|

| Dollar Tree* |

|

|

56,963 |

|

|

|

3,102 |

|

| DR Horton |

|

|

176,395 |

|

|

|

4,335 |

|

| Expedia |

|

|

2,780 |

|

|

|

219 |

|

| Family Dollar Stores |

|

|

2,269 |

|

|

|

150 |

|

| Ford Motor |

|

|

99,876 |

|

|

|

1,722 |

|

| Fossil Group* |

|

|

1,186 |

|

|

|

124 |

|

| GameStop, Cl A |

|

|

2,704 |

|

|

|

109 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Gannett |

|

|

5,297 |

|

|

$ |

166 |

|

| Gap |

|

|

6,962 |

|

|

|

289 |

|

| Garmin |

|

|

3,414 |

|

|

|

208 |

|

| General Motors |

|

|

52,092 |

|

|

|

1,891 |

|

| Genuine Parts |

|

|

3,969 |

|

|

|

348 |

|

| Goodyear Tire & Rubber |

|

|

6,330 |

|

|

|

176 |

|

| Graham Holdings, Cl B |

|

|

108 |

|

|

|

78 |

|

| H&R Block |

|

|

7,276 |

|

|

|

243 |

|

| Harley-Davidson |

|

|

5,285 |

|

|

|

369 |

|

| Harman International Industries |

|

|

1,818 |

|

|

|

195 |

|

| Hasbro |

|

|

30,911 |

|

|

|

1,639 |

|

| Hilton Worldwide Holdings* |

|

|

110,178 |

|

|

|

2,567 |

|

| Home Depot |

|

|

33,855 |

|

|

|

2,741 |

|

| Interpublic Group of |

|

|

9,726 |

|

|

|

190 |

|

| Johnson Controls |

|

|

86,740 |

|

|

|

4,331 |

|

| Kohl’s |

|

|

18,989 |

|

|

|

1,000 |

|

| L Brands |

|

|

6,325 |

|

|

|

371 |

|

| Las Vegas Sands |

|

|

63,400 |

|

|

|

4,832 |

|

| Leggett & Platt |

|

|

3,246 |

|

|

|

111 |

|

| Lennar, Cl A |

|

|

4,691 |

|

|

|

197 |

|

| Lowe’s |

|

|

132,923 |

|

|

|

6,380 |

|

| Macy’s |

|

|

8,942 |

|

|

|

519 |

|

| Marriott International, Cl A |

|

|

5,292 |

|

|

|

339 |

|

| Mattel |

|

|

34,193 |

|

|

|

1,333 |

|

| McDonald’s |

|

|

56,558 |

|

|

|

5,698 |

|

| MGM Resorts International* |

|

|

121,100 |

|

|

|

3,197 |

|

| Michael Kors Holdings* |

|

|

32,313 |

|

|

|

2,864 |

|

| Mohawk Industries* |

|

|

1,406 |

|

|

|

195 |

|

| Netflix* |

|

|

6,853 |

|

|

|

3,019 |

|

| Newell Rubbermaid |

|

|

6,401 |

|

|

|

198 |

|

| News* |

|

|

11,468 |

|

|

|

206 |

|

| NIKE, Cl B |

|

|

18,303 |

|

|

|

1,419 |

|

| Nordstrom |

|

|

3,349 |

|

|

|

227 |

|

| Omnicom Group |

|

|

59,549 |

|

|

|

4,241 |

|

| O’Reilly Automotive* |

|

|

2,587 |

|

|

|

390 |

|

| PetSmart |

|

|

2,481 |

|

|

|

148 |

|

| priceline.com* |

|

|

10,650 |

|

|

|

12,812 |

|

| PulteGroup |

|

|

9,301 |

|

|

|

188 |

|

| PVH |

|

|

1,942 |

|

|

|

226 |

|

| Ralph Lauren, Cl A |

|

|

1,404 |

|

|

|

226 |

|

| Ross Stores |

|

|

5,578 |

|

|

|

369 |

|

| Scripps Networks Interactive, Cl A |

|

|

2,491 |

|

|

|

202 |

|

| Staples |

|

|

101,723 |

|

|

|

1,103 |

|

| Starbucks |

|

|

93,214 |

|

|

|

7,214 |

|

| Starwood Hotels & Resorts Worldwide |

|

|

4,934 |

|

|

|

399 |

|

| Target |

|

|

90,981 |

|

|

|

5,273 |

|

The accompanying

notes are an integral part of the financial statements.

11

|

|

|

| THE KP FUNDS |

|

June 30, 2014 (Unaudited) |

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Tesla Motors* |

|

|

6,650 |

|

|

$ |

1,596 |

|

| Tiffany |

|

|

2,592 |

|

|

|

260 |

|

| Time* |

|

|

3,645 |

|

|

|

88 |

|

| Time Warner |

|

|

51,137 |

|

|

|

3,592 |

|

| Time Warner Cable |

|

|

7,091 |

|

|

|

1,045 |

|

| TJX |

|

|

17,440 |

|

|

|

927 |

|

| Tractor Supply |

|

|

51,343 |

|

|

|

3,101 |

|

| TripAdvisor* |

|

|

2,593 |

|

|

|

282 |

|

| Twenty-First Century Fox, Cl A |

|

|

203,021 |

|

|

|

7,136 |

|

| Under Armour, Cl A* |

|

|

4,200 |

|

|

|

250 |

|

| Urban Outfitters* |

|

|

2,490 |

|

|

|

84 |

|

| VF |

|

|

8,314 |

|

|

|

524 |

|

| Viacom, Cl B |

|

|

40,818 |

|

|

|

3,540 |

|

| Walt Disney |

|

|

87,524 |

|

|

|

7,504 |

|

| Whirlpool |

|

|

1,937 |

|

|

|

270 |

|

| Wyndham Worldwide |

|

|

3,427 |

|

|

|

259 |

|

| Wynn Resorts |

|

|

32,191 |

|

|

|

6,682 |

|

| Yum! Brands |

|

|

11,176 |

|

|

|

907 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

175,271 |

|

|

|

|

|

|

|

|

|

|

| Consumer Staples — 8.8% |

|

|

|

|

|

|

|

|

| Altria Group |

|

|

86,297 |

|

|

|

3,619 |

|

| Archer-Daniels-Midland |

|

|

16,047 |

|

|

|

708 |

|

| Avon Products |

|

|

10,056 |

|

|

|

147 |

|

| Brown-Forman, Cl B |

|

|

4,182 |

|

|

|

394 |

|

| Campbell Soup |

|

|

4,913 |

|

|

|

225 |

|

| Clorox |

|

|

3,425 |

|

|

|

313 |

|

| Coca-Cola |

|

|

93,820 |

|

|

|

3,974 |

|

| Coca-Cola Enterprises |

|

|

5,521 |

|

|

|

264 |

|

| Colgate-Palmolive |

|

|

21,432 |

|

|

|

1,461 |

|

| ConAgra Foods |

|

|

10,835 |

|

|

|

322 |

|

| Constellation Brands, Cl A* |

|

|

4,390 |

|

|

|

387 |

|

| Costco Wholesale |

|

|

11,062 |

|

|

|

1,274 |

|

| CVS Caremark |

|

|

108,298 |

|

|

|

8,163 |

|

| Danone |

|

|

38,804 |

|

|

|

2,881 |

|

| Diageo |

|

|

162,534 |

|

|

|

5,190 |

|

| Dr Pepper Snapple Group |

|

|

35,722 |

|

|

|

2,093 |

|

| Estee Lauder, Cl A |

|

|

41,646 |

|

|

|

3,093 |

|

| General Mills |

|

|

106,415 |

|

|

|

5,590 |

|

| Hershey |

|

|

3,861 |

|

|

|

376 |

|

| Hormel Foods |

|

|

3,035 |

|

|

|

150 |

|

| Imperial Tobacco Group |

|

|

16,434 |

|

|

|

740 |

|

| JM Smucker |

|

|

2,783 |

|

|

|

297 |

|

| Kellogg |

|

|

20,348 |

|

|

|

1,337 |

|

| Keurig Green Mountain |

|

|

3,000 |

|

|

|

374 |

|

| Kimberly-Clark |

|

|

9,565 |

|

|

|

1,064 |

|

| Kraft Foods Group |

|

|

14,539 |

|

|

|

872 |

|

|

|

|

|

|

|

|

|

|

| Description |

|

Shares |

|

|

Value

(000) |

|

|

|

|

|

|

|

|

|

|

| Kroger |

|

|

12,507 |

|

|

$ |

618 |

|

| Lorillard |

|

|

71,204 |

|

|

|

4,341 |

|

| McCormick |

|

|

3,030 |

|

|

|

217 |

|

| Mead Johnson Nutrition, Cl A |

|

|

5,152 |

|

|

|

480 |

|

| Molson Coors Brewing, Cl B |

|

|

4,176 |

|

|

|

310 |

|

| Mondelez International, Cl A |

|

|

41,857 |

|

|

|

1,574 |

|

| Monster Beverage* |

|

|

3,637 |

|

|