Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 10-Q

SQUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2016

OR

£TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission file number 001-36001

UCP, Inc.

(Exact name of registrant as specified in its charter)

|

| |

Delaware (State or other jurisdiction of incorporation) | 90-0978085 (IRS Employer Identification No.) |

99 Almaden Blvd., Suite 400, San Jose, CA 95113

(Address of principal executive offices, including Zip Code)

(408) 207-9499

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes S No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes S No £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | |

Large accelerated filer | £ | | Accelerated filer | S | |

Non-accelerated filer | £ | | Smaller reporting company | £ | |

(Do not check if a smaller reporting company) | | | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes £ No S

On October 27, 2016, the registrant had 7,911,195 shares of Class A common stock, par value $0.01 per share outstanding and 100 shares of Class B common stock, par value $0.01 per share outstanding.

UCP, Inc.

FORM 10-Q

For the Three and Nine Months Ended September 30, 2016

TABLE OF CONTENTS

Page No.

|

| | |

Part I - Financial Information | |

| | |

Item 1. | Financial Statements (Unaudited) | |

| | |

| Condensed Consolidated Balance Sheets as of September 30, 2016 and December 31, 2015 | |

| | |

| Condensed Consolidated Statements of Operations and Comprehensive Income or Loss for the Three and Nine Months Ended September 30, 2016 and 2015 | |

| | |

| Condensed Consolidated Statements of Equity for the Nine Months Ended September 30, 2016 and 2015 | |

| | |

| Condensed Consolidated Statements of Cash Flows for the Nine Months Ended September 30, 2016 and 2015 | |

| | |

| Notes to Condensed Consolidated Financial Statements | |

| | |

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| | |

Item 3. | Quantitative and Qualitative Disclosure About Market Risk | |

| | |

Item 4. | Controls and Procedures | |

| | |

Part II - Other Information | |

| | |

Item 1. | Legal Proceedings | |

| | |

Item 1A. | Risk Factors | |

| | |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

| | |

Item 3. | Defaults Upon Senior Securities | |

| | |

Item 4. | Mine Safety Disclosures | |

| | |

Item 5. | Other Information | |

| | |

Item 6. | Exhibits | |

| | |

Signatures | | |

UCP, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except shares and per share data)

|

| | | | | | | |

| September 30,

2016 | | December 31,

2015 |

Assets | | | |

Cash and cash equivalents | $ | 27,586 |

| | $ | 39,829 |

|

Restricted cash | 900 |

| | 900 |

|

Real estate inventories | 381,703 |

| | 360,989 |

|

Fixed assets, net | 966 |

| | 1,314 |

|

Intangible assets, net | 122 |

| | 236 |

|

Goodwill | — |

| | 4,223 |

|

Receivables | 4,512 |

| | 1,317 |

|

Other assets | 6,403 |

| | 5,889 |

|

Total assets | $ | 422,192 |

| | $ | 414,697 |

|

| | | |

Liabilities and equity | | | |

Accounts payable | $ | 21,714 |

| | $ | 14,882 |

|

Accrued liabilities | 22,719 |

| | 24,616 |

|

Customer deposits | 2,502 |

| | 1,825 |

|

Notes payable, net | 83,663 |

| | 82,486 |

|

Senior notes, net | 74,122 |

| | 73,480 |

|

Total liabilities | 204,720 |

| | 197,289 |

|

| | | |

Commitments and contingencies (Note 11) |

|

| |

|

|

| | | |

Equity | | | |

Preferred stock, par value $0.01 per share, 50,000,000 authorized, no shares issued and outstanding as of September 30, 2016; no shares issued and outstanding as of December 31, 2015 | — |

| | — |

|

Class A common stock, $0.01 par value; 500,000,000 authorized, 8,034,831 issued and 7,911,195 outstanding as of September 30, 2016; 8,014,434 issued and outstanding as of December 31, 2015 | 80 |

| | 80 |

|

Class B common stock, $0.01 par value; 1,000,000 authorized, 100 issued and outstanding as of September 30, 2016; 100 issued and outstanding as of December 31, 2015 | — |

| | — |

|

Additional paid-in capital | 96,892 |

| | 94,683 |

|

Treasury stock at cost; 123,636 shares as of September 30, 2016; none as of December 31, 2015 | (1,000 | ) | | — |

|

Accumulated deficit | (2,476 | ) | | (4,563 | ) |

Total UCP, Inc. stockholders’ equity | 93,496 |

| | 90,200 |

|

Noncontrolling interest | 123,976 |

| | 127,208 |

|

Total equity | 217,472 |

| | 217,408 |

|

Total liabilities and equity | $ | 422,192 |

| | $ | 414,697 |

|

See accompanying notes to condensed consolidated financial statements.

UCP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME OR LOSS

(Unaudited)

(In thousands, except shares and per share data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine months ended September 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

REVENUE: | | | | | | | |

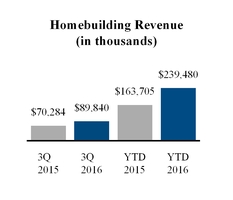

Homebuilding | $ | 89,840 |

| | $ | 70,284 |

| | $ | 239,480 |

| | $ | 163,705 |

|

Land development | 3,900 |

| | 1,116 |

| | 5,322 |

| | 3,156 |

|

Other revenue | — |

| | 2,272 |

| | — |

| | 5,060 |

|

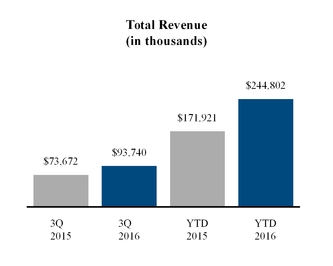

Total revenue: | 93,740 |

| | 73,672 |

| | 244,802 |

| | 171,921 |

|

| | | | | | | |

COSTS AND EXPENSES: | | | | | | | |

Cost of sales - homebuilding | 72,984 |

| | 57,006 |

| | 195,561 |

| | 134,744 |

|

Cost of sales - land development | 3,834 |

| | 716 |

| | 4,519 |

| | 2,264 |

|

Cost of sales - other revenue | — |

| | 1,958 |

| | — |

| | 4,363 |

|

Impairment on real estate | 192 |

| | — |

| | 2,589 |

| | — |

|

Total cost of sales | 77,010 |

| | 59,680 |

| | 202,669 |

| | 141,371 |

|

Gross margin - homebuilding | 16,856 |

| | 13,278 |

| | 43,919 |

| | 28,961 |

|

Gross margin - land development | 66 |

| | 400 |

| | 803 |

| | 892 |

|

Gross margin - other revenue | — |

| | 314 |

| | — |

| | 697 |

|

Gross margin - impairment on real estate | (192 | ) | | — |

| | (2,589 | ) | | — |

|

Total gross margin | 16,730 |

| | 13,992 |

| | 42,133 |

| | 30,550 |

|

Sales and marketing | 4,853 |

| | 4,692 |

| | 13,595 |

| | 13,246 |

|

General and administrative | 4,592 |

| | 5,539 |

| | 19,101 |

| | 19,311 |

|

Goodwill impairment | 4,223 |

| | — |

| | 4,223 |

| | — |

|

Total costs and expenses | 90,678 |

| | 69,911 |

| | 239,588 |

| | 173,928 |

|

Income (loss) from operations | 3,062 |

| | 3,761 |

| | 5,214 |

| | (2,007 | ) |

Other income, net | 204 |

| | 45 |

| | 253 |

| | 177 |

|

Net income (loss) before income taxes | $ | 3,266 |

| | $ | 3,806 |

| | $ | 5,467 |

| | $ | (1,830 | ) |

Provision for income taxes | (124 | ) | | — |

| | (271 | ) | | — |

|

Net income (loss) | $ | 3,142 |

| | $ | 3,806 |

| | $ | 5,196 |

| | $ | (1,830 | ) |

Net income (loss) attributable to noncontrolling interest | $ | 1,857 |

| | $ | 2,167 |

| | $ | 3,109 |

| | $ | (961 | ) |

Net income (loss) attributable to UCP, Inc. | 1,285 |

| | 1,639 |

| | 2,087 |

| | (869 | ) |

Other comprehensive income (loss), net of tax | — |

| | — |

| | — |

| | — |

|

Comprehensive income (loss) | $ | 3,142 |

| | $ | 3,806 |

| | $ | 5,196 |

| | $ | (1,830 | ) |

Comprehensive income (loss) attributable to noncontrolling interest | $ | 1,857 |

| | $ | 2,167 |

| | $ | 3,109 |

| | $ | (961 | ) |

Comprehensive income (loss) attributable to UCP, Inc. | $ | 1,285 |

| | $ | 1,639 |

| | $ | 2,087 |

| | $ | (869 | ) |

| | | | |

| |

|

Earnings (loss) per share of Class A common stock: | | | | |

| |

|

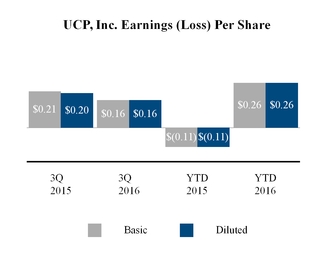

Basic | $ | 0.16 |

| | $ | 0.21 |

| | $ | 0.26 |

| | $ | (0.11 | ) |

Diluted | $ | 0.16 |

| | $ | 0.20 |

| | $ | 0.26 |

| | $ | (0.11 | ) |

| | | | |

| |

|

Weighted average shares of Class A common stock: | | | | |

| |

|

Basic | 7,948,268 |

| | 7,995,934 |

| | 7,993,371 |

| | 7,950,700 |

|

Diluted | 7,986,416 |

| | 8,017,768 |

| | 8,043,830 |

| | 7,950,700 |

|

See accompanying notes to condensed consolidated financial statements.

UCP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

(In thousands, except number of shares)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares of common stock outstanding | | Common stock | | Additional

paid-in

capital | | Treasury stock | | Accumulated

deficit | | Noncontrolling

interest | | Total

equity |

| Class A | | Class B | | Class A | | Class B | | | | | | | | | | |

Balance as of December 31, 2014 | 7,922,216 |

| | 100 | | $ | 79 |

| | $ | — |

| | $ | 94,110 |

| | $ | — |

| | $ | (6,934 | ) | | $ | 124,012 |

| | $ | 211,267 |

|

Class A - Issuance of common stock for RSUs, net of withholding taxes paid for vested RSUs | 92,218 |

| | | | 1 |

| | | | (160 | ) | | | | | | (211 | ) | | (370 | ) |

Stock-based compensation expense | | | | | | | | | 674 |

| | | | | | 898 |

| | 1,572 |

|

Distribution to noncontrolling interest | | | | | | | | | | | | | | | (981 | ) | | (981 | ) |

Net loss | | | | | | | | | | | | | (869 | ) | | (961 | ) | | (1,830 | ) |

Balance as of September 30, 2015 | 8,014,434 |

| | 100 |

| | $ | 80 |

| | $ | — |

| | $ | 94,624 |

| | $ | — |

| | $ | (7,803 | ) | | $ | 122,757 |

| | $ | 209,658 |

|

| | | | | | | | | | | | | | | | | |

Balance as of December 31, 2015 | 8,014,434 |

| | 100 |

| | $ | 80 |

| | $ | — |

| | $ | 94,683 |

| | $ | — |

| | $ | (4,563 | ) | | $ | 127,208 |

| | $ | 217,408 |

|

Class A - Issuance of common stock for RSUs, net of withholding taxes paid for vested RSUs | 20,397 |

| | | | | | | | (20 | ) | | | | | | (25 | ) | | (45 | ) |

Repurchase of common stock | (123,636) | | | | | | | | | | (1,000 | ) | | | | | | (1,000 | ) |

Re-allocation from stock issuances | | | | | | | | | 1,909 |

| | | | | | (1,909 | ) | | — |

|

Stock-based compensation expense | | | | | | | | | 320 |

| | | | | | 423 |

| | 743 |

|

Distribution to noncontrolling interest | | | | | | | | | | | | | | | (4,830 | ) | | (4,830 | ) |

Net income | | | | | | | | | | | | | 2,087 |

| | 3,109 |

| | 5,196 |

|

Balance as of September 30, 2016 | 7,911,195 |

| | 100 |

| | $ | 80 |

| | $ | — |

| | $ | 96,892 |

| | $ | (1,000 | ) | | $ | (2,476 | ) | | $ | 123,976 |

| | $ | 217,472 |

|

See accompanying notes to condensed consolidated financial statements.

UCP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

|

| | | | | | | |

| Nine months ended September 30, |

| 2016 | | 2015 |

Operating activities | | | |

Net income (loss) | $ | 5,196 |

| | $ | (1,830 | ) |

Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | |

Stock-based compensation | 743 |

| | 1,572 |

|

Abandonment charges | 505 |

| | 146 |

|

Impairment on real estate inventories | 2,589 |

| | — |

|

Depreciation and amortization | 492 |

| | 463 |

|

Goodwill impairment | 4,223 |

| | — |

|

Fair value adjustment of contingent consideration | (2,400 | ) | | (818 | ) |

Changes in operating assets and liabilities: | | | |

Real estate inventories | (23,067 | ) | | (60,715 | ) |

Receivables | (3,195 | ) | | 307 |

|

Other assets | (411 | ) | | (2,389 | ) |

Accounts payable | 6,832 |

| | 14,732 |

|

Accrued liabilities | 302 |

| | (4,360 | ) |

Customer deposits | 677 |

| | 1,125 |

|

Income taxes payable | 202 |

| | — |

|

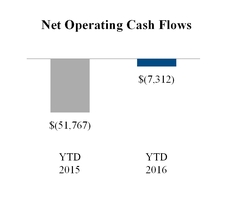

Net cash used in operating activities | (7,312 | ) | | (51,767 | ) |

Investing activities | | | |

Purchases of fixed assets | (117 | ) | | (311 | ) |

Net cash used in investing activities | (117 | ) | | (311 | ) |

Financing activities | | | |

Distribution to noncontrolling interest | (4,830 | ) | | (981 | ) |

Proceeds from notes payable | 106,663 |

| | 112,595 |

|

Repayment of notes payable | (105,488 | ) | | (77,895 | ) |

Debt issuance costs | (114 | ) | | (698 | ) |

Repurchase of common stock | (1,000 | ) | | — |

|

Withholding taxes paid for vested RSUs | (45 | ) | | (370 | ) |

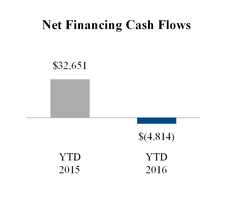

Net cash (used by) provided by financing activities | (4,814 | ) | | 32,651 |

|

Net decrease in cash and cash equivalents | (12,243 | ) | | (19,427 | ) |

Cash and cash equivalents – beginning of period | 39,829 |

| | 42,033 |

|

Cash and cash equivalents – end of period | $ | 27,586 |

| | $ | 22,606 |

|

| | | |

Non-cash investing and financing activity | | | |

Exercise of land purchase options acquired with acquisition of business | $ | 74 |

| | $ | 160 |

|

Issuance of Class A common stock for vested restricted stock units | $ | 189 |

| | $ | 680 |

|

| | | |

Supplemental cash flow information | | | |

Income taxes paid | $ | 69 |

| | $ | — |

|

See accompanying notes to condensed consolidated financial statements.

UCP, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. ORGANIZATION, BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

As used in this report, unless the context otherwise requires or indicates, references to “the Company,” “we,” “our” and “UCP” refer to UCP, Inc. and its consolidated subsidiaries, including UCP, LLC.

Business Description and Organizational Structure of the Company:

The Company is a homebuilder and land developer with expertise in residential land acquisition, development and entitlement, as well as home design, construction and sales. We operate in the states of California, Washington, North Carolina, South Carolina and Tennessee.

The Company’s operations began in 2004 and principally focused on acquiring land, and entitling and developing it for residential construction. In 2010, the Company formed Benchmark Communities, LLC, its wholly-owned homebuilding subsidiary, to design, construct and sell high quality single-family homes. In 2014, the Company completed the acquisition of the assets and liabilities of Citizens Homes, Inc. (“Citizens Acquisition”) to expand its operations for the purchase of real estate and the construction and marketing of residential homes in the Southeast.

The Company is a holding company, whose principal asset is its interest in UCP, LLC, the subsidiary through which it directly and indirectly conducts its business. As of September 30, 2016, the Company held a 43.1% economic interest in UCP, LLC and PICO Holdings, Inc. (“PICO”), a NASDAQ-listed, diversified holding company, held the remaining 56.9% economic interest in UCP, LLC.

Basis of Presentation:

The accompanying unaudited condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany accounts have been eliminated in consolidation.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Form 10-Q and Article 10 of Regulation S-X. These financial statements should be read in conjunction with the Company's audited financial statements for the year ended December 31, 2015, which are included in the Company’s Annual Report on Form 10-K that was filed with the Securities and Exchange Commission on March 14, 2016. The accompanying unaudited condensed consolidated financial statements include all adjustments (consisting of normal recurring adjustments) necessary for the fair presentation of the Company’s results for the interim periods presented. These consolidated and segment results are not necessarily indicative of the Company’s future performance.

As an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, the Company has taken advantage of certain temporary exemptions from various reporting requirements, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act and reduced disclosure obligations regarding executive compensation in its periodic reports and proxy statements. The Company could be an emerging growth company until the last day of the fiscal year following the fifth anniversary of the July 23, 2013 completion of its initial public offering, although a variety of circumstances can cause it to lose this status earlier.

Use of Estimates in Preparation of Financial Statements:

The preparation of condensed consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent liabilities at the date of the financial statements and the reported amounts of revenues and expenses for each reporting period. The significant estimates made in the preparation of the Company’s accompanying unaudited condensed consolidated financial statements relate to the assessment of real estate impairments, valuation of assets and liabilities acquired, warranty reserves, income taxes and contingent liabilities. While management believes that the carrying value of such assets and liabilities are appropriate as of September 30, 2016 and December 31, 2015, it is reasonably possible that actual results could differ from the estimates upon which the carrying values were based.

Related Party Transactions:

As of September 30, 2016, PICO holds an economic and voting interest in our Company equal to approximately 56.9%. The Company is party to certain agreements with PICO, including an Exchange Agreement (pursuant to which PICO has the right to cause the Company to exchange PICO’s interests in UCP, LLC for shares of the Company’s Class A common stock on a one-for-one basis, subject to equitable adjustments for stock splits, stock dividends, reclassifications and repurchases by UCP of Class A common stock), an Investor Rights Agreement (pursuant to which PICO has certain rights, including the right to select two individuals for nomination for election to the Company’s board of directors for as long as PICO owns at least a 25% voting interest in the Company), a Tax Receivable Agreement (pursuant to which PICO is entitled to 85% of any cash savings in U.S. federal, state and local income tax that the Company actually realizes as a result of any increase in tax basis caused by PICO’s exchange of UCP, LLC interests for shares of the Company’s Class A common stock) and a Registration Rights Agreement, with respect to the shares of Class A common stock that PICO may receive in exchanges made pursuant to the Exchange Agreement.

Segment Reporting:

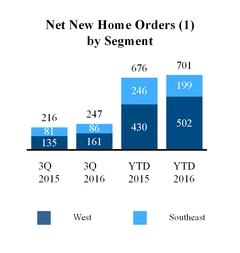

The Company has two operating segments, West and Southeast, and two reportable segments, Homebuilding and Land development. Each reportable segment includes real estate with similar economic characteristics, including similar historical and expected long-term gross margin percentages, product types, geography, production processes and methods of distribution.

Cash and Cash Equivalents and Restricted Cash:

Cash and cash equivalents include highly liquid instruments purchased with original maturities of three months or less.

Cash items that are restricted as to withdrawal or usage include deposits of $0.9 million as of September 30, 2016 and December 31, 2015, related to a construction loan, credit card agreements and a contractor’s license.

Capitalization of Interest:

The Company capitalizes interest to real estate inventories during the period that real estate is undergoing development. Interest capitalized as a cost of real estate inventories is included in cost of sales-homebuilding or cost of sales-land development as related homes or real estate are delivered.

Advertising Expenses:

The Company expenses advertising costs as incurred. Advertising expenses for the three months ended September 30, 2016 and 2015 were $0.5 million and $0.6 million, respectively, and for the nine months ended September 30, 2016 and 2015 were $1.5 million and $2.0 million, respectively.

Real Estate Inventories and Cost of Sales:

The Company capitalizes pre-acquisition costs, the purchase price of real estate, development costs and other allocated costs, including interest, during development and home construction. Pre-acquisition costs, including non-refundable land deposits, are expensed to cost of sales when the Company determines continuation of the related project is not probable. Applicable costs incurred after development or construction is substantially complete are charged to sales and marketing or general and administrative, as appropriate.

Land, development and other common costs are typically allocated to real estate inventories based on the number of homes to be constructed. Direct home construction costs are recorded using the specific identification method. Cost of sales-homebuilding includes the construction costs of each home and all applicable land acquisition, real estate development, capitalized interest and related allocated common costs. Changes to estimated total development costs subsequent to initial home closings in a community are allocated to remaining homes in the community. Cost of sales-land development includes land acquisition and development costs, capitalized interest, impairment charges, abandonment charges for projects that are no longer economically viable, and real estate taxes.

Real estate inventories are stated at cost, unless the carrying amount is determined not to be recoverable, in which case real estate inventories are written down to fair value.

All real estate inventories are classified as held until the Company commits to a plan to sell the real estate, the real estate can be sold in its present condition, the real estate is being actively marketed for sale and it is probable that the real estate will be sold within

twelve months. Homes completed or under construction are included in real estate inventories in the accompanying unaudited condensed consolidated balance sheets at the lower of cost or net realizable value.

Impairment and Abandonment of Real Estate Inventories:

The Company evaluates real estate inventories for impairment when conditions exist suggesting that the carrying amount of real estate inventories is not fully recoverable and may exceed its fair value. Indicators of impairment include, but are not limited to, significant decreases in local housing market values, decreases in the selling prices of comparable homes, significant decreases in gross margins and sales absorption rates, costs in excess of budget, and actual or projected cash flow losses. The Company prepares and analyzes cash flows at the lowest level for which there are identifiable cash flows that are independent of the cash flows of other groups of assets.

When estimating future cash flows of its real estate assets, the Company makes various assumptions, including: (i) expected sales prices and sales incentives (based on, among other things, an estimate of the number of homes available in the market, pricing and incentives, and potential sales price adjustments based on market and economic trends); (ii) expected sales pace and cancellation rates (based on local housing market conditions, competition and historical trends); (iii) costs incurred to date and expected to be incurred (including, but not limited to, land and land development costs, home construction costs, indirect construction costs, and selling and marketing costs); (iv) alternative product offerings that may be offered that could have an impact on sales pace, sales price and/or building costs; and (v) alternative uses for the property.

If events or circumstances indicate that the carrying amount of real estate inventories may be impaired, such impairment will be measured based upon the difference between the carrying amount and the fair value of such asset(s) determined using the estimated future discounted cash flows, excluding interest charges, generated from the use and ultimate disposition of such

asset(s). Such losses, if any, are reported within cost of sales for the period.

We estimate the fair value of each impaired community by determining the present value of the estimated future cash flows at a discount rate commensurate with the risk of the respective community. In determining the fair value of land held for sale, management considers, among other things, prices for land in recent comparable sale transactions, market analysis studies, which include the estimated price a willing buyer would pay for the land, and recent bona fide offers received from third parties.

During the three and nine months ended September 30, 2016, approximately $0.2 million and $2.6 million, respectively, of impairment losses were recorded. For the three months ended September 30, 2016, the impairment loss was recorded with respect to the Company’s real estate inventories at its Heathers at Westport community, located in Charlotte, North Carolina (“Heathers at Westport”). As of September 30, 2016, the four remaining completed homes at the Heathers at Westport project had a carrying value that exceeded their estimated undiscounted cash flow. As a result, the carrying values of those remaining homes were adjusted to their estimated fair values, resulting in an impairment loss of approximately $0.2 million.

For the nine months ended September 30, 2016, an additional $2.4 million of real estate impairment loss was recorded during the second quarter of 2016 with respect to the Company’s real estate inventories at its Sundance community, located in Bakersfield, California (“Sundance”). The 65 lots at our Sundance project resulted in an impairment loss of $2.1 million during the second quarter of 2016, as the carrying value of these lots was written down to the contractual sales price less costs to sell. In addition, as of June 30, 2016, homes under construction and completed homes at the Sundance project had a carrying value that exceeded their estimated undiscounted cash flows. As a result, the carrying values of those remaining homes not currently under contract were adjusted to their estimated fair values resulting in an impairment loss of approximately $0.3 million during the second quarter of 2016. See Note 8, “Fair Value Disclosures--Non-Financial Instruments Carried at Fair Value--Non-Recurring Estimated Fair Value of Real Estate Inventories” for a further discussion of the impairment of the real estate asset.

No such real estate impairment losses were recorded for the three and nine months ended September 30, 2015.

Abandonment charges during the three months ended September 30, 2016 and 2015 were $31,000 and $144,000, respectively, and were $505,000 and $146,000 during the nine months ended September 30, 2016 and 2015, respectively. Abandonment charges are included in cost of sales in the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss for the period in which they were recorded. These charges were related to the Company electing not to proceed with one or more land acquisitions after the incurrence of costs during due diligence.

Goodwill and Other Intangible Assets:

The purchase price of an acquired business is allocated between the net tangible assets and intangible assets of the acquired business, with any residual purchase price recorded as goodwill. The determination of the value of the assets acquired and liabilities assumed involves certain judgments and estimates. These judgments can include, but are not limited to, the cash flows that an asset is expected to generate in the future and the appropriate weighted average cost of capital.

Intangible assets with determinable useful lives are amortized on a straight-line basis over the estimated remaining useful lives (ranging from six months to five years), added to the value of land when an intangible option is used to purchase the land, or expensed in the period when the option is cancelled. Acquired intangible assets with contractual terms are generally amortized over their respective contractual lives. When certain events or changes in operating conditions occur, an impairment assessment is performed for the intangible assets. Goodwill is not amortized, but is evaluated annually for impairment or more frequently if events or circumstances indicate that goodwill may be impaired.

Impairment of Goodwill:

All goodwill has been attributed to the Southeast homebuilding reporting segment as part of the Citizens Acquisition, which was completed in 2014. In accordance with Financial Accounting Standards Board (“FASB”) issued Accounting Standards Codification (“ASC”) Topic 350 - Goodwill, the Company evaluates goodwill for impairment annually or when conditions exist suggesting that the carrying amount of goodwill will more likely than not exceed its fair value. Indicators of impairment include, but are not limited to, significant decreases in economic conditions and market valuations, limitations on access to capital, and actual or projected cash flow losses or increases in cost factors that have a negative effect on earnings and cash flows. The Company prepares and analyzes cash flows at the project level for which there are identifiable cash flows.

If events or circumstances indicate that the carrying amount of goodwill may be impaired, such impairment will be measured based upon the difference between the carrying amount and the fair value and determined using the estimated future discounted cash flows, excluding interest charges. Such losses, if any, are reported as an expense in the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss for the period.

We estimate the fair value of goodwill by applying the income approach and determining the present value of the estimated future cash flows at a discount rate. When estimating future cash flows, the Company makes various assumptions, including, but not limited to: (i) forecasted adjusted pre-tax net income over a ten-year period; (ii) weighted average cost of capital; (iii) terminal growth; and (iv) revenue growth and operating profit margin.

Based on the above factors, the Company determined that the carrying value of goodwill exceeded its fair value. As a result, the Company recorded goodwill impairment of $4.2 million during the three months ended September 30, 2016 related to its Southeast operating segment. For the year ended December 31, 2015, there was no impairment of goodwill. See Note 5, “Intangible Assets--Goodwill” for a further discussion of the impairment of goodwill.

Fixed Assets, Net:

Fixed assets are carried at cost, net of accumulated depreciation. Depreciation is computed using the straight-line method over the estimated remaining useful lives of the assets. Computer software and hardware are depreciated over three to five years, office furniture and fixtures are depreciated over five years, vehicles are depreciated over five years and leasehold improvements are depreciated over the shorter of their useful life or lease term and range from one to five years. Maintenance and repairs are charged to expense as incurred, while significant improvements are capitalized. Depreciation expense is included in general and administrative (“G&A”) expenses in the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss.

Receivables:

Receivables include amounts recoverable from warranty insurance, amounts due from utility companies for reimbursement of costs, manufacturer rebates and reimbursable land development costs for general contracting services under a fixed price contract. As of September 30, 2016, approximately $1.1 million of estimated recoverable from warranty insurance was included in receivables. In addition, approximately $2.8 million of reimbursable land development costs under an option and development agreement executed during the third quarter of 2016 was recorded as a receivable. See Note 11, “Commitments and Contingencies--Purchase Commitments” for a further discussion of the option and development agreement.

As of September 30, 2016 and December 31, 2015, the Company had no allowance for doubtful accounts recorded.

Other Assets:

The detail of other assets is set forth below (in thousands):

|

| | | | | | | |

| September 30, 2016 | | December 31, 2015 |

Customer deposits in escrow | $ | 2,479 |

| | $ | 1,834 |

|

Prepaid expenses | 823 |

| | 2,099 |

|

Other deposits and prepaid interest | 1,281 |

| | 466 |

|

Funds held in escrow | 1,490 |

| | 1,490 |

|

Other assets | 330 |

| | — |

|

Total | $ | 6,403 |

| | $ | 5,889 |

|

As part of the Company’s adoption of Accounting Standards Update (“ASU”) 2015-03, approximately $1.5 million of unamortized debt issuance costs that were included in the prepaid expenses category of other assets as of December 31, 2015 have been reclassified from other assets to notes payable and senior notes in the accompanying unaudited condensed consolidated balance sheets. See Note 7, “Notes Payable and Senior Notes, net” for a further discussion of the change in accounting principle.

Homebuilding, Land Development Sales and Other Revenues and Profit Recognition:

In accordance with applicable guidance under ASC Topic 360 - Property, Plant, and Equipment, revenue from home sales and other real estate sales is recorded and any profit is recognized when the respective sales are closed. Sales are closed when all conditions of escrow are met, title passes to the buyer, appropriate consideration is received and collection of associated receivables, if any, is reasonably assured and the Company has no continuing involvement with the sold asset. The Company does not offer financing to buyers. Sales price incentives are accounted for as a reduction of revenues when the sale is recorded. If the earnings process is not complete, the sale and any related profits are deferred for recognition in future periods. Any profit recorded is based on the calculation of cost of sales, which is dependent on an allocation of costs.

In addition to homebuilding and land development, the Company previously provided construction management services, pursuant to which it built homes on behalf of third-party property owners. The business was acquired in connection with the Citizens Acquisition and it was sold during the fourth quarter of 2015 and we no longer provide construction management services to third parties. Revenue and costs from providing these services for the three and nine months ended September 30, 2015 is included in other revenue and cost of sales-other revenue in the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss.

Stock-Based Compensation:

Stock-based compensation expense is measured at the grant date based on the fair value of the award and is recognized as expense over the period during which the award vests in accordance with applicable guidance under ASC Topic 718 - Compensation - Stock Compensation.

Stock Repurchase Program:

On June 6, 2016, our Board of Directors authorized the repurchase of up to $5.0 million of the Company’s Class A common stock between June 7, 2016 and June 1, 2018 (the “Stock Repurchase Program”). Treasury stock represents shares repurchased under the Stock Repurchase Program, which are reflected as a reduction in Stockholders’ Equity in accordance with ASC Topic 505-30 - Equity - Treasury Stock. The number of shares repurchased is based on the settlement date and factored into our weighted average calculation for earnings per share. See Note 9, “Equity--Stock Repurchase Program” for additional information regarding the Stock Repurchase Program. See Note 2, “Income or Loss Per Share” for details regarding the impact of treasury shares on earnings per share.

Warranty Reserves:

Estimated future direct warranty costs are accrued and charged to cost of sales-homebuilding in the period in which the related homebuilding revenue is recognized. Amounts accrued are based upon estimates of the amount the Company expects to pay for warranty work. Warranty reserves include insurance receivables for costs the Company expects to be reimbursed for from insurance. The Company assesses the adequacy of its warranty reserves on a quarterly basis and adjusts the amounts recorded, if necessary, in the

period in which the change in estimate occurs. The Company engaged a third-party actuary during the third quarter of 2016 to assist in the analysis of warranty reserves based on historical data and industry trends for our communities. Warranty reserves are included in accrued liabilities in the accompanying unaudited condensed consolidated balance sheets.

Changes in warranty reserves are detailed in the table set forth below (in thousands):

|

| | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

Warranty reserves, beginning of period | $ | 3,662 |

| | $ | 2,149 |

| | $ | 2,852 |

| | $ | 1,509 |

|

Warranty reserves accrued | 611 |

| | 214 |

| | 1,655 |

| | 888 |

|

Warranty expenditures | (209 | ) | | (51 | ) | | (443 | ) | | (85 | ) |

Additional reserves where corresponding amounts are recorded as receivables from insurance carriers | 1,118 |

| | — |

| | 1,118 |

| | — |

|

Warranty reserves, end of period | $ | 5,182 |

| | $ | 2,312 |

| | $ | 5,182 |

| | $ | 2,312 |

|

Consolidation of Variable Interest Entities:

The Company enters into purchase and option agreements for the purchase of real estate as part of the normal course of business. These purchase and option agreements enable the Company to acquire real estate at one or more future dates at pre-determined prices. The Company believes these acquisition structures reduce its financial risk associated with real estate acquisitions and holdings and allow the Company to better manage its cash position and return metrics.

In February 2015, the FASB issued ASU No. 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis (“ASU 2015-02”), to simplify consolidation accounting. ASU 2015-02 amends current consolidation guidance by modifying the evaluation of whether limited partnerships and similar legal entities are variable interest entities or voting interest entities, eliminating the presumption that a general partner should consolidate a limited partnership, and affects the consolidation analysis of reporting entities that are involved with variable interest entities. All legal entities are subject to reevaluation under the revised consolidation model. ASU 2015-02 was effective for the Company for interim and annual reporting periods beginning after December 15, 2015.

The Company adopted the provisions of ASU 2015-02 as of the effective date on January 1, 2016. The adoption of ASU 2015-02 did not have an impact on the Company's accompanying unaudited condensed consolidated balance sheet, results of operations or cash flows.

Based on the provisions of the relevant accounting guidance, the Company concluded that when it enters into a purchase agreement to acquire real estate from an entity, a variable interest entity (“VIE”) may be created. The Company evaluates all purchase and option agreements for real estate to determine whether a potential VIE has been formed. The applicable accounting guidance requires that for each potential VIE, the Company assess whether it is the primary beneficiary and, if it is, the Company would consolidate the VIE in its accompanying unaudited condensed consolidated financial statements in accordance with ASC Topic 810 - Consolidations, and reflect such assets and liabilities as “Real estate inventories not owned.”

In order to determine if the Company is the primary beneficiary, it must first assess whether it has the ability to control the activities of the VIE that most significantly impact its economic performance. Such activities include, but are not limited to: the ability to determine the budget and scope of land development work, if any; the ability to control financing decisions for the VIE; the ability to acquire additional land into the VIE or dispose of land in the VIE not under contract with the Company; and the ability to change or amend the existing option contract with the VIE. If the Company is not determined to control such activities, the Company is not considered the primary beneficiary of the VIE. If the Company does have the ability to control such activities, the Company will continue its analysis by determining if it is also expected to absorb a potentially significant amount of the VIE’s losses or, if no party absorbs the majority of such losses, if the Company will receive a disproportionate benefit from a potentially significant amount of the VIE’s expected gains.

In substantially all cases, land owners with which the Company has option agreements have no recourse against the Company and the maximum exposure to loss on the applicable option or purchase agreement is limited to non-refundable option deposits and any capitalized pre-acquisition costs. Some of the Company’s option or purchase deposits may be refundable to the Company if certain contractual conditions are not performed by the party selling the lots. The Company did not identify any VIEs from its evaluation of its purchase and option agreements for real estate. Therefore, the Company did not consolidate any land under option as of September 30, 2016 or December 31, 2015.

Income Taxes:

The Company’s provision for income tax expense includes federal and state income taxes currently payable and those deferred because of temporary differences between the income tax and financial reporting basis of the Company’s assets and liabilities. The asset and liability method of accounting for income taxes also requires the Company to reflect the effect of a tax rate change on accumulated deferred income taxes in income during the period in which the change is enacted.

In assessing the realization of deferred income taxes, the Company considered whether it is more likely than not that any deferred income tax assets will be realized. The realization of deferred tax assets is subject to the Company generating sufficient taxable income during the periods in which the deferred tax assets become realizable. Due to the Company's cumulative pre-tax operating losses generated prior to 2015, the Company has recorded a valuation allowance against its U.S. deferred tax assets. As of September 30, 2016, the valuation allowance against the Company’s deferred tax assets was approximately $6.3 million. So long as the valuation allowance exists, income tax expense related to deferred tax assets will be offset by the associated valuation allowance, resulting in an effective U.S. income tax rate substantially different than statutory rates. The Company continues to evaluate all available evidence of sustained profitability in the business. The Company’s business was profitable in 2015 and for the first nine months in 2016. During the fourth quarter of 2016, the Company will again evaluate all available evidence in determining the likelihood that it will be able to realize all or some portion of its deferred tax assets prior to their expiration. If, upon completing this evaluation, the Company concludes that it is more likely than not that the Company will be able to realize its deferred tax assets, the valuation allowance may be reversed at or before the end of the current year. If the Company were to reverse the valuation allowance, the Company would realize a one-time, non-cash tax benefit in the period of reversal. Prospectively, the Company would then expect to report an effective U.S. income tax rate that is closer to its statutory rates.

The Company recognizes any uncertain income tax positions on income tax returns at the largest amount that is more-likely-than-not to be sustained upon audit by the relevant taxing authority. An uncertain income tax position will not be recognized unless it has a greater than 50% likelihood of being sustained. The Company recognizes any interest and penalties related to uncertain tax positions in income tax expense. For each of the periods presented, the Company did not record any interest or penalties related to uncertain tax positions. See Note 12, “Income Taxes” for a further discussion of the Company’s income taxes for the applicable period.

Noncontrolling Interest:

The Company reports the share of its results of operations that is attributable to other owners of its consolidated subsidiaries that are less than wholly-owned as noncontrolling interest in the accompanying unaudited condensed consolidated financial statements. In the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss, the income or loss attributable to the noncontrolling interest is reported separately, and the accumulated income or loss attributable to the noncontrolling interest, along with any changes in ownership of the subsidiary, is reported as a component of total equity.

Recently Issued Accounting Standards:

The following recently issued accounting standards are not yet required to be adopted by the Company as of September 30, 2016:

|

| | | | | | | | |

Standard | | Description | | Date of Adoption | | Application | | Effect on the Consolidated Financial Statements (or Other Significant Matters) |

Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments (ASU 2016-15) | | Provides guidance on eight specific cash flow classification issues that are currently not clear or included under GAAP: (1) debt prepayment or debt extinguishment costs; (2) settlement of zero-coupon debt instruments or other debt instruments with coupon interest rates that are insignificant in relation to the effective interest rate of the borrowing; (3) contingent consideration payments made after a business combination; (4) proceeds from the settlement of insurance claims; (5) proceeds from the settlement of corporate-owned life insurance policies, including bank-owned life insurance policies; (6) distributions received from equity method investees; (7) beneficial interests in securitization transactions; and (8) separately identifiable cash flows and application of the predominance principle.

| | January 1, 2018; early adoption permitted | | Retrospective | | The Company is evaluating the method of adoption and the effect on its consolidated financial statements and related disclosures. |

Other than as described above, no new accounting pronouncement has had or is expected to have a material impact on the Company’s accompanying unaudited condensed consolidated financial statements.

2. INCOME OR LOSS PER SHARE

Basic income or loss per share of Class A common stock is computed by dividing net income or loss attributable to UCP, Inc. by the weighted average number of shares of Class A common stock outstanding during the period. Diluted income or loss per share of Class A common stock is computed similarly to basic income or loss per share except that the weighted average number of shares of Class A common stock outstanding during the period is increased to include additional shares from the assumed exercise of any Class A common stock equivalents using the treasury method, if dilutive. The Company’s restricted stock units (“RSUs”) and stock options (“Options”) are considered Class A common stock equivalents for this purpose. For the three and nine months ended September 30, 2016 and three months ended September 30, 2015, incremental Class A common stock equivalents were included in calculating diluted income per share. No incremental Class A common stock equivalents were included in calculating diluted loss per share for the nine months ended September 30, 2016 because such inclusion would be anti-dilutive given the net loss attributable to UCP, Inc. during such period.

Basic and diluted net income or loss per share of Class A common stock for the three and nine months ended September 30, 2016 and 2015 have been computed as follows (in thousands, except share and per share amounts):

|

| | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

Numerator | | | | | | | |

Net income (loss) attributable to UCP, Inc. | $ | 1,285 |

| | $ | 1,639 |

| | $ | 2,087 |

| | $ | (869 | ) |

| | | | | | | |

Denominator | | | | | | | |

Weighted average number of shares of Class A common stock outstanding - basic | 7,948,268 |

| | 7,995,934 |

| | 7,993,371 |

| | 7,950,700 |

|

| | | | | | | |

Effect of dilutive securities: | | | | | | | |

RSUs | 38,148 |

| | 21,834 |

| | 50,459 |

| | — |

|

Total shares for purpose of calculating diluted net income (loss) per share | 7,986,416 |

| | 8,017,768 |

| | 8,043,830 |

| | 7,950,700 |

|

| | | | | | | |

Earnings (loss) per share: | | | | | | | |

Net income (loss) per share of Class A common stock - basic | $ | 0.16 |

| | $ | 0.21 |

| | $ | 0.26 |

| | $ | (0.11 | ) |

Net income (loss) per share of Class A common stock - diluted | $ | 0.16 |

| | $ | 0.20 |

| | $ | 0.26 |

| | $ | (0.11 | ) |

The following RSUs and Options issued were excluded in the computation of diluted earnings per share for the three and nine months ended September 30, 2016 and 2015 because the effect would be anti-dilutive:

|

| | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

Anti-dilutive securities | 361,774 |

| | 280,148 |

| | 274,544 |

| | 340,074 |

|

3. REAL ESTATE INVENTORIES

Real estate inventories consisted of the following (in thousands):

|

| | | | | | | |

| September 30, 2016 | | December 31, 2015 |

Deposits and pre-acquisition costs | $ | 7,730 |

| | $ | 3,836 |

|

Land held and land under development | 133,386 |

| | 128,059 |

|

Finished lots | 113,555 |

| | 117,335 |

|

Homes completed or under construction | 102,606 |

| | 89,866 |

|

Model homes | 24,426 |

| | 21,893 |

|

Total | $ | 381,703 |

| | $ | 360,989 |

|

Deposits and pre-acquisition costs include costs relating to land purchase or option contracts. Land held and land under development includes costs incurred during site development, such as land, development, indirect costs and permits. Homes completed or under construction and model homes include all costs associated with home construction, including land, development, indirect costs, permits and fees, and vertical construction.

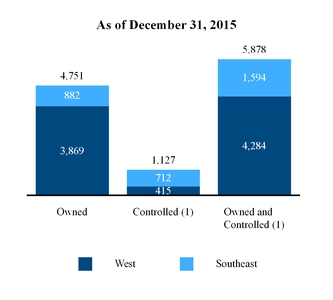

As of September 30, 2016, the Company had $7.7 million of deposits and pre-acquisition costs for 1,123 lots with an aggregate purchase price of approximately $49.1 million, net of deposits. As of December 31, 2015, the Company had $3.8 million of deposits and pre-acquisition costs for 1,127 lots with an aggregate purchase price of approximately $80.1 million, net of deposits.

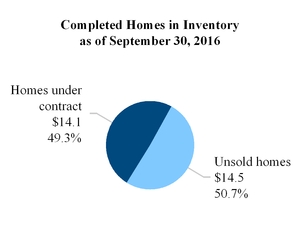

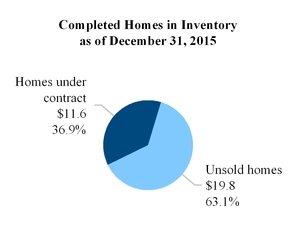

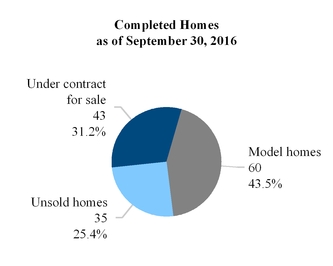

As of September 30, 2016 and December 31, 2015, the Company had completed homes included in inventories of approximately $28.6 million and $31.4 million, respectively, as shown in the charts below ($ in millions):

Interest Capitalization

Interest is capitalized on real estate inventories during construction and development. Interest capitalized is included in cost of sales in the Company’s accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss as related sales are recognized. Amounts capitalized to home inventory and land inventory were as follows (in thousands):

|

| | | | | | | | | | | | | | | |

| Three months ended September 30, | | Nine months ended September 30, |

| 2016 | | 2015 | | 2016 | | 2015 |

Interest expense capitalized as cost of home inventory | $ | 2,573 |

| | $ | 2,442 |

| | $ | 7,748 |

| | $ | 6,877 |

|

Interest expense capitalized as cost of land inventory | 606 |

| | 628 |

| | 1,551 |

| | 1,620 |

|

Total interest expense capitalized | 3,179 |

| | 3,070 |

| | 9,299 |

| | 8,497 |

|

Previously capitalized interest expense included in cost of sales - homebuilding | (1,990 | ) | | (1,443 | ) | | (5,319 | ) | | (3,367 | ) |

Previously capitalized interest expense included in cost of sales - land development | (224 | ) | | — |

| | (370 | ) | | (49 | ) |

Net activity of capitalized interest | 965 |

| | 1,627 |

| | 3,610 |

| | 5,081 |

|

Capitalized interest expense in beginning inventory | 15,919 |

| | 10,753 |

| | 13,274 |

| | 7,299 |

|

Capitalized interest expense in ending inventory | $ | 16,884 |

| | $ | 12,380 |

| | $ | 16,884 |

| | $ | 12,380 |

|

4. FIXED ASSETS, NET

Net fixed assets consisted of the following (in thousands):

|

| | | | | | | |

| September 30, 2016 | | December 31, 2015 |

Computer hardware and software | $ | 2,018 |

| | $ | 1,954 |

|

Office furniture and equipment and leasehold improvements | 888 |

| | 834 |

|

Vehicles | 83 |

| | 83 |

|

Total | 2,989 |

| | 2,871 |

|

Accumulated depreciation | (2,023 | ) | | (1,557 | ) |

Fixed assets, net | $ | 966 |

| | $ | 1,314 |

|

Depreciation expense for the three months ended September 30, 2016 and 2015 was $131,000 and $151,000, respectively, and for the nine months ended September 30, 2016 and 2015 was $466,000 and $438,000, respectively. Depreciation expense is recorded in G&A expenses in the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss.

5. INTANGIBLE ASSETS

Other purchased intangible assets consisted of the following (in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2016 | | December 31, 2015 |

| Gross Carrying Amount | | Accumulated Amortization (Used) | | Ending Balance | | Gross Carrying Amount | | Accumulated Amortization (Used) | | Ending Balance |

Architectural plans | $ | 170 |

| | $ | (86 | ) | | $ | 84 |

| | $ | 170 |

| | $ | (60 | ) | | $ | 110 |

|

Land options | 583 |

| | (545 | ) | | 38 |

| | 583 |

| | (457 | ) | | 126 |

|

Trademarks and trade names | 110 |

| | (110 | ) | | — |

| | 110 |

| | (110 | ) | | — |

|

| $ | 863 |

| | $ | (741 | ) | | $ | 122 |

| | $ | 863 |

| | $ | (627 | ) | | $ | 236 |

|

Amortization expense for the three months ended September 30, 2016 and 2015 related to the architectural plans and trademarks and trade names intangibles was approximately $8,500 for both periods and for the nine months ended September 30, 2016 and 2015 was $26,000 for both periods. The architectural plans intangible amortization period is 5 years. Amortization expense is recorded in G&A expenses in the accompanying unaudited condensed consolidated statements of operations and comprehensive income or loss. Future estimated amortization expense related to the architectural plans intangibles over the next five years is as follows (in thousands):

|

| | | |

| December 31, |

2016 | $ | 8 |

|

2017 | 34 |

|

2018 | 34 |

|

2019 | 8 |

|

Total | $ | 84 |

|

Additionally, $40,000 and $74,000 related to land options was capitalized to real estate inventories during the three and nine months ended September 30, 2016, respectively, as compared to $196,000 and $279,000 for the three and nine months ended September 30, 2015, respectively.

Goodwill

The changes in the carrying amount of goodwill for the nine months ended September 30, 2016 and 2015 were as follows (in thousands):

|

| | | | |

| | Goodwill |

Balance at December 31, 2014 | | $ | 4,223 |

|

Goodwill impairment | | — |

|

Balance as of September 30, 2015 | | $ | 4,223 |

|

| | |

| | Goodwill |

Balance at December 31, 2015 | | $ | 4,223 |

|

Goodwill impairment | | (4,223 | ) |

Balance as of September 30, 2016 | | $ | — |

|

All goodwill has been attributed to the Southeast homebuilding reporting segment as part of the Citizens Acquisition, which was completed in 2014. For the three months ended September 30, 2016, the Company evaluated goodwill for impairment in light of qualitative indicators. These indicators included revised financial forecasts for the Southwest operating segment as a result of items including weather that delayed new community openings, abandonment of certain opportunities to open new communities as the opportunities did not meet our underwriting criteria, and lower margins on older communities still in existence from the land purchased as part of the acquisition. The Company determined as a result of these qualitative factors, that it should conduct a Step One Test analysis of goodwill. As a result of the Step One Test and subsequent Step Two Test, the Company determined that the carrying valu

e of goodwill exceeded its fair value, resulting in an impairment of goodwill. The fair value of goodwill was estimated by applying the income approach and determining the present value of the estimated future cash flows at a discount rate. When estimating future cash flows, the Company used key assumptions, including, but not limited to: (i) forecasted adjusted pre-tax net income over a ten-year period; (ii) weighted average cost of capital; (iii) terminal growth; and (iv) revenue growth and operating profit margin. The risk adjusted discount rate of 14.5% and terminal growth rate of 2.0% were applied to forecast adjusted pre-tax net income.

During the third quarter of 2016, the Company recorded goodwill impairment of $4.2 million. There was no goodwill impairment for the three and nine months ended September 30, 2015.

6. ACCRUED LIABILITIES

Accrued liabilities consisted of the following (in thousands):

|

| | | | | | | |

| September 30, 2016 | | December 31, 2015 |

Real estate development cost to complete | $ | 9,694 |

| | $ | 11,992 |

|

Accrued expenses | 5,124 |

| | 5,692 |

|

| 5,182 |

| | 2,852 |

|

| 307 |

| | 2,707 |

|

Accrued payroll liabilities | 2,412 |

| | 1,373 |

|

Total | $ | 22,719 |

| | $ | 24,616 |

|

7. NOTES PAYABLE AND SENIOR NOTES, NET

The Company obtains various types of debt financing in connection with its acquisition, development and construction of real estate inventories and its construction of homes. Often, these debt obligations are secured by the underlying real estate. Certain loans are funded in full at the initial loan closing and others are revolving facilities under which the Company may borrow, repay and reborrow up to a specified amount during the term of the loan. Acquisition indebtedness matures on various dates, but is generally repaid when lots are released from the lien securing the relevant loan based upon a specific release price, as defined in the relevant loan agreement, or the loan is refinanced. Construction and development debt is required to be repaid with proceeds from home closings based upon a specific release price, as defined in the relevant loan agreement.

Certain construction and development debt agreements include provisions that require minimum tangible net worth and liquidity; limit leverage and risk asset ratios; specify maximum loan-to-cost or loan-to-value ratios (whichever is lower). During the term of the loan, the lender may require the Company to obtain a third-party written appraisal of the fair value of the underlying real estate collateral. If the appraised fair value of the collateral securing the loan is below the specified minimum, the Company may be required to make principal payments in order to maintain the required loan-to-value ratios. As of September 30, 2016, the Company had approximately $228.2 million of loan commitments of which approximately $69.6 million was available to us. As of September 30, 2016 and December 31, 2015, the weighted average interest rate on the Company’s outstanding debt was 6.48% and 6.35%, respectively. Interest rates charged under the Company’s variable rate debt are based on the 30-day London Interbank Offered Rate (“LIBOR”) plus a spread ranging from 3.00% to 3.75% or the U.S. Prime rate (“Prime”) plus a spread of 1.75%.

On October 21, 2014, the Company completed the private offering of $75.0 million in aggregate principal amount of 8.5% Senior Notes due 2017 (the “2017 Notes”). The net proceeds from the offering were approximately $72.5 million, after paying the debt issuance costs and offering expenses. The net proceeds from the offering were used for general corporate purposes, including financing construction of homes, acquisition of entitled land, development of lots and working capital. As of September 30, 2016, the Company was in compliance with the applicable financial covenants under the indenture pursuant to which the 2017 Notes were issued and all of its other loan agreements.

The Senior Notes were issued under an Indenture, dated as of October 21, 2014 (the “Indenture”), among the Company, certain subsidiary guarantors and Wilmington Trust, National Association, as trustee. The Senior Notes bear interest at 8.5% per annum,

payable on March 31, June 30, September 30 and December 31 of each year. The Senior Notes mature on October 21, 2017, unless earlier redeemed or repurchased.

As of September 30, 2016, the Company was in compliance with the applicable financial covenants under the Indenture and all of its loan agreements.

Notes payable and 2017 Notes consisted of the following (in thousands):

|

| | | | | | | |

| September 30, 2016 | | December 31, 2015 |

Variable Interest Rate: | | | |

LIBOR + 3.75% through 2016 (a) | $ | 4,856 |

| | $ | 30,132 |

|

Prime + 1.75% through 2016 (b) | — |

| | 717 |

|

LIBOR + 3.00% through 2016 (a) | — |

| | 4,832 |

|

LIBOR + 3.50% through 2017 (a) | 5,256 |

| | 9,785 |

|

LIBOR + 3.75% through 2017 (a) | 35,661 |

| | 21,732 |

|

LIBOR + 3.75% through 2018 (a) | 23,086 |

| | 1,120 |

|

5.50% through 2016 | 3,350 |

| | 2,342 |

|

5.00% through 2017 | 6,021 |

| | 4,581 |

|

Total variable notes payable | $ | 78,230 |

| | $ | 75,241 |

|

| | | |

Fixed Interest Rate: | | | |

10.00% through 2017 | $ | 1,604 |

| | $ | 1,604 |

|

0.00% through 2017 | — |

| | 1,935 |

|

8.00% through 2018 | 4,000 |

| | 4,000 |

|

Total fixed notes payable | $ | 5,604 |

| | $ | 7,539 |

|

| | | |

Senior Notes, net | 74,831 |

| | 74,710 |

|

Total notes payable and senior notes | $ | 158,665 |

| | $ | 157,490 |

|

| | | |

Debt issuance costs | (880 | ) | | (1,524 | ) |

Total notes payable and senior notes, net | $ | 157,785 |

| | $ | 155,966 |

|

(a) LIBOR is the 30-day London Interbank Offered Rate. As of September 30, 2016, LIBOR was 0.53111%; loans bear interest at LIBOR plus a spread ranging from 3.00% to 3.75%.

(b) Prime is the U.S Prime Rate. At December 31, 2015, Prime was 3.50% plus 1.75%.

As of September 30, 2016, principal maturities of notes payable and 2017 Notes for the years ending December 31 are as follows (in thousands):

|

| | | |

2016 | $ | 8,206 |

|

2017 | 123,373 |

|

2018 | 27,086 |

|

2019 and thereafter | — |

|

Total | $ | 158,665 |

|

8. FAIR VALUE DISCLOSURES

The accounting guidance regarding fair value disclosures defines fair value as the price that would be received for selling an asset or the price paid to transfer a liability in an orderly transaction between market participants at the measurement date under current market conditions.

The Company determines the fair values of its financial instruments based on the fair value hierarchy established in accordance with ASC Topic 820 - Fair Value Measurements, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The classification of a financial asset or liability within the hierarchy is based upon the lowest level input that is significant to the fair value measurement. The fair value hierarchy prioritizes the inputs into three levels that may be used to measure fair value:

| |

• | Level 1—Quoted prices for identical instruments in active markets |

| |

• | Level 2—Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments in markets that are inactive; and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets at measurement date |

| |

• | Level 3—Valuations derived from techniques where one or more significant inputs or significant value drivers are unobservable in active markets at measurement date |

Estimated Fair Value of Financial Instruments Not Carried at Fair Value

As of September 30, 2016 and December 31, 2015, the fair values of cash and cash equivalents, accounts payable and receivable approximated their carrying values because of the short-term nature of these assets and liabilities. The estimated fair value of the Company’s debt is based on cash flow models discounted at current market interest rates for similar instruments, which are based on Level 3 inputs. There were no transfers between fair value hierarchy levels during the nine months ended September 30, 2016 or the year ended December 31, 2015.

The following presents the carrying value and fair value of the Company’s financial instruments which are not carried at fair value (in thousands):

|

| | | | | | | | | | | | | | | | | |

| | | September 30, 2016 | | December 31, 2015 |

| Level in Fair Value Hierarchy | | Carrying Value | | Estimated Fair

Value | | Carrying Value | | Estimated Fair

Value |

Notes Payable | Level 3 | | $ | 83,834 |

| | $ | 86,671 |

| | $ | 82,780 |

| | $ | 84,712 |

|

2017 Notes | Level 3 | | 74,831 |

| | 80,705 |

| | 74,710 |

| | 82,057 |

|

Total Debt | | | $ | 158,665 |

| | $ | 167,376 |

| | $ | 157,490 |

| | $ | 166,769 |

|

The estimated fair value of the Company's debt is the present value of the contractual debt payments, based on cash flow models, discounted at the then-current interest rates, plus an estimate of the then-current credit spread, which is an estimate of the rate at which the Company could obtain replacement debt. These parameters are Level 3 inputs in the fair value hierarchy. To estimate the contractual cash flows, discount rates, and thereby the debt fair value, the Company considers various internal and external factors including: (1) loan economic data, (2) collateral performance, (3) market interest rate data, (4) the discount curve and implied forward rate curve, and (5) other factors, which may include market, region and asset type evaluations.

Recurring Financial Instruments Carried at Fair Value

The following presents the Company’s recurring financial instruments that are carried at fair value (in thousands):

|

| | | | | | | | | | | | | | |

Description | | Level 1 | | Level 2 | | Level 3 | | Balance as of September 30, 2016 |

Contingent consideration | | — |

| | — |

| | $ | 307 |

| | $ | 307 |

|

| | | | | | | | |

Description | | Level 1 | | Level 2 | | Level 3 | | Balance as of December 31, 2015 |

Contingent consideration | | — |

| | — |

| | $ | 2,707 |

| | $ | 2,707 |

|

Estimated Fair Value of Contingent Consideration

The change in estimated fair value of the contingent consideration for the nine months ended September 30, 2016 and 2015 consisted of the following (in thousands):

|

| | | | |

| | Contingent Consideration |

Balance as of December 31, 2014 | | $ | 3,525 |

|

Change in fair value | | (818 | ) |

Balance as of September 30, 2015 | | $ | 2,707 |

|

| | |

| | Contingent Consideration |

Balance as of December 31, 2015 | | $ | 2,707 |

|

Change in fair value | | (2,400 | ) |

Balance as of September 30, 2016 | | $ | 307 |

|

The fair value of the contingent consideration of $0.3 million as of September 30, 2016 was estimated based on significant inputs that are not observable in the market, which ASC Topic 820 - Fair Value Measurements, refers to as Level 3 inputs. Key assumptions include: (1) forecast adjusted pre-tax net income over the contingent consideration period; (2) revenue appreciation; (3) cost inflation; and (4) sales and marketing and general and administrative (“SG&A”) expenses. The estimated revenue appreciation of 4.5%, cost inflation of 1.5%, and SG&A expenses were applied to forecast adjusted net income over the contingent consideration period. See Note 11, “Commitments and Contingencies” for further discussion of contingent consideration.

Non-Financial Instruments Carried at Fair Value

Non-financial assets and liabilities include items such as inventory and long lived assets that are measured at fair value, on a nonrecurring basis, when events and circumstances indicate the carrying value is not recoverable. See Note 11, "Commitments and Contingencies" for a discussion of the non-financial measurements applied to the Citizens Acquisition included elsewhere in this report.

Non-Recurring Estimated Fair Value of Real Estate Inventories

During the third quarter of 2016, the Company had a non-recurring fair value measurement for the construction of Heathers at Westport. The Company recorded an impairment loss of $0.2 million with respect to the Company’s real estate inventories at Heathers at Westport for the remaining four homes and the carrying value of these homes was written down to their fair value. For the three and nine months ended September 30, 2016, impairment losses of $0.2 million and $2.6 million, respectively, were recorded to real estate inventories.

The following presents the Company’s non-financial instruments that are carried at fair value (in thousands):

|

| | | | | | | | | | | | | | | | |

Description | | Level 1 | | Level 2 | | Level 3 | | Balance as of September 30, 2016 | | Total Impairment During the Nine Months Ended September 30, 2016 |

Real estate and development costs - Heathers at Westport project | | | | | | $ | 1,066 |

| | $ | 1,066 |

| | $ | 192 |

|

Real estate and development costs - Sundance project | | | | | | $ | 1,128 |

| | $ | 1,128 |

| | $ | 2,397 |

|

Real estate and development costs - River Run project | | | | | | $ | 3,300 |

| | $ | 3,300 |

| | $ | — |

|

| | | | | | | | | | |

Description | | Level 1 | | Level 2 | | Level 3 | | Balance as of December 31, 2015 | | Total Impairment During the Twelve Months Ended December 31, 2015 |

Real estate and development costs - Heathers at Westport project | | | | | | $ | 975 |

| | $ | 975 |

| | $ | — |

|

Real estate and development costs - Sundance project | | | | | | $ | 9,448 |

| | $ | 9,448 |

| | $ | — |

|

Real estate and development costs - River Run project | | | | | | $ | 5,960 |

| | $ | 5,960 |

| | $ | 923 |

|

There were no such real estate impairment losses recorded for the three and nine months ended September 30, 2015. For the year ended December 31, 2015, an impairment of $923,000 was recorded to homebuilding real estate inventory in the River Run project, located in Bakersfield, California, to adjust its carrying value to its estimated fair value as of the date of the impairment.

9. EQUITY

Noncontrolling Interest

As of September 30, 2016, the Company holds an approximately 43.1% economic interest in UCP, LLC and is its sole managing member; UCP, LLC is fully consolidated.

The carrying value and ending balance as of September 30, 2016 of the noncontrolling interest was calculated as follows (in thousands):

|

| | | |

Beginning balance of noncontrolling interest as of December 31, 2015 | $ | 127,208 |

|

Net income attributable to noncontrolling interest | 3,109 |

|

Re-allocation of stock issuances | (1,909 | ) |

Stock-based compensation attributable to noncontrolling interest | 423 |

|

Stock issuance attributable to noncontrolling interest | (25 | ) |

Distribution to noncontrolling interest | (4,830 | ) |

Ending balance of noncontrolling interest as of September 30, 2016 | $ | 123,976 |

|

The distribution to the noncontrolling interest relates to cash distributions, which we refer to as “tax distributions,” that UCP, LLC is obligated to make as noted in the Company’s Annual Report on Form 10-K that was filed with the Securities and Exchange Commission on March 14, 2016.

Stock Repurchase Program

As part of the Board approved Stock Repurchase Program, between June 7, 2016 and June 1, 2018, management is authorized to repurchase up to $5.0 million of the Company’s Class A common stock in open market purchases, privately negotiated transactions or other transactions. The Stock Repurchase Program is subject to prevailing market conditions and other considerations, including our liquidity, the terms of our debt instruments, planned land investment and development spending, acquisition and other investment opportunities and ongoing capital requirements.

Since inception of the program through September 30, 2016, the Company repurchased an aggregate of 123,636 shares of Class A common stock for total consideration of $1.0 million, inclusive of commissions. The remaining value of shares that may be repurchased under the Stock Repurchase Program as of September 30, 2016 is approximately $4.0 million. The Company previously did not have a stock repurchase program, therefore there were no stock repurchases for the year ended December 31, 2015.

Re-Allocation from Stock Issuances