UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

OR

For the fiscal year ended

OR

OR

Date of event requiring this shell company report

For the transition period from to

Commission file number

(Exact name of Registrant as specified in its charter)

(Translation of Registrant’s name into English)

Republic of

(Jurisdiction of incorporation or organization)

Lima

(Address of principal executive offices)

Tel.

Lima

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| New York Stock Exchange |

| * | Not for trading purposes, but only in connection with the registration on the New York Stock Exchange of the American Depositary Shares representing those common shares. |

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation

pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

| At December 31, 2021 |

Indicate by check mark if the Registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934. Yes ☐

Note - Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the Registrant (1) has

filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☐

Indicate by check mark whether the Registrant has

submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of

this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | ☒ | Non-accelerated filer | ☐ | |

| Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has

filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting

under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued

its audit report.

Indicate by check mark which basis of accounting the Registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | Other ☐ | |||

| by the International Accounting Standards Board | ☒ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐

TABLE OF CONTENTS

i

ii

PART I. INTRODUCTION

Certain Definitions

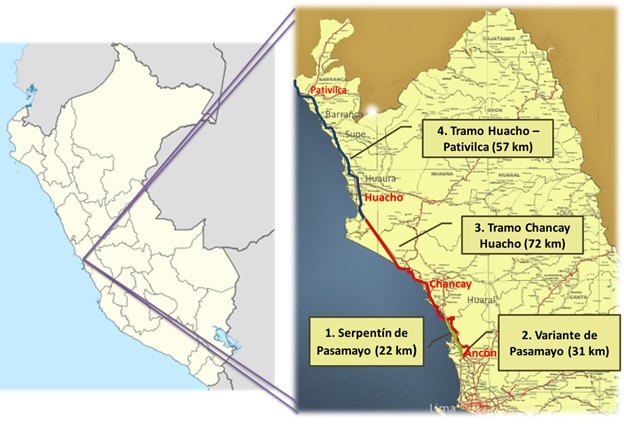

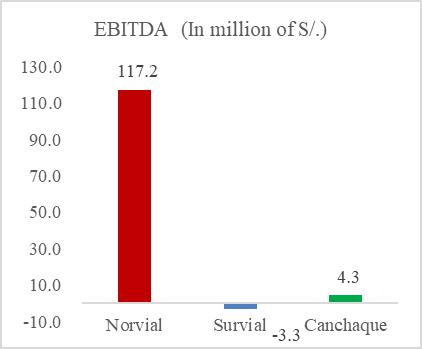

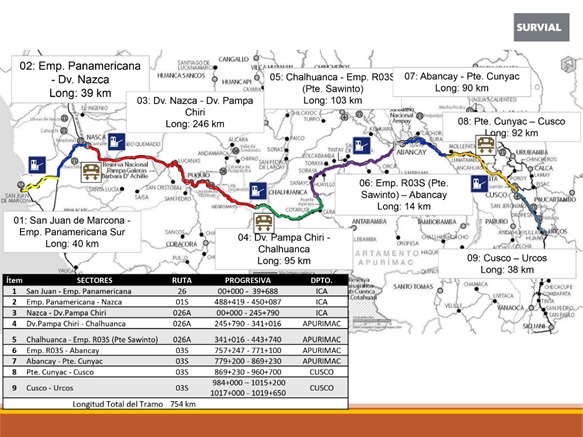

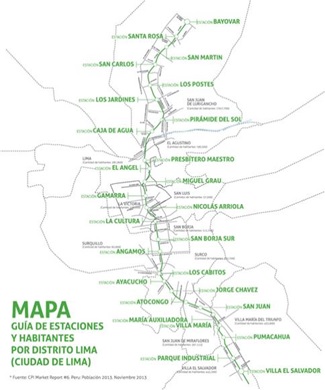

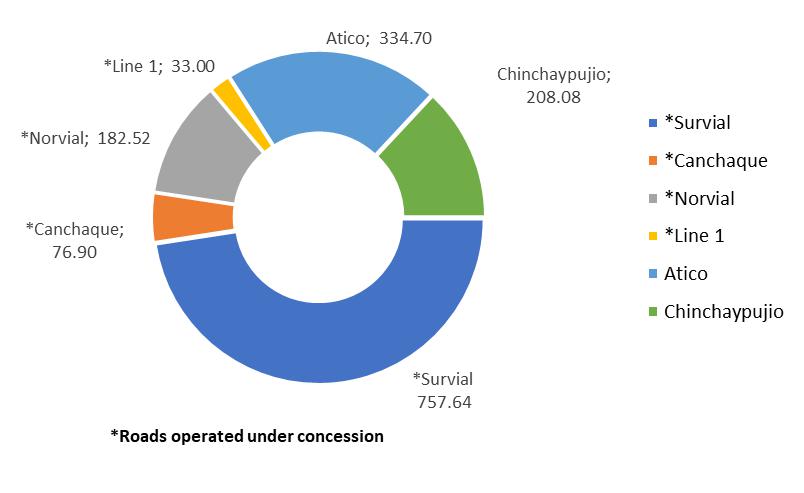

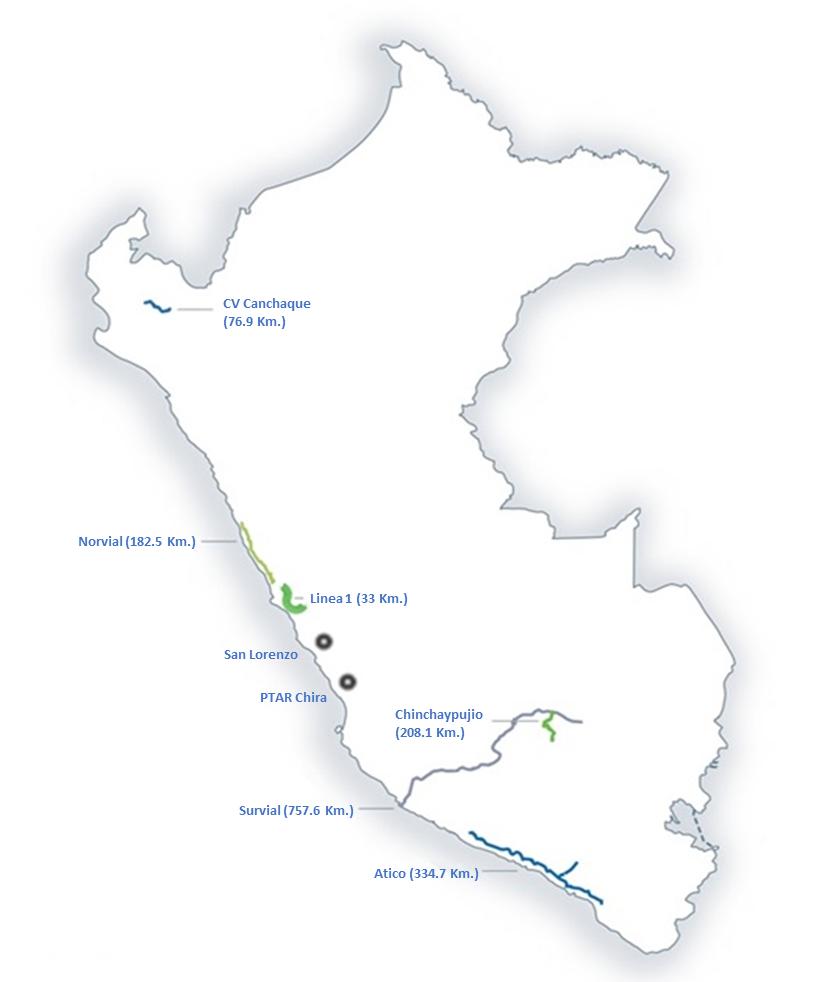

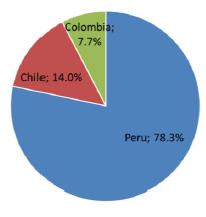

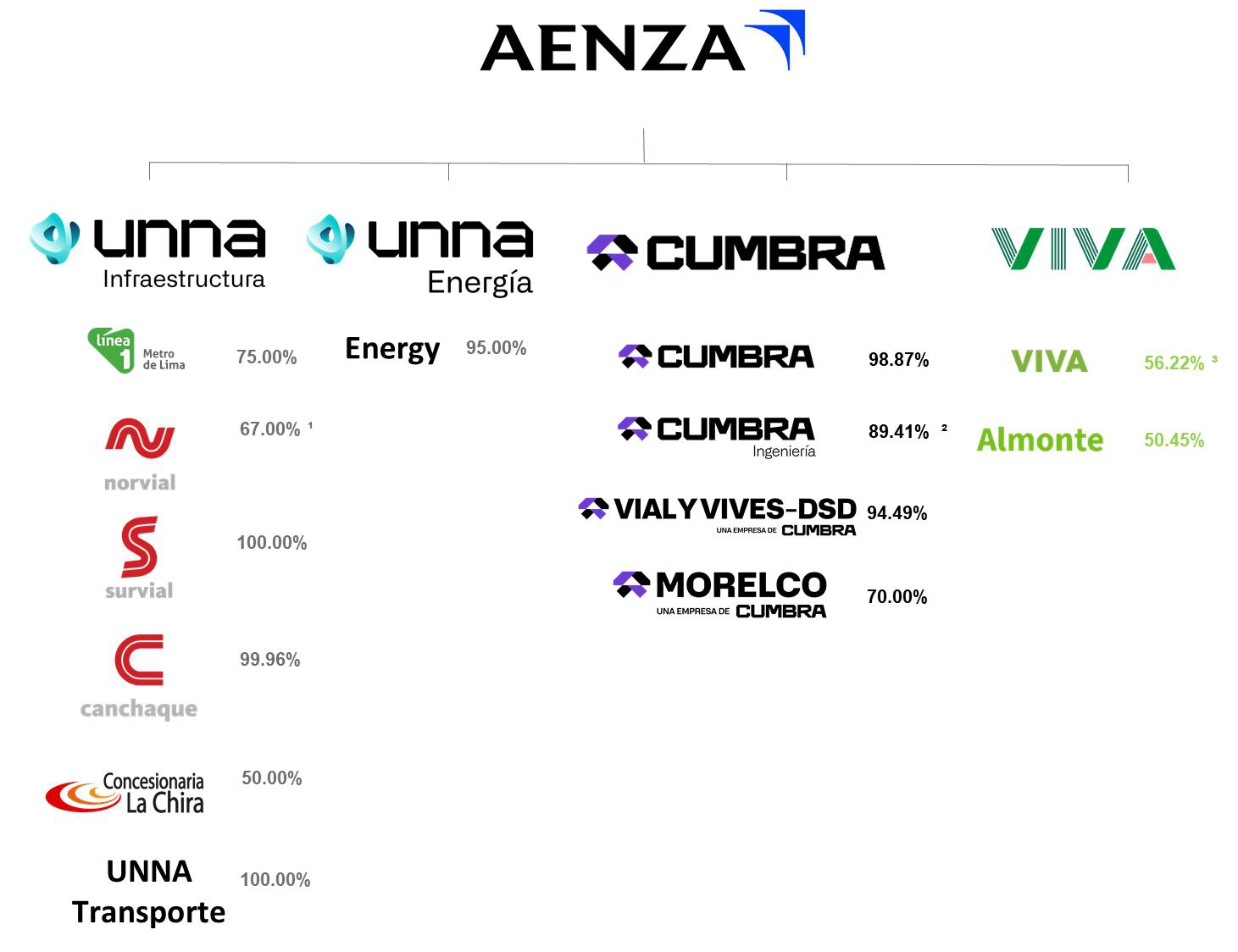

All references to “we,” “us,” “our,” “our company,” “the group” and “AENZA” in this annual report are to AENZA S.A.A. (formerly, “Graña y Montero S.A.A.”), a publicly-held corporation (sociedad anónima abierta) organized under the laws of the Republic of Peru (“Peru”). In this annual report, we refer to our principal subsidiaries, joint operations, joint ventures and associated companies as follows: (i) in our Infrastructure segment: Red Vial 5 S.A. as “Norvial”; Carretera Andina del Sur S.A. as “Survial”; Carretera Sierra Piura S.A.C as “Canchaque”; Tren Urbano de Lima S.A. (formerly, GyM Ferrovías S.A.) as “Línea 1”; Concesionaria La Chira S.A. as “La Chira”; and UNNA Transporte S.A.C. (formerly Concar S.A.C.) as “UNNA Transporte”; (ii) in our Energy segment: UNNA Energía S.A. (formerly GMP S.A.) as “UNNA Energía”; (iii) in our Engineering and Construction (“E&C”) segment: Cumbra Peru S.A. (formerly GyM S.A.) as “Cumbra”; Vial y Vives—DSD S.A. as “Vial y Vives—DSD”; Cumbra Ingeniería S.A. (formerly GMI S.A.) as “Cumbra Ingeniería”; Morelco S.A.S. as “Morelco”; and (iv) in our Real Estate segment: Viva Negocio Inmobiliario S.A. (formerly Viva GyM S.A.) as “Viva” and Inmobiliaria Almonte S.A.C. as “Almonte”. For more information on our subsidiaries, joint operations, joint ventures or associated companies, see notes 6a, 6c and 15 to our audited annual consolidated financial statements included in this annual report.

The term “U.S. dollar” and the symbol “US$” refer to the legal currency of the United States; the term “sol” and the symbol “S/” refer to the legal currency of Peru; the term “Chilean peso” and the symbol “CLP” refer to the legal currency of Chile; and the term “Colombian peso” and the symbol “COP” refer to the legal currency of Colombia.

Presentation of Financial Information

Our consolidated financial statements included in this annual report have been prepared in soles and in accordance with International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”). Our annual consolidated financial statements as of December 31, 2020 and 2021 and for the years ended December 31, 2019, 2020 and 2021 have been audited by Moore Assurance S.A.S. (a member firm of Moore Global Network Limited) in accordance with the standards of the Public Company Accounting Oversight Board (United States).

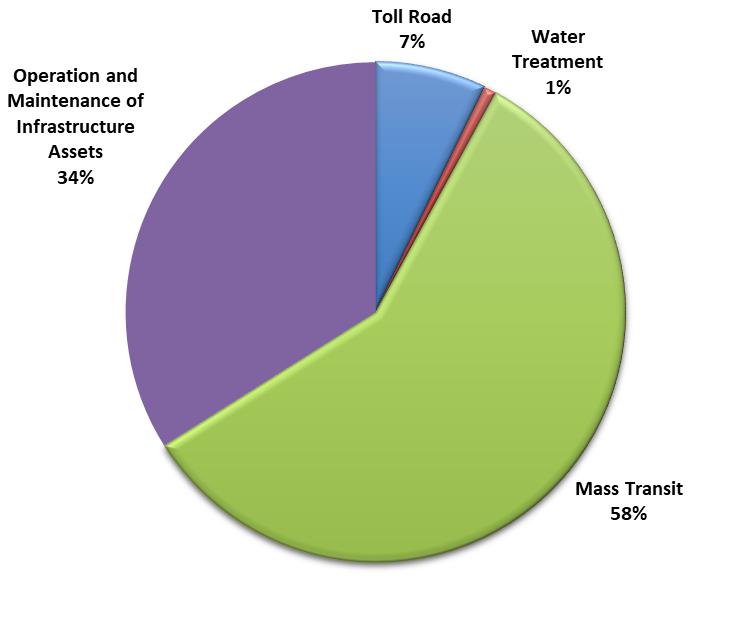

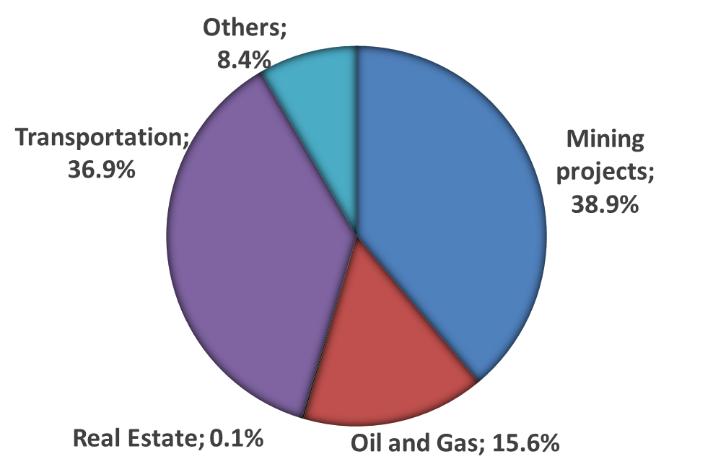

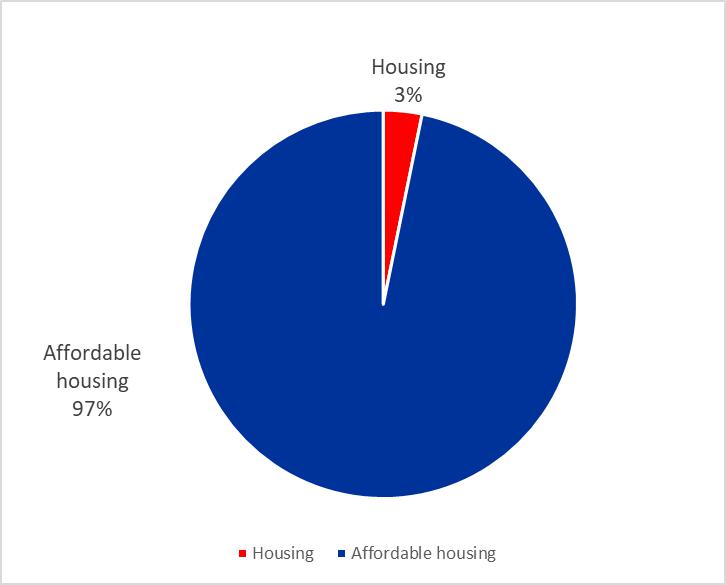

We manage our business in four segments: (i) Infrastructure; (ii) Energy; (iii) Engineering and Construction (E&C); and (iv) Real Estate. Prior to 2021, our Energy segment was part of our Infrastructure segment; however, beginning during the fourth quarter of 2021, we have changed our segment reportings to separately report our Energy business as a segment. The historical segment financial information included in this annual report has been adjusted accordingly. For information on our results of operations by business segment, see note 7 to our audited annual consolidated financial statements included in this annual report. In addition, on December 27, 2021, we sold Adexus S.A. (“Adexus”), our technical services subsidiary. As a result, our financial information included in this annual report has been adjusted accordingly. Our segment data presents Adexus as a parent company operation not part of any of our four business segments. See note 36 to our audited annual consolidated financial statements included in this annual report.

Non-IFRS Data

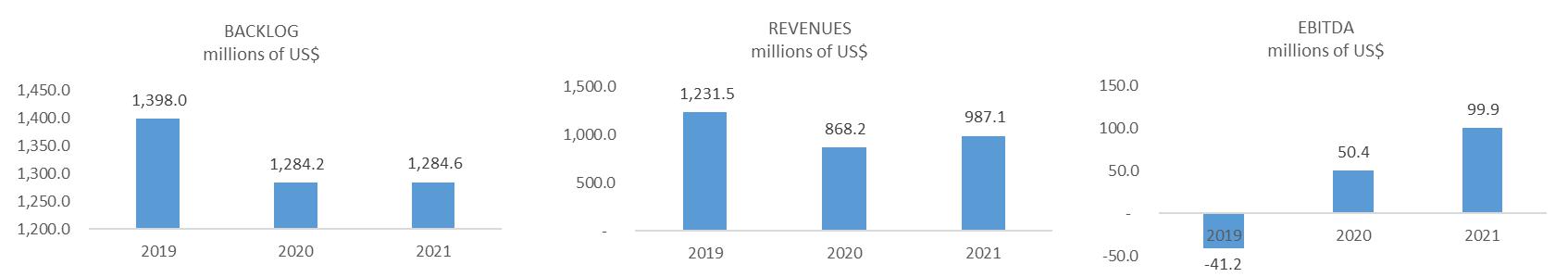

In this annual report, we present EBITDA, a non-GAAP financial measure. A non-GAAP financial measure is generally defined as one that purports to measure financial performance, financial position or cash flows but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure. We present EBITDA because we believe it provides readers with a supplemental measure of the financial performance of our core operations that facilitates period-to-period comparisons on a consistent basis. Our management uses EBITDA, among other measures, for internal planning and performance measurement purposes. We believe that EBITDA is useful in evaluating our operating performance compared to other companies operating in our sectors because the calculation of EBITDA generally eliminates the effects of financing and income taxes and the accounting effects of capital spending, which items may vary for different companies for reasons unrelated to overall operating performance. EBITDA should not be construed as an alternative to net profit or operating profit, as an indicator of operating performance, as an alternative to cash flow provided by operating activities or as a measure of liquidity (in each case, as determined in accordance with IFRS). EBITDA, as calculated by us, may not be comparable to similarly titled measures reported by other companies. For our definition of EBITDA and a reconciliation of EBITDA to the most directly comparable IFRS financial measure, see “Item 3.A. Key Information—Selected Financial Data—Non-GAAP Financial Measure and Reconciliation.”

Currency Translations

Our consolidated financial statements are prepared in soles. For a description of our translation of amounts in currencies other than soles in our consolidated financial statements, see note 2.4 to our audited annual consolidated financial statements included in this annual report.

1

We have translated some of the soles amounts contained in this annual report into U.S. dollars and some U.S. dollars amounts contained in this annual report into soles, for convenience purposes only. Unless otherwise indicated or the context otherwise requires, the rate used to translate soles amounts to U.S. dollars and U.S. dollars amounts into soles was S/3.998 to US$1.00, which was the average sale exchange rate for December 31, 2021 reported by the Peruvian Superintendence of Banks, Insurance and Private Pension Fund Administrators (Superintendencia de Banca, Seguros y AFPs, or “SBS”). We present our backlog in U.S. dollars. For contracts denominated in soles or other local currencies, amounts have been converted into U.S. dollars based on the exchange rate published by the SBS on December 31 of the corresponding year. When we present our ratios of backlog and revenues in this annual report, we similarly convert our revenues, which are reported in soles, into U.S. dollars based on the exchange rate reported for December 31 of the corresponding year. For conversions of macroeconomic indicators (particularly in “Item 5.D. Operating and Financial Review and Prospects—Trend Information” in this annual report), average annual exchange rates for the currencies of each of the countries addressed are used. The Federal Reserve Bank of New York does not report a noon buying rate for soles. The U.S. dollar equivalent information presented in this annual report is provided solely for convenience of the reader and should not be construed as implying that the soles or other currency amounts represent, or could have been or could be converted into, U.S. dollars at such rates or at any other rate.

Rounding

Certain figures included in this annual report have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be arithmetic aggregations of the figures that precede them.

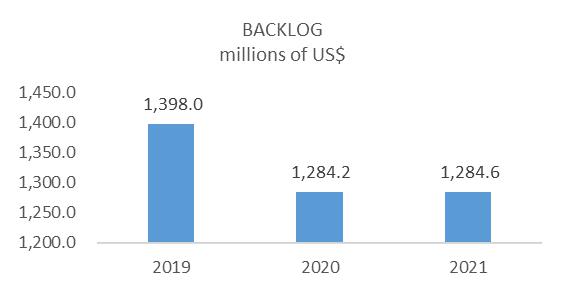

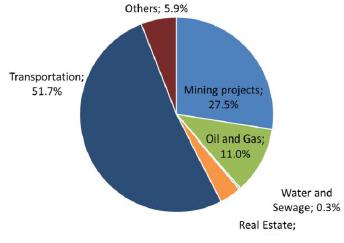

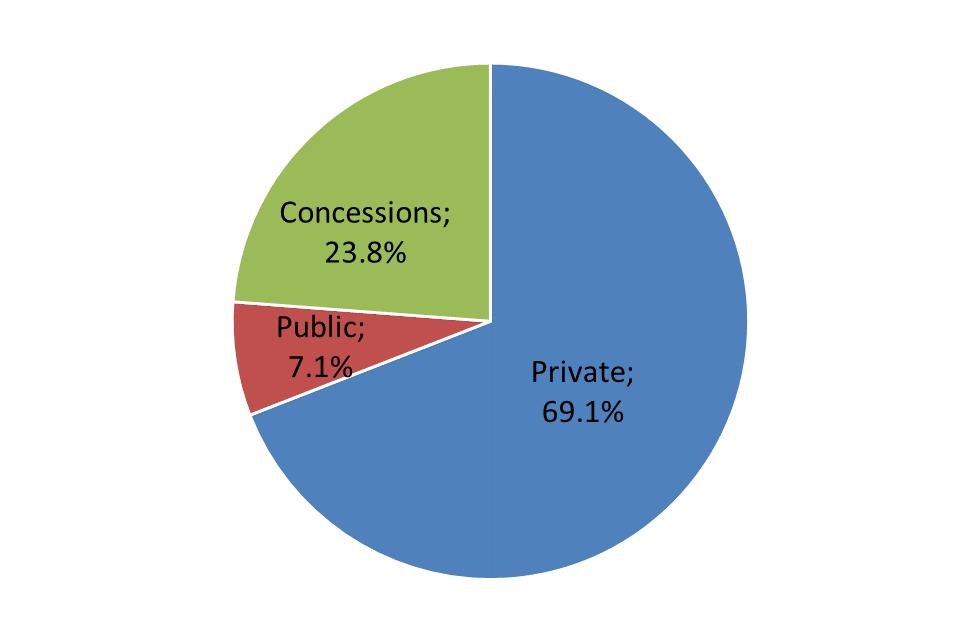

Backlog

This annual report includes our backlog for part of our Infrastructure segment and our Engineering and Construction (E&C), and Real Estate segments. We do not include backlog in this annual report in: (i) our Infrastructure segment for our Norvial toll road concession because its revenues from the concession are derived from toll fees charged to vehicles using the highway, and, as a result, such revenues are dependent on vehicular traffic levels; and (ii) our Energy segment because: (a) our revenues from hydrocarbon extraction services are dependent on the amounts of oil and gas we produce and their market prices, which fluctuate significantly; (b) our revenues from our gas processing plant are dependent on the amount of gas we process and market prices for natural gas liquids, which fluctuate significantly; and (c) our revenues from our fuel storage terminal operation partially depend on the volume of fuel stored and dispatched. When we present backlog on a segment basis, we do not include eliminations that are included in our consolidated backlog. Backlog is not a measure defined by IFRS, and our methodology for determining backlog may not be comparable to the methodology used by other companies in determining their backlog. Backlog is not audited. We have revised historical backlog data included in this annual report to exclude the presentation of entities that are presented as discontinued operations. For our definition of backlog, see “Item 4.B. Information on the Company—Business Overview—Backlog.” See also “Item 3.D. Key Information—Risk Factors—Risks Related to our Company—Our backlog and our ratio of historical backlog to revenues may not be reliable indicators of future revenues or profit.”

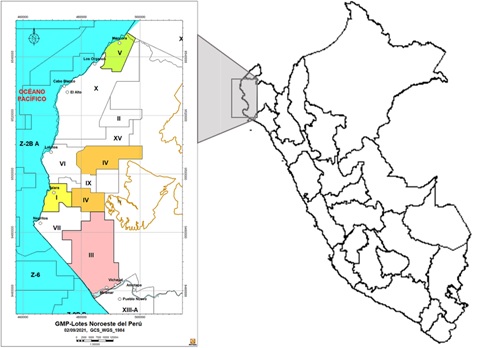

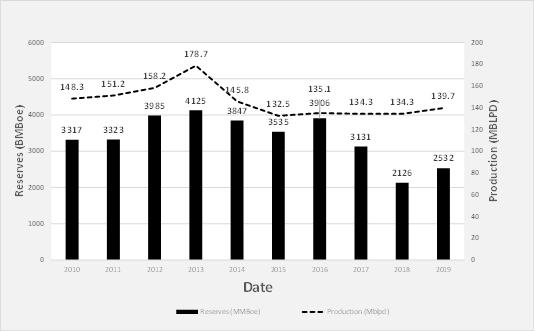

Reserves Estimates

This annual report includes our estimates for proved reserves in Block V, where UNNA Energía provides hydrocarbon extraction services to, and Blocks III and IV, where UNNA Energía extracts hydrocarbon under license agreements with, Perupetro S.A. (“Perupetro”). These reserves estimates were prepared internally by our team of engineers and have not been audited or reviewed by any independent external engineers. For further information on these reserves estimates, see “Item 3.D. Key Information—Risks Related to Our Company—Additional Risks Related to our Infrastructure Business” and “Item 4.B. Information on the Company—Business Overview—Infrastructure—Principal Infrastructure Lines of Business—Energy—Oil and Gas Production.”

Market Information

We make estimates in this annual report regarding our competitive position and market share, as well as the market size and expected growth of the infrastructure, energy, engineering and construction, and real estate services industries in Peru and elsewhere in Latin America. We have made these estimates on the basis of our management’s knowledge and statistics and other information, which we believe to be the most recently available as of the date of this annual report, from government agencies, industry professional organizations, industry publications and other sources. While we believe these estimates to be accurate as of the date of this annual report, we have not independently verified the data from third-party sources and our internal data has not been verified by any independent source. In this annual report we present gross domestic product (“GDP”) both on a nominal and real basis. Real GDP is nominal GDP adjusted to exclude the effect of inflation. Unless otherwise indicated, references to GDP are to real GDP.

2

Measurements and Other Data

In this annual report, we use the following measurements:

| ● | “m” means one meter, which equals approximately 3.28084 feet; |

| ● | “m2” means one square meter, which equals approximately 10.7630 square feet; |

| ● | “km” means one kilometer, which equals approximately 0.621371 miles; |

| ● | “hectare” means one hectare, which equals approximately 2.47105 acres; |

| ● | “tonne” means one metric ton, which equals approximately 2,204.6 pounds; |

| ● | “bbl” or barrel of oil means one stock tank barrel, which is equivalent to approximately 0.15898 cubic meters; |

| ● | “boe” means one barrel of oil equivalent, which equals approximately 160.2167 cubic meters, determined using the ratio of 5,658 cubic feet of natural gas to one barrel of oil; |

| ● | “cf” means one cubic foot; |

| ● | “M,” when used before bbl, boe or cf, means one thousand bbl, boe and cf, respectively; |

| ● | “MM,” when used before bbl, boe or cf, means one million bbl, boe and cf, respectively; |

| ● | “MW” means one megawatt, which equals one million watts; and |

| ● | “Gwh” means one gigawatt hour, which equals one billion watt hours. |

In this annual report, we use the term “accident incidence rate” with respect to our E&C segment, which is calculated as the number of injuries multiplied by 200,000 (which reflects 40 hours worked per week in a 50-week year by 100 equivalent full-time workers) divided by the total number of hours worked by all full-time employees of our E&C segment during the relevant year.

Forward-Looking Statements

This annual report contains forward-looking statements. Forward-looking statements convey our current expectations or forecasts of future events. These statements involve known and unknown risks, uncertainties and other factors, including those listed under “Item 3.D. Key Information—Risk Factors,” which may cause our actual results, performance or achievements to differ materially from the forward-looking statements that we make.

Forward-looking statements typically are identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “project,” “plan,” “believe,” “potential,” “continue,” “is/are likely to,” or other similar expressions. Any or all of our forward-looking statements in this annual report may turn out to be inaccurate. Our actual results could differ materially from those contained in forward-looking statements due to a number of factors, including, among others:

| ● | the impact that the ongoing Novel Coronavirus 2019 (“COVID-19”) pandemic, and governments’ extraordinary measures to limit the spread of the virus, will continue to have on economic activity and the industries in which we operate; |

| ● | the impact on our business reputation from our past association with Odebrecht S.A. affiliates (“Odebrecht”) in Peru and our alleged participation in what is referred to as the “construction club” in Peru; |

| ● | the potential effects of investigations of our company and certain of our former directors and senior managers, or any future investigations, regarding corruption or other illegal acts, including our settlement and cooperation agreement with Peruvian prosecutorial authorities, which includes, among other restrictions, significant penalties, admissions of guilt and temporary debarment from entering into new contracts with the government of Peru; |

| ● | our ability to fund our working capital and other obligations, through cash flow from operating activities, financing sources or the sale of assets; |

| ● | our ability to comply with the covenants in our debt instruments or obtain waivers in the event of non-compliance; |

| ● | our ability to obtain financing on favorable terms, including our ability to obtain performance bonds and similar financings required in the ordinary course of our business; |

| ● | our ability to consummate asset sales or other strategic transactions on favorable terms and on a timely basis, or at all; |

| ● | global macroeconomic conditions, including commodity prices; |

3

| ● | economic, political and social conditions in the markets in which we operate, including as a result of political disputes between the executive branch and congress in Peru, the drafting of a new constitution in Chile, and upcoming elections in Colombia; |

| ● | major changes in government policies at the national, regional or municipal levels, including in connection with infrastructure concessions, investments in infrastructure and affordable housing subsidies; |

| ● | social conflicts that disrupt infrastructure projects, particularly in the mining sector; |

| ● | interest rate fluctuation, inflation and devaluation or appreciation of the Peruvian sol, or Chilean peso or Colombian peso, in relation to the U.S. dollar (or other currencies in which we receive revenue); |

| ● | our backlog may not be a reliable indicator of future revenues or profit; |

| ● | the cyclical nature of some of our business segments; |

| ● | the level of capital investments and financings available for infrastructure projects of the types that we perform, both in the private and public sectors; |

| ● | competition in our markets, both from local and international companies; |

| ● | volatility in global prices of oil and gas; |

| ● | changes in real estate market prices, customer demand, preference and purchasing power, and financing availability and terms; |

| ● | our ability to obtain zoning and other license requirements for our real estate development; |

| ● | changes in tax, environmental, health and safety, or other laws and regulations; |

| ● | natural disasters, severe weather or other events that may adversely impact our business; and |

| ● | other factors identified or discussed under “Item 3.D. Key Information—Risk Factors.” |

The forward-looking statements in this annual report represent our expectations and forecasts as of the date of this annual report. These statements are intended to qualify for the safe harbors from liability provided by Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this annual report.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | [Reserved] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Summary of Risk Factors

The following summarizes some, but not all, of the principal risks set forth below. Please carefully consider all of the information discussed in this Item 3.D “Risk Factors” in this annual report for a detailed description of these and other risks.

4

Risks Related to Key Developments

| ● | The ongoing COVID-19 pandemic and government measures aimed at containing the spread of the virus have disrupted economic activity in the countries where we operate and adversely affected our business, results of operations and financial condition. | |

| ● | The outcome of investigations regarding potential corruption or other illegal acts could have a material adverse effect on our business, financial condition and results of operations. | |

| ● | We were in default under certain of our debt instruments in the past, and we cannot assure you that we will not be in default under our debt instruments in the future, or that we will be able to obtain additional waivers in the event of any future defaults. | |

| ● | We may not have sufficient cash or access to funding to meet our extraordinary payment obligations. | |

| ● | We may be unable to access financing that we need to operate our business on favorable terms or at all. |

Risks Related to Our Company

| ● | Global economic conditions could adversely affect our financial performance. | |

| ● | We face significant competition in each of our markets. | |

| ● | Social conflicts may disrupt infrastructure projects and ongoing operations. | |

| ● | Failure to comply with, or changes in, laws or regulations could have a material adverse effect on our business and financial performance. | |

| ● | We are exposed to the risk of increasing environmental legislation and the broader impacts of climate change. | |

| ● | Our backlog and our ratio of historical backlog to revenues may not be reliable indicators of future revenues or profit. | |

| ● | Debarment from participating in government bidding processes could have an adverse impact on our business and financial performance. |

Additional Risks Related to our Infrastructure Business

| ● | Our return on our investment in our concessions may not meet estimated returns. | |

| ● | Governmental entities may terminate prematurely our concessions and similar contracts under various circumstances, some of which are beyond our control. | |

| ● | We are exposed to risks related to the operation and maintenance of our concessions and similar contracts. | |

| ● | We may not be successful in obtaining new concessions. |

Additional Risks Related to our Energy Business

| ● | A substantial or sustained decline in oil prices would adversely affect our financial performance. | |

| ● | Our reserves estimates depend on many assumptions that may turn out to be inaccurate and are not subject to review by independent reserve auditors. | |

| ● | We may not be able to finance our mandatory capital expenditure requirements in connection with our oil and gas operations. |

Additional Risks Related to our Engineering and Construction Business

| ● | We are vulnerable to the cyclical nature of the end-markets we serve. | |

| ● | Decreases in capital investments by our clients may adversely affect the demand for our services. | |

| ● | Our business may be adversely affected if we incorrectly estimate the costs of our projects. |

5

Additional Risks Related to our Real Estate Business

| ● | We are exposed to risks associated with the development of real estate. | |

| ● | Real estate prices may decline. | |

| ● | Our business may be adversely affected if we are not able to obtain the necessary licenses and/or authorizations for our developments on a timely basis. | |

| ● | We may experience difficulties in finding desirable land and increases in the price of land may increase our cost of sales and decrease our earnings. | |

| ● | Changing market conditions may adversely affect our ability to sell home inventories in our land and at expected prices. |

Risks Related to Peru

| ● | Economic, social and political developments in Peru could adversely affect our business and financial performance. |

| ● | Fluctuations in the value of Peruvian sol could adversely affect financial performance. | |

| ● | Inflation could adversely affect our financial performance. |

Risks Related to Chile, Colombia and other Latin American Countries

| ● | We face risks related to our operations outside of Peru. |

Risks Related to our ADSs

| ● | We have identified a material weakness in our internal control over financial reporting, and if we cannot maintain effective internal controls or provide reliable financial and other information in the future, investors may lose confidence in the reliability of our consolidated financial statements, which could result in a decrease in the value of our ADSs. |

Risks Related to Key Developments

The ongoing COVID-19 pandemic and government measures aimed at containing the spread of the virus have disrupted economic activity in the countries where we operate and adversely affected our business, results of operations and financial condition

The outbreak of the Novel Coronavirus 2019 (COVID-19) pandemic, which has been declared by the World Health Organization to be a “public health emergency of international concern,” has spread across the world since the end of 2019. In response, countries around the world—including Peru, Chile and Colombia, adopted extraordinary measures to contain the spread of COVID-19, including imposing travel restrictions, requiring closures of non-essential businesses, establishing restrictions on public gatherings, instructing residents to practice social distancing, issuing stay-at-home orders, implementing quarantines, mandatory vaccinations and similar actions. While many of these measures have ended or been reduced in scope, depending on how the spread of the virus continues to evolve including as a result of the emergence of new variants, governments may adopt new extraordinary measures. The virus has spread significantly in Latin America, and the countries where we operate have fewer resources to address the effects of the pandemic.

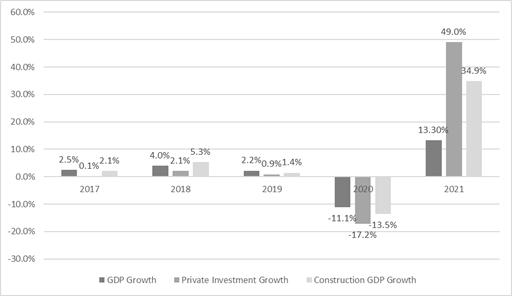

The COVID-19 pandemic and these government measures caused a global recession in 2020 which resulted in a severe economic impact on the countries where we operate. While these economies recovered during 2021, we cannot predict the full extent to these economies will ultimately be impacted. Even as initial outbreaks of COVID-19 subsided, subsequent outbreaks have occurred, including as a result of mutations of the virus. We cannot predict whether subsequent outbreaks will not continue to reoccur, nor whether governments will not implement new measures that affect economic activity. As a result, the negative impact of COVID-19 may continue well beyond the containment of the virus.

The COVID-19 pandemic significantly and adversely affected our business, results of operations and financial condition during 2020. Infections caused halts and delays in our engineering and construction projects, which have caused us to renegotiate performance targets with certain clients. These interruptions and negotiations added costs with respect to certain projects, and caused us to include additional allowances for certain accounts receivable and impairments to our long-term assets. Moreover, from mid-March through the end of May 2020, substantially all of our engineering and construction and real estate projects were mandatorily shut down. Although since July 2020, our projects have resumed operations with COVID-19 protocols in place, we cannot assure you that work will not be halted again or that projects will be completed on time or at all. Our infrastructure operations, which have for the most part been declared essential businesses, continued to operate during the pandemic; however, certain of our infrastructure businesses were adversely affected, in particular, by the sharp decline in traffic volumes and fluctuations in oil and gas prices.

The Peruvian government has further extended the state of national emergency as a result of COVID-19 pandemic. Similarly, certain economic activities are restricted pursuant to varying alert levels in each department of Peru. Although the activities carried out by the company are within the Peruvian government’s categories of permitted activities, we cannot assure you that our businesses will not be halted again, and, if so, that our projects will be completed on time or at all. Even if our businesses continue to be categorized essential businesses, they may be affected by other factors caused by the pandemic, such as the decline in traffic volumes, decline in economic activities, reduction in capital investments or decrease in purchasing power of individuals. We cannot assure you that we will be able to transfer any of these additional costs to our clients.

6

We continue to monitor the evolution of the pandemic and the guidance of Peruvian and international authorities, as events beyond our control may arise that require modifying our business strategy. COVID-19 and the government measures taken to limit the spread of the virus could affect our ability to conduct our business in the ordinary course and, therefore, affect our business, financial condition and results of operations.

Our reputation has been adversely affected by criminal investigations and administrative proceedings relating to allegations of past corruption

Our reputation has been adversely affected by criminal investigations and administrative proceedings relating to allegations of corruption with respect to events during the period from 2004 to 2016 in connection with the construction and operation of certain infrastructure projects in Peru in which we participated with Odebrecht. Our reputation has also been adversely affected by investigations and administrative proceedings arising from our alleged participation in a “construction club” that colluded to procure government contracts during the period from 2002 to 2016. Furthermore, in May 2021, we entered into a settlement and cooperation agreement with Peruvian prosecutorial authorities, which is subject to judicial approval, by which we have acknowledged that certain of our former directors and senior managers have used the company to commit wrongdoing and, as a result, we have agreed to indemnify the Peruvian government for the resulting damages.

Our reputation is a key factor in our clients’ evaluation of whether to engage our services, key industry players’ willingness to partner with us, financial institutions’ willingness to provide us credit, and recruiting and retaining talented personnel to our company. The outcome of these investigations and proceedings, any new charges or news reports containing new allegations against the company, or other similar developments, could further damage the reputation of the company.

The outcome of investigations regarding potential corruption or other illegal acts could have a material adverse effect on our business, financial condition and results of operations

Our company and certain of our subsidiaries, and certain of our former directors and senior managers, have been charged in connection with criminal and civil investigations relating to certain of our projects in connection with our association with Odebrecht and in connection with our alleged participation in the alleged “construction club” during the period from 2004 to 2016.

In 2018, the Peruvian criminal prosecutor charged our company and our engineering and construction subsidiary, Cumbra, as criminal defendants in connection with the IIRSA South (tranche II) project concession, and the Peruvian First National Preparatory Investigation Court (Primer Juzgado de Investigación Preparatoria Nacional) included our company and Cumbra in its criminal investigation. Separately, in connection with these investigations, in December 2018, the Peruvian First National Preparatory Investigation Court also resolved to include our company and Cumbra as civilly responsible third parties in the investigations related to the IIRSA South (tranche II) project concession and Cumbra as a civilly responsible third party in the investigations related to Tranches 1 and 2 of the Lima Metro.

In December 2018, Cumbra was formally included as a civilly responsible third party, along with eleven other construction companies, in the criminal investigation conducted by a Peruvian public prosecutor with respect to an alleged “construction club” that colluded to receive public contracts. In October 2021, the prosecutor filed a motion to criminally charged Cumbra and another of our subsidiaries, UNNA Transporte, and other companies in the construction sector in Peru, as well as a former director and former senior managers of our company, with collusion and other alleged crimes.

Additionally, Peruvian prosecutors have included José Graña Miró Quesada, the former Chairman of our company, in an investigation for the crime of collusion, and Hernando Graña Acuña, a former board member of our company and former chairman of our subsidiary Cumbra, for the crime of money laundering against the Peruvian government, each in connection with the IIRSA South (tranche II) project concession, in which we participated with Odebrecht. Gonzalo Ferraro Rey, the former Chief Infrastructure Officer of our company, has also been included in an investigation for the crime of money laundering in connection with the same project. In addition, José Graña and Hernando Graña, as well as Juan Manuel Lambarri, the former chief executive officer of our subsidiary Cumbra, have been charged in connection with Tranches 1 and 2 of the Lima Metro. On February 9, 2022, the Peruvian press reported that Peruvian prosecutorial authorities entered into plea agreements with José Graña Miró Quesada and Hernando Graña Acuña, which remain subject to judicial approval. These plea agreements are confidential under Peruvian law and we, therefore, do not know their content, however, they may include information related to wrongdoing or knowledge of improper behavior while José Graña Miró Quesada and Hernando Graña Acuña were at the company. We cannot assure you what they will ultimately say to government authorities, or that their statements will not adversely affect the company’s reputation.

We understand that Peruvian prosecutors had initiated an investigation with respect to the Chavimochic project. Neither the company nor any of its affiliates or personnel were subject to investigation and therefore we have limited information. However, we understand that the Chavimochic investigation has subsequently been closed without any further action. The project has not been operational since 2017, and parties, without our participation, are currently in discussions with the Peruvian government in relation to the future of the project.

7

In May 2021, we entered into a settlement and cooperation agreement (Acuerdo Preparatorio de Colaboración Eficaz y Beneficios) with Peruvian prosecutorial authorities by which we acknowledged that certain of our former directors and senior managers have used the company to commit wrongdoing during the period from 2004 to 2016 and, as a result, we have agreed to indemnify the Peruvian government for the resulting damages. The agreement is related to investigations of substantially all of the construction and operation of infrastructure projects in Peru in which we participated with Odebrecht, as well as our alleged participation in a “construction club” aimed to procure government contracts. Under the agreement, we have agreed to pay a civil penalty of S/321,916,404 and US$41,061,790 over 12 years, subject to a statutory interest rate in Peruvian and foreign currency, and to a pledge of collateral valued at S/197.0 million through a trust agreement that includes shares issued by a subsidiary of AENZA, a real estate asset guarantee and a debt service guaranty account. Among other conditions, the agreement includes a restriction on participating in new public construction and road maintenance contracts in Peru for two years from the approval of the agreement. As of December 31, 2021, we recorded an estimated provision reflecting the present value of the penalty, which amounted to S/164.6 million and US$18.9 million (in total, S/240.1 million, or approximately US$60.1 million).

According to the terms of the settlement and cooperation agreement, the civil penalty would cover the total contingency to Peruvian prosecutorial authorities to which the company is exposed as a result of the investigations of past projects in which the company participated with Odebrecht (other than the Chavimochic project, described below) and investigations relating to an alleged participation in the “construction club” (excluding INDECOPI’s separate administrative proceedings, described below). We cannot assure you that the agreement will be approved by the courts in a timely manner or at all. Nor can we assure you that our liability will not ultimately exceed the amount provisioned in our financial statements. Additionally, we cannot assure you that the Peruvian government will not claim the assets pledged as collateral or require that we include additional assets as collateral for our payment obligations, nor we can assure you that any pledged assets will fully satisfy our obligations to the Peruvian government due to fluctuations in their value or otherwise.

A conviction of corruption or settlements with government authorities could lead to criminal and civil fines as well as penalties, sanctions, injunctions against future conduct, profit disgorgement, disqualifications from directly and indirectly engaging in certain types of business, the loss of business licenses or permits, debarment from contracting or from participating in bidding processes with the Peruvian government, or other restrictions. Moreover, our alleged involvement in corruption investigations, and any findings or admissions of wrongdoing in such investigations, could further damage our reputation and have a material adverse impact on our ability to compete for business. In addition, these investigations may affect the company’s ability to secure financing in the future. Furthermore, investigations could continue to divert management’s attention and resources from other issues facing our business.

We cannot assure you that the scope of the foregoing proceedings will not be expanded to incorporate other projects in which we have been involved, that our company will not be included in other investigations or proceedings as a criminal defendant or third party civilly responsible in Peru or elsewhere, or that other of our former or current directors and senior managers will not be included in the foregoing proceedings.

If we do not comply with applicable laws and regulations designed to combat corruption, we could become subject to fines, penalties or other regulatory sanctions, and our business could suffer.

Although we are committed to conducting business in a legal and ethical manner in compliance with local and international legal requirements applicable to our business, there is a risk that our employees or representatives may take actions that violate applicable laws and regulations that generally prohibit the making of improper payments to government officials for the purpose of obtaining or keeping business, including laws relating to the 1997 OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions or the U.S. Foreign Corrupt Practices Act. If any of our employees or representatives violate anti-corruption laws, our business, financial condition and results of operation would be adversely affected.

INDECOPI has initiated an administrative proceeding alleging that certain construction companies in Peru, including our subsidiary Cumbra, colluded to receive public contracts

On July 11, 2017, the Peruvian National Institute for the Defense of Free Competition and the Protection of Intellectual Property (“INDECOPI”) initiated an investigation of several construction companies in Peru, including our subsidiary Cumbra, relating to allegations of a “construction club” that colluded to receive public contracts during the period from 2002 to 2016. On February 11, 2020, Cumbra was notified by the Technical Secretariat of the Commission for the Defense of Free Competition of INDECOPI of the beginning of a sanctioning administrative procedure involving a total of 35 companies and 28 natural persons, for alleged anti-competitive conduct to procure government contracts.

On November 17, 2021, the Commission imposed a fine of approximately S/67 million against our subsidiary Cumbra, which is currently being challenged and pending resolution by the final administrative proceeding within INDECOPI. As of December 31, 2021, we recorded an estimated provision amounting to S/52.6 million (approximately US$13.2 million) related to this fine.

We cannot predict the outcome of these investigations or proceedings, the timing thereof or how they may impact our business, financial condition and results of operations. We also cannot predict whether INDECOPI will bring additional investigations or proceedings in the future.

8

INDECOPI has initiated an administrative proceeding alleging anti-competitive practices in the labor market in the construction sector

On February 7, 2022, Cumbra and UNNA Transporte were notified that the Commission for the Defense of Free Competition of INDECOPI initiated an administrative sanctioning proceeding for alleged concerted distribution of suppliers in the labor market in the construction sector between 2011 and September 2017, in which competitor construction companies agreed not to hire staff of another party without its prior consent. As of December 31, 2021, Cumbra recorded an estimated provision amounting to S/4.8 million (or approximately US$1.2 million) related to this proceeding.

We cannot predict the outcome of any such investigations or proceedings, the timing thereof, or how they may impact our business, financial condition and results of operations. In addition, due to the lack of precedent administrative proceedings, we cannot assure you of the amount of any fine that INDECOPI may impose, or that any such fine will not have a material impact in our company.

We were in default under certain of our debt instruments in the past, and we cannot assure you that we will not be in default under our debt instruments in the future, or that we will be able to obtain additional waivers in the event of any future defaults

In the past we have been in default of financial covenants and payment obligations under certain of our debt instruments. These defaults have been cured as of the date of this annual report either with the obtainment of waivers or through the repayment in full of these debt instruments. However, we cannot assure you that we will not breach the covenants under our debt instruments in the future and, in such event, that we would be able to obtain the required waivers from our creditors. Failure to successfully obtain waivers could force us to precipitate the sale of assets, including on unfavorable terms, to repay these debt instruments. Moreover, if we are not able to renegotiate the terms of any debt instruments in which we are in default, or repay them promptly, our ability to obtain financings, including performance guarantees or similar financings required under many of our business contracts, would be impaired, which may have a material adverse effect on our business, financial condition and results of operations.

We may not have sufficient cash or access to funding to meet our extraordinary payment obligations

We have significant extraordinary payment obligations. For example, on May 2021, we entered into a settlement and cooperation agreement with Peruvian prosecutorial authorities, which is subject to judicial approval, under which we will be required to make payments of S/321,916,404 and US$41,061,790 over 12 years.

On March 17, 2022, we have entered into a Bridge Loan Agreement for up to US$120 million and we have used the proceeds to repay certain of our financial and other obligations. The bridge loan is required to be repaid over a period of 18 months, and is secured by a flow trust (first lien), a trust over the shares of Viva Negocio Inmobiliario S.A. (second lien), and a pledge on our shares in Unna Energía S.A. (first lien).

We cannot assure you that we will have sufficient cash from operations, any sale of assets, or access to equity or debt financing, in order to comply with payments regarding our agreements, or that following any such payments, we will have sufficient cash to continue to operate our business consistent with past practices.

We may be unable to access financing that we need to operate our business on favorable terms or at all

Due to uncertainty relating to the investigations of our company, our creditors and other financial institutions have placed restrictions in the past on our ability, and the ability of other Peruvian construction companies, to acquire future credit lines, performance bonds and other financings.

Our ability to obtain financings will also depend in part upon prevailing conditions in credit and capital markets, which are beyond our control. Emerging markets have been affected by changes in the U.S. monetary policy, resulting at times in a withdrawal of investments and increased volatility in the value of their currencies. If interest rates rise significantly in the United States, emerging market economies, including Peru, could find it more difficult and expensive to borrow capital and refinance existing debt. Higher interest rates globally or in Peru would in turn impact our costs of funding.

9

Additionally, volatility and instability due to the ongoing COVID-19 pandemic and government measures to contain the spread of the virus also negatively affected the general willingness of lenders to extend credit. At the same time, the COVID-19 pandemic put further pressure on our liquidity needs, including for short-term working capital, including by adding costs arising from delays in our engineering and construction and other projects as a result of infections.

We cannot assure you that we will be able to obtain new financings in the future on favorable terms or at all. Also, we may encounter difficulties in obtaining performance bonds or credit support that we require to secure, among other things, bids, advance payments and performance for our projects.

The inability to procure adequate financing or credit on favorable terms or at all could have a material adverse effect on our business, financial condition and results of operation.

There is uncertainty with regard to the amount, timing and manner in which the payment for the termination of the GSP gas pipeline concession will be paid

In November 2015, we acquired a 20% interest in Gasoducto Sur Peruano S.A. (“GSP”) and obtained a 29% interest in the related construction consortium, Consorcio Constructor Ductos del Sur, through our subsidiary Cumbra. GSP had signed, in July 2014, a concession contract with the Peruvian government to build, operate and maintain the pipelines transportation system of natural gas to meet the demand of cities in the south of Peru. On January 24, 2017, the Ministry of Energy and Mines notified the early termination of the concession contract based on GSP’s failure to obtain the required project financing by the stipulated deadline and proceeded to immediately enforce the concession contract’s performance guarantee.

Although the concession contract provides that payment must be made within one year of termination, the Peruvian Ministry of Energy and Mines has not made any payment or, to our knowledge, initiated the payment process or the auction process for a new concessionaire. Pursuant to the concession contract, the Peruvian government was obligated to appoint a recognized international audit firm to calculate the net book value (valor contable neto, or “VCN”) of the concession assets; however, as of the date hereof, the Peruvian government has not done so. An independent audit firm engaged by GSP calculated the VCN to equal US$2,602 million as of December 31, 2016.

On December 4, 2017, GSP entered into a bankruptcy proceeding before INDECOPI. The company registered a claim for accounts receivable for US$169.7 million, which amount is held in trust for the benefit of the company’s creditors. The debt recognition stage of the bankruptcy process has concluded and we expect that a meeting of creditors will be called during 2022. On December 21, 2018, the company submitted to the Peruvian government a claim demanding on behalf of GSP the payment of the VCN of GSP. On October 18, 2019, the company filed with CIADI (The International Centre for Settlement of Investment Disputes or Centro Internacional de Arreglo de Diferencias Relativas a Inversiones) a request for arbitration. On December 27, 2019 the company withdrew the arbitration in compliance with the preliminary settlement and cooperation agreement signed with Peruvian prosecutorial authorities on the same date. The withdrawal of the arbitration does not imply the loss of the company’s right of collection against GSP nor does it prohibit the possibility that GSP may exercise its rights against the government in the future through procedures other than the CIADI arbitration. As of December 31, 2019, we fully impaired the remaining amount of our investment in GSP, however, as of December 31, 2021, the company has recorded the value of its accounts receivables with GSP to be S/322.6 million, equivalent to US$81.1 million.

As of the date of this annual report, we consider that GSP can exercise its right to collect from the Peruvian government for the VCN of the concession assets and thus we believe we can recover our corresponding accounts receivable. However, we cannot assure you that the company will successfully receive these amounts, or as to the timing and manner of payment.

Risks Related to Our Company

Global economic conditions could adversely affect our financial performance

Global economic conditions, in particular fluctuations in commodity prices and financing costs, may impact our clients’ investment decisions. Should our clients choose to postpone or suspend new investments or delay or cancel the execution of existing projects as a result of global economic conditions, demand for our products and services would decline, which may result in a decline in revenues and in under-utilization of our capacity. Our business may be impacted by adverse economic developments even after economic conditions have improved because of the lag time between when investments decisions are made and when the projects are executed. Furthermore, financial difficulties suffered by our clients, joint operation partners, subcontractors or suppliers due to global economic conditions could result in payment delays or defaults or increase our costs or adversely impact our project execution. Accordingly, a global economic downturn could have a material adverse effect on our financial performance.

Interest rates are rising across markets. Economic forecasts are expecting that the U.S. Federal Reserve Fund Rate will rise to near or above 2% by year-end, which represents 200bps above 2021 levels. This could increase our financing costs and limit our ability to obtain financing in a timely manner and on acceptable terms. In addition, we are experiencing high levels of inflation in each country where we operate. During the last twelve months, Peru has raised rates from 0.25% to 5%, Colombia from 1.75% to 5% and Chile from 0.5% to 7%. These global economic conditions could adversely affect our financial performance.

10

We face significant competition in each of our markets

Each of the markets in which we operate is competitive. We compete on the basis of, among other factors, price, performance, product and service quality, skill and execution capability, client relations, reputation and brand, and health, safety and environmental record. We face significant competition from both local and international players. Some of these competitors may have greater resources than us or may have specialized expertise in certain sectors. In addition, a portion of our business is derived from open bidding processes which can be highly competitive. Certain of our markets are highly fragmented with a large number of companies competing for market share. Our competitors may be more inclined to take greater or unusual risks or accept terms and conditions in a contract that we might not deem acceptable. Moreover, we cannot assure you that we will not face new competition from industry players entering or expanding their operations in our markets. If we are unable to compete effectively, our ability to continue to grow our business or maintain our market share would be affected. In addition, because one of the factors on which we generally compete is price, increased competition could impact our operating margins. Accordingly, our business and financial performance could be adversely affected by competition in our markets.

A major change in government policies could affect our business

Our business is significantly affected by national, regional and municipal government policies and regulations in the countries where we operate, including with respect to infrastructure concessions or similar contracts to the private sector, public spending in infrastructure investment and government housing subsidies, among others. Any adverse change in government policies with respect to these matters could result in a material adverse effect on our business and financial performance.

For example, in May 2020 as a result of the COVID-19 pandemic, the Peruvian Congress suspended the payment of tolls on roads during the initial period of quarantine. Although the Peruvian Constitutional Court struck down the statute effective June 30, 2020, we have yet to collect compensation for tolls that were suspended during that period.

Social conflicts may disrupt infrastructure projects and ongoing operations

Despite Peru’s economic growth over the last decades, high levels of poverty and unemployment and social and political tensions continue to be pervasive problems in the country. Peru has, from time to time, experienced social and political turmoil, including riots, nationwide protests, strikes and street demonstrations. In recent years, certain regions experienced strikes and protests related mainly to the environmental impact of mining activities, which resulted in commercial disruptions. These protests may lead to the suspension of mining projects, such as occurred at Las Bambas mining project during the second half of 2021. Social conflicts may disrupt, delay or suspend infrastructure projects in the future, which could have a material adverse effect on our business and financial performance.

Recently in Peru, high inflation is causing civil unrest and rioting, including strikes and the blockade of main roads, which has affected business operations in certain regions of the country. If this situation continues, it could have an adverse effect on our business and financial performance.

In addition, in October 2019, Chile suffered from widespread social unrest and vandalism that has had a significant economic and political impact on the country. As a result, the Chilean congress convened a plebiscite in March 2020, which was rescheduled to October 25, 2020 as a result of the COVID-19 pandemic, in which Chilean constituents voted to amend the Chilean Constitution. The new Chilean Constitution will be drafted by a political body whose members were elected in May 2021. A new plebiscite to approve or reject the new Chilean Constitutional text is expected to be held in September 2022. This process may result in further social unrest and protest and could also result in substantial structural changes in Chile that could adversely impact the private sector, including our operations in the country.

Additionally, on May 29, 2022 Colombia will hold presidential elections. The result of these elections could result in civil unrest, including in the form of a national strike and anti-government protests such as those experienced during 2021, and, consequently, our Colombian operations could be adversely impacted by changing economic, political and social conditions in Colombia and by the new government’s response to such conditions.

New projects may require the prior approval of local indigenous communities

The legislative branches of Colombia, Chile and Peru have enacted legislation in accordance with the International Labor Organization Convention No. 169 (Ley del Derecho a la Consulta Previa a los Pueblos Indígenas y Originarios, Reconocido en el Convenio 169 de la Organización Internacional del Trabajo) that establishes prior non-binding consultation procedures (procedimiento de consulta previa) with respect to indigenous communities.

Under these laws the government must carry out non-binding consultation procedures with local indigenous communities, whose rights may be directly affected by new legislative or administrative measures, including the granting of certain permits or new concessions or similar contracts, such as for mining, energy and oil and gas projects. Local indigenous communities do not have a veto right; and therefore, upon completion of this prior consultation procedure, the government retains the discretion to approve or reject the applicable legislative or administrative measure. However, we cannot assure you that these consultation procedures will not negatively influence a decision by government to grant us a permit, concession or consent and, therefore, adversely affect new projects and concessions, or cause or incite confrontation if the government’s decision is perceived to be adverse to the communities’ opinion. Accordingly, our business and financial performance may be materially and adversely affected.

11

Our backlog and our ratio of historical backlog to revenues may not be reliable indicators of future revenues or profit

The amount of our backlog is not necessarily indicative of future revenues or profits related to the performance of the related contracts. Our backlog amount is subject to revision over time and our ability to realize revenues from our backlog is subject to a number of uncertainties. Cancellations, scope adjustments or deferrals may occur, from time to time, with respect to contracts reflected in our backlog and could reduce the amount of our backlog and the revenue and profits that we actually earn. Contracts may also remain in our backlog for an extended period of time and poor performance could also impact our profit from the contracts in our backlog. In addition, our backlog is expressed in U.S. dollars based on period-end exchange rates while a significant portion of our contracts are payable in soles or other local currencies. As a result, any depreciation of local currency would diminish the amount of revenues eventually earned relative to backlog.

Our backlog may decline in the future. We cannot assure you that we will be able to obtain sufficient contracts in the future in number and magnitude in order to increase our backlog. Additionally, the number of new contracts that we obtain can fluctuate significantly from period to period due to factors that are beyond our control.

Moreover, the ratio of our historical backlog to revenues earned in subsequent years is volatile and substantially affected by a number of factors, some of which are outside our control, including levels of contract scope adjustments and our ability to enter into new contracts (which are substantially influenced by general macroeconomic conditions), delays and cancellations, foreign exchange rate movements and our ability to increase the scale of our operations to expand the amount of work we carry out beyond that previously contracted. Accordingly, historical correlations between backlog and revenues may not recur in future periods.

Our success depends on key personnel

Our success depends, to a significant degree, upon the performance of our senior management, Board of Directors and other key personnel. Members of our management team are not subject to non-competition agreements with us. We cannot assure you that we will be successful in retaining our current senior management or members of our Board of Directors, nor can we assure you that, in such event, we would be able to find suitable replacements. In addition, the success of our business depends on our ongoing ability to attract, train and retain qualified engineers and other personnel. In recent years, the availability in Peru of qualified personnel who have the necessary expertise and experience has been lower than demand and, therefore, competition for human resources has become intense. We cannot assure that we will be able to hire and retain the number of qualified personnel required to meet the needs of, or to grow, our business. If we are unable to attract, train and retain the qualified personnel that we require at reasonable cost, our business and financial performance could be adversely affected.

Our success depends, to a large extent, on our reputation for the quality, reliability, timely delivery and safety of our products and services

We believe our track record and reputation are key factors in our clients’ evaluation of whether to engage our services and purchase our products, encouraging key industry players to partner with us, and recruiting and retaining talented personnel to our company. Our reputation is based, to a large extent, on the quality, reliability, timeliness and safety of our products and services. If our products do not meet expected standards or we fail to meet our deadlines, our relationship with our clients and partners could suffer, the reputation of our company could be adversely affected, we may not be invited to new bidding processes and our ability to capture new business could be severely diminished.

The nature of our business exposes us to potential liability claims and contract disputes

We may be subject to a variety of legal or administrative proceedings, liability claims or contract disputes. The government, clients and other third parties may present claims against us for injury or damage caused, directly or indirectly, by our operations, for example for alleged failures in our engineering and construction, the operation of our infrastructure concessions (such as our toll roads or the Lima Metro), and real estate developments we sell. Although we have a range of insurance coverage policies and have adopted risk management and risk avoidance programs designed to reduce potential liabilities, a catastrophic event resulting from the services we have performed or products we have provided could result in significant professional or product liability, warranty or other claims against us as well as reputational harm, especially if public safety is impacted. We may in the future be named as a defendant in legal proceedings where our clients or third parties may make a claim for damages or other remedies with respect to our projects or other matters. Any liability not covered by our insurance, or in excess of our insurance limits, could result in a significant loss for us, which may affect our financial performance.

We may not be able to recover on claims against clients for payment

If a client fails to pay our invoices on time or defaults in making its payments to us, we could incur significant losses. We occasionally bring claims against clients for delayed payments, additional costs that exceed the contract price or for amounts not included in the original contract price, including change orders. These types of claims can occur due to matters such as owner-caused delays or changes from the initial project scope, and, occasionally, these claims may be disputed through lengthy proceedings. When these types of events occur and unresolved claims are pending, we may invest significant working capital in projects to cover cost overruns pending the resolution of the relevant claims. Moreover, we have recently encountered difficulties collecting on claims, even following successful arbitration awards, particularly against the government. A failure to promptly recover on these types of claims and change orders could have a material adverse effect on our financial performance.

12

We are susceptible to operational risks that could affect our business and financial performance

Our business is subject to numerous industry-specific operational risks, including natural disasters, adverse weather conditions, operator errors or other accidents, mechanical and technical failures, explosions and other events and accidents, many of which are beyond our control. Such occurrences could result in injury or loss of life, severe damage to and destruction of property and equipment, business interruption, pollution and other environmental damage, clean-up responsibilities, regulatory requirements, investigations and penalties, potential liability claims and contractual disputes. In addition, such occurrences could materially impact our reputation. Although we maintain comprehensive insurance covering our assets and operations at levels that our management believes to be adequate, our insurance coverage will not be sufficient in all circumstances or to protect against all hazards. The occurrence of such an operational risk could have a material adverse effect on our business and financial performance.

Deterioration in our safety record could adversely affect our business and financial performance

Our ability to retain existing clients and attract new business is dependent on our ability to safely operate our business. Existing and potential clients consider the safety record of their services providers to be of high importance in their decision to award service contracts. Some of our activities, in particular in our E&C segment, can be high risk by their nature. If one or more accidents were to occur at a site, the affected client may terminate or cancel our contract and may be less likely to continue to use our services. Although our track record on safety matters is consistent with industry standards, we cannot assure you that we will not experience accidents in the future, causing our safety record to deteriorate. Accidents may be more likely as we continue to grow, particularly if we are required to hire less experienced employees due to shortages of skilled labor. Moreover, often times we do not perform these activities by ourselves and accidents can happen due to errors committed by partners and subcontractors over whom we have no control. Because many of our clients require us to report our safety metrics to them as part of the bidding process and because a substantial part of our client base is comprised of major companies with high safety standards, a general deterioration in our safety record could have a material adverse impact on our business including our ability to bid for new contracts.

Any safety incidents or deterioration in our safety record could adversely impact our ability to attract and retain qualified employees. In addition, we could also be subject to liability for damages as a result of accidents and could incur penalties or fines for violations of applicable safety laws and regulations.

Increases in the prices of energy, raw materials, equipment or wages could increase our operating costs

Our business requires significant purchases of energy, raw materials and components, including, among others, large quantities of fuel, cement and steel, as well as purchases or leases of equipment. Certain inputs used in our operations are susceptible to significant fluctuations in prices, over which we may have little control. The prices of some of these inputs are affected to a significant extent by the prices of commodities, such as oil and iron. Global oil prices decreased in 2018, increased in 2019, declined significantly in 2020 as a result of the COVID-19 pandemic but reached pre-COVID-19 levels by the end of 2020, increased in 2021 due to supply shocks and the resurgence of demand, and, more recently, rose sharply in early 2022 due to the conflict between Ukraine and Russia.

We cannot assure you that oil prices will decrease in the future (although increased oil prices would benefit revenues in our Energy segment). Substantial increases in the prices of such commodities generally result in increases in our suppliers’ operating costs and, consequently, lead to increases in the prices they charge for their products. Moreover, we do not have long-term contracts for the supply of our key inputs, and, as a result, if prices increase significantly or if we are required to find alternative suppliers, our costs to procure these inputs may increase significantly. In addition, growing demand for labor, especially when coupled with shortages of qualified employees in the countries where we operate, may result in significant wage inflation. To the extent that we are unable to pass along to our clients increases in the prices of our key inputs or increases in the wages that we must pay, our operating margins could be materially adversely impacted.

If we are unable to enter into consortia or other strategic alliances, our ability to compete for new business may be adversely affected

We may join with other companies to form joint operations or other strategic alliances to compete for a specific concession or contract, including with partners that contribute expertise in a specific field. Because a consortium or alliance can often offer stronger combined qualifications than a company on a stand-alone basis, these arrangements can be important to the success of a particular bid. If we are unable to enter into consortia or other strategic alliances, our ability to compete for new business may be adversely affected.

13

Our consortia and other strategic alliances may be affected by disputes with, or the unsatisfactory performance by, our partners

Although we have a thorough partner selection process, consortia and other strategic alliances that we enter into as part of our business, including arrangements where operating control may be shared with unaffiliated third parties, may involve risks not otherwise present when we operate independently, including: sharing approval rights over major decisions; responsibility for our partners’ unpaid obligations or liabilities; ensuring ethical and compliance behavior; our partners’ capacity to contribute with their share of project capital expenditures and inconsistencies in our and our partners’ economic or business interests or goals. Any disputes between us and our partners may result in delays, litigation or operational impasses. We may also incur liabilities as a result of action taken by or against our partners. In addition, if we participate in consortia or other strategic alliances where we are not the controlling party, we may have limited control over operational, financial and other management decisions and actions and the success of the consortium or other strategic alliance will depend largely on the performance of our partners. These risks could adversely affect our ability to transact the business of such consortium or other strategic alliance, and could result in the termination of the applicable concession or contract. Under these circumstances, we may be required to make additional investments and provide additional services to ensure adequate performance and delivery. These additional obligations could result in reduced profits or, in some cases, increased liabilities or significant losses for us. In addition, failure by a partner to comply with applicable laws or regulations could negatively impact our business and, in the case of government contracts, could result in fines, suspension or even debarment from participating in bidding processes. As a result, our business, reputation and financial performance could be adversely affected by disputes involving our consortia or other strategic alliances.

We are dependent upon third parties to complete many of our contractual obligations

We rely on third-party suppliers to provide a significant amount of the materials and equipment used in our businesses. A portion of the work performed under our infrastructure concessions and, to a lesser extent, other contracts is performed by third-party subcontractors. As a result, the timely completion and quality of our projects may depend on factors beyond our control, including the quality and timeliness of the delivery of materials supplied for use in the project and the technical skills of subcontractors hired for the project. If we are unable to find qualified suppliers or hire qualified subcontractors, our ability to meet our contractual obligations could be impaired. In addition, if the amount we are required to pay for supplies, equipment or subcontractors exceeds what we have estimated, we may suffer losses under our contract. If a supplier or a subcontractor fails to provide supplies, equipment or services as required under a negotiated arrangement for any reason, or provides supplies, equipment or services that are not of an acceptable quality, we may be required to source those supplies, equipment or services on a delayed basis or at a higher price than anticipated, which could impact our financial performance. In addition, faulty materials or equipment could result in claims against us for failure to meet contractual specifications, and failure by suppliers or subcontractors to comply with applicable laws and regulations could negatively impact our reputation and our business and, in the case of government contracts, could result in fines, suspension or even debarment from participating in bidding processes. These risks may be intensified during economic downturns if these suppliers or subcontractors experience financial difficulties. As a result, our business and financial performance may be adversely affected by our dependence on third-party providers.

Failure to comply with, or changes in, laws or regulations could have a material adverse effect on our business and financial performance

We operate in highly regulated industries. Our business and financial performance depends on our ability and the ability of our clients, suppliers, subcontractors and partners to comply on a timely and efficient basis with extensive national, regional and municipal laws and regulations relating to, among other matters, environmental, health and safety, building and zoning, labor, tax and other matters. The cost of complying with these laws and regulations can be substantial. In addition, compliance with these laws and regulations can cause scheduling delays. Although we believe we are in compliance with applicable laws and regulations in all material respects, including our concessions or similar contractual obligations, we cannot assure you we have been or will be at all times in full compliance. Failure by us or our clients, suppliers, subcontractors or partners to comply with these laws and regulations, or our concessions or similar contractual obligations, could result in a range of adverse consequences for our business, including subjecting us to significant fines, civil liabilities and criminal sanctions, requiring us to comply with costly restorative orders, the shutdown of operations, and revocation of permits and termination of concessions or similar contracts. In addition, we cannot assure you that future changes to existing laws and regulations, or stricter interpretation or enforcement of existing laws and regulations, will not impair our ability to comply with such laws and regulations, increase our compliance costs or impair our ability to perform our obligations with our clients, suppliers, subcontractors or partners as agreed.

We may be held liable for environmental damage caused by our operations