| Semi-Annual Report |

|

Type of Buyer

|

Deal Terms* | |||

|

Strategic

|

99.6%

|

Cash

|

36.2%

|

|

|

Financial

|

0.4%

|

Stock and Stub1

|

25.9%

|

|

|

Cash & Stock

|

16.9%

|

|||

|

By Deal Type

|

Undetermined2

|

8.5%

|

||

|

Friendly

|

97.5%

|

Stock with Flexible

|

||

|

Hostile

|

2.5%

|

Exchange Ratio (Collar)

|

6.4%

|

|

|

|

Stock with Fixed Exchange Ratio

|

6.1% | ||

|

*

|

Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of June 30, 2015.

|

|

1

|

“Stub” includes assets other than cash and stock (e.g., escrow notes).

|

|

2

|

The compensation is undetermined because the compensation to be received (e.g., stock, cash, escrow notes, other) will be determined at a later date, potentially at the option of the Fund’s investment adviser.

|

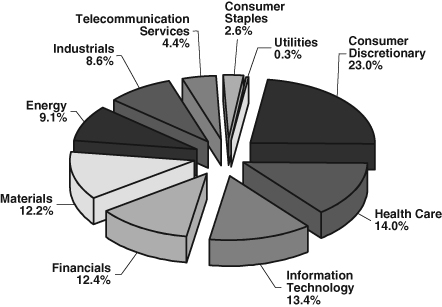

PORTFOLIO COMPOSITION

|

*

|

Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of June 30, 2015.

|

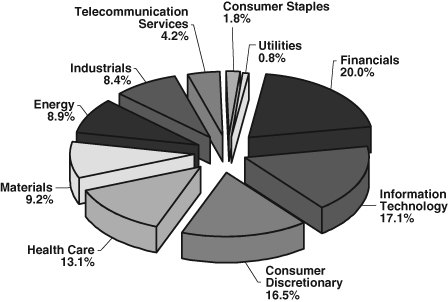

PORTFOLIO COMPOSITION

|

*

|

Data expressed as a percentage of long common stock, corporate bonds and swap contract positions as of June 30, 2015.

|

The Merger Fund and WCM Alternatives: Event-Driven Fund

|

Expenses

|

||||

|

Paid

|

||||

|

Beginning

|

Ending

|

During

|

||

|

Account

|

Account

|

Annualized

|

Period

|

|

|

Value

|

Value

|

Expense

|

1/1/15 —

|

|

|

1/1/15

|

6/30/15

|

Ratio

|

6/30/15*

|

|

|

The Merger Fund

|

||||

|

Investor Class

|

||||

|

Actual+(1)

|

$1,000.00

|

$1,007.00

|

1.72%

|

$8.56

|

|

Hypothetical+(2)

|

$1,000.00

|

$1,016.27

|

1.72%

|

$8.60

|

|

Institutional Class

|

||||

|

Actual++(3)

|

$1,000.00

|

$1,008.30

|

1.40%

|

$6.97

|

|

Hypothetical++(2)

|

$1,000.00

|

$1,017.85

|

1.40%

|

$7.00

|

|

WCM Alternatives: Event-Driven Fund

|

||||

|

Institutional Class

|

||||

|

Actual+++(4)

|

$1,000.00

|

$1,007.90

|

2.07%

|

$10.31

|

|

Hypothetical+++(2)

|

$1,000.00

|

$1,014.53

|

2.07%

|

$10.34

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

|

|

+

|

Excluding dividends and borrowing expense on securities sold short, your actual cost of investment in and your hypothetical cost of investment in The Merger Fund Investor Class would have been $6.57 and $6.61, respectively.

|

|

++

|

Excluding dividends and borrowing expense on securities sold short, your actual cost of investment in and your hypothetical cost of investment in The Merger Fund Institutional Class would have been $4.98 and $5.01, respectively.

|

|

+++

|

Excluding dividends and borrowing expense on securities sold short, your actual cost of investment in and your hypothetical cost of investment in the WCM Alternatives: Event-Driven Fund Institutional Class would have been $8.66 and $8.70, respectively.

|

|

(1)

|

Ending account values and expenses paid during the period based on a 0.70% return. This actual return is net of expenses.

|

|

(2)

|

Ending account values and expenses paid during period based on a hypothetical 5.00% annual return before expenses.

|

|

(3)

|

Ending account values and expenses paid during the period based on a 0.83% return. This actual return is net of expenses.

|

|

(4)

|

Ending account values and expenses paid during the period based on a 0.79% return. This actual return is net of expenses.

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS — 90.64%

|

|||||||

|

APPAREL RETAIL — 1.52%

|

|||||||

| 1,640,585 |

ANN, Inc. (a)(e)

|

$ | 79,223,850 | ||||

|

APPLICATION SOFTWARE — 1.34%

|

|||||||

| 1,102,168 |

Advent Software, Inc.

|

48,726,847 | |||||

| 442,782 |

Informatica Corporation (a)

|

21,461,644 | |||||

| 70,188,491 | |||||||

|

AUTOMOBILE MANUFACTURERS — 1.98%

|

|||||||

| 3,099,400 |

General Motors Company (f)

|

103,303,002 | |||||

|

BROADCASTING — 1.24%

|

|||||||

| 1,162,337 |

CBS Corporation Class B (f)

|

64,509,703 | |||||

|

CABLE & SATELLITE TV — 10.12%

|

|||||||

| 2,191,806 |

DIRECTV (a)(e)

|

203,377,679 | |||||

| 1,557,782 |

DISH Network Corporation Class A (a)(f)

|

105,477,419 | |||||

| 531,148 |

Liberty Global plc Series C (a)(b)

|

26,892,023 | |||||

| 12,659,437 |

Sirius XM Holdings, Inc. (a)

|

47,219,700 | |||||

| 816,637 |

Time Warner Cable, Inc. (f)

|

145,500,214 | |||||

| 528,467,035 | |||||||

|

CASINOS & GAMING — 0.06%

|

|||||||

| 171,231 |

International Game Technology plc (a)(b)

|

3,041,063 | |||||

|

CONSTRUCTION & FARM MACHINERY

|

|||||||

|

& HEAVY TRUCKS — 1.27%

|

|||||||

| 3,372,700 |

The Manitowoc Company, Inc. (f)

|

66,104,920 | |||||

|

DATA PROCESSING & OUTSOURCED SERVICES — 1.33%

|

|||||||

| 1,060,400 |

Computer Sciences Corporation (f)

|

69,604,656 | |||||

|

DIVERSIFIED BANKS — 0.24%

|

|||||||

| 451,964 |

Square 1 Financial, Inc. Class A (a)

|

12,361,215 | |||||

|

DIVERSIFIED CHEMICALS — 5.51%

|

|||||||

| 2,294,100 |

The Dow Chemical Company (f)

|

117,389,097 | |||||

| 934,100 |

E.I. Du Pont de Nemours & Company (f)

|

59,735,695 | |||||

| 5,014,793 |

Huntsman Corporation (f)

|

110,676,482 | |||||

| 287,801,274 | |||||||

|

DIVERSIFIED METALS & MINING — 0.15%

|

|||||||

| 241,080 |

RTI International Metals, Inc. (a)

|

7,598,842 | |||||

|

ELECTRICAL COMPONENTS & EQUIPMENT — 1.89%

|

|||||||

| 1,644,515 |

Polypore International, Inc. (a)

|

98,473,558 | |||||

|

GENERAL MERCHANDISE STORES — 3.05%

|

|||||||

| 2,018,406 |

Family Dollar Stores, Inc.

|

159,070,577 | |||||

|

Shares

|

Value

|

||||||

|

HEALTH CARE SERVICES — 1.93%

|

|||||||

| 1,071,817 |

Omnicare, Inc.

|

$ | 101,018,752 | ||||

|

HEALTH CARE TECHNOLOGY — 4.04%

|

|||||||

| 3,452,053 |

Catamaran Corporation (a)(b)(e)

|

210,851,397 | |||||

|

HOUSEHOLD PRODUCTS — 1.87%

|

|||||||

| 508,400 |

Energizer Holdings, Inc. (f)

|

66,880,020 | |||||

| 392,200 |

The Procter & Gamble Company

|

30,685,728 | |||||

| 97,565,748 | |||||||

|

INDUSTRIAL CONGLOMERATES — 0.39%

|

|||||||

| 772,100 |

General Electric Company

|

20,514,697 | |||||

|

INDUSTRIAL MACHINERY — 3.06%

|

|||||||

| 1,122,900 |

Pall Corporation

|

139,744,905 | |||||

| 151,300 |

SPX Corporation

|

10,952,607 | |||||

| 249,500 |

The Timken Company

|

9,124,215 | |||||

| 159,821,727 | |||||||

|

INTEGRATED OIL & GAS — 1.01%

|

|||||||

| 699,780 |

BG Group plc — ADR (h)

|

11,742,308 | |||||

| 26,400 |

BP plc — ADR

|

1,054,944 | |||||

| 515,041 |

Occidental Petroleum Corporation

|

40,054,739 | |||||

| 52,851,991 | |||||||

|

INTERNET RETAIL — 0.91%

|

|||||||

| 4,147,068 |

Orbitz Worldwide, Inc. (a)(f)

|

47,359,517 | |||||

|

INTERNET SOFTWARE & SERVICES — 3.94%

|

|||||||

| 1,423,200 |

eBay, Inc. (a)(f)

|

85,733,568 | |||||

| 3,056,094 |

Yahoo!, Inc. (a)(f)

|

120,073,933 | |||||

| 205,807,501 | |||||||

|

MANAGED HEALTH CARE — 1.66%

|

|||||||

| 310,200 |

Cigna Corporation (f)

|

50,252,400 | |||||

| 189,600 |

Humana, Inc.

|

36,266,688 | |||||

| 86,519,088 | |||||||

|

MOVIES & ENTERTAINMENT — 0.02%

|

|||||||

| 273,282 |

SFX Entertainment, Inc. (a)

|

1,227,036 | |||||

|

MULTI-LINE INSURANCE — 4.33%

|

|||||||

| 2,967,687 |

American International Group, Inc. (f)

|

183,462,410 | |||||

| 553,579 |

HCC Insurance Holdings, Inc.

|

42,537,011 | |||||

| 225,999,421 | |||||||

|

OIL & GAS EQUIPMENT & SERVICES — 1.36%

|

|||||||

| 1,147,923 |

Baker Hughes, Inc.

|

70,826,849 | |||||

|

Shares

|

Value

|

||||||

|

OIL & GAS EXPLORATION & PRODUCTION — 2.05%

|

|||||||

| 1,137,800 |

Anadarko Petroleum Corporation (f)

|

$ | 88,816,668 | ||||

| 787,690 |

Rosetta Resources, Inc. (a)

|

18,227,147 | |||||

| 107,043,815 | |||||||

|

OIL & GAS STORAGE & TRANSPORTATION — 2.78%

|

|||||||

| 1,008,669 |

The Williams Companies, Inc. (f)

|

57,887,514 | |||||

| 1,803,816 |

Williams Partners LP (f)

|

87,358,809 | |||||

| 145,246,323 | |||||||

|

PACKAGED FOODS & MEATS — 0.83%

|

|||||||

| 508,000 |

Kraft Foods Group, Inc. (f)

|

43,251,120 | |||||

|

PAPER PACKAGING — 1.32%

|

|||||||

| 1,314,993 |

MeadWestvaco Corporation

|

62,054,520 | |||||

| 112,000 |

Packaging Corporation of America

|

6,998,880 | |||||

| 69,053,400 | |||||||

|

PAPER PRODUCTS — 1.92%

|

|||||||

| 2,111,100 |

International Paper Company (f)

|

100,467,249 | |||||

|

PHARMACEUTICALS — 5.99%

|

|||||||

| 1,979,459 |

Hospira, Inc. (a)(e)

|

175,597,808 | |||||

| 195,300 |

Perrigo Company plc (b)

|

36,097,299 | |||||

| 2,421,169 |

Pfizer, Inc. (f)

|

81,181,797 | |||||

| 415,300 |

Zoetis, Inc.

|

20,025,766 | |||||

| 312,902,670 | |||||||

|

REINSURANCE — 0.89%

|

|||||||

| 363,409 |

PartnerRe Ltd. (b)(f)

|

46,698,056 | |||||

|

REITS — 5.32%

|

|||||||

| 2,108,349 |

Equity Commonwealth (a)

|

54,121,319 | |||||

| 1,192,585 |

Excel Trust, Inc.

|

18,807,065 | |||||

| 358,540 |

Home Properties, Inc.

|

26,191,347 | |||||

| 4,816,400 |

NorthStar Realty Finance Corporation

|

76,580,760 | |||||

| 2,029,110 |

Starwood Property Trust, Inc.

|

43,767,903 | |||||

| 288,499 |

Starwood Waypoint Residential Trust

|

6,854,736 | |||||

| 828,800 |

Ventas, Inc. (f)

|

51,460,192 | |||||

| 277,783,322 | |||||||

|

RESTAURANTS — 0.79%

|

|||||||

| 436,800 |

McDonald’s Corporation

|

41,526,576 | |||||

|

SEMICONDUCTORS — 4.95%

|

|||||||

| 2,419,792 |

Altera Corporation

|

123,893,350 | |||||

| 2,220,500 |

Broadcom Corporation Class A

|

114,333,545 | |||||

| 385,440 |

Freescale Semiconductor Ltd. (a)(b)(g)

|

15,406,037 | |||||

|

Shares

|

Value

|

||||||

| 357,712 |

Micrel, Inc.

|

$ | 4,972,197 | ||||

| 258,605,129 | |||||||

|

SPECIALTY CHEMICALS — 3.62%

|

|||||||

| 824,252 |

Sigma-Aldrich Corporation

|

114,859,516 | |||||

| 740,400 |

W.R. Grace & Company (a)

|

74,262,120 | |||||

| 189,121,636 | |||||||

|

THRIFTS & MORTGAGE FINANCE — 1.84%

|

|||||||

| 9,751,749 |

Hudson City Bancorp, Inc.

|

96,347,280 | |||||

|

TRUCKING — 1.59%

|

|||||||

| 4,593,568 |

Hertz Global Holdings, Inc. (a)(f)

|

83,235,452 | |||||

|

WIRELESS TELECOMMUNICATION SERVICES — 2.53%

|

|||||||

| 1,122,700 |

America Movil SAB de C.V. Class L — ADR

|

23,924,737 | |||||

| 2,501,300 |

T-Mobile U.S., Inc. (a)(f)

|

96,975,401 | |||||

| 306,925 |

Vodafone Group plc — ADR

|

11,187,416 | |||||

| 132,087,554 | |||||||

|

TOTAL COMMON STOCKS (Cost $4,671,765,155)

|

4,733,481,492 | ||||||

|

CONTINGENT VALUE RIGHTS — 0.03%

|

|||||||

| 1,713,496 |

Casa Ley, S.A. de C.V. (a)(d)(l)

|

813,910 | |||||

| 77,699 |

Leap Wireless International, Inc. (a)(d)(l)

|

320,508 | |||||

| 1,713,496 |

Property Development Centers LLC (a)(d)(l)

|

85,675 | |||||

|

TOTAL CONTINGENT VALUE RIGHTS (Cost $0)

|

1,220,093 | ||||||

|

Principal Amount

|

|||||||

|

CORPORATE BONDS — 1.94%

|

|||||||

|

Dresser-Rand Group, Inc.

|

|||||||

| $ | 945,000 |

6.500%, 5/1/2021

|

1,021,545 | ||||

|

Energy Future Intermediate Holding Company LLC

|

|||||||

| 11,394,393 |

11.750%, 3/1/2022 (i)(j)

|

13,003,851 | |||||

|

Freescale Semiconductor, Inc.

|

|||||||

| 16,617,000 |

10.750%, 8/1/2020

|

17,614,020 | |||||

|

The Manitowoc Company, Inc.

|

|||||||

| 26,148,000 |

5.875%, 10/15/2022

|

28,305,210 | |||||

|

Pinnacle Entertainment, Inc.

|

|||||||

| 38,907,000 |

7.500%, 4/15/2021

|

41,387,322 | |||||

|

TOTAL CORPORATE BONDS (Cost $101,017,837)

|

101,331,948 | ||||||

| Contracts (100 shares per contract) | Value | ||||||

|

PURCHASED CALL OPTIONS — 0.01%

|

|||||||

|

Avago Technologies Ltd.

|

|||||||

| 868 |

Expiration: January 2016, Exercise Price: $175.00

|

$ | 234,360 | ||||

|

PURCHASED PUT OPTIONS — 1.06%

|

|||||||

|

America Movil SAB de C.V. Class L — ADR

|

|||||||

| 3,027 |

Expiration: August 2015, Exercise Price: $18.00

|

22,702 | |||||

| 6,455 |

Expiration: August 2015, Exercise Price: $19.00

|

112,963 | |||||

|

American International Group, Inc.

|

|||||||

| 21,798 |

Expiration: August 2015, Exercise Price: $52.50

|

425,061 | |||||

|

Anadarko Petroleum Corporation

|

|||||||

| 5,120 |

Expiration: August 2015, Exercise Price: $75.00

|

957,440 | |||||

| 4,551 |

Expiration: August 2015, Exercise Price: $80.00

|

1,893,216 | |||||

|

Bayer AG

|

|||||||

| 287 |

Expiration: July 2015, Exercise Price: EUR 115.00 (k)

|

31,996 | |||||

| 2,646 |

Expiration: September 2015,

|

||||||

|

Exercise Price: EUR 120.00 (k)

|

1,507,397 | ||||||

|

BP plc — ADR

|

|||||||

| 2,317 |

Expiration: July 2015, Exercise Price: $34.00

|

3,475 | |||||

| 189 |

Expiration: July 2015, Exercise Price: $35.00

|

567 | |||||

|

CBS Corporation Class B

|

|||||||

| 13,199 |

Expiration: September 2015, Exercise Price: $50.00

|

1,036,121 | |||||

|

Charter Communications, Inc. Class A

|

|||||||

| 896 |

Expiration: January 2016, Exercise Price: $210.00

|

3,839,360 | |||||

|

Cigna Corporation

|

|||||||

| 1,022 |

Expiration: August 2015, Exercise Price: $140.00

|

178,850 | |||||

| 692 |

Expiration: August 2015, Exercise Price: $145.00

|

138,400 | |||||

|

Computer Sciences Corporation

|

|||||||

| 6,789 |

Expiration: September 2015, Exercise Price: $60.00

|

797,707 | |||||

|

DISH Network Corporation Class A

|

|||||||

| 9,941 |

Expiration: September 2015, Exercise Price: $60.00

|

944,395 | |||||

| 2,834 |

Expiration: September 2015, Exercise Price: $62.50

|

425,100 | |||||

|

The Dow Chemical Company

|

|||||||

| 7,344 |

Expiration: September 2015, Exercise Price: $43.00

|

205,632 | |||||

| 3,660 |

Expiration: September 2015, Exercise Price: $44.00

|

139,080 | |||||

| 4,929 |

Expiration: September 2015, Exercise Price: $45.00

|

224,270 | |||||

|

E.I. Du Pont de Nemours & Company

|

|||||||

| 1,023 |

Expiration: July 2015, Exercise Price: $62.50

|

71,098 | |||||

| 7,297 |

Expiration: July 2015, Exercise Price: $65.00

|

1,302,515 | |||||

|

eBay, Inc.

|

|||||||

| 8,512 |

Expiration: July 2015, Exercise Price: $50.00

|

42,560 | |||||

| 2,167 |

Expiration: July 2015, Exercise Price: $52.50

|

21,670 | |||||

| 1,319 |

Expiration: October 2015, Exercise Price: $50.00

|

56,058 | |||||

|

Contracts (100 shares per contract)

|

Value | ||||||

|

Energizer Holdings, Inc.

|

|||||||

| 2,343 |

Expiration: August 2015, Exercise Price: $115.00

|

$ | 257,730 | ||||

| 1,646 |

Expiration: August 2015, Exercise Price: $120.00

|

283,935 | |||||

|

General Electric Company

|

|||||||

| 3,956 |

Expiration: July 2015, Exercise Price: $25.00

|

35,604 | |||||

|

General Motors Company

|

|||||||

| 18,290 |

Expiration: September 2015, Exercise Price: $32.00

|

1,792,420 | |||||

|

Hertz Global Holdings, Inc.

|

|||||||

| 10,317 |

Expiration: September 2015, Exercise Price: $16.00

|

619,020 | |||||

| 24,780 |

Expiration: September 2015, Exercise Price: $19.00

|

4,770,150 | |||||

|

Humana, Inc.

|

|||||||

| 505 |

Expiration: August 2015, Exercise Price: $175.00

|

282,800 | |||||

| 1,001 |

Expiration: August 2015, Exercise Price: $185.00

|

915,915 | |||||

|

Huntsman Corporation

|

|||||||

| 35,640 |

Expiration: August 2015, Exercise Price: $18.00

|

267,300 | |||||

| 11,139 |

Expiration: August 2015, Exercise Price: $19.00

|

167,085 | |||||

|

International Paper Company

|

|||||||

| 8,967 |

Expiration: July 2015, Exercise Price: $45.00

|

188,307 | |||||

| 8,442 |

Expiration: July 2015, Exercise Price: $50.00

|

2,118,942 | |||||

|

The Manitowoc Company, Inc.

|

|||||||

| 11,448 |

Expiration: September 2015, Exercise Price: $17.00

|

400,680 | |||||

| 12,829 |

Expiration: September 2015, Exercise Price: $18.00

|

705,595 | |||||

|

McDonald’s Corporation

|

|||||||

| 2,816 |

Expiration: July 2015, Exercise Price: $85.00

|

8,448 | |||||

| 938 |

Expiration: July 2015, Exercise Price: $90.00

|

18,760 | |||||

|

NorthStar Realty Finance Corporation

|

|||||||

| 18,403 |

Expiration: August 2015, Exercise Price: $16.00

|

1,472,240 | |||||

| 20,128 |

Expiration: September 2015, Exercise Price: $16.00

|

1,811,520 | |||||

|

Occidental Petroleum Corporation

|

|||||||

| 4,120 |

Expiration: August 2015, Exercise Price: $67.50

|

144,200 | |||||

|

Packaging Corporation of America

|

|||||||

| 352 |

Expiration: July 2015, Exercise Price: $60.00

|

14,080 | |||||

| 455 |

Expiration: July 2015, Exercise Price: $65.00

|

127,855 | |||||

|

Perrigo Company plc

|

|||||||

| 370 |

Expiration: August 2015, Exercise Price: $155.00

|

63,825 | |||||

| 331 |

Expiration: August 2015, Exercise Price: $160.00

|

92,680 | |||||

| 325 |

Expiration: August 2015, Exercise Price: $165.00

|

118,300 | |||||

|

The Procter & Gamble Company

|

|||||||

| 2,310 |

Expiration: July 2015, Exercise Price: $75.00

|

39,270 | |||||

| 1,084 |

Expiration: August 2015, Exercise Price: $70.00

|

26,016 | |||||

|

Contracts (100 shares per contract)

|

Value

|

||||||

|

Rock-Tenn Company Class A

|

|||||||

| 1,991 |

Expiration: August 2015, Exercise Price: $55.00

|

$ | 164,257 | ||||

| 1,291 |

Expiration: October 2015, Exercise Price: $55.00

|

196,878 | |||||

|

SPDR S&P 500 ETF Trust

|

|||||||

| 2,239 |

Expiration: August 2015, Exercise Price: $198.00

|

577,662 | |||||

| 9,401 |

Expiration: August 2015, Exercise Price: $208.00

|

5,236,357 | |||||

| 7,421 |

Expiration: August 2015, Exercise Price: $210.00

|

4,845,913 | |||||

| 2,239 |

Expiration: August 2015, Exercise Price: $211.00

|

1,578,495 | |||||

| 6,268 |

Expiration: September 2015, Exercise Price: $189.00

|

1,582,670 | |||||

| 7,163 |

Expiration: September 2015, Exercise Price: $207.00

|

5,107,219 | |||||

|

SPX Corporation

|

|||||||

| 756 |

Expiration: September 2015, Exercise Price: $60.00

|

52,920 | |||||

|

T-Mobile U.S., Inc.

|

|||||||

| 8,675 |

Expiration: August 2015, Exercise Price: $25.00

|

121,450 | |||||

| 5,926 |

Expiration: August 2015, Exercise Price: $26.00

|

85,927 | |||||

| 8,132 |

Expiration: August 2015, Exercise Price: $34.00

|

459,458 | |||||

|

Ventas, Inc.

|

|||||||

| 1,872 |

Expiration: August 2015, Exercise Price: $55.00

|

46,800 | |||||

| 5,948 |

Expiration: August 2015, Exercise Price: $60.00

|

594,800 | |||||

|

W.R. Grace & Company

|

|||||||

| 5,554 |

Expiration: September 2015, Exercise Price: $92.50

|

666,480 | |||||

|

Yahoo!, Inc.

|

|||||||

| 1,756 |

Expiration: July 2015, Exercise Price: $37.00

|

36,876 | |||||

| 8,790 |

Expiration: July 2015, Exercise Price: $41.00

|

1,722,840 | |||||

| 1,794 |

Expiration: July 2015, Exercise Price: $42.00

|

511,290 | |||||

| 1,285 |

Expiration: August 2015, Exercise Price: $37.00

|

117,578 | |||||

| 3,410 |

Expiration: October 2015, Exercise Price: $37.00

|

501,270 | |||||

|

Zoetis, Inc.

|

|||||||

| 969 |

Expiration: July 2015, Exercise Price: $39.00

|

12,112 | |||||

| 1,425 |

Expiration: July 2015, Exercise Price: $40.00

|

17,813 | |||||

| 985 |

Expiration: July 2015, Exercise Price: $41.00

|

12,313 | |||||

| 55,369,688 | |||||||

|

TOTAL PURCHASED OPTIONS (Cost $44,803,490)

|

55,604,048 | ||||||

|

Principal Amount

|

|||||||

|

ESCROW NOTES — 0.03%

|

|||||||

| $ | 1,243,406 |

AMR Corporation (a)(d)(l)

|

1,709,683 | ||||

|

TOTAL ESCROW NOTES (Cost $679,555)

|

1,709,683 | ||||||

|

Shares

|

Value

|

||||||

|

SHORT-TERM INVESTMENTS — 9.20%

|

|||||||

| 304,000,000 |

Fidelity Institutional Government Portfolio,

|

||||||

|

Institutional Share Class, 0.01% (c)(f)

|

$ | 304,000,000 | |||||

| 176,654,078 |

The Liquid Asset Portfolio,

|

||||||

|

Institutional Share Class, 0.10% (c)

|

176,654,078 | ||||||

|

TOTAL SHORT-TERM INVESTMENTS

|

|||||||

|

(Cost $480,654,078)

|

480,654,078 | ||||||

|

TOTAL INVESTMENTS

|

|||||||

|

(Cost $5,298,920,115) — 102.91%

|

$ | 5,374,001,342 | |||||

|

(a)

|

Non-income producing security.

|

|

(b)

|

Foreign security.

|

|

(c)

|

The rate quoted is the annualized seven-day yield as of June 30, 2015.

|

|

(d)

|

Security fair valued by the Valuation Group in good faith in accordance with the policies adopted by the Board of Trustees.

|

|

(e)

|

All or a portion of the shares have been committed as collateral for open securities sold short.

|

|

(f)

|

All or a portion of the shares have been committed as collateral for written option contracts.

|

|

(g)

|

All or a portion of the shares have been committed as collateral for swap contracts.

|

|

(h)

|

All or a portion of the shares have been committed as collateral for forward currency exchange contracts.

|

|

(i)

|

Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of June 30, 2015, these securities represented 0.25% of total net assets.

|

|

(j)

|

Default or other conditions exist and the security is not presently accruing income.

|

|

(k)

|

Level 2 Security. Please see Note 2 on the Notes to the Financial Statements.

|

|

(l)

|

Level 3 Security. Please see Note 2 on the Notes to the Financial Statements.

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS — 84.29%

|

|||||||

|

APPAREL RETAIL — 0.74%

|

|||||||

| 11,055 |

ANN, Inc. (a)

|

$ | 533,846 | ||||

|

APPLICATION SOFTWARE — 0.99%

|

|||||||

| 15,753 |

Advent Software, Inc.

|

696,440 | |||||

| 297 |

Informatica Corporation (a)

|

14,396 | |||||

| 710,836 | |||||||

|

AUTO PARTS & EQUIPMENT — 0.81%

|

|||||||

| 11,800 |

Johnson Controls, Inc. (f)

|

584,454 | |||||

|

AUTOMOBILE MANUFACTURERS — 2.44%

|

|||||||

| 52,600 |

General Motors Company (f)

|

1,753,158 | |||||

|

BROADCASTING — 0.68%

|

|||||||

| 8,800 |

CBS Corporation Class B (f)

|

488,400 | |||||

|

CABLE & SATELLITE TV — 3.58%

|

|||||||

| 6,030 |

DIRECTV (a)

|

559,524 | |||||

| 21,478 |

DISH Network Corporation Class A (a)(f)

|

1,454,275 | |||||

| 780 |

Liberty Global plc Series C (a)(b)

|

39,491 | |||||

| 138,987 |

Sirius XM Holdings, Inc. (a)(f)

|

518,422 | |||||

| 2,571,712 | |||||||

|

CASINOS & GAMING — 0.01%

|

|||||||

| 295 |

International Game Technology plc (a)(b)

|

5,239 | |||||

|

CONSTRUCTION & FARM MACHINERY

|

|||||||

|

& HEAVY TRUCKS — 1.35%

|

|||||||

| 49,400 |

The Manitowoc Company, Inc. (f)

|

968,240 | |||||

|

DATA PROCESSING & OUTSOURCED SERVICES — 1.88%

|

|||||||

| 20,600 |

Computer Sciences Corporation (f)

|

1,352,184 | |||||

|

DIVERSIFIED CHEMICALS — 4.88%

|

|||||||

| 33,200 |

The Dow Chemical Company (f)

|

1,698,844 | |||||

| 10,700 |

E.I. Du Pont de Nemours & Company (f)

|

684,265 | |||||

| 49,145 |

Huntsman Corporation (f)

|

1,084,630 | |||||

| 1,300 |

Olin Corporation

|

35,035 | |||||

| 3,502,774 | |||||||

|

DIVERSIFIED METALS & MINING — 0.03%

|

|||||||

| 583 |

RTI International Metals, Inc. (a)

|

18,376 | |||||

|

ELECTRICAL COMPONENTS & EQUIPMENT — 0.37%

|

|||||||

| 4,477 |

Polypore International, Inc. (a)

|

268,083 | |||||

|

GENERAL MERCHANDISE STORES — 2.69%

|

|||||||

| 24,542 |

Family Dollar Stores, Inc.

|

1,934,155 | |||||

|

Shares

|

Value

|

||||||

|

HEALTH CARE EQUIPMENT — 0.85%

|

|||||||

| 8,700 |

Baxter International, Inc. (f)

|

$ | 608,391 | ||||

|

HEALTH CARE TECHNOLOGY — 1.70%

|

|||||||

| 20,010 |

Catamaran Corporation (a)(b)

|

1,222,211 | |||||

|

HOUSEHOLD PRODUCTS — 2.35%

|

|||||||

| 8,200 |

Energizer Holdings, Inc. (f)

|

1,078,710 | |||||

| 7,800 |

The Procter & Gamble Company (f)

|

610,272 | |||||

| 1,688,982 | |||||||

|

INDUSTRIAL CONGLOMERATES — 1.33%

|

|||||||

| 55 |

CK Hutchison Holdings Ltd. (b)

|

808 | |||||

| 35,900 |

General Electric Company (f)

|

953,863 | |||||

| 954,671 | |||||||

|

INDUSTRIAL MACHINERY — 0.75%

|

|||||||

| 7,200 |

SPX Corporation (f)

|

521,208 | |||||

| 500 |

The Timken Company

|

18,285 | |||||

| 539,493 | |||||||

|

INTEGRATED OIL & GAS — 1.63%

|

|||||||

| 1,917 |

BG Group plc — ADR

|

32,167 | |||||

| 12,200 |

BP plc — ADR (f)

|

487,512 | |||||

| 5,100 |

Hess Corporation (f)

|

341,088 | |||||

| 4,000 |

Occidental Petroleum Corporation

|

311,080 | |||||

| 1,171,847 | |||||||

|

INTERNET RETAIL — 1.23%

|

|||||||

| 77,149 |

Orbitz Worldwide, Inc. (a)(f)

|

881,042 | |||||

|

INTERNET SOFTWARE & SERVICES — 5.45%

|

|||||||

| 25,200 |

eBay, Inc. (a)(f)

|

1,518,048 | |||||

| 60,986 |

Yahoo!, Inc. (a)(f)

|

2,396,140 | |||||

| 3,914,188 | |||||||

|

MANAGED HEALTH CARE — 2.86%

|

|||||||

| 5,500 |

Cigna Corporation (f)

|

891,000 | |||||

| 6,100 |

Humana, Inc. (f)

|

1,166,808 | |||||

| 2,057,808 | |||||||

|

MOVIES & ENTERTAINMENT — 0.99%

|

|||||||

| 158,432 |

SFX Entertainment, Inc. (a)

|

711,360 | |||||

|

MULTI-LINE INSURANCE — 4.34%

|

|||||||

| 50,400 |

American International Group, Inc. (f)

|

3,115,728 | |||||

|

OIL & GAS EQUIPMENT & SERVICES — 1.71%

|

|||||||

| 16,989 |

Baker Hughes, Inc.

|

1,048,221 | |||||

| 2,150 |

Dresser-Rand Group, Inc. (a)

|

183,137 | |||||

| 1,231,358 | |||||||

|

Shares

|

Value

|

||||||

|

OIL & GAS EXPLORATION & PRODUCTION — 1.48%

|

|||||||

| 9,800 |

Anadarko Petroleum Corporation (f)

|

$ | 764,988 | ||||

| 12,964 |

Rosetta Resources, Inc. (a)

|

299,987 | |||||

| 1,064,975 | |||||||

|

OIL & GAS STORAGE & TRANSPORTATION — 3.27%

|

|||||||

| 14,800 |

The Williams Companies, Inc.

|

849,372 | |||||

| 30,992 |

Williams Partners LP (f)

|

1,500,943 | |||||

| 2,350,315 | |||||||

|

OTHER DIVERSIFIED FINANCIAL SERVICES — 1.48%

|

|||||||

| 19,200 |

Citigroup, Inc. (f)

|

1,060,608 | |||||

|

PACKAGED FOODS & MEATS — 1.13%

|

|||||||

| 9,500 |

Kraft Foods Group, Inc. (f)

|

808,830 | |||||

|

PAPER PACKAGING — 1.33%

|

|||||||

| 15,982 |

MeadWestvaco Corporation

|

754,191 | |||||

| 3,200 |

Packaging Corporation of America

|

199,968 | |||||

| 954,159 | |||||||

|

PAPER PRODUCTS — 1.76%

|

|||||||

| 26,500 |

International Paper Company (f)

|

1,261,135 | |||||

|

PHARMACEUTICALS — 4.76%

|

|||||||

| 4,154 |

Hospira, Inc. (a)

|

368,501 | |||||

| 14,100 |

Mylan NV (a)(b)(f)

|

956,826 | |||||

| 4,158 |

Perrigo Company plc (b)(f)

|

768,523 | |||||

| 29,800 |

Pfizer, Inc. (f)

|

999,194 | |||||

| 6,700 |

Zoetis, Inc. (f)

|

323,074 | |||||

| 3,416,118 | |||||||

|

REAL ESTATE MANAGEMENT & DEVELOPMENT — 0.00%

|

|||||||

| 55 |

Cheung Kong Property Holdings Ltd. (a)(b)

|

456 | |||||

|

REINSURANCE — 1.05%

|

|||||||

| 5,891 |

PartnerRe Ltd. (b)(f)

|

756,994 | |||||

|

REITS — 7.37%

|

|||||||

| 123 |

Blackstone Mortgage Trust, Inc. Class A

|

3,422 | |||||

| 36,362 |

CYS Investments, Inc.

|

281,078 | |||||

| 5,596 |

Equity Commonwealth (a)

|

143,649 | |||||

| 7,372 |

Home Properties, Inc. (g)

|

538,525 | |||||

| 96,873 |

NorthStar Realty Finance Corporation (e)

|

1,540,281 | |||||

| 63,081 |

Starwood Property Trust, Inc. (e)

|

1,360,657 | |||||

| 448 |

Starwood Waypoint Residential Trust

|

10,644 | |||||

| 16,000 |

Ventas, Inc. (f)

|

993,440 | |||||

| 37,578 |

Wheeler Real Estate Investment Trust, Inc.

|

76,283 | |||||

| 22,671 |

Winthrop Realty Trust

|

343,466 | |||||

| 5,291,445 | |||||||

|

Shares

|

Value

|

||||||

|

RESTAURANTS — 0.91%

|

|||||||

| 6,900 |

McDonald’s Corporation (f)

|

$ | 655,983 | ||||

|

SEMICONDUCTORS — 5.85%

|

|||||||

| 41,368 |

Altera Corporation

|

2,118,041 | |||||

| 35,975 |

Broadcom Corporation Class A (e)

|

1,852,353 | |||||

| 16,861 |

Micrel, Inc.

|

234,368 | |||||

| 4,204,762 | |||||||

|

SPECIALTY CHEMICALS — 1.80%

|

|||||||

| 12,900 |

W.R. Grace & Company (a)(f)

|

1,293,870 | |||||

|

SYSTEMS SOFTWARE — 1.95%

|

|||||||

| 31,800 |

Microsoft Corporation (f)

|

1,403,970 | |||||

|

THRIFTS & MORTGAGE FINANCE — 0.89%

|

|||||||

| 64,386 |

Hudson City Bancorp, Inc.

|

636,134 | |||||

|

TRUCKING — 1.56%

|

|||||||

| 62,053 |

Hertz Global Holdings, Inc. (a)(f)

|

1,124,400 | |||||

|

WIRELESS TELECOMMUNICATION SERVICES — 2.06%

|

|||||||

| 14,800 |

America Movil SAB de C.V. Class L — ADR

|

315,388 | |||||

| 30,000 |

T-Mobile U.S., Inc. (a)(f)

|

1,163,100 | |||||

| 11 |

Vodafone Group plc — ADR

|

401 | |||||

| 1,478,889 | |||||||

|

TOTAL COMMON STOCKS (Cost $62,297,574)

|

60,551,579 | ||||||

|

CLOSED-END FUNDS — 1.15%

|

|||||||

| 55,988 |

Eaton Vance Floating-Rate Income Trust

|

771,515 | |||||

| 149 |

First Trust MLP and Energy Income Fund

|

2,749 | |||||

| 2,772 |

First Trust Senior Floating Rate Income Fund II

|

36,480 | |||||

| 1,050 |

Nuveen Energy MLP Total Return Fund

|

17,293 | |||||

|

TOTAL CLOSED-END FUNDS (Cost $867,366)

|

828,037 | ||||||

|

PREFERRED STOCKS — 1.67%

|

|||||||

| 37,580 |

Equity Commonwealth, 7.250%, Series E (e)

|

958,666 | |||||

| 6,025 |

NorthStar Realty Finance Corporation, 8.750%, Series E

|

151,890 | |||||

| 2,018 |

Regions Financial Corporation, 6.375%, Series B

|

51,883 | |||||

| 717 |

SLM Corporation, 6.970%, Series A

|

35,671 | |||||

|

TOTAL PREFERRED STOCKS (Cost $1,199,148)

|

1,198,110 | ||||||

|

CONTINGENT VALUE RIGHTS — 0.00%

|

|||||||

| 5,338 |

Casa Ley, S.A. de C.V. (a)(d)(m)

|

2,535 | |||||

| 5,338 |

Property Development Centers LLC (a)(d)(m)

|

267 | |||||

|

TOTAL CONTINGENT VALUE RIGHTS (Cost $0)

|

2,802 | ||||||

|

Principal Amount

|

Value

|

||||||

|

BANK LOANS — 0.06%

|

|||||||

|

Energy Future Intermediate Holding Company LLC

|

|||||||

| $ | 40,905 |

4.250%, 6/19/2016 (k)

|

$ | 41,033 | |||

|

TOTAL BANK LOANS (Cost $41,246)

|

41,033 | ||||||

|

CORPORATE BONDS — 2.54%

|

|||||||

|

Energy Future Intermediate Holding Company LLC

|

|||||||

| 614,905 |

11.750%, 3/1/2022 (i)(j)

|

701,760 | |||||

|

The Manitowoc Company, Inc.

|

|||||||

| 174,000 |

5.875%, 10/15/2022

|

188,355 | |||||

|

NCR Corporation

|

|||||||

| 714,000 |

5.000%, 7/15/2022

|

726,495 | |||||

|

Pinnacle Entertainment, Inc. (h)

|

|||||||

| 83,000 |

7.500%, 4/15/2021

|

88,291 | |||||

|

US Foods, Inc.

|

|||||||

| 113,000 |

8.500%, 6/30/2019

|

117,847 | |||||

|

TOTAL CORPORATE BONDS (Cost $1,795,356)

|

1,822,748 | ||||||

|

Contracts (100 shares per contract)

|

|||||||

|

PURCHASED CALL OPTIONS — 0.01%

|

|||||||

|

Avago Technologies Ltd.

|

|||||||

| 11 |

Expiration: January 2016, Exercise Price: $175.00

|

2,970 | |||||

|

PURCHASED PUT OPTIONS — 1.21%

|

|||||||

|

America Movil SAB de C.V. Class L — ADR

|

|||||||

| 28 |

Expiration: August 2015, Exercise Price: $18.00

|

210 | |||||

| 101 |

Expiration: August 2015, Exercise Price: $19.00

|

1,767 | |||||

|

American International Group, Inc.

|

|||||||

| 442 |

Expiration: August 2015, Exercise Price: $52.50

|

8,619 | |||||

|

Anadarko Petroleum Corporation

|

|||||||

| 88 |

Expiration: August 2015, Exercise Price: $75.00

|

16,456 | |||||

| 14 |

Expiration: August 2015, Exercise Price: $77.50

|

3,990 | |||||

| 23 |

Expiration: August 2015, Exercise Price: $80.00

|

9,568 | |||||

|

Baxter International, Inc.

|

|||||||

| 29 |

Expiration: July 2015, Exercise Price: $60.00

|

217 | |||||

| 23 |

Expiration: August 2015, Exercise Price: $60.00

|

219 | |||||

| 29 |

Expiration: August 2015, Exercise Price: $65.00

|

986 | |||||

|

Bayer AG

|

|||||||

| 3 |

Expiration: July 2015, Exercise Price: EUR 115.00 (l)

|

335 | |||||

| 6 |

Expiration: September 2015,

|

||||||

|

Exercise Price: EUR 100.00 (l)

|

702 | ||||||

|

Contracts (100 shares per contract)

|

Value

|

||||||

|

Bayer AG (continued)

|

|||||||

| 22 |

Expiration: September 2015,

|

||||||

|

Exercise Price: EUR 120.00 (l)

|

$ | 12,533 | |||||

|

BP plc — ADR

|

|||||||

| 16 |

Expiration: July 2015, Exercise Price: $34.00

|

24 | |||||

| 31 |

Expiration: July 2015, Exercise Price: $39.00

|

1,209 | |||||

|

CBS Corporation Class B

|

|||||||

| 98 |

Expiration: September 2015, Exercise Price: $50.00

|

7,693 | |||||

|

Charter Communications, Inc. Class A

|

|||||||

| 11 |

Expiration: January 2016, Exercise Price: $210.00

|

47,135 | |||||

|

Cigna Corporation

|

|||||||

| 7 |

Expiration: August 2015, Exercise Price: $140.00

|

1,225 | |||||

| 19 |

Expiration: August 2015, Exercise Price: $145.00

|

3,800 | |||||

|

Citigroup, Inc.

|

|||||||

| 58 |

Expiration: July 2015, Exercise Price: $52.50

|

2,030 | |||||

| 84 |

Expiration: September 2015, Exercise Price: $49.00

|

3,864 | |||||

|

Computer Sciences Corporation

|

|||||||

| 138 |

Expiration: September 2015, Exercise Price: $60.00

|

16,215 | |||||

|

DISH Network Corporation Class A

|

|||||||

| 137 |

Expiration: September 2015, Exercise Price: $60.00

|

13,015 | |||||

| 38 |

Expiration: September 2015, Exercise Price: $62.50

|

5,700 | |||||

|

The Dow Chemical Company

|

|||||||

| 17 |

Expiration: September 2015, Exercise Price: $43.00

|

476 | |||||

| 8 |

Expiration: September 2015, Exercise Price: $44.00

|

304 | |||||

| 46 |

Expiration: September 2015, Exercise Price: $45.00

|

2,093 | |||||

| 195 |

Expiration: September 2015, Exercise Price: $48.00

|

18,817 | |||||

|

E.I. Du Pont de Nemours & Company

|

|||||||

| 18 |

Expiration: July 2015, Exercise Price: $62.50

|

1,251 | |||||

| 78 |

Expiration: July 2015, Exercise Price: $65.00

|

13,923 | |||||

|

eBay, Inc.

|

|||||||

| 28 |

Expiration: July 2015, Exercise Price: $50.00

|

140 | |||||

| 82 |

Expiration: July 2015, Exercise Price: $52.50

|

820 | |||||

| 89 |

Expiration: October 2015, Exercise Price: $50.00

|

3,782 | |||||

|

Energizer Holdings, Inc.

|

|||||||

| 43 |

Expiration: August 2015, Exercise Price: $115.00

|

4,730 | |||||

| 20 |

Expiration: August 2015, Exercise Price: $120.00

|

3,450 | |||||

|

General Electric Company

|

|||||||

| 190 |

Expiration: July 2015, Exercise Price: $25.00

|

1,710 | |||||

|

General Motors Company

|

|||||||

| 69 |

Expiration: September 2015, Exercise Price: $31.00

|

4,485 | |||||

| 365 |

Expiration: September 2015, Exercise Price: $32.00

|

35,770 | |||||

|

Contracts (100 shares per contract)

|

Value | ||||||

|

Hertz Global Holdings, Inc.

|

|||||||

| 293 |

Expiration: September 2015, Exercise Price: $16.00

|

$ | 17,580 | ||||

| 202 |

Expiration: September 2015, Exercise Price: $19.00

|

38,885 | |||||

|

Hess Corporation

|

|||||||

| 38 |

Expiration: August 2015, Exercise Price: $57.50

|

1,520 | |||||

|

Humana, Inc.

|

|||||||

| 10 |

Expiration: July 2015, Exercise Price: $195.00

|

11,300 | |||||

| 13 |

Expiration: August 2015, Exercise Price: $175.00

|

7,280 | |||||

| 21 |

Expiration: August 2015, Exercise Price: $185.00

|

19,215 | |||||

| 7 |

Expiration: August 2015, Exercise Price: $190.00

|

7,770 | |||||

|

Huntsman Corporation

|

|||||||

| 368 |

Expiration: August 2015, Exercise Price: $18.00

|

2,760 | |||||

| 213 |

Expiration: August 2015, Exercise Price: $19.00

|

3,195 | |||||

|

International Paper Company

|

|||||||

| 134 |

Expiration: July 2015, Exercise Price: $45.00

|

2,814 | |||||

| 84 |

Expiration: July 2015, Exercise Price: $50.00

|

21,084 | |||||

|

Johnson Controls, Inc.

|

|||||||

| 78 |

Expiration: October 2015, Exercise Price: $48.00

|

14,625 | |||||

|

The Manitowoc Company, Inc.

|

|||||||

| 111 |

Expiration: September 2015, Exercise Price: $17.00

|

3,885 | |||||

| 251 |

Expiration: September 2015, Exercise Price: $18.00

|

13,805 | |||||

|

McDonald’s Corporation

|

|||||||

| 60 |

Expiration: July 2015, Exercise Price: $85.00

|

180 | |||||

|

Microsoft Corporation

|

|||||||

| 45 |

Expiration: July 2015, Exercise Price: $36.00

|

45 | |||||

| 130 |

Expiration: July 2015, Exercise Price: $41.00

|

1,040 | |||||

| 78 |

Expiration: July 2015, Exercise Price: $42.00

|

1,170 | |||||

| 37 |

Expiration: October 2015, Exercise Price: $41.00

|

3,552 | |||||

|

Mylan NV

|

|||||||

| 57 |

Expiration: July 2015, Exercise Price: $67.50

|

10,203 | |||||

| 15 |

Expiration: July 2015, Exercise Price: $70.00

|

5,670 | |||||

| 35 |

Expiration: October 2015, Exercise Price: $65.00

|

13,562 | |||||

|

NorthStar Realty Finance Corporation

|

|||||||

| 139 |

Expiration: August 2015, Exercise Price: $16.00

|

11,120 | |||||

| 636 |

Expiration: September 2015, Exercise Price: $16.00

|

57,240 | |||||

|

Occidental Petroleum Corporation

|

|||||||

| 41 |

Expiration: August 2015, Exercise Price: $67.50

|

1,435 | |||||

|

Olin Corporation

|

|||||||

| 10 |

Expiration: August 2015, Exercise Price: $25.00

|

475 | |||||

|

Packaging Corporation of America

|

|||||||

| 9 |

Expiration: July 2015, Exercise Price: $60.00

|

360 | |||||

| 14 |

Expiration: July 2015, Exercise Price: $65.00

|

3,934 | |||||

|

Contracts (100 shares per contract)

|

Value

|

||||||

|

PartnerRe Ltd.

|

|||||||

| 6 |

Expiration: August 2015, Exercise Price: $120.00

|

$ | 1,020 | ||||

|

Perrigo Company plc

|

|||||||

| 5 |

Expiration: August 2015, Exercise Price: $155.00

|

863 | |||||

| 10 |

Expiration: August 2015, Exercise Price: $160.00

|

2,800 | |||||

| 8 |

Expiration: August 2015, Exercise Price: $165.00

|

2,912 | |||||

|

The Procter & Gamble Company

|

|||||||

| 37 |

Expiration: July 2015, Exercise Price: $75.00

|

629 | |||||

| 28 |

Expiration: August 2015, Exercise Price: $70.00

|

672 | |||||

|

Rock-Tenn Company Class A

|

|||||||

| 28 |

Expiration: August 2015, Exercise Price: $55.00

|

2,310 | |||||

| 15 |

Expiration: October 2015, Exercise Price: $55.00

|

2,288 | |||||

|

SPDR S&P 500 ETF Trust

|

|||||||

| 30 |

Expiration: August 2015, Exercise Price: $198.00

|

7,740 | |||||

| 126 |

Expiration: August 2015, Exercise Price: $208.00

|

70,182 | |||||

| 108 |

Expiration: August 2015, Exercise Price: $210.00

|

70,524 | |||||

| 30 |

Expiration: August 2015, Exercise Price: $211.00

|

21,150 | |||||

| 84 |

Expiration: September 2015, Exercise Price: $189.00

|

21,210 | |||||

| 96 |

Expiration: September 2015, Exercise Price: $207.00

|

68,448 | |||||

|

SPX Corporation

|

|||||||

| 35 |

Expiration: September 2015, Exercise Price: $60.00

|

2,450 | |||||

|

T-Mobile U.S., Inc.

|

|||||||

| 19 |

Expiration: August 2015, Exercise Price: $25.00

|

266 | |||||

| 17 |

Expiration: August 2015, Exercise Price: $26.00

|

247 | |||||

| 210 |

Expiration: August 2015, Exercise Price: $34.00

|

11,865 | |||||

|

Ventas, Inc.

|

|||||||

| 19 |

Expiration: August 2015, Exercise Price: $55.00

|

475 | |||||

| 121 |

Expiration: August 2015, Exercise Price: $60.00

|

12,100 | |||||

|

W.R. Grace & Company

|

|||||||

| 97 |

Expiration: September 2015, Exercise Price: $92.50

|

11,640 | |||||

|

Yahoo!, Inc.

|

|||||||

| 14 |

Expiration: July 2015, Exercise Price: $37.00

|

294 | |||||

| 93 |

Expiration: July 2015, Exercise Price: $41.00

|

18,228 | |||||

| 16 |

Expiration: July 2015, Exercise Price: $42.00

|

4,560 | |||||

| 35 |

Expiration: August 2015, Exercise Price: $37.00

|

3,203 | |||||

| 63 |

Expiration: October 2015, Exercise Price: $36.00

|

7,119 | |||||

| 30 |

Expiration: October 2015, Exercise Price: $37.00

|

4,410 | |||||

|

Zoetis, Inc.

|

|||||||

| 7 |

Expiration: July 2015, Exercise Price: $40.00

|

87 | |||||

| 51 |

Expiration: July 2015, Exercise Price: $41.00

|

638 | |||||

| 875,297 | |||||||

|

TOTAL PURCHASED OPTIONS (Cost $708,094)

|

878,267 | ||||||

|

Shares

|

Value

|

||||||

|

SHORT-TERM INVESTMENTS — 6.39%

|

|||||||

| 4,155,000 |

Fidelity Institutional Government Portfolio,

|

||||||

|

Institutional Share Class, 0.01% (c)(f)

|

$ | 4,155,000 | |||||

| 437,728 |

The Liquid Asset Portfolio,

|

||||||

|

Institutional Share Class, 0.10% (c)

|

437,728 | ||||||

|

TOTAL SHORT-TERM INVESTMENTS

|

|||||||

|

(Cost $4,592,728)

|

4,592,728 | ||||||

|

TOTAL INVESTMENTS

|

|||||||

|

(Cost $71,501,512) — 97.32%

|

$ | 69,915,304 | |||||

|

(a)

|

Non-income producing security.

|

|

(b)

|

Foreign security.

|

|

(c)

|

The rate quoted is the annualized seven-day yield as of June 30, 2015.

|

|

(d)

|

Security fair valued by the Valuation Group in good faith in accordance with the policies adopted by the Board of Trustees.

|

|

(e)

|

All or a portion of the shares have been committed as collateral for open securities sold short.

|

|

(f)

|

All or a portion of the shares have been committed as collateral for written option contracts.

|

|

(g)

|

All or a portion of the shares have been committed as collateral for swap contracts.

|

|

(h)

|

All or a portion of the shares have been committed as collateral for forward currency exchange contracts.

|

|

(i)

|

Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration normally to qualified institutional buyers. As of June 30, 2015, these securities represented 0.98% of total net assets.

|

|

(j)

|

Default or other conditions exist and the security is not presently accruing income.

|

|

(k)

|

Variable rate.

|

|

(l)

|

Level 2 Security. Please see Note 2 on the Notes to the Financial Statements.

|

|

(m)

|

Level 3 Security. Please see Note 2 on the Notes to the Financial Statements.

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS

|

|||||||

| 682,619 |

Alcoa, Inc.

|

$ | 7,611,202 | ||||

| 2 |

Alexion Pharmaceuticals, Inc.

|

361 | |||||

| 396,586 |

Alibaba Group Holding Ltd. — ADR

|

32,627,130 | |||||

| 65,211 |

American Airlines Group, Inc.

|

2,604,201 | |||||

| 106,887 |

ARRIS Group, Inc. (b)(c)

|

3,248,296 | |||||

| 1,115,598 |

Ascena Retail Group, Inc.

|

18,580,285 | |||||

| 4,753,759 |

AT&T, Inc.

|

168,853,520 | |||||

| 436,591 |

Avago Technologies Ltd.

|

58,036,042 | |||||

| 318,139 |

Charter Communications, Inc. Class A

|

54,481,304 | |||||

| 582 |

Cheung Kong Property Holdings Ltd. (a)

|

4,828 | |||||

| 582 |

CK Hutchison Holdings Ltd. (a)

|

8,552 | |||||

| 476,643 |

Dollar Tree, Inc.

|

37,650,030 | |||||

| 40,614 |

Equinix, Inc. (b)(c)

|

10,275,342 | |||||

| 1,198,984 |

Halliburton Company

|

51,640,241 | |||||

| 1 |

Harris Corporation

|

77 | |||||

| 529,841 |

Liberty Global plc Class A (a)

|

28,648,503 | |||||

| 819,630 |

M&T Bank Corporation

|

102,396,376 | |||||

| 135,708 |

NXP Semiconductors NV (a)

|

13,326,525 | |||||

| 271,063 |

PacWest Bancorp

|

12,674,906 | |||||

| 155,841 |

Royal Dutch Shell plc Class B — ADR

|

8,937,481 | |||||

| 333,206 |

XL Group plc (a)

|

12,395,263 | |||||

|

TOTAL SECURITIES SOLD SHORT

|

|||||||

|

(Proceeds $598,790,107)

|

$ | 624,000,465 | |||||

|

(a)

|

Foreign security.

|

|

(b)

|

Security fair valued by the Valuation Group in good faith in accordance with the policies adopted by the Board of Trustees.

|

|

(c)

|

Level 2 Security. Please see Note 2 on the Notes to the Financial Statements.

|

|

Shares

|

Value

|

||||||

|

COMMON STOCKS

|

|||||||

| 1,648 |

Alcoa, Inc.

|

$ | 18,375 | ||||

| 1 |

Alexion Pharmaceuticals, Inc.

|

181 | |||||

| 12,387 |

Alibaba Group Holding Ltd. — ADR

|

1,019,079 | |||||

| 1,354 |

ARRIS Group, Inc. (b)(c)

|

41,148 | |||||

| 7,516 |

Ascena Retail Group, Inc.

|

125,179 | |||||

| 10,808 |

AT&T, Inc.

|

383,900 | |||||

| 7,022 |

Avago Technologies Ltd.

|

933,435 | |||||

| 5,294 |

Charter Communications, Inc. Class A

|

906,598 | |||||

| 5,664 |

Dollar Tree, Inc.

|

447,399 | |||||

| 853 |

Equinix, Inc. (b)(c)

|

215,809 | |||||

| 7,717 |

Halliburton Company

|

332,371 | |||||

| 2 |

Harris Corporation

|

154 | |||||

| 859 |

Liberty Global plc Class A (a)

|

46,446 | |||||

| 5,409 |

M&T Bank Corporation

|

675,746 | |||||

| 427 |

Royal Dutch Shell plc Class B — ADR

|

24,488 | |||||

| 800 |

Time Warner Cable, Inc.

|

142,536 | |||||

| 1,223 |

XL Group plc (a)

|

45,496 | |||||

|

TOTAL SECURITIES SOLD SHORT

|

|||||||

|

(Proceeds $5,391,513)

|

$ | 5,358,340 | |||||

|

(a)

|

Foreign security.

|

|

(b)

|

Security fair valued by the Valuation Group in good faith in accordance with the policies adopted by the Board of Trustees.

|

|

(c)

|

Level 2 Security. Please see Note 2 on the Notes to the Financial Statements.

|

|

Contracts (100 shares per contract)

|

Value

|

||||||

|

CALL OPTIONS WRITTEN

|

|||||||

|

America Movil SAB de C.V. Class L — ADR

|

|||||||

| 3,784 |

Expiration: August 2015, Exercise Price: $20.00

|

$ | 548,680 | ||||

| 7,443 |

Expiration: August 2015, Exercise Price: $21.00

|

595,440 | |||||

|

American International Group, Inc.

|

|||||||

| 924 |

Expiration: August 2015, Exercise Price: $55.00

|

669,900 | |||||

| 27,935 |

Expiration: August 2015, Exercise Price: $57.50

|

14,107,175 | |||||

|

Anadarko Petroleum Corporation

|

|||||||

| 5,689 |

Expiration: August 2015, Exercise Price: $85.00

|

512,010 | |||||

| 5,689 |

Expiration: August 2015, Exercise Price: $90.00

|

193,426 | |||||

|

AT&T, Inc.

|

|||||||

| 1,358 |

Expiration: July 2015, Exercise Price: $34.00

|

222,712 | |||||

|

Bayer AG

|

|||||||

| 2,940 |

Expiration: September 2015,

|

||||||

|

Exercise Price: EUR 130.00 (b)

|

1,779,773 | ||||||

|

BP plc — ADR

|

|||||||

| 26 |

Expiration: July 2015, Exercise Price: $39.00

|

3,497 | |||||

| 237 |

Expiration: July 2015, Exercise Price: $40.00

|

17,301 | |||||

|

CBS Corporation Class B

|

|||||||

| 8,249 |

Expiration: September 2015, Exercise Price: $55.00

|

2,400,459 | |||||

| 8,250 |

Expiration: September 2015, Exercise Price: $57.50

|

1,419,000 | |||||

|

Charter Communications, Inc. Class A

|

|||||||

| 896 |

Expiration: January 2016, Exercise Price: $210.00

|

112,000 | |||||

|

Cigna Corporation

|

|||||||

| 1,278 |

Expiration: August 2015, Exercise Price: $155.00

|

1,744,470 | |||||

| 1,824 |

Expiration: August 2015, Exercise Price: $160.00

|

1,851,360 | |||||

|

Computer Sciences Corporation

|

|||||||

| 8,991 |

Expiration: September 2015, Exercise Price: $65.00

|

3,056,940 | |||||

| 1,613 |

Expiration: September 2015, Exercise Price: $67.50

|

415,348 | |||||

|

DISH Network Corporation Class A

|

|||||||

| 8,830 |

Expiration: September 2015, Exercise Price: $67.50

|

3,443,700 | |||||

| 6,747 |

Expiration: September 2015, Exercise Price: $70.00

|

1,902,654 | |||||

|

The Dow Chemical Company

|

|||||||

| 15,891 |

Expiration: September 2015, Exercise Price: $49.00

|

5,482,395 | |||||

| 7,050 |

Expiration: September 2015, Exercise Price: $50.00

|

1,959,900 | |||||

|

E.I. Du Pont de Nemours & Company

|

|||||||

| 1,233 |

Expiration: July 2015, Exercise Price: $70.00

|

12,330 | |||||

| 4,945 |

Expiration: July 2015, Exercise Price: $72.50

|

9,890 | |||||

|

eBay, Inc.

|

|||||||

| 7,930 |

Expiration: July 2015, Exercise Price: $55.00

|

4,401,150 | |||||

| 4,543 |

Expiration: July 2015, Exercise Price: $57.50

|

1,540,077 | |||||

| 1,759 |

Expiration: October 2015, Exercise Price: $57.50

|

879,500 | |||||

|

Contracts (100 shares per contract)

|

Value

|

||||||

|

Energizer Holdings, Inc.

|

|||||||

| 798 |

Expiration: August 2015, Exercise Price: $125.00

|

$ | 770,070 | ||||

| 4,286 |

Expiration: August 2015, Exercise Price: $130.00

|

2,914,480 | |||||

|

Equinix, Inc.

|

|||||||

| 415 |

Expiration: September 2015,

|

||||||

|

Exercise Price: $250.00 (a)(b)

|

506,300 | ||||||

|

General Electric Company

|

|||||||

| 7,721 |

Expiration: July 2015, Exercise Price: $27.00

|

239,351 | |||||

|

General Motors Company

|

|||||||

| 22,863 |

Expiration: September 2015, Exercise Price: $36.00

|

994,540 | |||||

|

Halliburton Company

|

|||||||

| 867 |

Expiration: July 2015, Exercise Price: $42.50

|

117,045 | |||||

|

Hertz Global Holdings, Inc.

|

|||||||

| 12,896 |

Expiration: September 2015, Exercise Price: $19.00

|

1,547,520 | |||||

| 33,039 |

Expiration: September 2015, Exercise Price: $21.00

|

1,651,950 | |||||

|

Humana, Inc.

|

|||||||

| 561 |

Expiration: August 2015, Exercise Price: $185.00

|

914,991 | |||||

| 1,335 |

Expiration: August 2015, Exercise Price: $195.00

|

1,361,700 | |||||

|

Huntsman Corporation

|

|||||||

| 46,960 |

Expiration: August 2015, Exercise Price: $22.00

|

4,696,000 | |||||

| 1,057 |

Expiration: August 2015, Exercise Price: $23.00

|

58,135 | |||||

|

International Paper Company

|

|||||||

| 10,557 |

Expiration: July 2015, Exercise Price: $52.50

|

10,557 | |||||

| 10,554 |

Expiration: July 2015, Exercise Price: $55.00

|

21,108 | |||||

|

Kraft Foods Group, Inc.

|

|||||||

| 2,515 |

Expiration: September 2015, Exercise Price: $82.50

|

1,081,450 | |||||

| 2,565 |

Expiration: September 2015, Exercise Price: $85.00

|

692,550 | |||||

|

The Manitowoc Company, Inc.

|

|||||||

| 16,622 |

Expiration: September 2015, Exercise Price: $19.00

|

2,576,410 | |||||

| 17,105 |

Expiration: September 2015, Exercise Price: $20.00

|

1,753,262 | |||||

|

McDonald’s Corporation

|

|||||||

| 4,368 |

Expiration: July 2015, Exercise Price: $95.00

|

679,224 | |||||

|

Noble Energy, Inc.

|

|||||||

| 4,269 |

Expiration: August 2015, Exercise Price: $40.00

|

1,494,150 | |||||

|

Occidental Petroleum Corporation

|

|||||||

| 5,150 |

Expiration: August 2015, Exercise Price: $75.00

|

2,214,500 | |||||

|

Orbitz Worldwide, Inc.

|

|||||||

| 3,514 |

Expiration: August 2015, Exercise Price: $12.00

|

3,514 | |||||

|

Packaging Corporation of America

|

|||||||

| 440 |

Expiration: July 2015, Exercise Price: $67.50

|

8,800 | |||||

| 680 |

Expiration: July 2015, Exercise Price: $75.00

|

3,400 | |||||

|

Contracts (100 shares per contract)

|

Value

|

||||||

|

PartnerRe Ltd.

|

|||||||

| 434 |

Expiration: August 2015, Exercise Price: $140.00

|

$ | 104,160 | ||||

|

Perrigo Company plc

|

|||||||

| 1,132 |

Expiration: August 2015, Exercise Price: $170.00

|

2,320,600 | |||||

| 414 |

Expiration: August 2015, Exercise Price: $180.00

|

587,880 | |||||

| 407 |

Expiration: August 2015, Exercise Price: $185.00

|

476,190 | |||||

|

Pfizer, Inc.

|

|||||||

| 11,245 |

Expiration: August 2015, Exercise Price: $34.00

|

612,853 | |||||

| 12,966 |

Expiration: September 2015, Exercise Price: $34.00

|

907,620 | |||||

|

The Procter & Gamble Company

|

|||||||

| 2,568 |

Expiration: July 2015, Exercise Price: $82.50

|

7,704 | |||||

| 1,354 |

Expiration: August 2015, Exercise Price: $77.50

|

259,291 | |||||

|

Rock-Tenn Company Class A

|

|||||||

| 4,356 |

Expiration: July 2015, Exercise Price: $60.00

|

642,510 | |||||

| 3,176 |

Expiration: August 2015, Exercise Price: $60.00

|

801,940 | |||||

| 1,614 |

Expiration: October 2015, Exercise Price: $65.00

|

205,785 | |||||

|

Royal Dutch Shell plc Class B

|

|||||||

| 67 |

Expiration: July 2015, Exercise Price: GBP 19.50 (b)

|

1,579 | |||||

|

Sirius XM Holdings, Inc.

|

|||||||

| 18,434 |

Expiration: July 2015, Exercise Price: $4.00

|

18,434 | |||||

| 66,925 |

Expiration: September 2015, Exercise Price: $4.00

|

401,550 | |||||

|

SPX Corporation

|

|||||||

| 1,513 |

Expiration: September 2015, Exercise Price: $65.00

|

1,323,875 | |||||

|

Time Warner Cable, Inc.

|

|||||||

| 593 |

Expiration: October 2015, Exercise Price: $175.00

|

486,260 | |||||

|

T-Mobile U.S., Inc.

|

|||||||

| 11,852 |

Expiration: August 2015, Exercise Price: $32.00

|

8,444,550 | |||||

| 5,422 |

Expiration: August 2015, Exercise Price: $37.00

|

1,669,976 | |||||

| 5,421 |

Expiration: August 2015, Exercise Price: $38.00

|

1,330,856 | |||||

|

Ventas, Inc.

|

|||||||

| 2,340 |

Expiration: August 2015, Exercise Price: $65.00

|

169,650 | |||||

| 5,948 |

Expiration: August 2015, Exercise Price: $70.00

|

104,090 | |||||

|

Vivendi SA

|

|||||||

| 4,108 |

Expiration: August 2015, Exercise Price: EUR 22.00 (b)

|

540,420 | |||||

|

Vodafone Group plc — ADR

|

|||||||

| 3 |

Expiration: July 2015, Exercise Price: $34.00

|

771 | |||||

| 3,066 |

Expiration: July 2015, Exercise Price: $36.00

|

324,996 | |||||

|

W.R. Grace & Company

|

|||||||

| 7,404 |

Expiration: September 2015, Exercise Price: $100.00

|

2,961,600 | |||||

|

The Williams Companies, Inc.

|

|||||||

| 3,146 |

Expiration: August 2015, Exercise Price: $46.00

|

3,759,470 | |||||

| 6,662 |

Expiration: August 2015, Exercise Price: $48.00

|

6,645,345 | |||||

| 5,052 |

Expiration: August 2015, Exercise Price: $50.00

|

4,092,120 | |||||

|

Contracts (100 shares per contract)

|

Value

|

||||||

|

Williams Partners LP

|

|||||||

| 1,038 |

Expiration: August 2015, Exercise Price: $50.00

|

$ | 166,080 | ||||

| 4,035 |

Expiration: September 2015, Exercise Price: $50.00

|

706,125 | |||||

|

Yahoo!, Inc.

|

|||||||

| 2,509 |

Expiration: July 2015, Exercise Price: $41.00

|

75,270 | |||||

| 8,409 |

Expiration: July 2015, Exercise Price: $45.00

|

25,227 | |||||

| 2,243 |

Expiration: July 2015, Exercise Price: $46.00

|

4,486 | |||||

| 1,285 |

Expiration: August 2015, Exercise Price: $40.00

|

200,460 | |||||

| 4,263 |

Expiration: October 2015, Exercise Price: $41.00

|

788,655 | |||||

|

Zoetis, Inc.

|

|||||||

| 2,411 |

Expiration: July 2015, Exercise Price: $44.00

|

1,048,785 | |||||

| 1,163 |

Expiration: July 2015, Exercise Price: $45.00

|

412,865 | |||||

| 579 |

Expiration: July 2015, Exercise Price: $46.00

|

165,015 | |||||

| 118,387,137 | |||||||

|

PUT OPTIONS WRITTEN

|

|||||||

|

SPDR S&P 500 ETF Trust

|

|||||||

| 9,401 |

Expiration: August 2015, Exercise Price: $202.00

|

3,295,051 | |||||

| 11,898 |

Expiration: August 2015, Exercise Price: $204.00

|

4,854,384 | |||||

| 13,431 |

Expiration: September 2015, Exercise Price: $198.00

|

5,694,744 | |||||

|

Vivendi SA

|

|||||||

| 2,069 |

Expiration: July 2015, Exercise Price: EUR 21.50 (b)

|

46,132 | |||||

|

Vodafone Group plc — ADR

|

|||||||

| 3,030 |

Expiration: July 2015, Exercise Price: $33.00

|

37,875 | |||||

| 13,928,186 | |||||||

|

TOTAL OPTIONS WRITTEN

|

|||||||

|

(Premiums received $161,023,744)

|

$ | 132,315,323 | |||||

|

(a)

|

Security fair valued by the Valuation Group in good faith in accordance with the policies adopted by the Board of Trustees.

|

|

(b)

|

Level 2 Security. Please see Note 2 on the Notes to the Financial Statements.

|

|

Contracts (100 shares per contract)

|

Value

|

||||||

|

CALL OPTIONS WRITTEN

|

|||||||

|

America Movil SAB de C.V. Class L — ADR

|

|||||||

| 35 |

Expiration: August 2015, Exercise Price: $20.00

|

$ | 5,075 | ||||

| 113 |

Expiration: August 2015, Exercise Price: $21.00

|

9,040 | |||||

|

American International Group, Inc.

|

|||||||

| 8 |

Expiration: August 2015, Exercise Price: $55.00

|

5,800 | |||||

| 566 |

Expiration: August 2015, Exercise Price: $57.50

|

285,830 | |||||

|

Anadarko Petroleum Corporation

|

|||||||

| 98 |

Expiration: August 2015, Exercise Price: $82.50

|

14,798 | |||||

| 16 |

Expiration: August 2015, Exercise Price: $85.00

|

1,440 | |||||

| 27 |

Expiration: August 2015, Exercise Price: $90.00

|

918 | |||||

|

AT&T, Inc.

|

|||||||

| 18 |

Expiration: July 2015, Exercise Price: $34.00

|

2,952 | |||||

|

Baxter International, Inc.

|

|||||||

| 85 |

Expiration: August 2015, Exercise Price: $70.00

|

14,025 | |||||

|

Bayer AG

|

|||||||

| 7 |

Expiration: September 2015,

|

||||||

|

Exercise Price: EUR 120.00 (b)

|

8,334 | ||||||

| 24 |

Expiration: September 2015,

|

||||||

|

Exercise Price: EUR 130.00 (b)

|

14,529 | ||||||

|

BP plc — ADR

|

|||||||

| 83 |

Expiration: July 2015, Exercise Price: $40.00

|

6,059 | |||||

| 39 |

Expiration: July 2015, Exercise Price: $42.00

|

429 | |||||

|

CBS Corporation Class B

|

|||||||

| 61 |

Expiration: September 2015, Exercise Price: $55.00

|

17,751 | |||||

| 61 |

Expiration: September 2015, Exercise Price: $57.50

|

10,492 | |||||

|

Charter Communications, Inc. Class A

|

|||||||

| 11 |

Expiration: January 2016, Exercise Price: $210.00

|

1,375 | |||||

|

Cigna Corporation

|

|||||||

| 9 |

Expiration: August 2015, Exercise Price: $155.00

|

12,285 | |||||

| 46 |

Expiration: August 2015, Exercise Price: $160.00

|

46,690 | |||||

|

Citigroup, Inc.

|

|||||||

| 64 |

Expiration: July 2015, Exercise Price: $55.00

|

8,384 | |||||

| 127 |

Expiration: September 2015, Exercise Price: $55.00

|

28,956 | |||||

|

Computer Sciences Corporation

|

|||||||

| 171 |

Expiration: September 2015, Exercise Price: $65.00

|

58,140 | |||||

| 35 |

Expiration: September 2015, Exercise Price: $67.50

|

9,012 | |||||

|

DISH Network Corporation Class A

|

|||||||

| 123 |

Expiration: September 2015, Exercise Price: $67.50

|

47,970 | |||||

| 91 |

Expiration: September 2015, Exercise Price: $70.00

|

25,662 | |||||

|

Contracts (100 shares per contract)

|

Value

|

||||||

|

The Dow Chemical Company

|

|||||||

| 35 |

Expiration: September 2015, Exercise Price: $49.00

|

$ | 12,075 | ||||

| 67 |

Expiration: September 2015, Exercise Price: $50.00

|

18,626 | |||||

| 230 |