Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

| |

| |

(Mark One) | |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2018 |

Or |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from to |

Commission File Number 001-36198

Intercontinental Exchange, Inc.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 46-2286804 |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification Number) |

5660 New Northside Drive, Atlanta, Georgia | 30328 (Zip Code) |

(Address of principal executive offices) | |

(770) 857-4700

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

|

| |

Title of Each Class | Name of Each Exchange on Which Registered |

Common Stock, $0.01 par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| |

Large accelerated filer þ | Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company ¨ |

| Emerging growth company ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No þ

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold as of the last business day of the registrant’s most recently completed second fiscal quarter was $42,085,643,250. As of February 4, 2019, the number of shares of the registrant’s Common Stock outstanding was 568,498,076 shares.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information contained in the registrant’s Proxy Statement for the 2019 Annual Meeting of Stockholders is incorporated herein by reference in Part III of this Annual Report on Form 10-K. The Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year to which this report relates.

Intercontinental Exchange, Inc.

ANNUAL REPORT ON FORM 10-K

For the Fiscal Year Ended December 31, 2018

TABLE OF CONTENTS

|

| | |

| | |

Item Number | | Page Number |

| PART I | |

1. | | |

1(A). | | |

1(B). | | |

2. | | |

3. | | |

4. | | |

| | |

| PART II | |

5. | | |

6. | | |

7. | | |

7(A). | | |

8. | | |

9. | | |

9(A). | | |

9(B). | | |

| | |

| PART III | |

10. | | |

11. | | |

12. | | |

13. | | |

14. | | |

| | |

| PART IV | |

15. | | |

16. | | |

| |

| |

PART I

In this Annual Report on Form 10-K, or Annual Report, and unless otherwise indicated, the terms “Intercontinental Exchange,” “ICE,” “we,” “us,” “our,” “our company,” and “our business” refer to Intercontinental Exchange, Inc. together with its consolidated subsidiaries. References to “ICE products” mean products listed on one or more of our markets.

The following discussion should be read in conjunction with our consolidated financial statements and related notes included elsewhere in this Annual Report. Due to rounding, figures in tables may not sum exactly. All references to “options” or “options contracts” in the context of our futures products refer to options on futures contracts.

Forward-Looking Statements

This Annual Report, including the sections entitled “Business,” “Legal Proceedings,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein that are not statements of historical fact may be forward-looking statements. Any forward looking statements are based on our present beliefs and assumptions as well as the information currently available to us. Forward-looking statements may be introduced by or contain terminology such as “may,” “will,” “should,” “could,” “would,” “targets,” “goal,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” or the antonyms of these terms or other comparable terminology.

Forward-looking statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our results, levels of activity, performance, cash flows, financial position or achievements to differ materially from those expressed or implied by these statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, cash flows, financial position or achievements. Accordingly, we caution you not to place undue reliance on any forward-looking statements we may make.

Factors that may affect our performance and the accuracy of any forward-looking statements include, but are not limited to, those listed below:

| |

• | conditions in global financial markets and domestic and international economic, political and social conditions; |

| |

• | the impact of the introduction of or any changes in laws, regulations, rules or government policies with respect to financial markets, increased regulatory scrutiny or enforcement actions and our ability to comply with these requirements; |

| |

• | volatility in commodity prices, equity prices, and price volatility of financial benchmarks and instruments such as interest rates, credit spreads, equity indices and foreign exchange rates; |

| |

• | the business environment in which we operate and trends in our industry, including trading volumes, clearing, data services, fees, changing regulations, competition and consolidation; |

| |

• | our ability to minimize the risks associated with operating clearing houses in multiple jurisdictions; |

| |

• | our equity and options exchanges and the exchanges’ compliance with their respective regulatory and oversight responsibilities; |

| |

• | the resilience of our electronic platforms and soundness of our business continuity and disaster recovery plans; |

| |

• | continued high renewal rates of subscription-based data revenues; |

| |

• | our ability to identify and effectively pursue, implement and integrate acquisitions and strategic alliances; and to realize the synergies and benefits of such transactions within the expected time frame; |

| |

• | the performance and reliability of our trading and clearing technologies and those of third-party service providers; |

| |

• | our ability to keep pace with technological developments and to ensure that the technology we utilize is not vulnerable to cybersecurity risks or other disruptive events; |

| |

• | our ability to identify trends and adjust our business to benefit from such trends; |

| |

• | the accuracy of our cost and other financial estimates and our belief that cash flows from operations will be sufficient to service our debt and to fund our operational and capital expenditure needs; |

| |

• | our ability to maintain existing market participants and data customers, and to attract new ones, and to offer additional products and services, leverage our risk management capabilities and enhance our technology in a timely and cost-effective fashion; |

| |

• | our ability to attract and retain key talent; |

| |

• | our ability to protect our intellectual property rights and to operate our business without violating the intellectual property rights of others; |

| |

• | potential adverse results of threatened or pending litigation and regulatory actions and proceedings; and |

| |

• | our ability to realize the expected benefits of our majority investment in Bakkt which could result in additional unanticipated costs and risks. |

These risks and other factors include, among others, those set forth in Item 1(A) under the caption “Risk Factors” and elsewhere in this Annual Report, as well as in other filings we make with the Securities and Exchange Commission, or SEC.

Due to the uncertain nature of these factors, management cannot assess the impact of each factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any of these statements to reflect events or circumstances occurring after the date of this Annual Report. New factors may emerge and it is not possible to predict all factors that may affect our business and prospects.

ITEM 1. BUSINESS

Introduction

We are a leading global operator of regulated exchanges, clearing houses and listings venues, and a provider of data services for commodity, financial, fixed income and equity markets. We operate regulated marketplaces for listing, trading and clearing of a broad array of derivatives contracts and securities across major asset classes, including energy and agricultural commodities, metals, interest rates, equities, exchange traded funds, or ETFs, credit derivatives, bonds and currencies. We also offer comprehensive data services to support the trading, investment, risk management and connectivity needs of customers around the world and across major asset classes.

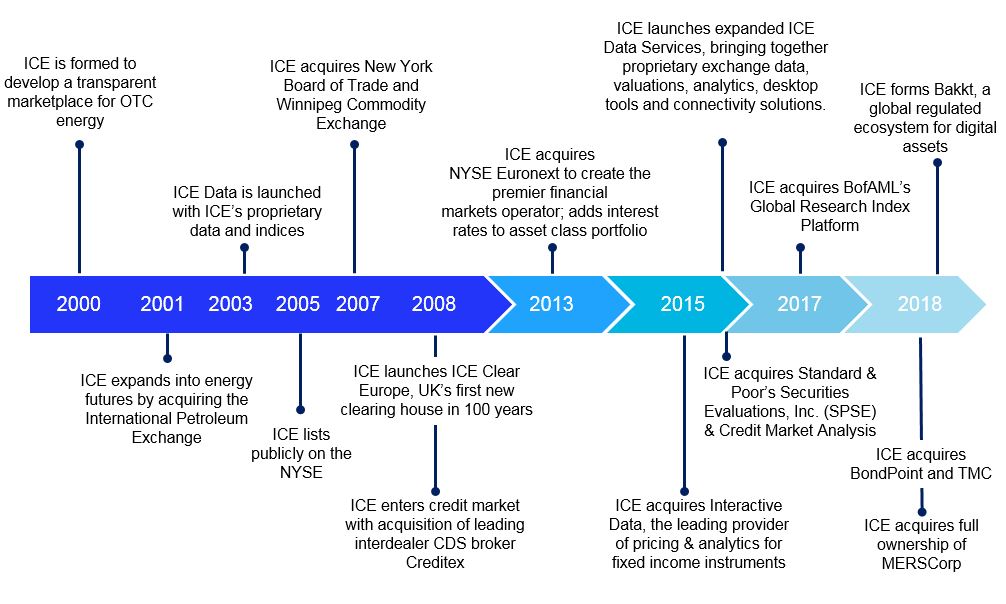

Our History

In 2000, ICE was founded with the idea of transforming the energy markets by creating a marketplace that removed barriers and drove greater transparency and access. By staying close to our customers, we have expanded into new asset classes and services, while retaining a core mission of reducing friction in markets and bringing efficiency to our customers’ workflows.

Today, we are a Fortune 500 company, providing a global community of market participants an array of execution venues, risk management tools, capital-raising capabilities and mission-critical data and analytics. With a leading-edge approach to developing technology, we provide trading infrastructure in major market centers around the world, offering customers the ability to manage risk and make informed decisions in the jurisdictions and asset classes of their choice. By leveraging our core strengths, we will continue to identify new ways to serve our customers and transform global markets.

Our Business Segments

Our business is conducted through two reportable business segments:

| |

• | Trading and Clearing; and |

The majority of our identifiable assets are located in the United States, or U.S. and the United Kingdom, or U.K. For a summary of our revenues, net assets and net property and equipment by geographic region, see Note 18 to our consolidated financial statements included in this Annual Report.

Trading and Clearing Segment

We provide execution and risk management services to businesses, investors and traders across major asset classes, such as commodities, interest rates, credit, foreign exchange, equities and mortgage-related products. We operate multiple trading venues, including 12 regulated exchanges and six clearing houses, which are strategically positioned in major market centers around the world, including the U.S., U.K., European Union, or EU, Canada and Singapore.

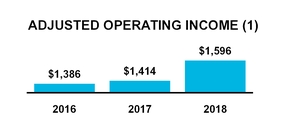

The Trading and Clearing segment accounted for 49% of our consolidated revenues, or $2.4 billion in 2018. Our Trading and Clearing business can experience moderate seasonal fluctuations, although such seasonal impacts have been somewhat negated in periods of high volume trading. Key products offered include:

| |

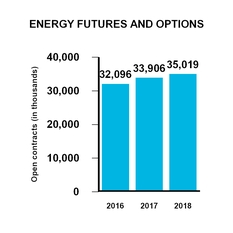

• | Energy Futures and Options: We are a leading marketplace for global crude and refined oil. We offer trading and clearing services across a range of global benchmark contracts, including: Brent, West Texas Intermediate, or WTI, Platts Dubai, Gasoil, Heating Oil, and hundreds of additional grades. The Brent complex, which includes the ICE Brent crude futures contract, our largest contract by volume traded, is a group of related benchmarks used to price a range of traded oil products, including approximately two-thirds of the world’s internationally traded crude oil. The ICE Low Sulphur Gasoil futures contract is a European diesel oil contract that serves as a middle distillate pricing benchmark for refined oil products, particularly in Europe and Asia. We also operate the world’s second largest market for trading in WTI crude oil futures, as measured by the volume of contracts traded. The WTI crude futures contract is the benchmark for pricing U.S. crude oil. |

Our global natural gas complex spans important trading hubs from the U.S. and Canada to Europe and Asia, underpinned by a global offering of more than 600 financially and physically-delivered natural gas contracts. We support liquidity and risk management across markets, from key delivery points in the U.S. to the U.K. NBP and European TTF futures contracts. In Asia, our Japan Korea Marker (JKM) Liquefied Natural Gas, or LNG, futures contract has become the leading LNG benchmark.

In our power markets, we offer a global suite of electric power contracts and are the largest venue for electronic power trading in the world. In addition, we operate the world’s leading market for emissions trading, an important component of risk management for global corporations and energy intensive industries.

| |

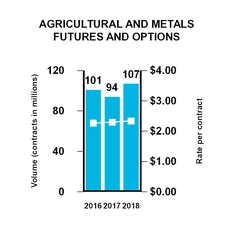

• | Agricultural & Metals Futures and Options: We offer benchmark futures and options contracts on the most globally relevant commodities including: sugar, coffee, cocoa and cotton, as well as key metal contracts such as |

gold, silver and iron ore. Our markets provide global businesses effective price risk management tools to hedge input costs critical to the global flow of goods and services around the world.

| |

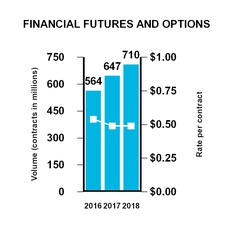

• | Financial Futures and Options: Our global interest rate complex spans geographies, currencies and tenors, providing market participants with effective tools to manage global interest rate risk. We offer the largest marketplace to transact in U.K. and European interest rates, including Short Sterling, Gilts, Sterling Overnight Index Average, or SONIA, and Euribor. In addition, we recently launched one- and three-month contracts on the Secured Overnight Financing Rates, or SOFR, adding to our interest rate complex. Other Financial Futures and Options include a range of contracts on key global equity and FX benchmarks such as the MSCI® World, MSCI® Emerging Markets, MSCI® EAFE, the FTSE® 100 and the U.S. Dollar Index, or USDX®. |

| |

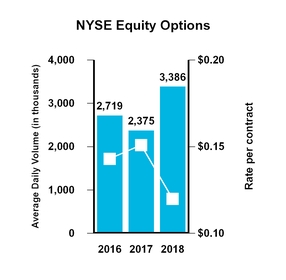

• | Cash Equities and Equity Options: Through the New York Stock Exchange, or the NYSE, we serve a broad range of global capital markets participants, including investors, traders, market makers and global corporations. With a mission to provide the most transparent, efficient and highest quality trading experience to our customers, the NYSE operates five cash equity exchange venues and two options markets, providing customers with unique optionality and choice in how they transact and manage risk. |

| |

• | Fixed Income and Credit: We offer electronic trade execution for credit default swap, or CDS, instruments and are the industry leader in global CDS clearing, as measured by gross notional cleared. Our fixed income execution businesses offer deep liquidity pools across multiple trading protocols, such as click-to-trade, auctions and request for quote, or RFQ, providing our customers choice in how they manage fixed income risk. Through ICE Mortgage Services, we operate the Mortgage Electronic Registration Systems, or MERS, a national electronic database that tracks changes in mortgage servicing and beneficial ownership interests in U.S. residential loans. |

| |

• | OTC and Other Transactions: Our over-the-counter, or OTC, energy markets comprise bilaterally-traded energy contracts. We operate our financially-settled bilateral energy markets through ICE Swap Trade and we offer electronic trading of contracts based on physically-settled natural gas, power and refined oil contracts through ICE U.S. OTC Commodity Markets. |

| |

• | Other Revenue: Other revenues primarily include interest income on certain clearing margin deposits, regulatory penalties and fines, fees for use of our facilities, regulatory fees charged to member organizations of our U.S. securities exchanges, designated market maker service fees, exchange membership fees and agricultural grading and certification fees. |

We operate six clearing houses, each of which acts as a central counterparty that, for its clearing members, becomes the buyer to every seller and the seller to every buyer. Through this central counterparty function, our clearing houses provide financial security for each transaction for the duration of the position by limiting counterparty credit risk. Our clearing houses are responsible for providing clearing services to each of our futures exchanges and certain of our clearing houses clear contracts traded outside of our execution venues.

Mechanisms have been created, called guaranty funds, to provide partial protection in the event of a clearing member default. With the exception of ICE NGX Canada Inc., or ICE NGX, each of the ICE Clearing Houses requires that each clearing member make deposits into a guaranty fund maintained by the relevant ICE Clearing House. In addition, we have contributed $320 million of our own cash to the guaranty funds as set forth below, and such amounts are at risk and could be used in the event of a clearing member default. Our contributions to each clearing house as of December 31, 2018 are listed below and our clearing houses are referred to herein collectively as “the ICE Clearing Houses”:

|

| | | | |

Clearing House | Products Cleared | Exchange where Executed | Location | ICE's Contribution to the Guaranty Fund |

ICE Clear Europe | Energy, agricultural, interest rates and equity index futures and options contracts and OTC European CDS instruments | ICE Futures Europe, ICE Futures U.S. and ICE Endex | U.K. | $206 million |

ICE Clear U.S. | Agricultural, metals, FX and equity index futures and options contracts | ICE Futures U.S. | U.S. | $61 million |

|

| | | | |

ICE Clear Credit | North American, European, Asian-Pacific and Emerging Market CDS instruments | Creditex and third-party venues | U.S. | $50 million |

ICE Clear Netherlands | Approved to offer clearing for Dutch equity options through ICE Endex | ICE Endex | EU | $2 million |

ICE Clear Singapore | Energy, metals and financial futures products | ICE Futures Singapore | Singapore | $1 million |

ICE NGX | Physical North American natural gas, electricity and oil futures | ICE NGX | Canada | — |

On January 31, 2019, we increased our contribution to ICE Clear Europe’s guaranty fund by $27 million due to changes in the size of its futures and options guaranty fund which included an increase to our exchange contribution to reflect an increase in the size of the average guaranty fund contributions.

ICE NGX maintains a guaranty fund utilizing a $100 million letter of credit with a major Canadian bank and backed by a default insurance policy. In the event of a participant default where a participant’s collateral becomes depleted, the remaining shortfall would be covered by a draw down on the letter of credit, following which ICE NGX would pay the first $15 million in losses per its deductible and recover additional losses under the insurance policy up to $100 million.

We previously operated ICE Clear Canada for the clearing and settlement of our canola contracts. On July 30, 2018, we transitioned the clearing of those contracts to ICE Clear U.S., after which ICE Clear Canada ceased operations.

Data and Listings Segment

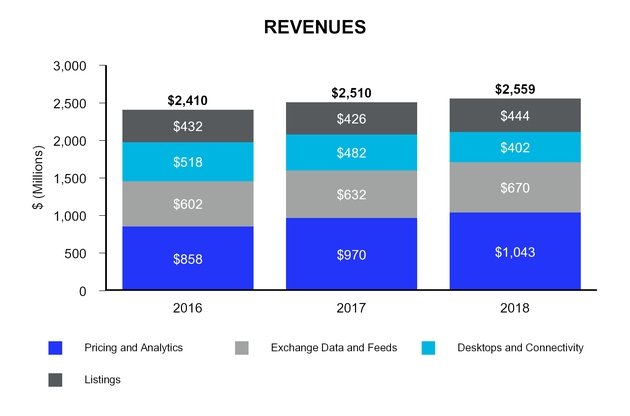

We provide a range of data and listing services for global financial and commodity markets, including pricing and reference data, exchange data, analytics, feeds, index services, desktops and connectivity solutions as well as corporate and ETF listing services on our cash equity exchanges. Our Data and Listings segment generated revenues of $2.6 billion in 2018 and accounted for 51% of our consolidated revenues. Revenues in our Data and Listings segment are largely subscription-based and recurring in nature and generally not impacted by seasonality.

| |

• | Pricing and Analytics: We provide global securities evaluations, reference data, market indices, risk analytics, derivative pricing and other information designed to meet our customers’ portfolio management, trading, risk management, reporting valuation and regulatory compliance needs. |

We provide fixed income valuations, including independent evaluated pricing services, on nearly 2.7 million fixed income securities and other hard-to-value financial instruments each day. These instruments span approximately 145 countries and cover a wide range of financial instruments including sovereign, corporate and municipal bonds, mortgage and asset-backed securities and leveraged loans.

Our reference data complements our evaluated pricing services by offering our clients a broad range of descriptive information, covering nearly 13 million financial instruments across over 210 markets. This data is used by clients to inform risk management, support regulatory and compliance needs, create indices and improve operational efficiency.

We also offer a range of multi-asset class analytics including valuation services for OTC derivatives and structured products, best execution services, ICE Liquidity Indicators™ and fixed income and equity portfolio analytics to help analyze risk and return exposures. These offerings, including our pricing and reference data, are delivered over our secure technology platforms and are used by investment professionals to simulate various market environments to help forecast performance, construct portfolios, validate investment strategies, conduct stress testing, generate dynamic risk measures, analyze asset cash flows and support regulatory compliance requirements.

We also design and distribute many of today’s leading indices and benchmarks across fixed income, equity, commodity and currency markets. Our ICE Bank of America Merrill Lynch, or ICE BofAML, indices are the second largest fixed income index family in the market, serving as the performance benchmarks for nearly $1 trillion of fund assets. Our index calculation agent services provide clients with independent and objective operational outsourcing, including design, support, maintenance, calculation and distribution of third-party indices. Our ETF valuations service provides clients with intraday calculations of indicative net asset values, or iNAVs.

ICE Benchmark Administration, or IBA, is the regulated administrator of a range of benchmarks including the London Interbank Offered Rate, or LIBOR, the ICE Swap Rate, the London Bullion Market, or LBMA Gold and Silver Price and the ISDA Standard Initial Margin Model, or SIMM, Crowdsourcing Utility. IBA has implemented processes, governance, systems and technology that enhance the transparency and security of these benchmarks and services, which are relied upon, globally.

| |

• | Exchange Data and Feeds: We provide real-time, historical, and derived pricing data, order book and transaction information related to our trading venues, which span global commodity and financial markets. We publish a broad range of prices and other transaction data and related content from our electronic futures trading platform, as well as data from a broad array of third-party trading venues and news feeds through our ICE Consolidated Feed offering. In addition, we develop equity market data solutions, known as proprietary data. We package this exchange proprietary market data as real-time products and as historical products, which are used for analysis by market participants and observers. Finally, we receive a share of revenue from the National Market System Plan, or NMS Plan, consolidated data products. Under the NMS Plan, all SEC-registered securities exchanges send their trades and top-of-book quotes in exchange listed securities to a central consolidator, which then distributes the data pursuant to SEC requirements. |

| |

• | Desktops and Connectivity: Our Desktop and Connectivity services provide the connection to our exchanges, clearing houses and data centers. These services also facilitate the global distribution of our ICE Data Services data. We offer connectivity solutions to access markets and data through highly secure, resilient and low latency network options through our ICE Global Network, as well as global colocation services and Direct Market Access to over 150 venues. Our ICE Global Network wireless service offers one of the most extensive ultra-low latency network connectivity solutions among the New York, Chicago, Toronto and Tokyo metro areas. Our Desktop service offers a range of products and services to support commodity and energy traders, risk managers, financial advisors, wealth managers, retail traders, Investor Relations Officers and Chief Financial Officers. These applications deliver real-time financial market information and decision-support tools to help clients analyze financial markets and make investment decisions. Our robust instant messaging, or IM, system protects the privacy of clients’ business information while allowing collaboration with other market participants in the industry through a secure, compliant channel. |

| |

• | Listings: Through our listings services, we offer corporate and ETF issuers access to the U.S. capital markets. Our listing venues allow companies to list domestic and international equity securities, corporate structured products, convertible bonds, trackers and debt securities. In 2018, the NYSE was the global leader in capital raised for the eighth consecutive year, with approximately $125 billion raised in total initial public offering, or IPO, proceeds and follow-on offerings from over 350 transactions, almost 1.5x the capital raised by any other exchange in the world. |

Product and Services Development

We leverage our customer relationships, global distribution, technology infrastructure and software development capabilities to diversify our products and services. We are continually developing, evaluating and testing new products for introduction into our markets to better serve our client base. The majority of our product development relates to evaluating new contracts or new markets based on customer demand. New contracts often must be reviewed and approved by relevant regulators. Outside of third-party licensing costs, we typically do not incur separate, material costs for the development of new products - such costs are embedded in our normal costs of operations.

While we primarily develop our products and services internally, we also periodically evaluate and enter into strategic partnerships and licensing arrangements to develop new products and services. We intend to continue to invest to expand our trading, clearing, data and listings offerings to serve the evolving needs of our global customer base.

Technology

Technology is a key component of our business strategy and competitive position and we regard effective execution of our technology initiatives as crucial to our sustainable business operations, market competitiveness, compliance and risk management and overall success. Our technology solutions support the entire risk management workflow: trading and clearing technology, multi-asset class analytics, risk assessment tools, robust data offerings, instant messaging capabilities and flexible connectivity and delivery solutions. Where feasible, we design and build our own systems and write our own software programs since we believe that having control over our technology allows us to be more responsive to our customers’ needs, better support the dynamic nature of our business, provide the highest quality markets and deliver relevant, timely and actionable data to the markets and customers we serve.

| |

• | ICE Trading Platform and Technology: The ICE trading platform supports trading in our cleared futures and options markets as well as our bilateral OTC markets. We also offer voice brokers a facility for submitting block trades for products that are eligible for clearing. Speed, reliability, resilience, capacity and security are critical performance criteria for electronic trading platforms. Connectivity to our trading platform for our markets is available through our web-based front-end, as well as multiple independent software vendors, or ISVs, and application programming interfaces, or APIs. |

| |

• | Clearing Technology: A broad range of trade management and clearing services are offered through the integrated technology infrastructure that serves our clearing houses. The ICE clearing systems encompass a number of integrated systems, including post-trade position management, risk management, settlement and treasury and reporting functions. A core component of our derivatives clearing houses is the risk management of clearing firm members. Our extensive technology and rules-based risk systems provide analytical tools that allow us to determine margin, evaluate credit risk and monitor trading activities as well as the overall risk of the clearing members. |

| |

• | NYSE Trading Platforms and Related Technology: The NYSE electronic trading platform features an open system architecture that allows users to access our system via one of the many front-end trading applications developed by ISVs. For equity options, we offer a hybrid model of electronic and open outcry trading through NYSE American Options and NYSE Arca Options. We have developed an integrated trading platform and matching engine known as NYSE Pillar and have migrated NYSE Arca Equities, NYSE American, NYSE National, and NYSE Tapes B and C to this platform. We also plan to complete the migration for our remaining U.S. cash equities and equity options markets in 2019, which currently operate on distinct platforms. This integrated platform with single specification will improve performance and reduce the complexity of operating multiple equity and options trading systems. |

| |

• | ICE Data Services Technology: ICE Data Services technology uses integrated platforms to capture, store and process information, perform analytics and maintain connectivity solutions using a single configurable data capture mechanism and a flexible delivery capability. Together, the platforms enable real-time processing and delivery of information, accelerate new product development and improve production reliability. Our data and analytics are delivered via real-time messaging, files, web services and other on-demand facilities and state-of-the-art front-ends. In addition, the technology underpinning our ICE Global Network supports scalable bandwidth and a wide variety of connectivity options including fiber, wireless, colocation and hosting. |

| |

• | Cybersecurity: Cybersecurity is critical to our operations. We employ a layered defense strategy, with leading-edge security technology and processes including robust network segmentation and access control, multi-factor authentication, advanced anti-malware detection/response endpoint software, tightly-controlled Internet access, distributed denial-of-service, or DDoS, mitigation services and significant commercial and bespoke anti-phishing and behavioral detection controls. Where our services are accessible via the Internet, we have implemented additional restrictions to limit access to specific approved networks. We monitor physical threats in addition to cyber threats and continuously review and update physical security and environmental controls to secure our office and data center locations. We also maintain cybersecurity incident response procedures that allow us to detect, alert, classify, escalate and report a cybersecurity security incident. We operate a strategy that focuses heavily on attack simulation and rapid control improvement. Further, we work closely with our peers, customers, and vendors to solve cybersecurity challenges in our industry. |

| |

• | Business Continuity Planning and Disaster Recovery: We maintain comprehensive business continuity and disaster recovery plans and facilities to provide nearly continuous availability of our markets and other services in the event of a business disruption or disaster. We maintain incident and crisis management plans that address responses to disruptive events at any of our locations worldwide. |

Intellectual Property

We rely on a wide range of intellectual property, both owned and licensed, in connection with the operation of our various businesses. We own the rights to a large number of trademarks, service marks, domain names and trade names in the U.S., Europe and in other parts of the world. We have registered many of our trademarks in the U.S. and in certain other countries. We hold the rights to a number of patents and have made a number of patent applications in the U.S. and other countries. We also own the copyright to a variety of material. Those copyrights, some of which are registered, include software code, printed and online publications, websites, advertisements, educational material, graphic presentations and other literature, both textual and electronic. We attempt to protect our intellectual property rights by relying on trademarks, patents, copyrights, database rights, trade secrets, restrictions on disclosure and other methods.

This Annual Report also includes references to third-party trademarks, trade names and service marks. Except as otherwise expressly noted, our use or display of any such trademarks, trade names or service marks is not an endorsement or sponsorship and does not indicate any relationship between us and the parties who own such marks and names.

Russell® and the Russell indexes are trademarks and service marks of the Russell Investment Group and are used under license. FTSE® and the FTSE indexes are trademarks and service marks of the London Stock Exchange plc and Financial Times Limited and are used under license. MSCI® and the MSCI indexes are trademarks and service marks of MSCI Inc. or its affiliates and are used under license.

Employees

As of December 31, 2018, we had a total of 5,161 employees with 1,587 employees in New York, 938 employees in Atlanta, 736 employees in the U.K. and a total of 1,900 employees across our other offices around the world. Of our total employee base, less than 1% is subject to collective bargaining agreements, and such relations are considered to be good.

Our Competitive Strengths

We believe we compete on the basis of a number of factors, including:

| |

• | depth and liquidity of markets; |

| |

• | reliability and speed of trade execution and processing; |

| |

• | technological capabilities and innovation; |

| |

• | breadth of products and services; |

| |

• | rate and quality of new product developments; |

| |

• | quality and stability of services; |

| |

• | distribution and ease of connectivity; |

| |

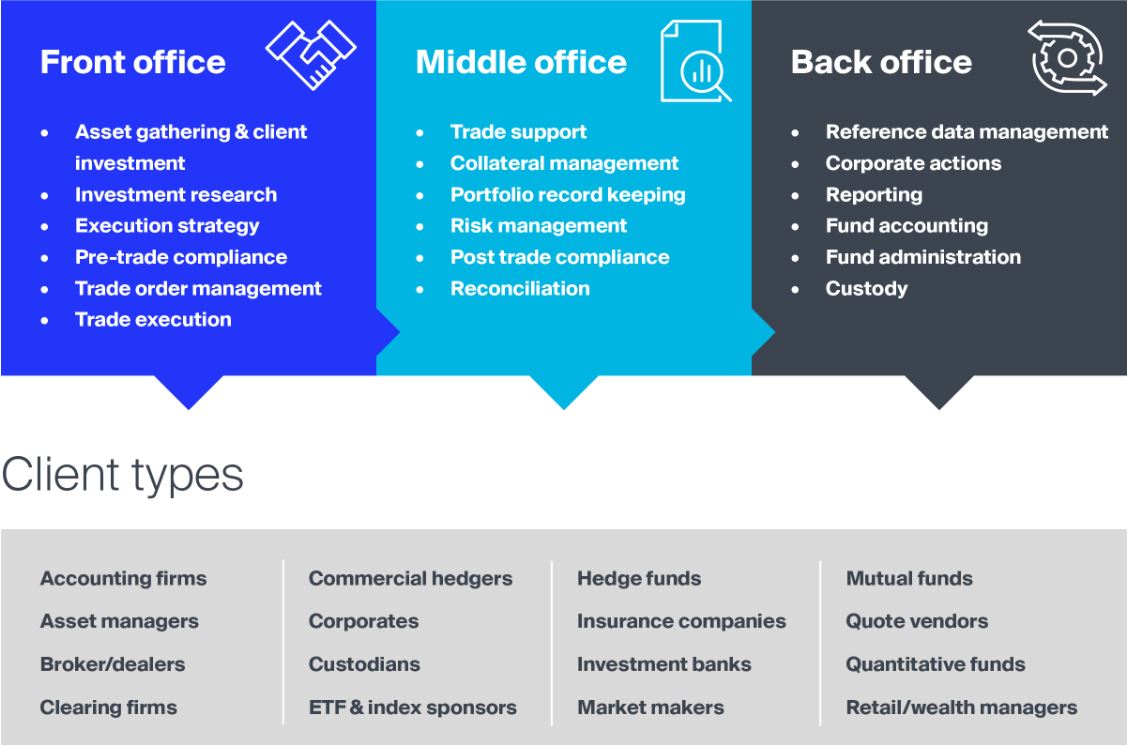

• | mid- and back-office service offerings, including differentiated and value-added services; |

We believe that we compete favorably with respect to these factors, and that our deep, liquid markets, breadth of product offerings, new product development, customer relationships and efficient, secure settlement, clearing and support services distinguish us from our competitors. We believe that to maintain our competitive position, we must continue to develop new and innovative products and services, enhance our technology infrastructure, maintain liquidity and offer competitive pricing.

We believe our key strengths include our:

| |

• | Diverse and Liquid Product Offerings: Many of our futures contracts serve as global benchmarks for managing risk relating to exposure to price movements in the underlying products, including financial, energy and agricultural commodities. For example, we operate the leading market for ICE Brent crude oil futures, as measured by the volume of contracts traded in 2018. The ICE Brent Crude futures contract is the benchmark for pricing light, sweet crude oil produced and consumed outside of the U.S. It is part of the Brent complex, which forms the price reference for approximately two-thirds of the world’s internationally-traded physical oil. In addition, we operate a leading market for short-term European interest rates contracts, with our principal contracts based on implied forward rates on European Money Markets Institute Euribor rates and a short-term Sterling contract based on the ICE LIBOR rate, as well as Gilts and the SONIA contract. We also offer markets in other key commodity and financial benchmarks such as: sugar, cocoa, cotton, coffee, MSCI® World, MSCI® Emerging Markets, MSCI® EAFE, the FTSE® 100 and the USDX®. In our cash equities markets, as evidenced by our leading market share, the NYSE's unique market model and technology delivers low levels of volatility and provides participants with deep liquidity. |

| |

• | Risk Management Expertise: We offer a range of central clearing and related risk management services to promote the liquidity and security of our markets in jurisdictions around the world to meet local regulatory and operational needs in key financial market centers. The credit and performance assurance provided by our clearing houses to clearing members is designed to substantially reduce counterparty risk and is a critical component of our exchanges’ identities as reliable and secure marketplaces for global transactions. Our clearing houses are designed to protect the financial integrity of our markets by maintaining strong governance and rules, managing collateral, facilitating payments and collections, enhancing capital efficiency and limiting counterparty credit risk. |

| |

• | Unique Derived Data Services: Our global data services business consists of unique information derived from our various execution venues and clearing houses, as well as analytics, valuation services, reference data, desktops, indices and connectivity solutions. Our acquisitions, including of the BofAML Indices, SuperDerivatives, Interactive Data, Standard & Poor’s Securities Evaluations, Inc., or SPSE, and Credit Market Analysis have served to expand our data services to better address the rising demand for independent, real-time information, which is being driven by regulation, market fragmentation, technology and data demands, passive investing and indexation. We believe our data services are relevant to our clients’ business operations regardless of market volatility and price levels due to the need for continuous information and analysis. |

| |

• | Global Distribution: We operate multiple trading venues, including 12 regulated exchanges, as well as six clearing houses, which are strategically-positioned in major market centers around the world, including the U.S., U.K., EU, Canada and Singapore. Our ICE Global Network, which is our highly secure, resilient and low latency connectivity offering, provides connectivity to over 150 trading venues and data from over 600 third-party sources, including ICE-operated markets and data services. |

| |

• | Technology: Our proprietary systems are built using state-of-the-art technology and support the entire risk management workflow: trading and clearing technology, multi-asset class analytics, risk management tools, a robust data offering, instant messaging capabilities and flexible connectivity and delivery solutions. We employ a significant number of employees in technology-related activities, including product management, system architecture, software development, network engineering, server maintenance and continuity, information security, system and data performance, systems analysis, quality assurance, database administration and customer technical support. Speed, reliability, resilience, capacity and security are critical performance criteria for electronic trading platforms. Connectivity to our trading platform for our markets is available through our web-based front-end, as well as multiple ISVs and APIs. |

Competitors

The markets in which we operate are global and highly competitive. We face competition in all aspects of our business from a number of different enterprises, both domestic and international, including traditional exchanges, electronic trading platforms, data vendors and voice brokers.

Trading and Clearing Segment

| |

• | In our derivatives markets, we face competition from multiple exchanges in the U.S. and globally. Some of these exchanges are consortiums formed by banks and exchanges. |

| |

• | We face competition from electronic trading systems, third-party clearing houses and technology firms. Additional ventures could form, or have been formed, to provide services that could potentially compete with certain services that we provide. |

| |

• | We compete with voice brokers active in the credit derivatives markets, other electronic trading platforms for derivatives, clearing houses and market data vendors. ICE Swap Trade and Creditex compete with other swap execution facilities, or SEFs, and large inter-dealer brokers in the credit derivatives market. |

| |

• | We face significant competition with respect to equities trading, and this competition is expected to remain intense. Our current and prospective competitors include regulated markets, dark pools and other alternative trading systems, or ATSs, market makers and other execution venues. We also face competition from large brokers and customers that may assume the role of principal and act as counterparty to orders originating from retail customers, or by matching their respective order flows through bilateral trading arrangements, including through internalization of order flow. NYSE Arca and NYSE American Options face considerable competition in the equity options markets; their principal U.S. competitors are the Cboe and Nasdaq. |

| |

• | Our fixed income trading venues, which include ICE Credit Trade, BondPoint, TMC Bonds, LLC, or TMC Bonds, and NYSE Bonds, compete with other electronic trading venues. Our platforms also compete for volume traded bilaterally or trading activity that is not done through an electronic venue. |

Data and Listings Segment

| |

• | ICE Data Services faces intense competition in all aspects of its business. We broadly compete with purchased third-party information and services from large global suppliers of financial market data. Our Exchange Data products compete with similar offerings by other exchange groups, and that competition for order flow among the exchange groups and other alternative trading venues constrains the pricing for our proprietary data products. Our Pricing and Analytics services compete with information obtained from informal industry relationships and sources, such as broker quotes as well as other index and portfolio analytics providers. Our Connectivity business competes with other extranet providers. |

| |

• | Our principal competitor for corporate listings in the U.S. is Nasdaq. For ETF listings, we compete with Nasdaq and Cboe Global Markets. We also face competition for foreign issuer listings from a number of stock exchanges outside the U.S. As other liquidity venues and new entrants seek exchange status, we may face more competition for trading volume and listings. |

Our Growth Strategy

We seek to advance our leadership position in our markets by focusing our efforts on the following key strategies for growth:

| |

• | expand our data offerings and the markets we serve to address the rising demand for information; |

| |

• | enhance our extensive trading, clearing and risk management capabilities; |

| |

• | maintain leadership in our listings businesses; |

| |

• | further develop our technology infrastructure and increase distribution; and |

| |

• | strengthen competitive position through select acquisitions and strategic relationships. |

The record consolidated revenues and futures and options trading volume we achieved in 2018 reflect our focus on the implementation and execution of our long-term growth strategy.

Expand our Data Offerings and the Markets We Serve to Address the Rising Demand for Information

With the growth of our ICE derivatives markets and NYSE equity markets, we have strengthened and enhanced our data services to meet the demand for more data solutions. Our growth has been driven by many factors, such as increased automation, regulation and demand for independent, secure, real-time information. To build on our exchange data and connectivity businesses, we have acquired multiple assets in the past two years, including Interactive Data, SPSE, which we renamed Securities Evaluations, Credit Market Analysis, TMX Atrium and BofAML’s Global Research division’s index business.

These assets are now part of ICE Data Services, supporting our growth strategy by expanding the markets we serve and adding new data, connectivity and valuation services to our platform. This growth allows us to serve the full trade life cycle from pre-trade, through-trading to post-trade activities. By bringing together a wide range of data and analytics as well

as delivery mechanisms through our Desktops and Connectivity business, we offer customers a comprehensive and flexible solution to address the need for more transparency, efficiency and information across their respective workflows.

We will continue to look for strategic opportunities to grow our data offerings and will also continue to pursue opportunities in markets we do not currently serve. Our recent acquisitions and new product and service offerings have allowed us to grow using a balanced approach, which is supported by an increased demand for these types of services including: portfolio management and analytics, exchange data, real time and historical trading data, pricing, reference and valuation data.

Enhance our Extensive Trading, Clearing and Risk Management Capabilities

Our derivatives customer base has grown and diversified as a result of several drivers, including the addition of new markets and products, the move toward increased risk management and counterparty credit management, mark-to-market and margining services as well as regulatory requirements. We continue to add new participants to our markets, which bring additional demand for new products and services. Our markets support price transparency and risk management, particularly in times of volatility and for products where there is less liquidity. In addition, the use of hedging, trading and risk management programs by commercial enterprises continues to rise based on the availability of technology to deliver more products, as well as the security and the capital efficiencies offered by clearing. We develop new products, but have also increased our capabilities through licenses and acquisitions of companies and intellectual property. Further, by acquiring, building and maintaining our own geographically diverse clearing operations, we are able to respond to market demand for central clearing and related risk management services across diverse geographic and regulatory jurisdictions. As new markets evolve, we intend to leverage our domain knowledge to meet additional demand for cleared products and related risk management solutions.

As requirements for regulatory compliance and capital efficiencies grow, the use of clearing, data and related post-trade services, particularly from independent data and benchmark providers also continues to grow. We intend to continue to expand our customer base by leveraging our existing relationships and our global sales and marketing team to promote participation in our markets, and by expanding our range of products and services.

Maintain Leadership in our Listings Businesses

There are over 2,200 total companies listed on the NYSE and NYSE American. We will continue to focus on enhancing our product offerings and services to retain and attract companies of all sizes and industries to our listing venues. In 2018, demand for our listing services continued to be strong in terms of new listings and secondary offerings. A total of 503 new issuers listed on NYSE markets in 2018. NYSE was the global leader in capital raised in 2018 with approximately $125 billion raised in over 350 transactions. The NYSE listed 73 IPOs in 2018, raising total IPO proceeds of approximately $30 billion, including the two largest U.S. IPOs of 2018. The NYSE has listed all of the last 25 U.S. IPOs greater than $1 billion in proceeds. Our listed companies benefit from:

| |

• | a high-tech/ high-touch platform that combines technology and human judgment; |

| |

• | the NYSE's proprietary hybrid trading model including access to Designated Market Makers, or DMMs, Supplemental Liquidity Providers, or SLPs, and NYSE Floor Brokers; |

| |

• | the deepest pools of liquidity; and |

| |

• | lower volatility and tighter spreads, particularly during times of heightened volatility. |

In ETFs, as of December 31, 2018, NYSE Arca’s listed ETFs had approximately $2.7 trillion in assets under management, or AUM, representing nearly 80% of all U.S. listed ETFs. We strive to maintain our leadership position by offering ETF issuers:

| |

• | guidance through the complete listings process, including expert consultations around regulatory and legal items; |

| |

• | over a decade of experience in listing more than 2,900 ETFs across a wide range of asset classes and investment strategies; |

| |

• | a focus on customer service from experienced ETF professionals; |

| |

• | the highest liquidity in ETFs of any exchange and some of the most narrow quoted bid / ask spreads; and |

| |

• | Lead Market Maker, or LMM, and incentive programs. |

Further Develop Our Technology Infrastructure and Increase Distribution

We develop and maintain our own infrastructure, electronic trading platforms, clearing systems and data and analytics platforms to ensure scalability and the delivery of technology that meets our expanding customer base’s demands for price transparency, reliability, risk management and transaction efficiency. We intend to continue to increase ease of access and connectivity with our existing and prospective market participants. We develop and maintain our trading and clearing systems, as well as our data solutions and post-trade systems. We have developed and have begun rolling out a new integrated trading platform and matching engine known as NYSE Pillar that will serve each of our U.S. cash equities and equity options markets to improve performance and reduce the complexity of operating multiple trading systems. We also own and operate two data centers and offer connectivity solutions to global exchanges and content service providers via dedicated data circuits.

Strengthen Competitive Position Through Select Acquisitions and Strategic Relationships

We were an early consolidator in global markets and we intend to continue to explore and pursue acquisitions and other strategic opportunities to strengthen our competitive position globally, broaden our product offerings and services and support the growth of our company while enhancing stockholder value as measured by return on invested capital, earnings and cash flow growth. We may enter into business combinations, make acquisitions or enter into strategic partnerships, joint ventures or other alliances, any of which may be material. In addition to growing our business, we may enter into these transactions for a variety of additional reasons, including leveraging our existing strengths to enter new markets in our industry or related industries, expanding our products and services, diversifying our business, addressing underserved markets, advancing our technology and anticipating or responding to regulatory change or potential changes in our industry or other industries.

Some of our recent key strategic transactions include:

| |

• | MERS: On October 3, 2018, we completed the purchase of all remaining interests and accordingly, own 100% of MERS. On that date, we gained control of MERS and began to include MERS's results as part of our consolidated operations. MERS is now part of ICE Mortgage Services. |

| |

• | TMC Bonds: In July 2018, we acquired TMC Bonds. TMC Bonds is an electronic fixed income marketplace, supporting anonymous trading across multiple trading protocols in various asset classes, including municipals, corporates, treasuries, agencies and certificates of deposit. |

| |

• | Chicago Stock Exchange: In July 2018, we acquired CHX Holdings, Inc., the parent company of the Chicago Stock Exchange, or CHX, a full-service stock exchange, including trading, data and corporate listings services. CHX operates as a registered national securities exchange. |

| |

• | BondPoint: In January 2018, we acquired 100% of BondPoint from Virtu Financial, Inc. BondPoint is a leading provider of electronic fixed income trading solutions for the buy-side and sell-side offering access to centralized liquidity and automated trade execution services through its ATS. |

| |

• | Euroclear: In October 2017, we acquired a 4.7% stake in Euroclear. In February 2018, we acquired an additional 5.1% stake in Euroclear. Euroclear is a leading provider of post-trade services, including settlement, central securities depositories and related services for cross-border transactions across asset classes. |

Our Customer Base

No single customer accounted for more than 10% of total consolidated revenues during 2018, 2017 or 2016.

Executive Officers of the Registrant

Information relating to our executive officers is included under “Executive Officers” in Part III, Item 10, “Directors, Executive Officers and Corporate Governance” of this Annual Report.

Regulation

Our markets are primarily subject to the jurisdiction of regulatory agencies in the U.S., U.K., EU, Canada and Singapore. Failure to satisfy regulatory requirements can or may give rise to sanctions by the applicable regulator. See the discussion below and Item 1(A) "-Risk Factors" in this Annual Report for additional descriptions of regulatory and legislative risks and uncertainties.

Regulation of our Derivatives Business

Our regulated derivatives markets and clearing houses are based primarily in the U.S., U.K., EU, Canada and Singapore.

| |

• | Our U.S. futures exchange, ICE Futures U.S., is subject to extensive regulation by the Commodity Futures Trading Commission, or CFTC, under the Commodity Exchange Act, or CEA. The CEA generally requires that futures trading in the U.S. be conducted on a commodity exchange registered as a Designated Contract Market, or DCM. As a registered DCM, ICE Futures U.S. is a self-regulatory organization, or SRO, that has implemented rules and procedures to comply with the core principles applicable to it under the CEA. |

| |

• | In the U.K., ICE Futures Europe is a Recognized Investment Exchange, or RIE, in accordance with the Financial Services and Markets Act 2000, or FSMA. Like U.S. regulated derivatives markets, RIEs are SROs with surveillance and compliance responsibilities. |

| |

• | In the EU, ICE Endex is a regulated market in the Netherlands and its derivative markets are licensed under the Dutch Financial Services Act and supervised by the Dutch National Bank, or DNB, and the Netherlands Authority for the Financial Markets, or AFM. |

| |

• | In Singapore, ICE Futures Singapore is an approved exchange and is supervised by the Monetary Authority of Singapore, or MAS. |

| |

• | ICE Clear Credit, ICE Clear U.S. and ICE NGX are regulated by the CFTC as Derivatives Clearing Organizations, or DCOs. DCOs are subject to extensive regulation by the CFTC under the CEA. The Financial Stability Oversight Council, or FSOC, has designated ICE Clear Credit as a systemically important financial market utility under Title VIII of the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act. As such, ICE Clear Credit has access to the Federal Reserve System and holds deposits of $19.5 billion of its U.S. dollar cash in its cash accounts at the Federal Reserve as of December 31, 2018. |

| |

• | ICE Clear Europe, which is primarily regulated in the U.K. by the Bank of England, or BOE, as a Recognized Clearing House, or RCH, is also subject to regulation by the CFTC as a DCO. Both ICE Clear Credit and ICE Clear Europe are also regulated by the SEC as clearing agencies because they clear security-based swaps. |

| |

• | In the EU, ICE Clear Netherlands is an authorized central counterparty and is regulated by the DNB and AFM. |

| |

• | In Singapore, ICE Clear Singapore is an approved clearing house supervised by the MAS. |

Regulation of our Securities Business

| |

• | In our cash equities and options markets, NYSE, NYSE Arca, NYSE American, NYSE National and CHX are national securities exchanges and, as such, are SROs and subject to oversight by the SEC. Accordingly, our U.S. securities exchanges are regulated by the SEC and, in turn, are the regulators of their members. As national securities exchanges, NYSE, NYSE Arca, NYSE American, NYSE National and CHX must comply with, and enforce compliance by their members with, the Securities Exchange Act of 1934, or the Exchange Act. |

| |

• | Our U.S.-based execution oriented fixed income markets are operated by our two SEC-registered broker-dealers, Creditex Securities Corporation, which operates two SEC registered alternative trading systems, ICE BondPoint and ICE Credit Trade, and TMC Bonds, which operates the TMC Bonds alternative trading system. Both Creditex Securities Corporation and TMC Bonds are subject to oversight by the SEC and are members of the Financial Industry Regulatory Authority, or FINRA, and are registered with the Municipal Securities Rulemaking Board, self-regulatory organizations that regulate broker-dealers in the U.S. |

| |

• | Our U.K.-based execution-oriented fixed income market is operated by Creditex Brokerage, L.L.P., which is an operator of a multilateral trading facility, or MTF, and ICE Markets Limited, which acts as the matched principal counterparty to transactions arranged on the MTF operated by Creditex Brokerage. Both Creditex Brokerage and ICE Markets Limited are regulated by the U.K.’s Financial Conduct Authority, or FCA. |

Regulation of our Data Business

We have U.S. subsidiaries that are registered with the SEC under the Investment Advisers Act of 1940, or the Investment Advisers Act, for their evaluated pricing services. The Investment Advisers Act imposes numerous regulatory obligations on registered investment advisers, including those relating to the management and distribution of products and services, record-keeping, compliance oversight, operational and marketing requirements, disclosure obligations and prohibitions on fraudulent activities. Investment advisers also are subject to certain state securities laws and regulations. ICE Data Services (Australia) Pty. Ltd. provides financial services in Australia and is licensed by the Australian Securities and Investment Commission, or ASIC. ICE Data Desktop Solutions (Europe) Limited provides certain financial services throughout Europe and is regulated by the FCA. ICE Data Indices, LLC applies the IOSCO Principles for Financial Benchmarks to its indices, and as a third country Benchmark Administrator in Europe, it is subject to the requirements of the European Benchmarks Regulation that regulates the provision of benchmarks, contribution of input data to benchmarks, and the use of benchmarks within the Union. See “Regulatory Changes” below for more information.

Regulatory Changes

Domestic and foreign policy makers continue to review their legal frameworks governing financial markets, and periodically change the laws and regulations that apply to our business and to our customers’ businesses. Our key areas of focus on these evolving efforts are:

| |

• | The harmonization of regulations globally. Global regulations are not fully harmonized and several of the regulations under the Markets in Financial Instruments Directive II, or MiFID II, are inconsistent with U.S. rules. In addition, in 2017, the CFTC announced its new agenda calling for regulatory simplification and the reduction of regulatory burdens. The CFTC is looking to restructure its rules by moving back to a more principles-based approach. As a result, there is potential for further divergence between MiFID II and U.S. rules if the U.S. makes changes to financial regulations while the EU finalizes its implementation of MiFID II. |

| |

• | The proposed revisions to the regulatory structure of non-EU clearing houses. In June 2017, the European Commission published a proposal to revise the current regulatory structure for non-EU clearing houses. The nature and extent of the regulation would depend on the “impact” of a non-EU clearing house’s business in the EU. Details on the classification of non-EU clearing will be established by the European Commission, or EC, in cooperation with the European Securities and Markets Authority, or ESMA, and the European System of Central Banks. The proposal is in the process of legislative review by the European Parliament and the EU Member States, and is subject to change. The proposal could have an impact on our non-EU clearing houses and lead to increased regulation to the extent they are doing business in Europe. |

| |

• | Requirement that European exchanges and CCPs offer non-discriminatory access. The non-discriminatory access provisions of MiFID II would require our European exchanges and central counterparty, or CCP, clearing houses to offer access to third parties on commercially reasonable terms. In addition, MiFID II could require our European exchanges and CCPs to allow participants to trade and/or clear at other venues, which may encourage competing venues to offer lookalikes of our products. In June 2016, the EU approved a 12-month postponement of implementation and compliance with this provision of MiFID II to January 3, 2018. On January 3, 2018, ICE Futures Europe and ICE Clear Europe received a deferral from the FCA and the BOE, respectively, which delays the non-discriminatory access provision of MiFID II until July 3, 2020. In addition, on February 28, 2018, the AFM granted ICE Endex and ICE Clear Netherlands a deferral which delays the non-discriminatory access provisions for those entities until July 3, 2020. |

| |

• | Basel III capital charges. The implementation of capital charges in Basel III, particularly, the Supplemental Leverage Ratio with respect to certain clearing members of central counterparties. These new standards may impose burdensome capital requirements on our clearing members and customers that may disincentivize clearing. The Federal Reserve Board and Office of the Comptroller of the Currency have proposed rule changes to the leverage ratio requirements, but these regulations still may have an impact on our clearing members. |

| |

• | The review of prudential requirements for European investment firms. In December 2018 the EC published a proposal on the review of the prudential framework for investment firms, which aims to introduce more proportionate and risk-sensitive rules for investment firms. The proposal is currently in the process of legislative review by the European Parliament and the EU Member States, and is subject to change. In its current form, the proposal imposes disproportionate capital requirements on proprietary trading firms which could encourage them to withdraw from the role of providing liquidity to our markets. The proposal also includes changes to the Markets in Financial Instruments Regulation, or MiFIR, third country framework, which could have a negative impact on the ability of third country firms to access our markets in Europe. |

| |

• | Position limits. The adoption and implementation of position limit rules in the U.S. and the EU could have an impact on our commodities business if comparable trading venues in foreign jurisdictions are not subject to equivalent rules. Position limits became effective in the EU beginning January 2018 under MiFID II. The FCA has published certain position limits for commodity contracts. In certain cases, the position limits are lower than on U.S. trading venues and in certain cases position limits are higher than U.S. equivalent contracts. The FCA is reviewing the issued position limits. Conversely, in December 2016, the CFTC re-proposed the position limit rules. There is potential for further divergence between MiFID II and U.S. position limit rules if the U.S. makes changes to the financial regulations while the EU does not review MiFID II. |

| |

• | A proposed European financial transaction tax. Although a number of Member States can envisage such a tax, many details remain to be discussed and agreed, including how to assess the tax at a Member State level. Implementation of a financial transaction tax could result in a reduction in volumes and liquidity which would have a negative impact on our European operations, if adopted. |

| |

• | The EU Benchmark Regulation, or BMR. The regulation was adopted in June 2016 and applies from January 2018. Under the BMR, benchmarks provided by a third country benchmark administrator may be used by EU-supervised entities provided that the EC has adopted an equivalence decision or the administrator has been recognized or endorsed and the benchmarks are listed on the register established by ESMA. The BMR provides for a transition period which applies |

from January 1, 2018, when the BMR enters into force, until January 1, 2020. During this period, ICE Data Indices has applied to the U.K.'s FCA for recognition, and benchmarks provided by ICE Data Indices may continue to be used by supervised entities. EU institutions are currently considering whether it would be appropriate to extend the transitional period for critical benchmarks by potentially one or two years. We are monitoring the impact to our business as a result of these discussions.

| |

• | Brexit timing and implications. In March 2017, the U.K. officially triggered Article 50 and notified the EU of its intention of leaving the EU following the U.K.’s June 2016 referendum vote to leave the EU (commonly known as Brexit). The triggering of Article 50 begins the process of withdrawal from the EU, which will last two years unless extended by the unanimous decision of Member States or withdrawn by the U.K. prior to the end of the two-year withdrawal period. In November 2018, the U.K. and the 27 other countries involved in Brexit negotiations, commonly referred to as the EU27, agreed upon the terms of a withdrawal agreement which sets out the terms of the U.K.’s withdrawal from the EU and includes a transitional period until December 31, 2020, during which EU law will continue to apply in and to the U.K. The withdrawal agreement will need to be ratified by the EU and the U.K. before it can enter into force and ratification is uncertain. |

| |

• | Continued access by EU market participants to U.K. CCPs and exchanges. In anticipation of Brexit, in December 2018, the EC adopted an equivalence decision regarding the U.K.’s legal and supervisory arrangements for CCPs. In addition, ESMA indicated its intention to complete the recognition of U.K. CCPs pursuant to the EC equivalence decision in a timely manner. Together, the equivalence decision of the EC and the final recognition decisions of ESMA will permit EU market participants to continue clearing through U.K. CCPs, such as ICE Clear Europe, for 12 months as of March 30, 2019 in the case of a U.K. exit from the EU without a transition period. Separately, following Brexit, ICE Futures Europe will continue to be able to permit access by persons in the EU to trading on its platform, even in the absence of a transition agreement. However, the lack of an equivalence decision and corresponding transition period may result in increased costs for certain EU market participants which could impact trading on ICE Futures Europe. Additionally, ICE Futures Europe will require local permissions or exemptions in certain EU jurisdictions to permit access to persons from the relevant EU jurisdictions in the case of a U.K. exit without a transition period. The impact to our business and corresponding regulatory changes remain uncertain at this time. We are monitoring the impact to our business as a result of these discussions and are pursuing avenues to facilitate continued access for EU customers to our services in the event the U.K. exits the EU without a transition period. |

| |

• | The SEC Transaction Fee Pilot. In December 2018, the SEC adopted a Transaction Fee Pilot. The adoption establishes a pilot program, for at least one-year and up to two-years, that will limit the fees charged and rebates paid by our five securities exchanges in certain securities to be designated by the SEC. The SEC has not yet announced the date that this Transaction Fee Pilot will commence. |

See the discussion below and Item 1(A) “- Risk Factors” in this Annual Report for additional description of regulatory and legislative risks and uncertainties.

Corporate Citizenship

We strive to create long-term value for our stockholders and meet sustainability goals for all of our stakeholders. That includes maintaining high ethical and business standards, giving back in the communities where we live and work and using our unique resources to bring together a network of the world's leading companies to learn from each other and exchange ideas on a broad range of issues, including those related to environmental, social and governance matters.

Much of our approach is driven by the core values that make up our culture. During 2018, we surveyed our employees to further assess how we, as a company, are living up to our core values.

For additional information, please refer to the Corporate Citizenship section of our website at www.theice.com/esg.

Available Information

Our principal executive offices are located at 5660 New Northside Drive, 3rd Floor, Atlanta, Georgia 30328. Our main telephone number is 1-770-857-4700, and our website is www.theice.com.

We are required to file reports and other information with the SEC. A copy of this Annual Report on Form 10-K, as well as any future Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to such reports are available free of charge, on our website as soon as reasonably practicable after we file such reports with, or furnish such reports to, the SEC. A copy of these filings is also available at the SEC’s website (www.sec.gov). The reference to our website address and to the SEC’s website address do not constitute incorporation by reference of the information contained on the website and should not be considered part of this report. From time to time, we may use our website and/or social media, including

Twitter, as distribution channels of material information. The website to access our Twitter account is https://twitter.com/ICE_Markets.

In addition, we have posted on our website the charters for our (i) Audit Committee, (ii) Compensation Committee, (iii) Nominating and Corporate Governance Committee and (iv) Risk Committee, as well as our Global Code of Business Conduct, which includes information regarding our whistleblower hotline information, Board of Directors Governance Principles and Board Communication Policy. We will provide a copy of these documents without charge to stockholders upon request.

ITEM 1(A). RISK FACTORS

The risks and uncertainties described below are those that we currently believe could materially adversely affect us. Other risks and uncertainties that we do not presently consider to be material or of which we are not presently aware may become important factors that affect us in the future. If any of the risks discussed below actually occur, our business, financial condition, operating results or cash flows could be materially adversely affected. Accordingly, you should carefully consider the following risk factors, as well as other information contained in or incorporated by reference in this Annual Report.

Global economic, political and financial market events or conditions may negatively impact our business.

Global economic, political and market conditions may impact our business. Adverse macroeconomic conditions, including recessions, inflation, high unemployment, government shutdowns, currency fluctuations, actual or anticipated large-scale defaults or failures or slowdown of global trade could decrease consumer and corporate confidence and reduce consumer, government and corporate spending. If our customers reduce spending, workforce, trading activity or demand for financial data as a result of challenges in the prevailing economic markets, our revenues could decline.

A significant portion of our revenues are derived from fees for transactions executed and cleared in our markets. We derived 44%, 42% and 43% of our consolidated revenues, less transaction-based expenses, from our net transaction-based revenues in 2018, 2017 and 2016, respectively. In particular, we derive a significant percentage of our net transaction-based revenues from trading in ICE Brent Crude futures and options contracts, North American natural gas futures and options contracts, sugar futures and options contracts, equity transactions and short-term interest rates contracts, including the Euribor and Short Sterling futures and options contracts. The trading volumes in our markets could decline substantially if our market participants reduce their level of trading activity for any reason, including:

| |

• | a reduction in the number of market participants that use our platform; |

| |

• | a reduction in trading demand by customers or a decision to curtail or cease hedging or speculative trading; |

| |

• | regulatory or legislative changes impacting our customers and financial markets; |

| |

• | a prolonged decrease in volatility in the financial markets; |

| |

• | heightened capital requirements or mandated reductions in leverage resulting from new regulation; |

| |

• | transactions effected on any of our markets or cleared through our clearing houses being reclassified as a result of regulatory or legal requirements; |

| |

• | defaults by clearing or exchange members or the inability of participants to pay out contractual obligations; |

| |

• | changes to our contract specifications that are not viewed favorably by our market participants; or |

| |

• | reduced access to or availability of capital required to fund trading activities. |

A reduction in our overall trading volume could render our markets less attractive to market participants as a source of liquidity, which could result in further loss of trading volume and associated transaction-based revenues. A reduction in trading volumes could also result in a corresponding decrease in the demand for our market data, which would further reduce our overall revenue.

Further, NYSE’s revenue increases when more companies are seeking access to public markets and stagnation or a decline in the IPO market could have an adverse effect on our revenues. The number of public companies in the U.S. has decreased significantly over the last 20 years.

A prolonged government shutdown could negatively impact our business. Our regulated exchanges and clearinghouses are required to obtain regulatory approvals from the CFTC and/or SEC in the ordinary course of business and failure or delay to provide these approvals could adversely affect our business and our ability to introduce new products and services.