UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED

OR

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ______ TO ______

COMMISSION FILE NUMBER:

(Exact name of registrant as specified in its charter)

(State or Other Jurisdiction of | (I.R.S. Employer Identification No.) |

|

|

(Registrant’s Telephone Number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

| The |

Securities registered pursuant to section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ | Accelerated filer ☐ |

Smaller reporting company | |

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No

The aggregate market value of the common stock held by non-affiliates of the registrant was $

As of March 25, 2024, the registrant had

Auditor Name: | Auditor Location: | Auditor Firm ID: | 00 |

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS | |||

Item Number and Caption | Page | ||

2 | |||

3 | |||

3 | |||

40 | |||

64 | |||

64 | |||

66 | |||

66 | |||

66 | |||

66 | |||

66 | |||

66 | |||

Management’s Discussion and Analysis of Financial Condition and Results of Operations | 67 | ||

74 | |||

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 75 | ||

75 | |||

77 | |||

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | 77 | ||

77 | |||

77 | |||

83 | |||

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | 89 | ||

Certain Relationships and Related Transactions, and Director Independence | 90 | ||

91 | |||

92 | |||

92 | |||

Item 16. | Form 10-K Summary | ||

96 | |||

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements, including, without limitation, in the sections captioned “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and elsewhere. Any and all statements contained in this report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the development of commercially viable pharmaceuticals, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”), and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events, or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant length of time associated with drug development and related insufficient cash flows and resulting illiquidity, our inability to expand our business, significant government regulation of pharmaceuticals and the healthcare industry, lack of product diversification, volatility in the price of our raw materials, existing or increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this report appears in the section captioned “Risk Factors” and elsewhere in this report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this report to reflect any new information or future events or circumstances or otherwise.

Unless the context otherwise indicates, references in this Annual Report on Form 10-K to the terms “Synaptogenix,” “Neurotrope,” “we,” the “Company,” “our,” and “us” refer to Synaptogenix, Inc.

“Synaptogenix,” and other trade names and trademarks of ours appearing in this Annual Report on Form 10-K are our property. This Annual Report on Form 10-K contains trade names and trademarks of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trade names or trademarks to imply an endorsement or sponsorship of us by such companies, or any relationship with any of these companies.

2

PART I

Item 1.Business.

Explanatory Note

From August 23, 2013 to December 6, 2020, Synaptogenix, Inc. (formerly known as Neurotrope Bioscience, Inc.) (the “Company” or “Synaptogenix”) was a wholly owned subsidiary of Neurotrope, Inc. (“Neurotrope”). Neurotrope’s operations were solely those of Synaptogenix. On May 17, 2020, Neurotrope announced plans for the complete legal and structural separation of Synaptogenix from Neurotrope (the “Spin-Off”). Under the Separation and Distribution Agreement between Neurotrope and Synaptogenix (the “Separation and Distribution Agreement”), Neurotrope distributed all of its equity interest in Synaptogenix to Neurotrope’s stockholders. Following the Spin-Off, Neurotrope does not own any equity interest in Synaptogenix, and Synaptogenix operates independently from Neurotrope. On December 6, 2020, Neurotrope approved the final distribution ratio and holders of record of Neurotrope common stock, Neurotrope preferred stock and certain warrants as of November 30, 2020 received a pro rata distribution of all the equity interest in Synaptogenix. For more information about the Spin-Off, see “Management’s Discussion and Analysis of Financial Condition and Result of Operation – Overview – Spin Off from Neurotrope, Inc.” When used in this report, the terms “we,” the “Company,” “our,” and “us” refers to Synaptogenix, Inc.

Introduction

We are a biopharmaceutical company with product candidates in pre-clinical and clinical development. We are principally focused on developing a product platform based upon a drug candidate called Bryostatin-1, which is synthesized from a natural product (bryostatin) that is isolated from a marine invertebrate organism, for the treatment of Alzheimer’s disease (“AD”), which is in the clinical testing stage. We are also evaluating potential therapeutic applications of bryostatin for other neurodegenerative or cognitive diseases and dysfunctions, such as Fragile X syndrome, Multiple Sclerosis (“MS”), and Niemann-Pick Type C disease, which have undergone pre-clinical testing. We are also pursuing strategic relationships with entities possessing technologies that supplement our existing technology. We are party to a technology license and services agreement with the original Blanchette Rockefeller Neurosciences Institute (which has been known as Cognitive Research Enterprises, Inc. (“CRE”) since October 2016), and its affiliate NRV II, LLC, which we collectively refer to herein as “CRE,” pursuant to which we now have an exclusive non-transferable license to certain patents and technologies required to develop our proposed products.

Synaptogenix was formed for the primary purpose of commercializing the technologies initially developed by CRE for therapeutic applications for AD or other cognitive dysfunctions. These technologies have been under development by CRE since 1999 and, until March 2013, had been financed through funding from a variety of non-investor sources (which include not-for-profit foundations, the National Institutes of Health, which is part of the U.S. Department of Health and Human Services, and individual philanthropists). From March 2013 forward, development of the licensed technology has been funded principally through the Company in collaboration with CRE. Licensing agreements have been entered into with Stanford University for the use of synthetic bryostatin for neurodegenerative disease therapeutics and for the potential use of bryostatin-like compounds, called Bryologs, for certain therapeutic indications. Other platform compounds, originally developed at CRE, that share Protein Kinase C Epsilon (“PKC ε”)-activating properties with bryostatin, are also being evaluated for potential therapeutic applications.

Results of Phase 2 Clinical Trial

On May 1, 2017, Neurotrope reported certain relevant top-line results from our Phase 2 exploratory clinical trial based on a preliminary analysis of a limited portion of the complete data set generated. A comprehensive analysis of the data from the Phase 2 exploratory trial evaluating Bryostatin-1 as a treatment of cognitive deficits in moderate to severe AD were published in the Journal of Alzheimer’s Disease, vol. 67, no. 2, pp. 555-570, 2019. A total of 147 patients were enrolled into the study; 135 patients in the mITT population (as defined below) and 113 in the Completer population (as defined below). This study was the first repeat dose study of Bryostatin-1 in patients with late-stage AD (defined as a MMSE-2 of 4-15), in which two dose levels of Bryostatin-1 were compared with placebo to assess safety and preliminary efficacy (p < 0.1, one-tailed) after 12 weeks of treatment. The pre-specified primary endpoint, the SIB) (used to evaluate cognition in severe dementia), compared each dose of Bryostatin-1 with placebo at week 13 in two sets of patients: (1) the modified intent-to-treat (“mITT”) population, consisting of all patients who received study drug and had at least one efficacy/safety evaluation, and (2) the “Completer” population, consisting of those patients within the mITT population who completed the 13-week dosing protocol and cognitive assessments.

3

These announced top-line results indicated that the 20 µg dose, administered after two weekly 20 µg doses during the first two weeks and every other week thereafter, met the pre-specified primary endpoint in the Completer population, but not in the mITT population. Among the patients who completed the protocol (n = 113), the patients on the 20 µg dose at 13 weeks showed a mean increase on the SIB of 1.5 versus a decrease in the placebo group of -1.1 (net improvement of 2.6, p < 0.07), whereas, in the mITT population, the 20 µg group had a mean increase on the SIB of 1.2 versus a decrease in the placebo group of -0.8 (net improvement of 2.0, p < 0.134). At the pre-specified 5 week secondary endpoint, the Completer patients in the 20 µg group showed a net improvement of 4.0 SIB (p < .016), and the mITT population showed a net improvement of 3.0 (p < .056). Unlike the 20 µg dose, there was no therapeutic signal observed with the 40 µg dose.

The Alzheimer Disease Cooperative Study Activities of Daily Living Inventory Severe Impairment version (the “ADCS-ADL-SIV”) was another pre-specified secondary endpoint. The p values for the comparisons between 20 µg and placebo for the ADCS-ADL endpoint at 13 weeks were 0.082 for the Completers and 0.104 for the mITT population.

Together, these initial results after preliminary analysis of this exploratory trial, provided signals that Bryostatin-1, at the 20 µg dose, caused sustained improvement in important functions that are impaired in patients with moderate to severe AD, i.e., cognition and the ability to care for oneself. Since many of the patients in this study were already taking donepezil and/or memantine, the efficacy of Bryostatin-1 was evaluated in the top line results over and above the standard of care therapeutics.

The safety profile of Bryostatin-1 20 µg was minimally different from the placebo group, except for a higher incidence of diarrhea and infusion reactions (11% versus 2% for diarrhea and 17% versus 6% for infusion reactions). Infusion reactions were minimized with appropriate i.v. line precautions. Fewer adverse events were reported in patients in the 20 µg group, compared to the 40 µg group. Patients dosed with 20 µg had a dropout rate less than or identical to placebo, while patients dosed at 40 µg experienced poorer safety and tolerability, and had a higher dropout rate. Treatment emergent adverse events (“TEAEs”) were mostly mild or moderate in severity. TEAEs, including serious adverse events, were more common in the 40 µg group, as compared to the 20 µg and placebo groups. The mean age of patients in the study was 72 years and similar across all three treatment groups.

Following presentation of the top line results in July 2017 at the Alzheimer’s Association International Conference in London, a much more extensive analysis of a complete set of the Phase 2 trial data was conducted.

On January 5, 2018, Neurotrope announced that a pre-specified exploratory analysis of the comprehensive data set from our recent Phase 2 trial in patients with advanced AD found evidence of sustained improvement in cognition in patients receiving the 20 µg Bryostatin-1 regimen. As specified in the Statistical Analysis Plan (“SAP”), analysis of patients who did not receive memantine, an approved AD treatment, as baseline therapy showed greater SIB improvement. These findings suggested that this investigational drug could potentially treat Alzheimer’s disease itself and help reduce and/or reverse the progression of AD, in addition to alleviating its symptoms.

Comprehensive follow-on analyses found that patients in the 20 µg treatment arm showed a sustained improvement in cognition over baseline compared to the placebo group at an exploratory endpoint week 15 (30 days after last dose at week 11). These data were observed in the study population as a whole, as well as in the Completers study group.

This follow-on analysis of the data evaluated SIB scores of patients at 15 weeks, 30 days after all dosing had been completed — a pre-specified exploratory endpoint. For the 20 µg group, patients in the mITT population (n=34) showed an overall improvement compared to controls (n=33) of 3.59 (p=0.0503) and in the Completers population (n=34) showed an overall improvement compared to controls (n=33) of 4.09 (p=0.0293). In summary, patients on the 20 µg dose showed a persistent SIB improvement 30 days after all dosing had been completed. These p-values and those below are one-tailed.

Additional analyses compared 20 µg dose patients who were on baseline therapy of Aricept versus patients off Aricept. No significant differences were observed. Another analysis compared the 20 µg dose patients who were on or off baseline therapy of memantine. The secondary analysis comparing SIB scores in non-memantine versus memantine patients found the following:

| ● | At week 15, non-memantine patients in the mITT group treated with 20 µg (n=14) showed an SIB improvement score of 5.88, while the placebo patients (n=11) showed a decline in their SIB scores of -0.05 for an overall treatment of 5.93 from baseline (p=0.0576). |

4

| ● | At week 15, non-memantine patients in the Completers group treated with 20 µg (n=14) showed an SIB improvement of 6.24, while the placebo patients (n=11) showed a decline in their SIB scores of -0.12 for an overall treatment of 6.36 from baseline (p=0.0488). |

| ● | Patients taking memantine as background therapy in the 20 µg (n=20) and control (n=22) groups showed no improvement in SIB scores. |

Memantine, an N-methyl-D-aspartate (“NMDA”) receptor antagonist, is marketed under the brand names Namenda®, Namenda® XR, and Namzaric® (a combination of memantine and donepezil) for the treatment of dementia in patients with moderate-to-severe AD. It has been shown to delay cognitive decline and help reduce disease symptoms.

Further follow-on analyses used trend analyses (testing the dependence of treatment effect on repeated doses).

In the trend analyses, we found that the SIB values did not increase over time for the placebo patients resulting in slopes that were non-significantly different from zero (e.g. “zero-slopes”). In contrast, the SIB slopes for the 20 µg Bryostatin-1 patients who did not receive baseline memantine were found to be statistically significant (p<.001), giving a slope (95% CI) = 0.38 (0.18, 0.57) SIB points per week in the random intercept model, and a slope (95% CI) = 0.38 (0.18, 0.59) points per week in the random intercept and slope model. These results provided evidence that SIB improvement (drug benefit) increased as the number of successive Bryostatin-1 doses increased for the 20 µg patient cohort.

Confirmatory Phase 2 Clinical Trial

On May 4, 2018, Neurotrope announced a confirmatory, 100 patient, double-blinded clinical trial for the safe, effective 20 µg dose protocol for advanced AD patients not taking memantine as background therapy to evaluate improvements in SIB scores with an increased number of patients. Neurotrope engaged Worldwide Clinical Trials, Inc. (“WCT”), in conjunction with consultants and investigators at leading academic institutions, to collaborate on the design and conduct of the trial, which began in April 2018. During July 2018, the first patient was enrolled in this study. Pursuant to a new Services Agreement with WCT dated as of May 4, 2018 (the “2018 Services Agreement”), WCT provided services relating to the trial. The total estimated budget for the services, including pass-through costs, drug supply and other statistical analyses, was approximately $7.8 million. The trial was substantially completed as of December 31, 2019. We incurred approximately $7.6 million in total expenses of which WCT has represented a total of approximately $7.2 million and approximately $400,000 of expenses were incurred to other trial-related vendors and consultants, resulting in a total savings for this trial of approximately $500,000.

On September 9, 2019, Neurotrope issued a press release announcing that the confirmatory Phase 2 study of Bryostatin-1 in moderate to severe AD did not achieve statistical significance on the primary endpoint, which was change from baseline to week 13 in the SIB total score.

An average increase in SIB total score of 1.3 points and 2.1 points was observed for the Bryostatin-1 and placebo groups, respectively, at week 13. There were multiple secondary outcome measures in this trial, including the changes from baseline at weeks 5, 9 and 15 in the SIB total score. No statistically significant difference was observed in the change from baseline in SIB total score between the Bryostatin -1 and placebo treatment groups.

The confirmatory Phase 2 multicenter trial was designed to assess the safety and efficacy of Bryostatin-1 as a treatment for cognitive deficits in patients with moderate to severe AD — defined as a MMSE-2 score of 4-15 — who are not currently taking memantine. Patients were randomized 1:1 to be treated with either Bryostatin-1 20µg or placebo, receiving 7 doses over 12 weeks. Patients on memantine, an NMDA receptor antagonist, were excluded unless they had been discontinued from memantine treatment for a 30-day washout period prior to study enrollment. The primary efficacy endpoint was the change in the SIB score between the baseline and week 13. Secondary endpoints included repeated SIB changes from baseline SIB at weeks 5, 9, 13 and 15.

5

On January 22, 2020, Neurotrope announced the completion of an additional analysis in connection with the confirmatory Phase 2 study, which examined moderately severe to severe AD patients treated with Bryostatin-1 in the absence of memantine. To adjust for the baseline imbalance observed in the study, a post-hoc analysis was conducted using paired data for individual patients, with each patient as his/her own control. For the pre-specified moderate stratum (i.e., MMSE-2 baseline scores 10-15), the baseline value and the week 13 value were used, resulting in pairs of observations for each patient. The changes from baseline for each patient were calculated and a paired t-test was used to compare the mean change from baseline to week 13 for each patient. A total of 65 patients had both baseline and week 13 values, from which there were 32 patients in the Bryostatin-1 treatment group and 33 patients in the placebo group. There was a statistically significant improvement over baseline (4.8 points) in the mean SIB at week 13 for subjects in the Bryostatin-1 treatment group (32 subjects), paired t-test p < 0.0076, 2-tailed. In the placebo group (33 subjects), there was also a statistically significant increase from baseline in the mean SIB at week 13, for paired t-test p < 0.0144, consistent with the placebo effect seen in the overall 203 study. Although there was a signal of Bryostatin-1’s benefit for the moderately severe stratum, the difference between the Bryostatin-1 and placebo treatment groups was not statistically significant (p=0.2727). As a further test of the robustness of this moderate stratum benefit signal, a pre-specified trend analysis (measuring increase of SIB improvement as a function of successive drug doses) was performed on the repeated SIB measures over time (weeks 0, 5, 9, and 13). These trend analyses showed a significant positive slope of improvement for the treatment groups in the 203 study that was significantly greater than for the placebo group (p<.01).

Extended Confirmatory Phase 2 Clinical Trial

In connection with the additional analysis regarding the confirmatory Phase 2 clinical trial mentioned above, Synaptogenix also announced a $2.7 million award from the National Institutes of Health to support an additional Phase 2 clinical study focused on the moderate stratum for which we saw improvement in the 203 study. We are planning to meet with the Food and Drug Administration (“FDA”) to present the totality of the clinical data for Bryostatin-1 upon trial completion.

On July 23, 2020, Synaptogenix executed a Services Agreement (the “2020 Services Agreement”) with WCT. The 2020 Services Agreement relates to services for Synaptogenix’s extended confirmatory Phase 2 Study. Pursuant to the terms of the 2020 Services Agreement, WCT provided services to enroll approximately 100 Phase 2 Study subjects. Synaptogenix initiated the first Phase 2 Study site during the third quarter of 2020 and enrollment was completed in March, 2022. On January 22, 2022, the Company executed a change order with WCT to accelerate trial subject recruitment totaling approximately $1.4 million. In addition, on February 10, 2022, the Company signed an additional agreement with a third-party vendor to assist with the increased trial recruitment retention totaling approximately $1.0 million which was subsequently canceled with no charges incurred by the Company. The updated total estimated budget for the current trial services, including pass-through costs, was approximately $11.0 million. As noted below, Neurotrope was granted a $2.7 million award from the National Institutes of Health, which award was used to support the Phase 2 Study, resulting in an estimated net budgeted cost of the Phase 2 Study to Neurotrope of $9.3 million. Synaptogenix may terminate the 2020 Services Agreement without cause upon 60 days prior written notice.

On December 16, 2022, Synaptogenix issued a press release announcing that an extended confirmatory Phase 2 study of Bryostatin-1 in moderate to severe AD (Study #204) did not achieve statistical significance on the primary endpoint, which was change from baseline to week 13 in the SIB total score assessment obtained after completion of the second seven-dose course of treatment (week 28 of trial). An average increase in the SIB total score of 1.4 points and 0.6 points was observed for the Bryostatin-1 and placebo groups, respectively, at week 28. On March 7, 2023, the Company announced the results of its analysis of secondary endpoints and post hoc analysis from our Phase 2 study of Bryostatin-1. In the secondary endpoint analysis, changes from baseline at Weeks 9, 20, 24, 30, and 42 in the SIB (Severe Impairment Battery) total score were not statistically significant in the total patient population, and no pre-specified secondary endpoints were met with statistical significance in the low-to-moderately severe AD patient stratum. However, nearly all pre-specified secondary endpoints in the most advanced and severe AD (MMSE: 10-14) patient population, with baseline MMSE-2 (Mini-Mental State Examination, 2nd Edition) scores of 10-14, were achieved with statistical significance (p = <0.05, 2-tailed). Data also showed statistical significance in exploratory secondary endpoints for the MMSE-2 10-14 stratum, and post hoc analysis was positive. The Company is currently evaluating the data and determining next steps with the development of Bryostatin-1 for AD as well as for other potential indications.

6

Other Development Projects

To the extent resources permit, we may pursue development of selected technology platforms with indications related to the treatment of various disorders, including neurodegenerative disorders such as AD, based on our currently licensed technology and/or technologies available from third party licensors or collaborators.

Nemours Agreement

On September 5, 2018, we announced a collaboration with Nemours A.I. DuPont Hospital (“Nemours”), a premier U.S. children’s hospital, to initiate a clinical trial in children with Fragile X syndrome, a genetic disorder. In addition to the primary objective of safety and tolerability, measurements will be made of working memory, language and other functional aspects such as anxiety, repetitive behavior, executive functioning, and social behavior. On August 5, 2021, the Company announced its memorandum of understanding with Nemours to initiate a clinical trial using Bryostatin-1, under Orphan Drug Status, to treat Fragile X. The Company intends to provide the Bryostatin-1 and obtain the IND, and Nemours intends to provide the clinical site and attendant support for the trial. The Company and Nemours, jointly, will develop the trial protocol. The Company estimates its total trial and IND cost to be approximately $2.0 million. As of December 31, 2023, the Company has incurred cumulative expenses associated with this agreement of approximately $100,000.

The Company has filed an IND with the FDA. The FDA has placed the development of the IND on clinical hold pending completion of further analytics relating to drug pharmacokinetics and pharmacodynamics. The Company is currently evaluating its plans to advance Fragile X development.

BryoLogyx Agreement

In connection with a supply agreement entered into with BryoLogyx Inc. (“BryoLogyx”) on June 9, 2020, we entered into a transfer agreement (the “Transfer Agreement”) with BryoLogyx. Pursuant to the terms of the Transfer Agreement, we agreed to assign and transfer to BryoLogyx all of our rights, title and interest in and to the Cooperative Research and Development Agreement (“CRADA”) with the National Cancer Institute (“NCI”), under which Bryostatin-1’s ability to modulate CD22 in patients with relapsed/refractory CD22+ disease has been evaluated to date. Under the CRADA, the parties agreed to collaborate with the NCI’s Center for Cancer Research, Pediatric Oncology Branch (“POB”) to develop a Phase I clinical trial testing the safety and toxicity of Bryostatin-1 in children and young adults with CD22 + leukemia and B-cell lymphoma. The CRADA was transferred to BryoLogyx and we assigned to BryoLogyx our IND application for CD22 currently on file with the FDA. As consideration for the transfer of the CRADA and IND, BryoLogyx has agreed to pay to us 2% of the gross revenue received in connection with the sale of bryostatin products, up to an aggregate payment amount of $1 million.

Cleveland Clinic

On February 23, 2022, the Company announced its collaboration with the Cleveland Clinic to pursue possible treatments for Multiple Sclerosis (“MS”), and on July 19, 2023, the Company announced that it had entered into an agreement with the Cleveland Clinic to conduct a Phase 1 trial of Bryostatin-1 in MS. The Cleveland Clinic will manage the clinical trial’s implementation, including the IND submission to the FDA which was filed during the fourth quarter of 2023 and future patient enrollment once the IND submission is approved. The total estimated costs associated with this collaboration are approximately $2.0 million. As of December 31, 2023, the Company has paid the Cleveland Clinic approximately $375,000.

7

Alzheimer’s Disease

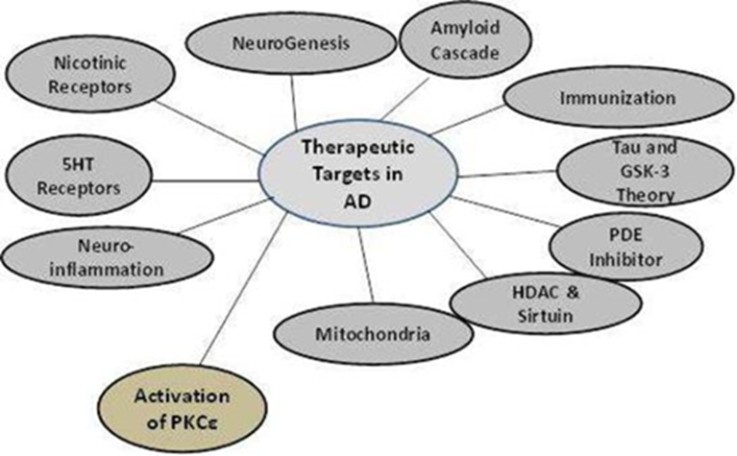

Figure 1. Different Pharmacologic Targets being pursued for the Treatment of AD(3)

It has been shown that during several years preceding the diagnosis of dementia associated with AD there can be gradual cognition decline, which at first may have rather benign characteristics. At this stage, known as mild cognitive impairment (“MCI”), 60% of these patients will convert to early AD. In MCI, there can already be significant loss of synapses (the junctions between nerve cells) and compromised release of the chemical messengers onto their post-synaptic targets. MCI, therefore, can transition into mild, moderate and, finally, severe stages of Alzheimer’s disease that are characterized by greater systemic loss of neurons and synapses in the brain tissue. Multiple failures in acetylcholine and glutamate neurotransmitter systems (neurotransmitters) may cause some of the symptoms of early AD, and thus these systems have become targets for pharmacologic intervention.

In MCI and early AD, the amyloid load in the brain may or may not increase while the symptoms of early AD begin to occur. Loss of neurons and synaptic networks can be accompanied by abnormal processing of β amyloid (“Aβ”) peptide, causing elevation of the soluble Aβ oligomers, eventually leading to the formation of Aβ plaques (protein deposits) in the brain.

The conventional amyloid cascade hypothesis holds that amyloid pathology leads to hyperphosphorylated tau proteins (a protein found in nerve cells) being deposited within neurons in the form of insoluble tangles, excitotoxicity (overstimulation of nerve cells by neurotransmitters), inflammation and finally synaptic depletion and neuronal death. Other hypotheses suggest that AD begins earlier with dysfunctional tau metabolism — independent of amyloid levels. However, the majority of drug development efforts during the past two decades have focused on stopping the production of Aβ or its fragments, and the elimination of these peptides from either intracellular or extracellular locations has represented the preponderance of drug design efforts to halt the progression of AD. However, these efforts have been largely unsuccessful.

(3) Business Insights: Reference Code B100040-005, Publication Date May 2011, “Advances in AD Drug Discovery”

8

We believe the current failures of therapies clearing formed amyloid plaques come from an incomplete view of the AD pathophysiologic process. In our view, amyloid plaques and the tau-based neurofibrillary tangles are pathologic hallmarks of AD, but not closely correlated with cognitive deficits. Synaptic loss at autopsy, on the other hand, has been consistently closely correlated with the degree of cognitive deterioration in clinical evaluations. We believe the appearance of these plaques and tangles is not necessarily linked to the death of neurons or synapses, and that the elimination of the plaques does not restore cognitive function as already demonstrated in extensive clinical testing with pathologic correlates. However, we believe that the soluble amyloid pre-plaque oligomers, through their toxicity to synapses and neurons, are important in the progression of the disease.

Furthermore, several comprehensive studies of autopsy brain samples from AD vs. control patients have demonstrated that the loss of the synapses is an early event in AD and usually precedes the loss of neurons. (Terry et al., 1991; Scheffe et al., 2006). These studies demonstrated that the rate of cognitive decline closely correlates with the loss of synapses, while that rate does not closely correlate with the number of amyloid plaques or neurofibrillary tangles (hyperphosphorylated tau). Based on these findings, the Synaptogenix therapeutic strategy focuses on restoration of the synapses (or “synaptogenesis”) and the prevention of neuronal death. Bryostatin has been shown in extensive pre-clinical testing to accomplish both synaptic restoration and prevention of neuronal death. Because these pathologic consequences are common to many neurodegenerative disorders (e.g. Fragile X mental retardation, MS, Multi-infarct dementia, and Amyotrophic Lateral Sclerosis), pre-clinical studies were undertaken by Synaptogenix scientists and scientists from other laboratories to demonstrate synaptic and neuronal loss. Based on this, common pathology therapeutic benefits of Bryostatin is being clinically tested for efficacy in AD.

In animal studies, the scientific team led by our President and Chief Scientific Officer, Dr. Alkon, at CRE, found that PKC ε activation in neurons targets the loss of synapses and prevents the loss of neurons in the brains of animals with AD, and can delay or temporarily arrest other elements of the disease, e.g., by preventing: the reduction of synaptic growth factors, such as BDNF; the elevation of the toxic Aβ peptide; the appearance of plaques and tangles, and / or reversing the loss of cognitive function. In pre-clinical testing, Dr. Alkon and his teams directly demonstrated that bryostatin prevents the death of neurons (anti-apoptosis) and induces synaptogenesis by mobilizing synaptic growth factors such as BDNF, NGF, and IGF. At the same time, bryostatin appeared to prevent the formation of A Beta oligomers, prevent the deposition of amyloid plaques (extra-neuronal), prevent the formation of neurofibrillary tangles (intra-neuronal), and may restore cognitive function. These neuro-restorative benefits may result from the multi-modal molecular cascades activated by the bryostatin — PKC ε efficacies.

AD and the Potential Market for our Products

The Epidemic of AD

According to the Alzheimer’s Association, it has been estimated that over 50 million people worldwide had AD, or other forms of dementia, in 2023. The prevalence of AD is independent of race, ethnicity, geography, lifestyle and, to a large extent, genetics. The most common cause of developing AD is living a long life. In developing countries where the median age of death is less than 65 years old, AD is rarely recognized or diagnosed. In the United States in 2023, 6.7 million people are estimated to have AD, and over 72% of these people are older than 75 years of age.

Researchers continue to explore a wide range of drug mechanisms in hopes of developing drugs to combat this disease. Figure 1 illustrates the range of mechanisms under consideration. Our approach, which involves the activation of the enzyme PKC ε, represents a novel mechanism in the armamentarium of potential AD drug therapies.

Potential Market for Our Products

According to an article titled “Progress in AD” published in The Journal of Neurology in 2012, there has been a dearth of new product introductions in the last 20 years either for the treatment of AD symptoms or its definitive diagnosis in patients who begin exhibiting the memory and cognitive disorders associated with the disease. According to the Alzheimer’s Association, all of the products introduced to date for the treatment of AD have yielded negative or marginal results with no long-term effect on the progression of AD and no improvement in the memory or cognitive performance of the patients receiving these therapies. With over 50 million people worldwide estimated to have had AD in 2023, there is significant commercial potential for a new therapeutic that is effective in delaying the progression of the disease.

9

We believe the markets for drugs or therapies to treat the underlying pathology of AD exist largely, but not exclusively, in the developed world and principally comprise the North American, European and Japanese markets.

Sales of the major drug therapies available only by prescription are approved for the symptomatic treatment of the cognitive aspects of AD, but have no meaningful effect on disease progression, causing only temporary improvement in cognitive decline. Despite their limited efficacy, this group of drugs had a collective, worldwide sales compounded annual growth rate from 2017 to 2021 of 6.5% in 2022 according to Future Markets Insights. Sales were approximately $2.8 billion and are projected to grow to approximately $6.8 billion by 2032, a compounded annual growth rate of 9.3%, according to Coherent Market Insights.

Our Proposed Products

Challenges in Treating AD

One of the challenges in treating AD is that its symptoms manifest only years after the disease process can be definitely diagnosed. Treatment strategies attempting to intervene once symptoms become more apparent are focused on stimulating the neurotransmitter activity of still healthy neurons, or removing the amyloid plaque deposited in the brain. Many drug development efforts to date that have targeted the removal of beta-amyloid or tau protein as their therapeutic mechanism of action have failed, and drugs approved for stimulating neurotransmitter activity offer short-lived, palliative results for AD patients. As such, these strategies have yielded negative or marginal results with no effect on the progression of AD and no improvement in the memory or cognitive performance of the patients receiving these therapies.

Dying neurons and synapses have, to date, not been therapeutic targets for restoration, and many in the AD field currently believe that stemming the progression of the disease may only be possible with very early-stage intervention. The FDA is encouraging the pharmaceutical industry to increase efforts to investigate such early-stage interventional treatments by recommending that modified clinical endpoints, both functional and cognitive, be established to monitor the efficacy of drug prototypes being tested in early stage AD patients, according to an article published in The New England Journal of Medicine.(4)

4 NEJM.org: The New England Journal of Medicine, March 15, 2013, page 1: Drug Development of Early AD, N. Kozauer, M.D., and Russell Katz, M.D,

10

In contrast, we believe that our data from various preclinical animal models and compassionate use trials support that activation of PKC ε – BDNF pathway in central nervous system neurons may improve neuronal vitality and function in areas of the brain damaged by AD, potentially resulting in the improvement of memory and cognition.

In recent years, two therapeutic trials with monoclonal antibodies (aduhelm and lecanemab) have provided evidence of some showing of the rate of decline for patients with mid cognitive impairment (MCI) and possibly very early AD. This slowing of the rate of decline (24 – 27%) occurred after 18 months of treatment with i.v. infusions with the antibodies.

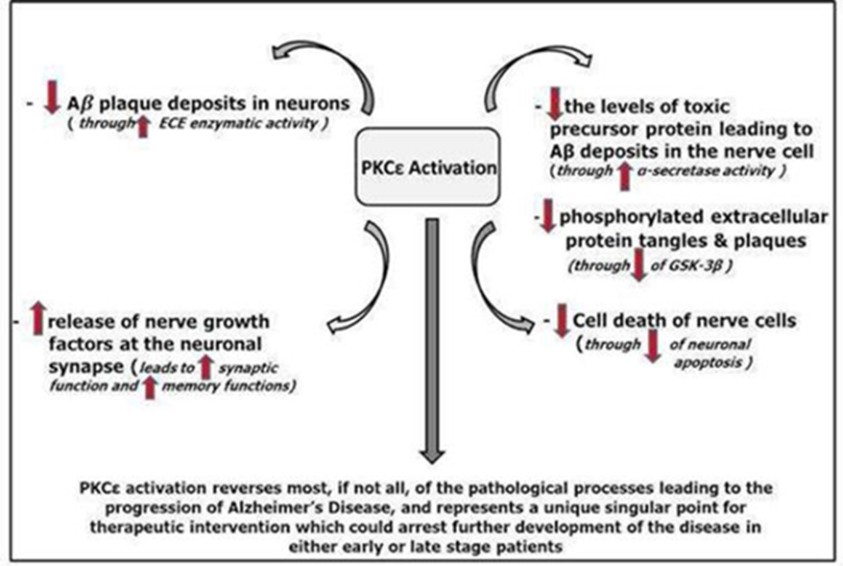

Synaptogenesis

Studies of autopsy brains of AD versus control patients showed that deficient activity or low concentrations of PKC ε in aging subjects is one of the main causes of the neurodegeneration seen in AD. These deficiencies result in the loss of BDNF, an important synaptic growth factor as demonstrated by other pre-clinical and clinical research. The schematic in Figure 2 illustrates only a portion of the changes mediated by PKC ε, and how it may help reverse the neuronal damage and loss central to the pathogenic process in AD.

Figure 2. PKC ε Activation Involves 5 Different Mechanisms to Stop the Progression of AD

11

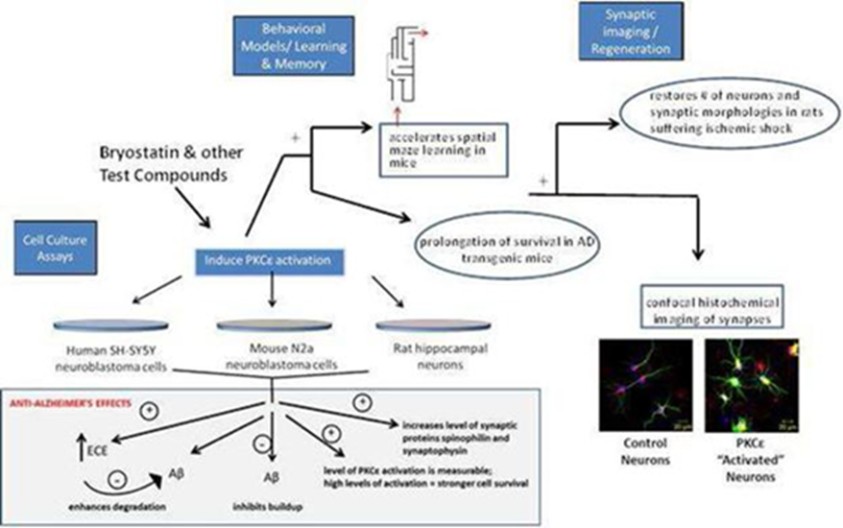

Activation of PKC ε has been achieved with drug prototypes that mimic the activity of diacylglycerol and phosphatidylserine, which are the natural binding targets for this enzyme. In addition, a variety of in vitro and in vivo animal models have demonstrated that these drug prototypes may be effective in restoring the structure and function of neuronal synapses. Our first clinical application of the PKC ε activators is focused on the treatment of AD, but a number of other neurodegenerative diseases may be amenable to similar treatment. A list of these potential future drug targets is shown in Figure 3.

Figure 3. Therapeutic targets for neuroregeneration through PKC ε activation

Treatment of AD by Stimulating Synaptic Regeneration and Prevention of Neuronal Death

Dr. Alkon’s team at CRE conducted research in synaptic regeneration and the prevention of neuronal death, outside the conventional wisdom that has dominated research efforts in the industry. The pathology of AD likely has multiple layers in its development, in addition to the presence of tau phosphorylated tangles and Aβ oligomers. However, once this process presents clinical manifestations of AD, restoring synaptic function thus far has not been effectively achieved by removing Aβ plaques with experimental drug interventions. Once neurons undergo toxic changes with soluble Aβ oligomers, the loss of function to the patient has been irreversible.

CRE’s and our approach has been to restore general viability and hence synaptic function in still-functioning neurons by stimulating the regeneration and growth of the dendritic branches, spines, and pre-synaptic terminals on these neurons. (Dendrites are the branched projections of a neuron that act to propagate the electrochemical stimulation received from other neural cells.) This process can be visualized with serial sections using an electron microscope in the brains of rats whose neurons and synapses have been damaged by ischemic shock (depriving oxygen) or traumatic injury to the brain. The morphology of the damaged neurons in these animal models looks strikingly different after they are treated with experimental drugs that activate PKC ε. The new growth of dendritic trees on the damaged neurons and the creation of a multiplicity of new synaptic connections, basically re-wiring the damaged neurons and restoring their function. Earlier therapeutic intervention with a PKC ε activator produces markedly improved outcomes in tests measuring restored animal cognitive function.

12

PKCε Activation Stimulates the Formation of New Synaptic Connections

The new synaptic connections formed from the damaged neurons revitalized by PKC ε in rats can be demonstrated in various behavioral models for the animals that are used to measure memory functions.

Treatment with Bryostatin-1, for 12 weeks in genetically modified rodents pre-disposed to develop an AD-type of pathology showed that Bryostatin-1 promoted the growth of new synapses and preserved the existing synapses. In addition, this drug also reversed the decrease of PKC ε and the reciprocal increase of soluble amyloid.(5)

In cell tissue cultures, there is a difference in morphology between neurons damaged by the application of ASPD (soluble oligomers of Aβ) as compared to synapses rejuvenated by the application of Bryostatin-1. Treatment with Bryostatin-1, through PKC ε activation, stimulates the revitalization of neurons and the formation of new synaptic connections.

The Central Role of PKC ε in Maintaining Neuron Structure and Function

Upon activation, PKC ε migrates from the intraneuronal cytoplasm to the cell membrane, where it activates signal-regulating enzymes (specifically the m-RNA stabilizing protein, HUD, and downstream growth factors such as BDNF, NGF, IGF, etc.; MAP kinases Erk1/2; the BCl-2 apoptosis cascade; and NF- ϰϰϰϰβ), causing a series of changes leading to increased DNA transcription, synaptic maturation, a consequent increase in levels of growth factor proteins (such as nerve growth factor and brain-derived neurotrophic factor), an inhibition of programmed cell-death and a reduction of β amyloid, and hyperphosphorylated tau.

This myriad of events is orchestrated by PKC ε and prompts a number of secondary events to occur in both the pre- and post-synaptic portions of the neuron. Cellular visualization of this effect shows an increase in the number of pre-synaptic vesicles in the neurons, an increase in pre-synaptic levels of PKC ε and an increase in the number of mushroom spines associated with individual synaptic boutons (knoblike enlargements at the end of a nerve fiber, where it forms a synapse). Their genesis in these neurons is responsible for the formation of new synapses during associative learning and memory, and for regeneration of synaptic networks in pre-clinical models of AD, stroke, traumatic brain injury, and Fragile X syndrome.

The central role of PKC ε activation in these dynamic events expands the amyloid and tau hypotheses for AD by including pathways to restore the synaptic networks lost during neurodegeneration and to prevent further loss as well as to prevent neuronal loss. This mechanistic framework offers new targets for therapeutic intervention which not only prevent the formation of tangles and plaque, but also prevents neuronal death, and promotes the induction of new, mature synaptic networks.

Decreased amyloid formation from PKC ε activation results from an increase in the rate of Aβ degradation by ECE (endothelin converting enzyme) neprilysin and IDE (insulin-degrading enzyme), and induction of α-secretase cleavage of amyloid precursor protein (the precursor molecule to Aβ) through phosphorylation of an enzyme known as Erk. In rodent models genetically predisposed to forming large amounts of amyloid deposits in their brains, PKC ε activation was found to interrupt the ongoing formation of amyloid, suggesting that this approach may delay the progression of AD.

The key to CRE’s innovation in this area has been in identifying highly potent drug prototypes that, at low concentrations, cause the specific and transient activation of PKC ε, without interacting with the other isozyme variants of PKC whose inactivation would negate the synaptogenic properties of the ε isoform.

(5) Journal of Neuroscience 2011, 31 (2), 630, D. Alkon et al.

13

Testing PKC ε Activation in Humans

The basic drug mechanism invoking PKC ε activation for neuronal rejuvenation and synaptic regeneration has never been evaluated in humans for any drug class or therapeutic application. We believe that the pre- clinical and clinical research in this field as described above is an ideal platform for testing this approach in human subjects.

We have licensed a body of biomedical research from CRE that is comprised of new methods and drug prototypes designed to stimulate synaptic restoration. For additional information, see “Business — Intellectual Property — Technology License and Services Agreement.” We believe the commercial application of this technology has potential to impact AD as well as traumatic brain injury, ischemic stroke, post-traumatic stress syndrome and other degenerative learning disorders.

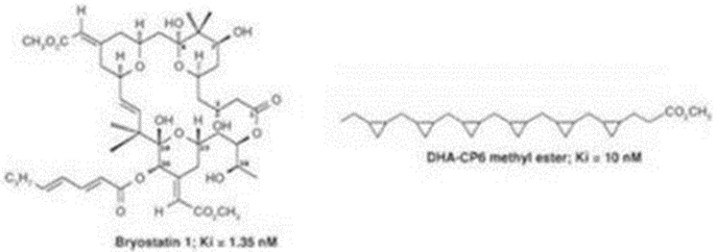

Drug Prototypes That Treat AD Through Regeneration

CRE has developed a new chemical family of polyunsaturated fatty acid (“PUFA”) analogs, which appear to be effective in the activation of PKC ε. Representative structures of Bryostatin-1 and a PUFA analog are shown in Figure 4.

Figure 4. Structures of Bryostatin-1 and a PUFA Analog Effective in the Activation of PKC ε(6)

Ki values = effective concentration of the drug in achieving 50% activation of PKC ε

These molecules activate PKC ε by binding to two different and distinct active sites on the enzyme. The natural ligands that bind to these sites are diacylglycerol and phosphatidylserine. Bryostatin-1 acts as a mimetic (mimic) for diacylglycerol by binding to the diacylglycerol site and, similarly, the PUFA analogs act as mimetics for phosphatidylserine by binding to the phosphatidylserine site.

6 (4) Trends in Biochemical Sciences V. 34, #3, p.136. T.J. Nelson et al, “Neuroprotective versus Tumorigenic protein kinase C activators.”

14

Collaborative Agreements

Stanford License Agreements

On May 12, 2014, the Company entered into a license agreement (the “Stanford Agreement”) with The Board of Trustees of The Leland Stanford Junior University (“Stanford”), pursuant to which Stanford has granted to the Company a revenue-bearing, world-wide right and exclusive license, with the right to grant sublicenses (on certain conditions), under certain patent rights and related technology for the use of bryostatin structural derivatives, known as “bryologs,” for use in the treatment of central nervous system disorders, lysosomal storage diseases, stroke, cardio protection and traumatic brain injury, for the life of the licensed patents. The Company is required to use commercially reasonable efforts to develop, manufacture and sell products (“Licensed Products”) in the Licensed Field of Use (as defined in the Stanford Agreement) during the term of the licensing agreement which expires upon the termination of the last valid claim of any licensed patent under this agreement. The Company is obligated to pay $10,000 annually as a license maintenance fee. In addition, the Company must meet specific product development milestones, and upon meeting such milestones, make specific milestone payments to Stanford. The Company must also pay Stanford royalties of 3% of net sales, if any, of Licensed Products (as defined in the Stanford Agreement) and milestone payments of up to $3.7 million dependent upon stage of product development. As of December 31, 2023, no royalties nor milestone payments have been required.

On January 19, 2017, the Company entered into a second license agreement with Stanford, pursuant to which Stanford has granted to the Company a revenue-bearing, world-wide right and exclusive license, with the right to grant sublicenses (on certain conditions), under certain patent rights and related technology for the use of “Bryostatin Compounds and Methods of Preparing the Same,” or synthesized bryostatin, for use in the treatment of neurological diseases, cognitive dysfunction and psychiatric disorders, for the life of the licensed patents. The Company paid Stanford $70,000 upon executing the license and is obligated to pay an additional $10,000 annually as a license maintenance fee. In addition, based upon certain milestones that include product development and commercialization, the Company will be obligated to pay up to an additional $2.1 million and between 1.5% and 4.5% royalty payments on certain revenues generated by the Company relating to the licensed technology. On November 9, 2021, the Company revised the existing licensing agreement with Stanford. The revisions extended all the required future product development and commercialization milestones. The Company is currently in full compliance with the revised agreement and is moving forward on its commitments. As of December 31, 2023, no royalties nor milestone payments have been earned or made.

The Company has advanced the development of synthetic bryostatin by demonstrating the equivalence of the synthetic to the natural bryostatin product. The estimated cost to initiate and produce sufficient quantities of the synthetic bryostatin drug product is approximately $1.5 million. The Company is evaluating production alternatives at this time.

Stanford retains the right, on behalf of itself and all other non-profit research institutions, to practice the licensed patents and use the licensed technology for any non-profit purpose, including sponsored research and collaborations. The license is also subject to Title 35, Sections 200-204, of the United States Code, which governs patent rights in inventions made with U.S. government assistance. Among other things, these provisions provide the United States government with nonexclusive rights in the licensed patents. They also impose the obligation that products based on the licensed patents sold or produced in the United States be “manufactured substantially in the United States.” These license agreements have been amended by a mutual agreement in December, 2021 – See above.

Mt. Sinai License Agreement

On July 14, 2014, we entered into an Exclusive License Agreement (the “Mount Sinai Agreement”) with the Icahn School of Medicine at Mount Sinai (“Mount Sinai”). Pursuant to the Mount Sinai Agreement, Mount Sinai granted us (a) a revenue-bearing, world-wide right and exclusive license, with the right to grant sublicenses (on certain conditions), under Mount Sinai’s interest in certain joint patents held by the Company and Mount Sinai (the “Joint Patents”) as well as in certain results and data (the “Data Package”) and (b) a non-exclusive license, with the right to grant sublicenses on certain conditions, to certain technical information, both relating to the diagnostic, prophylactic or therapeutic use for treating diseases or disorders in humans relying on activation of Protein Kinase C Epsilon (“PKC ε”), which includes Niemann-Pick Disease (the “Mount Sinai Field of Use”). The Mount Sinai Agreement allows us to research, discover, develop, make, have made, use, have used, import, lease, sell, have sold and offer certain products, processes or methods that are covered by valid claims of Mount Sinai’s interest in the Joint Patents or an Orphan Drug Designation Application covering the Data Package (“Mount Sinai Licensed Products”) in the Mount Sinai Field of Use (as such terms are defined in the Mount Sinai Agreement).

15

The Company is required to pay Mt. Sinai milestone payments of $2.0 million upon approval of a new drug application (“NDA”) in the United States and an additional $1.5 million for an NDA approval in the European Union or Japan. In addition, the Company is required to pay Mt. Sinai royalties on net sales of licensed product of 2.0% for up to $250 million of net sales and 3.0% of net sales over $250 million. Since inception, the Company has paid Mt. Sinai approximately $200,000 consisting of licensing fees of $125,000 plus development costs and patent fees of approximately $75,000. As of December 31, 2023, no royalties nor milestone payments have been required.

Strategic Investment

On October 31, 2023, we entered into a share purchase agreement (the “Cannasoul Purchase Agreement”) with Cannasoul Analytics Ltd. (“Cannasoul”), pursuant to which the Company agreed to purchase from Cannasoul (i) 12,737 shares of Cannasoul’s Series A preferred shares, no par value per share (the “Cannasoul Preferred Shares”), at a price of $44.1550 per Cannasoul Preferred Share and (ii) a convertible preferred note in an aggregate amount of up to $1,437,598.49 (the “Initial Convertible Note”) in a private placement (the “Cannasoul Investment”). Additionally, the Company agreed to purchase up to four additional convertible preferred notes in a total amount of up to approximately $2,000,000 (or approximately $500,000 per convertible preferred note), subject to Cannasoul achieving certain revenue and expense goals (the “Milestones”) over the four quarters following signing of the Cannasoul Purchase Agreement (the “Milestone Convertible Notes”) as set forth in the Cannasoul Purchase Agreement. If Cannasoul fails to achieve a Milestone, the Company will not be obligated to purchase the applicable Milestone Convertible Note. If Cannasoul achieves a Milestone and the Company fails to purchase the applicable Milestone Convertible Note, Cannasoul will have the right to convert all the Company’s Cannasoul Preferred Shares into Cannasoul’s ordinary shares and the Company will lose certain board appointment rights and certain rights in Cannasoul’s subsidiaries, each as further described below. As of the filing of this Annual Report on Form 10-K, Cannasoul has achieved one Milestone and we accordingly purchased one Milestone Convertible Note for an aggregate of $500,000 in January 2024.

Dr. David (Dedi) Meiri, founder of Cannasoul, heads the Laboratory of Cancer Biology and Cannabinoid Research at the Technion – Israel Institute of Technology (“Technion”), where he develops cannabinoids for various indications. Pursuant to a license agreement between Cannasoul, Dr. Meiri and Technion, Cannasoul has a right of first look with respect to each new cannabinoid indication developed in Dr. Meiri’s laboratory and not otherwise funded by a third party. Whenever Cannasoul exercises this right of first look, it creates a new subsidiary to carry out the development of such indication (each, a “Project Subsidiary”). In connection with the Investment, the Company received certain rights in existing Project Subsidiaries. Additionally, Cannasoul granted the Company a right of first look to invest in any new Project Subsidiaries as well as certain preemptive and veto rights in connection with such Project Subsidiaries. Pursuant to a collaboration agreement entered into by the Company and Cannasoul on October 31, 2023 (the “Collaboration Agreement”), the parties agreed to form a joint research committee with equal representation from the Company and Cannasoul (the “JRC”). The JRC will evaluate the technology and compounds developed by Dr. Meiri in his laboratory, assess the feasibility of developing and commercializing each compound and, for those compounds with respect to which we exercise our right of first look, collaborate on the strategy for clinical development of such compounds.

In connection with the Cannasoul Investment, Cannasoul adopted amended and restated articles of incorporation (the “Cannasoul Charter”). Pursuant to the Cannasoul Charter, we have a number of rights as investor, including but not limited to (i) the right to appoint and dismiss three of the seven members of Cannasoul’s board of directors and veto power with respect to a fourth member, (ii) preemptive rights to participate pro rata in any pre-initial public offering financings by Cannasoul, (iii) rights of first refusal with respect to transfers of Cannasoul ordinary shares by other investors, (iv) rights of co-sale with respect to proposed sales or transfers of Cannasoul ordinary shares by certain key investors, (v) veto rights with respect to certain major transactions, any amendment to the Cannasoul Charter, approval of Cannasoul’s budget and other items.

Also on October 31, 2023, we entered into an investor rights agreement (the “Investor Rights Agreement”) with Cannasoul, the founders of Cannasoul and certain investors in Cannasoul. Pursuant to the Investor Rights Agreement, if Cannasoul ever completes an initial public offering in the United States, we and certain other investors in Cannasoul may, subject to conditions set forth in the Investor Rights Agreement, request that Cannasoul file a registration statement with the U.S. Securities and Exchange Commission covering the resale of the ordinary shares underlying the Cannasoul Preferred Shares.

16

Bryostatin-1

Our lead product candidate is Bryostatin-1. Bryostatin is a natural product isolated from a marine invertebrate organism, a bryozoan called Bugula neritina. Several total syntheses of this complex molecule have been achieved in recent years in various academic chemistry laboratories, and these approaches represent a possible alternative source of this drug. Importantly, we have an exclusive license for neurologic disorders to a new, accelerated synthesis of Bryostatin-1 recently developed at Stanford University by Dr. Paul Wender and his team. Bryostatin-1 is a PKC α and ε activator that was originally developed as a potential anticancer drug. According to Clinical Cancer Research, this drug candidate was previously evaluated in 63 clinical studies involving more than 1,400 patients at the NCI for the treatment of various forms of cancer. While having failed these studies as an experimental anti-cancer therapy, much useful information on the safety, pharmacodynamics and toxicity of the drug was obtained from these in-human trials. In general, Bryostatin-1 was considered to be “well-tolerated” in these anti-cancer trials.

It was discovered that at doses at lower levels than those used in these anticancer trials, bryostatin is a potent activator of PKC ε and may have efficacy in treating AD. As described above, activation of PKC ε has been shown to partially restore synaptic function in neurons damaged by AD in in vitro and in vivo animal models.

The NCI has entered into a material transfer agreement with CRE to provide the bryostatin required for pre-clinical research as well as the Phase 2 clinical trials planned by the Company. Our license agreement with CRE (see “Business — Intellectual Property — Technology License and Services Agreement”) permits our access to new bryostatin clinical trial data and information held by the NCI, as well as past clinical, safety and toxicity data compiled by the NCI during the time this drug was being evaluated for its anticancer properties. See Item 1A – “Risk Factors — We are partly dependent upon the NCI to supply bryostatin for our clinical trials.”

CRE previously conducted an exploratory evaluation of bryostatin on a compassionate use basis in AD patients who have an inherited form of AD, frequently called familial AD, under an FDA-approved study protocol. Familial AD results from one of four major mutations in the genome, and this mutation is passed on from generation to generation within a family that carries the defective gene. The tragic consequence of familial AD is that it strikes its victims at an early age, often while they are in their twenties. The aggressive progression of familial AD can render these patients in the terminal stages of AD in their late 30’s and early 40’s.

PUFA Analogs

Several other drug prototypes termed the PUFA analogs have been synthesized at CRE and evaluated for their PKC ε activating properties in models of AD. The PUFA analogs are not structurally related to bryostatin and activate PKC ε at a different site. We believe the PUFA analogs may represent a potential source for follow-on drug candidates. PKC ε activators from the PUFA family of drug prototypes have demonstrated neuroregeneration efficacy roughly equivalent to and, in some cases, potentially superior to that of bryostatin. If the PUFA analogs show adequate potency in preclinical models of AD, we may advance a drug prototype from this chemical family.

Other Potential Products

We may acquire, by license or otherwise, other development stage products that are consistent with our product portfolio objectives and commercialization strategy.

17

WCT Services Agreements

On July 23, 2020, the Company entered into a services agreement with WCT (the “2020 Services Agreement”). The 2020 Services Agreement related to services for the current Phase 2 clinical trial assessing the safety, tolerability and long-term efficacy of Bryostatin-1 in the treatment of moderately severe AD subjects not receiving memantine treatment (the “2020 Study”). On January 22, 2022, the Company executed a change order with WCT to accelerate trial subject recruitment totaling approximately $1.4 million. In addition, on February 10, 2022, the Company signed an additional agreement with a third-party vendor to assist with the increased trial recruitment retention totaling approximately $1.0 million which was subsequently canceled with no charges incurred by the Company. In addition, on September 11, 2023, the Company signed an additional agreement with WCT to assist with documenting the trial results totaling approximately $300,000. The updated total estimated budget for these trial services, including pass-through costs, was approximately $11.3 million. As noted below, Neurotrope was granted a $2.7 million award from the National Institutes of Health, which award was used to support the Phase 2 Study, resulting in an estimated net budgeted cost of the Phase 2 Study to Neurotrope of $8.6 million.

The Company was awarded a $2.7 million grant from the NIH, which will be used to support the 2020 Study, resulting in an estimated net budgeted cost of the 2020 Study to the Company of $8.3 million. The NIH grant provided for funds of approximately $1.0 million in the first year, which began in April 2020, and funds of approximately $1.7 million in the second year, which began April 2021. As of February 22, 2022, virtually all of the NIH grant had been received and offset against the clinical trial costs. The Company incurred approximately $11.2 million of cumulative expenses associated with the current Phase 2 clinical trial as of December 31, 2023. Of the total $11.2 million incurred for the trial as of December 31, 2023, approximately $560,000 and $3.4 million is reflected in the statement of comprehensive loss for the years ended December 31, 2023 and 2022, respectively. As of December 31, 2023, $0 of WCT prepayments are included as a prepaid expense and other current assets in the Company’s balance sheet. In addition, approximately $343,000 is included in accounts payable and accrued expenses.

On May 12, 2022, the Company entered into a services agreement with WCT (the “2022 Services Agreement”). The 2022 Services Agreement related to services for a Phase 2 “open label,” dose ranging study, clinical trial assessing the safety, tolerability and efficacy of Bryostatin-1 administered via infusion in the treatment of moderately severe to severe AD subjects not receiving memantine treatment (the “2022 Study”).

Pursuant to the terms of the 2022 Services Agreement, WCT provided services to enroll approximately twelve 2022 Study subjects. The first 2022 Study site was initiated during the third quarter of 2022. The total estimated budget for the services, including pass-through costs, is currently approximately $2.0 million. The Company terminated the 2022 Services Agreement in December 2022.

The Company incurred approximately $1.6 million of cumulative expenses associated with the current 2022 Study as of December 31, 2023. Of the total $1.6 million incurred for the trial as of December 31, 2023, $0 and approximately $1.4 million is reflected in the statement of comprehensive loss for the years ended December 31, 2023 and 2022, respectively. As of December 31, 2023, $0 of WCT 2022 Study prepayments is included as a prepaid expense and other current assets in the Company’s balance sheet and approximately $22,000 is included in accounts payable and accrued expenses.

Intellectual Property

Technology License and Services Agreement

On February 4, 2015, we, CRE and NRV II, LLC entered into an Amended and Restated Technology License and Services Agreement (the “CRE License”), which further amended and restated the Technology License and Services Agreement dated as of October 31, 2012, as amended by Amendment No. 1 dated as of August 21, 2013.

18

Pursuant to the CRE License, we maintained our exclusive (except as described below), non-transferable (except pursuant to the CRE License’s assignment provision), world-wide, royalty-bearing right, with a right to sublicense (in accordance with the terms and conditions described below), under CRE’s and NRV II’s respective right, title and interest in and to certain patents and technology owned by CRE or licensed to NRV II, LLC by CRE as of or subsequent to October 31, 2012 to develop, use, manufacture, market, offer for sale, sell, distribute, import and export certain products or services for therapeutic applications for AD and other cognitive dysfunctions in humans or animals (the “Field of Use”). Additionally, the CRE License specifies that all patents that issue from a certain patent application, shall constitute licensed patents and all trade secrets, know-how and other confidential information claimed by such patents constitute licensed technology under the CRE License. Furthermore, on July 10, 2015, under the terms of the Statement of Work and Account Satisfaction Agreement dated February 4, 2015, our rights relating to an in vitro diagnostic test system reverted back to CRE and, accordingly, we no longer have any rights under the CRE License for diagnostic applications using the CRE patent portfolio or technology.

Notwithstanding the above license terms, CRE and its affiliates retain rights to use the licensed intellectual property in the Field of Use to engage in research and development and other non-commercial activities and to provide services to us or to perform other activities in connection with the CRE License.

Under the CRE License, we and CRE may not enter into sublicense agreements with third parties except with CRE’s prior written consent, which consent shall not be commercially unreasonably withheld. Furthermore, the CRE License dated February 4, 2015 revises the agreement that was entered into as of October 31, 2012 and amended on August 21, 2013, in that it provides that any intellectual property developed, conceived or created in connection with a sublicense agreement that we entered into with a third party pursuant to the terms of the CRE License will be licensed to CRE and its affiliates for any and all non-commercial purposes, on a worldwide, perpetual, non-exclusive, irrevocable, non-terminable, fully paid-up, royalty-free, transferable basis, with the right to freely sublicense such intellectual property. Previously, the agreement had provided that such intellectual property would be assigned to CRE.

Under the CRE License, we and CRE will jointly own data, reports and information that is generated on or after February 28, 2013, pursuant to the license agreement dated October 31, 2012 and amended on August 21, 2013, by us, on behalf of us by a third party or by CRE pursuant to a statement of work that the parties enter into pursuant to the CRE License, in each case to the extent not constituting or containing any data, reports or information generated prior to such date or by CRE not pursuant to a statement of work (the “Jointly Owned Data”). CRE has agreed not to use the Jointly Owned Data inside or outside the Field of Use for any commercial purpose during the term of the CRE License or following any expiration of the CRE License other than an expiration that is the result of a breach by us of the CRE License that caused any licensed patent to expire, become abandoned or be declared unenforceable or invalid or caused any licensed technology to enter the public domain (a “Natural Expiration”) provided, however, CRE may use the Jointly Owned Data inside or outside the Field of Use for any commercial purpose following any termination of the CRE License. Also, CRE granted us a license during the term and following any Natural Expiration, to use certain CRE data in the Field of Use for any commercial purposes falling within the scope of the license granted to us under the CRE License.

The CRE License further requires us to pay CRE (i) a fixed research fee equal to a pro rata amount of $1 million in the year during which we close on a Series B Preferred Stock financing resulting in proceeds of at least $25 million, (ii) a fixed research fee of $1 million per year for each of the five calendar years following the completion of such financing and (iii) an annual fixed research fee in an amount to be negotiated and agreed upon no later than 90 days prior to the end of the fifth calendar year following the completion of such financing to be paid with respect to each remaining calendar year during the term of the CRE License. This fixed research fee is not yet due as the Company has not completed a Series B Preferred Stock financing in excess of $25 million. The CRE License Agreement also requires the payment by us of royalties ranging between 2% and 5% of our revenues generated from the licensed patents and other intellectual property, dependent upon the percentage ownership that Neuroscience Research Ventures, Inc. (“NRV, Inc.”) holds in our company, which currently would be a royalty rate of 5% based on NRV, Inc.’s current ownership in us.

Pursuant to the terms of the November 12, 2015 amendment to the CRE License, we paid an aggregate of approximately $348,000 to CRE following the closings of the previous Series B private placement, which constituted an advance royalty payment to CRE and will be offset (with no interest) against the amount of future royalty obligations payable until such time that the amount of such future royalty obligations equals in full the amount of the advance royalty payments made, which shall be subtracted from the gross proceeds to determine the “Post-PA Fee Proceeds.”

19

On November 29, 2018, we entered into a Second Amendment to the CRE License, pursuant to which (i) we agreed to pay all outstanding invoices and accrued expenses associated with the licensed intellectual property and (ii) the parties agreed that CRE would no longer have the right, and we would have the sole and exclusive right, to apply for, file, prosecute, and maintain patents and applications for the licensed intellectual property.

Our Licensed Intellectual Property

We have licensed from CRE an extensive intellectual property portfolio that includes issued patents, pending patent applications and provisional patent applications, in the U.S. and elsewhere, which, we believe, together cover these key pharmaceutical markets. A method of use patent has been issued to CRE that covers the use of the PUFA family of molecules for the same therapeutic applications.

We believe the CRE License provides us rights to the patents and technologies required to develop our proposed products. The patents and technologies licensed to us pursuant to the CRE License include, without limitation, the following:

| ● | therapies based on bryostatin and PUFA chemical families; and |

| ● | methods for treating AD. |

A number of CRE’s patent applications for treatment of neurological disorders have been under active prosecution for many years and have been the subject of multiple rejections for anticipation and/or obviousness based on prior art. There are no guarantees that CRE’s pending patent applications will issue into commercially meaningful patents. If these patent applications are not approved or successfully prosecuted, then we will attempt to seek other means of protecting its proprietary position including, but not limited to, trade secrets, proprietary formulations and methods, etc.

A substantial amount of in-human data exists that was generated by the NCI that involves the earlier evaluation of bryostatin as an anticancer agent. The NCI also holds the existing inventory of bryostatin suitable for use in humans. Our use of the substantial data package generated by the NCI on bryostatin, as well as access to the clinical supply of this substance, is permitted under a material transfer agreement entered into and between the NCI and CRE.