SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(Registrant’s telephone number, including area code)

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which

Registered

|

|

|

|

|

|

|

|

|

None

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

|

☒

|

Smaller reporting company

|

|

|

Emerging growth company

|

|

|

Page

|

||

|

PART I

|

9

|

|

|

Item 1.

|

9

|

|

|

Item 1A.

|

16 | |

|

Item 1B.

|

43

|

|

|

Item 2.

|

43

|

|

|

Item 3.

|

43

|

|

|

Item 4.

|

43

|

|

|

PART II

|

44

|

|

|

Item 5.

|

44

|

|

|

Item 6.

|

47

|

|

|

Item 7.

|

48

|

|

|

Item 7A.

|

69

|

|

|

Item 8.

|

73 | |

|

Item 9.

|

117 | |

|

Item 9A.

|

117 | |

|

Item 9B.

|

120 | |

|

Item 9C.

|

120 | |

|

PART III

|

121 | |

|

Item 10.

|

121

|

|

|

Item 11.

|

121 | |

|

Item 12.

|

121 | |

|

Item 13.

|

121 | |

|

Item 14.

|

121 | |

|

PART IV

|

122 | |

|

Item 15.

|

122 | |

|

Item 16.

|

125 | |

| • |

the Company’s investment objectives and business strategy;

|

| • |

the Company’s ability to raise capital through the sale of its equity and debt securities and to invest the net proceeds of any such offering in the target assets, if any, identified at the time of the

offering;

|

| • |

the Company’s ability to obtain future financing arrangements and refinance existing financing arrangements as they mature;

|

| • |

the Company’s expected leverage;

|

| • |

the Company’s expected investments and the timing thereof;

|

| • |

the Company’s ability to acquire Servicing Related Assets and mortgage and real estate-related securities;

|

| • |

estimates and statements relating to, and the Company’s ability to make, future distributions to holders of the Company’s securities;

|

| • |

the Company’s ability to compete in the marketplace;

|

| • |

market, industry and economic trends;

|

| • |

recent market developments and actions taken and to be taken by the U.S. Government, the U.S. Treasury and the Board of Governors of the Federal Reserve System, Fannie Mae, Freddie Mac, Ginnie Mae and the

U.S. Securities and Exchange Commission (“SEC”), including actions such as forbearance programs and prohibitions on foreclosures taken in response to the ongoing coronavirus (“COVID-19”) pandemic;

|

| • |

mortgage loan modification programs and future legislative actions;

|

| • |

the Company’s ability to qualify and maintain qualification as a REITs under the Code and limitations on the Company’s business due to compliance with requirements for maintaining its qualification as a REIT

under the Code;

|

| • |

the Company’s ability to maintain an exception from the definitions of “investment company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”), or otherwise not fall within

those definitions;

|

| • |

projected capital and operating expenditures;

|

| • |

availability of qualified personnel; and

|

| • |

projected prepayment and/or default rates.

|

| • |

the factors referenced in this Annual Report on Form 10-K, including those set forth under “Item 1. Business” and “Item 1A. Risk Factors” of Part I and “Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations” of Part II;

|

| • |

general volatility of the capital markets;

|

| • |

accelerating inflationary trends, spurred by multiple factors including high commodity prices, a tight labor market, and low residential vacancy rates, may result further in interest rate increases and lead

to increased market volatility;

|

| • |

changes in the Company’s investment objectives and business strategy;

|

| • |

availability, terms and deployment of capital;

|

| • |

availability of suitable investment opportunities;

|

| • |

the Company’s ability to operate its licensed mortgage servicing subsidiary and oversee the activities of such subsidiary;

|

| • |

the Company’s ability to manage various operational and regulatory risks associated with its business;

|

| • |

the Company’s dependence on its external Manager, Cherry Hill Mortgage Management, LLC and the Company’s ability to find a suitable replacement if the Company or the Manager were to terminate the management

agreement the Company has entered into with the Manager;

|

| • |

changes in the Company’s assets, interest rates or the general economy;

|

| • |

increased rates of default and/or decreased recovery rates on the Company’s investments, including as a result of the effects of more severe weather and changes in traditional weather patterns;

|

| • |

the ultimate geographic spread, severity and duration of pandemics, such as the outbreak of the COVID-19 pandemic and the emergence of new variants of the virus, actions that may be taken by governmental

authorities to contain or address the impact of such pandemics, and the potential negative impacts of such pandemics on the U.S. and global economy generally and the U.S. residential mortgage market and our financial condition and results

of operations specifically;

|

| • |

changes in interest rates, interest rate spreads, the yield curve, prepayment rates or recapture rates;

|

| • |

limitations on the Company’s business due to compliance with requirements for maintaining its qualification as a REIT under the Code and the Company’s exception from the definitions of “investment company”

under the Investment Company Act (or of otherwise not falling within those definitions);

|

| • |

the degree and nature of the Company’s competition, including competition for the residential mortgage assets in which the Company invests; and

|

| • |

other risks associated with acquiring, investing in and managing residential mortgage assets.

|

| • |

The values of mortgage related assets have been adversely affected by the COVID-19 pandemic.

|

| • |

The Company uses third-party servicers to directly service the loans underlying its Servicing Related Assets which exposes the Company to the risk that such third-party servicers fail to comply with

applicable law, including data protection and privacy laws, and the requirements of the Agencies that own those loans.

|

| • |

Relatively high rates of prepayments on residential mortgage loans adversely affect the values of the Company’s assets.

|

| • |

The Company relies on financial modeling to value its Servicing Related Assets.

|

| • |

The Company uses leverage to increase returns, but it exposes the Company to margin calls on its investable assets.

|

| • |

The Company is dependent on its Manager to provide qualified personnel.

|

| • |

The amount of the fee the Company pays to its Manager is not affected by the performance of the Company’s investments.

|

| • |

The fee payable by the Company to the Manager upon termination of the management agreement is a material impediment to changing managers or internalizing management of the Company.

|

| • |

Certain of the Company’s lenders prohibit terminating its Manager without their consent.

|

| • |

Maintenance of certain exceptions from (or otherwise not falling within) the definitions of “investment company” under the Investment Company Act imposes significant limitations on the Company’s operations.

|

| • |

The REIT rules impose ownership limits which may discourage a possible takeover. Certain provisions of Maryland law have the same effect.

|

| • |

The trading volume and market prices for shares of the Company’s equity securities tend to be volatile due to the relatively small market capitalization of our Company.

|

| • |

The Company’s preferred stock has not been rated and is junior to its debt and any additional shares of senior stock that the Company may issue.

|

| • |

The Company may not be able to pay dividends on its equity securities.

|

| • |

The Company’s preferred stock has very limited voting rights which generally do not include voting for directors.

|

| • |

If the Company fails to satisfy the ongoing REIT qualification tests, it will become subject to taxation which will adversely affect the return on your investment.

|

| • |

In order to satisfy those requirements, the Company may be required to forgo or liquidate otherwise attractive investments.

|

| • |

The Company could lose its status as a REIT if the IRS successfully challenges its characterization of investments in internally created excess mortgage servicing rights.

|

| • |

The REIT rules require that the Company’s mortgage servicing rights be held by a taxable REIT subsidiary, and the taxes payable by its taxable REIT subsidiary reduce the returns from that investment.

|

| Item 1. |

Business

|

| • |

RMBS, including Agency RMBS, residential mortgage pass-through certificates, CMOs and TBAs; and

|

| • |

Servicing Related Assets consisting of MSRs and Excess MSRs.

|

| • |

allocating a substantial portion of our equity capital to the acquisition of Servicing Related Assets;

|

| • |

the creation of intercompany Excess MSRs from MSRs acquired by our mortgage servicing subsidiary, Aurora;

|

| • |

acquiring RMBS on a leveraged basis; and

|

| • |

opportunistically mitigating our prepayment and interest rate and, to a lesser extent, credit risk by using a variety of hedging instruments and, where applicable and available, recapture agreements.

|

| • |

No investment will be made if it causes us to fail to qualify as a REIT under the Code.

|

| • |

No investment will be made if it causes us to be regulated as an investment company under the Investment Company Act.

|

| • |

We will not enter into principal transactions or split price executions with Freedom Mortgage or any of its affiliates unless such transaction is otherwise in accordance with our investment guidelines and the

management agreement between us and our Manager and the terms of such transaction are at least as favorable to us as to Freedom Mortgage or its affiliate.

|

| • |

Any proposed material investment that is outside our targeted asset classes must be approved by at least a majority of our independent directors.

|

| Item 1A. |

Risk Factors

|

| • |

its failure to comply with applicable laws and regulations;

|

| • |

its failure to perform its loss mitigation obligations;

|

| • |

a downgrade in its servicer rating;

|

| • |

its failure to perform adequately in its external audits;

|

| • |

a failure in or poor performance of its operational systems or infrastructure;

|

| • |

a data breach and other cybersecurity incidents impacting a mortgage servicer;

|

| • |

regulatory or legal scrutiny, enforcement proceedings, consent orders or similar actions regarding any aspect of its operations, including, but not limited to, servicing practices and foreclosure processes

lengthening foreclosure timelines; or

|

| • |

the transfer of servicing to another party.

|

| • |

payments made by such mortgage servicer to us, or obligations incurred by it, being voided by a court under federal or state preference laws or federal or state fraudulent conveyance laws; or

|

| • |

any agreement between us and the mortgage servicer being rejected in a bankruptcy proceeding.

|

| • |

interest rate hedging can be expensive, particularly during periods of rising and volatile interest rates;

|

| • |

available interest rate hedges may not correspond directly with the interest rate risk for which protection is sought;

|

| • |

the duration of the hedge may not match the duration of the related assets or liabilities being hedged;

|

| • |

to the extent hedging transactions do not satisfy certain provisions of the Code, and are not made through a TRS, the amount of income that a REIT may earn from hedging transactions to offset interest rate

losses is limited by U.S. federal tax provisions governing REITs;

|

| • |

the value of derivatives used for hedging may be adjusted from time to time in accordance with accounting rules to reflect changes in fair value. Downward adjustments or “mark-to-market losses” would reduce

our total stockholders’ equity;

|

| • |

the credit quality of the hedging counterparty owing money on the hedge may be downgraded to such an extent that it impairs our ability to sell or assign our side of the hedging transaction; and

|

| • |

the hedging counterparty owing money in the hedging transaction may default on its obligation to pay.

|

| • |

“business combination” provisions that, subject to limitations, prohibit certain business combinations between us and an “interested stockholder” (defined generally as any person who beneficially owns 10% or

more of the voting power of our outstanding voting stock or an affiliate or associate of ours who, at any time within the two-year period immediately prior to the date in question, was the beneficial owner of 10% or more of the voting power

of our then-outstanding stock) or an affiliate of an interested stockholder for five years after the most recent date on which the stockholder became an interested stockholder, and thereafter require two supermajority stockholder votes to

approve any such combination; and

|

| • |

“control share” provisions that provide that a holder of “control shares” of the Company (defined as voting shares of stock which, when aggregated with all other shares of stock owned by the acquiror or in

respect of which the acquiror is able to exercise or direct the exercise of voting power (except solely by virtue of a revocable proxy), entitle the acquiror to exercise one of three increasing ranges of voting power in electing directors)

acquired in a “control share acquisition” (defined as the direct or indirect acquisition of ownership or control of issued and outstanding “control shares,” subject to certain exceptions) generally has no voting rights with respect to the

control shares except to the extent approved by our stockholders by the affirmative vote of two-thirds of all the votes entitled to be cast on the matter, excluding all interested shares.

|

| • |

actual receipt of an improper benefit or profit in money, property or services; or

|

| • |

active and deliberate dishonesty by the director or officer that was established by a final judgment and is material to the cause of action.

|

| • |

the uncertainty and economic impact of global pandemics, including the COVID-19 pandemic and the resulting impact on market liquidity, the value of assets and availability of financing;

|

| • |

actual or anticipated variations in our quarterly operating results;

|

| • |

increases in market interest rates that lead purchasers of our common stock to demand a higher yield or to seek alternative investments;

|

| • |

changes in market valuations of similar companies;

|

| • |

adverse market reaction to any increased indebtedness we incur in the future;

|

| • |

additions or departures of key personnel;

|

| • |

actions by stockholders;

|

| • |

speculation in the press or investment community;

|

| • |

general market, economic and political conditions and the impact of these conditions on the global credit markets;

|

| • |

the operating performance of other similar companies;

|

| • |

changes in accounting principles; and

|

| • |

passage of legislation, changes in monetary policy or other regulatory developments that adversely affect us or our industry.

|

| • |

prevailing interest rates, increases in which may have an adverse effect on the market price of the Preferred Stock;

|

| • |

trading prices of common and preferred equity securities issued by REITs and other similar companies;

|

| • |

the annual yield from distributions on the Preferred Stock as compared to yields on other financial instruments;

|

| • |

general economic and financial market conditions;

|

| • |

government action or regulation;

|

| • |

our financial condition, performance and prospects and those of our competitors;

|

| • |

changes in financial estimates or recommendations by securities analysts with respect to us, our competitors or our industry;

|

| • |

our issuance of additional preferred equity securities or the incurrence of debt; and

|

| • |

actual or anticipated variations in our quarterly operating results and those of our competitors.

|

| • |

85% of our REIT ordinary income for that year;

|

| • |

95% of our REIT capital gain net income for that year; and

|

| • |

any undistributed taxable income from prior years.

|

| Item 1B. |

Unresolved Staff Comments

|

| Item 2. |

Properties

|

| Item 3. |

Legal Proceedings

|

| Item 4. |

Mine Safety Disclosures

|

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Market Information

|

| • |

actual results of operations;

|

| • |

our level of retained cash flows;

|

| • |

our ability to make additional investments in our target assets;

|

| • |

restrictions under Maryland law;

|

| • |

the terms of our preferred stock;

|

| • |

any debt service requirements;

|

| • |

our taxable income;

|

| • |

the annual distribution requirements under the REIT provisions of the Code; and

|

| • |

other factors that our board of directors may deem relevant.

|

|

Declaration

Date

|

Record

Date

|

Payment Date |

Amount per

Share

|

||||||

|

2022

|

|||||||||

|

Fourth Quarter

|

12/16/2022

|

12/30/2022

|

1/31/2023

|

$

|

0.27

|

||||

|

Third Quarter

|

9/15/2022

|

9/30/2022

|

10/25/2022

|

$

|

0.27

|

||||

|

Second Quarter

|

6/17/2022

|

6/30/2022

|

7/26/2022

|

$

|

0.27

|

||||

|

First Quarter

|

3/11/2022

|

3/31/2022

|

4/26/2022

|

$

|

0.27

|

||||

|

2021

|

|||||||||

|

Fourth Quarter

|

12/9/2021

|

12/31/2021

|

1/25/2022

|

$

|

0.27

|

||||

|

Third Quarter

|

9/17/2021

|

9/30/2021

|

10/26/2021

|

$

|

0.27

|

||||

|

Second Quarter

|

6/17/2021

|

6/30/2021

|

7/27/2021

|

$

|

0.27

|

||||

|

First Quarter

|

3/4/2021

|

3/31/2021

|

4/27/2021

|

$

|

0.27

|

||||

|

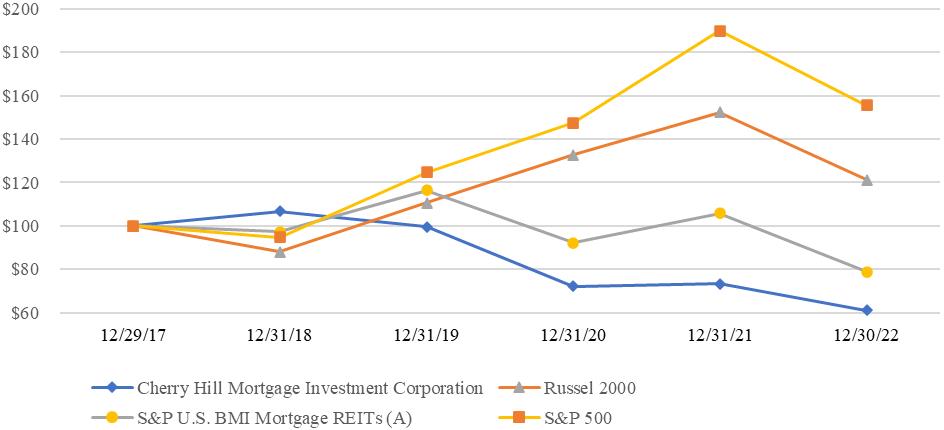

December 31, 2018

|

December 31, 2019

|

December 31, 2020

|

December 31, 2021

|

December 30, 2022

|

||||||||||||||||

|

Cherry Hill Mortgage Investment Corporation

|

$

|

106.63

|

$

|

$99.46

|

$

|

$72.09

|

$

|

$73.25

|

$

|

$61.09

|

||||||||||

|

Russel 2000

|

$

|

88.15

|

$

|

$110.65

|

$

|

$132.74

|

$

|

$152.41

|

$

|

$121.26

|

||||||||||

|

S&P U.S. BMI Mortgage REITs (A)

|

$

|

97.38

|

$

|

$116.47

|

$

|

$92.20

|

$

|

$105.80

|

$

|

$78.71

|

||||||||||

|

S&P 500

|

$

|

94.82

|

$

|

$124.68

|

$

|

$147.62

|

$

|

$190.00

|

$

|

$155.59

|

||||||||||

| (A) |

In addition to the Company, as of December 31, 2022, the S&P U.S. BMI Mortgage REITs Index comprised the following companies: AFC Gamma Inc., AG Mortgage Investment Trust, Inc., AGNC Investment Corp.,

Angel Oak Mortgage, Inc., Apollo Commercial Real Estate Finance, Inc., Arbor Realty Trust, Inc., Ares Commercial RE Corporation, Arlington Asset Invt Corp., ARMOUR Residential REIT, Inc., Blackstone Mortgage Trust, Inc., BrightSpire

Capital, Inc., Broadmark Realty Capital Inc., Chimera Investment Corporation, Claros Mortgage Trust, Inc., Dynex Capital, Inc., Ellington Financial Inc., Ellington Residential Mortgage REIT, Franklin BSP Realty Trust, Inc., Granite Point

Mortgage Trust, Inc., Great Ajax Corp., Hannon Armstrong Sustainable Infrastructure Capital, Inc., Invesco Mortgage Capital Inc., KKR Real Estate Finance Trust Inc., Ladder Capital Corp, Lument Finance Trust, Inc., MFA Financial, Inc., New

York Mortgage Trust, Inc., NexPoint Real Estate Finance, Inc., Orchid Island Capital, Inc., PennyMac Mortgage Investment Trust, Ready Capital Corporation, Redwood Trust, Inc., Rithm Capital Corp., Sachem Capital Corp., Seven Hills Realty

Trust, Starwood Property Trust, Inc., TPG RE Finance Trust, Inc, and Western Asset Mortgage Capital Corporation.

|

|

Number of Securities

Issued or to be Issued

Upon Exercise |

Number of Securities

Remaining Available For

Future Issuance Under

Equity Compensation

Plans

|

|||||||

|

Equity compensation Plans Approved By Shareholders

|

915,464

|

|||||||

|

LTIP-OP Units

|

459,897

|

|||||||

|

Forfeited LTIP-OP Units

|

(5,832

|

)

|

||||||

|

Converted LTIP-OP Units

|

(44,795

|

)

|

||||||

|

Redeemed LTIP-OP Units

|

(9,054

|

)

|

||||||

|

Shares of Common Stock

|

178,421

|

|||||||

|

Forfeited Shares of Common Stock

|

(3,155

|

)

|

||||||

|

Equity Compensation Plans Not Approved By Shareholders

|

-

|

|||||||

| Item 6. |

Reserved

|

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

Quarter Ended

|

Average Asset Yield

|

Average Cost of Funds

|

Average Net Interest Rate Spread

|

|||||||||

|

December 31, 2022

|

4.29

|

%

|

0.69

|

%

|

3.60

|

%

|

||||||

|

September 30, 2022

|

3.90

|

%

|

0.77

|

%

|

3.13

|

%

|

||||||

|

June 30, 2022

|

3.56

|

%

|

0.32

|

%

|

3.25

|

%

|

||||||

|

March 31, 2022

|

2.98

|

%

|

0.49

|

%

|

2.49

|

%

|

||||||

|

December 31, 2021

|

2.93

|

%

|

0.62

|

%

|

2.31

|

%

|

||||||

|

September 30, 2021

|

2.94

|

%

|

0.63

|

%

|

2.31

|

%

|

||||||

|

June 30, 2021

|

2.94

|

%

|

0.62

|

%

|

2.32

|

%

|

||||||

|

March 31, 2021

|

3.04

|

%

|

0.53

|

%

|

2.52

|

%

|

||||||

| • |

the interest expense associated with our borrowings to increase;

|

| • |

the value of our assets to fluctuate;

|

| • |

the coupons on any adjustable-rate and hybrid RMBS we may own to reset, although on a delayed basis, to higher interest rates;

|

| • |

prepayments on our RMBS to slow, thereby slowing the amortization of our purchase premiums and the accretion of our purchase discounts; and

|

| • |

an increase in the value of any interest rate swap agreements we may enter into as part of our hedging strategy.

|

| • |

prepayments on our RMBS to increase, thereby accelerating the amortization of our purchase premiums and the accretion of our purchase discounts;

|

| • |

the interest expense associated with our borrowings to decrease;

|

| • |

the value of our assets to fluctuate;

|

| • |

a decrease in the value of any interest rate swap agreements we may enter into as part of our hedging strategy; and

|

| • |

coupons on any adjustable-rate and hybrid RMBS assets we may own to reset, although on a delayed basis, to lower interest rates.

|

|

Year Ended December 31,

|

||||||||

|

2022

|

2021

|

|||||||

|

Income

|

||||||||

|

Interest income

|

$

|

29,642

|

$

|

14,956

|

||||

|

Interest expense

|

17,563

|

5,768

|

||||||

|

Net interest income

|

12,079

|

9,188

|

||||||

|

Servicing fee income

|

53,430

|

54,157

|

||||||

|

Servicing costs

|

11,837

|

13,624

|

||||||

|

Net servicing income

|

41,593

|

40,533

|

||||||

|

Other income (loss)

|

||||||||

|

Realized gain (loss) on RMBS, available-for-sale, net

|

(99,694

|

)

|

548

|

|||||

|

Realized gain (loss) on derivatives, net

|

1,363

|

(9,339

|

)

|

|||||

|

Realized gain on acquired assets, net

|

12

|

15

|

||||||

|

Unrealized gain (loss) on derivatives, net

|

61,864

|

(1,745

|

)

|

|||||

|

Unrealized gain (loss) on investments in Servicing Related Assets

|

22,976

|

(11,062

|

)

|

|||||

|

Total Income

|

40,193

|

28,138

|

||||||

|

Expenses

|

||||||||

|

General and administrative expense

|

6,305

|

6,983

|

||||||

|

Management fee to affiliate

|

6,629

|

7,844

|

||||||

|

Total Expenses

|

12,934

|

14,827

|

||||||

|

Income Before Income Taxes

|

27,259

|

13,311

|

||||||

|

Provision for corporate business taxes

|

5,070

|

781

|

||||||

|

Net Income

|

22,189

|

12,530

|

||||||

|

Net income allocated to noncontrolling interests in Operating Partnership

|

(450

|

)

|

(247

|

)

|

||||

|

Dividends on preferred stock

|

9,853

|

9,853

|

||||||

|

Net Income Applicable to Common Stockholders

|

$

|

11,886

|

$

|

2,430

|

||||

|

Servicing

Related Assets

|

RMBS

|

All Other

|

Total

|

|||||||||||||

|

Income Statement

|

||||||||||||||||

|

Year Ended December 31, 2022

|

||||||||||||||||

|

Interest income

|

$

|

-

|

$

|

29,642

|

$

|

-

|

$

|

29,642

|

||||||||

|

Interest expense

|

3,837

|

13,726

|

-

|

17,563

|

||||||||||||

|

Net interest income (expense)

|

(3,837

|

)

|

15,916

|

-

|

12,079

|

|||||||||||

|

Servicing fee income

|

53,430

|

-

|

-

|

53,430

|

||||||||||||

|

Servicing costs

|

11,837

|

-

|

-

|

11,837

|

||||||||||||

|

Net servicing income

|

41,593

|

-

|

-

|

41,593

|

||||||||||||

|

Other income (expense)

|

(26,655

|

)

|

13,176

|

-

|

(13,479

|

)

|

||||||||||

|

Other operating expenses

|

2,099

|

692

|

10,143

|

12,934

|

||||||||||||

|

Provision for corporate business taxes

|

5,070

|

-

|

-

|

5,070

|

||||||||||||

|

Net Income (Loss)

|

$

|

3,932

|

$

|

28,400

|

$

|

(10,143

|

)

|

$

|

22,189

|

|||||||

|

Year Ended December 31, 2021

|

||||||||||||||||

|

Interest income

|

$

|

376

|

$

|

14,580

|

$

|

-

|

$

|

14,956

|

||||||||

|

Interest expense

|

4,484

|

1,284

|

-

|

5,768

|

||||||||||||

|

Net interest income (expense)

|

(4,108

|

)

|

13,296

|

-

|

9,188

|

|||||||||||

|

Servicing fee income

|

54,157

|

-

|

-

|

54,157

|

||||||||||||

|

Servicing costs

|

13,624

|

-

|

-

|

13,624

|

||||||||||||

|

Net servicing income

|

40,533

|

-

|

-

|

40,533

|

||||||||||||

|

Other income (expense)

|

(34,103

|

)

|

12,520

|

-

|

(21,583

|

)

|

||||||||||

|

Other operating expenses

|

3,040

|

717

|

11,070

|

14,827

|

||||||||||||

|

Provision for corporate business taxes

|

781

|

-

|

-

|

781

|

||||||||||||

|

Net Income (Loss)

|

$

|

(1,499

|

)

|

$

|

25,099

|

$

|

(11,070

|

)

|

$

|

12,530

|

||||||

|

Servicing

Related Assets

|

RMBS

|

All Other

|

Total

|

|||||||||||||

|

Balance Sheet

|

||||||||||||||||

|

December 31, 2022

|

||||||||||||||||

|

Investments

|

$

|

279,739

|

$

|

931,431

|

$

|

-

|

$

|

1,211,170

|

||||||||

|

Other assets

|

32,849

|

106,885

|

57,921

|

197,655

|

||||||||||||

|

Total assets

|

312,588

|

1,038,316

|

57,921

|

1,408,825

|

||||||||||||

|

Debt

|

183,888

|

825,962

|

-

|

1,009,850

|

||||||||||||

|

Other liabilities

|

29,047

|

92,875

|

11,537

|

133,459

|

||||||||||||

|

Total liabilities

|

212,935

|

918,837

|

11,537

|

1,143,309

|

||||||||||||

|

Net assets

|

$

|

99,653

|

$

|

119,479

|

$

|

46,384

|

$

|

265,516

|

||||||||

|

December 31, 2021

|

||||||||||||||||

|

Investments

|

$

|

218,727

|

$

|

953,496

|

$

|

-

|

$

|

1,172,223

|

||||||||

|

Other assets

|

44,506

|

21,611

|

64,522

|

130,639

|

||||||||||||

|

Total assets

|

263,233

|

975,107

|

64,522

|

1,302,862

|

||||||||||||

|

Debt

|

145,268

|

865,494

|

-

|

1,010,762

|

||||||||||||

|

Other liabilities

|

1,847

|

1,411

|

10,026

|

13,284

|

||||||||||||

|

Total liabilities

|

147,115

|

866,905

|

10,026

|

1,024,046

|

||||||||||||

|

Net assets

|

$

|

116,118

|

$

|

108,202

|

$

|

54,496

|

$

|

278,816

|

||||||||

|

Year Ended

December 31, 2022 |

||||

|

Accumulated other comprehensive gain, December 31, 2021

|

$

|

7,527

|

||

|

Other comprehensive loss

|

(36,631

|

)

|

||

|

Accumulated other comprehensive loss, December 31, 2022

|

$

|

(29,104

|

)

|

|

|

Year Ended

December 31, 2021 |

||||

|

Accumulated other comprehensive gain, December 31, 2020

|

$

|

35,594

|

||

|

Other comprehensive loss

|

(28,067

|

)

|

||

|

Accumulated other comprehensive gain, December 31, 2021

|

$

|

7,527

|

||

| • |

earnings available for distribution; and

|

| • |

earnings available for distribution per average common share.

|

|

Year Ended December 31,

|

||||||||

|

2022

|

2021

|

|||||||

|

Net Income

|

$

|

22,189

|

$

|

12,530

|

||||

|

Realized loss (gain) on RMBS, net

|

99,694

|

(548

|

)

|

|||||

|

Realized loss on derivatives, net (A)

|

16,051

|

26,763

|

||||||

|

Realized gain on acquired assets, net

|

(12

|

)

|

(15

|

)

|

||||

|

Unrealized loss (gain) on derivatives, net

|

(61,864

|

)

|

1,745

|

|||||

|

Unrealized gain on investments in MSRs, net of estimated MSR amortization

|

(53,182

|

)

|

(16,358

|

)

|

||||

|

Tax expense on realized and unrealized gain on MSRs

|

9,460

|

4,639

|

||||||

|

Total EAD:

|

$

|

32,336

|

$

|

28,756

|

||||

|

EAD attributable to noncontrolling interests in Operating Partnership

|

(656

|

)

|

(566

|

)

|

||||

|

Dividends on preferred stock

|

9,853

|

9,853

|

||||||

|

EAD Attributable to Common Stockholders

|

$

|

21,827

|

$

|

18,337

|

||||

|

EAD Attributable to Common Stockholders, per Diluted Share

|

$

|

1.10

|

$

|

1.06

|

||||

|

GAAP Net Income Per Share of Common Stock, per Diluted Share

|

$

|

0.60

|

$

|

0.14

|

||||

| (A) |

Excludes drop income on TBA dollar rolls of $6.3 million and $13.1 million and interest rate swap periodic interest income of $11.1 million and $3.8 million, and includes trading expenses of $0 and $539,000

for the years ended December 31, 2022 and December 31, 2021, respectively.

|

|

Collateral Characteristics

|

||||||||||||||||||||||||||||

|

Current

Carrying

Amount

|

Current Principal Balance

|

WA Coupon(A)

|

WA

Servicing Fee(A)

|

WA

Maturity (months)(A)

|

WA

Loan Age (months)(A)

|

ARMs

%(B)

|

||||||||||||||||||||||

|

MSRs

|

$

|

279,739

|

$

|

21,688,353

|

3.49

|

%

|

0.25

|

%

|

310

|

31

|

0.1

|

%

|

||||||||||||||||

|

MSR Total/Weighted Average

|

$

|

279,739

|

$

|

21,688,353

|

3.49

|

%

|

0.25

|

%

|

310

|

31

|

0.1

|

%

|

||||||||||||||||

|

Collateral Characteristics

|

||||||||||||||||||||||||||||

|

Current

Carrying

Amount

|

Current Principal Balance

|

WA Coupon(A)

|

WA

Servicing Fee(A)

|

WA

Maturity (months)(A)

|

WA

Loan Age (months)(A)

|

ARMs

%(B)

|

||||||||||||||||||||||

|

MSRs

|

$

|

218,727

|

$

|

20,773,278

|

3.51

|

%

|

0.25

|

%

|

316

|

25

|

0.1

|

%

|

||||||||||||||||

|

MSR Total/Weighted Average

|

$

|

218,727

|

$

|

20,773,278

|

3.51

|

%

|

0.25

|

%

|

316

|

25

|

0.1

|

%

|

||||||||||||||||

| A) |

Weighted average coupon, servicing fee, maturity and loan age of the underlying residential mortgage loans in the pool are based on the unpaid principal balance.

|

| (B) |

ARMs % represents the percentage of the total principal balance of the pool that corresponds to ARMs and hybrid ARMs.

|

|

Gross Unrealized

|

Weighted Average

|

||||||||||||||||||||||||||||||||||||

|

Asset Type

|

Original

Face Value |

Book

Value |

Gains

|

Losses

|

Carrying Value(A)

|

Number of Securities

|

Rating

|

Coupon

|

Yield(C)

|

Maturity (Years)

|

|||||||||||||||||||||||||||

|

RMBS

|

|

||||||||||||||||||||||||||||||||||||

|

Fannie Mae

|

$

|

550,740

|

$

|

497,038

|

$

|

2,843

|

$

|

(16,484

|

)

|

$

|

483,397

|

45

|

(B)

|

4.27

|

%

|

4.34

|

%

|

29

|

|||||||||||||||||||

|

Freddie Mac

|

500,873

|

463,380

|

1,384

|

(16,730

|

)

|

448,034

|

38

|

(B)

|

4.18

|

%

|

4.24

|

%

|

29

|

||||||||||||||||||||||||

|

Total/Weighted Average

|

$

|

1,051,613

|

$

|

960,418

|

$

|

4,227

|

$

|

(33,214

|

)

|

$

|

931,431

|

83

|

4.23

|

%

|

4.29

|

%

|

29

|

||||||||||||||||||||

|

Gross Unrealized

|

Weighted Average

|

||||||||||||||||||||||||||||||||||||

|

Asset Type

|

Original

Face Value |

Book

Value |

Gains

|

Losses

|

Carrying Value(A)

|

Number of Securities

|

Rating

|

Coupon

|

Yield(C)

|

Maturity (Years)

|

|||||||||||||||||||||||||||

|

RMBS

|

|

||||||||||||||||||||||||||||||||||||

|

Fannie Mae

|

$

|

772,607

|

$

|

554,151

|

$

|

9,276

|

$

|

(3,650

|

)

|

$

|

559,777

|

76

|

(B)

|

3.09

|

%

|

2.96

|

%

|

27

|

|||||||||||||||||||

|

Freddie Mac

|

484,479

|

391,700

|

5,260

|

(3,241

|

)

|

393,719

|

45

|

(B)

|

3.02

|

%

|

2.89

|

%

|

28

|

||||||||||||||||||||||||

|

Total/Weighted Average

|

$

|

1,257,086

|

$

|

945,851

|

$

|

14,536

|

$

|

(6,891

|

)

|

$

|

953,496

|

121

|

3.06

|

%

|

2.93

|

%

|

28

|

||||||||||||||||||||

| (A) |

See “Item 8. Consolidated Financial Statements and Supplementary Data—Note 9. Fair Value” regarding the estimation of fair value, which approximates carrying value for all securities.

|

| (B) |

The Company used an implied AAA rating for the Agency RMBS.

|

| (C) |

The weighted average yield is based on the most recent gross monthly interest income, which is then annualized and divided by the book value of settled securities.

|

|

December 31, 2022

|

December 31, 2021

|

|||||||

|

Weighted Average Asset Yield

|

4.44

|

%

|

3.19

|

%

|

||||

|

Weighted Average Interest Expense

|

0.67

|

%

|

0.73

|

%

|

||||

|

Net Interest Spread

|

3.77

|

%

|

2.46

|

%

|

||||

|

Quarter Ended

|

Average Monthly

Amount |

Maximum Month-End

Amount

|

Quarter Ending

Amount |

|||||||||

|

December 31, 2022

|

$

|

808,623

|

$

|

825,962

|

$

|

825,962

|

||||||

|

September 30, 2022

|

$

|

776,544

|

$

|

865,414

|

$

|

865,414

|

||||||

|

June 30, 2022

|

$

|

679,702

|

$

|

702,130

|

$

|

683,173

|

||||||

|

March 31, 2022

|

$

|

820,270

|

$

|

859,726

|

$

|

764,885

|

||||||

|

December 31, 2021

|

$

|

830,099

|

$

|

865,494

|

$

|

865,494

|

||||||

|

September 30, 2021

|

$

|

790,587

|

$

|

821,540

|

$

|

777,416

|

||||||

|

June 30, 2021

|

$

|

858,269

|

$

|

897,047

|

$

|

897,047

|

||||||

|

March 31, 2021

|

$

|

1,012,389

|

$

|

1,118,231

|

$

|

934,001

|

||||||

|

RMBS Market

Value

|

Repurchase Agreements

|

Weighted Average Rate

|

||||||||||

|

Less than one month

|

$

|

750,218

|

$

|

715,899

|

4.39

|

%

|

||||||

|

One to three months

|

114,418

|

110,063

|

4.53

|

%

|

||||||||

|

Total/Weighted Average

|

$

|

864,636

|

$

|

825,962

|

4.41

|

%

|

||||||

|

RMBS Market

Value

|

Repurchase Agreements

|

Weighted Average Rate

|

||||||||||

|

Less than one month

|

$

|

297,720

|

$

|

291,007

|

0.13

|

%

|

||||||

|

One to three months

|

595,168

|

574,487

|

0.14

|

%

|

||||||||

|

Total/Weighted Average

|

$

|

892,888

|

$

|

865,494

|

0.14

|

%

|

||||||

| • |

actual results of operations;

|

| • |

our level of retained cash flows;

|

| • |

our ability to make additional investments in our target assets;

|

| • |

restrictions under Maryland law;

|

| • |

the terms of our preferred stock;

|

| • |

any debt service requirements;

|

| • |

our taxable income;

|

| • |

the annual distribution requirements under the REIT provisions of the Code; and

|

| • |

other factors that our board of directors may deem relevant.

|

|

Less than

1 year |

1 to 3

years |

3 to 5

years |

More than

5 years |

Total

|

||||||||||||||||

|

Repurchase agreements

|

||||||||||||||||||||

|

Borrowings under repurchase agreements

|

$

|

825,962

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

825,962

|

||||||||||

|

Interest on repurchase agreement borrowings(A)

|

$

|

2,797

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

2,797

|

||||||||||

|

Freddie Mac MSR Revolver

|

||||||||||||||||||||

|

Borrowings under Freddie Mac MSR Revolver

|

$

|

68,500

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

68,500

|

||||||||||

|

Interest on Freddie Mac MSR Revolver borrowings

|

$

|

1,010

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

1,010

|

||||||||||

|

Fannie Mae MSR Revolving Facility

|

||||||||||||||||||||

|

Borrowings under Fannie Mae MSR Revolving Facility

|

$

|

627

|

$

|

16,406

|

$

|

98,967

|

$

|

-

|

$

|

116,000

|

||||||||||

|

Interest on Fannie Mae MSR Revolving Facility

|

$

|

700

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

700

|

||||||||||

|

Less than

1 year |

1 to 3

years |

3 to 5

years |

More than

5 years |

Total

|

||||||||||||||||

|

Repurchase agreements

|

||||||||||||||||||||

|

Borrowings under repurchase agreements

|

$

|

865,494

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

865,494

|

||||||||||

|

Interest on repurchase agreement borrowings(A)

|

$

|

135

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

135

|

||||||||||

|

Freddie Mac MSR Revolver

|

||||||||||||||||||||

|

Borrowings under Freddie Mac MSR Revolver

|

$

|

63,000

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

63,000

|

||||||||||

|

Interest on Freddie Mac MSR Revolver borrowings

|

$

|

578

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

578

|

||||||||||

|

Fannie Mae MSR Revolving Facility

|

||||||||||||||||||||

|

Borrowings under Fannie Mae MSR Revolving Facility

|

$

|

-

|

$

|

7,566

|

$

|

75,434

|

$

|

-

|

$

|

83,000

|

||||||||||

|

Interest on Fannie Mae MSR Revolving Facility

|

$

|

215

|

$

|

-

|

$

|

-

|

$

|

-

|

$

|

215

|

||||||||||

| (A) |

Interest expense is calculated based on the interest rate in effect at December 31, 2022 and December 31, 2021, respectively, and includes all interest expense incurred through those dates.

|

| Item 7A. |

Quantitative and Qualitative Disclosures about Market Risk

|

|

(20)%

|

|

(10)%

|

|

-%

|

|

10%

|

|

20%

|

|

|||||||||||

|

Discount Rate Shift in %

|

||||||||||||||||||||

|

Estimated FV

|

$

|

305,821

|

$

|

292,241

|

$

|

279,739

|

$

|

268,201

|

$

|

257,526

|

||||||||||

|

Change in FV

|

$

|

26,082

|

$

|

12,502

|

$

|

-

|

$

|

(11,538

|

)

|

$

|

(22,213

|

)

|

||||||||

|

% Change in FV

|

9

|

%

|

4

|

%

|

-

|

(4

|

)%

|

(8

|

)%

|

|||||||||||

|

Voluntary Prepayment Rate Shift in %

|

||||||||||||||||||||

|

Estimated FV

|

$

|

296,237

|

$

|

288,025

|

$

|

279,739

|

$

|

271,707

|

$

|

264,005

|

||||||||||

|

Change in FV

|

$

|

16,498

|

$

|

8,286

|

$

|

-

|

$

|

(8,032

|

)

|

$

|

(15,734

|

)

|

||||||||

|

% Change in FV

|

6

|

%

|

3

|

%

|

-

|

(3

|

)%

|

(6

|

)%

|

|||||||||||

|

Servicing Cost Shift in %

|

||||||||||||||||||||

|

Estimated FV

|

$

|

288,345

|

$

|

284,042

|

$

|

279,739

|

$

|

275,436

|

$

|

271,133

|

||||||||||

|

Change in FV

|

$

|

8,606

|

$

|

4,303

|

$

|

-

|

$

|

(4,303

|

)

|

$

|

(8,606

|

)

|

||||||||

|

% Change in FV

|

3

|

%

|

2

|

%

|

-

|

(2

|

)%

|

(3

|

)%

|

|||||||||||

|

(20)%

|

|

(10)%

|

|

-%

|

|

10%

|

|

20%

|

|

|||||||||||

|

Discount Rate Shift in %

|

||||||||||||||||||||

|

Estimated FV

|

$

|

233,342

|

$

|

225,813

|

$

|

218,727

|

$

|

212,050

|

$

|

205,749

|

||||||||||

|

Change in FV

|

$

|

14,614

|

$

|

7,085

|

$

|

-

|

$

|

(6,677

|

)

|

$

|

(12,979

|

)

|

||||||||

|

% Change in FV

|

7

|

%

|

3

|

%

|

-

|

(3

|

)%

|

(6

|

)%

|

|||||||||||

|

Voluntary Prepayment Rate Shift in %

|

||||||||||||||||||||

|

Estimated FV

|

$

|

244,460

|

$

|

231,026

|

$

|

218,727

|

$

|

207,458

|

$

|

197,103

|

||||||||||

|

Change in FV

|

$

|

25,732

|

$

|

12,298

|

$

|

-

|

$

|

(11,270

|

)

|

$

|

(21,624

|

)

|

||||||||

|

% Change in FV

|

12

|

%

|

6

|

%

|

-

|

(5

|

)%

|

(10

|

)%

|

|||||||||||

|

Servicing Cost Shift in %

|

||||||||||||||||||||

|

Estimated FV

|

$

|

225,480

|

$

|

222,104

|

$

|

218,727

|

$

|

215,351

|

$

|

211,975

|

||||||||||

|

Change in FV

|

$

|

6,752

|

$

|

3,376

|

$

|

-

|

$

|

(3,376

|

)

|

$

|

(6,752

|

)

|

||||||||

|

% Change in FV

|

3

|

%

|

2

|

%

|

-

|

(2

|

)%

|

(3

|

)%

|

|||||||||||

|

Fair Value Change

|

||||||||||||||||||||||||

|

December 31, 2022

|

+25 Bps

|

+50 Bps

|

+75 Bps

|

+100 Bps

|

+150 Bps

|

|||||||||||||||||||

|

RMBS Portfolio

|

||||||||||||||||||||||||

|

RMBS, available-for-sale, net of swaps

|

$

|

785,308

|

||||||||||||||||||||||

|

RMBS Total Return (%)

|

0.07

|

%

|

0.10

|

%

|

0.09

|

%

|

0.05

|

%

|

(0.17

|

)%

|

||||||||||||||

|

RMBS Dollar Return

|

$

|

571

|

$

|

814

|

$

|

723

|

$

|

357

|

$

|

(1,298

|

)

|

|||||||||||||

|

Fair Value Change

|

||||||||||||||||||||||||

|

December 31, 2021

|

+25 Bps

|

+50 Bps

|

+75 Bps

|

+100 Bps

|

+150 Bps

|

|||||||||||||||||||

|

RMBS Portfolio

|

||||||||||||||||||||||||

|

RMBS, available-for-sale, net of swaps

|

$

|

1,429,335

|

||||||||||||||||||||||

|

RMBS Total Return (%)

|

(0.18

|

)%

|

(0.49

|

)%

|

(0.92

|

)%

|

(1.44

|

)%

|

(2.74

|

)%

|

||||||||||||||

|

RMBS Dollar Return

|

$

|

(2,584

|

)

|

$

|

(7,016

|

)

|

$

|

(13,110

|

)

|

$

|

(20,635

|

)

|

$

|

(39,125

|

)

|

|||||||||

|

Page

|

||||

| 74 | ||||

| 76 | ||||

| 77 | ||||

| 78 | ||||

| 79 | ||||

| 80 | ||||

| 81 | ||||

|

Description of the Matter

|

|

The Company invests in servicing related assets comprising mortgage servicing rights (MSRs) which have a fair value of $280 million as of

December 31, 2022 as included in Notes 5 and 9 to the consolidated financial statements. The Company records servicing related assets at fair value on a recurring basis with changes in fair value recognized in the income statement. These

fair value estimates are based on valuation techniques used to estimate future cash flows that incorporate significant unobservable inputs and assumptions which include prepayment speeds, discount rates and cost to service.

Auditing the valuation of servicing related assets is complex and required the use of a specialist due to the high degree of judgment in

management’s assumptions which are unobservable in nature. Additionally, selecting and applying audit procedures to address the estimation uncertainty involves auditor subjectivity and industry-specific knowledge of servicing related

assets including the current market conditions considered by a market participant.

|

|

|

|

|

|

How We Addressed the Matter in Our Audit

|

|

We obtained an understanding, evaluated and tested the Company's processes and the design and operating effectiveness of internal controls

addressing the valuation of servicing related assets including management’s review of the completeness and accuracy of the key inputs and data used in the valuation, management’s comparison of assumptions to independent third party data

and the internal fair value mark to third party independent valuation firms ranges to evaluate the reasonableness of the fair values developed by the Company.

To test the valuation of servicing related assets, our audit procedures included, among others, evaluating the Company’s use of the discounted

cash flow valuation technique, validating the accuracy of model objective inputs to underlying records, and evaluating significant subjective assumptions by comparing to current industry, market and economic trends. We involved our

valuation specialists to assist in our evaluation of the Company’s model, valuation methodology, significant assumptions and to independently develop a range of fair values for the MSRs. We evaluated the knowledge, skill and ability, and

objectivity of management’s independent valuation firms engaged to evaluate the reasonableness of the fair values developed by the Company. We compared management’s assumptions and fair value estimates to the assumptions and fair value

ranges developed by management’s valuation specialists and our independent range to assess management’s estimate of fair value and identify potential sources of contrary information. We evaluated the Company’s fair value disclosures

included in Note 9 for consistency with US GAAP.

|

Consolidated Balance Sheets

(in thousands — except share data)

|

December 31, 2022

|

December 31, 2021

|

|||||||

|

Assets

|

||||||||

|

RMBS, available-for-sale, at fair value (including pledged assets of $

|

$

|

|

$

|

|

||||

|

Investments in Servicing Related Assets, at fair value (including pledged assets of $

|

|

|

||||||

|

Cash and cash equivalents

|

|

|

||||||

|

Restricted cash

|

|

|

||||||

|

Derivative assets

|

|

|

||||||

|

Receivables from unsettled trades

|

||||||||

|

Receivables and other assets

|

|

|

||||||

|

Total Assets

|

$

|

|

$

|

|

||||

|

Liabilities and Stockholders’ Equity

|

||||||||

|

Liabilities

|

||||||||

|

Repurchase agreements

|

$

|

|

$

|

|

||||

|

Derivative liabilities

|

|

|

||||||

|

Notes payable

|

|

|

||||||

|

Dividends payable

|

|

|

||||||

|

Due to manager

|

|

|

||||||

|

Payables for unsettled trades

|

||||||||

|

Accrued expenses and other liabilities

|

|

|

||||||

|

Total Liabilities

|

$

|

|

$

|

|

||||

|

Stockholders’ Equity

|

||||||||

|

Series A Preferred stock, $

|

$

|

|

$

|

|

||||

|

Series B Preferred stock, $

|

|

|

||||||

|

Common stock, $

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Accumulated Deficit

|

(

|

)

|

(

|

)

|

||||

|

Accumulated other comprehensive income (loss)

|

(

|

)

|

|

|||||

|

Total Cherry Hill Mortgage Investment Corporation Stockholders’ Equity

|

$

|

|

$

|

|

||||

|

Non-controlling interests in Operating Partnership

|

|

|

||||||

|

Total Stockholders’ Equity

|

$

|

|

$

|

|

||||

|

Total Liabilities and Stockholders’ Equity

|

$

|

|

$

|

|

||||

Consolidated Statements of Income (Loss)

(in thousands — except per share data)

|

Year Ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Income

|

||||||||||||

|

Interest income

|

$

|

|

$

|

|

$

|

|

||||||

|

Interest expense

|

|

|

|

|||||||||

|

Net interest income

|

|

|

|

|||||||||

|

Servicing fee income

|

|

|

|

|||||||||

|

Servicing costs

|

|

|

|

|||||||||

|

Net servicing income

|

|

|

|

|||||||||

|

Other income (loss)

|

||||||||||||

|

Realized gain (loss) on RMBS, available-for-sale, net

|

(

|

)

|

|

(

|

)

|

|||||||

|

Realized loss on investments in MSRs, net

|

|

|

(

|

)

|

||||||||

|

Realized gain (loss) on derivatives, net

|

|

(

|

)

|

(

|

)

|

|||||||

|

Realized gain (loss) on acquired assets, net

|

|

|

(

|

)

|

||||||||

|

Unrealized gain (loss) on derivatives, net

|

|

(

|

)

|

|

||||||||

|

Unrealized gain (loss) on investments in Servicing Related Assets

|

|

(

|

)

|

(

|

)

|

|||||||

|

Total Income (Loss)

|

|

|

(

|

)

|

||||||||

|

Expenses

|

||||||||||||

|

General and administrative expense

|

|

|

|

|||||||||

|

Management fee to affiliate

|

|

|

|

|||||||||

|

Total Expenses

|

|

|

|

|||||||||

|

Income (Loss) Before Income Taxes

|

|

|

(

|

)

|

||||||||

|

Provision for (Benefit from) corporate business taxes

|

|

|

(

|

)

|

||||||||

|

Net Income (Loss)

|

|

|

(

|

)

|

||||||||

|

Net (income) loss allocated to noncontrolling interests in Operating Partnership

|

(

|

)

|

(

|

)

|

|

|||||||

|

Dividends on preferred stock

|

|

|

|

|||||||||

|

Net Income (Loss) Applicable to Common Stockholders

|

$

|

|

$

|

|

$

|

(

|

)

|

|||||

|

Net Income (Loss) Per Share of Common Stock

|

||||||||||||

|

Basic

|

$

|

|

$

|

|

$

|

(

|

)

|

|||||

|

Diluted

|

$

|

|

$

|

|

$

|

(

|

)

|

|||||

|

Weighted Average Number of Shares of Common Stock Outstanding

|

||||||||||||

|

Basic

|

|

|

|

|||||||||

|

Diluted

|

|

|

|

|||||||||

Consolidated Statements of Comprehensive Income (Loss)

(in thousands)

|

Year Ended December 31,

|

||||||||||||

|

2022

|

2021

|

2020

|

||||||||||

|

Net income (loss)

|

$

|

|

$

|

|

$

|

(

|

)

|

|||||

|

Other comprehensive income (loss):

|

||||||||||||

|

Unrealized loss on RMBS, available-for-sale, net

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Net other comprehensive loss

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Comprehensive loss

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

(

|

)

|

|||

|

Comprehensive loss attributable to noncontrolling interests in Operating Partnership

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Dividends on preferred stock

|

|

|

|

|||||||||

|

Comprehensive loss attributable to common stockholders

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

(

|

)

|

|||

Consolidated Statements of Changes in Stockholders’ Equity

(in thousands — except share data)

|

Common

Stock

Shares

|

Common

Stock

Amount

|

Preferred

Stock

Shares

|

Preferred

Stock

Amount

|

Additional

Paid-in

Capital

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Retained

Earnings

(Deficit)

|

Non-Controlling

Interest in

Operating

Partnership

|

Total

Stockholders’

Equity

|

||||||||||||||||||||||||||||

|

Balance, December 31, 2019

|

|

$

|

|

|

$

|

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

|

$

|

|

|||||||||||||||||||

|

Issuance of common stock

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Repurchase of common stock

|

(

|

)

|

|

|

|

(

|

)

|

|

|

|

(

|

)

|

||||||||||||||||||||||||

|

Issuance of preferred stock

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Conversion of OP units

|

-

|

|

-

|

|

|

|

|

(

|

)

|

(

|

)

|

|||||||||||||||||||||||||

|

Net Loss before dividends on preferred stock

|

-

|

|

-

|

|

|

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||||||||||||||||||||

|

Other Comprehensive Loss

|

-

|

|

-

|

|

|

(

|

)

|

|

|

(

|

)

|

|||||||||||||||||||||||||

|

LTIP-OP Unit awards

|

-

|

|

-

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Distribution paid on LTIP-OP Units

|

-

|

|

-

|

|

|

|

|

(

|

)

|

(

|

)

|

|||||||||||||||||||||||||

|

Common dividends declared, $

|

-

|

|

-

|

|

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Preferred Series A dividends declared, $

|

-

|

|

-

|

|

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Preferred Series B dividends declared, $

|

-

|

|

-

|

|

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||||||||||||||

|

Balance, December 31, 2020

|

|

$

|

|

|

$

|

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

|

$

|

|

|||||||||||||||||||

|

Issuance of common stock

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Conversion of OP units

|

-

|

|

-

|

|

|

|

|

(

|

)

|

(

|

)

|