UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☒ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended _______________________

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _______________

Commission file number _________________________

GREENBRIAR CAPITAL CORP.

(Exact name of Registrant specified in its charter)

Not Applicable

(Translation of Registrant's name into English)

British Columbia, Canada

(Jurisdiction of incorporation or organization)

632 Foster Avenue

Coquitlam, British Columbia, Canada, V3J 2L7

(Address of principal executive offices)

Jeffrey Ciachurski; (949) 903-5906; westernwind@shaw.ca

632 Foster Avenue, Coquitlam, British Columbia, Canada, V3J 2L7

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of Each Class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Not Applicable |

Not Applicable |

Not Applicable |

|

|

|

|

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Common Shares, without par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of business of the period covered by the annual report.

Not Applicable

Indicate by check mark if the Registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Yes ☐ No ☐

Indicate by check mark whether Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☐ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of "accelerated filer," "large accelerated filer," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☐ |

Accelerated Filer ☐ |

|

Non Accelerated Filer ☒ |

Emerging Growth Company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP ☐ |

International Financial Reporting Standards as issued |

Other ☐ |

|

|

by the International Accounting Standards Board ☒ |

|

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b 2 of the Exchange Act):

Yes ☐ No ☐

TABLE OF CONTENTS

Page

GENERAL MATTERS

In this Registration Statement on Form 20-F (this “Registration Statement”), all references to “Greenbriar” are to Greenbriar Capital Corp., and all references to the “Company”, “our”, “us” or “we” refer to Greenbriar Capital Corp. and its consolidated subsidiaries, unless the context clearly requires otherwise.

We report under International Financial Reporting Standards, as issued by the International Accounting Standards Board (“IFRS”). None of our financial statements were prepared in accordance with generally accepted accounting principles in the United States.

We use the Canadian dollar as our reporting currency. All references to “C$” are to Canadian dollars and references to “US$” are to United States dollars. On January 25, 2022, the daily average exchange rate for the conversion of Canadian dollars into U.S. dollars as reported by the Bank of Canada was C$1.00 = US$0.7918. See also Item 3, “Key Information” for more detailed currency and conversion information.

FORWARD LOOKING STATEMENTS

This Registration Statement contains statements that constitute "forward-looking statements". Any statements that are not statements of historical facts may be deemed to be forward-looking statements. These statements appear in a number of different places in this Registration Statement and, in some cases, can be identified by words such as "anticipates", "estimates", "projects", "expects", "contemplates", "intends", "believes", "plans", "may", "will" or their negatives or other comparable words, although not all forward-looking statements contain these identifying words. Forward-looking statements in this Registration Statement may include, but are not limited to, statements and/or information related to: strategy, future operations, revenues, earnings, projected costs, expected production capacity, expectations regarding demand and acceptance of our products, trends in the market in which we operate, plans and objectives of management.

Forward-looking statements are based on the reasonable assumptions, estimates, analysis and opinions made in light of our experience and our perception of trends, current conditions and expected developments, as well as other factors that we believe to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Management believes that the assumption and expectations reflected in such forward-looking statements are reasonable. Assumptions have been made regarding, among other things: the Company's ability to build Sage Ranch, the Montalva Solar Project and the Alberta Solar Projects, and to begin production deliveries within certain timelines; the Company's labor costs and material costs remaining consistent with the Company's current expectations; there being no material variations in the current regulatory environment; and the Company's ability to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used.

Such risks are discussed in Item 3.D "Risk Factors". In particular, without limiting the generality of the foregoing disclosure, the statements contained in Item 4.B. - "Business Overview", Item 5 - "Operating and Financial Review and Prospects" and Item 11 - "Quantitative and Qualitative Disclosures About Market Risk" are inherently subject to a variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly. Such risks, uncertainties and other factors include but are not limited to:

Although management has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There is no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking statements. Accordingly, readers should not place undue reliance on forward-looking statements. These cautionary remarks expressly qualify, in their entirety, all forward-looking statements attributable to our Company or persons acting on our Company's behalf. We do not undertake to update any forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting such statements, except as, and to the extent required by, applicable securities laws. You should carefully review the cautionary statements and risk factors contained in this Registration Statement and other documents that the Company may file from time to time with the securities regulators.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

A. Directors and Senior Management

The Directors and senior management of our Company as of January 24, 2022 are as follows:

|

Name |

Business Address |

Function |

|

Jeffrey J. Ciachurski |

632 Foster Avenue Coquitlam, British Columbia, Canada V3J 2L7 |

As our Chief Executive Officer, Mr. Ciachurski is responsible for strategic planning and operations, oversight of the Sage Ranch, the Alberta Solar Projects and the Montalva Solar Project, as well as managing our relations with our lawyers, regulatory authorities and investor community; as a director, Mr. Ciachurski participates in management oversight and helps to ensure compliance with our corporate governance policies and standards. As Corporate Secretary, Mr. Ciachurski is responsible for ensuring that the board of directors has the proper advice and resources to fulfill their duties to shareholders |

|

Anthony Balic |

632 Foster Avenue Coquitlam, British Columbia, Canada V3J 2L7 |

As our Chief Financial Officer, Mr. Balic is responsible for the management and supervision of all of the financial aspects of our business and corporate governance and standards. |

|

Clifford M. Webb |

632 Foster Avenue Coquitlam, British Columbia, Canada V3J 2L7 |

As President, Mr. Webb is responsible for the oversight, design, and construction of our Montalva Solar project. As a director, Mr. Webb participates in management oversight and helps to ensure compliance with our corporate governance policies and standards. |

|

J. Michael Boyd |

632 Foster Avenue Coquitlam, British Columbia, Canada V3J 2L7 |

As an independent director, Mr. Boyd supervises our management and helps to ensure compliance with our corporate governance policies and standards. |

|

Daniel Kunz |

632 Foster Avenue Coquitlam, British Columbia, Canada V3J 2L7 |

As an independent director, Mr. Kunz supervises our management and helps to ensure compliance with our corporate governance policies and standards. |

|

William Sutherland |

632 Foster Avenue Coquitlam, British Columbia, Canada V3J 2L7 |

As an independent director, Mr. Sutherland supervises our management and helps to ensure compliance with our corporate governance policies and standards. |

|

|

|

|

|

Devon Sandford |

632 Foster Avenue Coquitlam, British Columbia, Canada V3J 2L7 |

As President of Greenbriar Capital Corp. Alberta, our wholly-owned subsidiary, Mr. Sandford leads the effort to build high quality "inside-the-fence", utility scale and commercial solar facilities in Alberta. |

B. Advisers

Our legal advisers are McMillan LLP, Barristers & Solicitors, with a business address at Suite 1500, 1055 West Georgia Street, P.O. Box 1117, Vancouver, British Columbia, Canada V6E 4N7.

C. Auditors

Our auditors are Davidson & Company LLP, with a business address at 1200-609 Granville Street, P.O. Box 10372, Vancouver, British Columbia, Canada V7Y 1G6, which are members of the Institute of Chartered Accountants of British Columbia and are registered with both the Canadian Public Accountability Board (CPAB) and the U.S. Public Company Accounting Oversight Board (PCAOB). Davidson & Company LLP has audited our consolidated financial statements for the fiscal years ended December 31, 2019 and 2018. Our consolidated financial statements for the fiscal years ended December 31, 2017, 2016 and 2015 were audited by Deloitte LLP of 2800 - 1055 Dunsmuir Street, 4 Bentall Centre, P.O. Box 49279, Vancouver, British Columbia, Canada, V7X 1P4.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected financial data

The selected historical consolidated financial information set forth below has been derived from our financial statements for the fiscal years ended December 31, 2019, 2018, 2017 and 2016, and the nine months ended September 30, 2021 and 2020.

Consolidated Statement of Net Loss

| Consolidated Statement of Income (Loss) | |||||||||||||||||||||

| Nine months ended September 30, 2021 |

Nine months ended September 30, 2020 |

Year ended December 31, 2020 |

Year ended December 31, 2019 |

Year ended December 31, 2018 |

Year ended December 31, 2017 |

Year ended December 31, 2016 |

|||||||||||||||

| Revenues | - | - | - | - | - | - | - | ||||||||||||||

| Gross Profit | - | - | - | - | - | - | - | ||||||||||||||

| Net Income (Loss) | (8,050,137 | ) | (2,140,310 | ) | (3,145,139 | ) | 3,230,974 | (3,803,743 | ) | (4,443,154 | ) | (414,961 | ) | ||||||||

| Loss per Share - Basic and Diluted | (0.30 | ) | (0.10 | ) | (0.14 | ) | 0.16 | (0.21 | ) | (0.30 | ) | (0.03 | ) | ||||||||

| Consolidated Statement of Financial Position | |||||||||||||||||||||

| Nine months ended September 30, 2021 |

Nine months ended September 30, 2020 |

Year ended December 31, 2020 |

Year ended December 31, 2019 |

Year ended December 31, 2018 |

Year ended December 31, 2017 |

Year ended December 31, 2016 |

|||||||||||||||

| Cash and cash equivalents | 45,747 | 6,799 | 47,672 | 25,865 | 2,695 | 132 | - | ||||||||||||||

| Current Assets | 3,076,419 | 3,530,523 | 4,393,114 | 3,183,311 | 1,079,428 | 751,544 | 21,268 | ||||||||||||||

| Total Assets | 10,215,334 | 9,793,337 | 10,794,933 | 9,443,253 | 8,244,944 | 8,274,271 | 9,065,536 | ||||||||||||||

| Current Liabilities | 5,184,033 | 2,522,044 | 2,992,902 | 3,669,788 | 5,878,760 | 5,640,315 | 5,246,281 | ||||||||||||||

| Total Liabilities | 5,184,033 | 2,522,044 | 2,992,902 | 3,830,275 | 6,262,219 | 6,162,447 | 5,675,143 | ||||||||||||||

| Shareholders' Equity (Deficit) | 5,031,301 | 7,271,293 | 7,802,031 | 5,612,978 | 1,982,725 | 2,111,824 | 3,390,393 | ||||||||||||||

B. Capitalization and Indebtedness

Our authorized capital consists of unlimited number of shares of common stock without par value (the "Common Shares"). As of January 24, 2022, 29,202,429 shares of our common stock were issued and outstanding.

Our indebtedness as of January 24, 2022 is summarized in the table below:

|

|

As at January 24, 2022 |

|

Accounts payable and accrued liabilities |

4,789,246 |

|

Loans payable |

740,406 |

The loans payable are unsecured and are repayable on demand.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk Factors

An investment in our shares carries a significant degree of risk. You should carefully consider the following risks, as well as the other information contained in this Registration Statement, including our financial statements and related notes included elsewhere in this Registration Statement, before you decide to purchase our shares. Any one of these risks and uncertainties has the potential to cause material adverse effects on our business, prospects, financial condition and operating results which could cause actual results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value of our common shares. Refer to "Forward-Looking Statements".

We may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Risks Related to the Business of the Company

We must successfully develop our real estate and solar projects before we can earn revenue. None of these have any operating history and may not perform as expected.

Our Sage Ranch real estate project, our Montalva Solar Project and our Alberta Solar Projects are all in the early stages of development. None of the projects has any significant infrastructure constructed. If we are unable to complete construction of the projects, we will not be able to realize any revenues from these developments. These projects have no operating history. The ability of such projects to perform as expected will also be subject to risks inherent in newly constructed generation and transmission projects, including, but not limited to, equipment performance below the Corporation's expectations, unexpected component failures and product defects, and generation and transmission system failures and outages, as well as risks inherent in the marketing and sale of housing. The failure of some or all of the projects to perform as expected could have a material adverse effect on the Corporation's business, results of operations, financial condition and cash flows.

The Company's development and construction activities are subject to material risks, including expenditures for projects that may prove not to be viable, construction cost overruns and delays, or other factors.

Material delays or cost overruns could be incurred by the Company and its development and construction projects as a result of vendor or contractor non-performance, technical issues with the interconnection utility, disputes with landowners or other parties, severe weather and other causes.

The Company's construction activities relating to its projects - in particular, those related to utility and power generation - utilize a variety of products and materials. The cost to the Company of such products and materials may be impacted by a number of factors beyond the Company's control, including their general availability and the impact of tariffs and duties imposed by various governmental authorities. There is generally no such recovery mechanism available for such costs. The financial condition and results of operations of the Company may be impacted as a result.

The Company's development of the Montalva Solar Project are subject to material risks, including certain estimates about the strength and consistency of the solar radiance at its location, and other factors, that are beyond the Company's control.

The Company's plans include the development and construction of the Montalva Solar Project, a proposed solar and battery photovoltaic renewable solar electricity generating facility to be located in Puerto Rico. The Company's assessment of the feasibility, revenues and profitability of the Montalva Solar Project depends upon estimates regarding the strength and consistency of the solar radiance and other factors which are beyond the Company's control. If weather patterns change or actual data proves to be materially different than estimates, the amount of electricity to be generated by the facility, and resulting revenues and profitability, may differ significantly from expected amounts.

The Company and its planned projects, operations and personnel will be exposed to the effects of severe weather, natural disasters, diseases, and other catastrophic and force majeure events beyond the Company's control, as well as those that may be caused by climate change, and such events could result in a material adverse effect on the Company.

The Company's planned real estate development and renewable energy projects and operations will be exposed to potential interruption and damage, and partial or full loss, resulting from environmental disasters, seismic activity, equipment failures and the like. There can be no assurance that in the event of an earthquake, hurricane, tornado, fire, flood, ice storm, tsunami, typhoon, terrorist attack, cyber-attack, act of war or other natural, manmade or technical catastrophe, all or some parts of the Company's planned projects and infrastructure systems will not be disrupted. In particular, the occurrence of a significant event which disrupts the ability of the Company's planned power generation assets to produce or sell power for an extended period could have a material negative impact on the Company's business. The Company's real estate and renewable energy assets could be exposed to effects of severe weather conditions, natural and man-made disasters and potentially other catastrophic events. The occurrence of such an event may not release the Company from performing its obligations pursuant to agreements with third parties.

An outbreak of infectious disease, a pandemic (such as the current COVID-19 pandemic) or a similar public health threat, or a fear of any of the foregoing, could adversely impact the Company by causing operating, supply chain and project development delays and disruptions, labour shortages and shutdowns (including as a result of government regulation and prevention measures), and increased costs to the Company.

Climate change is predicted to lead to increased frequency and intensity of weather events and related impacts such as storms, wildfires, flooding and storm surge. Extreme weather events create a risk of physical damage to the Company's real estate and renewable energy assets. High winds can damage structures, and cause widespread damage to transmission and distribution infrastructure. Increased frequency and severity of weather events increases the likelihood that the duration of power outages and fuel supply disruptions could increase.

The potential impacts of climate change, such as rising sea levels and larger storm surges from more intense hurricanes, can combine to produce greater damage to power generation and other facilities located in coastal areas, such as our Montalva Solar Project. Although the project is planned to be constructed, operated and maintained to minimize such damage, there can be no assurance these measures will fully mitigate the risk.

Climate change is also characterized by increases in global air temperatures. Increased air temperatures could also result in decreased efficiencies over time of both generation and transmission facilities.

These and other operating events and conditions could result in service and operational disruptions and may reduce our revenues, increase costs or both, and may materially affect our business, results of operations, financial position, valuation and cash flows, particularly if a situation is not resolved in a timely manner or the financial impacts of restoration are not alleviated through insurance policies or regulated rate recovery.

Energy generated by the Montalva Solar Project, if completed, will be sold under a long-term power purchase agreement which will be subject to a number of conditions, the failure by the Company to comply with which could result in termination of the agreement. Any such termination could have a material adverse effect on the Company's results of operations and financial position.

Energy generated by the Montalva Solar Project, if completed, will be sold under a long-term power purchase agreement. This agreement contains customary terms including: the amount paid for energy from the project over the term of the agreement (which rate can be materially higher than prevailing market rates) and a requirement for the project to comply with technical standards and to achieve commercial operation within time frames prescribed by the contract. A failure to achieve satisfactory construction progress and/or the occurrence of any permitting or other unanticipated delays at a project could result in a failure to comply with the applicable agreement requirements within the specified time frames. Remedies for failure to comply with material provisions of the agreement generally include, among other things, the potential termination of the agreement by the non-defaulting party. Any such termination could have a material adverse effect on the Company's results of operations and financial position.

Our ability to develop our real estate and renewable energy projects depends on our ability to raise the necessary capital.

Our continued access to capital, through equity financing, project financing, credit facilities or other arrangements with acceptable terms is necessary for the development of our Sage Ranch real estate project and our Montalva Solar Project. Our attempts to secure the necessary capital may not be on favorable terms, or successful at all. Our ability to arrange for financing on favorable terms, and the costs of such financing, are dependent on numerous factors, including general economic and capital market conditions, investor confidence, the continued success of current projects, the credit quality of the project being financed and the continued existence of tax laws which are conducive to raising capital. If we are unable to secure capital through credit facilities or other arrangements, we may have to finance our projects using equity financing which would have a dilutive effect on our Common Shares. Our inability to raise capital, including on favourable terms, could have a material adverse effect on our growth prospects and financial condition.

Our Montalva Solar Project will be at financing risk if the project fails to satisfy tax incentive requirements or to meet third-party financing requirements.

The Company expects that it will rely on financing from third party tax equity investors to partially finance the construction of the Montalva Solar Project, the participation of which depends upon qualification of the project for U.S. tax incentives and satisfaction of the investors’ investment criteria. These investors typically provide funding upon commercial operation of the facilities in which they invest. Should the Montalva Solar Project fail to meet the conditions required for tax equity funding, returns from the facility expected by such investors may be adversely impacted and the investors may decline to continue financing the project.

Financial leverage and restrictive covenants contained in agreements to which we might become a party may restrict our future indebtedness and limit future business dealings.

We expect that any project financing entered into for the development of our Sage Ranch real estate project and our Montalva Solar Project, will make us subject to contractual restrictions governing our future indebtedness. The degree to which we and our subsidiaries are leveraged could have important consequences to shareholders, including: (i) our ability to obtain additional financing for working capital, capital expenditures, acquisitions or other project developments may be limited; (ii) a significant portion of our future cash flows from operations may be dedicated to the payment of the principal of and interest on this indebtedness, thereby reducing funds available for future operations; and (iii) we may be more vulnerable to economic downturns and be limited in their ability to withstand competitive pressures. We expect to be made subject to operating and financial restrictions through covenants in customary loan and security agreements. These restrictions would usually prohibit or limit our, or our subsidiaries', ability to, among other things, incur additional debt, provide guarantee for indebtedness, create liens, dispose of assets, liquidate, dissolve, amalgamate, consolidate or effect any corporate or capital reorganization, make distributions or pay dividends, issue any equity interests and create subsidiaries. These restrictions may limit our and our subsidiaries' ability to obtain additional financing, withstand downturns in our business and take advantage of business opportunities. If we or a subsidiary defaults in respect of its obligations under any of the loan agreements, including without limitation servicing existing indebtedness, or to refinance any such indebtedness, lenders may be entitled to demand repayment and enforce their security against certain projects or other assets.

The Company's planned power generation facilities, utility systems and other assets involve a variety of risks customary to the power and utilities sector which, if they materialize, could disrupt or adversely affect its business, results of operations, financial position and cash flows.

The Company's ability to safely and reliably operate, maintain, construct and decommission (as applicable) its planned power generation facilities, utility systems and other assets involve a variety of risks customary to the power and utilities sector, many of which are beyond the Company's control, including those that arise from:

-

casualty or other significant events such as fires, explosions, security breaches or drinking water contamination;

-

commodity supply and transmission constraints or interruptions;

-

workplace and public safety events;

-

loss of key personnel;

-

labour disputes;

-

employee performance/workforce effectiveness;

-

improper or erroneous acts of employees;

-

demand (including seasonality);

-

loss of key customers;

-

reduction in the price received for services;

-

reliance on transmission systems and facilities operated by third parties;

-

land use rights/access;

-

critical equipment breakdown or failure;

-

lower-than-expected levels of efficiency or operational performance;

-

acts by third parties, including cyber-attacks, criminal acts, vandalism, war and acts of terrorism;

-

projects with a limited operating history;

-

opposition by external stakeholders, including local groups, communities and landowners;

-

commodity price fluctuations;

-

lower prices for alternative fuel sources; and

-

the Company's reliance on subsidiaries.

These and other operating events and conditions could result in service and operational disruptions and may reduce the Company's revenues, increase costs or both, and may materially affect its business, results of operations, financial position, valuation and cash flows, particularly if a situation is not resolved in a timely manner or the financial impacts of restoration are not alleviated through insurance policies or regulated rate recovery.

It is costly to construct solar power facilities and bring them into commercial production.

Before the sale of any power can occur, we must construct all the necessary infrastructure to produce power, including a power plan, battery storage system and a transmission line. Considerable construction and administrative costs will need to be incurred before any revenue from power sales is received. To fund expenditures of this magnitude, we will need to seek additional financing and sources of capital. There can be no assurance that additional capital can be found and, even if found, the Company may still have to substantially reduce its interest in the project if the amount of additional capital proves to be inadequate.

It is costly to construct and sell residential real estate developments.

Before the sale of any home at Sage Ranch, we must construct all the necessary infrastructure, including streets, traffic signals, dry and wet utilities, sewer and drainage, and then construct homes after buyers are identified. Considerable construction and administrative costs will need to be incurred before any revenue from home sales is received. To fund expenditures of this magnitude, we may need to seek additional financing and sources of capital. There can be no assurance that additional capital can be found.

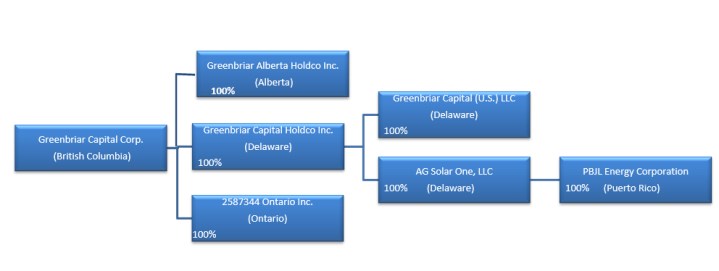

The Company is dependent on its operating subsidiaries.

The Company is a holding company with no business operations of its own or material assets other than the shares of its subsidiaries. Accordingly, all of its operations are conducted by indirect subsidiaries. As a holding company, the Company requires dividends and other payments from its subsidiaries to meet cash requirements. While the Company anticipates that its subsidiaries will have sufficient cash flow to enable such subsidiaries to pay dividends or otherwise distribute cash, the terms of loan and security agreements may contain restrictions on the ability of subsidiaries to pay dividends and otherwise transfer cash or other assets in certain circumstances. As such, a decline in the business, financial condition, cash flows or results of operation of any of the Company's subsidiaries may result in restrictions on such subsidiaries' ability to pay dividends or otherwise distribute cash.

Housing prices are subject to fluctuations that are beyond the Company's control.

The market price for housing can be volatile. If the price should drop significantly, the economic prospects of the Company's Sage Ranch real estate project could be significantly reduced. If the cost of constructing each home exceeds the price the market can support, then the construction of new homes will have to cease and be resumed if the market price exceeds the construction costs.

Environmental and other regulatory requirements may add costs and uncertainty.

The Company's existing and planned operations require licenses and permits from various governmental authorities, and such operations are and will be subject to laws and regulations governing development, taxes, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, project safety and other matters. The Company can experience increased costs, and delays in production and other schedules, as a result of the need to comply with applicable laws, regulations, licenses and permits. There is no assurance that all approvals or required licenses and permits will be obtained. Failure to comply with applicable laws, regulations, licensing or permitting requirements may result in enforcement actions, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. The Company may be required to compensate those suffering loss or damage by reason of its activities, and may have civil or criminal fines or penalties imposed upon it for violations of applicable laws or regulations.

Applicable laws and regulations, including environmental requirements and licensing and permitting processes, may require public disclosure and consultation. It is possible that a legal protest could be triggered through one of these requirements or processes that could delay, or require the suspension of the development of our real estate or renewable energy projects, or the operation of our renewable energy projects, and increase the Company's costs.

No assurance can be given that new laws and regulations will not be enacted or that existing laws and regulations will not be applied in a manner that could limit or curtail the Company's development or operation of our planned projects. Amendments to current laws, regulations, licenses and permits governing operations, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in capital expenditures or production costs, or reduction in levels of production.

There can be no assurance that existing permits will be renewed or that new permits required to advance or operate our planned projects will be granted.

The Company's operations are required to maintain permits issued by governments and agencies that govern overall facility construction or operations. If the Company is unable to renew existing permits or obtain new permits, then there may be adverse effects, such as loss of revenue and/or capital expenditures to enable long-term operations, potentially under different operating profiles.

The Company's officers and directors may have conflicts of interests arising out of their relationships with other companies.

Several of the Company's directors and officers serve (or may agree to serve) as directors or officers of other companies or have significant shareholdings in other companies. To the extent that such other companies may participate in ventures in which the Company participates, the directors may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation.

Insurance policies may be insufficient to cover losses.

As protection against operating hazards, the Company intends to maintain insurance coverage against some, but not all, potential losses. The Company may not fully insure against all risks associated with its business either because such insurance is not available or because the cost of such coverage is considered prohibitive. The occurrence of an event that is not covered, or not fully covered, by insurance could have a material adverse effect on the Company's financial

Security breaches, criminal activity, theft, terrorist attacks, cyber-attacks and other threats or incidents relating to the Company's information security could directly or indirectly interfere with the Company's operations, could expose the Company or its customers or employees to risk of loss, and could expose the Company to liability, regulatory penalties, reputational damage and other harm to its business.

The Company relies upon information technology networks, systems and devices to process, transmit and store electronic information, and to manage and support a variety of business processes and activities. The Company also uses information technology systems to record, process and summarize financial information and results of operations for internal reporting purposes and to comply with financial reporting, legal and tax requirements. The Company's technology networks, systems and devices collect and store sensitive data, including system operating information, proprietary business information belonging to the Company and third parties, as well as personal information belonging to the Company's customers and employees.

The Company's or its third-party vendor's information systems and information technology networks, devices and infrastructure may be vulnerable to damage, disruptions or shutdowns due to attacks by hackers or breaches due to employee error or malfeasance, disruptions during software or hardware upgrades, telecommunication failures, theft, natural disasters or other similar events. In addition, certain sensitive information and data may be stored by the Company in physical files and records on its premises or transmitted to the Company verbally, subjecting such information and data to a risk of loss, theft and misuse. The occurrence of any of these events could impact the reliability of the Company's planned power generation facilities and planned utility distribution systems; could expose the Company, its customers or its employees to a risk of loss or misuse of information; and could result in legal claims or proceedings, liability or regulatory penalties against the Company, damage the Company's reputation or otherwise harm the Company's business.

The Company cannot accurately assess the probability that a security breach may occur or accurately quantify the potential impact of such an event. The Company can provide no assurance that it will be able to identify and remedy all cybersecurity, physical security or system vulnerabilities or that unauthorized access or errors will be identified and remedied.

The loss of key personnel, the inability to hire and retain qualified employees, and labor disruptions could adversely affect the Company's business, financial position and results of operations.

The Company's operations depend on the continued efforts of its employees. Hiring and retaining key employees and maintaining the ability to attract new employees are important to the Company's operational and financial performance. The Company cannot guarantee that any member of its management or any one of its key employees will continue to serve in any capacity for any particular period of time or that any leadership transitions will be successful.

Certain events or conditions, such as an aging workforce, epidemic, pandemic or similar public health emergency, mismatch of skill set or complement to future needs, or unavailability of contract resources may lead to operating challenges, labor disruption and increased costs. The challenges the Company might face as a result of such risks include a lack of resources, losses to its knowledge base and the time required to develop new workers' skills. In any such case, costs, including costs for contractors to replace employees, productivity costs and safety costs may rise. If the Company is unable to successfully attract and retain an appropriately qualified workforce, its financial position or results of operations could be negatively affected.

The maintenance of a productive and efficient labor environment without disruptions cannot be assured. In the event of a strike, work stoppage or other form of labor disruption, the Company would be responsible for procuring replacement labor and could experience disruptions in its operations and incur additional expense.

There is a risk that our leases will not be renewed.

The Company does not own all of the land on which its projects are located. Such projects generally are, and future projects may be, located on land occupied under long-term easements, leases and rights of way. We generally expect that our leases will be renewed. However, if we are not granted renewal rights, or if our leases are renewed subject to conditions which impose additional costs, or impose additional restrictions such as setting a price ceiling for energy sales, our profitability and operational activity could be adversely impacted. Our use and enjoyment of real property rights for our planned renewable energy facilities may be adversely affected by the rights of lienholders and leaseholders that are superior to those of the grantors of those real property rights to us.

The Company may experience critical equipment breakdown or failure, which could have a material adverse effect on the Company's financial condition, results of operations, liquidity, reputation and ability to make distributions

The Company's planned facilities will be subject to the risk of critical equipment breakdown or failure and lower-than-expected levels of efficiency or operational performance due to the deterioration of assets from use or age, latent defect and design or operator error, among other things. These and other operating events and conditions could result in service disruptions and, to the extent that a facility's equipment requires longer than forecasted down times for maintenance and repair, or suffers disruptions of power generation, distribution or transmission for other reasons, the Company's business, operating results, financial condition or prospects could be adversely affected. In addition, a portion of the Company's infrastructure will be located in remote areas, which may make access to perform maintenance and repairs difficult if such assets become damaged.

Disruption in the Company's supply chain may have a material adverse effect on the Company's business, results of operation, financial condition and cash flows.

The Company's ability to operate effectively is in part dependent upon timely access to equipment, materials and service suppliers. Loss of key equipment, materials and service suppliers, and the reputational and financial risk exposures of key vendors, could affect the Company's operations and execution and profitability of capital projects. Manufacturing and delivery delays could adversely affect its projects, including (a) causing a delay in completion of a project, or (b) adversely impacting the availability of tax equity or other financing.

Challenges to the Company's tax positions, and changes in applicable tax laws, could materially and adversely affect returns to the Company's shareholders.

The Company conducts business and files tax returns in several different tax jurisdictions. The Company regularly assesses its tax positions, as well as the likely outcomes of its tax positions, with the benefit of such advice from its professional tax advisers as management deems appropriate. However, any tax authority could take a position on tax treatment that is contrary to the Company's expectations, which could result in additional tax liabilities. In addition, changes in tax laws or regulations could negatively impact the Company's effective tax rate and results of operations.

The Company makes certain judgments, estimates and assumptions that affect amounts reported in its consolidated financial statements, which, if not accurate, may adversely affect its financial results.

In preparation of the Company's consolidated financial statements, management is required to make significant judgments, estimates and assumptions that affect the reported amounts of assets, liabilities, net earnings (if any) and related disclosures. Although management believes that the amounts reported in its consolidated financial statements are reasonable, some uncertainty is inherent in these judgments, estimates and assumptions. If any material amounts so reported are determined to be inaccurate due to errors in judgment, estimates or assumptions, this could have a material adverse effect on the Company's financial results.

The Company's operations are and will be subject to numerous health and safety laws and regulations that could adversely affect its business, financial condition and results of operations.

The operation of the Company's planned facilities will require adherence to safety standards imposed by regulatory bodies. These laws and regulations will require the Company to obtain approvals and maintain permits, undergo environmental impact assessments and review processes and implement environmental, health and safety programs and procedures to control risks associated with the siting, construction, operation and decommissioning of real estate and renewable energy projects. Failure to develop its projects or, in the case of the Company's renewable energy projects, to operate the facilities, in strict compliance with these regulatory standards may expose the Company to claims and administrative sanctions.

Health and safety laws, regulations and permit requirements may change or become more stringent. Any such changes could require the Company to incur materially higher costs than the Company has incurred to date or that it expects to incur in the future. The Company's costs of complying with current and future health and safety laws, regulations and permit requirements, and any liabilities, fines or other sanctions resulting from violations of them, could adversely affect its business, financial condition and results of operations.

The Company has a single customer for its Montalva Solar Project. The loss of that customer or the failure to secure new power purchase agreements or renew existing agreements could material adversely impact the Company.

All of the proposed output of the Montalva Solar Project is to be sold under a long-term power purchase agreement with a single purchaser obligated to purchase all of the output of the facility. The termination or expiry of that purchase agreement, unless replaced or renewed on equally favourable terms, would adversely affect the Company's results of operations and cash flows and increase the Company's exposure to risks of price fluctuations in the wholesale power market. If, for any reason, the purchaser of our power is unable or unwilling to fulfill their contractual obligations under the power purchase agreement, or if they refuse to accept delivery of power, our assets, liabilities, business, financial condition, results of operations and cash flow could be materially and adversely affected. External events, such as a severe economic downturn, could impair the ability of our customer to pay for electricity received.

The development and completion of the Montalva Solar Project will require the engagement of a third-party engineering, procurement and construction company that the Company will have to rely on to meet the construction timeline and milestones required by the project lenders.

The Company will hire a third-party engineering, procurement and construction ("EPC") company to build and complete the Montalva Solar Project. It is customary that such EPC companies post financial security in the form of cashable letters of credit to mitigate financial risk in the event the EPC company of record cannot complete the project in accordance with the construction timeline and milestones required by the project lenders, and it is determined that the EPC company must be replaced with another EPC company. There is no assurance that any such financial security would be adequate to fully mitigate this risk, or that it would be sufficient to facilitate the replacement of the defaulting EPC company with a suitable successor.

The development and completion of the Sage Ranch real estate project will require the engagement of a general contractor company that the Company will have to rely on to meet the construction timeline and milestones required by the project lenders.

The Company will hire a third-party general contractor ("GC") company to build and complete the Sage Ranch real estate project. It is customary that such GC companies post financial security in the form of cashable letters of credit to mitigate financial risk in the event the GC company of record cannot complete the project in accordance with the construction timeline and milestones required by the project lenders, and it is determined that the GC company must be replaced with another GC company. There is no assurance that any such financial security would be adequate to fully mitigate this risk, or that it would be sufficient to facilitate the replacement of the defaulting GC company with a suitable successor.

Risks Related to Financing

Our ability to finance our operations is subject to various risks, including the state of the capital markets.

We expect to finance the development and construction of our existing real estate and renewable energy projects, future acquisitions and other capital expenditures with debt, possible future issuances of equity, capital recycling, and, once we achieve revenues, cash generated from our operations. Our ability to obtain debt or equity financing to fund our existing operations and future growth is dependent on, among other factors, the overall state of the capital markets (as well as local market conditions, particularly in the case of non-recourse financings), operating performance of our assets, future electricity market prices, the level of future interest rates, lenders' and investors' assessment of our credit risk, and investor appetite for investments in real estate projects and renewable energy and infrastructure assets in general To the extent that external sources of capital become limited or unavailable or available on onerous terms, our ability to make necessary capital investments to construct new or maintain existing facilities will be impaired, and as a result, our business, financial condition, results of operations and prospects may be materially and adversely affected.

Current global financial conditions have been subject to increased volatility.

Current global financial conditions have been subject to increased volatility. If these increased levels of volatility and market turmoil continue, the Company's ability to obtain equity or debt financing in the future and, if obtained, on terms reasonably acceptable to it, and its operations, could be adversely impacted. In addition, the trading price of the Company's Common Shares could be adversely affected.

Risks Related to our Common Shares

If the share price of the Company's Common Shares fluctuates, investors could lose a significant part of their investment.

In recent years, the stock market has experienced significant price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to the operating performance of these companies. The market price of the Company's Common Shares could similarly be subject to wide fluctuations in response to a number of factors, most of which the Company cannot control, including:

- changes in securities analysts' recommendations and their estimates of the Company's financial performance;

- the public's reaction to the Company's press releases, announcements and filings with securities regulatory authorities, and those of its competitors;

- changes in market valuations of similar companies;

- investor perception of the Company's industry or prospects;

- additions or departures of key personnel;

- commencement of or involvement in litigation;

- changes in environmental and other governmental regulations;

- announcements by the Company or its competitors of strategic alliances, significant contracts, new technologies, acquisitions, commercial relationships, joint ventures or capital commitments;

- variations in the Company's quarterly results of operations or cash flows or those of other companies;

- operating results failing to meet the expectations of securities analysts or investors;

- future issuances and sales of the Common Shares of the Company; and

- changes in general conditions in the domestic and worldwide economies, financial markets or the mining industry.

The impact of any of these risks and other factors beyond the Company's control could cause the market price of the Common Shares to decline significantly. In particular, the market price for the Common Shares may be influenced by variations in electricity prices. This may cause the price of the Common Shares to fluctuate with these underlying commodity prices, which are highly volatile.

As a foreign private issuer, the Company is subject to different U.S. securities laws and rules than a domestic U.S. issuer, which may limit the information publicly available to shareholders.

The Company is a "foreign private issuer," as such term is defined in Rule 405 under the United States Securities Act of 1933, as amended, and Rule 3b-4 under the United States Securities Exchange Act of 1934, as amended (the "U.S. Exchange Act"), and will be permitted to prepare its financial statements (including those contained in its annual reports filed under the U.S. Exchange Act on Form 20-F or, if available, on Form 40-F) in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. The Company's financial statements therefore may not be comparable to financial statements of U.S. domestic companies, which are required to be prepared in accordance with United States generally accepted accounting principles. In addition, the Company will not be required to file quarterly reports on Form 10-Q or current reports on Form 8-K that a U.S. domestic issuer would file with the United States Securities and Exchange Commission (the "SEC"), although the Company will be required to file or furnish to the SEC the continuous disclosure documents that it is required to file in Canada under Canadian securities laws.

Furthermore, the Company's officers, directors, and principal shareholders will be exempt from the reporting and "short swing" profit recovery provisions of Section 16 of the U.S. Exchange Act. Therefore, the Company's shareholders may not know on as timely a basis when the Company's officers, directors and principal shareholders purchase or sell shares, as the reporting deadlines under the corresponding Canadian insider reporting requirements are longer.

As a foreign private issuer, the Company will also be exempt from the rules and regulations under the U.S. Exchange Act related to the furnishing and content of proxy statements. The Company will also be exempt from Regulation FD, which prohibits issuers from making selective disclosures of material non-public information. While the Company will comply with the corresponding requirements relating to proxy statements and disclosure of material non-public information under Canadian securities laws, these requirements differ from those under the U.S. Exchange Act and Regulation FD, and shareholders should not expect to receive the same information at the same time as such information is provided by U.S. domestic companies.

.

The issuance of additional equity securities may negatively impact the trading price of Common Shares.

The Company may issue equity securities to finance its activities in the future. In addition, outstanding options or warrants to purchase the Common Shares may be exercised, resulting in the issuance of additional Common Shares. The issuance of additional equity securities or a perception that such an issuance may occur could have a negative impact on the trading price of the Common Shares.

ITEM 4. INFORMATION ON THE COMPANY

A. History and development of the Company

We were incorporated on April 2, 2009, under the laws of the Province of British Columbia, Canada pursuant to the Business Corporations Act (British Columbia) under the name “Greenbriar Capital Corp.”

Our head office is located at, and our principal address is, 632 Foster Avenue Coquitlam, British Columbia, Canada V3J 2L7. Our registered and records office is located at 1780 - 400 Burrard Street, Vancouver, British Columbia, V6C 3A6.

On September 18, 2009, we completed our initial public offering and our Common Shares were listed on the TSX Venture Exchange (the "TSXV"). We were initially listed as a "Capital Pool Company" (or "CPC") under the policies of the TSXV - that is, a newly-created company with no assets, other than cash, and no established business plan, and listed on the TSXV with the purpose of identifying and evaluating assets or businesses which, if acquired by means of a "Qualifying Transaction" (as defined in TSXV policies), would qualify the CPC for listing as a regular Tier 1 Issuer or Tier 2 Issuer on the TSXV. (Tier 1 is the TSXV's premier tier and is reserved for the TSXV's most advanced listed companies with the most significant financial resources.)

Our principal activity is the acquisition, development, operation and possible sale of commercial, residential, industrial, and renewable energy related real estate and energy projects in North America.

Our most advanced development project is Sage Ranch, a 995 unit entry level housing project, located on 138 acres of residential real estate located in Tehachapi, California, USA. As discussed in more detail below under the heading "Sage Ranch Sustainable Real Estate Development," our arm's length acquisition on September 27, 2011 of the vacant land which now comprises Sage Ranch was approved by the TSXV on October 6, 2011 as our Qualifying Transaction, and qualified us for regular listing on the TSXV as a Tier 2 real estate issuer.

On January 25, 2021 the Company announced that it, acting through its subsidiary Greenbriar Alberta Holdco Inc. ("Greenbriar Alberta"), had entered into a marketing partnership with Ridge Utilities Ltd. ("Ridge Utilities"). The partnership will see us support the development of multiple microgeneration capacity for various commercial and agricultural sites across southern Alberta, while Ridge Utilities will provide retail customers with access to preferential energy pricing through its "Solar Club". We intend to design, finance, build, own and operate the microgeneration facilities, and maintain and manage their operation for at least 20 years. In this Registration Statement, we refer to this project as the "Ridge Utilities Solar Project." None of the microgeneration facilities have been advanced to the planning and development phase as the Company is focused on larger solar project opportunities in Alberta.

On November 16, 2021 Greenbriar, acting through its subsidiary Greenbriar Alberta, executed an agreement for long-term solar energy supply with West Lake Energy Corp. ("West Lake"), a privately-owned independent Canadian oil and gas producer based in Calgary, Alberta. Under the agreement's terms Greenbriar will build, own and operate two solar energy production facilities capable of producing a total of up to 90 megawatts (MW) alternating current (AC) of solar energy, with the first solar site having a capacity for 30MW AC. West Lake has agreed to purchase all solar power generated from the project and has the option to purchase from the second site which will provide the remaining 60MW AC. There are several sites the Company is evaluating, with some being in the early stages of evaluation and others in very advanced stages. In this Registration Statement, we refer to this project as the "West Lake Solar Project" and, together with the Ridge Utilities Solar Project , the "Alberta Solar Projects".

Greenbriar and West Lake have also agreed to a framework to work together in future solar production facilities. With the goal of increasing capacity to 400MW over the next several years, the two companies intend on being the premier solar energy provider to other independent upstream oil and gas producers who do not have the capacity and expertise to build and own their own renewable energy facilities.

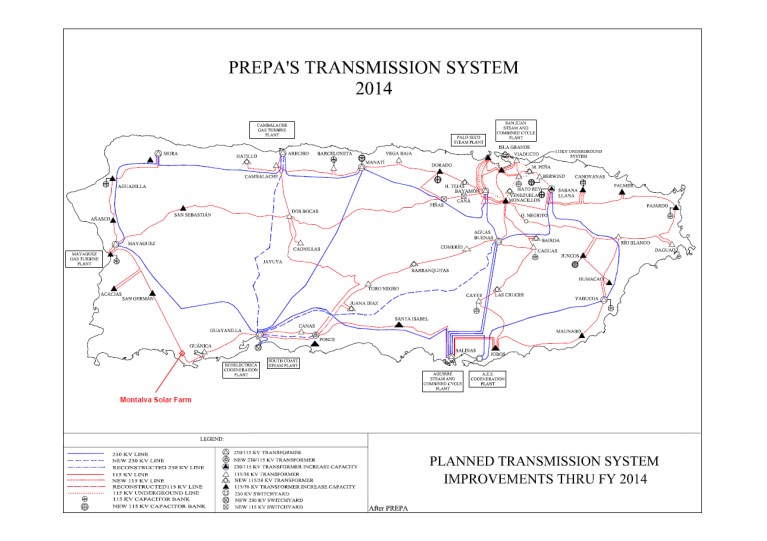

We are also pursuing our Montalva Solar Project, a proposed solar and battery photovoltaic renewable generating facility, to be located in municipalities of Guanica and Lajas, Puerto Rico. This project has, however, experienced delays and is subject to ongoing disputes.

The following table summarizes the current status of our Sage Ranch sustainable real estate project, the Alberta Solar Projects, and the Montalva Solar Project:

|

Project |

Current Status |

Next Steps |

|

Sustainable Real Estate Development Project - California |

||

|

Sage Ranch Sustainable Real Estate Project |

|

|

|

Renewable Energy - Alberta (Alberta Solar Project) |

||

|

Ridge Utilities Solar Project |

|

|

|

West Lake Solar Project |

|

|

|

Renewable Energy - Puerto Rico |

||

|

Montalva Solar Project |

|

|

|

|

|

In addition to the Sage Ranch and our solar projects, we also hold the exclusive Canadian sales, distribution and marketing rights for the entire suite of Smart Glass energy products developed and built by Gauzy of Tel-Aviv, Israel. Gauzy is a Smart Glass technology company, manufacturing a complete product line of liquid crystal glass (LCG) products for worldwide use. Gauzy embeds technology into glass, offering varying degrees of opacity for privacy or projection when needed, or transparency for an open atmosphere when desired. Gauzy glass can be installed in homes, office buildings, hospitals, apartments, universities, schools, hotels, trucks and automobiles. We acquired the distribution rights on September 25, 2017 when we completed the acquisition of an Ontario based private company which holds the exclusive Canadian sales rights. At this point in time we have put this project on hold in order to permit us to focus on the Sage Ranch real estate project and the Montalva Solar Project.

A real estate blockchain business we launched in November 2017 was sold (including the cancellation of certain royalty rights owed to us) in July 2019 for USD $229,000 cash and the cancellation of certain shares, options and share purchase warrants issued as payment to software developers.

Additional information related to us is available on SEDAR at www.sedar.com and www.greenbriarcapitalcorp.ca. We do not incorporate the contents of our website or of sedar.com into this Registration Statement. Information on our website does not constitute part of this Registration Statement. In addition, the SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC which can be viewed as www.sec.gov.

General Description of Business

The Company's business focus is the acquisition, permitting, zoning, management, development and sale of commercial, industrial and sustainable residential real estate; plus the development, financing, construction and operation of renewable energy facilities in North America. Greenbriar is listed as a Tier 2 Issuer on the TSXV under the symbol "GRB".

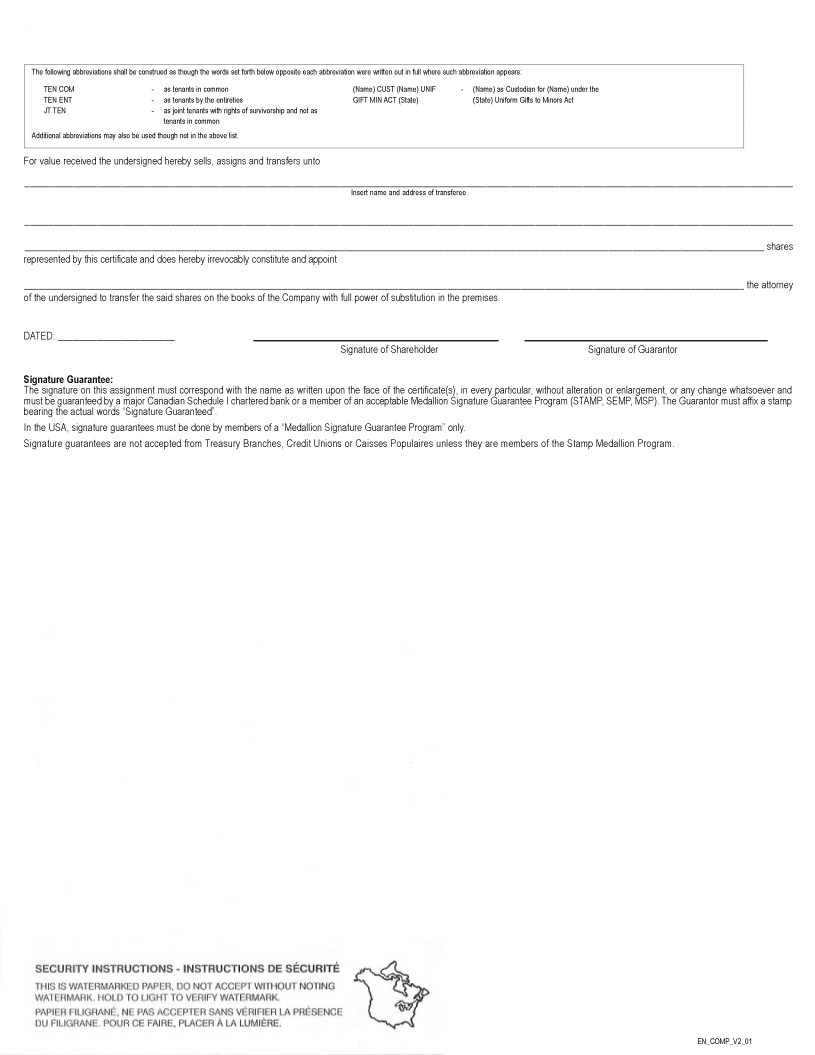

Sage Ranch Real Estate Project

On September 27, 2011 the Company acquired real property in Tehachapi, California, USA as its Qualifying Transaction under the policies of the TSXV. The purchase price for the property was US $1,040,000 for an aggregate of 161 acres of which 133 acres comprised Sage Ranch, with an approval to be divided into 689 lots on 133 acres. The Company expanded this holding by 5 acres to 138 acres, and received final City Council approval on September 12, 2021 to build 995 homes. On November 26, 2019, we acquired the additional 5-acres from the County Government, for a total of 138 acres (collectively, the "Property"), in consideration for the transfer of the non-Sage Ranch parcel of 28 acres. The Property is held by the Company through its indirect, wholly-owned subsidiary, Greenbriar Capital (U.S.) LLC.

On October 1, 2017, the Company entered into an agreement with Captiva Verde Land Corp. (“Captiva”) to sell a 50% undivided interest in the Property. The Chief Executive Officer of the Company, Jeffrey Ciachurski, is also the Chief Executive Officer of Captiva. On October 6, 2018, the Company completed the agreement and received 10,687,500 common shares of Captiva and $112,500 in a one-year interest-free promissory note (which has been paid) for total consideration of $1,181,250. On August 10, 2020 the Company modified its agreement with Captiva into a joint venture whereby the Company retained sole title to the Property and Captiva would fund all development expenditures for a 50% net profits interest.

Project Overview

Sage Ranch is being developed on the Property as a sustainable entry-level residential real estate development. It is to be constructed under a Master Plan that emphasizes a responsible sustainable approach to the planned community. The following table summarizes the proposed features of Sage Ranch:

|

Maximum total number of housing units |

995 |

|

Proposed home construction |

Mixture of single-family homes, townhomes, cottage homes and apartments |

|

Average building size |

Single family homes (between 1,650 and 2,500 square feet) Townhomes (between 1,250 and 1,550 square feet) Cottage homes (between 950 and 1,150 square feet) Apartments (2 stories; apartments between 780 and 1,280 square feet) |

|

Land area |

138 acres |

|

Total square footage of buildings |

Approximately 1,600,000 square feet |

|

Average density |

7.2 homes per square acres |

The Property is located between the parallel arterial roads of Valley Boulevard and Pinon Street near Downtown Tehachapi. The site is within a half mile from the Tehachapi City Hall and central Tehachapi, and in close proximity to the historic downtown including many shops, restaurants, and public spaces in the general downtown district. The Property is also immediately adjacent to Tehachapi High School, Middle School and Elementary School. It is commonly considered as Urban Infill (new development that is sited on vacant or undeveloped land within an existing community) and located within the T4 Transect Neighborhood General zone as identified in the city zoning code. The T4 zone "is applied to Tehachapi's general neighborhood areas to provide for a variety of single-family and multifamily housing choices in a small-town neighborhood setting.

Tehachapi is located in the Tehachapi Valley within Kern County on the edge of the Mojave Desert and the Tehachapi Mountains, approximately 35 miles east-southeast of Bakersfield, California and within 20 miles from Los Angeles County. The location of the Property is identified in the map below:

Project Status

Sage Ranch is located in an area zoned for residential development. The Company has obtained approvals under the City of Tehachapi's Planned Development Zone requirements to accommodate the Sage Ranch's varied density and product types.

Planned Development Zoning requires a variety of approvals from the City Council. We received approval of our Preliminary Development Plan from the Planning Commission in February 11, 2019. In connection with approving the Preliminary Development Plan, the City Council unanimously approved the general project concept and intensity of land uses, subject to formal conditions of development.

We received City Council approval of our Final Master Development Plan, 995 home Tract Map and our Final Environmental Impact Report on September 12, 2021.

We are now working to file a Precise Development Plan ("Precise Plan") for the first phase of the development. A Precise Plan will be required for each of the project phases and approvals are expected to be granted assuming each Precise Plan is consistent with the previously-approved Master Plan. Approval of the Phase I Precise Plan is expected to be received in Q1 2022 following which all the permits needed for construction can be applied for and, when obtained, construction can begin. The Company is planning to complete Sage Ranch in seven phases over a four-to-seven year period at the rate of between 143 to 250 homes per year.

Market Orientation

The Sage Ranch Master Plan provides for 995 total dwelling units at an overall gross density of 7.2 Homes/Acre. Eight different housing prototypes will be offered for sale ranging from 5,500 square foot single-family lots with 1,650 to 2,500 square foot homes to double story apartments at 780 square feet. The diversity of housing options within the community is expected to appeal to a broader demographic and broader spectrum income groups.

Design Elements

Sage Ranch is designed with a focus on "Complete Streets" running full length North/South and East/West to connected streets throughout the community versus the standard post-war suburban "within the fence" subdivision having non-contiguous streets and cul-de-sacs which can force a neighbor to travel half a mile by car to get to another home only 100 feet away on an opposing street. This allows multiple access points to traffic in all directions and smooth flow of traffic that do not rely on single access points which can create congestion. In addition, with the project being adjacent to the High School, Middle School, and Elementary School, the ability to be within a three block walk to all amenities offer a urban low carbon footprint living environment to a semi-rural mountain valley setting.

All streets are planned with curb-separated sidewalks and tree lined parkways adjacent to the roads. The intent is to create a strong street/tree character allowing abundant shade conditions. The vast majority of garages will be accessed through enhanced alley conditions, allowing architecture to front the streets with parallel guest parking directly in front of homes. Other special features will include a central theme road that ends in both directions from Valley Blvd and Pinon Street to a central park.

Parks and community amenities are part of the development. Community, neighborhood and pocket parks is proposed, including an approximate 4 acre sized central park located in the development. A community building is proposed to allow gathering functions with kitchen, meeting room and bathrooms.

Homes are all two-story maximum heights and approximately 10-15% of the homes will be one story. The architectural character for Sage Ranch will emphasize a regional and local vernacular. Basic tenants of the architecture will be oriented to front porch and entry court design, architecture fronting the streets, alley access garages, and special front elevations. All homes in the community have a majority of direct access two car garages, with a small percentage of one-car garages. Primary building materials will be wood, stone and stucco, with dominant porch front elevations and entry courtyards. Roof materials will likely be composition tile and asphalt, with some standing seam metal roofing.

Responsible Sustainable Approach

In compliance with new State of California policies, all homes will have solar roof panels and include energy savings devices, systems controls, and efficiency components. Water consumption will be reduced for parks and open space areas with reclaimed water connections to nearby non-potable water systems. Low flow irrigation technologies and drought tolerant landscaping will be promoted. Local materials will be sourced, with reclaimed materials promoted. Trash recycling will be included as a community standard with separate bins and receptacles. The intention is to create a community with an emphasis on conservation and sustainability with lower power, energy and water consumption.

Marketing and Sales

The Company has pre-marketed Sage Ranch to potential buyers. Once final development approvals are received, the Company will enter into purchase contracts with buyers and construction will commence only after a purchase agreement has been executed. We will apply for approval from the California Department of Real Estate to accept non-refundable deposits once all development approvals are acquired.

Under an Initial Master Sales and Marketing Agreement dated July 11, 2020, the Company has retained Paul Morris of Keller Williams Forward Living to market and sell each housing unit in Sage Ranch, at prices and commissions yet to be determined. The target market for the homes sales are the entire region of Kern County and the parallel Antelope Valley of Los Angeles Country.

Construction

We have preliminarily retained Landmark Builders Group as our general contractor to build Sage Ranch under a verbal agreement. In due course, we will convert this to a definitive agreement.

Kern County and the Antelope Valley

Kern County is located in California. As of the 2010 census, the population as 839,631. Its county seat is Bakersfield. The following map shows the location of Kern County in California and the adjacent Antelope Valley.

|

Location in the state of California |

Kern County comprises the Bakersfield, California, Metropolitan statistical area. The county spans the southern end of the Central Valley. Covering 8,161.42 square miles (21,138.0 km2), it ranges west to the southern slope of the Coast Ranges, and east beyond the southern slope of the eastern Sierra Nevada into the Mojave Desert, at the city of Ridgecrest. Its northernmost city is Delano, and its southern reach extends just beyond Lebec to Grapevine, and the northern extremity of the parallel Antelope Valley.

The county's economy is heavily linked to agriculture and to petroleum extraction. There is also a strong aviation, space, and military presence, such as Edwards Air Force Base, the China Lake Naval Air Weapons Station, and the Mojave Air and Space Port. The county is one of the fastest-growing areas in the United States in terms of population.

Sage Ranch is a 40-minute drive from 1,000,000 people who live in Greater Bakersfield and Antelope Valley and a two hour drive from 25,000,000 people of Greater Metropolitan Los Angeles.

The principal regulator of the Sage Ranch project is the City of Tehachapi.

Competition

There are no similar projects like Sage Ranch within a 50-mile radius of the project

Alberta Solar Projects

Microgeneration

In 2016, the Province of Alberta amended its microgeneration regulation to provide more flexibility for rules on how Albertans can generate electricity. Changes include increasing the size limit of each microgeneration system to 5 megawatts from 1 megawatt and allowing a microgenerating system to serve adjacent sites.

Ridge Utilities Solar Project

On January 25, 2021 the Company announced that it, acting through its subsidiary Greenbriar Capital Corp. Alberta, had entered into a marketing partnership with Ridge Utilities Ltd. ("Ridge"). The partnership will see us support the development of microgeneration capacity for numerous commercial and agricultural sites across southern Alberta, while Ridge Utilities will provide retail customers with access to preferential energy pricing through its "Solar Club".

Ridge Utilities offers exclusive solar club electricity rates for micro-generators who are on a bi-directional cumulative meter. Solar Club members can switch between these two rates at any time with just a 10-day notice, penalty free to accommodate seasonal generation fluctuations. Solar club members can also earn 5% cash back on all energy imported from the grid on an annual basis.

We will design, finance, build, own and operate the multiple microgeneration facilities and maintain and manage the operation for at least 20 years. Greenbriar will finance the projects at the project level and will be non-dilutive to Greenbriar Shareholders. None of the microgeneration facilities have been advanced to the planning and development phase.