UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22805

ClearBridge American Energy MLP Fund Inc.

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 49th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Robert I. Frenkel, Esq.

Legg Mason & Co., LLC

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888)777-0102

Date of fiscal year end: November 30

Date of reporting period: November 30, 2014

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

| Annual Report | November 30, 2014 |

CLEARBRIDGE

AMERICAN ENERGY MLP FUND INC. (CBA)

| INVESTMENT PRODUCTS: NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE |

Fund objective

The Fund’s investment objective is to provide a high level of total return, with an equal emphasis on current distributions and capital appreciation.

Dear Shareholder,

We are pleased to provide the annual report of ClearBridge American Energy MLP Fund Inc. for the twelve-month reporting period ended November 30, 2014. Please read on for a detailed look at prevailing economic and market conditions during the Fund’s reporting period and to learn how those conditions have affected Fund performance.

As always, we remain committed to providing you with excellent service and a full spectrum of investment choices. We also remain committed to supplementing the support you receive from your financial advisor. One way we accomplish this is through our website, www.lmcef.com. Here you can gain immediate access to market and investment information, including:

| Ÿ | Fund prices and performance, |

| Ÿ | Market insights and commentaries from our portfolio managers, and |

| Ÿ | A host of educational resources. |

We look forward to helping you meet your financial goals.

Sincerely,

Kenneth D. Fuller

Chairman, President and Chief Executive Officer

December 26, 2014

| II | ClearBridge American Energy MLP Fund Inc. |

Economic review

Despite weakness in early 2014, the U.S. economy expanded at a strong pace during the twelve months ended November 30, 2014 (the “reporting period”). The U.S. Department of Commerce reported that in the fourth quarter of 2013, U.S. gross domestic product (“GDP”)i growth was 3.5%. Severe winter weather then played a key role in a sharp reversal in the economy, a 2.1% contraction during the first quarter of 2014; this was the first negative GDP report in three years. Negative contributions were widespread: private inventory investment, exports, state and local government spending and nonresidential and residential fixed investment. Thankfully, this setback was very brief, as second quarter GDP growth was 4.6%. The rebound in GDP growth was driven by several factors, including an acceleration in personal consumption expenditures (“PCE”), increased private inventory investment and exports, as well as an upturn in state and local government spending. After the reporting period ended, the Department of Commerce reported that third quarter GDP growth was 5.0%, driven by contributions from PCE, exports, nonresidential fixed investment and government spending and the strongest reading for GDP growth since the third quarter of 2003.

The U.S. manufacturing sector was another tailwind for the economy. Based on figures for the Institute for Supply Management’s Purchasing Managers’ Index (“PMI”)ii, U.S. manufacturing expanded during all twelve months of the reporting period (a reading below 50 indicates a contraction, whereas a reading above 50 indicates an expansion). After a reading of 56.5 in December 2013, the PMI fell to 51.3 in January 2014, but generally rose over the next several months, reaching a high of 59.0 in August, its best reading since March 2011. While PMI dipped to 56.6 in September, it rose back to 59.0 in October and was 58.7 in November.

The improving U.S. job market was one of the factors supporting the overall economy during the reporting period. When the period began, unemployment, as reported by the U.S. Department of Labor, was 6.7%. Unemployment generally declined throughout the reporting period and reached a low of 5.8% in October and November 2014, the lowest level since July 2008.

The Federal Reserve Board (“Fed”)iii took a number of actions as it sought to meet its dual mandate of fostering maximum employment and price stability. As it has since December 2008, the Fed kept the federal funds rateiv at a historically low range between zero and 0.25%. The Fed also ended its asset purchase program that was announced in December 2012. At that time, the Fed said it would continue purchasing $40 billion per month of agency mortgage-backed securities (“MBS”), as well as $45 billion per month of longer-term Treasuries. Following the meeting that concluded on December 18, 2013, the Fed announced that it would begin reducing its monthly asset purchases, saying “Beginning in January 2014, the Committee will add to its holdings of agency MBS at a pace of $35 billion per month rather than $40 billion per month, and will add to its holdings of longer-term Treasury securities at a pace of $40 billion per month rather than $45 billion per month.” At each of the Fed’s next six meetings (January, March, April, June, July and September 2014), it announced further $10 billion tapering of its asset purchases.

| ClearBridge American Energy MLP Fund Inc. | III |

Investment commentary (cont’d)

At its meeting that ended on October 29, 2014, the Fed announced that its asset purchase program had concluded. Finally, on December 17, 2014, after the reporting period ended, the Fed said that “Based on its current assessment, the Committee judges that it can be patient… to maintain the 0 to 1/4 percent target range for the federal funds rate for a considerable time…”

As always, thank you for your confidence in our stewardship of your assets.

Sincerely,

Kenneth D. Fuller

Chairman, President and Chief Executive Officer

December 26, 2014

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results.

| i | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| ii | The Institute for Supply Management’s PMI is based on a survey of purchasing executives who buy the raw materials for manufacturing at more than 350 companies. It offers an early reading on the health of the U.S. manufacturing sector. |

| iii | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices and a sustainable pattern of international trade and payments. |

| iv | The federal funds rate is the rate charged by one depository institution on an overnight sale of immediately available funds (balances at the Federal Reserve) to another depository institution; the rate may vary from depository institution to depository institution and from day to day. |

| IV | ClearBridge American Energy MLP Fund Inc. |

Q. What is the Fund’s investment strategy?

A. The Fund’s investment objective is to provide a high level of total return, with an equal emphasis on current distributions and capital appreciation. The Fund seeks to achieve its investment objective by investing primarily in energy master limited partnerships (“MLPs”). Under normal market conditions, the Fund invests at least 80% of its managed assets in U.S. based energy MLPs (the “80% policy”). Currently, the Fund intends to focus its investments on MLPs that, in our opinion, are poised to benefit from the growing production and usage of natural gas, while minimizing exposure to commodity price fluctuations. For purposes of the 80% policy, the Fund considers investments in MLPs to include investments that offer economic exposure to public and private MLPs in the form of MLP equity securities, securities of entities holding primarily general partner or managing member interests in MLPs, securities that are derivatives of interests in MLPs, including I-Shares, exchange-traded funds that primarily hold MLP interests and debt securities of MLPs. Energy entities are engaged in the business of exploring, developing, producing, gathering, transporting, processing, storing, refining, distributing, mining or marketing natural gas, natural gas liquids (including propane), crude oil, refined petroleum products or coal.

ClearBridge Investments, LLC is the Fund’s subadviser. The portfolio managers primarily responsible for overseeing the day-to-day management of the Fund are Richard A. Freeman, Michael Clarfeld, CFA, Chris Eades, and Peter Vanderlee, CFA.

Q. What were the overall market conditions during the Fund’s reporting period?

A. U.S. equities posted strong gains over the one year period ending November 30, 2014, with the NASDAQ Composite Indexi, S&P 500 Indexii and Dow Jones Industrial Average (“DJIA”)iii returning 18.02%, 16.86% and 13.42%, respectively. MLPs were up around 20% through September but then sold off in October and November on the back of lower crude prices and a weaker outlook for activity in the energy patch. Within the S&P 500 Index, Health Care, Information Technology and Utilities paced the gains, up more than 25% each, while Energy and Telecommunications (telecoms) lagged the group. The Energy sector fell 5.5% while the telecoms sector advanced 8.8%. Small caps lagged their larger peers as the Russell 2000 Indexiv returned 3.99% over the period due to severe declines in the second and third quarters of the calendar year.

Other than the first calendar quarter of 2014 when harsh weather conditions drove a 2.1% contraction, U.S. gross domestic product (“GDP”)v has expanded healthily at an annualized pace between +3.5% and +5.0% each quarter since last summer. The unemployment rate declined steadily throughout the year to 5.8% and the Conference Board’s consumer confidence index increased more than +30% over the period as well, hitting the highest readings since 2007.

While 2014 opened with many economists and analysts forecasting higher interest rates, this did not play out as the 10-year yield declined from the year-end high of 3.0% to a low of 2.1% in mid-October. Low borrowing costs, combined with increased

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 1 |

Fund overview (cont’d)

confidence drove Mergers & Acquisitions (“M&A”) announcements to record levels. The Health Care and Information Technology sectors saw the lion’s share of the activity, with many companies acting to lower their tax bills by pursuing companies domiciled outside the U.S.

The Federal Reserve Board (“Fed”)vi stood squarely in the spotlight all year long as Janet Yellen replaced Ben Bernanke as Chairperson. The Fed tapered its quantitative easing program to a close in October but committed to low target interest rates for “considerable time” in order to boost inflation toward its 2% target. While the Fed was busy beginning to tighten monetary policy, other central banks around the world were loosening monetary policy to counter fears of a global slowdown, namely the European Central Bank (“ECB”)vii and the Bank of Japan. These divergent interest rate dynamics have spilled over into the foreign exchange markets, driving the dollar sharply higher against many other currencies.

Throughout the year geo-political events have dominated the headlines, but have had relatively little impact on the markets. Brent oil prices soared to touch $115 per barrel during June as the Sunni militant group Islamic State in Iraq and Syria (ISIS) started an insurgency against the predominantly Shia Iraqi government, capturing several cities in northern Iraq. But these gains in crude prices proved illusory as prices fell to $70 in November on over-supply concerns. We are not overly concerned that lower oil prices will dramatically reduce U.S. energy production and thereby meaningfully cloud the outlook for MLPs. Many U.S. shale plays remain economic at these lower prices and we therefore expect production growth to continue, albeit at a slightly slower pace than would be true if oil prices were higher.

Q. How did we respond to these changing market conditions?

A. After six years of strong returns, MLP stocks corrected sharply in the final months of 2014. This correction, spurred by the significant decline in oil prices, surprised many investors given the toll-road nature of MLPs and their limited direct commodity exposure.

The MLPs we favor do derive the majority of their cash flows from long-term contracts, with fee-based revenues that are reasonably insulated from the vicissitudes of the commodity markets. However, years of surging share prices left MLP stocks priced to near perfection at the time when oil prices declined. From January to August of 2014 MLPs surged over 20%, driving the securities to all-time highs and their yields to all-time lows. At the end of August the yield on the group had fallen to 5.1% (vs. a five-year average higher than 6%) and several high-fliers sported yields below 2% - full levels for yield-driven equities. These demanding valuations left MLPs vulnerable to a correction, which arrived with crude price declines.

The infrastructure assets owned by MLPs predominantly generate cash flow based on the volume of oil and gas moving through the system, not the price. So the key question for MLP investors is what is likely to happen to oil and gas production volumes. We believe that in spite of the decline in oil prices, overall energy volumes produced are likely to grow in 2015, although we do foresee a slower growth rate compared to our prior forecast. Further, over the long term, we believe the industry will produce continued production growth.

| 2 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

Lower oil prices do cloud the outlook for oil production as it reduces the incentive for exploration & production (“E&P”) companies to drill. Nevertheless, at current prices there are still many plays that are economic to produce, though clearly fewer than when oil prices are higher. In spite of the drop in oil prices, the U.S. Energy Information Administration (“EIA”) forecasts continued oil production growth in 2015 due to (1) the lagged response of producers to lower prices and (2) the high-grading of drilling programs to acreage that remains attractive even at current levels. This forecast could prove to be high or oil production could stumble in 2016 on the back of low prices throughout 2015. But we would expect any meaningful drop in production to be relatively short lived (e.g. 1-2 years).

Over time, we expect oil prices to recover and the clouds over the U.S. energy industry to lift (or at least diminish significantly) as the current oil price is unsustainably low. At current oil prices of around $50 per barrel only around one third of existing global oil fields would display positive returns to drill new wells. With drastically reduced industry drilling activity and existing production naturally declining at a high-single-digit rate, the global oil market should tighten and ultimately balance. Prices will have to move higher to incentivize drilling or else the current glut would likely turn into a significant shortage.

While the price of oil dominates energy investors’ minds these days, oil is not the only game in town. In fact, in the U.S. oil represents just over a third of energy produced with the balance driven by natural gas and natural gas liquids (“NGLs”). Natural gas production has grown significantly in the last few years and that is expected to continue as low-cost shale gas replaces coal for power generation. Over the past 10 years, natural gas has taken 10% market share from coal to generate electricity. The prevalence of low-cost gas also drives increased manufacturing and petro-chemical production, which further increases the demand for gas. Lastly, America’s large shale gas resources have positioned the country to begin exporting natural gas as liquefied natural gas (“LNG”). LNG exports should begin at the end of 2015 and should grow in scale through the end of the decade. So for natural gas, lower prices are generally beneficial as they drive increased demand and thereby production. Increasing production requires new pipelines and infrastructure, which translates to growth for MLPs.

MLPs have grown their distributions every year for the last ten years, in spite of all the ups and downs in commodity prices. Lower oil prices will likely result in slower growth but we still expect distributions for the industry to be up in 2015 and beyond. MLP stocks may not trade up significantly higher until oil stages a sustained recovery to the equilibrium we referenced earlier. We do not know when that will occur, but we believe that should happen in time. In the meantime, the asset class offers an average yield higher than 6%.

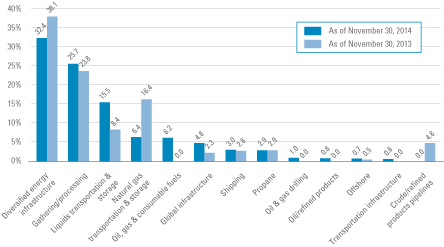

As of the end of the reporting period, the Fund held (as a percentage of total investments) 32.4% in diversified energy infrastructure MLPs, 25.7% in gathering/processing MLPs, 15.5% in liquids transportation & storage MLPs, 6.4% in natural gas transportation & storage MLPs, 6.2% oil, gas & consumable fuels MLPs, 4.8% in global infrastructure MLPs, 3.0% in shipping MLPs, 2.9% in propane MLPs, 1.0% in oil & gas drilling MLPs, 0.8% in oil/refined prod-

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 3 |

Fund overview (cont’d)

ucts MLPs, 0.7% in offshore MLPs and 0.6% in transportation infrastructure MLPs.

Performance review

For the twelve months ended November 30, 2014, ClearBridge American Energy MLP Fund Inc. returned 7.50% based on its net asset value (“NAV”)viii and 2.95% based on its New York Stock Exchange (“NYSE”) market price per share. The Lipper Energy MLP Closed-End Funds Category Averageix returned 12.30% over the same time frame. Please note that Lipper performance returns are based on each fund’s NAV.

During the twelve month period, the Fund made distributions to shareholders totaling $1.21 per share, all of which will be treated for tax purposes as a return of capital. The performance table shows the Fund’s twelve month total return based on its NAV and market price as of November 30, 2014. Past performance is no guarantee of future results.

| Performance Snapshot as of November 30, 2014 | ||||

| Price Per Share | 12-Month Total Return* |

|||

| $18.80 (NAV) | 7.50 | %† | ||

| $17.66 (Market Price) | 2.95 | %‡ | ||

All figures represent past performance and are not a guarantee of future results. Performance figures for periods shorter than one year represent cumulative figures and are not annualized.

* Total returns are based on changes in NAV or market price, respectively. Returns reflect the deduction of all Fund expenses, including management fees, operating expenses, and other Fund expenses. Returns do not reflect the deduction of brokerage commissions or taxes that investors may pay on distributions or the sale of shares.

† Total return assumes the reinvestment of all distributions, including returns of capital at NAV.

‡ Total return assumes the reinvestment of all distributions, including returns of capital in additional shares in accordance with the Fund’s Dividend Reinvestment Plan.

Q. What were the leading contributors to performance?

A. The diversified energy infrastructure and liquids transportation & storage sub-sectors contributed positively to absolute performance during the period. In terms of individual Fund holdings, leading contributors to performance for the period included Energy Transfer Partners LP, Kinder Morgan Management LLC, Enterprise Products Partners LP, Regency Energy Partners LP and Enbridge Energy Partners LP.

Q. What were the leading detractors from performance?

A. In terms of individual Fund holdings, leading detractors from performance for the period included positions in Boardwalk Pipeline Partners LP, ONEOK Partners LP, Transocean Partners LLC, JP Energy Partners LP and Midcoast Energy Partners LP.

Q. Were there any significant changes to the Fund during the reporting period?

A. During the reporting period, we established several new Fund positions, including Transocean Partners LLC, Antero Midstream Partners LP, Blueknight Energy Partners LP, JP Energy Partners LP and Genesis Energy LP. We also sold out of four holdings: Boardwalk Pipeline Partners LP, Atlas Pipeline Partners LP, Access Midstream Partners LP and Energy Transfer Equity LP. Meanwhile, during the period Kinder Morgan Inc. consolidated its LP subsidiaries: Kinder Morgan Energy Partners LP (KMP) and Kinder Morgan Management LLC (KMR) and El Paso Pipeline Partners LP (EPB). While we like the prospects for the go-forward Kinder

| 4 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

Morgan, we sold out of our positions in Kinder Morgan Energy Partners LP and El Paso Pipeline Partners LP to reduce the overall position size to a more manageable level.

Looking for additional information?

The Fund is traded under the symbol “CBA” and its closing market price is available in most newspapers under the NYSE listings. The daily NAV is available on-line under the symbol “XCBAX” on most financial websites. Barron’s and the Wall Street Journal’s Monday edition both carry closed-end fund tables that provide additional information. In addition, the Fund issues a quarterly press release that can be found on most major financial websites as well as www.lmcef.com.

In a continuing effort to provide information concerning the Fund, shareholders may call 1-888-777-0102 (toll free), Monday through Friday from 8:00 a.m. to 5:30 p.m. Eastern Time, for the Fund’s current NAV, market price and other information.

Thank you for your investment in ClearBridge American Energy MLP Fund Inc. As always, we appreciate that you have chosen us to manage your assets and we remain focused on achieving the Fund’s investment goals.

Sincerely,

Michael Clarfeld, CFA

Portfolio Manager

ClearBridge Investments, LLC

Chris Eades

Portfolio Manager

ClearBridge Investments, LLC

Richard A. Freeman

Portfolio Manager

ClearBridge Investments, LLC

Peter Vanderlee, CFA

Portfolio Manager

ClearBridge Investments, LLC

December 16, 2014

RISKS: All investments are subject to risk, including the risk of loss. MLP distributions are not guaranteed and there is no assurance that all distributions will be tax deferred. Investments in MLP securities are subject to unique risks. The Fund’s concentration of investments in energy related MLPs subject it to the risks of MLPs and the energy sector, including the risks of declines in energy and commodity prices, decreases in energy demand, adverse weather conditions, natural or other disasters, changes in government regulation, and changes in tax laws. Leverage may result in greater volatility of NAV and the market price of common shares and increases a shareholder’s risk of loss. Derivative instruments can be illiquid, may disproportionately increase losses, and have a potentially large impact on Fund performance. The Fund may invest in small capitalization or illiquid securities which can increase the risk and volatility of the Fund.

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 5 |

Fund overview (cont’d)

Portfolio holdings and breakdowns are as of November 30, 2014 and are subject to change and may not be representative of the portfolio managers’ current or future investments. The Fund’s top ten holdings (as a percentage of net assets) as of November 30, 2014 were: Energy Transfer Partners LP (13.2%), Buckeye Partners LP (9.1%), Enterprise Products Partners LP (9.0%), Enbridge Energy Partners LP (8.6%), Kinder Morgan Inc. (8.5%), Regency Energy Partners LP (8.1%), Williams Partners LP (7.6%), Brookfield Infrastructure Partners LP (6.6%), MarkWest Energy Partners LP (6.6%), and Targa Resources Partners LP (6.4%). Please refer to pages 8 through 9 for a list and percentage breakdown of the Fund’s holdings.

The mention of sector breakdowns is for informational purposes only and should not be construed as a recommendation to purchase or sell any securities. The information provided regarding such sectors is not a sufficient basis upon which to make an investment decision. Investors seeking financial advice regarding the appropriateness of investing in any securities or investment strategies discussed should consult their financial professional. The Fund’s top five sector holdings (as a percentage of net assets) as of November 30, 2014 were: Diversified Energy Infrastructure (44.7%), Gathering/Processing (35.5%), Liquids Transportation & Storage (21.3%), Natural Gas Transportation & Storage (8.8%) and Oil, Gas & Consumable Fuels (8.5%). The Fund’s portfolio composition is subject to change at any time.

All investments are subject to risk including the possible loss of principal. Past performance is no guarantee of future results. All index performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in an index.

The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. Views expressed may differ from those of the firm as a whole.

| i | The NASDAQ Composite Index is a market-value weighted index, which measures all securities listed on the NASDAQ stock market. |

| ii | The S&P 500 Index is an unmanaged index of 500 stocks and is generally representative of the performance of larger companies in the U.S. |

| iii | The Dow Jones Industrial Average (“DJIA”) is a widely followed measurement of the stock market. The average is comprised of thirty stocks that represent leading companies in major industries. These stocks, widely held by both individual and institutional investors, are considered to be all blue-chip companies. |

| iv | The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 3000 Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the U.S. equity market. |

| v | Gross domestic product (“GDP”) is the market value of all final goods and services produced within a country in a given period of time. |

| vi | The Federal Reserve Board (“Fed”) is responsible for the formulation of policies designed to promote economic growth, full employment, stable prices, and a sustainable pattern of international trade and payments. |

| vii | The European Central Bank (“ECB”) is responsible for the monetary system of the European Union and the euro currency. |

| viii | Net asset value (“NAV”) is calculated by subtracting total liabilities, including liabilities associated with financial leverage (if any) from the closing value of all securities held by the Fund (plus all other assets) and dividing the result (total net assets) by the total number of the common shares outstanding. The NAV fluctuates with changes in the market prices of securities in which the Fund has invested. However, the price at which an investor may buy or sell shares of the Fund is the Fund’s market price as determined by supply of and demand for the Fund’s shares. |

| ix | Lipper, Inc., a wholly-owned subsidiary of Reuters, provides independent insight on global collective investments. Returns are based on the twelve-month period ended November 30, 2014, including the reinvestment of all distributions, including returns of capital, if any, calculated among the 16 funds in the Fund’s Lipper category. |

| 6 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

Investment breakdown (%) as a percent of total investments

| † | The bar graph above represents the composition of the Fund’s investments as of November 30, 2014 and November 30, 2013. The Fund is actively managed. As a result, the composition of the Fund’s investments is subject to change at any time. |

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 7 |

November 30, 2014

ClearBridge American Energy MLP Fund Inc.

| Security | Shares/ Units |

Value | ||||||||||

| Master Limited Partnerships — 128.5% | ||||||||||||

| Diversified Energy Infrastructure — 44.7% |

||||||||||||

| Energy Transfer Partners LP |

2,225,000 | $ | 145,003,250 | |||||||||

| Enterprise Products Partners LP |

2,646,340 | 98,814,336 | ||||||||||

| Genesis Energy LP |

237,000 | 10,435,110 | ||||||||||

| ONEOK Partners LP |

1,446,700 | 63,770,536 | ||||||||||

| Regency Energy Partners LP |

3,103,100 | 88,407,319 | ||||||||||

| Williams Partners LP |

1,600,000 | 82,784,000 | ||||||||||

| Total Diversified Energy Infrastructure |

489,214,551 | |||||||||||

| Gathering/Processing — 35.5% |

||||||||||||

| Antero Midstream Partners LP |

536,700 | 14,861,223 | * | |||||||||

| Blueknight Energy Partners LP |

1,800,000 | 12,924,000 | (a) | |||||||||

| Crestwood Midstream Partners LP |

2,249,646 | 45,172,892 | ||||||||||

| DCP Midstream Partners LP |

935,771 | 44,832,789 | ||||||||||

| Enable Midstream Partners LP |

498,845 | 10,036,761 | ||||||||||

| EnLink Midstream Partners LP |

2,221,700 | 61,963,213 | ||||||||||

| MarkWest Energy Partners LP |

998,700 | 70,967,622 | ||||||||||

| Midcoast Energy Partners LP |

1,525,720 | 23,496,088 | ||||||||||

| Summit Midstream Partners LP |

404,000 | 18,341,600 | ||||||||||

| Targa Resources Partners LP |

1,279,982 | 70,181,413 | ||||||||||

| Western Gas Partners LP |

220,100 | 15,611,693 | ||||||||||

| Total Gathering/Processing |

388,389,294 | |||||||||||

| Global Infrastructure — 6.6% |

||||||||||||

| Brookfield Infrastructure Partners LP |

1,745,467 | 72,436,881 | ||||||||||

| Liquids Transportation & Storage — 21.3% |

||||||||||||

| Buckeye Partners LP |

1,301,600 | 100,053,992 | ||||||||||

| Enbridge Energy Partners LP |

2,500,005 | 93,750,187 | ||||||||||

| Holly Energy Partners LP |

100,000 | 3,365,000 | ||||||||||

| Plains All American Pipeline LP |

703,511 | 36,195,641 | ||||||||||

| Total Liquids Transportation & Storage |

233,364,820 | |||||||||||

| Natural Gas Transportation & Storage — 8.8% |

||||||||||||

| Cheniere Energy Partners LP |

652,403 | 18,971,879 | ||||||||||

| Cypress Energy Partners LP |

375,000 | 6,116,250 | (a) | |||||||||

| Spectra Energy Partners LP |

662,400 | 35,749,728 | ||||||||||

| TC Pipelines LP |

499,700 | 35,973,403 | ||||||||||

| Total Natural Gas Transportation & Storage |

96,811,260 | |||||||||||

| Offshore — 1.0% |

||||||||||||

| Dynagas LNG Partners LP |

600,000 | 10,746,000 | ||||||||||

See Notes to Financial Statements.

| 8 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

ClearBridge American Energy MLP Fund Inc.

| Security | Shares/ Units |

Value | ||||||||||

| Oil & Gas Drilling — 1.4% |

||||||||||||

| Transocean Partners LLC |

1,001,000 | $ | 15,695,680 | |||||||||

| Oil/Refined Products — 1.1% |

||||||||||||

| JP Energy Partners LP |

838,000 | 12,234,800 | * | |||||||||

| Propane — 4.0% |

||||||||||||

| AmeriGas Partners LP |

619,151 | 28,598,585 | ||||||||||

| Suburban Propane Partners LP |

337,900 | 15,205,500 | ||||||||||

| Total Propane |

43,804,085 | |||||||||||

| Shipping — 4.1% |

||||||||||||

| Teekay LNG Partners LP |

1,250,567 | 45,045,423 | ||||||||||

| Total Master Limited Partnerships (Cost — $1,231,348,761) |

1,407,742,794 | |||||||||||

| Common Stocks — 9.3% | ||||||||||||

| Energy — 8.5% | ||||||||||||

| Oil, Gas & Consumable Fuels — 8.5% |

||||||||||||

| Kinder Morgan Inc. |

2,256,582 | 93,309,683 | ||||||||||

| Industrials — 0.8% | ||||||||||||

| Transportation Infrastructure — 0.8% |

||||||||||||

| Macquarie Infrastructure Co. LLC |

125,000 | 8,787,500 | ||||||||||

| Total Common Stocks (Cost — $76,186,149) |

102,097,183 | |||||||||||

| Total Investments† — 137.8% (Cost — $1,307,534,910#) |

1,509,839,977 | |||||||||||

| Liabilities in Excess of Other Assets — (37.8)% |

(414,296,142 | ) | ||||||||||

| Total Net Assets — 100.0% |

$ | 1,095,543,835 | ||||||||||

| * | Non-income producing security. |

| † | The entire portfolio is subject to lien, granted to the lender and Senior Note holders, to the extent of the borrowing outstanding and any additional expenses. |

| (a) | In this instance, as defined in the Investment Company Act of 1940, an “Affiliated Company” represents Fund ownership of at least 5% of the outstanding voting securities of an issuer. At November 30, 2014, the total market value of Affiliated Companies was $19,040,250, and the cost was $20,655,063 (See Note 5). |

| # | Aggregate cost for federal income tax purposes is $1,240,518,747. |

See Notes to Financial Statements.

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 9 |

Statement of assets and liabilities

November 30, 2014

| Assets: | ||||

| Investments in unaffiliated securities, at value (Cost — $1,286,879,847) |

$ | 1,490,799,727 | ||

| Investments in affiliated securities, at value (Cost — $20,655,063) |

19,040,250 | |||

| Cash |

13,939,540 | |||

| Receivable for securities sold |

4,879,982 | |||

| Deferred debt issuance and offering costs |

1,583,279 | |||

| Dividends and distributions receivable |

712,150 | |||

| Prepaid expenses |

35,558 | |||

| Total Assets |

1,530,990,486 | |||

| Liabilities: | ||||

| Senior Secured Notes (Note 7) |

275,000,000 | |||

| Loan payable (Note 6) |

102,000,000 | |||

| Deferred tax liability (Note 9) |

52,282,861 | |||

| Payable for securities purchased |

2,567,466 | |||

| Interest payable |

1,489,466 | |||

| Investment management fee payable |

1,240,550 | |||

| Audit and tax fees payable |

387,000 | |||

| Directors’ fees payable |

9,276 | |||

| Accrued expenses |

470,032 | |||

| Total Liabilities |

435,446,651 | |||

| Total Net Assets | $ | 1,095,543,835 | ||

| Net Assets: | ||||

| Par value ($0.001 par value; 58,289,007 shares issued and outstanding; 100,000,000 shares authorized) |

$ | 58,289 | ||

| Paid-in capital in excess of par value |

1,005,695,416 | |||

| Accumulated net investment loss, net of income taxes |

(21,967,258) | |||

| Accumulated net realized loss on investments, net of income taxes |

(16,099,415) | |||

| Net unrealized appreciation on investments, net of income taxes |

127,856,803 | |||

| Total Net Assets | $ | 1,095,543,835 | ||

| Shares Outstanding | 58,289,007 | |||

| Net Asset Value | $18.80 | |||

See Notes to Financial Statements.

| 10 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

For the Year Ended November 30, 2014

| Investment Income: | ||||

| Dividends and distributions from unaffiliated investments |

$ | 83,070,932 | ||

| Dividends and distributions from affiliated investments |

649,142 | |||

| Less: Foreign taxes withheld |

(110,815) | |||

| Return of capital (Note 1(f)) |

(80,910,115) | |||

| Net dividends and distributions |

2,699,144 | |||

| Total Investment Income |

2,699,144 | |||

| Expenses: | ||||

| Investment management fee (Note 2) |

14,832,158 | |||

| Interest expense (Notes 6 and 7) |

12,435,959 | |||

| Legal fees |

393,129 | |||

| Audit and tax fees |

328,000 | |||

| Amortization of debt issuance and offering costs |

231,036 | |||

| Directors’ fees |

198,665 | |||

| Franchise taxes |

198,216 | |||

| Transfer agent fees |

195,333 | |||

| Commitment fees (Note 6) |

149,539 | |||

| Fund accounting fees |

96,882 | |||

| Rating agency fees |

95,416 | |||

| Stock exchange listing fees |

38,733 | |||

| Shareholder reports |

35,415 | |||

| Insurance |

20,293 | |||

| Custody fees |

5,053 | |||

| Miscellaneous expenses |

60,304 | |||

| Total Expenses |

29,314,131 | |||

| Net Investment Loss, before income taxes | (26,614,987) | |||

| Deferred tax benefit (Note 9) |

9,778,028 | |||

| Net Investment Loss, net of income taxes | (16,836,959) | |||

| Realized and Unrealized Gain (Loss) on Investments (Notes 1, 3 and 9): | ||||

| Net Realized Gain (Loss) From: |

||||

| Investment transactions |

(22,515,372) | |||

| Deferred tax benefit (Note 9) |

8,279,740 | |||

| Net Realized Loss, net of income taxes |

(14,235,632) | |||

| Change in Net Unrealized Appreciation (Depreciation) From: |

||||

| Unaffiliated investments |

177,908,117 | |||

| Affiliated investments |

(1,614,813) | |||

| Deferred tax expense (Note 9) |

(64,823,912) | |||

| Change in Net Unrealized Appreciation (Depreciation), net of income taxes |

111,469,392 | |||

| Net Gain on Investments, net of income taxes | 97,233,760 | |||

| Increase in Net Assets from Operations | $ | 80,396,801 | ||

See Notes to Financial Statements.

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 11 |

Statements of changes in net assets

| For the Year Ended November 30, 2014 and the Period Ended November 30, 2013 |

2014 | 2013† | ||||||

| Operations: | ||||||||

| Net investment loss, net of income taxes |

$ | (16,836,959) | $ | (5,130,299) | ||||

| Net realized loss, net of income taxes |

(14,235,632) | (1,863,783) | ||||||

| Change in net unrealized appreciation (depreciation), net of income taxes |

111,469,392 | 16,387,411 | ||||||

| Increase in Net Assets From Operations |

80,396,801 | 9,393,329 | ||||||

| Distributions to Shareholders From (Note 1): | ||||||||

| Return of capital |

(70,238,253) | (34,957,652) | ||||||

| Decrease in Net Assets From Distributions to Shareholders |

(70,238,253) | (34,957,652) | ||||||

| Fund Share Transactions: | ||||||||

| Net proceeds from sale of shares (0 and 58,236,499 shares issued, respectively) |

— | 1,109,987,873 | ‡ | |||||

| Reinvestment of distributions (0 and 52,508 shares issued, respectively) |

— | 961,737 | ||||||

| Increase in Net Assets From Fund Share Transactions |

— | 1,110,949,610 | ||||||

| Increase in Net Assets |

10,158,548 | 1,085,385,287 | ||||||

| Net Assets: | ||||||||

| Beginning of year |

1,085,385,287 | — | ||||||

| End of year* |

$ | 1,095,543,835 | $ | 1,085,385,287 | ||||

| *Includesaccumuated net investment loss, net of income taxes, of: |

$(21,967,258) | $(5,130,299) | ||||||

| † | For the period June 26, 2013 (commencement of operations) to November 30, 2013. |

| ‡ | Net of offering cost and sales charges of $54,742,309. |

See Notes to Financial Statements.

| 12 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

For the Year Ended November 30, 2014

| Increase (Decrease) in Cash: Cash Provided (used) by Operating Activities: |

||||

| Net increase in net assets resulting from operations |

$ | 80,396,801 | ||

| Adjustments to reconcile net increase in net assets resulting from operations to net cash provided (used) by operating activities: |

||||

| Purchases of portfolio securities |

(313,567,783) | |||

| Sales of portfolio securities |

336,669,450 | |||

| Return of capital |

80,910,115 | |||

| Increase in receivable for securities sold |

(4,879,982) | |||

| Increase in dividends and distributions receivable |

(345,575) | |||

| Amortization of deferred debt issuance and offering costs |

153,565 | |||

| Decrease in prepaid expenses |

95,965 | |||

| Increase in payable for securities purchased |

2,567,466 | |||

| Increase in investment management fee payable |

35,214 | |||

| Decrease in interest payable |

(6,687) | |||

| Increase in audit and tax fees payable |

217,500 | |||

| Increase in Directors’ fees payable |

24,445 | |||

| Increase in accrued expenses |

203,306 | |||

| Increase in deferred tax liability |

46,766,144 | |||

| Net realized loss on investments |

22,515,372 | |||

| Change in unrealized appreciation of investments |

(176,293,304) | |||

| Net Cash Provided by Operating Activities* |

75,462,012 | |||

| Cash Flows from Financing Activities: | ||||

| Distributions paid on common stock |

(70,238,253) | |||

| Increase in loan payable |

2,000,000 | |||

| Net Cash Used in Financing Activities |

(68,238,253) | |||

| Net Increase in Cash | 7,223,759 | |||

| Cash at Beginning of Year |

6,715,781 | |||

| Cash at End of Year |

$ | 13,939,540 | ||

| * | Included in operating expenses is cash of $12,597,434 paid for interest and commitment fees on borrowings. |

See Notes to Financial Statements.

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 13 |

| For a share of capital stock outstanding throughout each year ended November 30, unless otherwise noted: | ||||||||

| 20141 | 20131,2 | |||||||

| Net asset value, beginning of year | $18.62 | $19.06 | 3 | |||||

| Income (loss) from operations: | ||||||||

| Net investment loss |

(0.29) | (0.09) | ||||||

| Net realized and unrealized gain |

1.68 | 0.25 | ||||||

| Total income from operations |

1.39 | 0.16 | ||||||

| Less distributions from: | ||||||||

| Return of capital |

(1.21) | (0.60) | ||||||

| Total distributions |

(1.21) | (0.60) | ||||||

| Net asset value, end of year | $18.80 | $18.62 | ||||||

| Market price, end of year | $17.66 | $18.35 | ||||||

| Total return, based on NAV4,5 |

7.50 | % | 0.92 | % | ||||

| Total return, based on Market Price6 |

2.95 | % | (5.20) | % | ||||

| Net assets, end of year (millions) | $1,096 | $1,085 | ||||||

| Ratios to average net assets: | ||||||||

| Management fees |

1.34 | % | 1.23 | %7 | ||||

| Other expenses |

1.31 | 0.66 | 7 | |||||

| Subtotal |

2.65 | 1.89 | ||||||

| Income tax expense |

4.23 | 1.20 | 7 | |||||

| Total expenses8 |

6.88 | 3.09 | 7,9 | |||||

| Net investment loss, net of income taxes |

(1.52) | (1.12) | 7 | |||||

| Portfolio turnover rate | 21 | % | 3 | % | ||||

| Loan and Debt Issuance Outstanding, End of Year (000s) |

$377,000 | $375,000 | ||||||

| Asset Coverage for Loan and Debt Issuance Outstanding |

391 | % | 389 | % | ||||

| Weighted Average Loan and Debt Issuance (000s) |

$376,633 | $283,942 | ||||||

| Weighted Average Interest Rate on Loans and Debt Issuance |

3.30 | % | 2.03 | % | ||||

| 1 | Per share amounts have been calculated using the average shares method. |

| 2 | For the period June 26, 2013 (commencement of operations) to November 30, 2013. |

| 3 | Initial public offering price of $20.00 per share less offering costs and sales load totaling $0.94 per share. |

| 4 | Performance figures may reflect compensating balance arrangements, fee waivers and/or expense reimbursements. In the absence of compensating balance arrangements, fee waivers and/or expense reimbursements, the total return would have been lower. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 5 | The total return calculation assumes that distributions are reinvested at NAV. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 6 | The total return calculation assumes that distributions are reinvested in accordance with the Fund’s dividend reinvestment plan. Past performance is no guarantee of future results. Total returns for periods of less than one year are not annualized. |

| 7 | Annualized. |

| 8 | The impact of compensating balance arrangements was 0.01%. |

| 9 | Excludes the impact of reimbursement for organization fees in the amount of 0.01%. Inclusive of the reimbursement the ratio is 3.08%. The investment manager has agreed to reimburse all organization expenses. |

See Notes to Financial Statements.

| 14 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

1. Organization and significant accounting policies

ClearBridge American Energy MLP Fund Inc. (the “Fund”) was incorporated in Maryland on February 21, 2013 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Board of Directors authorized 100 million shares of $0.001 par value common stock. The Fund’s investment objective is to provide a high level of total return, with an equal emphasis on current distributions and capital appreciation. The Fund seeks to achieve its objective by investing primarily in master limited partnerships (“MLPs”) in the energy sector. There can be no assurance that the Fund will achieve its investment objective.

Under normal market conditions, the Fund will invest at least 80% of its Managed Assets in MLPs in the energy sector (the “80% policy”). For purposes of the 80% policy, the Fund considers investments in MLPs to include investments that offer economic exposure to public and private MLPs in the form of equity securities of MLPs, securities of entities holding primarily general partner or managing member interests in MLPs, securities that are derivatives of interests in MLPs, including I-Shares, exchange-traded funds that primarily hold MLP interests and debt securities of MLPs. Entities in the energy sector are engaged in the business of exploring, developing, producing, gathering, transporting, processing, storing, refining, distributing, mining or marketing of natural gas, natural gas liquids (including propane), crude oil, refined petroleum products or coal. “Managed Assets” means net assets plus the amount of any borrowings and assets attributable to any preferred stock of the Fund that may be outstanding.

The following are significant accounting policies consistently followed by the Fund and are in conformity with U.S. generally accepted accounting principles (“GAAP”). Estimates and assumptions are required to be made regarding assets, liabilities and changes in net assets resulting from operations when financial statements are prepared. Changes in the economic environment, financial markets and any other parameters used in determining these estimates could cause actual results to differ. Subsequent events have been evaluated through the date the financial statements were issued.

(a) Investment valuation. Equity securities for which market quotations are available are valued at the last reported sales price or official closing price on the primary market or exchange on which they trade. The valuations for fixed income securities (which may include, but are not limited to, corporate, government, municipal, mortgage-backed, collateralized mortgage obligations and asset-backed securities) and certain derivative instruments are typically the prices supplied by independent third party pricing services, which may use market prices or broker/dealer quotations or a variety of valuation techniques and methodologies. The independent third party pricing services use inputs that are observable such as issuer details, interest rates, yield curves, prepayment speeds, credit risks/spreads, default rates and quoted prices for similar securities. Short-term fixed income securities that will mature in 60 days or less are valued at amortized cost, unless it is determined that using this method would not reflect an investment’s fair value. If independent third party pricing services are unable to supply prices for a portfolio investment, or if the prices supplied are deemed by the manager to be unreliable, the market

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 15 |

Notes to financial statements (cont’d)

price may be determined by the manager using quotations from one or more broker/dealers or at the transaction price if the security has recently been purchased and no value has yet been obtained from a pricing service or pricing broker. When reliable prices are not readily available, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the Fund calculates its net asset value, the Fund values these securities as determined in accordance with procedures approved by the Fund’s Board of Directors.

The Board of Directors is responsible for the valuation process and has delegated the supervision of the daily valuation process to the Legg Mason North American Fund Valuation Committee (the “Valuation Committee”). The Valuation Committee, pursuant to the policies adopted by the Board of Directors, is responsible for making fair value determinations, evaluating the effectiveness of the Fund’s pricing policies, and reporting to the Board of Directors. When determining the reliability of third party pricing information for investments owned by the Fund, the Valuation Committee, among other things, conducts due diligence reviews of pricing vendors, monitors the daily change in prices and reviews transactions among market participants.

The Valuation Committee will consider pricing methodologies it deems relevant and appropriate when making fair value determinations. Examples of possible methodologies include, but are not limited to, multiple of earnings; discount from market of a similar freely traded security; discounted cash-flow analysis; book value or a multiple thereof; risk premium/yield analysis; yield to maturity; and/or fundamental investment analysis. The Valuation Committee will also consider factors it deems relevant and appropriate in light of the facts and circumstances. Examples of possible factors include, but are not limited to, the type of security; the issuer’s financial statements; the purchase price of the security; the discount from market value of unrestricted securities of the same class at the time of purchase; analysts’ research and observations from financial institutions; information regarding any transactions or offers with respect to the security; the existence of merger proposals or tender offers affecting the security; the price and extent of public trading in similar securities of the issuer or comparable companies; and the existence of a shelf registration for restricted securities.

For each portfolio security that has been fair valued pursuant to the policies adopted by the Board of Directors, the fair value price is compared against the last available and next available market quotations. The Valuation Committee reviews the results of such back testing monthly and fair valuation occurrences are reported to the Board of Directors quarterly.

The Fund uses valuation techniques to measure fair value that are consistent with the market approach and/or income approach, depending on the type of security and the particular circumstance. The market approach uses prices and other relevant information generated by market transactions involving identical or comparable securities. The income approach uses valuation techniques to discount estimated future cash flows to present value.

| 16 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

GAAP establishes a disclosure hierarchy that categorizes the inputs to valuation techniques used to value assets and liabilities at measurement date. These inputs are summarized in the three broad levels listed below:

| Ÿ | Level 1 — quoted prices in active markets for identical investments |

| Ÿ | Level 2 — other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| Ÿ | Level 3 — significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used in valuing the Fund’s assets carried at fair value:

| ASSETS | ||||||||||||||||

| Description | Quoted Prices (Level 1) |

Other Significant Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||

| Long-term investments†: | ||||||||||||||||

| Master limited partnerships |

$ | 1,407,742,794 | — | — | $ | 1,407,742,794 | ||||||||||

| Common stocks |

102,097,183 | — | — | 102,097,183 | ||||||||||||

| Total investments | $ | 1,509,839,977 | — | — | $ | 1,509,839,977 | ||||||||||

| † | See Schedule of Investments for additional detailed categorizations. |

(b) Repurchase agreements. The Fund may enter into repurchase agreements with institutions that its investment adviser has determined are creditworthy. Each repurchase agreement is recorded at cost. Under the terms of a typical repurchase agreement, the Fund acquires a debt security subject to an obligation of the seller to repurchase, and of the Fund to resell, the security at an agreed-upon price and time, thereby determining the yield during the Fund’s holding period. When entering into repurchase agreements, it is the Fund’s policy that its custodian or a third party custodian, acting on the Fund’s behalf, take possession of the underlying collateral securities, the market value of which, at all times, at least equals the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction maturity exceeds one business day, the value of the collateral is marked-to-market and measured against the value of the agreement in an effort to ensure the adequacy of the collateral. If the counterparty defaults, the Fund generally has the right to use the collateral to satisfy the terms of the repurchase transaction. However, if the market value of the collateral declines during the period in which the Fund seeks to assert its rights or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 17 |

Notes to financial statements (cont’d)

(c) Net asset value. The Fund determines the net asset value of its common stock on each day the NYSE is open for business, as of the close of the customary trading session (normally 4:00 p.m. Eastern Time), or any earlier closing time that day. The Fund determines the net asset value per share of common stock by dividing the value of the Fund’s securities, cash and other assets (including interest accrued but not collected) less all its liabilities (including accrued expenses, borrowings and interest payables), net of income taxes, by the total number of shares of common stock outstanding.

(d) Master limited partnerships. Entities commonly referred to as “MLPs” are generally organized under state law as limited partnerships or limited liability companies. The Fund intends to primarily invest in MLPs receiving partnership taxation treatment under the Internal Revenue Code of 1986 (the “Code”), and whose interests or “units” are traded on securities exchanges like shares of corporate stock. To be treated as a partnership for U.S. federal income tax purposes, an MLP whose units are traded on a securities exchange must receive at least 90% of its gross income from qualifying sources such as interest, dividends, real estate rents, gain from the sale or disposition of real property, income and gain from mineral or natural resources activities, income and gain from the transportation or storage of certain fuels, and, in certain circumstances, income and gain from commodities or futures, forwards and options with respect to commodities. Mineral or natural resources activities include exploration, development, production, processing, mining, refining, marketing and transportation (including pipelines) of oil and gas, minerals, geothermal energy, fertilizer, timber or industrial source carbon dioxide. An MLP consists of a general partner and limited partners (or in the case of MLPs organized as limited liability companies, a managing member and members). The general partner or managing member typically controls the operations and management of the MLP and has an ownership stake in the partnership. The limited partners or members, through their ownership of limited partner or member interests, provide capital to the entity, are intended to have no role in the operation and management of the entity and receive cash distributions. The MLPs themselves generally do not pay U.S. federal income taxes. Thus, unlike investors in corporate securities, direct MLP investors are generally not subject to double taxation (i.e., corporate level tax and tax on corporate dividends). Currently, most MLPs operate in the energy and/or natural resources sector.

(e) Concentration risk. Concentration in the energy sector may present more risks than if the Fund were broadly diversified over numerous sectors of the economy. A downturn in the energy sector of the economy could have a larger impact on the Fund than on an investment company that does not concentrate in the sector. At times, the performance of securities of companies in the sector may lag the performance of other sectors or the broader market as a whole.

(f) Return of capital estimates. Distributions received from the Fund’s investments in MLPs generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and

| 18 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded.

For the year ended November 30, 2014, the Fund estimated that approximately 96.90% of the MLP distributions received would be treated as a return of capital. The Fund recorded as return of capital the amount of $81,123,450 of dividends and distributions received from its investments.

Additionally, the Fund recorded revisions to the return of capital estimates from the period ended November 30, 2013 in the amount of an $213,335 increase in dividends and distributions received from investments.

(g) Security transactions and investment income. Security transactions are accounted for on a trade date basis. Interest income, adjusted for amortization of premium and accretion of discount, is recorded on the accrual basis. Dividends and distributions income are recorded on ex-dividend date. Foreign dividend income is recorded on the ex-dividend date or as soon as practicable after the Fund determines the existence of a dividend declaration after exercising reasonable due diligence. The cost of investments sold is determined by use of the specific identification method. To the extent any issuer defaults or a credit event occurs that impacts the issuer, the Fund may halt any additional interest income accruals and consider the realizability of interest accrued up to the date of default or credit event.

(h) Distributions to shareholders. Distributions to common stockholders are declared and paid on a quarterly basis and are recorded on the ex-dividend date. The estimated characterization of the distributions paid to common stockholders will be either a dividend (ordinary income) or distribution (return of capital). This estimate is based on the Fund’s operating results during the period. The Fund anticipates that 100% of its current period distribution will be comprised of return of capital as a result of the tax character of cash distributions made by the MLPs.

(i) Compensating balance arrangements. The Fund has an arrangement with its custodian bank whereby a portion of the custodian’s fees is paid indirectly by credits earned on the Fund’s cash on deposit with the bank.

(j) Partnership accounting policy. The Fund records its pro rata share of the income (loss) and capital gains (losses), to the extent of distributions it has received, allocated from the underlying partnerships and accordingly adjusts the cost basis of the underlying partnerships for return of capital. These amounts are included in the Fund’s Statement of Operations.

(k) Federal and other taxes. The Fund, as a corporation, is obligated to pay federal and state income tax on its taxable income. The Fund invests its assets primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund includes its allocable share of the MLP’s taxable income in computing its own taxable income. Deferred income taxes reflect (i) taxes on unrealized gains (losses),

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 19 |

Notes to financial statements (cont’d)

which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes and (iii) the net tax benefit of accumulated net operating and capital losses. To the extent the Fund has a deferred tax asset, consideration is given as to whether or not a valuation allowance is required. The need to establish a valuation allowance for deferred tax assets is assessed periodically by the Fund based on the Income Tax Topic of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification that it is more likely than not that some portion or all of the deferred tax asset will not be realized. In the assessment for a valuation allowance, consideration is given to all positive and negative evidence related to the realization of the deferred tax asset. This assessment considers, among other matters, the nature, frequency and severity of current and cumulative losses, forecasts of future profitability (which are highly dependent on future cash distributions from the Fund’s MLP holdings), the duration of statutory carryforward periods and the associated risk that operating and capital loss carryforwards may expire unused.

For all open tax years and for all major jurisdictions, management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Furthermore, management of the Fund is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

The Fund may rely to some extent on information provided by the MLPs, which may not necessarily be timely, to estimate taxable income allocable to the MLP units held in the portfolio and to estimate the associated deferred tax liability. Such estimates are made in good faith. From time to time, as new information becomes available, the Fund modifies its estimates or assumptions regarding the deferred tax liability.

The Fund’s policy is to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. The current and prior tax years remain open and subject to examination by tax jurisdictions.

(l) Reclassification. GAAP requires that certain components of net assets be reclassified to reflect permanent differences between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. During the year ended November 30, 2014, the Fund had no reclassifications.

2. Investment management agreement and other transactions with affiliates

Legg Mason Partners Fund Advisor, LLC (“LMPFA”) is the Fund’s investment manager and ClearBridge Investments, LLC (“ClearBridge”) is the Fund’s subadviser. LMPFA and ClearBridge are wholly-owned subsidiaries of Legg Mason, Inc. (“Legg Mason”).

Under the investment management agreement, the Fund pays an annual fee, paid monthly, in an amount equal to 1.00% of the Fund’s average daily Managed Assets.

| 20 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

LMPFA provides administrative and certain oversight services to the Fund. LMPFA delegates to the subadviser the day-to-day portfolio management of the Fund. For its services, LMPFA pays ClearBridge 70% of the net management fee it receives from the Fund.

During periods in which the fund utilizes financial leverage, the fees which are payable to the investment manager as a percentage of the Fund’s assets will be higher than if the Fund did not utilize leverage because the fees are calculated as a percentage of the Fund’s assets, including those investments purchased with leverage.

All officers and one Director of the Fund are employees of Legg Mason or its affiliates and do not receive compensation from the Fund.

3. Investments

During the year ended November 30, 2014, the aggregate cost of purchases and proceeds from sales of investments (excluding short-term investments) were as follows:

| Purchases | $ | 313,567,783 | ||

| Sales | 336,669,450 |

4. Derivative instruments and hedging activities

During the year ended November 30, 2014, the Fund did not invest in any derivative instruments.

5. Transactions with affiliated companies

An “Affiliated Company”, as defined in the 1940 Act, includes a company in which the Fund owns 5% or more of the company’s outstanding voting securities at any time during the period. The following transactions were effected in shares of such companies for the year ended November 30, 2014:

| Affiliate Value at 11/30/13 |

Purchased | Sold | Return of Capital |

Affiliate Value at 11/30/14 |

Realized Gain/Loss |

|||||||||||||||||||||||||||

| Company | Cost | Shares/ Units |

Cost | Shares/ Units |

||||||||||||||||||||||||||||

| Blueknight Energy Partners LP | — | $ | 13,804,205 | 1,800,000 | — | — | $ | 234,900 | $ | 12,924,000 | — | |||||||||||||||||||||

| Cypress Energy Partners LP | — | 7,500,000 | 375,000 | — | — | 414,242 | 6,116,250 | — | ||||||||||||||||||||||||

| — | $ | 21,304,205 | — | $ | 649,142 | $ | 19,040,250 | — | ||||||||||||||||||||||||

6. Loan

The Fund has a 364-day revolving credit agreement with a State Street Bank and Trust Company (“State Street”), which allows the Fund to borrow up to an aggregate amount of $200,000,000. Unless renewed, the agreement will terminate on July 13, 2015. The Fund pays a commitment fee up to an annual rate of 0.15% on the unutilized portion of the loan commitment amount. The interest on the loan is calculated at variable rates based on the LIBOR, plus any applicable margin. Securities held by the Fund are subject to a lien, granted to State Street, to the extent of the borrowing outstanding and any additional expenses. State Street and the senior secured note holders have equal access to the lien (See Note 7). The Fund’s credit agreement contains customary covenants that, among other things, may limit the Fund’s ability to pay distributions in certain circumstances, incur additional debt,

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 21 |

Notes to financial statements (cont’d)

change its fundamental investment policies and engage in certain transactions, including mergers and consolidations, and require asset coverage ratios in addition to those required by the 1940 Act. In addition, the credit agreement may be subject to early termination under certain conditions and may contain other provisions that could limit the Fund’s ability to utilize borrowing under the agreement. At November 30, 2014, the Fund had $102,000,000 of borrowings outstanding per the current credit agreement. Interest expense related to the loan for the year ended November 30, 2014 was $985,960. For the year ended November 30, 2014, the Fund incurred $149,539 in commitment fees. For the year ended November 30, 2014, the average daily loan balance was $101,632,877 and the weighted average interest rate was 0.97%.

7. Senior secured notes

On October 16, 2013, the Fund completed a private placement of $275,000,000 of fixed-rate senior secured notes (the “Senior Notes”). Net proceeds from such offering and borrowings under the credit facility were used to repay outstanding borrowings, make new portfolio investments, and for general corporate purposes. At November 30, 2014, the Fund had $275,000,000 aggregate principal amount of Senior Notes outstanding. Interest expense related to the Senior Notes for the year ended November 30, 2014 was $11,449,999. Securities held by the Fund are subject to a lien, granted to the Senior Notes holders, to the extent of the borrowings outstanding and any additional expenses. The Senior Notes holders and the lender have equal access to the lien (See Note 6).

The table below summarizes the key terms of the offering.

| Security | Amount | Rate | Maturity | |||||||||

| Senior secured notes: | ||||||||||||

| Series A | $ | 55,000,000 | 3.25 | % | October 15, 2018 | |||||||

| Series B | $ | 60,000,000 | 3.89 | % | October 15, 2020 | |||||||

| Series C | $ | 85,000,000 | 4.51 | % | October 15, 2023 | |||||||

| Series D | $ | 75,000,000 | 4.66 | % | October 15, 2025 | |||||||

8. Distributions subsequent to November 30, 2014

The following distribution has been declared by the Fund’s Board of Directors and is payable subsequent to the period end of this report:

| Record Date | Payable Date | Amount | ||||||

| 2/20/2015 | 2/27/2015 | $ | 0.305 | |||||

9. Income taxes

The Fund’s federal and state income tax provision consist of the following:

| Federal | State | Total | ||||||||||

| Current tax expense (benefit) | — | — | — | |||||||||

| Deferred tax expense (benefit) | $ | 43,311,469 | $ | 3,454,675 | $ | 46,766,144 | ||||||

| Total tax expense (benefit) | $ | 43,311,469 | $ | 3,454,675 | $ | 46,766,144 | ||||||

| 22 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

Total income taxes have been computed by applying the federal statutory income tax rate of 35% plus a blended state income tax rate of 1.8%. The Fund applied this rate to net investment income (loss) and realized and unrealized gains (losses) on investments before income taxes in computing its total income tax expense (benefit).

During the year, the Fund’s combined federal and state income tax rate decreased from 37.00% to 36.80% due to changes in the composition of MLP investments, changes in the underlying MLP activity in various state tax jurisdictions, and reductions of enacted state tax rates in certain jurisdictions. The decrease resulted in the additional income tax benefit and corresponding decrease in the Fund’s effective tax rate outlined below.

The provision for income taxes differs from the amount derived from applying the statutory income tax rate to net investment income (loss) and realized and unrealized gains (losses) before income taxes as follows:

| Provision at statutory rates | 35.00 | % | $ | 44,507,031 | ||||

| State taxes, net of federal tax benefit | 1.80 | % | 2,288,933 | |||||

| Change in blended state tax rate from 2.0% to 1.8% | -0.02 | % | (29,820) | |||||

| Total tax expense (benefit) | 36.78 | % | $ | 46,766,144 |

Deferred income taxes reflect (i) taxes on unrealized gains (losses), which are attributable to the difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes, and (iii) the net tax benefit of net operating loss and capital loss carryforwards.

Components of the Fund’s net deferred tax asset (liability) as of November 30, 2014 are as follows:

| Deferred Tax Assets | ||||

| Net operating loss carryforward | $ | 37,808,129 | ||

| Capital loss carryforward | 8,894,932 | |||

| Other carryforwards | 7,878 | |||

| Deferred Tax Liabilities | ||||

| Unrealized gains on investment securities | (74,448,265) | |||

| Basis reduction resulting from differences in the book vs. taxable income received from MLPs | (24,545,535) | |||

| Total net deferred tax asset (liability) | $ | (52,282,861) | ||

At November 30, 2014 the Fund had federal and state net operating loss carryforwards of $102,843,177 and $38,260,527 (net of state apportionment), respectively (deferred tax asset of $37,808,129). Several states compute net operating losses before apportionment, therefore the value of the state net operating loss carryforward disclosed may fluctuate for changes in apportionment factors. Realization of the deferred tax asset related to the net operating loss carryforwards is dependent, in part, on generating sufficient taxable income prior to expiration of the loss carryforwards. If not utilized, the federal net operating loss

| ClearBridge American Energy MLP Fund Inc. 2014 Annual Report | 23 |

Notes to financial statements (cont’d)

carryforward expires in tax years 2032 and 2033 and the state net operating loss carryforwards expire in tax years between 2017 and 2033.

Additionally, at November 30, 2014, the Fund had a capital loss carryforward of $24,171,010 (deferred tax asset of $8,894,932), which may be carried forward for 5 years. If not utilized, this capital loss will expire in tax years 2017 and 2018. The capital loss for the year ended November 30, 2014 has been estimated based on information currently available. Such estimate is subject to revision upon receipt of the 2014 tax reporting information from the individual MLPs. For corporations, capital losses can only be used to offset capital gains and cannot be used to offset ordinary income. Therefore the use of this capital loss carryforward is dependent upon the Fund generating sufficent net capital gains prior to the expiration of the loss carryforward.

The amount of net operating loss and capital loss carryforwards differed from the amounts disclosed in the prior year financial statements due to differences between the estimated and actual amounts of taxable income received from the MLPs for the prior year.

Although the Fund currently has a net deferred tax liability, it periodically reviews the recoverability of its deferred tax assets based on the weight of available evidence. When assessing the recoverability of its deferred tax assets, significant weight is given to the effects of potential future realized and unrealized gains on investments and the period over which these deferred tax assets can be realized. Based on the Fund’s assessment, it has determined that it is more likely than not that its deferred tax assets will be realized through future taxable income of the appropriate character. Accordingly, no valuation allowance has been established on the Fund’s deferred tax assets. The Fund will continue to assess the need for a valuation allowance in the future. Significant declines in the fair value of its portfolio of investments may change the Fund’s assessment regarding the recoverability of its deferred tax assets and may result in a valuation allowance. If a valuation allowance is required to reduce any deferred tax asset in the future, it could have a material impact on the Fund’s net asset value and results of operations in the period it is recorded.

At November 30, 2014, the cost basis of investments for Federal income tax purposes was $1,240,518,747. At November 30, 2014, gross unrealized appreciation and depreciation of investments for Federal income tax purposes were as follows:

| Gross unrealized appreciation | $ | 289,051,349 | ||

| Gross unrealized (depreciation) | (19,730,119) | |||

| Net unrealized appreciation (depreciation) before tax | $ | 269,321,230 | ||

| Net unrealized appreciation (depreciation) after tax | $ | 170,211,017 |

| 24 | ClearBridge American Energy MLP Fund Inc. 2014 Annual Report |

Report of independent registered public accounting firm

The Board of Directors and Shareholders

ClearBridge American Energy MLP Fund Inc.: