UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D. C. 20549

FORM

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the year ended | |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the transition period from _____________ to _____________ |

Commission

file number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices)

(Issuer’s telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| None | N/A | N/A |

Securities registered pursuant to Section 12(g) of the Act: Common stock, $0.001 par value

Indicate

by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. ☐ Yes ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for completing with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by the check mark whether the registration has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) ☐ Yes

As

of June 30, 2023, the aggregate market value of the issued and outstanding common stock held by non-affiliates of the registrant was

$

As of June 17, 2024, there were shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE - None.

CELL SOURCE, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

INDEX

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements regarding, among other things, our anticipated financial and operating results. Forward-looking statements reflect our management’s current assumptions, beliefs, and expectations. Words such as “anticipate,” “believe,” “estimate,” “seek,” “expect,” “intend,” “could,” “plan,” and similar expressions are intended to identify forward-looking statements. While we believe that the expectations reflected in our forward-looking statements are reasonable, we can give no assurance that such expectations will prove correct. Forward-looking statements are subject to risks and uncertainties that could cause our actual results to differ materially from the future results, performance, or achievements expressed in or implied by any forward-looking statement we make. Some of the relevant risks and uncertainties that could cause our actual performance to differ materially from the forward-looking statements contained in this report are discussed below under the heading “Risk Factors” and elsewhere in this Annual Report on Form 10-K. We caution investors that these discussions of important risks and uncertainties are not exclusive, and our business may be subject to other risks and uncertainties which are not detailed there. Investors are cautioned not to place undue reliance on our forward-looking statements. We make forward-looking statements as of the date on which this Annual Report on Form 10-K is filed with the U.S. Securities and Exchange Commission (“SEC”), and we assume no obligation to update the forward-looking statements after the date hereof whether as a result of new information or events, changed circumstances, or otherwise, except as required by law.

| i |

Summary of Principal Risk Factors

Our business operations are subject to numerous risks, factors and uncertainties, including those outside our control that could cause our actual results to be harmed, including risks regarding the following:

Risks Related to our Business and Industry

| ● | We may not receive regulatory approvals for our product candidates or there may be a delay in obtaining such approvals. |

| ● | Clinical trials for our product candidates are expensive and time consuming and their outcome is uncertain. |

| ● | We may be required to suspend or discontinue clinical trials due to unexpected side effects or safety risks. |

| ● | Delays in our clinical trials could delay our ability to obtain regulatory approval and our ability to commercialize our products. |

| ● | The results of our clinical trial are uncertain and could substantially delay or prevent us from bringing products to market. |

| ● | Pre-clinical studies and Phase 1 or 2 clinical trials of our product candidates may not predict the results of subsequent human trials. |

| ● | Our clinical trials may fail to demonstrate evidence substantial evidence of the safety and efficacy of our product candidates. |

| ● | We are subject to various government regulations, may become subject to increased government regulation and may fail to comply with regulatory requirements. |

| ● | Regulatory approval of our product candidates may be withdrawn at any time. |

| ● | Even if approved, our products may not gain market acceptance. |

| ● | We do not own any patents and rely on the patents we license from Yeda Research and Development Company Limited. |

| ● | Our success will depend in part on our ability to obtain and maintain patent protection for the patents we license. |

| ● | Confidentiality agreements may not prevent unauthorized disclosure of trade secrets or proprietary information. |

| ● | We are dependent on collaborative partners and service providers. |

| ● | We will be unable to operate profitability if we are unable to keep up with rapid technological developments. |

| ● | Our ability to sell products will depend to a large extent upon reimbursement from insurance companies. |

| ● | We may expend our limited resources to pursue a particular product candidate or indications and fail to capitalize on more profitable products or indications. |

| ● | Clinical trial data that we publish may change as more patient data becomes available. |

| ● | We rely on key personnel. |

| ● | We may be subject to foreign exchange fluctuations. |

| ii |

| ● | We may be subject to potential product and clinical trials liability and liabilities related to working with hazardous materials. |

| ● | If we conduct clinical trials outside of the United States, the FDA may not accept data from such trials. |

| ● | The Russia-Ukraine and Israel-Hamas wars and other geopolitical and macroeconomic events have resulted in disruption of global credit and financial markets and may make necessary debt or equity financing more difficult, costly or dilutive. |

Risks Related to Our Capital Resources and Impairments

| ● | We have a limited operating history and a history of operating losses and expect to incur significant additional losses. |

| ● | We will need to secure additional financing. |

| ● | There is substantial doubt about our ability to continue as a going concern. |

| ● | We are an early stage company with an unproven business strategy. |

| ● | We are in default of payment obligations under promissory notes. |

Risks Related to Our Common Stock

| ● | We may issue additional shares of preferred stock in the future. |

| ● | There is not an active liquid trading market for our Common Stock. |

| ● | We may not be able to attract the attention of brokerage firms because we became a public company by means of a reverse acquisition. |

| ● | Voting power of our shareholders is highly concentrated in insiders. |

| ● | We do not intend to pay dividends on our Common Stock for the foreseeable future. |

| ● | Shareholders may be diluted by future issuances of Common Stock. |

| ● | As an issuer of “penny stock”, protection provided by federal securities laws relating to forward looking statements does not apply to us. |

| ● | Our ability to use net operating loss carryforwards may be limited. |

| ● | Our issuance of Common Stock upon exercise of warrants or options may depress the price of our Common Stock. |

Other General Risk Factors

| ● | Applicable regulatory requirements may make it difficult to retain or attract qualified directors and officers. |

| ● | Our stock price could be adversely affected if we fail to maintain effective internal controls over financial reporting. |

| ● | Failure to comply with the Sarbanes-Oxley Act of 2002 could harm our business and stock price. |

| ● | Our stock price may decline or be volatile, regardless of our operating results. |

| ● | Our quarterly operating results may fluctuate significantly or fall below expectations of investors or securities analysts. |

| ● | As a result of reduced disclosure requirements applicable to a “smaller reporting company,” the information we provide to investors may be different than information provided by other public companies. |

| ● | We could be subject to securities class action litigation. |

| iii |

PART I

ITEM 1. BUSINESS.

Overview

Our Business

We are a cell therapy company focused on immunotherapy. Since our inception, we have been involved with the development of proprietary immune system management technology (“Cell Source technology”) licensed from Yeda Research & Development Company Limited (“Yeda”), the commercial arm of the Weizmann Institute of Science (“Weizmann Institute”) in Israel. The current focus of our Research and Development efforts is at the University of Texas MD Anderson Cancer Center (“MD Anderson”) in Houston, Texas.

This technology addresses one of the most fundamental challenges within human immunology: how to tune the immune response such that it tolerates selected desirable foreign cells, but continues to attack all other (undesirable) targets. In simpler terms, a number of potentially life-saving treatments have limited effectiveness today because the patient’s immune system rejects them. For example, while HSCT – hematopoietic stem cell transplantation (e.g. bone marrow transplantation) has become a preferred therapeutic approach for treating blood cell cancer, most patients do not have a matched family donor. Although matched unrelated donors and cord blood can each provide an option for such patients, haploidentical stem cell transplants (sourced from partially mismatched family members) are rapidly gaining favor as a treatment of choice. This is still a risky and difficult procedure primarily due to potential conflicts between host and donor immune systems and as well as viral infections that often follow even successful HSCT while the compromised new immune system works to reconstitute itself by using the transplanted stem cells. Today, rejection is partially overcome using aggressive immune suppression treatments that leave the patient exposed to many dangers by compromising their immune system.

The unique advantage of Cell Source technology lies in the ability to induce sustained tolerance of transplanted cells (or organs) by the recipient’s immune system in a setting that requires only mild immune suppression, while avoiding the most common transplant related complications. The scientific term for inducing such tolerance in a transplantation setting is chimerism, where the recipient’s immune system tolerates the co-existence of the (genetically different) donor type and host (recipient) type cells. Attaining sustained chimerism is an important prerequisite to achieving the intrinsic GvL (graft versus leukemia) effect of HSCT and supporting the reconstitution of normal hematopoiesis (generation of blood cells, including those that protect healthy patients from cancer) in blood cancer patients. Preclinical data, as well as initial clinical data, show that Cell Source’s Veto Cell technology (currently in a trial in the US) can provide superior results in allogeneic (donor-derived) HSCT by allowing for haploidentical stem cell transplants under a mild conditioning regimen, while avoiding the most common post-transplant complications. Combining this with CAR (Chimeric Antigen Receptor) T cell therapy employing Veto Cells, as a VETO CAR-T treatment, we plan to treat patients in relapse as well as those in remission and use the cancer killing power of CAR-T to protect the patient while their immune system fully reconstitutes, thus providing an end-to-end solution for blood cancer treatment by potentially delivering a fundamentally safer and more effective allogeneic HSCT: prevention of relapse; avoidance of graft versus host disease (GvHD); prevention of viral infections; and enhanced persistence of GvL effect. This means that the majority of patients will be able to find a donor, and will have access to a potentially safer procedure with higher long term survival rates than what either donor-derived HSCT or autologous CAR-T each on their own currently provide.

The ability to induce permanent chimerism (and thus sustained tolerance) in patients – which allows the transplantation to overcome rejection without having to compromise the rest of the immune system – may open the door to effective treatment of a number of severe medical conditions, in addition to blood cancers, which are characterized by this need. These include:

| ● | The broader set of cancers, including solid tumors, that can potentially be treated effectively using genetically modified cells such as CAR-T cell therapy, but also face efficacy and economic constraints due to limited persistence based on immune system issues (i.e., the need to be able to safely and efficiently deliver allogeneic CAR-T therapy). Inducing sustained tolerance to CAR-T cells may bring reduced costs and increased efficacy by allowing for off-the-shelf (vs. patient-derived) treatments with more persistent cancer killing capability. |

| 4 |

| ● | Organ failure and transplantation. A variety of conditions can be treated by the transplantation of vital organs. However, transplantation is limited both by the insufficient supply of available donor organs and the need for lifelong, daily anti-reject treatments post-transplant. Haploidentical organ transplants, with sustained chimerism, have the potential to make life saving transplants accessible to the majority of patients, with the prospect of improved life quality and expectancy. |

| ● | Non-malignant hematological conditions (such as type one diabetes and sickle cell anemia) which could, in many cases, also be more effectively treated by stem cell transplantation if the procedure could be made safer and more accessible by inducing sustained tolerance in the stem cell transplant recipient. |

Corporate History

Cell Source, Inc. (the “Company”) is a Nevada corporation formed on June 6, 2012 under the name Ticket to See, Inc. (“TTSI”). Cell Source Ltd. (“Cell Source Israel”) was founded in 2011 in order to commercialize a suite of inventions that were the result of over ten (10) years of research at the Weizmann Institute. Pursuant to a Research and License Agreement by and between Cell Source Israel and Yeda, dated October 3, 2011, as amended in April, 2014, November, 2016, March, 2018, August 2019, December, 2019, November, 2020, and December, 2021 (the “Yeda License Agreement”), Yeda, the commercial arm of the Weizmann Institute, granted Cell Source Israel an exclusive, worldwide license to certain patents, discoveries, inventions, and other intellectual property generated (together with others) by Yair Reisner, Ph.D. (“Dr. Reisner”), former head of the Immunology Department at the Weizmann Institute.

Implications of being a Smaller Reporting Company

As a company with less than $100 million in revenue during our last fiscal year and a public float of less than $250 million, we qualify as a “smaller reporting company” as defined in Item 10(f)(1) of Regulation S-K. A “smaller reporting company” may take advantage of reduced reporting requirements and disclosure obligations that are otherwise applicable to public companies. These provisions include, but are not limited to:

| ● | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations in this report on Form 10-K; |

| ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; and |

| ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements. |

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests. Decreased disclosures in our SEC filings due to our status as a “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

| 5 |

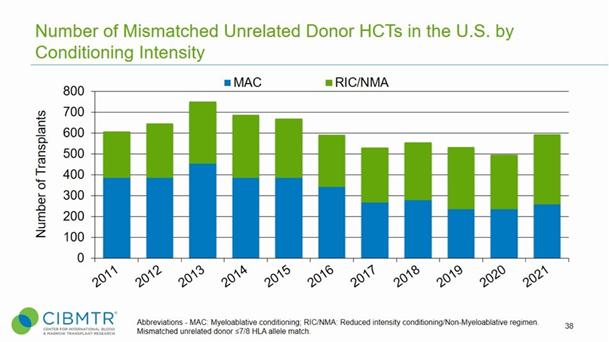

Hematological Malignancies

Hematological malignancies (blood cancers) comprise a variety of lymphomas and leukemias. A very important treatment protocol for these malignancies involves the use of HSCT. Approximately 100,000 of these transplants are performed annually worldwide (table below). Our technology has immediate relevance for, at a minimum, the roughly 40,000 worldwide stem cell transplants that are allogeneic (using cells taken from another individual, not the patient). According to the Center for International Blood and Marrow Transplant Research (“CIMBTR”), there were 22,827 stem cell transplants performed in the US in 2021, of which 9,349 were allogeneic. The journal Bone Marrow Transplantation reports that 46,143 stem cell transplants were performed in Europe in 2022, of which 19,011 were allogeneic.

HSCT often has a curative effect when successful. However, it is very risky. HSCT typically involves destroying the patient’s native immune system with radiation or chemotherapy (myeloablation) before the transplantation, and then suppressing immune response (immunosuppression) with drugs to manage the conflicts between host and donor cells. The majority of patients are unable to find a matched family donor. Over 50% of all adult haploidentical transplant patients in the US suffering from AML (the most common indication for allogeneic HSCT) die within three years of transplantation. Among adult patients receiving haploidentical HSCT, of those who die in the first 100 days post-transplant, 38% die from either infections (associated with a compromised immune system), graft rejection or GvHD (Graft versus Host Disease).

Myeloablation and immunosuppression are dangerous and difficult to tolerate, especially in patients over age 50. Therefore, HSCT has been used mainly with younger patients.

Another very important treatment protocol for blood cancers is CAR-T cell therapy. This novel approach uses the patient’s own immune system cells to directly attack cancer cells. CAR-T cells are made by removing a specific set of cells from the blood, genetically modifying them in order to intensify the immune system’s natural response to cancer, and then re-injecting them into the patient. This form of cellular therapy has produced exceptional near term results in blood cancer patients and is currently being tested against a variety of different cancer types.

CAR T-cell therapy has been approved by the U.S. Food and Drug Administration as standard therapy for some patients with lymphoma (drug names Yescarta, Kymriah, Tecartus and Breyanzi), leukemia (drug name Kymriah, Tecartus) and multiple myeloma (drug names Abecma and Carvykti).

| 6 |

These approved treatments use the patient’s own cells in order to create CAR-T cells, which involves high cost (can reach close to $500,000 per infusion) and significant safety risks (e.g. high rate of relapse, significant incidence of Cytokine Release Syndrome (CRS)). While a number of companies are attempting to develop allogeneic or “off-the-shelf” CAR-T, they face several challenges including rejection by the host’s immune system and GvHD. The currently approved autologous CAR-T treatments, while showing high early response rates, have not shown long term survival results for blood cancer that exceed those of allogeneic HSCT.

This means that:

| a) | many blood cancer patients are not candidates for the primary treatment (HSCT) that represents a potential cure; | |

| b) | there is high mortality among those patients who are candidates for HSCT and do undergo the procedure; | |

| c) | CAR-T cell therapy, which is currently used in limited indications and has had relatively slow adoption, has yet to demonstrate long term survival that substantively exceeds that of HSCT. |

There is widespread awareness of the need for improved immune-system management technologies for HSCT – both to improve outcomes of transplantations for the traditional target set of patients and to expand the use of the procedure by making transplantation safe enough to become appropriate for a broader set of patients.

There is also a strong awareness for the need of an off-the-shelf approach to CAR-T that overcomes rejection, avoids GvHD, and has increased persistence so as to deliver longer-term efficacy.

We aspire to use VETO CAR-T, combining Veto Cell technology with allogeneic CAR-T cell therapy, to dramatically improve the outcomes of the allogeneic transplantations already being performed, and thereby to rapidly penetrate the current market. However, our target population greatly exceeds those patients who currently undergo HSCT or CAR-T, as the firm’s tolerizing technology could potentially make allogeneic transplantation and off-the-shelf CAR-T an option for a much larger proportion of the diseased population. The following table shows the incidence of the specific hematological malignancies on which we will focus:

Initial Malignancy Indications (note estimates for North America and EU only) | Incidence (Annual New Cases) | Annual HSCT | ||||||

| Lymphoma | 222,149 | 12,484 | ||||||

| Leukemia | 151,655 | 15848 | ||||||

| Multiple Myeloma | 80,570 | 20,992 | ||||||

| Total | 454,374 | 49,324 | ||||||

Source: National Cancer Institute, World Health Organization, Leukemia & Lymphoma Society, Lymphoma, European Cancer Information System, Coalition Europe, EMBT, HRSA, CIMBTR

For the purposes of this document, it is assumed that the immediate candidates for Cell Source-enabled HSCT will be the subset of cancer patients that today receive transplantations as part of their cancer treatment (rightmost column in table above). We believe that a portion of these patients will benefit from Veto Cell adjunct therapy, as such therapy aspires to improve the success and reduce the risk and mortality of a procedure that they are having anyway. With time, as Veto Cell treatment becomes more widespread and data is accumulated, we believe that the percentage of patients that will be referred for Veto Cell enabled HSCT will increase significantly.

It is also important to note that incidence of these diseases is increasing. The global market for blood cancer therapeutics was estimated at $48 billion in 2022 and is projected to increase in size to reach $98 billion by 2030 according to DataBridgeGlobal Blood Cancer Drug Market – Industry Trends and Forecast to 2030 October, 2023. The aging of the US population and the increased incidence of hematologic malignancies are expected to significantly increase the number of older patients who receive allogeneic HSCT.

| 7 |

HSCT Market Trends

There are four important market trends affecting the hematological malignancies market:

| 1) | As noted above, increasing incidence of these disorders, largely driven by the aging population. | |

| 2) | Improvement and proliferation of HSCT treatments. | |

| 3) | A “virtuous circle” of lowered death rate due to better transplantations leading to more aggressive focus on HSCT. | |

| 4) | The growing use of milder conditioning regimens, which makes the procedure more survivable for older patients (see table below). |

However, despite the above trends, the use of HSCT, especially allogeneic, remains limited because of the risks associated with the myeloablative treatments required to reduce the host immune response, viral infections and GvHD. This means that the “gold-standard” of treatment is largely unavailable to an age cohort that constitute a significant proportion of sufferers of these diseases.

The Company addresses this issue in a distinctive manner by significantly reducing the need for myeloablative treatment while avoiding the risk of GvHD, thereby improving the outlook for allogeneic transplantations and enabling their use in a much larger population set.

CAR-T cell therapy

One of the most promising new approaches to treating hematological malignancies is by using genetically modified T cells in treatments such as CAR-T and TCR. CAR-T cell therapy for blood cancers, which has already been approved by the FDA, has shown the ability to attain remissions in a significant proportion of those patients treated. That said, the number of patients treated has been relatively low, in part due to the significant costs associated with this treatment. Since the approved treatment products rely on autologous (patient derived) production of the CAR-T cells, the costs can run into the hundreds of thousands of dollars for a single treatment, with the cost of the infusion in some cases exceeding $480,000 in the US. The broader hope for CAR-T cell therapy is for an allogeneic or “off the shelf” version that is expected to significantly lower the treatment costs.

| 8 |

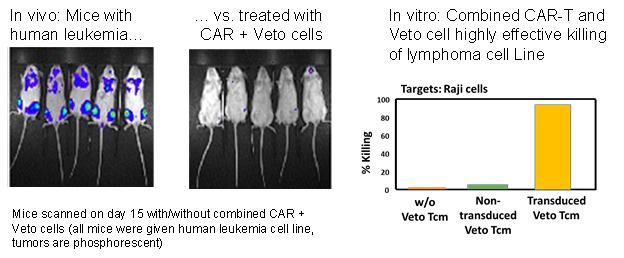

Cell Source has completed a preclinical proof-of-concept in collaboration with Professor Zelig Eshhar, the inventor of CAR-T cell technology, combining CAR-T and Veto Cell technology so as to allow for a successful allogeneic approach to CAR-T cell therapy.

Relevant Non-Malignant Diseases

While Hematological malignancies represent the Company’s initial focus, the Company’s selective immune response blocking technology may also be effective in treating certain non-malignant organ diseases as well as blood and immune system disorders. This would represent an additional growth opportunity for the Company.

The target non-malignant diseases are widespread. The Company’s first non-malignant disorder target is expected to be is support of organ transplantations (kidney, liver, etc.). Over 100,000 kidney and approximately 35,000 liver transplants are conducted worldwide each year. As with bone marrow transplantations, organ transplantations require substantial and ongoing immunosuppression to prevent rejection. This ongoing treatment is dangerous, quality-of-life and life expectancy reducing, and costly. The Company’s Veto Cell technology can potentially be used to selectively reduce immune response to the transplanted organ, thus broadening the donor pool and reducing or possibly eliminating the need for daily, life-long immunosuppression post transplantation.

A second target within non-malignant disorders are blood diseases such as sickle cell disease, aplastic anemia, beta thalassemia and scleroderma. Sickle cell anemia, for example, can be effectively treated by HSCT. However, because of HSCT’s riskiness, the procedure is currently used only in extreme cases. If successful in enabling safer HSCT, the Company can make this treatment available to a broader set of sickle cell anemia sufferers. Preclinical data have also shown the potential effectiveness of Veto Cells in preventing the development of Type 1 Diabetes.

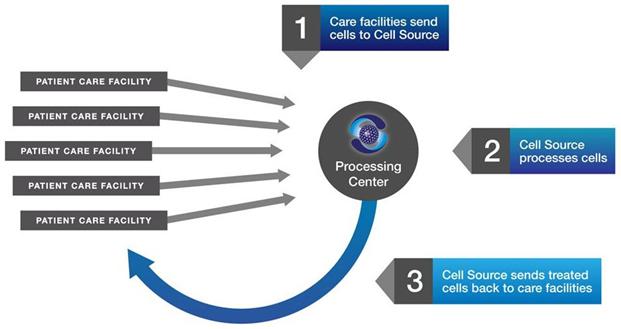

Market Access and Channels

The market for stem cell transplantation is relatively concentrated. There are over 1,700 transplantation centers worldwide, of which some 700 are in North America and Western Europe.

A relatively small subset of these (often termed “Centers of Excellence”) tends to set the practice standards for the entire transplantation community. Therefore, as discussed in the “Strategy” section, the Company plans to focus its initial penetration strategy on a relatively small group of influential centers. There are over 150 centers in the US today that provide CAR-T cell therapy treatments.

Reimbursement issues for our therapies are expected to be relatively straightforward. Once clinical effectiveness and regulatory approval are established, the value-proposition for payors and providers is expected to be clear and compelling. Issues connected with immunosuppression and rejection constitute a major component of bone marrow transplantation costs, and significant improvement in this area is expected to bring substantive cost-savings for payors.

Sector Focus

We are in the overall arena of immunotherapy. The cancer immunotherapy market was estimated at approximately $125 billion for 2023 and is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030, according to Grandview Research and is projected to grow to over $210 billion by 2030, according to Market Digits.

Within the immunotherapy field, our initial focus is on allogeneic therapies (treatments using donor derived-as opposed to patient derived-cells), with a focus on haploidentical transplantations (transplantations that use cells from partially matched-as opposed to fully matched-donors and recipients). While potentially valuable, allogeneic therapies are relatively complex, risky, and expensive. A key driver of this complexity and associated costs is the conflict between host and donor immune systems, as discussed above.

Our technology, which in preclinical studies, as well as in a first-in-human proof of concept, has shown the ability to enable tolerance of donor cells without affecting other immune processes, is fundamentally enabling. We expect it to significantly increase the safety, reduce the overall treatment cost, and therefore broaden the scope of indications for such procedures.

| 9 |

The delivery method for Veto Cell treatments would take the form of a non-invasive cell suspension treatment administered intravenously. For HSCT treatments, Veto Cells are derived from stem cells taken from the same donor who is providing the stem cells for the transplantation itself. In the case of VETO CAR-T cell therapy, this will initially be combined with HSCT, but a more generic “off the shelf” modality offering is planned, which would eventually be marketed as a pre-packaged suspension of cells and medium, prepared and stored in advance.

Our Value Drivers

Our current positioning in the cancer immunotherapy value chain is typical of an early clinical stage company: developing, validating and attaining regulatory approvals for the various applications of our technology platforms. Going forward, once the products are commercialized, physician and patient interest in these treatments is expected to drive insurer reimbursement for patients – a key demand lever. The generic value chain for biotechnology development commences with an invention which is formulated, patented and successful in pre-clinical animal trials. We have already passed this stage with our Veto Cell technology platform, for which we have an exclusive license to use from Yeda, the owner of these patents. We are currently at the stage of human trials (testing both safety and efficacy). Finally, the offering earns regulatory approval and patient treatment, along with the ensuing revenues, can commence. This can be a particularly lengthy process in the United States and therefore some medical treatments are approved in Europe or Asia and generate revenues there prior to commencing U.S. sales. Recently expanded “fast track” regulation in the U.S. is aimed at getting critical treatments for life threatening conditions to patients more quickly.

Our successful preclinical validation of the Veto Cell treatment involved basic laboratory research including both in-vivo (live) animal trials and in-vitro (in a glass dish) human cell trials. This validated the protocol prior to commencing human clinical trials. Human clinical trials fine-tune the treatment protocol and confirm both safety and efficacy in treating patents. In parallel, the patents on the core technology go into the national phase in various countries and are emended with claims associated with exact treatment protocols, bolstering the protection afforded by already issued patents on the base technology.

In some cases, successful biotech companies have been able to capitalize on positive human clinical results (even prior to full approval for patient treatment) by either signing lucrative non-dilutive distribution option deals or by being partially or fully acquired by larger market participants. High profile CAR-T acquisitions have included KITE Pharmaceuticals, a CAR-T cell therapy company, which was acquired outright by Gilead Sciences in 2017 for $11.9 billion in cash, prior to having attained FDA approval and prior to commencing any product sales, and Juno Therapeutics, which was acquired by Celgene Corporation in 2018 for approximately $9 billion, also without having FDA approval for its CAR-T cell therapy technology. Multi-billion dollar oncology transactions have continued, including the 2023 acquisition by Pfizer of Seagen $43B, and Abbvie’s $10B acquisition of Immunogen in early 2024. There is no indication or assurance that we are currently under consideration for any option or acquisition deal.

We are currently conducting a human clinical trial for approval for the Veto Cell based treatments in the United States. We have had positive preclinical results for three of our cell therapy treatments. Yeda, the proprietary owners of the patents underlying our technologies from whom we license our patents, has been granted patents for its original Veto Cell. The revised versions of the Veto Cell are the subject of patent applications which have been granted in some jurisdictions and are pending in others. These newer patent applications both leverage the priority of the already granted patents and extend the protection period for more advanced versions. We are currently engaged in our first human clinical trial. If such trials are successful, they will demonstrate both safety (the patients survived and were not harmed) and initial indications of efficacy (there are signs of successful engraftment under a mild conditioning regimen, with a reduction in GvHD, and in the case of cancer patients prolonging the progression free period).

| 10 |

Science and Technology Overview

The patent portfolio that we license from Yeda includes a variety of cell therapy applications. The portfolio includes both granted and pending patents. The total relevant patent portfolio consists of 16 patent “families” (i.e. grouping of similar patent applications in different territorial jurisdictions) which currently include: 68 granted patents; 4 allowed/accepted patents; and a further 68 pending patents. The key terms of the agreement pursuant to which we license all of Yeda’s patents related to our technology is set forth in the section entitled “Intellectual Property” herein. The license period (per product, per country) is for the full life of the patents and expires at the later of the patent expiration date in that country or 15 years after the date that the FDA or local equivalent regulatory authority in each country approves that particular product for sale in that country. Provided that Cell Source either sponsors research or pays either a nominal license fee of $50,000 per year (total for use of all the products), or pays royalties on product sales on at least one product as per the license agreement, the license will remain in effect continuously and expire only with the expiration of the patent or 15 years after regulatory approval (later of the two) per product per country as described above.

Professor Yair Reisner, the inventor of Veto Cell technology, left the Weizmann Institute and relocated to MD Anderson in Houston, Texas. He was awarded a $6 million grant from the Cancer Research and Prevention Institute of Texas. This, coupled with research funding from the University itself, provided him with a total funding commitment of $10 million for five years. Professor Reisner is now the Head of Stem Cell Research at the Department of Stem Cell Transplantation & Cellular Therapy as well as the Reisner Laboratory at MD Anderson.

Cell Source is currently sponsoring ongoing research by Professor Reisner and members of his team, some of whom have also relocated from the Weizmann Institute to MD Anderson, for developing existing and new applications for Veto Cell technology and plans to license any new intellectual property developed there on an exclusive basis, as it does from Yeda. MD Anderson is the largest HSCT center in the United States, performing over 850 transplantations per year. MD Anderson is currently conducting a human clinical trial sponsored by Cell Source for its Anti-Viral Veto Cell. Professor Richard Champlin (who Chairs their Department of Stem Cell Transplantation and Cellular Therapy and is a longtime associate and collaborator of Professor Reisner) serves as Principal Investigator for this trial.

Although Yeda has applied for and been granted various patents related to our technology, a granted patent only provides Yeda, and the Company by virtue of its exclusive license, the right to use the underlying invention. However, in order for our cell therapy and cancer therapy to be legally sold and administered to patients, the FDA or similar regulatory agencies must approve its use. In other words, having a patent provides legal “freedom to operate” for a certain technology, and may provide the ability to prevent others from using the same technology without the patent holder’s permission. However, in order to legally manufacture and distribute products, a company must go through all of the typical approval steps delineated in the “Overview” section above.

The following sections provide an overview of each platform. Further information on the underlying science is available upon written request and the execution of an appropriate nondisclosure agreement.

Our licensed technology portfolio consists of 17 patent families, 78 granted patents and 59 pending patent applications. The following table lists the patents and patent applications that Yeda holds and which we have a license to use in each of the below-referenced countries:

| Anti Third Party Central Memory T Cells, Methods of Producing Same and Use of Same in Transplantation and Disease Treatment | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 9,738,872 | 29-Oct-2009 | 29-Oct-2029 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Europe | 2365823 | 29-Oct-2009 | 29-Oct-2029 | Granted | Yeda Research and Development Co. Ltd. | |||||

| China | ZL200980153053.4 | 29-Oct-2009 | 29-Oct-2029 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Israel | 212587 | 29-Oct-2009 | 29-Oct-2029 | Granted | Yeda Research and Development Co. Ltd. | |||||

| India | 285832 | 29-Oct-2009 | 29-Oct-2029 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2506311 | 29-Oct-2009 | 29-Oct-2029 | Granted | Yeda Research and Development Co. Ltd. | |||||

| 11 |

| Use of Anti Third Party Central Memory T Cells for Anti-Leukemia/Lymphoma Treatment | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 9,421,228 | 08-Sep-2011 | 08-Sep-2031 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Europe | 2613801 | 08-Sep-2011 | 08-Sep-2031 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Canada | 2,810,632 | 08-Sep-2011 | 08-Sep-2031 | Granted | Yeda Research and Development Co. Ltd. | |||||

| China | ZL201180053858.9 | 08-Sep-2011 | 08-Sep-2031 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Israel | 225102 | 08-Sep-2011 | 08-Sep-2031 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Japan | 5,977,238 | 08-Sep-2011 | 08-Sep-2031 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | HK1187528 | 08-Sep-2011 | 08-Sep-2031 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Republic of Korea | 10-1788826 | 08-Sep-2011 | 08-Sep-2031 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Singapore | 188473 | 08-Sep-2011 | 08-Sep-2031 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Mexico | 357746 | 08-Sep-2011 | 08-Sep-2031 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Anti Third Party Central Memory T Cells, Methods of Producing Same and Use of Same in Transplantation and Disease Treatment | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA (Divisional) |

11,324,777 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| USA (Continuation) |

2023-0024587-A1 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 2753351 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Canada | 2,848,121 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| China | ZL201280054739.X | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Israel | 231397 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2012305931 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| New Zealand | 622749 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Japan | 6,196,620 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | HK1200099 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Republic of Korea | 10-2073901 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Singapore | 11201400513P | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Brazil | BR 11 2014 005355 3 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Mexico | 351226 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| South Africa | 2014/01993 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| India | 375463 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2636503 | 06-Sep-2012 | 06-Sep-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| 12 |

| Use of Anti Third Party Central Memory T Cells | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| Europe | 3322424 | 14-Jul-2016 | 16-Jul-2036 | Granted | Yeda Research and Development Co. Ltd. | |||||

| China | CN 108025026 A | 14-Jul-2016 | 16-Jul-2036 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Methods Of Transplantation And Disease Treatment | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 10,933,124 | 14-Jul-2016 | 14-JuL-2036 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Genetically Modified Anti-Third Party Central Memory T Cells and Use of Same in Immunotherapy | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 11,179,448 | 14-July-2016 | 16-Jul-2036 | Granted | Yeda Research and Development Co. Ltd. | |||||

| USA (Continuation) | 11,844,827 | 14-July-2016 | 16-Jul-2036 | Granted | Yeda Research and Development Co. Ltd. | |||||

| USA (Continuation) | 18/515,358 | 14-July-2016 | 16-Jul-2036 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 3322425 | 14-July-2016 | 16-Jul-2036 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Canada | 2,991,690 | 14-July-2016 | 16-Jul-2036 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | CN 108135938 A | 14-July-2016 | 16-Jul-2036 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 256916 | 14-July-2016 | 16-Jul-2036 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2016291825 | 14-July-2016 | 16-Jul-2036 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Japan | 7,057,748 | 14-July-2016 | 16-Jul-2036 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | HK1255063 | 14-July-2016 | 16-Jul-2036 | Granted | Yeda Research and Development Co. Ltd. | |||||

| 13 |

| Veto Cells Generated from Memory T-Cells | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 10,961,504 | 27-Jun-2017 | 27-Jun-2037 | Granted | Yeda Research and Development Co. Ltd. | |||||

| USA (Continuation) | 11,773,372 | 27-Jun-2017 | 27-Jun-2037 | Granted | Yeda Research and Development Co. Ltd. | |||||

| USA (Continuation) | 2023-0383254-A1 | 27-Jun-2017 | 27-Jun-2037 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 3475414 | 27-Jun-2017 | 27-Jun-2037 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Canada | 3,029,001 | 27-Jun-2017 | 27-Jun-2037 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | CN 109661463 A | 27-Jun-2017 | 27-Jun-2037 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Israel | 263924 | 27-Jun-2017 | 27-Jun-2037 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2017289879 | 27-Jun-2017 | 27-Jun-2037 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Japan | 7334043 | 27-Jun-2017 | 27-Jun-2037 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | 40007502A | 27-Jun-2017 | 27-Jun-2037 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Singapore | 11201811563R | 27-Jun-2017 | 27-Jun-2037 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Republic of Korea | 10-2444170 | 27-Jun-2017 | 27-Jun-2037 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Mexico | MX/a/2019/000022 | 27-Jun-2017 | 27-Jun-2037 | Pending | Yeda Research and Development Co. Ltd. | |||||

| India | 474458 | 27-Jun-2017 | 27-Jun-2037 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2779844 | 27-Jun-2017 | 27-Jun-2037 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Methods of Transplantation and Disease Treatment | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 10,751,368 | 18-Jan-2018 | 18-Jan-2038 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Genetically Modified Veto Cells and Use of Same in Immunotherapy | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 11,555,178 | 18-Jan-2018 | 18-Jan-2038 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Europe | 3571295 | 18-Jan-2018 | 18-Jan-2038 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 268126 | 18-Jan-2018 | 18-Jan-2038 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Anti-Viral Central Memory CD8+ Veto Cells in Haploidentical Stem Cell Transplantation | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| Canada | 3,149,379 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Japan | 2022-506965 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | HK40076176 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Brazil | BR 11 2022 001988 2 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 290337 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Mexico | MX/a/2022/001578 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| USA | 2023-0398214-A1 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2020326568 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| India | 202227011269 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 4009991 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | CN 114466925 A | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2022105687 | 06-Aug-2020 | 06-Aug-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| 14 |

| Veto CAR-T Cells | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 2023-0321235-A1 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 4196573 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Canada | 3,189,051 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | CN 116322717 A | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 300470 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2021323525 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Japan | 2023-509690 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | HK40096222 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Singapore | 11202300925X | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Mexico | MX/a/2023/001771 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| India | 202327016034 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2023105361 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Brazil | BR 11 2023 002424 2 | 11-Aug-2021 | 11-Aug-2041 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Conditioning Protocols for use with Anti-Viral Central Memory CD8+ Veto Cells in Haploidentical Stem Cell Transplantation | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| PCT | IL2023/051121 | 31-Oct-2023 | 31-Oct-2043 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Use of Veto Cells for the Treatment of Sickle Cell Disease | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA (Continuation) | 2022-0265726-A1 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 4055145 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Canada | 3,160,296 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | CN 114901801 A | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 292720 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Nigeria | NG/PT/PCT/2022/6020 | 05-Nov-2020 | 05-Nov-2040 | Granted | Yeda Research and Development Co. Ltd. | |||||

| South Africa | 2022/06164 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | HK40078965 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Mexico | MX/a/2022/005418 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Brazil | BR 11 2022 008700 4 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| 15 |

| Use of Veto Cells in Treatment of T Cell Mediated Autoimmune Diseases | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA (Continuation) | 2022-0265725-A1 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 4055146 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Canada | 3,160,301 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | CN 115175688 A | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Japan | 2022-525357 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 292722 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2020379319 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2022114785 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | HK40078964 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Mexico | MX/a/2022/005416 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Brazil | BR 11 2022 008638 5 | 05-Nov-2020 | 05-Nov-2040 | Pending | Yeda Research and Development Co. Ltd. | |||||

| A Combination Therapy for a Stable and Long Term Engraftment | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 10,369,172 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Europe | 2793914 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Israel | 233303 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2012355990 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| New Zealand | 627272 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | HK1202810 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Republic of Korea | 2109643 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Singapore (Divisional) | 10201801905W | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Mexico | 370404 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2657758 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| A Combination Therapy for a Stable and Long Term Engraftment Using Specific Protocols for T/B Cell Depletion | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 10,434,121 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| USA (Continuation) |

11,504,399 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Europe | 2797421 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Canada | 2,859,952 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Israel | 233302 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2012355989 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Australia (Divisional) | 2016259415 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| New Zealand | 627549 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Japan | 6,313,219 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | 1202775 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Singapore | 11201403456U | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Brazil | BR 11 2014 015959 9 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Mexico | 372502 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| South Africa | 2014/05298 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2648354 | 20-Dec-2012 | 20-Dec-2032 | Granted | Yeda Research and Development Co. Ltd. | |||||

| 16 |

Veto Cell Technology Platform

Background

Our Veto Cell technology is a unique immunotherapy platform technology that enables the selective attenuation of the immune system. In other words, pre-clinical studies as well as initial human clinical trial results show that the treatment has the ability to reduce the immune response to selective “threats,” with low risk for adverse side effects.

What makes the Veto Cell approach distinctive is the degree to which it leverages the inherent specificity of the human immune system. The immune system defends the body by creating a specific stream of T-cell clones for each of millions of possible individual threats. A given T-cell will attack only its specific target, ignoring all other threats. Our technology enables the physician to selectively attenuate immune response, thus effectively “switching-off” an individual stream of T-cell clones without affecting other such streams of T-cell clones dispatched by the immune system to attack unwanted incursions.

The technology is based on the discovery that certain T-cells can acquire the property of attracting and proactively neutralizing immune attacks on them.

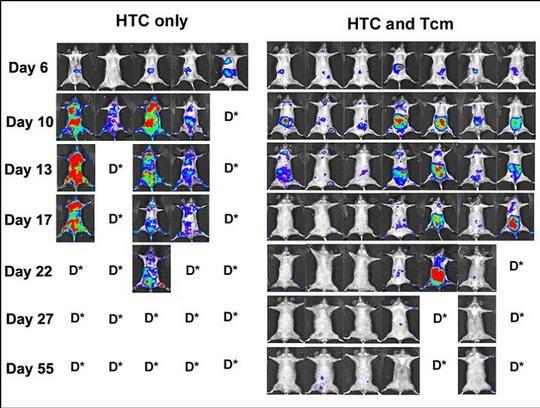

The technology has achieved distinctive results in animal live trial models. See, e.g., Eran Ophir et al. Murine anti-third party central-memory CD8+ promote hematopoietic chimerism under mild conditioning: lymph-node sequestration and deletion of anti-donor T cells, BLOOD, Feb. 14, 2013, at 1220; Towards off-the-shelf genetically modified T cells: prolonging functional engraftment in Mice by CD8 veto T cells, Leukemia 32, 2018; 1038-1040. Veto cells for safer nonmyeloablative haploidentical HSCT and CAR T cell therapy Seminars in Hematology 56, 2019; 173-182. It has also demonstrated both safety and efficacy thus far in human clinical trials.

The main objective of the trial is to achieve engraftment of the T-cell depleted transplant without GvHD by using Veto cells, and to define the optimal Veto cell dose. The initial version of the protocol has been very successful in achieving these primary endpoints in all of the first 10 patients. None of the patients experienced toxicity nor any other adverse outcome associated with the Veto cells. While a subsequently treated patient had initial engraftment, the patient developed secondary graft failure, associated with a viral infection which is known to cause this. Another patient with aplastic anemia, a nonmalignant disorder, achieved successful engraftment, but later developed autoimmune hemolytic anemia, and eventually died; this was not linked to the Veto cells.

Four patients who engrafted subsequently had reduced white blood cell counts, which responded to treatment. Importantly, none of these patients have rejected their transplant. These reduced white blood cell counts are antibody related issues, which are more common after T-cell depleted transplants and haploidentical transplants. Since this protocol uses a reduced intensity preparative regimen to reduce toxicity, there is limited depletion of B-cells. In other settings, the use of Rituximab prior to a T-cell deplete transplant has effectively addressed this issue, without adverse outcomes. The current protocol already includes Rituximab for patients with B-cell blood cell cancers, and we now plan to give Rituximab to all patients going forward. We have structured the balance of the trial to both determine the maximum Veto cell dose tolerance and also to ensure that we can avoid antibody related issues. If it continues to succeed in human clinical trials, we believe that it may have meaningful and potentially broad impact on the field of stem cell transplantation:

| 1) | Significantly improve outcomes of transplantations by reducing the host (transplant recipient) rejection rate of T-cell depleted stem cells (e.g. from bone marrow) – thus supporting successful engraftment of the transplanted cells, which is the treatment for the blood cancer itself. In order to improve the safety of this cancer treatment, Veto Cell technology has shown in both preclinical studies and initial clinical data that it can markedly reduce both the risk of GvHD and the need for using aggressive amounts of immunosuppression treatments. We have shown in preclinical studies, and are beginning to see in the clinic, the reduction of viral infections that typically threaten patients post transplantation. This safer means of deliver stem cell transplants would significantly reduce the HSCT mortality rate and therefore lead to broader use of this treatment. Furthermore, by adding CAR-T to the HSCT protocol, which we have already done successfully in preclinical studies, we can bridge between the initial transplantation and the conclusion of immune reconstitution, thus providing both short-term and ongoing protection against remission. This has the potential to significantly improve efficacy beyond that of the current outcomes of either CAR-T or HSCT on their own. |

| 17 |

| 2) | Substantively increase the number of transplantations by enabling successful engraftment under lower levels of immune suppression and therefore making the therapy accessible to older and sicker patients (who today may not survive ablation). | |

| 3) | Further increase the number of transplantations by making transplantation appropriate for other indications (for which today transplantation would be considered an inappropriately risky treatment). See, e.g. BMT 2021 Correction of Sickle Cell Disease by Allogeneic Hematopoietic Cell Transplantations with Anti-3rd Party Veto Cells, Bone Marrow Transplantation, March 3, 2021. |

In addition, our Veto Cell technology may possibly play a role in the treatment of a number of additional serious and currently poorly treated non-malignant diseases. Finally, based on preclinical studies using genetically modified cells, we believe that Veto Cells will be able to act as critical enabler for other cell therapies, most notably CAR-T cell therapy, which has recently shown strong initial indications of being effective in the near term in treating blood cancer.

Yeda has been granted two patents that extend the usage of Veto Cell technology as a critical enabler for other cell therapy treatments. One patent application highlights, based on preclinical data, the ability of Veto Cells to accompany other cell therapy treatments and help them overcome rejection and avoid GvHD in an allogeneic treatment setting. The other patent application involves a genetically modified Veto Cell that can have sustained survival in the patient’s body while avoiding rejection and GvHD. A more recent patent application was filed and has since been published which shows data that confirm combining Veto Cells with CAR-T cells, have the potential to make CAR-T cells, which to date have been effective primarily in an autologous (patient’s own cells) setting, succeed in an allogeneic setting. What follows is a description of the significance of these two new patent applications:

| - | Gene modified cell therapy is considered to be one of the most promising cancer treatment approaches in decades, with companies like Kite Pharma and JUNO Therapeutics having recently been acquired at multi-billion-dollar valuations after having successfully treated relatively small numbers of patients in clinical trials. | |

| - | While gene modified treatments such as CAR-T have shown remarkable results in cancer treatment trials, their published successes to date have been mostly limited to “autologous” blood cell cancer treatments using the patient’s own cells. There are concerns that this type of “personalized” treatment may not have favorable economics on a large-scale basis. | |

| - | The ideal, more lucrative commercial path for CAR-T and similar genetically engineered cell therapies is to become allogeneic or off the shelf product with drug-like distribution economics and to treat a broad spectrum of cancers including solid tumors. Allogene Therapeutics, an early-stage clinical company focused on allogeneic CAR-T, has in the past attained a valuation of $6 billion, whereas Legend Biotech valuation has recently reached a valuation of $10 billion and Fate Therapeutics valuation at one point reached the $10B level, underlining the importance of off-the-shelf CAR as a potential cancer treatment. Cell Source licenses Yeda’s patent applications for combining Veto Cells with genetically modified T cells and is currently developing a protocol to bring Veto and CAR-T combined cell therapy to the clinic. | |

| - | In the case of blood cancer treatment, we believe that a VETO CAR-T combined treatment will provide sustained protection for patients in relapse as well as a fundamentally superior approach for those in remission |

| 18 |

Cell Source previously completed a collaboration, through its licensing agreement with Yeda, with Professor Zelig Eshhar, the inventor of CAR-T cells. Professor Eshhar has served as both a scientist at the Weizmann Institute and on the Scientific Advisory Board of KITE Pharma. This collaboration confirmed the strength of combining Veto Cell technology with CAR-T cell therapy. Cell Source is now working towards the introduction of allogeneic VETO CAR-T HSCT combined cell treatment for lymphoma and leukemia and, eventually, off the shelf VETO CAR-T for these and other cancers, including solid tumors.

Furthermore, Yeda holds a granted patent, licensed to Cell Source, and has a pending patent based on more advanced data, for an Anti-Viral Veto Cell. Below is an explanation of the potential for this application:

| - | Other than primary disease (typically blood cell cancer) the leading causes of death in unrelated donor bone marrow transplants are rejection, GvHD, where the donor bone marrow rejects the host or recipient), and infections, which collectively are responsible for 38% of deaths after haploidentical donor transplants within the first 100 days post-transplant. | |

| - | It is well established that GvHD can be prevented by T cell depletion of the bone marrow transplant. However, this procedure is also associated with an increased rate of graft rejection. Preclinical studies and initial clinical results show that this problem can be overcome by adding Veto Cells to the bone marrow transplant, as well as allowing for a reduced intensity conditioning (RIC) regimen. However, viruses such as CMV and EBV remain a major threat to patients post-transplant. | |

| - | Cell Source has developed a next generation Veto Cell that not only facilitates mismatched transplants but also protects the transplant recipient against these common viruses. During the initial period after a stem cell transplantation the patient’s body undergoes an immune system reconstitution period. While the “new” immune system is building up, the patient is particularly vulnerable to viral infections, which develop in over 90% of bone marrow transplant recipients during the first 100 days post transplantation. Veto cells can fend off CMV and similar viral infection until such time as the patient’s own immune system reconstitutes to the point that it can fight off the infection on its own. | |

| - | Combining GvHD prevention by using T cell depleted transplants with anti-rejection action, under a mild conditioning regimen, as well as virus prevention, Veto Cell could potentially significantly increase survival rates post-transplant. Further adding the short-term cancer killing of CAR-T can combine to deliver even better long-term survival outcomes. | |

| - | Based on preclinical data, and as partially demonstrated in the case of a patient in the current trial, Veto Cells can also be used to facilitate organ transplants (e.g. kidney transplant combined with a bone marrow transplant) with partially mismatched donors and either reduce or eliminate the need for lifelong daily anti-rejection treatment currently given to even fully matched donor organ recipients. Among the data presented at the ASH annual meeting in late 2022, was the following: “One patient with a prior kidney transplant from the same donor had immunosuppressive therapy stopped without kidney rejection. This approach deserves further study in allogeneic HSCT for malignant and nonmalignant hematologic diseases, as well as enhancement of tolerance for organ transplantation.” |

Mechanism

Our Veto Cell is a CD8 central memory anti-3rd party T-cell that has five critical properties:

| 1) | It has an outer surface coating that triggers attack by specific host T-cells (and only those specific T-cells). | |

| 2) | It can annihilate an attacking T-cell without itself being damaged (specifically, it exposes or releases a death-signaling molecule when an attacking T-cell binds to it). | |

| 3) | It has been oriented to attack cells of a simulated third party (i.e., neither host nor donor), or a set of viral peptides, and thus exhibits markedly reduced risk of GvHD or graft rejection. |

| 19 |

| 4) | It is long-lived and endures in the body for extended periods. | |

| 5) | It migrates to the thymus and lymph nodes. |

The outcome is that when a large number of these cells are introduced into the body, they effectively eliminate the T-cell clones that the immune system dispatches to attack the desirable, transplanted stem cells.

Thus, for example, if a population of Veto Cells is derived from a donor, they will express the same peptide as do the donor’s cells. Therefore, the specific stream of host T-cells that would ordinarily attack the donor stem cells, are instead directed to “decoy” Veto Cells and disabled before they reach the transplantation.

Described in a Blood editorial as a “substantial advance in Cell Therapy,” a notable characteristic of our Veto Cell is that this mechanism is quite specific. Only those specific T-cell clones that were generated to attack cells from this specific donor are disabled. The rest of the immune system essentially remains intact. The conclusion of the ASH abstract for December 2022 states: “our data demonstrate reliable engraftment of haploidentical TCD (T Cell Depleted) HSCT combined with anti-viral CM (Central Memory) Veto CD8 T cells following a well-tolerated reduced intensity conditioning and show low rates of GVHD in the absence of immunosuppression (post transplantation).”

This is in marked contrast with conventional T cell depleted immunosuppression which degrades the entire immune system and is therefore associated with severe risk of infection and, in the case of stem cell transplantations, high mortality. It is also fundamentally superior to current T cell replete approaches, which, while attaining engraftment, are characterized by a marked incidence of GvHD, which can be debilitating, chronic, and sometimes even fatal.

This effect is long-lived. Firstly, the Veto Cells themselves are long-lived memory cells. Secondly, when infused with stem cells the latter migrate to the thymus where, over time, they create a new “identity” in the host and initiate chimerism where the host and donor cells peacefully co-exist. This chimerism has the effect of “educating” new T-cells being generated by the thymus to tolerate donor cells and this tolerance can become permanent. Furthermore, by inducing permanent tolerance to donor cells, Veto Cells may be able to enable both acceptance (i.e. mitigate both host rejection and GvH (graft) rejection) and thus persistence (i.e. extended survival resulting in enhanced efficacy) of important cell therapy treatments such as CAR-T cells, TCRs and NK cells in treating both blood cell and solid tumor cancers. Beyond this, Veto Cells are also effective not only in neutralizing host anti-donor rejecting cells, but also in the prevention of viruses such as EBV and CMV that are a common cause of post-transplantation morbidity and mortality.

Target Indications

Our Veto Cell technology, an intravenously administered cell suspension, if successful, could initially be used in stem cell (e.g. bone marrow) transplantations and other treatments associated with malignant disorders (i.e., cancers). Veto Cell technology may also be applied to selected non-malignant conditions. The following sections provide a brief overview of the use of the Veto Cell technology in both of these scenarios.

i. Stem Cell Transplantation

In order to describe the effect of Veto Cells in transplantation, it is helpful to first briefly review the state of the art:

In a conventional stem cell transplant, the recipient first receives myeloablative conditioning – powerful chemotherapy and/or radiation therapy intended to destroy his/her own bone marrow cells. This has a threefold purpose:

| 1) | It destroys the host T-cells so they will not attack (reject) the donor bone marrow cells. | |

| 2) | It makes space in the host bone marrow for the new donor cells. | |

| 3) | It destroys diseased host blood cells so that they do not proliferate and cause relapse following the procedure. |

| 20 |

In practice however, there are three major problems:

| ● | Host rejection – the myeloablative conditioning does not destroy all of the host T-cells. Those that remain may aggressively attack the donor bone marrow cells before they can engraft. | |

| ● | GvHD – the transplanted cells include donor T-cells which recognize the host’s body as foreign and attack it. | |

| ● | Infections are a common complication from HSCT and result in 28% of early patients deaths in haploidentical transplants of adult patients in the US. |

Rejection, GvHD and viral infections are all potentially life-threatening complications in and of themselves and also lead to the use of dangerous and costly immunosuppression medications.

ii. Veto Cell in Transplantation

The Veto Cell technology addresses not only rejection but also GvHD and infections. In a transplantation scenario, a population of donor Veto Cells is created to “escort” the stem cells when they are transplanted. This population is created by identifying donor cells with Veto Cell properties, exposing them to simulated 3rd party cells (e.g., selecting only those that react to a third person and therefore by definition will not react to either host or donor) or to viral peptides, and expanding their population in the lab.

The Veto Cells are then introduced into the host following the transplantation of the stem cells. The host mounts its normal immune response to the donor cells by generating a population of T-cell clones that will bind to any cells expressing markers from this specific donor. In a conventional transplantation, these T-cells would bind to and destroy donor stem-cells thus causing rejection of the transplant.