SUPPLEMENTAL FINANCIAL PACKAGE

2 This Supplemental Financial Package should be read in conjunction with the unaudited condensed consolidated financial statements appearing in our press release dated February 22, 2024, which has been furnished as Exhibit 99.1 to our Form 8-K furnished on February 22, 2024. The Company makes statements in this Supplemental Financial Package that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), and, as such, may involve known and unknown risks and uncertainties, and other factors that may cause the actual results or performance to differ from those projected in the forward-looking statement. These forward-looking statements may include comments relating to the current and future performance of the Company’s operating property portfolio, the Company’s development pipeline, the Company’s real estate financing program, the Company’s construction and development business, including backlog and timing of deliveries and estimated costs, financing activities, as well as acquisitions, dispositions, and the Company’s financial outlook, guidance, and expectations. For a description of factors that may cause the Company’s actual results or performance to differ from its forward-looking statements, please review the information under the heading “Risk Factors” included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and the other documents filed by the Company with the Securities and Exchange Commission (the “SEC”) from time to time. The Company’s actual future results and trends may differ materially from expectations depending on a variety of factors discussed in the Company’s filings with the SEC from time to time. The Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein, to reflect any change in the Company’s expectations with regard thereto, or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by applicable law. FORWARD-LOOKING STATEMENTS

3 BOARD OF DIRECTORS Daniel A. Hoffler, Executive Chairman of the Board Louis S. Haddad, Vice Chairman of the Board Eva S. Hardy, Lead Independent Director George F. Allen, Independent Director James A. Carroll, Independent Director James C. Cherry, Independent Director Dennis H. Gartman, Independent Director A. Russell Kirk, Director John W. Snow, Independent Director CORPORATE OFFICERS Louis S. Haddad, Chief Executive Officer Shawn J. Tibbetts, President and Chief Operating Officer Matthew T. Barnes-Smith, Chief Financial Officer Eric E. Apperson, President of Construction Shelly R. Hampton, President of Asset Management Jefferies Peter Abramowitz (212) 336-7241 pabramowitz@jefferies.com Bank of America Merrill Lynch Camille Bonnel (416) 369-2140 camille.bonnel@bofa.com Janney, Montgomery, & Scott LLC Robert Stevenson (646) 840-3217 robertstevenson@janney.com Raymond James & Associates Bill Crow (727) 567-2594 bill.crow@raymondjames.com ANALYST COVERAGE Armada Hoffler (NYSE: AHH) is a vertically integrated, self-managed real estate investment trust ("REIT") with over four decades of experience developing, building, acquiring, and managing high-quality retail, office, and multifamily properties located primarily in the Mid-Atlantic and Southeastern United States. The Company also provides general construction and development services to third-party clients, in addition to developing and building properties to be placed in its stabilized portfolio. Founded in 1979 by Daniel A. Hoffler, Armada Hoffler has elected to be taxed as a REIT for U.S. federal income tax purposes. For more information visit ArmadaHoffler.com. CORPORATE PROFILE Robert W. Baird & Co. Wesley Golladay (216) 737-7510 wgolladay@rwbaird.com Stifel Stephen Manaker (212) 271-3716 manakers@stifel.com CREDIT RATING Rating: BBB Agency: DBRS Morningstar

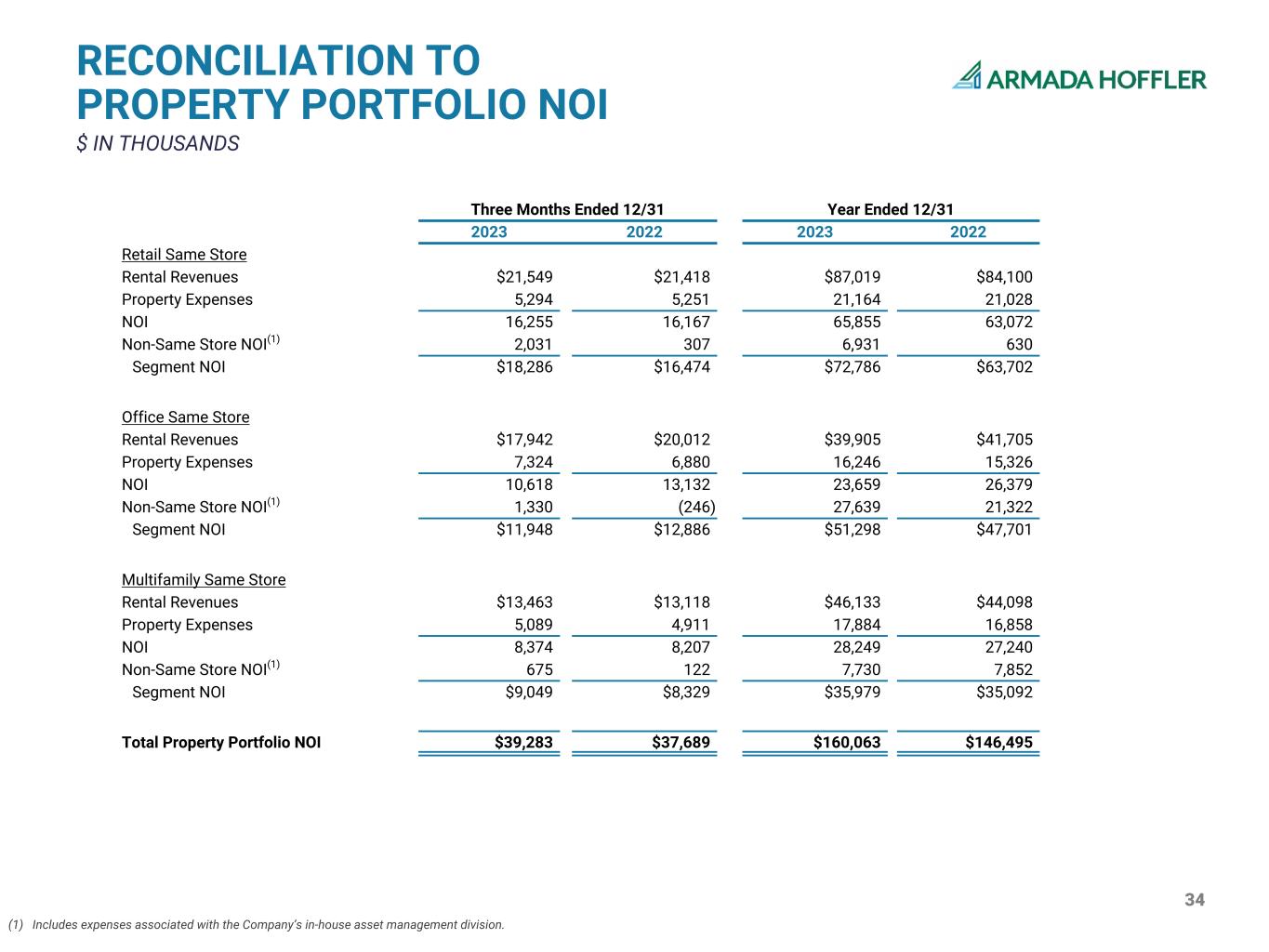

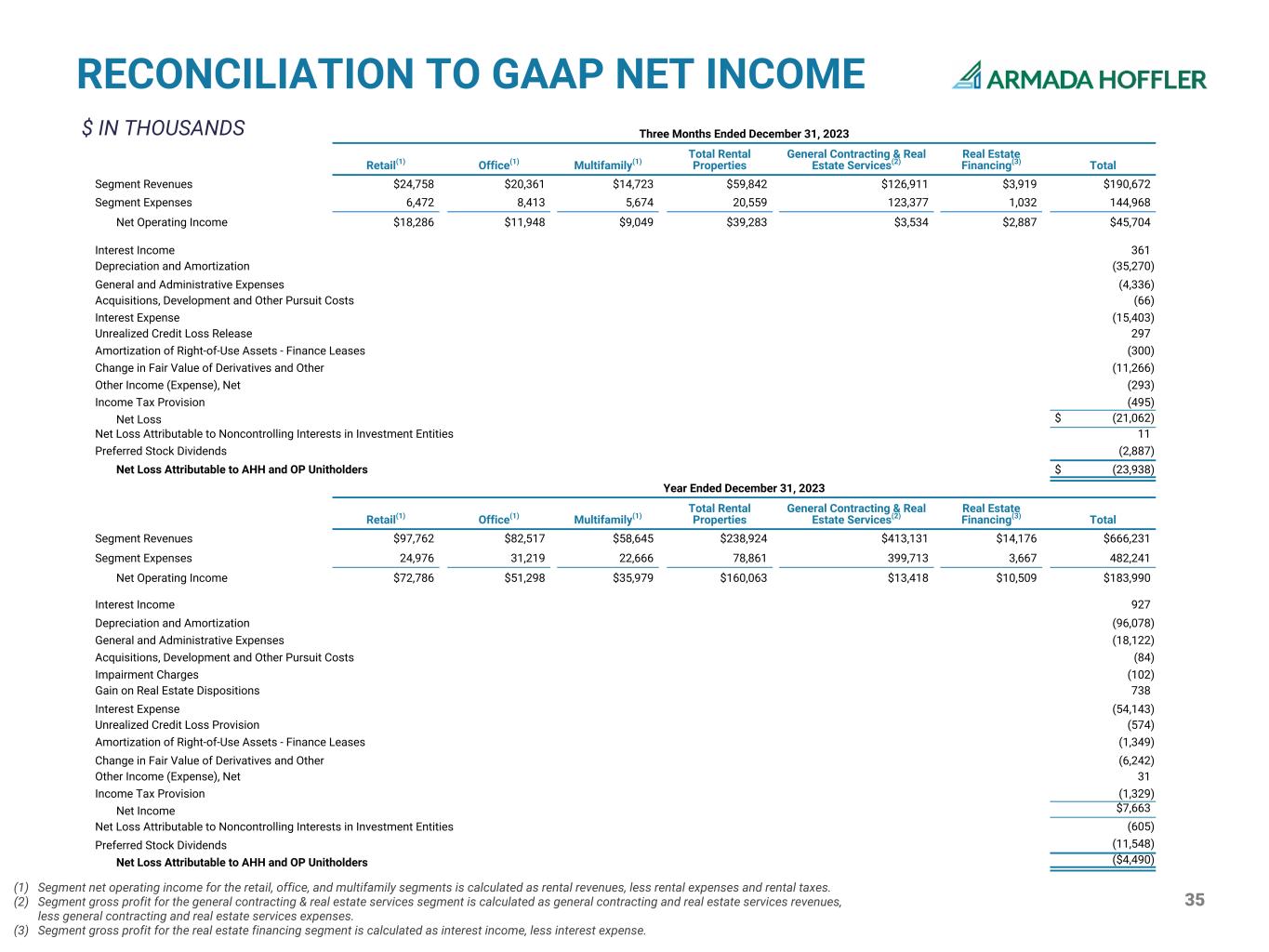

4 HIGHLIGHTS • Net loss attributable to common stockholders and OP Unitholders of $23.9 million and $4.5 million for the three months and year ended December 31, 2023, respectively, or $0.27 and $0.05 per diluted share, respectively. • Funds from operations attributable to common stockholders and OP Unitholders ("FFO") of $11.1 million and $90.7 million for the three months and year ended December 31, 2023, respectively, or $0.13 and $1.02 per diluted share, respectively. See "Non-GAAP Financial Measures." • Normalized funds from operations attributable to common stockholders and OP Unitholders ("Normalized FFO") of $27.9 million and $110.5 million for the three months and year ended December 31, 2023, or $0.31 and $1.24 per diluted share, respectively. See "Non-GAAP Financial Measures." • Investment grade credit rating of BBB reaffirmed by Morningstar DBRS. • Announced that the Board of Directors declared a cash dividend of $0.205 per common share, representing a 5% increase over the prior quarter's dividend. • Dividends declared during the year ended December 31, 2023 of $0.775 per share, representing a 7.6% year-over-year increase. • Introduced 2024 full-year Normalized FFO guidance of $1.21 to $1.27 per diluted share. • As part of the Company's leadership succession planning initiatives, appointed Shawn Tibbetts to President, in addition to his existing role as Chief Operating Officer. The Company's Board of Directors also endorses founder and current Chairman Dan Hoffler's intent to relinquish his role as Board Chairman in June 2024, whose role is expected to be assumed by Louis Haddad. Pending the shareholders’ vote at the 2024 Annual Meeting of Stockholders, Hoffler will continue to serve as a member of the Board of Directors as Chairman Emeritus. • Fourth quarter commercial lease renewal spreads increased 11.3% on a GAAP basis and 0.4% on a cash basis. • Executed 16 lease renewals and 8 new leases during the fourth quarter for an aggregate of 204,966 of net rentable square feet. • Property segment net operating income ("NOI") of $39.3 million for the fourth quarter of 2023, which represents an 4.2% increase compared $37.7 million for the fourth quarter of 2022. • Property segment NOI of $160.1 million for the fourth quarter of 2023, which represents an 9.3% increase compared to $146.5 million for the year ended December 31, 2022. • Same Store NOI for the fourth quarter of 2023 decreased 6.0% on a GAAP basis and increased less than 0.1% on a cash basis compared to the fourth quarter of 2022. • Same Store NOI for the year ended December 31, 2023 increased 0.9% on a GAAP basis and 2.3% on a cash basis compared to the year ended 2022. • For the year ended December 31, 2023, the Company repurchased 1,204,838 shares of common stock for a total of $12.6 million. • Third-party construction backlog as of December 31, 2023 was $472.2 million and construction gross profit for the fourth quarter was $3.5 million. • Weighted average stabilized portfolio occupancy was 96.1% as of December 31, 2023. Retail occupancy was 97.4%, office occupancy was 95.3%, and multifamily occupancy was 95.5%. • During the fourth quarter of 2023, unrealized losses on non-designated interest rate derivatives that negatively affected FFO were $16.2 million. As of December 31, 2023, the value of the Company’s entire interest rate derivative portfolio, net of unrealized losses, was $28.9 million.

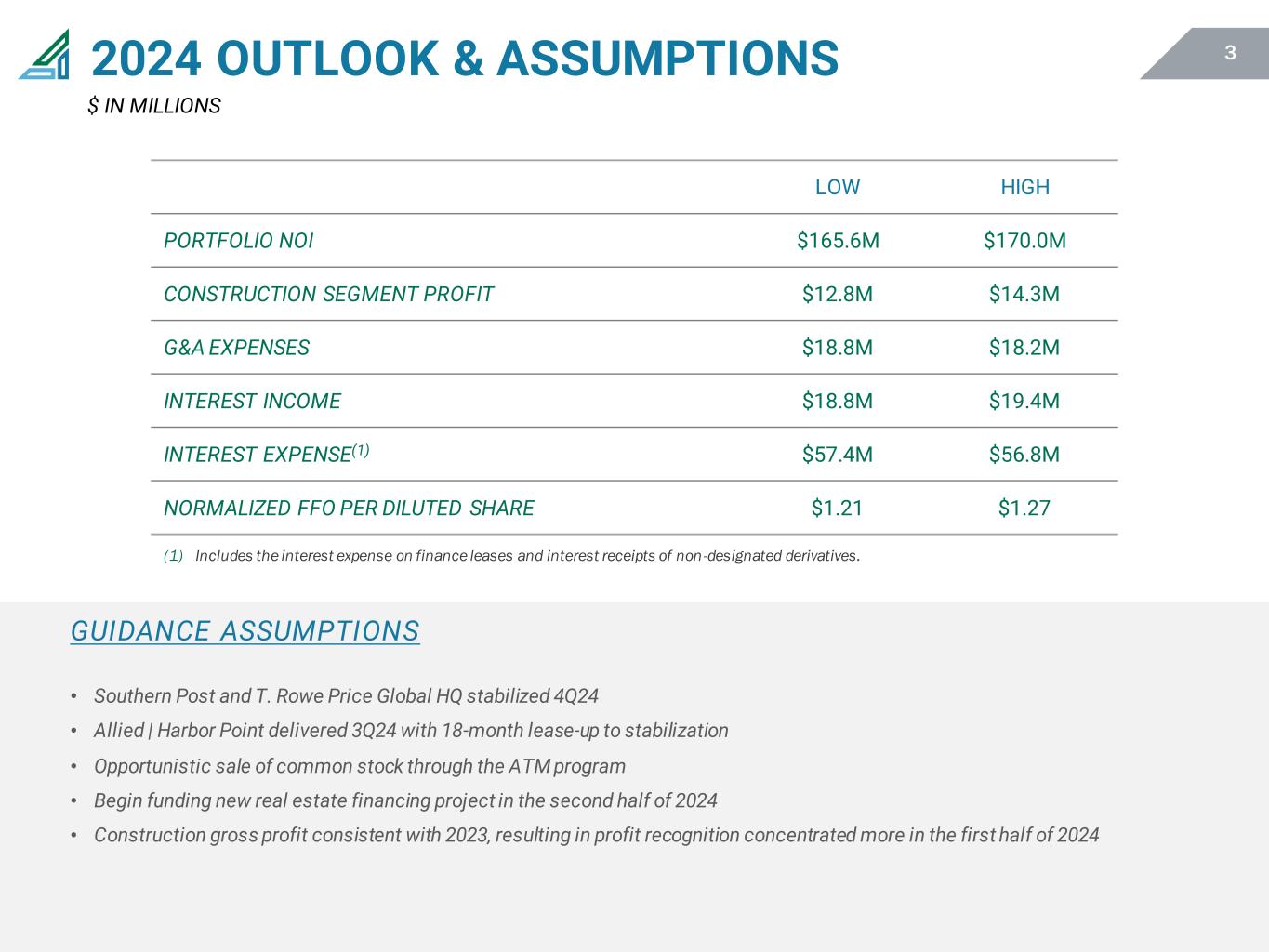

5 2024 OUTLOOK & ASSUMPTIONS OUTLOOK(1) LOW HIGH PORTFOLIO NOI $165.6M $170.0M CONSTRUCTION SEGMENT PROFIT $12.8M $14.3M G&A EXPENSES $18.8M $18.2M INTEREST INCOME $18.8M $19.4M INTEREST EXPENSE(2) $57.4M $56.8M NORMALIZED FFO PER DILUTED SHARE $1.21 $1.27 (1) See appendix for definitions. Ranges exclude certain items as per definition. (2) Includes the interest expense on finance leases and interest receipts of non-designated derivatives. GUIDANCE ASSUMPTIONS • Southern Post and T. Rowe Price Global HQ stabilized 4Q24 • Allied | Harbor Point delivered 3Q24 with 18-month lease-up to stabilization • Opportunistic sale of common stock through the ATM program • Begin funding new real estate financing project in the second half of 2024 • Construction gross profit consistent with 2023, resulting in profit recognition concentrated more in the first half of 2024

6 SUMMARY INFORMATION $ IN THOUSANDS, EXCEPT PER SHARE (1) Calculation updated 4Q 2023, see calculation definition on page 14. Prior period calculations have been adjusted to reflect new calculation. (2) Excludes GAAP adjustments. (3) See appendix for definitions. (4) Total occupancy weighted by annualized rent. Three Months Ended (Unaudited) OPERATIONAL METRICS 12/31/2023 9/30/2023 6/30/2023 3/31/2023 Net Income (Loss) Attributable to Common Stockholders and OP Unitholders ($23,938) $5,343 $11,729 $2,376 Net Income (Loss) per Diluted Share Attributable to Common Stockholders and OP Unitholders ($0.27) $0.06 $0.13 $0.03 Normalized FFO Attributable to Common Stockholders and OP Unitholders 27,933 27,735 28,301 26,498 Normalized FFO per Diluted Share Attributable to Common Stockholders and OP Unitholders $0.31 $0.31 $0.32 $0.30 Stabilized Portfolio Debt / Stabilized Portfolio Adjusted EBITDA 6.5x 6.2x 5.5x 5.4x Fixed Charge Coverage Ratio(1) 2.7x 2.3x 2.4x 2.5x CAPITALIZATION Common Shares Outstanding 66,793 67,885 67,945 67,939 Operating Partnership Units Outstanding 21,593 21,643 21,653 20,611 Common Shares and Operating Partnership Units Outstanding 88,386 89,528 89,598 88,550 Market Price per Common Share as of Last Trading Day of Quarter $12.37 $10.24 $11.68 $11.81 Common Equity Capitalization 1,093,334 916,766 1,046,505 1,045,776 Preferred Equity Capitalization 171,085 171,085 171,085 171,085 Total Equity Capitalization 1,264,419 1,087,851 1,217,590 1,216,861 Total Debt(2) 1,401,204 1,326,987 1,269,586 1,117,424 Total Capitalization $2,665,623 $2,414,838 $2,487,176 $2,334,285 STABILIZED PORTFOLIO OCCUPANCY(3) Retail 97.4 % 98.1 % 98.2 % 98.4 % Office 95.3 % 96.1 % 96.2 % 96.8 % Multifamily 95.5 % 96.0 % 96.2 % 95.7 % Weighted Average(4) 96.1 % 96.8 % 97.0 % 97.1 % STABILIZED PORTFOLIO Commercial Retail Portfolio Net Operating Income $18,213 $19,249 $18,412 $16,667 Number of Properties 38 38 39 38 Net Rentable Square Feet 3,929,937 3,931,079 4,023,183 3,915,809 Office Portfolio Net Operating Income $11,948 $13,890 $13,084 $12,376 Number of Properties 10 10 10 9 Net Rentable Square Feet 2,310,537 2,310,645 2,310,645 2,111,924 Multifamily Multifamily Portfolio Net Operating Income $9,049 $8,979 $9,148 $8,167 Number of Properties 11 11 11 10 Units 2,492 2,492 2,492 2,254

7 SUMMARY INCOME STATEMENT $ IN THOUSANDS, EXCEPT PER SHARE Three Months Ended Year Ended 12/31/2023 12/31/2022 12/31/2023 12/31/2022 (Unaudited) Revenues Rental Revenues $59,842 $55,692 $238,924 $219,294 General Contracting and Real Estate Services Revenues 126,911 95,912 413,131 234,859 Interest Income 4,280 6,568 15,103 16,978 Total Revenues 191,033 158,172 667,158 471,131 Expenses Rental Expenses 15,027 12,641 56,419 50,742 Real Estate Taxes 5,532 5,362 22,442 22,057 General Contracting and Real Estate Services Expenses 123,377 93,667 399,713 227,158 Depreciation and Amortization 35,270 18,109 96,078 72,974 Amortization of Right-of-Use Assets - Finance Leases 300 277 1,349 1,110 General & Administrative Expenses 4,336 3,512 18,122 15,691 Acquisition, Development & Other Pursuit Costs 66 — 84 37 Impairment Charges (5) 83 102 416 Total Expenses 183,903 133,651 594,309 390,185 Gain on Real Estate Dispositions, Net — 42 738 53,466 Operating Income 7,130 24,563 73,587 134,412 Interest Expense (16,435) (10,933) (57,810) (39,680) Loss on Extinguishment of Debt — (475) — (3,374) Change in Fair Value of Derivatives and Other (11,266) 1,186 (6,242) 8,698 Unrealized Credit Loss Release (Provision) 297 232 (574) (626) Other Income (Expense), Net (293) (37) 31 378 Income Before Taxes (20,567) 14,536 8,992 99,808 Income Tax (Provision) Benefit (495) 5 (1,329) 145 Net (Loss) Income ($21,062) $14,541 $7,663 $99,953 Net Loss (Income) Attributable to Noncontrolling Interests in Investment Entities 11 (137) (605) (5,948) Preferred Stock Dividends (2,887) (2,887) (11,548) (11,548) Net (Loss) Income Attributable to AHH and OP Unitholders ($23,938) $11,517 ($4,490) $82,457 Net (Loss) Income per Diluted Share and Unit Attributable to AHH and OP Unitholders ($0.27) $0.13 ($0.05) $0.93 Weighted Average Shares & OP Units - Diluted(1) 88,733 88,341 88,864 88,192 (1) Represents the weighted average number of common shares and OP Units outstanding during the respective periods presented.

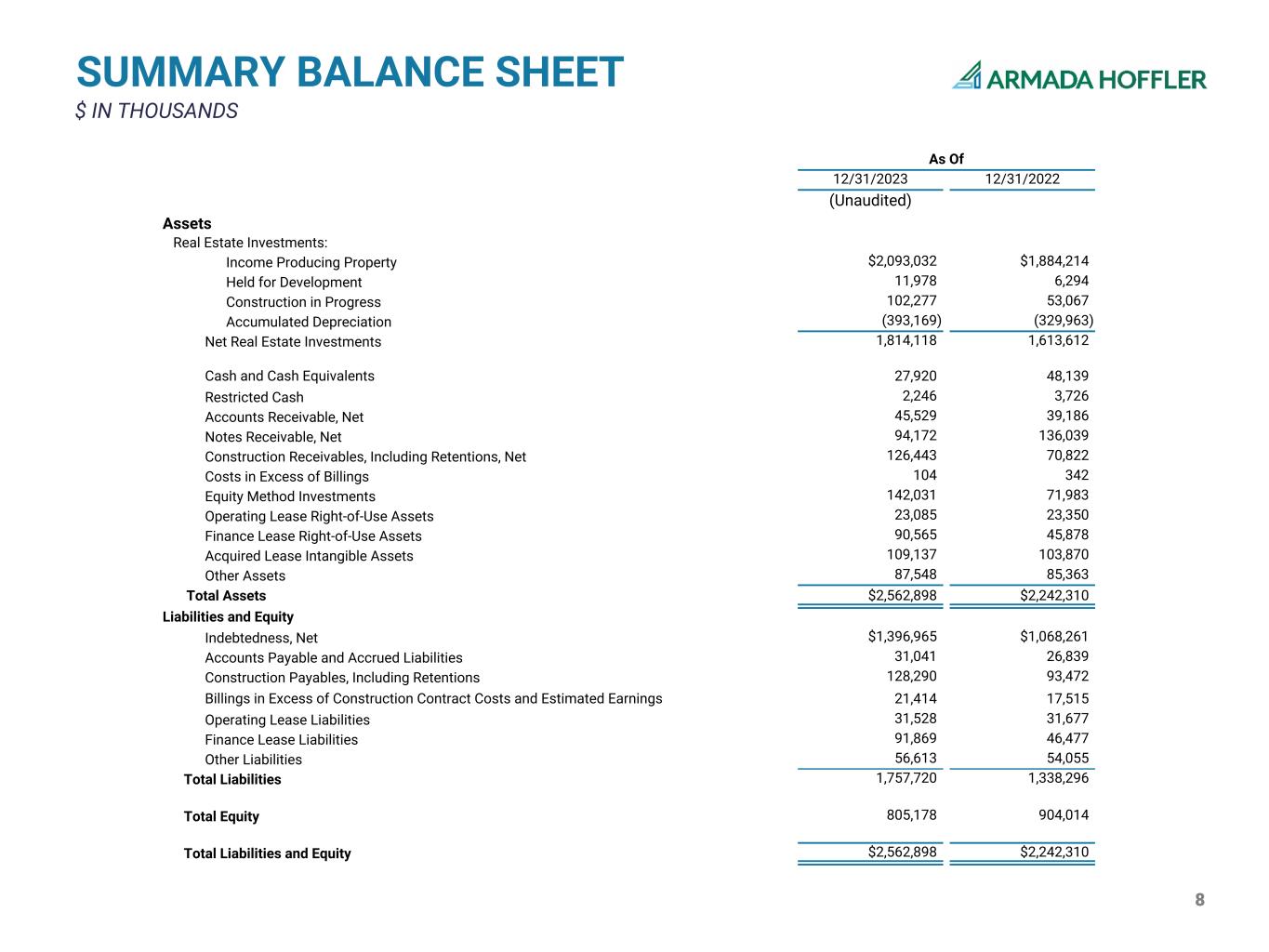

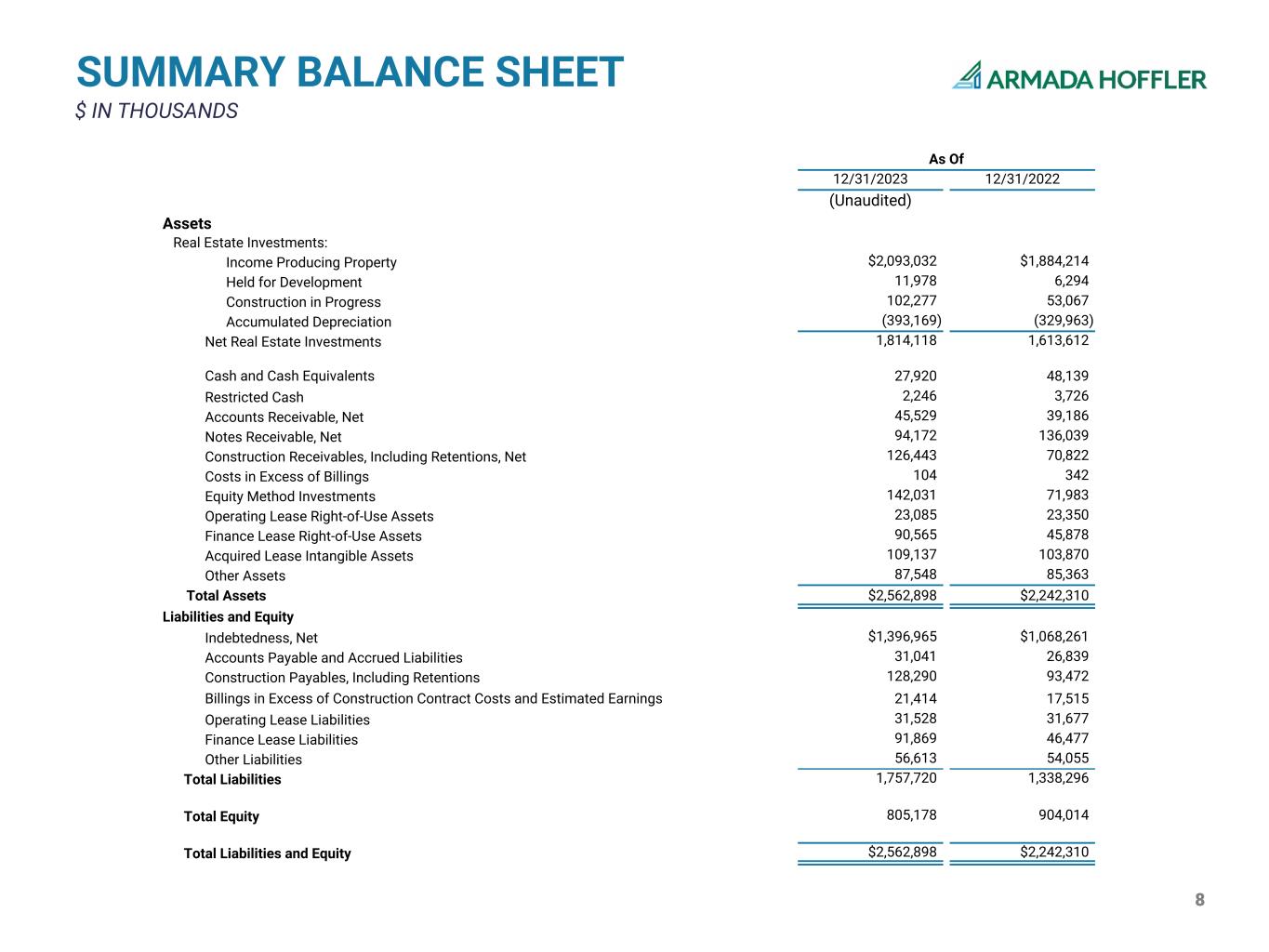

8 SUMMARY BALANCE SHEET $ IN THOUSANDS As Of 12/31/2023 12/31/2022 (Unaudited) Assets Real Estate Investments: Income Producing Property $2,093,032 $1,884,214 Held for Development 11,978 6,294 Construction in Progress 102,277 53,067 Accumulated Depreciation (393,169) (329,963) Net Real Estate Investments 1,814,118 1,613,612 Cash and Cash Equivalents 27,920 48,139 Restricted Cash 2,246 3,726 Accounts Receivable, Net 45,529 39,186 Notes Receivable, Net 94,172 136,039 Construction Receivables, Including Retentions, Net 126,443 70,822 Costs in Excess of Billings 104 342 Equity Method Investments 142,031 71,983 Operating Lease Right-of-Use Assets 23,085 23,350 Finance Lease Right-of-Use Assets 90,565 45,878 Acquired Lease Intangible Assets 109,137 103,870 Other Assets 87,548 85,363 Total Assets $2,562,898 $2,242,310 Liabilities and Equity Indebtedness, Net $1,396,965 $1,068,261 Accounts Payable and Accrued Liabilities 31,041 26,839 Construction Payables, Including Retentions 128,290 93,472 Billings in Excess of Construction Contract Costs and Estimated Earnings 21,414 17,515 Operating Lease Liabilities 31,528 31,677 Finance Lease Liabilities 91,869 46,477 Other Liabilities 56,613 54,055 Total Liabilities 1,757,720 1,338,296 Total Equity 805,178 904,014 Total Liabilities and Equity $2,562,898 $2,242,310

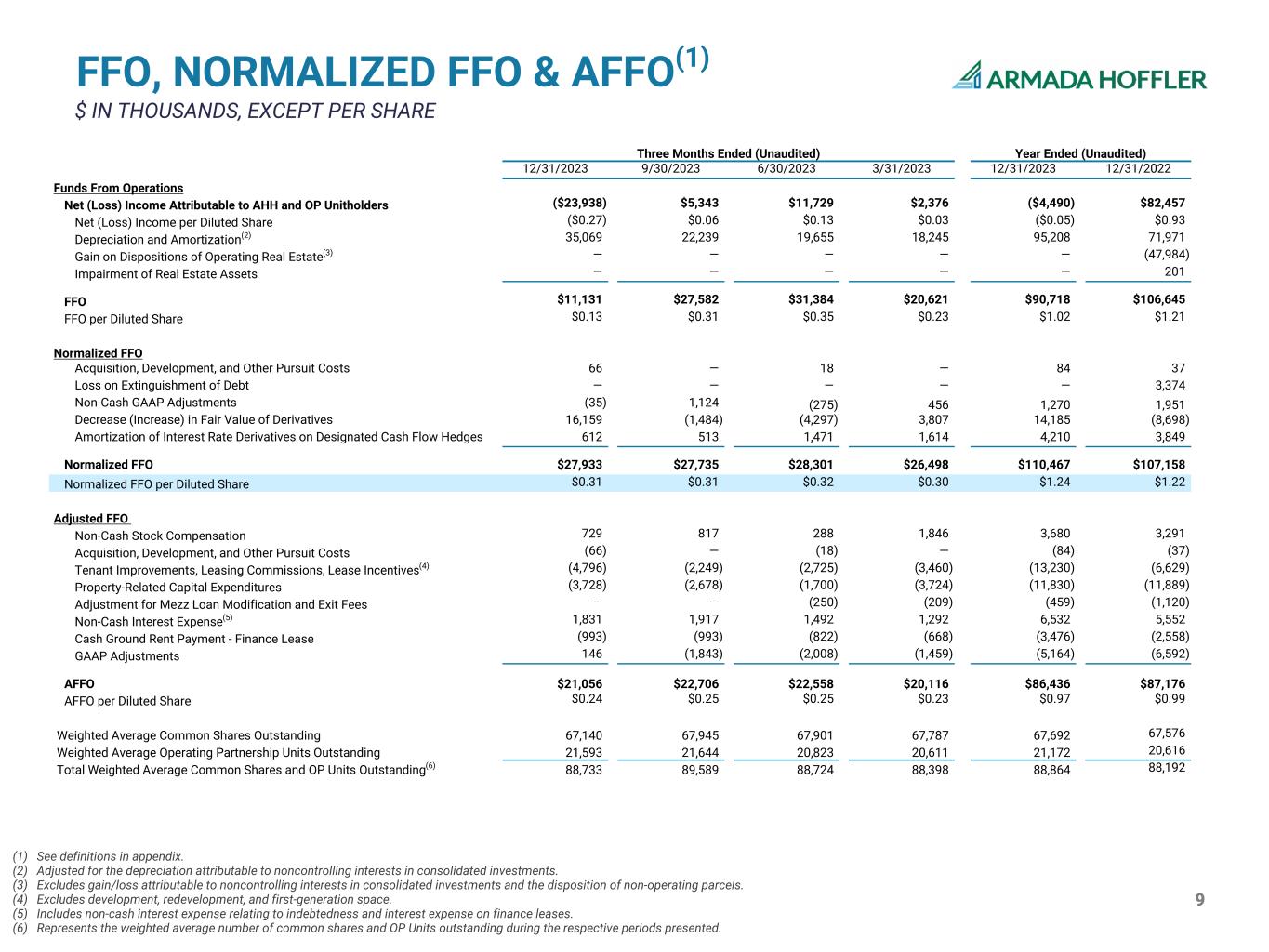

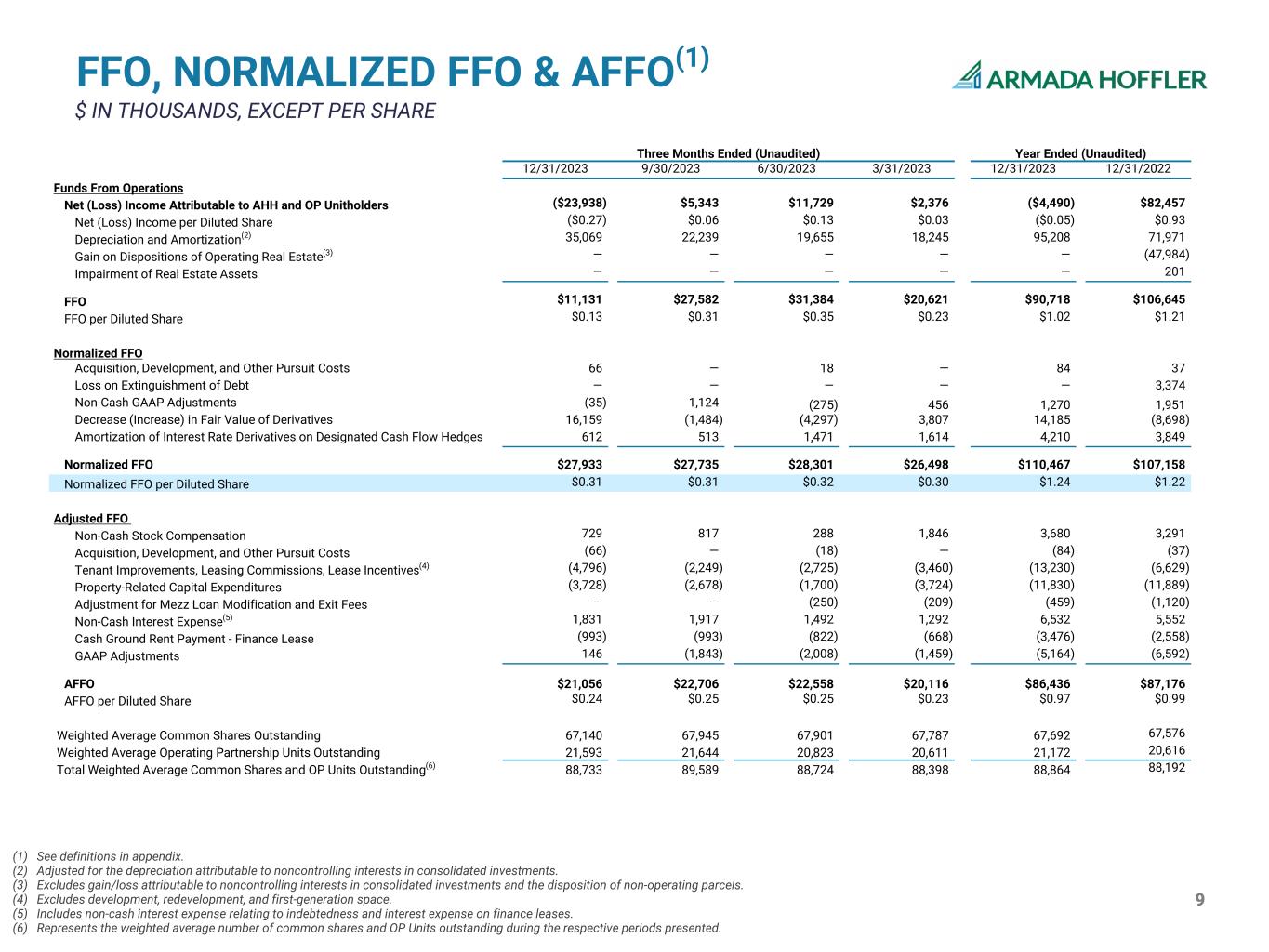

9 FFO, NORMALIZED FFO & AFFO(1) $ IN THOUSANDS, EXCEPT PER SHARE Three Months Ended (Unaudited) Year Ended (Unaudited) 12/31/2023 9/30/2023 6/30/2023 3/31/2023 12/31/2023 12/31/2022 Funds From Operations Net (Loss) Income Attributable to AHH and OP Unitholders ($23,938) $5,343 $11,729 $2,376 ($4,490) $82,457 Net (Loss) Income per Diluted Share ($0.27) $0.06 $0.13 $0.03 ($0.05) $0.93 Depreciation and Amortization(2) 35,069 22,239 19,655 18,245 95,208 71,971 Gain on Dispositions of Operating Real Estate(3) — — — — — (47,984) Impairment of Real Estate Assets — — — — — 201 FFO $11,131 $27,582 $31,384 $20,621 $90,718 $106,645 FFO per Diluted Share $0.13 $0.31 $0.35 $0.23 $1.02 $1.21 Normalized FFO Acquisition, Development, and Other Pursuit Costs 66 — 18 — 84 37 Loss on Extinguishment of Debt — — — — — 3,374 Non-Cash GAAP Adjustments (35) 1,124 (275) 456 1,270 1,951 Decrease (Increase) in Fair Value of Derivatives 16,159 (1,484) (4,297) 3,807 14,185 (8,698) Amortization of Interest Rate Derivatives on Designated Cash Flow Hedges 612 513 1,471 1,614 4,210 3,849 Normalized FFO $27,933 $27,735 $28,301 $26,498 $110,467 $107,158 Normalized FFO per Diluted Share $0.31 $0.31 $0.32 $0.30 $1.24 $1.22 Adjusted FFO Non-Cash Stock Compensation 729 817 288 1,846 3,680 3,291 Acquisition, Development, and Other Pursuit Costs (66) — (18) — (84) (37) Tenant Improvements, Leasing Commissions, Lease Incentives(4) (4,796) (2,249) (2,725) (3,460) (13,230) (6,629) Property-Related Capital Expenditures (3,728) (2,678) (1,700) (3,724) (11,830) (11,889) Adjustment for Mezz Loan Modification and Exit Fees — — (250) (209) (459) (1,120) Non-Cash Interest Expense(5) 1,831 1,917 1,492 1,292 6,532 5,552 Cash Ground Rent Payment - Finance Lease (993) (993) (822) (668) (3,476) (2,558) GAAP Adjustments 146 (1,843) (2,008) (1,459) (5,164) (6,592) AFFO $21,056 $22,706 $22,558 $20,116 $86,436 $87,176 AFFO per Diluted Share $0.24 $0.25 $0.25 $0.23 $0.97 $0.99 Weighted Average Common Shares Outstanding 67,140 67,945 67,901 67,787 67,692 67,576 Weighted Average Operating Partnership Units Outstanding 21,593 21,644 20,823 20,611 21,172 20,616 Total Weighted Average Common Shares and OP Units Outstanding(6) 88,733 89,589 88,724 88,398 88,864 88,192 (1) See definitions in appendix. (2) Adjusted for the depreciation attributable to noncontrolling interests in consolidated investments. (3) Excludes gain/loss attributable to noncontrolling interests in consolidated investments and the disposition of non-operating parcels. (4) Excludes development, redevelopment, and first-generation space. (5) Includes non-cash interest expense relating to indebtedness and interest expense on finance leases. (6) Represents the weighted average number of common shares and OP Units outstanding during the respective periods presented.

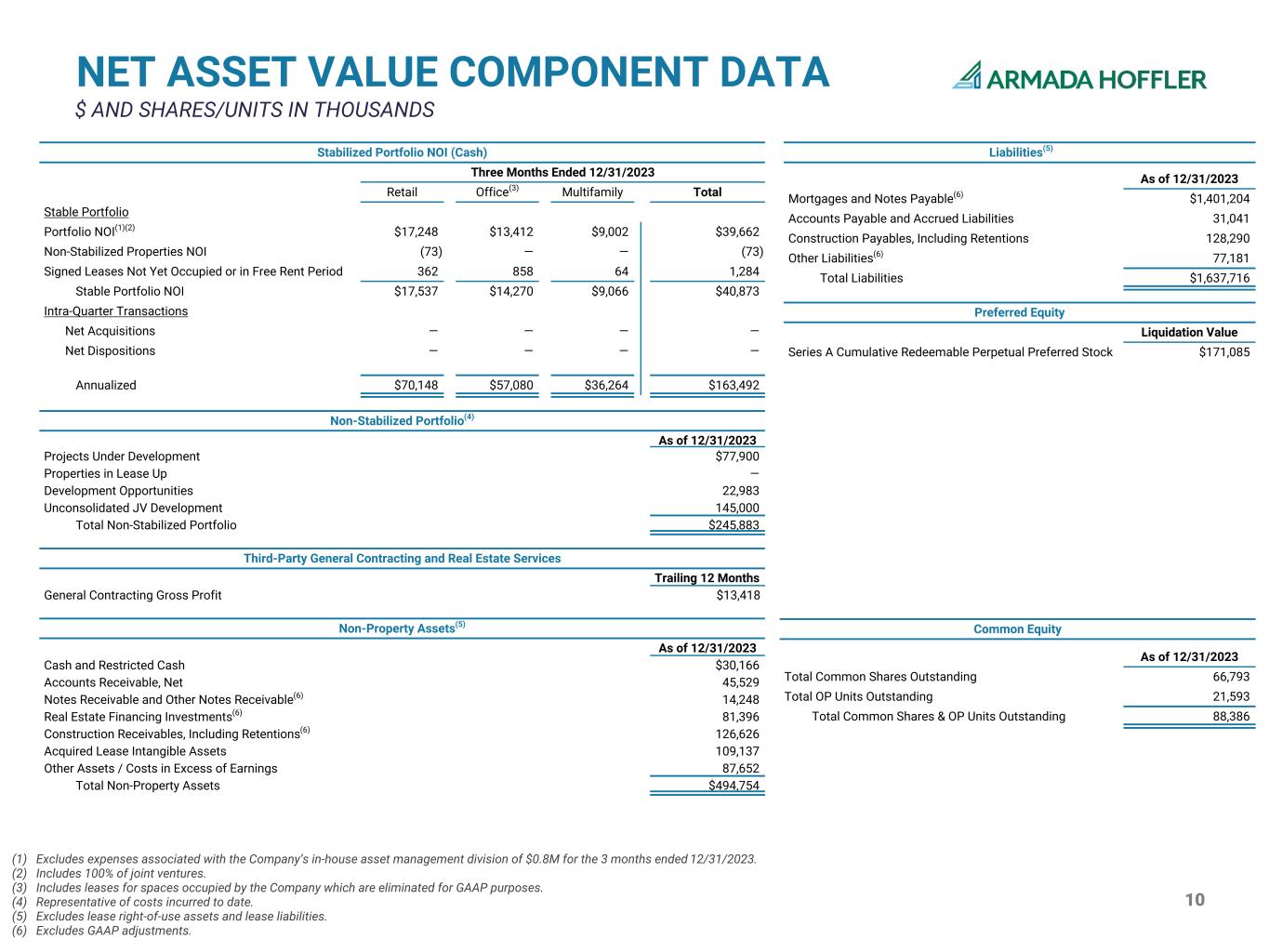

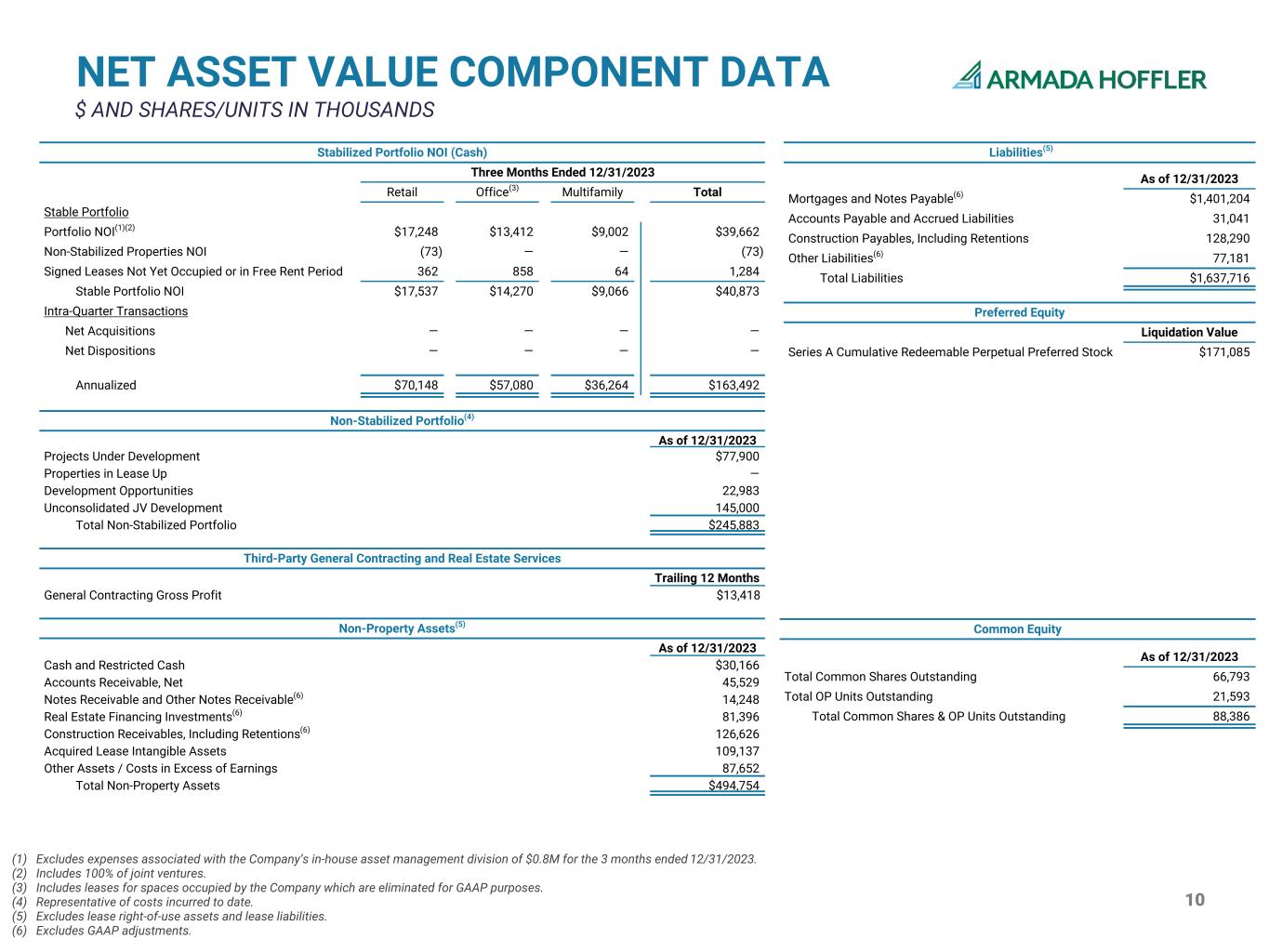

10 NET ASSET VALUE COMPONENT DATA (1) Excludes expenses associated with the Company’s in-house asset management division of $0.8M for the 3 months ended 12/31/2023. (2) Includes 100% of joint ventures. (3) Includes leases for spaces occupied by the Company which are eliminated for GAAP purposes. (4) Representative of costs incurred to date. (5) Excludes lease right-of-use assets and lease liabilities. (6) Excludes GAAP adjustments. $ AND SHARES/UNITS IN THOUSANDS Stabilized Portfolio NOI (Cash) Three Months Ended 12/31/2023 Retail Office(3) Multifamily Total Stable Portfolio Portfolio NOI(1)(2) $17,248 $13,412 $9,002 $39,662 Non-Stabilized Properties NOI (73) — — (73) Signed Leases Not Yet Occupied or in Free Rent Period 362 858 64 1,284 Stable Portfolio NOI $17,537 $14,270 $9,066 $40,873 Intra-Quarter Transactions Net Acquisitions — — — — Net Dispositions — — — — Annualized $70,148 $57,080 $36,264 $163,492 Non-Stabilized Portfolio(4) As of 12/31/2023 Projects Under Development $77,900 Properties in Lease Up — Development Opportunities 22,983 Unconsolidated JV Development 145,000 Total Non-Stabilized Portfolio $245,883 Third-Party General Contracting and Real Estate Services Trailing 12 Months General Contracting Gross Profit $13,418 Non-Property Assets(5) As of 12/31/2023 Cash and Restricted Cash $30,166 Accounts Receivable, Net 45,529 Notes Receivable and Other Notes Receivable(6) 14,248 Real Estate Financing Investments(6) 81,396 Construction Receivables, Including Retentions(6) 126,626 Acquired Lease Intangible Assets 109,137 Other Assets / Costs in Excess of Earnings 87,652 Total Non-Property Assets $494,754 Liabilities(5) As of 12/31/2023 Mortgages and Notes Payable(6) $1,401,204 Accounts Payable and Accrued Liabilities 31,041 Construction Payables, Including Retentions 128,290 Other Liabilities(6) 77,181 Total Liabilities $1,637,716 Preferred Equity Liquidation Value Series A Cumulative Redeemable Perpetual Preferred Stock $171,085 Common Equity As of 12/31/2023 Total Common Shares Outstanding 66,793 Total OP Units Outstanding 21,593 Total Common Shares & OP Units Outstanding 88,386

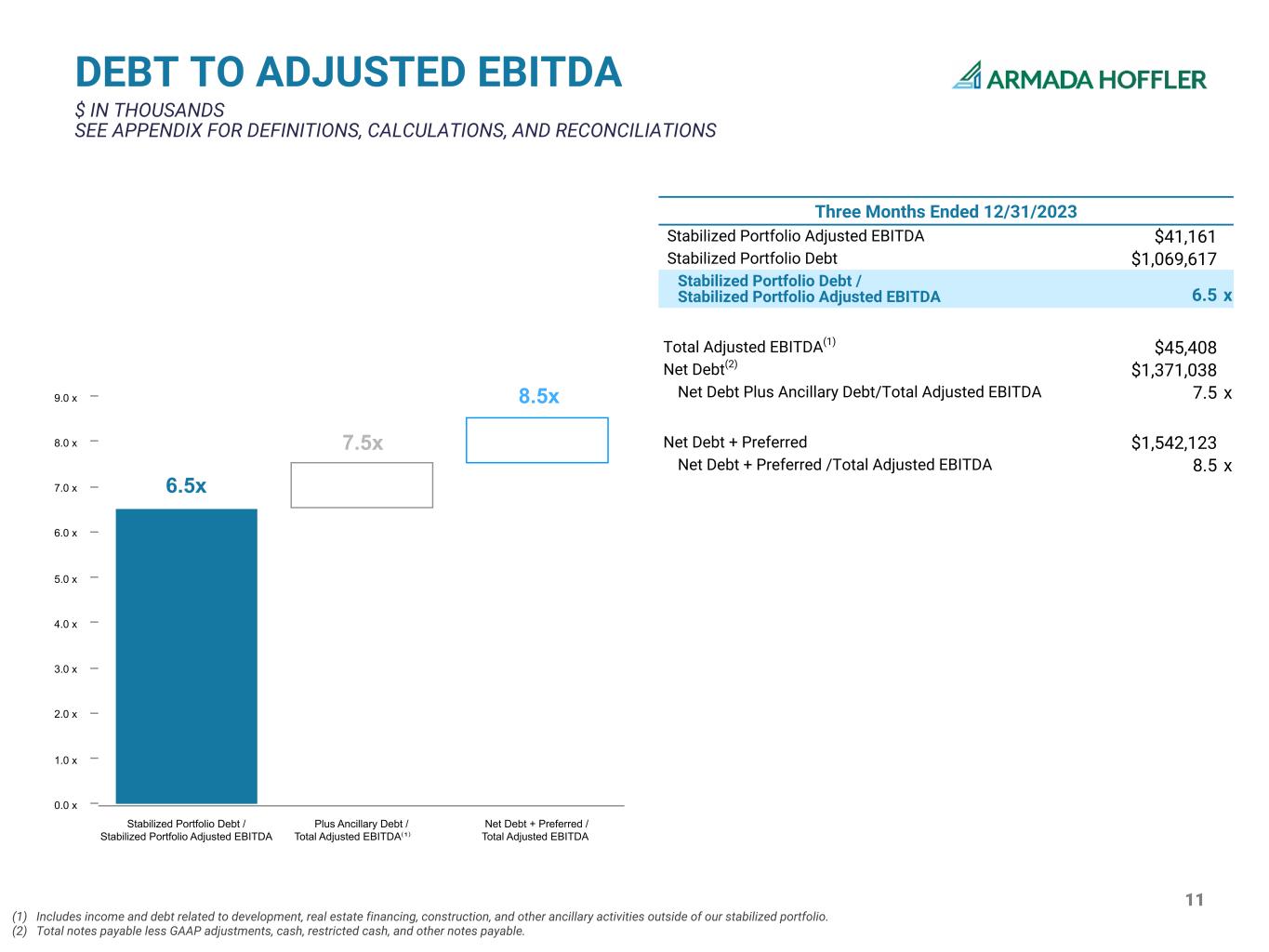

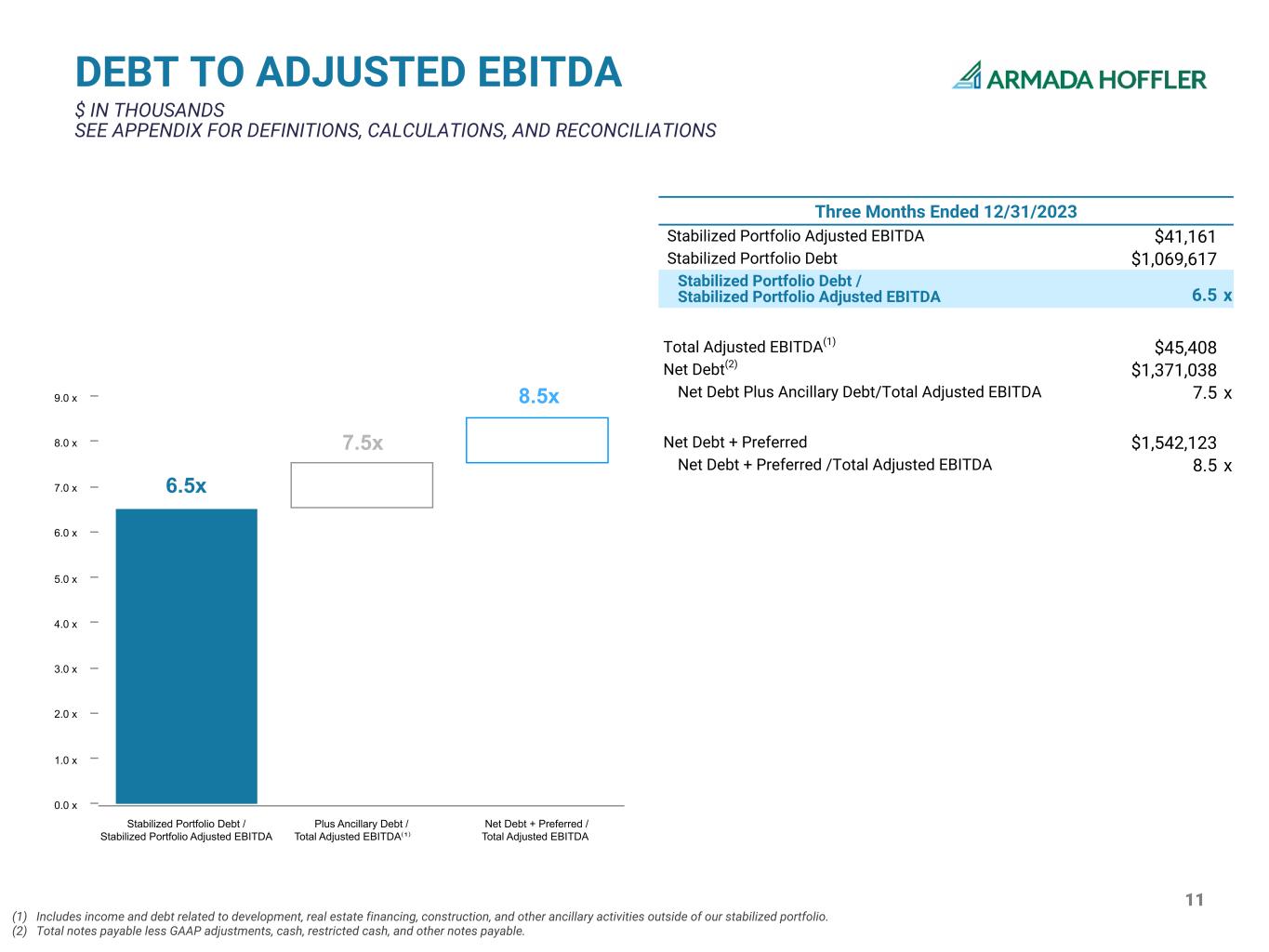

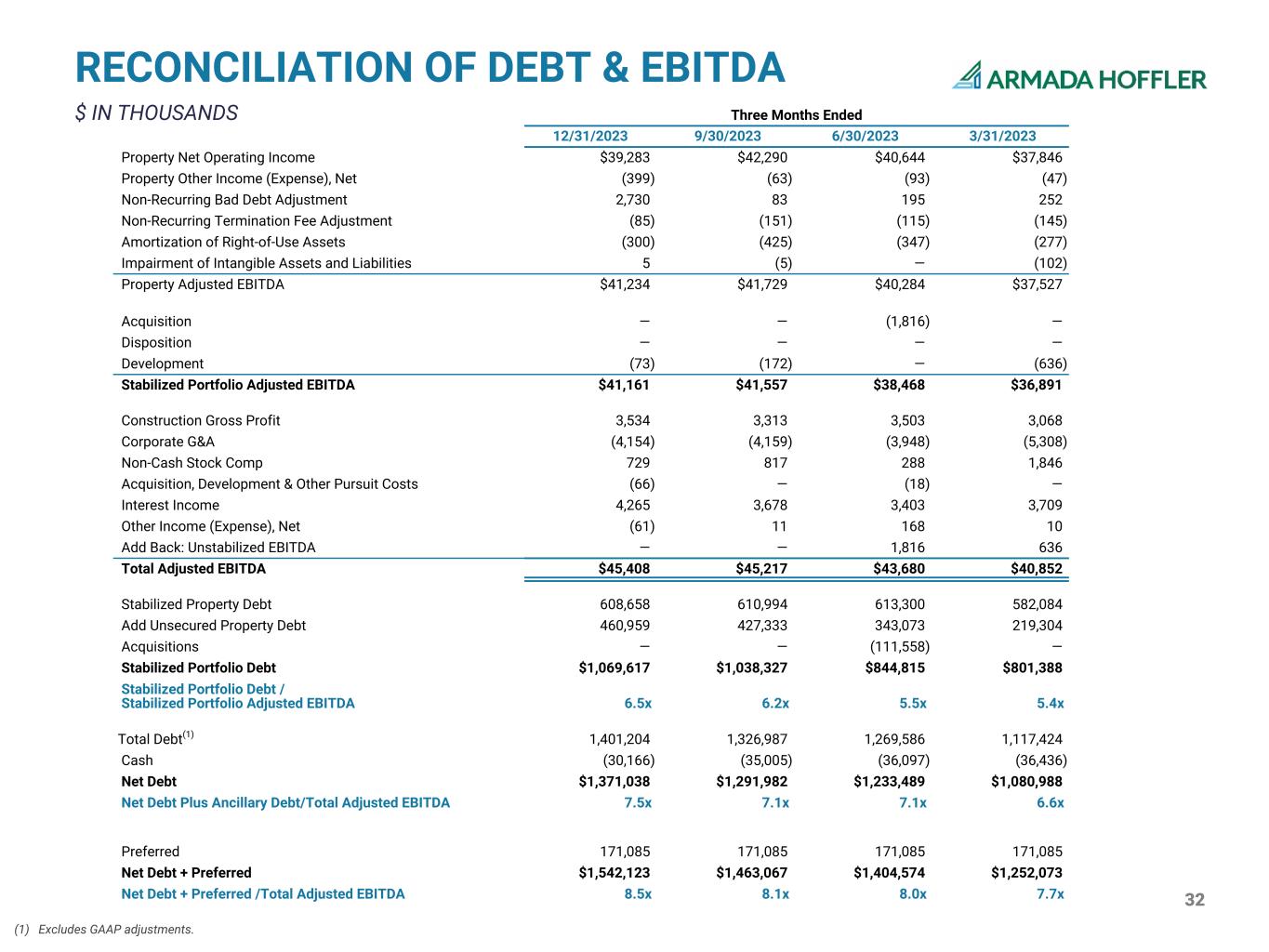

11 DEBT TO ADJUSTED EBITDA $ IN THOUSANDS SEE APPENDIX FOR DEFINITIONS, CALCULATIONS, AND RECONCILIATIONS (1) Includes income and debt related to development, real estate financing, construction, and other ancillary activities outside of our stabilized portfolio. (2) Total notes payable less GAAP adjustments, cash, restricted cash, and other notes payable. Three Months Ended 12/31/2023 Stabilized Portfolio Adjusted EBITDA $41,161 Stabilized Portfolio Debt $1,069,617 Stabilized Portfolio Debt / Stabilized Portfolio Adjusted EBITDA 6.5 x Total Adjusted EBITDA(1) $45,408 Net Debt(2) $1,371,038 Net Debt Plus Ancillary Debt/Total Adjusted EBITDA 7.5 x Net Debt + Preferred $1,542,123 Net Debt + Preferred /Total Adjusted EBITDA 8.5 x Stabilized Portfolio Debt / Stabilized Portfolio Adjusted EBITDA Plus Ancillary Debt / Total Adjusted EBITDA⁽¹⁾ Net Debt + Preferred / Total Adjusted EBITDA 0.0 x 1.0 x 2.0 x 3.0 x 4.0 x 5.0 x 6.0 x 7.0 x 8.0 x 9.0 x 6.5x 7.5x 8.5x

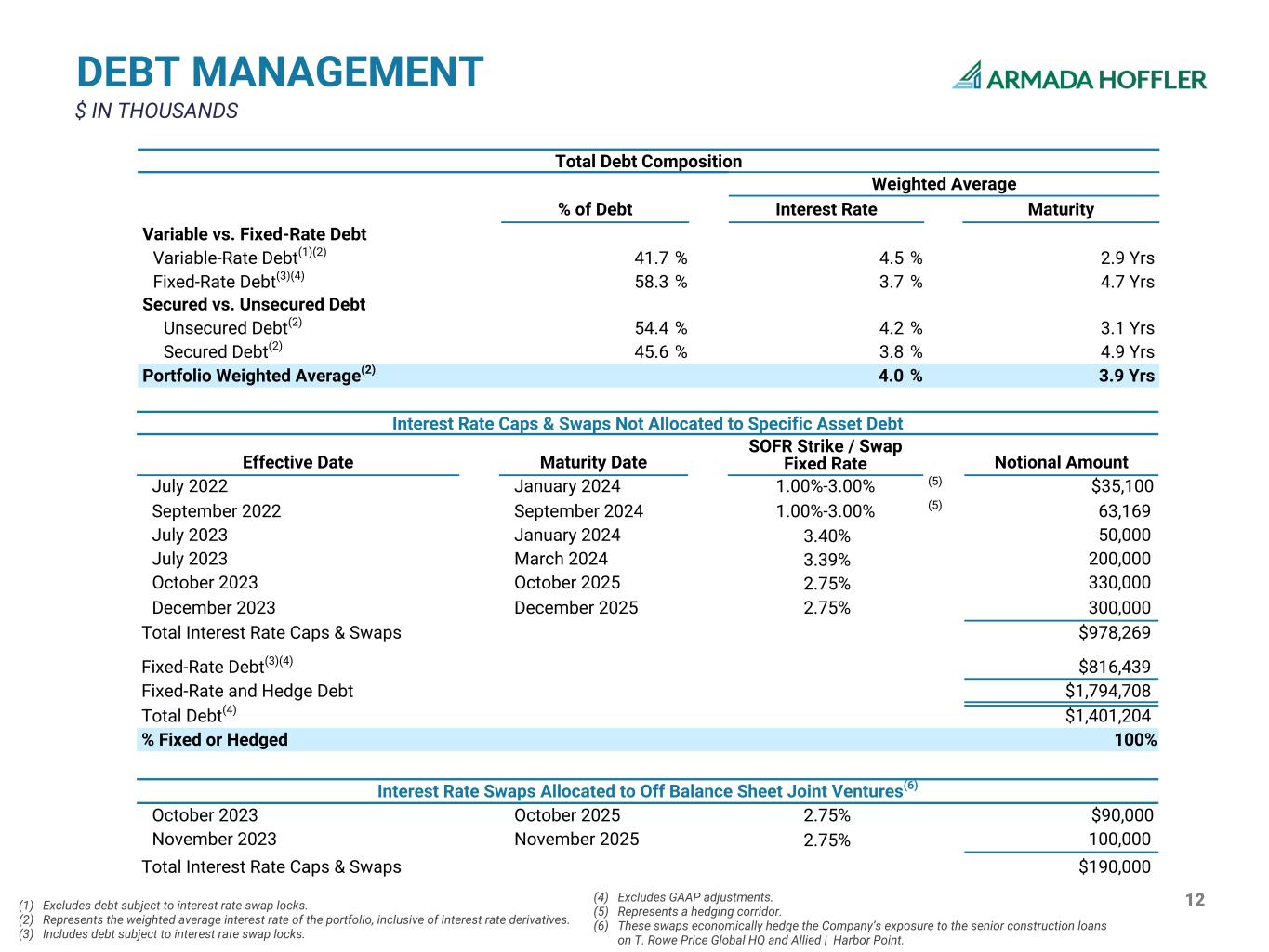

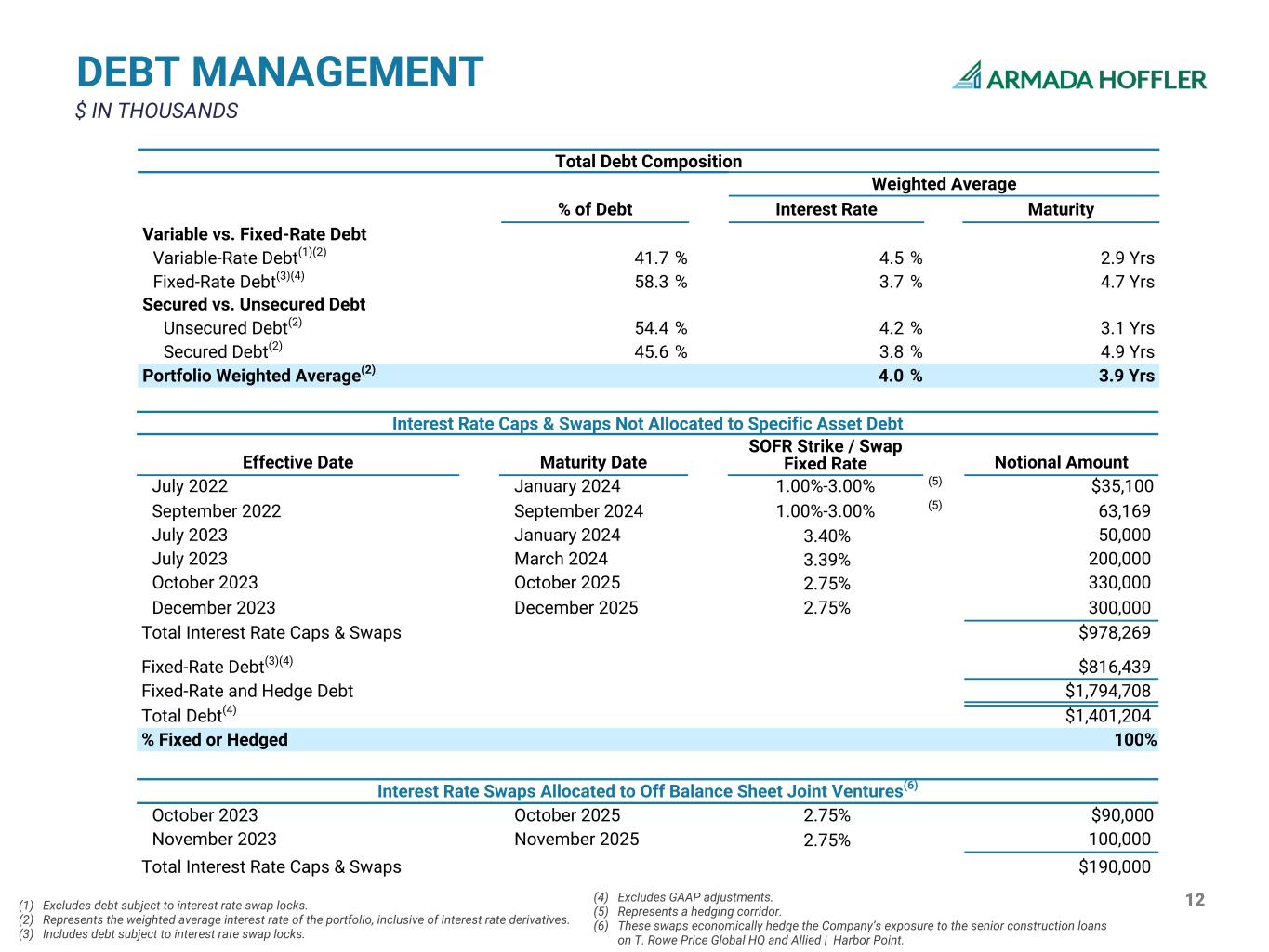

12 DEBT MANAGEMENT $ IN THOUSANDS Total Debt Composition Weighted Average % of Debt Interest Rate Maturity Variable vs. Fixed-Rate Debt Variable-Rate Debt(1)(2) 41.7 % 4.5 % 2.9 Yrs Fixed-Rate Debt(3)(4) 58.3 % 3.7 % 4.7 Yrs Secured vs. Unsecured Debt Unsecured Debt(2) 54.4 % 4.2 % 3.1 Yrs Secured Debt(2) 45.6 % 3.8 % 4.9 Yrs Portfolio Weighted Average(2) 4.0 % 3.9 Yrs Interest Rate Caps & Swaps Not Allocated to Specific Asset Debt Effective Date Maturity Date SOFR Strike / Swap Fixed Rate Notional Amount July 2022 January 2024 1.00%-3.00% (5) $35,100 September 2022 September 2024 1.00%-3.00% (5) 63,169 July 2023 January 2024 3.40% 50,000 July 2023 March 2024 3.39% 200,000 October 2023 October 2025 2.75% 330,000 December 2023 December 2025 2.75% 300,000 Total Interest Rate Caps & Swaps $978,269 Fixed-Rate Debt(3)(4) $816,439 Fixed-Rate and Hedge Debt $1,794,708 Total Debt(4) $1,401,204 % Fixed or Hedged 100% Interest Rate Swaps Allocated to Off Balance Sheet Joint Ventures(6) October 2023 October 2025 2.75% $90,000 November 2023 November 2025 2.75% 100,000 Total Interest Rate Caps & Swaps $190,000 (1) Excludes debt subject to interest rate swap locks. (2) Represents the weighted average interest rate of the portfolio, inclusive of interest rate derivatives. (3) Includes debt subject to interest rate swap locks. (4) Excludes GAAP adjustments. (5) Represents a hedging corridor. (6) These swaps economically hedge the Company’s exposure to the senior construction loans on T. Rowe Price Global HQ and Allied | Harbor Point.

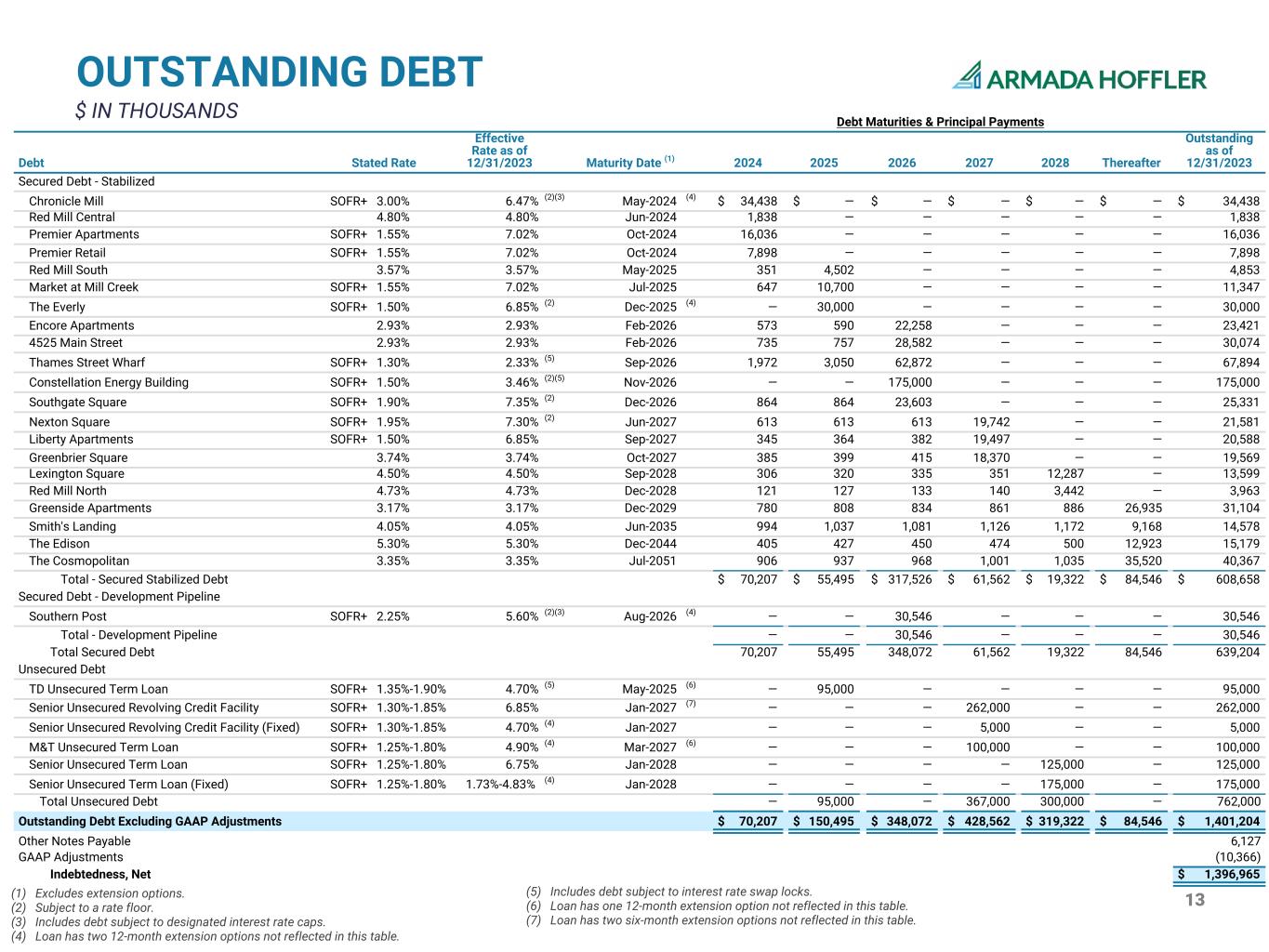

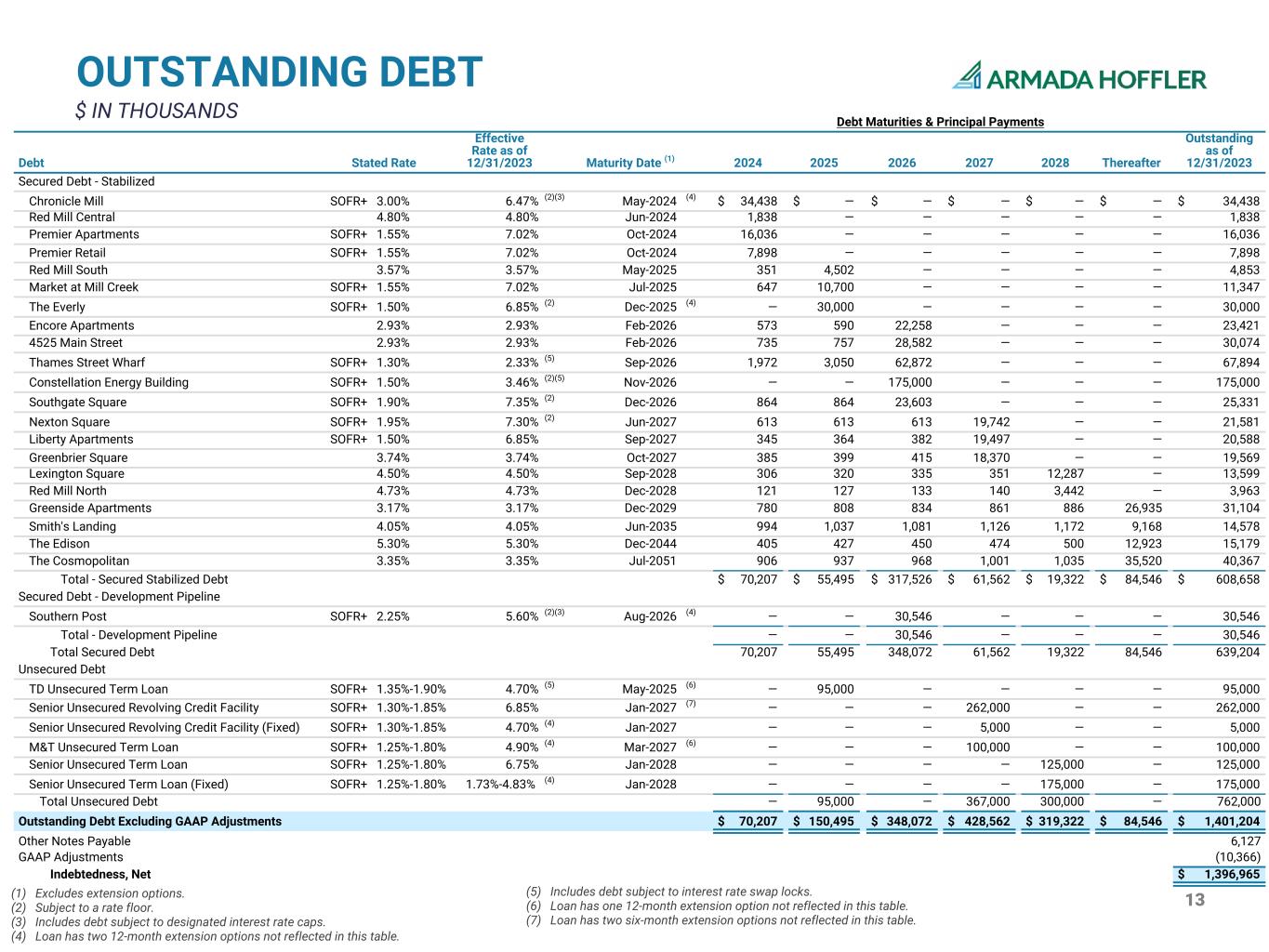

13 OUTSTANDING DEBT $ IN THOUSANDS (1) Excludes extension options. (2) Subject to a rate floor. (3) Includes debt subject to designated interest rate caps. (4) Loan has two 12-month extension options not reflected in this table. Debt Maturities & Principal Payments Debt Stated Rate Effective Rate as of 12/31/2023 Maturity Date (1) 2024 2025 2026 2027 2028 Thereafter Outstanding as of 12/31/2023 Secured Debt - Stabilized Chronicle Mill SOFR+ 3.00% 6.47 % (2)(3) May-2024 (4) $ 34,438 $ — $ — $ — $ — $ — $ 34,438 Red Mill Central 4.80% 4.80 % Jun-2024 1,838 — — — — — 1,838 Premier Apartments SOFR+ 1.55% 7.02 % Oct-2024 16,036 — — — — — 16,036 Premier Retail SOFR+ 1.55% 7.02 % Oct-2024 7,898 — — — — — 7,898 Red Mill South 3.57% 3.57 % May-2025 351 4,502 — — — — 4,853 Market at Mill Creek SOFR+ 1.55% 7.02 % Jul-2025 647 10,700 — — — — 11,347 The Everly SOFR+ 1.50% 6.85 % (2) Dec-2025 (4) — 30,000 — — — — 30,000 Encore Apartments 2.93% 2.93 % Feb-2026 573 590 22,258 — — — 23,421 4525 Main Street 2.93% 2.93 % Feb-2026 735 757 28,582 — — — 30,074 Thames Street Wharf SOFR+ 1.30% 2.33 % (5) Sep-2026 1,972 3,050 62,872 — — — 67,894 Constellation Energy Building SOFR+ 1.50% 3.46 % (2)(5) Nov-2026 — — 175,000 — — — 175,000 Southgate Square SOFR+ 1.90% 7.35 % (2) Dec-2026 864 864 23,603 — — — 25,331 Nexton Square SOFR+ 1.95% 7.30 % (2) Jun-2027 613 613 613 19,742 — — 21,581 Liberty Apartments SOFR+ 1.50% 6.85 % Sep-2027 345 364 382 19,497 — — 20,588 Greenbrier Square 3.74% 3.74% Oct-2027 385 399 415 18,370 — — 19,569 Lexington Square 4.50% 4.50 % Sep-2028 306 320 335 351 12,287 — 13,599 Red Mill North 4.73% 4.73 % Dec-2028 121 127 133 140 3,442 — 3,963 Greenside Apartments 3.17% 3.17 % Dec-2029 780 808 834 861 886 26,935 31,104 Smith's Landing 4.05% 4.05 % Jun-2035 994 1,037 1,081 1,126 1,172 9,168 14,578 The Edison 5.30% 5.30 % Dec-2044 405 427 450 474 500 12,923 15,179 The Cosmopolitan 3.35% 3.35 % Jul-2051 906 937 968 1,001 1,035 35,520 40,367 Total - Secured Stabilized Debt $ 70,207 $ 55,495 $ 317,526 $ 61,562 $ 19,322 $ 84,546 $ 608,658 Secured Debt - Development Pipeline Southern Post SOFR+ 2.25% 5.60 % (2)(3) Aug-2026 (4) — — 30,546 — — — 30,546 Total - Development Pipeline — — 30,546 — — — 30,546 Total Secured Debt 70,207 55,495 348,072 61,562 19,322 84,546 639,204 Unsecured Debt TD Unsecured Term Loan SOFR+ 1.35%-1.90% 4.70 % (5) May-2025 (6) — 95,000 — — — — 95,000 Senior Unsecured Revolving Credit Facility SOFR+ 1.30%-1.85% 6.85 % Jan-2027 (7) — — — 262,000 — — 262,000 Senior Unsecured Revolving Credit Facility (Fixed) SOFR+ 1.30%-1.85% 4.70 % (4) Jan-2027 — — — 5,000 — — 5,000 M&T Unsecured Term Loan SOFR+ 1.25%-1.80% 4.90 % (4) Mar-2027 (6) — — — 100,000 — — 100,000 Senior Unsecured Term Loan SOFR+ 1.25%-1.80% 6.75 % Jan-2028 — — — — 125,000 — 125,000 Senior Unsecured Term Loan (Fixed) SOFR+ 1.25%-1.80% 1.73%-4.83% (4) Jan-2028 — — — — 175,000 — 175,000 Total Unsecured Debt — 95,000 — 367,000 300,000 — 762,000 Outstanding Debt Excluding GAAP Adjustments $ 70,207 $ 150,495 $ 348,072 $ 428,562 $ 319,322 $ 84,546 $ 1,401,204 Other Notes Payable 6,127 GAAP Adjustments (10,366) Indebtedness, Net $ 1,396,965 (5) Includes debt subject to interest rate swap locks. (6) Loan has one 12-month extension option not reflected in this table. (7) Loan has two six-month extension options not reflected in this table.

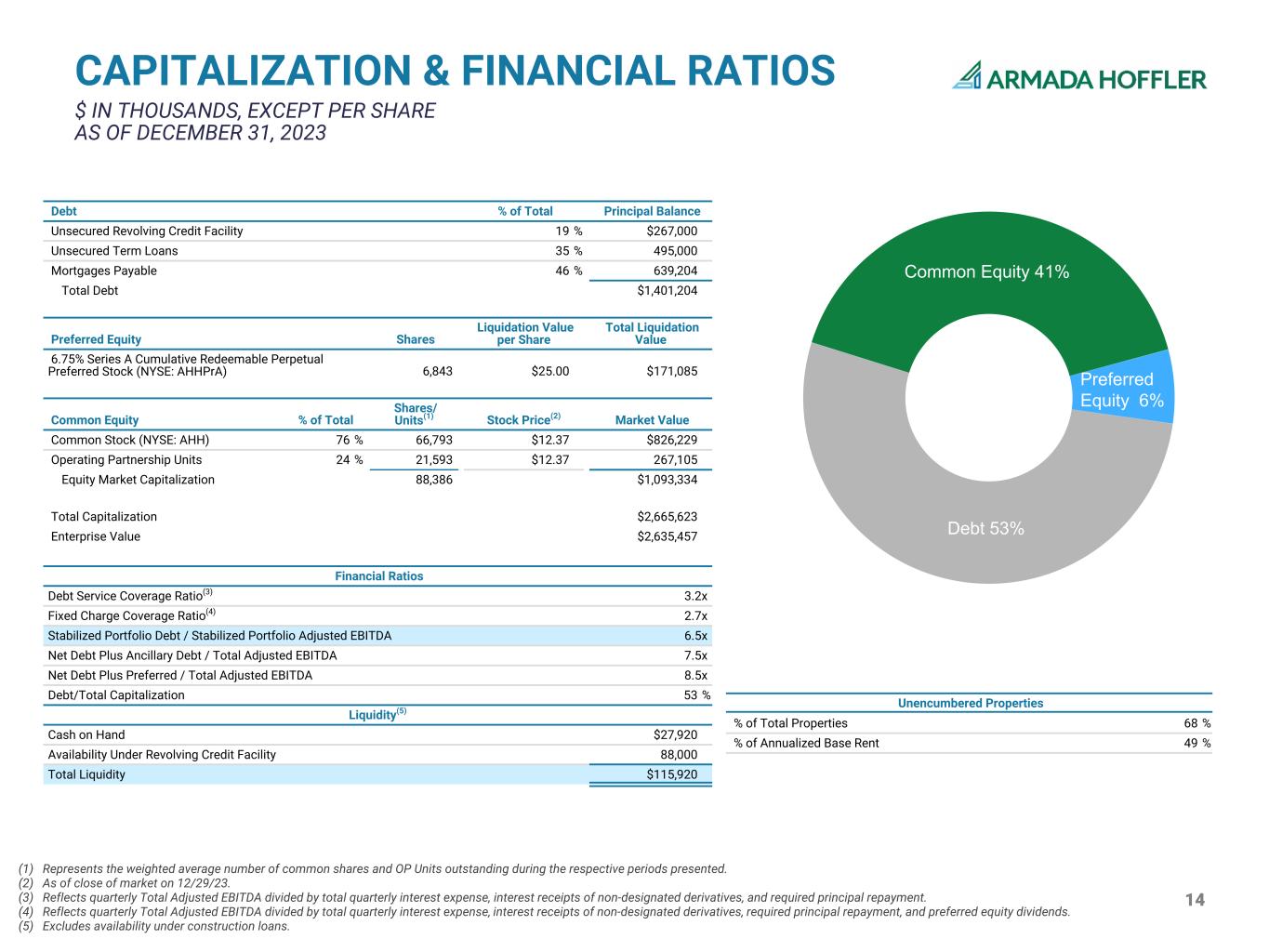

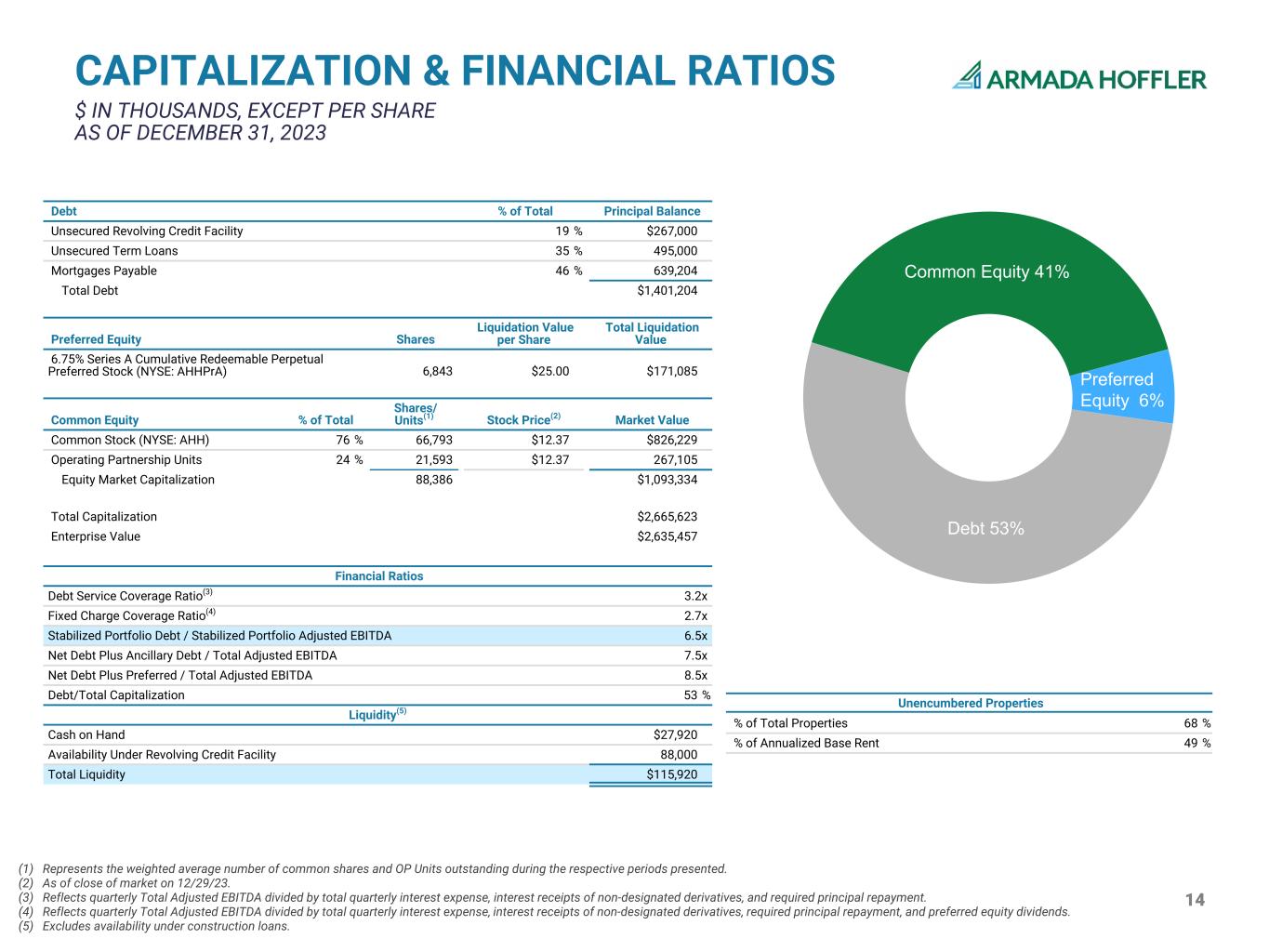

14 CAPITALIZATION & FINANCIAL RATIOS $ IN THOUSANDS, EXCEPT PER SHARE AS OF DECEMBER 31, 2023 (1) Represents the weighted average number of common shares and OP Units outstanding during the respective periods presented. (2) As of close of market on 12/29/23. (3) Reflects quarterly Total Adjusted EBITDA divided by total quarterly interest expense, interest receipts of non-designated derivatives, and required principal repayment. (4) Reflects quarterly Total Adjusted EBITDA divided by total quarterly interest expense, interest receipts of non-designated derivatives, required principal repayment, and preferred equity dividends. (5) Excludes availability under construction loans. Debt % of Total Principal Balance Unsecured Revolving Credit Facility 19 % $267,000 Unsecured Term Loans 35 % 495,000 Mortgages Payable 46 % 639,204 Total Debt $1,401,204 Preferred Equity Shares Liquidation Value per Share Total Liquidation Value 6.75% Series A Cumulative Redeemable Perpetual Preferred Stock (NYSE: AHHPrA) 6,843 $25.00 $171,085 Common Equity % of Total Shares/ Units(1) Stock Price(2) Market Value Common Stock (NYSE: AHH) 76 % 66,793 $12.37 $826,229 Operating Partnership Units 24 % 21,593 $12.37 267,105 Equity Market Capitalization 88,386 $1,093,334 Total Capitalization $2,665,623 Enterprise Value $2,635,457 Financial Ratios Debt Service Coverage Ratio(3) 3.2x Fixed Charge Coverage Ratio(4) 2.7x Stabilized Portfolio Debt / Stabilized Portfolio Adjusted EBITDA 6.5x Net Debt Plus Ancillary Debt / Total Adjusted EBITDA 7.5x Net Debt Plus Preferred / Total Adjusted EBITDA 8.5x Debt/Total Capitalization 53 % Liquidity(5) Cash on Hand $27,920 Availability Under Revolving Credit Facility 88,000 Total Liquidity $115,920 Unencumbered Properties % of Total Properties 68 % % of Annualized Base Rent 49 % Preferred Equity 6% Debt 53% Common Equity 41%

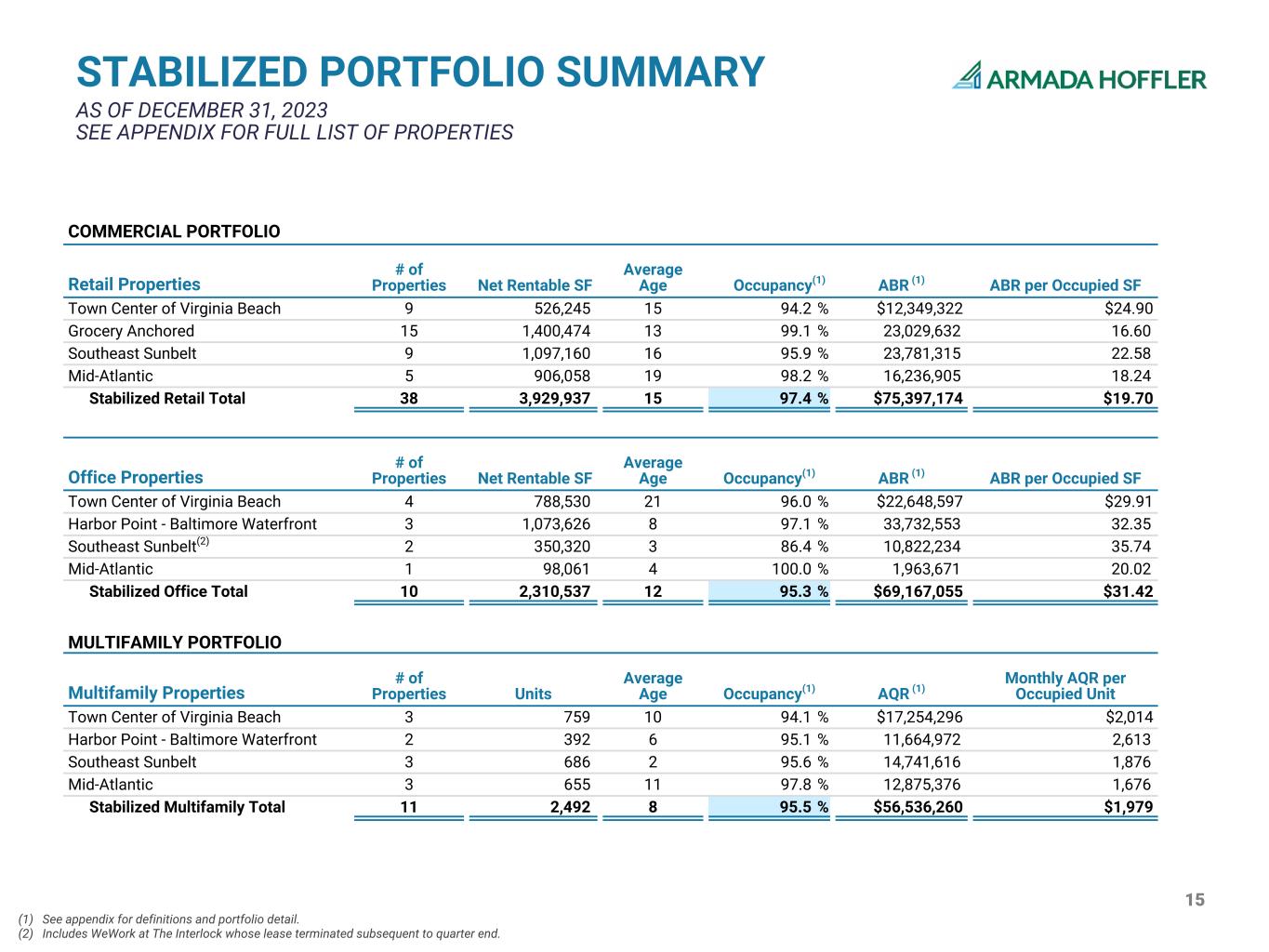

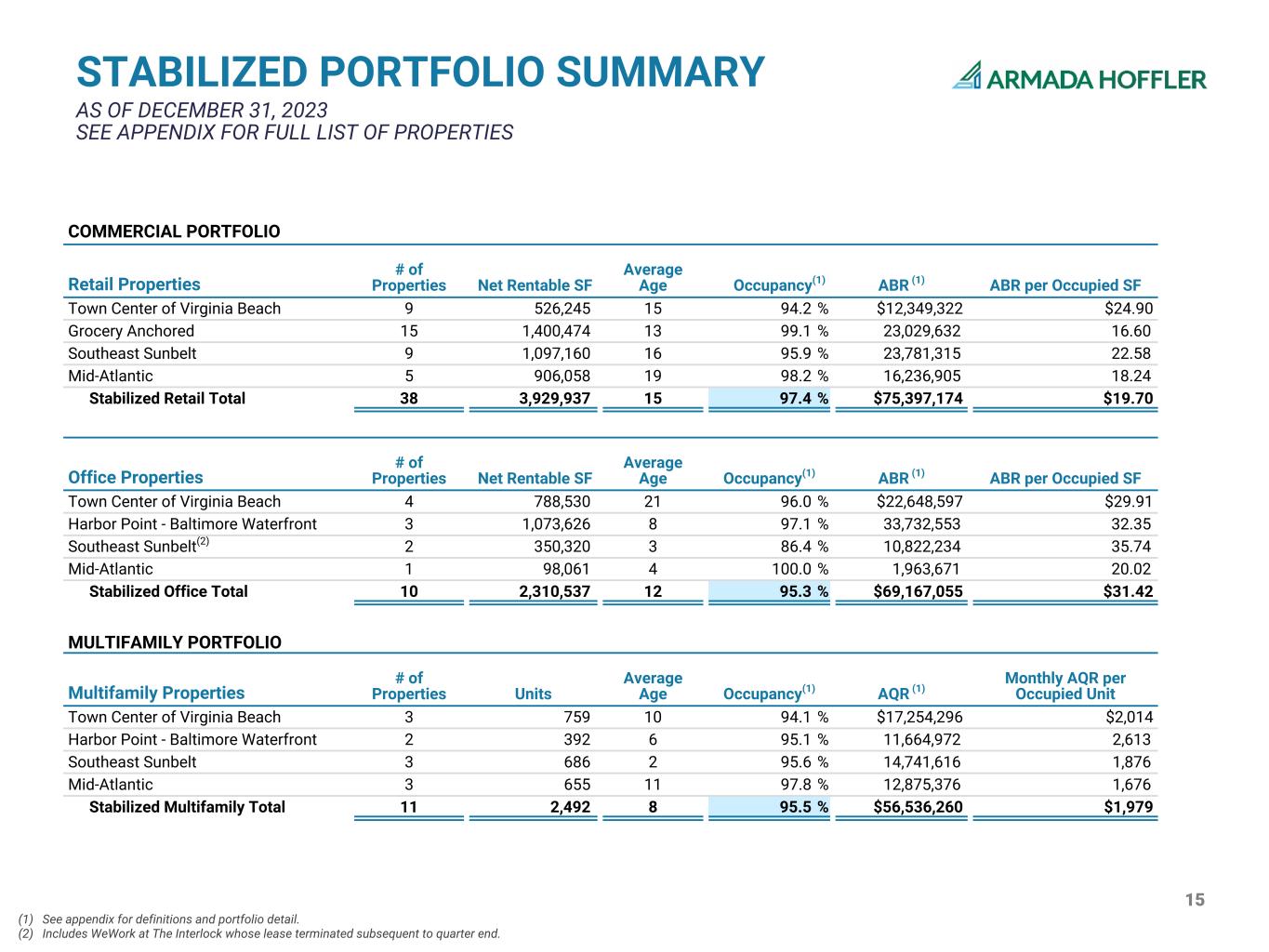

15 STABILIZED PORTFOLIO SUMMARY AS OF DECEMBER 31, 2023 SEE APPENDIX FOR FULL LIST OF PROPERTIES (1) See appendix for definitions and portfolio detail. (2) Includes WeWork at The Interlock whose lease terminated subsequent to quarter end. COMMERCIAL PORTFOLIO Retail Properties # of Properties Net Rentable SF Average Age Occupancy(1) ABR (1) ABR per Occupied SF Town Center of Virginia Beach 9 526,245 15 94.2 % $12,349,322 $24.90 Grocery Anchored 15 1,400,474 13 99.1 % 23,029,632 16.60 Southeast Sunbelt 9 1,097,160 16 95.9 % 23,781,315 22.58 Mid-Atlantic 5 906,058 19 98.2 % 16,236,905 18.24 Stabilized Retail Total 38 3,929,937 15 97.4 % $75,397,174 $19.70 Office Properties # of Properties Net Rentable SF Average Age Occupancy(1) ABR (1) ABR per Occupied SF Town Center of Virginia Beach 4 788,530 21 96.0 % $22,648,597 $29.91 Harbor Point - Baltimore Waterfront 3 1,073,626 8 97.1 % 33,732,553 32.35 Southeast Sunbelt(2) 2 350,320 3 86.4 % 10,822,234 35.74 Mid-Atlantic 1 98,061 4 100.0 % 1,963,671 20.02 Stabilized Office Total 10 2,310,537 12 95.3 % $69,167,055 $31.42 MULTIFAMILY PORTFOLIO Multifamily Properties # of Properties Units Average Age Occupancy(1) AQR (1) Monthly AQR per Occupied Unit Town Center of Virginia Beach 3 759 10 94.1 % $17,254,296 $2,014 Harbor Point - Baltimore Waterfront 2 392 6 95.1 % 11,664,972 2,613 Southeast Sunbelt 3 686 2 95.6 % 14,741,616 1,876 Mid-Atlantic 3 655 11 97.8 % 12,875,376 1,676 Stabilized Multifamily Total 11 2,492 8 95.5 % $56,536,260 $1,979

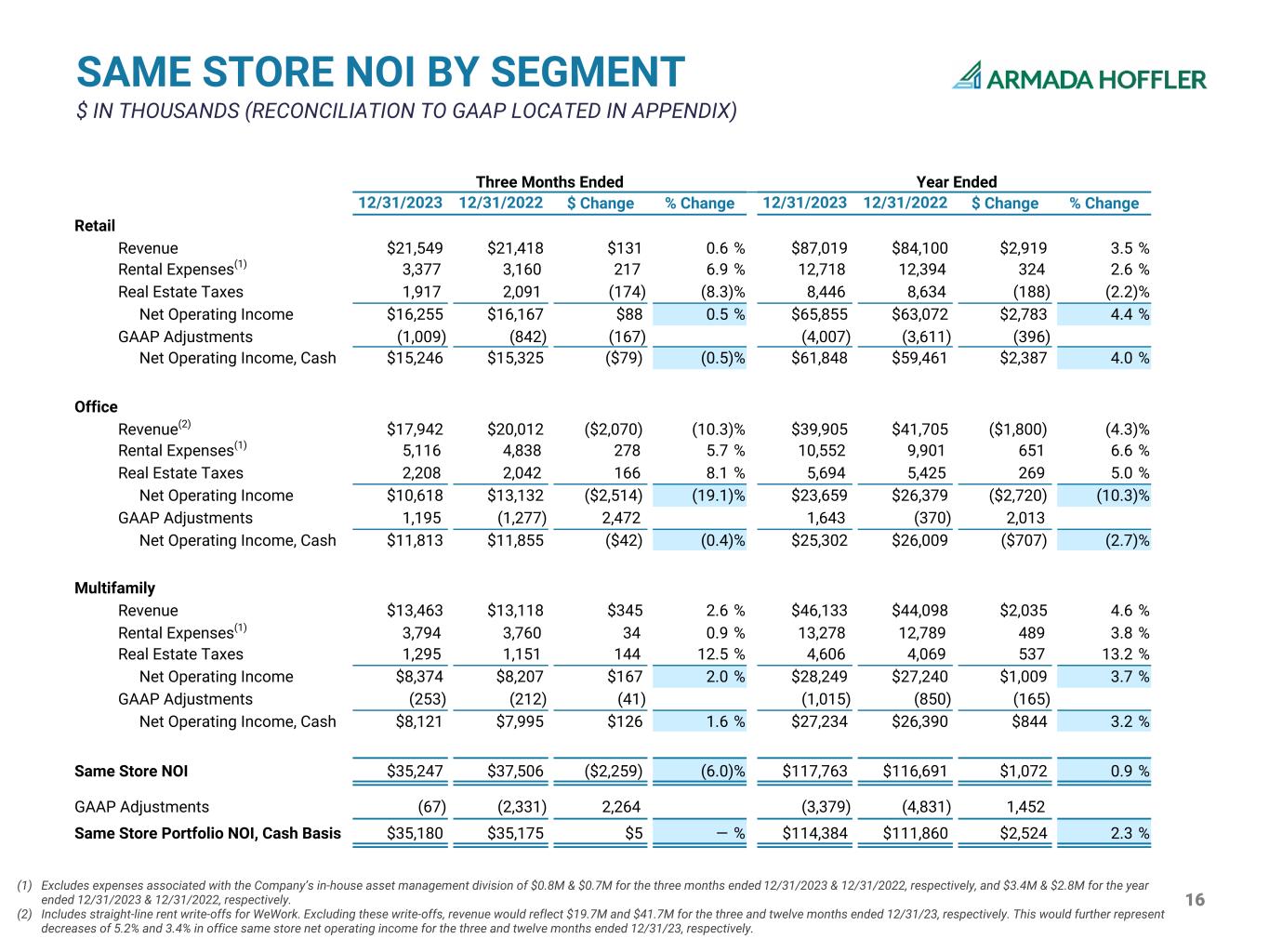

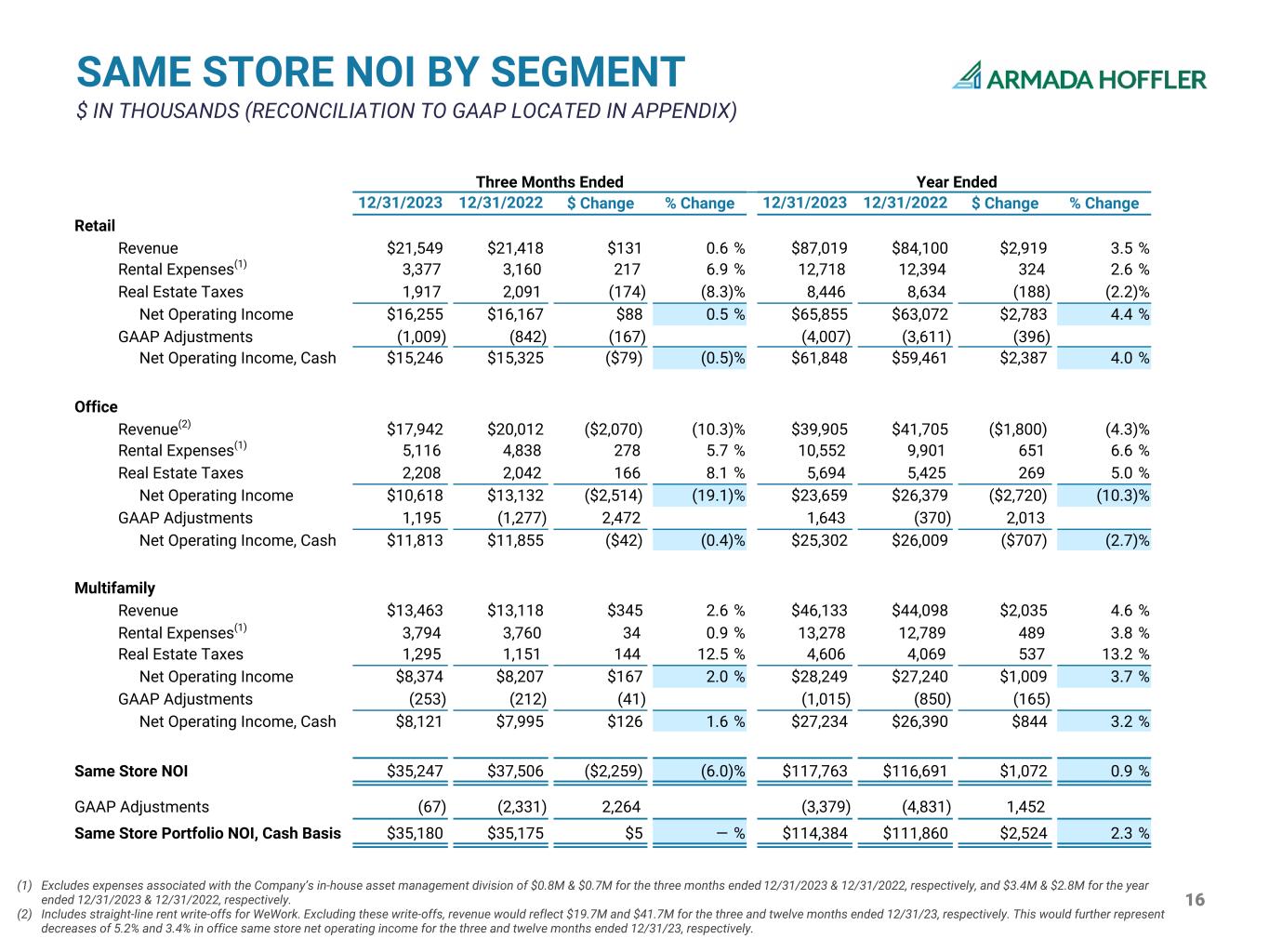

16 (1) Excludes expenses associated with the Company’s in-house asset management division of $0.8M & $0.7M for the three months ended 12/31/2023 & 12/31/2022, respectively, and $3.4M & $2.8M for the year ended 12/31/2023 & 12/31/2022, respectively. (2) Includes straight-line rent write-offs for WeWork. Excluding these write-offs, revenue would reflect $19.7M and $41.7M for the three and twelve months ended 12/31/23, respectively. This would further represent decreases of 5.2% and 3.4% in office same store net operating income for the three and twelve months ended 12/31/23, respectively. SAME STORE NOI BY SEGMENT $ IN THOUSANDS (RECONCILIATION TO GAAP LOCATED IN APPENDIX) Three Months Ended Year Ended 12/31/2023 12/31/2022 $ Change % Change 12/31/2023 12/31/2022 $ Change % Change Retail Revenue $21,549 $21,418 $131 0.6 % $87,019 $84,100 $2,919 3.5 % Rental Expenses(1) 3,377 3,160 217 6.9 % 12,718 12,394 324 2.6 % Real Estate Taxes 1,917 2,091 (174) (8.3) % 8,446 8,634 (188) (2.2) % Net Operating Income $16,255 $16,167 $88 0.5 % $65,855 $63,072 $2,783 4.4 % GAAP Adjustments (1,009) (842) (167) (4,007) (3,611) (396) Net Operating Income, Cash $15,246 $15,325 ($79) (0.5) % $61,848 $59,461 $2,387 4.0 % Office Revenue(2) $17,942 $20,012 ($2,070) (10.3) % $39,905 $41,705 ($1,800) (4.3) % Rental Expenses(1) 5,116 4,838 278 5.7 % 10,552 9,901 651 6.6 % Real Estate Taxes 2,208 2,042 166 8.1 % 5,694 5,425 269 5.0 % Net Operating Income $10,618 $13,132 ($2,514) (19.1) % $23,659 $26,379 ($2,720) (10.3) % GAAP Adjustments 1,195 (1,277) 2,472 1,643 (370) 2,013 Net Operating Income, Cash $11,813 $11,855 ($42) (0.4) % $25,302 $26,009 ($707) (2.7) % Multifamily Revenue $13,463 $13,118 $345 2.6 % $46,133 $44,098 $2,035 4.6 % Rental Expenses(1) 3,794 3,760 34 0.9 % 13,278 12,789 489 3.8 % Real Estate Taxes 1,295 1,151 144 12.5 % 4,606 4,069 537 13.2 % Net Operating Income $8,374 $8,207 $167 2.0 % $28,249 $27,240 $1,009 3.7 % GAAP Adjustments (253) (212) (41) (1,015) (850) (165) Net Operating Income, Cash $8,121 $7,995 $126 1.6 % $27,234 $26,390 $844 3.2 % Same Store NOI $35,247 $37,506 ($2,259) (6.0) % $117,763 $116,691 $1,072 0.9 % GAAP Adjustments (67) (2,331) 0 2,264 0 (3,379) (4,831) 0 1,452 0 Same Store Portfolio NOI, Cash Basis $35,180 $35,175 $5 — % $114,384 $111,860 $2,524 2.3 %

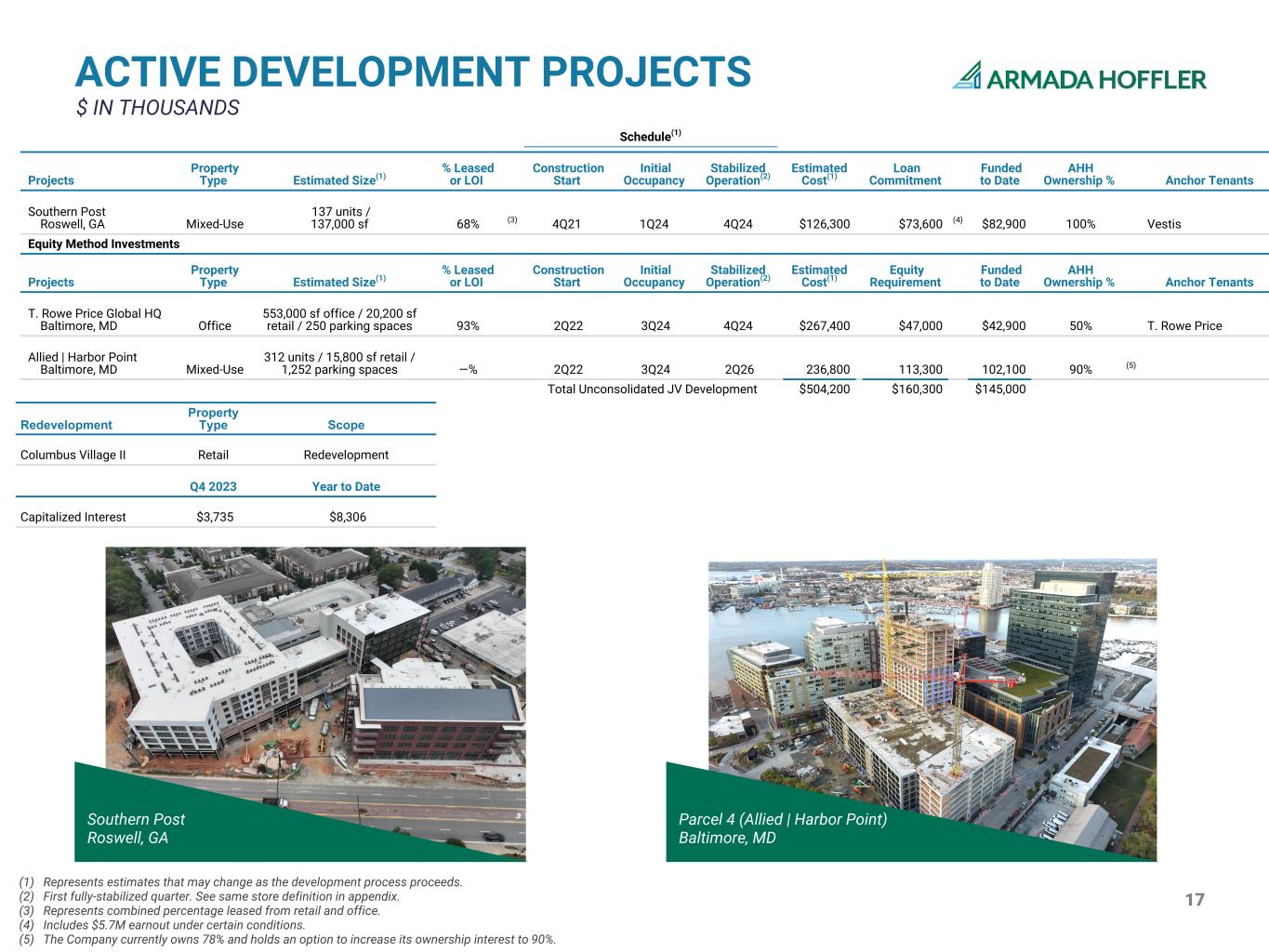

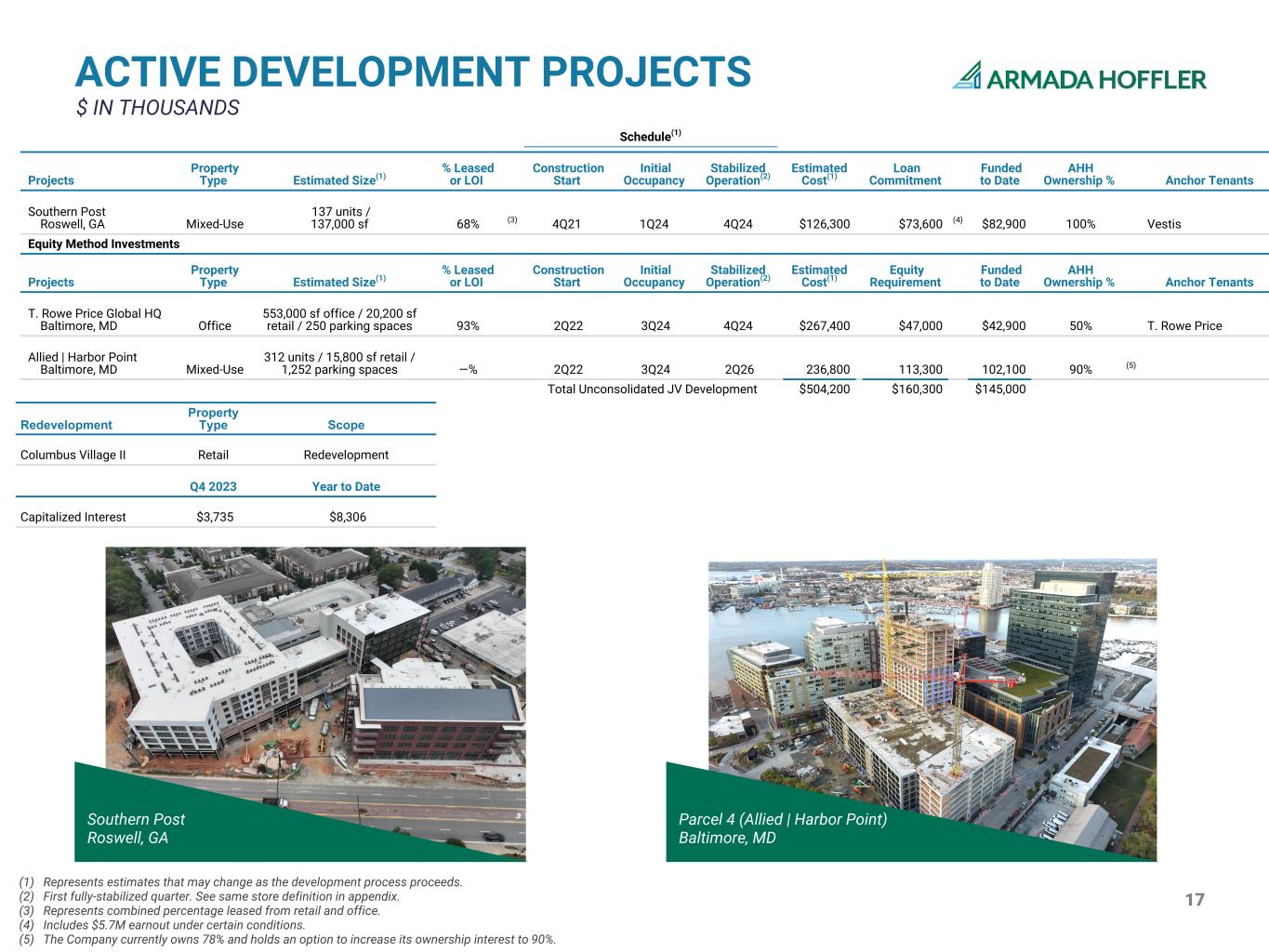

17 ACTIVE DEVELOPMENT PROJECTS $ IN THOUSANDS Southern Post Roswell, GA Parcel 4 (Allied | Harbor Point) Baltimore, MD Schedule(1) Projects Property Type Estimated Size(1) % Leased or LOI Construction Start Initial Occupancy Stabilized Operation(2) Estimated Cost(1) Loan Commitment Funded to Date AHH Ownership % Anchor Tenants Southern Post Roswell, GA Mixed-Use 137 units / 137,000 sf 68% (3) 4Q21 1Q24 4Q24 $126,300 $73,600 (4) $82,900 100% Vestis Equity Method Investments Projects Property Type Estimated Size(1) % Leased or LOI Construction Start Initial Occupancy Stabilized Operation(2) Estimated Cost(1) Equity Requirement Funded to Date AHH Ownership % Anchor Tenants T. Rowe Price Global HQ Baltimore, MD Office 553,000 sf office / 20,200 sf retail / 250 parking spaces 93% 2Q22 3Q24 4Q24 $267,400 $47,000 $42,900 50% T. Rowe Price Allied | Harbor Point Baltimore, MD Mixed-Use 312 units / 15,800 sf retail / 1,252 parking spaces —% 2Q22 3Q24 2Q26 236,800 113,300 102,100 90% (5) Total Unconsolidated JV Development $504,200 $160,300 $145,000 Redevelopment Property Type Scope Columbus Village II Retail Redevelopment Q4 2023 Year to Date Capitalized Interest $3,735 $8,306 (1) Represents estimates that may change as the development process proceeds. (2) First fully-stabilized quarter. See same store definition in appendix. (3) Represents combined percentage leased from retail and office. (4) Includes $5.7M earnout under certain conditions. (5) The Company currently owns 78% and holds an option to increase its ownership interest to 90%.

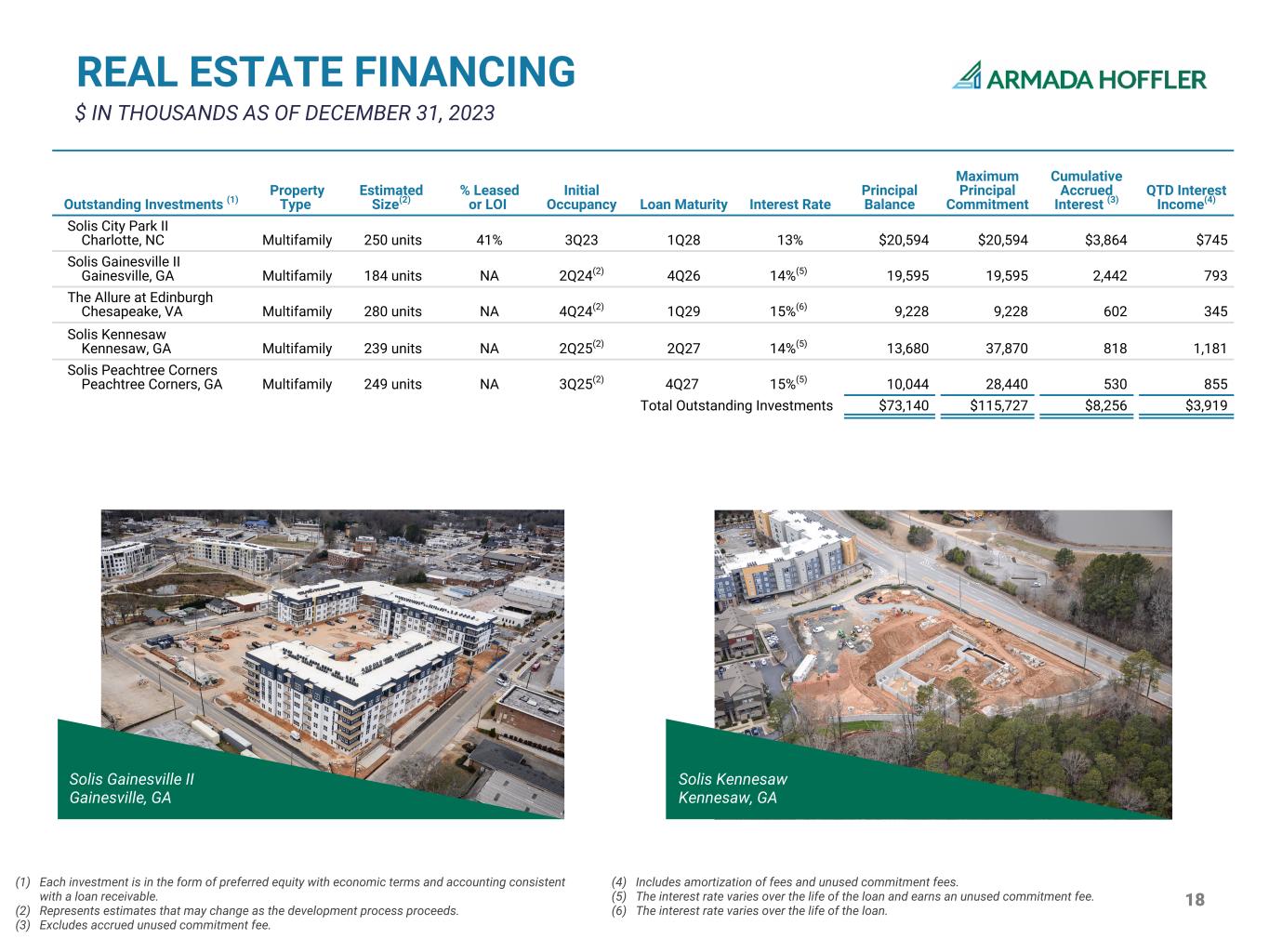

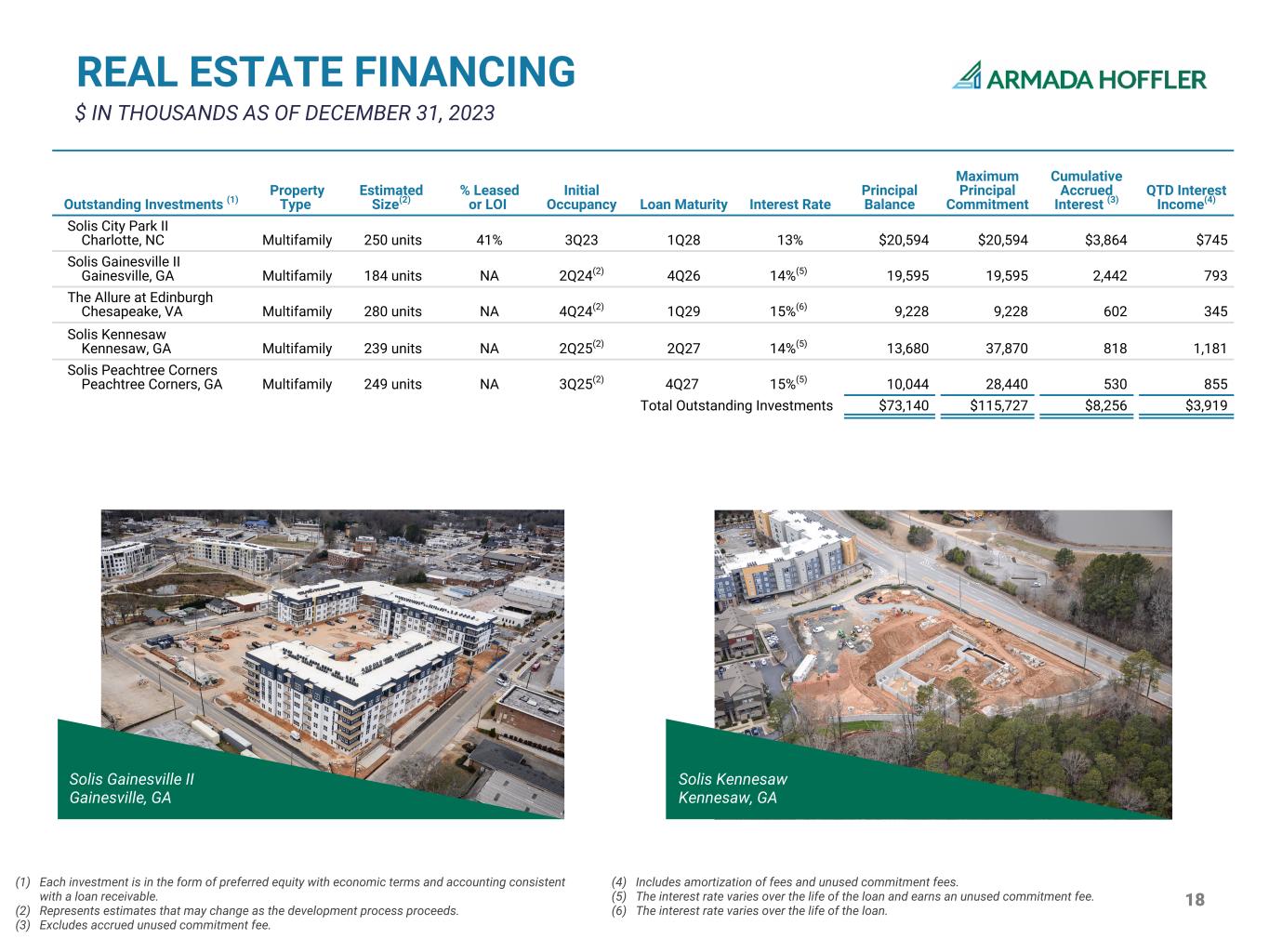

18 REAL ESTATE FINANCING $ IN THOUSANDS AS OF DECEMBER 31, 2023 Solis City Park Charlotte, NC The Interlock Atlanta, GA Solis Gainesville II Gainesville, GA Solis Kennesaw Kennesaw, GA Outstanding Investments (1) Property Type Estimated Size(2) % Leased or LOI Initial Occupancy Loan Maturity Interest Rate Principal Balance Maximum Principal Commitment Cumulative Accrued Interest (3) QTD Interest Income(4) Solis City Park II Charlotte, NC Multifamily 250 units 41% 3Q23 1Q28 13% $20,594 $20,594 $3,864 $745 Solis Gainesville II Gainesville, GA Multifamily 184 units NA 2Q24(2) 4Q26 14%(5) 19,595 19,595 2,442 793 The Allure at Edinburgh Chesapeake, VA Multifamily 280 units NA 4Q24(2) 1Q29 15%(6) 9,228 9,228 602 345 Solis Kennesaw Kennesaw, GA Multifamily 239 units NA 2Q25(2) 2Q27 14%(5) 13,680 37,870 818 1,181 Solis Peachtree Corners Peachtree Corners, GA Multifamily 249 units NA 3Q25(2) 4Q27 15%(5) 10,044 28,440 530 855 Total Outstanding Investments $73,140 $115,727 $8,256 $3,919 (1) Each investment is in the form of preferred equity with economic terms and accounting consistent with a loan receivable. (2) Represents estimates that may change as the development process proceeds. (3) Excludes accrued unused commitment fee. (4) Includes amortization of fees and unused commitment fees. (5) The interest rate varies over the life of the loan and earns an unused commitment fee. (6) The interest rate varies over the life of the loan.

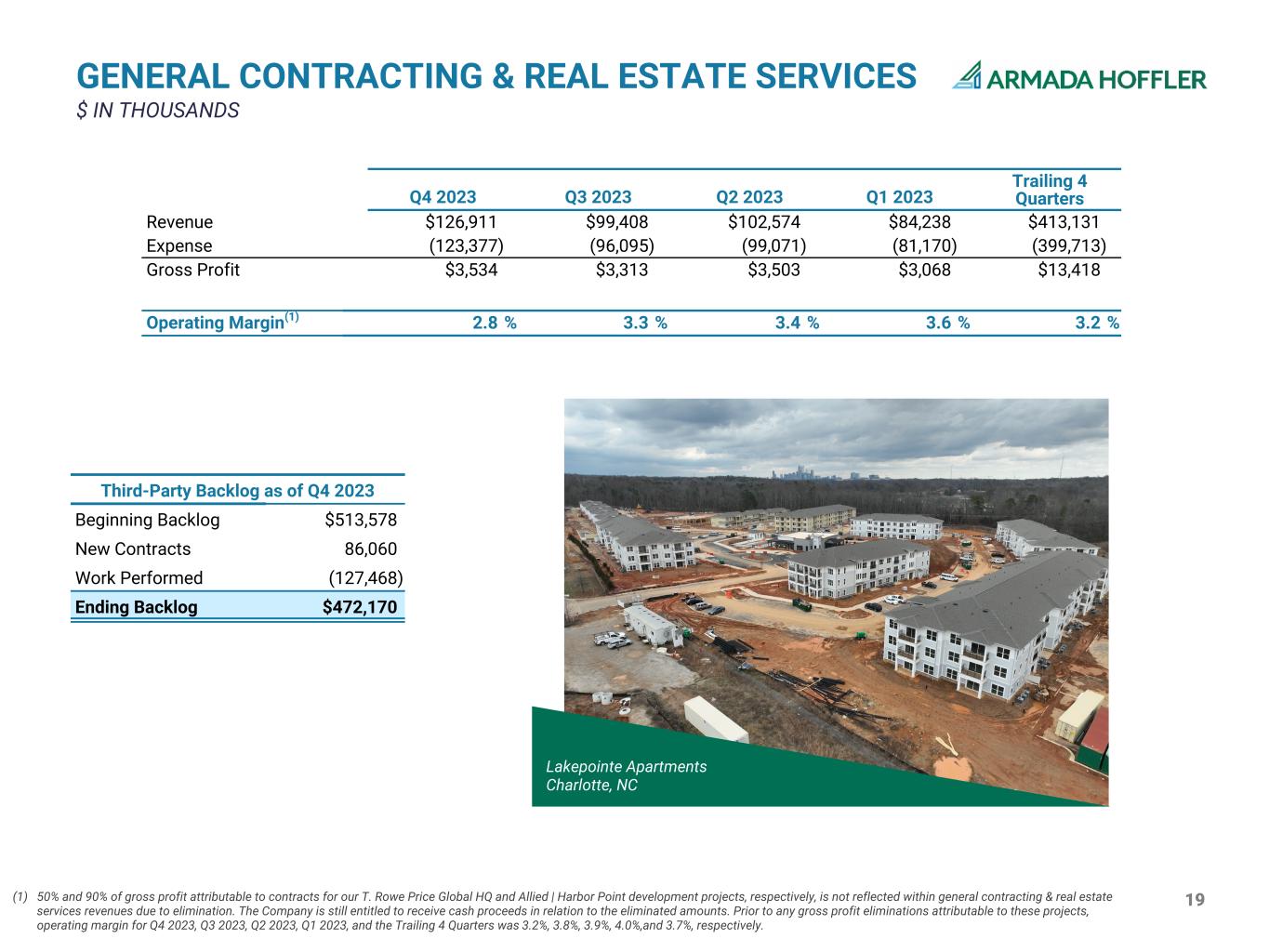

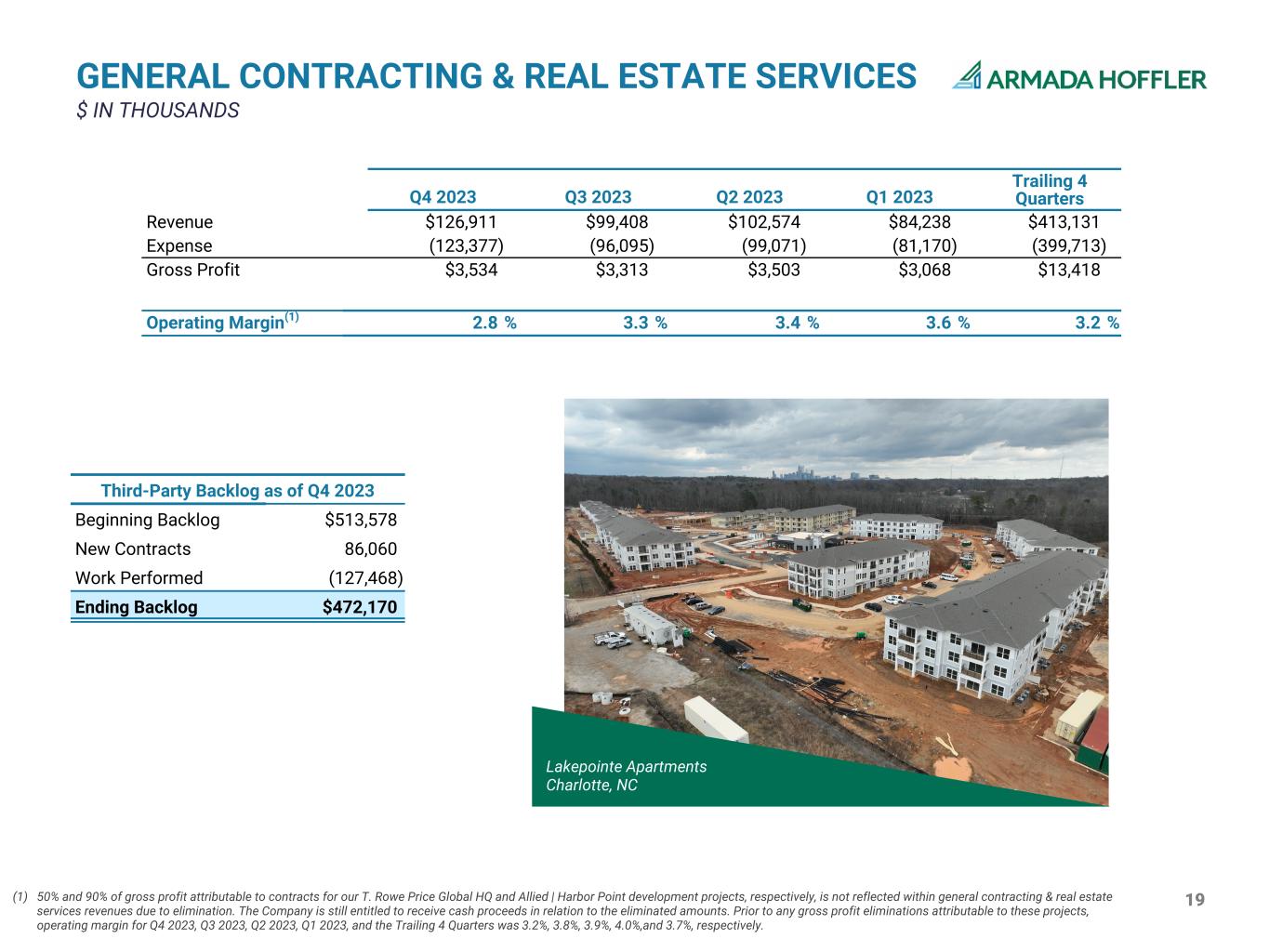

19 GENERAL CONTRACTING & REAL ESTATE SERVICES $ IN THOUSANDS Lakepointe Apartments Charlotte, NC Third-Party Backlog as of Q4 2023 Beginning Backlog $513,578 New Contracts 86,060 Work Performed (127,468) Ending Backlog $472,170 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Trailing 4 Quarters Revenue $126,911 $99,408 $102,574 $84,238 $413,131 Expense (123,377) (96,095) (99,071) (81,170) (399,713) Gross Profit $3,534 $3,313 $3,503 $3,068 $13,418 Operating Margin(1) 2.8 % 3.3 % 3.4 % 3.6 % 3.2 % (1) 50% and 90% of gross profit attributable to contracts for our T. Rowe Price Global HQ and Allied | Harbor Point development projects, respectively, is not reflected within general contracting & real estate services revenues due to elimination. The Company is still entitled to receive cash proceeds in relation to the eliminated amounts. Prior to any gross profit eliminations attributable to these projects, operating margin for Q4 2023, Q3 2023, Q2 2023, Q1 2023, and the Trailing 4 Quarters was 3.2%, 3.8%, 3.9%, 4.0%,and 3.7%, respectively.

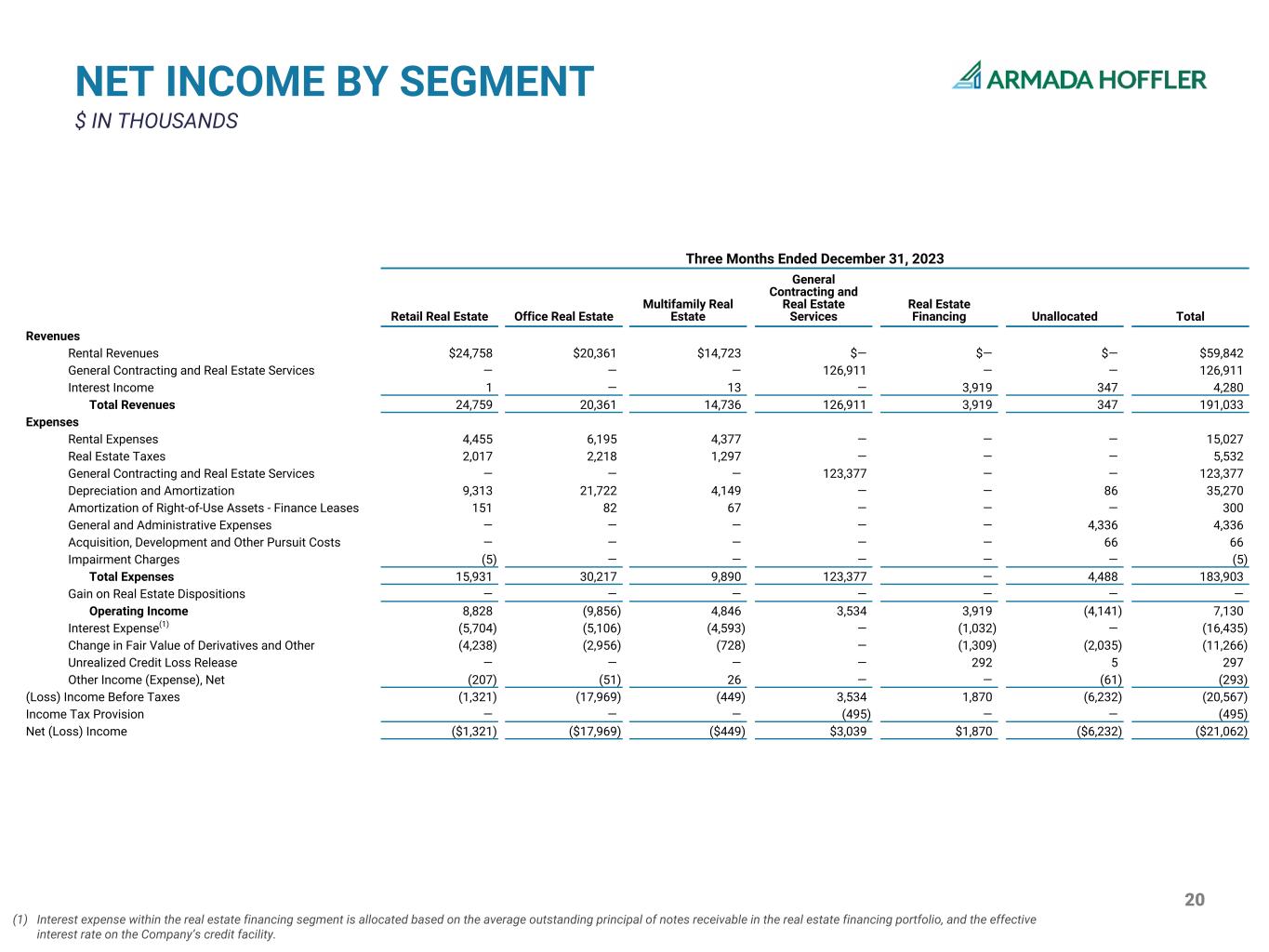

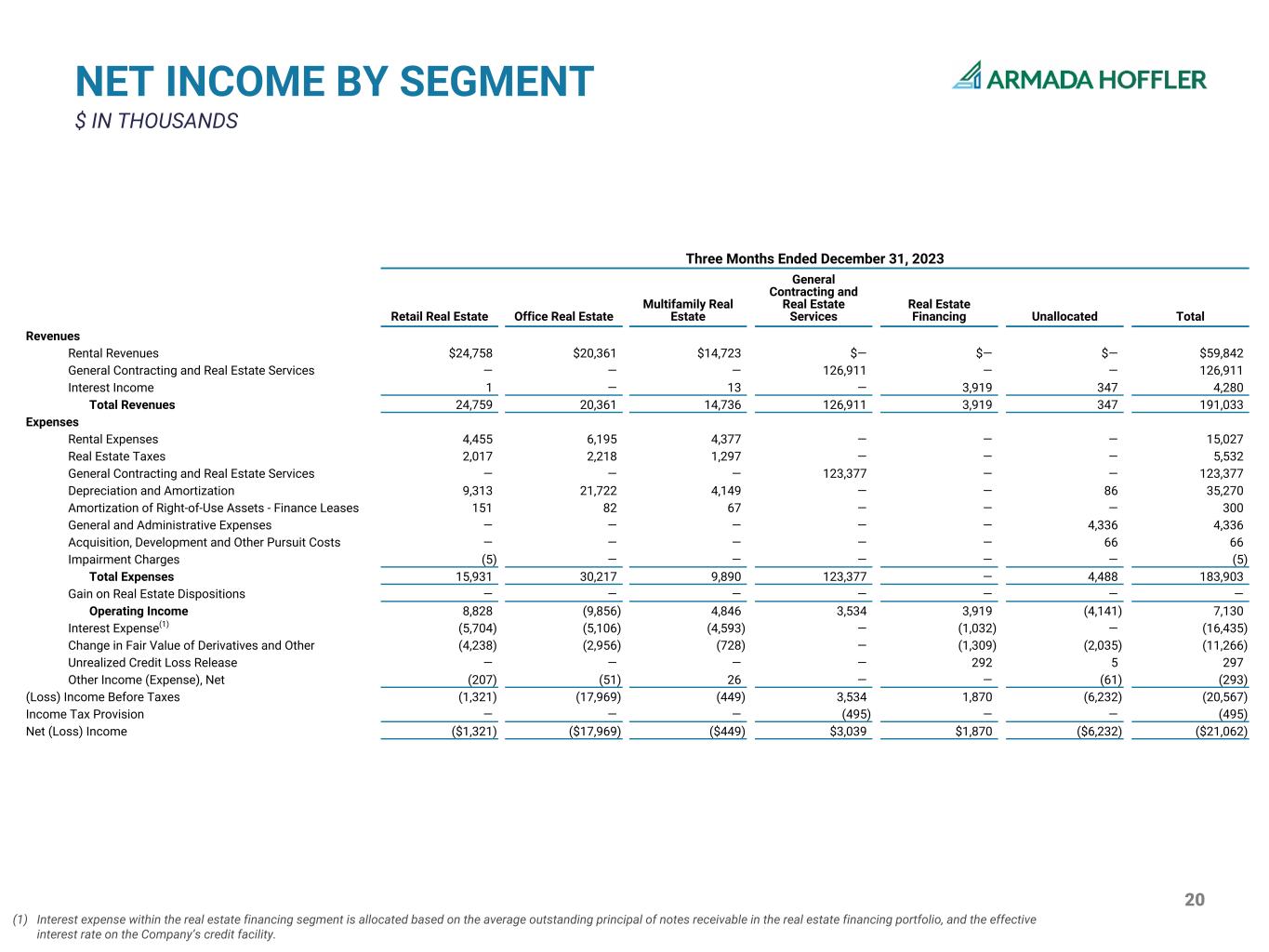

20 NET INCOME BY SEGMENT $ IN THOUSANDS Three Months Ended December 31, 2023 Retail Real Estate Office Real Estate Multifamily Real Estate General Contracting and Real Estate Services Real Estate Financing Unallocated Total Revenues Rental Revenues $24,758 $20,361 $14,723 $— $— $— $59,842 General Contracting and Real Estate Services Revenues — — — 126,911 — — 126,911 Interest Income 1 — 13 — 3,919 347 4,280 Total Revenues 24,759 20,361 14,736 126,911 3,919 347 191,033 Expenses Rental Expenses 4,455 6,195 4,377 — — — 15,027 Real Estate Taxes 2,017 2,218 1,297 — — — 5,532 General Contracting and Real Estate Services Expenses — — — 123,377 — — 123,377 Depreciation and Amortization 9,313 21,722 4,149 — — 86 35,270 Amortization of Right-of-Use Assets - Finance Leases 151 82 67 — — — 300 General and Administrative Expenses — — — — — 4,336 4,336 Acquisition, Development and Other Pursuit Costs — — — — — 66 66 Impairment Charges (5) — — — — — (5) Total Expenses 15,931 30,217 9,890 123,377 — 4,488 183,903 Gain on Real Estate Dispositions — — — — — — — Operating Income 8,828 (9,856) 4,846 3,534 3,919 (4,141) 7,130 Interest Expense(1) (5,704) (5,106) (4,593) — (1,032) — (16,435) Change in Fair Value of Derivatives and Other (4,238) (2,956) (728) — (1,309) (2,035) (11,266) Unrealized Credit Loss Release — — — — 292 5 297 Other Income (Expense), Net (207) (51) 26 — — (61) (293) (Loss) Income Before Taxes (1,321) (17,969) (449) 3,534 1,870 (6,232) (20,567) Income Tax Provision — — — (495) — — (495) Net (Loss) Income ($1,321) ($17,969) ($449) $3,039 $1,870 ($6,232) ($21,062) (1) Interest expense within the real estate financing segment is allocated based on the average outstanding principal of notes receivable in the real estate financing portfolio, and the effective interest rate on the Company’s credit facility.

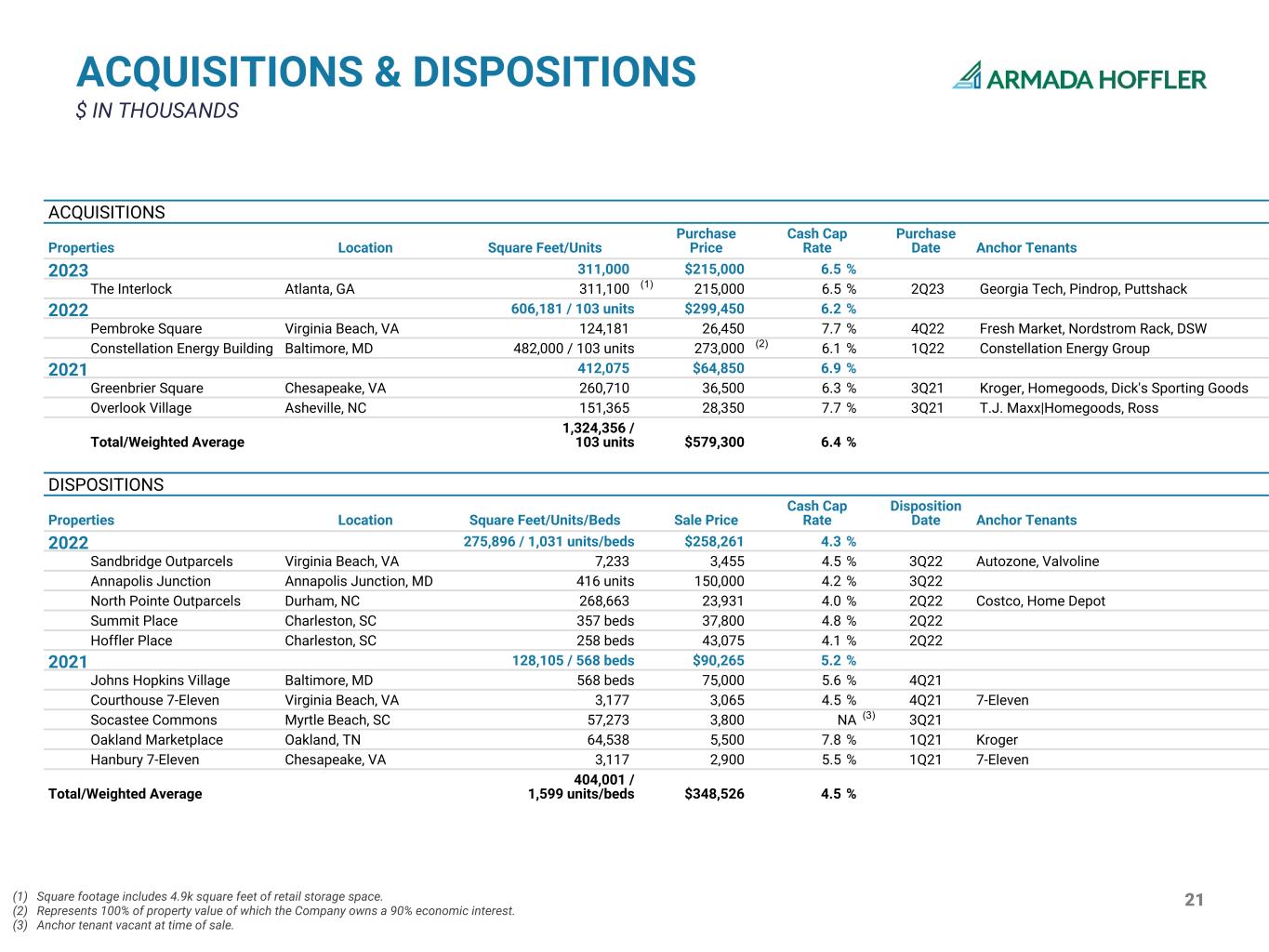

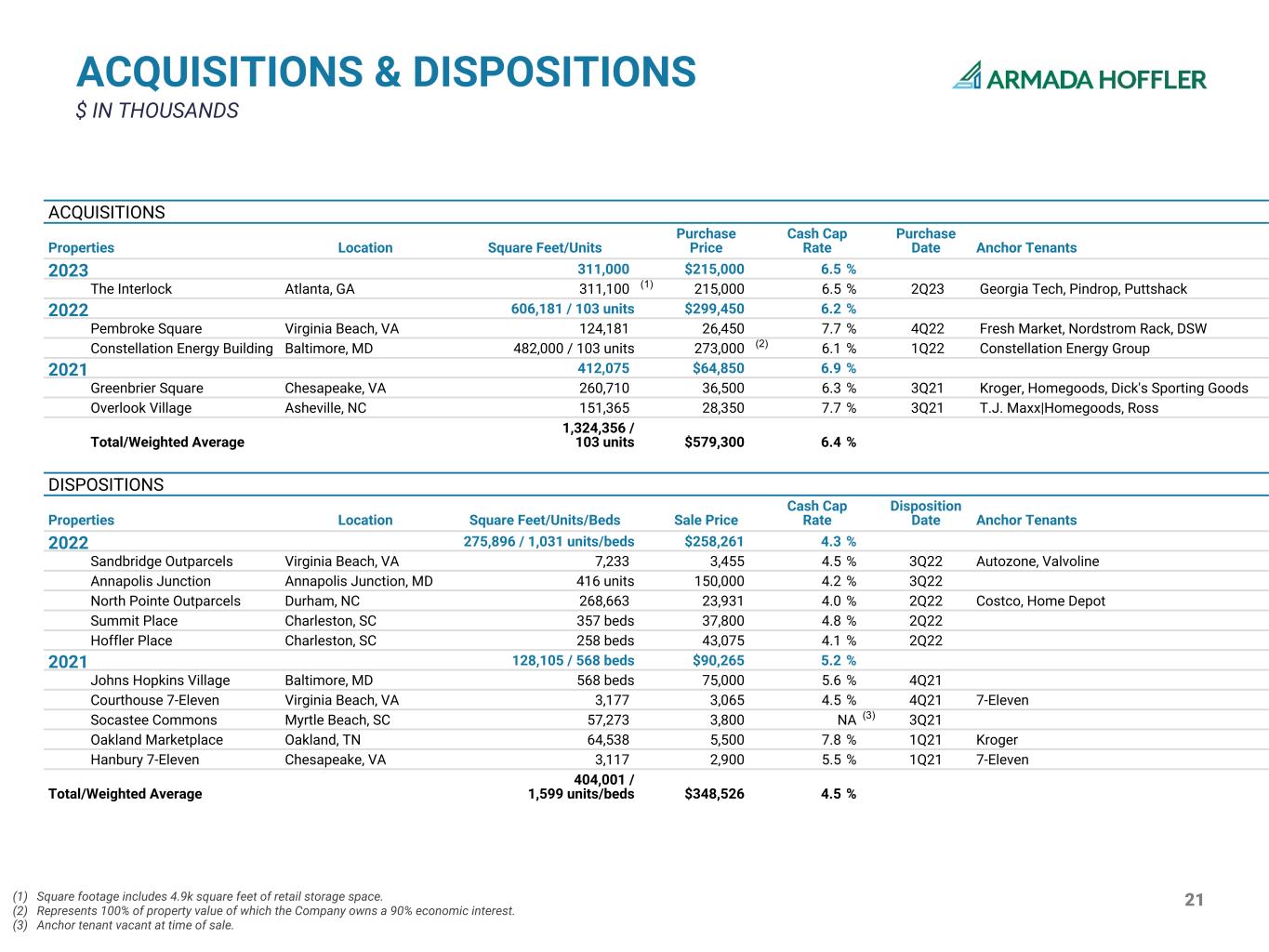

21 ACQUISITIONS & DISPOSITIONS $ IN THOUSANDS ACQUISITIONS Properties Location Square Feet/Units Purchase Price Cash Cap Rate Purchase Date Anchor Tenants 2023 311,000 $215,000 6.5 % The Interlock Atlanta, GA 311,100 (1) 215,000 6.5 % 2Q23 Georgia Tech, Pindrop, Puttshack 2022 606,181 / 103 units $299,450 6.2 % Pembroke Square Virginia Beach, VA 124,181 26,450 7.7 % 4Q22 Fresh Market, Nordstrom Rack, DSW Constellation Energy Building Baltimore, MD 482,000 / 103 units 273,000 (2) 6.1 % 1Q22 Constellation Energy Group 2021 412,075 $64,850 6.9 % Greenbrier Square Chesapeake, VA 260,710 36,500 6.3 % 3Q21 Kroger, Homegoods, Dick's Sporting Goods Overlook Village Asheville, NC 151,365 28,350 7.7 % 3Q21 T.J. Maxx|Homegoods, Ross Total/Weighted Average 1,324,356 / 103 units $579,300 6.4 % DISPOSITIONS Properties Location Square Feet/Units/Beds Sale Price Cash Cap Rate Disposition Date Anchor Tenants 2022 275,896 / 1,031 units/beds $258,261 4.3 % Sandbridge Outparcels Virginia Beach, VA 7,233 3,455 4.5 % 3Q22 Autozone, Valvoline Annapolis Junction Annapolis Junction, MD 416 units 150,000 4.2 % 3Q22 North Pointe Outparcels Durham, NC 268,663 23,931 4.0 % 2Q22 Costco, Home Depot Summit Place Charleston, SC 357 beds 37,800 4.8 % 2Q22 Hoffler Place Charleston, SC 258 beds 43,075 4.1 % 2Q22 2021 128,105 / 568 beds $90,265 5.2 % Johns Hopkins Village Baltimore, MD 568 beds 75,000 5.6 % 4Q21 Courthouse 7-Eleven Virginia Beach, VA 3,177 3,065 4.5 % 4Q21 7-Eleven Socastee Commons Myrtle Beach, SC 57,273 3,800 NA (3) 3Q21 Oakland Marketplace Oakland, TN 64,538 5,500 7.8 % 1Q21 Kroger Hanbury 7-Eleven Chesapeake, VA 3,117 2,900 5.5 % 1Q21 7-Eleven Total/Weighted Average 404,001 / 1,599 units/beds $348,526 4.5 % (1) Square footage includes 4.9k square feet of retail storage space. (2) Represents 100% of property value of which the Company owns a 90% economic interest. (3) Anchor tenant vacant at time of sale.

22 TOP 20 TENANTS BY ABR(1) $ IN THOUSANDS AS OF DECEMBER 31, 2023 Commercial Portfolio Tenant Investment Grade Rating(2) Number of Leases Lease Expiration Annualized Base Rent % of Total Annualized Base Rent Constellation Energy Generation ü 1 2036 $15,010 7.5% Morgan Stanley ü 3 2028 - 2035 8,733 4.3% Harris Teeter/Kroger ü 6 2026 - 2035 3,781 1.9% WeWork(3) 2 2023 ; 2034 3,732 1.9% Canopy by Hilton 1 2045 3,171 1.6% Clark Nexsen 1 2029 2,857 1.4% Lowes Foods 2 2037 ; 2039 1,976 1.0% Franklin Templeton ü 1 2038 1,861 0.9% Duke University ü 1 2029 1,700 0.8% Huntington Ingalls Industries ü 1 2029 1,638 0.8% Dick's Sporting Goods ü 1 2032 1,553 0.8% TJ Maxx/Homegoods ü 5 2025 - 2029 1,531 0.8% PetSmart 5 2025 - 2027 1,527 0.8% Georgia Tech ü 1 2031 1,418 0.7% Mythics 1 2030 1,285 0.6% Puttshack 1 2036 1,203 0.6% Amazon/Whole Foods ü 1 2040 1,144 0.6% Pindrop 1 2027 1,137 0.6% Apex Entertainment 1 2035 1,134 0.6% Kimley-Horn 1 2027 1,123 0.6% Top 20 Total $57,514 28.8% (1) Excludes leases from the development and redevelopment properties that have been delivered, but not yet stabilized. (2) Per public sources. (3) Tenant vacated The Interlock subsequent to Q4 2023. Removing this lease, the ABR would be ~$2.2M, which represents 1.1% of total annualized base rent.

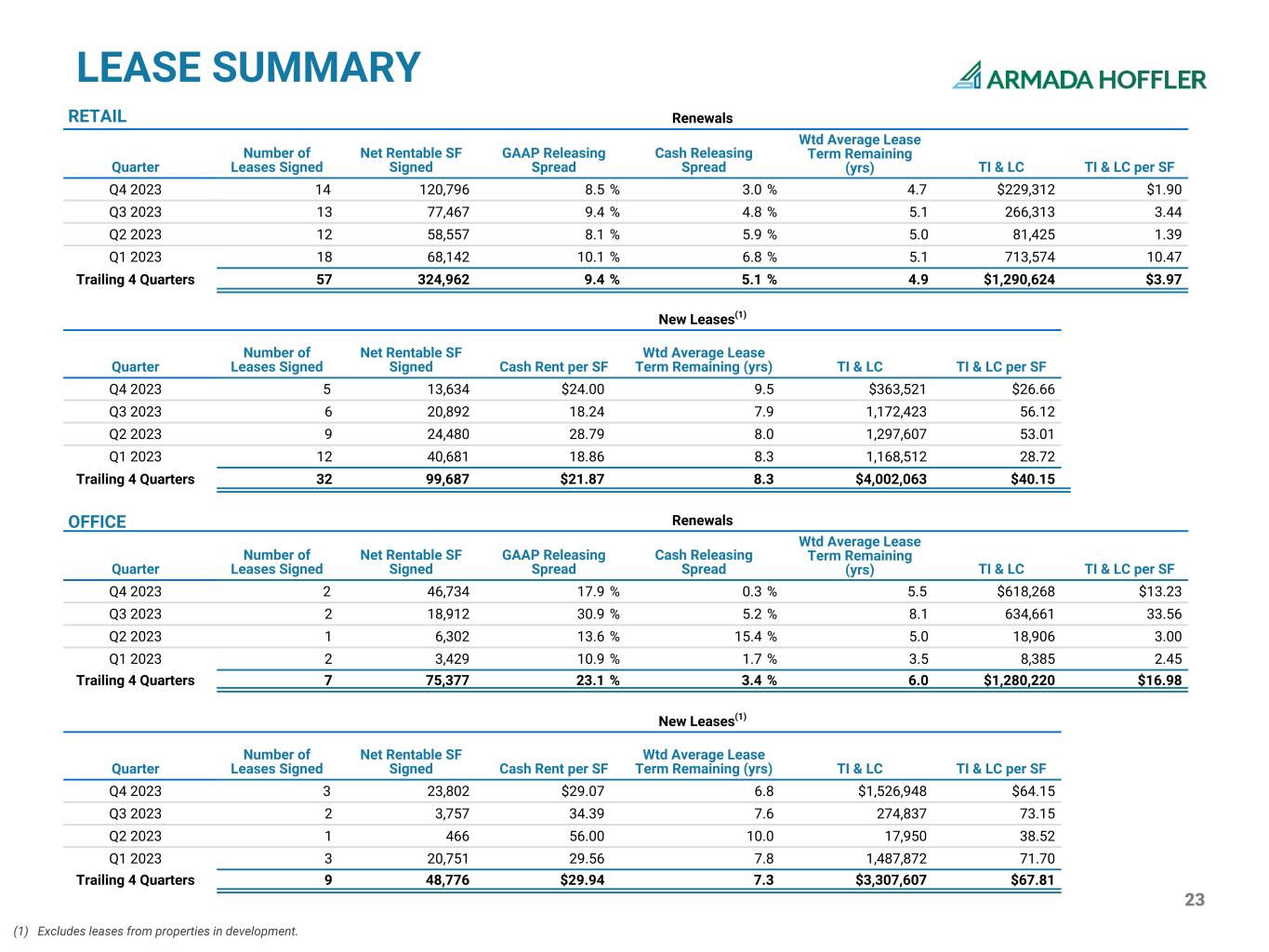

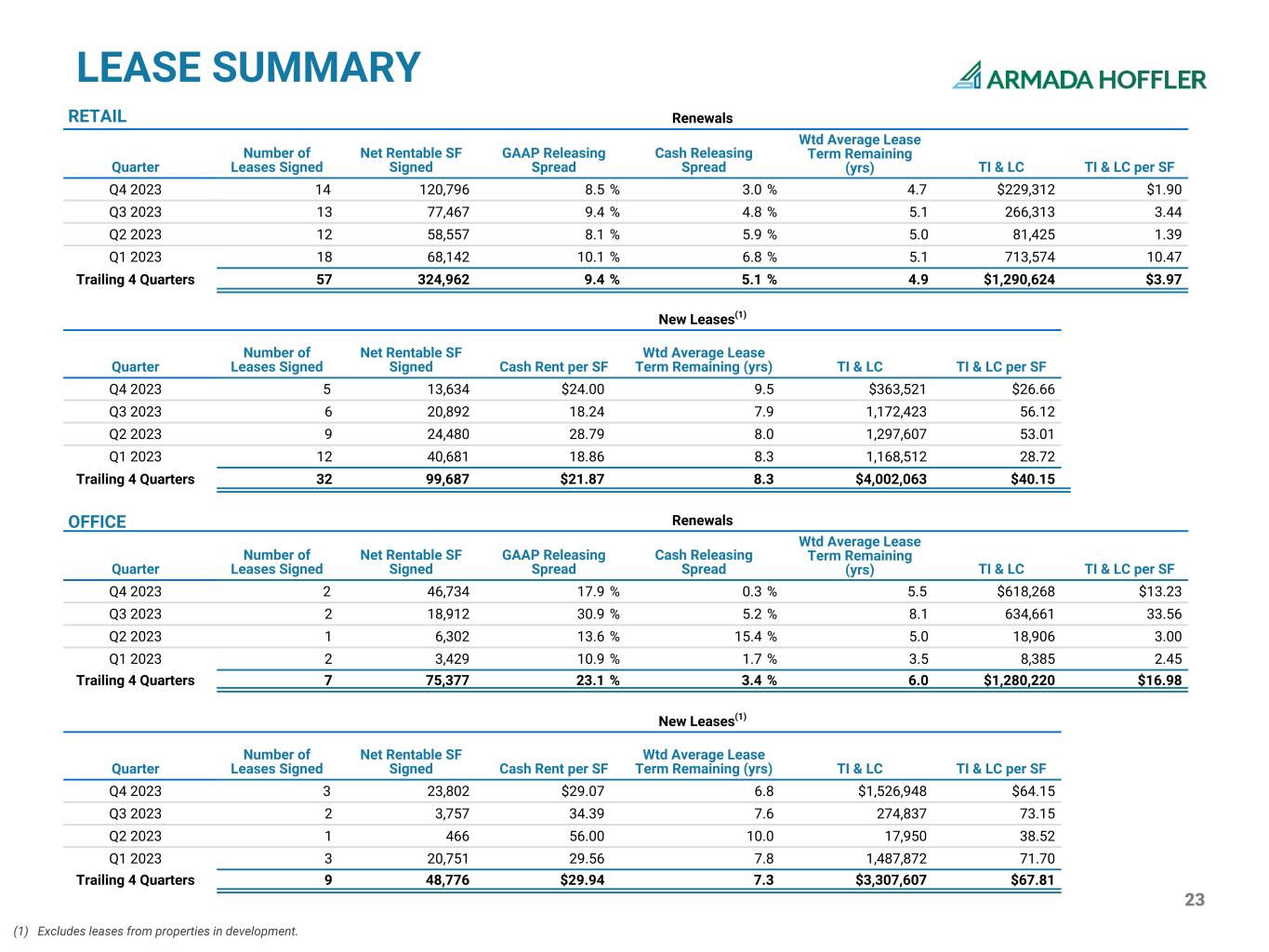

23 LEASE SUMMARY (1) Excludes leases from properties in development. RETAIL Renewals Quarter Number of Leases Signed Net Rentable SF Signed GAAP Releasing Spread Cash Releasing Spread Wtd Average Lease Term Remaining (yrs) TI & LC TI & LC per SF Q4 2023 14 120,796 8.5 % 3.0 % 4.7 $229,312 $1.90 Q3 2023 13 77,467 9.4 % 4.8 % 5.1 266,313 3.44 Q2 2023 12 58,557 8.1 % 5.9 % 5.0 81,425 1.39 Q1 2023 18 68,142 10.1 % 6.8 % 5.1 713,574 10.47 Trailing 4 Quarters 57 324,962 9.4 % 5.1 % 4.9 $1,290,624 $3.97 New Leases(1) Quarter Number of Leases Signed Net Rentable SF Signed Cash Rent per SF Wtd Average Lease Term Remaining (yrs) TI & LC TI & LC per SF Q4 2023 5 13,634 $24.00 9.5 $363,521 $26.66 Q3 2023 6 20,892 18.24 7.9 1,172,423 56.12 Q2 2023 9 24,480 28.79 8.0 1,297,607 53.01 Q1 2023 12 40,681 18.86 8.3 1,168,512 28.72 Trailing 4 Quarters 32 99,687 $21.87 8.3 $4,002,063 $40.15 OFFICE Renewals Quarter Number of Leases Signed Net Rentable SF Signed GAAP Releasing Spread Cash Releasing Spread Wtd Average Lease Term Remaining (yrs) TI & LC TI & LC per SF Q4 2023 2 46,734 17.9 % 0.3 % 5.5 $618,268 $13.23 Q3 2023 2 18,912 30.9 % 5.2 % 8.1 634,661 33.56 Q2 2023 1 6,302 13.6 % 15.4 % 5.0 18,906 3.00 Q1 2023 2 3,429 10.9 % 1.7 % 3.5 8,385 2.45 Trailing 4 Quarters 7 75,377 23.1 % 3.4 % 6.0 $1,280,220 $16.98 New Leases(1) Quarter Number of Leases Signed Net Rentable SF Signed Cash Rent per SF Wtd Average Lease Term Remaining (yrs) TI & LC TI & LC per SF Q4 2023 3 23,802 $29.07 6.8 $1,526,948 $64.15 Q3 2023 2 3,757 34.39 7.6 274,837 73.15 Q2 2023 1 466 56.00 10.0 17,950 38.52 Q1 2023 3 20,751 29.56 7.8 1,487,872 71.70 Trailing 4 Quarters 9 48,776 $29.94 7.3 $3,307,607 $67.81

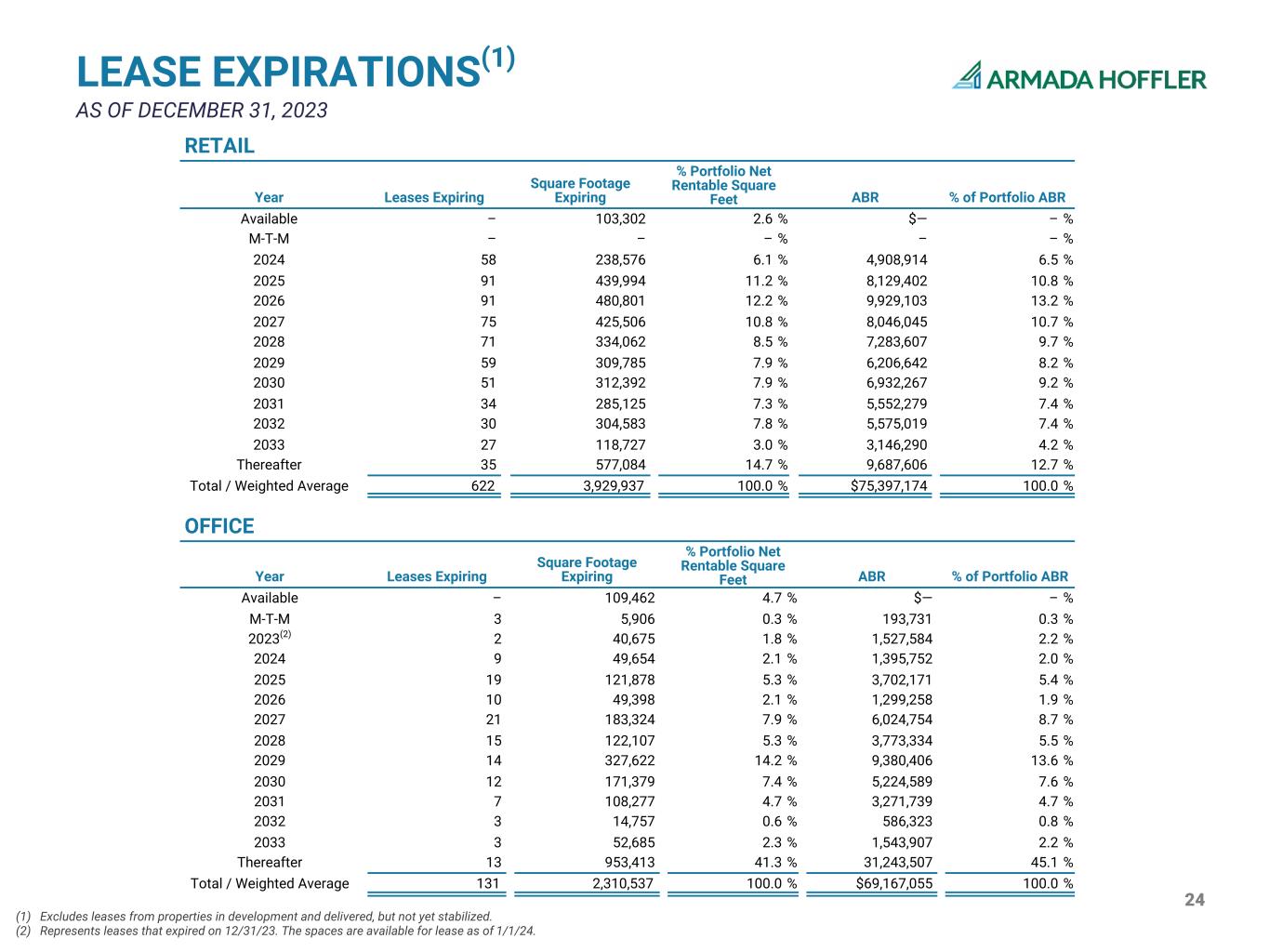

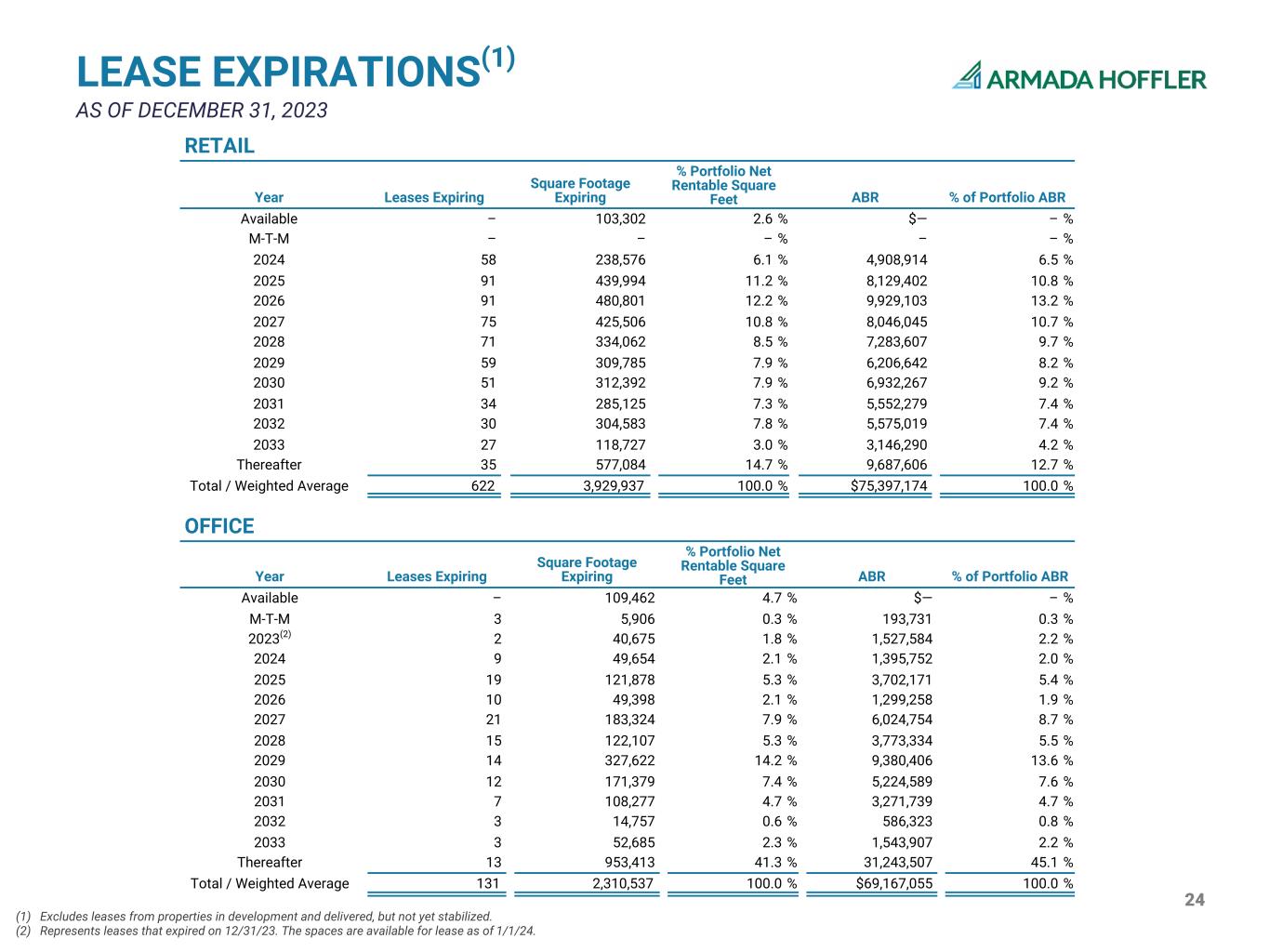

24 LEASE EXPIRATIONS(1) AS OF DECEMBER 31, 2023 (1) Excludes leases from properties in development and delivered, but not yet stabilized. (2) Represents leases that expired on 12/31/23. The spaces are available for lease as of 1/1/24. OFFICE Year Leases Expiring Square Footage Expiring % Portfolio Net Rentable Square Feet ABR % of Portfolio ABR Available – 109,462 4.7 % $— – % M-T-M 3 5,906 0.3 % 193,731 0.3 % 2023(2) 2 40,675 1.8 % 1,527,584 2.2 % 2024 9 49,654 2.1 % 1,395,752 2.0 % 2025 19 121,878 5.3 % 3,702,171 5.4 % 2026 10 49,398 2.1 % 1,299,258 1.9 % 2027 21 183,324 7.9 % 6,024,754 8.7 % 2028 15 122,107 5.3 % 3,773,334 5.5 % 2029 14 327,622 14.2 % 9,380,406 13.6 % 2030 12 171,379 7.4 % 5,224,589 7.6 % 2031 7 108,277 4.7 % 3,271,739 4.7 % 2032 3 14,757 0.6 % 586,323 0.8 % 2033 3 52,685 2.3 % 1,543,907 2.2 % Thereafter 13 953,413 41.3 % 31,243,507 45.1 % Total / Weighted Average 131 2,310,537 100.0 % $69,167,055 100.0 % RETAIL Year Leases Expiring Square Footage Expiring % Portfolio Net Rentable Square Feet ABR % of Portfolio ABR Available – 103,302 2.6 % $— – % M-T-M – – – % – – % 2024 58 238,576 6.1 % 4,908,914 6.5 % 2025 91 439,994 11.2 % 8,129,402 10.8 % 2026 91 480,801 12.2 % 9,929,103 13.2 % 2027 75 425,506 10.8 % 8,046,045 10.7 % 2028 71 334,062 8.5 % 7,283,607 9.7 % 2029 59 309,785 7.9 % 6,206,642 8.2 % 2030 51 312,392 7.9 % 6,932,267 9.2 % 2031 34 285,125 7.3 % 5,552,279 7.4 % 2032 30 304,583 7.8 % 5,575,019 7.4 % 2033 27 118,727 3.0 % 3,146,290 4.2 % Thereafter 35 577,084 14.7 % 9,687,606 12.7 % Total / Weighted Average 622 3,929,937 100.0 % $75,397,174 100.0 %

25Town Center of Virginia Beach Virginia Beach, VA APPENDIX DEFINITIONS & RECONCILIATIONS

26 ANNUALIZED BASE RENT: For the properties in our retail & office portfolios, we calculate annualized base rent (“ABR”) by multiplying (a) monthly base rent (defined as cash base rent, before contractual tenant concessions and abatements, and excluding tenant reimbursements for expenses paid by us) as of December 31, 2023, for in-place leases as of such date by (b) 12, and do not give effect to periodic contractual rent increases or contingent rental revenue (e.g., percentage rent based on tenant sales thresholds). ABR per leased square foot is calculated by dividing (a) ABR by (b) square footage under in-place leases as of December 31, 2023. In the case of triple net or modified gross leases, our calculation of ABR does not include tenant reimbursements for real estate taxes, insurance, common area, or other operating expenses. DEFINITIONS ADJUSTED FUNDS FROM OPERATIONS: We calculate Adjusted Funds From Operations (“AFFO”) as Normalized FFO adjusted for the impact of non-cash stock compensation, tenant improvement, leasing commission, and leasing incentive costs associated with second generation rental space, capital expenditures, non-cash interest expense, straight-line rents, cash ground rent payments for finance leases, the amortization of leasing incentives and above (below) market rents, and proceeds from government development grants, and payments made to purchase interest rate caps designated as cash flow hedges. Management believes that AFFO provides useful supplemental information to investors regarding our operating performance as it provides a consistent comparison of our operating performance across time periods and allows investors to more easily compare our operating results with other REITs. However, other REITs may use different methodologies for calculating AFFO or similarly entitled FFO measures and, accordingly, our AFFO may not always be comparable to AFFO or other similarly entitled FFO measures of other REITs. ANNUALIZED QUARTERLY RENT: For the properties in our multifamily portfolio, we calculate annualized quarterly rent (“AQR”) by multiplying (a) revenue for the quarter, by (b) 4.

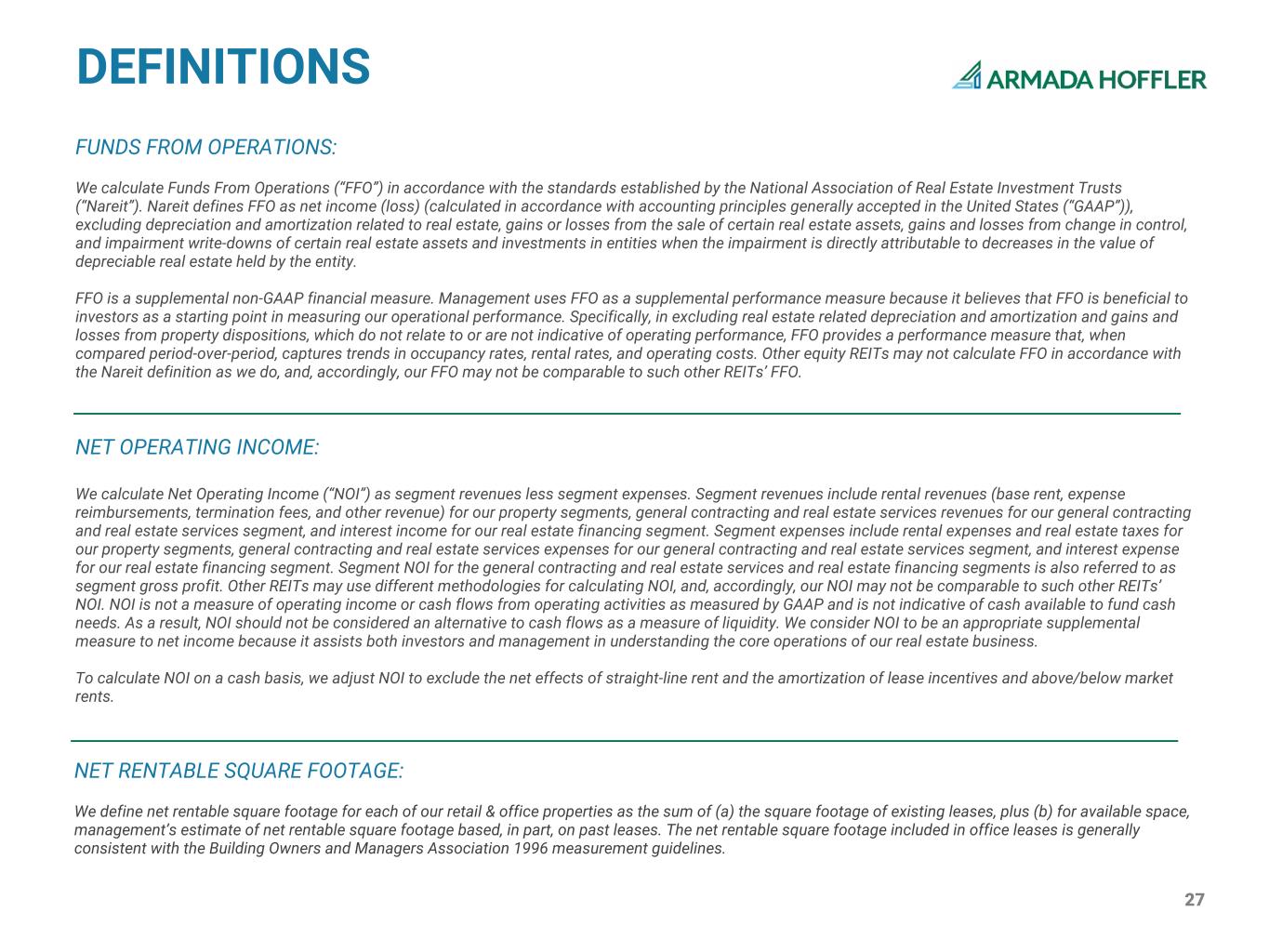

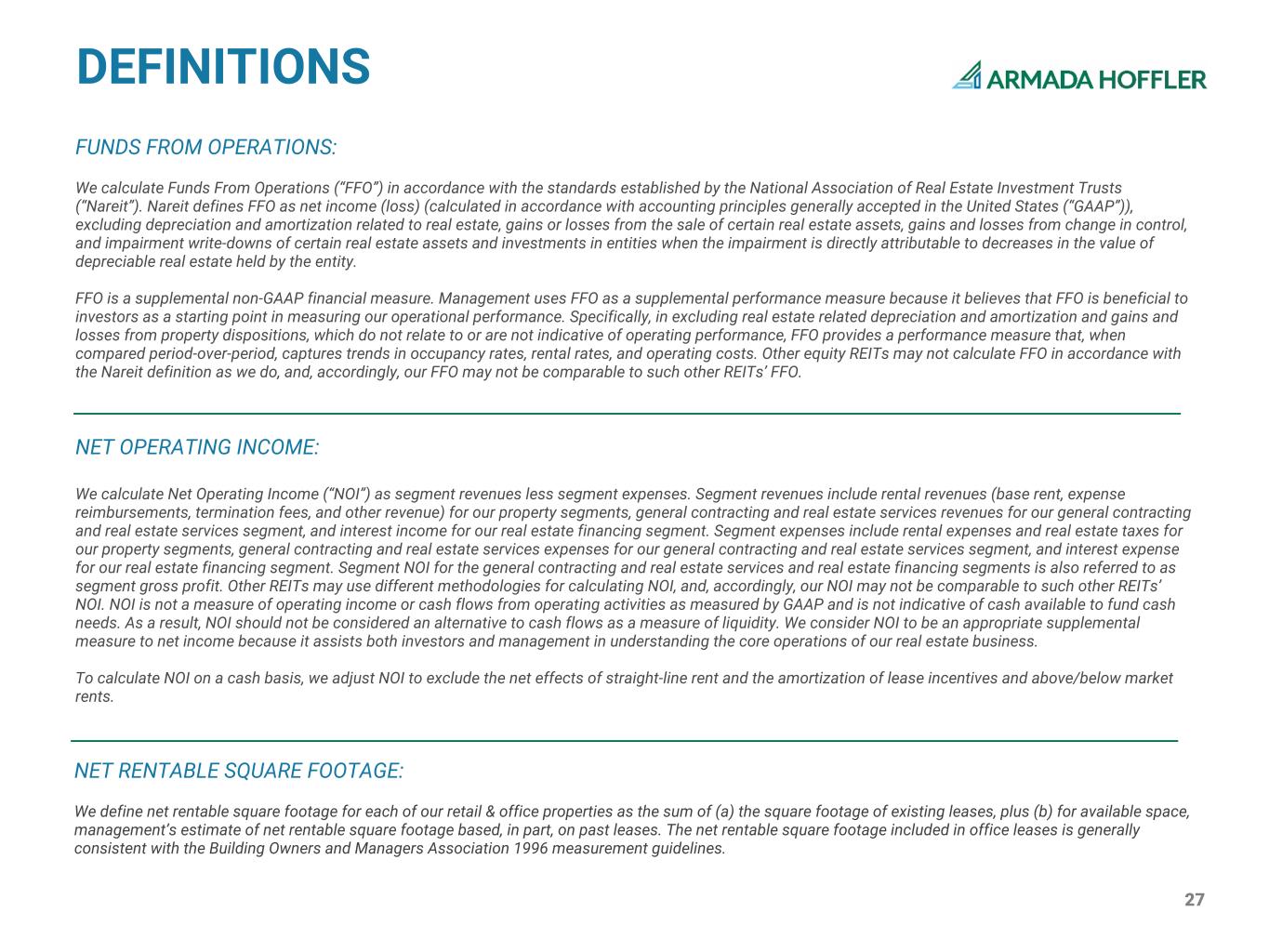

27 NET OPERATING INCOME: We calculate Net Operating Income (“NOI”) as segment revenues less segment expenses. Segment revenues include rental revenues (base rent, expense reimbursements, termination fees, and other revenue) for our property segments, general contracting and real estate services revenues for our general contracting and real estate services segment, and interest income for our real estate financing segment. Segment expenses include rental expenses and real estate taxes for our property segments, general contracting and real estate services expenses for our general contracting and real estate services segment, and interest expense for our real estate financing segment. Segment NOI for the general contracting and real estate services and real estate financing segments is also referred to as segment gross profit. Other REITs may use different methodologies for calculating NOI, and, accordingly, our NOI may not be comparable to such other REITs’ NOI. NOI is not a measure of operating income or cash flows from operating activities as measured by GAAP and is not indicative of cash available to fund cash needs. As a result, NOI should not be considered an alternative to cash flows as a measure of liquidity. We consider NOI to be an appropriate supplemental measure to net income because it assists both investors and management in understanding the core operations of our real estate business. To calculate NOI on a cash basis, we adjust NOI to exclude the net effects of straight-line rent and the amortization of lease incentives and above/below market rents. DEFINITIONS FUNDS FROM OPERATIONS: We calculate Funds From Operations (“FFO”) in accordance with the standards established by the National Association of Real Estate Investment Trusts (“Nareit”). Nareit defines FFO as net income (loss) (calculated in accordance with accounting principles generally accepted in the United States (“GAAP”)), excluding depreciation and amortization related to real estate, gains or losses from the sale of certain real estate assets, gains and losses from change in control, and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. FFO is a supplemental non-GAAP financial measure. Management uses FFO as a supplemental performance measure because it believes that FFO is beneficial to investors as a starting point in measuring our operational performance. Specifically, in excluding real estate related depreciation and amortization and gains and losses from property dispositions, which do not relate to or are not indicative of operating performance, FFO provides a performance measure that, when compared period-over-period, captures trends in occupancy rates, rental rates, and operating costs. Other equity REITs may not calculate FFO in accordance with the Nareit definition as we do, and, accordingly, our FFO may not be comparable to such other REITs’ FFO. NET RENTABLE SQUARE FOOTAGE: We define net rentable square footage for each of our retail & office properties as the sum of (a) the square footage of existing leases, plus (b) for available space, management’s estimate of net rentable square footage based, in part, on past leases. The net rentable square footage included in office leases is generally consistent with the Building Owners and Managers Association 1996 measurement guidelines.

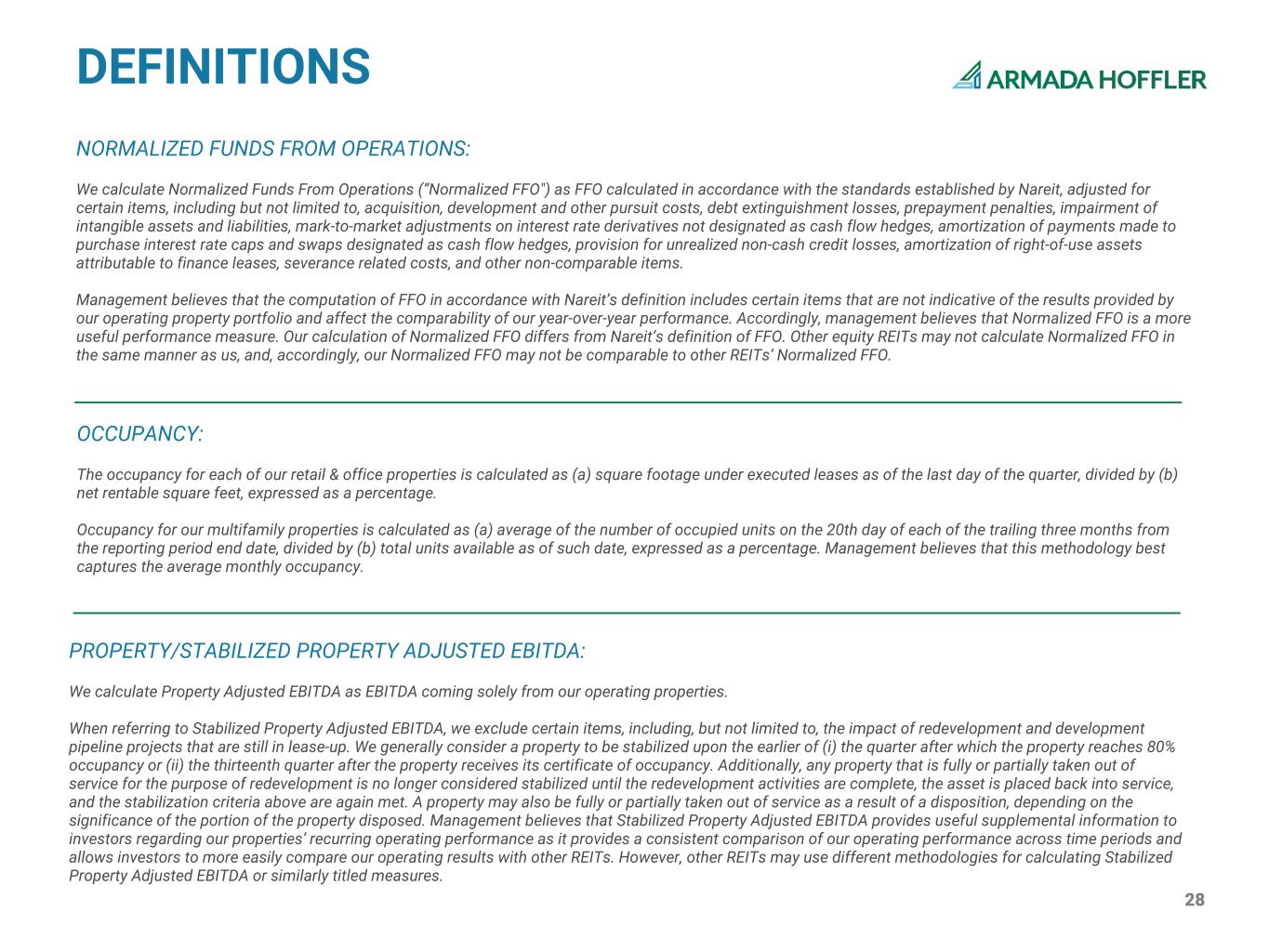

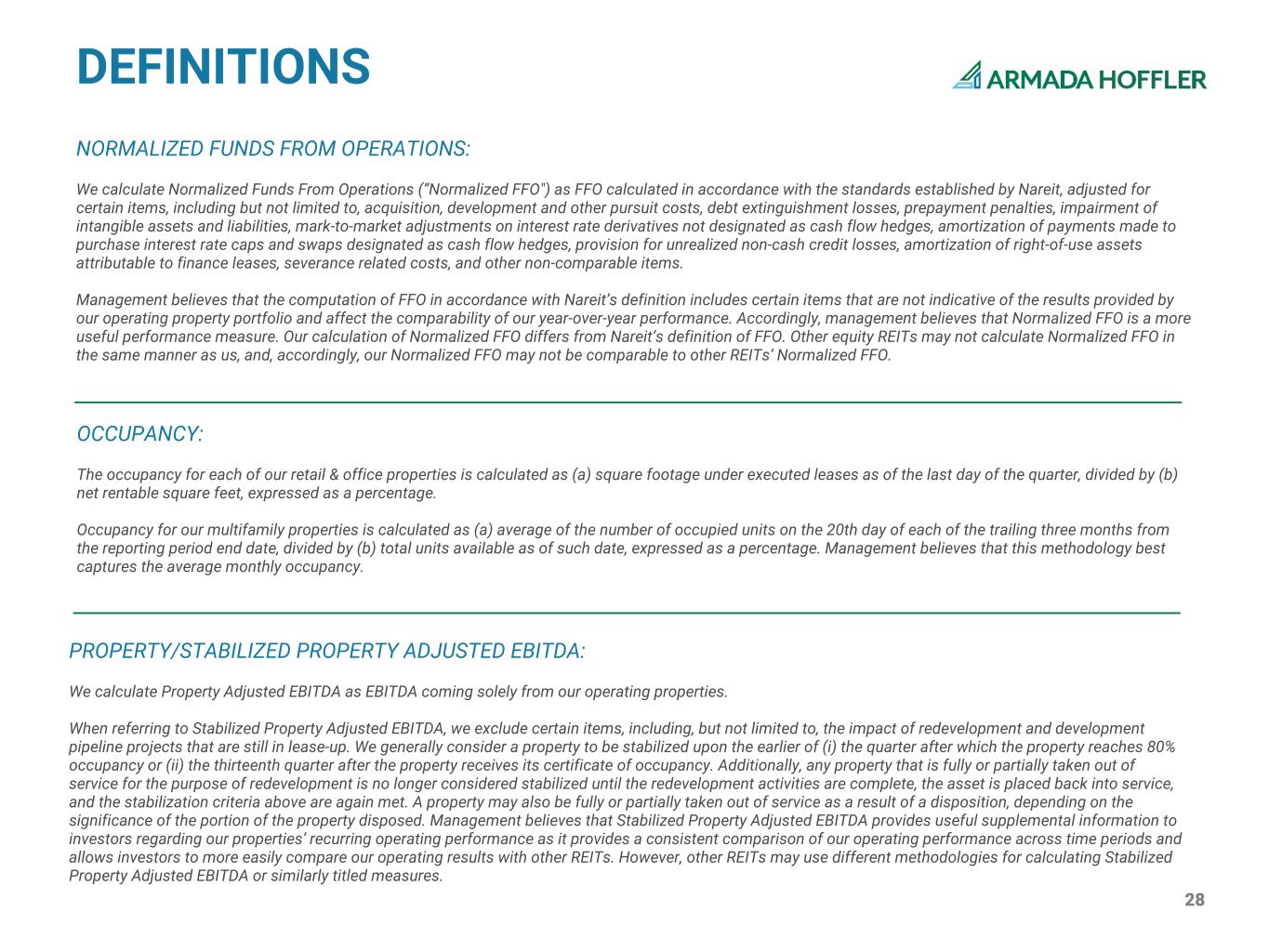

28 DEFINITIONS OCCUPANCY: The occupancy for each of our retail & office properties is calculated as (a) square footage under executed leases as of the last day of the quarter, divided by (b) net rentable square feet, expressed as a percentage. Occupancy for our multifamily properties is calculated as (a) average of the number of occupied units on the 20th day of each of the trailing three months from the reporting period end date, divided by (b) total units available as of such date, expressed as a percentage. Management believes that this methodology best captures the average monthly occupancy. NORMALIZED FUNDS FROM OPERATIONS: We calculate Normalized Funds From Operations (“Normalized FFO") as FFO calculated in accordance with the standards established by Nareit, adjusted for certain items, including but not limited to, acquisition, development and other pursuit costs, debt extinguishment losses, prepayment penalties, impairment of intangible assets and liabilities, mark-to-market adjustments on interest rate derivatives not designated as cash flow hedges, amortization of payments made to purchase interest rate caps and swaps designated as cash flow hedges, provision for unrealized non-cash credit losses, amortization of right-of-use assets attributable to finance leases, severance related costs, and other non-comparable items. Management believes that the computation of FFO in accordance with Nareit’s definition includes certain items that are not indicative of the results provided by our operating property portfolio and affect the comparability of our year-over-year performance. Accordingly, management believes that Normalized FFO is a more useful performance measure. Our calculation of Normalized FFO differs from Nareit’s definition of FFO. Other equity REITs may not calculate Normalized FFO in the same manner as us, and, accordingly, our Normalized FFO may not be comparable to other REITs’ Normalized FFO. PROPERTY/STABILIZED PROPERTY ADJUSTED EBITDA: We calculate Property Adjusted EBITDA as EBITDA coming solely from our operating properties. When referring to Stabilized Property Adjusted EBITDA, we exclude certain items, including, but not limited to, the impact of redevelopment and development pipeline projects that are still in lease-up. We generally consider a property to be stabilized upon the earlier of (i) the quarter after which the property reaches 80% occupancy or (ii) the thirteenth quarter after the property receives its certificate of occupancy. Additionally, any property that is fully or partially taken out of service for the purpose of redevelopment is no longer considered stabilized until the redevelopment activities are complete, the asset is placed back into service, and the stabilization criteria above are again met. A property may also be fully or partially taken out of service as a result of a disposition, depending on the significance of the portion of the property disposed. Management believes that Stabilized Property Adjusted EBITDA provides useful supplemental information to investors regarding our properties’ recurring operating performance as it provides a consistent comparison of our operating performance across time periods and allows investors to more easily compare our operating results with other REITs. However, other REITs may use different methodologies for calculating Stabilized Property Adjusted EBITDA or similarly titled measures.

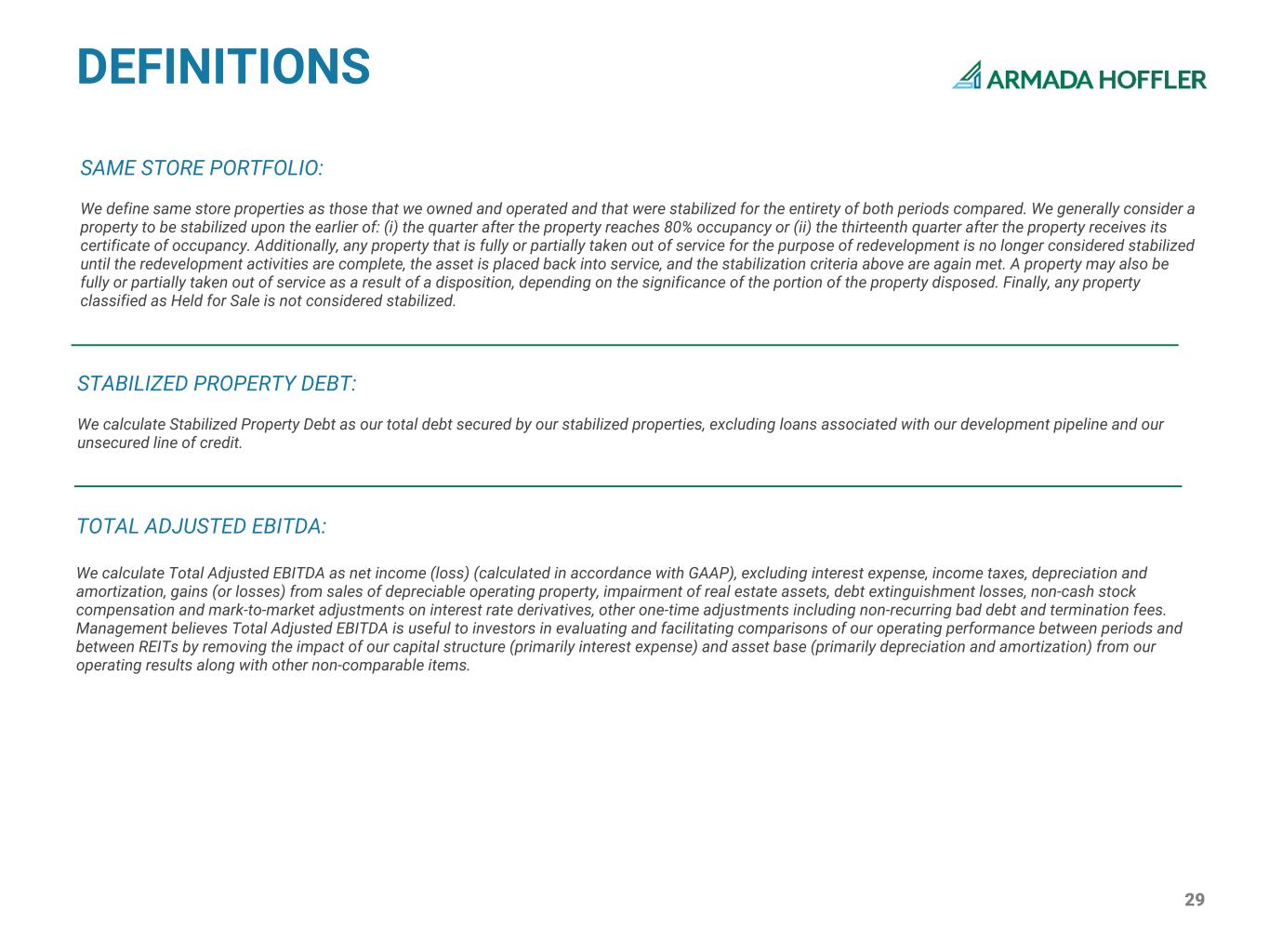

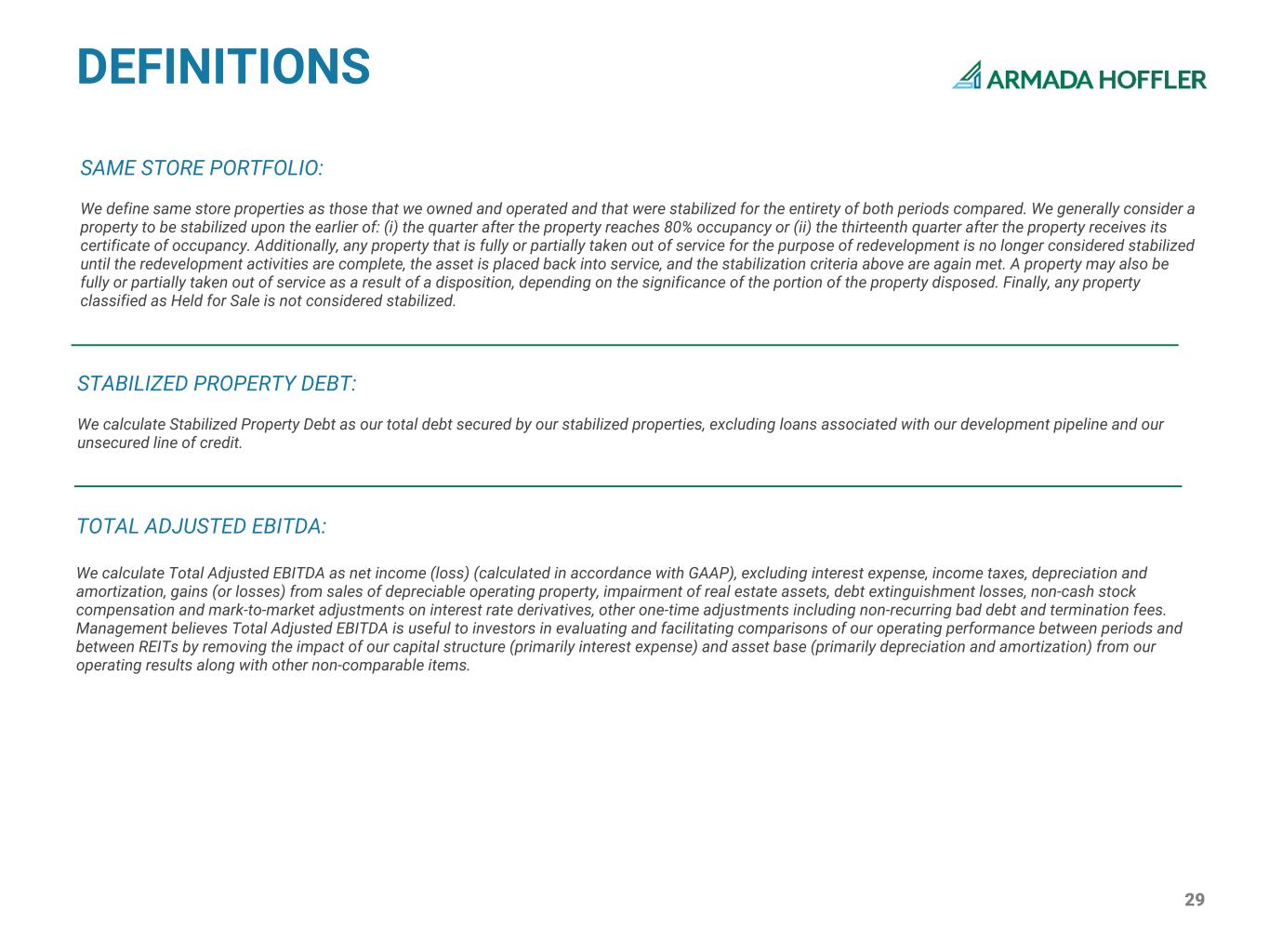

29 DEFINITIONS STABILIZED PROPERTY DEBT: We calculate Stabilized Property Debt as our total debt secured by our stabilized properties, excluding loans associated with our development pipeline and our unsecured line of credit. TOTAL ADJUSTED EBITDA: We calculate Total Adjusted EBITDA as net income (loss) (calculated in accordance with GAAP), excluding interest expense, income taxes, depreciation and amortization, gains (or losses) from sales of depreciable operating property, impairment of real estate assets, debt extinguishment losses, non-cash stock compensation and mark-to-market adjustments on interest rate derivatives, other one-time adjustments including non-recurring bad debt and termination fees. Management believes Total Adjusted EBITDA is useful to investors in evaluating and facilitating comparisons of our operating performance between periods and between REITs by removing the impact of our capital structure (primarily interest expense) and asset base (primarily depreciation and amortization) from our operating results along with other non-comparable items. SAME STORE PORTFOLIO: We define same store properties as those that we owned and operated and that were stabilized for the entirety of both periods compared. We generally consider a property to be stabilized upon the earlier of: (i) the quarter after the property reaches 80% occupancy or (ii) the thirteenth quarter after the property receives its certificate of occupancy. Additionally, any property that is fully or partially taken out of service for the purpose of redevelopment is no longer considered stabilized until the redevelopment activities are complete, the asset is placed back into service, and the stabilization criteria above are again met. A property may also be fully or partially taken out of service as a result of a disposition, depending on the significance of the portion of the property disposed. Finally, any property classified as Held for Sale is not considered stabilized.

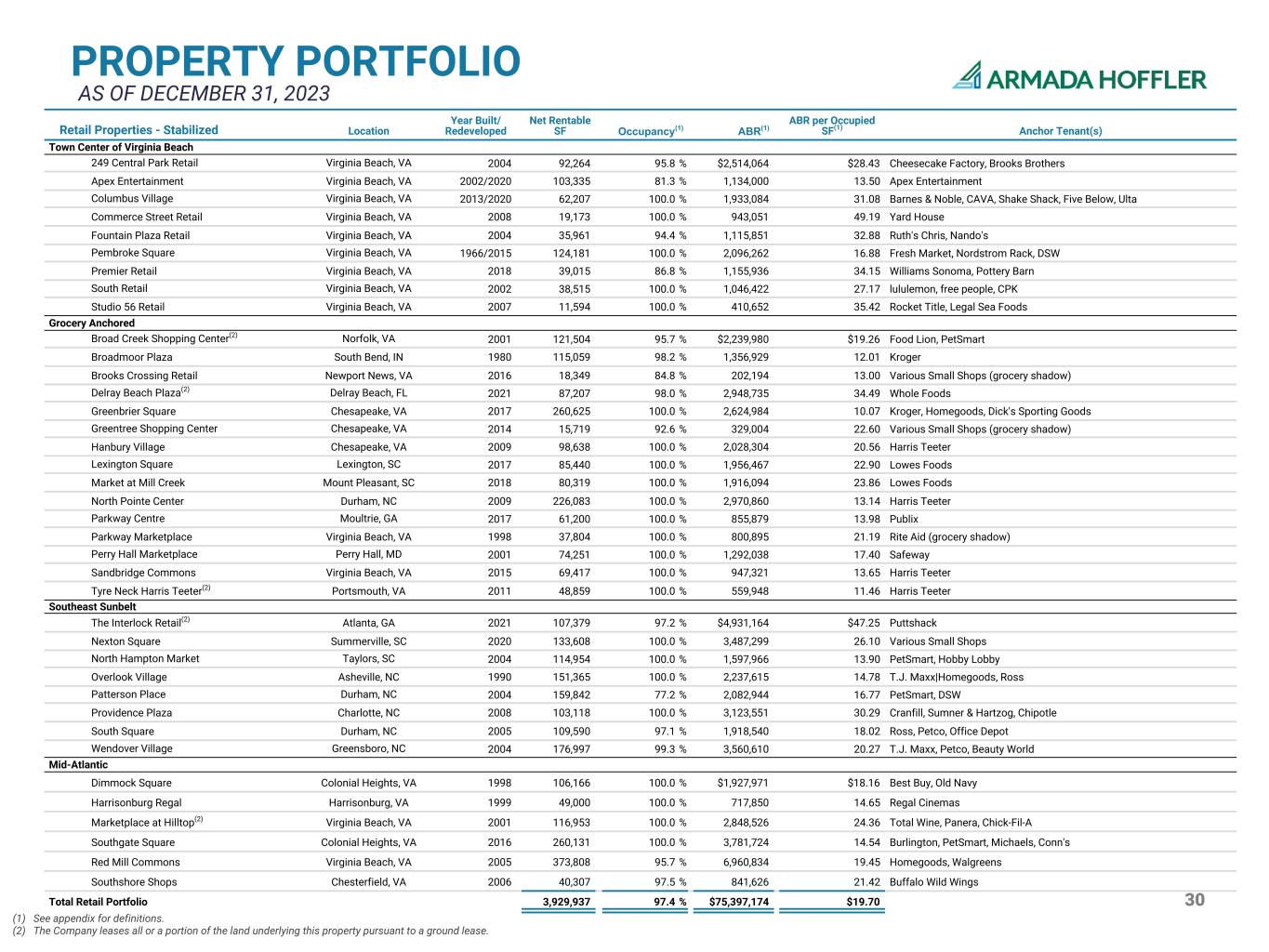

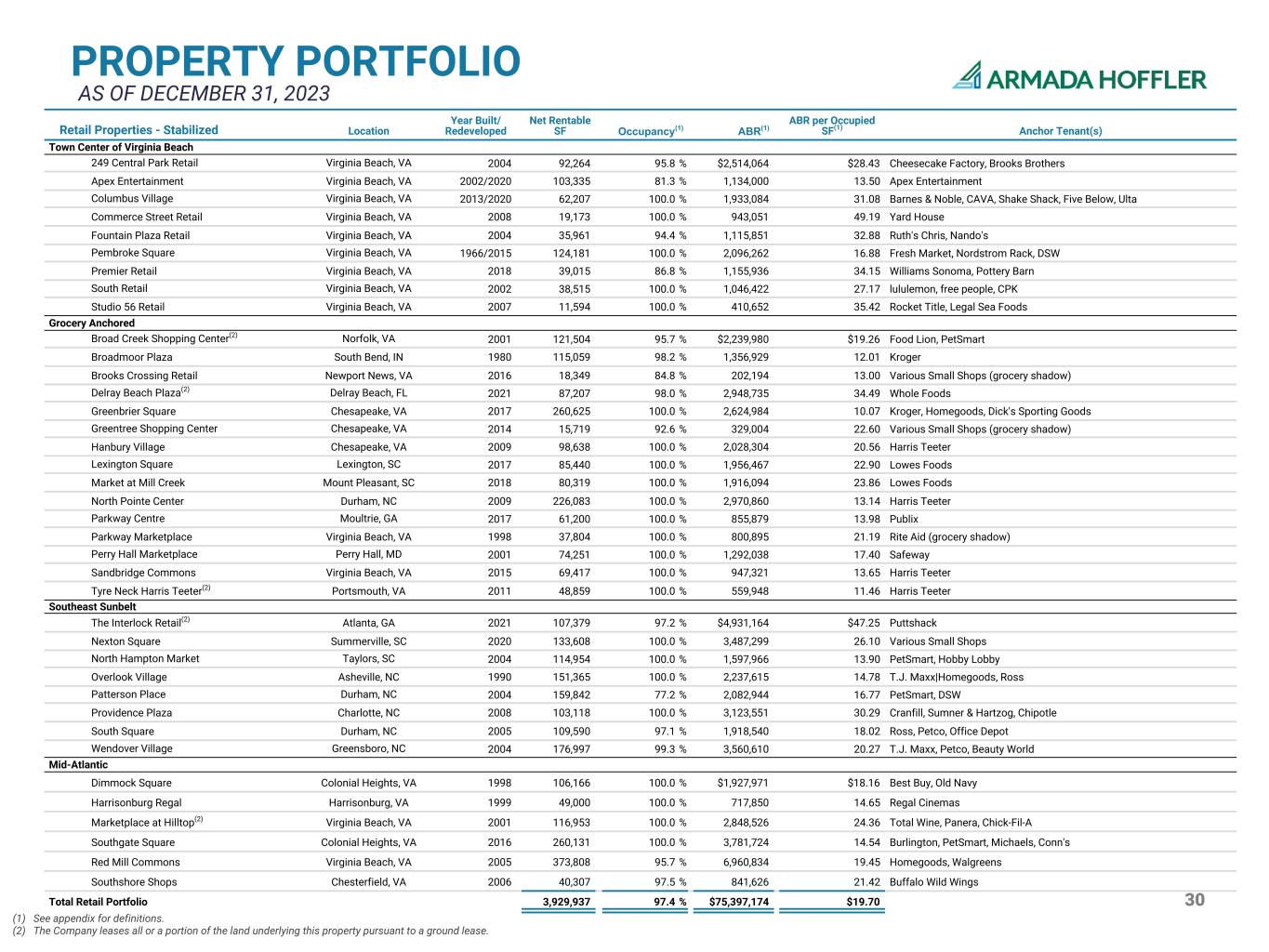

30 PROPERTY PORTFOLIO AS OF DECEMBER 31, 2023 (1) See appendix for definitions. (2) The Company leases all or a portion of the land underlying this property pursuant to a ground lease. Retail Properties - Stabilized Location Year Built/ Redeveloped Net Rentable SF Occupancy(1) ABR(1) ABR per Occupied SF(1) Anchor Tenant(s) Town Center of Virginia Beach 249 Central Park Retail Virginia Beach, VA 2004 92,264 95.8 % $2,514,064 $28.43 Cheesecake Factory, Brooks Brothers Apex Entertainment Virginia Beach, VA 2002/2020 103,335 81.3 % 1,134,000 13.50 Apex Entertainment Columbus Village Virginia Beach, VA 2013/2020 62,207 100.0 % 1,933,084 31.08 Barnes & Noble, CAVA, Shake Shack, Five Below, Ulta Commerce Street Retail Virginia Beach, VA 2008 19,173 100.0 % 943,051 49.19 Yard House Fountain Plaza Retail Virginia Beach, VA 2004 35,961 94.4 % 1,115,851 32.88 Ruth's Chris, Nando's Pembroke Square Virginia Beach, VA 1966/2015 124,181 100.0 % 2,096,262 16.88 Fresh Market, Nordstrom Rack, DSW Premier Retail Virginia Beach, VA 2018 39,015 86.8 % 1,155,936 34.15 Williams Sonoma, Pottery Barn South Retail Virginia Beach, VA 2002 38,515 100.0 % 1,046,422 27.17 lululemon, free people, CPK Studio 56 Retail Virginia Beach, VA 2007 11,594 100.0 % 410,652 35.42 Rocket Title, Legal Sea Foods Grocery Anchored Broad Creek Shopping Center(2) Norfolk, VA 2001 121,504 95.7 % $2,239,980 $19.26 Food Lion, PetSmart Broadmoor Plaza South Bend, IN 1980 115,059 98.2 % 1,356,929 12.01 Kroger Brooks Crossing Retail Newport News, VA 2016 18,349 84.8 % 202,194 13.00 Various Small Shops (grocery shadow) Delray Beach Plaza(2) Delray Beach, FL 2021 87,207 98.0 % 2,948,735 34.49 Whole Foods Greenbrier Square Chesapeake, VA 2017 260,625 100.0 % 2,624,984 10.07 Kroger, Homegoods, Dick's Sporting Goods Greentree Shopping Center Chesapeake, VA 2014 15,719 92.6 % 329,004 22.60 Various Small Shops (grocery shadow) Hanbury Village Chesapeake, VA 2009 98,638 100.0 % 2,028,304 20.56 Harris Teeter Lexington Square Lexington, SC 2017 85,440 100.0 % 1,956,467 22.90 Lowes Foods Market at Mill Creek Mount Pleasant, SC 2018 80,319 100.0 % 1,916,094 23.86 Lowes Foods North Pointe Center Durham, NC 2009 226,083 100.0 % 2,970,860 13.14 Harris Teeter Parkway Centre Moultrie, GA 2017 61,200 100.0 % 855,879 13.98 Publix Parkway Marketplace Virginia Beach, VA 1998 37,804 100.0 % 800,895 21.19 Rite Aid (grocery shadow) Perry Hall Marketplace Perry Hall, MD 2001 74,251 100.0 % 1,292,038 17.40 Safeway Sandbridge Commons Virginia Beach, VA 2015 69,417 100.0 % 947,321 13.65 Harris Teeter Tyre Neck Harris Teeter(2) Portsmouth, VA 2011 48,859 100.0 % 559,948 11.46 Harris Teeter Southeast Sunbelt The Interlock Retail(2) Atlanta, GA 2021 107,379 97.2 % $4,931,164 $47.25 Puttshack Nexton Square Summerville, SC 2020 133,608 100.0 % 3,487,299 26.10 Various Small Shops North Hampton Market Taylors, SC 2004 114,954 100.0 % 1,597,966 13.90 PetSmart, Hobby Lobby Overlook Village Asheville, NC 1990 151,365 100.0 % 2,237,615 14.78 T.J. Maxx|Homegoods, Ross Patterson Place Durham, NC 2004 159,842 77.2 % 2,082,944 16.77 PetSmart, DSW Providence Plaza Charlotte, NC 2008 103,118 100.0 % 3,123,551 30.29 Cranfill, Sumner & Hartzog, Chipotle South Square Durham, NC 2005 109,590 97.1 % 1,918,540 18.02 Ross, Petco, Office Depot Wendover Village Greensboro, NC 2004 176,997 99.3 % 3,560,610 20.27 T.J. Maxx, Petco, Beauty World Mid-Atlantic Dimmock Square Colonial Heights, VA 1998 106,166 100.0 % $1,927,971 $18.16 Best Buy, Old Navy Harrisonburg Regal Harrisonburg, VA 1999 49,000 100.0 % 717,850 14.65 Regal Cinemas Marketplace at Hilltop(2) Virginia Beach, VA 2001 116,953 100.0 % 2,848,526 24.36 Total Wine, Panera, Chick-Fil-A Southgate Square Colonial Heights, VA 2016 260,131 100.0 % 3,781,724 14.54 Burlington, PetSmart, Michaels, Conn's Red Mill Commons Virginia Beach, VA 2005 373,808 95.7 % 6,960,834 19.45 Homegoods, Walgreens Southshore Shops Chesterfield, VA 2006 40,307 97.5 % 841,626 21.42 Buffalo Wild Wings Total Retail Portfolio 3,929,937 97.4 % $75,397,174 $19.70

31 PROPERTY PORTFOLIO CONT. AS OF DECEMBER 31, 2023 (1) See appendix for definitions. (2) The Company leases all or a portion of the land underlying this property pursuant to a ground lease. (3) The Company occupies 47,644 square feet at these two properties at an ABR of $1.6M, or $33.8 per leased square foot, which are reflected in this table. The rent paid by us is eliminated in accordance with GAAP in the consolidated financial statements. (4) The AQR for The Cosmopolitan, 1405 Point, Chronicle Mill, The Edison, and Liberty Apartments excludes approximately $1.2M, $0.3M, $0.2M, $0.06M, and $0.2M, respectively, from ground floor retail leases. Multifamily Properties- Stabilized Location Units Year Built / Redeveloped Occupancy(1) AQR (1) Monthly AQR per Occupied Unit Town Center of Virginia Beach Encore Apartments Virginia Beach, VA 286 2014 94.5 % $5,729,220 $1,768 Premier Apartments Virginia Beach, VA 131 2018 93.1 % 2,861,412 1,955 The Cosmopolitan(4) Virginia Beach, VA 342 2006/2020 94.2 % 8,663,664 2,242 Harbor Point - Baltimore Waterfront 1305 Dock Street Baltimore, MD 103 2016 95.5 % $2,839,848 $2,415 1405 Point(2)(4) Baltimore, MD 289 2018 94.9 % 8,825,124 2,684 Southeast Sunbelt Chronicle Mill(4) Belmont, NC 238 2022 95.5 % $4,788,024 $1,758 The Everly Gainesville, GA 223 2022 95.2 % 4,941,168 1,942 Greenside Apartments Charlotte, NC 225 2018 96.0 % 5,012,424 1,934 Mid-Atlantic The Edison(4) Richmond, VA 174 2014 93.3 % $3,094,824 $1,592 Liberty Apartments(4) Newport News, VA 1972 2013 98.5 % 3,849,588 1,654 Smith's Landing(2) Blacksburg, VA 284 2009 100.0 % 5,930,964 1,740 Multifamily Total 2,492 95.5 % $56,536,260 $1,979 Office Properties- Stabilized Location Net Rentable SF Year Built Occupancy(1) ABR(1) ABR per Occupied SF(1) Anchor Tenant(s) Town Center of Virginia Beach 4525 Main Street Virginia Beach, VA 235,088 2014 100.0 % $7,272,362 $30.93 Clark Nexsen, Anthropologie, Mythics Armada Hoffler Tower(3) Virginia Beach, VA 315,916 2002 97.8 % 9,606,360 31.08 AHH, Troutman Pepper, Williams Mullen, Morgan Stanley, KPMG One Columbus Virginia Beach, VA 129,066 1984 96.0 % 3,229,531 26.07 Truist, HBA, Northwestern Mutual Two Columbus Virginia Beach, VA 108,460 2009 82.3 % 2,540,344 28.46 Hazen & Sawyer, Fidelity Harbor Point - Baltimore Waterfront Constellation Office Baltimore, MD 482,209 2016 98.1 % $15,866,391 $33.53 Constellation Energy Group Thames Street Wharf(3) Baltimore, MD 263,426 2010 99.5 % 7,990,745 30.50 Morgan Stanley Wills Wharf(2) Baltimore, MD 327,991 2020 93.8 % 9,875,417 32.10 Canopy by Hilton, Transamerica, RBC, Franklin Templeton Southeast Sunbelt The Interlock Office(2) Atlanta, GA 198,721 2021 87.1 % $6,470,562 $37.38 Georgia Tech, Pindrop One City Center Durham, NC 151,599 2019 85.6 % 4,351,672 33.55 Duke University Mid-Atlantic Brooks Crossing Office Newport News, VA 98,061 2019 100.0 % $1,963,671 $20.02 Huntington Ingalls Industries Stabilized Office Total 2,310,537 95.3 % $69,167,055 $31.42

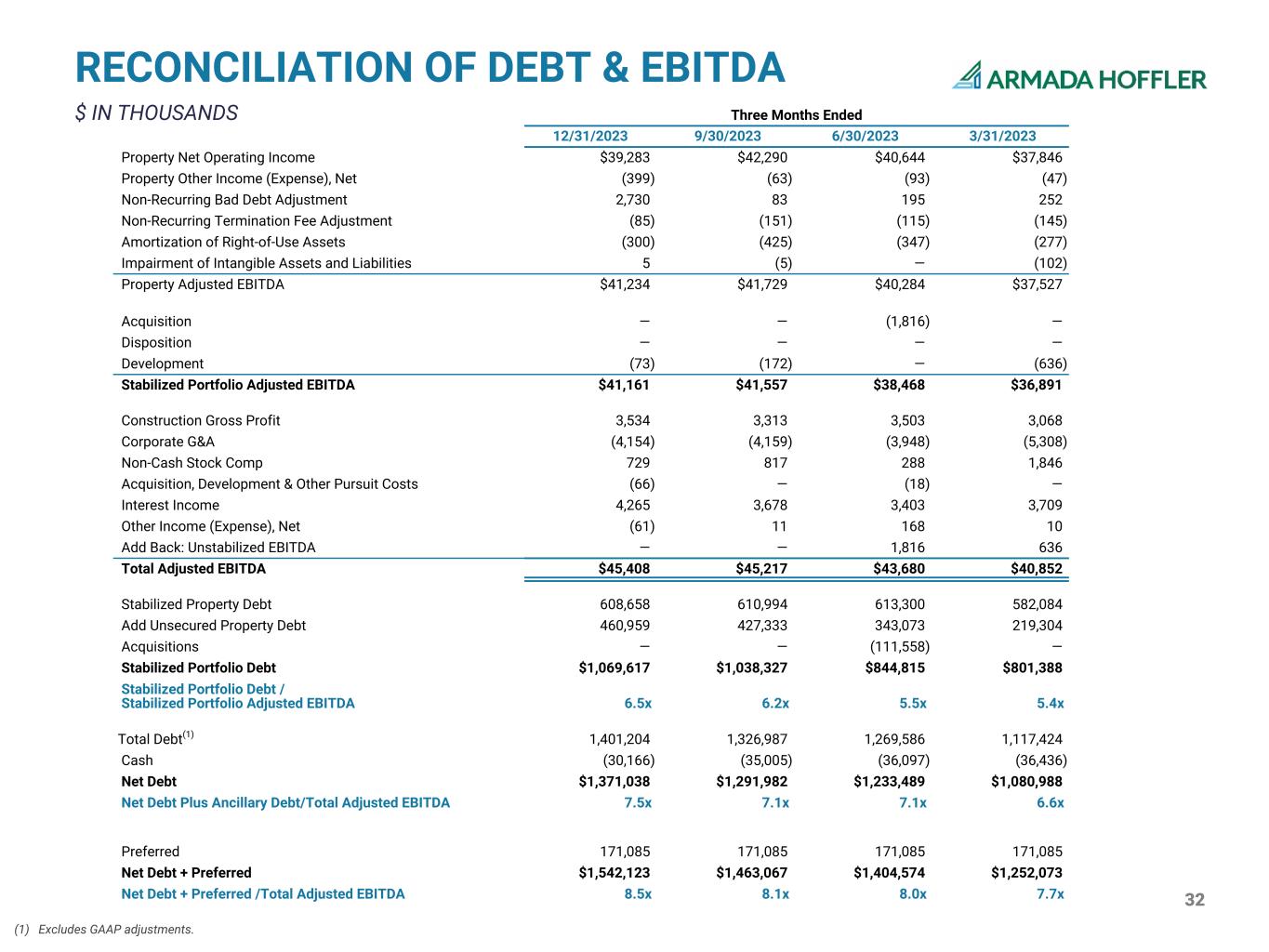

32 $ IN THOUSANDS RECONCILIATION OF DEBT & EBITDA (1) Excludes GAAP adjustments. Three Months Ended 12/31/2023 9/30/2023 6/30/2023 3/31/2023 Property Net Operating Income $39,283 $42,290 $40,644 $37,846 Property Other Income (Expense), Net (399) (63) (93) (47) Non-Recurring Bad Debt Adjustment 2,730 83 195 252 Non-Recurring Termination Fee Adjustment (85) (151) (115) (145) Amortization of Right-of-Use Assets (300) (425) (347) (277) Impairment of Intangible Assets and Liabilities 5 (5) — (102) Property Adjusted EBITDA $41,234 $41,729 $40,284 $37,527 Acquisition — — (1,816) — Disposition — — — — Development (73) (172) — (636) Stabilized Portfolio Adjusted EBITDA $41,161 $41,557 $38,468 $36,891 Construction Gross Profit 3,534 3,313 3,503 3,068 Corporate G&A (4,154) (4,159) (3,948) (5,308) Non-Cash Stock Comp 729 817 288 1,846 Acquisition, Development & Other Pursuit Costs (66) — (18) — Interest Income 4,265 3,678 3,403 3,709 Other Income (Expense), Net (61) 11 168 10 Add Back: Unstabilized EBITDA — — 1,816 636 Total Adjusted EBITDA $45,408 $45,217 $43,680 $40,852 Stabilized Property Debt 608,658 610,994 613,300 582,084 Add Unsecured Property Debt 460,959 427,333 343,073 219,304 Acquisitions — — (111,558) — Stabilized Portfolio Debt $1,069,617 $1,038,327 $844,815 $801,388 Stabilized Portfolio Debt / Stabilized Portfolio Adjusted EBITDA 6.5x 6.2x 5.5x 5.4x Total Debt(1) 1,401,204 1,326,987 1,269,586 1,117,424 Cash (30,166) (35,005) (36,097) (36,436) Net Debt $1,371,038 $1,291,982 $1,233,489 $1,080,988 Net Debt Plus Ancillary Debt/Total Adjusted EBITDA 7.5x 7.1x 7.1x 6.6x Preferred 171,085 171,085 171,085 171,085 Net Debt + Preferred $1,542,123 $1,463,067 $1,404,574 $1,252,073 Net Debt + Preferred /Total Adjusted EBITDA 8.5x 8.1x 8.0x 7.7x

33 QUARTER TO DATE(1) YEAR TO DATE(1) $ IN THOUSANDS AS OF DECEMBER 31, 2023 CAPITAL EXPENDITURES (1) Excludes activity related to held for sale, acquired, and/or disposed properties. (2) Represents recurring capital expenditures. Leasing Commissions Lease Incentive Tenant Improvements Land Improvements(2) Building Improvements(2) Fixtures & Equipment(2) Total Second Generation Capex Retail $659 $— $1,974 $593 $584 $— $3,810 Office 671 — 1,121 — 659 — 2,451 Multifamily 76 — 295 4 1,684 206 2,265 Total Portfolio $1,406 $— $3,390 $597 $2,927 $206 $8,526 Leasing Commissions Lease Incentive Tenant Improvements Land Improvements(2) Building Improvements(2) Fixtures & Equipment(2) Total Second Generation Capex Retail $2,143 $20 $6,823 $1,236 $4,614 $— $14,836 Office 1,247 — 2,419 — 1,865 — 5,531 Multifamily 236 — 340 38 3,139 939 4,692 Total Portfolio $3,626 $20 $9,582 $1,274 $9,618 $939 $25,059

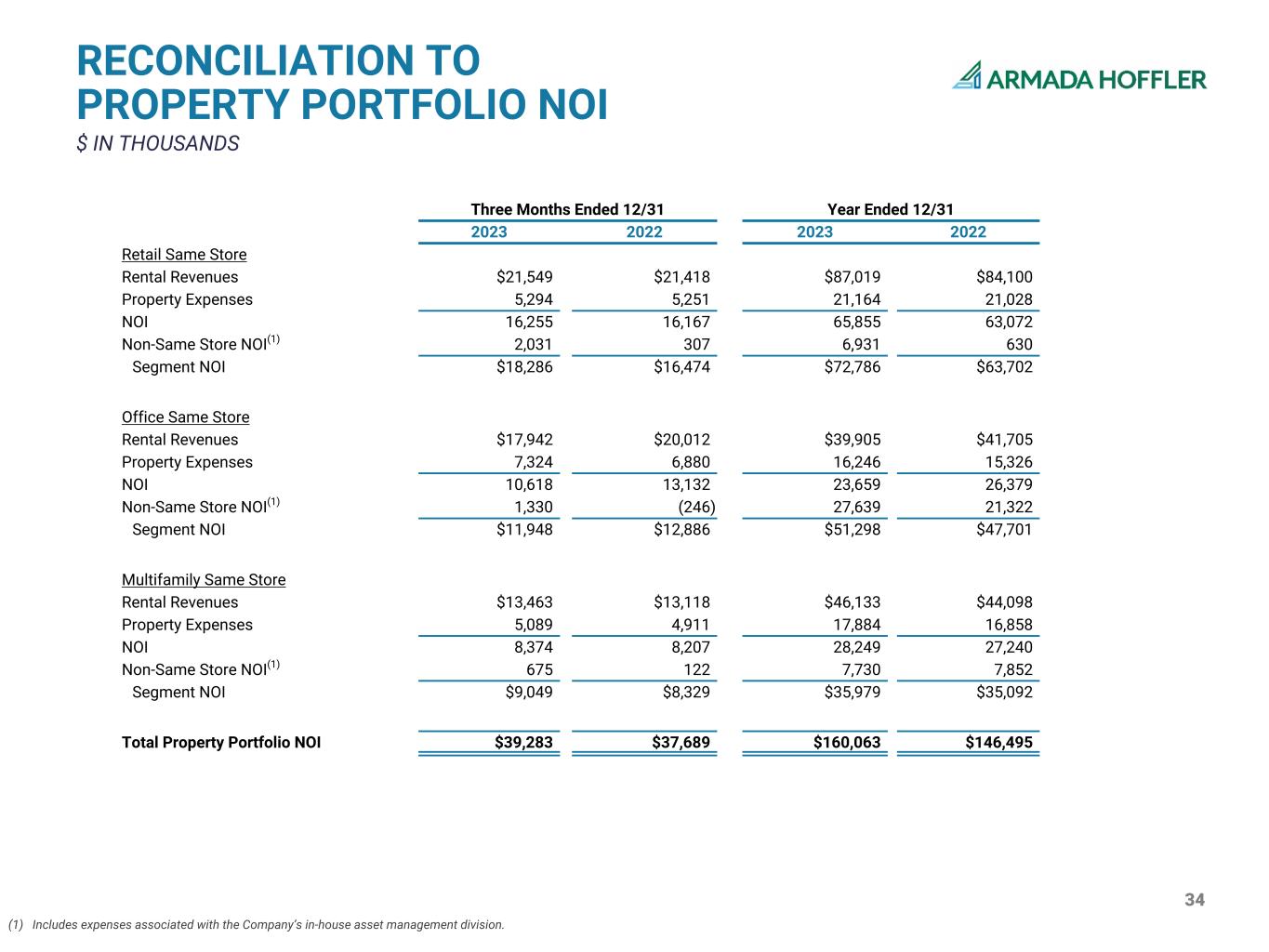

34 RECONCILIATION TO PROPERTY PORTFOLIO NOI $ IN THOUSANDS (1) Includes expenses associated with the Company’s in-house asset management division. Three Months Ended 12/31 Year Ended 12/31 2023 2022 2023 2022 Retail Same Store Rental Revenues $21,549 $21,418 $87,019 $84,100 Property Expenses 5,294 5,251 21,164 21,028 NOI 16,255 16,167 65,855 63,072 Non-Same Store NOI(1) 2,031 307 6,931 630 Segment NOI $18,286 $16,474 $72,786 $63,702 Office Same Store Rental Revenues $17,942 $20,012 $39,905 $41,705 Property Expenses 7,324 6,880 16,246 15,326 NOI 10,618 13,132 23,659 26,379 Non-Same Store NOI(1) 1,330 (246) 27,639 21,322 Segment NOI $11,948 $12,886 $51,298 $47,701 Multifamily Same Store Rental Revenues $13,463 $13,118 $46,133 $44,098 Property Expenses 5,089 4,911 17,884 16,858 NOI 8,374 8,207 28,249 27,240 Non-Same Store NOI(1) 675 122 7,730 7,852 Segment NOI $9,049 $8,329 $35,979 $35,092 Total Property Portfolio NOI $39,283 $37,689 $160,063 $146,495

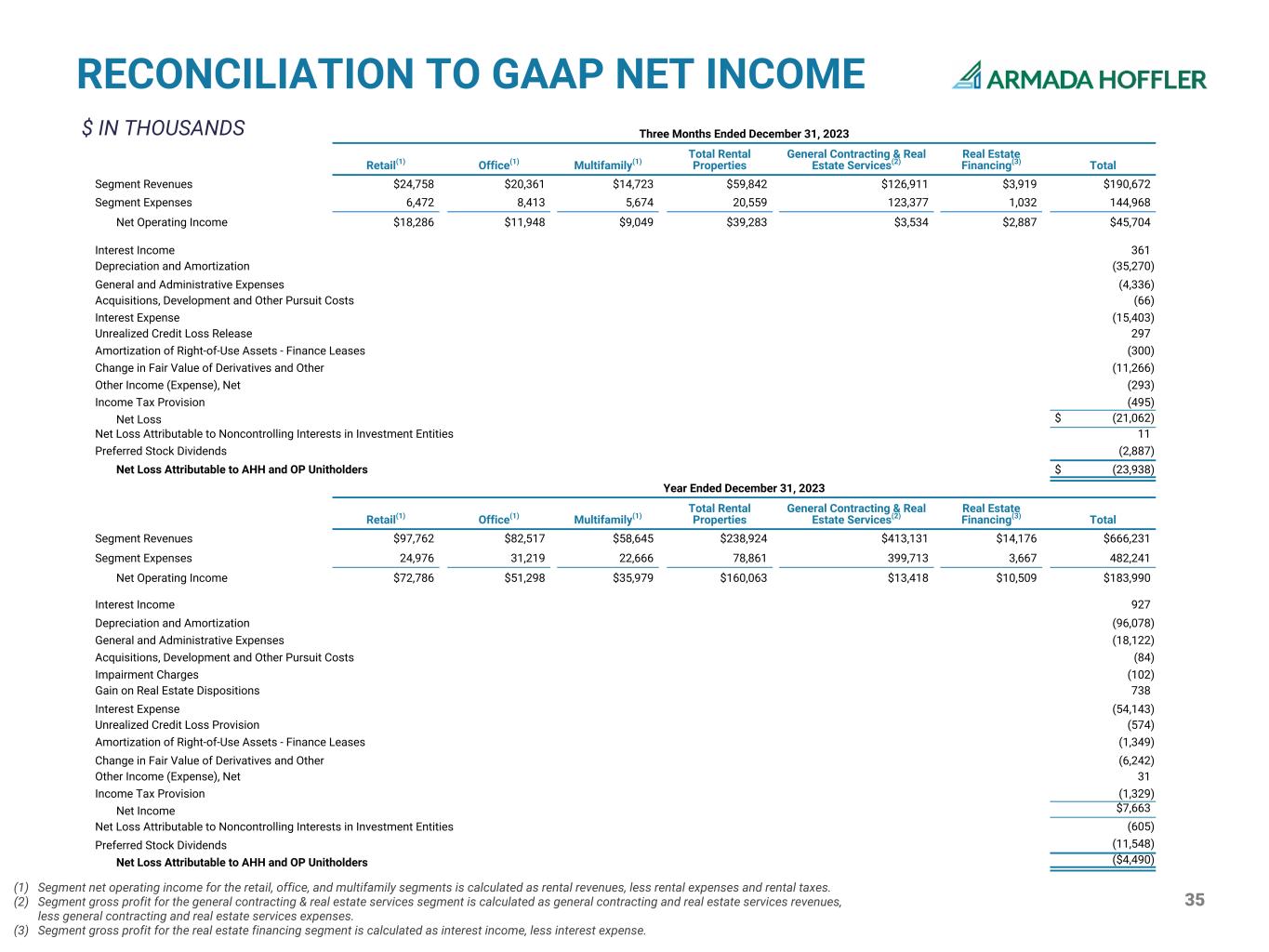

35 RECONCILIATION TO GAAP NET INCOME $ IN THOUSANDS (1) Segment net operating income for the retail, office, and multifamily segments is calculated as rental revenues, less rental expenses and rental taxes. (2) Segment gross profit for the general contracting & real estate services segment is calculated as general contracting and real estate services revenues, less general contracting and real estate services expenses. (3) Segment gross profit for the real estate financing segment is calculated as interest income, less interest expense. Three Months Ended December 31, 2023 Retail(1) Office(1) Multifamily(1) Total Rental Properties General Contracting & Real Estate Services(2) Real Estate Financing(3) Total Segment Revenues $24,758 $20,361 $14,723 $59,842 $126,911 $3,919 $190,672 Segment Expenses 6,472 8,413 5,674 20,559 123,377 1,032 144,968 Net Operating Income $18,286 $11,948 $9,049 $39,283 $3,534 $2,887 $45,704 Interest Income 361 Depreciation and Amortization (35,270) General and Administrative Expenses (4,336) Acquisitions, Development and Other Pursuit Costs (66) Interest Expense (15,403) Unrealized Credit Loss Release 297 Amortization of Right-of-Use Assets - Finance Leases (300) Change in Fair Value of Derivatives and Other (11,266) Other Income (Expense), Net (293) Income Tax Provision (495) Net Loss $ (21,062) Net Loss Attributable to Noncontrolling Interests in Investment Entities 11 Preferred Stock Dividends (2,887) Net Loss Attributable to AHH and OP Unitholders $ (23,938) Year Ended December 31, 2023 Retail(1) Office(1) Multifamily(1) Total Rental Properties General Contracting & Real Estate Services(2) Real Estate Financing(3) Total Segment Revenues $97,762 $82,517 $58,645 $238,924 $413,131 $14,176 $666,231 Segment Expenses 24,976 31,219 22,666 78,861 399,713 3,667 482,241 Net Operating Income $72,786 $51,298 $35,979 $160,063 $13,418 $10,509 $183,990 Interest Income 927 Depreciation and Amortization (96,078) General and Administrative Expenses (18,122) Acquisitions, Development and Other Pursuit Costs (84) Impairment Charges (102) Gain on Real Estate Dispositions 738 Interest Expense (54,143) Unrealized Credit Loss Provision (574) Amortization of Right-of-Use Assets - Finance Leases (1,349) Change in Fair Value of Derivatives and Other (6,242) Other Income (Expense), Net 31 Income Tax Provision (1,329) Net Income $7,663 Net Loss Attributable to Noncontrolling Interests in Investment Entities (605) Preferred Stock Dividends (11,548) Net Loss Attributable to AHH and OP Unitholders ($4,490)

36 RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA $ IN THOUSANDS Three Months Ended 12/31/2023 9/30/2023 6/30/2023 3/31/2023 Net (loss) income attributable to common stockholders and OP Unitholders ($23,938) $5,343 $11,729 $2,376 Excluding: Depreciation and Amortization 35,270 22,462 19,878 18,468 Gain on Real Estate Dispositions — (227) (511) — Income Tax Provision 495 310 336 188 Interest Expense 16,435 15,444 13,629 12,302 Change in Fair Value of Derivatives and Other 11,266 (2,466) (5,005) 2,447 Preferred Dividends 2,887 2,887 2,887 2,887 Loss on Extinguishment of Debt — — — — Non-Recurring Bad Debt Adjustment 2,730 83 195 252 Non-Recurring Termination Fee Adjustment (85) (151) (115) (145) Unrealized Credit Loss (Release) Provision (297) 694 100 77 Investment Entities (11) 193 269 154 Non-Cash Stock Compensation 729 817 288 1,846 Adjusted EBITDA $45,481 $45,389 $43,680 $40,852 Dispositions (73) (172) — — Acquisitions (Full Quarter) — — — — Total Adjusted EBITDA $45,408 $45,217 $43,680 $40,852 Construction Gross Profit (3,534) (3,313) (3,503) (3,068) Corporate G&A 4,154 4,159 3,948 5,308 Non-Cash Stock Comp (729) (817) (288) (1,846) Acquisition, Development & Other Pursuit Costs 66 — 18 — Interest Income (4,265) (3,678) (3,403) (3,709) Other Income (Expense), Net 61 (11) (168) (10) Add Back: Unstabilized EBITDA — — (1,816) (636) Stabilized Portfolio Adjusted EBITDA $41,161 $41,557 $38,468 $36,891 Acquisition — — 1,816 — Disposition — — — — Development 73 172 — 636 Property Adjusted EBITDA $41,234 $41,729 $40,284 $37,527