UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from_________ to_________

Commission file number: 000-54732

MAZZAL HOLDING CORP

| Nevada | 46-1845946 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

11 PERELL CHIAM

BENY-BERAK, ISRAEL 5130153

800-488-2760

Securities registered under 12(b) of the Exchange Act:

None

Securities registered under 12 (g) of the Exchange Act:

Common Stock, par value $0.0001

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 2 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicated by check mark whether the registrant:(1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filings pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2013, was $0. For purposes of the foregoing calculation only, directors and executive officers and holders of 10% or more of the issuer’s common capital stock have been deemed affiliates.

The number of shares of the Registrant’s common stock outstanding as of March 18, 2014, was 2,000,000.

MAZZAL HOLDING CORP

2013 FORM 10-K TABLE OF CONTENTS

| Page | ||

|

PART I

|

||

|

ITEM 1.

|

BUSINESS.

|

1

|

|

ITEM 2.

|

PROPERTIES.

|

8

|

|

ITEM 3.

|

LEGAL PROCEEDINGS.

|

8

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

9

|

|

PART II

|

||

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

9

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA.

|

11

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

11

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

16

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

16

|

|

.

|

||

|

ITEM 9A.

|

CONTROLS AND PROCEDURES.

|

16

|

|

ITEM 9B.

|

OTHER ITEMS.

|

17

|

|

PART III

|

||

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

|

17

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION.

|

19

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

21

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

|

21

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES.

|

22

|

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

|

22

|

| SIGNATURES |

24

|

|

PART I

Special Note Regarding Forward-Looking Statements

Information included or incorporated by reference in this Annual Report on Form 10-K contains forward-looking statements. All forward- looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements may contain the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, and are subject to numerous known and unknown risks and uncertainties. Additionally, statements relating to implementation of business strategy, future financial performance, acquisition strategies, capital raising transactions, performance of contractual obligations, and similar statements may contain forward-looking statements. In evaluating such statements, prospective investors and shareholders should carefully review various risks and uncertainties identified in this Report, including the matters set forth under the captions “Risk Factors” and in the Company’s other SEC filings. These risks and uncertainties could cause the Company’s actual results to differ materially from those indicated in the forward-looking statements. The Company disclaims any obligation to update or publicly announce revisions to any forward-looking statements to reflect future events or developments.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading “Risk Factors Related to Our Business” below, as well as those discussed elsewhere in this Annual Report on Form 10-K. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the Securities and Exchange Commission (“SEC”). You can read and copy any materials we file with the SEC at the SEC’s Public Reference Room, 100 F. Street, NE, Washington, D.C. 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We disclaim any obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

ITEM 1. BUSINESS

Preliminary Note

On March 24, 2014, Mazzal Holding Corp. filed an amendment to its Articles of Incorporation (as amended to date) to effectuate a 10-for-1 share forward stock split. All share totals listed in this Annual Report are given as pre-stock-split totals, i.e. not reflecting the effect of the stock split.

General

Mazzal Holding Corp. (formerly Boston Investment and Development Corp), was formed in the state of Nevada on January 23, 2013. We were founded by Nissim Trabelsi, who, as of the date of this Report, was our sole promoter.

The business and purpose of the Company is to purchase approved multi-family land, and then develop and build for profit.

On March 31, 2013, the Company entered into a Standard Land Purchase and Sale Agreement (the “Purchase Agreement”) with the Mazzal Trust, pursuant to which the Company purchased property (the “Property”) consisting of “the land and all buildings thereon known as 171 Hart St., Taunton MA 02780.” The property consists of approximately 25 acres. The property is located in the Green Pines Townhomes subdivision, and the subdivision is managed by the Green Pines Townhomes Condominium Trust. (The manager of the Green PinesTownhomes Condominium Trust is Green Pines, LLC, a shareholder of the Company, the manager of which is Marty Trabelsi, the brother of Nissim Trabelsi, the Company’s President.) The purchase price for the Property was 1,500,000 shares of the Company’s common stock. On May 29, 2013, the purchase of the property closed, and the seller delivered the deed, and the Company issued the shares. As of the date of this Annual Report, the Property sub-division had all the underground utilities installed, and one main road paved. Additionally, as of the date of this Annual Report, one building with two units had been completed, and approximately 47 more units remained to be built in Phase I of the development.However, as noted below in "Recent Developments", the Company plans to submit a zoning change request to invrease from 49 to 72 units for Phase I. There can be no guarantee that such change will be permitted. For Phase II, management anticipates that an additional 50 units will be in the future.

1

Multi-family Construction Industry –

Overall nationally, the multi-family construction industry, like much of the housing industry in general, is slowly recovering from the economic downturn that has been impacting the country since 2008. According to the record of the meeting of the Federal Advisory Council and Board of Governors on May 17, 2013:

Demand for rental housing, both multifamily and senior housing, is strong. This phenomenon is driven by former homeowners becoming renters, more stringent residential mortgage underwriting standards, and more cautious attitudes about the risk/reward tradeoffs of homeownership. (Source: Record of Meeting of the Federal Advisory Council and the Board of Governors, Friday, May 17, 2013, publicly available, on file with the Company.)

Additionally, according to a construction industry report,

Both interest rates and inflation remain at historically low levels, with real rates negative in many cases. This should create an environment that encourages investment in construction, since the cost of financing developments is low, and successful developments can offer far higher rates of return than available in many other forms of investment. For this reason, construction activity does have areas of relative strength. Among these is multi-family construction, where demand is strong enough to spur spending growth in excess of 50%, year on year, seasonally adjusted. (Source: Construction Industry Market Report: Fourth Quarter Outlook 2012, produced by Davis Langdon, publicly available, on file with the Company.)

Some housing industry experts believe that “housing, in general, and multifamily housing, in particular, should benefit from the demands for shelter represented by the transitioning of Echo Boomers into the workplace and by the Baby Boomers who will enjoy longer and healthier lifespans than any previous generation—simply put, the people are there in large numbers, and they require a place to live.” (Source: Millcreek Residential 2013 Outlook for the U.S. Multifamily Market (“Millcreek 2013”), publicly available, copy on file with the Company.)

Like the broader economy, management anticipates that that multifamily housing investments will exhibit steady and sustainable growth over a long period, absent some unexpected or unknowable economic shock.

As noted in the Millcreek 2013 report:

The multifamily asset class has consistently outperformed all other commercial real estate asset classes combined in terms of capital value growth and net operating income growth dating back to 1980. Taken together with the relatively shorter lease terms for rental apartments (a positive when inflation risks are factored into investment decisions), we believe that multifamily assets offer the best risk adjusted return opportunity of all the real estate asset classes over the near and longer term. (Millcreek 2013.)

Locally, in Massachusetts, the economic conditions in the Boston housing market area also have improved steadily during the past 2 years, led by job growth in the professional and business services and education and health services sectors. (Source: Boston, MA, Comprehensive Housing Market Analysis, US Department of Housing and Urban Development (“Boston HUD Report”), publicly available, copy on file with the Company.)

2

Additionally, according to the Boston HUD Report,

Multifamily building activity, as measured by the number of multifamily units permitted, increased rapidly in the Boston-Suffolk submarket during the past year as builders responded on a large scale to increased rental demand. According to the Boston Department of Neighborhood Development, more than $1 billion in new housing construction started in the city of Boston during 2011; approximately 90 percent of the construction represents new apartment development. Based on preliminary data, during the 12 months ending May 2012, the number of multifamily units permitted increased to 1,550 units, up by 1,325, or nearly 550 percent, from only 240 units permitted during the 12 months ending May 2011. (Boston HUD Report.)

On February 26, 2013, the Massachusetts Executive Office of Housing and Urban Development issued a press release, which discussed the increase in multi-family unit housing permits. The press release provided as follows:

The number of multi-family housing unit permits pulled in 2012 nearly doubled from 2011, reflecting the demand that led Governor Deval Patrick to announce a statewide housing production goal of 10,000 multi-family units per year through 2020.

In 2012, 5,019 multi-family permits were pulled, compared to 2,752 in 2011, representing an 84 percent increase, as based on preliminary numbers reported by the U.S. Census Bureau’s Building Permit Survey. The 5,019 permits are the most since 2007. Total permits increased 44 percent between 2011 and 2012 in the state and the proportion of multi-family permits increased from 38 percent of total permits pulled in 2011 to 48 percent in 2012.

In November 2012, Governor Patrick announced the Commonwealth’s goal of creating 10,000 multi-family housing units per year. By creating this type of housing, which is attractive to young families and individuals, Massachusetts is better prepared to keep in state the skilled, young workforce for which employers are looking.

“The trend in housing is people are looking for homes that are accessible to public transit and the commercial core of a downtown or town center,” said Greg Bialecki, the Secretary of Housing and Economic Development. “Governor Patrick’s goal and tools we have created support this type of housing and will help us keep in Massachusetts our strong, well-educated workforce.”

“Our economy is picking up and builders are starting to create more housing,” said Marc Draisen, the Executive Director of the Metropolitan Area Planning Council. “We especially need multi-family rental housing, because rents stayed high throughout the economic crisis. Now we need to redouble our efforts to meet the Governor’s goal of 10,000 multi-family units per year.” (Source: Press Release dated February 26, 2013, “At Onset of Nation-Leading Goal, Multi-Family Housing Permits Nearly Double in 2012,” publicly available, copy on file with the Company.)

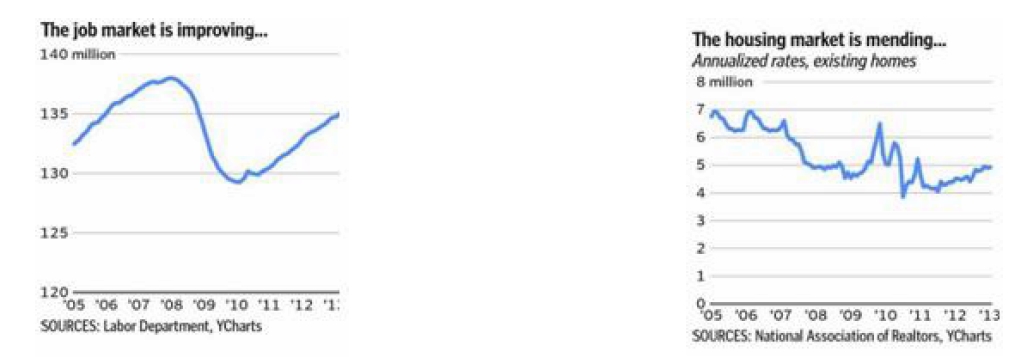

In March 2013, the Boston Globe noted that earlier in that month, “the Dow Jones industrial average surged to record highs while the Labor Department reported that US employers added 236,000 jobs in February and the unemployment rate declined to its lowest level in more than four years.” (Source: Boston Globe article: “As housing, job markets improve, homeowners spend on remodeling,” (“BG Article”) publicly available, copy on file with the Company.) With respect to the Massachusetts economy specifically, the BG Article pointed out that employers added about 50,000 jobs in Massachusetts, according to the Labor Department, and that home sales in Massachusetts in 2012 hit their highest level since 2006, according to Warren Group, a Boston real estate tracking firm. The BG Article included the following charts reflecting the improvement in the job market and the rebound in the housing market:

3

Based on the experience of the Company’s management, Massachusetts-area contractors, architects, interior designers, and others tied to the home construction industry are receiving an increasing number of inquiries these days from people who are looking to purchase new homes, rent larger homes and apartments, or remodel existing homes or apartments.

While there can be no guarantee of a continuation of this recovery and increase in interest in purchasing homes or multi-family dwellings, management believes that the Company’s business model of purchasing property, constructing multi-family dwellings, and then selling the improved property could prove to be a profitable business model.

The multi-family construction business is a very competitive industry. We not only plan to construct multi-family dwellings, but develop the land that we will place them on. This process is extremely expensive and we plan to use our current available capital to begin work on our business plan. These monies will not be enough, though, to build a profitable company. We will need to raise additional monies by selling shares of our stock or borrowing to carry on our business.

There are many steps that must be taken to provide a multi-family dwelling ready for occupancy. Many different groups of people are involved. We expect to work with other construction companies that specialize in services that we either cannot or do not desire to engage in, or do not have the ability to produce or install. To find these companies, we are relying on the research and knowledge that our President, Nissim Trabelsi, has about the multi-family housing industry and construction industry.

The multi-family housing industry is growing due to their low-cost housing options. These dwellings have numerous competitive advantages, including:

|

-

|

providing unique ownership opportunities;

|

|

-

|

lower construction costs, as multi-family units are usually lower in price because the Company plans to build in large quantities, resulting in discounts from suppliers and subcontractors, resulting in lower construction costs and lower sales prices on completed projects;

|

|

-

|

frequent discounts on mortgage rates for multi-family dwellings;

|

|

-

|

on-site amenities including clubhouses, landscaping, maintenance, and lower insurance costs;

|

|

-

|

efficient land use;

|

|

-

|

residential populations large enough to support neighborhood retail and public transportation;

|

|

-

|

the creation of open, public space; and

|

|

-

|

providing residential options for an increasing number of single-person and empty-nester households

|

We plan to purchase land, develop it, complete the infrastructure, construct the multi-family dwelling, and manage throughout the process. Management anticipates that the Company’s next purchase will be an approved subdivision but not yet started, although as of the date of this Annual Report, the Company had not identified any specific parcel for purchase. Management is aware of several subdivisions within 30-40 minutes travel around the greater Boston area.

We realize the high need for housing in Massachusetts, and plan to fill that need by producing high quality multi-family homes in various areas throughout the state.

4

Description of Property

Property for Development

The Property purchased from the Mazzal Trust (described above) consists of a 25-acre subdivision with approval for 49 town homes in the first phase.

As of the date of this Annual Report, the Property sub-division had all the underground utilities installed, and one main road paved. Additionally, as of the date of this Annual Report, one building with two units had been completed, and approximately 47 more units remained to be built in Phase 1 of the development. For Phase 2,

management anticipates that an additional 50 units will be in the future.

Under the Company’s plan, each subdivision takes approximately 3 years to complete, from purchase of the land, through development of the property, through construction of the units, and through sales of the units.

Management anticipates that the Company will need to raise between $500,000 and $800,000 to start and begin construction of one third of the units, approximately 15 units, which could be completed within approximately 12 months from start of construction. Once the first units are completed, from each unit that is sold in the first year, the revenues will be used to finance construction of the next phases and units. Management anticipates that at the end of the second year of operation, the Company will be able to complete an additional 15 units. Finally, management anticipates that the remaining 17 units will be built on during the third year, to meet the planned completion of 47 units in Phase

1 in three years from commencement of construction.

Additionally, Management believes that the second phase of the development could include up to 52 additional units. Management anticipates that both phases of the development could be completed by the end of 2016, although there can be no guarantee that the Company will be able to complete development on this schedule.

Management anticipates that the Property will become a new subdivision, and will include the following amenities and benefits:

|

-

|

Automatic security gate entry;

|

|

-

|

Lush landscaping;

|

|

-

|

Approximately two minutes to Galleria Mall, and one exit from proposed new casino development; and

|

|

-

|

Private pond and clubhouse.

|

With respect to the individual units, Management anticipates that they will include the following features:

|

-

|

Up to three bedrooms, 2 ½ baths, single car garage, and open basement room;

|

|

-

|

Open stairs and marble foyers;

|

|

-

|

Granite countertops in kitchens, stainless steel appliances, with natural gas;

|

|

-

|

Two-zone heating and air conditioning; and

|

|

-

|

Hardwood floors.

|

Management anticipates that the constructed units will have the benefits and features listed, although there can be no guarantee that the completed units will include all of the above features. Additionally, items such as landscaping and construction of the grounds may take additional time beyond the time of construction of the units.

The Company has no present plans to be acquired or to merge with another company or to enter into a change of control or similar transaction.. Additionally, to the knowledge of the Company’s management, none of the Company’s shareholders have plans to enter into a change of control transaction or any similar transaction.

Management does not believe that the Company is a “blank-check” company, because the Company has a business plan (described above and in more detail throughout this Report), and significant assets (consisting of land described more fully throughout this Report).

5

Company Offices

We are presently using office space located at 675 VFW Parkway, Suite 189, Chestnut Hill, MA 02467. There are presently no monthly lease payments. Mr. Trabelsi believes that the current office space is sufficient enough for the company for the foreseeable future.

Financing Strategy

We will not be able to develop land or construct multi-family dwellings on our own with the proceeds our initial private offering of shares without additional outside financing. Whenever possible we will attempt to make arrangements with providers of services to defer payment until a later stage in the construction process.

The Company anticipates that it will finance its operations, at least initially, through the sale of its shares of common stock, which will result in dilution to the current owners of our shares of common stock, and the purchasers of shares from the Selling Stockholders.

Management anticipates that the average construction price for the town homes will be approximately $180,000-$200,000, and the average selling price will be approximately $250,000, although there can be no guarantee that the Company will be able to construct all the town homes at this cost, or sell any or all of the town homes for the anticipated selling price.

Management anticipates that each unit will be approximately 1500 ft.², and that the Company’s building cost is roughly $100 for each square foot, for a total of $150,000 costs to build each unit. Additionally, the costs associated with the land are approximately $32,000 for each lot. Also, Management anticipates approximately $18,000 in commissions and soft costs for an approximate total cost of $200,000 to complete each unit. The figures in the preceding sentences relating to construction costs are only estimates made by management, and are based on management’s due diligence and research relating to local market conditions, building lot costs, local construction and material costs, rather than on third-party valuations, or other outside sources. Moreover, these estimates are based on management’s prior history and experience in construction in Massachusetts. There can be no guarantee that the Company will be able to construct any of the units for the costs and amounts indicated.

Competition

The construction industry is intensely competitive and fragmented. Competition comes from companies within the same business and companies in other types of housing industries. Different types of housing include homes built on site, apartment complexes, townhouses, duplexes, and condominiums. Our Company will also compete with other home building companies in finding desirable land, financing, raw materials and skilled labor.

Some of the Company’s competitors in the multi-family dwelling construction business have longer operating histories and greater financial, marketing and sales than the Company.

In order to be competitive, we intend to construct multi-family dwellings for low cost but high quality. Our multi-family dwellings will need to entice the customer not only financially, but aesthetically as well. We plan to appeal to a wide range of public taste throughout Massachusetts. We also plan to be very selective when choosing land to purchase and develop. Finally, we plan to only employ talented and established professionals with experience in our industry segment.

Employees

As of the date of this Annual Report, we had three employees. The Company is currently in the development stage. During the development stage, we plan to rely substantially on the services of Mr. Trabelsi, our President, CEO, and CFO, to set up our business operations. The other employees are Harold Fisher, Esq., who is serving as the Chairman of the Company, and Mazzal Ilooz, who is serving as the Company’s secretary and treasurer.

Mr. Trabelsi currently works for the Company on a part-time basis and their time and efforts are being provided to the Company without compensation. Mr. Trabelsi expects to devote approximately 40 hours each per week to our business. He is prepared to dedicate additional time to our operations, as needed. We believe that our operations are currently on a small scale that is manageable by these individual.

The construction professionals we plan to utilize will be considered independent sub contractors. We do not intend to enter into any employment agreements with any of these professionals. Thus, these persons are not intended to be employees of our company.

6

Employment Agreements

There are currently no employment agreements and none are anticipated to be entered into within the next six months.

Board Committees

The Company has not yet implemented any board committees as of the date of this Report.

Directors

The maximum number of directors the Company is authorized to have is nine. However, in no event may the Company have fewer than one director. Although the Company anticipates appointing additional directors, as of the date of this Annual Report, it had not identified any such person.

As of the date of this Annual Report, we had one director: Nissim Trabelsi.

Director Compensation

Mr. Fisher will receive 500 shares of the Company’s common stock per month for his service as Chairman of the Company once operations commence, and payable every three months thereafter.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements.

Recent Developments

Name Change

In February 2014, the Board of Directors of the Company recommended to the shareholders that the Company change its name from Boston Investment and Development Corp. to Mazzal Holding Corp. By written consent, the holders of a majority of the outstanding common stock approved the name change. All references to “the Company” and “MHC” in this Annual Report are to Mazzal Holding Corp., formerly Boston Investment and Development Corp.

Resignation of Director

On February 27, 2014, Mazzal Ilooz resigned as a director of the Company. Following Ms. Ilooz’s resignation, Mr. Trabelsi is the sole director of the Company. Mr. Fisher remains as the Chairman of the Company.

7

Property Development

The Company owns property in the Green Pines Townhomes subdivision in Taunton, MA. The Company plans to submit a request to the local zoning board in April 2014 for a change from 49 to 72 units for Phase I of the development. (Management anticipates that there will be no change to Phase II until Phase I is completed.) If the zoning board approves the change from 49 to 72 units, management anticipates that the Company could realize a significant increase in proceeds from sales.

The Company recently received an updated appraisal of the Taunton property, which is now appraised at approximately $2.1 million, which is an increase of approximately $600,000.

Casino Project – Taunton, MA

Additionally, in 2012, voters in the city of Taunton, MA, voted to approve the building of a tribal casino in Taunton, MA, that would be built by the Mashpee Wampanaog tribe. As of the date of this Annual Report, the casino project was continuing to progress. The location of the casino project is approximately one mile from the Company’s property. Management anticipates that if the casino project continues and receives final approval and is constructed, it could significantly increase the value of the units built on the Company’s property, although there can be no assurance of the increase in value.

Israel Operations

In the first quarter of 2014, the Company began to expand its operations to Israel, where a significant number of the Company’s initial shareholders are located. The Company will be working to acquire and develop property in Israel. As of the date of this Annual Report, the Company was negotiating an agreement to purchase land for building up to 13 condominiums. The property is locatedin the city of Netanya, Israel. Management anticipates that the project will consist of 12 standard units and one penthouse unit. Management of the Company is working on applying for and obtaining necessary permits, and anticipates that the permits could be obtained as early as the second or third quarter of 2014.

Forward Stock Split

On March 24, 2014, the Company filed with the Nevada Secretary of State an amendment to its Articles of Incorporation (as amended to date) to effectuate a forward stock split at a ratio of ten new shares for each on share (10:1). The share numbers given in this Annual Report all reflect pre-stock-split numbers, i.e. do not give effect to the 10:1 forward stock split.

ITEM 1A. RISK FACTORS

Not required for Smaller Reporting Companies.

ITEM 2. PROPERTIES

On March 31, 2013, the Company entered into a Standard Land Purchase and Sale Agreement (the “Purchase Agreement”) with the Mazzal

Trust, pursuant to which the Company purchased property (the “Property”) consisting of “the land and all buildings thereon known as 171

Hart St., Taunton MA 02780.” The property consists of approximately 25 acres. The property is located in the Green Pines Townhomes subdivision, and the subdivision is managed by the Green Pines Townhomes Condominium Trust. (The manager of the Green Pines

Townhomes Condominium Trust is Green Pines, LLC, a shareholder of the Company, the manager of which is Marty Trabelsi, the brother of Nissim Trabelsi, the Company’s President.) The purchase price for the Property was 1,500,000 shares of the Company’s common stock. On May 29, 2013, the purchase of the property closed, and the seller delivered the deed, and the Company issued the shares.

As of the date of this Annual Report, the Property sub-division had all the underground utilities installed, and one main road paved. Additionally, as of the date of this Annual Report, one building with two units had been completed, and initially approximately 47 more units remained to be built in Phase 1 of the development. As noted above, the Company recently filed with the local zoning board an application to change from 49 units to 72 units for Phase I of the development.

For Phase 2, management anticipates that an additional 50 units will be in the future.

ITEM 3. LEGAL PROCEEDINGS

None.

8

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

There is no established public trading market for our securities and a regular trading market may not develop, or if developed, may not be sustained. A stockholder in all likelihood, therefore, will not be able to resell his or her securities should he or he desire to do so when eligible for public resale. Furthermore, it is unlikely that a lending institution will accept our securities as pledged collateral for loans unless a regular trading market develops. We have no plans, proposals, arrangements, or understandings with any person with regard to the development of a trading market in any of our securities.

In 2013, the Company filed a registration statement (the “Registration Statement”) to register the resale by certain selling shareholders of shares of the Company’s common stock. The Registration Statement was declared effective in February 2014. That Registration Statement was a step toward creating a public market for the Company’s common stock, which may enhance the liquidity of the Company’s shares. However, there can be no assurance that a meaningful trading market will develop. The Company and its management make no representation about the present or future value of the Company’s common stock.

As of March 21, 2014:

1. There are no outstanding options or warrants to purchase, or other instruments convertible into, common equity of the Company; and

2. There were 2,000,000 shares of the Company’s common stock held by 46 shareholders, including of its President, Nissim Trabelsi.

At the present time, the Company is not classified as a “shell company” under Rule 405 of the Securities Act. As such, all restricted securities presently held by the founder and other officers or directors of the Company may be resold in reliance on Rule 144, once all requirements set forth in that Rule have been met.

Penny Stock Considerations

Our shares likely will be “penny stocks” as that term is generally defined in the Exchange Act and the rules and regulations promulgated thereunder to mean equity securities with a price of less than $5.00. Our shares thus will be subject to rules that impose sales practice and disclosure requirements on broker-dealers who engage in certain transactions involving a penny stock.

Under the penny stock regulations, a broker-dealer selling a penny stock to anyone other than an established customer or accredited investor must make a special suitability determination regarding the purchaser and must receive the purchaser’s written consent to the transaction prior to the sale. Generally, an individual with a net worth in excess of $1,000,000 or annual income exceeding $200,000 individually or $300,000 together with his or her spouse is considered an accredited investor. In addition, under the penny stock regulations the broker-dealer is required to:

9

| · |

Deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the SEC relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt;

|

|

·

|

Disclose commissions payable to the broker-dealer and our registered representatives and current bid and offer quotations for the securities;

|

|

·

|

Send monthly statements disclosing recent price information pertaining to the penny stock held in a customer’s account, the account’s value and information regarding the limited market in penny stocks; and

|

|

·

|

Make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction, prior to conducting any penny stock transaction in the customer’s account.

|

Because of these regulations, broker-dealers may encounter difficulties in their attempt to sell shares of our Common Stock, which may affect the ability of our stockholders to sell their shares in the secondary market and have the effect of reducing the level of trading activity in the secondary market. These additional sales practice and disclosure requirements could impede the sale of our securities, if our securities become publicly traded. In addition, the liquidity for our securities may be decreased, with a corresponding decrease in the price of our securities. Our shares in all probability will be subject to such penny stock rules and our stockholders will, in all likelihood, find it difficult to sell their securities.

Holders

As of the date of this Report, we had 46 holders of record of our Common Stock.

Dividends

We have not declared any cash dividends on our Common Stock since our inception and do not anticipate paying such dividends in the foreseeable future. Any decisions as to future payments of dividends will depend on our earnings and financial position and such other facts, as the Board of Directors deems relevant.

Securities Authorized for Issuance Under Equity Compensation Plans

As of the date of this Report, the Company did not have an equity compensation plan.

Recent Sales of Unregistered Securities

From January to April 2013, the Company sold a total of 22,000 shares of its restricted common stock to 44 individuals with whom Mr. Trabelsi had prior business and personal contacts. The price per share paid was $1.00. Each of the Selling Stockholders entered into a stock purchase agreement with the Company, pursuant to which he or she made the following representations and warranties:

|

-

|

That he or she was purchasing the shares for investment purposes, and not with a view to resell or distribute the shares;

|

|

-

|

whether direct or indirect;

|

|

-

|

That he or she understood that the shares were restricted securities, and could only be resold in compliance with the securities laws;

|

|

-

|

That he or she was experienced in evaluating and making speculative investments, and had the capacity to protect his or her interests in connection with the acquisition of the shares and

|

|

-

|

That he or she had such knowledge and experience in financial and business matters in general, and investments in the real estate industry in particular, to be capable of evaluating the merits and risks of an investment in the Company.

|

10

The shares were sold in a private placement transaction. Mr. Trabelsi, the Company’s founder, President, and sole promoter, had a pre- existing personal relationship with each of the Selling Stockholders.

Additionally, the Company issued 478,000 shares to Mr. Trabelsi in connection with his formation of the Company.

On March 31, 2013, the Company entered into the Purchase Agreement for the purchase of the Property, in connection with which the Company agreed to issue 1,500,000 shares of the Company’s common stock to the Mazzal Trust, an entity with which Mr. Trabelsi had a prior existing relationship.

No public solicitation was involved in any of the issuances, and each Selling Stockholder was contacted directly by the Company’s management. No commissions or fees were paid. The issuances of these shares were exempt from registration under Section 4(2) of the Securities Act of 1933, as amended, as sales of securities not involving any public offering.

ITEM 6. SELECTED FINANCIAL DATA

Because the Company is a “Smaller Reporting Company,” this information is not required to be provided.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion of our financial condition and results of operations together with the audited financial statements and the notes to the audited financial statements included in this Annual Report on Form 10-K. This discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results may differ materially from those anticipated in these forward- looking statements.

We are a development stage company and have not started operations or generated or realized any revenues from our business operations.

Our auditors have issued an explanatory note regarding our ability to continue as a going concern. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next 12 months. Our auditor's opinion is based on our suffering initial losses, having no operations, and having a working capital deficiency. The opinion results from the fact that we have not generated any revenues and no revenues are anticipated until we acquire the required licenses and complete our initial development. Accordingly, we must raise cash from sources other than operations. Our only other source for cash at this time is investments by others in our company. We must raise cash to implement our project and begin our operations. The money we raise in this offering will last six months.

We have one officer, Nissim Trabelsi, President and Director. He is responsible for our managerial and organizational structure which will include preparation of disclosure and accounting controls under the Sarbanes Oxley Act of 2002. When these controls are implemented, Mr. Trabelsi, together with any other executive officers in place at that time, will be responsible for the administration of the controls. Should they not have sufficient experience, they may be incapable of creating and implementing the controls which may cause us to be subject to sanctions and fines by the Securities and Exchange Commission which ultimately could cause you to lose your investment.

We must raise cash to implement our business plan. The amount of funds which the Company will need to raise that we feel will allow us to implement our business strategy is approximately $800,000. We feel if we cannot raise at least $500,000, the Company will not be able to accelerate the implementation of its business strategy and will be seriously curtailed. We will need to raise the funds through private offerings of our securities or through other means, as we will receive no proceeds from the sales of shares by the Selling Stockholders in this offering.

11

The Company was incorporated on January 23, 2013, under the laws of the State of Nevada. The Company is a startup and has not yet realized any revenues. Our efforts have focused primarily on the development and implementation of our business plan. No development related expenses have been or will be paid to affiliates of the Company.

Generating revenues in the next six to twelve months is important to support our planned ongoing operations. However, we cannot guarantee that we will generate such growth. If we do not generate sufficient cash flow to support our operations over the next 12 to 18 months, we may need to raise additional capital by issuing capital stock in exchange for cash in order to continue as a going concern. There are no formal or informal agreements to attain such financing. We cannot assure you that any financing can be obtained or, if obtained, that it will be on reasonable terms. Without realization of additional capital, it would be unlikely for us to continue as a going concern.

Our management does not anticipate the need to hire additional full or part- time employees over the next six months, as the services provided by our officers and directors appears sufficient at this time. We believe that our operations are currently on a small scale that is manageable by a few individuals. Our management's responsibilities are mainly administrative at this early stage. While we believe that the addition of employees is not required over the next six months, the professionals we plan to utilize will be considered independent sub-contractors. We do not intend to enter into any employment agreements with any of these professionals. Thus, these persons are not intended to be employees of our company.

Our management does not expect to incur research and development costs. We do not have any off-balance sheet arrangements.

We currently do not own any significant plants or equipment that we would seek to sell in the near future.

We have not paid for expenses on behalf of our director. Additionally, we believe that this fact shall not materially change.

Plan of Operation

The Company’s anticipated plan of operation is to construct multi-family dwellings in Massachusetts, both on the Property owned by the Company, and on additional parcels of property which the Company may purchase in the future.

Under the Company’s plan, each subdivision takes approximately 3 years to complete, from purchase of the land, through development of the property, through construction of the units, and through sales of the units.

Management anticipates that the Company will need to raise between $500,000 and $800,000 to start and begin construction of one third of the units, approximately 15 units, which could be completed within approximately 12 months from start of construction. Once the first units are completed, from each unit that is sold in the first year, the revenues will be used to finance construction of the next phases and units. Management anticipates that at the end of the second year of operation, the Company will be able to complete an additional 15 units. Finally, management anticipates that the remaining 17 units will be built on during the third year, to meet the planned completion of 47 units in three years from commencement of construction.

Upon completing this offering, we intend to commence development of our Property, provide infrastructure, and manage the process, within the state of Massachusetts. To begin these developments we will need to acquire the correct licenses to begin producing our homes. Mr. Trabelsi currently has all licenses that would be required to successfully engage in all activities envisioned in our business plan.

Management anticipates that the average construction price for the town homes will be approximately $180,000-$200,000, and the average selling price will be approximately $250,000, although there can be no guarantee that the Company will be able to construct all the town homes at this cost, or sell any or all of the town homes for the anticipated selling price.

12

As noted above, third-party lenders generally provide consumer financing for multi-family dwelling purchases. Our sales will depend in large part on the availability and cost of financing for multi-family home purchasers. The availability and cost of such financing is further dependent on the number of financial institutions participating in the industry, the departure of financial institutions from the industry, the financial institutions' lending practices, and the strength of the credit markets generally, governmental policies and other conditions, all of which are beyond our control. If additional third-party financing for the purchases of our Company’s homes does not become available, our operations could be negatively affected.

Management anticipates that each unit will be approximately 1500 ft.², and that the Company’s building cost is roughly $100 for each square foot, for a total of $150,000 costs to build each unit. Additionally, the costs associated with the land are approximately $32,000 for each lot. Also, Management anticipates approximately $18,000 in commissions and soft costs for an approximate total cost of $200,000 to complete each unit. As noted above, the figures in the preceding sentences relating to construction costs are only estimates made by management, and are not based on surveys, third-party valuations, or other outside sources. These estimates are based on management’s prior history and experience in construction in Massachusetts, and there can be no guarantee that the Company will be able to construct any of the units for the costs and amounts indicated.

The Company’s ability to commence operations is entirely dependent upon its ability to raise additional capital, most likely through the sale of additional shares of the Company’s common stock or other securities. As noted above, Management anticipates that the Company will need approximately $500,000 - $800,000 over the next twelve months to implement the Company’s business plan and commence construction of multi-family dwellings.

Management believes that if the Company cannot raise the funds needed through equity offerings of the Company’s securities, the Company likely will look to commercial or bank financing of its project for the capital needed. There can be no guarantee that the Company will be able to obtain such bank or commercial financing on terms that are acceptable to the Company, or at all.

The realization of revenues in the next twelve months is important in the execution of the plan of operations. However, if the Company cannot raise additional capital by issuing capital stock in exchange for cash, or through obtaining commercial or bank financing, in order to continue as a going concern, the Company may have to curtail or cease its operations. As of the date of this Report, there were no formal or informal agreements to attain such financing. The Company cannot assure any investor that, if needed, sufficient financing can be obtained or, if obtained, that it will be on reasonable terms. Without realization of additional capital, it would be unlikely for operations to continue.

Forward Looking Statements.

Information in this Annual Report on Form 10-K contains “forward looking statements” within the meaning of Rule 175 of the Securities Act of 1933, as amended, and Rule 3b-6 of the Securities Act of 1934, as amended. When used in this Form 10-K, the words “expects,” “anticipates,” “believes,” “plans,” “forecasts,” “projects,” “intends,” “strategy,” “may,” “will,” “will likely result,” and similar expressions are intended to identify forward-looking statements. These are statements that relate to future periods and include, but are not limited to, statements regarding the adequacy of cash, expectations regarding net losses and cash flow, statements regarding growth, the need for future financing, dependence on personnel, and operating expenses.

Forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date hereof. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

13

Critical Accounting Policies

The SEC has issued Financial Reporting Release No. 60, “Cautionary Advice Regarding Disclosure About Critical Accounting Policies” (“FRR 60”), suggesting companies provide additional disclosure and commentary on their most critical accounting policies. In FRR 60, the Commission has defined the most critical accounting policies as the ones that are most important to the portrayal of a company’s financial condition and operating results, and require management to make its most difficult and subjective judgments, often as a result of the need to make estimates of matters that are inherently uncertain. Based on this definition, the Company’s most critical accounting policies include: (a) use of estimates; (b) real estate assets; (c) impairment long lived assets; (d) Real Estate Assets Held for Sale and Discontinued Operations; and (e) Share Based Payments. The methods, estimates and judgments the Company uses in applying these most critical accounting policies have a significant impact on the results the Company reports in its financial statements.

(a) Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts or revenues and expenses during the reporting period. Actual results could differ from those estimates.

(b) Real estate assets

Real estate assets are stated at cost less accumulated depreciation and amortization. Costs directly related to the acquisition, development and construction of properties are capitalized. Acquisition-related costs are expensed as incurred. Capitalized development and construction costs include pre-construction costs essential to the development of the property, development and construction costs, interest, property taxes, insurance, salaries and other project costs incurred during the period of development.

Ordinary repairs and maintenance are expensed as incurred; major replacements and betterments, which improve or extend the life of the asset, are capitalized and depreciated over their estimated useful lives. Fully-depreciated assets are removed from the accounts.

The Company considers a construction project as substantially completed and held available for sale upon the completion of tenant improvements, but no later than one year from cessation of major construction activity (as distinguished from activities such as routine maintenance and cleanup).

Depreciation is calculated using the straight-line method over the estimated useful lives of the properties. The estimated useful lives are as follows:

| Buildings and improvements | 10 to 40 years |

| Other building and land improvements | 20 years |

| Furniture, fixtures and equipment | 5 to 10 years |

(c) Impairment Long-Lived Assets

For purposes of recognition and measurement of an impairment loss, a long-lived asset or assets are grouped with other assets and liabilities at the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and liabilities. The Company assesses the impairment of long-lived assets (including identifiable intangible assets) annually or whenever events or changes in circumstances indicate that the carrying value may not be recoverable.

When management determines that the carrying value of long-lived assets may not be recoverable based upon the existence of one or more of the above indicators of impairment, we test for any impairment based on a projected undiscounted cash flow method. Projected future operating results and cash flows of the asset or asset group are used to establish the fair value used in evaluating the carrying value of long- lived and intangible assets. The Company estimates the future cash flows of the long-lived assets using current and long-term financial forecasts. The carrying amount of a long-lived asset is not recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use and eventual disposition of the asset. If this were the case, an impairment loss would be recognized. The impairment loss recognized is the amount by which the carrying amount exceeds the fair value.

14

(d) Real Estate Assets Held for Sale and Discontinued Operations

The Company periodically classifies real estate assets as held for sale. An asset is classified as held for sale after the approval of the Company’s board of directors and after an active program to sell the asset has commenced. Upon the classification of a real estate asset as held for sale, the carrying value of the asset is reduced to the lower of its net book value or its estimated fair value, less costs to sell the asset. Subsequent to the classification of assets as held for sale, no further depreciation expense is recorded. Real estate assets held for sale are stated separately on the accompanying balance sheets. Upon a decision to no longer market an asset for sale, the asset is classified as an operating asset and depreciation expense is reinstated.

(e) Share based payments

The Company accounts for the issuance of equity instruments to acquire goods and/or services based on the fair value of the goods and services or the fair value of the equity instrument at the time of issuance, whichever is more readily determinable. The Company's accounting policy for equity instruments issued to consultants and vendors in exchange for goods and services follows the provisions of standards issued by the FASB. The measurement date for the fair value of the equity instruments issued is determined at the earlier of (i) the date at which a commitment for performance by the consultant or vendor is reached or (ii) the date at which the consultant or vendor's performance is complete. In the case of equity instruments issued to consultants, the fair value of the equity instrument is recognized over the term of the consulting agreement.

JOBS Act

On April 5, 2012, the JOBS Act was signed into law. The JOBS Act contains provisions that, among other things, reduce certain reporting requirements for qualifying public companies. As an “emerging growth company,” we have the option to delay adoption of new or revised accounting standards until those standards would otherwise apply to private companies, until the earlier of the date that (i) we are no longer an emerging growth company or (ii) we affirmatively and irrevocably opt out of the extended transition period for complying with such new or revised accounting standards. We have elected to opt out of this extended transition period. As noted, this election is irrevocable.

To date, we have not earned any revenue from operations. Accordingly, our activities have been accounted for as those of a “Development Stage Company” as set forth in Financial Accounting Standards Board ASC 915. Among the disclosures required by ASC 915 are that the our financial statements be identified as those of a development stage company, and that the statements of operations, stockholders’ equity and cash flows disclose activity since the date of our inception.

Our financial statements and related public financial information are based on the application of accounting principles generally accepted in the United States ("US GAAP"). US GAAP requires the use of estimates; assumptions, judgments and subjective interpretations of accounting principles that have an impact on the assets, liabilities, revenues and expenses amounts reported. These estimates can also affect supplemental information contained in our external disclosures including information regarding contingencies, risk and financial condition. We believe our use of estimates and underlying accounting assumptions adhere to GAAP and are consistently and conservatively applied. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions. We continue to monitor significant estimates made during the preparation of our financial statements.

We suggest that our significant accounting policies, as described in our financial statements in the Summary of Significant Accounting Policies, be read in conjunction with this Management's Discussion and Analysis of Financial Condition and Results of Operations.

15

Recent Accounting Pronouncements

In July 2013, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) No. 2013-11: Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists. The new guidance requires that unrecognized tax benefits be presented on a net basis with the deferred tax assets for such carryforwards. This new guidance is effective for fiscal years and interim periods within those years beginning after December 15, 2013. We do not expect the adoption of the new provisions to have a material impact on our financial condition or results of operations.

Off-Balance Sheet Arrangements

None.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Audited financial statements as of and for the period ended December 31, 2013 and for the period of inception (January 23, 2013) through December 31, 2013, are presented in a separate section of this report following Item 15.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

(a) Disclosure Controls and Procedures

Disclosure controls and procedures are the controls and other procedures that are designed to provide reasonable assurance that information required to be disclosed by the issuer in the reports that it files or submits under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including the principal executive and principal financial officer, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure. Any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

We have carried out an evaluation, under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer, of the effectiveness of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act as of the end of the fiscal year covered by this Annual Report.

Based on that evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that the Company’s disclosure controls and procedures were effective as of the end of the fiscal year covered by this Annual Report on Form 10-K.

(b) Management’s Annual Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Securities Exchange Act Rule 13a-15(f). Internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and preparation of financial statements for external purposes in accordance with U.S. GAAP. This annual report does not include a report of management's assessment regarding internal control over financial reporting due to a transition period established by rules of the Securities and Exchange Commission for newly public companies.

16

(c) Change in Internal Control over Financial Reporting

There were no significant changes to our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during our fourth fiscal quarter, that could materially affect, or are reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER ITEMS

Registration Statement; OTC BB

On February 4, 2014, a registration statement on Form S-1 (the “Registration Statement”), filed to register the resale of shares of common stock held by 46 selling shareholders named in the Registration Statement, was declared effective by the Commission.

Code of Ethics

As of the date of this Report, we had not adopted a formal, written code of conduct (“Code of Ethics”) within the specific guidelines promulgated by the SEC, although we intend to adopt a Code of Ethics during the second or third quarter of 2014.

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE Directors and Executive Officers

Directors are elected by the stockholders to a term of one year and serves until his or her successor is elected and qualified. Each of the officers is appointed by the Board of Directors to a term of one year and serves until her or her successor is duly elected and qualified, or until he or she is removed from office. The Board of Directors has no nominating, auditing or compensation committees.

Background of Directors, Executive Officers

Nissim Trabelsi, President, CEO, CFO, Director; Age 50: Mr. Trabelsi was born in Tiberias, Israel, and served in the Israel Army in combat engineering services. He studied for two years at a technical engineering school in Tel Aviv, Israel. In 1989, he began his own building company, Trabelsi Builders, Inc., in Boston, Massachusetts. He holds an unrestricted supervisor building license, and has been building unique design and custom built homes. Over the past five years, he has been active in the commercial and multi-family construction industries. Mr. Trabelsi’s roles in these projects included being involved with architectural designs of the projects, as a manufacturer and builder of the structures, and being project manager for the projects.

Mr. Trabelsi has over 25 years’ experience in the construction industry. In the past five years, Mr. Trabelsi was involved in building residential and commercial structures. With respect to commercial construction, he recently completed construction of a 10,000-square-foot synagogue in Newton, Massachusetts, in addition to a multi-family building with 7 units. Mr. Trabelsi is also certified engineer steel structure disturber. Management anticipates that in connection with the construction of the initial and subsequent projects, Mr. Trabelsi will directly manage the entire construction of the subdivision to completion. Management believes that Mr. Trabelsi’s years of construction, contracting, and building experience make him an ideal officer and director of the Company.

17

Harold R. Fisher, Esq., Chairman of the Company; Age 77: Mr. Fisher graduated from Penn State with a B.S. in business, and attended the University of Pennsylvania Law School. After serving in the U.S. Marine Corps, he practiced law for approximately 40 years in various fields including litigation, federal government (State Dept. and the SEC) and as outside counsel for several high-tech corporations. He retired after working for the Commonwealth of Massachusetts. Since then, he has been engaged in consulting for several entities. He also received an MBA from Babson College in Wellesley, and is a member of the bar in Washington, D.C., Maryland, and Massachusetts. Management believes that Mr. Fisher’s vast legal experience will help the Company with all of the Company daily activities, including executing all purchase and sales agreements, closing real estate transactions, and recording transactions.

Mazzal Ilooz, Secretary, Treasurer, Director; Age 72: Ms. Ilooz was born in Tel Aviv Israel. In 1980, she started a real estate office in Israel called Mazzal real estate services. She has over 20 years of experience as a real estate broker, helping hundreds of customers to achieve their dreams of home ownership. Over the last five years, she has focused on two principal areas which are of benefit to the Company: commercial and residential real estate transactions as a broker and as an agent; and real estate and project management. As a broker, over the past five years, Ms. Ilooz has been involved in over 27 real estate transactions, which were managed and completed by her brokerage, including managing documentation and closings, home inspections, and mortgage applications. With respect to real estate project management, her brokerage manages 11 projects in Israel and two in the United States (including the Company’s project). The projects in Israel include construction of a new small mall development and managing 19 storefront rentals; property management of two supermarket locations; management of 36 apartments over seven locations; working with a home builder to build and sell a single-family home. The project management duties include collection of rent; locating tenants and/or purchasers; negotiating leases and purchase contracts; and responsibility for maintenance and repairs. In the United States, on the project management side, Ms. Illooz has worked with a home builder to build and sell a single-family home, and has been working with the Company in connection with the construction and sale of the townhomes in the Project. Her work includes supervision of contractors and marketing the Project. Management anticipates that in connection with the initial projects and future projects, Ms. Ilooz will be involved in on-site project management and the sales office supervisor. As noted above, Ms. Ilooz resigned as a director on February 27, 2014.

Meetings of the Board of Directors

The Board of Directors met monthly during 2013, and all Directors attended all of the meetings of the Board.

The Board of Directors and Committees

As of the date of this Report, we had no independent directors. However, because we intend to list our stock for trading on the OTC Bulletin Board or the OTC Markets, which do not require independent directors, we are not required to have independent directors. We anticipate appointing independent directors as required in the future.

Audit Committee

As of the date of this Report, we did not have a standing Audit Committee. We intend to establish an Audit Committee of the Board of Directors, which will consist of independent directors, of which at least one director will qualify as a qualified financial expert as defined in the regulations of the SEC. The Audit Committee’s duties would be to recommend to our Board of Directors the engagement of independent auditors to audit our consolidated financial statements and to review our accounting and auditing principles. The Audit Committee would review the scope, timing and fees for the annual audit and the results of audit examinations performed by the internal auditors, if any, and independent public accountants, including their recommendations to improve the system of accounting and internal control. The Audit Committee would at all times be composed exclusively of directors who are, in the opinion of our Board of Directors, free from any relationship that would interfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles. As of the date of this Report, we did not have an audit committee financial expert, in light of our size, although we intend to review this issue as the Company grows, especially as the Company implements a standing Audit Committee.

18

Compensation Committee

As of the date of this Report, we did not have a standing Compensation Committee. We intend to establish a Compensation Committee of the Board of Directors. The Compensation Committee would review and approve our salary and benefits policies, including compensation of executive officers. The Compensation Committee would also administer any stock option plans that we may adopt and recommend and approve grants of stock options under such plans.

Nominating and Corporate Governance Committee

As of the date of this Report, we did not have a standing Nominating and Corporate Governance Committee. We intend to establish a Nominating and Corporate Governance Committee of the Board of Directors to assist in the selection of director nominees, approve director nominations to be presented for stockholder approval at our annual meeting of stockholders and fill any vacancies on our Board of Directors, consider any nominations of director candidates validly made by stockholders, and review and consider developments in corporate governance practices.

Code of Ethics

As of the date of this Report, we had not adopted a formal, written code of conduct (“Code of Ethics”) within the specific guidelines promulgated by the SEC, although we intend to adopt a Code of Ethics during the second or third quarter of 2014.

Corporate Governance

As of the date of this Annual Report, we had one director and three officers. Once the Company is able to increase its number of directors and executive officers, the Company intends to approve an Internal Control Manual so that management has an organizational guide for the purpose of establishing policy toward Company-wide treatment of check writing and receiving, as well as the items relating to disclosure to shareholders and regulators.

Indemnification

Under our Articles of Incorporation and Bylaws, we may indemnify an officer or director who is made a party to any proceeding, including a lawsuit, because of his position, if he acted in good faith and in a manner he reasonably believed to be in our best interest. We may advance expenses incurred in defending a proceeding. To the extent that the officer or director is successful on the merits in a proceeding as to which he is to be indemnified, we must indemnify him against all expenses incurred, including attorney's fees. With respect to a derivative action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceeding, and if the officer or director is judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Regarding indemnification for liabilities arising under the Securities Act which may be permitted to directors or officers under Nevada law, we are informed that, in the opinion of the Securities and Exchange Commission, indemnification is against public policy, as expressed in the Securities Act and is, therefore, unenforceable.

ITEM 11. EXECUTIVE COMPENSATION

Executive Compensation

The Company was formed in January 2013. No officer or director has received any compensation from the Company since the inception of the Company. Until the Company acquires additional capital, it is not anticipated that any officer or director will receive compensation from the Company other than reimbursement for out-of-pocket expenses incurred on behalf of the Company.

19

The Company has no stock option, retirement, pension, or profit sharing programs for the benefit of directors, officers or other employees, but our officers and directors may recommend adoption of one or more such programs in the future.

We have no employment agreements with our officers, although we may enter into such agreements following our receipt of additional capital.

The Company does not have a standing compensation committee, audit committee, nomination committee, or committees performing similar functions. We anticipate that we will form such committees of the Board of Directors once we have a full Board of Directors.