UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended: December 31, 2017 |

|

|

or |

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

|

Commission File Number 001‑37943

PETROSHARE CORP.

(Exact name of registrant as specified in its charter)

|

Colorado |

46‑1454523 |

9635 Maroon Circle, Suite 400

Englewood, Colorado 80112

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number including area code: (303) 500‑1160

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes☒ No ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S‑T (§203.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S‑K (§229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference into Part III of this Form 10‑K or any amendment to this Form 10‑K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and emerging growth company in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Smaller reporting company ⌧ |

|

|

Emerging growth company ⌧ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ⌧

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act). Yes ☐ No ☒

As of June 30, 2017, the last business day of the registrant’s most recently completed second fiscal quarter, there were 13,142,637 shares outstanding and held by non‑affiliates of the registrant. The aggregate market value of those shares, based on the closing price of the Company’s common stock on the OTCQB on June 30, 2017, was $22,999,615.

On March 28, 2018, there were 27,788,802 shares of the Company’s common stock outstanding.

Documents incorporated by reference: None

ANNUAL REPORT ON FORM 10‑K

TABLE OF CONTENTS

ADDITIONAL INFORMATION

Descriptions of agreements or other documents in this report are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see the Exhibit Index at the end of this report for a complete list of those exhibits.

Cautionary Language Regarding Forward-Looking Statements

Please see Cautionary Language Regarding Forward‑Looking Statements on page 28 of this report for important information contained herein.

Glossary

Please see page 42 for a glossary of certain terms used in this report.

ITEMS 1. AND 2. BUSINESS AND PROPERTIES

Our History and Organization

PetroShare Corp. (“we,” “our,” “us” or the “Company”) is an independent oil and gas company incorporated under the laws of the State of Colorado on September 4, 2012 to investigate, acquire and develop crude oil and natural gas properties in the Rocky Mountain or mid-continent portion of the United States. Since 2016, our operational focus has been in the Wattenberg Field in the Denver-Julesburg Basin, or DJ Basin, in northeast Colorado. We believe the Wattenberg Field is one of the premier, liquids-rich oil and natural gas resource plays in the United States. It contains hydrocarbon-bearing deposits in several formations, including the Niobrara and Codell. The area has produced oil and natural gas since the 1970s and benefits from an established infrastructure and seasoned service providers.

All of our properties are located in Colorado. As of March 28, 2018, we had an interest in 94 gross (31.8 net) productive wells plus 11 gross (1.3 net) wells in the final stages of completion and 33,681 gross (9,770 net) acres of oil and gas properties. As of December 31, 2017, we were producing hydrocarbons at the rate of approximately 785 BOE/D. At December 31, 2017, we had an estimated 1,534.1 MBOE of proved developed reserves and 6,310.8 MBOE of proved undeveloped reserves.

Our strategy to date has been to focus on acquiring and developing crude oil and natural gas properties in those areas we consider as geo‑mechanical sweet spots, including the southern‑Wattenberg area of the DJ Basin, which we refer to as the Southern Core area. We elected to concentrate on the Southern Core due to the high quality of hydrocarbon‑bearing rock and the production from other, nearby wells. The Southern Core area contains the Niobrara and Codell geologic formations, which tend to yield oil‑weighted production that remains economic in lower commodity price environments.

During 2017, we drilled our first operated wells, located on our Shook Pad in northwest Adams County, for which we expect to initiate completion activities beginning in April 2018. In addition to the 14 wells on the Shook Pad operated by the Company, all of the other horizontal wells in which we have an interest as of March 28, 2018 are operated by independent third-parties. We maintain less than a 50% interest in all of these wells as we seek to diversify risk and minimize capital exposure to development, drilling and completion costs. In any drilling, we expect that our retained working interest will be determined based upon factors such as, level of interest ownership, well costs and geologic and engineering risk. See Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for more information.

Our executive and administrative offices are currently located at 9635 Maroon Circle, Suite 400, Englewood, Colorado 80112 and we maintain a website at www.petrosharecorp.com. We commenced filing reports under the Securities Exchange Act of 1934, as amended, or the Exchange Act, in February 2015, when we completed our initial public offering. You may access and read our public filings through the U.S. Securities and Exchange Commission’s, or the SEC’s, website at www.sec.gov and on our website.

Our Competitive Strengths

We believe we are well‑positioned to capitalize on current conditions in the oil and natural gas industry as a result of the following competitive strengths, in addition to the location of our properties.

1

Our Management

Our Chief Executive Officer, Stephen Foley, has over 16 years of experience as a real estate developer in Colorado, with an extensive background in surface development, including in the areas in which we have acquired acreage. Our President, Frederick Witsell, and Chief Operating Officer, William Lloyd, bring a long history and knowledge of basins in Colorado and depth of experience in the industry to our company. Mr. Witsell has over 37 years of experience in several facets of the oil and gas industry, including prospect development, conventional and horizontal drilling and completion operations, project management, gathering and compression systems and marketing and risk management. Mr. Lloyd also has over 37 years of experience in the industry, serving in engineering, management and senior leadership capacities. In addition to their experience, these individuals bring valuable relationships with other recognized industry participants which have, and we believe will continue to, provide opportunities to our company.

Our Strategic Partnerships

Through relationships cultivated by our executive officers, we have formalized agreements with business partners that have, and we believe will continue to, contribute significantly to our growth. Our relationships with real estate developers and other stakeholders in and around our focus areas, continue to yield leasing and surface access opportunities.

In May 2015, in connection with a credit agreement, we entered into a participation agreement with Providence Energy Operators, LLC (“PEO”). PEO is an affiliate of Providence Energy Corp., a privately‑held multi‑million dollar acquirer of oil and gas properties throughout the United States, and which currently owns and/or manages over two million net acres in 37 states with royalty or working interests in over 10,000 wells. As discussed elsewhere in this report, an affiliate of PEO is a major participant in our principal lender group through which we currently maintain a $25.0 million term credit facility, and PEO is the beneficial owner of 11.7% of our common stock currently outstanding. PEO and related entities could beneficially own up to 37% of our common stock after exercising certain conversion rights. The participation agreement grants PEO the option to acquire up to a 45% interest and participate in any oil and gas development on acreage we obtain within an area of mutual interest (AMI) near our Southern Core area. To date, PEO has exercised its option under the participation agreement or otherwise participated or agreed to participate in all of our acreage acquisitions.

We believe our relationship with PEO is instrumental to our success. In addition to providing funding for our acquisition and development strategy, the relationship provides us access to PEO’s oil and gas expertise. We believe our relationship with PEO is strong, as evidenced by its participation in our acreage acquisitions, our borrowing arrangement, and its holdings in our common stock.

Liquids-Weighted Reserves

Our net proved reserves at December 31, 2017 were comprised of approximately 67% oil and NGLs (collectively, liquids). Given the current commodity price environment and resulting disparity between oil and natural gas prices on a BOE basis, we believe our high percentage of liquid reserves and drilling program focused on oil-weighted projects, compared to our overall reserve base, is a key strength.

Multi-Year Drilling Inventory Targeting the Niobrara and Codell Formations

We believe nearby operator horizontal drilling activity and well results in and around our acreage have significantly mitigated the geologic risk in our drilling program. Our Todd Creek Farms and South Brighton prospects are located in an area where drilling results and the liquids-weighted nature of the assets allow for generating accretive returns even in a low commodity price environment. To date, we have identified up to 237 gross horizontal drilling

2

locations (up to 15.5 net wells) in our Todd Creek Farms and South Brighton Focus Areas which we are in the process of increasing our interests through acreage swaps and lease purchases. As of December 31, 2017, 94 of these locations have been designated proved undeveloped reserves by our third-party reserve engineer. We believe our multi-year drilling portfolio provides the potential for near-term growth in our production and reserves and highlights the long-term resource potential across our asset base.

Recent Developments

As discussed in more detail below, we drilled and cased 14 wells on our operated Shook pad during 2017. In March 2018, following successful negotiations to obtain access to gathering and pipeline facilities, we entered into an agreement to fracture treat all the wells on the Shook pad. The wells on the Shook pad targeted all three benches of the Niobrara plus the Codell sandstone formations. Pressure pumping equipment is scheduled to be on location on April 1, 2018 with all completion activities and production facilities expected to be finalized by mid-May. Subject to completion of the gathering pipeline by an independent third party, we expect these wells to be on full production by June 2018.

Non‑Operated Drilling Participation

Beginning in 2016 and continuing into 2017, we participated in the drilling and completion of 17 gross (2.9 net) horizontal wells in the Southern Core as a non-operator. All of these wells are being operated by operators with an established track record in the Wattenberg Field. Of the 17 gross wells, three were put in production in late 2016 and the 14 Jacobucci mid-range lateral wells were put on production in February and March 2017. Our participation in these wells provided us with the first significant revenue in our history, providing the vast majority of our fiscal 2017 revenue of $11.1 million.

We are also currently participating as a non-operator in 22 Codell and Niobrara horizontal wells in which we have a working interest ranging from 3.4% to 18.6%. These non-op horizontal wells are in various stage of flowback and clean-up after fracture stimulation or have been drilled and cased and are waiting on fracture treatment and final completion activities.

Credit Facility

In December 2017, we completed the first closing of $5.0 million of what ultimately became a $25.0 million Credit Facility, all of which was used to reduce our accounts payable or accrued liabilities. On February 1, 2018, we finalized a credit agreement with Providence Wattenberg Ltd., a Texas limited partnership and affiliate of PEO, and 5NR Wattenberg, LLC, a Texas limited liability company (collectively, the “Lenders”) pursuant to which the Lenders loaned us $25.0 million under a term credit facility. This facility allowed us to partially or fully repay certain lines of credit and extend a line of credit that was to mature in December 2017. The remaining capital is earmarked for pipeline construction, drilling and completion activities and additional working capital.

Capital Raises

During 2017, we completed two financings which provided approximately a net $11.8 million of working capital. In the two private financings, completed in January and October 2017, we sold convertible promissory notes with warrants, the proceeds of which allowed us to continue our drilling and other development activities during the year.

3

Oil and Gas Properties

DJ Basin and Wattenberg (Southern Core Area)

Our area of focus, the Southern Core area, is located within the Wattenberg Field, which is a part of the DJ Basin. Discovered in 1970, and historically a gas field, the Wattenberg Field, which covers more than 2,000 square miles, now produces both crude oil and natural gas primarily from the Niobrara and Codell formations. The DJ Basin generally extends from the Denver metropolitan area throughout northeast Colorado into parts of Wyoming, Nebraska, and Kansas. The majority of the DJ Basin lies in Weld County, but reaches into Adams, Arapahoe, Boulder, Broomfield, Denver, and Larimer Counties.

The Southern Core area covers areas in northwest Adams County and southwest Weld County. The Southern Core area saw significant development through vertical drilling in the preceding decades, but modern horizontal drilling is relatively new for the area. The “northern core Wattenberg,” located south of Greeley in west‑central Weld County, has been the primary focus of oil and gas producers for the past seven years. We believe the Southern Core area provides us compelling economics in even lower price environments.

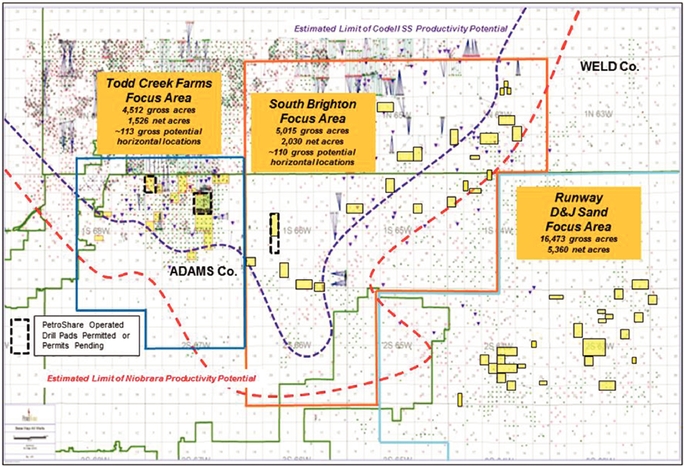

The following map depicts our properties in the Southern Core

4

We currently possess an inventory of approximately 237 gross potential horizontal drilling locations within our Southern Core area including over 200 locations that are fully permitted or in the permitting stages. The remaining locations are potential infill wells located in and around current drilling spacing units established under applicable industry rules. We have not included certain of these potential horizontal drilling locations in our proved undeveloped or probable reserves because we have not yet established a development plan for those locations in accordance with SEC rules.

Todd Creek Farms

Within our Southern Core focus area, our primary prospect is Todd Creek Farms, which is located in northwest Adams County, Colorado. Our Shook pad, on which we have drilled and cased 14 wells, is located in the Todd Creek focus area. We have also permitted eights wells on the Corcillius pad located with this focus area, but we have no immediate plans in 2018 to commence drilling those wells.

Our working interest in the Shook pad wells averages approximately 42%. Since the final well was cased in August 2017, we have been negotiating pipeline and gathering access, and have identified and reached agreement with a suitable third party. Assuming completion of the pipeline and gathering line, and completion of fracture activities scheduled to commence in April 2018, we expect these 14 wells to be fully producing by June 2018, adding significantly to our revenue.

Our most significant non‑operated interest in the Todd Creek Farms focus areas is the Jacobucci pad. In connection with an acquisition in April 2016, we acquired the seller’s right to participate in this 14 mid‑range well program. Our working interest in these wells ranges from 8% to 27%, resulting in a net of 2.9 wells to our interest. These wells were completed in February and March 2017 and have been producing since that time. These wells provided the majority of our cash flow during 2017.

South Brighton

Our South Brighton Focus Area is east of our Todd Creek Farms prospect and sits in northern Adams County and southern Weld County. We acquired the majority of this acreage in 2016. We have leaseholds encompassing 5,807 (2,235 net) acres in the South Brighton Focus Area.

During 2017 and early 2018, we have assembled drill spacing units and made application for 100 gross extended length (2 mile) horizontal wells as the operator targeting the Niobrara and the Codell formations. Of that amount, eight pending permits are for our Brighton Lakes Pad.

Runway

Our Runway prospect area is east of Todd Creek Farms and South Brighton and lies principally within Adams County, Colorado east of the Denver International Airport. We have leaseholds encompassing 20,117 gross (5,240 net) acres in the Runway prospect.

Buck Peak

We divested of our interest in the Buck Peak prospect, located in Western Colorado in Moffat County, during 2017 and no longer hold any leaseholds in this area.

5

Productive Wells

The following table sets forth the number of productive oil and natural gas wells in which we owned a working interest as of March 28, 2018:

|

|

|

Productive Wells(1)(2) |

||||||||||

|

|

|

Crude Oil |

|

Natural Gas |

|

Total |

||||||

|

Location |

|

Gross |

|

Net |

|

Gross |

|

Net |

|

Gross |

|

Net |

|

Southern Core |

|

57 |

|

16 |

|

37 |

|

16 |

|

94 |

|

32 |

|

Total productive wells |

|

57 |

|

16 |

|

37 |

|

16 |

|

94 |

|

32 |

|

(1) |

Includes a total of 21 gross wells (2.9 net) in which we are participating as a non-operator. |

|

(2) |

Includes up to 33 gross wells that are currently or periodically shut-in. |

Developed and Undeveloped Acreage

The following table shows our developed and undeveloped acreage as of March 28, 2018:

|

|

|

|

|

|

|

Acreage |

|

|

|

|

||

|

|

|

Developed |

|

Undeveloped(1) |

|

Total |

||||||

|

Location |

|

Gross |

|

Net |

|

Gross |

|

Net |

|

Gross |

|

Net |

|

Todd Creek Farms |

|

2,570 |

|

990 |

|

1,351 |

|

425 |

|

3,921 |

|

1,415 |

|

South Brighton |

|

4,529 |

|

1,783 |

|

1,278 |

|

452 |

|

5,807 |

|

2,235 |

|

Northern Wattenberg |

|

80 |

|

32 |

|

3,756 |

|

848 |

|

3,836 |

|

880 |

|

Runway |

|

12,284 |

|

4,402 |

|

7,833 |

|

838 |

|

20,117 |

|

5,240 |

|

Total acreage |

|

19,463 |

|

7,207 |

|

14,218 |

|

2,563 |

|

33,681 |

|

9,770 |

Following industry standard, we generally acquire oil and gas leases without warranty of title, except as to claims made by, through, or under the transferor. Accordingly, we conduct due diligence as to title prior to acquiring properties, but we cannot guarantee that there will not be losses resulting from title defects. We obtain drilling title opinions and perform any necessary curative work prior to commencing drilling operations. We believe the leasehold title to our properties is good and defensible in accordance with industry standards, subject to such exceptions that, in our opinion, are not so material as to detract from the use or value of our properties. Title to our properties generally carry encumbrances, such as royalties, overriding royalties, contractual obligations, liens, easements, and other matters that commonly affect real property, all of which are customary in the oil and gas industry. We intend to acquire additional leases by lease sale, farm‑in, or purchase.

Leases that are held by production generally remain in force so long as the well on the particular lease is producing or capable of producing. Leased acres that are not held by production may require annual rental payments to maintain the lease until the expiration of the lease or the time oil or gas is produced from one or more wells drilled on the leased acreage. At the time the well begins producing or is capable of producing, the lease is considered to be held by production. Unless production is established within the area covering our undeveloped acreage, the leases for such acreage eventually will expire. Our leases which are not held by production are scheduled to expire, including potential extensions, from 2018 until 2022. If our leases expire in an area we intend to explore, we or our working interest

6

partners will have to negotiate the price and terms of lease renewals with the lessors. The cost to renew such leases may increase significantly and we may not be able to renew the lease on commercially reasonable terms, or at all

The following table shows the calendar years during which our leases not currently held by production will expire unless a productive oil or gas well is drilled:

|

Leased Acres |

|

Expiration of |

||

|

Gross |

|

Net |

|

Lease |

|

80 |

|

20 |

|

2018 |

|

4,378 |

|

1,153 |

|

2019 |

|

8,317 |

|

1,074 |

|

2020 |

|

1,123 |

|

156 |

|

2021 |

|

320 |

|

160 |

|

2022 |

Drilling Results

The following table sets forth information with respect to the number of wells either drilled by us or in which we participated as a non‑operator during the three years ended December 31, 2017. The information should not be considered indicative of future performance, nor should it be assumed that there is necessarily any correlation between the number of productive wells drilled, quantities of reserves found or economic value.

|

|

|

For the Year Ended December 31, |

||||||||||

|

|

|

2017(1) |

|

2016(2) |

|

2015 |

||||||

|

|

|

Gross |

|

Net |

|

Gross |

|

Net |

|

Gross |

|

Net |

|

Development Wells |

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive |

|

36 |

|

7.6 |

|

17.0 |

|

2.9 |

|

— |

|

— |

|

Dry |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

Exploratory Wells |

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

Dry |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

Total Wells |

|

|

|

|

|

|

|

|

|

|

|

|

|

Productive |

|

36 |

|

7.6 |

|

17.0 |

|

2.9 |

|

— |

|

— |

|

Dry |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

|

(1) |

Includes 22 non-operated wells. |

|

(2) |

All non-operated wells. |

7

Sales Data

The following table shows the net sales volumes, average sales prices, and average production costs for the periods presented:

|

|

|

Year Ended December 31, |

||||

|

|

|

2017 |

|

2016 |

|

2015 |

|

Sales volumes |

|

|

|

|

|

|

|

Oil (Bbls) |

|

188,529 |

|

4,903 |

|

37 |

|

Gas (Mcf) |

|

549,846 |

|

26,059 |

|

— |

|

NGLs (Bbls) |

|

50,111 |

|

1,511 |

|

— |

|

BOE |

|

330,281 |

|

10,756 |

|

37 |

|

Average sales price |

|

|

|

|

|

|

|

Oil (per Bbl) |

$ |

46.25 |

$ |

48.91 |

$ |

36.29 |

|

Gas (per Mcf) |

$ |

2.78 |

$ |

2.62 |

$ |

— |

|

NGLs (per Bbl) |

$ |

17.20 |

$ |

16.55 |

$ |

— |

|

BOE |

$ |

33.63 |

$ |

30.97 |

$ |

36.29 |

|

Average production cost per BOE |

$ |

5.19 |

$ |

19.21 |

$ |

871.82 |

Oil, Natural Gas and NGL Data

Proved Reserves

Estimation of Proved Reserves

Under SEC rules, proved reserves are those quantities of oil, natural gas and NGL, which, by analysis of geoscience and engineering data, can be estimated with reasonable certainty to be economically producible—from a given date forward, from known reservoirs and under existing economic conditions, operating methods and government regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation. If deterministic methods are used, the SEC has defined reasonable certainty for proved reserves as a “high degree of confidence that the quantities will be recovered.” All of our proved reserves as of December 31, 2017 and 2016 were estimated using a deterministic method. The estimation of reserves involves two distinct determinations. The first determination results in the estimation of the quantities of recoverable oil and natural gas and the second determination results in the estimation of the uncertainty associated with those estimated quantities in accordance with the definitions established under SEC rules. The process of estimating the quantities of recoverable oil, natural gas and NGL reserves relies on the use of certain generally accepted analytical procedures. These analytical procedures fall into four broad categories or methods: (1) production performance‑based methods; (2) material balance‑based methods; (3) volumetric‑based methods; and (4) analogy. These methods may be used singularly or in combination by the reserve evaluator in the process of estimating the quantities of reserves. Reserves for proved developed producing wells were estimated using production performance methods for the vast majority of properties. Certain new producing properties with very little production history were forecast using a combination of production performance and analogy to similar production, both of which are considered to provide a relatively high degree of accuracy. Non‑producing reserve estimates, for developed and undeveloped properties, were forecast using either volumetric or analogy methods, or a combination of both. These methods provide a relatively high degree of accuracy for predicting proved developed non‑producing and proved undeveloped reserves for our properties, due to the mature nature of the properties targeted for development and an abundance of subsurface control data.

8

To estimate economically recoverable proved reserves and related future net cash flows Cawley Gillespie & Associates, Inc. (“Cawley Gillespie”) considered many factors and assumptions, including the use of reservoir parameters derived from geological and engineering data which cannot be measured directly, economic criteria based on current costs and the SEC pricing requirements and forecasts of future production rates.

Under SEC rules, reasonable certainty can be established using techniques that have been proven effective by actual production from projects in the same reservoir or an analogous reservoir or by other evidence using reliable technology that establishes reasonable certainty. Reliable technology is a grouping of one or more technologies (including computational methods) that has been field tested and has been demonstrated to provide reasonably certain results with consistency and repeatability in the formation being evaluated or in an analogous formation. To establish reasonable certainty with respect to our estimated proved reserves, the technologies and economic data used in the estimation of our proved reserves have been demonstrated to yield results with consistency and repeatability, and include production and well test data, downhole completion information, geologic data, electrical logs, radioactivity logs, core analyses, historical well cost and operating expense data.

Summary of Oil, Natural Gas and NGL Reserves

The table below presents summary information with respect to the estimates of our net proved oil and gas reserves at December 31, 2017, all of which are located in Colorado, based on a reserve report prepared by Cawley Gillespie.

|

|

|

|

|

|

|

Natural Gas |

|

|

|

|

|

Crude Oil |

|

Natural Gas |

|

Liquids |

|

|

|

(MBbls) |

(MMcf) |

(MBbls) |

MBOE |

|||||

|

Proved Developed Producing |

|

254.8 |

|

2,500.0 |

|

187.4 |

|

858.9 |

|

Proved Developed Non‑Producing |

|

266.5 |

|

1,252.4 |

|

200.0 |

|

675.2 |

|

Proved Undeveloped Reserves |

|

2,502.8 |

|

11,666.9 |

|

1,863.5 |

|

6,310.8 |

|

Total Proved Reserves |

|

3,024.1 |

|

15,419.3 |

|

2,250.9 |

|

7,844.9 |

At December 31, 2017, we had estimated total proved reserves of 7,844.9 MBOE, consisting of 3,024.1 MBbls of crude oil, 15,419.3 MMcf of natural gas, and 2,250.9 MBbls of natural gas liquids. Our proved reserves include only those amounts that we reasonably expect to recover in the future from known oil and gas reservoirs under existing economic and operating conditions, at current prices and costs, under existing regulatory practices, and with existing technology and anticipated capital resources. Accordingly, any changes in prices, operating and development costs, regulations, technology, or other factors could significantly increase or decrease estimates of our proved reserves. Estimates of volumes of proved reserves are presented in MBbls for crude oil and MMcf for natural gas at the official temperature and pressure basis of the areas in which the gas reserves are located.

Proved Undeveloped Reserves

At December 31, 2017, we had 6,310.8 MBOE of proved undeveloped reserves. We have included in our proved undeveloped reserves only those locations for which we have established a development plan and believe we can drill and complete within five years of the date of this report considering our existing and anticipated capital resources. We also have included certain non‑operated properties the operator of which has informed of us of planned development within the next five years and in which we have plans to participate.

9

The table below presents summary information with respect to the changes in our proved undeveloped reserves for the year ended December 31, 2017:

|

|

|

Total (MBOE) |

|

|

Total proved undeveloped reserves: |

|

|

|

|

Beginning of year |

|

|

5,567.8 |

|

Revisions of previous estimates |

|

|

35.8 |

|

Additions from discoveries, extensions and infill |

|

|

2,168.2 |

|

Sales of reserves |

|

|

— |

|

Purchases of minerals in place |

|

|

— |

|

Removed for five-year rule |

|

|

— |

|

Conversions to proved developed |

|

|

(1,461.0) |

|

End of year |

|

|

6,310.8 |

Independent Reserve Engineers

Our proved reserves estimate as of December 31, 2017, shown herein, has been independently prepared by Cawley Gillespie, which was founded in 1961 and performs consulting petroleum engineering services under Texas Board of Professional Engineers Registration No. F‑693. Zane Meekins was the technical person within Cawley Gillespie primarily responsible for preparing the estimates shown herein. Mr. Meekins has been practicing consulting petroleum engineering at Cawley Gillespie since 1989. Mr. Meekins is a Registered Professional Engineer in the State of Texas (License No. 71055) and has approximately 31 years of practical experience in petroleum engineering, with approximately 29 years in the estimation and evaluation of reserves. He graduated from Texas A&M University in 1987 with a B.S. in Petroleum Engineering. Mr. Meekins meets or exceeds the education, training, and experience requirements set forth in the Standards Pertaining to the Estimating and Auditing of Oil and Gas Reserves Information promulgated by the Society of Petroleum Engineers.

The report of Cawley Gillespie, dated March 7, 2018, which contains further discussions of the reserve estimates and evaluations prepared by Cawley Gillespie, as well as the qualifications of Cawley Gillespie’s technical personnel responsible for overseeing such estimates and evaluations, is attached as Exhibit 99.1 to this report.

Internal Controls Over Reserve Estimation Process

Our President, Frederick J. Witsell, and our Chief Operating Officer, William B. Lloyd, work closely with our independent reserve engineers to ensure the integrity, accuracy and timeliness of data furnished to our independent reserve engineers in their reserve estimation process and are the technical persons within our company primarily responsible for overseeing the preparation of our reserve estimates. Each of Mr. Witsell and Mr. Lloyd has over 37 years of industry experience. Both have evaluated numerous properties throughout the United States with an emphasis on Colorado oil and natural gas production, as well as conventional and unconventional reservoirs, operations, reservoir development and property evaluation. Mr. Witsell holds a B.S. in Geology, an M.B.A. in Energy Management, and is an active member in the Society of Petroleum Engineers, American Association of Petroleum Geologists, and the Rocky Mountain Association of Geologists. Mr. Lloyd holds a B.S. in Petroleum Engineering.

During relevant time periods, Mr. Witsell and Mr. Lloyd meet with representatives of our independent reserve engineers to review properties and discuss methods and assumptions used in preparation of the proved reserve estimates. We do not have a formal committee specifically designated to review our reserve reporting and our reserve estimation process. A preliminary copy of the reserve report was reviewed by Mr. Witsell with representatives of our independent reserve engineers and internal technical staff.

10

Regulatory Environment

The production and sale of oil and gas is subject to various federal, state, and local governmental regulations, which may be changed from time to time in response to economic or political conditions. Matters subject to regulation include discharge permits for drilling operations, drilling bonds, reports concerning operations, the spacing of wells, noise, unitization and pooling of properties, setbacks, the location and reclamation of piping, taxation and environmental protection. Many laws and regulations govern the location of wells, the method of drilling, casing and completing wells, the plugging and abandoning of wells, the restoration of properties upon which wells are drilled, temporary storage tank operations, air emissions from flaring, compression, the construction and use of access roads, and the disposal of fluids used in connection with operations. From time to time, regulatory agencies have imposed price controls and limitations on production by restricting the rate of flow of oil and gas wells below actual production capacity in order to conserve supplies of oil and gas. Changes in these regulations could have a material adverse effect on our company.

The failure to comply with any such laws and regulations can result in substantial penalties. In addition, the effect of all these laws and regulations may limit the amount of oil and gas we can produce from our wells and may limit the number of wells or the locations at which we can drill. Although we believe we are in substantial compliance with current applicable laws and regulations relating to our oil and natural gas operations, we are unable to predict the future cost or impact of complying with such laws and regulations because such laws and regulations are frequently amended or reinterpreted.

As an oil and gas operator, we are responsible for obtaining all permits and government permission necessary to drill the wells and develop our interests. We must obtain permits for any new well sites and wells that are drilled.

In February 2014, the Colorado Department of Public Health and Environment’s Air Quality Control Commission, or AQCC, finalized regulations imposing stringent new requirements relating to air emissions from oil and gas facilities in Colorado. The new rules impose significantly more stringent control, monitoring, recordkeeping, and reporting requirements than those required under comparable federal rules. In addition, as part of the rule, the AQCC approved the direct regulation of hydrocarbon (i.e., methane) emissions from the Colorado oil and gas sector.

On January 25, 2016, the Colorado Oil and Gas Conservation Commission, or COGCC, approved new rules enhancing local government participation in locating and planning for large scale oil and gas operations. The COGCC defined large scale facilities as (i) any location that proposes eight new horizontal, directional, or vertical wells, or (ii) cumulative hydrocarbon storage capacity of 4,000 Bbls or more, which are located within an urban mitigation area as defined by COGCC rules. The new COGCC rules also include additional notice and consultation requirements for operators when planning such large-scale facilities. As of December 31, 2017, only one non-operated multi-well horizontal drilling units would be subject to these new large-scale facilities regulations.

We currently own or lease numerous properties that have been used for the exploration and production of crude oil and natural gas for many years. If hydrocarbons or other wastes have been disposed of or released on or under the properties that we own or lease or on or under locations where such wastes have been taken for disposal by us or prior owners or operators of such properties, we could be subject to liability under the Comprehensive Environmental Response, Compensation and Liability Act, or CERCLA, the Federal Resource Conservation and Recovery Act, or RCRA and analogous state laws, as well as state laws governing the management of crude oil and natural gas wastes. CERCLA and similar state laws impose liability, without regard to fault or the legality of the original conduct, on certain classes of persons that are considered to have contributed to the release of a “hazardous substance” into the environment. These persons include the owner or operator of the disposal site or sites where the release occurred and companies that disposed of, transported, or arranged for the disposal of the hazardous substances found at the site. Persons who are or were responsible for release of hazardous substances under CERCLA may be subject to full liability for the costs of cleaning up the hazardous substances that have been released into the environment or remediation to prevent future

11

contamination and for damages to natural resources. Under state laws, it is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the hazardous substances released into the environment.

In March 2017, the Colorado Court of Appeals held that Colorado oil and gas regulations require the COGCC to grant permits for new oil wells on the condition that requisite levels of environmental and public safety are met based on a determination by an independent third party. The Court of Appeals’ holding invalidates the COGCC’s prior balancing inquiry, which weighed interests in oil and gas development against environmental and public safety factors. The case has been remanded to the lower court for further findings. It remains unclear what impact this holding will have on the oil and gas industry.

Hydraulic Fracturing

We operate primarily in the Wattenberg Field of the DJ Basin where the rock formations are typically tight, and it is a common practice to utilize hydraulic fracturing to allow for or increase hydrocarbon production. Hydraulic fracturing involves the process of injecting substances such as water, sand and additives (some proprietary) under pressure into a targeted subsurface formation to create pores and fractures, thus creating a passageway for the release of oil and gas. Hydraulic fracturing is a technique that we intend to employ extensively in future wells that we may drill and complete.

We expect to outsource all hydraulic fracturing services to service providers with significant experience, and which we deem to be competent and responsible. Our service providers supply all personnel, equipment, and materials needed to perform each stimulation, including the chemical mixtures that might be injected into our wells. We require our service companies to carry insurance covering incidents that could occur in connection with their activities. In addition to the drilling permit that we are required to obtain and the notice of intent that we provide the appropriate regulatory authorities, our service providers are responsible for obtaining any regulatory permits necessary for them to perform their services in the relevant geographic location. We have not had any incidents, citations, or lawsuits relating to any environmental issues resulting from hydraulic fracturing, and we are not presently aware of any such matters.

In recent years, environmental opposition to hydraulic fracturing has increased, and various governmental and regulatory authorities have adopted or are considering new requirements for this process. To the extent that these requirements increase our costs or restrict our development activities, our business and prospects may be adversely affected.

The United States Environmental Protection Area, or EPA has asserted that the Safe Drinking Water Act (“SDWA”) applies to hydraulic fracturing involving diesel fuel, and in February 2014, it issued final guidance on this subject. The guidance defines the term “diesel fuel,” describes the permitting requirements that apply under SDWA for the underground injection of diesel fuel in hydraulic fracturing and makes recommendations for permit writers. Although the guidance applies only in those states, excluding Colorado, where the EPA directly implements the Underground Injection Control Class II program, it could encourage state regulatory authorities to adopt permitting and other requirements for hydraulic fracturing. In addition, from time to time, Congress has considered legislation that would provide for broader federal regulation of hydraulic fracturing under the SDWA. If such legislation were enacted, hydraulic fracturing operations could be required to meet additional federal permitting and financial assurance requirements, adhere to certain construction specifications, fulfill monitoring, reporting, and recordkeeping obligations, and provide for additional public disclosure of the chemicals used in the fracturing process.

The EPA is also conducting a nationwide study into the effects of hydraulic fracturing on drinking water. In June 2015, the EPA released a draft assessment of the potential impacts to drinking water resources from hydraulic fracturing for public comment and peer review. The assessment concluded that while there are mechanisms by which

12

hydraulic fracturing can impact drinking water resources, there was no evidence that these mechanisms have led to widespread, systemic impacts on drinking water resources in the United States. The EPA’s science advisory board subsequently questioned several elements and conclusions in the EPA’s draft assessment. In December 2016, the EPA released the final report on impacts from hydraulic fracturing activities on drinking water, concluding that hydraulic fracturing activities can impact drinking water resources under some circumstances and identified some factors that could influence these impacts.

Federal agencies have also adopted or are considering additional regulation of hydraulic fracturing. On March 26, 2016, the U.S. Occupational Safety and Health Administration (“OSHA”) issued a final rule, with effective dates of 2018 and 2021 for the hydraulic fracturing industry, which imposes stricter standards for worker exposure to silica, including worker exposure to sand in hydraulic fracturing. In May 2014, the EPA issued an advance notice of proposed rulemaking under the Toxic Substances Control Act (“TSCA”) to obtain data on chemical substances and mixtures used in hydraulic fracturing. In March 2015, the Bureau of Land Management (“BLM”) issued a new rule regulating hydraulic fracturing activities involving federal and tribal lands and minerals, including requirements for chemical disclosure, wellbore integrity and handling of flowback and produced water.

In Colorado, the primary regulator is the COGCC, which has adopted regulations regarding chemical disclosure, pressure monitoring, prior agency notice, emission reduction practices, and offset well setbacks with respect to hydraulic fracturing operations and may in the future adopt additional requirements for this purpose. As part of these requirements, operators must report all chemicals used in hydraulically fracturing a well to a publicly searchable registry website developed and maintained by the Ground Water Protection Council and the Interstate Oil and Gas Compact Commission.

Apart from these ongoing federal and state initiatives, local governments are adopting new requirements and restrictions on hydraulic fracturing and other oil and gas operations. Some local governments in Colorado, for instance, have amended their land use regulations to impose new requirements on oil and gas development, while other local governments have entered memoranda of agreement with oil and gas producers to accomplish the same objective. Beyond that, during the past few years, a total of five Colorado cities have passed initiatives temporarily or permanently prohibiting hydraulic fracturing. Since that time, however, local district courts have struck down the ordinances for certain of those Colorado cities, and such decisions were upheld by the Colorado Supreme Court in May 2016. Nevertheless, there is a continued risk that cities will adopt local ordinances that seek to regulate the time, place, and manner of hydraulic fracturing activities and oil and gas operations within their respective jurisdictions.

During 2014, opponents of hydraulic fracturing also sought statewide ballot initiatives that would have restricted oil and gas development in Colorado by, among other things, significantly increasing the setback between oil and natural gas wells and occupied buildings. These initiatives were withdrawn from the November 2014 ballot in return for the creation of a task force to craft recommendations for minimizing land use conflicts over the location of oil and natural gas facilities.

During 2016, opponents of hydraulic fracturing again advanced various options for ballot initiatives restricting oil and gas development in Colorado. Proponents of two such initiatives attempted to qualify the initiatives to appear on the ballot for the November 2016 election. One would have amended the Colorado constitution to impose a minimum distance of 2,500 feet between wells and any occupied structures or “areas of special concern.” If implemented, this proposal would have made the vast majority of the surface area of the state ineligible for drilling, including substantially all of our planned future drilling locations. The second proposal would have amended the state constitution to give local governmental authorities the ability to regulate, or to ban, oil and gas exploration, development, and production activities within their boundaries notwithstanding state rules and approvals to the contrary. If implemented, this proposal could have resulted in us becoming subject to onerous, and possibly inconsistent, regulations that vary from jurisdiction to jurisdiction, or to outright bans on our activities in various jurisdictions. Neither of these proposals ultimately appeared

13

on the ballot. However, similar proposals may be made in the future. Because all of our operations and reserves are located in Colorado, the risks we face with respect to such future proposals are greater than those of our competitors with more geographically diverse operations. Although we cannot predict the outcome of future ballot initiatives, statutes, or regulatory developments, such developments could materially impact our results of operations, production, and reserves.

Adams County USR Process

On March 22, 2016, the Adams County Board of County Commissioners approved amendments to the county’s oil and gas regulatory process, which ended a temporary drilling moratorium previously imposed. The new regulations include an enhanced administrative review process for operators that share a Memorandum of Understanding, or MOU, with Adams County, including a site‑specific review of any oil and gas permit application. The regulations also require compliance with the USR approval process for oil and gas facilities governed by an MOU between the operator and Adams County. This approval process includes increased notice and filing requirements. The USR process is designed to consist of a six‑week administrative review of the application by the county and appropriate agencies. The application can be approved, approved with conditions, denied or referred to the Board of County Commissioners for a public hearing. If denied, the applicant can appeal to the Board of County Commissioners.

In March 2016, we submitted a USR application for our Shook pad to Adams County, which was approved by the county in September 2016. The above newly‑enacted regulations in Adams County and any additional regulations that may result in the future may delay or prevent our drilling activities and increase our costs of development and production and limit the quantity of oil and gas that we can economically produce.

Joint Operating Agreements

We are registered with the COGCC as an operator of oil and natural gas wells and properties in the State of Colorado and have posted the appropriate bonds to support our activities. We have entered into operating agreements with our working interest partners that stipulate, among other things, that each partner is responsible for paying its proportionate share of costs and expenses in connection with the wells we operate. As operator, we are an independent contractor not subject to the control or direction of our other working interest partners except as to the type of operation to be undertaken as provided in the operating agreement. Further, we are responsible for hiring employees or contractors to conduct operations, taking custody of funds for the account of all working interest partners, keeping books and records relating to operations, and filing operational notices, reports or applications required to be filed with governmental bodies having jurisdiction over operations. Our liability to the other working interest partners for losses sustained or liabilities incurred are limited to losses incurred as a result of our gross negligence or willful misconduct.

Competition

We encounter significant competition from numerous other oil and gas companies in all areas of operations, including drilling and marketing oil and natural gas; obtaining desirable oil and natural gas leases; obtaining drilling, pumping and other services; attracting and retaining qualified employees; and obtaining capital. International developments may influence other companies to increase their domestic crude oil and natural gas exploration. Competition among companies for favorable prospects can be expected to continue and we anticipate that the cost of acquiring properties will increase in the future. Most of our competitors possess larger staffs and greater financial resources than we do, which may enable them to identify and acquire desirable producing properties and drilling prospects more economically and to attract more capital. Our ability to acquire additional properties and to explore for oil and natural gas prospects in the future depends upon our ability to conduct our operations, raise capital, evaluate and select suitable properties, and consummate transactions in this highly competitive environment.

14

The oil and gas industry is characterized by rapid and significant technological advancements and introduction of new products and services using new technologies. If one or more of the technologies we use now or in the future become obsolete or if we are unable to use the most advanced commercially available technology, our business, financial condition, results of operations and cash flows could be materially adversely affected.

Market for Our Products

Currently, all of our produced oil and gas is sold under a variety of month-to-month contracts with local marketing companies. We have no long‑term marketing contract commitments at this time. The availability of a ready market for our oil and gas depends upon numerous factors beyond our control, including the extent of domestic production and importation of oil and gas, the relative status of the domestic and international economies, the proximity of our properties to gas pipeline systems, the capacity of those systems, the marketing of other competitive fuels, fluctuations in seasonal demand, and governmental regulation of production, refining, transportation, and pricing of oil, gas, and other fuels.

Employees

We currently have 12 employees, including our Chief Executive Officer, President, Chief Operating Officer, and Chief Financial Officer. We also engage a number of independent contractors and consultants to supplement the services of our employees, including land services, geologic mapping, reservoir and facilities engineers, drilling contractors, attorneys, and accountants.

Company Facilities

Our executive and administrative offices are currently located at 9635 Maroon Circle, Suite 400, Englewood, Colorado 80112, where we lease approximately 5,282 square feet at a rate of $10,894 per month.

This report, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, contains forward‑looking statements that may be affected by several risk factors. The following information summarizes the material risks known to us as of the date of filing this report:

Risks Relating To Our Company

Since we are a new business with a limited operating history, investors have no basis to evaluate our ability to operate profitability.

We were incorporated in September 2012 and our activities to date have been limited to organizational efforts, raising capital, developing our business plan, assembling an initial lease inventory, participating as a non‑operator in several drilling programs and limited drilling efforts. We face all of the risks commonly encountered by other new businesses, including the lack of an established operating history, need for additional capital and personnel, and competition. Our business may not be successful, or we may never operate profitably. We may not be able to effectively manage the demands required of a new business in our industry, such that we may be unable to successfully implement our business plan or achieve profitability.

15

As described in the notes to our consolidated financial statements, there is substantial doubt about our ability to continue as a going concern and we are dependent on receipt of additional capital to fund our obligations and to continue development of our business plan.

The uncertainty regarding our ability to continue as a going concern is based on our substantial near-term liabilities, limited revenue and cash flow and negative working capital, among other things which existed as of December 31, 2017. At December 31, 2017, we had a cash balance of approximately $0.7 million and other current assets of approximately $2.7 million. In June 2018, we are obligated to repay approximately $2.1 million in principal plus accrued interest on our supplemental line of credit and we are obligated to pay approximately $9.6 million in principal plus accrued interest on our outstanding convertible promissory notes in December 2018. We also will incur additional expenses related to our operated drilling program on our Shook pad during the second and third quarters of this year. We had net losses, including non-cash charges, of approximately $10.8 million and $4.5 million during the years ended December 31, 2017 and 2016, respectively.

Our ability to continue as a going concern depends on the success of our current drilling efforts, future exploration and development efforts, our ability to generate revenue sufficient to cover our costs and expenses and receipt of additional capital. In addition to funds required for the satisfaction of existing obligations and development of our existing acreage, we will require capital to acquire and develop additional acreage as well as pay our administrative expenses, including salary and rent. In the event we are unable to obtain adequate funding from our ongoing drilling efforts, both operated and non-operated, and through the sale of debt or equity securities, we may have to delay, reduce or eliminate certain of our planned operations, reduce overall overhead expense, or divest assets. This in turn may have an adverse effect on our ability to realize the value of our assets. If we are unable to continue as a going concern, you may lose all or part of your investment.

Our use of debt financing could have a material adverse effect on our financial condition.

We are subject to the risks normally associated with debt financing, including the risk that our cash flow will be insufficient to meet required principal and interest payments and the long‑term risk that we will be unable to refinance our existing indebtedness, or that the terms of such refinancing will not be as favorable as the terms of existing indebtedness. If our debt cannot be paid, refinanced or extended, we may be required to divest our assets or file for bankruptcy. Further, if prevailing interest rates or other factors at the time of a refinancing result in higher interest rates or other restrictive financial covenants, then such refinancing would adversely affect our cash flow and funds available for operation and development of our assets and properties.

We are also subject to financial covenants under our existing debt instruments. These covenants generally require us to satisfy certain financial ratios related to our oil and gas reserves and debt to earnings, and prohibit us without the lenders’ consent from, among other things, incurring additional indebtedness or making loans to any third party, other than trade debt incurred in the ordinary course of business or selling, leasing, or otherwise disposing of any material amount of assets. Failure to comply with these covenants could result in a default which, if we were unable to obtain a waiver from our lenders, could accelerate our repayment obligations under the lines of credit and thereby have a material adverse impact on our liquidity, financial condition, and ability to remain in business. We would also likely be unable to borrow any further amounts under our other debt instruments, which could adversely affect our ability to fund operations.

We are highly leveraged and any default by us may cause us to forfeit all or a portion of our properties.

As of December 31, 2017, we had outstanding debt in excess of $23.1 million, approximately $18.1 million of which is due 2018. If we are unable to repay any of this debt on a timely basis, we may be forced to forfeit all or a portion of our properties.

16

Of the total debt outstanding at December 31, 2017, approximately $13.6 million is secured by liens on our property. Of that amount, $2.1 million under the supplemental line of credit is due in June 2018. All of our convertible notes, approximately $9.6 million are due in December 2018. Our ability to repay our supplemental line of credit and convertible notes payable is dependent on our ability to generate sufficient revenue from operations or obtain cash from other sources. If we are unable to repay the short-term indebtedness or default under our other indebtedness, the lenders may foreclose on our assets. As a result, we may not be able to develop as much property as we presently expect.

Our estimates of oil and gas reserves involve inherent uncertainty, which could materially affect the quantity and value of our reported reserves and our financial condition.

There are numerous uncertainties inherent in estimating quantities of proved oil and gas reserves and cash flows attributable to such unconventional resource reserves, including factors beyond our reserve engineers’ control. Reserve engineering is a subjective process of estimating underground accumulations of oil and gas that cannot be measured in an exact manner. The accuracy of an estimate of quantities of reserves, or of cash flows attributable to such reserves, is a function of the available data, assumptions regarding future oil and gas prices, expenditures for future development and exploration activities, engineering and geological interpretations and judgment. In addition, accurately estimating reserves in unconventional resources such as the shale and tight sand formations, of the Niobrara and Codell, can be even more difficult than estimating reserves in more traditional hydrocarbon‑bearing formations given the complexities of the projected decline curves and economics of unconventional oil and gas resource wells.

As such, investors should not place undue reliance on these estimates contained in this report. Reserves and future cash flows may be subject to material downward or upward revisions, based upon production history, development and exploration activities and prices of oil and gas. In addition, different reserve engineers may make different estimates of reserves and cash flows based on the same available data. Due to our smaller volume of reserves compared to our competitors, revisions in reserve estimates and future cash flows have a greater chance of being material to us.

Oil and gas wells are depleting assets and our failure or inability to reinvest in additional wells will lead to reduced production.

Our ability to invest additional amounts in new wells and additional acreage is a function of the availability of capital. If we are unable to obtain that capital in amounts sufficient to allow for additional investment, our existing and contemplated production will eventually diminish. This may lead to a drop in the price of our stock, and investors may lose all or part of their investment.

Our Southern Core area assets may be less valuable to us than expected.

We have made several oil and gas acquisitions in the Southern Core area since January 1, 2016. Much of the acreage is within our Southern Core focus areas, while the remainder of the acreage is located in outlying areas of Adams, Weld and Broomfield Counties and is prospective for formations other than the Niobrara and Codell. The value of our Southern Core area assets is based in large part on our ability to develop the properties and increase proven and probable reserves. This, in turn, requires us to make accurate estimates of our capital needs to implement and continue a development program for those properties, to obtain that capital and to successfully drill the wells. We may not be able to obtain the capital necessary to develop these properties or our development efforts may not be successful. If we are unable to obtain the necessary capital or successfully develop these properties, the price of our stock may decline, and investors may lose some of their investment.

17

We have limited control over activities on properties we do not operate.

Our ability to exercise influence over the operations of the properties which we do not operate, or their associated costs, is limited. Our dependence on the operators and other working interest owners of these projects and any future projects, our limited ability to influence operations and associated costs or control the risks, and our access to required capital could materially and adversely affect the realization of our targeted returns on capital in drilling or acquisition activities. The success and timing of our drilling and development activities on properties operated by others therefore depends upon a number of factors, including:

|

· |

timing and amount of capital expenditures; |

|

· |

the operator’s expertise and financial resources; |

|

· |

the rate of production of reserves, if any; |

|

· |

approval of other participants in drilling wells; and |

|

· |

selection of technology. |

As a result, our ability to exercise influence over the operations of some of our current or future properties is and may be limited.

The due diligence undertaken by us in connection with recent acquisitions may not have revealed all relevant considerations or liabilities related to those assets, which could have a material adverse effect on our financial condition or results of operations.

The due diligence undertaken by us in connection with the acquisition of our properties may not have revealed all relevant facts that may be necessary to evaluate such acquisitions. The information provided to us in connection with our diligence may have been incomplete or inaccurate. As part of the diligence process, we have also made subjective judgments regarding the results of operations and prospects of the assets. If the due diligence investigations have failed to correctly identify material issues and liabilities that may be present, such as title defects or environmental problems, we may incur substantial impairment charges or other losses in the future. In addition, we may be subject to significant, previously undisclosed liabilities that were not identified during the due diligence processes and which may have a material adverse effect on our financial condition or results of operations.

We have granted PEO and its affiliate the option to participate in certain of our acreage acquisitions.

On May 13, 2015, we entered into a participation agreement with PEO which has been amended on two subsequent occasions. Under the terms of the original participation agreement, we assigned an undivided 50% interest to our right, title and interest in and to our then existing leases in our Todd Creek Farms prospect and granted PEO the right to acquire up to 50% of other acquisitions within an area of mutual interest, or AMI. The Participation Agreement was subsequently amended to provide an option to another affiliate of PEO, potentially reducing our retained interest in any properties to 45%. The AMI covers all of our Southern Core area and part of our other properties. To date, PEO has exercised its option to participate in all of our acreage acquisitions.

We have limited management and staff and are dependent upon partnering arrangements and third‑party service providers.

We currently have 12 employees, including our Chief Executive Officer, President, Chief Financial Officer and Chief Operating Officer. The loss of any of these individuals would have an adverse effect on our business, as we have

18

very limited personnel. We leverage the services of other independent consultants and contractors to perform various professional services, including engineering, oil and gas well planning and supervision, and land, legal, environmental and tax services. We also pursue alliances with partners in the areas of geological and geophysical services and prospect generation, evaluation and prospect leasing. Our dependence on third‑party consultants and service providers create a number of risks, including but not limited to:

|

· |

the possibility that such third parties may not be available to us as and when needed; and |

|

· |

the risk that we may not be able to properly control the timing and quality of work conducted with respect to its projects. |

If we experience significant delays in obtaining the services of such third parties or they perform poorly, our results of operations and stock price could be materially adversely affected.

Competition in the oil and natural gas industry is intense and many of our competitors have resources that are substantially greater than ours.

Our industry is intensely competitive, and we compete with other companies that have greater resources. Many of these companies not only explore for and produce oil, natural gas and NGLs, but also purchase and transport hydrocarbons, carry on refining operations and market petroleum and other products on a regional, national or worldwide basis. These companies are able to attract more capital and pay more for productive properties and exploratory prospects or define, evaluate, bid for and purchase a greater number of properties and prospects than we can. Our ability to acquire additional properties and to discover reserves in the future will be dependent upon our ability to raise capital and evaluate and select suitable properties and to consummate transactions in a highly competitive environment. In addition, larger companies have a greater ability to continue exploration activities during periods of low commodity prices. Larger competitors are also able to absorb the burden of present and future federal, state, local and other laws and regulations more easily than we can, which could adversely affect our competitive position. These factors could adversely affect the success of our operations and our profitability.

We are concentrated in one geographic area, which increases our exposure to many of the risks enumerated herein.

Operating in a concentrated area increases the potential impact that many of the risks stated herein may have upon our ability to perform. For example, we have greater exposure to regulatory actions impacting Colorado, natural disasters in the geographic area, competition for equipment, services and materials available in the area and access to infrastructure and markets. In addition, the effect of fluctuations on supply and demand may become more pronounced within specific geographic oil and gas producing areas such as the DJ Basin, which may cause these conditions to occur with greater frequency or magnify the effect of these conditions. Due to the concentrated nature of our portfolio of properties, a number of our properties could experience any of the same conditions at the same time, resulting in a relatively greater impact on our results of operations than they might have on other companies that have a more diversified portfolio of properties. Such delays or interruptions could have a material adverse effect on our financial condition and results of operations.

Our ability to sell any production and/or receive market prices for our production may be adversely affected by a lack of transportation, capacity constraints and interruptions.

The marketability of any production from any of our properties depends in part upon the availability, proximity and capacity of third‑party refineries, natural gas gathering systems and processing facilities. We expect to deliver much of the oil and natural gas produced from our properties through pipelines that we do not own. The availability of delivery capacity in these pipelines is in part dependent on the market price for oil and natural gas, as higher prices will attract

19

additional production, which in turn will take up capacity in these systems. The lack of availability or capacity of these systems and facilities could reduce the price offered for any production or result in the shut‑in of producing wells or the delay or discontinuance of development plans for properties.

We are not required to obtain an opinion from our independent registered public accounting firm on the effectiveness of our internal controls over financial reporting under Section 404(b) of the Sarbanes‑Oxley Act of 2002 until we are no longer an emerging growth company.

For so long as we remain an emerging growth company as defined in the JOBS Act, we intend to take advantage of certain exemptions from various reporting requirements that are applicable to public companies that are not emerging growth companies, including, but not limited to, not being required to obtain the auditor attestation of our assessment of our internal controls. Once we are no longer an emerging growth company or, if prior to such date, we opt to no longer take advantage of the applicable exemption, we will be required to include an opinion from our independent registered public accounting firm on the effectiveness of our internal controls over financial reporting. We will remain an “emerging growth company” until the earliest to occur of (1) the last day of the fiscal year during which our total annual revenues equal or exceed $1.0 billion (subject to adjustment for inflation), (2) the last day of the fiscal year during which occurs the fifth anniversary of our initial public offering, (3) the date on which we have, during the previous three‑year period, issued more than $1.0 billion in non‑convertible debt, or (4) the date on which we are deemed a “large accelerated filer” under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Once we are no longer an emerging growth company, compliance with Section 404(b) will be costly.

Colorado law and our Articles of Incorporation may protect our directors from certain types of lawsuits at the expense of the shareholders.

The laws of the State of Colorado provide that directors of a corporation shall not be liable to the corporation or its shareholders for monetary damages for all but limited types of conduct. Our Articles of Incorporation permit us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing shareholders from recovering damages against our directors caused by their negligence, poor judgment or other circumstances.

Risks Relating to the Energy Production and/or Distribution Industry

Oil and natural gas exploration and development are affected by fluctuations in oil and natural gas prices, and low prices could have a material adverse effect on the future of our business.