UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended |

|

or

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from |

to |

|

Commission File No. |

|

|

|

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

|

Registrant’s telephone number, including area code |

( |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

The |

Securities registered pursuant to Section 12(g) of the Act:

|

None |

|

(Title of class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

|

Smaller reporting company |

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Ex‐change Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect a correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of the voting and non-voting common equity held by non-affiliates (2,254,793 shares of common stock) as of June 30, 2023 was $

As of March 29, 2024,

DOCUMENTS INCORPORATED BY REFERENCE:

None.

|

Page |

||

|

Item 1. |

||

|

Item 1A. |

||

|

Item 1B. |

||

| Item 1C. | Cybersecurity | 25 |

|

Item 2. |

||

|

Item 3. |

||

|

Item 4. |

||

|

Item 5. |

||

|

Item 6. |

||

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

|

Item 7A. |

||

|

Item 8. |

||

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

|

Item 9A. |

||

|

Item 9B. |

||

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

|

Item 10. |

||

|

Item 11. |

||

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

|

|

Item 14. |

||

|

Item 15. |

||

|

Item 16. |

||

Throughout this Annual Report on Form 10-K (the “Report”), the terms “we,” “us,” “our,” “Blackbox,” “Blackboxstocks,” or the “Company” refers to Blackboxstocks Inc., a Nevada corporation.

“Blackboxstocks,” the Blackboxstocks design logo and the trademark or service marks of Blackboxstocks, Inc. appearing in this Report are the property of Blackboxstocks, Inc. Trade names, trademarks and service marks of other companies that may appear in this report are the property of their respective holders. We have omitted the ® and ™ designations, as applicable, for the trademarks used in this Report.

When used in this Report, the words “may,” “will,” “expect,” “anticipate,” “continue,” “estimate,” “intend,” and similar expressions are intended to identify forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) regarding events, conditions and financial trends which may affect the Company’s future plans of operations, business strategy, operating results and financial position. Such statements are not guarantees of future performance and are subject to risks and uncertainties described herein and actual results may differ materially from those included within the forward-looking statements. Additional factors are described in the Company’s other public reports and filings with the Securities and Exchange Commission (the “SEC”). Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. The Company undertakes no obligation to publicly release the result of any revision of these forward-looking statements to reflect events or circumstances after the date they are made or to reflect the occurrence of unanticipated events.

This Report contains certain estimates and plans related to us and the industry in which we operate, which assume certain events, trends and activities will occur and the projected information based on those assumptions. We do not know that all of our assumptions are accurate. If our assumptions are wrong about any events, trends and activities, then our estimates for future growth for our business may also be wrong. There can be no assurance that any of our estimates as to our business growth will be achieved.

The following discussion and analysis should be read in conjunction with our financial statements and the notes associated with them contained elsewhere in this Report. This discussion should not be construed to imply that the results discussed in this Report will necessarily continue into the future or that any conclusion reached in this Report will necessarily be indicative of actual operating results in the future. The discussion represents only the best assessment of management.

|

Business |

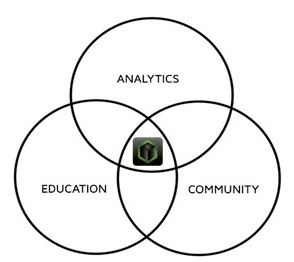

Overview of Business

We have developed a financial technology and social media hybrid platform offering real-time proprietary analytics and news for stock and options traders of all levels combined with a social media element and educational materials. Our web-based platform and native iOS and Android applications (the “Blackbox System”) employ “predictive technology” enhanced by artificial intelligence to find volatility and unusual market activity that may result in the rapid change in the price of a stock or option. We continuously scan the New York Stock Exchange (“NYSE”), NASDAQ, Chicago Board Options Exchange (the “CBOE”) and other options markets, analyzing over 10,000 stocks and over 1,500,000 options contracts multiple times per second. We provide our subscribing members with a fully interactive audio and text based social media platform that is integrated into our dashboard, enabling our members to exchange information and ideas quickly and efficiently through a common network. We believe that the Blackbox System is a disruptive financial technology platform that uniquely integrates proprietary analytics with a community supported by a broadcast enabled social media system which connects traders of all kinds worldwide on an intuitive and user-friendly platform.

Our goal is to provide retail investors with the type of sophisticated trading tools that were previously available only to large institutional hedge funds and high-frequency traders together with an interactive community of traders and investors of all levels at an affordable price. We also strive to provide these trading tools in a user-friendly format that does not require complicated configurations by the user.

We employ a subscription-based Software as a Service (“SaaS”) business model and maintain a growing base of members that spans over 40 countries. We currently offer monthly subscriptions to our platform for $99 per month and annual subscriptions for $959 per year.

Our Mission

Our mission is to provide powerful proprietary analytics in a simple and concise format to level the playing field for the average retail investor. We strive to educate our members through our live trading community as well as our scheduled, calendared classes with live instructors. We want every member to feel they are part of a team with the goal of improving financial literacy. We believe that we are the antithesis of the “trading guru” platforms that feature a trading or investing expert that charges for what are often expensive courses. We do not charge for our classes. We do not upsell our members. All education and community programs are free with the subscription to our platform.

Revenue Model

We generate revenue from a software as a service (or SaaS) model whereby members pay either an annual or monthly fee for a subscription to our platform. We do not currently offer more than one level of subscription with varying levels of features. All members have full access to all of the features and educational resources of our platform.

Monthly subscriptions are currently priced at $99 and annual subscriptions are currently priced at $959 (a discount of $241). We occasionally offer gift cards and promotional discounts on our subscriptions.

Development of the Blackbox System

The Blackbox System was launched and made available for use to subscribing customers worldwide in September 2016. The initial product was a web-based platform focused on providing proprietary analytics and broadcast enabled social media for our community of members. In 2022 we launched full-featured native iOS and Android applications. Our product offering is comprised of three key elements: stock and options trading analytics, social media interaction, and educational programs and resources.

Stock and Options Trading Analytics

Our preconfigured dashboard is designed to be simple and easy to navigate and includes real-time proprietary alerts, stock and options scanners, financial news, institutional grade charting, and our proprietary analytics that can be utilized by traders of all levels. Our Blackbox System populates the stock and option data in real time and provides a wide range analytics and tools for traders. We offer many of the standard market tool features used by traders but differentiate our product with an array of unique proprietary features and derived data. These proprietary features are designed to filter out “market noise” and locate, in real-time, specific stocks and options that are likely to become market movers.

Standard Features

(Including but not limited to)

|

● |

Real Time NYSE/NASDAQ Market Data |

|

|

● |

Real Time OPRA Options Trade Data |

|

|

● |

Real Time Streaming Market News Feed |

|

|

● |

Symbol Specific News |

|

|

● |

Options News and Upgrades/Downgrades |

|

|

● |

Institutional Grade Charts |

|

|

● |

Multi-Chart Capability |

|

|

● |

Earnings and Dividend Dates |

|

|

● |

Daily Advancers / Decliners Scanner |

|

|

● |

User-specific Watch List |

Proprietary and Advanced Features

(Including but not limited to)

|

● |

Real Time Algorithm Driven Stock & Options Alerts |

|

|

● |

User Defined Symbol Specific Alert Criteria |

|

|

● |

Options Flow Scanner / Heatmap |

|

|

● |

Pre-Configured Pre/Post Market Scanners |

|

|

● |

Stock and Option Volume Ratio Scanner |

|

|

● |

Volatility Indicator |

|

● |

Dark Pool Analysis |

|

|

● |

Insider Buying Analysis |

|

|

● |

Gamma Exposure |

|

|

● |

FINRA Short Interest Analysis |

|

|

● |

Net Options Delta and Dollar Flow |

|

|

● |

Feature Rich Text- and Audio-based Social Media Components |

Added in 2023:

|

● |

Added GoNoGo Trend® indicator |

|

|

● |

Added Team Trades Push Alerts |

|

|

● |

Added Ability to Create and Manage Watchlists in the Mobile Application |

|

|

● |

Optimized and Improved the Mobile Version of the Website |

|

|

● |

Added a Pro Tier |

|

|

● |

Added Additional Filters and Layouts to Extend Functionality of the Application |

In 2022 and 2023, we added several new proprietary and advanced studies to the Blackbox system to help both options and stock traders. These studies encompass advanced data tools with real time data that are easy for traders of all levels to use.

Dark Pool Analysis: we added dark pool trades on our charting system that updates in real time. Dark Pools are privately organized financial forums or exchanges for securities trading. Using our system, traders can easily see levels where large institutions or funds are trading. The Dark Pool Volume Profile is an indicator that visually displays a Dark Pool transaction directly on to the chart. The Volume Profile bar is overlayed at the price level at which the Dark Pool transaction is executed. The length of the volume profile is a visual representation of the share size of the dark pool transaction. The Dark Pool Volume Profile will also display historical activity when you change the time frame.

Insider Buying Analysis: we use the EDGAR portal to access all Form 4’s filed and update our charts where you find insiders buying stocks. This is a powerful tool for traders to easily see where the insiders or management are buying.

Gamma Exposure (GEX): Gamma is a measure of the rate of change of an options delta and it represents the rate at which an options delta will change as the price of the underlying changes. This proprietary study tracks the Gamma levels of all strike prices in real time by displaying a green/red bar at the strike prices. The day opens with the gamma levels from Open Interest and will adjust accordingly throughout the day as options are bought and sold. Finding the largest levels of Gamma Exposure (GEX) can serve as potential levels of support and/or resistance.

FINRA Short Interest Analysis: all the FINRA short interest data for stocks is plotted on our charts to let traders see how the shorting ratio of trades in the dark pools has changed over time.

Net Options Delta and Dollar Flow: This BlackBox proprietary study shows you the daily Net Options Delta (NOD) on a ticker. The delta of a net options position is the ratio of the change in the value of the position to the change in the price of the underlying asset. In other words, it is a measure of how much the value of the options position will change for a small change in the price of the underlying asset. Every single option trade is calculated in real time and the NOD of the stock is updated. This is further broken down into Put and Call NOD. Options dollar flow is a metric that measures the net flow of money into or out of options contracts. It is calculated by taking the difference between the total premium paid for call options and the total premium paid for put options. Positive dollar flow indicates a bullish sentiment, where in turn a negative dollar flow would indicate a bearish sentiment. This proprietary BlackBox study breaks down the dollar flow into three expiration time frames from near term, monthly and total.

Go/No-Go Study: We added the GoNoGo Trend ® indicator that provides a simple colored study available in our charts that displays the strength of a stock’s momentum using multiple technical factors.

Team Trade Push Alerts: We provided access to push alert notifications so that our members could get real time alerts on their mobile devices of the trades made by their favorite Blackbox Team Trader(s).

Watchlists for our Mobile Application: We improved our mobile application to include the capability to add watchlists. This feature allows our members to quickly analyze their specific portfolio positions using our powerful mobile application while on the go.

Pro Tier Capability: We added a pro-tier capability allowing professional traders to subscribe to our platform. Professional traders are required to pay substantially higher fees than retail traders for the exchange data we provide them. Due to these higher fees, most applications such as Blackbox are unable to provide access to their systems as it is not economically viable. We now have a new onboarding system that allows us to provide professional traders the ability to use our system.

Brokerage Integrations

We have trading integrations with the online brokerages E*Trade and TradeStation. These integrations allow our members to execute trades through E*Trade or TradeStation directly from our platform. Our members that use this integration feature have access to certain custom tools. One of these tools is a “quick-click” feature that loads our system’s stock and options alerts with two simple clicks, greatly reducing the time it takes for order entry. This feature is especially helpful for the order entry of option contracts, as they are detailed, lengthy, and cumbersome to enter. The system has been designed to quickly integrate with new brokers and we intend to expand the number of brokerages with whom we have trading integrations in the future.

Education

We offer all members full access to our curriculum of classes, orientations, and live market sessions. All of our education programs are free to our members. Our curriculum includes classes for beginner, intermediate, and advanced-level traders. We believe education is vital to increasing the probability of our members long term success in the markets. We have many regularly calendared live webinars, Q&A sessions, as well as recorded classes. In addition to our regularly calendared classes, we often feature ad hoc classes taught by seasoned members of our community. The educators of these classes often specialize in specific market sectors or trading strategies. Classes and webinar events offered to our members include but are not limited to:

|

Beginner |

Intermediate |

Advanced |

|

Blackbox Intro Live |

Dark Pool Basics |

Options Adjustments |

|

Intro to the Market |

Technical Analysis 101 |

Understanding options for a Bull & Bear Market |

|

Charting 101 |

Blackbox Trading System -Stocks |

Options Strategies for Higher Volatility |

|

Stock Basics |

Blackbox Trading System -Options |

Insights for Options Core Concepts |

|

Understanding Options Flow |

Short Term Options Explained |

|

|

Implied & Historical Volatility |

||

|

Options Pricing Explained |

In addition to our internal curriculum, we have partnered with the Options Industry Council (OIC), a nonprofit organization funded by the Options Clearing Corporation (OCC) with the mission of providing the investing public a better understanding of the options markets. Classes taught by the OIC to our members include but are not limited to:

|

● |

The Greeks Part I |

|

|

● |

The Greeks Part II |

|

|

● |

Implied Volatility |

|

|

● |

Short Term Options Explained |

|

|

● |

Options Pricing Explained |

One of the most attractive aspects of our education program is that the classes are taught by members of our community. The student members who take these are often familiar with the instructor from following them in live trading channels on our platform. We believe this familiarity often brings an element of authenticity and heightened engagement increasing the success of these educational endeavors as well as adding to the community aspect of our platform.

The Blackbox Advantage

A principal component to our platform is the flexibility to provide members intuitive yet powerful technical analytics that scale with user knowledge. Our preconfigured dashboard defaults to a general setting that is designed to be easy for new members to navigate. Within this same dashboard we provide a multitude of toggles and filters for more sophisticated traders to allow them to implement custom features for their more advanced trading strategies. Most importantly, our live community consisting of thousands of traders creates a real-time community curated support system whereby seasoned traders often mentor newer members. We believe this is one of the primary strengths and differentiators of our platform. Although we offer a complete curriculum of scheduled classes weekly, the live interaction amongst our members proves to be invaluable. We believe this is due to the level of excitement created when new members can watch seasoned members of the community making trades in real time and providing an accompanying narrative. In addition to the educational component, the community element of our platform harnesses a powerful dynamic that can be described as “the best of man and machine”. Our powerful algorithm technology scans the NYSE, NASDAQ, CBOE and other options exchanges to find market volatility and anomalies and displays them on a common dashboard shared across the globe. With thousands of eyes on this data, our members can quickly interact and form a consensus on the trading opportunity at hand.

Our Market Opportunity

We believe the global COVID-19 pandemic of 2020 stimulated significant change for online technologies including financial and trading related companies such as Blackbox. More than 10 million new brokerage accounts were opened by individuals in 2020 — more than ever in one year, according to Devin Ryan, an analyst at JMP Securities. This newfound interest in the market was very positive for us as our user base grew rapidly ind2021. The combination of an influx of new investors as well as the tendency for those new investors to gravitate towards innovative financial technology have been positive long term macro-economic trends for us.

It is difficult to quantify the number of people that can be classified as day traders, since the term is somewhat ambiguous, especially since there has been a large influx of self-directed investors in 2020 and 2021. The two types of traders often overlap and separating these demographics can be difficult. Recent data suggest the following size for this growing market:

|

● |

20%: One in 5 people in the U.S. invested in stocks, or mutual funds, in the final three months of 2020, up from 15% in the second quarter, a Conference Board survey showed. Harry Robertson, Business Insider, Feb 10, 2021 |

|

|

● |

31 YEARS: The median age of user of Robinhood, one of the original commission-free online brokerages. More young adults are joining. Apex Clearing, which helps facilitate trades for brokerages, told Reuters around 1 million of new accounts it opened last year belonged to Gen Z investors, with an average age of 19. John McCrank, Reuters Jan 29, 2021 |

|

|

● |

~$15.5 TRILLION: Total client assets at two of the top retail-focused brokerages. Fidelity Investments had $8.8 trillion in customer assets at the end of the third quarter, up from $8.3 trillion at the end of 2019. Schwab had $6.69 trillion in client assets as of Dec. 31, and 29.6 million brokerage accounts, up 66% and 140%, respectively, from a year earlier. John McCrank, Reuters Jan 29, 2021 |

We believe that the market opportunity for the technology that we have developed and targeted towards day traders can be utilized for self-directed investors as well as institutions -a substantially broader market. We intend to develop mobile applications for self-directed investors that provide them with financial information and data that is not commonly provided by retail brokers. Our first product aimed at this initiative will be Stock Nanny (see “New Products” below). We also intend to market our technologies to institutional financial companies for integration into their existing products or for sub-licensing to their customers.

Recent Technology and Development Initiatives

We continually upgrade our platform to provide the best user experience and maximum value for our members. Many of the new features or improvements to our existing features are suggested by our members. Much of our platform is community curated and we take pride in collaborating with and implementing the suggestions from our members that use our system every day. Our development efforts in 2023 were largely focused on enhancing core parts of our applications and fine-tuning the overall architecture to improve cost efficiencies, eliminate remaining technical debt, and provide our members with a more stable, scalable, and performant system

Development of Native Applications for iOS and Android

We currently have fully-featured native applications for iOS and Android devices which were released in April of 2022. We believe that our mobile applications provide our members additional flexibility in their ability to access our platform when away from a desktop computer.

Platform Upgrades

Since the end of 2021, we have made significant upgrades and changes to our platform. We launched version 2.0 of the application which was a complete rewrite of the application front-end and overhaul of the backend to take advantage of modern technology capabilities that were widely unavailable when the product was initially released. This resulted in much better performance, a smaller resource footprint, and improved reliability and scale. Other development initiatives included the ability to view multiple charts, an enhanced social media capability, and enhanced charting studies, which include additions of new features or indicators such as our GoNoGo indicator, gamma exposure, net options delta and others.

We believe that technological developments to the Blackbox System and platform have been and will continue to be critical to the success of our company. Although we have experienced significant growth and received positive feedback from our members, we believe adding these new technology sets in parallel will be significant drivers of future growth.

New Products

We intend to leverage our existing financial technology platform and data resources for the creation of new and unique products to serve our existing subscribers, as well as address a broader market. We currently have a vast array of derived data that we believe will be extremely useful to self-directed investors as well the day traders and swing traders that we currently cater to. We believe the self-directed investor demographic is significantly larger than that of day traders and swing traders and presents an enormous opportunity for our growth.

Stock Nanny

We are currently developing a new product named Stock Nanny in the form of a mobile app for iOS and Android that will provide real-time portfolio alerts for a broad demographic of investors. Many of these alerts are a product of derived data currently generated on the Blackbox platform. This app will be designed to integrate with online brokerage platforms and allow the user to import their current stock positions and stocks on their watchlist into our app. We believe these alerts will be extremely useful for portfolio management, loss mitigation, and other investment strategies. We plan to provide extensive menu options to allow the user to customize this application to their specific needs. This will be a stand-alone product and we plan to target all self-directed retail investors, not just day traders or swing traders allowing the Company to address a much broader segment of the market. We expect to release this product in 2024.

Enterprise Products for Professionals

We have not historically marketed our product to persons or entities deemed by the exchanges as “professional traders” or financial institutions. A professional trader is generally defined by the exchanges as a person that:

|

● |

Is registered or qualified with the Securities and Exchange Commission, the Commodities Futures Trading Commission, any state securities agency, any securities exchange or association, or any commodities or futures contract market or association. |

|

|

● |

Is engaged as an “investment advisor” as that term is defined in Section 201(11) of the Investment Advisor's Act of 1940 (whether or not registered or qualified under that Act). |

|

|

● |

Is employed by a bank or another organization that is exempt from registration under Federal and/or state securities laws to perform functions that would require him or her to be so registered or qualified if he or she were to perform such functions for an organization not so exempt. |

The exchanges charge a substantial premium for their data to users who meet the criteria described above. In addition to the higher rates, the onboarding and subsequent approval process by these exchanges is cumbersome and not easily accomplished solely through an online process.

In 2023 we developed a streamlined digital onboarding process allowing financial professionals to be able to use our product. We believe that this is an important first step to not only marketing our existing products to financial professionals but also developing new and even bespoke products for this market segment. We are targeting financial institutions to utilize our products, subsets of our systems or even creating bespoke products on their behalf. Poor market performance in 2022 presented significant challenges to retail oriented companies in our industry including us. In order to provide different and more stable revenue streams, we believe it is important for us to use our existing technology base as a basis to develop new revenue streams from professional and institutional customers.

Marketing of the Blackbox System

We launched our Blackbox System and platform for use in the United States and made it available to subscribers in September 2016. Use of the platform is sold on a monthly or annual subscription basis to individual consumers through our website at https://blackboxstocks.com. We believe our Blackbox System subscriptions are priced competitively with similar web-based trading tools although the number of competitors offering limited aspects of what our system provides at lower prices has increased in 2023. We primarily use a combination of digital marketing campaigns and customer referral compensation plans in our advertising program. Our digital advertising efforts are comprised of display and video ads, along with banner and text ads across multiple search and social platforms. We also utilize targeted email marketing and a strategic global marketing campaign for brand awareness. We believe that this form of advertising has been and will continue to be effective in attracting subscribers. We continuously monitor and evaluate the effectiveness of specific social media platforms and allocate marketing funds accordingly. We also promote our subscriptions through an established compensated customer referral program. We offer certain subscribers the right to promote the Blackbox System and receive referral fees for subscribers generated from such subscribers’ effort. Generally, we pay referring subscribers $25 for each subscription generated and $25 for each month the subscriber continues their subscription. We incurred $187,781 and $379,353 in customer referral expenditures in each of the years ended December 31, 2023 and 2022, respectively. We expect to continue utilizing the customer referral sales program as it has proven to be an efficient form of advertising. Our advertising and marketing expense was $629,984 and $1,468,702 for the years ended December 31, 2023 and 2022, respectively. We significantly reduced the amount of our digital marketing spend during 2023 as part of an overall expense reduction as well as a review of the effectiveness of certain marketing strategies. We intend to continue to deploy a significant amount of marketing funds on both digital campaigns and customer referral programs in the future. In addition, we may also utilize television and radio advertising.

Our marketing of products targeted toward institutional customers is anticipated to rely less on the current digital marketing that we have historically utilized and is not expected to utilize affiliate marketing strategies.

Industry Partners and Relationships

We have several arrangements and agreements with financial industry partners that encompass marketing partnerships, educational resources and licenses. We believe our relationship with large well-known brokerage firms enhance our credibility and provide added value to our members. Among these partnerships are marketing agreements with E*TRADE and TastyTrade whereby these firms provide us with a referral fee for new accounts that we bring to them as well as offering our members discounted commissions on options trades. The referral fees are not currently material to our revenue but we believe the that our initial relationship with these firms is significant and provides us with an opportunity to expand these relationships to bring greater value to our members.

We have agreements with E*Trade and TradeStation permitting the integration of our platform with their brokerage platforms. These integrations allow our users to trade directly from our platform using their E*Trade or TradeStation account. In addition, TradeStation advertises our platform to 140,000 users through its webinars and in their internal app store. We believe the ability to enable our members to execute trades with third party brokers without having to leave our platform is particularly valuable to options traders who are able to execute more complicated orders without having to re-enter option contract information on another platform. We intend to integrate our platform with other brokers.

Industry partnerships such as the one we have with Options Industry Council, a non-profit entity funded by the Options Clearing Corp. also help provide our members with added educational benefits.

Data Suppliers

We contract with data suppliers and aggregators to provide our subscribers real time access to most major newswires, historical charting data and the real time stock and options data that drive the backend algorithms. We currently maintain servers connected with our stock and options data provider and utilize an Amazon Web Services (AWS) network as a backup.

Intellectual Property

We rely on a combination of trademark and copyright laws, trade secrets, confidentiality provisions and other contractual provisions to protect our proprietary rights, which are primarily our brand names, product coding and marks. The Company has registered its name and logo with the United States Patent and Trademark Office (“USPTO”) and is pursuing registration of other brand names and marks. The proprietary portion of the Blackbox System including its coding and methodology is protected by contractual confidentiality provisions of both employees and independent contractors.

Government Regulation and Approvals

We offer our subscribing customers a trading tool and not a trading platform, broker dealer or exchange, and therefore we do not believe we are subject to regulatory oversight by the SEC, FINRA or other financial regulatory agencies. We are not aware of any governmental regulations or approvals required for the marketing or use of our Blackbox System or the services provided.

We are subject to a variety of laws and regulations in the United States and abroad that involve matters central to our business. Many of these laws and regulations are still evolving and being tested in courts, and could be interpreted in ways that could harm our business including, but not limited to, privacy, data protection and personal information, rights of publicity, content, intellectual property, advertising, marketing, distribution, data security, data retention and deletion, and other communications, protection of minors, consumer protection, telecommunications, product liability, taxation, economic or other trade prohibitions or sanctions, anti-corruption law compliance and securities law compliance. In particular, we are subject to federal, state and foreign laws regarding privacy and protection of people's data. Foreign data protection, privacy, content and other laws and regulations can impose different obligations or be more restrictive than those in the United States. U.S. federal and state and foreign laws and regulations, which in some cases can be enforced by private parties in addition to government entities, are constantly evolving and can be subject to significant change. As a result, the application, interpretation and enforcement of these laws and regulations are often uncertain, particularly in the new and rapidly evolving industry in which we operate and may be interpreted and applied inconsistently from country to country and inconsistently with our current policies and practices.

Competition

We operate in a highly competitive environment. Although, we believe that our Blackbox System is the only platform that has successfully merged a comprehensive analytics system or “scanner” and a social media platform within the same “dashboard” allowing members to view the same real-time data in parallel, there are a number of companies that offer one or more features that are similar to or attempt to address the same market as we do. Some of these competitors have financial and other resources that are significantly greater than ours. The greatest amount of competition exists within products that provide trading analytics often referred to as “scanners”. We compete with these entities based on a number of factors including price, ease of use, standard features and proprietary features (if applicable). Ultimately, we believe the primary factor used in evaluating the trading analytics by any platform is the user’s ability to derive actionable information from that platform. This is where we believe our proprietary features differentiate the Blackbox System.

In addition to these technical tools, there are also a number of social media platforms that provide forums for traders and investors at little or no cost. The integration of our social media component within our platform creates a community that we believe is significantly superior to stand alone social media sites. Our members are able to interact and discuss ideas while viewing the same dashboard as opposed to having to switch back and forth between applications.

The final component to our platform is education. There are numerous standalone investment and trading applications, books, seminars and courses offered at many different price points. These products compete based on price, perceived value, level of sophistication and reputation among other factors. We offer our courses at no additional charge to our subscribers. In addition, we believe that our social media community provides our more experienced traders the opportunity to mentor newer traders which in turn contributes to the community environment we have developed.

In spite of these factors that differentiate us, we believe the following companies may be considered competitors due to similar product features and retail price points: Trade Ideas, Flow Algo, Unusual Whales and Trade Alert. Companies with social media platforms dedicated to financial markets include Stock Twits and Wall Street Bets.

Employees

As of March 28, 2024, the Company had ten full-time employees. We also currently have eighteen contract workers that primarily serve as team traders on our Blackbox System platform or developers.

None of our employees are represented by a labor organization, and we are not a party to any collective bargaining agreement. We have not experienced any work stoppages and consider our relations with our employees to be good.

We believe that our future success will depend in part on our continued ability to hire, motivate and retain qualified management, sales, marketing, and technical personnel. To date, we have not experienced significant difficulties in attracting or retaining qualified employees.

Recent Developments

Binding Amendment to Amended Letter of Intent

On November 24, 2023, the Company entered into a Binding Amendment to Amended Letter of Intent (the “LOI Amendment”) with Evtec Group Limited (“Evtec Group”), Evtec Automotive Limited (“Evtec Automotive”), and Evtec Aluminium Limited (“Evtec Aluminium, and together with Evtec Group and Evtec Automotive, the “Evtec Companies”), which amended a non-binding Amended Letter of Intent (the “LOI”) dated April 14, 2023. Pursuant to the LOI Amendment, the Company agreed to continue to negotiate in good faith to consummate a proposed acquisition of the Evtec Companies contemplated by the LOI (the “Proposed Transaction”), subject to the terms of the LOI Amendment.

As a condition to the Company’s continued good faith negotiations regarding the Proposed Transaction, the Evtec Companies agreed to (i) pay the Company aggregate extension fees totaling $400,000 which were guaranteed by a credit worthy affiliate of the Evtec Companies, (ii) provide extension loans of up to $400,000 to the Company if the Proposed Transaction has not closed on or before April 1, 2024, (iii) pay the Company amounts in cash equal to any documented legal fees and third-party expenses incurred or payable by the Company in connection with the Proposed Transaction up to $175,000, including any such expenses incurred prior to the date of the LOI Amendment, (iv) forfeit and return 2,400,000 shares of the Series B Convertible Preferred Stock (the “Series B Stock”) acquired by Evtec Group under the terms of that certain Securities Exchange Agreement dated June 9, 2023 (the “Securities Exchange Agreement”), and (v) permit the Company to convert each of the 4,086 preferred shares of Evtec Group issued to the Company pursuant to the Securities Exchange Agreement into one ordinary share of Evtec Group. The Company recorded $575,000 as other income on the statement of operations of which $475,000 was outstanding as of December 31, 2023.

As provided for in the LOI Amendment, Evtec Group entered into an agreement with the Company dated November 28, 2023 (the “Forfeiture Agreement”) pursuant to which Evtec Group forfeited all of its right, title and interest in and to the 2,400,000 Series B Stock acquired by Evtec Group pursuant to the Securities Exchange Agreement in order to further induce the Company to continue to negotiate in good faith to consummate the Proposed Transaction. Pursuant to the Forfeiture Agreement, the Company has no obligation to make any payment to Evtec Group, in cash or otherwise, for any such Series B Stock that are so forfeited. The shares of Series B Stock forfeited by Evtec Group were cancelled as of the date as of the date of the Forfeiture Agreement.

Share Exchange Agreement

On December 12, 2023, we entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with Evtec Aluminium, and the shareholders of Evtec (the “Sellers”). Upon the terms and subject to the satisfaction of the conditions described in the Share Exchange Agreement, we expect to acquire all of the issued and outstanding share capital of Evtec Aluminium, with the result of Evtec Aluminium becoming a wholly-owned subsidiary of the Company (the “Exchange”). At the closing of the Exchange, the Evtec Aluminium shareholders will receive shares of our common stock in exchange for capital shares of Evtec Aluminium based on the exchange ratio formula in the Share Exchange Agreement. Upon closing of the Exchange, the Evtec Aluminium shareholders are expected to collectively own 73.2% of the aggregate common stock of the Company.

Closing of the Exchange is subject to various customary closing conditions, and, among other things, conditioned upon (i) organization of a wholly-owned corporate subsidiary expected to be known as Blackbox.io Inc. (“Blackbox Operating”) to hold Company legacy assets and continue the Company’s legacy business operations, (ii) execution of an employment agreement between the Company and Robert L. Winspear, (iii) execution of an Option Agreement by the Company and Gust Kepler for the sale and repurchase of Mr. Kepler’s Series A Stock (described below), (iv) effectiveness of a registration statement registering shares to be issued in the transaction, (v) Evtec Aluminium securing pre-close equity financing in the amount of at least $5,000,000, and (vi) the Evtec Companies’ satisfaction of all obligations set forth in the LOI Amendment. The Share Exchange Agreement contains certain termination rights for both the Company and Evtec Aluminium, and further provides that upon termination of the Share Exchange Agreement under specified circumstances, the terminating party may be required to pay the other party a termination fee of $500,000 plus up to $250,000 in fees and expenses incurred by such other party.

Following the Closing, it is expected that the board of directors of the combined organization will consist of 5 members. Robert Winspear will remain as a director and the remaining 4 directors will be designated by Evtec Aluminium and will include David Roberts, the founder of the Evtec Companies, who is expected to be named Chairman of the Company’s board of directors. Following the Closing, the Company will change its name to Evtec Holdings, Inc. and it is expected that the shares of common stock of the combined organization will be listed on the Nasdaq Capital Market.

The Share Exchange Agreement contains customary representations, warranties and covenants of the Company and Evtec Aluminium, including, among others, (i) a covenant to issue contractual contingent value rights agreements (each a “Contingent Value Rights Agreement” to each holder of Company Common Stock immediately prior to Closing (described below), (ii) if mutually agreed, the Company will use commercially reasonable efforts to effect a reverse stock split of its common stock, (iii) organize Blackbox Operating and contribute all current pre-Closing business assets of the Company to Blackbox Operating and cause Blackbox Operating to assume all pre-Closing business liabilities of the Company, subject to certain reservations, and (iv) covenants that require each of the Company and Evtec Aluminium to (A) conduct its business in the ordinary course during the period between the execution of the Share Exchange Agreement and the Closing or earlier termination of the Share Exchange Agreement, subject to certain exceptions, and (B) not engage in certain kinds of transactions during such period (without the prior written consent of the other). Each of the Company and Evtec Aluminium have agreed not to (i) solicit proposals relating to alternative business combination transactions or (ii) subject to certain exceptions, enter into discussions or negotiations or provide confidential information in connection with any proposals for alternative business combination transactions.

Option Agreement

As a condition to the parties’ execution of the Share Exchange Agreement, the Company and Mr. Kepler will execute an Option Agreement (the “Option Agreement”), pursuant to which the Company will have the right to call for redemption and Mr. Kepler will have the right to cause the Company to redeem all of the issued and outstanding Series A Convertible Preferred Stock, par value $0.001 per share (the “Series A Stock”), of the Company held by Mr. Kepler in exchange for shares of Series A Convertible Preferred Stock of Blackbox Operating, which shall be substantially similar to the Series A Convertible Preferred Stock of the Company.

Contingent Value Rights Agreements

At the Closing of the Share Exchange Agreement transaction, the Company, a representative of the Company stockholders prior to the Closing, and a to be appointed Rights Agent, will enter into a Contingent Value Rights Agreement. Pursuant to the Share Exchange Agreement and the Contingent Value Rights Agreement, each share of Company common stock held by Company stockholders as of a record date immediately prior to the Closing will receive a dividend of one contingent value right (“CVR”) entitling such holders to receive, in connection with certain transactions involving Blackbox Operating (a “CVR Transaction”), an amount equal to the net proceeds actually received by the Company at the closing of such transaction, or in the event that the Option Agreement is exercised, its pro-rata portion of the aggregate number of shares of Blackbox Operating common stock held by the Company at the time the Option Agreement is exercised. A CVR Transaction is generally a transaction pursuant to which (i) the Company or Blackbox Operating grants, sells, licenses or otherwise transfers some or all of the rights to the Blackbox Operating assets, or other monetizing event of all or any part of the Blackbox Operating assets; or (ii) the exercise of that certain Option Agreement.

The CVR payment obligations will expire on the second anniversary following the Closing. The CVRs will not be transferable, except in certain limited circumstances, will not be certificated or evidenced by any instrument, will not accrue interest and will not be registered with the SEC or listed for trading on any exchange. Until the CVR expiration date, subject to certain exceptions, the Company will be required to use commercially reasonable efforts to continue the operations of Blackbox Operating and seek to consummate a CVR Transaction.

Corporate Information

Our principal executive offices are located at 5430 LBJ Freeway, Suite 1485, Dallas, Texas 75240, and our telephone number is (972) 726-9203. Our website is https://blackboxstocks.com. The information on, or that can be accessed through, our website is not part of this Report on Form 10-K. We have included our website address as an inactive textual reference only.

Additional Information

We file annual reports on Form 10-K and quarterly reports on Form 10-Q with the Securities and Exchange Commission (the “SEC”) on a regular basis, and disclose certain material events in current reports on Form 8-K. Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to reports filed or furnished pursuant to Sections 13(a) and 15(d) of the Exchange Act are available free of charge on our investor relations section of our website as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission ("SEC"). The SEC also maintains an Internet website that contains reports and other information regarding issuers, such as Blackboxstocks, that can be filed electronically with the SEC. The SEC's Internet website is located at http://www.sec.gov.

|

Risk Factors |

An investment in our securities involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information contained in this Report, including our financial statements and related notes, before deciding to invest in our securities. If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline, and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business or results of operations.

Risks Related to Ownership of Our Common Stock

We may not be able to satisfy listing requirements of Nasdaq or maintain a listing of our common stock on Nasdaq.

We are required to meet certain financial and liquidity criteria to maintain our Nasdaq listing. If we violate Nasdaq listing requirements, our common stock may be delisted. If we fail to meet any of Nasdaq’s listing standards, our common stock may be delisted. In addition, our board of directors may determine that the cost of maintaining our listing on a national securities exchange outweighs the benefits of such listing. A delisting of our common stock from Nasdaq may materially impair our stockholders’ ability to buy and sell our common stock and could have an adverse effect on the market price of, and the efficiency of the trading market for, our common stock. The delisting of our common stock would significantly impair our ability to raise capital and the value of your investment.

If our shares of securities become subject to the penny stock rules, it would become more difficult to trade our shares.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or authorized for quotation on certain automated quotation systems, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. If we do not retain a listing on Nasdaq or another national securities exchange and if the price of our common stock is less than $5.00, our common stock could be deemed a penny stock. The penny stock rules require a broker-dealer, before a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document containing specified information. In addition, the penny stock rules require that before effecting any transaction in a penny stock not otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive (i) the purchaser’s written acknowledgment of the receipt of a risk disclosure statement; (ii) a written agreement to transactions involving penny stocks; and (iii) a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our common stock, and therefore stockholders may have difficulty selling their shares.

Fluctuations in our quarterly revenues may cause the price of our common stock to decline.

Our operating results have varied significantly from quarter to quarter in the past, and we expect our operating results to vary from quarter to quarter in the future due to a variety of factors, many of which are outside of our control. Therefore, if revenues are below our expectations, this shortfall is likely to adversely and disproportionately affect our operating results. Accordingly, we may not attain positive operating margins in future quarters. Any of these factors could cause our operating results to be below the expectations of securities analysts and investors, which likely would negatively affect the price of our common stock.

We are a “controlled company” within the meaning of the Nasdaq rules and, as a result, qualify for, and may elect to rely on, exemptions from certain corporate governance requirements that provide protection to the stockholders of companies that are subject to such corporate governance requirements.

Gust C. Kepler, who serves as a director, President and Chief Executive Officer of the Company, beneficially owns more than 50% of the voting power for the election of members of our board of directors. As a result, we are and will continue to be a “controlled company” within the meaning of the corporate governance standards of the Nasdaq rules. Under these rules, a listed company of which more than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not to comply with certain of Nasdaq’s corporate governance requirements.

As a controlled company, we may rely on certain exemptions from the Nasdaq standards that may enable us not to comply with certain Nasdaq corporate governance requirements. As a consequence, in the event that we elect to rely on certain exemptions from the Nasdaq standards provided to “controlled companies,” you will not have the same protections afforded to stockholders of companies that are subject to all of the corporate governance requirements of the Nasdaq Capital Market.

We do not anticipate paying any cash dividends in the foreseeable future.

We have never declared or paid cash dividends, and we do not anticipate paying cash dividends in the foreseeable future. Therefore, you should not rely on an investment in our common stock as a source for any future dividend income. Our board of directors has complete discretion as to whether to declare dividends. Even if our board of directors decides to declare and pay dividends, the timing, amount and form of future dividends, if any, will depend on our future results of operations and cash flow, our capital requirements, our financial condition, contractual restrictions and other factors deemed relevant by our board of directors.

Risks Related to Our Business

We expect to invest heavily in growing our business, which may cause our sales and marketing, research and development, and other expenses to increase and our margins to decline.

We believe that our revenue growth, as well as our ability to improve or maintain margins and profitability, will depend upon, among other factors, our ability to address the challenges, risks, and difficulties described elsewhere in this “Risk Factors” section and the extent to which our various service offerings grow and contribute to our results of operations. We cannot provide assurance that we will be able to successfully manage any such challenges or risks to our future growth. In addition, our customer base may not continue to grow or may decline due to a variety of possible risks, including increased competition, changes in the regulatory landscape, and the maturation of our business. Any of these factors could cause our revenue growth to decline and may adversely affect our margins and profitability. Failure to continue our revenue growth or margin improvement could have a material adverse effect on our business, financial condition, and results of operations. You should not rely on our historical rate of revenue growth as an indication of our future performance.

If we do not continue to attract new subscriber customers, or if existing customers do not renew their subscriptions, or renew on less favorable terms, it could have a material adverse effect on our business, financial condition, and results of operations.

In order to grow our business, we must continually attract new subscribing customers and reduce the level of non-renewals in our business. Our ability to do so depends in large part on the success of our sales and marketing efforts. We may not accurately predict future trends with respect to rates of customer renewals. Our subscribing customer base may decline or fluctuate due to a number of factors, including the prices of our subscriptions, the prices of services offered by our competitors and the efficacy and cost-effectiveness of our solutions. If we are unable to retain and increase sales of our Blackbox System platform to existing subscribing customers or attract new ones for any of the reasons above or for other reasons, our business, financial condition, and results of operations could be adversely affected.

In order to achieve profitability, we must increase revenue levels.

We need to increase current revenue levels by increasing paid subscriptions to our Blackbox System platform or develop additional revenue sources from new products if we are to attain and maintain consistent profitability. If we are unable to achieve increased revenue levels, losses could continue for the near term and possibly longer, and we may not attain profitability or generate positive cash flow from operations in the future.

We intend to introduce new products and services. There can be no assurance that we will be able to introduce such products and services effectively or profitably.

We intend to expand our product and service offering including the introduction of products and services which employ and expand upon our current proprietary system and technology. These products and services are expected to include applications targeted for investors who are not day traders or swing traders and products designed for professional traders. We expect to introduce these products and services in 2023 and spend significant capital on advertising and marketing of the products and services. If we are unable to generate significant revenue from this or other new products and services, we may incur significant operating losses.

We expect to face increasing competition in the market for our platform and services.

We face significant competition and we expect such competition to increase. Our industry and the markets we serve are evolving rapidly and becoming increasingly competitive. Larger and more established companies may focus on our markets and could directly compete with us. Smaller companies could also launch new platforms and services that compete with us and that could gain market acceptance quickly. We also expect our existing competitors in the markets to continue to focus on these areas. A number of these companies may have greater financial, technological, and other resources than we do and greater name recognition than us, which may enable them to compete more effectively. Specifically, we believe the following companies to be direct competitors: Trade Ideas, Flow Algo, Unusual Whales and Trade Alert. Companies with social media platforms dedicated to financial markets include Stock Twits and Wall Street Bets. Our competitors may announce new products, services, or enhancements that better address changing industry standards or the needs of our customers, such as mobile access. Any such increased competition could cause pricing pressure, loss of market share, or decreased customer engagement, any of which could adversely affect our business and operating results.

If we are not able to maintain and enhance our reputation and brand recognition, our business, financial conditions and results of operations will be harmed.

We believe that maintaining and enhancing our reputation and brand recognition is critical to our relationships with existing subscribing customers and our ability to attract new subscribing customers. The promotion of our brand may require us to make substantial investments and we anticipate that, as our market becomes increasingly competitive, these marketing initiatives may become increasingly difficult and expensive. Our marketing activities may not be successful or yield increased revenue, and to the extent that these activities yield increased revenue, the increased revenue may not offset the expenses we incur, and our results of operations could be harmed. In addition, any factor that diminishes our reputation or that of our management, including failing to meet the expectations of our customers, could make it substantially more difficult for us to attract new customers. Similarly, because our subscribing customers often act as references for us with prospective new customers, any existing customer that questions the quality of our work or that of our employees could impair our ability to secure additional new customers. If we do not successfully maintain and enhance our reputation and brand recognition with our customers, our business may not grow and we could lose these relationships, which would harm our business, financial condition, and results of operations.

The estimates of market opportunity and forecasts of market growth included in this report may prove to be inaccurate, and even if the markets in which we compete achieve the forecasted growth, our business may not grow at similar rates, or at all.

Market opportunity estimates and growth forecasts included in this report are subject to significant uncertainty and are based on assumptions and estimates which may not prove to be accurate. The estimates and forecasts included in this report relating to size and expected growth of our target market may prove to be inaccurate. Even if the markets in which we compete meet the size estimates and growth forecasts included in this report, our business may not grow at similar rates, or at all. Our growth is subject to many factors, including our success in implementing our business strategy, which is subject to many risks and uncertainties.

We rely on software-as-a-service, or SaaS, technologies from third parties.

We rely on SaaS technologies from third parties in order to operate critical functions of our business, including financial management services, relationship management services, marketing services and data storage services. Some of our vendor agreements may be unilaterally terminated by the counterparty for convenience. If these services become unavailable due to contract cancellations, extended outages or interruptions, because they are no longer available on commercially reasonable terms or prices, or for any other reason, our expenses could increase, our ability to manage our finances could be interrupted, our processes for managing our offerings and supporting our consumers and partners could be impaired, and our ability to access or save data stored to the cloud may be impaired until equivalent services, if available, are identified, obtained, and implemented, all of which could harm our business, financial condition, and results of operations.

Any restrictions on our use of, or ability to license data, or our failure to license data and integrate third-party technologies, could have a material adverse effect on our business, financial condition, and results of operations.

We depend upon licenses from third parties for some of the technology and data used in our applications, and for some of the technology platforms upon which these applications are built and operate. We expect that we may need to obtain additional licenses from third parties in the future in connection with the development of our solutions and services. In addition, we obtain a portion of the data that we use from various securities and option exchanges. We believe that we have all rights necessary to use the data that is incorporated into our solutions and services. However, we cannot assure you that our licenses for information will allow us to use that information for all potential or contemplated applications and solutions.

In the future, data providers could withdraw their data from us or restrict our usage for any reason, including if there is a competitive reason to do so, if legislation is passed restricting the use of the data, or if judicial interpretations are issued restricting use of the data that we currently use in our solutions and services. If a substantial number of data providers were to withdraw or restrict their data and if we are unable to identify and contract with suitable alternative data suppliers and integrate these data sources into our service offerings, our ability to provide solutions and services to our subscribing customers would be materially adversely impacted, which could have a material adverse effect on our business, financial condition, and results of operations.

We also integrate into our proprietary applications and use third-party software to maintain and enhance, among other things, content generation and delivery, and to support our technology infrastructure. Our use of third-party technologies exposes us to increased risks, including, but not limited to, risks associated with the integration of new technology into our solutions, the diversion of our resources from development of our own proprietary technology, and our inability to generate revenue from licensed technology sufficient to offset associated acquisition and maintenance costs. These technologies may not be available to us in the future on commercially reasonable terms or at all and could be difficult to replace once integrated into our own proprietary applications. Most of these licenses can be renewed only by mutual consent and may be terminated if we breach the terms of the license and fail to cure the breach within a specified period of time. Our inability to obtain, maintain, or comply with any of these licenses could delay development until equivalent technology can be identified, licensed, and integrated, which would harm our business, financial condition, and results of operations.

Most of our third-party licenses are non-exclusive and our competitors may obtain the right to use any of the technology covered by these licenses to compete directly with us. If our data suppliers choose to discontinue support of the licensed technology in the future, we might not be able to modify or adapt our own solutions.

We are dependent on a limited number of key executives and employees, the loss of which could negatively impact our business.

Our business is led by our CEO Gust Kepler and a small group of key employees. The loss of one or more of these executives could negatively impact our business.

Risks Related to Intellectual Property

We may not be able to halt the operations of entities that copy our intellectual property or that aggregate our data as well as data from other companies, including social networks, or copycat online services that may misappropriate our data. These activities could harm our brand and our business.

From time to time, third parties may try to access content or data from our networks through scraping, robots, or other means and use this content and data or combine this content and data with other content and data as part of their services. These activities could degrade our brand, negatively impact our platform and system performance and harm our business. We have employed contractual, technological or legal measures in an attempt to halt unauthorized activities, but these measures may not be successful. In addition, if our customers do not comply with our terms of service, they also may be able to abuse our tools, solutions, and services and provide access to our solutions and content to unauthorized users. We may not be able to detect any or all of these types of activities in a timely manner and, even if we could, technological and legal measures may be insufficient to stop these actions. In some cases, particularly in the case of online services operating from outside of the United States, our available legal remedies may not be adequate to protect our business against such activities. Regardless of whether we can successfully enforce our rights against these parties, any measures that we may take could require us to expend significant financial or other resources.

Third parties may initiate legal proceedings alleging that we are infringing or otherwise violating their intellectual property rights, the outcome of which would be uncertain and could have a material adverse effect on our business, financial condition, and results of operations.

Our commercial success depends on our ability to develop and commercialize our platform, products and services and use our proprietary technology without infringing the intellectual property or proprietary rights of third parties. From time to time, we may be subject to legal proceedings and claims in the ordinary course of business with respect to intellectual property. We are not currently subject to any material claims from third parties asserting infringement of their intellectual property rights.

Intellectual property disputes can be costly to defend and may cause our business, operating results, and financial condition to suffer. Whether merited or not, we have in the past and may in the future face allegations that we, our partners, our licensees, or parties indemnified by us have infringed or otherwise violated the patents, trademarks, copyrights, or other intellectual property rights of third parties. Such claims may be made by competitors seeking to obtain a competitive advantage or by other parties. Some third parties may be able to sustain the costs of complex litigation more effectively than we can because they have substantially greater resources. Even if resolved in our favor, litigation or other legal proceedings relating to intellectual property claims may cause us to incur significant expenses and could distract our technical and management personnel from their normal responsibilities. In addition, there could be public announcements of the results of hearings, motions, or other interim proceedings or developments, and if securities analysts or investors perceive these results to be negative, it could have a material adverse effect on the price of our common stock. Moreover, any uncertainties resulting from the initiation and continuation of any legal proceedings could have a material adverse effect on our ability to raise the funds necessary to continue our operations. Assertions by third parties that we violate their intellectual property rights could therefore have a material adverse effect on our business, financial condition, and results of operations.

Failure to maintain, protect, or enforce our intellectual property rights could harm our business and results of operations.

We may pursue the registration of our domain names, trademarks, and service marks in the United States. We also strive to protect our intellectual property rights by relying on federal, state, and common law rights, as well as contractual restrictions. We typically enter into confidentiality and invention assignment agreements with our employees and contractors, and confidentiality agreements with parties with whom we conduct business in order to limit access to, and disclosure and use of, our proprietary information. However, we may not be successful in executing these agreements with every party who has access to our confidential information or contributes to the development of our technology or intellectual property rights. Those agreements that we do execute may be breached, and we may not have adequate remedies for any such breach. These contractual arrangements and the other steps we have taken to protect our intellectual property rights may not prevent the misappropriation or disclosure of our proprietary information nor deter independent development of similar technology or intellectual property by others.

Effective trade secret, patent, copyright, trademark and domain name protection is expensive to obtain, develop and maintain, both in terms of initial and ongoing registration or prosecution requirements and expenses and the costs of defending our rights. We have invested in and may, over time, increase our investment in protecting our intellectual property through patent filings that could be expensive and time-consuming. Our trademarks and other intellectual property rights may be challenged by others or invalidated through administrative process or litigation. We have not yet applied for or obtained any issued patents that provide protection for our technology or products. Moreover, any issued patents we may obtain may not provide us with a competitive advantage and, as with any technology, competitors may be able to develop similar or superior technologies to our own, now or in the future. In addition, due to a recent U.S. Supreme Court case, it has become increasingly difficult to obtain and assert patents relating to software or business methods, as many such patents have been invalidated for being too abstract to constitute patent-eligible subject matter. We do not know whether this will affect our ability to obtain patents on our innovations, or successfully assert any patents we may pursue in litigation or pre-litigation campaigns.