0001567683FALSE--12-312021Q154.9345.0700015676832021-01-012021-03-310001567683us-gaap:CommonClassAMember2021-01-012021-03-310001567683us-gaap:CommonClassCMember2021-01-012021-03-31xbrli:shares0001567683us-gaap:CommonClassAMember2021-04-300001567683us-gaap:CommonClassBMember2021-04-300001567683us-gaap:CommonClassCMember2021-04-300001567683cwen:CommonClassDMember2021-04-30iso4217:USD00015676832020-01-012020-03-310001567683us-gaap:CommonClassAMember2020-01-012020-03-310001567683us-gaap:CommonClassCMember2020-01-012020-03-31iso4217:USDxbrli:shares00015676832021-03-3100015676832020-12-310001567683us-gaap:CommonClassBMember2020-12-310001567683us-gaap:CommonClassAMember2021-03-310001567683us-gaap:CommonClassCMember2021-03-310001567683us-gaap:CommonClassCMember2020-12-310001567683us-gaap:CommonClassAMember2020-12-310001567683us-gaap:CommonClassBMember2021-03-310001567683cwen:CommonClassDMember2021-03-310001567683cwen:CommonClassDMember2020-12-3100015676832019-12-3100015676832020-03-310001567683us-gaap:PreferredStockMember2020-12-310001567683us-gaap:CommonStockMember2020-12-310001567683us-gaap:AdditionalPaidInCapitalMember2020-12-310001567683us-gaap:RetainedEarningsMember2020-12-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001567683us-gaap:NoncontrollingInterestMember2020-12-310001567683us-gaap:RetainedEarningsMember2021-01-012021-03-310001567683us-gaap:NoncontrollingInterestMember2021-01-012021-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001567683us-gaap:NoncontrollingInterestMembercwen:CEGMember2021-01-012021-03-310001567683cwen:CEGMember2021-01-012021-03-310001567683us-gaap:NoncontrollingInterestMembercwen:TaxEquityInvestorsMember2021-01-012021-03-310001567683cwen:TaxEquityInvestorsMember2021-01-012021-03-310001567683us-gaap:NoncontrollingInterestMembercwen:AquaClienteAcquisitionMember2021-01-012021-03-310001567683cwen:AquaClienteAcquisitionMember2021-01-012021-03-310001567683us-gaap:NoncontrollingInterestMembercwen:RattlensakeDownMember2021-01-012021-03-310001567683cwen:RattlensakeDownMember2021-01-012021-03-310001567683us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310001567683us-gaap:AdditionalPaidInCapitalMembercwen:CEGMember2021-01-012021-03-310001567683us-gaap:PreferredStockMember2021-03-310001567683us-gaap:CommonStockMember2021-03-310001567683us-gaap:AdditionalPaidInCapitalMember2021-03-310001567683us-gaap:RetainedEarningsMember2021-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001567683us-gaap:NoncontrollingInterestMember2021-03-310001567683us-gaap:PreferredStockMember2019-12-310001567683us-gaap:CommonStockMember2019-12-310001567683us-gaap:AdditionalPaidInCapitalMember2019-12-310001567683us-gaap:RetainedEarningsMember2019-12-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001567683us-gaap:NoncontrollingInterestMember2019-12-310001567683us-gaap:RetainedEarningsMember2020-01-012020-03-310001567683us-gaap:NoncontrollingInterestMember2020-01-012020-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001567683us-gaap:NoncontrollingInterestMembercwen:CEGMember2020-01-012020-03-310001567683cwen:CEGMember2020-01-012020-03-310001567683us-gaap:NoncontrollingInterestMembercwen:TaxEquityInvestorsMember2020-01-012020-03-310001567683cwen:TaxEquityInvestorsMember2020-01-012020-03-310001567683us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001567683us-gaap:AdditionalPaidInCapitalMembercwen:CEGMember2020-01-012020-03-310001567683us-gaap:PreferredStockMember2020-03-310001567683us-gaap:CommonStockMember2020-03-310001567683us-gaap:AdditionalPaidInCapitalMember2020-03-310001567683us-gaap:RetainedEarningsMember2020-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001567683us-gaap:NoncontrollingInterestMember2020-03-31utr:MW0001567683cwen:ConventionalGenerationUtilityScaleSolarDistributedSolarandWindMember2021-03-310001567683cwen:GenerationalFacilitiesAndDistrictEnergySystemsMember2021-03-31xbrli:pure0001567683cwen:ClearwayEnergyInc.Membercwen:ClearwayEnergyLLCMember2021-01-012021-03-310001567683cwen:CEGMembercwen:ClearwayEnergyLLCMember2021-01-012021-03-310001567683cwen:CEGMembercwen:ClearwayEnergyInc.Member2021-01-012021-03-310001567683cwen:PublicShareholdersMembercwen:ClearwayEnergyInc.Member2021-01-012021-03-310001567683cwen:OperatingFundsMember2021-03-310001567683cwen:LongTermDebtCurrentMember2021-03-310001567683cwen:DebtServiceObligationsMember2021-03-310001567683us-gaap:CashDistributionMember2021-03-310001567683us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:StateAndLocalJurisdictionMember2021-03-310001567683us-gaap:SubsequentEventMemberus-gaap:CommonClassAMember2021-04-292021-04-290001567683us-gaap:CommonClassCMemberus-gaap:SubsequentEventMember2021-04-292021-04-290001567683us-gaap:CommonClassBMembercwen:ClearwayEnergyLLCMember2021-01-012021-03-310001567683cwen:CommonClassDMembercwen:ClearwayEnergyLLCMember2021-01-012021-03-310001567683us-gaap:SubsequentEventMembercwen:CommonClassDMembercwen:ClearwayEnergyLLCMember2021-04-292021-04-290001567683us-gaap:CommonClassBMemberus-gaap:SubsequentEventMembercwen:ClearwayEnergyLLCMember2021-04-292021-04-290001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMembercwen:EnergyRevenueMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMembercwen:RenewablesMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMembercwen:ThermalMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMembercwen:CapacityRevenueMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMembercwen:RenewablesMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMembercwen:ThermalMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:RenewablesMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:ThermalMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMembercwen:ProductsAndServicesOtherMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMembercwen:RenewablesMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMembercwen:ThermalMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMember2021-01-012021-03-310001567683cwen:EnergyRevenueMember2021-01-012021-03-310001567683cwen:CapacityRevenueMember2021-01-012021-03-310001567683cwen:ConventionalGenerationMember2021-01-012021-03-310001567683cwen:RenewablesMember2021-01-012021-03-310001567683cwen:ThermalMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMembercwen:EnergyRevenueMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMembercwen:RenewablesMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMembercwen:ThermalMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:EnergyRevenueMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMembercwen:CapacityRevenueMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMembercwen:RenewablesMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMembercwen:ThermalMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:CapacityRevenueMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:RenewablesMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:ThermalMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMembercwen:ProductsAndServicesOtherMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMembercwen:RenewablesMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMembercwen:ThermalMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMember2020-01-012020-03-310001567683cwen:EnergyRevenueMember2020-01-012020-03-310001567683cwen:CapacityRevenueMember2020-01-012020-03-310001567683cwen:ConventionalGenerationMember2020-01-012020-03-310001567683cwen:RenewablesMember2020-01-012020-03-310001567683cwen:ThermalMember2020-01-012020-03-310001567683us-gaap:CustomerContractsMember2021-03-310001567683us-gaap:CustomerContractsMember2020-12-310001567683us-gaap:LeaseAgreementsMember2021-03-310001567683us-gaap:LeaseAgreementsMember2020-12-310001567683cwen:RattlesnakeTEHoldcoLLCMember2021-01-122021-01-120001567683cwen:WindPowerGenerationMembercwen:RattlesnakeTEHoldcoLLCMember2021-01-120001567683cwen:TaxEquityInvestorsMember2021-01-122021-01-120001567683cwen:CEGMember2021-01-122021-01-1200015676832021-01-122021-01-120001567683cwen:RattlesnakeTEHoldcoLLCMember2021-01-120001567683cwen:AguaCalienteMember2021-02-032021-02-030001567683cwen:AguaCalienteMember2021-02-030001567683cwen:AguaCalienteMembercwen:ClearwayEnergyInc.Member2021-02-020001567683cwen:AguaCalienteMember2021-02-032021-02-030001567683cwen:AguaCalienteMembercwen:ThirdPartyInvestorMember2021-03-310001567683us-gaap:SubsequentEventMembercwen:NedPowerMountStormLLCMember2021-04-230001567683us-gaap:SubsequentEventMembercwen:NedPowerMountStormLLCMember2021-04-232021-04-230001567683cwen:EnergyCenterDoverMember2020-03-032020-03-030001567683cwen:EnergyCenterDoverMember2021-03-032021-03-030001567683cwen:AltaXandXITEHoldcoMember2021-03-310001567683cwen:BuckthornRenewablesLLCMember2021-03-310001567683cwen:DGPVHoldco3Member2021-03-310001567683cwen:KawailoaSolarPartnershipLLCMember2021-03-310001567683cwen:LangfordTEPartnershipLLCMember2021-03-310001567683cwen:LighthouseRenewableHoldcoLLCMember2021-03-310001567683cwen:OahuSolarPartnershipMember2021-03-310001567683cwen:PinnacleRepoweringPartnershipHoldCoLLCMember2021-03-310001567683cwen:RattlesnakeTEHoldcoLLCMember2021-03-310001567683cwen:RosieTargetCoLLCMember2021-03-310001567683cwen:WildoradoTEHoldcoMember2021-03-310001567683cwen:OtherConsolidatedVariableInterestEntitiesMember2021-03-310001567683cwen:RattlesnakeTEHoldcoLLCMemberus-gaap:CapitalUnitClassAMembercwen:ThirdPartyInvestorMember2021-01-120001567683cwen:RattlesnakeClassBLLCCreditFacilityMember2021-01-122021-01-120001567683cwen:PinnacleRepoweringPartnershipHoldCoLLCMember2021-02-260001567683us-gaap:CapitalUnitClassAMembercwen:PinnacleRepoweringPartnershipHoldCoLLCMember2021-03-310001567683cwen:PinnacleRepoweringPartnershipHoldCoLLCMemberus-gaap:CapitalUnitClassBMember2021-03-310001567683us-gaap:NoncontrollingInterestMembercwen:PinnacleRepoweringPartnershipHoldCoLLCMembercwen:CEGMember2021-03-310001567683us-gaap:NoncontrollingInterestMembercwen:PinnacleRepoweringPartnershipHoldCoLLCMembercwen:CEGMember2021-03-102021-03-100001567683cwen:AvenalMember2021-03-310001567683cwen:DesertSunlightMember2021-03-310001567683cwen:ElkhornRidgeMember2021-03-310001567683cwen:GenConnEnergyLlcMember2021-03-310001567683cwen:SanJuanMesaMember2021-03-310001567683cwen:UtahPortfolioMember2021-03-310001567683us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-03-310001567683us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310001567683us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001567683us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-03-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001567683us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-03-310001567683us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-03-310001567683us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001567683us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Membercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMember2021-03-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMember2021-03-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Membercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMember2020-12-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membercwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMember2020-12-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-03-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-03-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001567683us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-03-310001567683us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-03-310001567683us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001567683us-gaap:CommodityContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2019-12-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-01-012021-03-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-01-012020-03-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-03-310001567683us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-03-31iso4217:USDutr:MWh0001567683us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membersrt:MinimumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputCommodityForwardPriceMember2021-03-310001567683us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputCommodityForwardPriceMember2021-03-310001567683us-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputCommodityForwardPriceMember2021-03-310001567683cwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-03-310001567683cwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membersrt:MinimumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputCommodityForwardPriceMember2021-03-310001567683cwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputCommodityForwardPriceMember2021-03-310001567683cwen:SolarRenewableEnergyCreditsAndOtherFinancialInstrumentsMemberus-gaap:FairValueMeasurementsRecurringMembersrt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:MeasurementInputCommodityForwardPriceMember2021-03-31utr:MMBTU0001567683srt:NaturalGasReservesMemberus-gaap:LongMember2021-01-012021-03-310001567683srt:NaturalGasReservesMemberus-gaap:LongMember2020-01-012020-12-31utr:MWh0001567683us-gaap:ShortMembercwen:PowerMember2021-01-012021-03-310001567683us-gaap:ShortMembercwen:PowerMember2020-01-012020-12-310001567683cwen:InterestMemberus-gaap:LongMember2021-03-310001567683cwen:InterestMemberus-gaap:LongMember2020-12-310001567683cwen:InterestRateContractCurrentMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-03-310001567683cwen:InterestRateContractCurrentMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001567683cwen:InterestRateContractNonCurrentMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-03-310001567683cwen:InterestRateContractNonCurrentMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001567683us-gaap:DesignatedAsHedgingInstrumentMember2021-03-310001567683us-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001567683us-gaap:NondesignatedMembercwen:InterestRateContractCurrentMember2021-03-310001567683us-gaap:NondesignatedMembercwen:InterestRateContractCurrentMember2020-12-310001567683cwen:InterestRateContractNonCurrentMemberus-gaap:NondesignatedMember2021-03-310001567683cwen:InterestRateContractNonCurrentMemberus-gaap:NondesignatedMember2020-12-310001567683cwen:CommodityContractCurrentMemberus-gaap:NondesignatedMember2021-03-310001567683cwen:CommodityContractCurrentMemberus-gaap:NondesignatedMember2020-12-310001567683cwen:CommodityContractLongTermMemberus-gaap:NondesignatedMember2021-03-310001567683cwen:CommodityContractLongTermMemberus-gaap:NondesignatedMember2020-12-310001567683us-gaap:NondesignatedMember2021-03-310001567683us-gaap:NondesignatedMember2020-12-310001567683us-gaap:CommodityContractMember2021-03-310001567683us-gaap:InterestRateContractMember2021-03-310001567683us-gaap:CommodityContractMember2020-12-310001567683us-gaap:InterestRateContractMember2020-12-310001567683us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-12-310001567683us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001567683us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2021-01-012021-03-310001567683us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-03-310001567683us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2021-03-310001567683us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-03-310001567683us-gaap:AociAttributableToNoncontrollingInterestMember2021-03-310001567683us-gaap:AociAttributableToNoncontrollingInterestMember2020-03-310001567683us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMember2021-01-012021-03-310001567683us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMember2020-01-012020-03-310001567683us-gaap:EnergyRelatedDerivativeMember2021-01-012021-03-310001567683us-gaap:EnergyRelatedDerivativeMember2020-01-012020-03-310001567683cwen:A5.75SeniorNotesdue2025Member2021-03-310001567683cwen:A5.75SeniorNotesdue2025Member2020-12-310001567683cwen:A5.00SeniorNotesduein2026Member2021-03-310001567683cwen:A5.00SeniorNotesduein2026Member2020-12-310001567683cwen:A475SeniorNotesDue2028Member2021-03-310001567683cwen:A475SeniorNotesDue2028Member2020-12-310001567683cwen:SeniorNotes3Point750PercentDue2031Member2021-03-310001567683cwen:SeniorNotes3Point750PercentDue2031Member2020-12-310001567683us-gaap:LetterOfCreditMembercwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityMember2021-03-310001567683us-gaap:LetterOfCreditMembercwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityMember2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityMember2021-01-012021-03-310001567683cwen:AguaCalienteSolarLLCDue2037Member2021-03-310001567683cwen:AguaCalienteSolarLLCDue2037Member2020-12-310001567683cwen:AguaCalienteSolarLLCDue2037Membersrt:MinimumMember2021-03-310001567683cwen:AguaCalienteSolarLLCDue2037Membersrt:MaximumMember2021-03-310001567683cwen:AguaCalienteSolarLLCDue2037Memberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:AltaWindAssetManagementLLCDue2031Member2021-03-310001567683cwen:AltaWindAssetManagementLLCDue2031Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:AltaWindAssetManagementLLCDue2031Member2021-03-310001567683us-gaap:LetterOfCreditMembercwen:AltaWindAssetManagementLLCDue2031Member2021-03-310001567683cwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2021-03-310001567683cwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2020-12-310001567683cwen:AltaWindIVleasefinancingarrangementdue2034and2035Membersrt:MinimumMember2021-03-310001567683cwen:AltaWindIVleasefinancingarrangementdue2034and2035Membersrt:MaximumMember2021-03-310001567683cwen:AltaWindIVleasefinancingarrangementdue2034and2035Memberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:AltaWindRealtyInvestmentsLLCDue2031Member2021-03-310001567683cwen:AltaWindRealtyInvestmentsLLCDue2031Member2020-12-310001567683us-gaap:LetterOfCreditMembercwen:AltaWindRealtyInvestmentsLLCDue2031Member2021-03-310001567683cwen:BorregoDue2024And2038Member2021-03-310001567683cwen:BorregoDue2024And2038Member2020-12-310001567683us-gaap:LetterOfCreditMembercwen:BorregoDue2024And2038Member2021-03-310001567683cwen:BuckthornSolardue2025Member2021-03-310001567683cwen:BuckthornSolardue2025Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:BuckthornSolardue2025Member2021-01-012021-03-310001567683cwen:BuckthornSolardue2025Memberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2027Member2021-03-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2027Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:CarlsbadEnergyHoldingsLLCDue2027Member2021-01-012021-03-310001567683us-gaap:LetterOfCreditMembercwen:CarlsbadEnergyHoldingsLLCDue2027Member2021-03-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2038Member2021-03-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2038Member2020-12-310001567683us-gaap:LetterOfCreditMembercwen:CarlsbadEnergyHoldingsLLCDue2038Member2021-03-310001567683cwen:CarlsbadHoldcoDue2038Member2021-03-310001567683cwen:CarlsbadHoldcoDue2038Member2020-12-310001567683cwen:CarlsbadHoldcoDue2038Memberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:CVSRHoldcodue2037Member2021-03-310001567683cwen:CVSRHoldcodue2037Member2020-12-310001567683us-gaap:LetterOfCreditMembercwen:CVSRHoldcodue2037Member2021-03-310001567683cwen:CvsrFinancingAgreementMember2021-03-310001567683cwen:CvsrFinancingAgreementMember2020-12-310001567683cwen:CvsrFinancingAgreementMembersrt:MinimumMember2021-03-310001567683cwen:CvsrFinancingAgreementMembersrt:MaximumMember2021-03-310001567683us-gaap:LetterOfCreditMembercwen:CvsrFinancingAgreementMember2021-03-310001567683cwen:DGCSMasterBorrowerLLCDue2040Member2021-03-310001567683cwen:DGCSMasterBorrowerLLCDue2040Member2020-12-310001567683cwen:DGCSMasterBorrowerLLCDue2040Memberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:DuquesneDue2059Member2021-03-310001567683cwen:DuquesneDue2059Member2020-12-310001567683us-gaap:LetterOfCreditMembercwen:DuquesneDue2059Member2021-03-310001567683cwen:ElSegundoEnergyCenterdue2023Member2021-03-310001567683cwen:ElSegundoEnergyCenterdue2023Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:ElSegundoEnergyCenterdue2023Membersrt:MinimumMember2021-01-012021-03-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:ElSegundoEnergyCenterdue2023Membersrt:MaximumMember2021-01-012021-03-310001567683cwen:ElSegundoEnergyCenterdue2023Memberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:EnergyCenterMinneapolisSeriesDEFGHNotesMember2021-03-310001567683cwen:EnergyCenterMinneapolisSeriesDEFGHNotesMember2020-12-310001567683us-gaap:LetterOfCreditMembercwen:EnergyCenterMinneapolisSeriesDEFGHNotesMember2021-03-310001567683cwen:KawailoaSolarHoldingsLLCdue2026Member2021-03-310001567683cwen:KawailoaSolarHoldingsLLCdue2026Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:KawailoaSolarHoldingsLLCdue2026Member2021-01-012021-03-310001567683cwen:KawailoaSolarHoldingsLLCdue2026Memberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:LaredoRidgeWindLLCDueIn2028Member2021-03-310001567683cwen:LaredoRidgeWindLLCDueIn2028Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:LaredoRidgeWindLLCDueIn2028Member2021-01-012021-03-310001567683us-gaap:LetterOfCreditMembercwen:LaredoRidgeWindLLCDueIn2028Member2021-03-310001567683cwen:MarshLandingTermLoanFacilityMember2021-03-310001567683cwen:MarshLandingTermLoanFacilityMember2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:MarshLandingTermLoanFacilityMember2021-01-012021-03-310001567683cwen:MarshLandingTermLoanFacilityMemberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:NIMHSolarDue2024Member2021-03-310001567683cwen:NIMHSolarDue2024Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:NIMHSolarDue2024Member2021-01-012021-03-310001567683us-gaap:LetterOfCreditMembercwen:NIMHSolarDue2024Member2021-03-310001567683cwen:OahuSolarHoldingsLLCdue2026Member2021-03-310001567683cwen:OahuSolarHoldingsLLCdue2026Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:OahuSolarHoldingsLLCdue2026Member2021-01-012021-03-310001567683us-gaap:LetterOfCreditMembercwen:OahuSolarHoldingsLLCdue2026Member2021-03-310001567683cwen:PinnacleRepoweringPartnershipLLCDue2021Member2021-03-310001567683cwen:PinnacleRepoweringPartnershipLLCDue2021Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:PinnacleRepoweringPartnershipLLCDue2021Member2021-01-012021-03-310001567683cwen:PinnacleRepoweringPartnershipLLCDue2021Memberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:RosieClassBLLCDue2027Member2021-03-310001567683cwen:RosieClassBLLCDue2027Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:RosieClassBLLCDue2027Member2021-01-012021-03-310001567683us-gaap:LetterOfCreditMembercwen:RosieClassBLLCDue2027Member2021-03-310001567683cwen:TapestryWindLLCduein2031Member2021-03-310001567683cwen:TapestryWindLLCduein2031Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:TapestryWindLLCduein2031Member2021-01-012021-03-310001567683us-gaap:LetterOfCreditMembercwen:TapestryWindLLCduein2031Member2021-03-310001567683cwen:UtahSolarHoldingsDue2036Member2021-03-310001567683cwen:UtahSolarHoldingsDue2036Member2020-12-310001567683us-gaap:LetterOfCreditMembercwen:UtahSolarHoldingsDue2036Member2021-03-310001567683cwen:WalnutCreekEnergyLLCduein2023Member2021-03-310001567683cwen:WalnutCreekEnergyLLCduein2023Member2020-12-310001567683cwen:WalnutCreekEnergyLLCduein2023Memberus-gaap:LondonInterbankOfferedRateLIBORMember2021-01-012021-03-310001567683cwen:WalnutCreekEnergyLLCduein2023Memberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:WCEPHoldingsLLCDue2023Member2021-03-310001567683cwen:WCEPHoldingsLLCDue2023Member2020-12-310001567683us-gaap:LondonInterbankOfferedRateLIBORMembercwen:WCEPHoldingsLLCDue2023Member2021-01-012021-03-310001567683cwen:WCEPHoldingsLLCDue2023Memberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:OtherDebtMember2021-03-310001567683cwen:OtherDebtMember2020-12-310001567683cwen:OtherDebtMemberus-gaap:LetterOfCreditMember2021-03-310001567683cwen:ProjectLevelDebtMember2021-03-310001567683cwen:ProjectLevelDebtMember2020-12-310001567683cwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityMember2021-03-310001567683cwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityMember2021-01-012021-03-310001567683cwen:SeniorNotes3Point750PercentDue2031Member2021-03-090001567683cwen:A5.75SeniorNotesdue2025Member2021-03-090001567683cwen:A5.75SeniorNotesdue2025Member2021-03-110001567683cwen:A5.75SeniorNotesdue2025Member2021-03-170001567683cwen:A5.75SeniorNotesdue2025Member2021-03-012021-03-310001567683cwen:AguaCalienteSolarLLCNonrecourseCreditAgreementFederalFinancingBankDue2037Member2021-02-030001567683cwen:AguaCalienteSolarLLCNonrecourseCreditAgreementFederalFinancingBankDue2037Membersrt:MinimumMember2021-02-030001567683cwen:AguaCalienteSolarLLCNonrecourseCreditAgreementFederalFinancingBankDue2037Membersrt:MaximumMember2021-02-030001567683us-gaap:ConstructionLoansMembercwen:PinnacleRepoweringPartnershipHoldCoLLCMember2021-03-100001567683us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:ConstructionLoansMembercwen:PinnacleRepoweringPartnershipHoldCoLLCMember2021-03-102021-03-100001567683cwen:TapestryWindLLCduein2031Member2021-03-102021-03-100001567683us-gaap:CommonClassCMembercwen:A3.25ConvertibleNotesdue2020Member2020-01-012020-03-310001567683us-gaap:CorporateNonSegmentMember2021-01-012021-03-310001567683us-gaap:OperatingSegmentsMembercwen:ConventionalGenerationMember2021-03-310001567683us-gaap:OperatingSegmentsMembercwen:RenewablesMember2021-03-310001567683us-gaap:OperatingSegmentsMembercwen:ThermalMember2021-03-310001567683us-gaap:CorporateNonSegmentMember2021-03-310001567683us-gaap:CorporateNonSegmentMember2020-01-012020-03-310001567683cwen:RENOMMember2021-01-012021-03-310001567683cwen:RENOMMember2020-01-012020-03-310001567683cwen:RENOMMember2021-03-310001567683cwen:RENOMMember2020-12-31cwen:subsidiary0001567683cwen:CEGMember2021-03-310001567683cwen:CEGMember2021-01-012021-03-310001567683cwen:CEGMember2020-01-012020-03-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | | | | |

| ☒ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the quarterly period ended March 31, 2021

| | | | | |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 001-36002

Clearway Energy, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | 46-1777204 |

(State or other jurisdiction

of incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

| 300 Carnegie Center, Suite 300 | Princeton | New Jersey | 08540 |

| (Address of principal executive offices) | (Zip Code) |

(609) 608-1525

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 | CWEN.A | New York Stock Exchange |

| Class C Common Stock, par value $0.01 | CWEN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of April 30, 2021, there were 34,599,645 shares of Class A common stock outstanding, par value $0.01 per share, 42,738,750 shares of Class B common stock outstanding, par value $0.01 per share, 81,759,563 shares of Class C common stock outstanding, par value $0.01 per share, and 42,738,750 shares of Class D common stock outstanding, par value $0.01 per share.

TABLE OF CONTENTS

Index

| | | | | |

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION | |

GLOSSARY OF TERMS | |

PART I — FINANCIAL INFORMATION | |

ITEM 1 — FINANCIAL STATEMENTS AND NOTES | |

ITEM 2 — MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

ITEM 3 — QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

ITEM 4 — CONTROLS AND PROCEDURES | |

PART II — OTHER INFORMATION | |

ITEM 1 — LEGAL PROCEEDINGS | |

ITEM 1A — RISK FACTORS | |

ITEM 2 — UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |

ITEM 3 — DEFAULTS UPON SENIOR SECURITIES | |

ITEM 4 — MINE SAFETY DISCLOSURES | |

ITEM 5 — OTHER INFORMATION | |

ITEM 6 — EXHIBITS | |

SIGNATURES | |

| |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q of Clearway Energy, Inc., together with its consolidated subsidiaries, or the Company, includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The words "believes," "projects," "anticipates," "plans," "expects," "intends," "estimates" and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These factors, risks and uncertainties include the factors described under Item 1A — Risk Factors in Part I of the Company's Annual Report on Form 10-K for the year ended December 31, 2020, as well as the following:

•The Company's ability to maintain and grow its quarterly dividend;

•Potential risks related to COVID-19 or any other pandemic;

•Potential risks related to the Company's relationships with GIP and CEG;

•The Company's ability to successfully identify, evaluate and consummate acquisitions from third parties;

•The Company's ability to acquire assets from GIP or CEG;

•The Company's ability to raise additional capital due to its indebtedness, corporate structure, market conditions or otherwise;

•Changes in law, including judicial decisions;

•Hazards customary to the power production industry and power generation operations such as fuel and electricity price volatility, unusual weather conditions (including wind and solar conditions), catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs, unanticipated changes to fuel supply costs or availability due to higher demand, shortages, transportation problems or other developments, environmental incidents, or electric transmission or gas pipeline system constraints and the possibility that the Company may not have adequate insurance to cover losses as a result of such hazards;

•The Company's ability to operate its businesses efficiently, manage maintenance capital expenditures and costs effectively, and generate earnings and cash flows from its asset-based businesses in relation to its debt and other obligations;

•The willingness and ability of counterparties to the Company's offtake agreements to fulfill their obligations under such agreements;

•The Company's ability to enter into contracts to sell power and procure fuel on acceptable terms and prices as current offtake agreements expire;

•Government regulation, including compliance with regulatory requirements and changes in market rules, rates, tariffs and environmental laws;

•Operating and financial restrictions placed on the Company that are contained in the project-level debt facilities and other agreements of certain subsidiaries and project-level subsidiaries generally, in the Clearway Energy Operating LLC amended and restated revolving credit facility and in the indentures governing the Senior Notes;

•Cyber terrorism and inadequate cybersecurity, or the occurrence of a catastrophic loss and the possibility that the Company may not have adequate insurance to cover losses resulting from such hazards or the inability of the Company's insurers to provide coverage;

•The Company's ability to engage in successful mergers and acquisitions activity; and

•The Company's ability to borrow additional funds and access capital markets, as well as the Company's substantial indebtedness and the possibility that the Company may incur additional indebtedness going forward.

Forward-looking statements speak only as of the date they were made, and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The foregoing review of factors that could cause the Company's actual results to differ materially from those contemplated in any forward-looking statements included in this Quarterly Report on Form 10-Q should not be construed as exhaustive.

GLOSSARY OF TERMS

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| | | | | | | | |

| 2025 Senior Notes | | $600 million aggregate principal amount of 5.750% unsecured senior notes due 2025, issued by Clearway Energy Operating LLC, which were repaid in March 2021 |

| 2026 Senior Notes | | $350 million aggregate principal amount of 5.00% unsecured senior notes due 2026, issued by Clearway Energy Operating LLC |

| 2028 Senior Notes | | $850 million aggregate principal amount of 4.750% unsecured senior notes due 2028, issued by Clearway Energy Operating LLC |

| 2031 Senior Notes | | $925 million aggregate principal amount of 3.750% unsecured senior notes due 2031, issued by Clearway Energy Operating LLC |

| Adjusted EBITDA | | A non-GAAP measure, represents earnings before interest, tax, depreciation and amortization adjusted for mark-to-market gains or losses, asset write offs and impairments; and factors which the Company does not consider indicative of future operating performance |

| AOCI | | Accumulated Other Comprehensive Income |

| AOCL | | Accumulated Other Comprehensive Loss |

| ASC | | The FASB Accounting Standards Codification, which the FASB established as the source of

authoritative GAAP |

| ASU | | Accounting Standards Updates - updates to the ASC |

| ATM Programs | | At-The-Market Equity Offering Programs |

| CAFD | | A non-GAAP measure, Cash Available for Distribution is defined as of March 31, 2021 as Adjusted EBITDA plus cash distributions/return of investment from unconsolidated affiliates, adjustments to reflect CAFD generated by unconsolidated investments that were not able to distribute project dividends prior to PG&E's emergence from bankruptcy on July 1, 2020 and subsequent release post-bankruptcy, cash receipts from notes receivable, cash distributions from noncontrolling interests, adjustments to reflect sales-type lease cash payments, less cash distributions to noncontrolling interests, maintenance capital expenditures, pro-rata Adjusted EBITDA from unconsolidated affiliates, cash interest paid, income taxes paid, principal amortization of indebtedness, changes in prepaid and accrued capacity payments, and adjusted for development expenses. |

| CEG | | Clearway Energy Group LLC (formerly Zephyr Renewables LLC) |

| CEG Master Services Agreement | | Master Services Agreements entered into as of August 31, 2018 between the Company, Clearway Energy LLC and Clearway Energy Operating LLC, and CEG |

| | |

| Clearway Energy LLC | | The holding company through which the projects are owned by Clearway Energy Group LLC, the holder of Class B and Class D units of Clearway Energy LLC, and Clearway Energy, Inc., the holder of the Class A and Class C units |

| Clearway Energy Group LLC | | The holder of the Company's Class B and Class D common shares and Clearway Energy LLC's Class B and Class D units |

| Clearway Energy Operating LLC | | The holder of the project assets that are owned by Clearway Energy LLC |

| COD | | Commercial Operation Date |

| Company | | Clearway Energy, Inc. together with its consolidated subsidiaries |

| CVSR | | California Valley Solar Ranch |

| CVSR Holdco | | CVSR Holdco LLC, the indirect owner of CVSR |

| | |

| | |

| | |

| | |

| Distributed Solar | | Solar power projects, typically less than 20 MW in size (on an alternating current, or AC, basis), that primarily sell power produced to customers for usage on site, or are interconnected to sell power into the local distribution grid |

| Drop Down Assets | | Collectively, assets under common control acquired by the Company from NRG from January 1, 2014 through the period ended August 31, 2018 and from CEG from August 31, 2018 through the period ended March 31, 2021 |

| Economic Gross Margin | | A non-GAAP measure, energy and capacity revenue, less cost of fuels. See Item 2 — Management's Discussion and Analysis of Financial Condition and Results of Operations — Management's discussion of the results of operations for the quarters ended March 31, 2021 and 2020 for a discussion of this measure. |

| ECP | | Energy Center Pittsburgh LLC, a subsidiary of the Company |

| EPA | | United States Environmental Protection Agency |

| Exchange Act | | The Securities Exchange Act of 1934, as amended |

| | | | | | | | |

| FASB | | Financial Accounting Standards Board |

| GAAP | | Accounting principles generally accepted in the U.S. |

| GenConn | | GenConn Energy LLC |

| GIP | | Collectively, Global Infrastructure Partners III-C Intermediate AIV 3, L.P., Global Infrastructure Partners III-A/B AIV 3, L.P., Global Infrastructure Partners III-C Intermediate AIV 2, L.P., Global Infrastructure Partners III-C2 Intermediate AIV, L.P. and GIP III Zephyr Friends & Family, LLC |

| HLBV | | Hypothetical Liquidation at Book Value |

| LIBOR | | London Inter-Bank Offered Rate |

| MBTA | | Migratory Bird Treaty Act |

| MMBtu | | Million British Thermal Units |

| MW | | Megawatt |

| MWh | | Saleable megawatt hours, net of internal/parasitic load megawatt-hours |

| MWt | | Megawatts Thermal Equivalent |

| Net Exposure | | Counterparty credit exposure to Clearway Energy, Inc. net of collateral |

| NOLs | | Net Operating Losses |

| NPPD | | Nebraska Public Power District |

| NRG | | NRG Energy, Inc. |

| OCL | | Other comprehensive loss |

| O&M | | Operations and Maintenance |

| PG&E | | Pacific Gas and Electric Company |

| PPA | | Power Purchase Agreement |

| PTC | | Production Tax Credit |

| RENOM | | Clearway Renewable Operation & Maintenance LLC |

| RTO | | Regional Transmission Organization |

| SCE | | Southern California Edison |

| SEC | | U.S. Securities and Exchange Commission |

| Senior Notes | | Collectively, the 2026 Senior Notes, the 2028 Senior Notes and the 2031 Senior Notes |

| SPP | | Solar Power Partners |

| SREC | | Solar Renewable Energy Credit |

| Tax Act | | Tax Cuts and Jobs Act of 2017 |

| Thermal Business | | The Company's thermal business, which consists of thermal infrastructure assets that provide steam, hot water and/or chilled water, and in some instances electricity, to commercial businesses, universities, hospitals and governmental units |

| U.S. | | United States of America |

| Utah Solar Portfolio | | Collection consists of Four Brothers Solar, LLC, Granite Mountain Holdings, LLC, and Iron Springs Holdings, LLC, which are equity investments owned by Four Brothers Capital, LLC, Granite Mountain Capital, LLC, and Iron Springs Capital, LLC, respectively |

| Utility Scale Solar | | Solar power projects, typically 20 MW or greater in size (on an alternating current, or AC, basis), that are interconnected into the transmission or distribution grid to sell power at a wholesale level |

| VaR | | Value at Risk |

| VIE | | Variable Interest Entity |

PART I - FINANCIAL INFORMATION

ITEM 1 — FINANCIAL STATEMENTS

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | Three months ended March 31, |

| (In millions, except per share amounts) | | | | | 2021 | | 2020 |

| Operating Revenues | | | | | | | |

| Total operating revenues | | | | | $ | 237 | | | $ | 258 | |

| Operating Costs and Expenses | | | | | | | |

| | | | | | | |

| Cost of operations | | | | | 110 | | | 93 | |

| Depreciation, amortization and accretion | | | | | 128 | | | 102 | |

| | | | | | | |

| General and administrative | | | | | 10 | | | 9 | |

| Transaction and integration costs | | | | | 2 | | | 1 | |

| Development costs | | | | | 1 | | | 1 | |

| Total operating costs and expenses | | | | | 251 | | | 206 | |

| Operating (Loss) Income | | | | | (14) | | | 52 | |

| Other Income (Expense) | | | | | | | |

| Equity in earnings (losses) of unconsolidated affiliates | | | | | 4 | | | (13) | |

| | | | | | | |

| Other income, net | | | | | 1 | | | 2 | |

| Loss on debt extinguishment | | | | | (42) | | | (3) | |

| Interest expense | | | | | (45) | | | (167) | |

| Total other expense, net | | | | | (82) | | | (181) | |

| Loss Before Income Taxes | | | | | (96) | | | (129) | |

| Income tax benefit | | | | | (20) | | | (22) | |

| Net Loss | | | | | (76) | | | (107) | |

| | | | | | | |

| Less: Loss attributable to noncontrolling interests and redeemable interests | | | | | (79) | | | (78) | |

Net Income (Loss) Attributable to Clearway Energy, Inc. | | | | | $ | 3 | | | $ | (29) | |

Earnings Per Share Attributable to Clearway Energy, Inc. Class A and Class C Common Stockholders | | | | | | | |

Weighted average number of Class A common shares outstanding - basic and diluted | | | | | 35 | | | 35 | |

| | | | | | | |

Weighted average number of Class C common shares outstanding - basic and diluted | | | | | 82 | | | 79 | |

| | | | | | | |

Earnings (Loss) per Weighted Average Class A and Class C Common Share - Basic and Diluted | | | | | $ | 0.03 | | | $ | (0.26) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Dividends Per Class A Common Share | | | | | $ | 0.324 | | | $ | 0.210 | |

| Dividends Per Class C Common Share | | | | | $ | 0.324 | | | $ | 0.210 | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | Three months ended March 31, |

| (In millions) | | | | | 2021 | | 2020 |

| Net Loss | | | | | $ | (76) | | | $ | (107) | |

| Other Comprehensive Income (Loss) | | | | | | | |

Unrealized gain (loss) on derivatives, net of income tax expense (benefit) of $2 and $(2) | | | | | 11 | | | (12) | |

| Other comprehensive income (loss) | | | | | 11 | | | (12) | |

| Comprehensive Loss | | | | | (65) | | | (119) | |

| Less: Comprehensive loss attributable to noncontrolling interests and redeemable interests | | | | | (72) | | | (84) | |

| Comprehensive Income (Loss) Attributable to Clearway Energy, Inc. | | | | | $ | 7 | | | $ | (35) | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| (In millions, except shares) | March 31, 2021 | | December 31, 2020 |

| ASSETS | (unaudited) | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 144 | | | $ | 268 | |

| Restricted cash | 287 | | | 197 | |

| Accounts receivable — trade | 159 | | | 143 | |

| | | |

| Inventory | 43 | | | 42 | |

| | | |

| | | |

| Prepayments and other current assets | 101 | | | 58 | |

| Total current assets | 734 | | | 708 | |

| Property, plant and equipment, net | 7,490 | | | 7,217 | |

| Other Assets | | | |

| Equity investments in affiliates | 645 | | | 741 | |

| | | |

| Intangible assets for power purchase agreements, net | 2,223 | | | 1,231 | |

| Other intangible assets, net | 136 | | | 139 | |

| Derivative instruments | 8 | | | 1 | |

| Deferred income taxes | 125 | | | 104 | |

| Right of use assets, net | 348 | | | 337 | |

| | | |

| Other non-current assets | 139 | | | 114 | |

| Total other assets | 3,624 | | | 2,667 | |

| Total Assets | $ | 11,848 | | | $ | 10,592 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current Liabilities | | | |

| Current portion of long-term debt | $ | 500 | | | $ | 384 | |

| | | |

| Accounts payable — trade | 93 | | | 72 | |

| | | |

| Accounts payable — affiliates | 17 | | | 17 | |

| Derivative instruments | 37 | | | 38 | |

| Accrued interest expense | 39 | | | 44 | |

| | | |

| Accrued expenses and other current liabilities | 62 | | | 79 | |

| Total current liabilities | 748 | | | 634 | |

| Other Liabilities | | | |

| Long-term debt | 7,463 | | | 6,585 | |

| Derivative instruments | 107 | | | 135 | |

| Long-term lease liabilities | 354 | | | 345 | |

| Other non-current liabilities | 181 | | | 178 | |

| Total non-current liabilities | 8,105 | | | 7,243 | |

| Total Liabilities | 8,853 | | | 7,877 | |

| | | |

| Commitments and Contingencies | | | |

| Stockholders' Equity | | | |

Preferred stock, $0.01 par value; 10,000,000 shares authorized; none issued | — | | | — | |

Class A, Class B, Class C and Class D common stock, $0.01 par value; 3,000,000,000 shares authorized (Class A 500,000,000, Class B 500,000,000, Class C 1,000,000,000, Class D 1,000,000,000); 201,818,187 shares issued and outstanding (Class A 34,599,645, Class B 42,738,750, Class C 81,741,042, Class D 42,738,750) at March 31, 2021 and 201,635,990 shares issued and outstanding (Class A 34,599,645, Class B 42,738,750, Class C 81,558,845, Class D 42,738,750) at December 31, 2020 | 1 | | | 1 | |

| Additional paid-in capital | 1,886 | | | 1,922 | |

| Accumulated deficit | (81) | | | (84) | |

| Accumulated other comprehensive loss | (10) | | | (14) | |

| Noncontrolling interest | 1,199 | | | 890 | |

| Total Stockholders' Equity | 2,995 | | | 2,715 | |

| Total Liabilities and Stockholders' Equity | $ | 11,848 | | | $ | 10,592 | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| Three months ended March 31, |

| (In millions) | 2021 | | 2020 |

| Cash Flows from Operating Activities | | | |

| Net Loss | $ | (76) | | | $ | (107) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Equity in (earnings) losses of unconsolidated affiliates | (4) | | | 13 | |

| Distributions from unconsolidated affiliates | 13 | | | 5 | |

| Depreciation, amortization and accretion | 128 | | | 102 | |

| Amortization of financing costs and debt discounts | 4 | | | 4 | |

| Amortization of intangibles | 32 | | | 22 | |

| Loss on debt extinguishment | 42 | | | 3 | |

| Reduction in carrying amount of right-of-use assets | 2 | | | 2 | |

| | | |

| | | |

| Changes in deferred income taxes | (20) | | | (22) | |

| Changes in derivative instruments | (27) | | | 85 | |

| | | |

| Cash used in changes in other working capital | | | |

| Changes in prepaid and accrued liabilities for tolling agreements | (44) | | | (45) | |

| Changes in other working capital | (3) | | | 22 | |

| Net Cash Provided by Operating Activities | 47 | | | 84 | |

| Cash Flows from Investing Activities | | | |

Acquisition of Agua Caliente, net of cash acquired | (111) | | | — | |

| | | |

| Acquisition of Drop Down Asset | (132) | | | — | |

| | | |

| | | |

| Capital expenditures | (79) | | | (40) | |

| Return of investment from unconsolidated affiliates | 8 | | | 12 | |

| Investments in unconsolidated affiliates | — | | | (7) | |

| Proceeds from sale of assets | — | | | 15 | |

| Insurance proceeds | — | | | 3 | |

| | | |

| Net Cash Used in Investing Activities | (314) | | | (17) | |

| Cash Flows from Financing Activities | | | |

| Net contributions from noncontrolling interests | 229 | | | 154 | |

| | | |

| Net proceeds from the issuance of common stock | — | | | 10 | |

| Payments of dividends and distributions | (66) | | | (42) | |

| Payments of debt issuance costs | (15) | | | — | |

| Proceeds from the revolving credit facility | 195 | | | 180 | |

| Payments for the revolving credit facility | (170) | | | — | |

| Proceeds from the issuance of long-term debt | 1,004 | | | 31 | |

| Payments for long-term debt | (957) | | | (437) | |

| Other | 13 | | | — | |

| Net Cash Provided by (Used in) Financing Activities | 233 | | | (104) | |

| Net Decrease in Cash, Cash Equivalents and Restricted Cash | (34) | | | (37) | |

| Cash, Cash Equivalents and Restricted Cash at beginning of period | 465 | | | 417 | |

| Cash, Cash Equivalents and Restricted Cash at end of period | $ | 431 | | | $ | 380 | |

| | | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

For the Three Months Ended March 31, 2021

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Preferred Stock | | Common Stock | | Additional

Paid-In

Capital | | Accumulated Deficit | | Accumulated

Other

Comprehensive Loss | | Noncontrolling

Interest | | Total

Stockholders'

Equity |

| Balances at December 31, 2020 | $ | — | | | $ | 1 | | | $ | 1,922 | | | $ | (84) | | | $ | (14) | | | $ | 890 | | | $ | 2,715 | |

| Net income (loss) | — | | | — | | | — | | | 3 | | | — | | | (81) | | | (78) | |

| Unrealized gain on derivatives, net of tax | — | | | — | | | — | | | — | | | 4 | | | 7 | | | 11 | |

| Contributions from CEG, non-cash | — | | | — | | | — | | | — | | | — | | | 27 | | | 27 | |

| Contributions from CEG, cash | — | | | — | | | — | | | — | | | — | | | 103 | | | 103 | |

| Contributions from noncontrolling interests, net of distributions, cash | — | | | — | | | — | | | — | | | — | | | 126 | | | 126 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Agua Caliente acquisition | — | | | — | | | — | | | — | | | — | | | 273 | | | 273 | |

| Rattlesnake Drop Down | — | | | — | | | — | | | — | | | — | | | (118) | | | (118) | |

| Non-cash adjustments for change in tax basis | — | | | — | | | 2 | | | — | | | — | | | — | | | 2 | |

| | | | | | | | | | | | | |

| Common stock dividends and distributions to CEG | — | | | — | | | (38) | | | — | | | — | | | (28) | | | (66) | |

| Balances at March 31, 2021 | $ | — | | | $ | 1 | | | $ | 1,886 | | | $ | (81) | | | $ | (10) | | | $ | 1,199 | | | $ | 2,995 | |

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

For the Three Months Ended March 31, 2020

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Preferred Stock | | Common Stock | | Additional

Paid-In

Capital | | Accumulated Deficit | | Accumulated

Other

Comprehensive Loss | | Noncontrolling

Interest | | Total

Stockholders'

Equity |

| Balances at December 31, 2019 | $ | — | | | $ | 1 | | | $ | 1,936 | | | $ | (72) | | | $ | (15) | | | $ | 413 | | | $ | 2,263 | |

| Net loss | — | | | — | | | — | | | (29) | | | — | | | (78) | | | (107) | |

| Unrealized loss on derivatives, net of tax | — | | | — | | | — | | | — | | | (6) | | | (6) | | | (12) | |

| Contributions from CEG, cash | — | | | — | | | — | | | — | | | — | | | 4 | | | 4 | |

| Contributions from tax equity interests, net of distributions, cash | — | | | — | | | — | | | — | | | — | | | 150 | | | 150 | |

| Net proceeds from the issuance of common stock under the ATM Program | — | | | — | | | 10 | | | — | | | — | | | — | | | 10 | |

| Distributions to tax equity investors, non-cash | — | | | — | | | — | | | — | | | — | | | (2) | | | (2) | |

| Common stock dividends and distributions to CEG | — | | | — | | | (24) | | | — | | | — | | | (18) | | | (42) | |

| Balances at March 31, 2020 | $ | — | | | $ | 1 | | | $ | 1,922 | | | $ | (101) | | | $ | (21) | | | $ | 463 | | | $ | 2,264 | |

CLEARWAY ENERGY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 — Nature of Business

Clearway Energy, Inc., together with its consolidated subsidiaries, or the Company, is a publicly-traded energy infrastructure investor in and owner of modern, sustainable and long-term contracted assets across North America. The Company is indirectly owned by Global Infrastructure Partners III. Global Infrastructure Management, LLC is an independent fund manager that invests in infrastructure assets in energy and transport sectors, and Global Infrastructure Partners III is its third equity fund. The Company is sponsored by GIP through GIP's portfolio company, CEG.

The Company is one of the largest renewable energy owners in the U.S. with over 4,200 net MW of installed wind and solar generation projects. The Company's over 8,000 net MW of assets also includes approximately 2,500 net MW of environmentally-sound, highly efficient generation facilities as well as a portfolio of district energy systems. Through this environmentally-sound, diversified and primarily contracted portfolio, the Company endeavors to provide its investors with stable and growing dividend income. Substantially all of the Company's generation assets are under long-term contractual arrangements for the output or capacity from these assets.

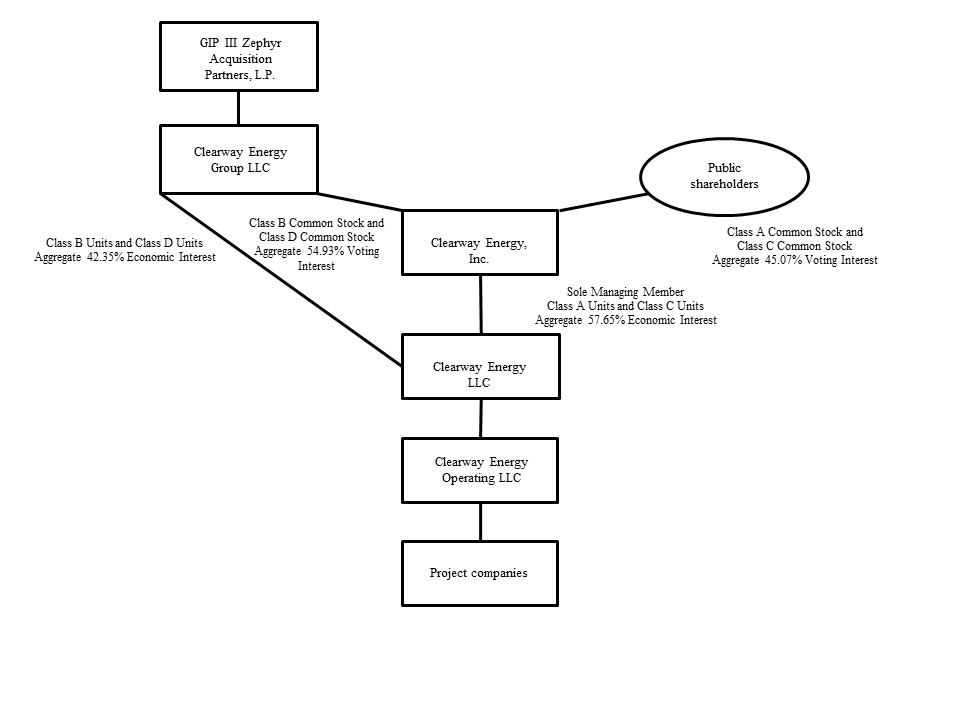

The Company consolidates the results of Clearway Energy LLC through its controlling interest, with CEG's interest shown as non-controlling interest in the financial statements. The holders of the Company's outstanding shares of Class A and Class C common stock are entitled to dividends as declared. CEG receives its distributions from Clearway Energy LLC through its ownership of Clearway Energy LLC Class B and Class D units.

The Company owns 57.65% of the economic interests of Clearway Energy LLC, with CEG owning 42.35% of the economic interests of Clearway Energy LLC as of March 31, 2021.

The following table represents the structure of the Company as of March 31, 2021:

Basis of Presentation

The accompanying unaudited interim consolidated financial statements have been prepared in accordance with the SEC’s regulations for interim financial information and with the instructions to Form 10-Q. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. The following notes should be read in conjunction with the accounting policies and other disclosures as set forth in the notes to the consolidated financial statements included in the Company's 2020 Form 10-K. Interim results are not necessarily indicative of results for a full year.

In the opinion of management, the accompanying unaudited interim consolidated financial statements contain all material adjustments consisting of normal and recurring accruals necessary to present fairly the Company's consolidated financial position as of March 31, 2021, and the results of operations, comprehensive income (loss) and cash flows for the three months ended March 31, 2021 and 2020.

Note 2 — Summary of Significant Accounting Policies

Use of Estimates

The preparation of consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions. These estimates and assumptions impact the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could be different from these estimates.

Cash and Cash Equivalents, and Restricted Cash

Cash and cash equivalents include highly liquid investments with an original maturity of three months or less at the time of purchase. Cash and cash equivalents held at project subsidiaries was $111 million and $149 million as of March 31, 2021 and December 31, 2020, respectively.

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the consolidated balance sheets that sum to the total of the same such amounts shown in the statements of cash flows:

| | | | | | | | | | | |

| | March 31, 2021 | | December 31, 2020 |

| | (In millions) |

| Cash and cash equivalents | $ | 144 | | | $ | 268 | |

| Restricted cash | 287 | | | 197 | |

| Cash, cash equivalents and restricted cash shown in the statement of cash flows | $ | 431 | | | $ | 465 | |

Restricted cash consists primarily of funds held to satisfy the requirements of certain debt agreements and funds held within the Company's projects that are restricted in their use. As of March 31, 2021, these restricted funds were comprised of $114 million designated to fund operating expenses, approximately $45 million designated for current debt service payments, and $93 million restricted for reserves including debt service, performance obligations and other reserves, as well as capital expenditures. The remaining $35 million is held in distribution reserve accounts.

In 2020, the members of the partnerships holding the Oahu Solar and Kawailoa Solar projects submitted applications to the state of Hawaii for refundable tax credits based on the cost of construction of the projects. The Company recorded a receivable for these refundable tax credits of $49 million which is reflected in prepayments and other current assets on the Company's consolidated balance sheet as of March 31, 2021 with an offsetting reduction to the construction costs in property, plant and equipment, net. The Company received the cash proceeds from the refundable tax credits on April 7, 2021. In accordance with the projects' related agreements, the cash will be held in a restricted account and utilized to offset future invoiced amounts under the projects PPAs.

Accumulated Depreciation, Accumulated Amortization

The following table presents the accumulated depreciation included in the property, plant and equipment, net, and accumulated amortization included in intangible assets, net, respectively, as of March 31, 2021 and December 31, 2020:

| | | | | | | | | | | |

| March 31, 2021 | | December 31, 2020 |

| (In millions) |

| Property, Plant and Equipment Accumulated Depreciation | $ | 2,447 | | | $ | 2,323 | |

| Intangible Assets Accumulated Amortization | 519 | | | 487 | |

Dividends to Class A and Class C common stockholders

The following table lists the dividends paid on the Company's Class A common stock and Class C common stock during the three months ended March 31, 2021:

| | | | | | | | | | | |

| | | | | | | First Quarter 2021 |

| Dividends per Class A share | | | | | | | $ | 0.324 | |

| Dividends per Class C share | | | | | | | $ | 0.324 | |

Dividends on the Class A common stock and Class C common stock are subject to available capital, market conditions, and compliance with associated laws, regulations and other contractual obligations. The Company expects that, based on current circumstances, comparable cash dividends will continue to be paid in the foreseeable future.

On April 29, 2021, the Company declared quarterly dividends on its Class A common stock and Class C common stock of $0.329 per share payable on June 15, 2021 to stockholders of record as of June 1, 2021.

Noncontrolling Interests

Clearway Energy LLC Distributions to CEG

The following table lists distributions paid to CEG during the three months ended March 31, 2021 on Clearway Energy LLC's Class B and D units:

| | | | | | | | | | | |

| | | | | | | First Quarter 2021 |

| Distributions per Class B Unit | | | | | | | $ | 0.324 | |

| Distributions per Class D Unit | | | | | | | $ | 0.324 | |

On April 29, 2021, Clearway Energy LLC declared a distribution on its Class B and Class D units of $0.329 per unit payable on June 15, 2021 to unit holders of record as of June 1, 2021.

Revenue Recognition

Revenue from Contracts with Customers

The Company applies the guidance in ASC 606, Revenue from Contracts with Customers, or Topic 606, when recognizing revenue associated with its contracts with customers. The Company's policies with respect to its various revenue streams are detailed below. In general, the Company applies the invoicing practical expedient to recognize revenue for the revenue streams detailed below, except in circumstances where the invoiced amount does not represent the value transferred to the customer.

Thermal Revenues

Steam and chilled water revenue is recognized as the Company transfers the product to the customer, based on customer usage as determined by meter readings taken at month-end. Some locations read customer meters throughout the month and recognize estimated revenue for the period between meter read date and month-end. For thermal contracts, the Company’s performance obligation to deliver steam and chilled water is satisfied over time and revenue is recognized based on the invoiced amount. The Thermal Business subsidiaries collect, and remit state and local taxes associated with sales to their customers, as required by governmental authorities. These taxes are presented on a net basis in the income statement.

As contracts for steam and chilled water are long-term contracts, the Company has performance obligations under these contracts that have not yet been satisfied. These performance obligations have transaction prices that are both fixed and variable, and that vary based on the contract duration, customer type, inception date and other contract-specific factors. For the fixed price contracts, the Company cannot accurately estimate the amount of its unsatisfied performance obligations as it will vary based on customer usage, which will depend on factors such as weather and customer activity.

Power Purchase Agreements, or PPAs

The majority of the Company’s revenues are obtained through PPAs or other contractual agreements. Energy, capacity and where applicable, renewable attributes, from the majority of the Company’s renewable energy assets and certain conventional energy plants is sold through long-term PPAs and tolling agreements to a single counterparty, which is often a utility or commercial customer. The majority of these PPAs are accounted for as leases. ASC 842 requires the minimum lease payments received to be amortized over the term of the lease and contingent rentals are recorded when the achievement of the contingency becomes probable. Judgment is required by management in determining the economic life of each generating facility, in evaluating whether certain lease provisions constitute minimum payments or represent contingent rent and other factors in determining whether a contract contains a lease and whether the lease is an operating lease or capital lease. Certain of these leases have no minimum lease payments and all of the rental income under these leases is recorded as contingent rent on an actual basis when the electricity is delivered.

Renewable Energy Credits, or RECs

Renewable energy credits, or RECs, are usually sold through long-term PPAs. Revenue from the sale of self-generated RECs is recognized when the related energy is generated and simultaneously delivered even in cases where there is a certification lag as it has been deemed to be perfunctory.

In a bundled contract to sell energy, capacity and/or self-generated RECs, all performance obligations are deemed to be delivered at the same time and hence, timing of recognition of revenue for all performance obligations is the same and occurs over time. In such cases, it is often unnecessary to allocate transaction price to multiple performance obligations.

Disaggregated Revenues

The following tables represent the Company’s disaggregation of revenue from contracts with customers along with the reportable segment for each category for the three months ended March 31, 2021 and 2020, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2021 |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | | | | | Total |

Energy revenue(a) | $ | 1 | | | $ | 126 | | | $ | 29 | | | | | | | $ | 156 | |

Capacity revenue(a) | 107 | | | — | | | 13 | | | | | | | 120 | |

| Contract amortization | (6) | | | (25) | | | (1) | | | | | | | (32) | |

| Other revenue | — | | | 9 | | | 8 | | | | | | | 17 | |

| Mark-to-market for economic hedges | — | | | (24) | | | — | | | | | | | (24) | |

Total operating revenue | 102 | | | 86 | | | 49 | | | | | | | 237 | |

| Less: Mark-to-market for economic hedges | — | | | 24 | | | — | | | | | | | 24 | |

| Less: Lease revenue | (108) | | | (145) | | | (1) | | | | | | | (254) | |

| Less: Contract amortization | 6 | | | 25 | | | 1 | | | | | | | 32 | |

Total revenue from contracts with customers | $ | — | | | $ | (10) | | | $ | 49 | | | | | | | $ | 39 | |

| | | | | | | | | | | |

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | | Conventional Generation | | Renewables | | Thermal | | Total |

| Energy revenue | | $ | 1 | | | $ | 145 | | | $ | 1 | | | $ | 147 | |

| Capacity revenue | | 107 | | | — | | | — | | | 107 | |

Total | | $ | 108 | | | $ | 145 | | | $ | 1 | | | $ | 254 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2020 |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | | | Total |

Energy revenue(a) | $ | 2 | | | $ | 125 | | | $ | 28 | | | | | $ | 155 | |

Capacity revenue(a) | 107 | | | — | | | 14 | | | | | 121 | |

| Contract amortization | (6) | | | (15) | | | (1) | | | | | (22) | |

| Mark-to-market for economic hedges | — | | | (5) | | | — | | | | | (5) | |

| Other revenue | — | | | 2 | | | 7 | | | | | 9 | |

Total operating revenue | 103 | | | 107 | | | 48 | | | | | 258 | |

| Less: Lease revenue | (109) | | | (115) | | | (1) | | | | | (225) | |

| Less: Contract amortization | 6 | | | 15 | | | 1 | | | | | 22 | |

Total revenue from contracts with customers | $ | — | | | $ | 7 | | | $ | 48 | | | | | $ | 55 | |

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | | Conventional Generation | | Renewables | | Thermal | | Total |

| Energy revenue | | $ | 2 | | | $ | 115 | | | $ | 1 | | | $ | 118 | |

| Capacity revenue | | 107 | | | — | | | — | | | 107 | |

Total | | $ | 109 | | | $ | 115 | | | $ | 1 | | | $ | 225 | |

Contract Amortization

Assets and liabilities recognized from power sales agreements assumed through acquisitions related to the sale of electric capacity and energy in future periods for which the fair value has been determined to be significantly less (more) than market are amortized to revenue over the term of each underlying contract based on actual generation and/or contracted volumes or on a straight-line basis, where applicable.

Contract Balances

The following table reflects the contract assets and liabilities included on the Company’s balance sheet as of March 31, 2021 and December 31, 2020:

| | | | | | | | | | | | | | |

| | March 31, 2021 | | December 31, 2020 |

| | (In millions) |

| Accounts receivable, net - Contracts with customers | | $ | 66 | | | $ | 57 | |

| Accounts receivable, net - Leases | | 93 | | | 86 | |

| Total accounts receivable, net | | $ | 159 | | | $ | 143 | |

Recently Adopted Accounting Standards

In March 2020, the FASB issued ASU No. 2020-4, Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The amendments provide for optional expedients and exceptions for applying GAAP to contracts, hedging relationships and other transactions affected by reference rate reform if certain criteria is met. These amendments apply only to contracts that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform. The guidance is effective for all entities as of March 12, 2020 through December 31, 2022. The Company intends to apply the amendments to all its eligible contract modifications where applicable during the reference rate reform period.

In December 2019, the FASB issued ASU No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. The amendments in this ASU simplify the accounting for income taxes by removing certain exceptions to the general principles in Topic 740, Income Taxes. The amendments also improve consistent application of and simplify GAAP for other areas of Topic 740 by clarifying and amending existing guidance. The Company adopted the guidance as of January 1, 2021, with no material impact to the financial statements.

Note 3 — Acquisitions and Dispositions

2021 Acquisitions

Rattlesnake Drop Down — On January 12, 2021, the Company acquired CEG's equity interest and a third party investor's minority interest in CWSP Rattlesnake Holding LLC for $132 million. CWSP Rattlesnake Holding LLC indirectly consolidates the Rattlesnake wind project, a 160 MW wind facility with 144 MW of deliverable capacity in Adams County, Washington, as further described in Note 4, Investments Accounted for by the Equity Method and Variable Interest Entities. The project has a 20-year PPA with Avista Corporation, which began when the facility reached commercial operations in December 2020. The Rattlesnake operations are included in the Company's Renewables segment. The acquisition was determined to be an asset acquisition and not a business combination, therefore the Company consolidated the financial information for Rattlesnake on a prospective basis. The membership interests acquired by the Company relate to interests under common control by GIP and were recorded at historical cost. The difference between the cash paid of $132 million and the historical cost of the Company's acquired interests of $14 million was recorded as an adjustment to noncontrolling interest.

The following is a summary of assets and liabilities transferred in connection with the acquisition as of January 12, 2021:

| | | | | | | | |

| (In millions) | | Rattlesnake |

| Current Assets | | $ | 8 | |

| Property, plant and equipment, net | | 200 | |

| Right-of-use asset | | 12 | |

| Total assets acquired | | 220 | |

| | |

Debt(a) | | 176 | |

| Long-term lease liabilities | | 12 | |

Other current and non-current liabilities | | 18 | |

| Total liabilities assumed | | 206 | |

| | |

| Net assets acquired | | $ | 14 | |

(a) Repaid at acquisition date utilizing $107 million contributed by tax equity investor and $103 million contributed by CEG, both recorded as contributions in noncontrolling interest. Of the $210 million contributed, $176 million was utilized to pay down the acquired debt, $29 million was utilized to fund project reserve accounts and $5 million was utilized to pay associated fees.