cwen-202003310001567683FALSE--12-312020Q154.9545.0500015676832020-01-012020-03-310001567683us-gaap:CommonClassAMember2020-01-012020-03-310001567683us-gaap:CommonClassCMember2020-01-012020-03-31xbrli:shares0001567683us-gaap:CommonClassAMember2020-04-300001567683us-gaap:CommonClassBMember2020-04-300001567683us-gaap:CommonClassCMember2020-04-300001567683cwen:CommonClassDMember2020-04-30iso4217:USD00015676832019-01-012019-03-310001567683us-gaap:CommonClassAMember2019-01-012019-03-310001567683us-gaap:CommonClassCMember2019-01-012019-03-31iso4217:USDxbrli:shares00015676832020-03-3100015676832019-12-310001567683cwen:CommonClassDMember2020-03-310001567683us-gaap:CommonClassBMember2019-12-310001567683us-gaap:CommonClassCMember2020-03-310001567683us-gaap:CommonClassAMember2019-12-310001567683us-gaap:CommonClassAMember2020-03-310001567683us-gaap:CommonClassBMember2020-03-310001567683cwen:CommonClassDMember2019-12-310001567683us-gaap:CommonClassCMember2019-12-3100015676832018-12-3100015676832019-03-310001567683us-gaap:PreferredStockMember2019-12-310001567683us-gaap:CommonStockMember2019-12-310001567683us-gaap:AdditionalPaidInCapitalMember2019-12-310001567683us-gaap:RetainedEarningsMember2019-12-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001567683us-gaap:NoncontrollingInterestMember2019-12-310001567683us-gaap:RetainedEarningsMember2020-01-012020-03-310001567683us-gaap:NoncontrollingInterestMember2020-01-012020-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001567683cwen:CEGMemberus-gaap:NoncontrollingInterestMember2020-01-012020-03-310001567683cwen:CEGMember2020-01-012020-03-310001567683us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001567683cwen:TaxEquityInvestorsMemberus-gaap:NoncontrollingInterestMember2020-01-012020-03-310001567683cwen:TaxEquityInvestorsMember2020-01-012020-03-310001567683us-gaap:PreferredStockMember2020-03-310001567683us-gaap:CommonStockMember2020-03-310001567683us-gaap:AdditionalPaidInCapitalMember2020-03-310001567683us-gaap:RetainedEarningsMember2020-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001567683us-gaap:NoncontrollingInterestMember2020-03-310001567683us-gaap:PreferredStockMember2018-12-310001567683us-gaap:CommonStockMember2018-12-310001567683us-gaap:AdditionalPaidInCapitalMember2018-12-310001567683us-gaap:RetainedEarningsMember2018-12-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001567683us-gaap:NoncontrollingInterestMember2018-12-310001567683us-gaap:RetainedEarningsMember2019-01-012019-03-310001567683us-gaap:NoncontrollingInterestMember2019-01-012019-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310001567683us-gaap:AdditionalPaidInCapitalMember2019-01-012019-03-310001567683cwen:TaxEquityInvestorsMemberus-gaap:NoncontrollingInterestMember2019-01-012019-03-310001567683cwen:TaxEquityInvestorsMember2019-01-012019-03-310001567683us-gaap:RetainedEarningsMember2019-01-010001567683us-gaap:NoncontrollingInterestMember2019-01-0100015676832019-01-010001567683us-gaap:PreferredStockMember2019-03-310001567683us-gaap:CommonStockMember2019-03-310001567683us-gaap:AdditionalPaidInCapitalMember2019-03-310001567683us-gaap:RetainedEarningsMember2019-03-310001567683us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-310001567683us-gaap:NoncontrollingInterestMember2019-03-31utr:MW0001567683cwen:ConventionalGenerationUtilityScaleSolarDistributedSolarandWindMember2020-03-310001567683cwen:ThermalMember2020-03-31xbrli:pure0001567683cwen:ClearwayEnergyLLCMember2020-01-012020-03-310001567683cwen:ClearwayEnergyLLCMembercwen:CEGMember2020-01-012020-03-310001567683cwen:PGEMember2020-03-310001567683cwen:PGEMember2020-03-310001567683cwen:CEGMembercwen:ClearwayEnergyInc.Member2020-01-012020-03-310001567683cwen:PublicShareholdersMembercwen:ClearwayEnergyInc.Member2020-01-012020-03-310001567683cwen:OperatingFundsMember2020-03-310001567683cwen:LongTermDebtCurrentMember2020-03-310001567683cwen:DebtServiceObligationsMember2020-03-310001567683us-gaap:CashDistributionMember2020-03-310001567683cwen:SubsidiariesAffectedByBankruptcyMember2020-03-310001567683us-gaap:SubsequentEventMember2020-04-302020-04-300001567683us-gaap:SubsequentEventMember2020-06-152020-06-150001567683us-gaap:SubsequentEventMember2020-06-012020-06-010001567683us-gaap:CommonClassBMember2020-01-012020-03-310001567683cwen:CommonClassDMember2020-01-012020-03-310001567683cwen:EnergyRevenueMembercwen:ConventionalGenerationMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001567683cwen:EnergyRevenueMemberus-gaap:OperatingSegmentsMembercwen:RenewablesMember2020-01-012020-03-310001567683cwen:ThermalMembercwen:EnergyRevenueMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001567683cwen:EnergyRevenueMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001567683cwen:CapacityRevenueMembercwen:ConventionalGenerationMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001567683cwen:CapacityRevenueMemberus-gaap:OperatingSegmentsMembercwen:RenewablesMember2020-01-012020-03-310001567683cwen:ThermalMembercwen:CapacityRevenueMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001567683cwen:CapacityRevenueMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001567683cwen:ConventionalGenerationMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:RenewablesMember2020-01-012020-03-310001567683cwen:ThermalMemberus-gaap:OperatingSegmentsMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMember2020-01-012020-03-310001567683cwen:ConventionalGenerationMemberus-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMembercwen:RenewablesMember2020-01-012020-03-310001567683cwen:ThermalMemberus-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMember2020-01-012020-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMember2020-01-012020-03-310001567683cwen:ConventionalGenerationMember2020-01-012020-03-310001567683cwen:RenewablesMember2020-01-012020-03-310001567683cwen:ThermalMember2020-01-012020-03-310001567683cwen:EnergyRevenueMembercwen:ConventionalGenerationMember2020-01-012020-03-310001567683cwen:EnergyRevenueMembercwen:RenewablesMember2020-01-012020-03-310001567683cwen:ThermalMembercwen:EnergyRevenueMember2020-01-012020-03-310001567683cwen:EnergyRevenueMember2020-01-012020-03-310001567683cwen:CapacityRevenueMembercwen:ConventionalGenerationMember2020-01-012020-03-310001567683cwen:CapacityRevenueMembercwen:RenewablesMember2020-01-012020-03-310001567683cwen:ThermalMembercwen:CapacityRevenueMember2020-01-012020-03-310001567683cwen:CapacityRevenueMember2020-01-012020-03-310001567683cwen:EnergyRevenueMembercwen:ConventionalGenerationMemberus-gaap:OperatingSegmentsMember2019-01-012019-03-310001567683cwen:EnergyRevenueMemberus-gaap:OperatingSegmentsMembercwen:RenewablesMember2019-01-012019-03-310001567683cwen:ThermalMembercwen:EnergyRevenueMemberus-gaap:OperatingSegmentsMember2019-01-012019-03-310001567683cwen:EnergyRevenueMemberus-gaap:OperatingSegmentsMember2019-01-012019-03-310001567683cwen:CapacityRevenueMembercwen:ConventionalGenerationMemberus-gaap:OperatingSegmentsMember2019-01-012019-03-310001567683cwen:CapacityRevenueMemberus-gaap:OperatingSegmentsMembercwen:RenewablesMember2019-01-012019-03-310001567683cwen:ThermalMembercwen:CapacityRevenueMemberus-gaap:OperatingSegmentsMember2019-01-012019-03-310001567683cwen:CapacityRevenueMemberus-gaap:OperatingSegmentsMember2019-01-012019-03-310001567683cwen:ConventionalGenerationMemberus-gaap:OperatingSegmentsMember2019-01-012019-03-310001567683us-gaap:OperatingSegmentsMembercwen:RenewablesMember2019-01-012019-03-310001567683cwen:ThermalMemberus-gaap:OperatingSegmentsMember2019-01-012019-03-310001567683us-gaap:OperatingSegmentsMember2019-01-012019-03-310001567683cwen:ConventionalGenerationMemberus-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMember2019-01-012019-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMembercwen:RenewablesMember2019-01-012019-03-310001567683cwen:ThermalMemberus-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMember2019-01-012019-03-310001567683us-gaap:OperatingSegmentsMembercwen:ProductsAndServicesOtherMember2019-01-012019-03-310001567683cwen:ConventionalGenerationMember2019-01-012019-03-310001567683cwen:RenewablesMember2019-01-012019-03-310001567683cwen:ThermalMember2019-01-012019-03-310001567683cwen:EnergyRevenueMembercwen:ConventionalGenerationMember2019-01-012019-03-310001567683cwen:EnergyRevenueMembercwen:RenewablesMember2019-01-012019-03-310001567683cwen:EnergyRevenueMember2019-01-012019-03-310001567683cwen:CapacityRevenueMembercwen:ConventionalGenerationMember2019-01-012019-03-310001567683cwen:CapacityRevenueMembercwen:RenewablesMember2019-01-012019-03-310001567683cwen:CapacityRevenueMember2019-01-012019-03-310001567683us-gaap:CustomerContractsMember2020-03-310001567683us-gaap:LeaseAgreementsMember2020-03-310001567683cwen:EnergyCenterDoverMember2020-03-032020-03-030001567683cwen:OahuSolarPartnershipMember2020-03-310001567683cwen:KawailoaSolarPartnershipLLCMember2020-03-310001567683cwen:RepoweringPartnershipIILLCMember2020-03-310001567683cwen:AltaXandXITEHoldcoMember2020-03-310001567683cwen:SpringCanyonMember2020-03-310001567683cwen:BuckthornRenewablesLLCMember2020-03-310001567683cwen:OtherConsolidatedVariableInterestEntitiesMember2020-03-310001567683cwen:WildoradoTEHoldcoMembercwen:ThirdPartyInvestorMemberus-gaap:CapitalUnitClassAMember2020-02-070001567683cwen:WildoradoTEHoldcoMember2020-02-072020-03-3100015676832020-02-070001567683cwen:WildoradoTEHoldcoMember2020-02-070001567683cwen:WildoradoTEHoldcoMembercwen:RepoweringPartnershipIILLCMember2020-01-012020-03-310001567683cwen:RepoweringPartnershipIILLCMembercwen:ElbowCreekTEHoldcoMember2020-01-012020-03-310001567683cwen:RepoweringPartnershipIILLCMembercwen:WindTEHoldcoLLCMember2020-03-310001567683cwen:CWSPWildoradoElbowHoldingLLCMembercwen:RepoweringPartnershipIILLCMember2020-03-310001567683cwen:UtahPortfolioMember2020-03-310001567683cwen:DesertSunlightMember2020-03-310001567683cwen:DGPVHoldco3Member2020-03-310001567683cwen:AguaCalienteBorrower2Member2020-03-310001567683cwen:GenConnEnergyLlcMember2020-03-310001567683cwen:DGPVHoldco1Member2020-03-310001567683cwen:NRGDGPVHoldco2Member2020-03-310001567683cwen:SanJuanMesaMember2020-03-310001567683cwen:ElkhornRidgeMember2020-03-310001567683cwen:RPVHoldcoMember2020-03-310001567683cwen:AvenalMember2020-03-310001567683cwen:DGPVHoldco3Member2020-01-012020-03-310001567683cwen:DGPVHoldco3Member2019-01-012019-03-310001567683cwen:RPVHoldcoMember2020-01-012020-03-310001567683cwen:RPVHoldcoMember2019-01-012019-03-310001567683cwen:DGPVHoldco3Member2019-03-310001567683cwen:RPVHoldcoMember2019-03-310001567683us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-03-310001567683us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-03-310001567683us-gaap:CarryingReportedAmountFairValueDisclosureMember2019-12-310001567683us-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-03-310001567683us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2019-12-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMember2020-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2020-03-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CommodityContractMember2019-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2019-12-310001567683us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMember2020-03-310001567683us-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateContractMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-03-310001567683us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2018-12-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-01-012020-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2019-01-012019-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2019-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMember2020-03-31iso4217:USDutr:MWh0001567683us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputCommodityForwardPriceMember2020-03-310001567683us-gaap:FairValueInputsLevel3Membersrt:MaximumMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputCommodityForwardPriceMember2020-03-310001567683us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:WeightedAverageMemberus-gaap:EnergyRelatedDerivativeMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MeasurementInputCommodityForwardPriceMember2020-03-31cwen:facility0001567683cwen:PGEMember2019-01-290001567683cwen:PGEMembercwen:SolarFacilitiesMember2019-01-290001567683cwen:MarshLandingMembercwen:SolarFacilitiesMember2019-01-29utr:MMBTU0001567683us-gaap:LongMembersrt:NaturalGasReservesMember2020-01-012020-03-310001567683us-gaap:LongMembersrt:NaturalGasReservesMember2019-01-012019-12-31utr:MWh0001567683us-gaap:ShortMembercwen:PowerMember2020-01-012020-03-310001567683us-gaap:ShortMembercwen:PowerMember2019-01-012019-12-310001567683us-gaap:LongMembercwen:InterestMember2020-03-310001567683us-gaap:LongMembercwen:InterestMember2019-12-310001567683us-gaap:DesignatedAsHedgingInstrumentMembercwen:InterestRateContractCurrentMember2020-03-310001567683us-gaap:DesignatedAsHedgingInstrumentMembercwen:InterestRateContractCurrentMember2019-12-310001567683us-gaap:DesignatedAsHedgingInstrumentMembercwen:InterestRateContractNonCurrentMember2020-03-310001567683us-gaap:DesignatedAsHedgingInstrumentMembercwen:InterestRateContractNonCurrentMember2019-12-310001567683us-gaap:DesignatedAsHedgingInstrumentMember2020-03-310001567683us-gaap:DesignatedAsHedgingInstrumentMember2019-12-310001567683us-gaap:NondesignatedMembercwen:InterestRateContractCurrentMember2020-03-310001567683us-gaap:NondesignatedMembercwen:InterestRateContractCurrentMember2019-12-310001567683us-gaap:NondesignatedMembercwen:InterestRateContractNonCurrentMember2020-03-310001567683us-gaap:NondesignatedMembercwen:InterestRateContractNonCurrentMember2019-12-310001567683us-gaap:NondesignatedMembercwen:CommodityContractCurrentMember2020-03-310001567683us-gaap:NondesignatedMembercwen:CommodityContractCurrentMember2019-12-310001567683cwen:CommodityContractLongTermMemberus-gaap:NondesignatedMember2020-03-310001567683cwen:CommodityContractLongTermMemberus-gaap:NondesignatedMember2019-12-310001567683us-gaap:NondesignatedMember2020-03-310001567683us-gaap:NondesignatedMember2019-12-310001567683us-gaap:CommodityContractMember2020-03-310001567683us-gaap:InterestRateContractMember2020-03-310001567683us-gaap:CommodityContractMember2019-12-310001567683us-gaap:InterestRateContractMember2019-03-310001567683us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2019-12-310001567683us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2018-12-310001567683us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2020-01-012020-03-310001567683us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2019-01-012019-03-310001567683us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2020-03-310001567683us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2019-03-310001567683us-gaap:AociAttributableToNoncontrollingInterestMember2020-03-310001567683us-gaap:AociAttributableToNoncontrollingInterestMember2019-03-310001567683us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMember2020-01-012020-03-310001567683us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMember2019-01-012019-03-310001567683us-gaap:EnergyRelatedDerivativeMember2020-01-012020-03-310001567683us-gaap:EnergyRelatedDerivativeMember2019-01-012019-03-310001567683cwen:A3.25ConvertibleNotesdue2020Member2020-03-310001567683cwen:A3.25ConvertibleNotesdue2020Member2019-12-310001567683cwen:A5.375SeniorNotesduein2024Member2020-03-310001567683cwen:A5.375SeniorNotesduein2024Member2019-12-310001567683cwen:A5.75SeniorNotesdue2025Member2020-03-310001567683cwen:A5.75SeniorNotesdue2025Member2019-12-310001567683cwen:A5.00SeniorNotesduein2026Member2020-03-310001567683cwen:A5.00SeniorNotesduein2026Member2019-12-310001567683cwen:A475SeniorNotesDue2028Member2020-03-310001567683cwen:A475SeniorNotesDue2028Member2019-12-310001567683cwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityDue2023Memberus-gaap:LetterOfCreditMember2020-03-310001567683cwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityDue2023Memberus-gaap:LetterOfCreditMember2019-12-310001567683cwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityDue2023Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683cwen:AlpineFinancingAgreementDue2022Member2020-03-310001567683cwen:AlpineFinancingAgreementDue2022Member2019-12-310001567683cwen:AlpineFinancingAgreementDue2022Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:AlpineFinancingAgreementDue2022Member2020-03-310001567683cwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2020-03-310001567683cwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2019-12-310001567683srt:MinimumMembercwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2020-03-310001567683srt:MaximumMembercwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2020-03-310001567683us-gaap:LetterOfCreditMembercwen:AltaWindIVleasefinancingarrangementdue2034and2035Member2020-03-310001567683cwen:BuckthornSolardue2025Member2020-03-310001567683cwen:BuckthornSolardue2025Member2019-12-310001567683cwen:BuckthornSolardue2025Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:BuckthornSolardue2025Member2020-03-310001567683cwen:CarlsbadHoldcoDue2038Member2020-03-310001567683cwen:CarlsbadHoldcoDue2038Member2019-12-310001567683us-gaap:LetterOfCreditMembercwen:CarlsbadHoldcoDue2038Member2020-03-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2027Member2020-03-310001567683cwen:CarlsbadEnergyHoldingsLLCDue2027Member2019-12-310001567683us-gaap:LetterOfCreditMembercwen:CarlsbadEnergyHoldingsLLCDue2027Member2020-03-310001567683cwen:CvsrFinancingAgreementMember2020-03-310001567683cwen:CvsrFinancingAgreementMember2019-12-310001567683cwen:CvsrFinancingAgreementMembersrt:MinimumMember2020-03-310001567683srt:MaximumMembercwen:CvsrFinancingAgreementMember2020-03-310001567683us-gaap:LetterOfCreditMembercwen:CvsrFinancingAgreementMember2020-03-310001567683cwen:CVSRHoldcodue2037Member2020-03-310001567683cwen:CVSRHoldcodue2037Member2019-12-310001567683us-gaap:LetterOfCreditMembercwen:CVSRHoldcodue2037Member2020-03-310001567683cwen:DuquesneDue2059Member2020-03-310001567683cwen:DuquesneDue2059Member2019-12-310001567683cwen:ElSegundoEnergyCenterdue2023Member2020-03-310001567683cwen:ElSegundoEnergyCenterdue2023Member2019-12-310001567683srt:MinimumMembercwen:ElSegundoEnergyCenterdue2023Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683srt:MaximumMembercwen:ElSegundoEnergyCenterdue2023Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:ElSegundoEnergyCenterdue2023Member2020-03-310001567683cwen:EnergyCenterMinneapolisSeriesDEFGHNotesMember2020-03-310001567683cwen:EnergyCenterMinneapolisSeriesDEFGHNotesMember2019-12-310001567683cwen:EnergyCenterMinneapolisSeriesDEFGHNotesMemberus-gaap:LetterOfCreditMember2020-03-310001567683cwen:LaredoRidgeWindLLCDueIn2028Member2020-03-310001567683cwen:LaredoRidgeWindLLCDueIn2028Member2019-12-310001567683cwen:LaredoRidgeWindLLCDueIn2028Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:LaredoRidgeWindLLCDueIn2028Member2020-03-310001567683cwen:KansasSouthduein2030Member2020-03-310001567683cwen:KansasSouthduein2030Member2019-12-310001567683cwen:KansasSouthduein2030Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:KansasSouthduein2030Member2020-03-310001567683cwen:KawailoaSolarHoldingsLLCdue2026Member2020-03-310001567683cwen:KawailoaSolarHoldingsLLCdue2026Member2019-12-310001567683cwen:KawailoaSolarHoldingsLLCdue2026Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:KawailoaSolarHoldingsLLCdue2026Member2020-03-310001567683cwen:MarshLandingTermLoanFacilityMember2020-03-310001567683cwen:MarshLandingTermLoanFacilityMember2019-12-310001567683cwen:MarshLandingTermLoanFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:MarshLandingTermLoanFacilityMember2020-03-310001567683cwen:OahuSolarHoldingsLLCdue2026Member2020-03-310001567683cwen:OahuSolarHoldingsLLCdue2026Member2019-12-310001567683cwen:OahuSolarHoldingsLLCdue2026Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:OahuSolarHoldingsLLCdue2026Member2020-03-310001567683cwen:RepoweringPartnershipHoldcoLLCdue2020Member2020-03-310001567683cwen:RepoweringPartnershipHoldcoLLCdue2020Member2019-12-310001567683cwen:RepoweringPartnershipHoldcoLLCdue2020Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683cwen:RepoweringPartnershipHoldcoLLCdue2020Memberus-gaap:LetterOfCreditMember2020-03-310001567683cwen:SouthTrentWindDue2028Member2020-03-310001567683cwen:SouthTrentWindDue2028Member2019-12-310001567683cwen:SouthTrentWindDue2028Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:SouthTrentWindDue2028Member2020-03-310001567683cwen:TapestryWindLLCduein2031Member2020-03-310001567683cwen:TapestryWindLLCduein2031Member2019-12-310001567683cwen:TapestryWindLLCduein2031Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:TapestryWindLLCduein2031Member2020-03-310001567683cwen:UtahSolarPortfoliodue2022Member2020-03-310001567683cwen:UtahSolarPortfoliodue2022Member2019-12-310001567683cwen:UtahSolarPortfoliodue2022Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:UtahSolarPortfoliodue2022Member2020-03-310001567683cwen:VientoFundingIIInc.duein2023Member2020-03-310001567683cwen:VientoFundingIIInc.duein2023Member2019-12-310001567683cwen:VientoFundingIIInc.duein2023Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:VientoFundingIIInc.duein2023Member2020-03-310001567683cwen:WalnutCreekEnergyLLCduein2023Member2020-03-310001567683cwen:WalnutCreekEnergyLLCduein2023Member2019-12-310001567683cwen:WalnutCreekEnergyLLCduein2023Memberus-gaap:LondonInterbankOfferedRateLIBORMember2020-01-012020-03-310001567683us-gaap:LetterOfCreditMembercwen:WalnutCreekEnergyLLCduein2023Member2020-03-310001567683cwen:OtherDebtMember2020-03-310001567683cwen:OtherDebtMember2019-12-310001567683us-gaap:LetterOfCreditMembercwen:OtherDebtMember2020-03-310001567683cwen:ProjectLevelDebtMember2020-03-310001567683cwen:ProjectLevelDebtMember2019-12-310001567683cwen:ClearwayEnergyLLCAndClearwayEnergyOperatingLLCRevolvingCreditFacilityDue2023Member2020-03-310001567683cwen:A5.375SeniorNotesduein2024Member2020-01-030001567683cwen:A5.375SeniorNotesduein2024Member2020-01-032020-01-030001567683cwen:ConstructionDebtMember2020-02-012020-02-290001567683cwen:A3.25ConvertibleNotesdue2020Memberus-gaap:CommonClassCMember2020-01-012020-03-310001567683cwen:A3.25ConvertibleNotesdue2020Memberus-gaap:CommonClassCMember2019-01-012019-03-310001567683cwen:ATMProgramMember2020-03-310001567683us-gaap:CorporateNonSegmentMember2020-01-012020-03-310001567683cwen:ConventionalGenerationMemberus-gaap:OperatingSegmentsMember2020-03-310001567683us-gaap:OperatingSegmentsMembercwen:RenewablesMember2020-03-310001567683cwen:ThermalMemberus-gaap:OperatingSegmentsMember2020-03-310001567683us-gaap:CorporateNonSegmentMember2020-03-310001567683us-gaap:CorporateNonSegmentMember2019-01-012019-03-310001567683cwen:RENOMMember2020-01-012020-03-310001567683cwen:RENOMMember2019-01-012019-03-310001567683cwen:RENOMMember2020-03-310001567683cwen:RENOMMember2019-12-310001567683cwen:CEGMember2019-01-012019-03-310001567683cwen:CEGMember2020-01-012020-03-3100015676832019-01-012019-12-310001567683us-gaap:AssetsLeasedToOthersMember2020-03-310001567683us-gaap:AssetsLeasedToOthersMember2019-12-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | | | | |

| ☒ | Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |

For the quarterly period ended March 31, 2020

| | | | | |

| ☐ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 001-36002

Clearway Energy, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | | 46-1777204 |

(State or other jurisdiction

of incorporation or organization) | | | (I.R.S. Employer

Identification No.) |

| | | | |

| 300 Carnegie Center, Suite 300 | Princeton | New Jersey | 08540 |

| (Address of principal executive offices) | | | (Zip Code) |

(609) 608-1525

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.01 | CWEN.A | New York Stock Exchange |

| Class C Common Stock, par value $0.01 | CWEN | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of April 30, 2020, there were 34,599,645 shares of Class A common stock outstanding, par value $0.01 per share, 42,738,750 shares of Class B common stock outstanding, par value $0.01 per share, 79,330,275 shares of Class C common stock outstanding, par value $0.01 per share, and 42,738,750 shares of Class D common stock outstanding, par value $0.01 per share.

TABLE OF CONTENTS

Index

| | | | | |

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION | |

GLOSSARY OF TERMS | |

PART I — FINANCIAL INFORMATION | |

ITEM 1 — FINANCIAL STATEMENTS AND NOTES | |

ITEM 2 — MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

ITEM 3 — QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

ITEM 4 — CONTROLS AND PROCEDURES | |

PART II — OTHER INFORMATION | |

ITEM 1 — LEGAL PROCEEDINGS | |

ITEM 1A — RISK FACTORS | |

ITEM 2 — UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | |

ITEM 3 — DEFAULTS UPON SENIOR SECURITIES | |

ITEM 4 — MINE SAFETY DISCLOSURES | |

ITEM 5 — OTHER INFORMATION | |

ITEM 6 — EXHIBITS | |

SIGNATURES | |

| |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Quarterly Report on Form 10-Q of Clearway Energy, Inc., together with its consolidated subsidiaries, or the Company, includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The words "believes," "projects," "anticipates," "plans," "expects," "intends," "estimates" and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company's actual results, performance and achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These factors, risks and uncertainties include the factors described under Item 1A — Risk Factors in Part II of this Quarterly Report on Form 10-Q and under Item 1A — Risk Factors in Part I of the Company's Annual Report on Form 10-K for the year ended December 31, 2019, as well as the following:

•Potential risks related to the PG&E Bankruptcy;

•The Company's ability to maintain and grow its quarterly dividend;

•Potential risks related to the Company's relationships with GIP and CEG;

•Potential risks related to the COVID-19 pandemic;

•The Company's ability to successfully identify, evaluate and consummate acquisitions from third parties;

•The Company's ability to acquire assets from GIP or CEG;

•The Company's ability to raise additional capital due to its indebtedness, corporate structure, market conditions or otherwise;

•Changes in law, including judicial decisions;

•Hazards customary to the power production industry and power generation operations such as fuel and electricity price volatility, unusual weather conditions (including wind and solar conditions), catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs, unanticipated changes to fuel supply costs or availability due to higher demand, shortages, transportation problems or other developments, environmental incidents, or electric transmission or gas pipeline system constraints and the possibility that the Company may not have adequate insurance to cover losses as a result of such hazards;

•The Company's ability to operate its businesses efficiently, manage maintenance capital expenditures and costs effectively, and generate earnings and cash flows from its asset-based businesses in relation to its debt and other obligations;

•The willingness and ability of counterparties to the Company's offtake agreements to fulfill their obligations under such agreements;

•The Company's ability to enter into contracts to sell power and procure fuel on acceptable terms and prices as current offtake agreements expire;

•Government regulation, including compliance with regulatory requirements and changes in market rules, rates, tariffs and environmental laws;

•Operating and financial restrictions placed on the Company that are contained in the project-level debt facilities and other agreements of certain subsidiaries and project-level subsidiaries generally, in the Clearway Energy Operating LLC amended and restated revolving credit facility, in the indentures governing the Senior Notes and in the indentures governing the Company's convertible notes;

•Cyber terrorism and inadequate cybersecurity, or the occurrence of a catastrophic loss and the possibility that the Company may not have adequate insurance to cover losses resulting from such hazards or the inability of the Company's insurers to provide coverage;

•The Company's ability to engage in successful mergers and acquisitions activity; and

•The Company's ability to borrow additional funds and access capital markets, as well as the Company's substantial indebtedness and the possibility that the Company may incur additional indebtedness going forward.

Forward-looking statements speak only as of the date they were made, and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The foregoing review of factors that could cause the Company's actual results to differ materially from those contemplated in any forward-looking statements included in this Quarterly Report on Form 10-Q should not be construed as exhaustive.

GLOSSARY OF TERMS

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

| | | | | | | | |

| 2019 Convertible Notes | | $220 million aggregate principal amount of 3.50% convertible notes due 2019, issued by Clearway Energy, Inc. |

| 2019 Form 10-K | | Clearway Energy, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2019 |

| 2020 Convertible Notes | | $45 million aggregate principal amount of 3.25% convertible notes due 2020, issued by Clearway Energy, Inc. |

| 2024 Senior Notes | | $500 million aggregate principal amount of 5.375% unsecured senior notes due 2024, issued by Clearway Energy Operating LLC |

| 2025 Senior Notes | | $600 million aggregate principal amount of 5.750% unsecured senior notes due 2025, issued by Clearway Energy Operating LLC |

| 2026 Senior Notes | | $350 million aggregate principal amount of 5.00% unsecured senior notes due 2026, issued by Clearway Energy Operating LLC |

| 2028 Senior Notes | | $600 million aggregate principal amount of 4.75% unsecured senior notes due 2028, issued by Clearway Energy Operating LLC |

| Adjusted EBITDA | | A non-GAAP measure, represents earnings before interest, tax, depreciation and amortization adjusted for mark-to-market gains or losses, asset write offs and impairments; and factors which the Company does not consider indicative of future operating performance |

| AOCI | | Accumulated Other Comprehensive Income |

| ASC | | The FASB Accounting Standards Codification, which the FASB established as the source of

authoritative GAAP |

| ASU | | Accounting Standards Updates - updates to the ASC |

| ATM Program | | At-The-Market Equity Offering Program |

| Bankruptcy Code | | Title 11 of the U.S. Code |

| Bankruptcy Court | | U.S. Bankruptcy Court for the Northern District of California |

| CAFD | | A non-GAAP measure, Cash Available for Distribution is Adjusted EBITDA plus cash distributions/return of investment from unconsolidated affiliates, adjustments to reflect CAFD generated by unconsolidated investments that are not able to distribute project dividends due to the PG&E Bankruptcy, cash receipts from notes receivable, cash distributions from noncontrolling interests, less cash distributions to noncontrolling interests, maintenance capital expenditures, pro-rata Adjusted EBITDA from unconsolidated affiliates, cash interest paid, income taxes paid, principal amortization of indebtedness, Walnut Creek investment payments, and changes in prepaid and accrued capacity payments, and adjusted for development expenses |

| CEG | | Clearway Energy Group LLC (formerly Zephyr Renewables LLC) |

| CEG Master Services Agreements | | Master Services Agreements entered into as of August 31, 2018 between the Company, Clearway Energy LLC and Clearway Energy Operating LLC, and CEG |

| Clearway Energy LLC | | The holding company through which the projects are owned by Clearway Energy Group LLC, the holder of Class B and Class D units of the Company, and Clearway Energy, Inc., the holder of the Class A and Class C units |

| Clearway Energy Group LLC | | The holder of the Company's Class B and Class D common shares and Clearway Energy LLC's Class B and Class D units |

| Clearway Energy Operating LLC | | The holder of the project assets that are owned by Clearway Energy LLC |

| COD | | Commercial Operation Date |

| Company | | Clearway Energy, Inc. together with its consolidated subsidiaries |

| CVSR | | California Valley Solar Ranch |

| CVSR Holdco | | CVSR Holdco LLC, the indirect owner of CVSR |

| DGPV Holdco 1 | | DGPV Holdco 1 LLC |

| DGPV Holdco 2 | | DGPV Holdco 2 LLC |

| | | | | | | | |

| DGPV Holdco 3 | | DGPV Holdco 3 LLC |

| Distributed Solar | | Solar power projects, typically less than 20 MW in size, that primarily sell power produced to customers for usage on site, or are interconnected to sell power into the local distribution grid |

| Drop Down Assets | | Collectively, assets under common control acquired by the Company from NRG from January 1, 2014 through the period ended August 31, 2018 and from CEG from August 31, 2018 through the period ending March 31, 2020 |

| EBITDA | | A non-GAAP measure, represents earnings before interest, tax, depreciation and amortization |

| Economic Gross Margin | | A non-GAAP measure, energy and capacity revenue less cost of fuels. See Item 2 — Management's Discussion and Analysis of Financial Condition and Results of Operations — Management's discussion of the results of operations for the quarters ended March 31, 2020 and 2019 for a discussion of this measure. |

| ECP | | Energy Center Pittsburgh LLC, a subsidiary of the Company |

| EPA | | U.S. Environmental Protection Agency |

| Exchange Act | | The Securities Exchange Act of 1934, as amended |

| FASB | | Financial Accounting Standards Board |

| GAAP | | Accounting principles generally accepted in the U.S. |

| GenConn | | GenConn Energy LLC |

| GIP | | Collectively, Global Infrastructure Partners III-C Intermediate AIV 3, L.P., Global Infrastructure Partners III-A/B AIV 3, L.P., Global Infrastructure Partners III-C Intermediate AIV 2, L.P., Global Infrastructure Partners III-C2 Intermediate AIV, L.P. and GIP III Zephyr Friends & Family, LLC. |

| GIP Transaction | | On August 31, 2018, NRG transferred its full ownership interest in the Company to Clearway Energy Group LLC and subsequently sold 100% of its interests in Clearway Energy Group LLC, which includes NRG's renewable energy development and operations platform, to an affiliate of GIP. GIP, NRG and the Company also entered into a consent and indemnity agreement in connection with the purchase and sale agreement, which was signed on February 6, 2018 |

| HLBV | | Hypothetical Liquidation at Book Value |

| LIBOR | | London Inter-Bank Offered Rate |

| March 2017 Drop Down Assets | | (i) Agua Caliente Borrower 2 LLC, which owns a 16% interest (approximately 31% of NRG's 51% interest) in the Agua Caliente solar farm and (ii) NRG's 100% ownership in the Class A equity interests in the Utah Solar Portfolio (defined below), both acquired by the Company on March 27, 2017 |

| MMBtu | | Million British Thermal Units |

| MW | | Megawatts |

| MWh | | Saleable megawatt hours, net of internal/parasitic load megawatt-hours |

| MWt | | Megawatts Thermal Equivalent |

| Net Exposure | | Counterparty credit exposure to Clearway Energy, Inc. net of collateral |

| NOLs | | Net Operating Losses |

| NPPD | | Nebraska Public Power District |

| NRG | | NRG Energy, Inc. |

| NRG TSA | | Transition Services Agreement, dated as of August 31, 2018, by and between NRG and the Company |

| OCL | | Other comprehensive loss |

| O&M | | Operation and Maintenance |

| PG&E | | Pacific Gas and Electric Company |

| PG&E Bankruptcy | | On January 29, 2019, PG&E Corporation and Pacific Gas and Electric Company filed voluntary petitions for relief under the Bankruptcy Code in the Bankruptcy Court |

| PPA | | Power Purchase Agreement |

| RENOM | | Clearway Renewable Operation & Maintenance LLC |

| RPV Holdco | | RPV Holdco 1 LLC |

| RTO | | Regional Transmission Organization |

| | | | | | | | |

| SEC | | U.S. Securities and Exchange Commission |

| Senior Notes | | Collectively, the 2024 Senior Notes, the 2025 Senior Notes, the 2026 Senior Notes and the 2028 Senior Notes |

| SPP | | Solar Power Partners |

| Tax Act | | Tax Cuts and Jobs Act of 2017 |

| Thermal Business | | The Company's thermal business, which consists of thermal infrastructure assets that provide steam, hot water and/or chilled water, and in some instances electricity, to commercial businesses, universities, hospitals and governmental units |

| TSA | | Transition Services Agreement |

| UPMC Thermal Project | | The University of Pittsburgh Medical Center Thermal Project, a 73 MWt district energy system that allows ECP to provide steam, chilled water and 7.5 MW of emergency backup power service to UPMC |

| U.S. | | United States of America |

| Utah Solar Portfolio | | Collection consists of Four Brothers Solar, LLC, Granite Mountain Holdings, LLC, and Iron Springs Holdings, LLC, which are equity investments owned by Four Brothers Capital, LLC, Granite Mountain Capital, LLC, and Iron Springs Capital, LLC, respectively, and are part of the March 2017 Drop Down Assets acquisition that closed on March 27, 2017 |

| Utility Scale Solar | | Solar power projects, typically 20 MW or greater in size (on an alternating current, or AC, basis), that are interconnected into the transmission or distribution grid to sell power at a wholesale level |

| VaR | | Value at Risk |

| VIE | | Variable Interest Entity |

| Wind TE Holdco | | Wind TE Holdco LLC, an 814 net MW portfolio of twelve wind projects |

PART I - FINANCIAL INFORMATION

ITEM 1 — FINANCIAL STATEMENTS

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | |

| Three months ended March 31, | | | | | | |

| (In millions, except per share amounts) | 2020 | | 2019 | | | | |

| Operating Revenues | | | | | | | |

| Total operating revenues | $ | 258 | | | $ | 217 | | | | | |

| Operating Costs and Expenses | | | | | | | |

| Cost of operations | 93 | | | 83 | | | | | |

| Depreciation, amortization and accretion | 102 | | | 85 | | | | | |

| | | | | | | |

| General and administrative | 9 | | | 6 | | | | | |

| Transaction and integration costs | 1 | | | 1 | | | | | |

| Development costs | 1 | | | 1 | | | | | |

| Total operating costs and expenses | 206 | | | 176 | | | | | |

| Operating Income | 52 | | | 41 | | | | | |

| Other Income (Expense) | | | | | | | |

| Equity in (losses) earnings of unconsolidated affiliates | (13) | | | 3 | | | | | |

| Other income, net | 2 | | | 3 | | | | | |

| Loss on debt extinguishment | (3) | | | — | | | | | |

| Interest expense | (167) | | | (101) | | | | | |

| Total other expense, net | (181) | | | (95) | | | | | |

| Loss Before Income Taxes | (129) | | | (54) | | | | | |

| Income tax benefit | (22) | | | (7) | | | | | |

| Net Loss | (107) | | | (47) | | | | | |

| | | | | | | |

| | | | | | | |

| Less: Loss attributable to noncontrolling interests | (78) | | | (27) | | | | | |

Net Loss Attributable to Clearway Energy, Inc. | $ | (29) | | | $ | (20) | | | | | |

Losses Per Share Attributable to Clearway Energy, Inc. Class A and Class C Common Stockholders | | | | | | | |

Weighted average number of Class A common shares outstanding - basic and diluted | 35 | | | 35 | | | | | |

| | | | | | | |

Weighted average number of Class C common shares outstanding - basic and diluted | 79 | | | 73 | | | | | |

| | | | | | | |

Losses per Weighted Average Class A and Class C Common Share - Basic and Diluted | $ | (0.26) | | | $ | (0.18) | | | | | |

| | | | | | | |

| | | | | | | |

| Dividends Per Class A Common Share | 0.21 | | | 0.20 | | | | | |

| Dividends Per Class C Common Share | $ | 0.21 | | | $ | 0.20 | | | | | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

| | | | | | | | | | | | | | | | | |

| | | | | Three months ended March 31, | | |

| (In millions) | | | | | 2020 | | 2019 |

| Net Loss | | | | | $ | (107) | | | $ | (47) | |

| Other Comprehensive Loss | | | | | | | |

Unrealized loss on derivatives, net of income tax benefit of $2 and $0 | | | | | (12) | | | (2) | |

| Other comprehensive loss | | | | | (12) | | | (2) | |

| Comprehensive Loss | | | | | (119) | | | (49) | |

| Less: Comprehensive loss attributable to noncontrolling interests | | | | | (84) | | | (28) | |

| Comprehensive Loss Attributable to Clearway Energy, Inc. | | | | | $ | (35) | | | $ | (21) | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | |

| (In millions, except shares) | March 31, 2020 | | December 31, 2019 |

| ASSETS | (unaudited) | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 110 | | | $ | 155 | |

| Restricted cash | 270 | | | 262 | |

| Accounts receivable — trade | 99 | | | 116 | |

| Accounts receivable — affiliate | 1 | | | 2 | |

| Inventory | 41 | | | 40 | |

| | | |

| Prepayments and other current assets | 33 | | | 33 | |

| Total current assets | 554 | | | 608 | |

| Property, plant and equipment, net | 6,001 | | | 6,063 | |

| Other Assets | | | | |

| Equity investments in affiliates | 1,149 | | | 1,183 | |

| | | |

| Intangible assets, net | 1,406 | | | 1,428 | |

| | | |

| Deferred income taxes | 116 | | | 92 | |

| Right of use assets, net | 221 | | | 223 | |

| | | |

| Other non-current assets | 108 | | | 103 | |

| Total other assets | 3,000 | | | 3,029 | |

| Total Assets | $ | 9,555 | | | $ | 9,700 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current Liabilities | | | | | |

| Current portion of long-term debt | $ | 1,480 | | | $ | 1,824 | |

| Accounts payable — trade | 70 | | | 74 | |

| | | |

| Accounts payable — affiliate | 27 | | | 31 | |

| Derivative instruments | 38 | | | 16 | |

| Accrued interest expense | 60 | | | 41 | |

| | | |

| Accrued expenses and other current liabilities | 39 | | | 71 | |

| Total current liabilities | 1,714 | | | 2,057 | |

| Other Liabilities | | | | | |

| Long-term debt | 5,081 | | | 4,956 | |

| Derivative instruments | 151 | | | 76 | |

| Long-term lease liabilities | 222 | | | 227 | |

| Other non-current liabilities | 123 | | | 121 | |

| Total non-current liabilities | 5,577 | | | 5,380 | |

| Total Liabilities | 7,291 | | | 7,437 | |

| Commitments and Contingencies | | | | |

| Stockholders' Equity | | | | | |

Preferred stock, $0.01 par value; 10,000,000 shares authorized; none issued | — | | | — | |

Class A, Class B, Class C and Class D common stock, $0.01 par value; 3,000,000,000 shares authorized (Class A 500,000,000, Class B 500,000,000, Class C 1,000,000,000, Class D 1,000,000,000); 199,406,906 shares issued and outstanding (Class A 34,599,645, Class B 42,738,750, Class C 79,329,761, Class D 42,738,750) at March 31, 2020 and 198,819,999 shares issued and outstanding (Class A 34,599,645, Class B 42,738,750, Class C 78,742,854, Class D 42,738,750) at December 31, 2019 | 1 | | | 1 | |

| Additional paid-in capital | 1,922 | | | 1,936 | |

| Accumulated deficit | (101) | | | (72) | |

| Accumulated other comprehensive loss | (21) | | | (15) | |

| Noncontrolling interest | 463 | | | 413 | |

| Total Stockholders' Equity | 2,264 | | | 2,263 | |

| Total Liabilities and Stockholders' Equity | $ | 9,555 | | | $ | 9,700 | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| Three months ended March 31, | | |

| 2020 | | 2019 |

| (In millions) | | |

| Cash Flows from Operating Activities | | | |

| Net loss | $ | (107) | | | $ | (47) | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Equity in earnings (losses) of unconsolidated affiliates | 13 | | | (3) | |

| Distributions from unconsolidated affiliates | 5 | | | 11 | |

| Depreciation, amortization and accretion | 102 | | | 85 | |

| Amortization of financing costs and debt discounts | 4 | | | 4 | |

| Amortization of intangibles and out-of-market contracts | 22 | | | 17 | |

| Loss on debt extinguishment | 3 | | | — | |

| Right-of-use asset amortization | 2 | | | — | |

| Changes in deferred income taxes | (22) | | | (7) | |

| Changes in derivative instruments | 85 | | | 28 | |

| Loss on disposal of asset components | — | | | 2 | |

| Cash provided by (used in) changes in other working capital | | | |

| Changes in prepaid and accrued liabilities for tolling agreements | (45) | | | (35) | |

| Changes in other working capital | 22 | | | 6 | |

| Net Cash Provided by Operating Activities | 84 | | | 61 | |

| Cash Flows from Investing Activities | | | |

| Partnership interest acquisition | — | | | (4) | |

| Buyout of Wind TE Holdco noncontrolling interest | — | | | (19) | |

| Capital expenditures | (40) | | | (16) | |

| Return of investment from unconsolidated affiliates | 12 | | | 14 | |

| Investments in unconsolidated affiliates | (7) | | | (4) | |

| Proceeds from sale of assets | 15 | | | — | |

Insurance proceeds

| 3 | | | — | |

| Other | — | | | 3 | |

| Net Cash Used in Investing Activities | (17) | | | (26) | |

| Cash Flows from Financing Activities | | | |

| Net contributions from noncontrolling interests | 154 | | | 19 | |

| Net proceeds from the issuance of common stock | 10 | | | — | |

| Payments of dividends and distributions | (42) | | | (39) | |

| Proceeds from the revolving credit facility | 180 | | | — | |

| Proceeds from the issuance of long-term debt | 31 | | | 4 | |

| | | |

| | | |

| Payments for long-term debt - external | (437) | | | (304) | |

| Net Cash Used in Financing Activities | (104) | | | (320) | |

| Net Decrease in Cash, Cash Equivalents and Restricted Cash | (37) | | | (285) | |

| Cash, Cash Equivalents and Restricted Cash at beginning of period | 417 | | | 583 | |

| Cash, Cash Equivalents and Restricted Cash at end of period | $ | 380 | | | $ | 298 | |

| | | |

| | | |

See accompanying notes to consolidated financial statements.

CLEARWAY ENERGY, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

For the Three Months Ended March 31, 2020

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Preferred Stock | | Common Stock | | Additional

Paid-In

Capital | | Accumulated Deficit | | Accumulated

Other

Comprehensive Loss | | Noncontrolling

Interest | | Total

Stockholders'

Equity |

| Balances at December 31, 2019 | $ | — | | | | $ | 1 | | | | $ | 1,936 | | | | $ | (72) | | | | $ | (15) | | | | $ | 413 | | | | $ | 2,263 | |

Net loss | — | | | | — | | | | — | | | | (29) | | | | — | | | | (78) | | | | (107) | |

| Unrealized loss on derivatives, net of tax | — | | | | — | | | | — | | | | — | | | | (6) | | | | (6) | | | | (12) | |

| | | | | | | | | | | | | |

| Contributions from CEG, cash | — | | | | — | | | | — | | | | — | | | | — | | | | 4 | | | | 4 | |

| Contributions from tax equity interests, net of distributions, cash. | — | | | | — | | | | — | | | | — | | | | — | | | | 150 | | | | 150 | |

| Net proceeds from the issuance of common stock under the ATM | — | | | | — | | | | 10 | | | | — | | | | — | | | | — | | | | 10 | |

| Distributions to tax equity investors, non-cash | — | | | | — | | | | — | | | | — | | | | — | | | | (2) | | | | (2) | |

| Common stock dividends and distributions to CEG | — | | | | — | | | | (24) | | | | — | | | | — | | | | (18) | | | | (42) | |

| Balances at March 31, 2020 | $ | — | | | $ | 1 | | | $ | 1,922 | | | $ | (101) | | | $ | (21) | | | $ | 463 | | | $ | 2,264 | |

For the Three Months Ended March 31, 2019

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Preferred Stock | | Common Stock | | Additional

Paid-In

Capital | | Accumulated Deficit | | Accumulated

Other

Comprehensive Loss | | Noncontrolling

Interest | | Total

Stockholders'

Equity |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balances at December 31, 2018 | $ | — | | | | $ | 1 | | | | $ | 1,897 | | | | $ | (58) | | | | $ | (18) | | | | $ | 402 | | | | $ | 2,224 | |

Net loss | — | | | | — | | | | — | | | | (20) | | | | — | | | | (27) | | | | (47) | |

| Unrealized loss on derivatives, net of tax | — | | | | — | | | | — | | | | — | | | | (1) | | | | (1) | | | | (2) | |

| Buyout of Wind TE Holdco noncontrolling interest | — | | | | — | | | | (5) | | | | — | | | | — | | | | (14) | | | | (19) | |

| Contributions from tax equity interests, net of distributions,cash. | — | | | | — | | | | — | | | | — | | | | — | | | | 19 | | | | 19 | |

| Contributions from CEG for Oahu Partnership, non-cash | — | | | | — | | | | — | | | | — | | | | — | | | | 12 | | | | 12 | |

| Cumulative effect of change in the accounting principle | — | | | | — | | | | — | | | | (2) | | | | — | | | | (1) | | | | (3) | |

| Common stock dividends and distributions to CEG | — | | | | — | | | | (22) | | | | — | | | | — | | | | (17) | | | | (39) | |

| Balances at March 31, 2019 | $ | — | | | $ | 1 | | | $ | 1,870 | | | $ | (80) | | | $ | (19) | | | $ | 373 | | | $ | 2,145 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

CLEARWAY ENERGY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 — Nature of Business

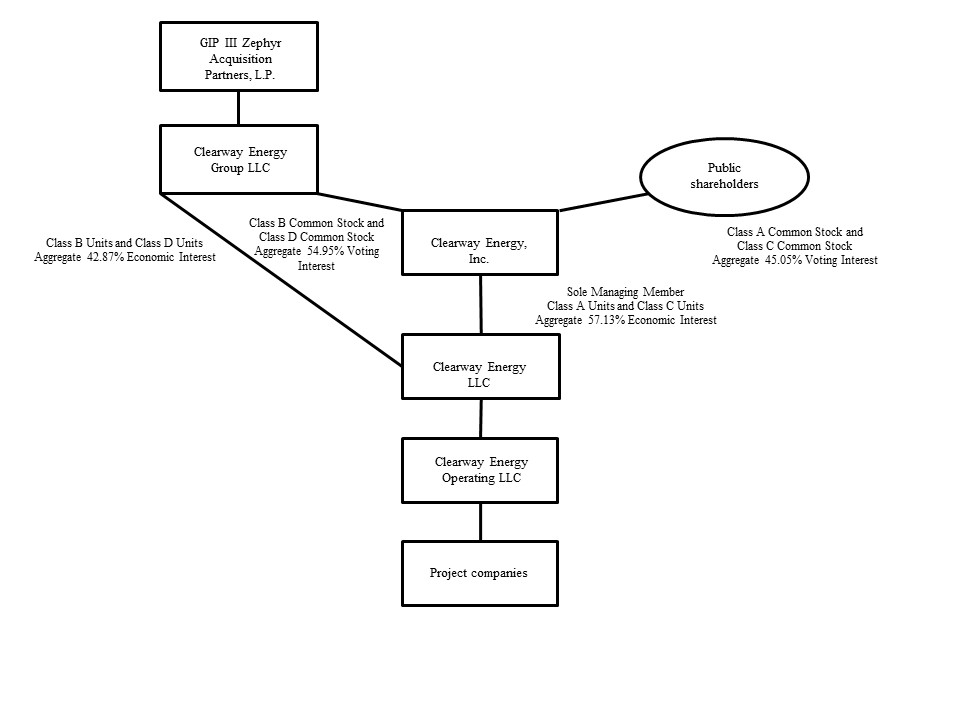

Clearway Energy, Inc., together with its consolidated subsidiaries, or the Company, is a publicly-traded energy infrastructure investor in and owner of modern, sustainable and long-term contracted assets across North America. The Company is sponsored by GIP III Zephyr Acquisition Partners, L.P. through its portfolio company, CEG. GIP is an independent fund manager that invests in infrastructure assets in energy and transport sectors.

The Company’s environmentally-sound asset portfolio includes over 5,875 MW of wind, solar and natural gas-fired power generation facilities. Through this diversified and contracted portfolio, the Company endeavors to provide its investors with stable and growing dividend income. Nearly all of these assets sell substantially all of their output pursuant to long-term offtake agreements with creditworthy counterparties. The weighted average remaining contract duration of these offtake agreements was approximately 13 years as of March 31, 2020 based on CAFD. The Company also owns thermal infrastructure assets with an aggregate steam and chilled water capacity of 1,530 net MWt and electric generation capacity of 36 net MW. These thermal infrastructure assets provide steam, hot and/or chilled water, and, in some instances, electricity to commercial businesses, universities, hospitals and governmental units in multiple locations, principally through long-term contracts or pursuant to rates regulated by state utility commissions.

The Company consolidates the results of Clearway Energy LLC through its controlling interest, with CEG's interest shown as noncontrolling interest in the financial statements. The holders of the Company's outstanding shares of Class A and Class C common stock are entitled to dividends as declared. CEG receives its distributions from Clearway Energy LLC through its ownership of Clearway Energy LLC Class B and Class D units.

As a result of the Class C common stock issuance under the ATM during the first quarter of 2020, the Company owns 57.13% of the economic interests of Clearway Energy LLC, with CEG retaining 42.87% of the economic interests of Clearway Energy LLC as of March 31, 2020. For further discussion, see Note 9, Changes in Capital Structure.

The following table represents the structure of the Company as of March 31, 2020:

Basis of Presentation

The accompanying unaudited interim consolidated financial statements have been prepared in accordance with the SEC’s regulations for interim financial information and with the instructions to Form 10-Q. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. The following notes should be read in conjunction with the accounting policies and other disclosures as set forth in the notes to the consolidated financial statements included in the Company's 2019 Form 10-K. Interim results are not necessarily indicative of results for a full year.

In the opinion of management, the accompanying unaudited interim consolidated financial statements contain all material adjustments consisting of normal and recurring accruals necessary to present fairly the Company's consolidated financial position as of March 31, 2020, and the results of operations, comprehensive loss and cash flows for the three months ended March 31, 2020 and 2019.

PG&E Bankruptcy Update

During 2019, PG&E, one of the Company's largest customers, filed for reorganization under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the Northern District of California, or the Bankruptcy Court. On January 31, 2020, PG&E filed with the Bankruptcy Court a Chapter 11 plan of reorganization, as amended, or the PG&E Plan. The PG&E Plan provides for PG&E to assume all of its PPAs with the Company. There are many conditions that must be satisfied before the PG&E Plan and assumption of the PPAs can become effective, including but not limited to approvals by various classes of creditors, the Bankruptcy Court, and the CPUC. A hearing before the Bankruptcy Court to consider whether the PG&E Plan will be approved and confirmed is currently expected to occur on May 27, 2020. As of March 31, 2020, the Company had $1.37 billion of property, plant and equipment, net, $368 million investments in unconsolidated affiliates and $1.19 billion of borrowings with final maturity dates ranging from 2022 to 2037 related to subsidiaries that sell their output to PG&E under the

long-term contracts. These subsidiaries of the Company are parties to financing agreements consisting of non-recourse project-level debt and, in certain cases, non-recourse holding company debt. The PG&E Bankruptcy has triggered defaults under the PPAs with PG&E and such related financing agreements, as further discussed in Item 1 — Note 7, Long-term Debt. As a result, the Company recorded approximately $1.19 billion of principal, net of the related unamortized debt issuance costs, with final maturity dates ranging from 2022 to 2037, as short-term debt. As of May 7, 2020, the Company's contracts with PG&E have operated in the normal course and the Company currently expects these contracts to continue as such. Additionally, the Company has entered into forbearance agreements for certain project-level financing arrangements and continues to seek forbearance agreements for other project-level financing arrangements affected by the PG&E Bankruptcy. The Company continues to assess the potential future impacts of the PG&E Bankruptcy as events occur. For further discussion see Note 7, Long-term Debt.

Note 2 — Summary of Significant Accounting Policies

Use of Estimates

The preparation of consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions. These estimates and assumptions impact the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could be different from these estimates.

Cash and Cash Equivalents, and Restricted Cash

Cash and cash equivalents include highly liquid investments with an original maturity of three months or less at the time of purchase. Cash and cash equivalents held at project subsidiaries was $95 million and $125 million as of March 31, 2020 and December 31, 2019, respectively.

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the consolidated balance sheets that sum to the total of the same such amounts shown in the statements of cash flows.

| | | | | | | | | | | |

| | March 31, | | December 31, |

| | 2020 | | 2019 |

| | (In millions) | | |

| Cash and cash equivalents | $ | 110 | | | $ | 155 | |

| Restricted cash | 270 | | | 262 | |

Cash, cash equivalents and restricted cash shown in the statement of cash flows | $ | 380 | | | $ | 417 | |

Restricted cash consists primarily of funds held to satisfy the requirements of certain debt agreements and funds held within the Company's projects that are restricted in their use. As of March 31, 2020, these restricted funds were comprised of $111 million designated to fund operating expenses, approximately $35 million designated for current debt service payments, and $46 million restricted for reserves including debt service, performance obligations and other reserves, as well as capital expenditures. The remaining $78 million is held in distributions reserve accounts, of which $68 million related to subsidiaries affected by the PG&E Bankruptcy as discussed in Note 1, Nature of Business, and may not be distributed during the pendency of the bankruptcy.

Accumulated Depreciation, Accumulated Amortization

The following table presents the accumulated depreciation included in the property, plant and equipment, net, and accumulated amortization included in intangible assets, net, respectively, as of March 31, 2020 and December 31, 2019:

| | | | | | | | | | | |

| March 31, 2020 | | December 31, 2019 |

| (In millions) | | |

| Property, Plant and Equipment Accumulated Depreciation | $ | 1,970 | | | $ | 1,880 | |

| Intangible Assets Accumulated Amortization | 416 | | | 394 | |

Dividends to Class A and Class C common stockholders

The following table lists the dividends paid on the Company's Class A common stock and Class C common stock during the three months ended March 31, 2020:

| | | | | | | | | | | | | |

| | | | | | | First Quarter 2020 |

| Dividends per Class A share | | | | | | | $ | 0.21 | |

| Dividends per Class C share | | | | | | | $ | 0.21 | |

Dividends on the Class A common stock and Class C common stock are subject to available capital, market conditions, and compliance with associated laws, regulations and other contractual obligations. The Company expects that, based on current circumstances, comparable cash dividends will continue to be paid in the foreseeable future. The Company will continue to evaluate its capital allocation approach during the pendency of the PG&E Bankruptcy, including the Company’s ability to receive unrestricted project distributions.

On April 30, 2020, the Company declared quarterly dividends on its Class A common stock and Class C common stock of $0.21 per share payable on June 15, 2020, to stockholders of record as of June 1, 2020.

Noncontrolling Interests

Clearway Energy LLC Distributions to CEG

The following table lists distributions paid to CEG during the period ended March 31, 2020 on Clearway Energy LLC's Class B and D units:

| | | | | | | | | | | | | | | |

| | | | | | | First Quarter 2020 |

| Distributions per Class B Unit | | | | | | | $ | 0.21 | |

| Distributions per Class D Unit | | | | | | | $ | 0.21 | |

On April 30, 2020, Clearway Energy LLC declared a distribution on its Class B and Class D units of $0.21 per unit payable on June 15, 2020 to unit holders of record as of June 1, 2020.

Revenue Recognition

Revenue from Contracts with Customers

The Company applies the guidance in ASC 606, Revenue from Contracts with Customers, or Topic 606, when recognizing revenue associated with its contracts with customers. The Company's policies with respect to its various revenue streams are detailed below. In general, the Company applies the invoicing practical expedient to recognize revenue for the revenue streams detailed below, except in circumstances where the invoiced amount does not represent the value transferred to the customer.

Thermal Revenues

Steam and chilled water revenue is recognized as the Company transfers the product to the customer, based on customer usage as determined by meter readings taken at month-end. Some locations read customer meters throughout the month and recognize estimated revenue for the period between meter read date and month-end. For thermal contracts, the Company’s performance obligation to deliver steam and chilled water is satisfied over time and revenue is recognized based on the invoiced amount. The Thermal Business subsidiaries collect and remit state and local taxes associated with sales to their customers, as required by governmental authorities. These taxes are presented on a net basis in the income statement.

As contracts for steam and chilled water are long-term contracts, the Company has performance obligations under these contracts that have not yet been satisfied. These performance obligations have transaction prices that are both fixed and variable, and which vary based on the contract duration, customer type, inception date and other contract-specific factors. For the fixed price contracts, the Company cannot accurately estimate the amount of its unsatisfied performance obligations as it will vary based on customer usage, which will depend on factors such as weather and customer activity.

Power Purchase Agreements

The majority of the Company’s revenues are obtained through PPAs or other contractual agreements. Energy, capacity and where applicable, renewable attributes, from the majority of the Company’s renewable energy assets and certain conventional energy plants is sold through long-term PPAs and tolling agreements to a single counterparty, which is often a utility or commercial customer. The majority of these PPAs are accounted for as leases. Previously ASC 840, and currently ASC 842, requires the minimum lease payments received to be amortized over the term of the lease and contingent rentals are recorded when the achievement of the contingency becomes probable. Management's judgment is required in determining the economic life of each generating facility, in evaluating whether certain lease provisions constitute minimum payments or represent contingent rent and other factors in determining whether a contract contains a lease and whether the lease is an operating lease or capital lease.

Renewable Energy Credits

Renewable energy credits, or RECs, are usually sold through long-term PPAs. Revenue from the sale of self-generated RECs is recognized when the related energy is generated and simultaneously delivered even in cases where there is a certification lag as it has been deemed to be perfunctory.

In a bundled contract to sell energy, capacity and/or self-generated RECs, all performance obligations are deemed to be delivered at the same time and hence, timing of recognition of revenue for all performance obligations is the same and occurs over time. In such cases, it is often unnecessary to allocate transaction price to multiple performance obligations.

Disaggregated Revenues

The following tables represent the Company’s disaggregation of revenue from contracts with customers along with the reportable segment for each category for the three months ended March 31, 2020 and 2019 respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2020 | | | | | | | | | | |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | | | | | Total |

Energy revenue(a) | $ | 2 | | | $ | 125 | | | $ | 28 | | | | | | | $ | 155 | |

Capacity revenue(a) | 107 | | | — | | | 14 | | | | | | | 121 | |

| Contract amortization | (6) | | | (15) | | | (1) | | | | | | | (22) | |

| Other revenue | — | | | 2 | | | 7 | | | | | | | 9 | |

| Mark-to-market for economic hedges | — | | | (5) | | | — | | | | | | | (5) | |

Total operating revenue | 103 | | | 107 | | | 48 | | | | | | | 258 | |

| Less: Lease revenue | (109) | | | (115) | | | (1) | | | | | | | (225) | |

| Less: Contract amortization | 6 | | | 15 | | | 1 | | | | | | | 22 | |

Total revenue from contracts with customers | $ | — | | | $ | 7 | | | $ | 48 | | | | | | | $ | 55 | |

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | | Conventional Generation | | Renewables | | Thermal | | Total |

| Energy revenue | | $ | 2 | | | $ | 115 | | | $ | 1 | | | $ | 118 | |

| Capacity revenue | | 107 | | | — | | | — | | | 107 | |

Total | | $ | 109 | | | $ | 115 | | | $ | 1 | | | $ | 225 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2019 | | | | | | | | |

| (In millions) | Conventional Generation | | Renewables | | Thermal | | | | Total |

Energy revenue(a) | $ | 1 | | | $ | 108 | | | $ | 32 | | | | | $ | 141 | |

Capacity revenue(a) | 79 | | | — | | | 13 | | | | | 92 | |

| Contract amortization | (1) | | | (15) | | | (1) | | | | | (17) | |

| Other revenue | — | | | 2 | | | 6 | | | | | 8 | |

| Mark-to-market for economic hedges | — | | | (7) | | | — | | | | | (7) | |

Total operating revenue | 79 | | | 88 | | | 50 | | | | | 217 | |

| Less: Lease revenue | (80) | | | (99) | | | — | | | | | (179) | |

| Less: Contract amortization | 1 | | | 15 | | | 1 | | | | | 17 | |

Total revenue from contracts with customers | $ | — | | | $ | 4 | | | $ | 51 | | | | | $ | 55 | |

(a) The following amounts of energy and capacity revenue relate to leases and are accounted for under ASC 842:

| | | | | | | | | | | | | | | | | | | | |

| (In millions) | | Conventional Generation | | Renewables | | Total |

| Energy revenue | | $ | 1 | | | $ | 99 | | | $ | 100 | |

| Capacity revenue | | 79 | | | — | | | 79 | |

Total | | $ | 80 | | | $ | 99 | | | $ | 179 | |

Contract Amortization

Assets and liabilities recognized from power sales agreements assumed through acquisitions related to the sale of electric capacity and energy in future periods for which the fair value has been determined to be significantly less (more) than market are amortized to revenue over the term of each underlying contract based on actual generation and/or contracted volumes or on a straight-line basis, where applicable.

Contract Balances

The following table reflects the contract assets and liabilities included on the Company’s balance sheet as of March 31, 2020:

| | | | | | | | |

| (In millions) | | |

| Accounts receivable, net - Contracts with customers | | $ | 29 | |

| Accounts receivable, net - Leases | | 70 | |

Total accounts receivable, net (a) | | $ | 99 | |

(a) Total accounts receivable, net, excludes $5 million generated at projects affected by PG&E Bankruptcy, which were recorded in non-current assets as of March 31, 2020.

Recently Issued Accounting Standards Not Yet Adopted

In March 2020, the FASB issued ASU 2020-4, Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The amendments provide for optional expedients and exceptions for applying GAAP to contracts, hedging relationships and other transactions affected by reference rate reform if certain criteria is met. These amendments apply only to contracts that reference LIBOR or another reference rate expected to be discontinued because of reference rate reform. The guidance is effective for all entities as of March 12, 2020 through December 31, 2022. The Company intends to apply the amendments to all its eligible contract modifications where applicable.

In December 2019, the FASB issued ASU No. 2019-12, Income Taxes (Topic 740): Simplifying the Accounting for Income Taxes. The amendments in this ASU simplify the accounting for income taxes by removing certain exceptions to the general principles in Topic 740, Income Taxes. The amendments also improve consistent application of and simplify GAAP for other areas of Topic 740 by clarifying and amending existing guidance. The guidance is effective January 1, 2021, with early adoption permitted. The Company does not expect the effect of the new guidance to be material on its consolidated financial statements.

Reclassification

Certain prior year amounts have been reclassified for comparative purposes.

Note 3 — Acquisitions and Dispositions

2020 Dispositions

Sale of Energy Center Dover LLC and Energy Center Smyrna LLC Assets — On March 3, 2020, the Company, through Thermal LLC, sold 100% of its interests in Energy Center Dover LLC and Energy Center Smyrna LLC to DB Energy Assets, LLC.

Note 4 — Investments Accounted for by the Equity Method and Variable Interest Entities

Entities that are Consolidated

The Company has a controlling financial interest in certain entities which have been identified as VIEs under ASC 810, Consolidations, or ASC 810. These arrangements are primarily related to tax equity arrangements entered into with third parties in order to monetize certain tax credits associated with wind and solar facilities, as further described in Note 5, Investments Accounted for by the Equity Method and Variable Interest Entities, to the consolidated financial statements included in the Company's 2019 Form 10-K.

Summarized financial information for the Company's consolidated VIEs consisted of the following as of March 31, 2020:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions) | Oahu Solar Partnership | | Kawailoa Partnership | | Repowering Partnership II LLC | | Alta TE Holdco | | Spring Canyon | | Buckthorn Renewables LLC | | Other (a) |

| Other current and non-current assets | $ | 27 | | | $ | 23 | | | $ | 45 | | | $ | 57 | | | $ | 3 | | | $ | 1 | | | | $ | 5 | |

| Property, plant and equipment | 185 | | | 145 | | | 358 | | | 376 | | | 85 | | | 213 | | | | 8 | |

| Intangible assets | — | | | — | | | 1 | | | 234 | | | — | | | — | | | | — | |

| Total assets | 212 | | | 168 | | | 404 | | | 667 | | | 88 | | | 214 | | | | 13 | |

| Current and non-current liabilities | 129 | | | 117 | | | 54 | | | 44 | | | 5 | | | 8 | | | | 3 | |

| Total liabilities | 129 | | | 117 | | | 54 | | | 44 | | | 5 | | | 8 | | | | 3 | |

| Noncontrolling interest | 35 | | | 43 | | | 206 | | | 48 | | | 32 | | | 68 | | | | — | |

| Net assets less noncontrolling interests | $ | 48 | | | $ | 8 | | | $ | 144 | | | $ | 575 | | | $ | 51 | | | $ | 138 | | | | $ | 10 | |

(a) Other is comprised of Crosswinds and Hardin projects.

The discussion below describes material changes to VIEs during the three months ended March 31, 2020.