FALSE0001567514DEF 14A00015675142023-01-012023-12-31iso4217:USDxbrli:pure00015675142022-01-012022-12-3100015675142021-01-012021-12-3100015675142020-01-012020-12-310001567514ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001567514ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2023-01-012023-12-310001567514ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310001567514ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2022-01-012022-12-310001567514ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310001567514ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2021-01-012021-12-310001567514ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310001567514ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2020-01-012020-12-310001567514ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2023-01-012023-12-310001567514ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2023-01-012023-12-310001567514ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2022-01-012022-12-310001567514ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2022-01-012022-12-310001567514ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2021-01-012021-12-310001567514ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2021-01-012021-12-310001567514ecd:NonPeoNeoMemberecd:EqtyAwrdsInSummryCompstnTblForAplblYrMember2020-01-012020-12-310001567514ecd:NonPeoNeoMemberecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMember2020-01-012020-12-310001567514ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001567514ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001567514ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001567514ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001567514ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-01-012023-12-310001567514ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310001567514ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310001567514ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001567514ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310001567514ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-01-012022-12-310001567514ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310001567514ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310001567514ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310001567514ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310001567514ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-01-012021-12-310001567514ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310001567514ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310001567514ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310001567514ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310001567514ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-01-012020-12-310001567514ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2023-01-012023-12-310001567514ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2023-01-012023-12-310001567514ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-01-012023-12-310001567514ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310001567514ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2023-01-012023-12-310001567514ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2022-01-012022-12-310001567514ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2022-01-012022-12-310001567514ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2022-01-012022-12-310001567514ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310001567514ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2022-01-012022-12-310001567514ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2021-01-012021-12-310001567514ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2021-01-012021-12-310001567514ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2021-01-012021-12-310001567514ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310001567514ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2021-01-012021-12-310001567514ecd:NonPeoNeoMemberecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMember2020-01-012020-12-310001567514ecd:NonPeoNeoMemberecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMember2020-01-012020-12-310001567514ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2020-01-012020-12-310001567514ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310001567514ecd:NonPeoNeoMemberecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMember2020-01-012020-12-31000156751412023-01-012023-12-31000156751422023-01-012023-12-31000156751432023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Under §240.14a-12 |

Intra-Cellular Therapies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| x | No fee required |

| |

| o | Fee paid previously with preliminary materials |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

430 East 29th Street

New York, New York 10016

April 29, 2024

To Our Stockholders:

You are cordially invited to attend the 2024 annual meeting of stockholders of Intra-Cellular Therapies, Inc. to be held in a virtual format at 11:00 a.m. Eastern Time on Friday, June 14, 2024.

Details regarding the meeting, the business to be conducted at the meeting, and information about Intra-Cellular Therapies, Inc. that you should consider when you vote your shares are described in the accompanying proxy statement.

At the annual meeting, one person will be elected to our board of directors. In addition, we will ask stockholders to approve an amendment and restatement of the Intra-Cellular Therapies, Inc. Amended and Restated 2018 Equity Incentive Plan, to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024, and to approve the compensation of our named executive officers, as disclosed in this proxy statement. The board of directors recommends the approval of each of these proposals. Such other business will be transacted as may properly come before the annual meeting.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to the majority of our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On or about May 1, 2024, we intend to send to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Availability Notice”) containing instructions on how to access our proxy statement for our 2024 annual meeting of stockholders and our 2023 annual report to stockholders. The Internet Availability Notice also provides instructions on how to vote online or by telephone and how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the annual meeting. Whether you plan to attend the annual meeting or not, it is important that you cast your vote either in person or by proxy. You may vote over the Internet as well as by telephone or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in the proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your continued support of Intra-Cellular Therapies, Inc.

Sincerely,

Sharon Mates, Ph.D.

Chairman and Chief Executive Officer

430 East 29th Street

New York, New York 10016

April 29, 2024

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | |

| TIME: | | 11:00 a.m. Eastern Time |

| | |

| DATE: | | Friday, June 14, 2024 |

| | |

| PLACE: | | Virtually at https://meetnow.global/MLNFN5Z |

| | |

| PURPOSES: | | |

1.To elect one director to serve a three-year term expiring in 2027;

2.To approve an amendment and restatement of the Intra-Cellular Therapies, Inc. Amended and Restated 2018 Equity Incentive Plan (the "2018 Plan") to, among other things, increase the number of shares of our common stock authorized for issuance under the 2018 Plan by 5,000,000 shares;

3.To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024;

4.To approve by an advisory vote the compensation of our named executive officers, as disclosed in this proxy statement; and

5.To transact such other business that is properly presented at the annual meeting and any adjournments or postponements thereof.

WHO MAY VOTE:

You may vote if you were the record owner of Intra-Cellular Therapies, Inc. common stock at the close of business on April 25, 2024. A list of stockholders of record will be available at the annual meeting and, during the 10 days prior to the annual meeting, at our principal executive offices located at 430 East 29th Street, New York, New York 10016.

All stockholders are cordially invited to attend the annual meeting. Whether you plan to attend the annual meeting or not, we urge you to vote by following the instructions in the Notice of Internet Availability of Proxy Materials that you previously received and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the meeting.

BY ORDER OF THE BOARD OF DIRECTORS

John P. Condon

Senior Vice President, General Counsel and Secretary

TABLE OF CONTENTS

INTRA-CELLULAR THERAPIES, INC.

430 East 29th Street

New York, NY 10016

PROXY STATEMENT FOR INTRA-CELLULAR THERAPIES, INC.

2024 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 14, 2024

This proxy statement, along with the accompanying notice of 2024 annual meeting of stockholders, contains information about the 2024 annual meeting of stockholders of Intra-Cellular Therapies, Inc., including any adjournments or postponements of the annual meeting. We are holding the annual meeting at 11:00 a.m. Eastern Time on Friday, June 14, 2024, virtually at https://meetnow.global/MLNFN5Z.

In this proxy statement, we refer to Intra-Cellular Therapies, Inc. as “ITI,” “the Company,” “we” and “us.” This proxy statement relates to the solicitation of proxies by our board of directors for use at the annual meeting.

On or about May 1, 2024, we intend to begin sending to our stockholders the Important Notice Regarding the Availability of Proxy Materials, or Internet Availability Notice, containing instructions on how to access our proxy statement for our 2024 annual meeting of stockholders and our 2023 annual report to stockholders.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 14, 2024

This proxy statement and our Annual Report on Form 10-K for the year ended December 31, 2023 are available for viewing, printing and downloading at www.envisionreports.com/ITCI if you are a holder of record (or www.edocumentview.com/ITCI if you hold your shares in street name). To view these materials please have your 15-digit control number(s) available that appears on your Internet Availability Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2023 on the website of the Securities and Exchange Commission, or the SEC, at www.sec.gov, or in the “Financials & Filings” section of the “Investors” section of our website at www.intracellulartherapies.com. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, free of charge, from us by sending a written request to: Intra-Cellular Therapies, Inc., Attn: Investor Relations, 430 East 29th Street, New York, NY 10016. Exhibits will be provided upon written request and payment of an appropriate processing fee.

PROXY SUMMARY

This summary highlights information described in more detail elsewhere in this proxy statement and is provided for your convenience only. It does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting or authorizing your proxy to vote for you.

Meeting Information

| | | | | | | | |

Time and Date: | | 11:00 a.m. Eastern Time, Friday, June 14, 2024 |

| | |

Place: | | Virtually at https://meetnow.global/MLNFN5Z |

| | |

Record Date: | | April 25, 2024 |

| | |

Voting: | | Each share of our common stock that you own entitles you to one vote |

Voting Matters and Board Recommendations

| | | | | | | | |

| Matter | | Board Recommendation |

1.Election of one director to serve a three-year term expiring in 2027 | | FOR the nominee |

2. Approval of an amendment and restatement of the Intra-Cellular Therapies, Inc. Amended and Restated 2018 Equity Incentive Plan | | FOR |

3. Ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024 | | FOR |

4. Approval by an advisory vote the compensation of our named executive officers, as disclosed in this proxy statement | | FOR |

Business Overview

We are a biopharmaceutical company focused on the discovery, clinical development and commercialization of innovative, small molecule drugs that address underserved medical needs primarily in neuropsychiatric and neurological disorders by targeting intracellular signaling mechanisms within the central nervous system, or CNS. In December 2019, CAPLYTA® (lumateperone) was approved by the U.S. Food and Drug Administration, or FDA, for the treatment of schizophrenia in adults (42mg/day) and we initiated the commercial launch of CAPLYTA in March 2020. In December 2021, CAPLYTA was approved by the FDA for the treatment of bipolar depression in adults (42mg/day). We initiated the commercial launch of CAPLYTA for the treatment of bipolar depression in December 2021. Additionally, in April 2022, the FDA approved two additional dosage strengths of CAPLYTA, 10.5 mg and 21 mg capsules, to provide dosage recommendations for patients concomitantly taking strong or moderate CYP3A4 inhibitors, and 21 mg for patients with moderate or severe hepatic impairment (Child-Pugh class B or C). We initiated the commercial launch for these special population doses in August 2022. Lumateperone is in Phase 3 clinical development as a novel treatment for major depressive disorder, or MDD.

Within the lumateperone portfolio, we have conducted or are in the process of conducting studies with pediatric patients in schizophrenia, bipolar disorder and irritability associated with autism spectrum disorder. In addition, we are developing a long-acting injectable, or LAI, formulation to provide more treatment options to patients suffering from mental illness. Given the encouraging efficacy and favorable safety profile to date with oral lumateperone, we believe that an LAI option, in particular, may lend itself to being an important formulation choice for certain patients.

We are also developing ITI-1284-ODT-SL for the treatment of generalized anxiety disorder, the treatment of agitation in patients with dementia, and the treatment of dementia-related psychosis. ITI-1284-ODT-SL is a deuterated form of lumateperone, a new molecular entity formulated as an oral disintegrating tablet for sublingual administration.

We have another major program that has yielded a portfolio of compounds that selectively inhibit the enzyme phosphodiesterase type 1, or PDE1. PDE1 enzymes are highly active in multiple disease states and our PDE1 inhibitors are designed to reestablish normal function in these disease states. Lenrispodun (ITI-214) is our lead compound in this program. Following the favorable safety and tolerability results in our Phase 1 program, we initiated our development program for lenrispodun for Parkinson’s disease. We also have a development program with our ITI-333 compound as a potential treatment for substance use disorders, pain and psychiatric comorbidities including depression and anxiety. There is a pressing need to develop new drugs to treat opioid addiction and safe, effective, non-addictive treatments to manage pain. ITI-333 is a novel compound that uniquely combines activity as an antagonist at serotonin 5-HT2A receptors and a partial agonist at µ-opioid receptors. These combined actions support the potential utility of ITI-333 in the treatment of opioid use disorder and associated comorbidities (e.g., depression, anxiety, sleep disorders) without opioid-like safety and tolerability concerns.

We also have our ITI-1500 program focused on the development of novel non-hallucinogenic psychedelics. Compounds in this series interact with serotonergic (5-HT2a) receptors in a unique way, potentially allowing the development of this new drug class in mood, anxiety and other neuropsychiatric disorders without the liabilities of known psychedelics including the hallucinogenic potential and risk for cardiac valvular pathologies. Our lead compound in this program, ITI-1549, is currently being evaluated in Investigational New Drug, or IND, enabling studies.

Election of Directors

Please see page 14 of this proxy statement for additional information about our board of directors. Independence as noted below is determined by our board of directors in accordance with the applicable Nasdaq Stock Market listing standards. Director Nominee

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age* | | Independent? | | Committee

Memberships | | Board

Recommendation |

| Joel S. Marcus | | 76 | | Yes | | CC, NGC | | FOR |

CC = Compensation Committee

NGC = Nominating and Governance Committee

* as of April 24, 2024

Directors Continuing in Office

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age* | | Independent? | | Committee

Memberships |

| Sharon Mates, Ph.D. | | 71 | | No (CEO) | | — |

| Rory B. Riggs | | 70 | | Yes | | AC, CC |

| E. Rene Salas | | 62 | | Yes | | AC, NGC |

| Robert L. Van Nostrand | | 67 | | Yes | | AC, CC |

AC = Audit Committee

CC = Compensation Committee

NGC = Nominating and Governance Committee

* as of April 24, 2024

Intra-Cellular Therapies, Inc. Amended and Restated 2018 Equity Incentive Plan

We are requesting that our stockholders approve an amendment and restatement of our Amended and Restated 2018 Equity Incentive Plan, or the 2018 Plan, to, among other things, increase the number of shares of our common stock authorized for issuance under the 2018 Plan by 5,000,000 shares to accommodate organizational growth as we continue to commercialize CAPLYTA.

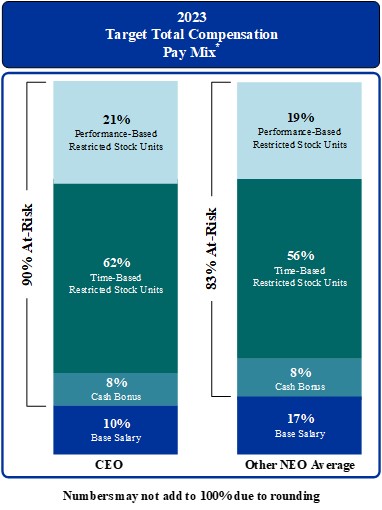

Executive Compensation Highlights

Please see page 21 of this proxy statement for our Compensation Discussion and Analysis, which discusses our executive compensation program in detail. Our named executive officers for this proxy statement are: •Sharon Mates, Ph.D., our Chairman and Chief Executive Officer

•Michael I. Halstead, our President

•Lawrence J. Hineline, our Senior Vice President of Finance, Chief Financial Officer, Treasurer and Assistant Secretary

•Suresh Durgam, M.D., our Executive Vice President, Chief Medical Officer

•Mark Neumann, our Executive Vice President, Chief Commercial Officer

We are asking our stockholders to approve, on an advisory basis, the compensation of our named executive officers. Our board of directors recommends a FOR vote because we believe our compensation program aligns the interests of our named executive officers with those of our stockholders in both the short- and long-term. Although stockholder votes on executive compensation are non-binding, our board of directors and the compensation committee consider the results when reviewing whether changes should be made to our compensation program and policies. As discussed in more detail in the Compensation Discussion and Analysis section of this proxy statement, key features of our compensation and governance practices include:

•Designing executive compensation to align pay with performance;

•Emphasizing at-risk compensation;

•Reevaluating our compensation program annually and making adjustments where appropriate based on stockholder feedback and market developments;

•Discouraging inappropriate risk-taking;

•Hiring an independent compensation consultant who reports directly to the compensation committee; and

•Having 100% independent directors on the compensation committee.

We believe that our executive compensation program aligns the interests of our named executive officers with those of our stockholders in both the short- and long-term by, among other things, rewarding our management team based on both individual performance as well as Company performance. As a biopharmaceutical company with one commercial product and multiple product candidates in clinical development, our performance achievements are primarily related to specific strategic goals, including advancing our development programs, research function, clinical activities, commercialization activities and certain corporate and financial goals, which we believe will create long-term value for stockholders.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

Our board of directors is soliciting your proxy to vote at the 2024 annual meeting of stockholders to be held virtually at https://meetnow.global/MLNFN5Z on Friday, June 14, 2024, at 11:00 a.m. Eastern Time and any adjournments or postponements of the meeting, which we refer to as the annual meeting. The proxy statement, along with the accompanying notice of 2024 annual meeting of stockholders, summarizes the purposes of the meeting and the information you need to know to vote at the annual meeting.

We have made available to you on the Internet or have sent you this proxy statement, the notice of 2024 annual meeting of stockholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 because you owned shares of our common stock on the record date. We intend to commence distribution of the Important Notice Regarding the Availability of Proxy Materials, which we refer to throughout this proxy statement as the Internet Availability Notice, and, if applicable, proxy materials to stockholders on or about May 1, 2024.

Will the Annual Meeting Be Held Virtually?

As in past few years, the annual meeting will be held in a virtual format only. Stockholders will not be able to attend the annual meeting in person. Stockholders at the close of business on the record date, April 25, 2024 are entitled to attend the annual meeting by going to https://meetnow.global/MLNFN5Z. To be admitted to the annual meeting at https://meetnow.global/MLNFN5Z, stockholders must enter the 15-digit control number found on their proxy card, voting instruction form, Internet Availability Notice, or email previously received. We encourage you to access the annual meeting prior to the start time. Online access will begin at 10:30 a.m. Eastern Time. Stockholders may vote during the annual meeting by following the instructions available on the meeting website during the meeting. A support line will be available on the meeting website shortly prior to, and during, the annual meeting to assist stockholders with any technical difficulties they may have accessing or hearing the virtual meeting. As always, we encourage you to vote your shares prior to the annual meeting.

How Do I Participate, Vote Electronically and Submit Questions at the Annual Meeting?

Stockholders of Record

Stockholders of record will be able to participate in the annual meeting, vote electronically and submit questions during the live webcast of the meeting, without advance registration. The following information is needed to access the live webcast of the meeting:

Computershare Control Number: the 15-digit control number found on your proxy card, voting instruction form, Internet Availability Notice or email you previously received.

Beneficial Owners

If you are a beneficial owner and hold your shares through an intermediary, such as a bank, broker or nominee, you must register in advance to participate in the annual meeting, vote electronically and submit questions during the live webcast of the meeting. To register in advance you must obtain a legal proxy from the bank, broker or other nominee that holds your shares giving you the right to vote the shares. You must forward a copy of the legal proxy along with your email address to Computershare Trust Company, N.A., or Computershare.

Requests for registration should be directed to Computershare by email at legalproxy@computershare.com no later than 11:00 a.m. Eastern Time, on Tuesday, June 4, 2024. You will receive a confirmation of your registration and instructions on how to attend the meeting by email after Computershare receives your registration materials.

Stockholders may also submit questions in advance of the annual meeting by emailing your question, along with proof of ownership, to ir@itci-inc.com. We will, subject to time constraints, answer all questions that are pertinent to the business of the annual meeting.

Why Did I Receive an Internet Availability Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the Securities and Exchange Commission, or the SEC, we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Most stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the annual meeting and help to conserve natural resources. If you received an Internet Availability Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Internet Availability Notice. Instead, the Internet Availability Notice instructs you as to how you may access and review all of the proxy materials and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

Who May Vote?

Only stockholders who owned our common stock at the close of business on April 25, 2024 are entitled to vote at the annual meeting. On this record date, there were 105,570,855 shares of our common stock outstanding and entitled to vote. Our common stock is our only class of voting stock.

You do not need to attend the annual meeting to vote your shares. Shares represented by valid proxies, received in time for the annual meeting and not revoked prior to the annual meeting, will be voted at the annual meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the annual meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via the Internet or telephone. You may specify whether your shares should be voted for or withheld for the nominee for director and whether your shares should be voted for, against or abstain with respect to each of the other proposals. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the board of directors’ recommendations as noted below. Voting by proxy will not affect your right to attend the annual meeting. If your shares are registered directly in your name through our stock transfer agent, Computershare Trust Company, N.A., or you have stock certificates registered in your name, you may vote:

•By Internet or by telephone. Follow the instructions included in the Internet Availability Notice or, if you received printed materials, in the proxy card to vote by Internet or telephone. Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on June 13, 2024.

•By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with the board of directors’ recommendations as noted below.

•Virtually at the meeting. Stockholders of record will be able to participate in the annual meeting, vote electronically and submit questions during the live webcast of the meeting, without advance registration. The following information is needed to access the live webcast of the meeting:

Computershare Control Number: the 15-digit control number found on your proxy card, voting instruction form, Internet Availability Notice, or email you previously received.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If you are a beneficial owner and hold your shares through an intermediary, such as a bank, broker or nominee, you must register in advance to participate in the annual meeting, vote electronically and submit questions during the live webcast of the meeting. To register in advance you must obtain a legal proxy from the bank, broker or other nominee that holds your shares giving you the right to vote the shares. You must forward a copy of the legal proxy along with your email address to Computershare Trust Company, N.A. Requests for registration should be directed to Computershare by email at legalproxy@computershare.com no later than 11:00 a.m. Eastern Time, on Tuesday, June 4, 2024. You will receive a confirmation of your registration and instructions on how to attend the meeting by email after Computershare receives your registration materials.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The board of directors recommends that you vote as follows:

•“FOR” the election of the nominee for director;

•“FOR” an amendment and restatement of the Intra-Cellular Therapies, Inc. Amended and Restated 2018 Equity Incentive Plan;

•“FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; and

•“FOR” the compensation of our named executive officers, as disclosed in this proxy statement.

If any other matter is presented at the annual meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his or her best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the annual meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the annual meeting. You may change or revoke your proxy in any one of the following ways:

•if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above;

•by re-voting by Internet or by telephone as instructed above;

•by notifying our Corporate Secretary, John P. Condon, in writing before the annual meeting that you have revoked your proxy; or

•by attending the annual meeting and voting virtually. Attending the annual meeting virtually will not in and of itself revoke a previously submitted proxy. You must specifically request at the annual meeting that it be revoked.

Your most current vote, whether by telephone, Internet or proxy card, is the one that will be counted.

What if I Receive More Than One Internet Availability Notice or Proxy Card?

You may receive more than one Internet Availability Notice or proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will My Shares Be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?”. If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the ratification of the appointment of our independent registered public accounting firm (Proposal 3) without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the annual meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Your bank, broker or other nominee does not have the ability to vote your uninstructed shares in the election of directors. Therefore, if you hold your shares in street name, it is critical that you cast your vote if you want your vote to be counted for the election of directors (Proposal 1). In addition, your bank, broker or other nominee is prohibited from voting your uninstructed shares on any matters related to our equity incentive plan (Proposal 2) or executive compensation (Proposal 4). Thus, if you hold your shares in street name and you do not instruct your bank, broker or other nominee how to vote in the election of directors or on matters related to executive compensation, no votes will be cast on these proposals on your behalf.

What Vote is Required to Approve Each Proposal and How are Votes Counted?

| | | | | | | | |

| Proposal 1: Elect Directors | | The nominee for director who receives the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR the nominee or WITHHOLD your vote from the nominee. Votes that are withheld will not be included in the vote tally for the election of the director. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| | |

Proposal 2: Approve an Amendment and Restatement of the Intra-Cellular Therapies, Inc. Amended and Restated 2018 Equity Incentive Plan | | The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to approve an amendment and restatement of the Intra-Cellular Therapies, Inc. Amended and Restated 2018 Equity Incentive Plan. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers' unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| | |

Proposal 3: Ratify Appointment of Independent Registered Public Accounting Firm | | The affirmative vote of a majority of the votes cast affirmatively or negatively for this proposal is required to ratify the appointment of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to appoint our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2024, the audit committee of our board of directors will reconsider its appointment. |

| | |

Proposal 4: Approve an Advisory Vote on the Compensation of our Named Executive Officers | | The affirmative vote of a majority of the votes cast affirmatively or negatively for this proposal is required to approve, on an advisory basis, the compensation of our named executive officers, as described in this proxy statement. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. Although the advisory vote is non-binding, the compensation committee and the board of directors will review the voting results and take them into consideration when making future decisions regarding executive compensation. |

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspector of Election, a representative of Computershare Trust Company, N.A., examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make on the proxy card or that you otherwise provide.

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced at the annual meeting, and we will publish preliminary results, or final results if available, in a Current Report on Form 8-K within four business days of the annual meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. In addition, the Company has engaged Alliance Advisors, LLC, a firm specializing in proxy solicitation, to solicit proxies, and to assist in the distribution and collection of proxy materials, for an estimated fee of approximately $32,000. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, in person (which would include presence at a virtual meeting) or by proxy, of the holders of a majority of the voting power of all outstanding shares of our common stock entitled to vote at the annual meeting is necessary to constitute a quorum at the annual meeting. Votes of stockholders of record who are present at the annual meeting in person (which would include presence at a virtual meeting) or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

Attending the Annual Meeting

The annual meeting will be held virtually at 11:00 a.m. Eastern Time on Friday, June 14, 2024. Stockholders at the close of business on the record date, April 25, 2024, are entitled to attend the annual meeting by going to https://meetnow.global/MLNFN5Z. To be admitted to the annual meeting at https://meetnow.global/MLNFN5Z, stockholders must enter the 15-digit control number found on their proxy card, voting instruction form, Internet Availability Notice, or email previously received. We encourage you to access the annual meeting prior to the start time. Online access will begin at 10:30 a.m. Eastern Time. Stockholders may vote during the annual meeting by following the instructions available on the meeting website during the meeting.

Householding of Annual Disclosure Documents

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single Internet Availability Notice or, if applicable, a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our Internet Availability Notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single Internet Availability Notice or, if applicable, a single set of proxy materials this year, but you would prefer to receive your own copy, please contact our transfer agent, Computershare Trust Company, N.A., by calling their toll free number, 1-877-373-6374.

If you do not wish to participate in “householding” and would like to receive your own Internet Availability Notice or, if applicable, set of our proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another stockholder and together both of you would like to receive only a single Internet Availability Notice or, if applicable, set of proxy materials, follow these instructions:

•If your shares are registered in your own name, please contact our transfer agent, Computershare Trust Company, N.A., and inform them of your request by calling them at 1-877-373-6374 or writing them at P.O. BOX 43006, Providence, RI 02940-3006.

•If a broker or other nominee holds your shares, please contact the broker or other nominee directly and inform them of your request. Be sure to include your name, the name of your brokerage firm and your account number.

Electronic Delivery of Company Stockholder Communications

Most stockholders can elect to view or receive copies of future proxy materials over the Internet instead of receiving paper copies in the mail.

You can choose this option and save us the cost of producing and mailing these documents by:

•following the instructions provided on your Internet Availability Notice or proxy card;

•following the instructions provided when you vote over the Internet; or

•going to https://www-us.computershare.com/Investor and following the instructions provided.

Description of the Merger

On August 29, 2013, Intra-Cellular Therapies, Inc., or ITI, completed a reverse merger, referred to throughout this proxy statement as “the Merger,” with a public shell company named Oneida Resources Corp., or Oneida. As a result of the Merger and related transactions, ITI survived as a wholly-owned subsidiary of Oneida, Oneida changed its name to Intra-Cellular Therapies, Inc. and we began operating ITI and its business, and therefore ceased being a shell company.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the number of shares of our common stock beneficially owned as of April 24, 2024 by (i) each of our directors, director nominees and named executive officers, (ii) all of our current executive officers and directors as a group, and (iii) each person known by us to be the beneficial owner of more than 5% of the outstanding shares of our common stock. Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them based on information provided to us by these stockholders, subject to community property laws, where applicable. Percentage of ownership is based on 105,570,855 shares of common stock outstanding on April 24, 2024. Unless otherwise noted below, the address of each stockholder below is c/o Intra-Cellular Therapies, Inc., 430 East 29th Street, New York, New York 10016.

| | | | | | | | | | | | | | |

| | Shares Beneficially Owned(1) |

| Name and Address | | Number | | Percent |

| Sharon Mates, Ph.D.(2) | | 1,973,700 | | 1.9 | % |

| Lawrence J. Hineline | | 0 | | * |

| Michael I. Halstead(3) | | 93,999 | | * |

| Suresh Durgam, M.D.(4) | | 137,871 | | * |

| Mark Neumann(5) | | 60,358 | | * |

| Joel S. Marcus(6) | | 58,238 | | * |

| Rory B. Riggs(7) | | 224,828 | | * |

| E. Rene Salas(8) | | 45,333 | | * |

| Robert L. Van Nostrand(9) | | 155,023 | | * |

| All directors, director nominees and current executive officers as a group (9 persons)(10) | | 2,749,350 | | 2.6 | % |

| Other 5% or More Stockholders | | | | |

Christopher D. Alafi, Ph.D. and Alafi Capital Company, LLC(11) 8 Admiral Drive, Suite 324 Emeryville, CA 94608 | | 5,594,318 | | 5.3 | % |

BlackRock, Inc.(12) 50 Hudson Yards New York, NY 10001 | | 8,192,987 | | 7.8 | % |

Entities affiliated with Fidelity Investments(13) 245 Summer Street Boston, MA 02210 | | 12,310,002 | | 11.7 | % |

The Vanguard Group, Inc.(14) 100 Vanguard Blvd. Malvern, PA 19355 | | 9,469,302 | | 9.0 | % |

*Represents beneficial ownership of less than 1% of the outstanding shares of our common stock.

(1)Beneficial ownership is determined in accordance with SEC rules, and includes any shares as to which the stockholder has sole or shared voting power or investment power, and also any shares which the stockholder has the right to acquire within 60 days of April 24, 2024, whether through the vesting of restricted stock units, or RSUs, or the exercise or conversion of any stock option, convertible security, warrant or other right. The indication herein that shares are beneficially owned is not an admission on the part of the stockholder that he, she or it is a direct or indirect beneficial owner of those shares.

(2)Includes 903,371 shares issuable upon the exercise of options to purchase common stock, which are exercisable within 60 days of April 24, 2024.

(3)Consists of 93,999 shares issuable upon the exercise of options to purchase common stock, which are exercisable within 60 days of April 24, 2024.

(4)Includes 118,068 shares issuable upon the exercise of options to purchase common stock, which are exercisable within 60 days of April 24, 2024.

(5)Includes 30,658 shares issuable upon the exercise of options to purchase common stock, which are exercisable within 60 days of April 24, 2024.

(6)Consists of 39,662 shares of common stock held by Mr. Marcus individually, 7,009 shares issuable upon the exercise of options to purchase common stock, which are exercisable within 60 days of April 24, 2024, 1,567 shares issuable upon the vesting of restricted stock units, which vest within 60 days of April 24, 2024 and includes 10,000 shares of common stock held by Alexandria Real Estate Equities, Inc. Excludes shares held by Alexandria Venture Investments, LLC as Mr. Marcus does not have voting or investment control over the shares held by Alexandria Venture Investments, LLC. Mr. Marcus is the Executive Chairman and Founder of Alexandria Real Estate Equities, Inc. and may be deemed to have voting and investment power with respect to the shares owned by Alexandria Real Estate Equities, Inc. Mr. Marcus disclaims beneficial ownership of the shares held by Alexandria Real Estate Equities, Inc., except to the extent of his underlying pecuniary interest therein.

(7)Consists of 99,495 shares of common stock held by Mr. Riggs, 123,766 shares issuable upon the exercise of options to purchase common stock, which are exercisable within 60 days of April 24, 2024, and 1,567 shares issuable upon the vesting of restricted stock units, which vest within 60 days of April 24, 2024.

(8)Consists of 43,766 shares issuable upon the exercise of options to purchase common stock, which are exercisable within 60 days of April 24, 2024 and 1,567 shares issuable upon the vesting of restricted stock units, which vest within 60 days of April 24, 2024.

(9)Consists of 9,690 shares of common stock held by Mr. Van Nostrand, 143,766 shares issuable upon the exercise of options to purchase common stock, which are exercisable within 60 days of April 24, 2024, and 1,567 shares issuable upon the vesting of restricted stock units, which vest within 60 days of April 24, 2024.

(10)See footnotes 2 through 9.

(11)Based on the Form 4 filed by Christopher D. Alafi, Ph.D., our former director, on May 28, 2021. Consists of 4,743,770 shares of common stock held by Alafi Capital Company, LLC, or Alafi Capital, 503,753 shares of common stock held by a trust for the benefit of members of the Alafi family, and 346,795 shares of common stock held by Christopher D. Alafi, Ph.D. individually. Dr. Alafi is a managing partner of Alafi Capital and has shared voting and investment power with respect to the shares owned by Alafi Capital and full voting and investment power with respect to shares owned by the trusts. Does not include 95,000 shares held by the Christopher D. Alafi Family Trust for which Dr. Alafi does not have voting or investment control.

(12)Based on the Schedule 13G/A filed by BlackRock, Inc. and its affiliates with the SEC on January 25, 2024. Includes shares beneficially owned by BlackRock Life Limited, BlackRock Advisors, LLC, Aperio Group, LLC, BlackRock (Netherlands) B.V., BlackRock Institutional Trust Company, National Association, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Japan Co., Ltd., BlackRock Asset Management Schweiz AG, BlackRock Investment Management, LLC, BlackRock Investment Management (UK) Limited, BlackRock Asset Management Canada Limited, BlackRock (Luxembourg) S.A., BlackRock Investment Management (Australia) Limited, BlackRock Fund Advisors, and BlackRock Fund Managers Ltd. The filing noted that BlackRock, Inc. is a parent holding company or control person and has sole dispositive power for 8,192,987 shares and sole voting power for 8,044,422 shares.

(13)Based on (i) 852,308 shares of common stock purchased by entities affiliated with Fidelity Investments in our public offering that closed on April 22, 2024 and April 24, 2024, plus (ii) 11,457,694 shares of common stock based on the Schedule 13G/A filed by FMR LLC and its affiliates with the SEC on February 9, 2024. Includes shares beneficially owned by FIAM LLC, Fidelity Management & Research Company LLC, Fidelity Management Trust Company, and Strategic Advisers LLC. The filing noted that FMR LLC has sole voting power with respect to 11,448,034 shares of common stock and sole dispositive power with respect to 11,457,694 shares of common stock. Abigail P. Johnson is a Director, the Chairman and the Chief Executive Officer of FMR LLC. Members of the Johnson family, including Abigail P. Johnson, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B shareholders have entered into a shareholders’ voting agreement under which all Series B voting common shares will be voted in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of voting common shares and the execution of the shareholders’ voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC.

(14)Based on (i) 375,000 shares of common stock purchased by The Vanguard Group, Inc. or Vanguard, in our public offering that closed on April 22, 2024 and April 24, 2024, plus (ii) 9,094,302 shares of common stock based on the Schedule 13G/A filed by Vanguard, with the SEC on February 13, 2024. Vanguard’s clients, including investment companies registered under the Investment Company Act of 1940 and other managed accounts, have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, these securities. The filing noted that Vanguard has sole voting power with respect to no shares of common stock, shared voting power with respect to 170,174 shares of common stock, sole dispositive power with respect to 8,829,327 shares of common stock, and shared dispositive power with respect to 264,975 shares of common stock.

MANAGEMENT AND CORPORATE GOVERNANCE

The Board of Directors

Our restated certificate of incorporation, as amended, provides that our business is to be managed by or under the direction of our board of directors. Our board of directors is divided into three classes for purposes of election. One class is elected at each annual meeting of stockholders to serve for a three-year term. Our board of directors currently consists of five members, classified into three classes as follows: (1) Joel S. Marcus constitutes a class with a term ending at the 2024 annual meeting; (2) Sharon Mates, Ph.D., Rory B. Riggs and Robert L. Van Nostrand constitute a class with a term ending at the 2025 annual meeting; and (3) E. Rene Salas constitutes a class with a term ending at the 2026 annual meeting.

On April 22, 2024, our board of directors voted to nominate Joel S. Marcus for election at the annual meeting for a term of three years to serve until the 2027 annual meeting of stockholders and until his successor has been elected and qualified.

Set forth below are the names of the person nominated as a director and directors whose terms do not expire this year, their ages, their offices in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships during the past five years, as of April 24, 2024. Additionally, information about the specific experience, qualifications, attributes or skills that led to our board of directors’ conclusion at the time of filing of this proxy statement that each person listed below should serve as a director is set forth below:

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) with the Company |

| Sharon Mates, Ph.D. | | 71 | | Chairman and Chief Executive Officer |

| Joel S. Marcus(2)(3) | | 76 | | Director |

| Rory B. Riggs(1)(2) | | 70 | | Director |

| E. Rene Salas(1)(3) | | 62 | | Director |

| Robert L. Van Nostrand(1)(2)(4) | | 67 | | Director |

(1)Member of our audit committee

(2)Member of our compensation committee

(3)Member of our nominating and governance committee

(4)Lead independent director

Sharon Mates, Ph.D. has been Chairman and Chief Executive Officer of the Company since the Merger in August 2013, was the President of the Company from August 2013 until March 2024, has been the Chairman of the board of directors and Chief Executive Officer of ITI since June 2002. Dr. Mates co-founded ITI in May 2002. Prior to co-founding ITI, Dr. Mates was a co-founder of Functional Genetics, and served as its Chairman and Chief Executive Officer from December 2000 until August 2003. From 1989 to 1998, Dr. Mates was the President and a board member of North American Vaccine Inc. and its predecessor companies. Dr. Mates serves on the board of the Biotechnology Innovation Organization (BIO), emerging companies section. Dr. Mates has also served on the Advisory Council of the Center for Society and Health at the Harvard School of Public Health, the Board of Visitors of the Biotechnology Institute of the University of Maryland and the board of directors of Gilda’s Club of New York. Earlier in her career, Dr. Mates spent several years as a research analyst and investment banker, and as an advisor to the life sciences industry. Dr. Mates received her B.S. from the Ohio State University and her Ph.D. from the University of Washington, and completed her postdoctoral fellowships at The Massachusetts General Hospital and Harvard Medical School.

We believe that Dr. Mates possesses specific attributes that qualify her to serve as chairman of our board of directors, including the perspective and experience she brings as the co-founder and Chief Executive Officer of ITI, which brings historic knowledge, operational expertise and continuity to our board of directors, and her industry expertise, including over 25 years of experience leading both private and public companies.

Joel S. Marcus, JD, CPA, became a director of the Company following the Merger that occurred in August 2013 and has served on the board of directors of ITI since April 2006. Mr. Marcus is Executive Chairman and Founder of Alexandria Real Estate Equities, Inc. (NYSE: ARE) (“Alexandria”), a real estate investment trust (“REIT”) that pioneered life science real estate and transformed it from a specialty niche to a mainstream asset class. Alexandria is the preeminent, largest, and longest-tenured owner, operator, and developer uniquely focused on collaborative life science mega campuses in AAA innovation cluster locations. Since co-founding the company in 1994 as a garage startup with $19 million in Series A capital and a mission to advance human health, Mr. Marcus has led the remarkable growth of Alexandria into an S&P 500 company that has become the leading REIT focused on the life science industry, with a total market capitalization of $33.1 billion and a total asset base in North America of 73.5 million SF as of December 31, 2023. From its IPO in May 1997 through December 31, 2023, Alexandria, which celebrated its 25th anniversary as a New York Stock Exchange listed company in May 2022, has generated an outstanding total shareholder return exceeding 1,510%. Mr. Marcus also founded and continues to lead Alexandria Venture Investments, the company’s strategic venture capital platform. Since its inception in 1996, Alexandria Venture Investments has actively invested in disruptive life science companies as well as promising agrifoodtech and technology companies that are advancing new, transformative therapeutic modalities and platforms to meaningfully improve human health. Mr. Marcus also currently serves on the board of directors of Applied Therapeutics, Inc., a publicly traded biopharmaceutical company. Mr. Marcus previously served as a director of Atara Biotherapeutics, Inc., Frequency Therapeutics, Inc. (now Korro Bio, Inc.), MeiraGTx Holdings plc, and Yumanity Therapeutics, Inc. He earned his undergraduate and Juris Doctor degrees from the University of California, Los Angeles.

We believe that Mr. Marcus possesses specific attributes that qualify him to serve as a member of our board of directors, including his many years of experience in the life sciences industry and his extensive experience serving as a director and an executive officer of other public companies.

Rory B. Riggs has served on our board of directors since January 2014. Mr. Riggs is Chairman and CEO of Cibus , Inc. (NASDAQ: CBUS), a leading company in gene editing in agriculture. Mr. Riggs is a co-founder and director of Royalty Pharma (NASDAQ: RPRX), an investment company focused on drug royalties. From 1996 until 2000, Mr. Riggs served as President and as a director of Biomatrix, Inc. (NYSE: BXM) until its sale to Genzyme Biosurgery. From 1991 to 1995, Mr. Riggs served as CEO of RF&P Corporation, an investment company owned by the State of Virginia Retirement System. Mr. Riggs is founder and executive chairman of Syntax, LLC, a relational data company for risk management and serves as a Managing Member of Scientia Ventures, a healthcare venture fund. Mr. Riggs previously served as a director of Fibrogen. Mr. Riggs holds a B.A. from Middlebury College and an M.B.A. from Columbia University.

We believe that Mr. Riggs possesses specific attributes that qualify him to serve as a member of our board of directors, including his financial expertise, extensive knowledge of the life sciences industry, and many years of experience as a developer (founder), executive officer and director of successful companies (both public and private) in the life sciences and healthcare industries.

E. Rene Salas, CPA has served on our board of directors since April 2022. Mr. Salas has over 35 years of experience with accounting and advisory projects in the life sciences and technology industries. From 2020 to 2022, he served as the Chief Financial Officer of Wellstat, LLC, an early-stage biopharmaceutical company. Before joining Wellstat, from 1987 to 2019, Mr. Salas worked at Ernst & Young, LLP in a variety of roles, most recently as a senior client partner from 2010 to 2019. At Ernst & Young LLP, Mr. Salas also served in various leadership roles on diversity, equity and inclusion (DEI) at the national and regional level, including the firm’s national task force on DEI. Mr. Salas served on the board of directors for Embody, Inc., a privately-held medical device company prior to its acquisition by Zimmer Biomet, Inc. Currently, Mr. Salas serves as the audit committee chair for Northern Virginia Family Services and is a member of the Dean’s Advisory Council of the Alvarez School of Business at the University of Texas at San Antonio. Mr. Salas received his B.B.A. in accounting from the University of Texas at San Antonio. He has also completed executive education programs in strategic leadership for Ernst & Young partners at Harvard Business School and Northwestern University’s Kellogg School. Mr. Salas is a Certified Public Accountant.

We believe that Mr. Salas possesses specific attributes that qualify him to serve as a member of our board of directors, including his many years of experience in the healthcare industry and his accounting and advisory expertise.

Robert L. Van Nostrand, CPA has served on our board of directors since January 2014. Mr. Van Nostrand has been a self-employed advisor and investor since 2010, as well as a member of various public and private company boards of directors. Mr. Van Nostrand was Executive Vice President and Chief Financial Officer of Aureon Biosciences, Inc., a private pathology life science company, from January 2010 to July 2010. Prior to joining Aureon Biosciences, Mr. Van Nostrand served as Executive Vice President and Chief Financial Officer of AGI Dermatics, Inc., a private biotechnology company, from July 2007 to September 2008 when the company was acquired. From May 2005 to July 2007, Mr. Van Nostrand served as the Senior Vice President and Chief Compliance Officer of OSI Pharmaceuticals, Inc., then a publicly-traded biotechnology company, where he previously served as Vice President and Chief Financial Officer from December 1996 through May 2005 and as Vice President, Finance and Administration prior to that. He also served as OSI’s Treasurer from March 1992 to May 2005 and Secretary from March 1995 to January 2004. Mr. Van Nostrand joined OSI as Controller and Chief Accounting Officer in September 1986. Prior to joining OSI, Mr. Van Nostrand served in a managerial position with the accounting firm, Touche Ross & Co., currently Deloitte. Mr. Van Nostrand serves as chairman of the board of directors of Yield10 Bioscience, Inc., a publicly-traded agricultural bioscience company, as well as chairman of its audit committee and a member of its compensation committee. He also serves on the board of SELLAS Life Sciences Group, Inc., a publicly-traded biotechnology company, where he serves as chairman of the audit committee and a member of the nominating and governance committee. From December 2014 until May 2018, Mr. Van Nostrand served on the board of directors of Enumeral Biomedical Holdings, Inc., a publicly-traded biotechnology company, and from April 2007 to January 2020, Mr. Van Nostrand served on the board of directors of Achillion Pharmaceuticals, a publicly-traded biotechnology company. Mr. Van Nostrand is the former chairman of, and serves on, the board of the New York Biotechnology Association and serves on the Foundation Board of Farmingdale University. Previously, Mr. Van Nostrand served on the board of directors of Apex Bioventures, Inc., a special purpose acquisition company focused on life sciences. Mr. Van Nostrand holds a B.S. in Accounting from Long Island University, New York. He is a Certified Public Accountant.

We believe that Mr. Van Nostrand possesses specific attributes that qualify him to serve as a member of our board of directors, including his many years of experience in the life sciences industry, as well as his expertise in financial operations, transaction structuring and risk management.

There are no family relationships between or among any of our directors or nominee. The principal occupation and employment during the past five years of each of our directors and nominee was carried on, in each case except as specifically identified above, with a corporation or organization that is not a parent, subsidiary or other affiliate of us. There is no arrangement or understanding between any of our directors or nominee and any other person or persons pursuant to which he or she is to be selected as a director or nominee.

There are no legal proceedings to which any of our directors is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

Director Independence

Our board of directors has reviewed the materiality of any relationship that each of our directors has with Intra-Cellular Therapies, Inc., either directly or indirectly. Based upon this review, our board has determined that all of our directors and our director nominee other than Dr. Mates, our chief executive officer, are “independent directors” as defined by The Nasdaq Stock Market. In making such determinations, the board of directors considered the relationships that each such non-employee director or director nominee has with our Company and all other facts and circumstances the board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director and director nominee. In addition, our board of directors considered the effect of each of the transactions described in “Certain Relationships and Related Person Transactions” below.

Director Diversity

| | | | | | | | | | | | | | |

| Board Diversity Matrix (As of April 24, 2024) |

| Total Number of Directors | 5 |

| Female | Male | Non-Binary | Did Not Disclose

Gender |

| Gender: |

| Directors | 1 | 4 | 0 | 0 |

| Number of Directors Who Identify in Any of the Categories Below: |

| African American or Black | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | 0 | 0 | 0 | 0 |

| Asian (other than South Asian) | 0 | 0 | 0 | 0 |

| South Asian | 0 | 0 | 0 | 0 |

| Hispanic or Latinx | 0 | 1 | 0 | 0 |

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 |

| White | 1 | 3 | 0 | 0 |

| Two or More Races or Ethnicities | 0 | 0 | 0 | 0 |

| LGBTQ+ | 0 |

| Persons with Disabilities | 0 |

Committees of the Board of Directors and Meetings

Meeting Attendance. During the fiscal year ended December 31, 2023, there were six meetings of our board of directors, four meetings of the audit committee, three meetings of the compensation committee and one meeting of the nominating and governance committee. No director attended fewer than 75% of the total number of meetings of the board of directors and of committees of the board on which he or she served during fiscal 2023. The board of directors has adopted a policy under which each member of our board of directors is strongly encouraged but not required to attend each annual meeting of our stockholders. Four of our directors attended the annual meeting of our stockholders held in 2023.

Our board of directors has established an audit committee, a compensation committee and a nominating and governance committee. Each committee operates under a charter approved by our board of directors. Copies of each committee’s charter are posted on the Investors section of our website, which is located at www.intracellulartherapies.com, under the caption “Corporate Governance.” The composition and function of each of these committees are described below.

Audit Committee. This committee currently has three members, Mr. Van Nostrand (Chairman), Mr. Riggs and Mr. Salas. Our audit committee’s role and responsibilities are set forth in the audit committee’s written charter and include the authority to retain and terminate the services of our independent registered public accounting firm. In addition, the audit committee reviews the annual financial statements, considers matters relating to accounting policy and internal controls and reviews the scope of annual audits. All members of the audit committee satisfy the current independence standards promulgated by the Securities and Exchange Commission and by The Nasdaq Stock Market, as such standards apply specifically to members of audit committees. The board of directors has determined that Mr. Van Nostrand, Mr. Riggs and Mr. Salas are “audit committee financial experts,” as the Securities and Exchange Commission has defined that term in Item 407 of Regulation S-K. Please also see the report of the audit committee set forth elsewhere in this proxy statement.

Compensation Committee. This committee currently has three members, Mr. Marcus (Chairman), Mr. Riggs and Mr. Van Nostrand. Our compensation committee’s role and responsibilities are set forth in the compensation committee’s written charter and include reviewing, approving and making recommendations regarding our compensation policies, practices and procedures to ensure that legal and fiduciary responsibilities of the board of directors are carried out and that such policies, practices and procedures contribute to our success. Our compensation committee also administers our Amended and Restated 2018 Equity Incentive Plan, or 2018 Plan. The compensation committee is responsible for the determination of the compensation of our chief executive officer. All members of the compensation committee qualify as independent under the definition promulgated by The Nasdaq Stock Market.

Our compensation committee makes all compensation decisions regarding our executive officers and directors, after which it makes a recommendation to our full board of directors. Our board of directors then approves the compensation for our executive officers and directors.

Nominating and Governance Committee. Our nominating and governance committee currently has two members, Mr. Salas (Chairman) and Mr. Marcus. The nominating and governance committee’s role and responsibilities are set forth in the nominating and governance committee’s written charter and include evaluating and making recommendations to the full board of directors as to the size and composition of the board of directors and its committees, evaluating and making recommendations as to potential candidates, and evaluating current board members’ performance. The members of the nominating and governance committee qualify as independent under the definition promulgated by The Nasdaq Stock Market.

If a stockholder wishes to nominate a candidate for director who is not to be included in our proxy statement, it must follow the procedures described in our restated bylaws and in “Stockholder Proposals and Nominations for Director” at the end of this proxy statement.

In addition, under our current corporate governance policies, the nominating and governance committee may consider candidates recommended by stockholders as well as from other sources such as other directors or officers, third-party search firms or other appropriate sources. Once identified, the nominating and governance committee will evaluate a candidate’s qualifications in accordance with our nominating and governance committee policy regarding qualifications of directors appended to our nominating and governance committee’s written charter. For all potential candidates, the nominating and governance committee may consider all factors it deems relevant, such as a candidate’s personal integrity and sound judgment, business and professional skills and experience, independence, knowledge of the biotechnology industry, possible conflicts of interest, diversity, the extent to which the candidate would fill a present need on the board of directors, and concern for the long-term interests of the stockholders. Our nominating and governance committee has not adopted a formal diversity policy in connection with the consideration of director nominations or the selection of nominees. However, the nominating and governance committee considers issues of diversity among its members in identifying and considering nominees for director, and will strive where appropriate to achieve a diverse balance of backgrounds, perspectives, experience, age, gender, ethnicity and country of citizenship on the board of directors and its committees.

If a stockholder wishes to propose a candidate for consideration as a nominee for election to our board of directors, it must follow the procedures described in our restated bylaws and in “Stockholder Proposals and Nominations for Director” at the end of this proxy statement. In general, persons recommended by stockholders will be considered in accordance with our Policy on Stockholder Recommendation of Candidates for Election as Directors appended to our nominating and governance committee’s written charter. Any such recommendation should be made in writing to the Nominating and Governance Committee, care of our Corporate Secretary at our principal office, and should be accompanied by the following information concerning each recommending stockholder and the beneficial owner, if any, on whose behalf the nomination is made:

•the name and address of such stockholder and such beneficial owner;

•certain share ownership and similar information about such stockholder and such beneficial owner;

•all information relating to such person that would be required to be disclosed in a proxy statement;

•a description of certain arrangements and understandings between the proposing stockholder and beneficial owner and any other person in connection with such stockholder nomination; and

•a statement whether or not either such stockholder or beneficial owner intends to deliver a proxy statement and form of proxy to holders of voting shares sufficient to carry the proposal.

The recommendation must also be accompanied by the following information concerning the proposed nominee:

•certain biographical information concerning the proposed nominee;