UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

| Filed by the Registrant | ☒ |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

LogicMark, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

2801 Diode Lane

Louisville, KY 40299

(502) 442-7911

Important Notice Regarding

the Availability of Proxy Materials

for the Special Meeting of Stockholders to Be Held on October 1, 2024

The Notice of Special Meeting

and Proxy Statement

are available at:

http://www.viewproxy.com/LGMK/2024SM.

NOTICE OF SPECIAL MEETING

OF STOCKHOLDERS

TO BE HELD ON OCTOBER 1, 2024

To the Stockholders of LogicMark, Inc.:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders (“Special Meeting”) of LogicMark, Inc., a Nevada corporation (the “Company”), will be held on October 1, 2024 at 11:00 a.m. (Eastern Time) in the offices of Sullivan & Worcester LLP at 1251 Avenue of the Americas, 19th Floor, New York, NY 10020. The Special Meeting is being held for the following purposes:

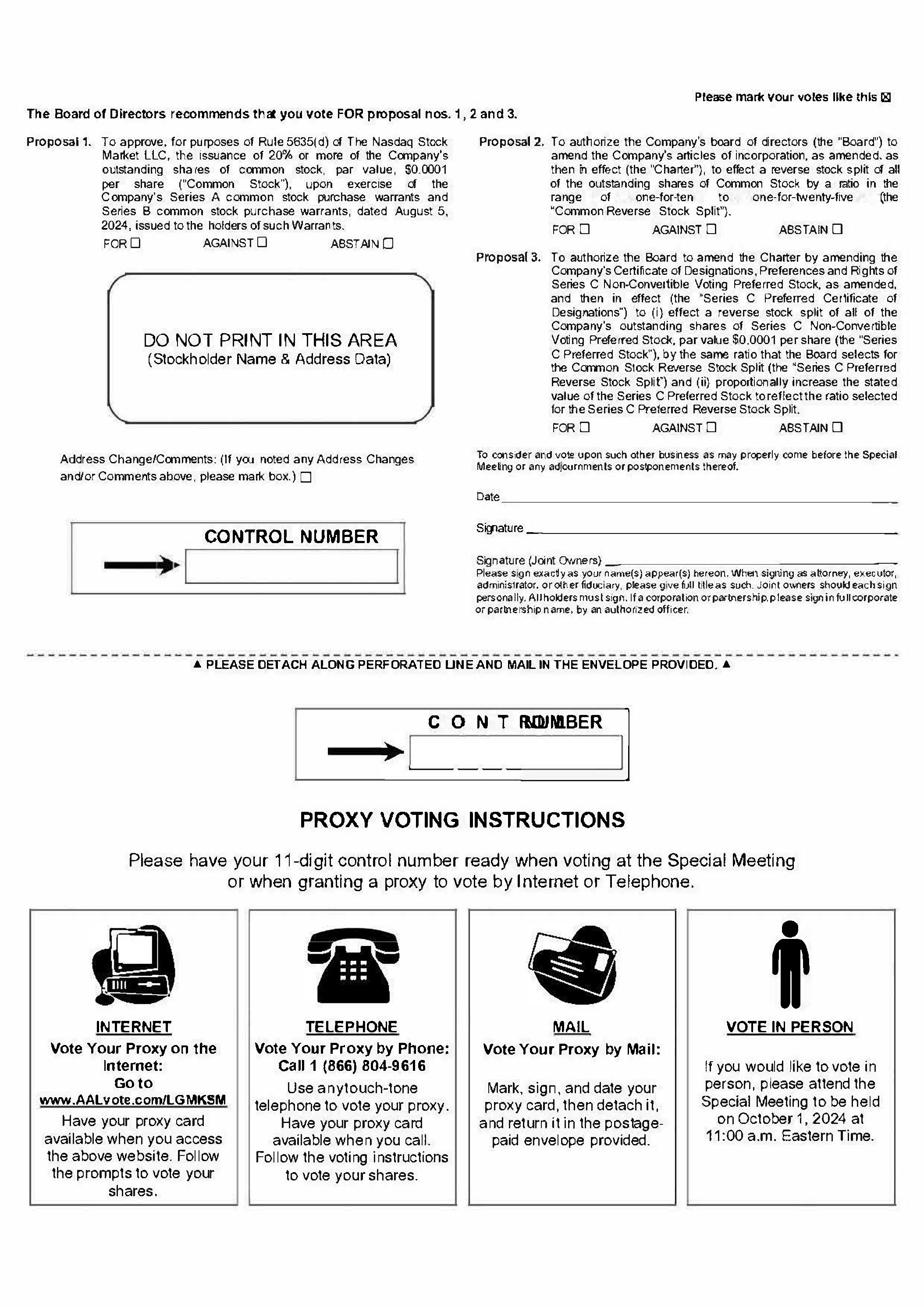

| 1. | To approve, for purposes of Rule 5635(d) of The Nasdaq Stock Market LLC (“Nasdaq”), the issuance of 20% or more of our outstanding shares of Common Stock upon exercise of the Company’s Series A common stock purchase warrants (the “Series A Warrants”) and the Company’s Series B common stock purchase warrants (the “Series B Warrants” and collectively, the “Warrants”), dated August 5, 2024, issued to the holders of such Warrants (“Proposal No. 1”); |

| 2. | To authorize the Board, for purposes of maintaining compliance with the minimum bid price requirement for continued listing on the Nasdaq Capital Market, as set forth under Nasdaq Rule 5550(a)(2), to amend the Company’s articles of incorporation, as amended, as then in effect (the “Charter”), to effect a reverse stock split of all of the Company’s outstanding shares of common stock, par value $0.0001 per share (the “Common Stock”), by a ratio in the range of one-for-ten to one-for-twenty-five (“Proposal No. 2”); |

| 3. | To authorize the Board to amend the Charter by amending the Company’s Certificate of Designations, Preferences and Rights of Series C Non-Convertible Voting Preferred Stock, as amended, and then in effect (the “Series C Preferred Certificate of Designations”) to (i) effect a reverse stock split of all of the Company’s outstanding shares of Series C Non-Convertible Voting Preferred Stock, par value $0.0001 per share (the “Series C Preferred Stock”), by the same ratio that the Board selects for the reverse stock split of our Common Stock described in Proposal No. 2 (the “Series C Preferred Reverse Stock Split”) and (ii) proportionally increase the stated value of the Series C Preferred Stock to reflect the ratio selected for the Series C Preferred Reverse Stock Split (collectively, “Proposal No. 3”); and |

| 4. | To consider and act upon such other business as may properly come before the Special Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement that is attached and made a part of this Notice. Only stockholders of record of shares of Common Stock, stockholders of record of the Company’s Series C Preferred Stock, and stockholders of record of the Company’s Series F Convertible Preferred Stock, par value $0.0001 per share (the “Series F Preferred Stock”), at the close of business on August 5, 2024 (the “Record Date”) will be entitled to notice of, and to vote at, the Special Meeting or any adjournment thereof.

Our Board of Directors recommends that you vote “FOR” each of the proposals.

All stockholders who are record or beneficial owners of shares of Common Stock, the one record holder of shares of Series C Preferred Stock and the one record holder of shares of Series F Preferred Stock on the Record Date are cordially invited to attend the Special Meeting in person. Your vote is important regardless of the number of shares of Common Stock, Series C Preferred Stock and/or Series F Preferred Stock that you own. Only record or beneficial owners of the Common Stock, Series C Preferred Stock and/or Series F Preferred Stock as of the Record Date may attend the Special Meeting in person. When you arrive at the Special Meeting, you must present photo identification, such as a driver’s license. Beneficial owners also must provide evidence of stockholdings as of the Record Date, such as a recent brokerage account or bank statement.

Instructions regarding each method of voting are provided in the Notice of Internet Availability and stockholders can access such proxy materials and vote at www.viewproxy.com. If you desire to submit your vote by mail, you may request a paper proxy card at no charge at any time from (i) www.viewproxy.com, (ii) call 1-877-777-2857 or (iii) send an email to requests@viewproxy.com on or before ______, 2024. If you desire to submit your vote via internet or telephone, follow the instructions at www.viewproxy.com and use the stockholder identification number provided in the Notice of Internet Availability.

Your proxy is revocable in accordance with the procedures set forth in the Proxy Statement. Please be advised that if you are not a record or beneficial owner of shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock on the Record Date, you are not entitled to vote and any proxies received from persons who are not record or beneficial owners of shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock on the Record Date will be disregarded.

| Louisville, Kentucky | By Order of the Board of Directors, |

| ___________ , 2024 | |

| Mark Archer | |

| Chief Financial Officer |

WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL

MEETING, WE ENCOURAGE YOU TO READ THE PROXY STATEMENT AND CAST YOUR PROXY VOTE PROMPTLY, EITHER ONLINE, OVER THE PHONE OR BY RETURNING

YOUR SIGNED PROXY CARD BY MAIL AS SOON AS POSSIBLE SO THAT YOUR SHARES MAY BE REPRESENTED AT THE SPECIAL MEETING.

TABLE OF CONTENTS

i

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS

In this proxy statement (“Proxy Statement”), LogicMark, Inc., a Nevada corporation, is referred to as “LogicMark,” the “Company,” “we,” “us” and “our.”

Information Concerning the Proxy Materials and the Special Meeting

Proxies are being solicited by our board of directors (the “Board”) for use at our Special Meeting of Stockholders (the “Special Meeting”) to be held at 11:00 a.m. (Eastern Time) on October 1, 2024 in the offices of Sullivan & Worcester LLP at 1251 Avenue of the Americas, 19th Floor, New York, NY 10020, and at any adjournment thereof. Your vote is very important. For this reason, our Board is requesting that you permit your shares of common stock, par value $0.0001 per share (the “Common Stock”), your shares of Series C Non-Convertible Voting Preferred Stock, par value $0.0001 per share (the “Series C Preferred Stock”), and/or your shares of Series F Convertible Preferred Stock, par value $0.0001 per share (the “Series F Preferred Stock”), to be represented at the Special Meeting by the proxies named on the proxy card. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Special Meeting. Please read it carefully.

The Notice of Internet Availability will be first mailed to stockholders on or about August ___, 2024. Voting materials, which will include this Proxy Statement and the proxy card, are available at http://www.viewproxy.com/LGMK/2024SM.

Only stockholders of record of our shares of Common Stock, Series C Preferred Stock and Series F Preferred Stock as of the close of business on August 5, 2024 (the “Record Date”) will be entitled to notice of, and to vote at, the Special Meeting. As of the Record Date, 4,412,812 shares of Common Stock were issued and outstanding, 10 shares of Series C Preferred Stock were issued and outstanding, held by one record holder, and 106,333 shares of Series F Preferred Stock were issued and outstanding, held by one record holder. Holders of shares of Common Stock and the holder of the shares Series C Preferred Stock are entitled to one (1) vote per share for each share of Common Stock and share of Series C Preferred Stock held by them, respectively. The holder of shares of Series F Preferred Stock will be entitled to vote on an as-converted to Common Stock basis with respect to 2,040 votes for the shares of Series F Preferred Stock held by such holder. Stockholders may vote in person or by proxy; however, granting a proxy does not in any way affect a stockholder’s right to attend the Special Meeting and vote in person. Any stockholder giving a proxy has the right to revoke that proxy by (i) filing a later-dated proxy or a written notice of revocation with us at our principal office at any time before the original proxy is exercised or (ii) attending the Special Meeting and voting in person.

Mark Archer is named as attorney-in-fact in the proxy. Mr. Archer is our Chief Financial Officer (“CFO”) and will vote all shares represented by properly executed proxies returned in time to be counted at the Special Meeting, as described below under “Voting Procedures and Vote Required.” Where a vote has been specified in the proxy with respect to the matters identified in the Notice of Internet Availability, the shares represented by the proxy will be voted in accordance with those voting specifications. If no voting instructions are indicated, your shares will be voted as recommended by our Board on all matters, and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote before the Special Meeting.

The stockholders will consider and vote upon (i) a proposal to approve, for purposes of Rule 5635(d) of The Nasdaq Stock Market LLC (“Nasdaq”), the issuance of 20% or more of our outstanding shares of Common Stock upon exercise of (a) the Company’s Series A common stock purchase warrants, (the “Series A Warrants”), and (b) the Company’s Series B common stock purchase warrants (the “Series B Warrants” and collectively with the Series A Warrants, the “Warrants”), issued by the Company to certain holders (each, a “Holder”) on August 5, 2024 (“Proposal No. 1”); (ii) a proposal to authorize the Board, for purposes of maintaining compliance with the minimum bid price requirement for continued listing on the Nasdaq Capital Market, as set forth under Nasdaq Rule 5550(a)(2), to amend the Company’s articles of incorporation, as then in effect (the “Charter”), to effect a reverse stock split of all of the outstanding shares of Common Stock by a ratio in the range of one-for-ten to one-for-twenty-five (the “Common Stock Reverse Stock Split”, and such proposal, “Proposal No. 2”); and (iii) a proposal to authorize the Board to amend the Charter by amending the Company’s Certificate of Designations, Preferences and Rights of Series C Non-Convertible Voting Preferred Stock, as amended, and then in effect (the “Series C Preferred Certificate of Designations”) to (a) effect a reverse stock split of all of the Company’s outstanding shares of Series C Preferred Stock by the same ratio that the Board selects for the Common Stock Reverse Stock Split (the “Series C Preferred Reverse Stock Split”) and (b) proportionally increase the stated value of the Series C Preferred Stock to reflect the ratio selected for the Series C Preferred Reverse Stock Split (collectively, “Proposal No. 3”). Stockholders also will consider and act upon such other business as may properly come before the Special Meeting.

1

Voting Procedures and Vote Required

Instructions regarding each method of voting are provided in the Notice of Internet Availability and stockholders can access such proxy materials and vote at www.viewproxy.com. If you desire to submit your vote by mail, you may request a paper proxy card at no charge at any time from (i) www.viewproxy.com, (ii) call 1-877-777-2857 or (iii) send an email to requests@viewproxy.com on or before ___, 2024. If you desire to submit your vote via internet or telephone, follow the instructions at www.viewproxy.com and use the stockholder identification number provided in the Notice of Internet Availability.

Mr. Archer will vote all shares represented by properly executed proxies returned in time to be counted at the Special Meeting. The presence, in person or by proxy, of at least one-third (1/3) of the issued and outstanding shares of Common Stock, Series C Preferred Stock and Series F Preferred Stock, in the aggregate, entitled to vote at the Special Meeting is necessary to establish a quorum for the transaction of business. Shares represented by proxies which contain an abstention and “broker non-vote” shares (described below) are counted as present for purposes of determining the presence of a quorum for the Special Meeting.

All properly executed proxies delivered pursuant to this solicitation and not revoked will be voted at the Special Meeting as specified in such proxies.

Vote Required for the Approval of the Issuance of All Shares of Common Stock Upon Exercise of the Warrants (Proposal No. 1).

Our Bylaws provide that, on all matters (other than the election of directors and except to the extent otherwise required by our Charter, Bylaws or applicable law), the affirmative vote of a majority of all votes cast by the holders of shares of stock entitled to vote will be required for approval. Accordingly, the affirmative vote of a majority of the votes cast by holders of the shares of Common Stock and Series C Preferred Stock, as well as the Series F Preferred Stock on an as-converted to Common Stock basis, in the aggregate, and entitled to vote on the matter, will be required to approve this proposal. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

Vote Required for Authorization of the Board to Amend the Charter to Effect a Reverse Stock Split of All Outstanding Shares of Common Stock by a Ratio in the Range of One-for-Ten to One-for-Twenty-Five (Proposal No. 2).

Nevada law and our Bylaws provide that a proposal to amend the Charter to effect a reverse stock split of all outstanding shares of Common Stock shall be determined by the affirmative vote of a majority of all votes cast by the holders of shares of stock entitled to vote. Accordingly, the affirmative vote of a majority of the votes cast by holders of the shares of Common Stock and Series C Preferred Stock, as well as the Series F Preferred Stock on an as-converted to Common Stock basis, in the aggregate, entitled to vote on the matter, will be required to approve this proposal. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

2

Vote Required for Authorization of the Board to Amend the Charter by Amending the Series C Preferred Certificate of Designations to (i) Effect a Reverse Stock Split of All Outstanding Shares of Series C Preferred Stock by the same ratio that the Board selects for the Common Stock Reverse Stock Split and (ii) Proportionally Increase the Stated Value of the Series C Preferred Stock to Reflect the Ratio Selected for the Series C Preferred Reverse Stock Split (collectively, Proposal No. 3).

Nevada law and our Bylaws provide that, on all matters (other than the election of directors and except to the extent otherwise required by our Charter, Bylaws or applicable law), the affirmative vote of a majority of all votes cast by the holders of the shares entitled to vote will be required for approval. Additionally, pursuant to the provisions of the Series C Preferred Certificate of Designations and the applicable provisions of Chapter 78 of the Nevada Revised Statutes, as amended (“NRS”), as long as the Series C Preferred Reverse Stock Split is implemented at the same ratio as the Common Stock Reverse Stock Split described in Proposal No. 2 and is conditioned upon our implementing the Common Stock Reverse Stock Split, the affirmative vote of a majority of the votes cast by holders of the shares of Common Stock and the Series C Preferred Stock, as well as the Series F Preferred Stock on an as-converted to Common Stock basis, in the aggregate, entitled to vote on the matter will be required to approve the Series C Preferred Reverse Stock Split.

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. Brokers that have not received voting instructions from their clients cannot vote on their clients’ behalf on “non-routine” proposals.

The vote on Proposal No. 1 is considered “non-routine” and the votes on Proposals No. 2 and No. 3 are considered “routine”.

Abstentions are counted as “shares present” at the Special Meeting for purposes of determining the presence of a quorum. Abstentions only have an effect on the outcome of any matter being voted on that requires a certain level of approval based on our total voting stock outstanding. Thus, abstentions will have no effect on any of the proposals.

Votes at the Special Meeting will be tabulated by one or more inspectors of election appointed by the Chief Financial Officer.

Stockholders will not be entitled to dissenter’s rights with respect to any proposal to be considered and voted on at the Special Meeting.

Delivery of Documents to Stockholders Sharing an Address

We will provide only one set of Special Meeting materials and other corporate mailings to stockholders who share a single address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of the Special Meeting proxy materials to a stockholder at a shared address to which a single copy of the Special Meeting materials was delivered. You may make such a written or oral request by sending a written notification stating (i) your name, (ii) your shared address and (iii) the address to which the Company should direct any additional copy of the Special Meeting proxy materials to the Company at Corporate Secretary, 2801 Diode Lane, Louisville, KY 40299, telephone: (502) 442-7911, email: legal@logicmark.com.

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of August 8, 2024, information regarding beneficial ownership of our capital stock by:

| ● | each person, or group of affiliated persons, known by us to beneficially own more than 5% of our outstanding voting securities; |

| ● | each of our named executive officers; |

| ● | each of our directors; and |

| ● | all of our named executive officers and directors as a group. |

The percentage ownership information shown in the table is based upon 4,412,812 shares of Common Stock, 10 shares of Series C Preferred Stock, and 106,333 shares of Series F Preferred outstanding as of August 8, 2024. Beneficial ownership is determined according to the rules of the Securities and Exchange Commission (the “SEC’) and generally means that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power of that security, including securities that are exercisable for shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock within sixty (60) days of August 8, 2024. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the holders named in the table below have sole voting and investment power with respect to all shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock shown that they beneficially own, subject to community property laws where applicable.

For purposes of computing the percentage of outstanding shares of our Common Stock, Series C Preferred Stock and Series F Preferred Stock held by each holder or group of holders named above, any shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock that such holder or holders has the right to acquire within sixty (60) days of August 8, 2024 is deemed to be outstanding, but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other holder. The inclusion herein of any shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock listed as beneficially owned does not constitute an admission of beneficial ownership. Unless otherwise identified, the address of each beneficial owner listed in the table below is c/o LogicMark, Inc., 2801 Diode Lane, Louisville, KY 40299.

4

| Shares Beneficially Owned | ||||||||||||||||||||||||||||

| Common Stock | Series C Preferred Stock | Series F Preferred Stock | % Total Voting | |||||||||||||||||||||||||

| Name of Beneficial Owner | Shares(1) | % (1) | Shares | % | Shares | % | Power(1) (2) | |||||||||||||||||||||

| Non-Director or Officer 5% Stockholders: | ||||||||||||||||||||||||||||

| Anson Investments Master Fund LP(3) | 446,260 | 9.99 | % | — | — | — | — | 9.99 | % | |||||||||||||||||||

| Alpha Capital Anstalt(4) | 193,770 | 4.29 | % | — | — | 106,333 | 100 | % | 4.29 | % | ||||||||||||||||||

| Giesecke+Devrient Mobile Security America, Inc.(5) | — | — | 10 | 100 | % | — | — | * | ||||||||||||||||||||

| Directors and Executive Officers: | ||||||||||||||||||||||||||||

| Chia-Lin Simmons, Chief Executive Officer and Director(6) | 153,222 | 3.47 | % | — | — | — | — | 3.47 | % | |||||||||||||||||||

| Mark Archer, Chief Financial Officer(7) | 50,297 | 1.14 | % | — | — | — | — | 1.14 | % | |||||||||||||||||||

| Robert A. Curtis, Director(8) | 59,498 | 1.34 | % | — | — | — | — | 1.34 | % | |||||||||||||||||||

| John Pettitt, Director(9) | 57,241 | 1.29 | % | — | — | — | — | 1.29 | % | |||||||||||||||||||

| Barbara Gutierrez, Director(10) | 57,014 | 1.28 | % | — | — | — | — | 1.28 | % | |||||||||||||||||||

| Carine Schneider, Director(11) | 38,904 | * | — | — | — | — | * | |||||||||||||||||||||

| Directors and Executive Officers as a Group (6 persons) | 416,176 | 9.17 | % | — | — | — | — | 9.17 | % | |||||||||||||||||||

| * | Less than 1% |

| (1) | The number of shares owned and the beneficial ownership percentages set forth in these columns are based on 4,412,812 shares of Common Stock issued and outstanding as of August 8, 2024. Shares of Common Stock issuable pursuant to options, preferred stock or warrants currently exercisable or exercisable within sixty (60) days are considered outstanding for purposes of computing the percentage beneficial ownership of the holder of such options, preferred stock or warrants; they are not considered outstanding for purposes of computing the percentage of any other stockholder. Exercises of certain warrants and conversions of certain shares of preferred stock held by certain stockholders listed above are subject to certain beneficial ownership limitations, which provide that a holder of such securities will not have the right to exercise or convert any portion of such securities, as applicable, if such holder, together with such holder’s affiliates, would beneficially own in excess of 4.99% or 9.99%, as applicable, of the number of shares of Common Stock outstanding immediately after giving effect to such exercise, provided that upon at least 61 days’ prior notice to the Company, such holder may increase or decrease such limitation up to a maximum of 9.99% of the number of shares of Common Stock outstanding. As a result, the number of shares of Common Stock reflected in these columns as beneficially owned by the applicable stockholders includes (a) any outstanding shares of Common Stock held by such stockholder, and (b) if any, the securities convertible into or exercisable for shares of Common Stock that may be held by such stockholder, in each case which such stockholder has the right to acquire as of August 8, 2024 and without such holder or any of such holder’s affiliates beneficially owning more than 4.99% or 9.99%, as applicable, of the number of outstanding shares of Common Stock as of August 8, 2024. |

| (2) | Percentage of total voting power represents voting power with respect to all shares of Common Stock, Series C Preferred Stock and Series F Preferred Stock. The holders of our Common Stock and Series C Preferred Stock are entitled to one vote per share. The holders of our Series F Preferred Stock vote on as as-converted to Common Stock basis. |

| (3) |

Beneficial ownership includes (i) 392,000 shares of Common Stock and (ii) an aggregate of 54,260 shares of Common Stock issuable upon exercise of common stock purchase warrants and pre-funded common stock purchase warrants of the Company held by such holder in any combination, which are in each case subject to 9.99% beneficial ownership limitation provisions included in such warrants and pre-funded warrants, but excludes an aggregate of (i) 2,176,058 shares of Common Stock issuable upon exercise of such warrants and pre-funded warrants of the Company held as a result of the triggering of such 4.99% and 9.99% beneficial ownership limitation provisions, as applicable (other than the Warrants held by such holder), and (ii) an aggregate of 4,770,542 shares of Common Stock issuable upon exercise of the Warrants, which will not be exercisable until Stockholder Approval is obtained.

Anson Advisors Inc. (“AAI”) and Anson Funds Management LP (“AFM”, and together with AAI, “Anson”) are the co-investment advisers of Anson Investments Master Fund LP (“AIMF”) and Anson East Master Fund LP (“AEMF”). Anson holds voting and dispositive power over the securities held by AIMF and AEMF. Bruce Winson is the managing member of Anson Management GP LLC, which is the general partner of AFM. Moez Kassam and Amin Nathoo are directors of AAI. Mr. Winson, Mr. Kassam and Mr. Nathoo each disclaim beneficial ownership of these securities except to the extent of their pecuniary interest therein. The principal business address of the AIMF and AEMF is Walkers Corporate Limited, Cayman Corporate Centre, 27 Hospital Road, George Town, Grand Cayman KY1-9008, Cayman Islands. |

5

| (4) | Beneficial ownership includes an aggregate of 193,770 shares of Common Stock issuable upon exercise of all such warrants of the Company and shares of Series F Preferred Stock held by such holder, irrespective of the beneficial ownership limitation provisions in such warrants and shares of Series F Preferred Stock. Konrad Ackermann has voting and investment control over the securities held by Alpha Capital Anstalt. The principal business address of Alpha Capital Anstalt is Altenbach 8 -9490 Vaduz, Principality of Liechtenstein. |

| (5) | Giesecke+Devrient Mobile Security America, Inc. (“G&D”) is the sole holder of our Series C Preferred Stock and thus has 100% of the voting power of our outstanding shares of Series C Preferred Stock, which have the same voting rights as our shares of Common Stock (one vote per share). The address for G&D is 45925 Horseshoe Drive, Dulles, VA 20166. |

| (6) | Beneficial ownership represents (i) 13,328 shares of restricted stock granted outside the 2013 LTIP and the 2017 SIP, which vest over a period of 48 months, with one quarter on the anniversary of the grant and 1/16 each subsequent quarter until all shares have vested, so long as Ms. Simmons remains in the service of the Company, (ii) 10,208 shares of restricted stock granted under the 2013 LTIP, which shares vest over a period of three (3) years commencing on January 3, 2022, with 1,702 shares having vested on July 3, 2022, and thereafter, 850 shares to vest on the first day of each subsequent quarter until the entire award has vested, so long as Ms. Simmons remains in the service of the Company for each such quarter, (iii) 62,000 shares of restricted stock granted pursuant to the Company’s 2023 Stock Incentive Plan (“2023 SIP”), which shares vest over a period commencing on July 3, 2023, with 1/4 of such shares to vest on July 3, 2024, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested, so long as Ms. Simmons remains in the service of the Company for each such quarter, (iv) 46,200 shares of restricted stock granted pursuant to the Company’s 2023 SIP, which shares vest over a period commencing on April 3, 2024, with 1/4 of such shares to vest on April 3, 2025, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested, so long as Ms. Simmons remains in the service of the Company for each such quarter, and (v) 21,486 shares of Common Stock purchased by Ms. Simmons in connection with a best efforts public offering by the Company, which closed on August 5, 2024 (the “Offering”). Beneficial ownership excludes an aggregate of 85,944 shares of Common Stock issuable upon exercise of the Warrants purchased by Ms. Simmons in the Offering, which will not be exercisable until Stockholder Approval is obtained. |

| (7) | Beneficial ownership represents (i) 6,470 shares of restricted stock granted outside the 2013 LTIP and the 2017 SIP, which vest over a period of 48 months, with one quarter on the anniversary of the grant and 1/16 each subsequent quarter until all shares have vested, so long as Mr. Archer remains in the service of the Company; (ii) 20,900 shares of restricted stock granted pursuant to the 2023 SIP, which vest commencing on July 3, 2023, with 1/4 of such shares to vest on July 3, 2024, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested, so long as Mr. Archer remains in the service of the Company for each such quarter, and (iii) and (v) 21,486 shares of Common Stock purchased by Mr. Archer in connection with the Offering. In addition, FLG Partners, LLC (“FLG Partners”), of which Mr. Archer is a partner, was granted (i) 341 restricted shares of Common Stock outside the 2013 LTIP and the 2017 SIP, which vested one quarter on July 15, 2022, with subsequent vesting at 6.25% for each three-month period thereafter, and (ii) 1,100 restricted shares of Common Stock, pursuant to the 2023 SIP, which vest commencing on July 3, 2023, with 1/4 of such shares to vest on July 3, 2024, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested. Mr. Archer disclaims beneficial ownership of such shares of Common Stock granted to FLG Partners. Beneficial ownership excludes an aggregate of 85,944 shares of Common Stock issuable upon exercise of the Warrants purchased by Mr. Archer in the Offering, which will not be exercisable until Stockholder Approval is obtained. |

| (8) | Beneficial ownership includes stock options exercisable for 36,630 shares of Common Stock at a weighted exercise price of $4.79 per share and 21,486 shares of Common Stock purchased by Mr. Curtis in the Offering, but excludes an aggregate of 85,944 shares of Common Stock issuable upon exercise of the Warrants purchased by Mr. Curtis in this offering, which will not be exercisable until Stockholder Approval is obtained. |

| (9) | Beneficial ownership includes stock options exercisable for 35,755 shares of Common Stock at a weighted average exercise price of $2.54 per share and 21,486 shares of Common Stock purchased by Mr. Pettitt in the Offering, but excludes an aggregate of 85,944 shares of Common Stock issuable upon exercise of the Warrants purchased by Mr. Pettitt in the Offering, which will not be exercisable until Stockholder Approval is obtained. |

| (10) | Beneficial ownership includes stock options exercisable for 35,528 shares of Common Stock at a weighted average exercise price of $2.28 per share and 21,486 shares of Common Stock purchased by Ms. Gutierrez in the Offering, but excludes an aggregate of 85,944 shares of Common Stock issuable upon exercise of the Warrants purchased by Ms. Gutierrez in the Offering, which will not be exercisable until Stockholder Approval is obtained. |

| (11) | Beneficial ownership includes stock options exercisable for 16,918 shares of Common Stock at a weighted average exercise price of $1.02 per share and 21,486 shares of Common Stock purchased by Ms. Schneider in the Offering, but excludes an aggregate of 85,944 shares of Common Stock issuable upon exercise of the Warrants purchased by Ms. Schneider in the Offering, which will not be exercisable until Stockholder Approval is obtained. |

6

APPROVAL OF THE ISSUANCE OF SHARES OF COMMON STOCK UPON EXERCISE OF THE WARRANTS

(Proposal No. 1)

The Company is seeking stockholder approval, for purposes of complying with Nasdaq Rule 5635(d), for the issuance of up to 77,339,226 shares of Common Stock upon exercise of the Warrants, consisting of up to 38,669,613 shares of Common Stock issuable upon exercise of the Series A Warrants, and up to 38,669,613 shares of Common Stock issuable upon exercise of the Series B Warrants, in each case, issued in a public financing that closed on August 5, 2024.

The information set forth in this proposal is qualified in its entirety by reference to the full text of the form of the Series A Warrant and the form of Series B Warrant, attached as Exhibits 4.1 and 4.2., respectively, to the Company’s Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on August 5, 2024 (the “Form 8-K”). Stockholders are urged to carefully read these documents.

Background and Description of the Warrants

On August 5, 2024, the Company, in connection with the best efforts public Offering, sold an aggregate of (x) 1,449,916 units (the “Units”) at an offering price of $0.4654 per Unit, consisting of (i) 1,449,916 shares (the “Shares”) of Common Stock, (ii) 1,449,916 Series A Warrants, each exercisable for one share of Common Stock, and (iii) 1,449,916 Series B Warrants, each exercisable for one share of Common Stock; and (y) 8,220,084 pre-funded units of the Company (the “Pre-Funded Units”) at an offering price of $0.4644 per Pre-Funded Unit, consisting of (i) 8,220,084 pre-funded common stock purchase warrants exercisable at $0.001 per share, (the “Pre-Funded Warrants”), (ii) 8,220,084 Series A Warrants and (iii) 8,220,084 Series B Warrants, pursuant to the Registration Statement (as defined below) and a securities purchase agreement, dated August 2, 2024 (the “Securities Purchase Agreement”), between the Company and each of the purchasers signatory thereto (the “Purchasers”). The Shares and Warrants included in the Units, and the Pre-Funded Warrants and Warrants included in the Pre-Funded Units, were immediately separable from one another and were issued separately in the Offering.

The Warrants included in the Units and Pre-Funded Units, as well as all shares of Common Stock issuable upon exercise of such Warrants, were offered and sold to investors in the Offering and registered pursuant to the Company’s registration statement on Form S-1, as amended (File No. 333-279133) (the “Registration Statement”), filed by the Company with the SEC under the Securities Act of 1933, as amended, which became effective on August 1, 2024.

The Warrants are exercisable at a per share price of $0.4654 on or after the date on which stockholder approval is obtained by the Company in order to approve the issuance of all shares of Common Stock (the “Warrant Shares”) issuable upon exercise of the Warrants, solely to the extent required under Nasdaq Rule 5635(b). The Series A Warrants expire on the fifth anniversary of their issuance and the Series B Warrants expire two and one-half years after their issuance. The Series B Warrants include an “alternative cashless exercise” provision pursuant to which the holders thereof have the option not to pay a cash purchase price upon exercise, but instead receive upon such exercise four (4) shares of Common Stock for every Series B Warrant exercised. The exercise price of each of the Warrants is subject to a one-time adjustment upon the next reverse stock split of the Common Stock after each such Warrant’s issuance, such that in the event that the lowest VWAP (as defined in the Warrants) during the five trading day period before and after such reverse stock split is lower than the exercise price of the Warrants then in effect, the exercise price of the Warrants will be reduced to such lowest price during such 11-trading day period, subject to a floor price of $0.0931 per share. Further, upon such an exercise price adjustment, the number of Warrant Shares issuable upon exercise of such Warrants will increase such that the aggregate exercise price payable under the Warrants, after taking into account such decreased exercise price, will equal the aggregate exercise price of such Warrants on the date of their issuance; however in the event that such adjustment would result in an increase in such exercise price, the exercise price of the Warrants will be reduced to such lowest price during the five trading day period prior to and ending on the date of such exercise.

In addition, (i) in the event that the Company sells or enters into an agreement to sell any shares of Common Stock or Common Stock Equivalents (as defined in the Series A Warrants), at an effective price per share below the exercise price of the Series A Warrant then in effect, the exercise price of the Series A Warrants will be reduced to such effective price, subject to a floor price of $0.0931 per share, and upon such reduction, the number of Warrant Shares issuable upon exercise of such Series A Warrant will increase such that the aggregate exercise price payable under the Series A Warrant, after taking into account such reduced exercise price, will equal the aggregate exercise price of such Series A Warrant on such warrant’s date of issuance, and (ii) the Series A Warrants contain a one-time exercise price adjustment provision whereby such exercise price will be adjusted to the greater of (i) the floor price of $0.0931 per share and (ii) the lowest VWAP during the five trading day period immediately preceding the thirtieth (30th) trading day immediately following the issuance date of the Series A Warrant, and the number of Warrant Shares issuable under the Series A Warrant will increase such that the aggregate exercise price payable under the Series A Warrant, after taking into account such decreased exercise price, equals the aggregate exercise price on the date of issuance of such warrant.

Each of the Series A Warrants and the Series B Warrants were also issued in accordance with a warrant agency agreement, dated August 5, 2024, between the Company and Nevada Agency and Transfer Company, the form of which is filed as Exhibit 10.2 to the Form 8-K.

7

The Board has determined that the Warrants, and the Company’s ability to issue Common Stock upon exercise of the Warrants, are in the best interests of the Company and its stockholders because the sale of the Warrants provided the Company with significant capital. Accordingly, we are seeking stockholder approval of this proposal in order to comply with the terms of the Securities Purchase Agreement and Nasdaq Rule 5635(d), to the extent applicable.

Nasdaq Rule 5635(d) requires stockholder approval in connection with a transaction, other than a public offering, involving the sale or issuance by the issuer of Common Stock (or securities convertible into or exchangeable for Common Stock) equal to 20% or more of the Common Stock or 20% or more of the voting power of such company outstanding before the issuance for a price that is less than the lower of: (i) the closing price of the Common Stock immediately preceding the signing of the binding agreement for the issuance of such securities and (ii) the average closing price of the Common Stock for the five trading days immediately preceding the signing of the binding agreement for the issuance of such securities.

Therefore, the Company is seeking stockholder approval to issue more than 20% of the Company’s outstanding Common Stock pursuant to the Warrants in compliance with Nasdaq Rule 5635(d).

Potential Consequences if this Proposal is Not Approved

If the Company does not obtain Stockholder Approval at the Special Meeting, the Company is required pursuant to the terms of the Warrants to hold a subsequent annual or special meeting every one hundred and eighty (180) days thereafter to seek Stockholder Approval until the earlier of the date Stockholder Approval is obtained or the Warrants are no longer outstanding. If the stockholders do not approve this proposal at the Special Meeting, the Company will not be able to issue shares of Common Stock to the investors upon the receipt of a notice of exercise of the Warrants, thereby requiring the Company to hold another meeting seeking stockholder approval, costing the Company time and money. Accordingly, if stockholder approval of this proposal is not obtained, the Company may need to seek alternative sources of financing, which financing may not be available on advantageous terms, or at all, and which may result in the incurrence of additional transaction expenses. The Company’s ability to successfully implement its business plans and ultimately generate value for its stockholders is dependent on its ability to maximize capital raising opportunities.

Potential Adverse Effects of this Proposal

Each share of Common Stock that would be issuable upon exercise of the Warrants would have the same rights and privileges as each currently outstanding share of Common Stock. The issuance to the investors of the Warrants or the Common Stock upon exercise of the Warrants will not affect the rights of the holders of outstanding shares of Common Stock, but such issuances will have a dilutive effect on the Company’s existing stockholders, including the voting power and economic rights of existing stockholders, and may result in a decline in the Company’s stock price or greater price volatility. Further, due to the fact that the Warrants include certain mechanisms such as (i) an alternative cashless exercise provision in the Series B Warrants and (ii) certain anti-dilution provisions and reverse stock split provisions (with proportional share adjustment features), stockholders may experience an even greater dilutive effect.

Vote Required and Recommendation of Board

Our Bylaws provide that all matters (other than the election of directors and except to the extent otherwise required by our Charter, Bylaws or applicable law) shall be determined by a majority of the votes cast and entitled to vote thereon. Accordingly, the affirmative vote of a majority of all votes cast by the holders of the shares of Common Stock and Series C Preferred Stock, as well as the Series F Preferred Stock on an as-converted to Common Stock basis, in the aggregate, and entitled to vote on the matter, will be required to approve this proposal. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

THE BOARD UNANIMOUSLY

RECOMMENDS A VOTE TO APPROVE THE ISSUANCE OF ALL OF THE SHARES

OF COMMON STOCK ISSUABLE UPON EXERCISE OF THE WARRANTS.

8

BOARD TO AMEND THE

CHARTER TO EFFECT A REVERSE STOCK SPLIT OF ALL

OUTSTANDING SHARES OF COMMON STOCK

(Proposal No. 2)

Our Board has unanimously approved a proposal to amend the Charter to effect a reverse stock split of all of our outstanding shares of Common Stock by a ratio in the range of one-for-ten to one-for-twenty-five, to be determined in the Board’s sole discretion (the “Common Stock Reverse Stock Split”), and in any event, before the Company’s 2025 Annual Meeting of Stockholders. The proposal provides that if the Common Stock Reverse Stock Split is approved by stockholders, the Board will implement the Common Stock Reverse Stock Split, as soon as practicable or as otherwise required after such approval, for the purposes of (i) maintaining the listing of our Common Stock on the Nasdaq Capital Market, and (ii) to assure that there are a sufficient number of authorized shares of Common Stock available to reserve for issuance upon exercise and conversion of all outstanding warrants and convertible securities.

As previously disclosed by the Company’s Current Report on Form 8-K filed with the SEC on May 10, 2024, on May 8, 2024, the Company received a written notification (the “Nasdaq Notice”) from the Listing Qualifications Department of Nasdaq notifying the Company that it was not in compliance with the minimum bid price requirement for continued listing on the Nasdaq Capital Market, as set forth under Nasdaq Rule 5550(a)(2) (the “Minimum Bid Price Requirement”), because the closing bid price of the Common Stock was below $1.00 per share for the previous thirty (30) consecutive business days. Pursuant to Nasdaq Rule 5810(c)(3)(A), the Company has been granted 180 calendar days from the date of the Nasdaq Notice, or until November 4, 2024 (the “Compliance Period”), to regain compliance with the Minimum Bid Price Requirement. If at any time during the Compliance Period, the bid price of the Common Stock closes at or above $1.00 per share for a minimum of ten (10) consecutive business days, Nasdaq will provide the Company with written confirmation of compliance with the Minimum Bid Price Requirement and the matter will be closed.

The Board has elected to approve the Common Stock Reverse Stock Split and this Proposal No. 2 in order to allow the Company to regain compliance with the Minimum Bid Price Requirement and enable the Company to reserve a sufficient number of authorized shares of Common Stock for issuance upon exercise or conversion of all outstanding warrants and other convertible securities.

The exact ratio of the Common Stock Reverse Stock Split shall be set at a whole number within the above range as determined by our Board in its sole discretion. Our Board believes that the availability of alternative reverse stock split ratios will provide it with the flexibility to implement the Common Stock Reverse Stock Split in a manner designed to maximize the anticipated benefits for the Company and its stockholders. In determining how to implement the Common Stock Reverse Stock Split following the receipt of stockholder approval, our Board may consider, among other things, factors such as:

| ● | the historical trading price and trading volume of our Common Stock; | |

| ● | the then prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Common Stock Reverse Stock Split on the trading market for our Common Stock; | |

| ● | our ability to have our shares of Common Stock remain listed on the Nasdaq Capital Market; | |

| ● | the number of shares of Common Stock needed to reserve for issuance upon exercise and conversion of all outstanding warrants and convertible securities; | |

| ● | the anticipated impact of the Common Stock Reverse Stock Split on our ability to raise additional financing; and | |

| ● | prevailing general market and economic conditions. |

9

The Common Stock Reverse Stock Split will become effective upon filing of an amendment or certificate to our Charter”) with the Secretary of State of the State of Nevada, if applicable and required pursuant to NRS 78.2055. The amendment or certificate filed thereby will set forth the number of shares of Common Stock to be combined into one share of our Common Stock, within the limits set forth in this proposal. Except for adjustments that may result from the treatment of fractional shares as described below, each holder of our shares of Common Stock will hold the same percentage of our outstanding Common Stock immediately following the Common Stock Reverse Stock Split as such stockholder holds immediately prior to the Common Stock Reverse Stock Split.

The text of the form of amendment or certificate to the Charter, which would be filed with the Secretary of State of the State of Nevada to effect the Common Stock Reverse Stock Split, if applicable and required pursuant to NRS 78.2055, is substantially as set forth in Appendix A to this Proxy Statement. The text of such form of amendment or certificate accompanying this Proxy Statement is, however, subject to modification to reflect the exact ratio for the Common Stock Reverse Stock Split and any changes that may be required by the office of the Secretary of State of the State of Nevada, or that the Board may determine to be necessary or advisable ultimately to comply with applicable law and to effect the Common Stock Reverse Stock Split.

Our Board believes that approval of the amendment to the Charter to effect the Common Stock Reverse Stock Split is in the best interests of the Company and our stockholders and has unanimously recommended that such proposal be presented to our stockholders for approval.

Board Requirement to Implement the Common Stock Reverse Stock Split

If this Proposal No. 2 and the Common Stock Reverse Stock Split is approved, the Common Stock Reverse Stock Split will be effected as soon as practicable or otherwise required after approved (with an exchange ratio determined by our Board as described above) in order (i) to maintain the listing of our Common Stock on the Nasdaq Capital Market, and (ii) to assure that there are a sufficient number of authorized shares of Common Stock available to reserve for issuance upon exercise and conversion of all outstanding warrants and convertible securities, and that it is also in the best interests of the Company and its stockholders. Such determination shall be based upon certain factors, including, but not limited to, the historical trading price and trading volume of our Common Stock, the then prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Common Stock Reverse Stock Split on the trading market for our Common Stock, our ability to have our shares of Common Stock remain listed on the Nasdaq Capital Market, the number of authorized and unissued shares of Common Stock available, the anticipated impact of the Common Stock Reverse Stock Split on our ability to raise additional financing, and prevailing general market and economic conditions. No further action on the part of stockholders would be required to either implement or not implement the Common Stock Reverse Stock Split. If our stockholders approve the proposal, we would communicate to the public, prior to the Effective Date (as defined below), additional details regarding the Common Stock Reverse Stock Split, including the specific ratio selected by the Board. If the Board does not implement the Common Stock Reverse Stock Split prior to the Company’s 2025 Annual Meeting of Stockholders, the authority granted in this proposal to implement the Common Stock Reverse Stock Split will terminate. The Board is requesting authorization to implement the Common Stock Reverse Stock Split up until such time in the event the Company needs to utilize this Proposal No. 2.

Effective Date

If the proposed amendment to the Charter to give effect to the Common Stock Reverse Stock Split is approved at the Special Meeting, subject to the conditions set out in this Proposal No. 2, then the Common Stock Reverse Stock Split will become effective, as of 5:30 p.m. Eastern Time on the effective date of the certificate or amendment to our Charter filed with the office of the Secretary of State of the State of Nevada, as applicable and required pursuant to NRS 78.2055, which we would expect to be the date of filing (the “Effective Date”). Except as explained below with respect to fractional shares, each issued share of Common Stock immediately prior to the Effective Date will automatically be changed, as of the Effective Date, into a fraction of a share of Common Stock, based on the exchange ratio within the approved range determined by the Board.

Purposes of the Reverse Stock Split

The primary purpose for the Common Stock Reverse Stock Split is based on the Board’s belief that the Common Stock Reverse Stock Split will be necessary to maintain the listing of our Common Stock on the Nasdaq Capital Market. The Company also needs to assure that there are a sufficient number of authorized shares available for any future issuance of Common Stock upon the exercise or conversion of its outstanding warrants and convertible securities. The Common Stock Reverse Stock Split would not change the number of authorized shares of our Common Stock or the par value of the Common Stock. The Board believes that the Common Stock Reverse Stock Split could also improve the marketability and liquidity of the Common Stock.

10

Maintain our listing on the Nasdaq Capital Market. Our Common Stock is traded on the Nasdaq Capital Market. On May 8, 2024, the Company received notice from Nasdaq that it no longer satisfied the Minimum Bid Price Requirement and had 180 calendar days from the date therein to regain compliance. The Board has considered the potential harm to the Company and its stockholders should Nasdaq delist our Common Stock from the Nasdaq Capital Market. Delisting our Common Stock could adversely affect the liquidity of our Common Stock because alternatives, such as the OTC Bulletin Board, OTC Markets, and the Pink Sheets, are generally considered to be less efficient markets. An investor likely would find it less convenient to sell, or to obtain accurate quotations in seeking to buy our Common Stock on an over-the-counter market. Many investors likely would not buy or sell our Common Stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange or other reasons. The Board believes that the Reverse Stock Split is an effective means for us to maintain compliance with the rules of Nasdaq and to avoid, or at least mitigate, the likely adverse consequences of our Common Stock being delisted from the Nasdaq Capital Market by producing the immediate effect of increasing the bid price of our Common Stock.

Improve the marketability and liquidity of the Common Stock. If this proposal is approved by the stockholders at the Special Meeting and the Common Stock Reverse Stock Split is implemented, we also believe that the increased market price of our Common Stock expected as a result of implementing the Common Stock Reverse Stock Split will improve the marketability and liquidity of our Common Stock and will encourage interest and trading in our Common Stock. The Common Stock Reverse Stock Split could allow a broader range of institutions to invest in our Common Stock (namely, funds that are prohibited from buying stocks whose price is below a certain threshold), potentially increasing the liquidity of our Common Stock. The Common Stock Reverse Stock Split could also help increase analyst and broker interest in our stock as their policies can discourage them from following or recommending companies with low stock prices. Because of the trading volatility often associated with low-priced stocks, many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Additionally, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of our Common Stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. It should be noted, however, that the liquidity of our Common Stock may in fact be adversely affected by the proposed Common Stock Reverse Stock Split given the reduced number of shares of Common Stock that would be outstanding after the Common Stock Reverse Stock Split.

For the above reasons, we believe that will help us regain and maintain compliance with the Nasdaq listing requirements and, as a result, could also improve the marketability and liquidity of our Common Stock, is in the best interests of the Company and our stockholders.

Risks of the Common Stock Reverse Stock Split

We cannot assure you that the proposed Common Stock Reverse Stock Split will increase our stock price and have the desired effect of maintaining compliance with the rules of Nasdaq. The Board expects that the Common Stock Reverse Stock Split of our Common Stock will increase the market price of our Common Stock so that we are able to regain and maintain compliance with the Minimum Bid Price Requirement. However, the effect of the Common Stock Reverse Stock Split upon the market price of our Common Stock cannot be predicted with any certainty, and the history of similar reverse stock splits for companies in like circumstances is varied.

11

It is possible that the per share price of our Common Stock after the Common Stock Reverse Stock Split will not rise in proportion to the reduction in the number of shares of our Common Stock outstanding resulting from the Common Stock Reverse Stock Split, and the market price per post-Common Stock Reverse Stock Split share may not exceed or remain in excess of the $1.00 minimum bid price for a sustained period of time, and the Common Stock Reverse Stock Split may not result in a per share price that would attract brokers and investors who do not trade in lower priced stocks. Even if we effect the Common Stock Reverse Stock Split, the market price of our Common Stock may decrease due to factors unrelated to the Common Stock Reverse Stock Split. In any case, the market price of our Common Stock may also be based on other factors which may be unrelated to the number of shares outstanding, including our future performance. If the Common Stock Reverse Stock Split is consummated and the trading price of the Common Stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Common Stock Reverse Stock Split. Even if the market price per post-Common Stock Reverse Stock Split share of our Common Stock remains in excess of $1.00 per share, we may be delisted due to a failure to meet other continued listing requirements, including Nasdaq requirements related to the minimum stockholders’ equity, the minimum number of shares that must be in the public float, the minimum market value of the public float and the minimum number of round lot holders.

The Common Stock Reverse Stock Split may decrease the liquidity of our Common Stock. The liquidity of our Common Stock may be harmed by the Common Stock Reverse Stock Split given the reduced number of shares of Common Stock that would be outstanding after the Common Stock Reverse Stock Split, particularly if the stock price does not increase as a result of the Common Stock Reverse Stock Split. In addition, investors might consider the increased proportion of unissued authorized shares of Common Stock to issued shares to have an anti-takeover effect under certain circumstances, because the proportion allows for dilutive issuances which could prevent certain stockholders from changing the composition of the Board or render tender offers for a combination with another entity more difficult to successfully complete. The Board does not intend for the Common Stock Reverse Stock Split to have any anti-takeover effects.

The Common Stock Reverse Stock Split may increase the dilutive impact of the Warrants outlined in Proposal No. 1. Pursuant to the terms of the Series A Warrant and Series B Warrant, upon the implementation of the Common Stock Reverse Stock Split, the exercise price of each of the Warrants may be subject to a one-time adjustment such that in the event that the lowest VWAP (as defined in the Warrants) during the five trading day period before and after such reverse stock split is lower than the exercise price of the Warrants then in effect, the exercise price of the Warrants will be reduced to such lowest price during such 11-trading day period, subject to a floor price. Further, upon such an exercise price adjustment, the number of shares issuable upon exercise of the Warrants will increase such that the aggregate exercise price payable under the Warrants, after taking into account such decreased exercise price, will equal the aggregate exercise price of such Warrants on the date of their issuance; provided that in the event that such adjustment would result in an increase in such exercise price, the exercise price of the Warrants will be reduced to such lowest price during the five trading day period prior to and ending on the date of such exercise. Accordingly, the Common Stock Reverse Stock Split, if implemented, may increase the dilutive impact of the Warrants outlined in Proposal No 1.

Principal Effects of the Common Stock Reverse Stock Split

Common Stock. If this proposal is approved by the stockholders at the Special Meeting and the Common Stock Reverse Stock Split is implemented, subject to the conditions set out in this Proposal No. 2, the Company will file a certificate of amendment to the Charter with the Secretary of State of the State of Nevada, if applicable and required pursuant to NRS 78.2055. Except for adjustments that may result from the treatment of fractional shares as described below, each issued share of Common Stock immediately prior to the Effective Date will automatically be changed, as of the Effective Date, into a fraction of a share of Common Stock based on the exchange ratio within the approved range determined by the Board. In addition, proportional adjustments will be made to the maximum number of shares of Common Stock issuable under, and other terms of, (i) our stock plans, and (ii) the number of shares of Common Stock issuable under, and the exercise price of, our outstanding preferred stock, options and warrants.

12

Except for adjustments that may result from the treatment of fractional shares of Common Stock as described below, because the Common Stock Reverse Stock Split would apply to all issued shares of our Common Stock, and assuming Proposal No. 3 is approved by the Company’s stockholders and the Board implements the Series C Preferred Reverse Stock Split at the same ratio that the Board sets for the Common Stock Reverse Stock Split, as described in Proposal No. 3, the Common Stock Reverse Stock Split would not alter the relative rights and preferences of our existing stockholders nor affect any stockholder’s proportionate equity interest in the Company. For example, a holder of two percent (2%) of the voting power of the outstanding shares of our Common Stock and Series C Preferred Stock, in the aggregate, immediately prior to the effectiveness of the Common Stock Reverse Stock Split will generally continue to hold two percent (2%) of the voting power of the outstanding shares of our Common Stock and Series C Preferred Stock, in the aggregate, immediately after the Common Stock Reverse Stock Split. Moreover, the number of stockholders of record of the Company’s Common Stock and Series C Preferred Stock will not be affected by the Common Stock Reverse Stock Split. The Common Stock Reverse Stock Split would not result in a change to the number of authorized shares of our Common Stock or the par value of the Common Stock. The Common Stock Reverse Stock Split will have the effect of creating additional unreserved shares of our authorized Common Stock. Although at present we have no current arrangements or understandings providing for the issuance of the additional shares of Common Stock that would be made available for issuance upon effectiveness of the Common Stock Reverse Stock Split, other than those shares needed to satisfy the exercise of the Company’s outstanding warrants, preferred stock and options, these additional shares of Common Stock may be used by us for various purposes in the future without further stockholder approval, including, among other things:

| ● | raising capital to fund our operations and to continue as a going concern; |

| ● | establishing strategic relationships with other companies; | |

| ● | providing equity incentives to our employees, officers or directors; and | |

| ● | expanding our business or product lines through the acquisition of other businesses or products. |

While the Common Stock Reverse Stock Split will make additional shares of Common Stock available for the Company to use in connection with the foregoing, the primary purpose of the Common Stock Reverse Stock Split is to increase our stock price in order to regain and maintain compliance with the Minimum Bid Price Requirement. In addition, the additional shares of Common Stock available for the Company to use in connection with the foregoing, will also provide for a sufficient number of authorized shares of Common Stock available for any future issuance of Common Stock upon the exercise of the Company’s outstanding warrants, which will be considered in determining the ratio of the Common Stock Reverse Stock Split.

Effect on Employee Plans, Options, Restricted Stock Awards and Convertible or Exchangeable Securities. Pursuant to the terms of the 2013 Long Term Incentive Plan and the 2017 Stock Incentive Plan (collectively, the “Plans”), the Board or a committee thereof, as applicable, will adjust the number of shares of Common Stock available for future grant under the Plans, the number of shares of Common Stock underlying outstanding awards, the exercise price per share of outstanding stock options, and other terms of outstanding awards issued pursuant to the Plans to equitably reflect the effects of the Common Stock Reverse Stock Split. Based upon the Common Stock Reverse Stock Split ratio determined by the Board, proportionate adjustments are also generally required to be made to the per share exercise or conversion prices, as applicable, and the number of shares of Common Stock issuable upon the exercise or conversion, as applicable, of outstanding options, preferred stock and warrants, and any other convertible or exchangeable securities that may entitle the holders thereof to purchase, exchange for, or convert into, shares of Common Stock. This would result in approximately the same aggregate price being required to be paid under such options, preferred stock, warrants and other then outstanding convertible or exchangeable securities upon exercise or conversion, as applicable, and approximately the same value of shares of Common Stock being delivered upon such exercise, exchange or conversion, immediately following the Common Stock Reverse Stock Split as was the case immediately preceding the Common Stock Reverse Stock Split. The number of shares of Common Stock subject to restricted stock awards and restricted stock units will be similarly adjusted, subject to our treatment of fractional shares of Common Stock. The number of shares of Common Stock reserved for issuance pursuant to these securities and our Plans will be adjusted proportionately based upon the Common Stock Reverse Stock Split ratio determined by the Board, subject to our treatment of fractional shares of Common Stock.

Listing. Our shares of Common Stock currently trade on the Nasdaq Capital Market. The Common Stock Reverse Stock Split will directly affect the listing of our Common Stock on the Nasdaq Capital Market, and we believe that the Common Stock Reverse Stock Split could potentially increase our stock price, facilitating compliance with the Minimum Bid Price Requirement. Following the Common Stock Reverse Stock Split, we intend for our Common Stock to continue to be listed on the Nasdaq Capital Market under the symbol “LGMK”, subject to our ability to continue to comply with Nasdaq rules, although our Common Stock would have a new committee on uniform securities identification procedures (“CUSIP”) number, a number used to identify our Common Stock.

“Public Company” Status. Our Common Stock is currently registered under Section 12(b) and 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and we are subject to the “public company” periodic reporting and other requirements of the Exchange Act. The proposed Common Stock Reverse Stock Split will not affect our status as a public company or this registration under the Exchange Act. The Common Stock Reverse Stock Split is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 under the Exchange Act.

13

Odd Lot Transactions. It is likely that some of our stockholders will own “odd-lots” of less than 100 shares of Common Stock following the Common Stock Reverse Stock Split. A purchase or sale of less than 100 shares of Common Stock (an “odd lot” transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers, and generally may be more difficult than a “round lot” sale. Therefore, those stockholders who own less than 100 shares of Common Stock following the Common Stock Reverse Stock Split may be required to pay somewhat higher transaction costs and may experience some difficulties or delays should they then determine to sell their shares of Common Stock.

Authorized but Unissued Shares; Potential Anti-Takeover Effects. Our Charter presently authorizes 100,000,000 shares of Common Stock and 10,000,000 shares of blank check preferred stock, par value $0.0001 per share. The Common Stock Reverse Stock Split would not change the number of authorized shares of the Common Stock or the par value of the Common Stock, although the Common Stock Reverse Stock Split would decrease the number of issued and outstanding shares of Common Stock. Therefore, because the number of issued and outstanding shares of Common Stock would decrease, the number of shares of Common Stock remaining available for issuance by us in the future would increase.

Such additional shares of Common Stock would be available for issuance from time to time for corporate purposes such as issuances of Common Stock in connection with capital-raising transactions and acquisitions of companies or other assets, as well as for issuance upon conversion or exercise of securities such as convertible preferred stock, convertible debt, warrants or options convertible into or exercisable for Common Stock. We believe that the availability of the additional shares of Common Stock will provide us with the flexibility to meet business needs as they arise, to take advantage of favorable opportunities and to respond effectively in a changing corporate environment. For example, we may elect to issue shares of Common Stock to raise equity capital, to make acquisitions through the use of stock, to establish strategic relationships with other companies, to adopt additional employee benefit plans or reserve additional shares of Common Stock for issuance under such plans, where the Board determines it advisable to do so, without the necessity of soliciting further stockholder approval, subject to applicable stockholder vote requirements under Nevada law, and Nasdaq rules. If we issue additional shares of Common Stock for any of these purposes, the aggregate ownership interest of our current stockholders, and the interest of each such existing stockholder, would be diluted, possibly substantially.

The additional shares of our Common Stock that would become available for issuance upon an effective Common Stock Reverse Stock Split could also be used by us to oppose a hostile takeover attempt or delay or prevent a change of control or changes in or removal of our management, including any transaction that may be favored by a majority of our stockholders or in which our stockholders might otherwise receive a premium for their shares of Common Stock over then-current market prices or benefit in some other manner. Although the increased proportion of authorized but unissued shares of Common Stock to issued shares of Common Stock could, under certain circumstances, have an anti-takeover effect, the Common Stock Reverse Stock Split is not being proposed in order to respond to a hostile takeover attempt or to an attempt to obtain control of the Company.

We will not issue fractional certificates for post-Common Stock Reverse Stock Split shares of Common Stock in connection with the Common Stock Reverse Stock Split. To the extent any holders of pre-Common Stock Reverse Stock Split shares of Common Stock are entitled to fractional shares of Common Stock as a result of the Common Stock Reverse Stock Split, the Company will issue an additional share to all holders of fractional shares of Common Stock.

14

Under Nevada law, our stockholders would not be entitled to dissenters’ rights or rights of appraisal in connection with the implementation of the Common Stock Reverse Stock Split, and we will not independently provide our stockholders with any such rights.

Certain United States Federal Income Tax Consequences

The following is a summary of certain United States federal income tax consequences of the Common Stock Reverse Stock Split. It does not address any state, local or foreign income or other tax consequences, which, depending upon the jurisdiction and the status of the stockholder/taxpayer, may vary from the United States federal income tax consequences. It applies to you only if you held pre-Common Stock Reverse Stock Split shares of Common Stock as capital assets for United States federal income tax purposes. This discussion does not apply to you if you are a member of a class of our stockholders subject to special rules, such as (a) a dealer in securities or currencies, (b) a trader in securities that elects to use a mark-to-market method of accounting for your securities holdings, (c) a bank, (d) a life insurance company, (e) a tax-exempt organization, (f) a person that owns shares of Common Stock that are a hedge, or that are hedged, against interest rate risks, (g) a person who owns shares of Common Stock as part of a straddle or conversion transaction for tax purposes, or (h) a person whose functional currency for tax purposes is not the U.S. dollar. The discussion is based on the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), its legislative history, existing, temporary and proposed regulations under the Internal Revenue Code, published rulings and court decisions, all as of the date hereof. These laws, regulations and other guidance are subject to change, possibly on a retroactive basis. We have not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the United States federal income tax consequences of the Common Stock Reverse Stock Split.

PLEASE CONSULT YOUR OWN TAX ADVISOR CONCERNING THE CONSEQUENCES OF THE COMMON STOCK REVERSE STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

Tax Consequences to United States Holders of Common Stock. A United States holder, as used herein, is a stockholder who or that is, for United States federal income tax purposes: (a) a citizen or individual resident of the United States, (b) a domestic corporation, (c) an estate whose income is subject to United States federal income tax regardless of its source, or (d) a trust, if a United States court can exercise primary supervision over the trust’s administration and one or more United States persons are authorized to control all substantial decisions of the trust. This discussion applies only to United States holders.

If a partnership (or other entity or arrangement treated as a partnership for U.S. federal income tax purposes) is a beneficial owner of our Common Stock, the tax treatment of a partner in the partnership will depend upon the status of the partner and the activities of the partnership. Partnerships and partners of a partnership holding our Common Stock are urged to consult their tax advisors regarding the U.S. tax consequences of this Common Stock Reverse Stock Split.

The Company intends for the transaction to qualify as a “reorganization” within the meaning of Section 368(a) of the Code for U.S. federal income tax purposes, and the remainder of the disclosure assumes it will so qualify. However, the Company has not sought and will not seek any ruling from the IRS regarding any matters relating to the transaction, and as a result, there can be no assurance that the IRS will not assert, or that a court would not sustain, a contrary position, in which case the consequences of the transaction could be materially different from those described herein.

Provided that the Common Stock Reverse Stock Split qualifies as a “reorganization,” and except for adjustments that may result from the treatment of fractional shares of Common Stock as described above, no gain or loss should be recognized by a stockholder upon such stockholder’s exchange of pre-Common Stock Reverse Stock Split shares of Common Stock for post-Common Stock Reverse Stock Split shares of Common Stock pursuant to the Common Stock Reverse Stock Split. The aggregate adjusted basis of the post-Common Stock Reverse Stock Split shares of Common Stock received will be the same as the aggregate adjusted basis of the Common Stock exchanged for such new shares. The stockholder’s holding period for the post-Common Stock Reverse Stock Split shares of Common Stock will include the period during which the stockholder held the pre-Common Stock Reverse Stock Split shares of Common Stock surrendered.

15