UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number: 000-54960

Nxt-ID, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 46-0678374 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

285 North Drive

Suite D

Melbourne, FL 32934

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (203) 266-2103

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: | |

|

Common Stock, par value $0.0001 Warrants to purchase Common Stock (expiring September 15, 2019) |

The Nasdaq Stock Market LLC The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III or this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the common stock held by non-affiliates of the registrant, as of June 30, 2017, the last business day of the second fiscal quarter, was approximately $15,500,905 based on a total number of shares of our common stock outstanding that day of 8,289,254 and a closing price of $1.87. Shares of common stock held by each director, each officer and each person who owns 10% or more of the outstanding common stock have been excluded from this calculation in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily conclusive.

The registrant had 24,347,482 shares of its common stock outstanding as of March 29, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of the Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of Nxt-ID, Inc.’s (“Nxt-ID”, the “Company”, “our”, “us” or “we”) operations; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future operations, future cash needs, business plans and future financial results, and any other statements that are not historical facts.

From time to time, forward-looking statements also are included in our other periodic reports on Forms 10-Q and 8-K, in our press releases, in our presentations, on our website and in other materials released to the public. Any or all of the forward-looking statements included in this Report and in any other reports or public statements made by us are not guarantees of future performance and may turn out to be inaccurate. These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

For discussion of factors that we believe could cause our actual results to differ materially from expected and historical results see “Item 1A - Risk Factors” below.

ii

| Item 1. | Business |

Nxt-ID is an emerging technology company engaged in the development of proprietary products and solutions that serve multiple end markets, including the security, healthcare, financial technology (“FinTech”) and the Internet of Things (“IoT”) markets. With extensive experience in access control, biometric and behavior-metric identity verification, security and privacy, encryption and data protection, payments, miniaturization, and sensor technologies, we develop and market groundbreaking solutions for payment, IoT, and healthcare applications.

Two of Nxt-ID’s subsidiaries operate in the mobile and IoT-related markets: LogicMark, LLC (“LogicMark”), a manufacturer and distributor of non-monitored and monitored personal emergency response systems (“PERS”) that are sold through dealers, distributors and the United States Department of Veterans Affairs (the “VA”), and Fit Pay, Inc. (“Fit Pay”), a proprietary technology platform that delivers end-to-end solutions to device manufacturers for contactless payment capabilities, credential management, authentication and other secure services within the IoT ecosystem, which we acquired on May 23, 2017. Through these lines of business, Nxt-ID creates and markets technologies that are at the center of the rapidly expanding IoT space. Our core competencies leverage emerging business opportunities with significant high-growth potential, as well as revenue-producing lines of business with clear paths to expansion.

With technologies that validate and connect users to devices, and devices to ecosystems, we are playing a central role in the expansion of IoT ecosystems, focusing on the areas of healthcare and payments. Our strategic initiatives include: (1) monetizing our core technologies; (2) focusing on key addressable market segments and verticals; and (3) executing clear go-market strategies for our products and services.

This strategy allows us to take advantage of multilayered and recurring revenue opportunities within the healthcare and payment market segments. In healthcare, LogicMark produced consistent revenue growth, while positioning itself as the VA’s leading provider of non-monitored PERS devices and further expanding into the domestic retail market with its disruptive value proposition.

With respect to our payments business, Fit Pay became one of the first successful third-party payment network token service provider with the commercialization of its platform and the launch of the Garmin Pay™ feature for one of its customers, Garmin International, Inc. Fit Pay also announced key ecosystem partnerships with Visa International, Mastercard, Bank of America, and Australia and New Zealand Banking Group Limited (ANZ). We are continuing to integrate our initial 15 device manufactures onto the core Fit Pay Trusted Payment Manager™ platform (“TPMP”) with the product launches of the Token ring by Tokenize Inc. and the Bee payment device by Radiius. We are also working to expand the capabilities of the platform in order to integrate it with additional payment networks and issuing banks, and to offer new products, such as cryptocurrency, to emerging markets.

1

Healthcare

Overview

With respect to the healthcare market, our business initiatives are driven by LogicMark, which serves a market that enables two-way communication, medical device connectivity and patient data tracking of key vitals through sensors, biometrics, and security to make home health care a reality. There are three major trends driving this market: (1) an increased desire for connectivity; specifically, a greater desire for connected devices by people over 60 years of age who now represent the fastest growing demographic for social media; (2) the growth of “TeleHealth”, which is the means by which telecommunications technologies are meeting the increased need for health systems to better distribute doctor care across a wider range of health facilities, making it easier to treat and diagnose patients, and (3) rising healthcare costs – as health spending continues to outpace the economy, representing between 6% and 7% of the overall economy, the need to reduce hospital readmissions, increase staffing efficiency and improve patient engagement remain the highest priorities. Together, these trends have produced a large and growing market for us to serve. LogicMark has built a successful business on emergency communications in healthcare. We have a strong business relationship with the VA today, serving veterans who suffer from chronic conditions that often require emergency assistance. This business is steady and growing, producing record revenue in 2017. Our strategic plan calls for expanding LogicMark’s business into other healthcare verticals as well as retail and enterprise channels in order to better serve the expanding demand for connected and remote healthcare solutions.

Home healthcare, which includes health monitoring and management using IoT and cloud-based processing, is an emerging area for LogicMark. The long-term trend toward more home-based healthcare is a massive shift that is being driven by demographics (an aging population) and basic economics. People also value autonomy and privacy which are important factors in determining which solutions will suit the market. Consumers are beginning to enjoy the benefits of smart home technologies and online digital assistants. One of the promising applications of our VoiceMatch™ technology is enabling secure commands for restricted medical access. This solution, when coupled with Nxt-ID BioCloud™, combines biometrics with encryption and distributed access control.

Our Healthcare Monitoring Market Opportunity

PERS devices are used to call for help and medical care during an emergency. These devices are also used by a wide patient pool, as well as the general population, to ensure safety and security when living or traveling alone. The global medical alert systems market caters to different end-users across the healthcare industry, including individual users, hospitals and clinics, assisted living facilities and senior living facilities. The growing demand for home healthcare devices is mainly driven by an aging population and rising healthcare costs worldwide. We believe that this will spur the usage of medical alert systems across the globe, as they offer safety and medical security while being affordable and accessible.

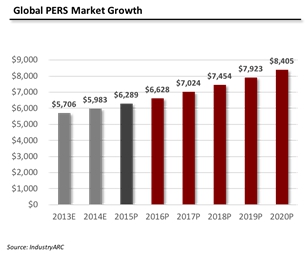

The PERS market is divided into three device segments: landline-based PERS, mobile PERS, and standalone devices. The global PERS market is projected to grow at a CAGR of 5.83% to $8.4 billion in 2020, benefiting from strong demographic tailwinds. North America and Europe are the largest markets for PERS, accounting for approximately 40% and 37% of total sales, respectively in 2020. According to IndustryARC, improvements in healthcare infrastructure and emerging economies will fuel growth and significantly improve the relative market share of the Asia Pacific and the rest of world regions.

2

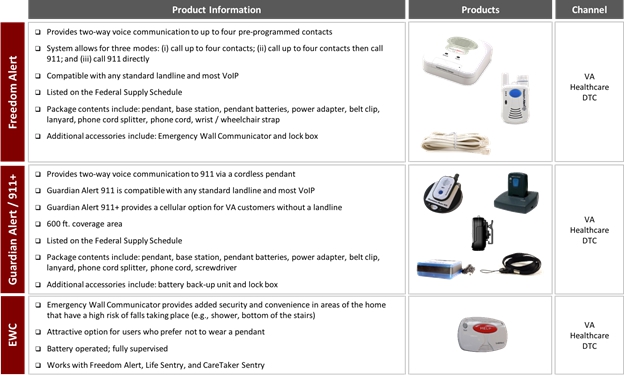

Our Health Care Products

LogicMark produces a range of products within the PERS market and has differentiated itself by offering non-monitored products, which only require a one-time purchase fee, instead of a recurring monthly contract. As a result, LogicMark’s products are typically the most cost-effective PERS option. LogicMark’s non-monitored solution offers a significant value proposition over monitored solutions.

The cost of ownership of a monitored solution, which includes a monthly service fee, can be as much as $1,500 – $3,000 over a five-year period. This compares to a one-time purchase of a LogicMark non-monitored device, which provides a similar level of security for a purchase price as low as one tenth of that amount.

LogicMark offers both traditional (i.e., landline) and mPERS (i.e., cell-based) options. Our non-monitored products are sold primarily through the VA and healthcare distributors.

3

LogicMark offers monitored products that are primarily sold by dealers and distributors for the monitored product channel. LogicMark sells its devices to the dealers and distributors, who in turn offer the devices to consumers as part of their product/service offering. The service providers charge consumers a monthly monitoring fee for the associated monitoring service. These products are monitored by a third-party central station

Our Health Care Competition

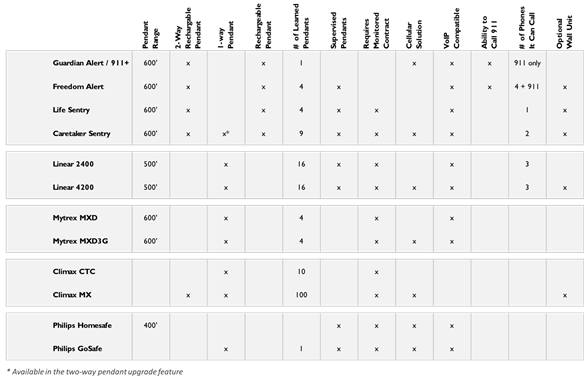

LogicMark offers a wide variety of products, enabling it to cater to users with different levels of health and safety needs. Compared to its competitors, LogicMark’s PERS products offer enhanced functionality at the best value.

The chart below summarizes LogicMark’s product offering versus those of its competitors:

Our Health Care Business Strategy

Through LogicMark, we intend to expand distribution by using larger distributors who can leverage the consumer value proposition of offering a one-time device purchase as opposed to a leased monthly solution. We also intend to apply our technology to the next generation of PERS devices that will have greater functionality, innovative design and clinical monitoring capability. We believe that there is further potential for expansion in the domestic and international retail and international markets, and we intend to take advantage of this through a new product offering, Notify911, which is a non-monitored device developed for direct-to-consumer sales through retail channels and direct marketing initiatives. We are also seeking to leverage our PERS experience to develop new offerings in the home healthcare monitoring market.

Overall, our healthcare division, through LogicMark, is positioned to take advantage of favorable market dynamics, a stable revenue-producing customer base, a differentiated product line, a robust new product development pipeline and compelling growth opportunities.

4

Payments and Financial Technology

Overview

We conduct our payments business through Fit Pay, which was acquired by Nxt-ID in May 2017. Fit Pay’s core technology is a proprietary platform that enables contactless payment capabilities, allowing manufacturers of “smart devices” to add payment capabilities to their products with very little start-up time and minimal investment in software development, while granting them access to the leading card network and global credit card issuing banks. It is one of the first successful commercializations of a token requestor service provider integrated with the major payment card networks. The existing propriety capabilities of the contactless payment companies are not available to other original equipment manufacturers (“OEMs”). The Fit Pay TPMP creates an opportunity for a whole new range of devices to be payment-enabled.

Fit Pay is currently on-boarding 15 device manufactures to its platform. Garmin Pay™, a contactless payment feature for a new line of smartwatches by Garmin International, Inc., is powered by Fit Pay’s TPMP technology and went live in the fall of 2017. Fit Pay also announced the product launches for three other customers, including the Token ring by Tokenize Inc., the Bee payment device by Radiius and a luxury smart clasp by Wearatec Inc.

In addition to launching new customers, our emerging payments business also announced key ecosystem partnerships with Visa International, Mastercard, Bank of America, and Australia and New Zealand Banking Group Limited (ANZ). These agreements, along with the growing network of issuing banks, now enables cardholders to use devices powered by the TPMP, increasing our revenue potential and providing the opportunity to expand our customer and geographical footprint. At year-end, the TPMP was enabled by more than 60 issuing banks in 8 countries in the largest markets worldwide.

Our payment and financial technology business has also expanded to include new products and services. This includes growing the capabilities of the TPMP to integrate it with additional payment networks and issuing banks. Fit Pay has also developed proprietary payment devices that it will offer through business-to-business and direct-to-consumer channels. These new products will leverage the TPMP and allow us to access new customers and emerging markets, such as cryptocurrency. Fit Pay’s initial product offering is a platform extension and contactless payment device called Flip™, which enables Bitcoin holders to make contactless payment transactions at millions of retail locations with value exchanged from their cryptocurrency.

Together, these opportunities position our emerging payment and financial technology business for future growth as Fit Pay begins to monetize its core TPMP technology, and expand its products and services to new markets and customers.

Our Payments and Financial Technology Market Opportunity

Our payments business targets the rapidly expanding IoT and wearable devices markets. According to the research firm, Gartner, IoT devices will grow at a 32.9% CAGR through 2020, reaching an installed base of 20.4 billion units. Gartner estimates that by 2020 there will be more than 500 million wearable devices in use alone and it predicts that 1 million IoT devices will be purchased every hour by 2021.

As the markets for wearables and IoT devices expand, payments are also emerging as a key feature. A Business Insider Intelligence study estimates that by 2020 an estimated 63% of wearable devices will be payment-enabled. The research firm International Data Corporation predicts that wearable devices will transact more than $501 billion payment by 2020, overtaking plastic payment methods as the primary payment method in the next 5-7 years.

A recent survey by Visa and the industry publication, PYMTS, entitled “How We Will Pay: Consumers Connected Devices and the Future of Payments” supports consumer demand for adding payment capabilities to devices. The survey found strong support among consumers for new forms of payments. Of the survey’s respondents:

| ● | 60% found buying and paying for things unproductive and time-consuming, and in need of improvements; |

| ● | 83% viewed using connected devices as a way to eliminate friction from how they pay; |

5

| ● | 66% would use a connected device to enable a seamless payment experience; and |

| ● | 77% want their financial institution/bankcard network to enable these new ways to pay. |

As an early and established entrant into the payments market, we believe that we are well-positioned to take advantage of both the growth of payment-enabled devices and the consumer demand for new forms of payments.

Our Payments Product Offerings

We offer a range of technology platform services and products that leverage both the core payment technologies that we have developed as well as the assets gained through our business combination with Fit Pay. These include:

The Fit Pay Trusted Payment Manager Platform™

The TPMP provides IoT and wearable devices with contactless payment capabilities and full digital wallet functionality. It enables consumers to simply tap and pay at near field communication (“NFC”)-enabled point-of-sale (“POS”) terminals or ATMs using an existing credit, debit or prepaid card account. The TPMP uses tokenization, a payment security technology that replaces cardholders’ account information with a unique digital identifier (a “token”), to transact highly secure contactless payments and authentication services. Fit Pay leverages embedded secure element chip technology within devices to offer a payment solution that is very power and memory efficient. This frees devices from needing to be tethered to a host device or connected to the Internet to transact payments, creating a convenient and completely frictionless payment experience for consumers.

We consider Fit Pay to be the primary connection point between card networks, banks, merchants and the wearable user. Fit Pay has built a payment ecosystem that includes 15 devices manufactures, the Visa, Mastercard, Discover card networks (with additional networks to be added), and more than 60 issuing banks in 8 countries in the largest markets worldwide. Issuing banks accepting payments from devices connected to the TPMP include Bank of America, Capital One, U.S. Bank, Wells Fargo in the United States, BonusCard, Cornérbank, ANZ and NAB (National Australia Bank), among others.

Fit Pay became one of the first successful third-party payment network token service providers with the commercialization of the TPMP and the launch of the Garmin Pay™ feature for its customer Garmin International, Inc.

World Ventures Flye™ SmartCard

We continue to operate pursuant to our master product development agreement, dated December 31, 2015, with World Ventures Holdings, LLC (“WVH”), an international direct selling travel company, pursuant to which WVH committed to purchase an exclusive smart card from us for distribution to WVH’s members. . In connection with such agreement, WVH also made a strategic investment in our securities in 2015. The Flye™ smart card is customized for WVH with additional technologies and wireless features, such as the ability to seamlessly integrate with WVH’s DreamTrips™ smartphone application to wirelessly check-in and earn loyalty points towards free DreamTrips™ vacations at select restaurants. DreamTrips™ is a travel club and entertainment community where members can enjoy exciting excursions year-round to extraordinary destinations.

During the year ended December 31, 2017, we recorded revenue of $7,065,755 from WVH, a related party. WVH is considered a related party, as the Chief Technology Officer of WVH is a director of Nxt-ID.

For additional information on our transactions with WVH, see “Management Discussion and Analysis of Financial Condition and Results of Operations”.

Fit Pay General Purpose Reloadable (GRP) Mastercard®

Fit Pay offers prepaid capabilities on wearable devices connected to the TPMP. The general purpose reloadable (“GPR”) program, the Fit Pay Prepaid Mastercard®, gives consumers with Fit Pay’s contactless payment-enabled devices the convenience of storing funds directly on their devices. The program provides consumers with the ease and security of contactless payments. The Fit Pay Prepaid Mastercard® is available to device OEMs that integrate their products with the TPMP. The program allows consumers to load their Fit Pay-enabled IoT or wearable device with a prepaid value for contactless purchases. A digital wallet allows the user to re-load the account, set top-off thresholds and manage account settings. The Fit Pay Prepaid Mastercard® is sponsored by Sunrise Banks, N.A. Cascade Financial Technology Corp. serves as the program manager. The device can be used everywhere that debit Mastercard is accepted.

6

Flip™

Fit Pay recently announced Flip™, a new contactless payment device that will enable cryptocurrency holders to use the value of their currency to make purchases at millions of retail locations. The new device leverages an expansion of the TPMP to connect cryptocurrencies to the payment ecosystem. Flip™ will use value exchanged from Bitcoin to make traditional payment transactions.

Flip™ will be NFC-enabled, allowing it to transact payments at any retail point of sale location that accepts contactless payments. Flip™ will store a preloaded amount of U.S. dollars that are exchanged from a user’s existing cryptocurrency account. It includes a digital wallet that allows users to set how much value they would like their Flip™ to hold and when they would like it to reload, and to suspend the account should the device become lost or stolen. Initially, Flip™ will accept value exchanged from Bitcoin and will potentially expand to other cryptocurrencies in the future. Fit Pay has begun taking pre-orders for Flip™ and anticipates initial shipments of the device will begin in the second quarter of 2018.

Wi-Mag™

Our proprietary antenna and payment technology can be embedded in a mobile device to make wireless payments at most POS terminals which do not require NFC or Europay, MasterCard, and Visa (“EMV”) technology, potentially allowing users to make payments at most POS terminals in the United States and abroad.

SmartPay™

We have developed a standalone capability, SmartPayTM, on various devices with the ability to make payments by dynamic magnetic stripe or through interacting with a terminal through EMV, NFC or barcode functionality. We are currently pursuing significant strategic partnerships for this product.

Our Payments Competition

The markets for our products are extremely competitive and are characterized by rapid technological change as a result of technical developments exploited by our competitors, changing technical needs of customers, and frequent introductions of new features. We expect competition to increase as other companies introduce products that are competitively priced, that may have increased performance or functionality, or that incorporate technological advances not yet developed or implemented by us. Some of our present and potential competitors may have financial, marketing, and research resources substantially greater than ours.

Competitors in the digital wallet marketplace include:

| ● | Google Wallet – A mobile payment system developed by Google that allows its users to store debit cards, credit cards, loyalty cards, and gift cards among other things, as well as redeeming sales promotions on their mobile phone. |

| ● | Apple Pay – A mobile payment service that lets certain Apple mobile devices make payments at the time of retail and online checkout. |

| ● | Paypal – A mobile service that can send money between other PayPal users and friends, track your balances, to pay from one’s phone, and order ahead at restaurants. |

| ● | SamsungPay – A mobile payment system that uses Magnetic Secure Transmission to broadcast a signal to a POS payment terminal. |

| ● | Fitbit Pay – Payment capability launch by fitness tracker and smartwatch producer Fitbit. |

7

We believe that our payment products have certain competitive advantages. The existing contactless payment companies propriety capabilities are not available to other device manufacturers. Fit Pay’s TPMP creates an opportunity for a whole new range of devices to be payment-enabled by significantly reducing the cost and time to market. While other companies are seeking to build a similar white-labeled solution, we believe that the extent of Fit Pay’s existing relationships provides it with an advantage in the market.

The TPMP offers several distinctive features, including (1) it removes friction for the consumer with very little user interaction required; (2) it does not require a device to be present at the time of a transaction; (3) it is extendible to any operating system or device; and (4) it is highly secure and card data is not exposed at the point of sale.

Furthermore, we believe that the following factors create a defensible market position for Fit Pay: (1) we are the only independent platform to complete secure element (“SE”) tokenization integrations with major card networks; (2) complex service deployment barriers make it difficult for new entrants and for manufacturers to develop the capability themselves; (3) we own the security keys which eliminate the ability of OEMs to change providers without major service disruption; (4) we offer a comprehensive, end-to-end solution as a single source for all SE-related applications, including full-featured APIs (application programming interfaces) and SDKs (software development kits) to simplify implementation; and (5) we offer a scalable platform with direct access the major card network and issuing banks.

Our Payments Business Strategy

Our primary strategy for our payment business is to leverage our technological and competitive advantages across various industries in combination with established partners that can create meaningful distribution, monetizing the technologies and capabilities that we have developed. Our unique position as an independent platform provider with our comprehensive, end-to-end platform positions us to serve the rapidly expanding wearable and IoT markets. As described above, the complex ecosystem needed to support full-function payment capabilities creates a barrier for new entrants and manufacturers who may have considered developing the capability on their own, and offers continuity for our existing customer base.

Our business strategy is to leverage these attributes to (1) scale our platform to add more customers and payment use cases; (2) build new revenue streams by adding additional OEMs and our GPR program to new form factors; (3) add new capabilities to the TPMP such as cryptocurrency payments; (4) develop our own proprietary payment devices for business-to-business or business-to-consumer channels; and (5) integrate our platform with additional ecosystems such as transit, hotels, and building access systems.

Our Intellectual Property

Our ability to compete effectively depends to a significant extent on our ability to protect our proprietary information. We currently rely and will continue to rely primarily on patents and trade secret laws and confidentiality procedures to protect our intellectual property rights. We have filed the following 32 patents, six of which have been awarded to date:

METHOD FOR REPLACING TRADITIONAL PAYMENT AND IDENTITY MANAGEMENT SYSTEMS AND COMPONENTS TO PROVIDE ADDITIONAL SECURITY AND A SYSTEM IMPLEMENTING SAID METHOD

Filed October 8, 2013

Application Number 14/049,175

8

METHOD FOR REPLACING TRADITIONAL PAYMENT AND IDENTITY MANAGEMENT SYSTEMS AND COMPONENTS TO PROVIDE ADDITIONAL SECURITY AND A SYSTEM IMPLEMENTING SAID METHOD

Continuation application of 001 with new claims

Filed August 31, 2016

Application Number 15/252,468

THE UN-PASSWORD™: RISK AWARE END-TO-END MULTI-FACTOR AUTHENTICATION VIA DYNAMIC PAIRING

Patent issued August 2, 2016

Patent Number 9,407,619

UNIVERSAL AUTHENTICATION AND DATA EXCHANGE METHOD, SYSTEM AND SERVICE

Filed March 17, 2014

Application Number 14/217,289

METHOD TO LOCALLY VALIDATE IDENTITY WITHOUT PUTTING PRIVACY AT RISK

Application filed September 1, 2015

Application Number 14/842,252

DISTRIBUTED METHOD AND SYSTEM TO IMPROVE COLLABORATIVE SERVICES ACROSS MULTIPLE DEVICES

Application filed February 8, 2016

Application Number 15/018,496

VOICE DIRECTED PAYMENT SYSTEM AND METHOD

Application filed February 10, 2016

Application Number 15/040,984

SYSTEM AND METHOD FOR LOW-POWER CLOSE-PROXIMITY COMMUNICATIONS and energy transfer USING A MINIATURE MULTI-PURPOSE ANTENNA

Application filed April 4, 2016

Application Number 15/089,826

SYSTEM AND METHOD FOR LOW-POWER CLOSE-PROXIMITY COMMUNICATIONS and energy transfer USING A MINIATURE MULTI-PURPOSE ANTENNA

Application filed November 16, 2016

Application Number 15/353,018

MULTI-INSTANCE SHARED AUTHENTICATION (MISA) METHOD AND SYSTEM PRIOR TO DATA ACCESS

Application filed June 23, 2016

Application Number 15/191,456

BIOMETRIC, BEHAVIORAL-METRIC, KNOWLEDGE-METRIC AND ELECTRONIC-METRIC DIRECTED AUTHENTICATION AND TRANSACTION METHOD AND SYSTEM

Application filed July 5, 2016

Application Number 15/202,515

PERSONALIZED TOKENIZATION SYSTEM AND METHOD

Application filed July 14, 2016

Application Number 15/210,728

METHODS AND SYSTEMS RELATED TO MULTI-FACTOR, MULTI-DIMENSIONAL, MATHEMATICAL HIDDEN AND MOTION SECURITY PINS

Filed August 1, 2016

Application Number 15/224,998

ELECTRONIC CRYPTO-CURRENCY MANAGEMENT METHOD AND SYSTEM

Filed August 1, 2016

Application Number 15/225,780

9

SYSTEMS AND DEVICES FOR WIRELESS CHARGING OF A POWERED TRANSACTION CARD AND EMBEDDING ELECTRONICS IN A WEARABLE ACCESSORY

Filed September 2, 2015

Application Number 14/843,925

COMPONENTS FOR ENHANCING OR AUGMENTING WEARABLE ACCESSORIES BY ADDING ELECTRONICS THERETO

Filed September 2, 2015

Application Number 14/843,930

LOW BANDWIDTH CRYPTO-CURRENCY TRANSACTION EXECUTION AND SYNCHRONIZATION METHOD AND SYSTEM

Filed September 7, 2016

Application Number 15/259,023

METHOD AND SYSTEM TO ORGANIZE AND MANAGE TRANSACTIONS

Filed December 2, 2016

Application Number 15/368,546

THE UN-PASSWORD™: RISK AWARE END-TO-END MULTI-FACTOR AUTHENTICATION VIA DYNAMIC PAIRING

Filed March 14, 2016

Application Number 15/068,834

SYSTEM AND METHOD TO PERSONALIZE PRODUCTS AND SERVICES

Filed July 15, 2016

Application number 15/212,184

SYSTEM AND METHOD TO PERSONALIZE PRODUCTS AND SERVICES

Filed September 6, 2016

Application number 15/257,101

ACCORDION ANTENNA STRUCTURE

Filed April 4, 2016

Application Number 15/089,844

SYSTEM AND METHOD TO AUTHENTICATE ELECTRONICS USING ELECTRONIC-METRICS

Filed July 5, 2016

Application Number 15/202,553

SYSTEM AND METHOD TO DETERMINE USER PREFERENCES

Filed July 15, 2016

Application number 15/212,163

PREFERENCES DRIVEN ADVERTISING SYSTEMS AND METHODS

Filed July 15, 2016

Application number 15/212,161

AUTOMATED WEARABLE ACTIVATION SYSTEM

Filed July 27, 2017

Application number 62/537,904

SYSTEMS AND METHODS FOR PROVIDING AN INTERNET OF THINGS PAYMENT PLATFORM

Filed March 25, 2015

Application number 62/138,298

10

WIRELESS, CENTRALIZED EMERGENCY SERVICES SYSTEM

Patent Number 8,275,346

VOICE-EXTENDING EMERGENCY RESPONSE SYSTEM

Patent Number 8,121,588

LIST-BASED EMERGENCY CALLING DEVICE

Patent Number 8,369,821

ALARM SIGNALING DEVICE AND ALARM SYSTEM

Patent Number 7,312,709

FALL DETECTION SYSTEM HAVING A FLOOR HEIGHT THRESHOLD AND RESIDENT HEIGHT DETECTION DEVICE

Patent Number 7,893,844

We enter into confidentiality agreements with our consultants and key employees, and maintain control over access to and distribution of our technology, software and other proprietary information. The steps that we have taken to protect our technology may be inadequate to prevent others from using what we regard as our technology to compete with us.

We do not generally conduct exhaustive patent searches to determine whether the technology used in our products infringes on the patents that are held by third parties. In addition, product development is inherently uncertain in a rapidly evolving technological environment in which there may be numerous patent applications pending, many of which are confidential when filed, with regard to similar technologies.

We may face claims by third parties that our products or technology infringe their patents or other intellectual property rights in the future. Any claim of infringement could cause us to incur substantial costs defending against the claim, even if the claim is invalid, and could distract the attention of our management. If any of our products are found to violate third-party proprietary rights, we may be required to pay substantial damages. In addition, we may be required to re-engineer our products or seek to obtain licenses from third parties to continue to offer our products. Any efforts to re-engineer our products or obtain licenses on commercially reasonable terms may not be successful, which would prevent us from selling our products, and in any case, could substantially increase our costs and have a material adverse effect on our business, financial condition and results of operations.

11

Corporate Information

History

We were incorporated in the state of Delaware on February 8, 2012. We are an emerging technology company engaged in the development of proprietary products, services and solutions for security that serve multiple end markets, including the security, healthcare, finance and IoT markets.

On June 25, 2012, we acquired 100% of the membership interests in 3D-ID LLC (“3D-ID”), a limited liability company that we formed in Florida in February 2011 and that was previously owned by the Company’s founders. By acquiring 3D-ID, we gained the rights to a portfolio of patented technology in the field of three-dimensional facial recognition and imaging including 3D facial recognition products for access control, as well as the law enforcement and travel and immigration sectors. 3D-ID is an early stage company engaged in the design, research and development, integration, analysis, modeling, system networking, sales and support of intelligent surveillance, three-dimensional facial recognition and three-dimensional imaging devices and systems primarily for identification and access control in the security industries. As our acquisition of 3D-ID was a transaction between entities under common control in accordance with Accounting Standards Codification (“ASC”) 805, “Business Combinations”, we recognized the net assets of 3D-ID at their carrying amounts in our accounts on the date that 3D-ID was organized, February 14, 2011.

On July 25, 2016, we completed the acquisition of LogicMark pursuant to an interest purchase agreement by and among the Company, LogicMark and the holders of all of the membership interests of LogicMark (the “LogicMark Sellers”), dated May 17, 2016 (the “Interest Purchase Agreement”). Pursuant to the Interest Purchase Agreement, we acquired all of the membership interests of LogicMark from the LogicMark Sellers for (i) $17.5 million in cash consideration (ii) a $2.5 million secured promissory note (the “LogicMark Note”) issued to LogicMark Investment Partners, LLC, as representative of the LogicMark Sellers (the “LogicMark Representative”) (iii) 78,740 shares of our common stock, par value $0.0001 per share (the “Common Stock”), which were issued upon signing of the Interest Purchase Agreement (the “LogicMark Shares”), and (iv) warrants (the “LogicMark Warrants”) to purchase an aggregate of 157,480 shares of our Common Stock (the “LogicMark Warrant Shares”) for no additional consideration. In addition, we may be required to pay the LogicMark Sellers earn-out payments of (i) up to $1,500,000 for calendar year 2016 and (ii) up to $5,000,000 for calendar year 2017 if LogicMark meets certain gross profit targets set forth in the Interest Purchase Agreement. The LogicMark Note originally was to mature on September 23, 2016 but was extended to July 15, 2017. The earn-out payment related to 2016 and the remaining balance owed on the LogicMark Note including accrued interest were both paid in July 2017. Based on LogicMark’s operating results for the year ended December 31, 2017, the 2017 earnout amount owed by the Company is $3,156,088. As a result, the Company reduced the amount of contingent consideration due to the LogicMark Sellers by $1,843,912.

On May 23, 2017, we completed a merger (the “Merger”) pursuant to an agreement and plan of merger (the “Merger Agreement”) by and among the Company, Fit Merger Sub, Inc., a wholly-owned subsidiary of the Company (the “Merger Sub”), Fit Pay, Michael J. Orlando, Giesecke & Devrient Mobile Security America, Inc. (“G&D”), the other stockholders of Fit Pay (the “Other Holders”) and Mr. Orlando in his capacity as stockholder representative representing the Other Holders (the “Stockholder Representative”, and together with Orlando and G&D, the “Fit Pay Sellers”). In connection with the Merger, Fit Pay merged with and into the Merger Sub, with the Merger Sub continuing as the surviving entity and a wholly owned subsidiary of the Company.

Pursuant to the terms of the Merger Agreement, the aggregate purchase price paid for Fit Pay was: (i) 19.96% of the outstanding shares of Common Stock; (ii) 2,000 shares of the Series C Non-Convertible Preferred Stock of the Company, par value $0.0001 per share (the “Series C Preferred Stock”); (iii) the payment of certain debts by the Company; and (iv) the payment of certain unpaid expenses by the Company. In addition, the Company will be required to pay the Sellers an earnout payment equal to 12.5% of the gross revenue derived from Fit Pay’s technology for sixteen (16) fiscal quarters commencing on October 1, 2017 and ending on December 31, 2021.

In connection with the Fit Pay transaction, Mr. Orlando became our Chief Operating Officer, as well as the President of Fit Pay, effective as of May 23, 2017.

Other

Our principal executive offices are located at 285 North Drive, Suite D, Melbourne, FL 32934, and our telephone number is (203) 266-2103. Our website address is www.nxt-id.com. The information contained therein or connected thereto shall not be deemed to be incorporated into this Report. The information on our website is not part of this Report.

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). We will remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period. Pursuant to Section 102 of the JOBS Act, we have provided reduced executive compensation disclosure and have omitted a compensation discussion and analysis from this Report. Pursuant to Section 107 of the JOBS Act, we have elected to utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. Our emerging growth company status will expire on December 31, 2018.

Employees

As of December 31, 2017, we had a total of 55 full-time employees, comprising 15 employees in product engineering, 7 employees in finance and administration, 17 employees in sales and customer service and 16 employees in product fulfillment. None of our employees are represented by a collective bargaining agreement, nor have we experienced any work stoppage. We consider our relations with our employees to be good. Our future success depends on our continuing ability to attract and retain highly qualified engineers, graphic designers, computer scientists, sales and marketing and senior management personnel. In addition, we have independent contractors whose services we are using on an as-needed basis to assist with the engineering and design of our products.

12

| Item 1A. | Risk Factors |

Our business, financial condition and operating results are subject to a number of risk factors, both those that are known to us and identified below and others that may arise from time to time. These risk factors could cause our actual results to differ materially from those suggested by forward-looking statements in this report and elsewhere, and may adversely affect our business, financial condition or operating results. If any of these risk factors should occur, moreover, the trading price of our securities could decline, and investors in our securities could lose all or part of their investment in our securities. These risk factors should be carefully considered in evaluating our prospects.

Risks Relating to our Business

We are uncertain of our ability to generate sufficient revenue and profitability in the future.

We continue to develop and refine our business model, but we can provide no assurance that we will be able to generate a sufficient amount of revenue, from our business in order to achieve profitability. It is not possible for us to predict at this time the potential success of our business. The revenue and income potential of our proposed business and operations are currently unknown. If we cannot continue as a viable entity, you may lose some or all of your investment in our Company.

The Company is an emerging growth company and has incurred net losses of $8,264,873 for the year ended December 31, 2017. As of December 31, 2017, the Company had cash and stockholders’ equity of $5,636,415 and $19,130,167, respectively. At December 31, 2017, the Company had working capital of $1,319,766. We cannot provide any assurance that we will be able to raise additional cash from equity financings, secure debt financing, and/or generate revenue from the sales of our products. If we are unable to secure additional capital, we may be required to curtail our research and development initiatives and take additional measures to reduce costs in order to conserve our cash in amounts sufficient to sustain operations and meet our obligations.

We and the businesses we have recently acquired or propose to acquire have limited operating histories and we cannot offer any assurance as to our future financial results, and you should not rely on the historical financial date included in this prospectus as an indicator of our future financial performance. You may lose your entire investment.

We and the businesses we have recently acquired or propose to acquire have limited operating histories upon which to base any assumption as to the likelihood that we will be successful in implementing our business plan, and we may not be able to generate significant revenues or achieve profitability. You should consider our business and prospects in light of the risks and difficulties we face with our limited operating history and should not rely on our past results or the past results of any of such businesses as an indication of our future performance. There is no assurance that the growth rate we or they have experienced to date will continue. Even if we generate future revenues sufficient to expand operations, increased infrastructure costs and cost of goods sold and marketing expenses could impair or prevent us from generating profitable returns. We recognize that if we are unable to generate significant revenues from our business development, we will not be able to earn profits or potentially continue operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

13

If we fail to keep pace with changing industry technology and consumer preferences, we will be at a competitive disadvantage.

The industry segments in which we are operating are evolving rapidly. They are characterized by changing technology, budding industry standards, frequent new and enhanced product introductions, rapidly changing end-user/consumer preferences and product obsolescence. In order to continue to compete effectively in these markets, we need to respond quickly to technological changes and to understand their impact on our customers’ preferences. It may take significant time and resources to respond to these technological changes. If we fail to keep pace with these changes, our business may suffer. Moreover, developments by others may render our technologies and intended products noncompetitive or obsolete, or we may be unable to keep pace with technological developments or other market factors. If any of our competitors implement new technologies before we are able to implement them, those competitors may be able to provide more effective products than ours. Any delay or failure in the introduction of new or enhanced products, could have a material adverse effect on our business, results of operations and financial condition. Furthermore, our inability to keep pace with changing industry technology and consumer preferences may cause our inventory to become obsolete at a rate faster than anticipated, which may result in our taking goodwill impairment charges in past or future acquisitions that negatively impact our results of operations.

We have made a significant acquisition in each of 2016 and 2017, and we may encounter difficulties in integrating these acquisitions and managing our growth, which would adversely affect our results of operations.

During 2016 and 2017, we completed the acquisitions of LogicMark and Fit Pay, and are considering other acquisitions to improve our position in market segments that we consider to be significant and strategic. We may be unable to integrate the operations of the acquired companies into our own in the manner we anticipated or at all, and such integration could be expensive. Moreover, this significant expansion of our operations could put significant strain on our management and our operational and financial resources. To manage future growth, we will need to hire, train, and manage additional employees, as well as properly integrate personnel from acquired businesses. Concurrent with expanding our operational and marketing capabilities, we will also need to increase our product development activities. We may not be able to support, financially or otherwise, future growth, or hire, train, motivate, and manage the required personnel. Our failure to manage growth effectively could limit our ability to achieve our goals.

Our ability to integrate our acquisitions and manage our growth will depend in part on the ability of our executive officers to continue to implement and improve our operational, management, information and financial control systems and to expand, train and manage our employee base, and particularly to attract, expand, train, manage and retain a sales force to market our products on acceptable terms. Our inability to manage growth effectively could cause us to fail to realize the anticipated benefits of our acquisitions or could cause our operating costs to grow at a faster pace than we currently anticipate, any of which could have a material adverse effect on our business, financial condition, results of operations and prospects.

Because we are an emerging growth company, we expect to incur significant additional operating losses.

We are an emerging growth company. The amount of future losses and when, if ever, we will achieve profitability are uncertain. Our current products have not generated significant commercial revenue for us and there can be no guarantee that we can generate sufficient revenues from the commercial sale of our products in the near future to fund our ongoing capital needs.

We have a limited operating history upon which you can gauge our ability to obtain profitability.

We have a limited operating history and our business and prospects must be considered in light of the risks and uncertainties to which emerging growth companies are exposed. We cannot provide assurances that our business strategy will be successful or that we will successfully address those risks and the risks described herein. Most importantly, if we are unable to secure future capital, we may be unable to continue our operations. We may incur losses on a quarterly or annual basis for a number of reasons, some of which may be outside our control.

If we cannot obtain additional capital required to finance our research and development efforts, our business may suffer and you may lose the value of your investment.

We may require additional funds to further execute our business plan and expand our business. If we are unable to obtain additional capital when needed, we may have to restructure our business or delay or abandon our development and expansion plans. If this occurs, you may lose part or all of your investment. We will have ongoing capital needs as we expand our business. We have recently been informed by the U.S. Securities and Exchange Commission (the “SEC”) that our failure to file the financial statements associated with our Fit Pay acquisition within the 75 days of the closing of that acquisition has resulted in our no longer being eligible to register our securities with the SEC on Form S-3. Our inability to use Form S-3 to register our securities may negatively affect our ability to raise capital. If we raise additional funds through the sale of equity or convertible securities, your ownership percentage of our Common Stock will be reduced. In addition, these transactions may dilute the value of our Common Stock. We may have to issue securities that have rights, preferences and privileges senior to our Common Stock. The terms of any additional indebtedness may include restrictive financial and operating covenants that would limit our ability to compete and expand. There can be no assurance that we will be able to obtain the additional financing we may need to fund our business, or that such financing will be available on terms acceptable to us.

14

We face intense competition in our market, especially from larger, well-established companies, and we may lack sufficient financial or other resources to maintain or improve our competitive position.

A number of other companies engage in the business of developing applications for facial recognition for access control. The market for biometric security products is intensely competitive, and we expect competition to increase in the future from established competitors and new market entrants. Our current competitors include both emerging or developmental stage companies, such as ourselves, as well as larger companies. Many of our existing competitors have, and some of our potential competitors could have, substantial competitive advantages such as:

| ● | greater name recognition and longer operating histories; | |

| ● | larger sales and marketing budgets and resources; | |

| ● | broader distribution and established relationships with distribution partners and end-customers; | |

| ● | greater customer support resources; | |

| ● | greater resources to make acquisitions; | |

| ● | larger and more mature intellectual property portfolios; and | |

| ● | substantially greater financial, technical, and other resources. |

In addition, some of our larger competitors have substantially broader product offerings and leverage their relationships based on other products or incorporate functionality into existing products to gain business in a manner that discourages users from purchasing our products, including through selling at zero or negative margins, product bundling, or closed technology platforms. Conditions in our market could change rapidly and significantly as a result of technological advancements, partnering by our competitors or continuing market consolidation. New start-up companies that innovate and large competitors that are making significant investments in research and development may invent similar or superior products and technologies that compete with our products and technology. Our current and potential competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their resources.

Our markets are subject to technological change and our success depends on our ability to develop and introduce new products.

Each of the governmental and commercial markets for our products is characterized by:

| ● | changing technologies; | |

| ● | changing customer needs; | |

| ● | frequent new product introductions and enhancements; | |

| ● | increased integration with other functions; and | |

| ● | product obsolescence. |

Our success will be dependent in part on the design and development of new products. To develop new products and designs for our target markets, we must develop, gain access to and use leading technologies in a cost-effective and timely manner and continue to expand our technical and design expertise. The product development process is time-consuming and costly, and there can be no assurance that product development will be successfully completed, that necessary regulatory clearances or approvals will be granted on a timely basis, or at all, or that the potential products will achieve market acceptance. Our failure to develop, obtain necessary regulatory clearances or approvals for, or successfully market potential new products could have a material adverse effect on our business, financial condition and results of operations.

Claims by others that we infringe their intellectual property rights could increase our expenses and delay the development of our business. As a result, our business and financial condition could be harmed.

Our industries are characterized by the existence of a large number of patents as well as frequent claims and related litigation regarding patent and other intellectual property rights. We cannot be certain that our products do not and will not infringe issued patents, patents that may be issued in the future, or other intellectual property rights of others.

We do not have the resources to conduct exhaustive patent searches to determine whether the technology used in our products infringe patents held by third parties. In addition, product development is inherently uncertain in a rapidly evolving technological environment in which there may be numerous patent applications pending, many of which are confidential when filed.

We may face claims by third parties that our products or technology infringe on their patents or other intellectual property rights. Any claim of infringement could cause us to incur substantial costs defending against the claim, even if the claim is invalid, and could distract our management. If any of our products are found to violate third-party proprietary rights, we may be required to pay substantial damages. In addition, we may be required to re-engineer our products or obtain licenses from third parties to continue to offer our products. Any efforts to re-engineer our products or obtain licenses on commercially reasonable terms may not be successful, which would prevent us from selling our products, and, in any case, could substantially increase our costs and have a material adverse effect on our business, financial condition and results of operations.

15

We may not be able to protect our intellectual property rights adequately.

Our ability to compete for government contracts is affected, in part, by our ability to protect our intellectual property rights. We rely on a combination of patents, trademarks, copyrights, trade secrets, confidentiality procedures and non-disclosure and licensing arrangements to protect our intellectual property rights. Despite these efforts, we cannot be certain that the steps we take to protect our proprietary information will be adequate to prevent misappropriation of our technology or protect that proprietary information. The validity and breadth of claims in technology patents involve complex legal and factual questions and, therefore, may be highly uncertain. Nor can we assure you that, if challenged, our patents will be found to be valid or enforceable, or that the patents of others will not have an adverse effect on our ability to do business. In addition, the enforcement of laws protecting intellectual property may be inadequate to protect our technology and proprietary information.

We may not have the resources to assert or protect our rights to our patents and other intellectual property. Any litigation or proceedings relating to our intellectual property, whether or not meritorious, will be costly and may divert the efforts and attention of our management and technical personnel.

We also rely on other unpatented proprietary technology, trade secrets and know-how and no assurance can be given that others will not independently develop substantially equivalent proprietary technology, techniques or processes, that such technology or know-how will not be disclosed or that we can meaningfully protect our rights to such unpatented proprietary technology, trade secrets, or know-how. Although we intend to enter into non-disclosure agreements with our employees and consultants, there can be no assurance that such non-disclosure agreements will provide adequate protection for our trade secrets or other proprietary know-how.

Our success will depend, in part, on our ability to obtain new patents.

To date, we have applied for 32 patents in the U.S., six of which have been awarded, and our success will depend, in part, on our ability to obtain patent and trade secret protection for proprietary technology that we currently possess or that we may develop in the future. No assurance can be given that any pending or future patent applications will issue as patents, that the scope of any patent protection obtained will be sufficient to exclude competitors or provide competitive advantages to us, that any of our patents will be held valid if subsequently challenged or that others will not claim rights in or ownership of the patents and other proprietary rights held by us.

Furthermore, there can be no assurance that our competitors have not or will not independently develop technology, processes or products that are substantially similar or superior to ours, or that they will not duplicate any of our products or design around any patents issued or that may be issued in the future to us. In addition, whether or not patents are issued to us, others may hold or receive patents which contain claims having a scope that covers products or processes developed by us.

We may not have the resources to adequately defend any patent infringement litigation or proceedings. Any such litigation or proceedings, whether or not determined in our favor or settled by us, is costly and may divert the efforts and attention of our management and technical personnel. In addition, we may be required to obtain licenses to patents or proprietary rights from third parties. There can be no assurance that such licenses will be available on acceptable terms if at all. If we do not obtain required licenses, we could encounter delays in product development or find that the development, manufacture or sale of products requiring such licenses could be foreclosed. Accordingly, challenges to our intellectual property, whether or not ultimately successful, could have a material adverse effect on our business and results of operations.

Our future success depends on the continued service of management, engineering and sales personnel and our ability to identify, hire and retain additional personnel.

Our success depends, to a significant extent, upon the efforts and abilities of members of senior management. We have entered into an employment agreement with our Chief Executive Officer and President, as well as our Chief Operating Officer, but have not entered into an employment agreement with our Chief Financial Officer or Chief Technology Officer. The loss of the services of one or more of our senior management or other key employees could adversely affect our business. We currently maintain a key person life insurance policy on our Chief Executive Officer only.

There is intense competition for qualified employees in our industry, particularly for highly skilled design, applications, engineering and sales people. We may not be able to continue to attract and retain developers, managers, or other qualified personnel necessary for the development of our business or to replace qualified individuals who may leave us at any time in the future. Our anticipated growth is expected to place increased demands on our resources, and will likely require the addition of new management and engineering staff as well as the development of additional expertise by existing management employees. If we lose the services of or fail to recruit engineers or other technical and management personnel, our business could be harmed.

16

The requirements of being a public company may strain our resources and divert management’s attention.

As a public company, we are subject to the reporting requirements of the Exchange Act, the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act), the Dodd-Frank Wall Street Reform and Consumer Protection Act and other applicable securities rules and regulations. Compliance with these rules and regulations will increase our legal and financial compliance costs, make some activities more difficult, time-consuming, or costly, and increase demand on our systems and resources. The Exchange Act requires, among other things, that we file annual and current reports with the SEC with respect to our business and operating results.

As a result of disclosure of information in this annual report and in filings required of a public company, our business and financial condition is more visible, which we believe may result in threatened or actual litigation, including by competitors and other third parties. If such claims are successful, our business and operating results could be harmed, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert resources of our management and harm our business and operating results.

Periods of rapid growth and expansion could place a significant strain on our resources, including our employee base, which could negatively impact our operating results.

We may experience periods of rapid growth and expansion, which may place significant strain and demands on our management, our operational and financial resources, customer operations, research and development, marketing and sales, administrative, and other resources. To manage our possible future growth effectively, we will be required to continue to improve our management, operational and financial systems. Future growth would also require us to successfully hire, train, motivate and manage our employees. In addition, our continued growth and the evolution of our business plan will require significant additional management, technical and administrative resources. If we are unable to manage our growth successfully we may not be able to effectively manage the growth and evolution of our current business and our operating results could suffer.

We depend on contract manufacturers, and our production and products could be harmed if it is unable to meet our volume and quality requirements and alternative sources are not available.

We rely on contract manufacturers to provide manufacturing services for our products. If these services become unavailable, we would be required to identify and enter into an agreement with a new contract manufacturer or take the manufacturing in-house. The loss of our contract manufacturers could significantly disrupt production as well as increase the cost of production, thereby increasing the prices of our products. These changes could have a material adverse effect on our business and results of operations.

We are presently a small company with too limited resources and personnel to establish a comprehensive system of internal controls. If we fail to maintain an effective system of internal controls, we would not be able to accurately report our financial results on a timely basis or prevent fraud. As a result, current and potential stockholders could lose confidence in our financial reporting, which would harm our business and the trading price of our Common Stock.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. If we cannot provide reliable financial reports or prevent fraud, our brand and operating results would be harmed. We may in the future discover areas of our internal controls that need improvement. For example, because of size and limited resources, our external auditors may determine that we lack the personnel and infrastructure necessary to properly carry out an independent audit function. Although we believe that we have adequate internal controls for a company with our size and resources, we are not certain that the measures that we have in place will ensure that we implement and maintain adequate controls over our financial processes and reporting in the future. Any failure to implement required new or improved controls, or difficulties encountered in their implementation, would harm our operating results or cause us to fail to meet our reporting obligations. Inferior internal controls would also cause investors to lose confidence in our reported financial information, which would have a negative effect on our company and, if a public market develops for our securities, the trading price of our Common Stock.

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with U.S. generally accepted accounting principles. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of annual or interim financial statements will not be prevented or detected on a timely basis.

As of December 31, 2017, we have identified certain matters that constituted a material weakness in our internal controls over financial reporting. Specifically, we have difficulty in accounting for complex accounting transactions due to an insufficient number of accounting personnel with experience in that area and limited segregation of duties within our accounting and financial reporting functions. In addition, management needs additional time to fully document the systems and controls related to the acquisition of Fit Pay in May 2017.

17

If we do not effectively manage changes in our business, these changes could place a significant strain on our management and operations.

Our ability to grow successfully requires an effective planning and management process. The expansion and growth of our business could place a significant strain on our management systems, infrastructure and other resources. To manage our growth successfully, we must continue to improve and expand our systems and infrastructure in a timely and efficient manner. Our controls, systems, procedures and resources may not be adequate to support a changing and growing company. If our management fails to respond effectively to changes and growth in our business, including acquisitions, this could have a material adverse effect on our business, financial condition, results of operations and future prospects.

We are an emerging growth company within the meaning of the Securities Act, and if we decide to take advantage of certain exemptions from various reporting requirements applicable to emerging growth companies, our Common Stock could be less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act. For as long as we continue to be an emerging growth company, we may take advantage of exemptions from various reporting requirements that are not applicable to other public companies that are not emerging growth companies, including not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We could be an emerging growth company for up to five years, although we could lose that status sooner if our annual gross revenues exceed $1.07 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our Common Stock held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, in which case we would no longer be an emerging growth company as of the following December 31. We cannot predict if investors will find our Common Stock less attractive because we may rely on these exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and the price of our Common Stock may be more volatile.

Under the JOBS Act, emerging growth companies may also delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption from new or revised accounting standards and, therefore, will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

We may not be able to access the equity or credit markets.

We face the risk that we may not be able to access various capital sources including investors, lenders, or suppliers. Failure to access the equity or credit markets from any of these sources could have a material adverse effect on our business, financial condition, results of operations, and future prospects.

Persistent global economic trends could adversely affect our business, liquidity and financial results.

Although improving, persistent global economic conditions, particularly the scarcity of capital available to smaller businesses, could adversely affect us, primarily through limiting our access to capital and disrupting our clients’ businesses. In addition, continuation or worsening of general market conditions in economies important to our businesses may adversely affect our clients’ level of spending and ability to obtain financing, leading to us being unable to generate the levels of sales that we require. Current and continued disruption of financial markets could have a material adverse effect on our business, financial condition, results of operations and future prospects.

We may seek or need to raise additional funds. Our ability to obtain financing for general corporate and commercial purposes or acquisitions depends on operating and financial performance, and is also subject to prevailing economic conditions and to financial, business and other factors beyond our control. The global credit markets and the financial services industry have been experiencing a period of unprecedented turmoil characterized by the bankruptcy, failure or sale of various financial institutions. An unprecedented level of intervention from the U.S. and other governments has been seen. As a result of such disruption, our ability to raise capital may be severely restricted and the cost of raising capital through such markets or privately may increase significantly at a time when we would like, or need, to do so. Either of these events could have an impact on our flexibility to fund our business operations, make capital expenditures, pursue additional expansion or acquisition opportunities, or make another discretionary use of cash and could adversely impact our financial results.

18