Table of Contents

Registration No. 333-189428

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

To

FORM F-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Iroko Pharmaceuticals Inc.

(Exact name of registrant as specified in its charter)

| British Virgin Islands | 2834 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Iroko Pharmaceuticals Inc.

One Kew Place, 150 Rouse Boulevard, Philadelphia, PA 19112

(267) 546-3003

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Moji James

General Counsel

Iroko Pharmaceuticals Inc.

One Kew Place, 150 Rouse Boulevard, Philadelphia, PA 19112

(267) 546-3003

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Carmelo M. Gordian Ted A. Gilman Andrews Kurth LLP 111 Congress, Suite 1700 Austin, TX 78701 (512) 320-9200 |

Richard D. Truesdell, Jr. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

|

| ||||

| TITLE OF EACH CLASS OF SECURITIES TO BE REGISTERED |

PROPOSED MAXIMUM OFFERING PRICE (1) |

AMOUNT

OF REGISTRATION FEE | ||

| Ordinary shares, par value $0.01 |

$128,750,000 | $17,562 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of computing the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED , 2013

Preliminary Prospectus

Shares

Iroko Pharmaceuticals Inc. is offering ordinary shares. This is our initial public offering and no public market currently exists for our shares. We expect that the initial public offering price will be between $ and $ per share.

We have applied to list our ordinary shares on the NASDAQ Global Select Market under the symbol “IRKO”.

We are an “emerging growth company” under applicable federal securities laws and will be subject to reduced public company reporting requirements. Investing in our ordinary shares involves risks. See “Risk Factors” beginning on page 14 to read about risks you should consider before buying your ordinary shares.

$ Per Ordinary Share

| PER SHARE | TOTAL | |||||||

| Price to the public |

$ | $ | ||||||

| Underwriting discounts and commissions (1) |

$ | $ | ||||||

| Proceeds to us (before expenses) |

$ | $ | ||||||

| (1) | See the section of this prospectus entitled “Underwriting.” |

To the extent that the underwriters sell more than ordinary shares, the underwriters have a 30-day option to purchase up to an additional ordinary shares from us on the same terms as set forth above. See the section of this prospectus entitled “Underwriting.”

The Securities and Exchange Commission and state securities commissions have not approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ordinary shares to purchasers on , 2013.

| Jefferies | William Blair | |||

| Canaccord Genuity |

The date of this prospectus is , 2013

Table of Contents

Table of Contents

| PAGE | ||||

| 1 | ||||

| 7 | ||||

| 9 | ||||

| 11 | ||||

| 14 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| 55 | ||||

| Management’s Discussion And Analysis Of Financial Condition And Results Of Operations |

57 | |||

| Changes In And Disagreements With Accountants On Accounting And Financial Disclosure |

85 | |||

| 86 | ||||

| 119 | ||||

| 127 | ||||

| 134 | ||||

| 138 | ||||

| 141 | ||||

| 153 | ||||

| 155 | ||||

| 159 | ||||

| 164 | ||||

| 165 | ||||

| 166 | ||||

| 167 | ||||

| 168 | ||||

| F-1 | ||||

Table of Contents

We have not authorized anyone to provide you with information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give to you. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

Dealer Prospectus Delivery Obligation

Until (25 days after the commencement of the offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

ii

Table of Contents

IMPORTANT INTRODUCTORY INFORMATION

As described under “Corporate Formation and Reorganization,” we have effected a number of transactions, which we refer to as the Reorganization Transactions, which resulted in our issuance of convertible preference shares and the redesignation of any ordinary shares we previously issued into class 1 ordinary shares. See “Corporate Formation and Reorganization” for a complete description of the Reorganization Transactions. The conversion ratio of our convertible preference shares and class 1 ordinary shares issued in connection with the Reorganization Transactions into ordinary shares is dependent on the actual per-share initial public offering price in this offering and the timing of the offering. Accordingly, the number of our ordinary shares that will be outstanding as of the consummation of this offering cannot be determined at this time. Where information in this prospectus gives effect to the Reorganization Transactions, such information is presented assuming an initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, and a closing date of . For an analysis of how such information would change if the initial public offering price is not equal to the midpoint of the price range, see “Pricing Sensitivity Analysis.”

In addition, our ordinary shares were recently redesignated as class 1 ordinary shares solely to effect a restructuring of our share capital in connection with this offering, which we refer to as the Restructuring. As part of the Restructuring, prior to the consummation of this offering, all class 1 ordinary shares will be converted into ordinary shares and, at such time, all class 1 ordinary shares will cease to be outstanding. All historical references to ordinary shares throughout this prospectus are therefore technically references to class 1 ordinary shares, but have not been so reflected given the expected short duration of such designation. See “Corporate Formation and Reorganization” for further information regarding the Restructuring.

Unless the context otherwise requires, references in this prospectus to “Iroko,” “we,” “our,” “us,” and the “company” refer to Iroko Pharmaceuticals Inc. together with its subsidiaries and, in the case of historical information, its predecessor entities. References in this prospectus to “iCeutica” refer to iCeutica Holdings Inc. and its subsidiaries. iCeutica is a company that is also controlled by our parent company.

iii

Table of Contents

This summary highlights the information contained elsewhere in this prospectus and is a brief overview of the key aspects of the offering. Because this is only a summary, it does not contain all of the information that may be important to you. Before investing in our ordinary shares, you should read this entire prospectus, including the information set forth under the headings “Risk Factors,” “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and our consolidated financial statements and related notes thereto. Some of the statements in this prospectus constitute forward-looking statements. Please read “Special Note Regarding Forward-Looking Statements” for more information.

Overview

We are a global, specialty pharmaceutical company focused on the development and commercialization of novel nonsteroidal anti-inflammatory drug, or NSAID, therapeutics for patients with mild to moderate acute and chronic pain. Our pipeline includes six submicron NSAID product candidates, two of which have been submitted to the U.S. Food and Drug Administration or FDA for marketing approval. We use the iCeutica proprietary SoluMatrix™ technology platform, which we have exclusively licensed, or have the option to exclusively license, for all NSAIDs, to create submicron, lower dose formulations of established NSAIDs. NSAIDs are one of the largest classes of pain-relieving medications and have been a mainstay of treatment for a variety of pain related conditions notwithstanding their potential adverse side effects. The proprietary technology platform we use has been shown, at a statistically significant level in clinical studies, to fundamentally change the absorption profile of our late-stage NSAID product candidates so that they are quickly dissolved and absorbed to allow for rapid onset of pain relief at lower doses and lower systemic exposures, as measured by plasma levels of a drug over time, than the comparable commercially available NSAID, which are diclofenac, indomethacin, and naproxen. We are applying this proprietary technology platform to additional NSAID molecules in preclinical development and expect to experience similar results. We believe that our product candidates offer promising, efficacious pain treatment options for patients with the potential for an improved safety profile.

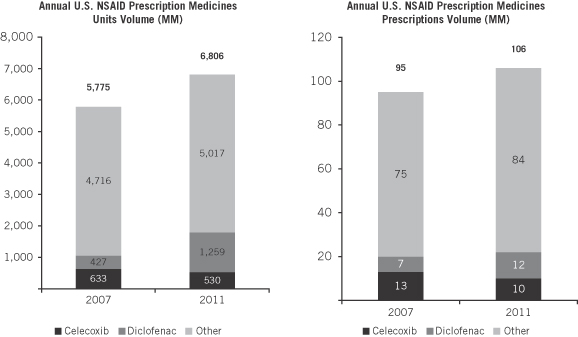

The NSAID market is one of the largest therapeutic classes in the United States with approximately 106 million prescriptions written representing approximately 7 billion units in 2011. While NSAIDs are generally considered to be safe and effective, they have also been associated with dose-related serious, adverse events in some patients, including gastrointestinal, renal and cardiovascular events. The recognized correlation between systemic exposure to NSAIDs and these adverse events led the U.S. Food and Drug Administration, or FDA, to issue its 2005 public health advisory recommending that NSAIDs should be used at their lowest effective dose for the shortest duration of time. We believe that our lower dose submicron NSAIDs address the FDA’s 2005 public health advisory by offering lower overall systemic exposure and thereby potentially reducing the occurrence of adverse events.

Our late-stage product candidates are submicron diclofenac (Zorvolex™), submicron indomethacin (Tiforbex™), submicron meloxicam and submicron naproxen and are being developed for both acute pain (Zorvolex™, Tiforbex™) and osteoarthritis pain (Zorvolex™, submicron meloxicam, submicron naproxen) indications in adult patients. We have completed Phase 3 clinical trials for Zorvolex™ and Tiforbex™ for acute pain in adult patients. We received an Agreement Letter for our Special Protocol Assessment, or SPA, from the FDA for Zorvolex™ and in December 2012 submitted a new drug application, or NDA, with the FDA for the treatment of acute pain in adult patients, which was accepted for filing in February 2013. We also intend to submit a supplemental NDA, or sNDA, with the FDA for Zorvolex™ for treatment of osteoarthritis pain in adult patients in late 2013. We submitted an NDA for Tiforbex™ for the treatment of acute pain in adult patients in April 2013. Phase 3 clinical trials commenced for the treatment of osteoarthritis pain in adult patients for submicron meloxicam in March 2013 and are planned to begin for submicron naproxen in 2014. The two product candidates in preclinical development are submicron celecoxib and submicron ibuprofen. We intend to continue advancing these and potentially other product candidates as we build our pipeline.

1

Table of Contents

In addition to our submicron NSAID product pipeline, our two approved products, Indocin® (indomethacin) and Aldomet® (methyldopa), are marketed in 48 countries. The approved indications for Indocin® (indomethacin) include moderate to severe rheumatoid arthritis, including acute flares of chronic disease, moderate to severe ankylosing spondylitis, moderate to severe osteoarthritis, acute painful shoulder (bursitis and/or tendinitis) and acute gouty arthritis. The approved indication for Aldomet® (methyldopa) includes the treatment of hypertension. These products generated approximately $20.0 million in net sales globally in 2012, including $13.3 million in sales by our licensee, Aspen Pharmacare Holdings Limited and its subsidiaries, or Aspen. We sell these products in the U.S. and seven European countries (Austria, Belgium, France, Italy, Portugal, Spain and Switzerland), which generated $6.7 million of net sales in 2012. In addition, we received $3.2 million in royalties from rest of world net sales generated by Aspen in 2012. The operations and capabilities established to support these products have demonstrated our ability to manage the manufacture, distribution and sale of drug therapeutic products globally.

NSAID Market Background

The NSAID market is one of the largest therapeutic classes in the U.S. with approximately 106 million prescriptions written representing approximately 7 billion units in 2011. The prescribing of NSAIDs has increased by approximately 12% from 2007 to 2011 primarily driven by an aging population, improvements in recognition and treatment of pain and increasing concerns with the use of other alternatives such as acetaminophen and opioids, including hydrocodone-NSAID combinations, oxycodone-NSAID combinations, hydrocodone-acetaminophen combinations and oxycodone-acetaminophen combinations. This market is largely composed of off-patent products. The largest remaining on-patent branded NSAID, Celebrex® (celecoxib), generated approximately 10 million prescriptions, resulting in U.S. sales of approximately $1.9 billion in 2011. If all 106 million NSAID prescriptions were sold at pricing levels comparable to Celebrex®, we believe that the aggregate U.S. NSAID market value would be approximately $20 billion annually.

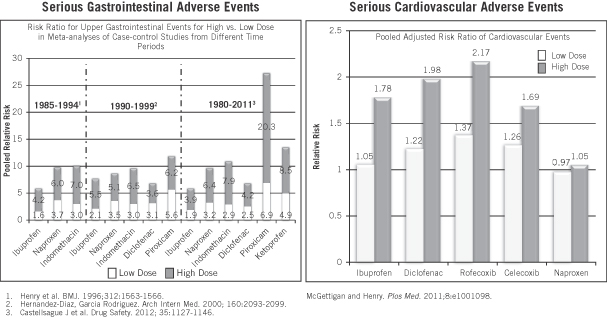

NSAIDs are used to treat a variety of painful conditions including acute pain, back pain, gout, osteoarthritis, rheumatoid arthritis and ankylosing spondylitis. NSAIDs provide relief from symptoms of many of these conditions including pain and inflammation. While NSAIDs are generally considered to be safe and effective, they have also been associated with serious adverse events in some patients. These serious adverse events include gastrointestinal events such as bleeding and ulcers, cardiovascular events such as acute myocardial infarctions, or heart attacks, strokes and renal events. The serious gastrointestinal complications alone account for an estimated 3,200 to 16,000 deaths and 32,000 to 103,000 hospitalizations per year in the U.S. Multiple studies have indicated a correlation between systemic exposure to NSAIDs and these adverse events. As a result, in 2005 the FDA issued a public health advisory titled “Important Changes and Additional Warnings for COX-2 Selective and Non-Selective Non-Steroidal Anti-Inflammatory Drugs (NSAIDs)”. In this advisory the FDA requires manufacturers of all marketed prescription NSAIDs to revise the labeling (package insert) for their products to include a boxed warning (commonly referred to as a “black box” warning) and a medication guide. The boxed warning highlights the potential for increased risk of cardiovascular events with these drugs and the documented, serious, and potentially life-threatening adverse health effects associated with their use. The FDA requires companies to provide a medication guide which informs patients of the need to discuss with their doctor the risks and benefits of using NSAIDs and the importance of using the lowest effective dose for the shortest duration possible if treatment with an NSAID is warranted for an individual. Health Canada also issued a guidance document to aid in the revision of the content of the NSAID Product Monograph and associated labeling materials by the pharmaceutical industry. This guidance indicated that the use of NSAID products “should be limited to the lowest effective dose for the shortest possible duration of treatment in order to minimize the potential risk for cardiovascular or gastrointestinal adverse events.” Additionally, the European Medicines Agency, or EMA, and other regulatory bodies and medical societies similarly have recommended that NSAIDs should be used at their lowest effective dose for the shortest duration of time.

2

Table of Contents

Our Strategy

We use the proprietary SoluMatrix™ technology platform to create a suite of submicron, lower dose formulations of known NSAIDs. The proprietary technology platform we use has been shown to fundamentally change the absorption profile of our late-stage NSAID product candidates so that they are quickly dissolved and absorbed to allow for rapid onset of pain relief at lower doses and lower systemic exposures than comparable commercially available NSAIDs. With improved dissolution, formulations using this technology may offer meaningful benefits: reduction of the amount of drug required to achieve, speed up or improve consistency of, the drug’s therapeutic effect. We are applying this proprietary technology platform to additional NSAID molecules in preclinical development and expect to experience similar results. We believe that our product candidates offer potentially promising, efficacious pain treatment options for patients with the potential for an improved safety profile.

The key elements of our strategy are to:

| n | build a leading pain treatment company focused on our branded submicron NSAID franchise; |

| n | build marketing and sales capabilities in the U.S.; |

| n | maximize the value of our submicron NSAID franchise by launching in selected markets outside the U.S.; and |

| n | maximize the value of our currently marketed products. |

Our Product Candidates

Our product candidates address a critical need for new NSAIDs that provide efficacious pain relief while potentially reducing the risk of serious gastrointestinal, cardiovascular and renal events. They address FDA, EMA and other regulatory bodies’ and medical societies’ recommendations that NSAIDs should be used at their lowest effective dose for the shortest duration of time. The availability of these product candidates will provide physicians and patients with alternatives to currently available NSAIDs and other analgesic products, including, in some cases, opioid and acetaminophen products. The following table highlights the current stage of clinical development for each of our product candidates.

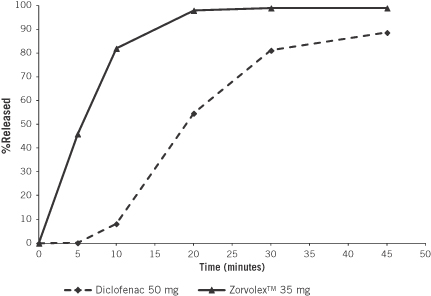

SoluMatrix™ Technology Platform

The proprietary SoluMatrix™ technology platform uses a dry milling process to reduce the drug particle size in our submicron NSAIDs by at least ten times compared to the particle size in the pre-milled NSAID. The smaller particle size results in increased surface area relative to mass, which increases the dissolution and absorption rates without changing the chemical structures of the drug molecules themselves. Because of this altered absorption profile, our late-stage NSAID product candidates dissolve and are absorbed at a rate that allows for the rapid onset of pain relief at lower doses and lower systemic exposures than comparable commercially available NSAIDs. This technology has been licensed to us by iCeutica for exclusive use in the NSAID market.

Late-Stage Pipeline

| PRODUCT CANDIDATE |

TARGET INDICATION |

DEVELOPMENT STATUS |

COMMERCIAL RIGHTS | |||

| Zorvolex™ |

Acute pain | NDA submitted December 2012; accepted for filing February 2013 |

Worldwide | |||

| Zorvolex™ |

Osteoarthritis pain | Phase 3 complete | Worldwide | |||

| Tiforbex™ |

Acute pain | NDA submitted April 2013 | Worldwide | |||

| Submicron meloxicam |

Osteoarthritis pain | Phase 1 and Phase 3 ongoing (1) | Worldwide | |||

| Submicron naproxen |

Osteoarthritis pain | Phase 2 complete (2) | Worldwide |

3

Table of Contents

| (1) | We have begun, and are enrolling patients for, two Phase 3 clinical trials for submicron meloxicam. In addition, we have completed two Phase 1 clinical trials for submicron meloxicam and have commenced a third Phase 1 clinical trial, which is proceeding concurrently with the Phase 3 clinical trials. |

| (2) | Phase 2 clinical trials have been completed for submicron naproxen. We are planning Phase 3 clinical trials with a potential start date in 2014. |

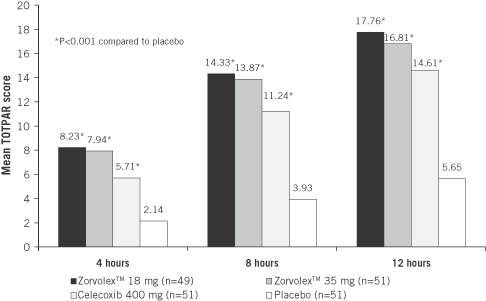

Zorvolex™ is a novel formulation of diclofenac developed using the proprietary SoluMatrixTM technology platform and is being developed for the treatment of acute pain of mild to moderate severity in adult patients. Products containing diclofenac salts have been approved in the U.S. since 1988 and are indicated for a range of conditions, including primary dysmenorrhea, the treatment of mild to moderate pain, and for the relief of the signs and symptoms of osteoarthritis and rheumatoid arthritis. We have completed a Phase 3 trial for the treatment of acute pain. We have an SPA in place and in December 2012 submitted an NDA with the FDA for this initial product candidate for acute pain, which was accepted for filing in February 2013. We believe we have followed all procedures and met all endpoints described in this SPA. We have completed the efficacy component of our Phase 3 trial program for osteoarthritis pain, have completed the open label safety study component and intend to file an sNDA with the FDA in late 2013.

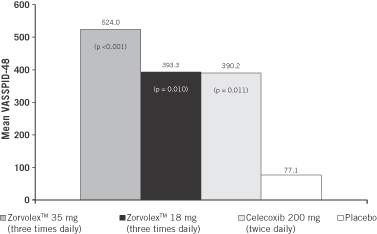

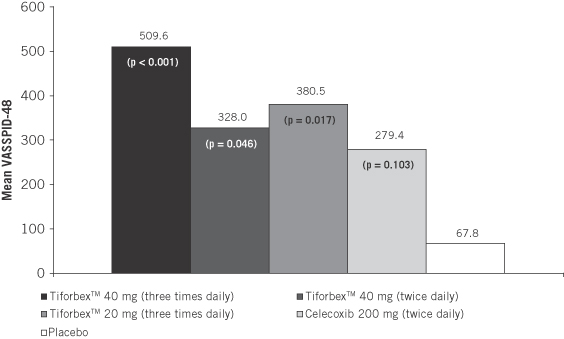

Tiforbex™ is a novel formulation of indomethacin using the proprietary SoluMatrix™ technology platform and is being developed for the treatment of acute pain of mild to moderate severity in adult patients. Products containing indomethacin have been licensed in the U.S. since 1965 and are indicated for the treatment of moderate to severe rheumatoid arthritis, including acute flares of chronic disease, moderate to severe ankylosing spondylitis, moderate to severe osteoarthritis, acute painful shoulder (bursitis and/or tendinitis) and acute gouty arthritis. We have completed two Phase 3 clinical trials for the treatment of acute pain in adult patients. We have submitted an NDA for this product candidate for acute pain with the FDA in April 2013.

Submicron meloxicam is a novel formulation of meloxicam using the proprietary SoluMatrix™ technology platform. Meloxicam is the active ingredient in Mobic® Tablets, a product sold by Boehringer Ingelheim Pharmaceuticals Inc. Mobic® was approved in the U.S. in 2000 and is indicated for the relief of the signs and symptoms of osteoarthritis, rheumatoid arthritis and pauciarticular or polyarticular juvenile rheumatoid arthritis in patients two years of age and older. We are developing submicron meloxicam for the treatment of osteoarthritis pain in adult patients. We commenced Phase 3 clinical trials for this product candidate for this indication in March 2013. We plan to submit an NDA with the FDA in late 2014.

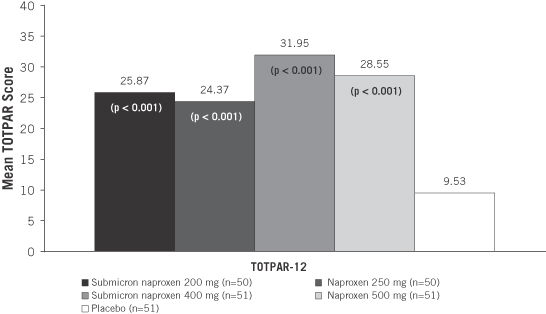

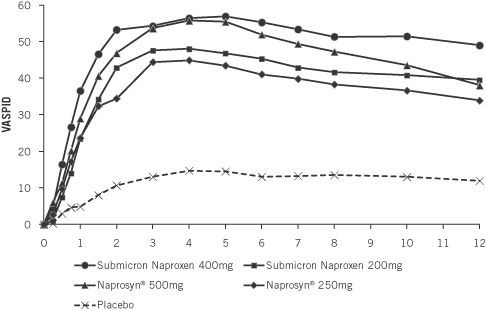

Submicron naproxen is a novel formulation of naproxen using the proprietary SoluMatrix™ technology platform. Products containing naproxen have been available in the U.S. since 1976 and are indicated for the treatment of rheumatoid arthritis, osteoarthritis, ankylosing spondylitis, tendonitis, bursitis, acute gout, relief of mild to moderate acute pain and acute dysmenorrhea. We are developing submicron naproxen for the treatment of osteoarthritis pain in adult patients. We have completed Phase 2 clinical trials and plan to commence Phase 3 clinical trials for the treatment of osteoarthritis pain in adult patients in 2014.

Preclinical Pipeline

In addition to late-stage product candidates, we have submicron formulations of celecoxib and ibuprofen. We intend to continue advancing these and potentially other submicron NSAID product candidates that we have the right to exclusively license from iCeutica as we build our pipeline.

Our Marketing Strategy

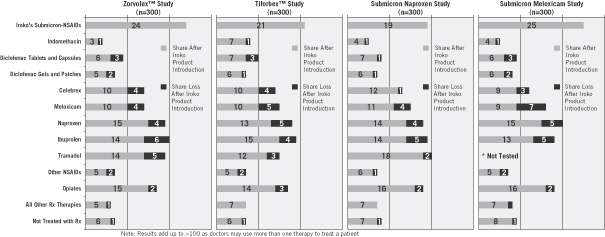

Our marketing plan involves increasing awareness among physicians of the rationale and the FDA’s and other regulatory bodies’ and medical societies’ recommendations for the use of the lowest effective doses of NSAIDs. Our submicron NSAID products will be positioned as uniquely offering effective pain relief at lower doses and systemic exposures. Zorvolex™ will be positioned as the effective lower dose NSAID that can be used both for short and long periods of time. Tiforbex™ will be positioned as the effective lower dose NSAID best used for pain relief related with acute conditions and for shorter periods of time. We believe that co-positioning Zorvolex™ and Tiforbex™, in part a reflection of existing medical practice, will allow these products to gain share from the different NSAID market segments.

4

Table of Contents

Our marketing strategies for the submicron NSAIDs are based on extensive marketing research studies conducted with over 2,400 physicians, predominantly primary care physicians and rheumatologists. Market research studies were conducted with over 1,500 physicians for Zorvolex™ alone. These market research studies were conducted over the last two and a half years beginning in the fall of 2010 and consisted of both qualitative and quantitative studies including conjoint studies, positioning, message testing and concept testing studies. The insights derived from these studies along with sophisticated analytics such as segmentation and core base statistical areas, or CBSA, mapping has shaped our focus on the appropriate targets of physicians matched to CBSAs where patients are likely to have relatively unrestricted managed care coverage and core product messages that will be compelling to those physicians. About $1.5 million has been spent over the past two and a half years for the primary market research studies to physicians and an additional $1.4 million has been spent on data and analytics.

The marketing strategy for our submicron NSAIDs has been developed to:

| n | ensure physicians have top of mind awareness of the rationale and numerous recommendations to use the lowest effective dose of NSAIDs for the shortest period of time; |

| n | differentiate our submicron NSAIDs individually and as a portfolio from other NSAIDs; |

| n | effectively co-position our submicron NSAID products for optimal share penetration; |

| n | ensure formulary availability and optimize reimbursement of our submicron NSAID products; and |

| n | use sophisticated analytics for efficient segmentation, targeting and geographical allocation of resources. |

Reimbursement Strategy

Our reimbursement strategy in the U.S. is to demonstrate the value proposition of our submicron NSAID products to managed care payors. Our payor targeting and strategies have been guided by extensive market intelligence studies and analytics. During the past two and a half years, qualitative and quantitative market research have been conducted with about 50 key managed care decision makers made of medical directors and pharmacy directors. An additional 14 managed care decision makers have provided guidance in advisory board settings. Detailed CBSA level analysis has been conducted indexing coverage by plan and co-pay levels allowing for prioritization of favorable areas. Also, detailed plan level analytics have been conducted for approximately 55 payor accounts, including managed care plans and pharmacy benefit managers, evaluating their formulary management strategies and the relative effectiveness of those strategies. Overall, approximately $500,000 has been spent over the past two and a half years towards the efforts to understand the payors’ perspectives that guide our payor strategies.

The value proposition is as follows:

| n | provide effective pain relief at lower doses; |

| n | provide products that facilitate the use of NSAIDs in accordance with the recommendations provided by the FDA, EMA, other regulatory bodies and medical societies; |

| n | potentially reduce serious adverse events thereby improving the pharmacoeconomic advantage of using our submicron NSAID products; and |

| n | provide an alternative that could reduce the usage of opioids. |

Suppliers/Manufacturing

Our supply chain is composed of a network of third-party providers. This network consists of suppliers of raw material, excipients, active pharmaceutical ingredients, or APIs, contract manufacture operations and packaging. We do not own or operate facilities for the manufacturing or packaging of any of our current products. We do not have any current plans to establish our own manufacturing or packaging operations for our products.

5

Table of Contents

Risks Affecting Our Business

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows and prospects, that you should consider before making a decision to invest in our ordinary shares. These risks are discussed more fully in the “Risk Factors” section of this prospectus, beginning on page 14.

These risks include, but are not limited to, the following:

| n | we expect to incur losses in the near term and may never achieve or sustain profitability; |

| n | we cannot be certain that Zorvolex™, Tiforbex™ or any of our other product candidates will receive regulatory approval, and without regulatory approval we will not be able to market our product candidates; |

| n | our products, if approved, may not be accepted in the marketplace; |

| n | we could be unsuccessful in obtaining or maintaining adequate patent protection for one or more of our product candidates and may be unable to maintain and protect our intellectual property assets, which could impair the advancement of our pipeline and commercial opportunities; and |

| n | all of our rights to patents and patent applications are exclusively licensed from iCeutica and we currently do not own or license any issued U.S. patents with respect to any of our proposed products. |

Corporate Information

Iroko Pharmaceuticals, LLC, our primary operating company, was founded in 2007. Iroko Pharmaceuticals Inc. was incorporated on September 10, 2012, under the laws of the British Virgin Islands and is registered at the Registry of Corporate Affairs of the British Virgin Islands under the number 1732699, in connection with the transactions further described in “Corporate Formation and Reorganization” below and as a result controls Iroko Pharmaceuticals, LLC. Our principal executive office is located at One Kew Place, 150 Rouse Boulevard, Philadelphia, PA 19112, and our telephone number is (267) 546-3003. Our website address is http://www.iroko.com. The information contained in or accessible from our website is not incorporated into this prospectus, and you should not consider it part of this prospectus.

The “Iroko” name, the “Indocin®” name, the “Aldomet®” name, the “Zorvolex™” name, the “Tiforbex™” name, and related images, logos and symbols appearing in this prospectus are registered trademarks of Iroko in the U.S. and/or foreign jurisdictions. The “SoluMatrix™” name is the property of iCeutica. Other marks appearing in this prospectus are the property of their respective owners.

6

Table of Contents

| Ordinary shares offered by us |

shares. |

| Ordinary shares outstanding after this offering |

shares (assuming no exercise of the underwriters’ over-allotment option). |

| Option to purchase additional shares |

We have granted the underwriters a 30-day option to purchase up to additional ordinary shares to cover over-allotments, if any. |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and estimated offering expenses payable by us, will be approximately $ million, assuming an initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), or approximately $ million if the underwriters exercise in full their option to purchase additional shares. We intend to use the net proceeds of this offering for working capital, and other general corporate purposes, which may include financing growth (including payment of increased levels of expenditures), developing, commercializing and launching new products and funding capital expenditures, acquisitions and investments. See “Use of Proceeds.” |

| Dividend policy |

We do not anticipate paying any cash dividends on our ordinary shares in the foreseeable future. See “Dividend Policy.” |

| Proposed NASDAQ Global Select Market listing symbol (reserved) |

“IRKO” |

| Risk factors |

Investment in our ordinary shares involves substantial risks. You should read and consider this prospectus carefully, including the section entitled “Risk Factors” and the financial statements and the related notes to those statements included in this prospectus, before investing in our ordinary shares. |

The number of ordinary shares outstanding after this offering is based on ordinary shares outstanding as of March 31, 2013, which number assumes the automatic conversion of all of our outstanding convertible preference shares and class 1 ordinary shares into an aggregate of ordinary shares, and the conversion of our convertible note into ordinary shares, in each case assuming an initial public offering price of $ per ordinary share (the midpoint of the price range set forth on the cover page of this prospectus), a closing date of , 2013 and the completion of the Reorganization Transactions as described in the section of this prospectus titled “Corporate Formation and Reorganization.”

The number of ordinary shares outstanding after this offering excludes the following (each as of March 31, 2013 and at an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus) and a closing date of , 2013):

| n | ordinary shares issuable upon the exercise of options at a weighted-average exercise price of $ per share; and |

| n | ordinary shares reserved for future issuance under our 2012 Share Option Plan, or the 2012 Plan. Prior to the consummation of this offering, we intend to issue restricted ordinary shares or grant options to purchase ordinary shares (which will have an exercise price equal to the price at which |

7

Table of Contents

| ordinary shares are sold in this offering) to certain of our employees and consultants for all of the remaining ordinary shares reserved for issuance under the 2012 Plan. |

Except as otherwise noted, all information in this prospectus:

| n | assumes no exercise of the underwriters’ over-allotment option to purchase additional shares; |

| n | gives effect to the assumed automatic conversion prior to the completion of this offering of all of our outstanding convertible preference shares and class 1 ordinary shares into an aggregate of ordinary shares; |

| n | assumes the conversion upon the completion of this offering of our convertible note into ordinary shares; |

| n | assumes the effectiveness of our Amended and Restated Memorandum and Articles of Association, which we will adopt prior to the consummation of this offering; and |

| n | assumes an initial public offering price of $ per ordinary share (the midpoint of the price range set forth on the cover page of this prospectus) and a closing date of , 2013. |

8

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize the consolidated financial data for the periods indicated. The summary consolidated statements of operations data for the years ended December 31, 2011 and 2012 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The consolidated statements of operations data for the three months ended March 31, 2012 and 2013 and the summary consolidated balance sheet data as of March 31, 2013 have been derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future and our interim period results are not necessarily indicative of the results for a full year. The summary consolidated financial data below should be read in conjunction with the information contained in “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” the consolidated financial statements and notes thereto, and other financial information included elsewhere in this prospectus.

| YEAR ENDED DECEMBER 31, | THREE MONTHS ENDED MARCH 31, | |||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||

| (unaudited) | ||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||

| Revenues: |

||||||||||||||||

| Net product sales |

$ | 7,443 | $ | 6,704 | $ | 1,652 | $ | 1,879 | ||||||||

| Royalty revenues |

3,538 | 3,176 | 770 | 755 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 10,981 | 9,880 | 2,422 | 2,634 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Costs and expenses: |

||||||||||||||||

| Cost of sales (excluding amortization of intangible assets) |

6,054 | 3,187 | 812 | 747 | ||||||||||||

| Amortization of intangible assets |

1,717 | 1,717 | 429 | 429 | ||||||||||||

| Selling, general and administrative |

18,913 | 27,017 | 4,946 | 10,519 | ||||||||||||

| Research and development |

18,299 | 33,884 | 10,112 | 4,786 | ||||||||||||

| Acquired in-process research and development |

— | 11,000 | — | — | ||||||||||||

| Related-party management fee |

1,500 | 1,500 | 375 | 375 | ||||||||||||

| Change in fair value of contingent consideration |

1,000 | 3,500 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 47,483 | 81,805 | 16,674 | 16,856 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating loss |

(36,502 | ) | (71,925 | ) | (14,252 | ) | (14,222 | ) | ||||||||

| Total other income (expense), net |

1,697 | (2,789 | ) | 58 | (2,887 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from continuing operations before income tax benefit |

(34,805 | ) | (74,714 | ) | (14,194 | ) | (17,109 | ) | ||||||||

| Income tax benefit |

(1,079 | ) | — | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Loss from continuing operations |

(33,726 | ) | (74,714 | ) | (14,194 | ) | (17,109 | ) | ||||||||

| Income from discontinued operations, net of tax |

1,877 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss |

$ | (31,849 | ) | $ | (74,714 | ) | $ | (14,194 | ) | $ | (17,109 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) earnings per ordinary share—basic and diluted: |

||||||||||||||||

| Loss per ordinary share from continuing operations |

$ | (33,726 | ) | $ | (74,714 | ) | $ | (14,194 | ) | $ | (17,109 | ) | ||||

| Discontinued operations per ordinary share, net of tax |

1,877 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net loss per ordinary share—basic and diluted |

$ | (31,849 | ) | $ | (74,714 | ) | $ | (14,194 | ) | $ | (17,109 | ) | ||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average basic and diluted ordinary shares outstanding |

1,000 | 1,000 | 1,000 | 1,000 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Unaudited pro forma net loss |

$ | — | $ | — | ||||||||||||

|

|

|

|

|

|||||||||||||

| Unaudited pro forma basic and diluted net loss per ordinary share |

$ | — | $ | — | ||||||||||||

|

|

|

|

|

|||||||||||||

| Unaudited pro forma weighted average basic and diluted ordinary shares outstanding |

— | — | ||||||||||||||

|

|

|

|

|

|||||||||||||

9

Table of Contents

| AS OF MARCH 31, 2013 | ||||||||||||

| ACTUAL | PRO FORMA (1) | PRO FORMA AS ADJUSTED (1)(2) |

||||||||||

| (unaudited) (in thousands) |

||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents |

$ | 11,060 | $ | 36,060 | $ | |||||||

| Related-party note receivable |

4,500 | — | ||||||||||

| Working capital |

(68,088 | ) | 22,024 | |||||||||

| Total assets |

79,371 | 99,871 | ||||||||||

| Related-party line of credit |

49,500 | — | ||||||||||

| Related-party note payable |

25,000 | 10,000 | ||||||||||

| Total liabilities |

100,922 | 31,310 | ||||||||||

| Total shareholder’s equity (deficit) |

(21,551 | ) | 68,561 | |||||||||

| (1) | Reflects (i) in April 2013, the conversion of $45.0 million in borrowings under our related-party line of credit and accrued interest of $4.9 million into 45,000,000 convertible preference shares, the conversion of $15.0 million of related-party promissory notes and accrued interest of $0.2 million into 15,000,000 convertible preference shares and the repayment of $4.5 million in borrowings under our related-party line of credit via an assignment of a $4.5 million note receivable due from iCeutica, (ii) the May 2013 issuance of 5,000,000 convertible preference shares for $5.0 million, (iii) the June 2013 issuance of 5,000,000 convertible preference shares for $5.0 million, (iv) the June 2013 issuance of a convertible note for $15.0 million and (v) the automatic conversion of all outstanding convertible preference shares and class 1 ordinary shares into an aggregate of ordinary shares prior to the consummation of this offering and the conversion of our convertible note into ordinary shares upon the consummation of this offering, in each case at an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus) and a closing date of , 2013, in each case as if such events had occurred on March 31, 2013. |

| (2) | Further reflects (i) the effectiveness of our Amended and Restated Memorandum and Articles of Association which we will adopt prior to consummation of this offering, (ii) the issuance and sale by us of ordinary shares in this offering at an assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus) and a closing date of , 2013 and (iii) the application of our estimated net proceeds from this offering as set forth under “Use of Proceeds,” after deducting the estimated underwriting discounts and estimated offering expenses payable by us, as if this offering had occurred on March 31, 2013. |

10

Table of Contents

CORPORATE FORMATION AND REORGANIZATION

Iroko Pharmaceuticals, LLC, a Delaware limited liability company and our primary operating company, was founded in 2007. On August 10, 2010, an investor group comprised of Vollin Holdings Limited, or Vollin, our controlling shareholder, and affiliates of Phoenix IP Ventures-III, LLC, or Phoenix IP Ventures, acquired Iroko Holdings LLC, a Delaware limited liability company, or Iroko Holdings, and the parent of Iroko Pharmaceuticals, LLC, through Iroko Intermediate Holdings, Inc., or Iroko Intermediate, a newly-formed Delaware corporation. Simultaneously with the acquisition of Iroko Holdings LLC, Iroko Holdings S.A. purchased 68,237,335 shares of common stock of Iroko Intermediate for aggregate proceeds of $68.2 million.

Subsequent to such acquisition, Iroko Holdings S.A. purchased 25,724,853 shares of common stock of Iroko Intermediate for aggregate proceeds to Iroko Intermediate of $25.7 million. In February 2012, Iroko Intermediate issued 98,393,500 shares of Series A preferred stock and 9,000,000 shares of common stock in exchange for all 93,962,188 shares of its common stock that were outstanding at that time. The terms of the Series A preferred stock provide that, upon a liquidation event, the holder of each share shall receive $1.00 per share plus a 20% annual compounding dividend from the date of purchase (which date of purchase was deemed to be date of the various original purchases of common stock). Subsequent to such exchange, Iroko Holdings S.A. purchased 14,000,000 shares of Series A preferred stock of Iroko Intermediate for $14.0 million.

In order to fund the company’s ongoing operations and development activities, during 2012 Vollin made loans to Iroko Pharmaceuticals, LLC totaling $49.5 million. Upon receipt of certain of these loans, Iroko Pharmaceuticals, LLC lent an aggregate of $4.5 million to iCeutica Inc., a subsidiary of Iroko Holdings S.A. at that time.

In September 2012, Iroko Pharmaceuticals Inc. was incorporated under the laws of the British Virgin Islands. In December 2012, Iroko Pharmaceuticals Inc. and iCeutica Holdings Inc. (which is also incorporated under the laws of the British Virgin Islands) each became wholly owned subsidiaries of Cordial Investments Inc., or Cordial, also incorporated under the laws of the British Virgin Islands. Vollin and affiliates of Phoenix IP Ventures own 100% of the outstanding voting interests of Cordial. Also in December 2012, all shares of Series A preferred stock and common stock of Iroko Intermediate held by Iroko Holdings S.A. were transferred to Iroko Pharmaceuticals Inc.

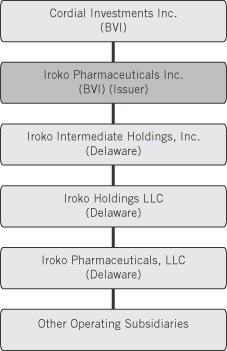

The chart below shows our corporate structure as of December 31, 2012:

11

Table of Contents

In February 2013, Cordial entered into a promissory note with Iroko Pharmaceuticals Inc. whereby Iroko Pharmaceuticals Inc. could request that up to $30.0 million be lent to it by Cordial. In February 2013, Cordial lent Iroko Pharmaceuticals Inc. $5.0 million pursuant to such promissory note. In March 2013, Cordial lent Iroko Pharmaceuticals Inc. an additional $10.0 million pursuant to such promissory note. This promissory note was terminated on April 12, 2013 in connection with the consummation of the April Transactions.

On April 12, 2013, we consummated a series of transactions, or the April Transactions, which consolidated our capital structure. As part of the Reorganization Transactions, (i) the loans made by Vollin were repaid via an assignment of a related-party $4.5 million note receivable due from iCeutica and the issuance to Cordial of 45,000,000 of Iroko Pharmaceuticals Inc.’s convertible preference shares, which will convert into ordinary shares prior to the consummation of this offering and (ii) the loans made by Cordial were repaid via the issuance to Cordial of 15,000,000 of our convertible preference shares, which will convert into ordinary shares prior to the consummation of this offering. The convertible preference shares of Iroko Pharmaceuticals Inc. have substantially the same economic terms as the Series A preferred stock of Iroko Intermediate, and the date of purchase of the convertible preference shares issued in connection with the loan repayment was deemed to be the date of each respective loan.

Additionally, the April Transactions resulted in (i) the conversion of all 112,393,500 shares of Series A preferred stock of Iroko Intermediate into 112,393,501 convertible preference shares of Iroko Pharmaceuticals Inc., (ii) the conversion of all 9,000,000 shares of common stock of Iroko Intermediate held by Iroko Pharmaceuticals Inc. into 8,999,000 class 1 ordinary shares of Iroko Pharmaceuticals Inc., (iii) the conversion of the 18,375 shares of common stock of Iroko Intermediate into 18,375 class 1 ordinary shares of Iroko Pharmaceuticals Inc., (iv) the conversion of options to purchase 962,925 shares of common stock of Iroko Intermediate held by our officers, employees and consultants into options to purchase 962,925 class 1 ordinary shares of Iroko Pharmaceuticals Inc., and (v) the distribution of an aggregate of 112,393,501 convertible preference shares and 9,000,000 class 1 ordinary shares of Iroko Pharmaceuticals Inc. to Cordial.

Upon the consummation of the April Transactions, Cordial owned 172,393,501 convertible preference shares and 9,000,000 class 1 ordinary shares of Iroko Pharmaceuticals Inc., which will constitute the only outstanding equity interests of Iroko Pharmaceuticals Inc. other than the 18,375 class 1 ordinary shares issued pursuant to our 2012 Share Option Plan, or the 2012 Plan, and the 981,625 options to purchase class 1 ordinary shares issued pursuant to, or reserved under, the 2012 Plan or any successor plan adopted by Iroko Pharmaceuticals Inc. The convertible preference shares of Iroko Pharmaceuticals Inc. have a liquidation preference equal to the number of outstanding convertible preference shares plus a 20% annual compounding dividend.

On May 8, 2013, we issued Cordial an additional 5,000,000 convertible preference shares in exchange for $5.0 million. On June 3, 2013, we issued Cordial an additional 5,000,000 convertible preference shares in exchange for $5.0 million.

In May 2013, we entered into a revolving credit facility with Cordial under which Cordial agreed to lend us up to $40 million in one or more installments upon our request at an annual interest rate of 0.25%. We are required to repay all amounts borrowed on or before September 1, 2013.

On June 26, 2013, we issued a convertible note with a principal balance of up to $15.0 million to Cordial, which we refer to as the convertible note. Pursuant to the terms of the convertible note, Cordial funded $5.0 million on June 26, 2013 and funded an additional $10.0 million on July 8, 2013. The convertible note provides for interest to accrue on the principal balance of the convertible note that has been funded, at a rate of 0.23% percent per year. Pursuant to the terms of the convertible note, upon the consummation of this offering, the principal amount of the convertible note, plus any accrued but unpaid interest thereon, will convert into our ordinary shares at the per-share initial public offering price of ordinary shares in this offering. In the event that this offering is not consummated prior to September 30, 2013, the unpaid principal amount of the convertible note will convert into a number of convertible preference shares equal to the principal amount plus a 20% internal rate of return from the funding dates of the convertible note.

On July 10, 2013, we filed amendments to our constitutional documents with the Registry of Corporate Affairs of the British Virgin Islands, which will become effective upon their registration by the Registry of Corporate Affairs, to

12

Table of Contents

effect certain changes to our capital structure, which changes we refer to as the Restructuring. The effect of the Restructuring will be to redesignate the previously outstanding ordinary shares as class 1 ordinary shares, and to provide that the class 1 ordinary shares and convertible preference shares will convert into an aggregate of 25,089,846 ordinary shares upon pricing of this offering. The conversion ratios of the convertible preference shares and class 1 ordinary shares will be based on our valuation as reflected by the price at which ordinary shares are sold pursuant to this offering, with the convertible preference shares being converted into the percentage of the 25,089,846 ordinary shares equal to the ratio of the liquidation preference of our convertible preference shares to our value based on the price at which ordinary shares are sold in this offering, and the class 1 ordinary shares converting into the remainder of the 25,089,846 ordinary shares. We refer to the April Transactions and the Restructuring together as the Reorganization Transactions.

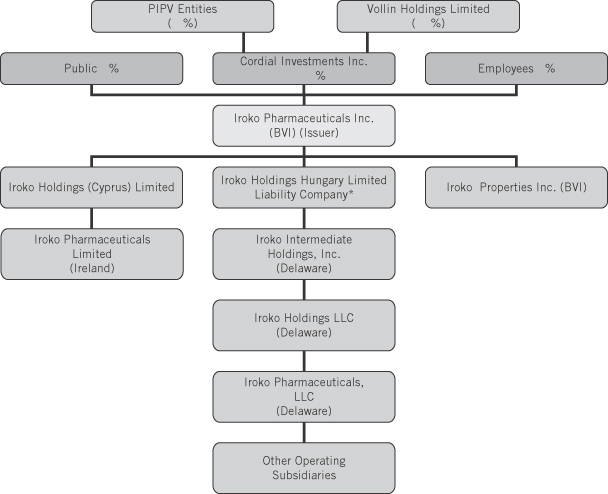

Except as noted below, upon the consummation of this offering, our organizational structure, and the ownership of voting shares of Cordial, will be as follows (percentages assume (i) an initial offering price of $ , the midpoint of the price range set forth on the cover page of this prospectus and (ii) a closing date of , 2013):

| * | Entity is in the process of being formed. |

13

Table of Contents

Any investment in our ordinary shares involves risk. You should carefully consider the risks and uncertainties described below and all information contained in this prospectus, including our consolidated financial statements and the related notes thereto, before you decide whether to purchase our ordinary shares. If any of the following risks or uncertainties actually occur, our business, financial condition, results of operations and prospects would likely suffer, possibly materially. In addition, the trading price of our ordinary shares could decline due to any of these risks or uncertainties, and you may lose part or all of your investment.

Risks Related to Our Business and Our Industry

We expect to incur losses in the near term and may never achieve or sustain profitability.

Subsequent to 2009, we have not been profitable and do not expect to be profitable in the near term due to expenditures associated with developing and marketing our submicron product candidates. We have incurred net losses of $31.8 million and $74.7 million for the years ended December 31, 2011 and 2012, respectively. We had an accumulated deficit of $114.1 million as of December 31, 2012. Our cash and cash equivalents and working capital deficit as of December 31, 2012 were $11.9 million and $50.3 million, respectively.

To date, we have devoted most of our financial resources to our corporate overhead and research and development of our submicron product candidates, including our drug formulations, preclinical development activities and clinical trials. We expect to continue to incur losses in the near term, and we expect our losses to increase as we continue our development of, and seek regulatory approvals for, our product candidates, prepare for and begin the commercialization of any approved products, and add infrastructure and personnel to support our product development efforts and operations as a public company. We anticipate that any such losses could be significant as we complete clinical trials and other activities required for regulatory approval of our products. As a result of the foregoing, we expect to continue to experience net losses and negative cash flows for the foreseeable future. These net losses and negative cash flows have had, and will continue to have, an adverse effect on our shareholders’ equity and working capital.

We face substantial hurdles to achieving profitability. For example, we may never become profitable if:

| n | our clinical trials for our product candidates are not successful; |

| n | Zorvolex™, Tiforbex™ or any of our other product candidates does not gain regulatory approval; |

| n | we are not able to obtain satisfactory contracts with manufacturers of our product candidates; |

| n | we are not able to build our sales and marketing capabilities; |

| n | our product candidates do not achieve market acceptance; or |

| n | we are unable to adequately protect our intellectual property. |

Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses and when, or if, we will be able to achieve profitability. In addition, our expenses could increase if we are required by the U.S. Food and Drug Administration, or FDA, to perform studies or trials in addition to those currently expected, or if there are any delays in completing our clinical trials or the development of any of our product candidates. The amount of future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenues.

Our recurring losses from operations have raised substantial doubt regarding our ability to continue as a going concern.

Our recurring losses from operations, our need for additional capital, and the uncertainties surrounding our ability to raise such capital raise substantial doubt about our ability to continue as a going concern, and as a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements as of and for the year ended December 31, 2012 with respect to this uncertainty. This going concern opinion could materially limit our ability to raise additional funds through the issuance of new debt or equity securities or otherwise. Future reports on our financial statements may include an explanatory paragraph with respect to our ability to continue as a going concern. To the extent that our capital resources are insufficient to meet

14

Table of Contents

our future operating and capital requirements, we may be forced to reduce our operating expenses and will need to finance our cash needs through public or private equity offerings, debt financings, corporate collaboration and licensing arrangements or other financing alternatives. We have no committed external sources of funds other than the Cordial revolving credit facility which is described below under “Certain Relationships and Related Person Transactions—Cordial Investments Inc. Revolving Credit Facility”. Additional equity or debt financing or corporate collaboration and licensing arrangements may not be available on acceptable terms, if at all. If we are unable to raise sufficient additional capital or complete a strategic transaction, we may be unable to continue to fund our operations, develop our product candidates, or realize value from our assets and discharge our liabilities in the normal course of business. These uncertainties raise substantial doubt about our ability to continue as a going concern. If we become unable to continue as a going concern, we may have to liquidate our assets, and might realize significantly less than the values at which they are carried on our financial statements, and stockholders may lose all or part of their investment in our common stock.

We are subject to significant regulatory requirements which could delay, prevent or limit our ability to market our product candidates.

Our development activities, preclinical studies, clinical trials, manufacturing and anticipated marketing of our product candidates are subject to extensive regulation by a wide range of governmental authorities in the U.S., including the FDA, and by comparable authorities in other jurisdictions. We will not be able to commercialize any of our product candidates until we obtain approval of the FDA in the U.S., or the approval of comparable regulatory agencies in other jurisdictions. To satisfy the FDA or non-U.S. regulatory approval standards for the commercial sale of our product candidates, we must, among other requirements, demonstrate in adequate and well-controlled clinical trials that our product candidates are safe and effective.

We have successfully conducted Phase 3 clinical trials of Zorvolex™ and Tiforbex™, Phase 2 trials of submicron naproxen and Phase 1 trials of submicron meloxicam. Even if our product candidates achieve positive results in preclinical and clinical trials, similar results may not be observed in subsequent trials and results may not prove to be statistically significant or demonstrate safety and efficacy to the satisfaction of the FDA or other non-U.S. regulatory agencies.

The FDA and non-U.S. regulatory authorities also regulate the conduct of clinical trials, ensuring compliance with current good clinical practice regulations and guidance, or cGCP, and other applicable U.S. and non-U.S. regulatory requirements. Clinical investigator sites contracted by us may be inspected, unannounced, by any regulatory authority at any time. Failure of the clinical site to successfully complete the regulatory inspection may adversely affect us whether or not our trials are the cause of the inspection. This occurs because clinical investigators routinely conduct trials for other companies and inspection of those trials may uncover systemic problems at the site that are not known to us.

The regulatory approval process is expensive and, while the time required to complete clinical trials and FDA and non-U.S. regulatory approval processes is uncertain, it typically takes many years. Our analysis of data obtained from our preclinical studies and clinical trials is subject to confirmation and interpretation by these regulatory authorities who may have different views on the design, scope, or results of our clinical trials, which could delay, limit, or prevent regulatory approval. At any time, changes in regulatory policy during the development period of any of our product candidates, changes in, or the enactment of, additional regulations or statutes, or changes in regulatory review practices for a submitted product application may result in failure of the agency to accept our application for review, which could cause a delay in obtaining approval, or result in the rejection of an application for regulatory approval. We could also encounter unanticipated delays or increased costs due to government regulation from future legislation or administrative action or changes in FDA or non-U.S. regulatory policies during the period of product development, clinical trials, or regulatory review. We seek to ensure a productive dialogue with regulatory authorities throughout product development, application review and thereafter. We may reach the conclusion to not follow all of the regulatory authorities’ advice for the content of a new drug application and instead justify our position with supporting data and expert analyses contained in the original application. The regulatory authorities may agree or disagree with this approach, which may affect acceptance of the application, the length of agency review, or other action on the application. The regulatory review process may be subject to political, technical, economic, and other developments. This results in dynamic and unpredictable risks in drug development, regulatory compliance, and commercialization of pharmaceuticals.

15

Table of Contents

The FDA also regulates the manufacturing facilities of our third-party manufacturers. Prior to approval, the FDA, and other non-U.S. regulatory authorities, may inspect manufacturing facilities to ensure compliance with current good manufacturing practice, or cGMP, including quality control and record-keeping measures. Post-approval, the FDA and certain state and non-U.S. agencies subject these facilities to unannounced inspections to ensure continued compliance with cGMP. Failure to satisfy the pre-approval inspection or subsequent discovery of problems with a product, or a manufacturing or laboratory facility used by us or third-party manufacturers may result in an inability to receive approval, recall of products, delay in approval or restrictions on the product or on the manufacturing post-approval, including a voluntary withdrawal of the drug from the market or suspension of manufacturing. Such inspections of third-party manufacturers may adversely affect us whether or not our products are the cause of the inspection because other products or a general cGMP review may cause the inspection. Our third-party manufacturers rely on a variety of suppliers of raw materials, equipment, and other supplies to comply with cGMP and other specifications and standards. The failure of a supplier to our third-party manufacturers to meet such requirements could have a material adverse effect on our research, development, and future commercial activities. Non-U.S. regulatory authorities have similar manufacturing compliance requirements that may result in similar outcomes to those noted above.

As a result of these factors, our product candidates could require a significantly longer time to gain regulatory approval than expected or may never gain approval. We cannot assure you that, even after expending substantial time and resources, we will obtain regulatory approval for any of our product candidates. A delay or denial of regulatory approval could delay or prevent our ability to generate product revenues and to achieve profitability. If regulatory approval is obtained, our marketing of any product will be limited to its indicated uses, which will limit the size of the market for a product and affect our potential product revenues.

We cannot be certain that Zorvolex™, Tiforbex™ or any of our other product candidates will receive regulatory approval, and without regulatory approval we will not be able to market our product candidates and our ability to become profitable may be materially impaired.

We are developing Zorvolex™ for acute and osteoarthritis pain and Tiforbex™ for acute pain. Our ability to achieve profitability currently depends on the successful development and commercialization of Zorvolex™, Tiforbex™ or one of our other product candidates.

The development of a product candidate and issues relating to its approval and marketing are subject to extensive regulation by the FDA in the U.S. and regulatory authorities in other countries, with regulations differing from country to country. We are not permitted to market our product candidates in the U.S. until we receive approval of an NDA from the FDA.

NDAs must include extensive preclinical and clinical data and supporting information to establish the product candidate’s safety and effectiveness for each desired indication. NDAs must also include significant information regarding the chemistry, manufacturing and controls for the product. Obtaining approval of an NDA is a lengthy, expensive and uncertain process, and we may not be successful in obtaining approval. If we submit an NDA to the FDA, the FDA must decide whether to accept or reject the submission for filing. We cannot be certain that any submissions will be accepted for filing and review by the FDA. Even if a product is approved, the FDA may limit the indications for which the product may be marketed, require extensive warnings on the product labeling or require expensive and time-consuming clinical trials or reporting as conditions of approval. Regulators of other countries and jurisdictions have their own procedures for approval of product candidates with which we must comply prior to marketing in those countries or jurisdictions.

Obtaining regulatory approval for marketing of a product candidate in one country does not ensure that we will be able to obtain regulatory approval in any other country. In addition, delays in approvals or rejections of marketing applications in the U.S. or other countries may be based upon many factors, including regulatory requests for additional analyses, reports, data, preclinical studies and clinical trials, regulatory questions regarding different interpretations of data and results, changes in regulatory policy during the period of product development and the emergence of new information regarding our product candidates or other products. Also, regulatory approval for any of our product candidates may be withdrawn.

We have completed Phase 3 trials for Zorvolex™ and Tiforbex™ in acute pain in adult patients. In December 2012, we submitted an NDA for Zorvolex™ for acute pain, which was accepted for filing with the FDA in February 2013,

16

Table of Contents

and submitted an NDA for Tiforbex™ for acute pain in April 2013. Before we submit the NDA to the FDA for Zorvolex™ for osteoarthritis pain, we must successfully complete our ongoing open label safety Phase 3 trial of Zorvolex™ for that indication. We cannot predict whether our ongoing trials and studies will be successful or whether regulators will agree with our conclusions regarding the preclinical studies and clinical trials we have conducted to date.

If we are unable to obtain approval from the FDA or other regulatory agencies for Zorvolex™, Tiforbex™ or our other product candidates, we will not be able to market such product candidates and our ability to achieve profitability may be materially impaired.

Our future revenue growth depends entirely on the success of our submicron NSAID product candidates. Even if approved, our submicron NSAID product candidates may not be accepted in the marketplace and our business may be materially harmed.

Even if all regulatory approvals are obtained and we are allowed to market our submicron NSAID product candidates, the commercial success of our submicron NSAID product candidates depends on gaining market acceptance among physicians, patients and third-party payors. The degree of market acceptance of our submicron NSAID product candidates will depend on many factors, including:

| n | the scope of regulatory approvals, including limitations or warnings contained in a submicron NSAID product candidate’s regulatory-approved labeling; |

| n | the acceptance in the medical community of the safety and efficacy of the submicron NSAID product candidate; |

| n | the incidence, prevalence and severity of adverse side effects of our submicron NSAID product candidates; |

| n | the willingness of physicians to prescribe submicron NSAIDs and of the target patient population to try these therapies; |

| n | the price and cost-effectiveness of our submicron NSAID product candidates; |

| n | alternative treatment methods and potentially competitive products; |

| n | the potential advantages of the submicron NSAID product candidate over existing and future treatment methods; |

| n | the strength of our sales, marketing and distribution support; and |

| n | the availability of sufficient third-party coverage and reimbursement. |

If our submicron NSAID product candidates are approved but do not achieve an adequate level of acceptance by physicians, patients and third-party payors, we may never generate significant revenue from these products, and our business, financial condition and results of operations may be materially harmed. Even if our products achieve market acceptance, we may not be able to maintain that market acceptance over time if new therapeutics are introduced that are more favorably received than our products or that render our products obsolete, or if significant adverse events occur. If our products do not achieve and maintain market acceptance, we will not be able to generate sufficient revenue from product sales to attain profitability.

The market opportunity for submicron NSAIDs may be smaller than we estimate.

The potential market opportunity for our product candidates is difficult to precisely estimate. Our estimates of the potential market opportunity for submicron NSAIDs include several key assumptions based on our industry knowledge, industry publications, third-party research reports and other surveys. While we believe that our internal assumptions are reasonable, if any of these assumptions proves to be inaccurate, then the actual market for submicron NSAIDs could be smaller than our estimates of our potential market opportunity. If the actual market for submicron NSAIDs is smaller than we expect, our product revenue may be limited and it may be more difficult for us to achieve or maintain profitability.

Our revenues to date have been generated through sales of and royalties on sales of Indocin® and Aldomet®, our currently approved products, and we will not achieve profitability if our product candidates are not approved.

To date, our sources of revenue have been generated through sales of and royalties on sales of Indocin® and Aldomet®, our currently approved products. If we are unable to develop and commercialize one or more of our product candidates, or if revenues from any such product candidate that receives marketing approval are insufficient, we will not achieve profitability. Even if we achieve profitability, we may not be able to sustain or increase profitability.

17

Table of Contents

Even if our product candidates receive regulatory approval, we may still face future development and regulatory difficulties. If we fail to comply with continuing U.S. and non-U.S. regulations or new safety data arise, we could lose our marketing approvals and our business would be seriously harmed.

Our product candidates, if approved, will also be subject to ongoing regulatory requirements for manufacturing, distribution, sale, labeling, packaging, storage, advertising, promotion, record-keeping and submission of safety and other post-market information. In addition, approved products, manufacturers and manufacturers’ facilities are required to comply with extensive FDA requirements and requirements of other similar agencies even after approval, including ensuring that quality control and manufacturing procedures conform to cGMPs. As such, we and our contract manufacturers are subject to continual review and periodic inspections, both announced and unannounced, to assess compliance with cGMPs. Accordingly, we and others with whom we work must continue to expend time, money and effort in all areas of regulatory compliance, including manufacturing, production and quality control. We will also be required to report certain adverse reactions and production problems, if any, to the FDA and other similar agencies and to comply with certain requirements concerning advertising and promotion for our products. Promotional communications with respect to prescription drugs are subject to a variety of legal and regulatory restrictions and must be consistent with the information in the product’s approved label. Accordingly, we may not promote our approved products, if any, for indications or uses for which they are not approved.

If a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, or disagrees with the promotion, marketing or labeling of a product, it may impose restrictions on that product or us, including requiring withdrawal of the product from the market. These unknown problems could be discovered as a result of any post-marketing follow-up studies, routine safety surveillance or other reporting required as a condition to approval.

If our product candidates fail to comply with applicable regulatory requirements, or if a problem with one of our products is discovered, a regulatory agency may:

| n | issue warning letters which may require corrective action; |

| n | mandate modifications to promotional materials or require us to provide corrective information to healthcare practitioners; |

| n | require us to enter into a consent decree or permanent injunction, which can include imposition of various fines, reimbursements for inspection costs, required due dates for specific actions and penalties for noncompliance; |

| n | impose other administrative or judicial civil or criminal penalties including fines, imprisonment and disgorgement of profits; |

| n | suspend or withdraw regulatory approval; |

| n | refuse to approve pending applications or supplements to approved applications filed by us; |