UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

[X]

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended June 30, 2017

OR

[ ]

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ________to ________

Commission

file number: 000-55314

nFüsz,

Inc.

(Exact

name of Registrant as Specified in its Charter)

| Nevada |

|

90-1118043 |

| (State

or Other Jurisdiction |

|

(I.R.S.

Employer |

| of

Incorporation or Organization) |

|

Identification

Number) |

344

S. Hauser Blvd

Suite

414

Los

Angeles, CA 90036

(Address of Principal Executive Offices including

Zip Code)

(855)

250-2300

(Registrant’s Telephone Number, Including Area

Code)

(Former

name, former address and former fiscal year, if changed since last report)

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file reports),

and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [X] NO [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large

accelerated filer [ ] |

Accelerated

filer [ ] |

Non-accelerated

filer [ ] |

Smaller

reporting company [X] |

| |

|

(Do

not check if a smaller reporting company) |

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES [ ] NO

[X]

As

of August 10, 2017, 105,677,520 shares of the issuer’s common stock, par value of $0.0001 per share, were outstanding.

nFÜSZ,

INC.

TABLE

OF CONTENTS

PART

I — FINANCIAL INFORMATION

ITEM

1 – FINANCIAL STATEMENTS

nFÜSZ,

INC.

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

June 30,

2017 | | |

December

31, 2016 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Current asssets: | |

| | | |

| | |

| Cash | |

$ | 27,008 | | |

$ | 16,762 | |

| Accounts receivable | |

| - | | |

| 8,468 | |

| Prepaid expenses | |

| 33,101 | | |

| 10,871 | |

| Total current assets | |

| 60,109 | | |

| 36,101 | |

| Property and equipment, net | |

| 41,398 | | |

| 52,066 | |

| Other assets | |

| 9,073 | | |

| 16,036 | |

| | |

| | | |

| | |

| Total assets | |

$ | 110,580 | | |

$ | 104,203 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 435,309 | | |

$ | 431,650 | |

| Accrued interest (including $109,946 and $118,451 payable to related parties) | |

| 215,557 | | |

| 118,137 | |

| Accrued officers’ salary | |

| 386,279 | | |

| 200,028 | |

| Notes payable, net of discount of $0 and $48,942, respectively | |

| 125,000 | | |

| 177,358 | |

| Notes payable - related party | |

| 1,964,985 | | |

| 1,964,985 | |

| Convertible note payable, net of discount of $105,061

and $0, respectively | |

| 685,207 | | |

| 680,268 | |

| Total current liabilities | |

| 3,812,337 | | |

| 3,572,426 | |

| | |

| | | |

| | |

| Notes Payable Series A Preferred, net of discount

of $20,857 | |

| 294,143 | | |

| - | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ deficit | |

| | | |

| | |

| Preferred stock, $0.0001 par value, 15,000,000 shares authorized, none issued

or outstanding | |

| - | | |

| - | |

| Common stock, $0.0001 par value, 200,000,000 shares authorized, 105,072,899 and 94,661,566

shares issued and outstanding as of June 30, 2017 and December 31, 2016, respectively | |

| 10,507 | | |

| 9,465 | |

| Additional paid in capital | |

| 20,235,598 | | |

| 17,815,732 | |

| Stock subscription | |

| (20 | ) | |

| (20,020 | ) |

| Accumulated deficit | |

| (24,241,985 | ) | |

| (21,273,400 | ) |

| | |

| | | |

| | |

| Total stockholders’ deficit | |

| (3,995,900 | ) | |

| (3,468,223 | ) |

| | |

| | | |

| | |

| Total liabilities and stockholders’ deficit | |

$ | 110,580 | | |

$ | 104,203 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements

nFÜSZ,

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | |

For the Three Months Ended | | |

For the Six Months Ended | |

| | |

June 30,

2017 | | |

June 30,

2016 | | |

June 30,

2017 | | |

June 30,

2016 | |

| | |

| | |

| | |

| | |

| |

| Net Sales | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 92,240 | | |

| 83,366 | | |

| 181,840 | | |

| 119,816 | |

| General and administrative | |

| 1,352,028 | | |

| 1,047,580 | | |

| 1,970,028 | | |

| 1,556,539 | |

| Loss from operations | |

| (1,444,268 | ) | |

| (1,130,946 | ) | |

| (2,151,868 | ) | |

| (1,676,355 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income | |

| - | | |

| 31,525 | | |

| - | | |

| 31,593 | |

| Debt Extinguishment | |

| (526,871 | ) | |

| - | | |

| (552,871 | ) | |

| - | |

| Interest expense (including $58,788 and $69,034 to related parties for six months and $116,930

and $122,978 to related parties for three months) | |

| (86,816 | ) | |

| (87,779 | ) | |

| (170,822 | ) | |

| (160,349 | ) |

| Interest expense - amortization of debt discount | |

| (53,346 | ) | |

| (100,452 | ) | |

| (93,024 | ) | |

| (179,822 | ) |

| Net loss | |

$ | (2,111,301 | ) | |

$ | (1,287,652 | ) | |

$ | (2,968,585 | ) | |

$ | (1,984,933 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings per share - basic and diluted | |

$ | (0.02 | ) | |

$ | (0.02 | ) | |

$ | (0.03 | ) | |

$ | (0.03 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of common shares outstanding

- basic and diluted | |

| 102,734,185 | | |

| 73,186,149 | | |

| 99,184,826 | | |

| 65,067,157 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements

nFÜSZ,

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF STOCKHOLDERS DEFICIT

(Unaudited)

| | |

| | |

Additional | | |

| | |

| | |

| |

| | |

Common Stock | | |

Paid-in | | |

Stock | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Subscription | | |

Deficit | | |

Total | |

| Balance at December 31, 2016 | |

| 94,661,566 | | |

$ | 9,465 | | |

$ | 17,815,732 | | |

$ | (20,020 | ) | |

$ | (21,273,400 | ) | |

$ | (3,468,223 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fair value vested options | |

| - | | |

| - | | |

| 242,630 | | |

| - | | |

| - | | |

| 242,630 | |

| Proceeds from sale of common stock | |

| 6,275,000 | | |

| 628 | | |

| 429,372 | | |

| 20,000 | | |

| - | | |

| 450,000 | |

| Shares of common stock issued upon conversion of debt | |

| 462,000 | | |

| 46 | | |

| 110,834 | | |

| | | |

| | | |

| 110,880 | |

| Fair value of warrants issued to extinguish debt and accounts payable | |

| - | | |

| - | | |

| 517,291 | | |

| | | |

| | | |

| 517,291 | |

| Shares of common stock issued to settle accounts payable | |

| 400,000 | | |

| 40 | | |

| 55,960 | | |

| - | | |

| - | | |

| 56,000 | |

| Fair value of common shares, warrants and beneficial conversion feature of issued convertible

note | |

| 50,000 | | |

| 5 | | |

| 99,995 | | |

| | | |

| | | |

| 100,000 | |

| Share based compensation - shares issued for services | |

| 3,224,333 | | |

| 323 | | |

| 963,784 | | |

| - | | |

| - | | |

| 964,107 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,968,585 | ) | |

| (2,968,585 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at June 30, 2017 | |

| 105,072,899 | | |

$ | 10,507 | | |

$ | 20,235,598 | | |

$ | (20 | ) | |

| (24,241,985 | ) | |

$ | (3,995,900 | ) |

The

accompanying notes are an integral part of these condensed consolidated financial statements

nFÜSZ,

INC.

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

For the Six Months Ended | |

| | |

June 30,

2017 | | |

June 30,

2016 | |

| | |

| | |

| |

| Operating Activities: | |

| | | |

| | |

| Net loss | |

$ | (2,968,585 | ) | |

$ | (1,984,933 | ) |

| Adjustments to reconcile net loss to net cash used in

operating activities: | |

| | | |

| | |

| Share-based compensation | |

| 1,206,737 | | |

| 714,274 | |

| Debt extinguishment | |

| 552,871 | | |

| - | |

| Amortization of debt discount and debt issuance costs | |

| 93,024 | | |

| 179,822 | |

| Depreciation and amortization | |

| 10,668 | | |

| 11,652 | |

| Effect of changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

| 317,330 | | |

| 259,856 | |

| Accounts receivable | |

| 8,468 | | |

| (34,362 | ) |

| Other assets | |

| 6,963 | | |

| - | |

| Prepaid expenses and other current assets | |

| (22,230 | ) | |

| (41,984 | ) |

| Net cash used in operating activities | |

| (794,754 | ) | |

| (895,675 | ) |

| | |

| | | |

| | |

| Financing Activities: | |

| | | |

| | |

| Proceeds from sale of common stock | |

| 450,000 | | |

| 918,980 | |

| Proceeds from series A preferred stock | |

| 255,000 | | |

| - | |

| Proceeds from note payable | |

| 100,000 | | |

| - | |

| Proceeds from notes payable - related parties | |

| - | | |

| 82,446 | |

| Repurchases of common stock | |

| - | | |

| (166,226 | ) |

| Net cash provided by financing activities | |

| 805,000 | | |

| 835,200 | |

| | |

| | | |

| | |

| Net change in cash | |

| 10,246 | | |

| (60,475 | ) |

| | |

| | | |

| | |

| Cash - beginning of period | |

| 16,762 | | |

| 103,019 | |

| | |

| | | |

| | |

| Cash - end of period | |

$ | 27,008 | | |

$ | 42,544 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 67,364 | | |

$ | 6,250 | |

| Cash paid for income taxes | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Supplemental disclosure of non-cash investing and financing activities: | |

| | | |

| | |

| Conversion of note payable to common stock | |

$ | 110,880 | | |

$ | - | |

| Fair value of common shares, warrants and beneficial conversion feature of

issued convertible note | |

$ | 100,000 | | |

$ | - | |

| Common stock issued to settle accounts payable | |

$ | 56,000 | | |

$ | - | |

| Conversion of notes payable to convertible notes payable | |

$ | - | | |

$ | 600,000 | |

| Conversion of notes payable to related parties to convertible notes payable | |

$ | - | | |

$ | 332,446 | |

| Conversion of accrued payroll to related party note | |

$ | - | | |

$ | 121,875 | |

| Conversion of accrued interest on notes payable to convertible notes payable | |

$ | - | | |

$ | 66,463 | |

| Conversion of accrued interest on notes payable to related parties to convertible

notes payable | |

$ | - | | |

$ | 10,421 | |

The

accompanying notes are an integral part of these condensed consolidated financial statements

nFÜSZ,

INC.

Notes

to Condensed Consolidated Financial Statements

The Six Months Ended June 30, 2017 and 2016

(Unaudited)

| 1. |

DESCRIPTION

OF BUSINESS |

Organization

Cutaia

Media Group, LLC (“CMG”) was a limited liability company formed on December 12, 2012 under the laws of the State of

Nevada. On May 19, 2014, bBooth, Inc. was incorporated under the laws of the State of Nevada. On May 19, 2014, CMG was merged

into bBooth, Inc. and bBooth, Inc. changed its name to bBooth (USA), Inc. The operations of CMG and bBooth (USA), Inc. are collectively

referred to as “bBoothUSA”.

On

October 16, 2014, bBoothUSA completed a Share Exchange Agreement with Global System Designs, Inc. (“GSD”) which was

accounted for as a reverse merger transaction. In connection with the closing of the Share Exchange Agreement, GSD management

was replaced by bBoothUSA management, and GSD changed its name to bBooth, Inc.

Effective

April 21, 2017, the registrant (referred to as “we,” “our,” or the “Company”) changed our

corporate name from bBooth, Inc. to nFüsz, Inc. The name change was effected through a parent/subsidiary short-form merger

of nFüsz, Inc., our wholly-owned Nevada subsidiary, formed solely for the purpose of the name change, with and into us. We

were the surviving entity. To effectuate the merger, we filed Articles of Merger with the Secretary of State of the State of Nevada

on April 4, 2017 and a Certificate of Correction with the Secretary of State of the State of Nevada on April 17, 2017. The merger

became effective on April 21, 2017. Our board of directors approved the merger, which resulted in the name change on that date.

In accordance with Section 92A.180 of the Nevada Revised Statutes, stockholder approval of the merger was not required.

On

the effective date of the merger, our name was changed to “nFüsz, Inc.” and our Articles of Incorporation, as

amended (the “Articles”), were further amended to reflect our new legal name. With the exception of the name change,

there were no other changes to our Articles.

Nature

of Business

The

Company has developed proprietary interactive video technology which serves as the basis for certain products and services that

it licenses under the brand name “Notifi”. Its NotifiCRM, NotifiADS, NotifiLINKS, and NotifiWEB products are cloud-based,

SaaS, CRM, sales lead generation, advertising and social engagement software, accessible on mobile and desktop platforms, for

sales-based organizations, consumer brands, marketing and advertising agencies, and artists and social influencers seeking greater

levels of viewer engagement, and higher sales conversion rates. The Company’s NotifiCRM platform is enterprise scalable

and incorporates unique, proprietary, push-to-screen, interactive audio/video messaging and interactive on-screen “virtual

salesperson” communications technology. The Company’s NotifiLIVE service is a proprietary broadcast video platform

allowing viewers to interact with broadcast video content by clicking on links embedded in people, objects, graphics or sponsors’

signage displayed on the screen. Viewers can experience NotifiLIVE interactive content and capabilities on most devices available

in the market today without the need to download special software or proprietary video players.

| 2. |

SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES |

Basis

of Presentation

The

accompanying condensed consolidated financial statements are unaudited. These unaudited interim condensed consolidated financial

statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”)

and applicable rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial

reporting. Certain information and note disclosures normally included in the financial statements prepared in accordance with

GAAP have been condensed or omitted pursuant to such rules and regulations. Accordingly, these interim condensed consolidated

financial statements should be read in conjunction with the consolidated financial statements and notes thereto contained in the

Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 filed with the SEC. The condensed consolidated

balance sheet as of December 31, 2016 included herein was derived from the audited consolidated financial statements as of that

date.

In

the opinion of management, the accompanying unaudited condensed consolidated financial statements contain all adjustments necessary

to fairly present the Company’s financial position and results of operations for the interim periods reflected. Except as

noted, all adjustments contained herein are of a normal recurring nature. Results of operations for the fiscal periods presented

herein are not necessarily indicative of fiscal year-end results.

Principles

of Consolidation

The

condensed consolidated financial statements include the accounts of nFusz, Inc. and its wholly owned subsidiary Songstagram, Inc.

(“Songstagram”). All intercompany transactions have been eliminated in consolidation.

Going

Concern

We

have incurred operating losses since inception and have negative cash flows from operations. We had a stockholders’ deficit

of $3,995,900 as of June 30, 2017 and utilized $794,754 of cash for the period then ended. These factors raise substantial doubt

about the Company’s ability to continue as a going concern. The ability of the Company to continue as a going concern is

dependent upon the Company’s ability to raise additional funds and implement its business plan. The financial statements

do not include any adjustments that might be necessary if the Company is unable to continue as a going concern. In addition, the

Company’s independent registered public accounting firm, in its report on the Company’s December 31, 2016 consolidated

financial statements, has raised substantial doubt about the Company’s ability to continue as a going concern.

Our

continuation as a going concern is dependent on our ability to obtain additional financing until we can generate sufficient cash

flows from operations to meet our obligations. We intend to continue to seek additional debt or equity financing to continue our

operations. There is no assurance that we will ever be profitable or that debt or equity financing will be available to us. The

consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability

and classification of assets or the amounts and classifications of liabilities that may result should we be unable to continue

as a going concern.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses during the reported periods. Significant estimates include accruals

for potential liabilities, assumptions used in determining the fair value of share based payments, and realization of deferred

tax assets. Amounts could materially change in the future.

Share

Based Payment

The

Company issues stock options, common stock, and equity interests as share-based compensation to employees and non-employees. The

Company accounts for its share-based compensation to employees in accordance with FASB ASC 718 “Compensation – Stock

Compensation.” Stock-based compensation cost is measured at the grant date, based on the estimated fair value of the award,

and is recognized as expense over the requisite service period.

The

Company accounts for share-based compensation issued to non-employees and consultants in accordance with the provisions of FASB

ASC 505-50 “Equity - Based Payments to Non-Employees.” Measurement of share-based payment transactions

with non-employees is based on the fair value of whichever is more reliably measurable: (a) the goods or services received;

or (b) the equity instruments issued. The final fair value of the share-based payment transaction is determined at the

performance completion date. For interim periods, the fair value is estimated and the percentage of completion is applied to that

estimate to determine the cumulative expense recorded.

The

Company values stock compensation based on the market price on the measurement date. As described above, for employees this is

the date of grant, and for non-employees, this is the date of performance completion. The Company values stock options and warrants

using the Black-Scholes option pricing model.

Net

Loss Per Share

Basic

net loss per share is computed by using the weighted-average number of common shares outstanding during the period. Diluted net

loss per share is computed giving effect to all dilutive potential common shares that were outstanding during the period. Dilutive

potential common shares consist of incremental common shares issuable upon exercise of stock options. No dilutive potential common

shares were included in the computation of diluted net loss per share because their impact was anti-dilutive. As of June 30, 2017,

the Company had a total of 23,030,953 options and 20,540,456 warrants outstanding, which were excluded from the computation of

net loss per share because they are anti-dilutive. As of June 30, 2016, the Company had total of 11,600,000 options and 16,449,734

warrants which were excluded from the computation of net loss per share because they are anti-dilutive.

Recent

Accounting Pronouncements

On

May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts

with Customers. ASU 2014-09 is a comprehensive revenue recognition standard that will supersede nearly all existing revenue recognition

guidance under current U.S. GAAP and replace it with a principle based approach for determining revenue recognition. ASU 2014-09

will require that companies recognize revenue based on the value of transferred goods or services as they occur in the contract.

The ASU also will require additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising

from customer contracts, including significant judgments and changes in judgments and assets recognized from costs incurred to

obtain or fulfill a contract. ASU 2014-09 is effective for interim and annual periods beginning after December 15, 2017. Early

adoption is permitted only in annual reporting periods beginning after December 15, 2016, including interim periods therein. Entities

will be able to transition to the standard either retrospectively or as a cumulative-effect adjustment as of the date of adoption.

The Company is in the process of evaluating the impact of ASU 2014-09 on the Company’s financial statements and disclosures.

In

February 2016, the FASB issued Accounting Standards Update (ASU) No. 2016-02, Leases. ASU 2016-02 requires a lessee to record

a right of use asset and a corresponding lease liability on the balance sheet for all leases with terms longer than 12 months.

ASU 2016-02 is effective for all interim and annual reporting periods beginning after December 15, 2018. Early adoption is permitted.

A modified retrospective transition approach is required for lessees for capital and operating leases existing at, or entered

into after, the beginning of the earliest comparative period presented in the financial statements, with certain practical expedients

available. The Company is in the process of evaluating the impact of ASU 2016-02 on the Company’s financial statements and

disclosures.

In

March 2016, the FASB issued the ASU 2016-09, Compensation - Stock Compensation (Topic 718): Improvements to Employee Share-Based

Payment Accounting. The amendments in this ASU require, among other things, that all income tax effects of awards be recognized

in the income statement when the awards vest or are settled. The ASU also allows for an employer to repurchase more of an employee’s

shares than it can today for tax withholding purposes without triggering liability accounting and allows for a policy election

to account for forfeitures as they occur. The amendments in this ASU are effective for fiscal years beginning after December 15,

2016, including interim periods within those fiscal years. Early adoption is permitted for any entity in any interim or annual

period. The Company is currently evaluating the expected impact that the standard could have on its financial statements and related

disclosures.

Other

recent accounting pronouncements issued by the FASB, including its Emerging Issues Task Force, the American Institute of Certified

Public Accountants, and the Securities and Exchange Commission did not or are not believed by management to have a material impact

on the Company’s present or future consolidated financial statement presentation or disclosures.

| 3. |

PROPERTY

AND EQUIPMENT |

Property

and equipment consisted of the following as of June 30, 2017 and December 31, 2016.

| | |

June 30, 2017 | | |

December 31, 2016 | |

| | |

(Unaudited) | | |

| |

| Furniture and fixtures | |

$ | 56,890 | | |

$ | 56,890 | |

| Office equipment | |

| 50,669 | | |

| 50,669 | |

| | |

| | | |

| | |

| | |

| 107,559 | | |

| 107,559 | |

| Less: accumulated depreciation | |

| (66,161 | ) | |

| (55,493 | ) |

| | |

| | | |

| | |

| | |

$ | 41,398 | | |

$ | 52,066 | |

Depreciation

expense amounted to $10,668 and $11,652 for six months ended June 30, 2017 and 2016, respectively.

The

Company has the following notes payable as of June 30, 2017 and December 31, 2016:

| Note | |

Note Date | |

Maturity Date | |

Interest Rate | | |

Original Borrowing | | |

Balance at

June 30, 2017 | | |

Balance at

December 31, 2016 | |

| | |

| |

| |

| | |

| | |

(Unaudited) | | |

| |

| Note payable (a) | |

March 21, 2015 | |

March 20, 2018 | |

| 12 | % | |

$ | 125,000 | | |

$ | 125,000 | | |

$ | 125,000 | |

| Note payable (b) | |

December 15, 2016 | |

June 15, 2017 | |

| 5 | % | |

$ | 101,300 | | |

| - | | |

| 101,300 | |

| Total notes payable | |

| |

| |

| | | |

| | | |

| 125,000 | | |

| 226,300 | |

| Debt discount | |

| |

| |

| | | |

| | | |

| - | | |

| (48,942 | ) |

| | |

| |

| |

| | | |

| | | |

| | | |

| | |

| Total notes payable, net of debt discount | |

| | | |

| | | |

$ | 125,000 | | |

$ | 177,358 | |

| |

(a) |

On

March 21, 2015, the Company entered into an agreement with DelMorgan Group LLC (“DelMorgan”), pursuant to which

DelMorgan agreed to act as the Company’s exclusive financial advisor. In connection with the agreement, the Company

paid DelMorgan $125,000, which was advanced by a third-party lender in exchange for an unsecured note payable issued by the

Company bearing interest at the rate of 12% per annum payable monthly beginning on April 20, 2015. |

| |

|

|

| |

|

Effective

March 20, 2017, the Company entered into an extension agreement (the “Extension Agreement”) with DelMorgan to

extend the maturity date of the Note to and including March 20, 2018. All other terms of the Note remain unchanged. |

| |

|

|

| |

(b) |

On

December 15, 2016, the Company entered into an agreement with a buyer, whereby the Company agreed to issue and sell to the

Buyer, and the Buyer agreed to purchase from the Company, (i) a non-interest bearing Note in the original principal amount

of $250,000, (ii) Warrants, and (iii) shares of the Company’s common stock in an amount equal to 30% of the purchase

price of the respective tranche divided by the closing price of the Common Stock on the trading day immediately prior to the

date of funding of the respective tranche (collectively, the “Inducement Shares”). The “Maturity Date”

shall be six months from the date of each payment of Consideration. A one-time interest charge of five percent (5%) (“Interest

Rate”) is to be applied on the Issuance Date to the original principal amount. In addition, there is a 10% Original

Issue Discount that is to be prorated based on the consideration paid by the Buyer. |

On

December 16, 2016, the Buyer purchased for $80,000 the first tranche of the Note and the respective securities to be issued and

the Company sold to it including (i) a three-year warrant to acquire 176,000 shares of the Company’s common stock with an

exercise price of $0.25 per share, and (ii) 240,000 shares of the Company’s common stock.

Upon

issuance of the note, the company accounted for an original issue discount of $21,300, which consisted of (i) the 10% original

issue discount of $8,800, and (ii) the fixed interest of 5% which aggregated $12,500 (such rate based on the entire funding due

of $250,000). The original issue discount will be accreted to interest expense over the life of the note, resulting in a net amount

due the holder of $101,300 at maturity. In addition, the (iii) the fair value of the 240,000 common shares of $21,600 issued to

the holder, and (iv) the relative fair value of the warrants of $32,059 was considered as additional valuation discount to be

amortized as interest expense over the life of the note.

The

aggregate fair value of the original issue discount and the equity securities issued upon inception of the note of $53,659 was

recorded as a valuation discount. The balance of the valuation discount at December 31, 2016 was $48,942. During the six months

ended June 30, 2017, $48,942 of this amount was amortized as interest expense.

On

June 7, 2017, the Company converted the debt and issued the Buyer 462,000 shares of its Common Stock (the “Shares”)

with a fair value of $110,880 at the date of the agreement. In the event the Buyer does not realize sufficient proceeds through

sales of the Shares, in accordance with the terms set forth herein, to equal $92,400, after deduction of reasonable sale transaction-related

expenses, the Company agrees to issue additional shares to make up the deficiency or to pay such deficiency in cash, at the Company’s

option. The Parties agree that this “Make Whole” provision shall expire and be of no further force and effect on the

date the sum of net proceeds realized from the sale of the initial issuance of 462,000 shares is equal to or great than $92,400;

or any deficiency is paid in cash by the Company at its option; or June 7, 2018, whichever occurs first. The buyer agrees not

to sell more than 10 percent (10%) of the total weekly volume of FUSZ common shares traded in the United States domestic over-the-counter

stock market in any one week. The Buyer agrees, that upon request of the Company, to provide trading records to the Company reflecting

all sales of the Shares, within 1 (one) business days following such request. As a result of this conversion, the Company recognized

a loss on extinguishment of $9,580 to account the difference between the fair value of the share issued and the note converted.

Total

interest expense for notes payable for the six months ended June 30, 2017 and 2016 was $7,500 and $7,500 respectively. Total interest

expense for notes payable for the three months ended June 30, 2017 and 2016 was $3,750 and $3,750, respectively.

| 5. |

NOTES

PAYABLE – RELATED PARTIES |

The

Company has the following related parties notes payable as of June 30, 2017 and December 31, 2016:

| Note | |

Issuance Date | |

Maturity Date | |

Interest Rate | | |

Original Borrowing | | |

Balance at

June 30, 2017 | | |

Balance at

December 31, 2016 | |

| | |

| |

| |

| | |

| | |

(Unaudited) | | |

| |

| Note 1 | |

Year 2015 | |

August 8, 2018 | |

| 12.0 | % | |

$ | 1,203,242 | | |

$ | 1,198,883 | | |

$ | 1,198,883 | |

| Note 2 | |

December 1, 2015 | |

August 8, 2018 | |

| 12.0 | % | |

| 189,000 | | |

| 189,000 | | |

| 189,000 | |

| Note 3 | |

December 1, 2015 | |

April 1, 2017 | |

| 12.0 | % | |

| 111,901 | | |

| 111,901 | | |

| 111,901 | |

| Note 4 | |

August 4, 2016 | |

August 4, 2017 | |

| 12.0 | % | |

| 343,326 | | |

| 343,326 | | |

| 343,326 | |

| Note 5 | |

August 4, 2016 | |

August 4, 2017 | |

| 12.0 | % | |

| 121,875 | | |

| 121,875 | | |

| 121,875 | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | |

| Total notes payable – related parties,

net | |

| | | |

| | | |

$ | 1,964,985 | | |

$ | 1,964,985 | |

| |

● |

On

various dates during the year ended December 31, 2015, Rory J. Cutaia, the Company’s majority shareholder and Chief

Executive Officer, loaned the Company total principal amounts of $1,203,242. The loans were unsecured and all due on demand,

bearing interest at 12% per annum. On December 1, 2015, the Company entered into a Secured Convertible Note agreement with

Mr. Cutaia whereby all outstanding principal and accrued interest owed to Mr. Cutaia from previous loans amounting to an aggregate

total of $1,248,883 and due on demand, was consolidated under a note payable agreement, bearing interest at 12% per annum,

and converted from due on demand to due in full on April 1, 2017. In consideration for Mr. Cutaia’s agreement to consolidate

the loans and extend the maturity date, the Company granted Mr. Cutaia a senior security interest in substantially all current

and future assets of the Company. Per the terms of the agreement, at Mr. Cutaia’s discretion, he may convert up to $374,665

of outstanding principal, plus accrued interest thereon, into shares of common stock at a conversion rate of $0.07 per share.

|

| |

|

On

May 4, 2017, the Company entered into an extension agreement (the “Extension Agreement”) with Rory J. Cutaia to

extend the maturity date of the $1,198,883 Secured Note due on April 1, 2017 to and including August 1, 2018. In consideration

for extending the Note the Company issued Mr. Cutaia 1,755,192 warrants at a price of $0.355. All other terms of the Note

remain unchanged. The Company determined that the extension of the note’s maturity resulted in a debt extinguishment

for accounting purposes since the fair value of the warrants granted was more than 10% of the recorded value of the original

convertible note. As a result, Company recorded the fair value of the new note which approximates the original carrying value

$1,198,883 and expensed the entire fair value of the warrants granted of $517,291 as part of loss on debt extinguishment.

As of June 30, 2017, and December 31, 2016, the principal amount of the notes payable was $1,198,883. |

| |

|

|

| |

● |

On

December 1, 2015, the Company entered into an Unsecured Convertible Note with Mr. Cutaia in the amount of $189,000, bearing

interest at 12% per annum, representing a portion of Mr. Cutaia’s accrued salary for 2015. The note extends the payment

terms from on-demand to due in full on April 1, 2017. The outstanding principal and accrued interest may be converted at Mr.

Cutaia’s discretion into shares of common stock at a conversion rate of $0.07. |

| |

|

|

| |

|

On

May 4, 2017, the Company entered into an extension agreement (the “Extension Agreement”) with Rory J. Cutaia to

extend the maturity date of the $189,000 Unsecured Note due on April 1, 2017 to and including August 1, 2018. All other terms

of the Note remain unchanged. |

| |

|

|

| |

● |

On

December 1, 2015, the Company entered into an Unsecured Note agreement with a consulting firm owned by Michael Psomas, a former

member of the Company’s Board of Directors, in the amount of $111,901 representing unpaid fees earned for consulting

services previously rendered but unpaid as of November 30, 2015. The outstanding amounts bear interest at 12% per annum, and

are due in full on April 1, 2017, and is currently past due. |

| |

|

|

| |

● |

On

April 4, 2016, the Company issued a secured convertible note to the Chief Executive Officer (“CEO”) and a director

of the Company, in the amount of $343,326, which represents additional sums of $93,326 that the CEO advanced to the Company

during the period from December 2015 through March 2016, and the conversion of $250,000 other pre-existing notes. This note

bears interest at the rate of 12% per annum, compounded annually and matures on August 4, 2017. The note is also convertible

up to 30% of the principal balance into shares of the Company’s common stock at $0.07 per share. In addition, the Company

also issued 2,452,325 share purchase warrants, exercisable at $0.07 per share until April 4, 2019, which warrants represent

50% of the amount of such note. |

| |

|

|

| |

● |

On

April 4, 2016, the Company issued an unsecured convertible note payable to the CEO in the amount of $121,875, which represents

the amount of the accrued but unpaid salary owed to the CEO for the period from December 2015 through March 2016. The note

bears interest at the rate of 12% per annum, compounded annually and matures on August 4, 2017. The note is also convertible

into shares of the Company’s common stock at $0.07 per share, which approximated the trading price or the Company’s

common stock on the date of the agreement. |

Total

interest expense for notes payable to related parties for the six months ended June 30, 2017 and 2016 was $116,930 and $122,978,

respectively. Total interest expense for notes payable to related parties for the three months ended June 30, 2017 and 2016 was

$58,788 and $69,034, respectively.

| 6. |

CONVERTIBLE

NOTE PAYABLE |

The

Company has the following notes payable as of June 30, 2017 and December 31, 2016:

| Note | |

Note Date | |

Maturity Date | |

Interest Rate | | |

Original Borrowing | | |

Balance at

June 30, 2017 | | |

Balance at

December 31, 2016 | |

| | |

| |

| |

| | |

| | |

(Unaudited) | | |

| |

| Note payable (a) | |

Various | |

August 4, 2017 | |

| 12 | % | |

$ | 600,000 | | |

$ | 680,268 | | |

$ | 680,268 | |

| Note payable (b) | |

June 19, 2017 | |

February 19, 2018 | |

| 5 | % | |

$ | 110,000 | | |

| 110,000 | | |

| - | |

| Total notes payable | |

| |

| |

| | | |

| | | |

| 790,268 | | |

| 680,268 | |

| Debt discount | |

| |

| |

| | | |

| | | |

| (105,061 | ) | |

| - | |

| | |

| |

| |

| | | |

| | | |

| | | |

| | |

| Total notes payable, net of debt discount | |

| | | |

| | | |

$ | 685,207 | | |

$ | 680,268 | |

| (a) |

The

Company entered into a series of unsecured loan agreement with Oceanside Strategies, Inc. (“Oceanside”) a third

party-lender, in the aggregate principal amount of $600,000 through December 31, 2015. The loans bear interest at rates ranging

from 5% to 12% per annum and were due on demand. |

| |

|

| |

On

April 3, 2016, the Company issued an unsecured convertible note payable to Oceanside in the amount of $680,268 (this amount

includes $600,000 principal amount and $80,268 accrued and unpaid interest). This note superseded and replaced all previous

notes and current liabilities due to Oceanside for sums Oceanside loaned to the Company in 2014 and 2015. This note bears

interest at the rate of 12% per annum, compounded annually. In consideration for Oceanside’s agreement to convert the

prior notes from current demand notes and extend the maturity date to December 4, 2016, the Company granted Oceanside the

right to convert up to 30% of the amount of such note into shares of the Company’s common stock at $0.07 per share and

issued 2,429,530 share purchase warrants, exercisable at $0.07 per share until April 4, 2019. |

| |

|

| |

Effective

December 30, 2016, the Company entered into an extension agreement (the “Extension Agreement”) with Oceanside

to extend the maturity date of the Note to and including August 4, 2017. All other terms of the Note remain unchanged. In

consideration for Oceanside’s agreement to extend the maturity date to August 4, 2017, the Company issued Oceanside

2,429,530 share purchase warrants, exercisable at $0.08 per share until December 29, 2019. |

| |

|

| (b) |

On

June 19, 2017, the Company issued an unsecured convertible note to Lucas Holdings in the amount of $100,000 in exchange for

50,000 shares of common stock and a three-year warrant to acquire 330,000 shares of the Company’s common stock with

an exercise price of $.30 per share. The “Maturity Date” is February 18, 2018. A one-time interest charge of five

percent (5%) (“Interest Rate”) is to be applied on the Issuance Date to the original principal amount. In addition,

there is a 5% Original Issue Discount. |

| |

|

| |

Upon

issuance of the note, the company accounted for an original issue discount of $10,000 which consisted of (i) the 5% original

issue discount of $5,000, and (ii) the fixed interest of 5% which aggregated $5,000. The original issue discount of $10,000

has been added to the note balance and will be accreted to interest expense over the life of the note, resulting in a net

amount due the holder of $110,000 at maturity. In addition, the (iii) the fair value of the 50,000 common shares of $12,500

issued to the holder, (iv) the relative fair value of the warrants of $40,180, and (v) a beneficial conversion feature of

$47,320 were considered as additional valuation discount and will be amortized as interest expense over the life of the note. |

| |

|

| |

The

aggregate fair value of the original issue discount and the equity securities issued upon inception of the note of $110,000

has been recorded as a valuation discount. As of June 30, 2017, $4,939 of this amount was amortized as interest expense, resulting

in an unamortized balance of $105,061 at June 30, 2017. |

| |

|

| |

Total

interest expense for convertible notes payable for the six months ended June 30, 2017 and 2016 was $40,481 and $40,704, respectively.

Total interest expense for convertible notes payable for the three months ended June 30, 2017 and 2016 was $20,352 and $20,352,

respectively. |

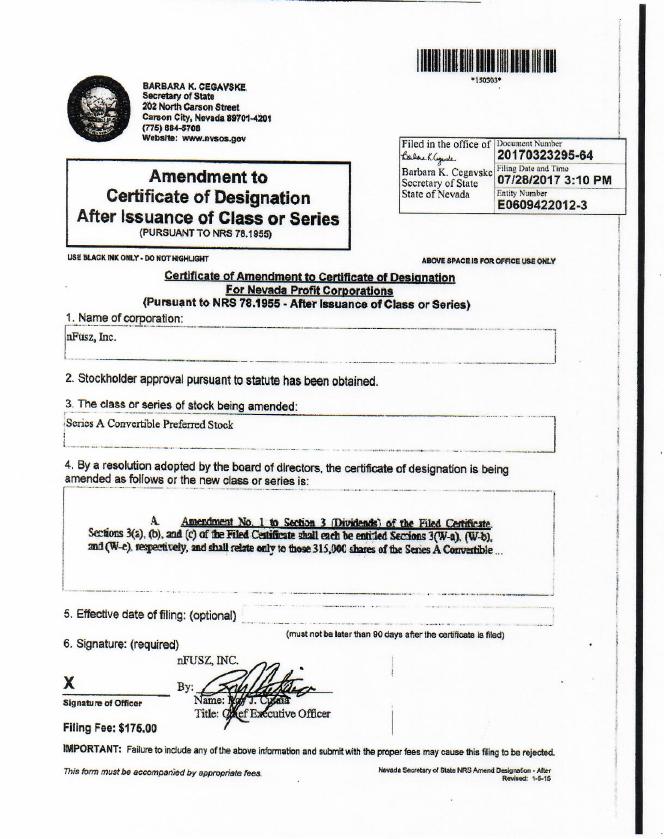

| 7. |

CONVERTIBLE

SERIES A PREFERRED STOCK |

Effective

February 14, 2017, the Company entered into a Securities Purchase Agreement, (the “Purchase Agreement”), by and between

an otherwise unaffiliated, accredited investor (the “Purchaser”) and the Company in connection with our issuance and

sale to the Purchaser of shares of Series A Preferred Stock under the terms and conditions as set forth in the Purchase Agreement

(the “Sale”).

In

connection with the Sale, our Board of Directors (our “Board”) authorized and approved a series of preferred stock

to be known as “Series A Convertible Preferred Stock”, for which 1,050,000 shares, $0.0001 par value per share, were

authorized and a Certificate of Designations, Preferences and Rights of the Series A Convertible Preferred Stock, (the “Certificate”),

was filed with the Office of the Secretary of State of the State of Nevada (the “State”) to effectuate the authorization.

Pursuant to the Purchase Agreement, the purchase of shares of our Series A Preferred Stock may occur in several tranches (each,

a “Tranche”; and, collectively, the “Tranches”). The first Tranche of $300,000 ($315,000 in stated value,

represented by 315,000 shares of our Series A Preferred Stock) closed simultaneously with the execution of the Purchase Agreement

on February 14, 2017 (the “First Closing”), and each additional Tranche shall close at such times and on such financial

terms as may be agreed to by the Purchaser and us. The net proceeds to us after offering costs was $255,000.

The

Series A PS has the following rights and privileges:

| |

● |

Senior

rights in terms preference as to dividends, distributions and payments upon the liquidation, dissolution and winding up of

the Company; |

| |

● |

Accrues

dividends at a rate of 5% per annum; |

| |

● |

Mandatorily

redeemable at an installment basis starting August 13, 2017 in the amount of $63,000 plus accrued interest. The Company has

the option to redeem the Series A shares in cash or in shares of common stock based upon the Company’s 5 day Volume

Weighted Average Price (“VWAP”). |

Pursuant

to the terms of the Purchase Agreement, the shares of our Series A Preferred Stock issued in the First Closing are to be redeemed

by us in five (5) equal weekly payments (each, a “Redemption Payment”), commencing in approximately 180 days from

the First Closing. All but one of the Redemption Payments may be made by us in cash or in shares of our common stock, at our option.

The Holder shall have the option to demand payment of one Installment Redemption Payment in shares of Common Stock Redemption

Payments made using shares of our common stock will be valued based upon a VWAP formula, tied to the then-current quoted price

of shares of our common stock, described with greater particularity in the Purchase Agreement.

The

Company considered the guidance of ASC 480-10, Distinguishing Liabilities From Equity to determine the appropriate treatment of

the Series A shares. Pursuant to ASC 480-10, the Company determined that the Series A shares is an obligation to be settled, at

the option of the Company, in cash or in variable number of shares with a fixed monetary value that should be recorded as a liability

under ASC 480-10. As a result, the Company determined the fair value of the Series A to be $300,000 upon issuance with the difference

of $15,000 from the face amount, and incurred legal fees of $45,000, to be accounted as a debt discount which will be amortized

over the term of the redemption period of the Series A shares.

As

a result of this transaction, the Company recorded a liability of $315,000 and a debt discount of $60,000, upon issuance. As of

June 30, 2017, the remaining unamortized discount was $20,857 resulting in a net amount due of $294,143.

The

Company’s common stock activity for the six months ended June 30, 2017 is as follows:

Common

Stock

Shares

Issued for Services – During the period ended June 30, 2017, the Company issued 3,224,333 common shares to employees

and vendors for services rendered with a fair value of $964,107 and are expensed based on fair market value of the stock price

at the date of grant.

Shares

Issued to Settle Accounts Payable - During the period ended June 30, 2017, the Company amended an agreement with a vendor

and issued 400,000 shares of common stock as full and final payment to the vendor on accounts payable owed of $30,000. The fair

value of the shares issued was $56,000, a loss on extinguishment of debt totaling $26,000 was recorded as part of the transaction.

Shares

Issued from Stock Subscription – The Company issued stock subscription to investors. For the six months ended June

30, 2017, the Company issued 6,275,000 common shares for a net proceed of $430,000.

The

Company previously received $20,000 related to the Subscription Receivable that was outstanding as of December 31, 2016.

Shares

Issued from Conversion of Note Payable - During the period ended June 30, 2017, the Company converted a $92,400 note payable

into 462,000 shares of its Common Stock (the “Shares”) with a fair value of $110,880 (see Note 4).

Shares

Issued as Part of Convertible Note Payable - During the period ended June 30 2017, the Company issued 50,000 shares of

common stock with a fair market value of $12,500 (see Note 6).

Stock

Options

Effective

October 16, 2014, the Company adopted the 2014 Stock Option Plan (the “Plan”) under the administration of the board

of directors to retain the services of valued key employees and consultants of the Company.

At

its discretion, the Company grants share option awards to certain employees and non-employees, as defined by ASC 718, Compensation—Stock

Compensation, under the 204 Stock Option Plan (the “Plan”) and accounts for its share-based compensation in accordance

with ASC 718.

A

summary of option activity for the six months ended June 30, 2017 is presented below.

| | |

Shares | | |

Weighted

Average

Exercise Price | | |

Weighted

Average

Remaining

Contractual

Life

(in Years) | | |

Aggregate

Intrinsic

Value | |

| Outstanding at December 31, 2016 | |

| 10,530,953 | | |

$ | 0.33 | | |

| 4.03 | | |

| | |

| Granted | |

| 12,500,000 | | |

| 0.17 | | |

| | | |

| | |

| Exercised | |

| - | | |

| - | | |

| | | |

| | |

| Forfeited or expired | |

| - | | |

| - | | |

| | | |

| | |

| Outstanding at June 30, 2017 | |

| 23,030,953 | | |

$ | 0.26 | | |

| 1.97 | | |

$ | 1,443,767 | |

| Vested and expected to vest at June 30, 2017 | |

| 9,614,625 | | |

$ | 0.34 | | |

| | | |

$ | 480,923 | |

| Exercisable at June 30, 2017 | |

| 6,389,286 | | |

$ | 0.46 | | |

| | | |

$ | 153,142 | |

For

the six months ended June 30, 2017, the Company approved and granted 5,500,000 non-qualified stock options to employees and 2,000,000

to a Director with an aggregate fair value of $684,787. Each exercisable into one share of our common stock and vest 100% in three

years from the grant date.

For

the six months ended June 30, 2017, the Company approved and granted 5,000,000 non-qualified stock options to consultants with

an aggregate fair value of $1,228,046. Each exercisable into one share of our common stock. The options vest based on consultant

achieving quantifiable milestones. As of June 30, 2017, the Company determined that the probability of the consultants achieving

these milestones was probable. As a result, the Company record compensation expense of $56,335 to account the estimated 296,527

options that vest.

The

Company recognized $242,630 in share-based compensation expense for the six months ended June 30, 2017. As of June 30, 2017, total

unrecognized stock-based compensation expense was $1,975,437, which is expected to be recognized as an operating expense through

July 2020. The intrinsic value of the stock options outstanding at June 30, 2017 was approximately $1,444,000.

The

fair value of each share option award on the date of grant is estimated using the Black-Scholes method based on the following

weighted-average assumptions:

| | |

3 Months Ended June 30, | | |

6 Months Ended June 30, | |

| | |

2017 | | |

2016 | | |

2017 | | |

2016 | |

| Risk-free interest rate | |

| 1.77%

- 1.89 | % | |

| 1.22

- 1.24 | | |

| 1.22%

- 1.93 | % | |

| 1.22%

- 1.65 | % |

| Average expected term (years) | |

| 5

years | | |

| 5

years | | |

| 5

years | | |

| 5

years | |

| Expected volatility | |

| 157.09 | % | |

| 100.18

– 101.25 | | |

| 153.07

– 160 | % | |

| 100.18

– 101.25 | |

| Expected dividend yield | |

| - | | |

| - | | |

| - | | |

| - | |

The

risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of measurement corresponding with the

expected term of the share option award; the expected term represents the weighted-average period of time that share option awards

granted are expected to be outstanding giving consideration to vesting schedules and historical participant exercise behavior;

the expected volatility is based upon historical volatility of the Company’s common stock; and the expected dividend yield

is based upon the Company’s current dividend rate and future expectations

Warrants

The

Company has the following warrants outstanding as of June 30, 2017 all of which are exercisable:

| | |

Issuance Date | |

Expiration Date | |

Warrant Shares | | |

Exercise Price | |

| Warrant #1 | |

November 12, 2014 | |

November 12, 2019 | |

| 600,000 | | |

$ | 0.50 | |

| Warrant #2 | |

March 21, 2015 | |

March 20, 2018 | |

| 48,000 | | |

$ | 0.10 | |

| Warrant #3 | |

October 30, 2015 | |

October 30, 2020 | |

| 600,000 | | |

$ | 0.50 | |

| Warrant #4 | |

December 1, 2015 | |

November 30, 2018 | |

| 9,719,879 | | |

$ | 0.07 | |

| Warrant #5 | |

April 4, 2016 | |

April 4, 2019 | |

| 2,452,325 | | |

$ | 0.07 | |

| Warrant #6 | |

April 4, 2016 | |

April 4, 2019 | |

| 2,429,530 | | |

$ | 0.07 | |

| Warrant #7 | |

December 15, 2016 | |

December 14, 2019 | |

| 176,000 | | |

$ | 0.25 | |

| Warrant #8 | |

December 30, 2016 | |

December 29, 2019 | |

| 2,429,530 | | |

$ | 0.08 | |

| Warrant #9 | |

May 4, 2017 | |

May 3, 2020 | |

| 1,755,192 | | |

$ | 0.36 | |

| Warrant #10 | |

June 19, 2017 | |

June 30, 2020 | |

| 330,000 | | |

$ | 0.30 | |

| Outstanding at June 30, 2017 | |

| |

| |

| 20,540,456 | | |

| | |

During

the period ended June 30, 2017, the Company granted warrants to purchase 1,755,192 shares of common stock to an officer of the

Company pursuant to an extinguishment of a note payable (see Note 5). In addition, the Company also granted warrants to purchase

330,000 shares of common stock pursuant to issuance of a convertible note payable (see Note 6).

The

intrinsic value of the warrants outstanding at June 30, 2017 was $2,365,362.

| 9. |

COMMITMENTS

AND CONTINGENCIES |

Litigation

We

have one pending litigation, filed. on September 19, 2016. The action is captioned as Multicore Technologies, an Indian Corporation,

plaintiff, v. Rocky Wright, an individual, bBooth, Inc., a Nevada corporation, and Blabeey, Inc, a Nevada corporation, defendants.

The action is pending in the United States District Court for the Central District of California under Case No.: 2:16-cv-7026

DSF (AJWx). The First Amended Complaint was filed on January 27, 2017, alleging breach of Implied-in-fact Contract and Quantum

Meruit relating to services Multicore allegedly performed on behalf of bBooth in connection with various web and mobile applications.

Multicore is seeking damages of approximately $157,000 plus interest and cost of suit. We filed an Answer denying Multicore’s

claims on March 13, 2017. We do not believe plaintiff’s claims of an implied contract or quantum meruit have any basis in

fact, nor do we believe they have any other viable claims against us. We intend to vigorously defend the action and have determined

not to create a reserve in our financial statements for an unfavorable outcome.

We

know of no material proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder

is a party adverse to our company or any of our subsidiaries or has a material interest adverse to our company or any of our subsidiaries.

Subsequent

to June 30, 2017, 510,001 shares of common stock that were subject to vesting schedules and previously accounted for were issued.

The

Company issued 94,620 shares of common stock to vendors subsequent to June 30, 2017, with a fair value of $14,750 for services

rendered.

Subsequent

to June 30, 2017, the Company issued 300,000 non-qualified stock options with an exercise price of $.25 to employees for services

to be rendered. The options vest monthly based on consultant achieving quantifiable milestones.

Effective

August 4, 2017, the Company entered into an extension agreement (the “Extension Agreement”) with Rory J. Cutaia to

extend the maturity date of the $343,326 Unsecured Note due on August 4, 2017 to and including December 4, 2018. In consideration

for extending the Note the Company issued Mr. Cutaia 1,329,157 warrants at a price of $.15. All other terms of the Note remain

unchanged.

Effective

August 4, 2017, the Company entered into an extension agreement (the “Extension Agreement”) with Rory J. Cutaia to

extend the maturity date of the $121,875 Unsecured Note due on August 4, 2017 to and including December 4, 2018. All other terms

of the Note remain unchanged.

Effective

August 4, 2017, the Company entered into an extension agreement (the “Extension Agreement”) with Oceanside to extend

the maturity date of the Note to and including April 4, 2018. All other terms of the Note remain unchanged. In consideration for

Oceanside’s agreement to extend the maturity date to April 4, 2018, the Company issued Oceanside 1,316,800 warrants at a

price of $.15. All other terms of the Note remain unchanged.

On

July 7, 2017, the Company issued 52,500 shares of Series A Preferred stock for cash proceeds of $50,000. The Series A Preferred

stock has the same terms as described in Note 7, except that only one redemption payment shall be due on January 8, 2018, in the

amount of $52,500. As a result of this transaction the Company will record liability of $52,500 and a debt discount of $2,500

upon issuance.

On

July 28, 2017, the Company has agreed to issue 262,500 shares of Series A Preferred stock for cash proceeds of $250,000. $125,000

was paid to the Company on July 28, 2017 and the remaining $125,000 will be paid on or about August 28, 2017, unless the Company

is in material, uncured default of the provisions of this Agreement. The Series A Preferred stock has the same terms as described

in Note 7. As a result of this transaction, the Company will record liability of $262,500 and debt discount of $12,500 upon issuance.

Effective

August 4, 2018, the Company issued the CEO 3,750,000 restricted shares of common stock with a fair value of $562,500.

ITEM

1A – RISK FACTORS

Not

applicable to smaller reporting companies.

ITEM

2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking

Statements

This

quarterly report contains “forward-looking statements”. All statements other than statements of historical fact are

“forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any

projections of earnings, revenue or other financial items; any statements of the plans, strategies and objections of management

for future operations; any statements concerning proposed new services, products or developments; any statements regarding future

economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing.

Forward-looking

statements may include the words “may,” “could,” “estimate,” “intend,” “continue,”

“believe,” “expect” or “anticipate” or other similar words. These forward-looking statements

present our estimates and assumptions only as of the date of this quarterly report. Accordingly, readers are cautioned not to

place undue reliance on forward-looking statements, which speak only as of the dates on which they are made. Except as required

by applicable law, we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information,

future events or otherwise, even if experience or future changes make it clear that any projected results or events expressed

or implied therein will not be realized. You are advised, however, to consult any further disclosures we make in future public

filings, statements and press releases.

Forward-looking

statements in this quarterly report include express or implied statements concerning our future revenues, expenditures, capital

and funding requirements; the adequacy of our current cash and working capital to fund present and planned operations and financing

needs; our proposed expansion of, and demand for, product offerings; the growth of our business and operations through acquisitions

or otherwise; and future economic and other conditions both generally and in our specific geographic and product markets. These

statements are based on currently available operating, financial and competitive information and are subject to various risks,

uncertainties and assumptions that could cause actual results to differ materially from those anticipated or implied in the forward-looking

statements due to a number of factors including, but not limited to, those set forth below in the section entitled “Risk

Factors” in this quarterly report, which you should carefully read. Given those risks, uncertainties and other factors,

many of which are beyond our control, you should not place undue reliance on these forward-looking statements. You should be prepared

to accept any and all of the risks associated with purchasing any securities of our company, including the possible loss of all

of your investment.

In

this quarterly report, unless otherwise specified, all references to “common shares” refer to the common shares in

our capital stock.

As

used in this quarterly report on Form 10-Q, the terms “we”, “us” “our” and “nFusz”

refer to nFusz, Inc., a Nevada corporation unless otherwise specified.

The

discussion and analysis of our financial condition and results of operations are based on our financial statements, which we have

prepared in accordance with accounting principles generally accepted in the United States of America. The preparation of these

condensed consolidated financial statements requires us to make estimates and assumptions that affect the reported amounts of

assets and liabilities and the disclosure of contingent assets and liabilities at the date of the condensed consolidated financial

statements, as well as the reported revenues and expenses during the reporting periods. On an ongoing basis, we evaluate estimates

and judgments, including those described in greater detail below. We base our estimates on historical experience and on various

other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments

about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ

from these estimates under different assumptions or conditions.

The

following discussion should be read together with the information contained in the unaudited condensed consolidated financial

statements and related notes included in Item 1 – Financial Statements, in this Form 10-Q.

Overview

The

Company has developed proprietary interactive video technology which serves as the basis for certain products and services that

it licenses under the brand name “Notifi”. Its NotifiCRM, NotifiADS, NotifiLINKS, and NotifiWEB products are cloud-based,

SaaS, CRM, sales lead generation, advertising, and social engagement software, accessible on mobile and desktop platforms, for

sales-based organizations, consumer brands, marketing and advertising agencies, and artists and social influencers seeking greater

levels of viewer engagement and higher sales conversion rates. The Company’s NotifiCRM platform is enterprise scalable and

incorporates unique, proprietary, push-to-screen, interactive audio/video messaging and interactive on-screen “virtual salesperson”

communications technology. The Company’s NotifiLIVE service is a proprietary broadcast video platform allowing viewers to

interact with broadcast video content by clicking on links embedded in people, objects, graphics or sponsors’ signage displayed

on the screen. Viewers can experience NotifiLIVE interactive content and capabilities on most devices available in the market

today without the need to download special software or proprietary video players.

The

Company was previously engaged in the manufacture, marketing, and operation of audition booths deployed in shopping malls and

other high-traffic venues in the United States and in the production of interactive television content. The audition booths were

portable recording studio kiosks, branded and marketed as “bBooth,” in which customers could audition for TV shows

such as American Idol. The kiosks were Internet connected and integrated into a social media, messaging, gaming, music streaming

and video sharing app called bBoothGO.

Critical

Accounting Policies

Our

company’s financial statements have been prepared in accordance with accounting principles generally accepted in the United

States, which require that we make certain assumptions and estimates that affect the reported amounts of assets and liabilities

at the date of the financial statements and the reported amounts of net revenue and expenses during each reporting period. On

an ongoing basis, management evaluates its estimates, including those related to valuation of the fair value of financial instruments,

share based compensation arrangements and long-lived assets. These estimates are based on historical experience and on various

other factors that it believes to be reasonable under the circumstances. Actual results could differ from those estimates.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of revenues and expenses during the reported periods. Significant estimates include the value

of share based payments. Amounts could materially change in the future.

Long-Lived

Assets

The

Company evaluates long-lived assets for impairment whenever events or changes in circumstances indicate that their net book value

may not be recoverable. When such factors and circumstances exist, the Company compares the projected undiscounted future cash

flows associated with the related asset or group of assets over their estimated useful lives against their respective carrying

amount. Impairment, if any, is based on the excess of the carrying amount over the fair value, based on market value when available,

or discounted expected cash flows, of those assets and is recorded in the period in which the determination is made. No impairment

of long-lived assets was required for the six months ended June 30, 2017.

Stock-

Compensation

The

Company periodically issues stock options and warrants to employees and non-employees in non-capital raising transactions for

services and for financing costs. The Company accounts for stock option and warrant grants issued and vesting to employees based

on the authoritative guidance provided by the Financial Accounting Standards Board whereas the value of the award is measured

on the date of grant and recognized over the vesting period. The Company accounts for stock option and warrant grants issued and

vesting to non-employees in accordance with the authoritative guidance of the Financial Accounting Standards Board whereas the

value of the stock compensation is based upon the measurement date as determined at either a) the date at which a performance

commitment is reached, or b) at the date at which the necessary performance to earn the equity instruments is complete. Non-employee

stock-based compensation charges generally are amortized over the vesting period on a straight-line basis. In certain circumstances

where there are no future performance requirements by the non-employee, option grants are immediately vested and the total stock-based

compensation charge is recorded in the period of the measurement date.

The

fair value of the Company’s common stock option grant is estimated using the Black-Scholes Option Pricing model, which uses

certain assumptions related to risk-free interest rates, expected volatility, expected life of the common stock options, and future

dividends. Compensation expense is recorded based upon the value derived from the Black-Scholes Option Pricing model, and based

on actual experience. The assumptions used in the Black-Scholes Option Pricing model could materially affect compensation expense

recorded in future periods.

Recent

Accounting Policies

For

a summary of our recent accounting policies, refer to Note 2 of our unaudited condensed consolidated financial statements included

under Item 1 – Financial Statements in this Form 10-Q.

Results

of Operations for the Three Months Ended June 30, 2017 as Compared to the Three Months Ended June 30, 2017.

Revenues

We

did not have any revenue in 2017 or 2016.

Operating

Expenses

Research

and development expenses were $92,240 for the three months ended June 30, 2017, as compared to $83,366 for the three months ended

June 30, 2016. The increase was primarily due to an increase in fees for coders dedicated to software development enhancements

and modifications.

General

and administrative expenses for the three months ended June 30, 2017 and 2016 was $1,352,028 and $1,047,580, respectively. The

increase was primarily due to an increase in stock based compensation expense of approximately $395,000.

Other

expense, net, for the three months ended June 30, 2017 amounted to $667,034, which represented interest expense of $86,816 on

outstanding notes payable and $53,346 as interest expense for amortization of debt discount. We also incurred a loss from debt

extinguishment in the amount of $526,871. The amount of other expense, net, was higher in 2017 as we did not have loss from debt

extinguishment offset by lower amortization of debt discount as most of the debt discounts from 2016 were fully amortized in 2016.

Other

Income

During

2016, we earned income from rental of our interactive booths of $31,525. There was no similar transaction in 2017.

Results

of Operations for the Six Months Ended June 30, 2017 as Compared to the Six Months Ended June 30, 2017.

Revenues

We

did not have any revenue in 2017 or 2016.

Operating

Expenses

Research

and development expenses were $181,840 for the six months ended June 30, 2017, as compared to $119,816 for the six months ended

June 30, 2016. The increase was primarily due to an increase in fees for coders dedicated to software development enhancements

and modifications during.

General

and administrative expenses for the six months ended June 30, 2017 and 2016 was $1,970,028 and $1,556,539, respectively. The increase

was primarily due to an increase in stock based compensation expense of approximately $492,000.

Other

expense, net, for the six months ended June 30, 2017 amounted to $816,717, which represented interest expense of $170,822 on outstanding

notes payable and $93,024 as interest expense for amortization of debt discount. We also incurred a loss from debt extinguishment

in the amount of $552,871. The amount of other expense, net, was higher in 2017 as we did not have loss from debt extinguishment

offset by lower amortization of debt discount as most of the debt discounts from 2016 were fully amortized in 2016.

Other

Income

During

2016, we earned income from rental of our interactive booths of $31,525. There was no similar transaction in 2017.

Liquidity

and Capital Resources

The

following is a summary of our cash flows from operating, investing and financing activities for the six months ended June 30,

2017 and 2016.

| | |

For

the Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2017 | | |

2016 | |

| Cash used in operating activities | |

$ | (794,754 | ) | |

$ | (895,675 | ) |

| Cash used in investing activities | |

| - | | |

| - | |

| Cash provided by financing activities | |

| 805,000 | | |

| 835,200 | |

| Increase / (Decrease) in cash | |

$ | 10,246 | | |

$ | (60,475 | ) |

For

the six months ended June 30, 2017, our cash flows used in operating activities amounted to $794,754 compared to cash used in