UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended: December 31 , 2023

Or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: 001-35764

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||||||

| (Address of principal executive offices) | (Zip Code) | ||||||||||

(973 ) 455-7500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act.

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| N/A | N/A | N/A | ||||||

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

PBF Holding Company LLC ¨ Yes x No

PBF Finance Corporation ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

PBF Holding Company LLC x Yes ¨ No

PBF Finance Corporation x Yes ¨ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

PBF Holding Company LLC ¨ Yes x No

PBF Finance Corporation ¨ Yes x No

(Note: The registrant is a voluntary filer of reports under Section 13 or 15(d) of the Securities Exchange Act of 1934 and has filed during the preceding 12 months all reports it would have been required to file by Section 13 or 15(d) of the Securities Exchange Act of 1934 if the registrant had been subject to one of such Sections.)

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

PBF Holding Company LLC x Yes ¨ No

PBF Finance Corporation x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| PBF Holding Company LLC | Large accelerated filer | ☐ | Accelerated filer | ☐ | ☒ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||||

| PBF Finance Corporation | Large accelerated filer | ☐ | Accelerated filer | ☐ | ☒ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

PBF Holding Company LLC ¨

PBF Finance Corporation ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

PBF Holding Company LLC ¨

PBF Finance Corporation ¨

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

PBF Holding Company LLC ¨

PBF Finance Corporation ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

PBF Holding Company LLC ¨

PBF Finance Corporation ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

PBF Holding Company LLC ¨ Yes x No

PBF Finance Corporation ¨ Yes x No

There is no trading in the membership interests of PBF Holding LLC or the common stock of PBF Finance Corporation and therefore an aggregate market value based on such is no

PBF Holding Company LLC has no common stock outstanding. As of February 23, 2024, 100% of the membership interests of PBF Holding Company LLC were owned by PBF Energy Company LLC, and PBF Finance Corporation had 100 shares of common stock outstanding, all of which were held by PBF Holding Company LLC.

PBF Finance Corporation meets the conditions set forth in General Instruction (I)(1)(a) and (b) of Form 10-K and is therefore filing this Form with the reduced disclosure format.

DOCUMENTS INCORPORATED BY REFERENCE

PBF HOLDING COMPANY LLC

TABLE OF CONTENTS

2

GLOSSARY OF SELECTED TERMS

Unless otherwise noted or indicated by context, the following terms used in this Annual Report on Form 10-K have the following meanings:

“AB 32” refers to the greenhouse gas emission control regulations in the state of California to comply with Assembly Bill 32.

“ANS” refers to Alaskan North Slope crude oil reflective of West Coast economics, characterized by API gravity between 28° and 35°.

“ASCI” refers to the Argus Sour Crude Index, a pricing index used to approximate market prices for sour, heavy crude oil.

“Bakken” refers to both a crude oil production region generally covering North Dakota, Montana and Western Canada, and the crude oil that is produced in that region.

“barrel” refers to a common unit of measure in the oil industry, which equates to 42 gallons.

“blendstocks” refers to various compounds that are combined with gasoline or diesel from the crude oil refining process to make finished gasoline and diesel; these may include natural gasoline, FCC unit gasoline, ethanol, reformate or butane, among others.

“bpd” is an abbreviation for barrels per day.

“CAM Pipeline” or “CAM Connection Pipeline” refers to the Clovelly-Alliance-Meraux pipeline in Louisiana.

“CARB” refers to the California Air Resources Board; gasoline and diesel fuel sold in the state of California are regulated by CARB and require stricter quality and emissions reduction performance than required by other states.

“catalyst” refers to a substance that alters, accelerates, or instigates chemical changes, but is not produced as a product of the refining process.

“coke” refers to a coal-like substance that is produced from heavier crude oil fractions during the refining process.

“complexity” refers to the number, type and capacity of processing units at a refinery, measured by the Nelson Complexity Index, which is often used as a measure of a refinery’s ability to process lower quality crude in an economic manner.

“crack spread” refers to a simplified calculation that measures the difference between the price for light products and crude oil. For example, we reference (a) the 2-1-1 crack spread, which is a general industry standard utilized by our Delaware City, Paulsboro and Chalmette refineries that approximates the per barrel refining margin resulting from processing two barrels of crude oil to produce one barrel of gasoline and one barrel of heating oil or ULSD, (b) the 4-3-1 crack spread, which is a benchmark utilized by our Toledo and Torrance refineries that approximates the per barrel refining margin resulting from processing four barrels of crude oil to produce three barrels of gasoline and one-half barrel of jet fuel and one-half barrel of ULSD and (c) the 3-2-1 crack spread, which is a benchmark utilized by our Martinez refinery that approximates the per barrel refining margin resulting from processing three barrels of crude oil to produce two barrels of gasoline and three-quarters of a barrel jet fuel and one-quarter of a barrel ULSD.

“Dated Brent” refers to Brent blend oil, a light, sweet North Sea crude oil, characterized by an American Petroleum Institute (“API”) gravity of 38° and a sulfur content of approximately 0.4 weight percent, that is used as a benchmark for other crude oils.

3

“distillates” refers primarily to diesel, heating oil, kerosene and jet fuel.

“downstream” refers to the downstream sector of the energy industry generally describing oil refineries, marketing and distribution companies that refine crude oil and sell and distribute refined products. The opposite of the downstream sector is the upstream sector, which refers to exploration and production companies that search for and/or produce crude oil and natural gas underground or through drilling or exploratory wells.

“EPA” refers to the United States Environmental Protection Agency.

“ESG” refers to environmental, social, and governance matters.

“ethanol” refers to a clear, colorless, flammable oxygenated liquid. Ethanol is typically produced chemically from ethylene, or biologically from fermentation of various sugars from carbohydrates found in agricultural crops. It is used in the United States as a gasoline octane enhancer and oxygenate.

“ExxonMobil” refers to Exxon Mobil Corporation.

“FCC” refers to fluid catalytic cracking.

“feedstocks” refers to crude oil and partially refined products that are processed and blended into refined products.

“GAAP” refers to U.S. generally accepted accounting principles developed by the Financial Accounting Standards Board for nongovernmental entities.

“GHG” refers to greenhouse gas.

“Group I base oils or lubricants” refers to conventionally refined products characterized by sulfur content less than 0.03% with a viscosity index between 80 and 120. Typically, these products are used in a variety of automotive and industrial applications.

“heavy crude oil” refers to a relatively inexpensive crude oil with a low API gravity characterized by high relative density and viscosity. Heavy crude oils require greater levels of processing to produce high value products such as gasoline and diesel.

“IPO” refers to the initial public offering of PBF Energy Class A common stock which closed on December 18, 2012.

“IRA” refers to the Inflation Reduction Act; a U.S. federal law enacted on August 16, 2022 that resulted in significant law changes related to tax, climate change, energy, and health care. The tax provision includes, but is not limited to, a corporate alternative minimum tax of 15%, excise tax of 1% on certain corporate stock buy-backs, energy-related tax credits and incentives, and additional Internal Revenue Service (“IRS”) funding.

“J. Aron” refers to J. Aron & Company, a subsidiary of The Goldman Sachs Group, Inc.

“KV” refers to Kilovolts.

“LCM” refers to a GAAP requirement for inventory to be valued at the lower of cost or market.

“light crude oil” refers to a relatively expensive crude oil with a high API gravity characterized by low relative density and viscosity. Light crude oils require lower levels of processing to produce high value products such as gasoline and diesel.

“light products” refers to the group of refined products with lower boiling temperatures, including gasoline and distillates.

4

“LLS” refers to Light Louisiana Sweet benchmark for crude oil reflective of Gulf coast economics for light sweet domestic and foreign crudes. It is characterized by an API gravity of between 35° and 40° and a sulfur content of approximately .35 weight percent.

“LPG” refers to liquefied petroleum gas.

“Maya” refers to Maya crude oil, a heavy, sour crude oil characterized by an API gravity of approximately 22° and a sulfur content of approximately 3.3 weight percent that is used as a benchmark for other heavy crude oils.

“MLP” refers to the master limited partnership.

“MMBTU” refers to million British thermal units.

“MOEM Pipeline” refers to a pipeline that originates at a terminal in Empire, Louisiana approximately 30 miles north of the mouth of the Mississippi River. The MOEM Pipeline is 14 inches in diameter, 54 miles long and transports crude from South Louisiana to the Chalmette refinery and transports Heavy Louisiana Sweet (“HLS”) and South Louisiana Intermediate (“SLI”) crude.

“MW” refers to Megawatt.

“Nelson Complexity Index” refers to the complexity of an oil refinery as measured by the Nelson Complexity Index, which is calculated on an annual basis by the Oil and Gas Journal. The Nelson Complexity Index assigns a complexity factor to each major piece of refinery equipment based on its complexity and cost in comparison to crude distillation, which is assigned a complexity factor of 1.0. The complexity of each piece of refinery equipment is then calculated by multiplying its complexity factor by its throughput ratio as a percentage of crude distillation capacity. Adding up the complexity values assigned to each piece of equipment, including crude distillation, determines a refinery’s complexity on the Nelson Complexity Index. A refinery with a complexity of 10.0 on the Nelson Complexity Index is considered ten times more complex than crude distillation for the same amount of throughput.

“NYH” refers to the New York Harbor market value of petroleum products.

“OSHA” refers to the Occupational Safety and Health Administration of the U.S. Department of Labor.

“refined products” refers to petroleum products, such as gasoline, diesel and jet fuel, that are produced by a refinery.

“Renewable Fuel Standard” or “RFS” refers to the Renewable Fuel Standard issued pursuant to the Energy Independence and Security Act of 2007 implementing mandates to blend renewable fuels into petroleum fuels produced and sold in the United States.

“RINs” refers to renewable fuel credits required for compliance with the RFS.

“Saudi Aramco” refers to Saudi Arabian Oil Company.

“SEC” refers to the United States Securities and Exchange Commission.

“sour crude oil” refers to a crude oil that is relatively high in sulfur content, requiring additional processing to remove the sulfur. Sour crude oil is typically less expensive than sweet crude oil.

“Sunoco” refers to Sunoco, LLC.

“sweet crude oil” refers to a crude oil that is relatively low in sulfur content, requiring less processing to remove the sulfur than sour crude oil. Sweet crude oil is typically more expensive than sour crude oil.

“Syncrude” refers to a blend of Canadian synthetic oil, a light, sweet crude oil, typically characterized by API gravity between 30° and 32° and a sulfur content of approximately 0.1-0.2 weight percent.

5

“throughput” refers to the volume processed through a unit or refinery.

“turnaround” refers to a periodically required shutdown and comprehensive maintenance event to refurbish and maintain a refinery unit or units that involves the cleaning, repair, and inspection of such units and occurs generally on a periodic cycle.

“ULSD” refers to ultra-low-sulfur diesel.

“WCS” refers to Western Canadian Select, a heavy, sour crude oil blend typically characterized by API gravity between 20° and 22° and a sulfur content of approximately 3.5 weight percent that is used as a benchmark for heavy Western Canadian crude oil.

“WTI” refers to West Texas Intermediate crude oil, a light, sweet crude oil, typically characterized by API gravity between 38° and 40° and a sulfur content of approximately 0.3 weight percent that is used as a benchmark for other crude oils.

“WTS” refers to West Texas Sour crude oil, a sour crude oil characterized by API gravity between 30° and 33° and a sulfur content of approximately 1.28 weight percent that is used as a benchmark for other sour crude oils.

“yield” refers to the percentage of refined products that is produced from crude oil and other feedstocks.

Explanatory Note

This Annual Report on Form 10-K is filed by PBF Holding Company LLC (“PBF Holding”) and PBF Finance Corporation (“PBF Finance”). PBF Holding is a wholly-owned subsidiary of PBF Energy Company LLC (“PBF LLC”) and is the parent company for PBF LLC's refinery operating subsidiaries. PBF Finance is a wholly-owned subsidiary of PBF Holding. PBF Holding is an indirect subsidiary of PBF Energy Inc. (“PBF Energy”), which is the sole managing member of, and owner of an equity interest representing approximately 99.3% of the outstanding economic interests in PBF LLC as of December 31, 2023. PBF Energy operates and controls all of the business and affairs and consolidates the financial results of PBF LLC and its subsidiaries. PBF Holding, together with its consolidated subsidiaries, owns and operates oil refineries and related facilities in North America.

6

PART I

In this Annual Report on Form 10-K, unless the context otherwise requires, references to the “Company,” “we,” “our” or “us” refer to PBF Holding, and, in each case, unless the context otherwise requires, its consolidated subsidiaries. References to “subsidiary guarantors” refer to PBF Services Company LLC (“PBF Services”), PBF Power Marketing LLC (“PBF Power”), Paulsboro Refining Company LLC (“PRC”), Toledo Refining Company LLC (“Toledo Refining”), Delaware City Refining Company LLC (“DCR”), PBF Investments LLC (“PBF Investments”), PBF International Inc., Chalmette Refining, L.L.C. (“Chalmette Refining”), PBF Energy Western Region LLC (“PBF Western Region”), Torrance Refining Company LLC (“Torrance Refining”), and Martinez Refining Company LLC (“MRC”), which are the subsidiaries of PBF Holding that guarantee PBF Holding’s 7.875% senior unsecured notes due 2030 (the “2030 Senior Notes”) and the 6.00% senior unsecured notes due 2028 (the “2028 Senior Notes”) as of December 31, 2023.

In this Annual Report on Form 10-K, we make certain forward-looking statements, including statements regarding our plans, strategies, objectives, expectations, intentions, and resources. You should read our forward-looking statements together with our disclosures under the heading: “Cautionary Statement Regarding Forward-Looking Statements.” When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements set forth in this Annual Report on Form 10-K under “Risk Factors” in Item 1A.

ITEM 1. BUSINESS

Overview and Corporate Structure

We are one of the largest independent petroleum refiners and suppliers of unbranded transportation fuels, heating oil, petrochemical feedstocks, lubricants and other petroleum products in the United States. We sell our products throughout the Northeast, Midwest, Gulf Coast and West Coast of the United States, as well as in other regions of the United States, Canada and Mexico and are able to ship products to other international destinations. We own and operate six domestic oil refineries and related assets. Our refineries have a combined processing capacity, known as throughput, of approximately 1,000,000 bpd, and a weighted-average Nelson Complexity Index of 12.7 based on current operating conditions. The complexity and throughput capacity of our refineries are subject to change dependent upon configuration changes we make to respond to market conditions, as well as a result of investments made to improve our facilities and maintain compliance with environmental and governmental regulations. The Company’s six oil refineries represent one reportable segment.

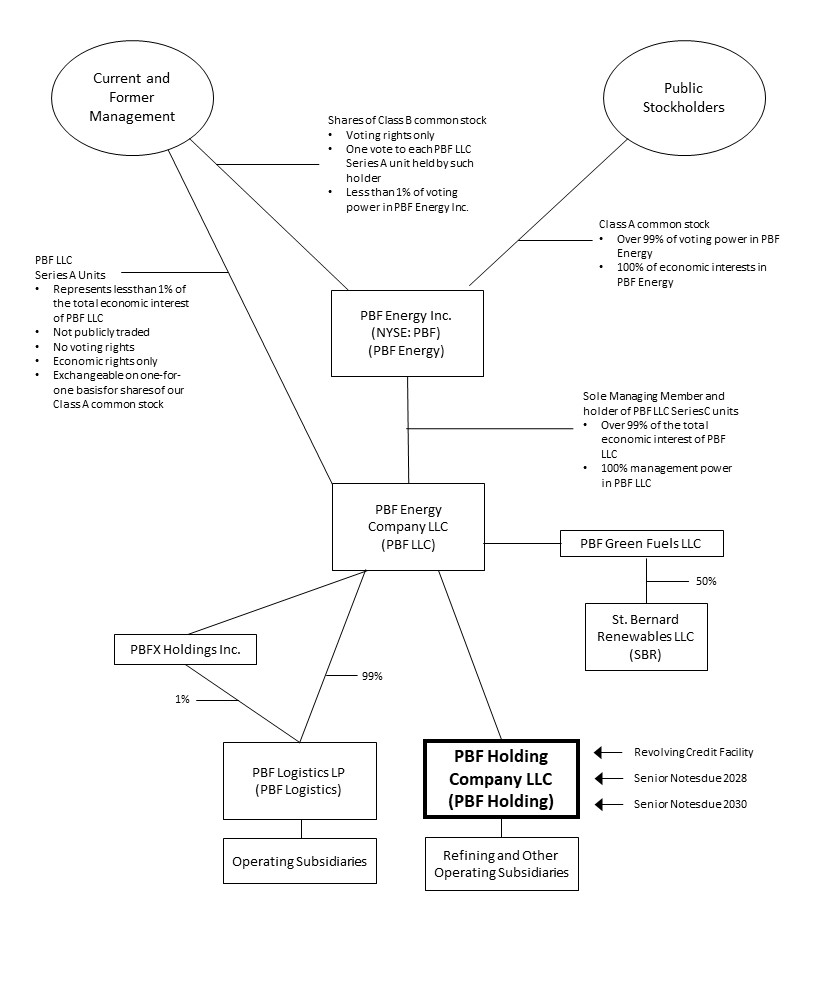

Ownership Structure

We are a Delaware limited liability company and a holding company for our operating subsidiaries. PBF Finance is a wholly-owned subsidiary of PBF Holding. We are a wholly-owned subsidiary of PBF LLC, and PBF Energy is the sole managing member of, and owner of an equity interest as of December 31, 2023 representing approximately 99.3% of the outstanding economic interests in PBF LLC.

On December 18, 2012, our indirect parent, PBF Energy completed its IPO. As a result of PBF Energy’s IPO and related organization transactions, PBF Energy became the sole managing member of PBF LLC and operates and controls all of its business and affairs and consolidates the financial results of PBF LLC and its subsidiaries, including PBF Holding and PBF Finance. As of December 31, 2023, PBF Energy held 120,461,851 PBF LLC Series C Units and its current and former executive officers and directors and certain employees and others held 862,780 PBF LLC Series A Units and the holders of PBF Energy’s issued and outstanding shares of its Class A common stock have approximately 99.3% of the voting power in PBF Energy, and the members of PBF LLC other than PBF Energy through their holdings of Class B common stock have approximately 0.7% of the voting power in PBF Energy.

7

PBF Holding Refineries

Our six refineries are located in Delaware City, Delaware, Paulsboro, New Jersey, Toledo, Ohio, Chalmette, Louisiana, Torrance, California and Martinez, California. Each refinery is briefly described in the table below:

| Refinery | Region | Nelson Complexity Index (1) | Throughput Capacity (in barrels per day) (1) | PADD | Crude Processed (2) | Source (2) | ||||||||||||||

| Delaware City | East Coast | 13.6 | 180,000 | 1 | light sweet through heavy sour | water, rail | ||||||||||||||

| Paulsboro | East Coast | 8.8 (3) | 155,000(3) | 1 | light sweet through heavy sour | water | ||||||||||||||

| Toledo | Mid-Continent | 11.0 | 180,000 | 2 | light sweet | pipeline, truck, rail | ||||||||||||||

| Chalmette | Gulf Coast | 13.0 | 185,000 | 3 | light sweet through heavy sour | water, pipeline | ||||||||||||||

| Torrance | West Coast | 13.8 | 166,000 | 5 | medium and heavy | pipeline, water, truck | ||||||||||||||

| Martinez | West Coast | 16.1 | 157,000 | 5 | medium and heavy | pipeline and water | ||||||||||||||

(1) Reflects operating conditions at each refinery as of the date of this filing. Changes in complexity and throughput capacity reflect the result of current market conditions, in addition to investments made to improve our facilities and maintain compliance with environmental and governmental regulations. Configurations at each of our refineries are evaluated periodically and updated accordingly.

(2) Reflects the typical crude and feedstocks and related sources utilized under normal operating conditions and prevailing market environments.

(3) Under normal operating conditions and prevailing market environments, our Nelson Complexity Index and throughput capacity for the Paulsboro refinery would be 13.1 and 180,000, respectively. As a result of the reconfiguration of our East Coast refineries in 2020, and subsequent restart of several idled processing units at the Paulsboro refinery in 2022, our Nelson Complexity Index and throughput capacity were adjusted.

PBF Logistics LP Transactions

PBF Logistics LP (“PBFX”) is an affiliate of ours. PBFX, an indirect wholly-owned subsidiary of PBF Energy and PBF LLC, owns or leases, operates, develops and acquires crude oil and refined products terminals, pipelines, storage facilities and similar logistics assets. PBFX engages in the receiving, handling, storage and transferring of crude oil, refined products, natural gas and intermediates from sources located throughout the United States and Canada for PBF Energy in support of its refineries, as well as for third-party customers. The majority of PBFX’s revenues are derived from long-term, fee-based commercial agreements with us, which include minimum volume commitments, for receiving, handling, storing and transferring crude oil, refined products, and natural gas. PBF Energy also has agreements with PBFX that establish fees for certain general and administrative services and operational and maintenance services provided by us to PBFX.

See “Agreements with PBFX” below as well as “Note 9 - Related Party Transactions” of our Notes to Consolidated Financial Statements for additional information. See “Item 1A. Risk Factors” and “Item 13. Certain Relationships and Related Transactions, and Director Independence.”

8

PBF Logistics GP LLC (“PBFX GP”) serves as the general partner of PBFX. PBFX GP is wholly-owned by PBF LLC. On May 14, 2014, PBFX completed its initial public offering (the “PBFX Offering”). In connection with the PBFX Offering, we distributed to PBF LLC, which in turn contributed to PBFX, the assets and liabilities of certain crude oil terminaling assets. In a series of transactions subsequent to the PBFX Offering, we distributed certain additional assets to PBF LLC, which in turn contributed those assets to PBFX. On November 30, 2022, PBF Energy acquired all of the publicly held common units in PBFX representing limited partner interests in the MLP not already owned by certain wholly-owned subsidiaries of PBF Energy and its affiliates, and PBFX became an indirect wholly-owned subsidiary of PBF Energy.

St. Bernard Renewables LLC Transactions

On June 27, 2023, PBF Energy and Eni Sustainable Mobility US Inc., a subsidiary of Eni SpA (“Eni”), consummated the closing of the equity method investment transaction and the capitalization of St. Bernard Renewables LLC (“SBR”), a jointly held investee designed to own, develop, and operate the renewable diesel facility co-located with our Chalmette refinery in Louisiana (the “Renewable Diesel Facility”). In connection with this transaction, we distributed to PBF LLC, which in turn contributed to SBR, certain assets. We have no interest in SBR.

See “Agreements with SBR” below as well as “Note 9 - Related Party Transactions” of our Notes to Consolidated Financial Statements for additional information. See “Item 1A. Risk Factors” and “Item 13. Certain Relationships and Related Transactions, and Director Independence.”

Available Information

Our website address is www.pbfenergy.com. Information contained on our website is not part of this Annual Report on Form 10-K. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any other materials filed with (or furnished to) the SEC by us are available on our website (under “Investors”) free of charge, soon after we file or furnish such material.

9

The diagram below depicts our organizational structure as of December 31, 2023:

10

Refining Operations

We own and operate six refineries (two of which are operated as a single unit) that provide us with geographic and market diversity. We produce a variety of products at each of our refineries, including gasoline, ULSD, heating oil, jet fuel, lubricants, petrochemicals and asphalt. We sell our products throughout the Northeast, Midwest, Gulf Coast and West Coast of the United States, as well as in other regions of the United States, Canada and Mexico, and are able to ship products to other international destinations.

Our refinery assets as of December 31, 2023 are described below.

East Coast Refining System (Delaware City Refinery and Paulsboro Refinery)

Overview. The Delaware City refinery is located on an approximately 5,000-acre site, with access to waterborne cargoes and an extensive distribution network of pipelines, barges and tankers, truck and rail. The Delaware City refinery is a fully integrated operation that receives crude via rail at our crude unloading facilities, or via ship or barge at the docks owned by the Delaware City refinery located on the Delaware River. The crude and other feedstocks are stored in an extensive tank farm prior to processing. In addition, there is a 15-lane, 76,000 bpd capacity truck loading rack located adjacent to the refinery and a 23-mile interstate pipeline that are used to distribute clean products. The Paulsboro refinery is located on approximately 950-acres on the Delaware River in Paulsboro, New Jersey, near Philadelphia and approximately 30 miles away from Delaware City. Paulsboro receives crude and feedstocks via its marine terminal on the Delaware River.

As a result of its configuration and process units, Delaware City has the capability of processing a slate of heavy crudes with a high concentration of high sulfur crudes, as well as other high sulfur feedstock when economically viable, and is one of the largest and most complex refineries on the East Coast. The Delaware City refinery is one of two heavy crude processing refineries, the other being our Paulsboro refinery, on the East Coast of the United States. The Delaware City coking capacity is equal to approximately 25% of crude capacity.

The Delaware City refinery primarily processes a variety of medium to heavy, sour crude oils, but can run light, sweet crude oils as well. The refinery has large conversion capacity with its 82,000 bpd FCC unit, 54,500 bpd fluid coking unit and 24,000 bpd hydrocracking unit.

11

The following table approximates the East Coast Refining System’s current major process unit capacities. Unit capacities are shown in barrels per stream day.

| Delaware City Refinery Units | Nameplate Capacity | ||||

| Crude Distillation Unit | 180,000 | ||||

| Vacuum Distillation Unit | 105,000 | ||||

| Fluid Catalytic Cracking Unit | 82,000 | ||||

| Hydrotreating Units | 180,000 | ||||

| Hydrocracking Unit | 24,000 | ||||

| Catalytic Reforming Unit | 43,000 | ||||

| Benzene / Toluene Extraction Unit | 15,000 | ||||

| Butane Isomerization Unit | 6,000 | ||||

| Alkylation Unit | 12,500 | ||||

| Polymerization Unit | 16,000 | ||||

| Fluid Coking Unit | 54,500 | ||||

| Paulsboro Refinery Units | Nameplate Capacity | |||||||

Crude Distillation Units (1) | 155,000 | |||||||

Vacuum Distillation Units (1) | 50,000 | |||||||

Fluid Catalytic Cracking Unit (1) | Idled | |||||||

Hydrotreating Units (1) | 102,000 | |||||||

Catalytic Reforming Unit (1) | 29,000 | |||||||

Alkylation Unit (1) | Idled | |||||||

| Lube Oil Processing Unit | 12,000 | |||||||

Delayed Coking Unit (1) | Idled | |||||||

| Propane Deasphalting Unit | 11,000 | |||||||

——————————

(1) Current nameplate capacity was fully or partially reduced as part of the 2020 reconfiguration of our Delaware City and Paulsboro refineries (the “East Coast Refining Reconfiguration”).

Feedstocks and Supply Arrangements. We source our crude oil and feedstock needs for the East Coast Refining System through waterborne deliveries, primarily through short-term and spot market agreements. We also have a crude supply contract with Saudi Aramco, the term of which is currently year to year, for up to approximately 100,000 bpd that is processed at the Paulsboro refinery.

Refined Product Yield and Distribution. The Delaware City refinery predominantly produces gasoline, jet fuel, ULSD and ultra-low sulfur heating oil as well as certain other products. Products produced at the Delaware City refinery are transferred to customers through pipelines, barges or at its truck rack. We market and sell all of our refined products independently to a variety of customers on the spot market or through term agreements. The Paulsboro refinery predominantly manufactures Group I base oils or lubricants and asphalt, jet fuel and ULSD. Products produced at the Paulsboro refinery are transferred to customers primarily through pipelines, barges, or at its truck rack. We market and sell all of our refined products independently to a variety of customers on the spot market or through term agreements.

12

Inventory Intermediation Agreement. On July 31, 2023, we early terminated the third amended and restated inventory intermediation agreement (the “Third Inventory Intermediation Agreement”), previously entered into by and among PBF Holding and its subsidiaries, DCR, PRC and Chalmette Refining (collectively, the “PBF Entities”) and J. Aron to support the operations of the PBF Entities.

Pursuant to the Third Inventory Intermediation Agreement, J. Aron had purchased and held title to certain inventory, including crude oil, intermediate and certain finished products (the “J. Aron Products”), purchased or produced by the Paulsboro and Delaware City refineries (and, at the election of the PBF Entities, the Chalmette refinery) (the “Refineries”) and delivered into our storage tanks at the Refineries (the “Storage Tanks”). Following the early termination, we purchased, and now own all of the inventory previously held by J. Aron.

Tankage Capacity. The Delaware City refinery has total storage capacity of approximately 10.0 million barrels. Of the total, approximately 3.6 million barrels of storage capacity are dedicated to crude oil and other feedstock storage with the remaining 6.4 million barrels allocated to finished products, intermediates and other products. The Paulsboro refinery has total storage capacity of approximately 7.5 million barrels. Of the total, approximately 2.1 million barrels are dedicated to crude oil storage with the remaining 5.4 million barrels allocated to finished products, intermediates and other products.

Energy and Other Utilities. Under normal operating conditions, the Delaware City refinery consumes approximately 75,000 MMBTU per day of natural gas supplied via pipeline from third parties. The Delaware City refinery has a 280 MW power plant located on site that consists of two natural gas-fueled turbines with combined capacity of approximately 140 MW and four turbo generators with combined nameplate capacity of approximately 140 MW. Collectively, this power plant produces electricity in excess of Delaware City’s refinery load of approximately 90 MW. Excess electricity is sold into the Pennsylvania-New Jersey-Maryland, or PJM, grid. Steam is primarily produced by a combination of three dedicated boilers, two heat recovery steam generators on the gas turbines, and is supplemented by secondary boilers at the FCC and Coker. Hydrogen is currently provided via the refinery’s steam methane reformer and continuous catalytic reformer.

Under normal operating conditions, the Paulsboro refinery currently consumes approximately 40,000 MMBTU per day of natural gas supplied via pipeline from third parties. The Paulsboro refinery is mostly self-sufficient for electrical power through a mix of gas and steam turbine generators. The Paulsboro refinery generation supplies all of the 20MW total refinery load. There are circumstances where available generation is greater than the total refinery load, and the Paulsboro refinery can export up to about 40MW of power to the utility grid if warranted. If necessary, supplemental electrical power is available on a guaranteed basis from the local utility. The Paulsboro refinery is connected to the grid via three separate 69KV aerial feeders and has the ability to run entirely on imported power. Steam is produced in three boilers and a heat recovery steam generator fed by the exhaust from the gas turbine. In addition, there are a number of waste heat boilers and furnace stack economizers throughout the refinery that supplement the steam generation capacity. The Paulsboro refinery’s hydrogen needs are met by the steam methane reformer and the catalytic reformer.

Toledo Refinery

Overview. The Toledo refinery primarily processes a slate of light, sweet crudes from Canada, the Mid-Continent, the Bakken region and the U.S. Gulf Coast. The Toledo refinery is located on a 282-acre site near Toledo, Ohio, approximately 60 miles from Detroit. Crude is delivered to the Toledo refinery through three primary pipelines: (1) Enbridge from the north, (2) Patoka from the west and (3) Mid-Valley from the south. Crude is also delivered to a nearby terminal by rail and from local sources by truck to a truck unloading facility within the refinery.

13

The following table approximates the Toledo refinery’s current major process unit capacities. Unit capacities are shown in barrels per stream day.

| Toledo Refinery Units | Nameplate Capacity | ||||

| Crude Distillation Unit | 180,000 | ||||

| Fluid Catalytic Cracking Unit | 82,000 | ||||

| Hydrotreating Units | 95,000 | ||||

| Hydrocracking Unit | 52,000 | ||||

| Catalytic Reforming Units | 52,000 | ||||

| Alkylation Unit | 11,000 | ||||

| Polymerization Unit | 7,000 | ||||

| UDEX Unit | 16,300 | ||||

Feedstocks and Supply Arrangements. We source our crude oil and feedstock needs for the Toledo refinery through connections to the Marysville Pipeline and Maumee Pipeline, and via truck rack, primarily through short-term and spot market agreements.

Refined Product Yield and Distribution. The Toledo refinery produces finished products, including gasoline, jet and ULSD, in addition to a variety of high-value petrochemicals including benzene, toluene, xylene, nonene and tetramer. The Toledo refinery is connected, via pipelines, to an extensive distribution network throughout Ohio, Illinois, Indiana, Kentucky, Michigan, Pennsylvania and West Virginia. The finished products are transported on pipelines owned by Sunoco Logistics Partners L.P. and Buckeye Partners L.P. In addition, we have proprietary connections to a variety of smaller pipelines and spurs that help us optimize our clean products distribution. A significant portion of the Toledo refinery’s gasoline and ULSD are distributed through various terminals in this network.

We have an agreement with Sunoco whereby Sunoco purchases gasoline and distillate products representing approximately one-third of the Toledo refinery’s gasoline and distillates production. The agreement expires in June 2025, subject to certain early termination rights. We sell the bulk of the petrochemicals produced at the Toledo refinery through short-term contracts or on the spot market and the majority of the petrochemical distribution is done via rail.

Tankage Capacity. The Toledo refinery has total storage capacity of approximately 4.5 million barrels. The Toledo refinery receives its crude through pipeline connections and a truck rack. Of the total, approximately 1.3 million barrels are dedicated to crude oil storage with the remaining 3.2 million barrels allocated to intermediates and products.

Energy and Other Utilities. Under normal operating conditions, the Toledo refinery consumes approximately 25,000 MMBTU per day of natural gas supplied via pipeline from third parties. The Toledo refinery purchases its electricity from the PJM grid and has a long-term contract to purchase hydrogen and steam from a local third-party supplier. In addition to the third-party steam supplier, the Toledo refinery consumes a portion of the steam that is generated by its various process units.

14

Chalmette Refinery

Overview. The Chalmette refinery is located on a 400-acre site near New Orleans, Louisiana. It is a dual-train coking refinery and is capable of processing both light and heavy crude oil through its 185,000 bpd crude units and downstream units. Chalmette Refining owns 100% of the MOEM Pipeline, providing access to the Empire Terminal, as well as the CAM Connection Pipeline, providing access to the Louisiana Offshore Oil Port facility through a third-party pipeline. Chalmette Refining also owns 80% of each of the Collins Pipeline Company (“Collins”) and T&M Terminal Company (“T&M”), both located in Collins, Mississippi, which provide a clean products outlet for the refinery to the Plantation and Colonial Pipelines. In addition, there is also a marine terminal capable of importing waterborne feedstocks and loading or unloading finished products. There is also a clean products truck rack that provides access to local markets and crude storage. The Renewable Diesel Facility is also located at our Chalmette refinery. The facility incorporates a repurposed hydrocracker, along with a newly-constructed pre-treatment unit to establish a capacity to produce 20,000 bpd renewable diesel.

The following table approximates the Chalmette refinery’s current major process unit capacities. Unit capacities are shown in barrels per stream day.

| Chalmette Refinery Units | Nameplate Capacity | ||||

| Crude Distillation Units | 185,000 | ||||

| Vacuum Distillation Unit | 114,000 | ||||

| Fluid Catalytic Cracking Unit | 75,000 | ||||

| Hydrotreating Units | 189,000 | ||||

| Delayed Coking Unit | 42,000 | ||||

| Catalytic Reforming Unit | 42,000 | ||||

| Alkylation Unit | 17,000 | ||||

| Aromatics Extraction Unit | 17,000 | ||||

Feedstocks and Supply Arrangements. We source our crude oil and feedstock needs for the Chalmette refinery through connections to the CAM Pipeline and MOEM Pipeline, and via waterborne deliveries, primarily through short-term and spot market agreements.

Refined Product Yield and Distribution. The Chalmette refinery predominantly produces gasoline and diesel fuels and also manufactures high-value petrochemicals including benzene and xylene. Products produced at the Chalmette refinery are transferred to customers through pipelines, the marine terminal and truck rack. The majority of our clean products are delivered to customers via pipelines. Our ownership of the Collins pipeline and T&M terminal provides the Chalmette refinery with strategic access to Southeast and East Coast markets through third-party logistics.

Inventory Intermediation Agreement. On July 31, 2023, we early terminated the Third Inventory Intermediation Agreement. Refer to East Coast Refining System (Delaware City refinery and Paulsboro refinery), above, for further details.

Tankage Capacity. The Chalmette refinery has a total tankage capacity of approximately 8.1 million barrels. Of this total, approximately 2.6 million barrels are allocated to crude oil storage with the remaining 5.5 million barrels allocated to intermediates and products.

Energy and Other Utilities. Under normal operating conditions, the Chalmette refinery consumes approximately 25,000 MMBTU per day of natural gas supplied via pipeline from third parties. The Chalmette refinery purchases its electricity from a local utility and has a long-term contract to purchase hydrogen from a third-party supplier.

15

Torrance Refinery

Overview. The Torrance refinery is located on 750-acres in Torrance, California. It is a high-conversion crude, delayed-coking refinery capable of processing both heavy and medium crude oils through its crude unit and downstream units. In addition to refining assets, the Torrance refinery acquisition included a number of high-quality logistics assets including a sophisticated network of crude and products pipelines, product distribution terminals and refinery crude and product storage facilities. The most significant logistics asset is a crude gathering and transportation system which delivers San Joaquin Valley crude oils directly from the field to the refinery, which is now owned by PBFX. Additionally, there are several pipelines serving the refinery that provide access to sources of waterborne crude oils including the Ports of Long Beach and Los Angeles, as well as clean product outlets with a direct pipeline that supplies jet fuel to the Los Angeles airport that are held by affiliates of the refinery.

The following table approximates the Torrance refinery’s current major process unit capacities. Unit capacities are shown in barrels per stream day.

| Torrance Refinery Units | Nameplate Capacity | ||||

| Crude Distillation Unit | 166,000 | ||||

| Vacuum Distillation Unit | 102,000 | ||||

| Fluid Catalytic Cracking Unit | 90,000 | ||||

| Hydrotreating Units | 155,500 | ||||

| Hydrocracking Unit | 25,000 | ||||

| Alkylation Unit | 25,500 | ||||

| Delayed Coking Unit | 58,000 | ||||

Feedstocks and Supply Arrangements. We source our crude oil and feedstock needs for the Torrance refinery mainly through connections to our own pipeline, and via waterborne deliveries and truck racks, primarily through short-term and spot market agreements.

Refined Product Yield and Distribution. The Torrance refinery predominantly produces gasoline, jet fuel and diesel fuels. Products produced at the Torrance refinery are transferred to customers through pipelines, the marine terminal and truck rack. The majority of clean products are delivered to customers via pipelines. We currently market and sell all of our refined products independently to a variety of customers either on the spot market or through term agreements.

Tankage Capacity. The Torrance refinery has a total tankage capacity of approximately 8.6 million barrels. Of this total, approximately 2.1 million barrels are allocated to crude oil storage with the remaining 6.5 million barrels allocated to intermediates and products.

Energy and Other Utilities. Under normal operating conditions, the Torrance refinery consumes approximately 47,000 MMBTU per day of natural gas supplied via pipeline from third parties. The Torrance refinery generates some power internally using a combination of steam and gas turbines and purchases any additional needed power from the local utility. The Torrance refinery has a long-term contract to purchase hydrogen from a third-party supplier.

16

Martinez Refinery

Overview. The Martinez refinery is located on an 860-acre site in the City of Martinez, 30 miles northeast of San Francisco, California. The refinery is a high-conversion, dual-coking facility and one of the most complex refineries in the United States. The facility is strategically positioned in Northern California and provides for operating and commercial synergies with the Torrance refinery located in Southern California. In addition to refining assets, the Martinez refinery includes a number of high-quality onsite logistics assets including a deep-water marine facility, product distribution terminals and refinery crude and product storage facilities with approximately 8.8 million barrels of shell capacity.

The following table approximates the Martinez refinery’s current major process unit capacities. Unit capacities are shown in barrels per stream day.

| Martinez Refinery Units | Nameplate Capacity | |||||||

| Crude Distillation Unit | 157,000 | |||||||

| Vacuum Distillation Unit | 102,000 | |||||||

| Fluid Catalytic Cracking Unit | 72,000 | |||||||

| Hydrotreating Units | 268,000 | |||||||

| Hydrocracking Unit | 42,900 | |||||||

| Alkylation Unit | 12,500 | |||||||

| Delayed Coking Unit | 25,500 | |||||||

| Flexi Coking Unit | 22,500 | |||||||

| Isomerization Unit | 15,000 | |||||||

Feedstocks and Supply Arrangements. We source our crude oil and feedstock needs for the Martinez refinery through connections to the Crimson San Pablo Bay Pipeline, and via waterborne deliveries, primarily through short-term and spot market agreements. We also have crude supply agreements with Shell Trading (US) Company (primarily serving the Martinez refinery) for up to 95,000 bpd, which, upon expiration of one of the agreements in early 2024, will be reduced to up to approximately 65,000 bpd, through early 2025.

Refined Product Yield and Distribution. We entered into certain offtake agreements for our West Coast system with Shell Oil Products for clean products with varying terms up to 15 years. We currently market and sell all of our refined products independently to a variety of customers either on the spot market or through term agreements.

Tankage Capacity. Martinez has a total tankage capacity of approximately 8.8 million barrels. Of this total, approximately 2.5 million barrels are allocated to crude oil storage with the remaining 6.3 million barrels allocated to intermediates and products.

Energy and Other Utilities. Under normal operating conditions, the Martinez refinery consumes approximately 80,000 MMBTU per day of natural gas (including natural gas consumed in hydrogen production) supplied via pipeline from third parties. The Martinez refinery generates some power internally using a combination of steam and gas turbines and purchases any additional needed power from the local utility. The Martinez refinery has a long-term contract to purchase hydrogen from a third-party supplier.

17

Agreements with PBFX

Beginning with the completion of the PBFX Offering, we have entered into a series of agreements with PBFX, including commercial and operational agreements. Each of these agreements and their impact to our operations is outlined below.

Contribution Agreements

Immediately prior to the closing of certain contribution agreements, which PBF LLC entered into with PBFX (as defined in the table below, and collectively referred to as the “Contribution Agreements”), we contributed certain assets to PBF LLC. PBF LLC in turn contributed those assets to PBFX pursuant to the Contribution Agreements. Certain proceeds received by PBF LLC from PBFX in accordance with the Contribution Agreements were subsequently contributed by PBF LLC to us. The Contribution Agreements include the following:

| Contribution Agreement | Effective Date | Assets Contributed | Total Consideration | ||||||||

| Contribution Agreement I | 5/8/2014 | DCR Rail Terminal and the Toledo Truck Terminal | 74,053 PBFX common units and 15,886,553 PBFX subordinated units | ||||||||

| Contribution Agreement II | 9/16/2014 | DCR West Rack | $135.0 million in cash and $15.0 million through the issuance of 589,536 PBFX common units | ||||||||

| Contribution Agreement III | 12/2/2014 | Toledo Storage Facility | $135.0 million in cash and $15.0 million through the issuance of 620,935 PBFX common units | ||||||||

| Contribution Agreement IV | 5/5/2015 | DCR Products Pipeline and DCR Truck Rack | $112.5 million in cash and $30.5 million through the issuance of 1,288,420 PBFX common units | ||||||||

| Contribution Agreement V | 8/31/2016 | Torrance Valley Pipeline (50% equity interest in TVPC) | $175.0 million in cash | ||||||||

| Contribution Agreement VI | 2/15/2017 | Paulsboro Natural Gas Pipeline | $11.6 million affiliate promissory note | ||||||||

| Contribution Agreements VII-X | 7/16/2018 | Development Assets | $31.6 million through the issuance of 1,494,134 PBFX common units | ||||||||

| Contribution Agreement XI | 4/24/2019 | Remaining 50% equity interest in TVPC | $200.0 million in cash | ||||||||

Commercial Agreements

PBFX currently derives the majority of its revenue from long-term, fee-based agreements with us, which generally include a minimum volume commitment, as applicable, and are supported by contractual fee escalations for inflation adjustments and certain increases in operating costs. We believe the terms and conditions under these agreements, as well as the Omnibus Agreement and the Services Agreement (each as defined below), each with PBFX, are generally no less favorable to either party than those that could have been negotiated with unaffiliated parties with respect to similar services.

Omnibus Agreement

In addition to the commercial agreements described above, PBFX entered into an omnibus agreement, which has been amended and restated in connection with the closing of certain of the Contribution Agreements with PBFX GP, PBF LLC and us (as amended, the “Omnibus Agreement”). The Omnibus Agreement addresses the payment of an annual fee for the provision of various general and administrative services and reimbursement of salary and benefit costs for certain PBF Energy employees.

18

The annual fee under the Omnibus Agreement for the year ended December 31, 2023 was $7.9 million, inclusive of obligations under the Omnibus Agreement to reimburse us for certain compensation and benefit costs of employees who devoted more than 50% of their time to PBFX during the year ended December 31, 2023. We currently estimate to receive $6.0 million, inclusive of estimated obligations under the Omnibus Agreement as a reimbursement for certain compensation and benefit costs of employees who devote more than 50% of their time to PBFX for the year ending December 31, 2024.

Services Agreement

Additionally, PBFX entered into an operation and management services and secondment agreement with us and certain of our subsidiaries (as amended, the “Services Agreement”), pursuant to which we provide PBFX with the personnel necessary for PBFX to perform its obligations under its commercial agreements. PBFX reimburses us for the use of such employees and the provision of certain infrastructure-related services to the extent applicable to its operations, including storm water discharge and waste water treatment, steam, potable water, access to certain roads and grounds, sanitary sewer access, electrical power, emergency response, filter press, fuel gas, API solids treatment, fire water and compressed air. For the year ended December 31, 2023, PBFX paid us an annual fee of $8.7 million pursuant to the Services Agreement and we currently estimate to receive the same annual reimbursement pursuant to the Services Agreement for the year ending December 31, 2024.

The Services Agreement will terminate upon the termination of the Omnibus Agreement, provided that PBFX may terminate any service on 30-days’ notice.

Agreements with SBR

The Company has entered into agreements with SBR for the sale of RINs and Low Carbon Fuel Standard (“LCFS”) credits.

Refer to “Note 9 - Related Party Transactions” of our Notes to Consolidated Financial Statements for further discussion regarding the above agreements with PBFX and SBR.

Principal Products

Our refineries make various grades of gasoline, distillates (including diesel fuel, jet fuel, and ULSD) and other products from crude oil, other feedstocks, and blending components. We sell these products through our commercial accounts, and sales with major oil companies. For the years ended December 31, 2023, 2022 and 2021, gasoline and distillates accounted for 88.8%, 88.6% and 86.4% of our revenues, respectively.

Customers

We sell a variety of refined products to a diverse customer base. The majority of our refined products are primarily sold through short-term contracts or on the spot market. In addition, we have product offtake arrangements for a portion of our clean products. For the years ended December 31, 2023 and December 31, 2022 only one customer, Shell plc (“Shell”), accounted for 10% or more of our revenues (approximately 14% and 14%, respectively). As of December 31, 2023 and December 31, 2022, only one customer, Shell, accounted for 10% or more of our total trade accounts receivable (approximately 19% and 19%, respectively).

Seasonality

Traditionally, demand for gasoline and diesel is generally higher during the summer months than during the winter months due to seasonal increases in highway traffic and construction work. Decreased demand during the winter months can lower gasoline and diesel prices. However, due to global supply disruptions, the effects of seasonality on our operating results have been less impactful in recent years.

19

Competition

The refining business is very competitive. We compete directly with various other refining companies on the East, Gulf and West Coasts and in the Mid-Continent, with integrated oil companies, with foreign refiners that import products into the United States and with producers and marketers in other industries supplying alternative forms of energy and fuels to satisfy the requirements of industrial, commercial and individual consumers. Some of our competitors have expanded the capacity of their refineries and internationally new refineries are coming on line which could also affect our competitive position.

Profitability in the refining industry depends largely on refined product margins, which can fluctuate significantly, as well as crude oil prices and differentials between the prices of different grades of crude oil, operating efficiency and reliability, product mix and costs of product distribution and transportation. Certain of our competitors that have larger and more complex refineries may be able to realize lower per-barrel costs or higher margins per barrel of throughput. Several of our principal competitors are integrated national or international oil companies that are larger and have substantially greater resources. Because of their integrated operations and larger capitalization, these companies may be more flexible in responding to volatile industry or market conditions, such as shortages of feedstocks or intense price fluctuations. Refining margins are frequently impacted by sharp changes in crude oil costs, which may not be immediately reflected in product prices.

The refining industry is also highly competitive with respect to feedstock supply. Unlike certain of our competitors that have access to proprietary controlled sources of crude oil production available for use at their own refineries, we obtain all of our crude oil and substantially all other feedstocks from unaffiliated sources. The availability and cost of crude oil and feedstock are affected by global supply and demand. We have no crude oil reserves and are not engaged in the exploration or production of crude oil. We believe, however, that we will be able to obtain adequate crude oil and other feedstocks at generally competitive prices for the foreseeable future.

Pursuant to its RFS, EPA has implemented mandates to blend renewable fuels into the petroleum fuels produced and sold in the United States. Because we do not directly produce renewable fuels, increasing the volume of renewable fuels that must be blended into our products could displace an increasing volume of our refineries’ product pool, potentially resulting in lower earnings and profitability. In addition, in order to meet certain of these and future EPA requirements, we may be required to continue to purchase RINs, which historically had, and we expect to have, fluctuating costs based on market conditions.

Corporate Offices

We currently lease approximately 63,000 square feet for our principal corporate offices in Parsippany, New Jersey. The lease for our principal corporate offices expires in 2026. Functions performed in the Parsippany office include overall corporate management, refinery and health, safety and environmental management, planning and strategy, corporate finance, commercial operations, logistics, contract administration, marketing, investor relations, governmental affairs, accounting, tax, treasury, information technology, legal and human resources support functions.

We lease approximately 8,800 square feet for our regional corporate office in Long Beach, California. The lease for our Long Beach office expires in 2026. Functions performed in the Long Beach office include overall regional corporate management, planning and strategy, commercial operations, logistics, contract administration, marketing and governmental affairs.

20

Employees and Human Capital

Safety

We believe our responsibility to our employees, neighbors, members, other stakeholders and the environment is only fulfilled through our commitment to safety and reliability. Through rigorous training, sharing of expertise across our sites, continuous monitoring and through promoting a culture of excellence in operations, we continuously strive to keep our people, the communities in which we operate in and the environment safe.

We are subject to the requirements of OSHA and comparable state statutes that regulate the protection of the health and safety of workers. In addition, the OSHA Hazard Communication Standard requires that information be maintained about hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens. We believe that our operations are in compliance with OSHA requirements, including general industry standards, record keeping requirements and monitoring of occupational exposure to regulated substances.

Development and Retention

The development, attraction and retention of employees is a critical success factor for our Company. To support the advancement of our employees, we offer rigorous training and development programs and encourage the sharing of expertise across our sites. We actively promote inclusion and diversity in our workforce at each of our locations and provide our employees with opportunities to give back through engagement in our local communities through supportive educational programs, philanthropic and volunteer activities.

We believe that a combination of competitive compensation and career growth and development opportunities help increase employee morale and reduce voluntary turnover. Our comprehensive benefit packages are competitive in the marketplace and we believe in recognizing and rewarding talent through our various cash and equity compensation programs.

21

Headcount

As of December 31, 2023, we had approximately 3,686 employees, of which 1,917 are covered by collective bargaining agreements. Our hourly employees are covered by collective bargaining agreements through the United Steel Workers (“USW”), the Independent Oil Workers (“IOW”) and the International Brotherhood of Electrical Workers (“IBEW”). We consider our relations with the represented employees to be satisfactory.

| Location | Number of employees | Employees covered by collective bargaining agreements | Collective bargaining agreements | Expiration date | ||||||||||||||||||||||

| Headquarters | 470 | — | N/A | N/A | ||||||||||||||||||||||

| Delaware City refinery | 535 | 374 | USW | January 2026 | ||||||||||||||||||||||

| Paulsboro refinery | 301 | 189 | IOW | March 2026 | ||||||||||||||||||||||

| Toledo refinery | 524 | 327 | USW | February 2026 | ||||||||||||||||||||||

| Chalmette refinery | 587 | 335 | USW | January 2026 | ||||||||||||||||||||||

| Torrance refinery | 592 | 304 15 | USW IBEW | January 2026 January 2026 | ||||||||||||||||||||||

| Torrance logistics | 97 | 10 28 13 | USW USW USW | April 2024 January 2026 March 2028 | ||||||||||||||||||||||

| Martinez refinery | 580 | 307 15 | USW IBEW | February 2026 February 2026 | ||||||||||||||||||||||

| Total employees | 3,686 | 1,917 | ||||||||||||||||||||||||

22

Environmental, Health and Safety Matters

Our refineries, pipelines and related operations are subject to extensive and frequently changing federal, state and local laws and regulations, including, but not limited to, those relating to the discharge of materials into the environment or that otherwise relate to the protection of the environment, waste management and the characteristics and the compositions of fuels. Compliance with existing and anticipated laws and regulations can increase the overall cost of operating the refineries, including remediation, operating costs and capital costs to construct, maintain and upgrade equipment and facilities. Permits are also required under these laws for the operation of our refineries, pipelines and related operations and these permits are subject to revocation, modification and renewal. Compliance with applicable environmental laws, regulations and permits will continue to have an impact on our operations, results of operations and capital requirements. We believe that our current operations are in substantial compliance with existing environmental laws, regulations and permits.

We incorporate by reference into this Item the environmental disclosures contained in the following sections of this report:

•Item 1A. “Risk Factors”

◦Our results of operations continue to be impacted by significant costs to comply with renewable fuels mandates. The market prices for RINs have been volatile and may harm our profitability;

◦We may have capital needs for which our internally generated cash flows and other sources of liquidity may not be adequate;

◦We may incur significant liability under, or costs and capital expenditures to comply with, environmental and health and safety regulations, which are complex and change frequently;

◦Potential further laws and regulations related to climate change could have a material adverse impact on our operations and adversely affect our facilities;

◦Regulation of emissions of greenhouse gases could force us to incur increased capital expenditures and operating costs that could have a material adverse effect on our results of operations and financial condition;

◦Environmental clean-up and remediation costs of our sites and environmental litigation could decrease our net cash flow, reduce our results of operations and impair our financial condition;

◦Our pipelines are subject to federal and/or state regulations, which could reduce profitability and the amount of cash we generate;

◦We could incur substantial costs or disruptions in our business if we cannot obtain or maintain necessary permits and authorizations or otherwise comply with health, safety, environmental and other laws and regulations;

◦Enhanced scrutiny on ESG matters and developments related to climate change may negatively impact our business and our access to capital markets;

◦We are subject to strict laws and regulations regarding employee and process safety, and failure to comply with these laws and regulations could have a material adverse effect on our results of operations, financial condition and profitability.

•Item 3. “Legal Proceedings”

•Item 8. “Financial Statements and Supplementary Data”

◦ Note 7 - Accrued Expenses,

◦ Note 10 - Commitments and Contingencies

23

Applicable Federal and State Regulatory Requirements

As is the case with all companies engaged in industries similar to ours, we face potential exposure to future claims and lawsuits involving environmental and safety matters. These matters include soil and water contamination, air pollution, personal injury and property damage allegedly caused by substances which we manufactured, handled, used, released or disposed of.

Current and future environmental regulations are expected to require additional expenditures, including expenditures for investigation and remediation, which may be significant, at our refineries and at our other facilities. To the extent that future expenditures for these purposes are material and can be reasonably determined, these costs are disclosed and accrued.

Our operations are also subject to various laws and regulations relating to occupational health and safety. We maintain safety training and maintenance programs as part of our ongoing efforts to ensure compliance with applicable laws and regulations. Compliance with applicable health and safety laws and regulations has required and continues to require substantial expenditures.

We cannot predict what additional health, safety and environmental legislation or regulations will be enacted or become effective in the future or how existing or future laws or regulations will be administered or interpreted with respect to our operations. Compliance with more stringent laws or regulations or adverse changes in the interpretation of existing requirements or discovery of new information such as unknown contamination could have an adverse effect on the financial position and the results of our operations and could require substantial expenditures for the installation and operation of systems and equipment that we do not currently possess.

We incorporate by reference into this Item the federal and state regulatory requirements disclosures contained in the following sections of this report:

•Item 8. “Financial Statements and Supplementary Data”

◦ Note 10 - Commitments and Contingencies

24

ITEM 1A. RISK FACTORS

Summary of Risk Factors

Operating in our industry involves a degree of risk. These risks are discussed more fully below and include, but are not limited to, the following, any of which could have a material adverse effect on our financial condition, results of operations and cash flows:

Risks Relating to Our Business and Industry

•The price volatility of crude oil, other feedstocks, blendstocks, refined products and fuel and utility services;

•Volatility in commodity prices and refined product demand;

•Crude oil differentials and related factors, which fluctuate substantially;

•Significant interruptions or casualty losses at any of our refineries and related assets;

•Interruptions of supply and distribution at our refineries;

•Renewable fuels mandates and the cost of RINs;

•Existence of capital needs for which our internally generated cash flows and other sources of liquidity may not be adequate;

•Regulation related to climate change and emissions of greenhouse gases and other regulatory environmental and health and safety regulations;

•Enhanced scrutiny on ESG matters;

•Rate of inflation and its impacts on supply and demand, pricing, and supply chain disruption;

•Actions taken by our competitors, including adjustments to refining capacity or renewable fuels production in response to regulations and market conditions;

•Volatility and uncertainty in the credit and capital markets, including as a result of higher interest rates;

•Any political instability, including as a result of Russia’s military action in Ukraine, the outbreak of armed hostilities in the middle east, disruption in international shipping resulting from recent attacks by armed groups on cargo ships in the Red Sea, military strikes, sustained military campaigns, terrorist activity, changes in foreign policy, or other catastrophic events;

•A cyber-attack on, or other failure of, our technology infrastructure;

•Competition from other companies in the refining industry;

•Delays or cost increases related to capital spending programs;

•Product liability claims, operational liability claims and other material litigation;

•Acquisition or integration of new assets into our business;

•Labor disruptions that would interfere with our operations;

•Discontinuation of employment of any of our senior executives or other key employees;

•Our activity in commodity derivatives markets.

Risks Related to Our Indebtedness

•Our levels of indebtedness;

•Our ability to secure necessary financing on acceptable terms;

•Changes in our credit ratings;

•Limitations on our operations or ability to make distributions arising out of restrictive covenants in our debt instruments;

•Anti-takeover provisions in our indentures.

25

Risk Factors

You should carefully read the risks and uncertainties described below. The risks and uncertainties described below are not the only ones facing our Company. Additional risks and uncertainties may also impair our business operations. If any of the following risks actually occur, our business, financial condition, results of operations or cash flows would likely suffer.

Risks Relating to Our Business and Industry

Demand for our refined products can significantly decline due to changes in global and regional economic conditions.

Business closings and layoffs in the markets we operate may adversely affect demand for our refined products. Deterioration of general economic conditions or weak demand levels could require additional actions on our part to lower our operating costs, including temporarily or permanently ceasing to operate units at our facilities. There may be significant incremental costs associated with such actions. Deterioration of global and regional economic conditions may harm our liquidity and ability to repay our outstanding debt.

The price volatility of crude oil, other feedstocks, blendstocks, refined products and fuel and utility services may have a material adverse effect on our revenues, profitability, cash flows and liquidity.

Our profitability, cash flows and liquidity from operations depend primarily on the margin above operating expenses (including the cost of refinery feedstocks, such as crude oil, intermediate partially refined products, and natural gas liquids that are processed and blended into refined products) at which we are able to sell refined products. Refining is primarily a margin-based business and, to increase profitability, it is important to maximize the yields of high value finished products while minimizing the costs of feedstock and operating expenses. When the margin between refined product prices and crude oil and other feedstock costs contracts, our earnings, profitability and cash flows are negatively affected. Historically, refining margins have been volatile, and are likely to continue to be volatile, as a result of a variety of factors, including fluctuations in the prices of crude oil, other feedstocks, refined products and fuel and utility services. An increase or decrease in the price of crude oil will likely result in a similar increase or decrease in prices for refined products; however, there may be a time lag in the realization, or no such realization, of the similar increase or decrease in prices for refined products. The effect of changes in crude oil prices on our refining margins therefore depends in part on how quickly and how fully refined product prices adjust to reflect these changes.

The nature of our business has required us to maintain substantial crude oil, feedstock and refined product inventories. Because crude oil, feedstock and refined products are commodities, we have no control over the changing market value of these inventories. Our crude oil, feedstock and refined product inventories are valued at the LCM value under the last-in-first-out (“LIFO”) inventory valuation methodology. At December 31, 2023 and December 31, 2022, the replacement value of inventories exceeded the LIFO carrying value, therefore no LCM inventory reserve was recorded. If the market value of our crude oil, feedstock and refined product inventory declines to an amount less than our LIFO cost, we would record a write-down of inventory and a non-cash impact to cost of products and other.

Prices of crude oil, other feedstocks, blendstocks, and refined products depend on numerous factors beyond our control, including the supply of and demand for crude oil, other feedstocks, gasoline, diesel, ethanol, asphalt and other refined products. Such supply and demand are affected by a variety of economic, market, environmental and political conditions.

26

Our direct operating expense structure also impacts our profitability. Our major direct operating expenses include employee and contract labor, maintenance and energy. Our predominant variable direct operating cost is energy, which is comprised primarily of fuel and other utility services. The volatility in costs of fuel, principally natural gas, and other utility services, principally electricity, used by our refineries and other operations affect our operating costs. Fuel and utility prices have been, and will continue to be, affected by factors outside our control, such as supply and demand for fuel and utility services in both local and regional markets. Natural gas prices have historically been volatile and, typically, electricity prices fluctuate with natural gas prices. Future increases in fuel and utility prices may have a negative effect on our refining margins, profitability and cash flows.

Our working capital, cash flows and liquidity can be significantly impacted by volatility in commodity prices and refined product demand.

Payment terms for our crude oil purchases are typically longer than those terms we extend to our customers for sales of refined products. Additionally, reductions in crude oil purchases tend to lag demand decreases for our refined products. As a result of this timing differential, the payables for our crude oil purchases are generally proportionally larger than the receivables for our refined product sales. As we are normally in a net payables position, a decrease in commodity prices generally results in a use of working capital. Given we process a significant volume of crude oil, the impact can materially affect our working capital, cash flows and liquidity.

Our profitability is affected by crude oil differentials and related factors, which fluctuate substantially.

A significant portion of our profitability is derived from the ability to purchase and process crude oil feedstocks that historically have been less expensive than benchmark crude oils, such as the heavy, sour crude oils processed at our Delaware City, Paulsboro, Chalmette, Torrance and Martinez refineries. For our Toledo refinery, aside from recent crude differential volatility, purchased crude prices have historically been above the WTI benchmark, however, such crude slate typically results in favorable refinery production yield. For all locations, these crude oil differentials can vary significantly from quarter to quarter depending on overall economic conditions and trends and conditions within the markets for crude oil and refined products. Any change in these crude oil differentials may have an impact on our earnings. Our rail investment and strategy to acquire cost advantaged Mid-Continent and Canadian crude, which are priced based on WTI, could be adversely affected when the WTI/Dated Brent or related differentials narrow. A narrowing of the WTI/Dated Brent differential may result in our Toledo refinery losing a portion of its crude oil price advantage over certain of our competitors, which negatively impacts our profitability. In addition, imbalances between the production and capacity to export crude in Canada may continue to result in price volatility and the narrowing of the WTI/WCS differential, which is a proxy for the difference between light U.S. and heavy Canadian crude oil, and may reduce our refining margins and adversely affect our profitability and earnings. Divergent views have been expressed as to the expected magnitude of changes to these crude differentials in future periods. Any continued or further narrowing of these differentials could have a material adverse effect on our business and profitability.