UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from__________ to__________

Commission

File Number:

(Exact name of registrant as specified in its charter)

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

(Address of principal executive offices) (Zip Code)

(Registrant’s

telephone number, including area code): (

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically on its corporate Website, if any, every Interactive Data File required

to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for a such

shorter period that the registrant was required to submit such files).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large, accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

If securities are registered pursuant to Section 12(b)

of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of

an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller

reporting company | |

| Emerging

growth company |

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period to comply with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No

As

of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market

value of the common stock held by non-affiliates of the registrant was approximately $

The registrant had shares of its common stock outstanding as of March 29, 2024.

VISLINK TECHNOLOGIES, INC.

FORM 10-K

ANNUAL REPORT

For the Fiscal Year Ended December 31, 2023

TABLE OF CONTENTS

| 2 |

FORWARD-LOOKING INFORMATION

This Annual Report on Form 10-K (including the section regarding Management’s Discussion and Analysis of Financial Condition and Results of Operations) (this “Report”) contains forward-looking statements regarding the business, financial condition, results of operations, and prospects of Vislink Technologies, Inc. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and similar words and phrases are intended to identify forward-looking statements. However, this report does not include an all-inclusive list of words or phrases identifying forward-looking statements. Also, all information concerning future matters is forward-looking statements.

Although forward-looking statements in this Report reflect our management’s good faith judgment, such information can only be based on facts and circumstances currently known by us. Forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from those discussed or anticipated by the forward-looking statements. Without limitation, factors that could cause or contribute to such differences in results and outcomes include those discussed elsewhere in this Report.

We undertake no obligation to revise or update any forward-looking statements to reflect any event or circumstance that may arise after the date of this Report. We urge you to carefully review and consider all the disclosures made in this Report.

References to Vislink in this report, unless otherwise stated or the context otherwise requires, reference to “VISL,” “Vislink,” “the Company,” “we,” “us,” “our,” and similar reference refer to Vislink Technologies, Inc., a Delaware corporation and its subsidiaries.

Risk Factor Summary

The following summarizes certain factors that may make our company’s investment speculative or risky. You should carefully consider the entire risk factor disclosure outlined in this Annual Report and the other information herein, including the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section and our financial statements and related notes.

| ● | We have incurred losses in the past and may be unable to achieve or sustain profitability in the future. | |

| ● | We may require additional capital to fund our existing commercial operations, develop, market, and commercialize new products, and expand our operations. If we do not obtain additional financing, our business prospects, financial condition, and results of operations will be adversely affected if required. | |

| ● | Our industry is highly competitive, and we may need to compete more effectively. | |

| ● | Defects or errors in our products and services or products made by our suppliers could harm our brand and relations with our customers and expose us to liability. If we experience product recalls, we may incur significant expenses and experience decreased demand for our products. | |

| ● | We acknowledge material weaknesses in our internal controls and procedures over financial reporting. In the future, we may identify additional material weaknesses that may cause us to fail to meet our reporting obligations, including timeliness, or result in material misstatements of our financial statements. | |

| ● | We rely extensively on information technology systems and could face cybersecurity risks. | |

| ● | We rely on key executive officers, and their knowledge of our business and technical expertise would be difficult to replace. | |

| ● | We purchase some components, subassemblies, and products from a limited number of suppliers. The loss of these suppliers may substantially disrupt our ability to obtain orders and fulfill sales as we design and qualify new components. | |

| ● | Our intellectual property protections may be insufficient to safeguard our technology adequately. | |

| ● | We may be subject to claims of intellectual property infringement or invalidity. Expenses incurred for monitoring, protecting, and defending our intellectual property rights could adversely affect our business. | |

| ● | Enforcement of our intellectual property rights abroad, particularly in China, is limited, and it is often difficult to protect and enforce such rights. | |

| ● | The intellectual property rights of others may prevent us from developing new products or entering new markets. | |

| ● | We may be subject to infringement claims in the future. | |

| ● | If our technology did not work as planned or if we were unsuccessful in developing and selling new products or penetrating new markets, our business and operating results would suffer. | |

| ● | Demand for our defense-related products and products for emergency response services depends on government spending. | |

| ● | Regulation of the telecommunications industry could harm our operating results and prospects. | |

| ● | New regulations or standards or changes in existing laws or standards in the United States or internationally related to our products may result in unanticipated costs or liabilities, which could have a material adverse effect on our business, results of operations, and future sales and could place additional burdens on our business operations. | |

| ● | Our industry is subject to rapid technological change, and to compete successfully, we must make substantial investments in new products, services, and technologies. | |

| ● | At several of our annual stockholder meetings, including our 2019 Annual Meeting of Stockholders, we failed to obtain ratification by our stockholders of specific proposals submitted for approval of our stockholders at prior annual meetings, which could be deemed defective corporate acts. | |

| ● | Our failure to meet Nasdaq’s continued listing requirements could result in our common stock’s delisting, which could negatively impact its market price and liquidity and our ability to access the capital markets. |

| 3 |

PART I

Item 1. Business

Overview

Vislink Technologies, Inc., incorporated in Delaware in 2006, is a global technology business that collects, delivers, and manages high-quality, live video and associated data from the action scene to the viewing screen. We provide solutions for collecting live news, sports, entertainment, and news events for the broadcast markets. We also furnish the surveillance and defense markets with real-time video intelligence solutions using various tailored transmission products. Our team also provides professional and technical services utilizing a staff of technology experts with decades of applied knowledge and real-world experience in the terrestrial microwave, fiber optic, surveillance, and wireless communications systems, delivering a broad spectrum of customer solutions.

Live Broadcast:

We deliver an extensive portfolio of solutions for live news, sports, and entertainment industries. These solutions include video collection, transmission, management, and distribution via microwave, cellular, IP (Internet Protocol), MESH, and bonded cellular/5G networks. We also provide solutions utilizing AI (Artificial Intelligence) technologies to provide automated news and sporting events coverage. With over 50 years in operation, we have the expertise and technology portfolio to deliver fully integrated, seamless, end-to-end solutions that encompass hardware components, hosted systems management platforms, related software licenses and ancillary support services.

Industry-wide contributors acknowledge our live broadcast solutions. Our equipment is used to transmit most outside wireless broadcast video content, with over 200,000 systems installed worldwide. We work closely with the majority of the world’s broadcasters. Our wireless cameras and ultra-compact encoders help bring many of the world’s most prestigious sporting and entertainment events to life. Recent examples include globally watched international sporting contests, award shows, racing events, and annual music and cultural events.

Military and Government:

We have developed high-quality solutions to meet surveillance and defense markets’ operational and industry challenges based on our knowledge of live video delivery. Our solutions are specifically designed with interagency cooperation, utilizing the internationally recognized IP platform and a web interface for video delivery. We provide comprehensive video, audio, and data communications solutions to law enforcement and the public safety community, including Airborne, Unmanned Systems, Maritime, and Tactical Mobile Command Posts. These solutions may include:

| ● | integrated suites of airborne downlink transmitters, receivers, and antenna systems | |

| ● | data and video connectivity for airborne, marine, and ground assets | |

| ● | UAV video distribution | |

| ● | flexible support for COFDM and bonded cellular/5G Networks | |

| ● | terrestrial point-to-point | |

| ● | tactical mobile command | |

| ● | IP-based, high-end encryption, full-duplex, real-time connectivity at extended operating ranges | |

| ● | high-throughput air/marine/ground-to-anywhere uplink and downlink systems | |

| ● | secure live streaming platforms for use in mobile and fixed assets, and | |

| ● | personal portable products |

Our public safety and surveillance solutions are deployed worldwide, including throughout the U.S., Europe, and the Middle East, at the local, regional, and federal levels of operation for criminal investigation, crisis management, mobile command posts, and field operations. These solutions are designed to meet the demands of field operations, command centers, and central receiving sites. Short-range and long-range solutions are available in areas including established infrastructure and exceptionally remote regions, making valuable video intelligence available regardless of location.

| 4 |

Connected Edge Solutions:

Mobile Viewpoint (MVP) offers the hardware and software solutions needed to acquire, produce, contribute to, and deliver video over all private and public networks. Connected edge solutions aid the video transport concept of ubiquitous IP networks and cloud-scale computing across 5G, WiFi6, Mesh, and COFDM-enabled networks. These solutions include:

| ● | live video encoding, stream adaptation, decoding, and production solutions, | |

| ● | remote production workflows, | |

| ● | wireless cameras, | |

| ● | AI-driven automated production, and | |

| ● | the ability to contribute video over | |

| ○ bonded cellular (3G and 4G) | ||

| ○ satellite, | ||

| ○ fiber, and | ||

| ○ emerging networks, including 5G and Starlink |

Our Strategy

Our participation in the Live Production and Mil/Gov sectors allows us to offer various end-to-end, high-reliability, high-data-rate, long-range wireless video transmission solutions.

We use our solutions for applications in growing market segments, including in-game sports, mobile video feeds, real-time capture and display footage from drones and other aerial platforms, and rapid-response electronic newsgathering operations.

The acquisition of MVP in August 2021 is a component of our strategy to provide an industry-leading portfolio of live video acquisition, contribution, and distribution solutions that meet the demanding needs of media, enterprise, defense, and government organizations. Our customers can benefit from the ability to address the most transformative trends in today’s live video market, such as:

| ● | live internet video traffic is growing fast: from 2016 to 2021, there was a 15-fold increase in live video internet traffic (71.9% CAGR); | |

| ● | the acceleration towards cloud-based remote production; | |

| ● | the increasing demand for enhanced video content formats such as 4K, 8K, and 360-degree video, and | |

| ● | the proliferation of new video transport capable networks such as 5G and Starlink. |

MPV has allowed us to expand our offerings, which serve most of these transformative live video trends and economically bring high-quality live production to the previously challenging presentation of historical events involving amateur and semi-pro athletics. MVP’s technology enhances our go-to-market strategy as we seek to take advantage of new technologies such as 5G and other new networks and machine learning, which we believe are revolutionizing how video is generated and transported.

The recent acquisition of the assets of Broadcast Microwave Services, LLC. (“BMS”) assets represents a pivotal step in our ongoing mission to enhance our product offerings, extend our market reach, and solidify our position as a force in the Airborne Video Downlink Systems (AVDS) market. The integration of BMS’s assets into our operations is expected to enhance the reach of product offerings to our customers as follows:

| ● | it provides us with a long-standing customer base in U.S federal sectors, global OEMs, and EMEA markets, | |

| ● | combinations to make Vislink the de facto leader in the COFDM/Mesh/5G-Based AVDS, | |

| ● | access to advanced, reliable, and robust video downlink solutions to drive additional software and services recurring revenue via the air to anywhere platform, | |

| ● | the positioning of the Company in the growing drone command and control market, | |

| ● | one-stop solutions for live video communications needs, using proprietary COFDM bonded cellular, 5G, and AI-driven technologies for public safety, air-to-ground video distribution, streamlining operational processes and enhancing efficiency, | |

| ● | a more responsive and globally accessible support network ensuring that customers remain connected with their audiences, teams, and operations, and | |

| ● | new opportunities for our customers to access a more comprehensive array of cutting-edge solutions. |

| 5 |

Market

Our services and product offerings broadly address Live Production and Mil/Gov.

Within the sports and entertainment market, we have identified the e-sports live-streaming applications markets as those where our solutions have applicability. The live production market is focused on applying more agile wireless video systems for live production and broadcasting sports, entertainment, and news events. Drivers in this market include small, lightweight, easy-to-use equipment, low-latency video systems, reliability of the wireless links, and the ability to use licensed and unlicensed bands. Current trends within the market reduce the size of these products further and improve the wireless video systems’ agility as users demand higher link reliability at longer ranges. There is also an increased desire to provide audiences with new views and camera angles to enhance the viewing experience. We address this need by incorporating 4K, HDR, and other emerging video technologies.

The Live Production market’s broadcast news sector looks to improve operational efficiencies in gathering, producing, and transmitting wireless content. Recent trends in the market include a movement towards I.P. connectivity over point-to-point links for infrastructure, high-definition upgrades of remote newsgathering vehicles, and continued pressure to reduce expenses by improving operational efficiencies. We focus on how these customers create and gather content wirelessly. As the wireless communications industry begins transitioning to fifth generation (5G) networks, the speed increases they will usher in expect to augment the availability of on-demand live streaming, where our equipment is already in use.

The Mil/Gov market comprises vital segments, including state and local law enforcement agencies, federal agencies, and military system integrators. The market looks to improve video content’s reliability and quality without adding complexity and omitting technical intervention while operating video systems. State and local agencies benefit from the Department of Homeland Security grant programs to improve overall security. Recent trends within these segments include improved interoperability within agencies and demand for fully integrated systems, including robust microwave combined with ubiquitous I.P. networks; as the wireless video systems become more reliable and straightforward to deploy, the wireless systems’ option rate increases. Customers within this market include state police forces, sheriff’s departments, fire departments, first responders, the Department of Justice, and Homeland Security.

Our Products and Solutions: Overview

We offer a full spectrum of wireless video products built around providing complete solutions. We have traditionally focused on developing core product technologies for the final assembled products that cross-market segments. Such technology focus areas include R.F., Live Streaming, and microwave component development spanning the frequency range from D.C. to 18GHz, waveform modulation, advanced video encoding (HEVC) and decoding, 4K UHD (Ultra High Definition) camera systems, and digital signal processing. Through these products, we are positioned with significant technology I.P. and an established reputation for rapidly and economically delivering complex, bespoke engineering products and solutions to customers that are expertly managed to tight deadlines. Production of these products can quickly be scaled to respond to changes in market demand.

Live Production Products and Solutions

Our Live Production Solutions include high-definition communication links that reliably capture, transmit and manage live event footage. We offer a line of high-margin wireless camera transmitter and receiver products that may be interconnected over I.P. networks, expanding and simplifying their widespread use and significantly reducing deployment costs. HCAM is a 4K Ultra HD-capable on-camera wireless system designed to cover significant events among our transmitter products. Our flagship receiver product is the Quantum Receiver. The Quantum is an ultra-low latency, waveform agnostic central receiver representing our premier receiver in all market verticals, including MilGov. Features include HEVC quad signal decode, seamless geographical coverage, and an I.P. stream engine with cloud integration possibilities, OTT, and social media platforms. IP Link 3.0 is a studio-transmitter link system that enables broadcasting service platforms to access new monetization opportunities. Other essential receiver products include the ViewBack, CRx6, and CIRAS-X6. ViewBack is a lightweight, low-power, low latency, dual-channel diversity receiver-decoder that enables quicker production, more efficient editing, and more effective collaboration between camera operators and studio teams. We also offer ultra-compact onboard solutions integrating our MDR (Modular Diversity Receiver) technology with ruggedized support components designed to capture video from high-speed motorsports.

| 6 |

As a result of our acquisition of Mobile Viewpoint, we also offer a portfolio of products that includes the WMT line of mobile encoders and TerraLink rack encoders for live streaming over 4G and 5G, and systems developed using AI technologies for the automated coverage of news and sports productions., The TrolleyLive Remote Pro is an all-in-one production unit for remote live broadcasts. LinkMatrix is a central platform for managing all devices and synchronizing all data sources.

Quantum

IP Link 3.0

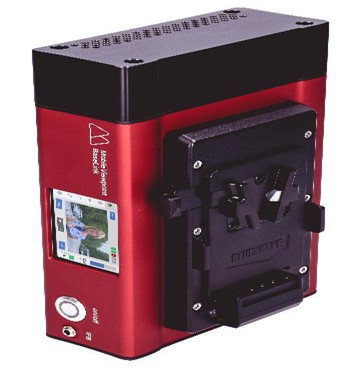

WMT BaseLink Encoder

TerraLink 4CM Rack Encoder

| 7 |

Mil/Gov Products and Solutions

In the Mil/Gov sector, the Vislink Airborne Video Downlink System (AVDS) is a comprehensive aerial-based video transmission solution that delivers real-time surveillance to enhance law enforcement, emergency, and critical infrastructure operations. It includes an integrated suite of downlink transmitters, receivers, and antennas that capture real-time, reliable, high-definition video from drones, helicopters, and other aircraft for display at command centers, mobile units, and video management systems. AVDS allows an unlimited number of observers to view the video over any network connection, including wired Ethernet, Wi-Fi, I.P. satellite, and I.P. cellular. AeroLink is an aircraft-based transmitter unit that provides bi-directional data transmission and is tightly integrated with other elements of the AVDS, including the Quantum and our other central receivers. In addition to supporting Mil/Gov applications, AeroLink supports broadcast/ENG applications for transmitting air-based feeds from breaking news and sporting events. The Aero5 is an airborne downlink transmitter that provides an extended bidirectional link using local cellular infrastructure as the receive system. The HHT3 and Mobil Commander are handheld receivers/monitors designed for tactical situations.

As a result of our acquisition of the assets of BMS in September 2023, we now also offer their wireless microwave equipment designed for use in government surveillance, law enforcement, uncrewed aerial vehicles (“UAV”), and uncrewed ground vehicles (“UGV”) markets.

HHT3

Mobil Commander

AeroLink

Aero5

| 8 |

Competition and Competitive Positioning

We believe our primary competitors are Domo Tactical Communications (formerly a division of Cobham), Silvus Technologies, Persistent Systems, Troll Systems, and several smaller market-specific businesses.

We believe that we are one of the market share leaders in the professional broadcast and media video transmission sector. We have successfully leveraged our history of broadcast industry leadership, reputation for advanced technology, and the ability to provide end-to-end solutions to maintain and increase our customer base and continue delivering highly competitive offerings. Our products solve a growing market need for regular, high-definition, wireless video communications. Our product offerings address applications in growing market segments, including in-game sports video mobile feeds, real-time capture and display footage from drones and other aerial platforms, and rapid-response electronic newsgathering operations.

Since completing the global rebranding of our solutions under the single Vislink Technologies, Inc. entity in 2018 and the acquisition of MVP in 2021, we believe we can now offer an expanded range of product offerings, additional services, and enhanced capabilities. We think this expansion of product offerings will position us for growth in the Live Production and Mil/Gov markets. We seek to improve margins and control product quality and our competitive agility as we refine our production processes.

Sales and Marketing

Our sales team comprises sales managers responsible for defined regional areas, inside sales personnel, and business development representatives focused on targeted sectors and regions, supported by solution engineers trained in technical sales with a given market focus. The sales team focuses on helping current customers and nurturing relationships with prospective customers in key domestic and international markets. We employ a combination of sales channels, including direct-to-end customer sales, network group sales, reseller/integrators, and Original Equipment Manufacturer (“OEM”) sales channels to use the most efficient means of reaching customers depending on the market segment. Marketing and public relations activities, digital and print marketing initiatives, the creation of support materials, trade shows, and other event appearances support our sales efforts.

As of December 31, 2023, our business development, sales, and marketing team comprised 20 full-time employees and five contractors.

Customers

We have developed a significant following based on our product offerings’ reputation for performance, reliability, and advanced technology use. We have created a diverse and stable customer base among blue-chip, tier-1 clients in Live Production markets and high-profile agencies and organizations in Mil/Gov markets.

Manufacturing and Suppliers

We utilize a combination of external contract manufacturers and internal resources to manufacture, test, assure the quality of, and ship our products, allowing us to develop supply chains tailored to our needs on a per-product and per-solution basis. As we advance, we anticipate focusing on our core strengths: innovation and technology design and developing, creating, and exploiting our intellectual property.

We may continue to rely upon third-party components and technology to build our products, particularly in the short term, as we procure components, subassemblies, and products necessary to manufacture our products based on our design, development, and production needs. While parts and supplies are generally available from various sources, we currently depend on a single or limited number of suppliers for several components for our products. We rely on purchase orders rather than long-term contracts with our suppliers. A delay in production could result if a supply disruption of critical components required us to re-engineer our products to incorporate alternate features.

| 9 |

Intellectual Property

We have developed a broad intellectual property portfolio covering wired and wireless communications systems. As of December 31, 2023, we have 11 patents granted in the United States, no patent applications pending, no provisional applications pending, and one disclosure. Internationally, we have two patents granted, no patent applications pending, and no Patent Cooperation Treaty (PCT) applications.

Areas of our development activities that have culminated in filings and/or awarded patents include:

| ● | Self-Organizing Networks; | |

| ● | R.F. Modulation; | |

| ● | Compression (protocols, payload, signaling, etc.); | |

| ● | Modulators/Demodulators; | |

| ● | Antennas/Shielding; | |

| ● | Wired and Wireless Networks; | |

| ● | Media Access Control Protocols; and | |

| ● | Interference Mitigation. |

We protect our intellectual property rights using federal, state, and common law rights and contractual restrictions. We control access to our proprietary technology by entering confidentiality and invention assignment agreements with our employees and contractors and confidentiality agreements with third parties. We also actively monitor activities concerning third parties’ infringing uses of our intellectual property.

In addition to these contractual arrangements, we rely on a combination of trade secrets, copyrights, trademarks, trade dress, domain names, and patents to protect our products and other intellectual property. We own a substantial portion of the copyright interests in the software code used in connection with our products and the brand or title name trademark under our marketed products. We pursue our domain names, trademarks, and service marks in the United States and locations outside the United States. Our registered trademarks in the United States include “xG,” “IMT,” “Vislink,” “Mobile Viewpoint,” and the names of our products, among others.

Circumstances outside our control could pose a threat to our intellectual property rights. For example, adequate intellectual property protection may not be available in the United States or other countries where our products are sold or distributed. Also, our efforts to protect our proprietary rights may need to be revised. Any significant impairment of our intellectual property rights could harm our business or our ability to compete. Also, protecting our intellectual property rights is costly and time-consuming. Any unauthorized disclosure or use of our intellectual property could make it more expensive to do business, harming our operating results.

Mobile wireless communications technology and other industries may own many patents, copyrights, and trademarks. They may frequently request license agreements, threaten litigation, or file a suit against us based on infringement allegations or other violations of intellectual property rights. We may face third-party claims that our competitors and non-practicing entities infringe on their trademarks, copyrights, patents, and other intellectual property rights. As our business grows, we might face more claims of infringement.

| 10 |

Company Information

Effective February 11, 2019, xG Technology, Inc. changed its name to Vislink Technologies, Inc. Our predecessor company was initially incorporated in Delaware in 2006. Our executive offices are at 350 Clark Dr., Suite 125, Mt. Olive, NJ 07828, and (908) 852-3700 is the telephone number. Our website address is www.vislink.com. Our website’s information is not part of the report but only for informational purposes.

Available Information

We file reports with the Securities and Exchange Commission (“SEC”), and those reports are available free of charge on our website (www.vislink.com) under “About/Investor Information/SEC Filings.” The reports available include our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, which are available as soon as reasonably practicable after we electronically file such materials or furnish them to the SEC. You can also read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. You can obtain additional information about the Public Reference Room’s operation by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site (www.sec.gov) containing reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us. The information contained on the SEC’s website is not incorporated by reference into this Form 10-K and should not be considered to be part of this Report. Within the Investors section of our website, we provide information concerning corporate governance, including our corporate governance guidelines, board committee charters, Code of Ethics and other information. A copy of the Code of Ethics may be provided to any person without charge upon written request to: Vislink Technologies, Inc., Attn: Corporate Secretary, 350 Clark Dr., Suite 125, Mt. Olive, NJ 07828. The content reflected on any website reflected in this Report is not incorporated by reference herein unless expressly noted.

Human Capital

Overall

Our business results depend partly on our ability to successfully manage our human capital resources, including attracting, identifying, and retaining key talent. As of December 31, 2023, we employed 112 full-time employees and 11 independent contractors, including 22 in development (including one contractor), two officers, 16 in general and administrative (includes two contractors), 58 in operations (includes three contractors), and 25 in sales and marketing (consists of five contractors). As a global industrial technology company, many of our employees are engineers or trained trade or technical workers focusing on advanced manufacturing, and many possess advanced college degrees. No labor union represented our employees at any of our worldwide facilities as of December 31, 2023.

We emphasize several measures and objectives in managing its human capital assets, including, among others, employee safety and wellness, talent acquisition and retention, employee engagement, development and training, diversity and inclusion, and compensation. These targeted ideals vary by country/region. They may include annual bonuses, stock-based compensation awards, a 401(k) plan with matching opportunities, healthcare and insurance benefits, health savings and flexible spending accounts, paid time off, family leaves, family care resources, employee assistance programs, and tuition assistance. We also provide our employees with access to various innovative, flexible, and convenient health and wellness programs. We designed these programs to support employees’ physical and mental health by providing tools and resources to improve or maintain their health status and encourage engagement in healthy behaviors. We generally consider our employee relations to be good.

| 11 |

Item 1A. Risk Factors

In addition to the other information in this Form 10-K, readers should consider the following essential factors carefully. These factors, among others, in some cases, have affected, and in the future could affect, our financial condition and results of operations and could cause our future results to differ materially from those expressed or implied in any forward-looking statements that appear in this Form 10-K or that we have made or will make elsewhere.

Risks Related to the Company and Our Business

We have incurred losses in the past and may be unable to achieve or sustain profitability in the future.

We have incurred net losses since inception, including net losses of $9.1 million and $13.6 million for the years ended December 31, 2023, and 2022, respectively. As a result of ongoing losses, as of December 31, 2023, we had an accumulated deficit of $309.2 million, $8.5 million of cash, and $5.7 million of investments in governmental securities. We expect to continue to incur significant sales and marketing, product development, regulatory, and other expenses as we seek to expand existing relationships with our customers, obtain new customers, reach new markets, and develop new products or add new features to our existing products. Our net income (loss) may fluctuate significantly from fiscal period to period. We will need to generate significant additional revenues and/or cost-cutting to achieve and sustain profitability, and even if we achieve profitability, we cannot be sure that we will remain profitable for any substantial period. Our failure to gain or maintain profitability could negatively impact the value of our common stock.

We may require additional capital to fund our existing commercial operations, develop, market, and commercialize new products, and expand our operations. If we do not obtain additional financing, our business prospects, financial condition, and results of operations will be adversely affected if required.

Our available cash balances, potential borrowing capacity, and anticipated cash flow from operations may need to be revised to satisfy our liquidity requirements, including because of lower demand for our products, whether as a result of the risks described in this Annual Report or otherwise. As such, we may seek to sell common or preferred equity or debt securities, other forms of third-party funding, or seek debt financing. Our current and future funding requirements will depend on many different factors, including:

| ● | the cost of expanding our operations and offerings, including our sales and marketing efforts; | |

| ● | our rate of progress in, and cost of the sales and marketing activities associated with, establishing adoption of our products and maintaining or improving our sales to our current customers; | |

| ● | the cost of research and development activities, including research and development relating to new products and technologies or features for existing products; | |

| ● | the effect of competing technological and market developments; | |

| ● | costs related to international expansion, and | |

| ● | the potential cost and delays resulting from regulatory oversight of our business and products. |

We may also consider raising additional capital in the future to expand our business, pursue strategic investments, take advantage of financing opportunities, or for other reasons, including:

| ● | expanding our sales and marketing efforts to increase market adoption of our products and address competitive developments; | |

| ● | funding development and marketing efforts of any future products or additional features to then-current products; | |

| ● | acquiring, licensing, or investing in new technologies; | |

| ● | providing for supply and inventory costs associated with plans to accommodate potential increases in demand for our products; | |

| ● | acquiring or investing in complementary businesses or assets, and | |

| ● | financing capital expenditures and general and administrative expenses. |

| 12 |

Additional capital may not be available to us at such times or in needed amounts. Even if capital is available, it might be available only on unfavorable terms. Any issuance of additional equity or equity-linked securities could be dilutive to our existing stockholders, and any new equity securities could have rights, preferences, and privileges superior to those of holders of our common stock. Debt financing, if available, may involve restrictive covenants on our operations or our ability to incur additional debt, pay dividends, repurchase our stock, make investments, and engage in merger, consolidation, or asset sale transactions. If we raise additional funds through collaboration and licensing arrangements with third parties. It may be necessary to relinquish or license some rights to our technologies or products on terms that are not favorable to us. If access to sufficient capital is unavailable as and when needed, our business will be materially impaired. We may be required to cease operations, curtail one or more product development or expansion programs, significantly reduce expenses, sell assets, seek a merger or joint venture partner, file for protection from creditors, or liquidate all our assets.

Furthermore, we may require additional capital to develop new products in the future, and we may not be able to secure adequate additional financing when needed on acceptable terms or at all. To execute our business strategy, we may issue additional equity securities in public or private offerings, potentially at discounts to our common stock’s current or future market price. If we can secure further funding, we may be able to forego strategic opportunities or delay, scale back, and eliminate future product development.

Our global operations expose us to risks associated with public health crises or pandemic outbreaks. These crises or outbreaks could disrupt our operations and materially and adversely affect our results of operations and financial condition.

Our business may be exposed to risks associated with public health crises, such as pandemics and epidemics. Widespread outbreaks of a pandemic, such as the COVID-19 pandemic, have created a significant global economic downturn, disrupted global trade and supply chains, adversely impacted many industries, and contributed to significant volatility in financial markets. A public health crisis or an outbreak of a pandemic in one or more of the geographic areas in which we operate could affect our ability to source product materials and components, labor, and otherwise to provide products and services to our customers and adversely affect our results of operations and financial condition.

Our industry is highly competitive, and we may need to compete more effectively.

The communications industry is highly competitive, rapidly evolving, and constantly changing. We expect that new competitors are likely to join existing competitors. Many of our competitors may be larger and have more excellent financial, technical, operational, marketing, and other resources and experience than we do. If a competitor expends significant resources, we may not compete successfully. Also, the pace of technological change makes it impossible for us to predict whether we will face new competitors using different technologies to provide products. If our competitors were to offer better and more cost-effective products than our products, we might not be able to capture any significant market share.

Defects or errors in our products and services or products made by our suppliers could harm our brand and relations with our customers and expose us to liability. If we experience product recalls, we may incur significant expenses and experience decreased demand for our products.

Our products are inherently complex and may contain defects and errors that are only detectable when the products are in use. Because our products are used for personal and business purposes, such faults or errors could severely impact our end customers, damaging our reputation and customer relationships and exposing us to liability. Defects or impurities in our components, materials, or software, equipment failures, or other difficulties could adversely affect our customers’ ability to ship products on a timely basis and customer or licensee demand for our products. Any shipment delays or declines in demand could reduce our revenues and harm our ability to achieve or sustain desired levels of profitability. Our customers may also experience component or software failures or defects requiring significant product recalls, rework, and repairs not covered by warranty reserves.

| 13 |

Future impairment charges could have a material adverse effect on our financial condition and the results of operations.

We must test our finite-lived intangible assets for impairment if events occur or circumstances change that would indicate that the remaining net book value of the intangible assets might not be recoverable. These events or circumstances could include a significant change in the business climate, including a substantial, sustained decline in an entity’s market value, legal factors, operating performance indicators, competition, sale, or disposition of a considerable portion of our business, potential government actions, and other factors. If our finite-lived intangible assets’ fair value is less than their book value in the future, we could be required to record impairment charges. The amount of any future impairment could be significant and could have a material adverse effect on our reported financial results for the period in which the charge is taken.

Although our products may not cause users technical issues, our business and reputation may be harmed if users perceive our solutions to cause a slow or unreliable network connection or a high-profile network failure.

We expect our products to be in many different locations and user environments and can provide video transmission, mobile broadband connectivity, and interference mitigation, among other applications. Our products’ ability to operate effectively can be negatively impacted by many different elements unrelated to our products. Although our products may not cause technical issues, users often may perceive the underlying cause of our technology’s poor performance. This perception, even if incorrect, could harm our business and reputation. Similarly, a high-profile network failure may be caused by improper operation or failure of a network component we did not supply. Still, other service providers may perceive that our products were implicated, which, even if incorrect, could harm our business, operating results, and financial condition.

Our ability to sell our products will be highly dependent on the quality of our support and service offerings, and our failure to offer high-quality support and services would adversely affect our sales and the results of operations.

Once our products are deployed, our channel partners and end customers will depend on our support organization to resolve any issues relating to our products. Significant support will be necessary for our products’ successful marketing and sales. In many cases, our channel partners will likely provide support directly to our end customers, and we will need more control over the quality of the support supplied by our channel partners. These channel partners may also support other third-party products, potentially distracting resources from support for our products. Our channel partners need to effectively assist our end customers in deploying our products, succeed in helping our end customers quickly, resolve post-deployment issues, or provide adequate ongoing support to maintain our ability to sell our products to existing end customers. Our reputation with potential end customers could be harmed. We sometimes guarantee a certain performance level to our channel partners and end customers, which could prove resource-intensive and expensive if unforeseen technical problems arise.

We are subject to increasing operating costs and inflation risks, which may adversely affect our performance.

While we attempt to offset increases in operating costs through various measures focused on increasing revenues, there is no assurance that we will do so. Therefore, operating expenses may rise faster than associated revenues, resulting in a material adverse impact on our cash flow and margins.

We are also impacted by inflationary increases in wages and benefits, whether driven by competition for talent or ordinary course pay increases and other rising costs. Increases in the inflation rate could also significantly impact our cost base. In all countries in which we operate, wage inflation, whether driven by competition for talent or ordinary course pay increases, may also increase our cost of providing services and reduce our profitability if we are not able to pass those costs on to our clients or charge premium prices when justified by market demand.

| 14 |

We may need to recruit and retain qualified personnel, which may affect our business, financial condition, results of operations, and prospects.

We expect to rapidly expand our operations and grow our sales, development, and administrative functions. This expansion is expected to significantly strain our management and require hiring a considerable quantity of qualified personnel. Accordingly, recruiting and retaining such personnel in the future will be critical to our success. There is intense competition from other companies for qualified personnel in our activities. If we fail to identify, attract, retain, and motivate these highly skilled personnel, we may be unable to continue our marketing and development activities, which could adversely affect our business, financial condition, results of operations, and prospects.

We rely on key executive officers, and their knowledge of our business and technical expertise would be difficult to replace.

We depend highly on our executive officers because of their expertise and experience in the telecommunications industry. We have agreements with our executive officers containing customary non-disclosure, non-compete, confidentiality, and assignment of inventions provisions. Our officers do not have “key person” life insurance policies. The loss of our key personnel’s technical knowledge, management, and industry expertise could result in delays in product development, the loss of customers and sales, and the diversion of management resources, adversely affecting our operating results.

We purchase some components, subassemblies, and products from a limited number of suppliers. The loss of these suppliers may substantially disrupt our ability to obtain orders and fulfill sales as we design and qualify new components.

We sometimes rely on third-party components and technology to build and operate our products. Until full integration with IMT and VCS, we may rely on our contract manufacturers to obtain the parts, subassemblies, and products necessary to manufacture our products. Shortages in components we use in our products are possible, and our ability to predict such components’ availability is limited. While parts and supplies are generally available from various sources, our contract manufacturers currently depend on a single or limited number of suppliers for several of our products. If our suppliers of these components or technology were to enter into exclusive relationships with other providers of wireless networking equipment or were to discontinue providing such components and technology to us, and we could not replace them cost-effectively or at all, our ability to deliver our products would be impaired. Our contract manufacturers generally rely on purchase orders rather than long-term contracts with these suppliers.

Specific supply chain disruptions may also arise because of global conflicts, such as the armed conflict between Russia and Ukraine, the war in Gaza, trade sanctions, and similar events. It may be difficult for us to assess our suppliers’ ability to meet our future demand promptly based on past performance. As a result, even if available, our contract manufacturers and we may not secure sufficient components at reasonable prices or acceptable quality to build our products on time. Therefore, we may be unable to meet customer demand for our products, adversely affecting our business, operating results, and financial condition.

We do not have long-term contracts with our existing contract manufacturers. The loss of any of our current contract manufacturers could adversely affect our business, operating results, and financial condition.

We do not have long-term contracts with our existing contract manufacturers. If any of our current contract manufacturers are unable or unwilling to manufacture our products in the future, the loss of such contract manufacturers could adversely affect our business, operating results, and financial condition.

| 15 |

Our intellectual property protections may be insufficient to safeguard our technology adequately.

Given the rapid pace of innovation and technological change within the wireless and broadband industries, our personnel, consultants, and contractors’ technical and creative skills and ability to develop, enhance, and market new products and upgrade existing products are critical to continued success. Our success and ability to compete effectively depend on the proprietary technology we have developed internally. We rely primarily on patent laws to protect our proprietary rights. As of December 31, 2023, in the United States, we have 11 patents granted, no patent applications pending, and no provisional applications pending. Internationally, we have two patents granted, no patent applications pending, and no Patent Cooperation Treaty (PCT) applications. There can be no assurance that patents are awaiting, that future patent applications will be issued, or that we will have the resources to protect any such issued patent from infringement if issued.

Further, we cannot patent critical technology for our business. To date, we have relied on copyright, trademark, and trade secret laws, as well as confidentiality procedures, non-compete and work-for-hire invention assignment agreements, and licensing arrangements with our employees, consultants, contractors, customers, and vendors, to establish and protect our rights to this technology and, to the best extent possible, control the access to and distribution of our technology, software, documentation, and other proprietary information. Despite these precautions, it may be possible for a third party to copy or otherwise obtain and use this technology without authorization. Policing unauthorized use of this technology is challenging. We need to be confident that our steps will prevent the misappropriation of or prevent unauthorized third parties from obtaining or using the technology we rely on. Also, adequate protection may be unavailable or limited in some jurisdictions. Litigation may be necessary in the future to enforce or protect our rights.

We may be subject to claims of intellectual property infringement or invalidity. Expenses incurred for monitoring, protecting, and defending our intellectual property rights could adversely affect our business.

Competitors and others may infringe on our intellectual property rights or allege we have violated theirs. If we are found to infringe on others’ rights, we could be required to discontinue offering certain products or systems, pay damages, or purchase a license from its owner to use the intellectual property in question. Monitoring infringement and misappropriation of intellectual property can be difficult and expensive, and we may be unable to detect infringement or misappropriation of our proprietary rights. We may also incur significant litigation expenses in protecting our intellectual property or defending our use of intellectual property, reducing our ability to fund product initiatives. These expenses could hurt our future cash flows and the results of operations. Litigation can also distract management from the day-to-day operations of the business.

Enforcement of our intellectual property rights abroad, particularly in China, is limited, and it is often difficult to protect and enforce such rights.

Many companies have encountered substantial intellectual property infringement in countries where we sell, or intend to sell, products or have our products manufactured. Patent protection outside the United States is generally less comprehensive than in the United States. It may not protect our intellectual property in some countries where our products are sold or may be sold in the future. Even if patents are granted outside the United States, effective enforcement may not be available in those countries.

In particular, the legal regime relating to China’s intellectual property rights is limited, and it is often difficult to protect and enforce such rights. The regulatory scheme for implementing China’s intellectual property laws may not be as developed as other countries’ regulatory schemes. Any advancement of an intellectual property enforcement claim through China’s regulatory system may require extensive time, allowing intellectual property infringers to continue mostly unimpeded, to our commercial detriment in the Chinese and other export markets. Also, rules of evidence may be unclear, inconsistent, or difficult to comply with, making it difficult to prove infringement of our intellectual property rights. As a result, enforcement cases involving technology, such as copyright infringement of software code or unauthorized manufacture or sale of products containing patented inventions, may be difficult or impossible to sustain.

These factors may make it increasingly complicated for us to enforce our intellectual property rights against parties misappropriating or copying our technology or products without our authorization, allowing competing enterprises to harm our business in the Chinese or other export markets by affecting the pricing for our products, reducing our sales, and diluting our brand or product quality reputation.

The intellectual property rights of others may prevent us from developing new products or entering new markets.

The telecommunications industry is characterized by the rapid development of new technologies, which requires us to continuously introduce new products and expand into new markets that may be created. Therefore, our success depends on adapting our products and systems, incorporating new technologies, and growing into markets that new technologies may design. If technologies are protected by others’ intellectual property rights, including our competitors, we may be prevented from introducing new products or expanding into new markets created by these technologies. If others’ intellectual property rights prevent us from using innovative technologies, our financial condition, operating results, or prospects may be harmed.

| 16 |

We may be subject to infringement claims in the future.

We may need to be made aware of filed patent applications and issued patents that could include claims covering our products. Parties making claims of infringement may be able to obtain injunctive or other equitable relief that could effectively block our ability to sell or supply our products or license our technology and cause us to pay substantial royalties, licensing fees, or damages. The defense of any lawsuit could divert management’s efforts and attention from ordinary business operations and result in time-consuming and expensive litigation, regardless of the merits of such claims. These outcomes may (i) require us to stop selling products or using technology that contains the allegedly infringing intellectual property; (ii) need us to redesign those products that have the allegedly infringing intellectual property; (iii) require us to pay substantial damages to the party whose intellectual property rights we may be found to be infringing; (iv) result in the loss of existing customers or prohibit the acquisition of new customers; (v) cause us to attempt to obtain a license to the relevant intellectual property from third parties, which may not be available on reasonable terms or at all; (vi) materially and adversely affect our brand in the market place and cause a substantial loss of goodwill; (vii) cause our stock price to decline significantly; (viii) materially and adversely affect our liquidity, including our ability to pay debts and other obligations as they become due; or (ix) lead to our bankruptcy or liquidation.

We rely on the availability of third-party licenses. If these licenses are available only on less favorable terms or not in the future, our business and operating results will be harmed.

We have incorporated third-party licensed technology into our products. It may be necessary to renew licenses relating to these products or seek additional licenses for existing or new products. There can be no assurance that the required licenses will be available on acceptable terms or at all. The inability to obtain specific licenses or other rights, or to obtain those licenses or rights on favorable terms, or the need to engage in litigation regarding these matters could result in delays in product releases until such time, if ever, as equivalent technology could be identified, licensed or developed and integrated into our products and might have a material adverse effect on our business, operating results and financial condition. Moreover, including intellectual property licensed from third parties in our products on a nonexclusive basis could limit our ability to protect our proprietary rights.

We expect to base our inventory purchasing decisions on our forecasts of customers’ demand, and if our projections are inaccurate, our operating results could be materially harmed.

As our customer base increases, we expect to place orders based on customer demand forecasts with our contract manufacturers. Our projections will be based on multiple assumptions, each of which may cause our estimates to be inaccurate, affecting our ability to provide products to our customers. When demand for our products increases significantly, we may not be able to meet demand on a timely basis, and we may need to expend a significant amount of time working with our customers to allocate limited supply and maintain positive customer relations, or we may incur additional costs to rush the manufacture and delivery of other products. If we underestimate customers’ demand, we may forego revenue opportunities, lose market share, and damage customer relationships. Conversely, if we overestimate customer demand, we may purchase more inventory than we can sell at any given time or at all. Also, we grant our distributors stock rotation rights, which require us to accept stock back from a distributor’s inventory, including obsolete inventory. As a result of our failure to correctly estimate the demand for our products, we could have excess or obsolete inventory, resulting in a decline in our inventory value, which would increase our costs of revenues and reduce our liquidity. Our failure to accurately manage inventory relative to demand would adversely affect our operating results.

| 17 |

If our technology did not work as planned or if we were unsuccessful in developing and selling new products or penetrating new markets, our business and operating results would suffer.

Our ability to compete successfully depends on our ability to design, develop, manufacture, assemble, test, market, and support new products and enhancements on a timely and cost-effective basis to keep pace with market needs and satisfy customers’ demands. Our success and ability to compete depend on the technology we have developed or may develop in the future. There is a risk that the technology we have developed or may develop may not work as intended or that the technology marketing may not be as successful as anticipated. Further, the markets in which our customers and we compete or plan to compete are characterized by regularly and rapidly changing technologies and technological obsolescence. A fundamental technological shift in our target markets could harm our competitive position. Our failure to anticipate these shifts, develop new technologies, or react to changes in existing technologies could materially delay our development of new products, resulting in product obsolescence, decreased revenue, and a loss of customer wins to our competitors. New technologies and products require substantial investment, prolonged development, and testing before being commercially viable. We intend to continue investing significantly in developing new technologies and products. We may not be able to build or acquire new products or product enhancements that compete effectively within our target markets or differentiate our products based on functionality, performance, or cost, and our latest technologies and products will not result in meaningful revenue. Any delays in developing and releasing new or enhanced products could cause us to lose revenue opportunities and customers. Any technical flaws in product releases could diminish our products’ innovative impact and harm customer adoption and reputation. If we fail to introduce new products that meet our customers’ demands or target markets, do not achieve market acceptance, or forget to penetrate new markets, our revenue will not increase over time, and our operating results and competitive position will suffer.

We rely extensively on information technology systems and could face cybersecurity risks.

We rely extensively and increasingly on information technologies and infrastructure to manage our business, including developing new business opportunities and digital streaming products and services. Our business operations depend on secure transmission and other data and video processing over the internet and interconnected systems. Malicious technology-related events, such as cyberattacks, computer hacking, computer viruses, ransomware, worms, and other destructive or disruptive software and other attempts to access confidential or personal data, denial of service attacks, and other malicious activities, are becoming increasingly diverse and sophisticated. These events are rising worldwide, highlighting the need for continual and effective cybersecurity awareness and education. Our business, which involves the collection, use, transmission, and other distribution of data and video, may make us and our clients and business partners attractive targets of hackers, denial of service attacks, malicious code, phishing attacks, ransomware attacks, and other threat actors, including malicious insiders (such as employees and prior employees), which may result in security incidents, including the unauthorized access, misuse, loss, corruption, inaccessibility, or destruction of this data (including personal, confidential and sensitive information), unavailability of services, or other adverse events. In the past, we have faced cyber-attacks of this nature, and we expect to continue to face such attacks in the future. Some of these attacks have been successful, although we believe that none to date have been material. We cannot guarantee that our defensive measures will prevent such attacks in the future. These types of cyber-attacks and incidents can give rise to various losses and costs, including legal exposure and regulatory fines, damage to reputation, and others. If successful, these incidents could also materially disrupt operational systems and result in the loss of intellectual property, trade secrets, other proprietary or competitively sensitive information, and general data (including personal information).

Data breaches and improper use of social media by employees and others may risk sensitive data, such as personal information, strategic plans, and trade secrets, being exposed to third parties or the public. Any such breaches or breakdowns could expose us to legal liability, be expensive to remedy, result in a loss of our or our clients’ or vendors’ proprietary information, and damage our reputation. Efforts to develop, implement, and maintain security measures are costly, may not successfully prevent these events from occurring, and may require ongoing monitoring and updating as technologies and cyberattack techniques change frequently or are not recognized until they are successful.

Furthermore, computer malware, viruses, hacking, and phishing attacks have become more prevalent in our industry and may occur in future systems. Though it is difficult to determine what, if any, harm may directly result from any specific interruption or attack, any failure to maintain performance, reliability, security, and availability of our products and technical infrastructure to the satisfaction of our users may harm our reputation and our ability to attract and retain customers.

| 18 |

Our industry is subject to rapid technological change, and to compete successfully, we must make substantial investments in new products, services, and technologies.

New technological innovations generally require a substantial investment before they are commercially viable. We intend to continue to make significant investments in developing new products and technologies, and it is possible that our development efforts will not be successful and that our latest technologies will not result in meaningful revenues. Our future success will depend on our ability to quickly develop and introduce new products, technologies, and enhancements. Our future success will also rely on our ability to keep pace with technological developments, protect our intellectual property, satisfy customer requirements, meet customer expectations, price our products and services competitively, and achieve market acceptance. Introducing products embodying new technologies and emerging new industry standards could render our existing products and technologies and products currently under development obsolete and unmarketable. If we fail to anticipate or respond adequately to technological developments or customer requirements or experience any significant delays in the development, introduction, or shipment of our products and technologies in commercial quantities, demand for our products and our customer’s and licensees’ products that use our technologies could decrease, and our competitive position could be damaged.

Adopting and implementing such regulations could decrease demand for our products, increase the cost of building and selling them, impact our ability to ship products into affected areas, and reduce our ability to recognize revenue on time. Any of these impacts could have a material adverse effect on our business, financial condition, and results of operations.

At several of our annual stockholder meetings, including our 2019 Annual Meeting of Stockholders, we failed to obtain ratification by our stockholders of specific proposals submitted for approval of our stockholders at prior annual meetings, which could be deemed defective corporate acts.

At our 2015 Annual Meeting of Stockholders, our Board submitted to our stockholders for their approval (i) a proposal to approve our 2015 Employee Stock Purchase Plan and (ii) a proposal to approve our 2015 Incentive Compensation Plan. At our 2016 Annual Meeting of Stockholders, our Board submitted to our stockholders for their approval (i) a proposal to approve our 2016 Employee Stock Purchase Plan and (ii) a proposal to approve our 2016 Incentive Compensation Plan. At our 2017 Annual Meeting of Stockholders, our Board submitted to our stockholders, for their approval, (i) a proposal to approve an amendment to our 2016 Employee Stock Purchase Plan to increase the number of shares of common stock available for sale under such plan; (ii) a proposal to approve an amendment to our 2016 Incentive Compensation Plan to increase the number of shares of Common stock available for sale under such plan; and (iii) a proposal to approve our 2017 Incentive Compensation Plan.

At each of these annual meetings, our inspector of elections determined that the applicable proposal received the requisite stockholder approval under our amended and restated bylaws (“Bylaws”) and certified that the proposal passed, which was subsequently disclosed in an applicable Current Report on Form 8-K. Questions have been raised about whether the votes on such proposals were tabulated following our Bylaws’ provisions and whether the requisite votes were obtained to approve each of these proposals.

According to the provisions of Section 204 of the General Corporation Law of the State of Delaware (“DGCL”) and to continue to remain in compliance with Nasdaq’s Listing Rules, we submitted all these proposals, again, to our stockholders at our 2019 Annual Meeting of Stockholders for ratification to resolve any defects in the corporate acts relating to the approval of these proposals by our stockholders at the prior meetings. We could not obtain ratification by our stockholders for any proposals submitted to them at the 2019 Annual Meeting of Stockholders. Although we intend to resubmit these proposals to our stockholders for ratification, there can be no assurance that any of these proposals will be ratified. If we cannot secure such ratifications or are deemed inadequate, this could result in a determination that none of the shares issued by us under these plans were duly authorized and validly issued, which could create accounting issues, affect our liquidity and capital structure, and expose us to claims from recipients of any stock awards granted according to such plans, any of which could have a material adverse effect on our business and results of operations.

| 19 |

Demand for our defense-related products and products for emergency response services depends on government spending.

A portion of our business is derived from military and government markets. The military and government market largely depends on government budgets and is subject to governmental appropriations. Although multi-year contracts may be authorized with major procurements, funds are generally appropriated on a fiscal-year basis, even though a program may be expected to continue for several years. Consequently, programs are often only partially funded, and additional funds are committed if further appropriations are made. We cannot assure you that maintenance of or increases in military and government spending will be allocated to programs that would benefit our business. A decrease in levels of military and government spending or the government’s termination of, or failure to fully fund, one or more of the contracts for the programs in which we participate could have a material adverse effect on our financial position and the results of operations. Moreover, we cannot assure you that the new military and government-related communication and broadcasting programs we participate in will enter full-scale production as expected.

Our potential customers for our communication and surveillance products and solutions will likely include the U.S. Government or Government-related entities subject to congressional appropriations. Reduced funding for military and government procurement and research and development programs would likely adversely impact our ability to generate revenues.

We anticipate that a portion of our revenue will be derived from our communication, surveillance, and satellite products and solutions, at least in the foreseeable future, from U.S. Government and Government-related entities, including the U.S. Department of Defense and other departments and agencies. Government programs where we may seek to participate and contracts for our products must compete with different programs for consideration during Congress’ budget and appropriations hearings. They may be affected by political power changes, appointments, general economic conditions, and other factors beyond our control. A government closure based on a failure of Congress to agree on federal appropriations or the uncertainty surrounding a continuing resolution may result in the termination or delay of federal funding opportunities we are pursuing. Reductions, extensions, or terminations in a program in which we seek to participate, or overall defense or another spending could adversely affect our ability to generate revenues and realize profits. We cannot predict whether potential changes in security, military, communications, and intelligence priorities will afford opportunities for our business regarding research and development or product contracts. Still, a possible reduction in government spending on such programs could negatively impact our ability to generate revenues. In addition, our ability to participate in U.S. Government programs may be affected by the adoption of new laws or regulations relating to government contracting, changes in existing laws or regulations, changes in political or public support for security, military, and government programs, and uncertainties associated with the current global threat environment and other geo-political matters.

Contracting with government entities can be complex, expensive, and time-consuming.

The procurement process for government entities is, in many ways, more challenging than contracting in the private sector. We must comply with laws and regulations relating to the formation, administration, performance, and pricing of contracts with government entities, including U.S. federal, state, and local governmental bodies.

Government entities often require highly specialized contract terms that may differ from our standard arrangements. Government entities frequently impose complicated compliance requirements, require preferential pricing or “most favored nation” terms and conditions, or are otherwise time-consuming and expensive. Compliance with these exceptional standards or satisfaction with such requirements could complicate our efforts to obtain business or increase costs. Even if we meet these standards or conditions, the increased costs of providing our solutions to government customers could harm our margins.